Patents

Literature

36 results about "MasterCard" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Mastercard Incorporated (stylized as MasterCard from 1979 to 2016 and mastercard from 2016) is an American multinational financial services corporation headquartered in the Mastercard International Global Headquarters in Purchase, New York, United States. The Global Operations Headquarters is located in O'Fallon, Missouri, United States, a municipality of St. Charles County, Missouri. Throughout the world, its principal business is to process payments between the banks of merchants and the card issuing banks or credit unions of the purchasers who use the "Mastercard" brand debit, credit and prepaid to make purchases. Mastercard Worldwide has been a publicly traded company since 2006. Prior to its initial public offering, Mastercard Worldwide was a cooperative owned by the more than 25,000 financial institutions that issue its branded cards.

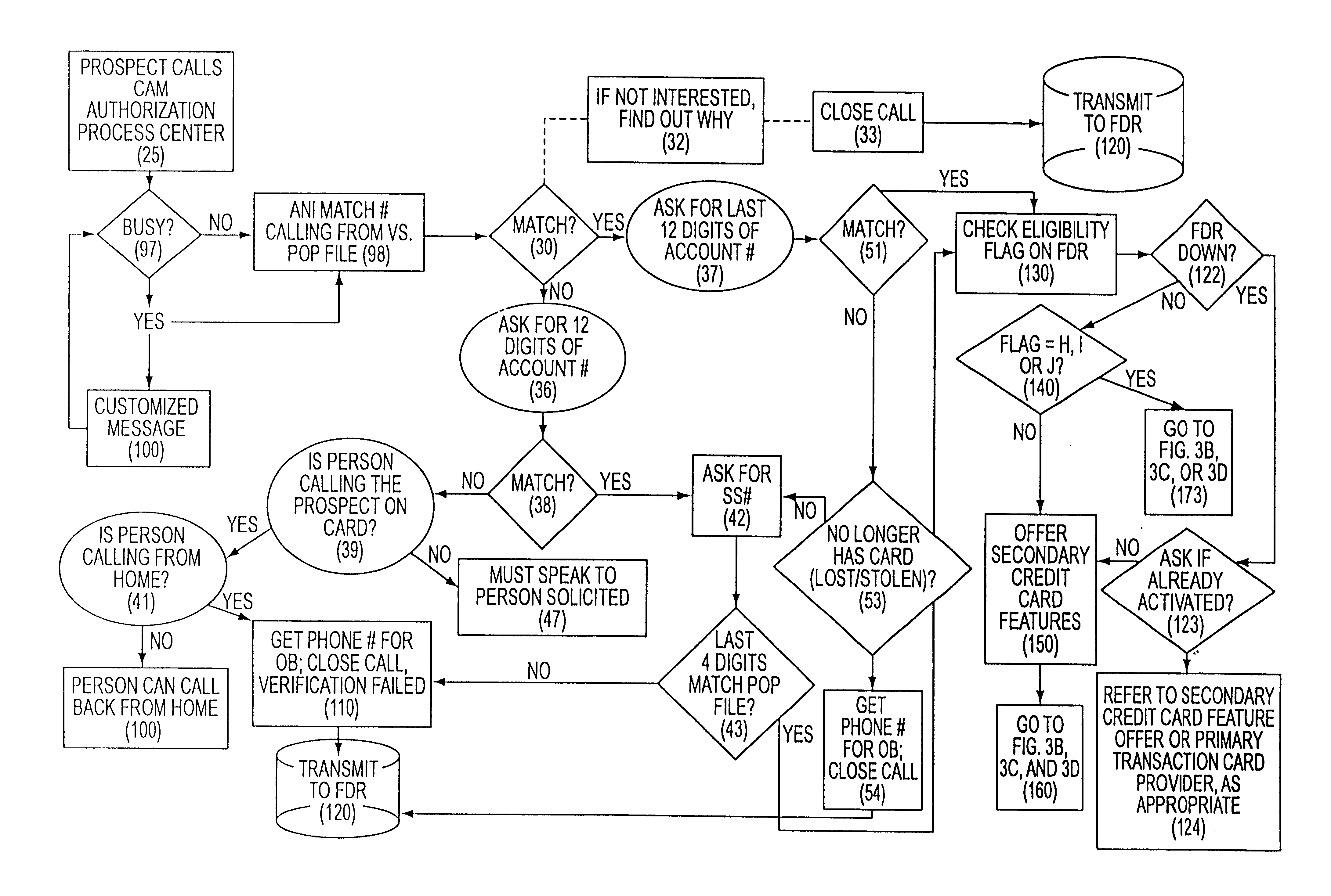

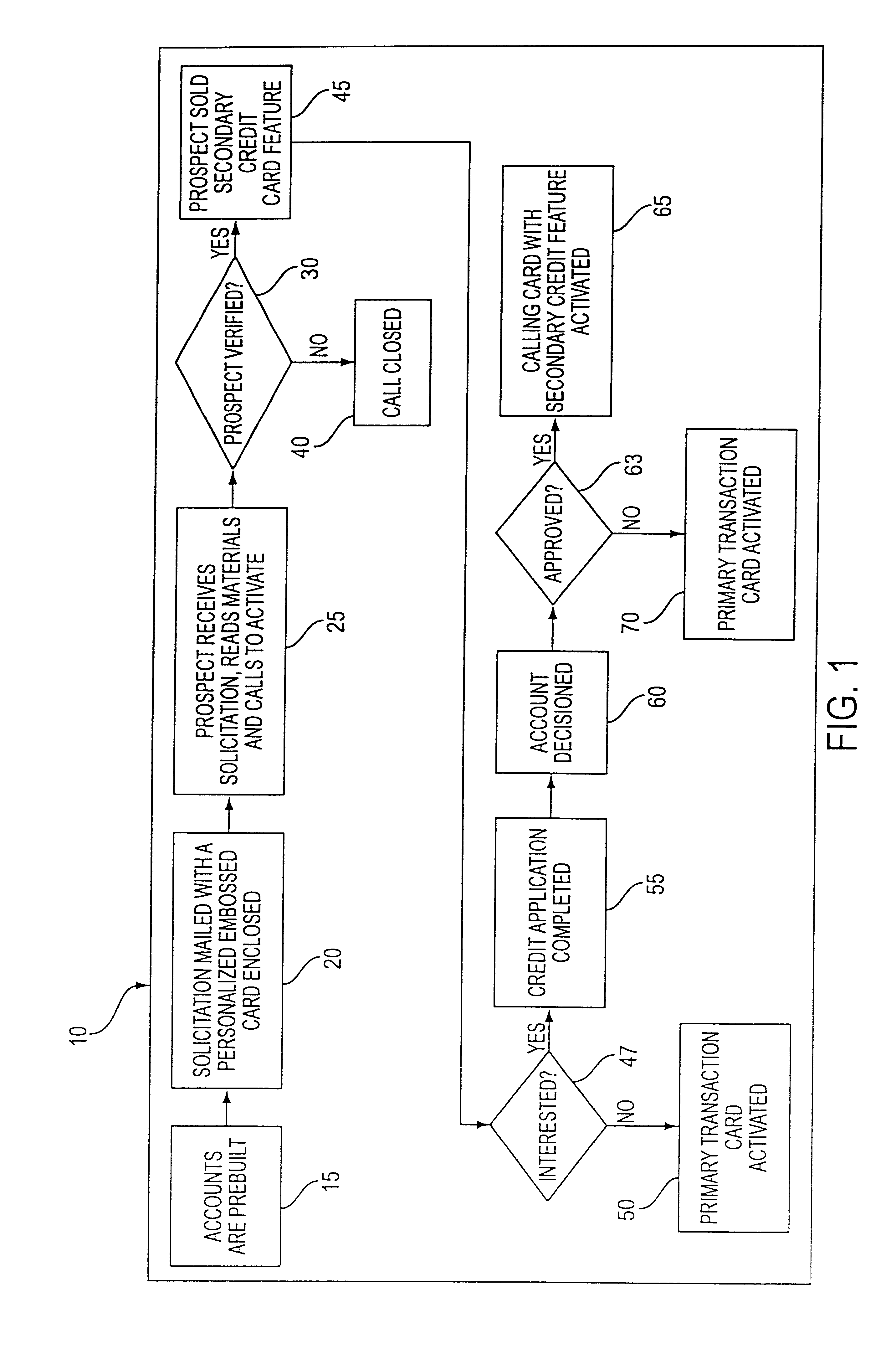

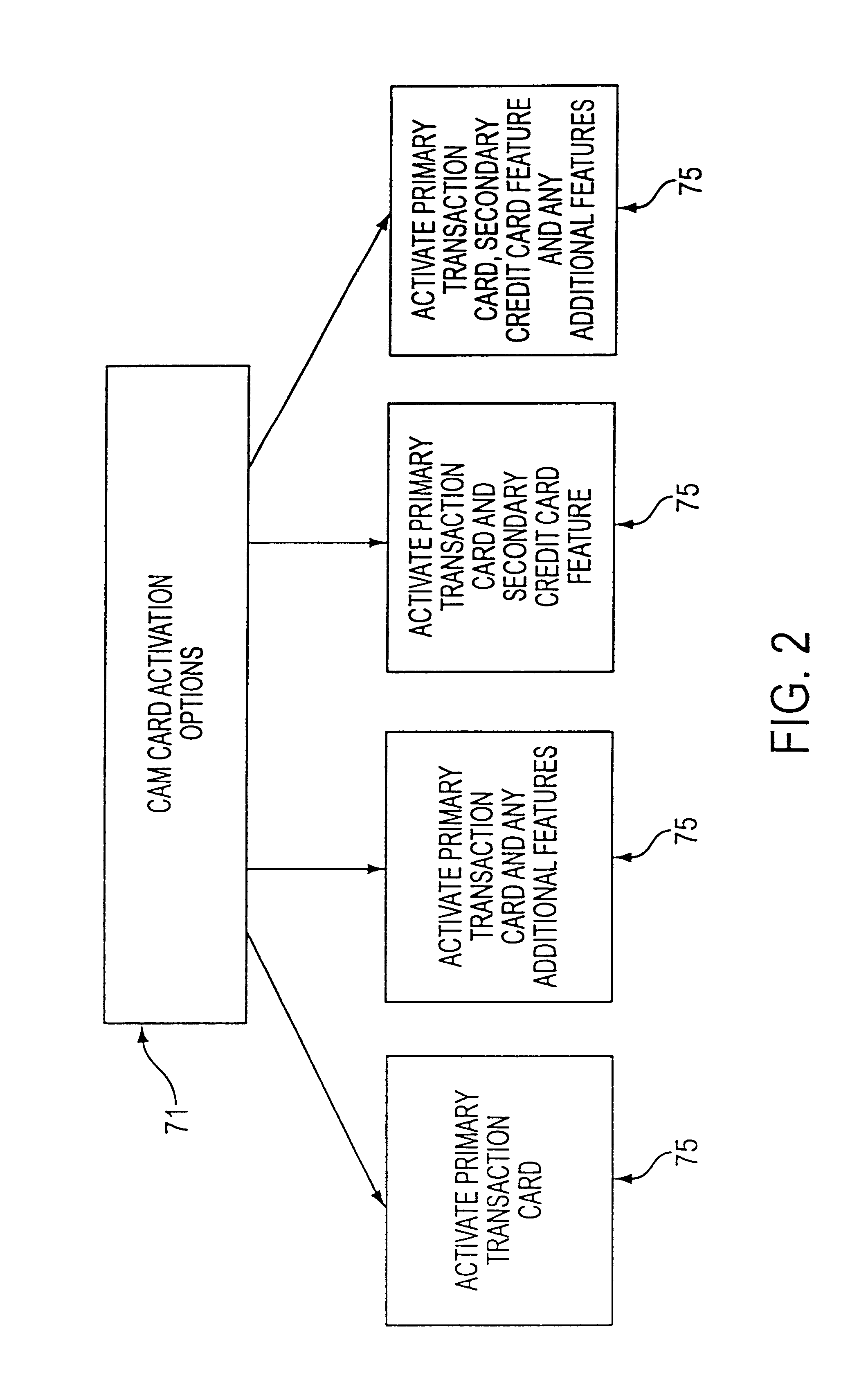

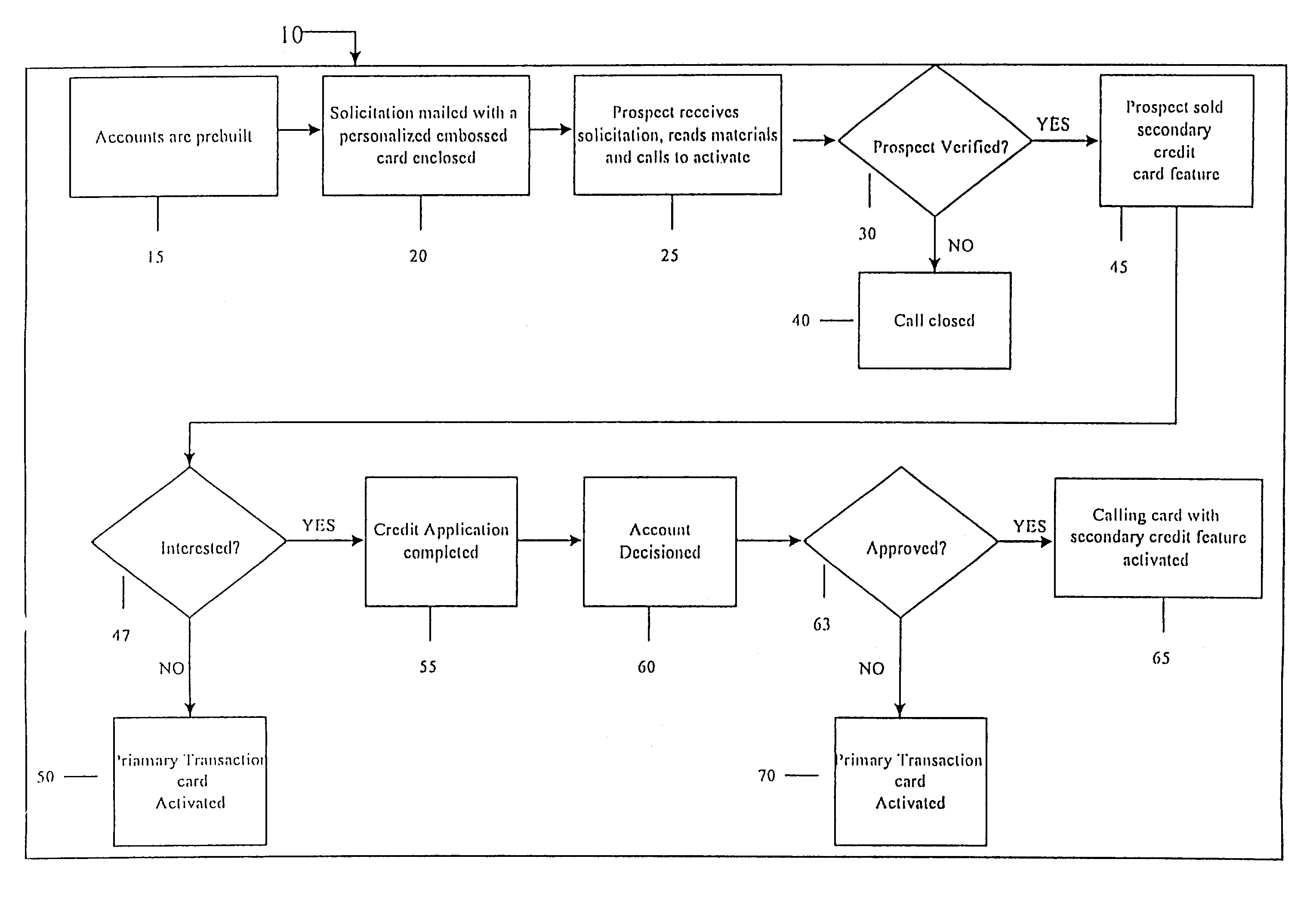

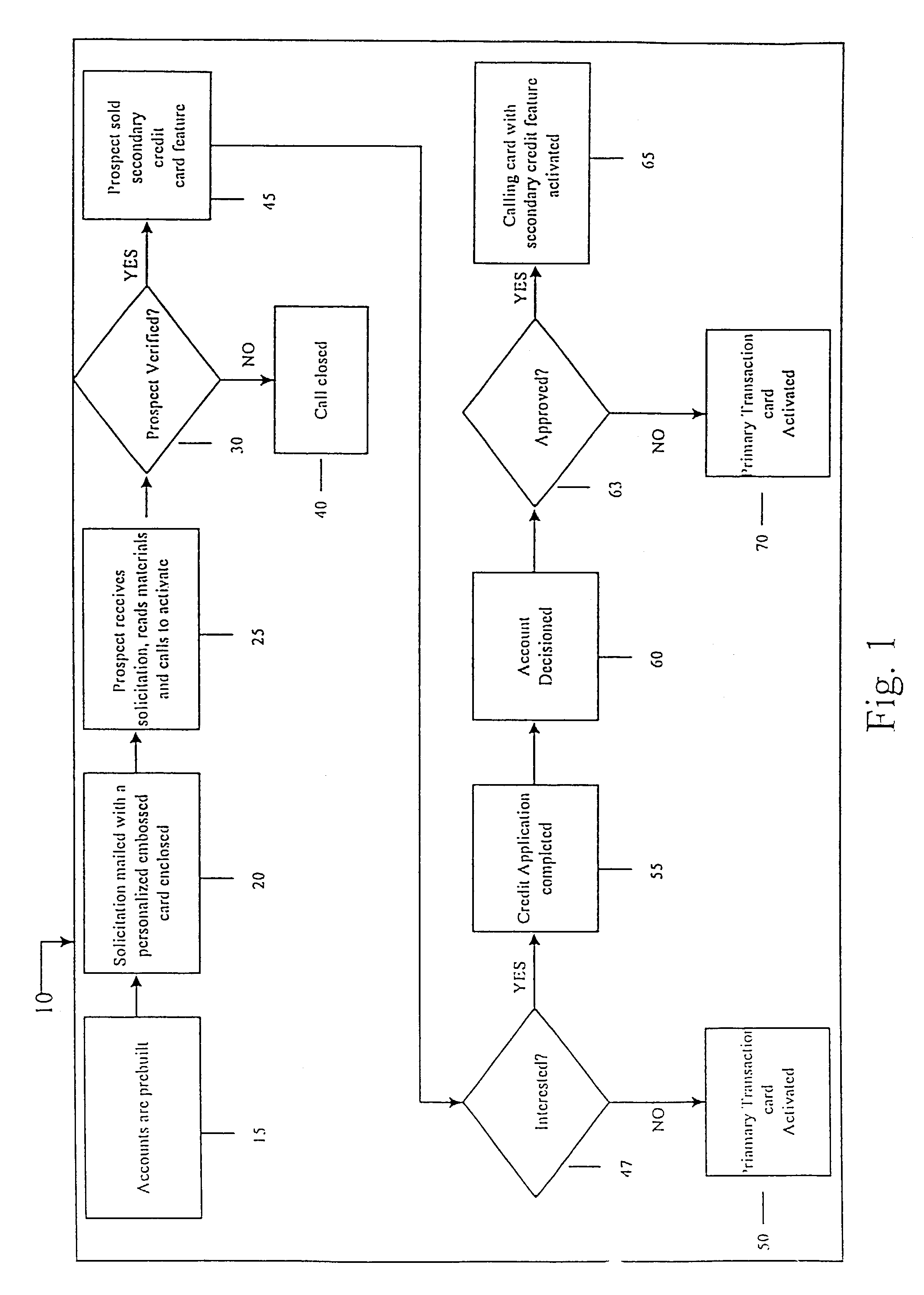

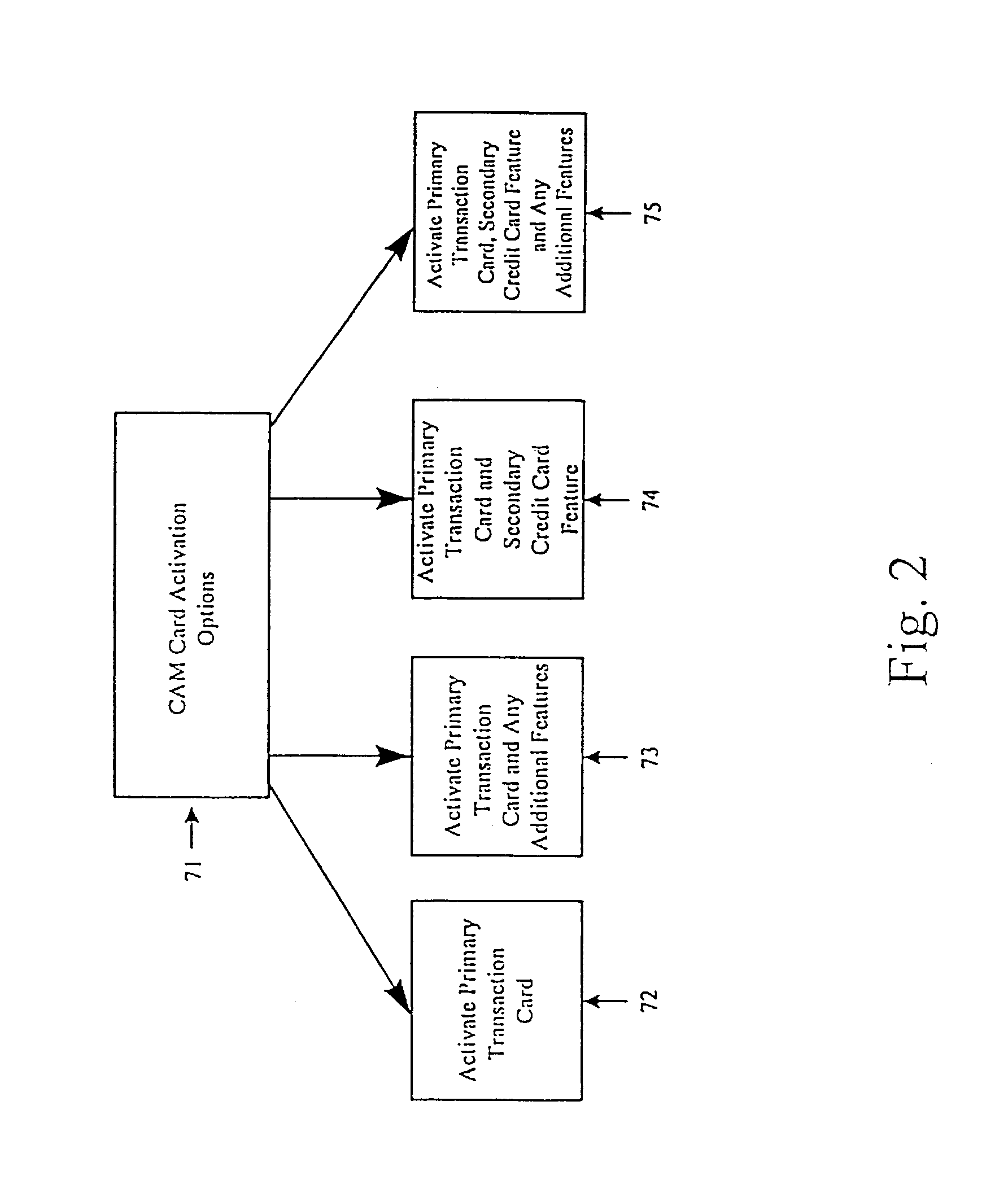

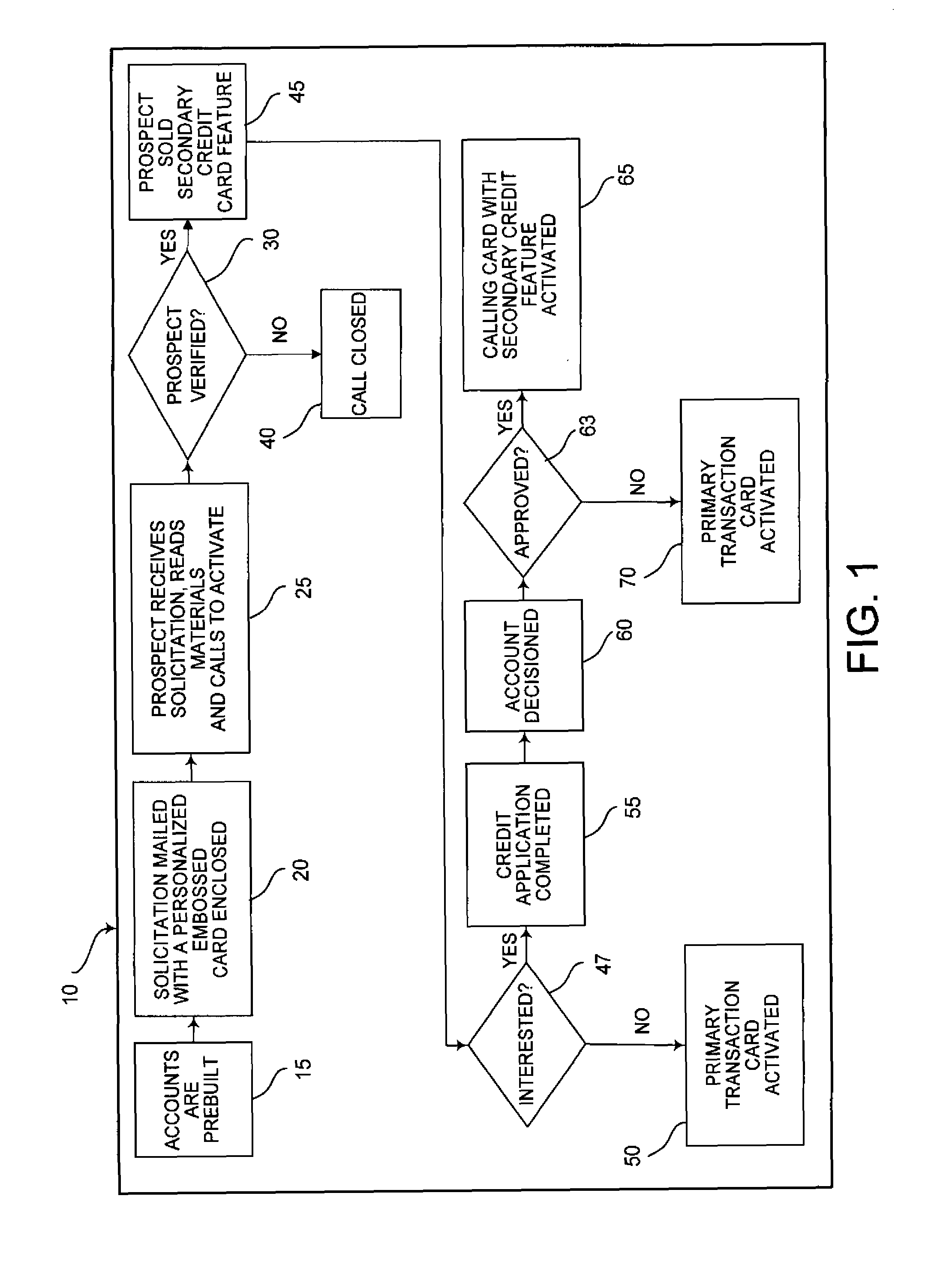

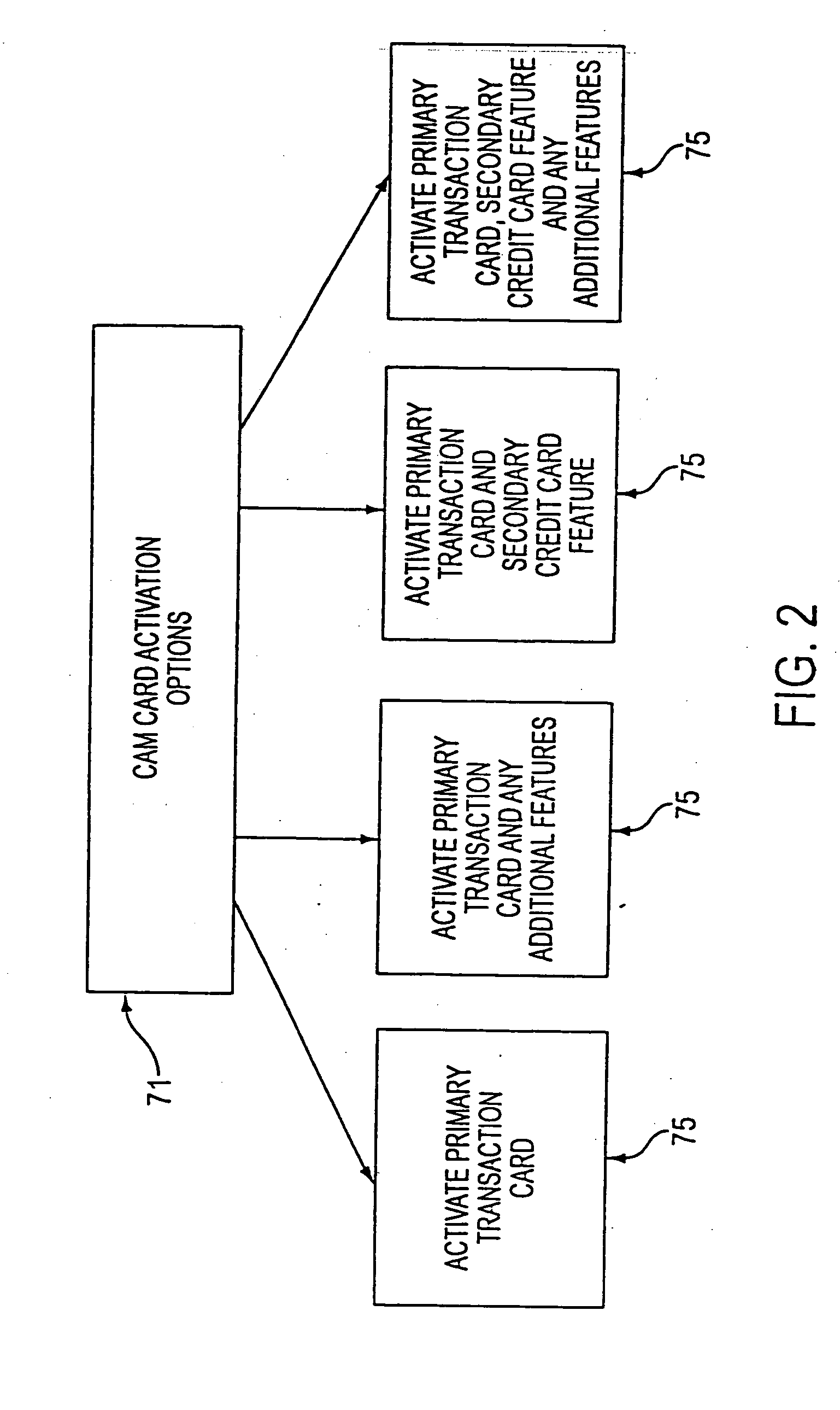

Customer activated multi-value (CAM) card

InactiveUS6865547B1Easy to useCredit registering devices actuationDiscounts/incentivesCredit cardGasoline

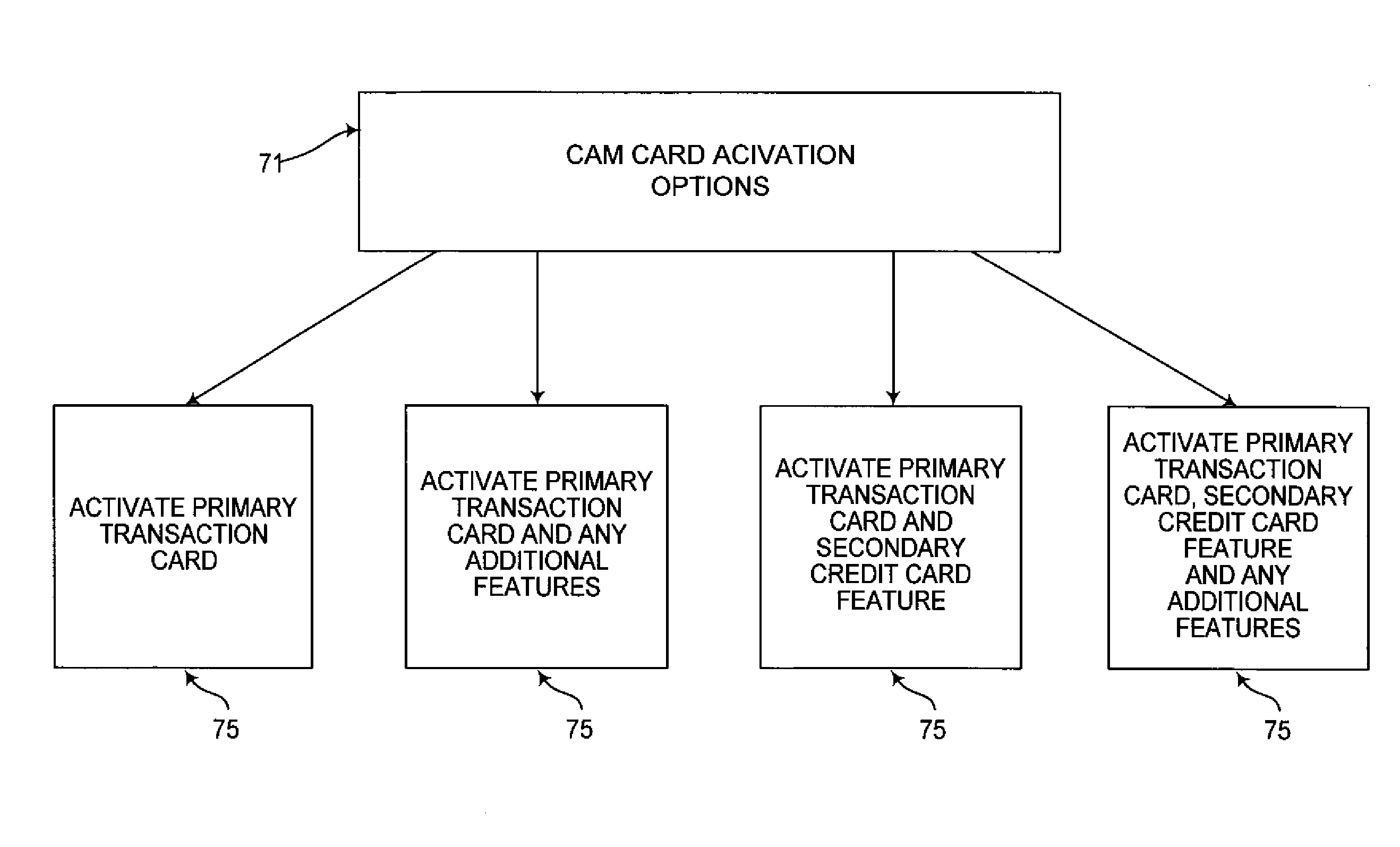

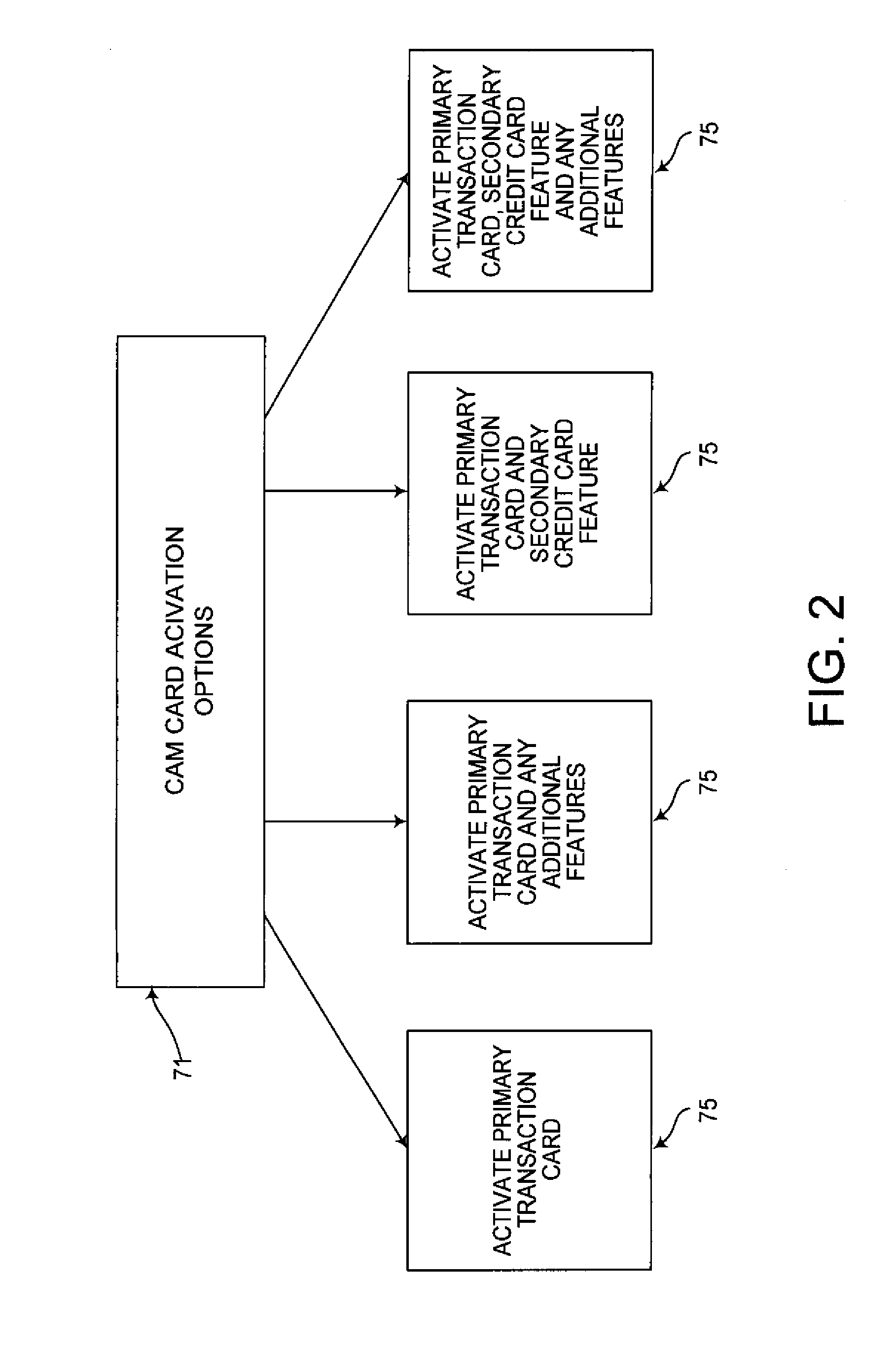

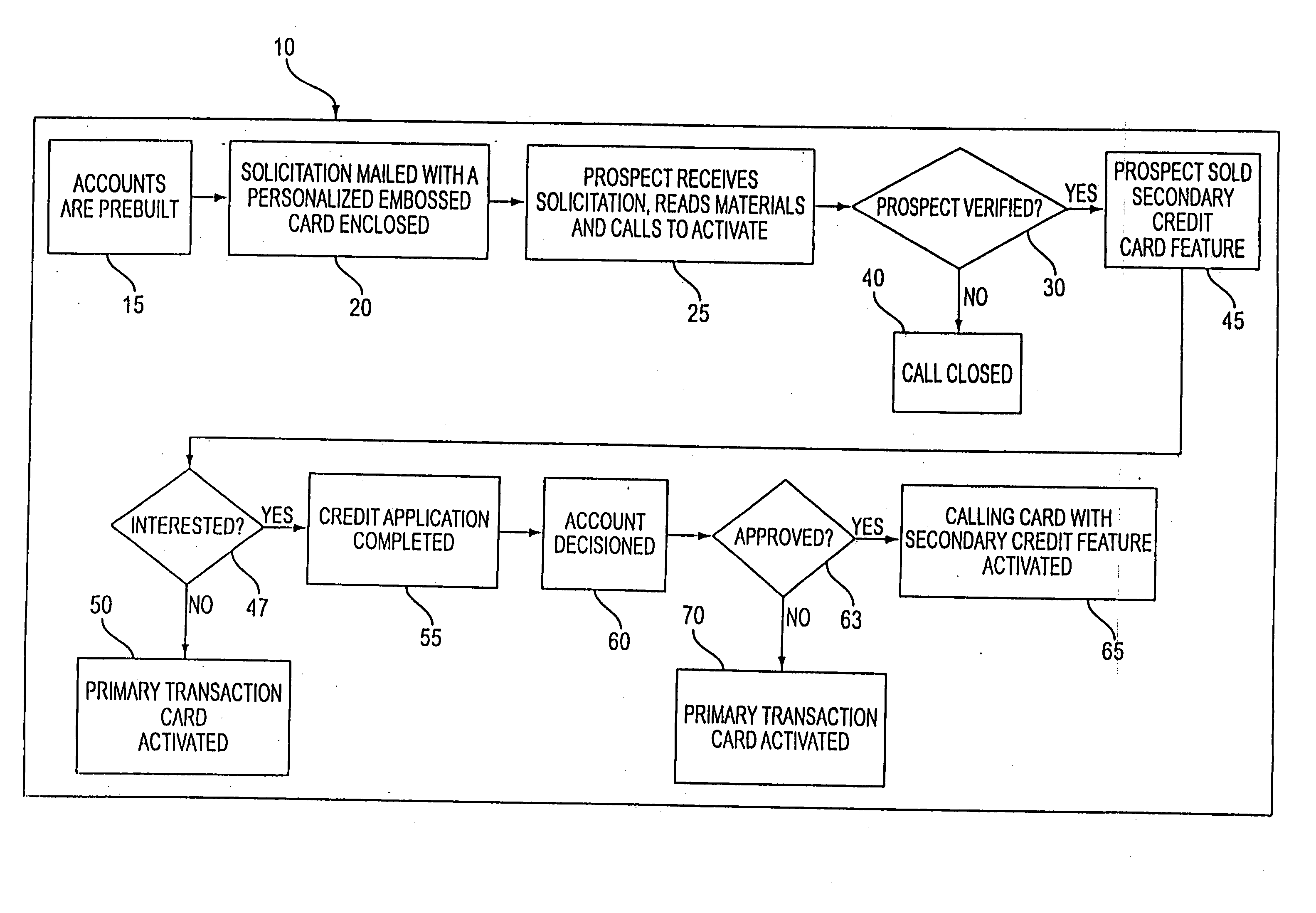

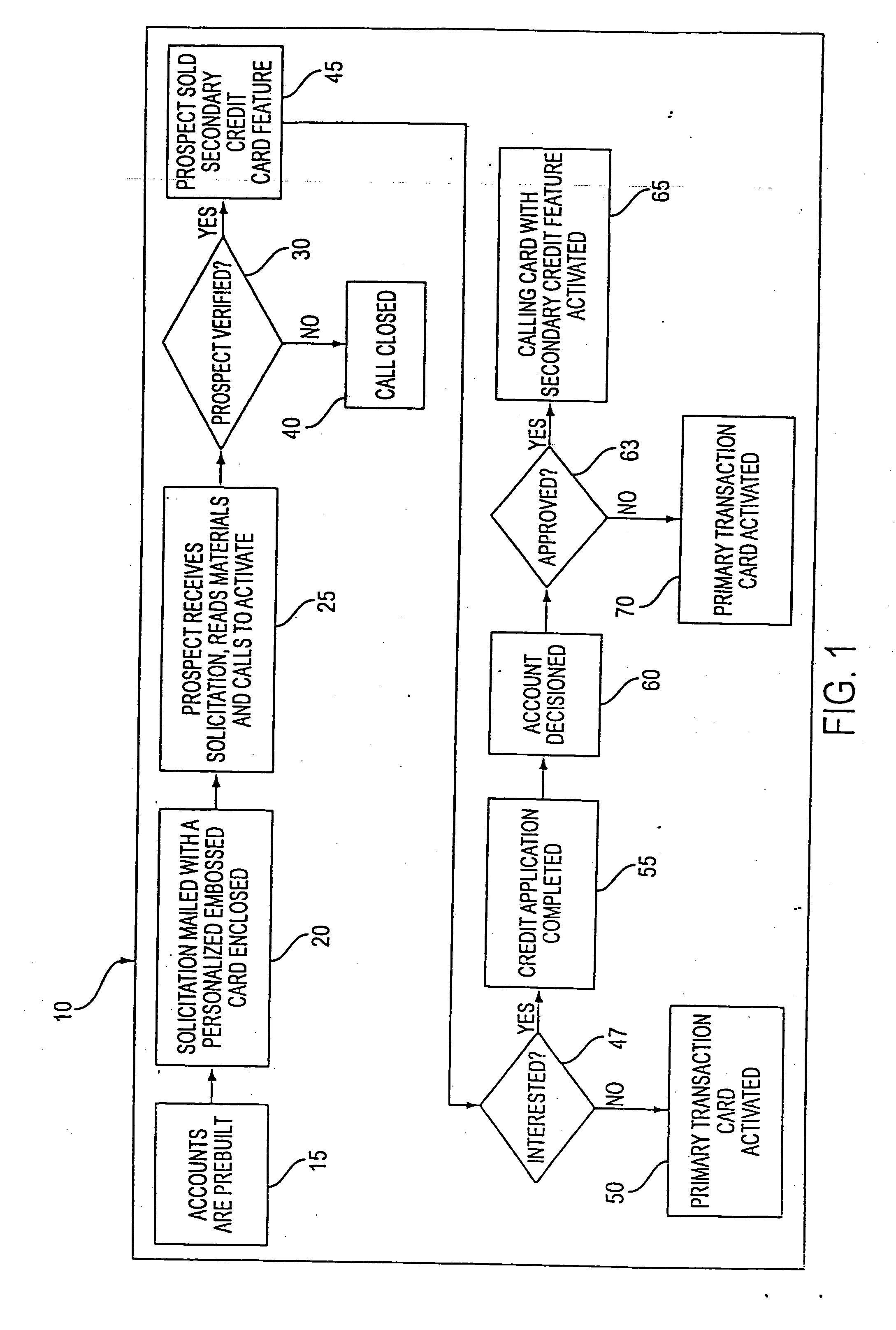

The Customer Activated Multi-Value (CAM) card provides a customer with a primary use as a transaction card which can be further activated to have a secondary use as a credit card. The CAM card can be activated as a transaction card or as a transaction card with a credit card feature. Activation of the CAM card as a transaction card allows the customer to purchase goods and services from one specific vendor and to establish a relationship with that vendor for the goods or services rendered (for example, telephone calling card or gasoline product purchasing card) while enjoying reward benefits based on those purchases. Activation of the credit feature of the card allows the customer to interact with any merchant that accepts traditional credit cards such as VISA®, MASTERCARD®, AMERICAN EXPRESS®, or DISCOVER®. The combination of features allows a customer to purchase various goods and services from several different merchants. If the customer chooses to activate the CAM card as both a transaction card and a credit card, the customer is given the benefit of using the card in both manners described above.

Owner:JPMORGAN CHASE BANK NA

Customer activated multi-value (CAM) card

InactiveUS7072864B2Easy to useCredit registering devices actuationDiscounts/incentivesCredit cardTelephone card

The Customer Activated Multi-Value (CAM) card provides a customer with a primary use as a transaction card which can be further activated to have a secondary use as a credit card. The CAM card can be activated as a transaction card or as a transaction card with a credit card feature. Activation of the CAM card as a transaction card allows the customer to purchase goods and services from one specific vendor and to establish a relationship with that vendor for the goods or services rendered (for example, telephone calling card or gasoline product purchasing card) while enjoying reward benefits based on those purchases. Activation of the credit feature of the card allows the customer to interact with any merchant that accepts traditional credit cards such as VISA®, MASTERCARD®, AMERICAN EXPRESS®, or DISCOVER®. The combination of features allows a customer to purchase various goods and services from several different merchants. If the customer chooses to activate the CAM card as both a transaction card and a credit card, the customer is given the benefit of using the card in both manners described above.

Owner:BANK ONE DELAWARE NAT ASSOC

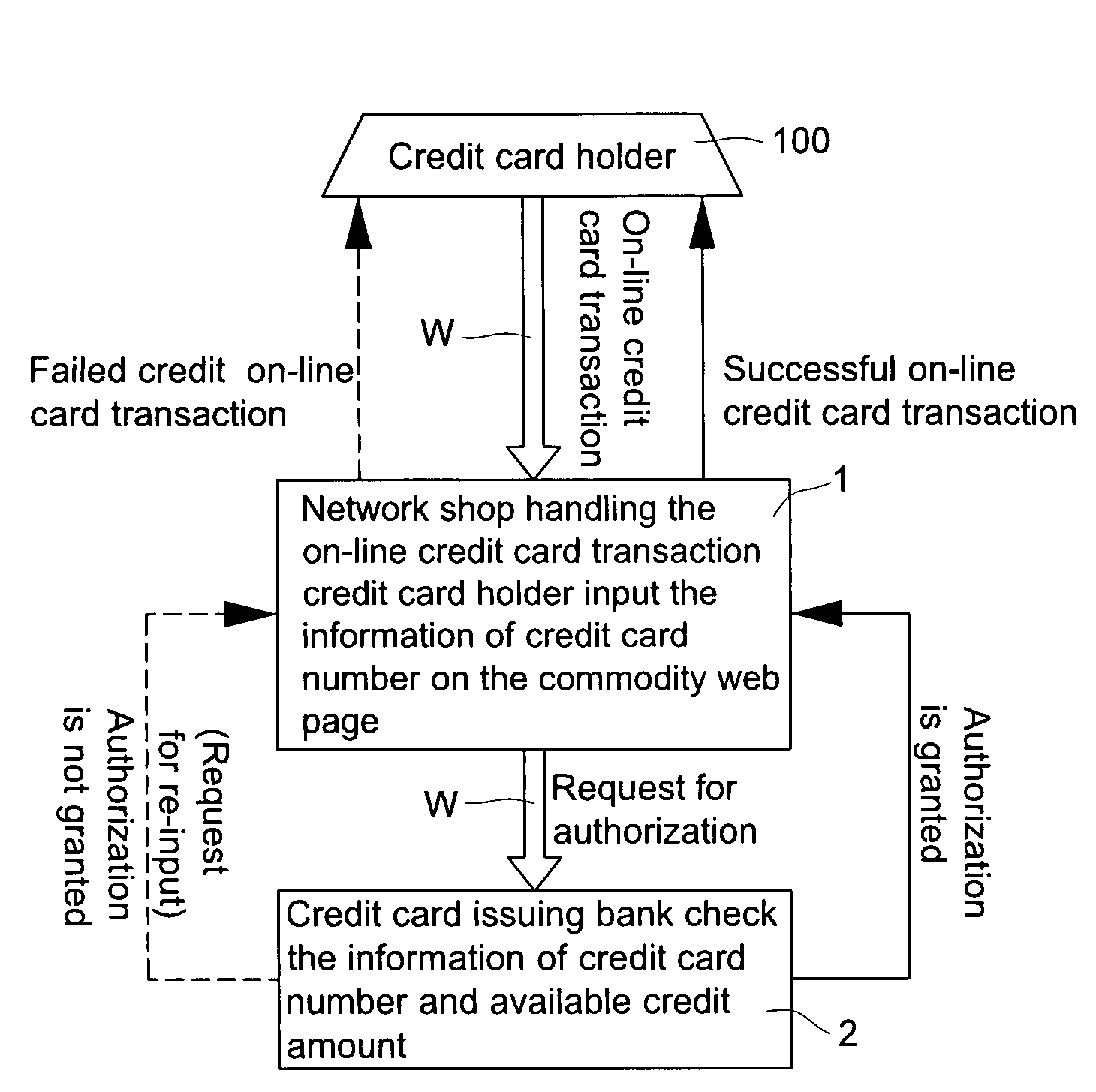

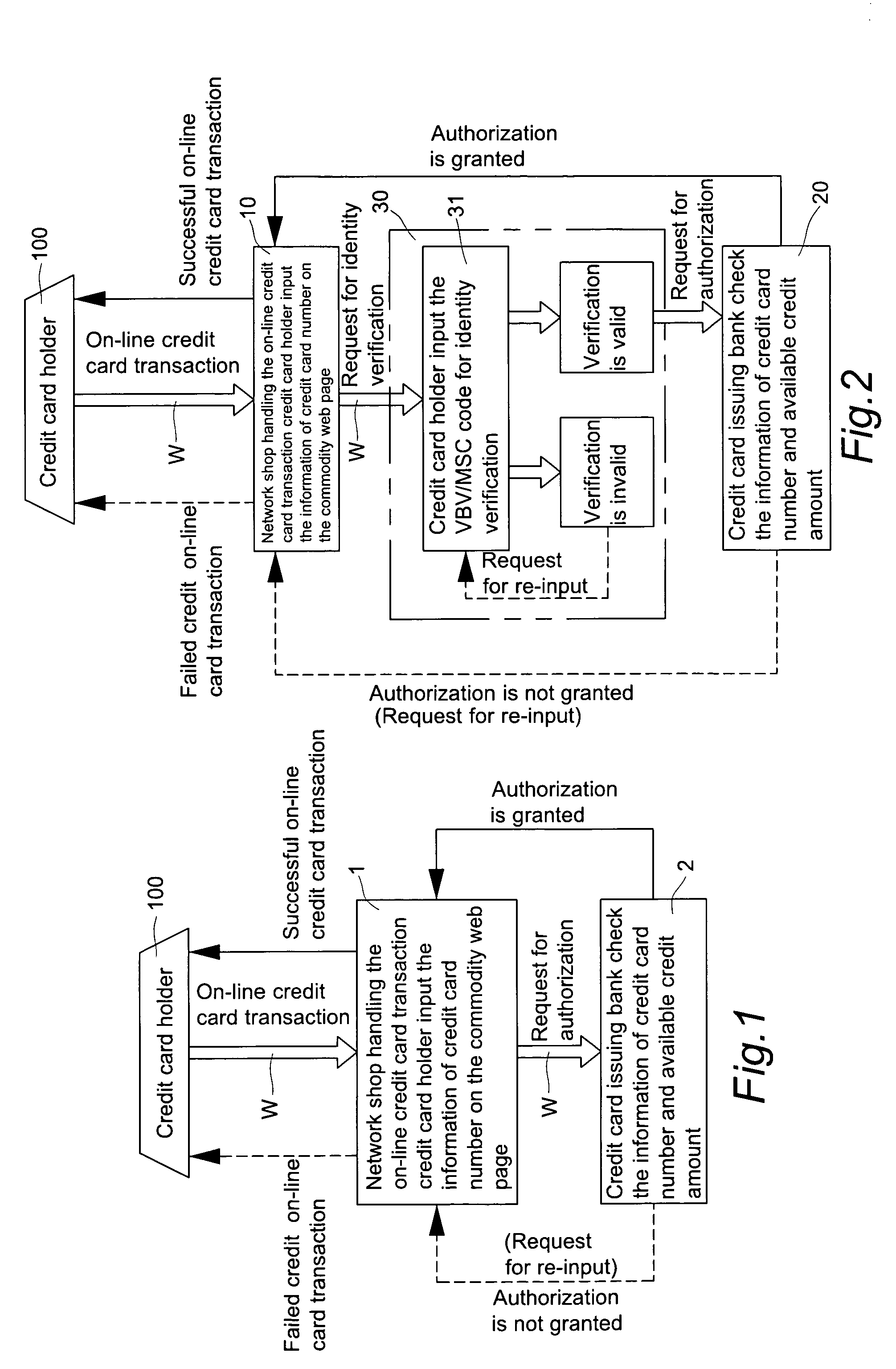

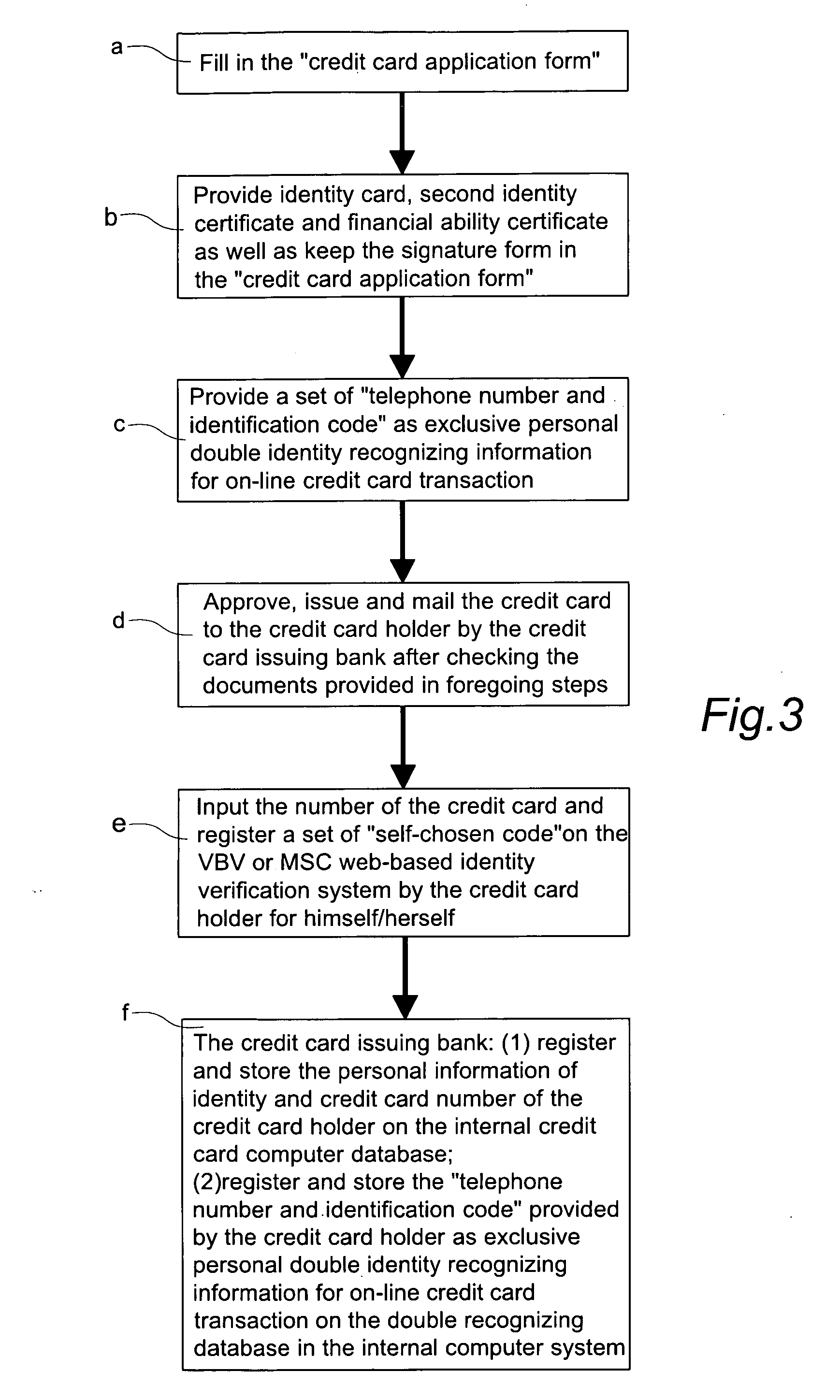

Double recognizing method by means of telephone number and identification code for online credit card transactions over the internet

The present invention relates to a “double recognizing method by means of telephone number and identification code for online credit card transactions over the internet,” in which the credit card holder not only registers a “self-chosen code” by himself / herself for VBV (Verified By VISA) or MSC (MasterCard SecureCode) network identity verification but also registers another set of “telephone number and identification code” by himself / herself for serving as an exclusive personal double identity recognizing information for online credit card transactions. The credit card issuing bank registers and stores the set of “telephone number and identification code” on a double recognizing database after checking truth of the related identity certificate provided by the credit card holder. When the credit card issuing bank handles the online credit card transaction of the credit card holder over the network, the credit card issuing bank not only proceeds the check on the “self-chosen code” used in the original VBV or MSC verification system but also performs the double check on the “telephone number and identification code” used in the telecommunications transceiving processor platform of the internal credit card double recognizing computer system, for example by sending out a short message to the credit card holder for requesting him / her to immediately reply by another short message to his / her “telephone number and identification code.”

Owner:LIN CHUNG YU

Customer activated multi-value (CAM) card

The Customer Activated Multi-Value (CAM) card provides a customer with a primary use as a transaction card which can be further activated to have a secondary use as a credit card. The CAM card can be activated as a transaction card or as a transaction card with a credit card feature. Activation of the CAM card as a transaction card allows the customer to purchase goods and services from one specific vendor and to establish a relationship with that vendor for the goods or services rendered (for example, telephone calling card or gasoline product purchasing card) while enjoying reward benefits based on those to purchases. Activation of the credit feature of the card allows the customer to interact with any merchant that accepts traditional credit cards such as VISA®, MASTERCARD®, AMERICAN EXPRESS®, or DISCOVER®. The combination of features allows a customer to purchase various goods and services from several different merchants. If the customer chooses to activate the CAM card as both a transaction card and a credit card, the customer is given the benefit of using the card in both manners described above.

Owner:JPMORGAN CHASE BANK NA

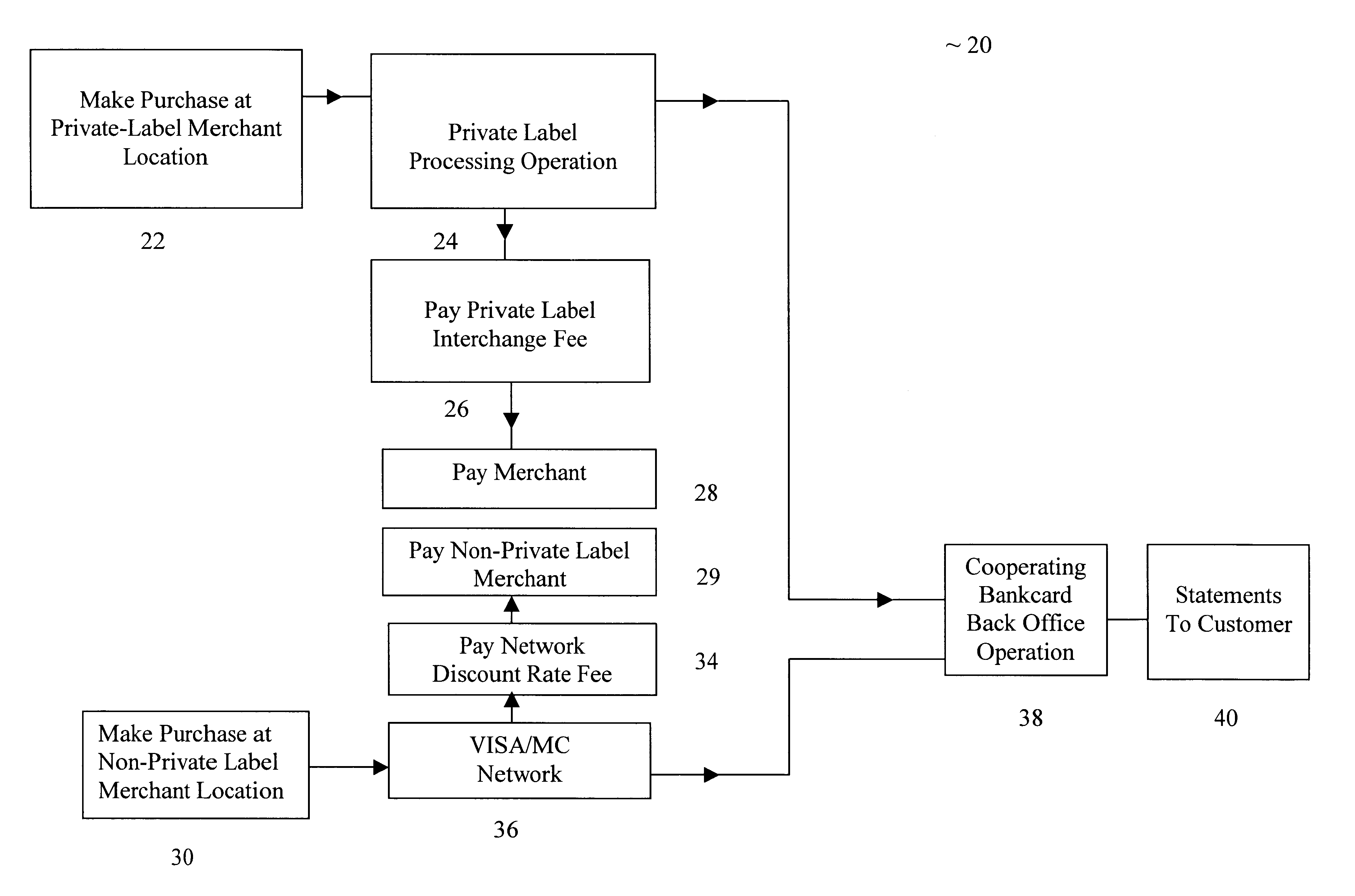

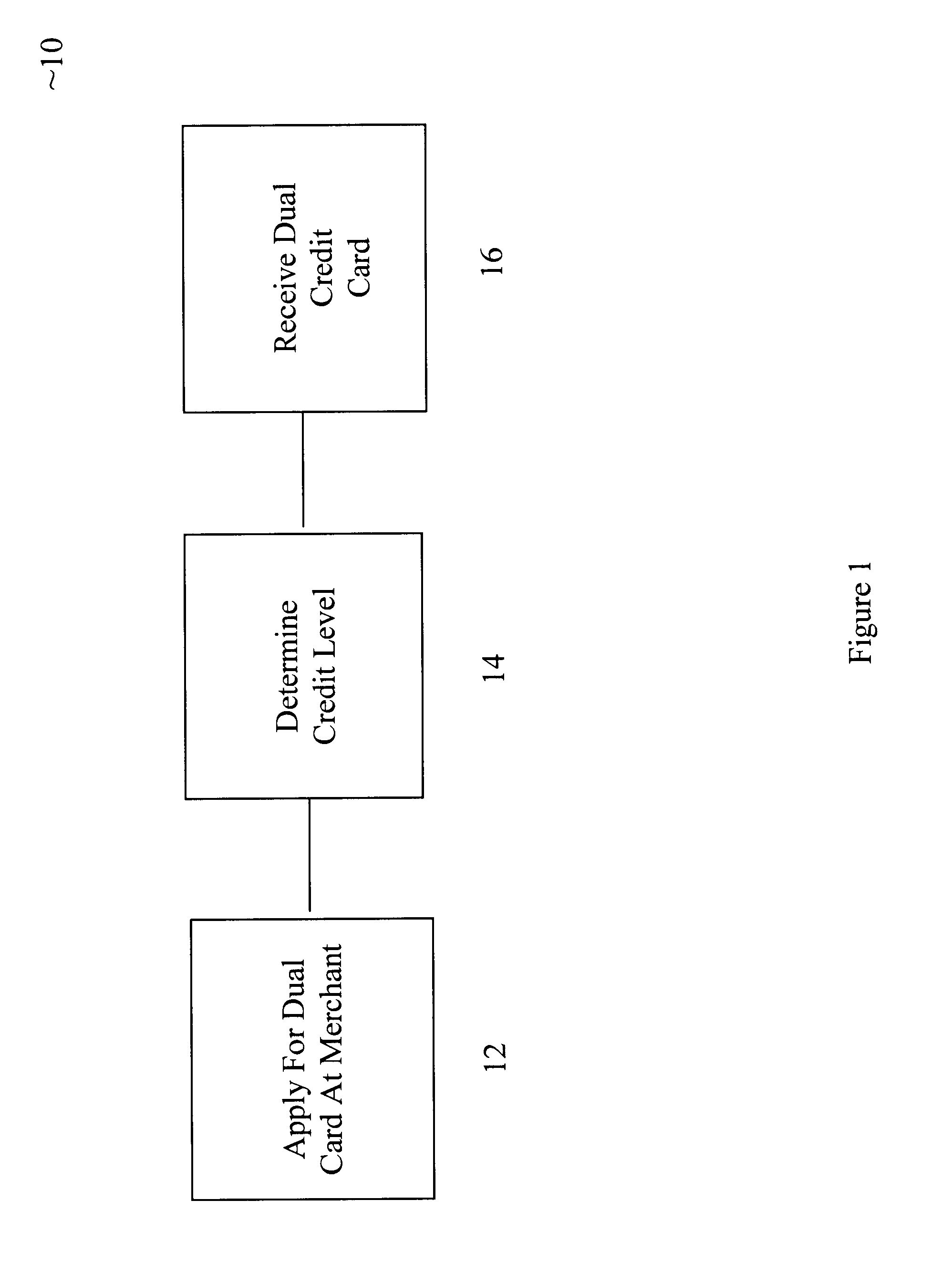

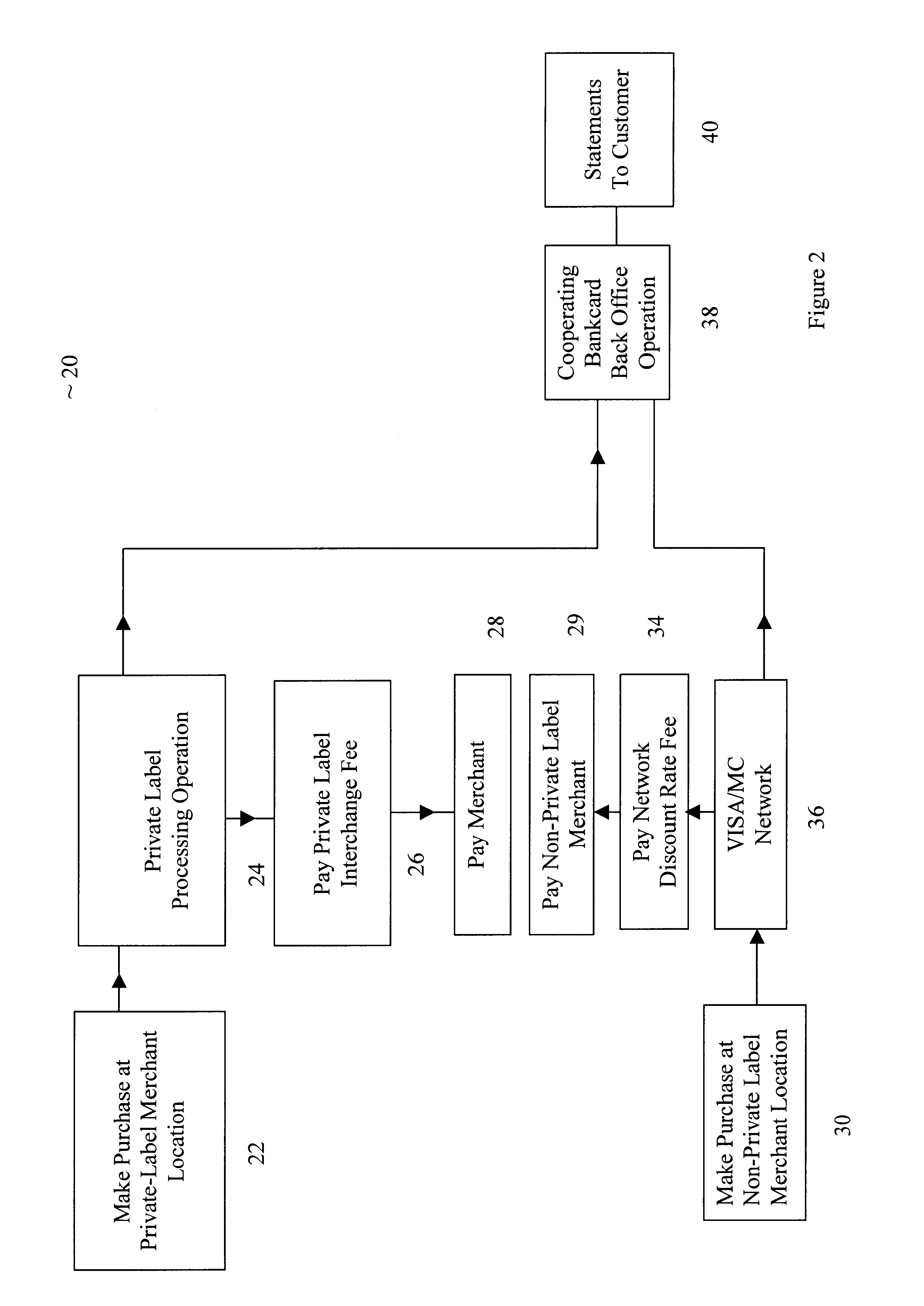

Method for dual credit card system

A dual credit card system is in two parts: a) the creation of a dual credit card; and b) the usage of a dual credit card. The creation begins with the receipt of an application by merchant for a dual credit card. The issuing organization issues the dual credit card to the applicant. The user may make a purchase with the dual credit card at either a private label merchant location or at a location accepting the bankcard. These locations may traditional physical locations, a web site on the Internet or a catalog. When a purchase is made at a merchant location, the processing of the merchant location dual credit card purchase is done via a private-label processing channel. If the user uses the dual credit card at a non-merchant location, the purchase may be processed through the VISA / MasterCard network.

Owner:SYNCHRONY BANK

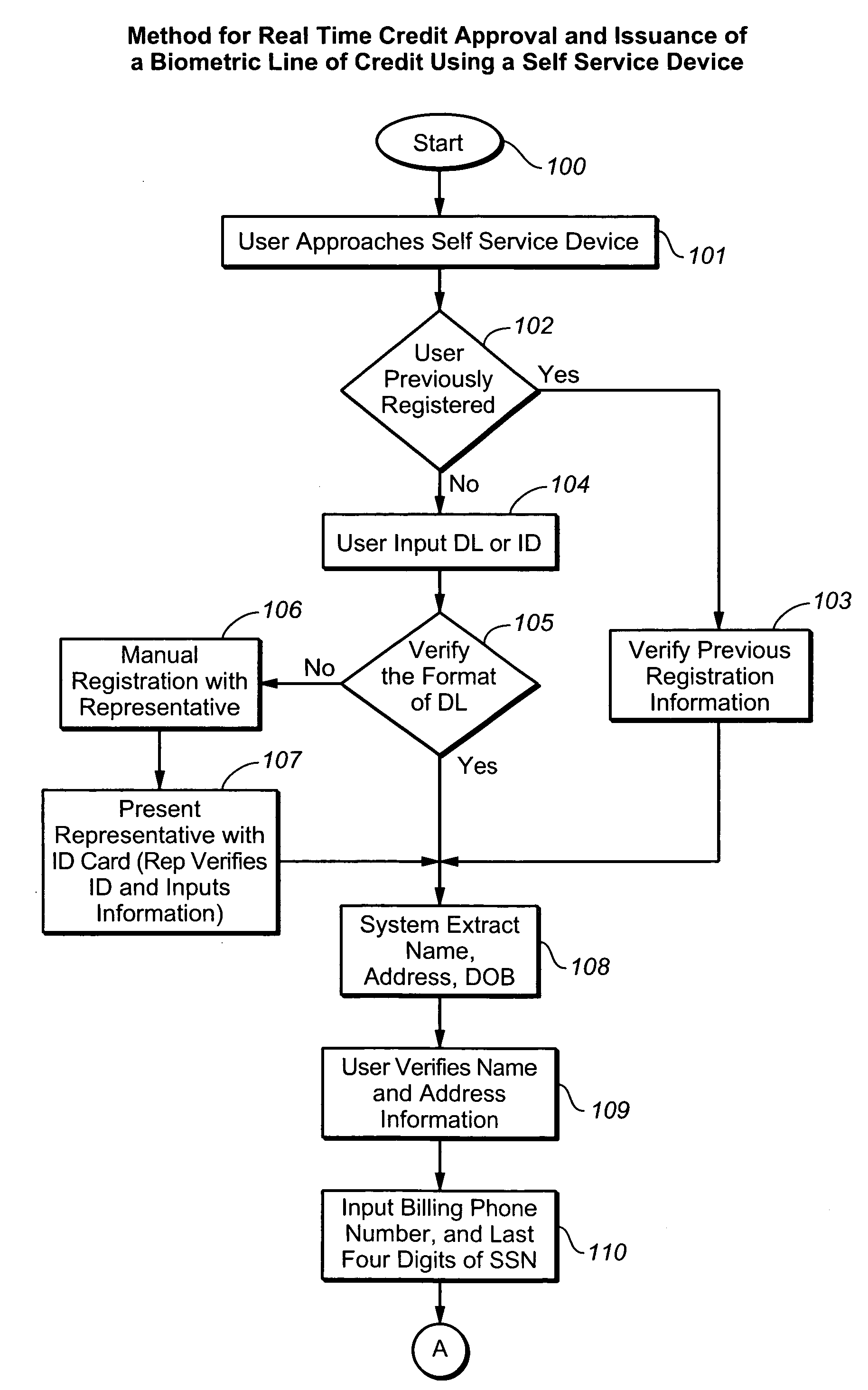

Methods and systems for performing tokenless financial transactions over a transaction network using biometric data

InactiveUS20060064380A1Simplify the search processFinanceProtocol authorisationBiometric dataFinancial transaction

Systems and methods for performing tokenless financial transactions over a transaction network using biometric data. Financial transactions are completed without tokens, such as credit cards, debit cards, magnetic stripe cards, smart cards, RFID devices, and the like. A customer's identity is authenticated and the transaction is accepted by the customer using biometric information obtained at the point of sale from the customer by means of a point of sale terminal. In preferred embodiments, the customer's biometric information never leaves the point of sale terminal, but, rather, is authenticated over a transaction network in conjunction with a server that holds reference templates of the customer's biometric information, as well as account information. Transactions may be authorized directly by a participating financial institution or indirectly through payment networks such as Visa® and MasterCard®.

Owner:GOLDFINGER BIOMETRIC SERVICES CORP

Customer activated multi-value (CAM) card

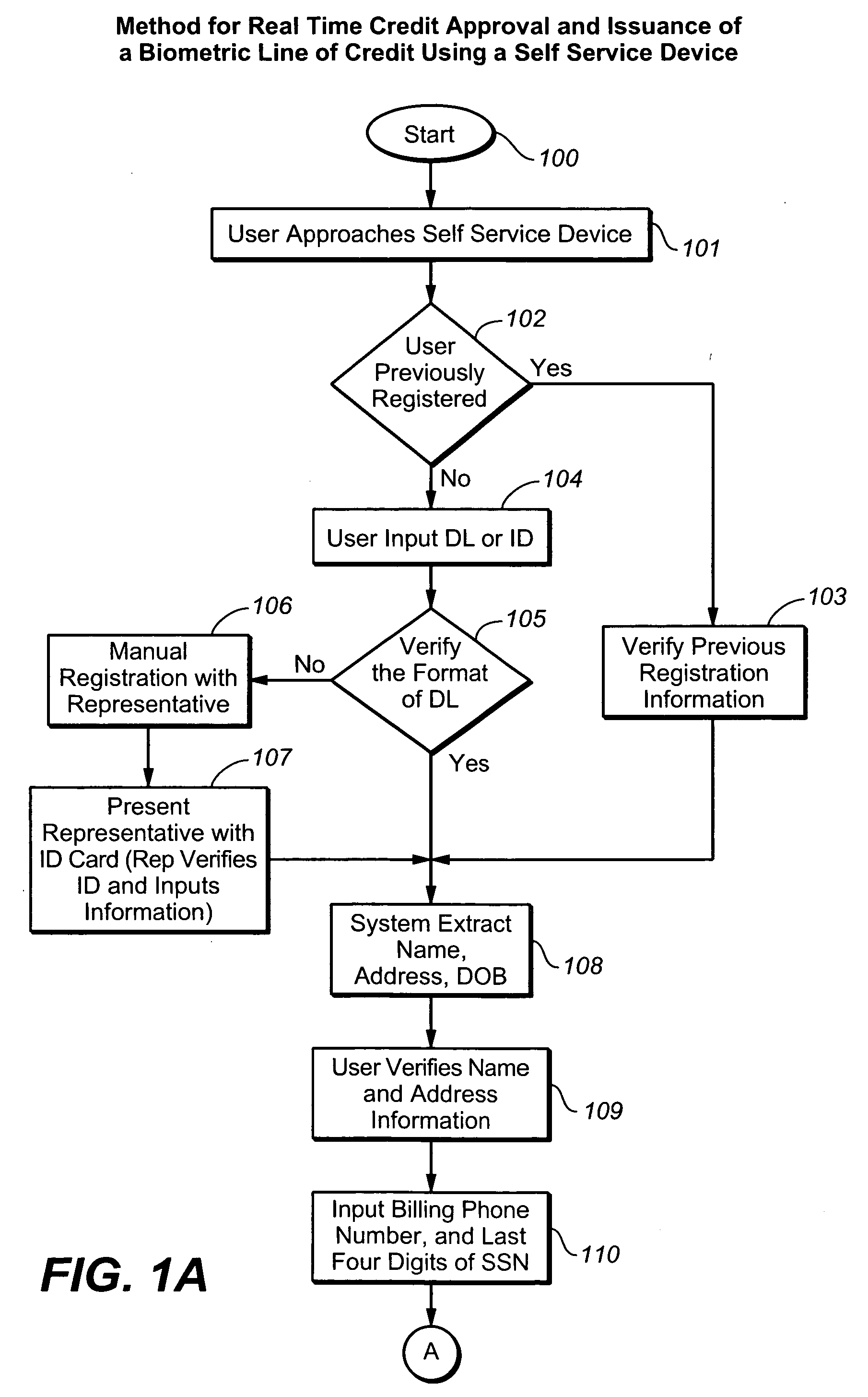

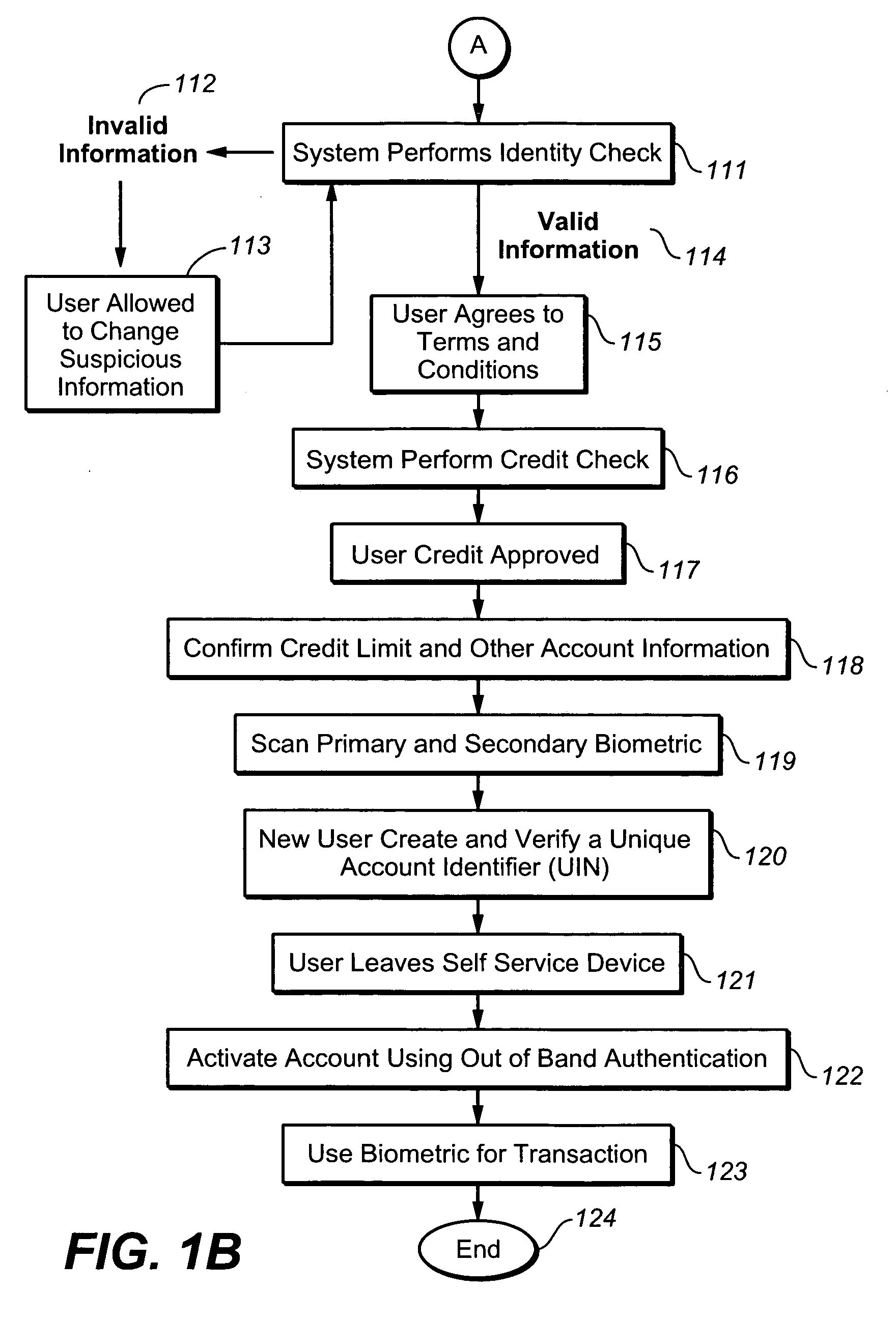

InactiveUS20050086167A1Easy to useComplete banking machinesCredit registering devices actuationComputer hardwareCredit card

The Customer Activated Multi-Value (CAM) card provides a customer with a primary use as a transaction card which can be further activated to have a secondary use as a credit card. The CAM card can be activated as a transaction card or as a transaction card with a credit card feature. Activation of the CAM card as a transaction card allows the customer to purchase goods and services from one specific vendor and to establish a relationship with that vendor for the goods or services rendered (for example, telephone calling card or gasoline product purchasing card) while enjoying reward benefits based on those purchases. Activation of the credit feature of the card allows the customer to interact with any merchant that accepts traditional credit cards such as VISA®, MASTERCARD®, AMERICAN EXRESS®, or DISCOVER®. The combination of features allows a customer to purchase various goods and services from several different merchants. If the customer chooses to activate the CAM card as both a transaction card and a credit card, the customer is given the benefit of using the card in both manners described above.

Owner:JPMORGAN CHASE BANK NA

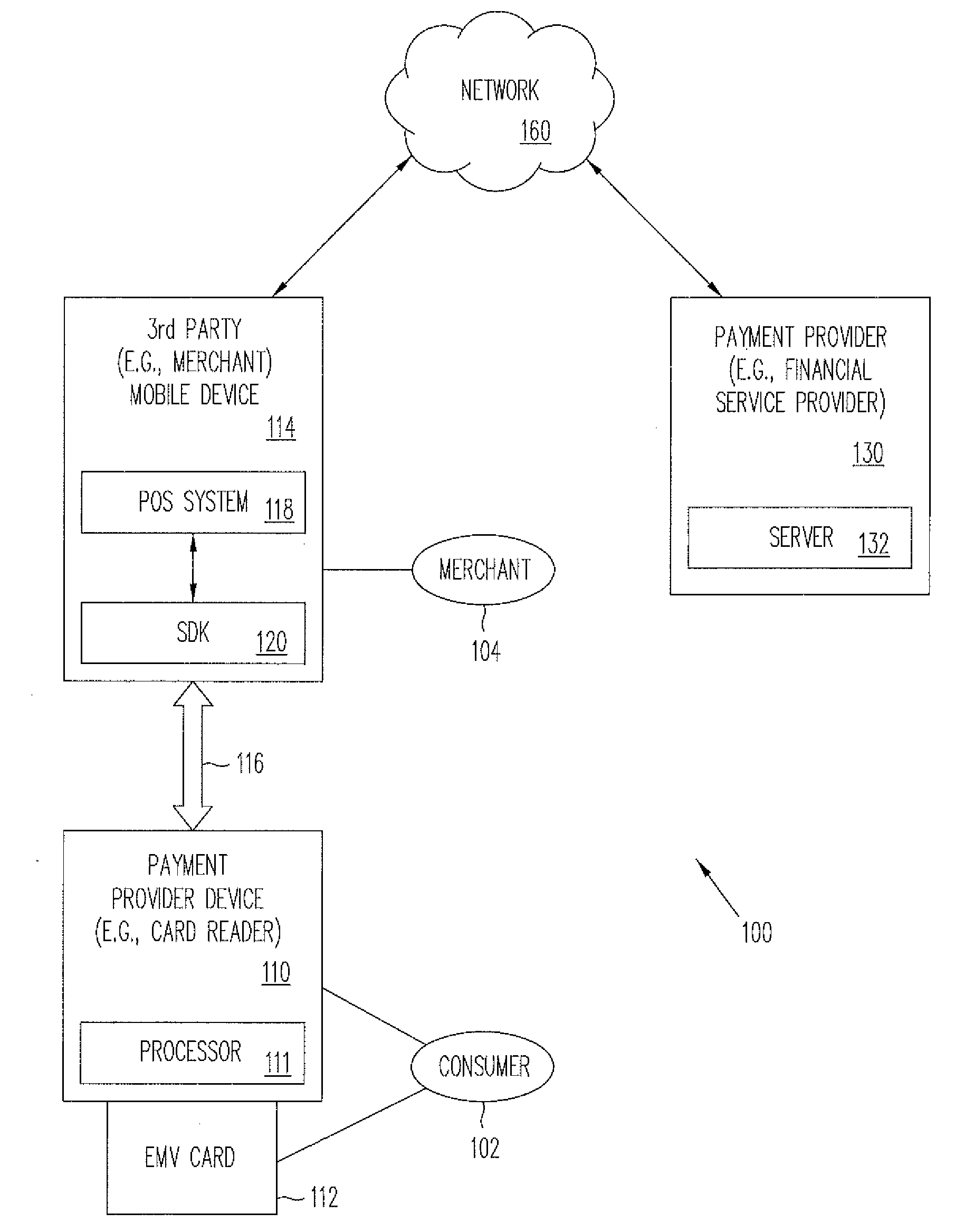

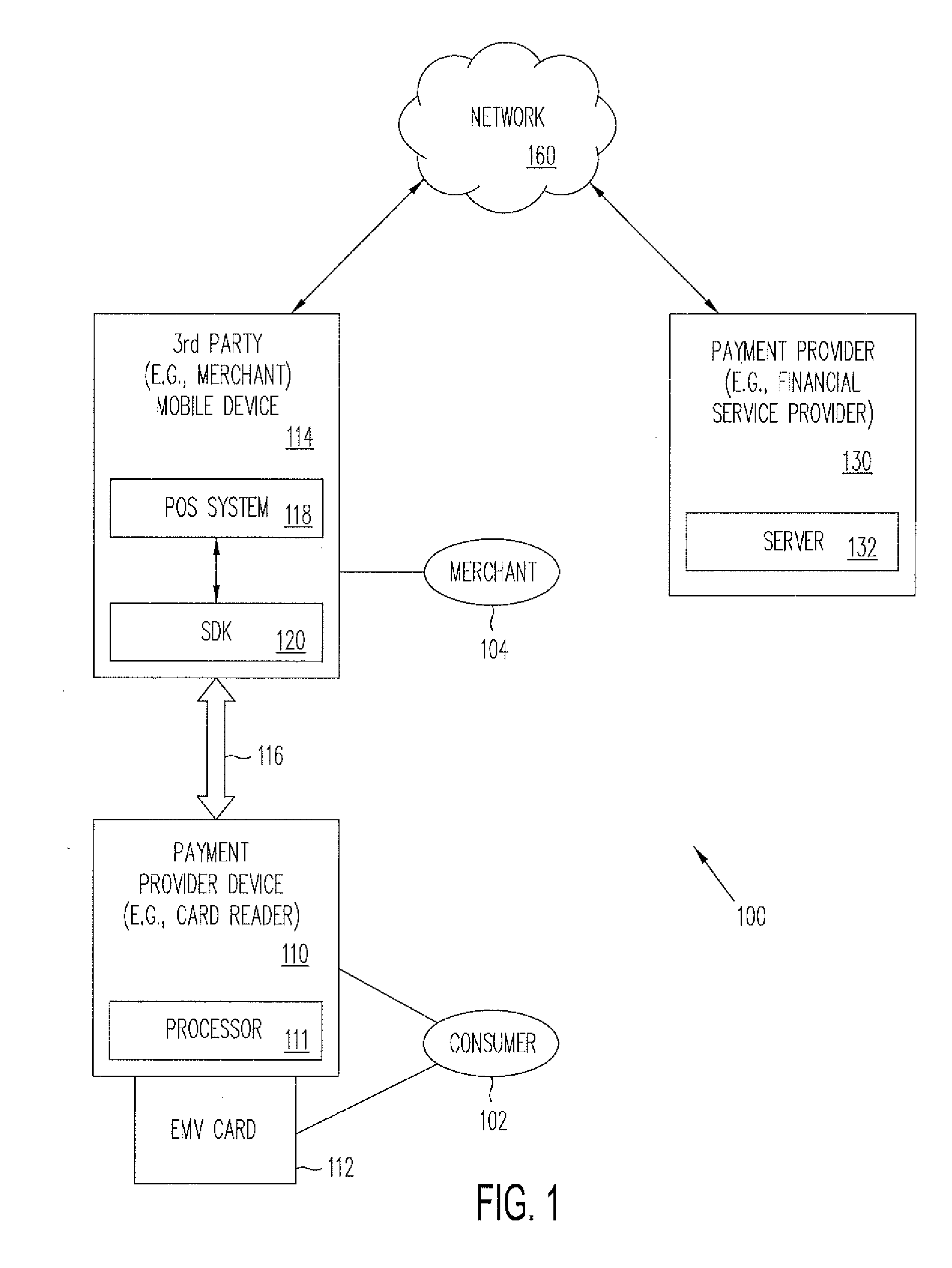

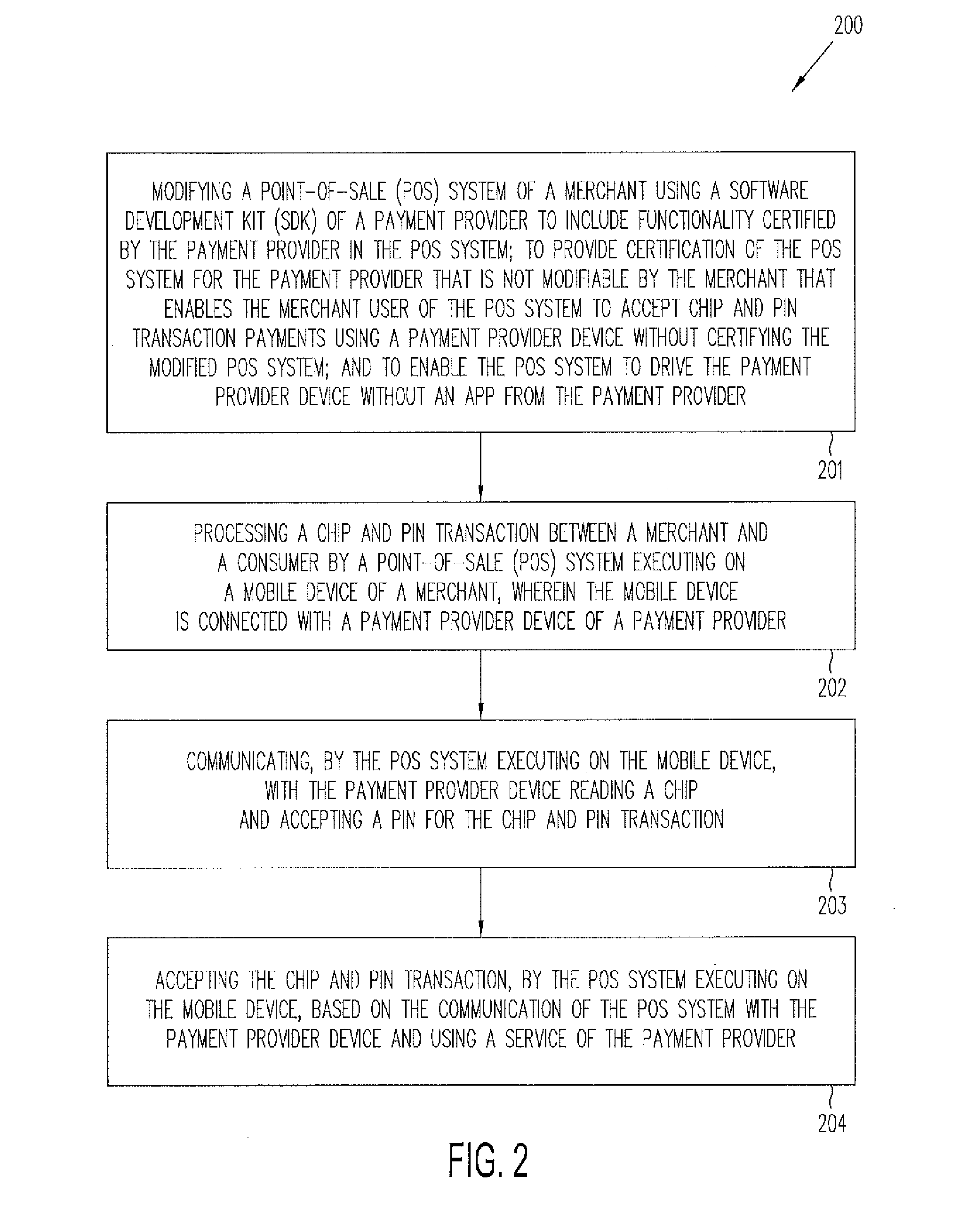

Systems and methods for emv chip and pin payments

In transactions between a consumer and a merchant (or other third party) using services of a payment provider (e.g., credit card company, or financial services provider), methods and systems are provided for enabling any third party to accept chip and PIN payment and payment provider services using a payment provider device that is enabled using the third party's own application (referred to herein as “app”) and not the app of the payment provider. Enabling a merchant to accept chip and PIN payments usually requires the merchant to certify (accredit) their application (e.g., a point-of-sale (POS) system) end to end with the payment providers (e.g., Visa, MasterCard). A software development kit (SDK) modification to the application allows the merchant to accept chip and PIN cards the without the need to certify the application. The SDK includes the functionality that needs to be certified, and certifies it once with a service provider.

Owner:PAYPAL INC

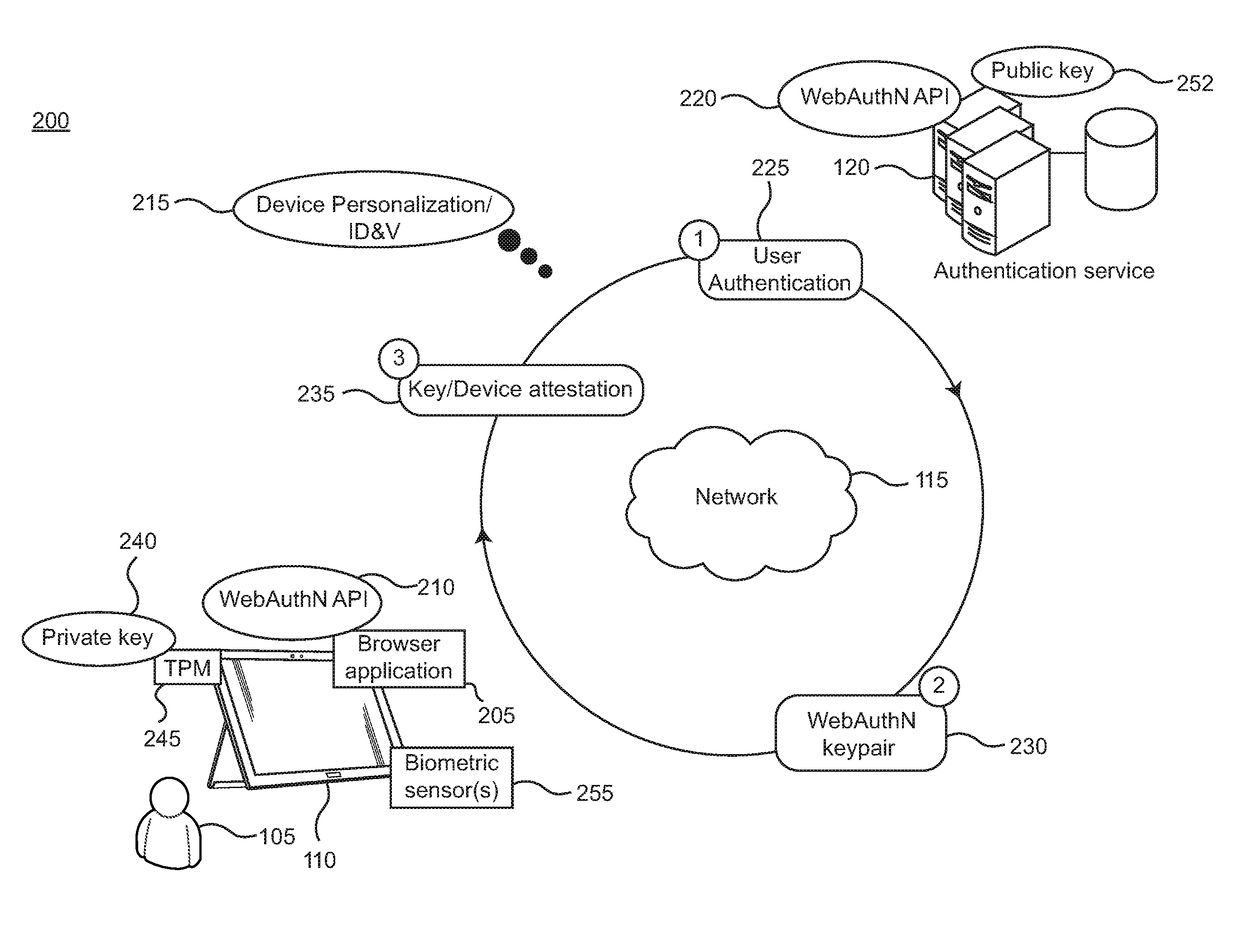

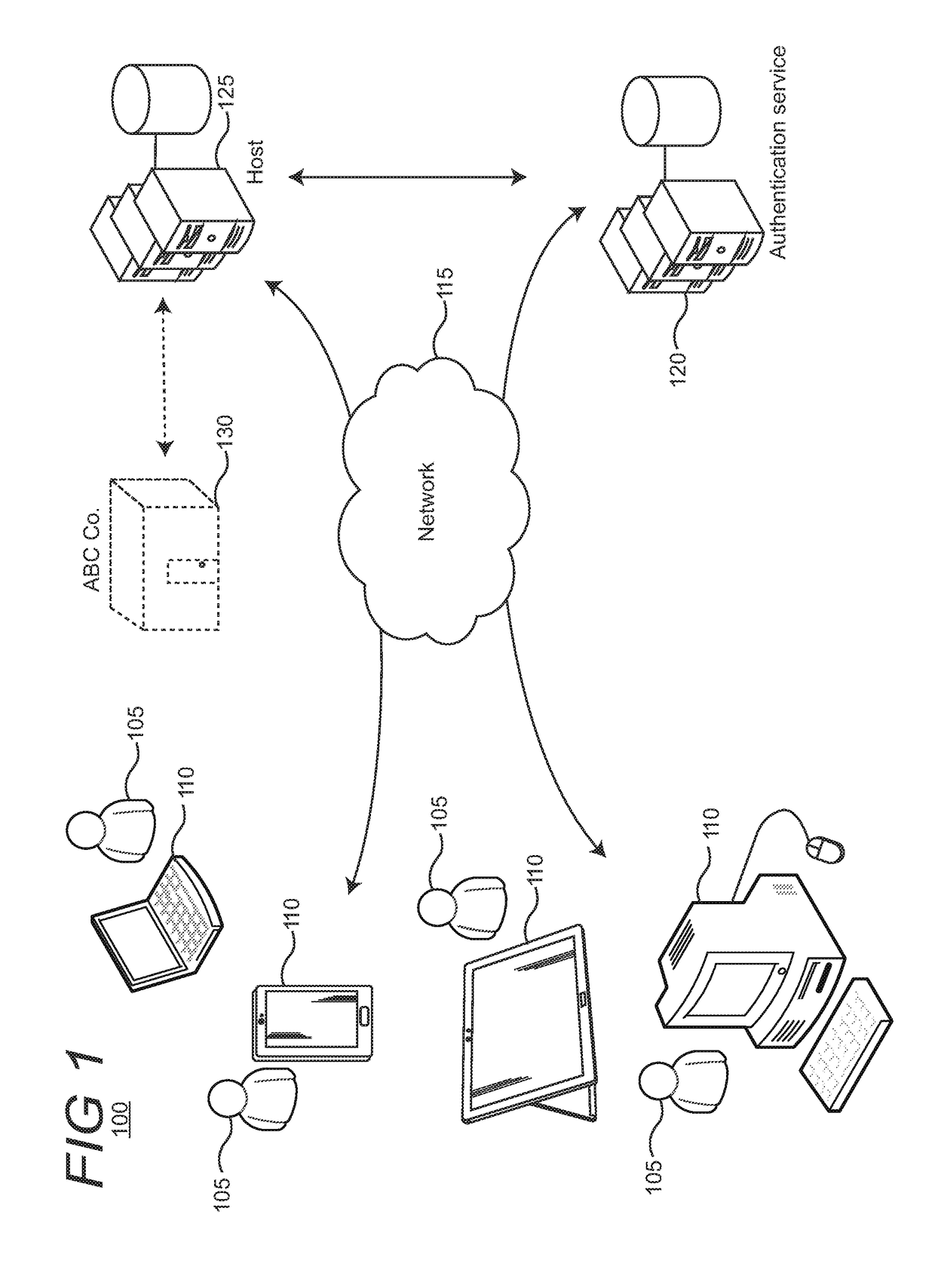

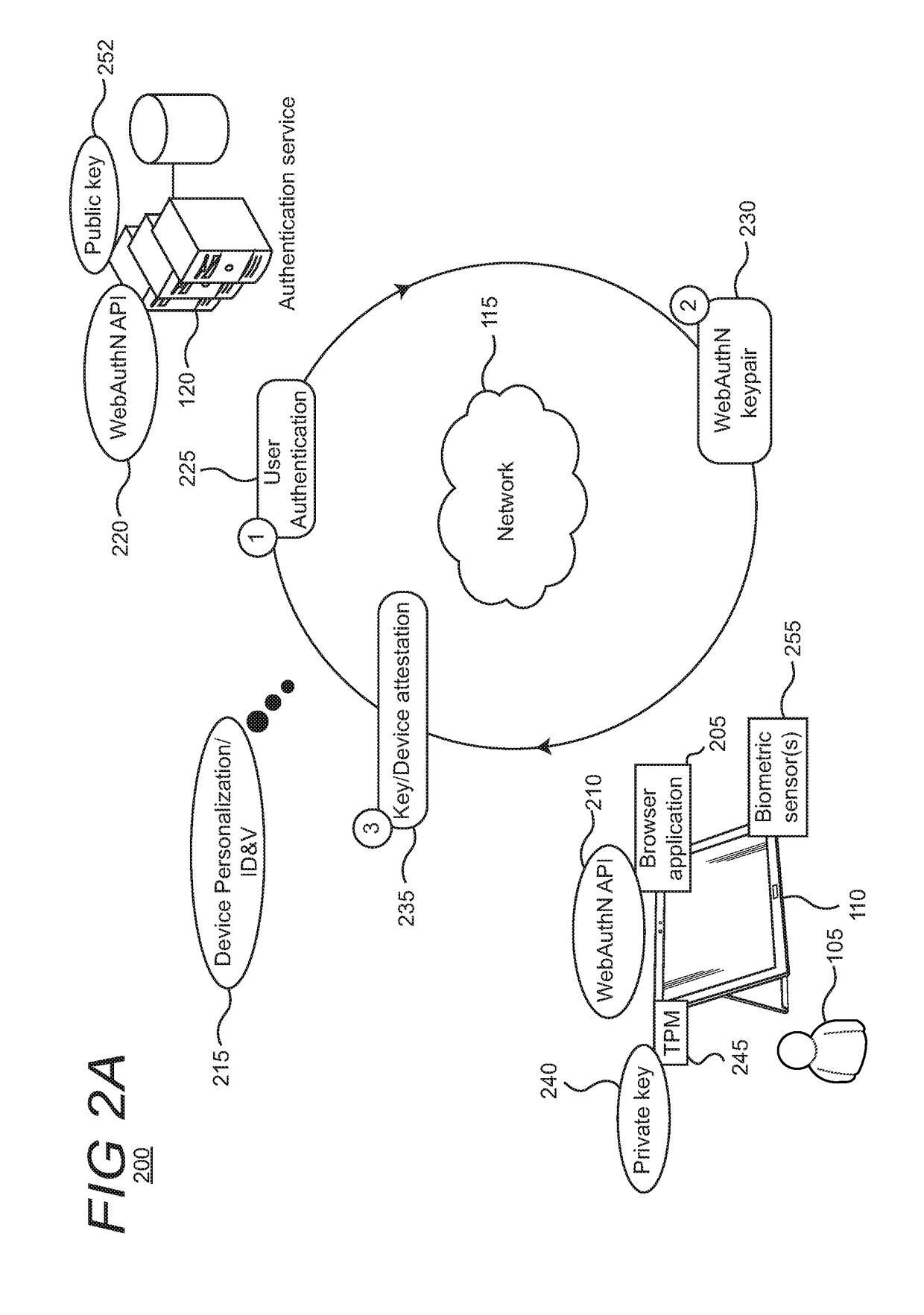

User and device authentication for web applications

InactiveUS20180101850A1Improve bindingImprove securityDigital data authenticationTransmissionComputer hardwareWeb application

A computing device supports a Web Authentication (WebAuthN) application program interface (API) that is configured to exposes functionalities that may substitute for those utilized in the EMV (Europay, Mastercard, and Visa) standard for transactions using smart payment instruments like debit and credit cards that include embedded computer chips. The functionality of the WebAuthN-compliant computing device is analogous to a physical card in the conventional chip and PIN (personal identification number) where the chip serves as proof of payment device and the PIN as proof of payment account holder.

Owner:MICROSOFT TECH LICENSING LLC

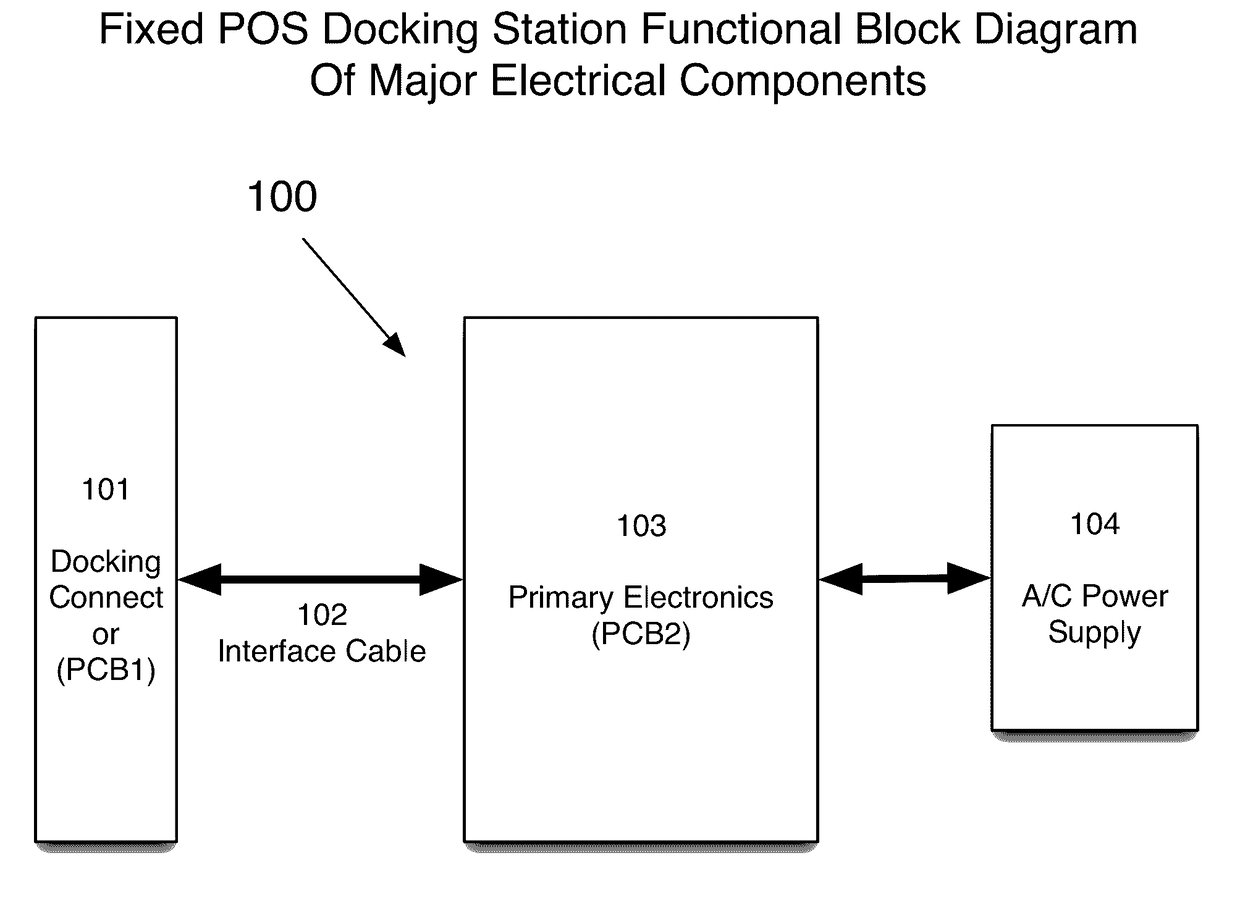

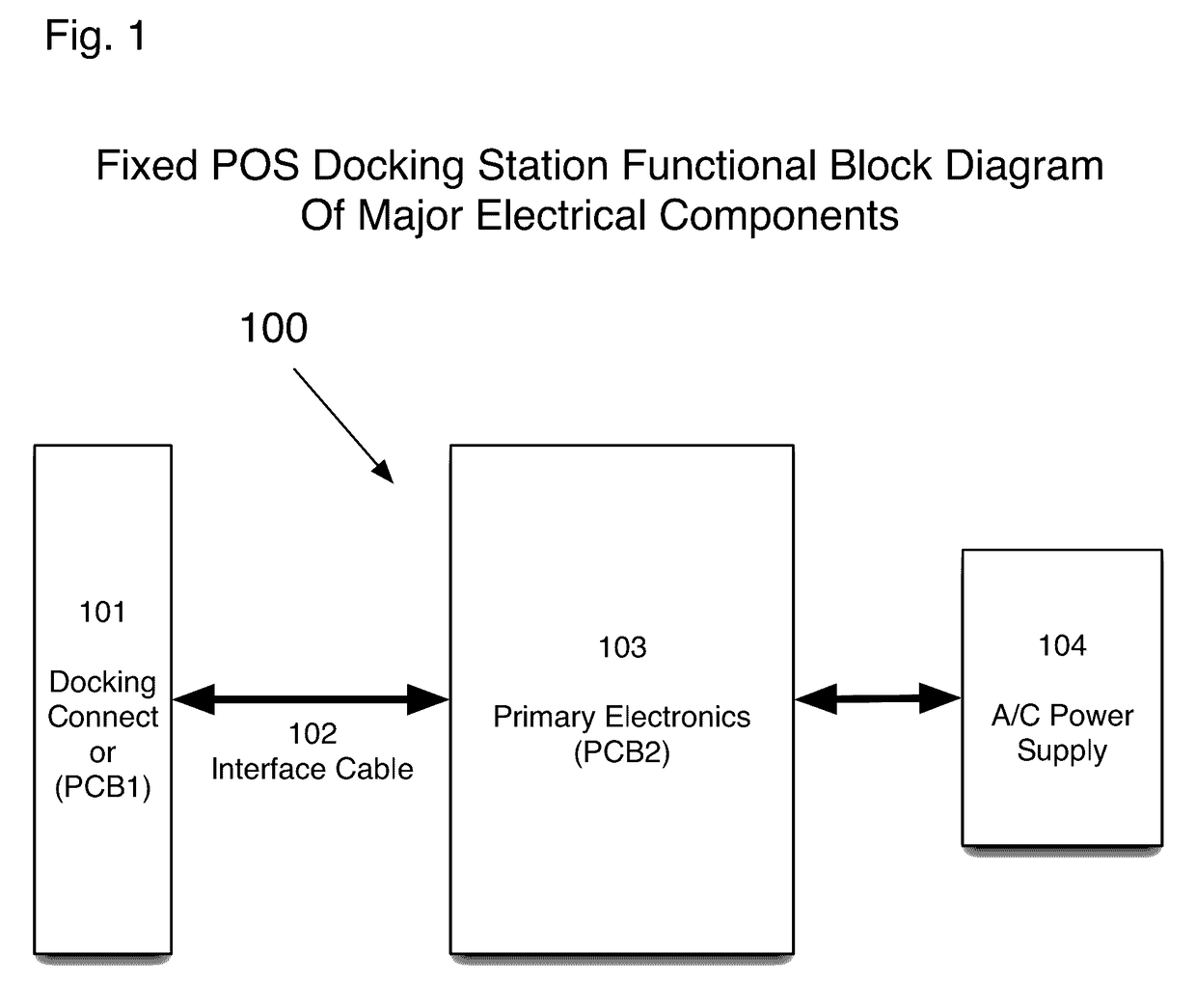

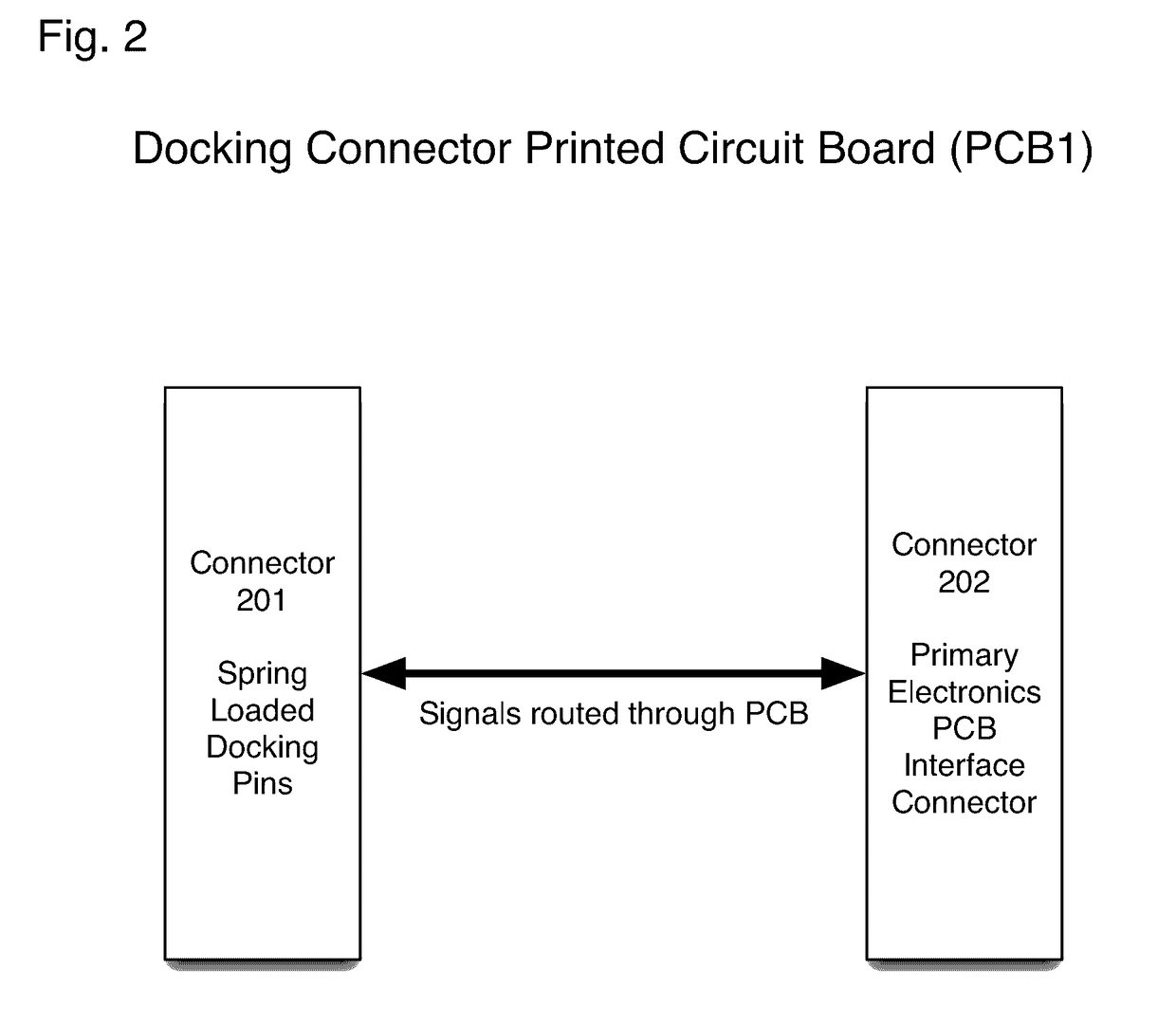

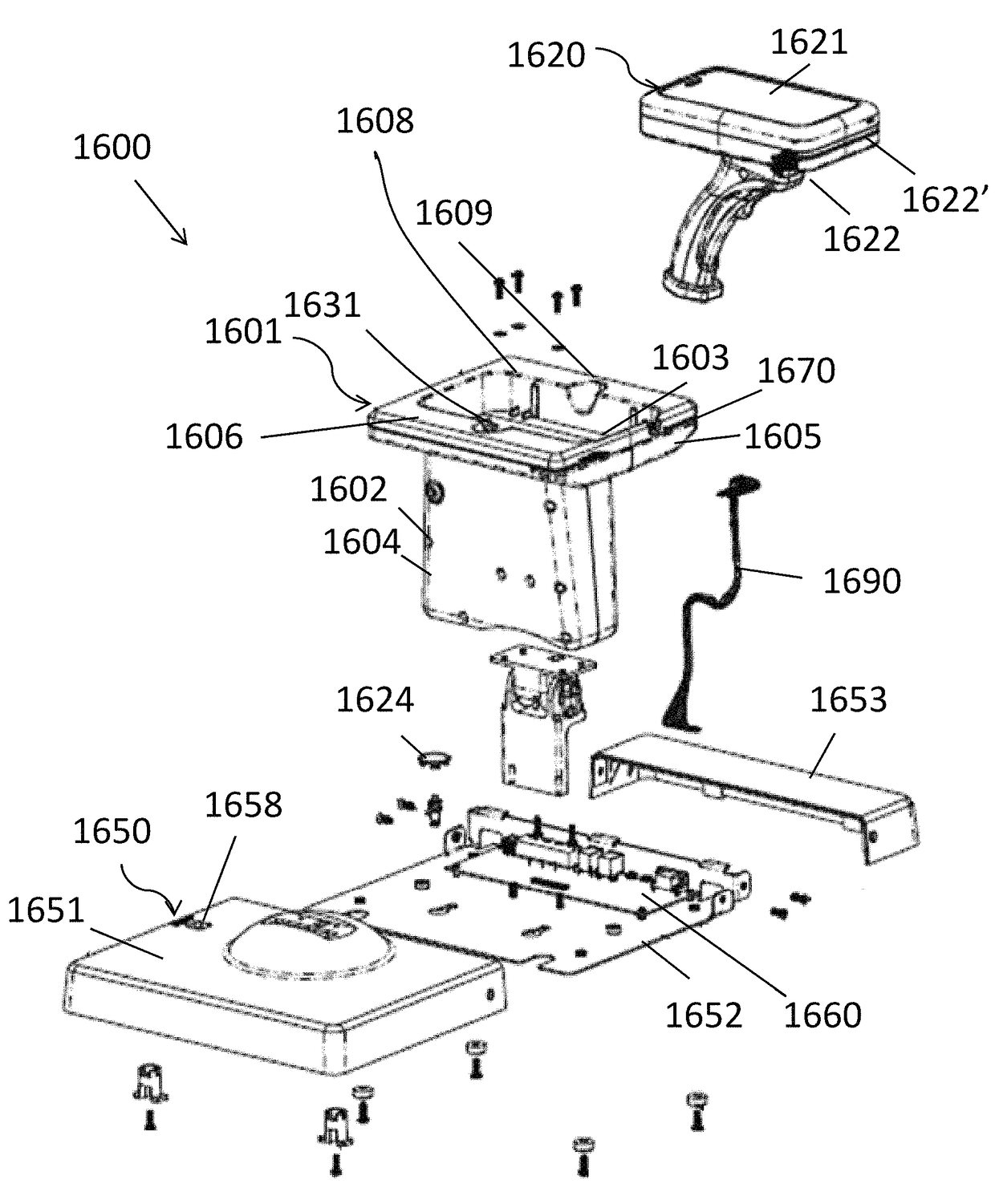

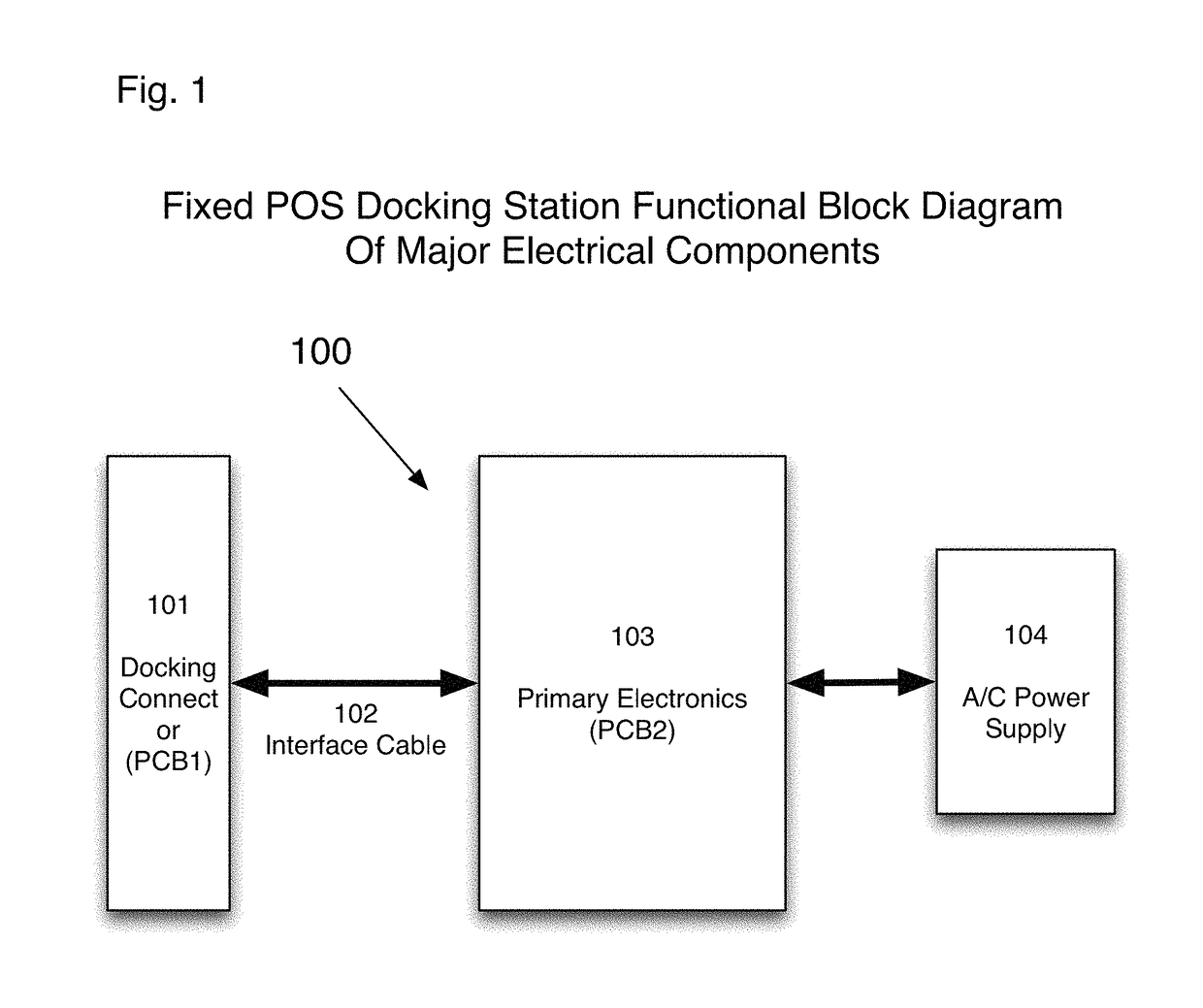

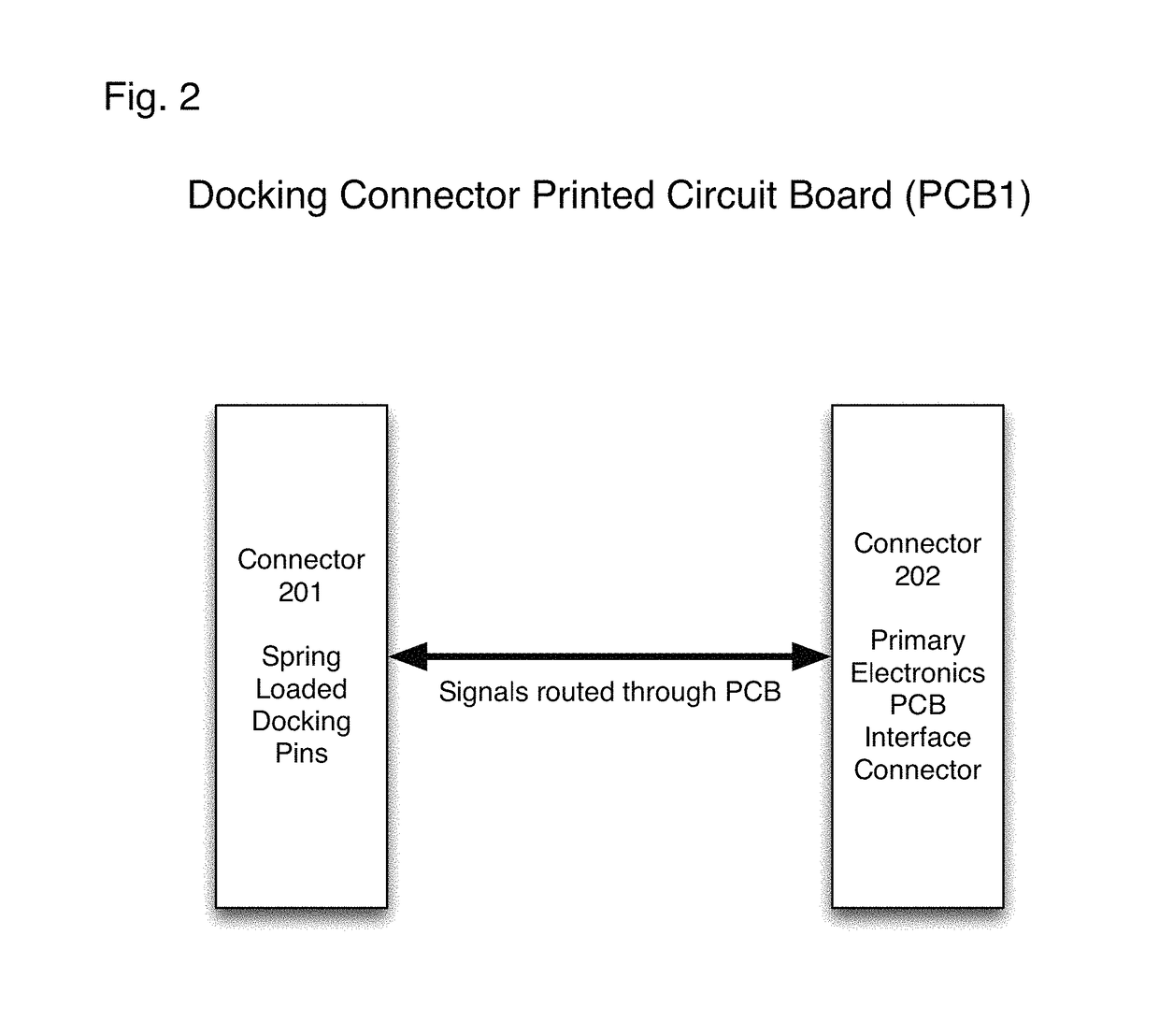

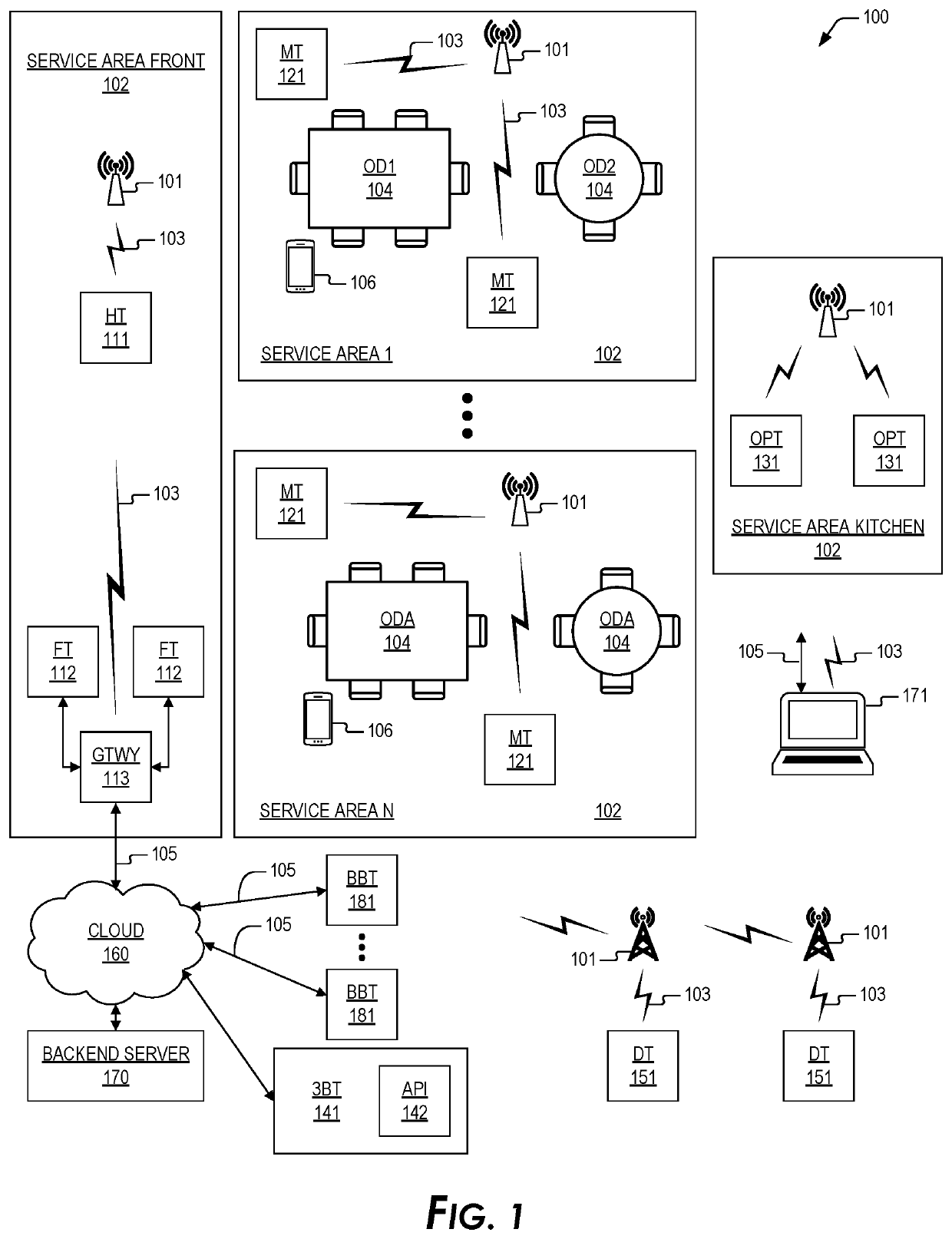

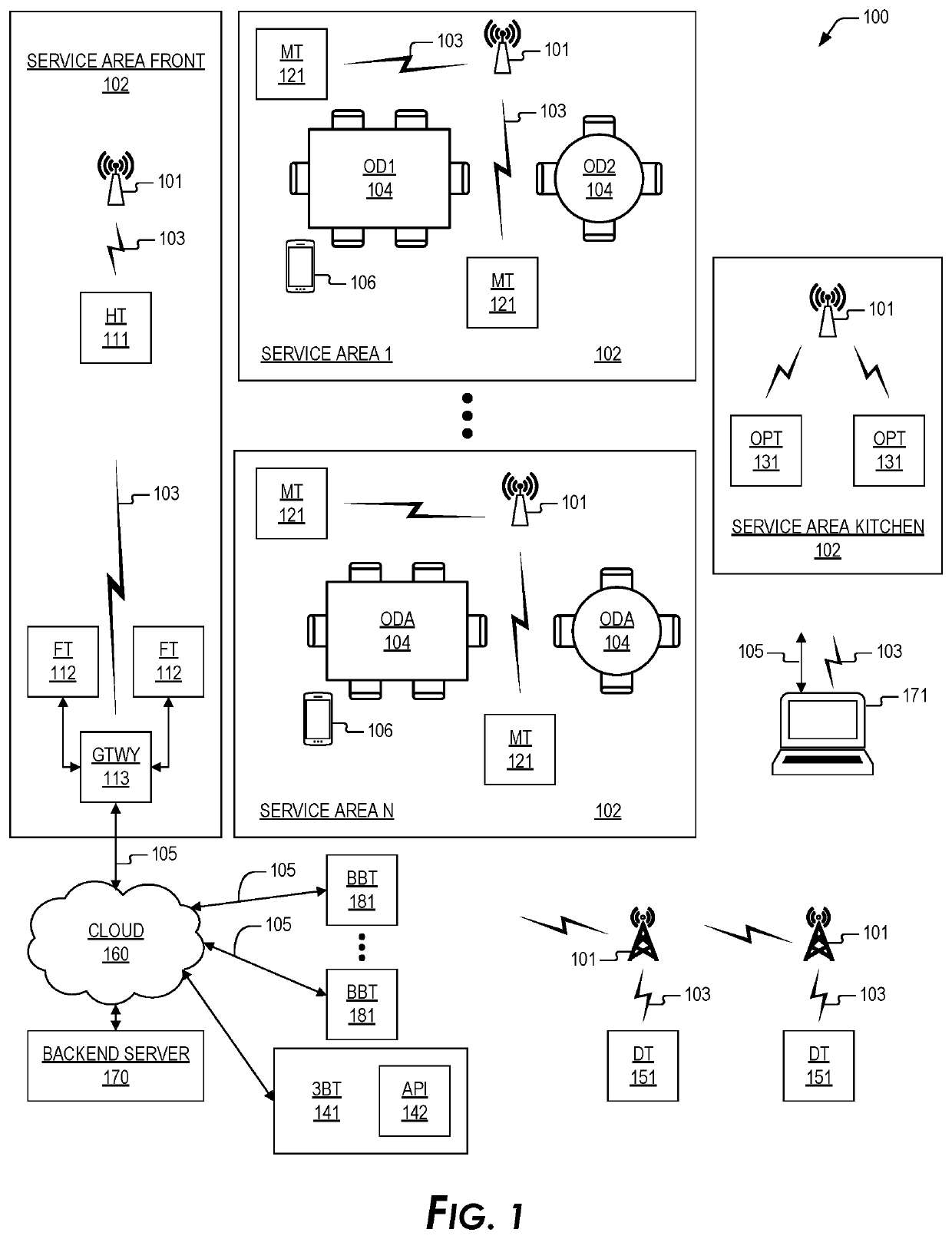

Point of sale (POS) docking station system and method for a mobile barcode scanner gun system with mobile tablet device or stand alone mobile tablet device.

ActiveUS20170140363A1Robust designConsistencyCash registersOffice automationDocking stationEngineering

A mobile scanner gun system processes a POS sale transaction and performs real-time daily store level inventory management. The system includes a main body portion extending toward a handle portion and forms an interior cavity and an aperture with a lens. A plurality of Universal Serial Bus (USB) mobile input devices are attached to the mobile scanner gun, including a barcode scanner and payment card input devices including a “Magnetic Stripe Reader” (MSR) and a “Europay, MasterCard and Visa” (EMV) reader, both with USB access to a PIN Entry Device (PED) and a “Near Field Communications” (NFC) reader through a specialized universal serial bus wiring harness. The specialized universal series bus wiring harness is adapted to be attached to and communicate with the mobile tablet device for communicating with a system integrated therein that enables store level real-time inventory management and a fully functioning POS capability for selling merchandise in a retail sales environment. A main Printed Circuit Board (PCB) having a previously programmed Electrically Erasable Programmable Read-Only Memory (EEPROM) controlling all MSR, EMV or NFC operations through the corresponding payment card input devices of each. When a customer payment card is swiped through the MSR slot or dipped into EMV reader or tapped on the NFC reader for payment card processing, customer payment is processed through the proper secured bank card processing network.

Owner:RETAIL TECH

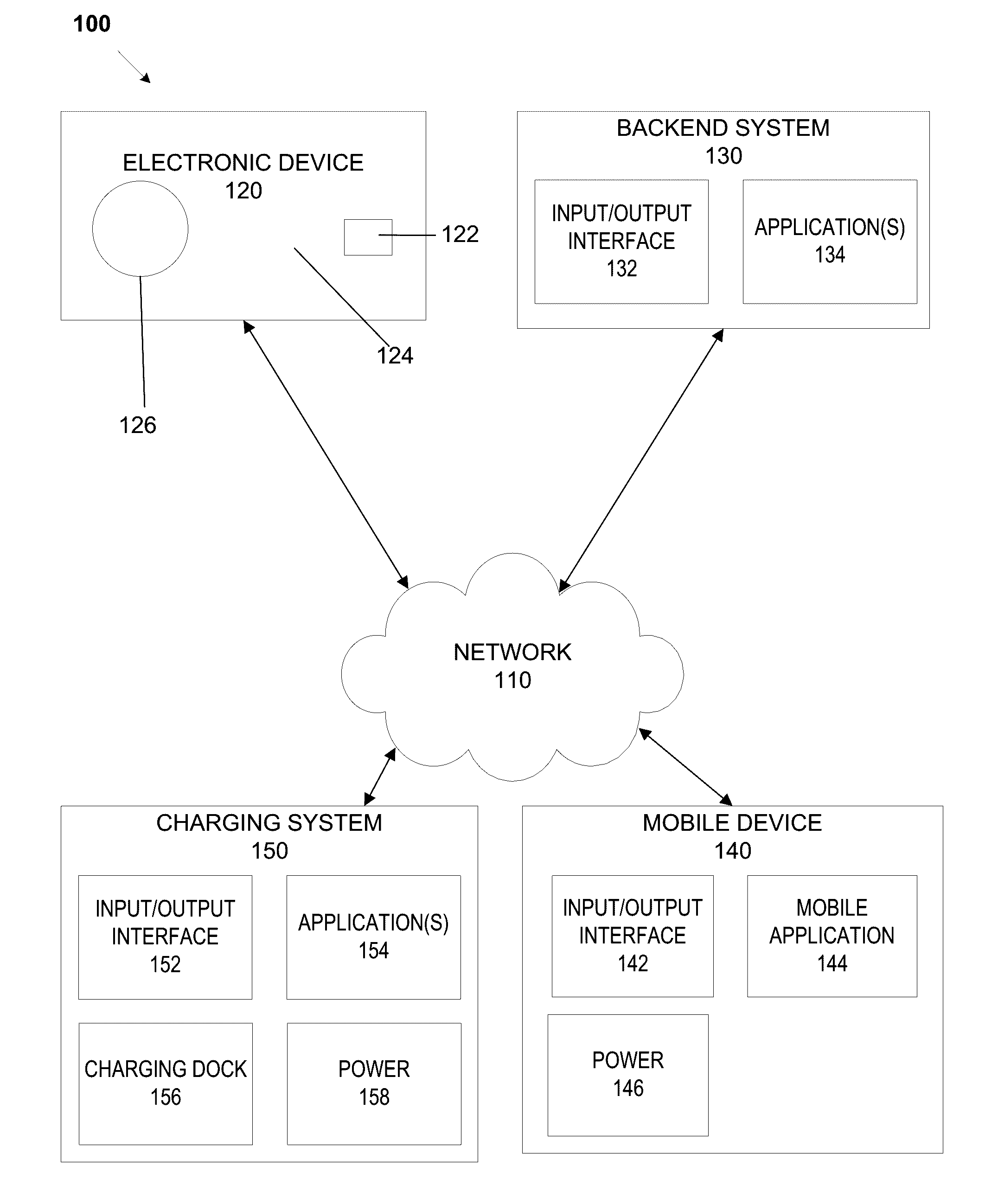

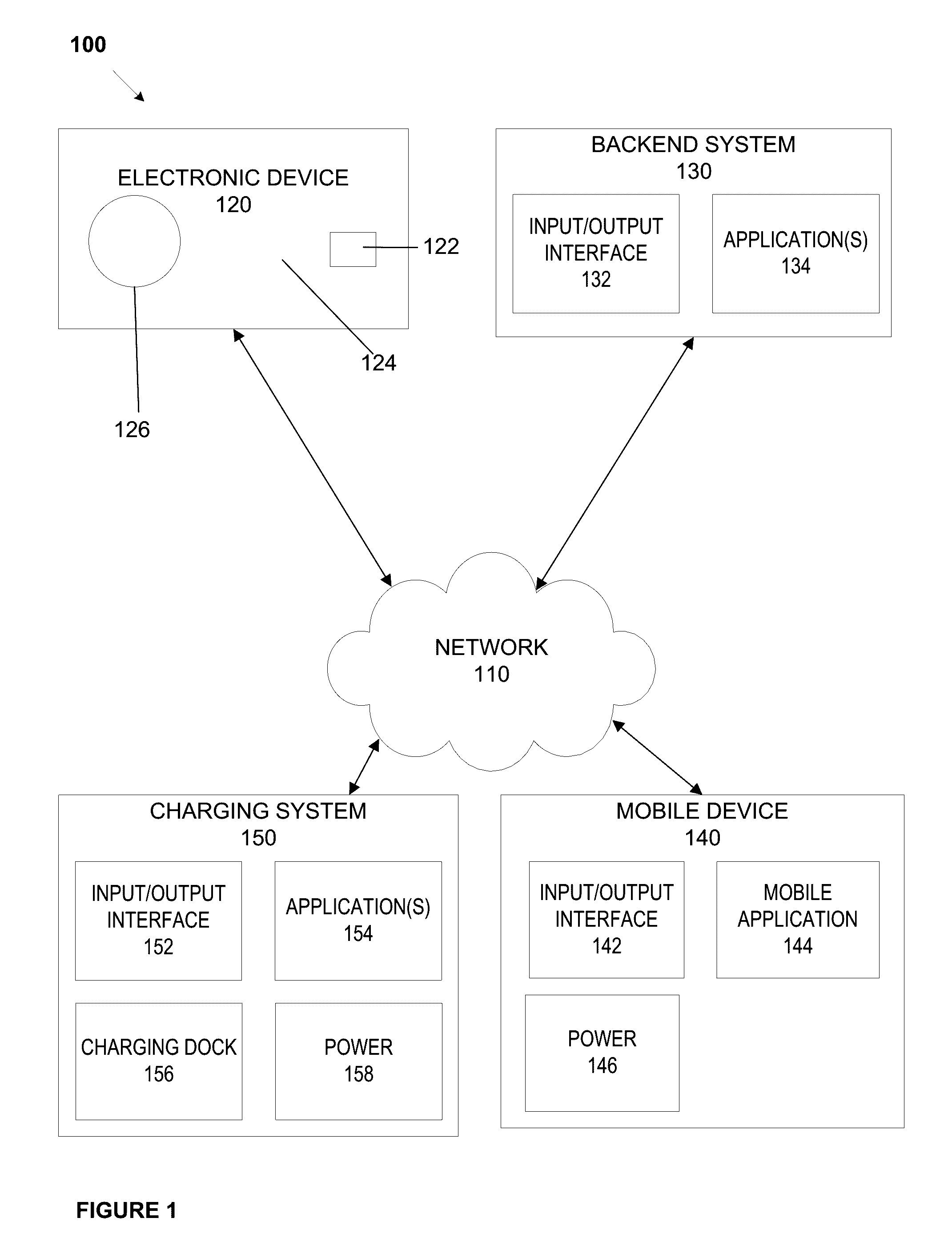

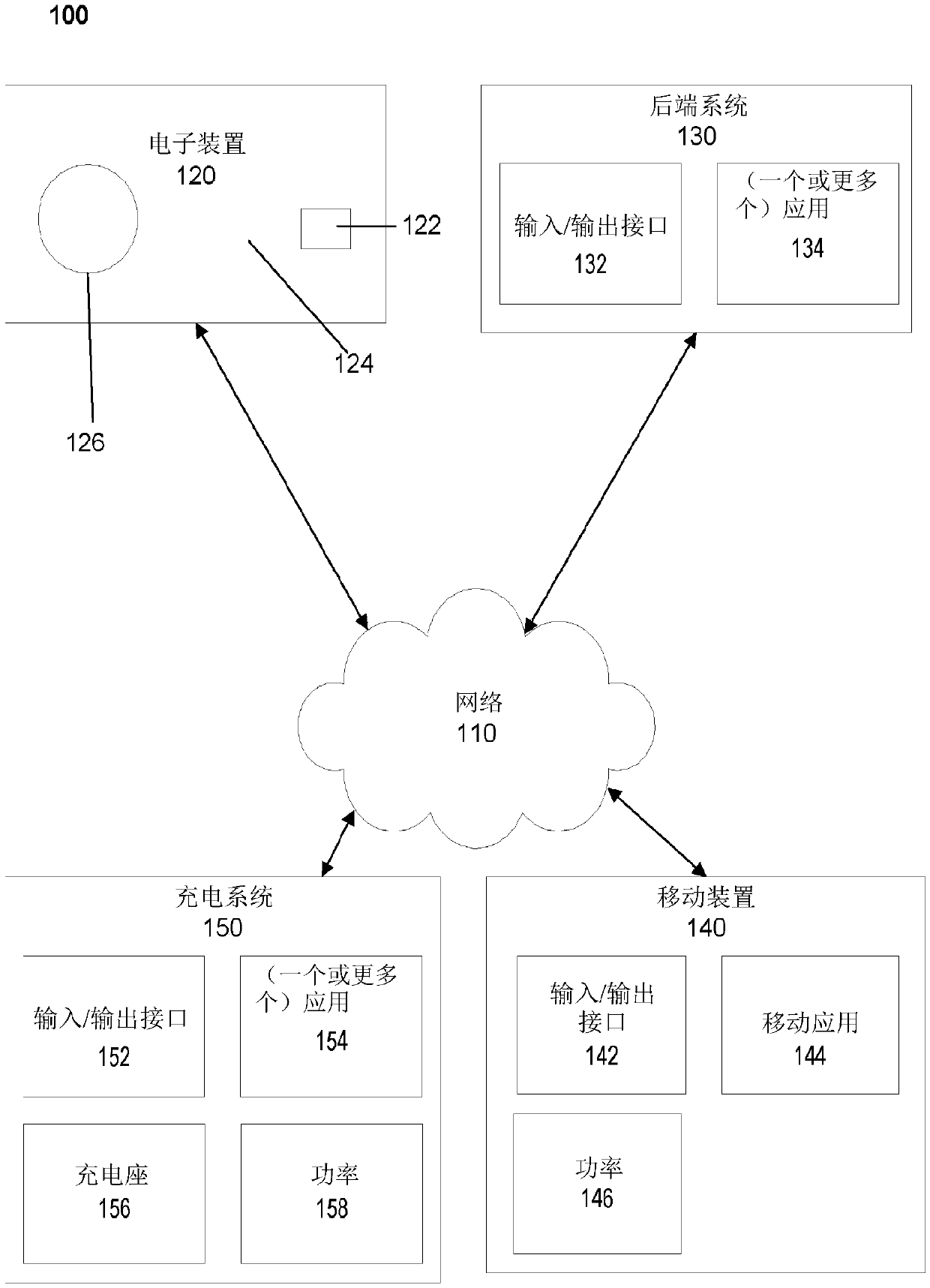

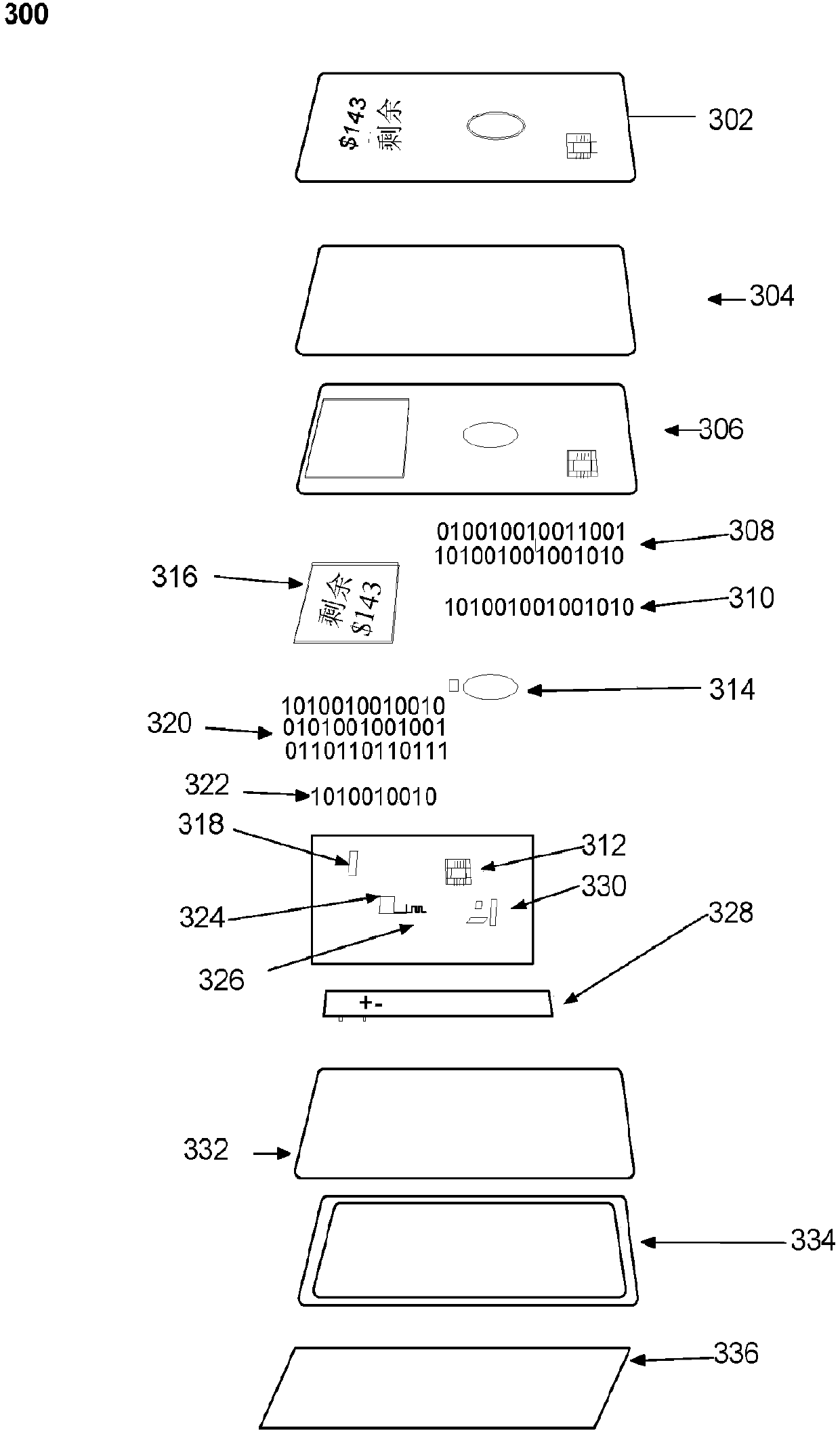

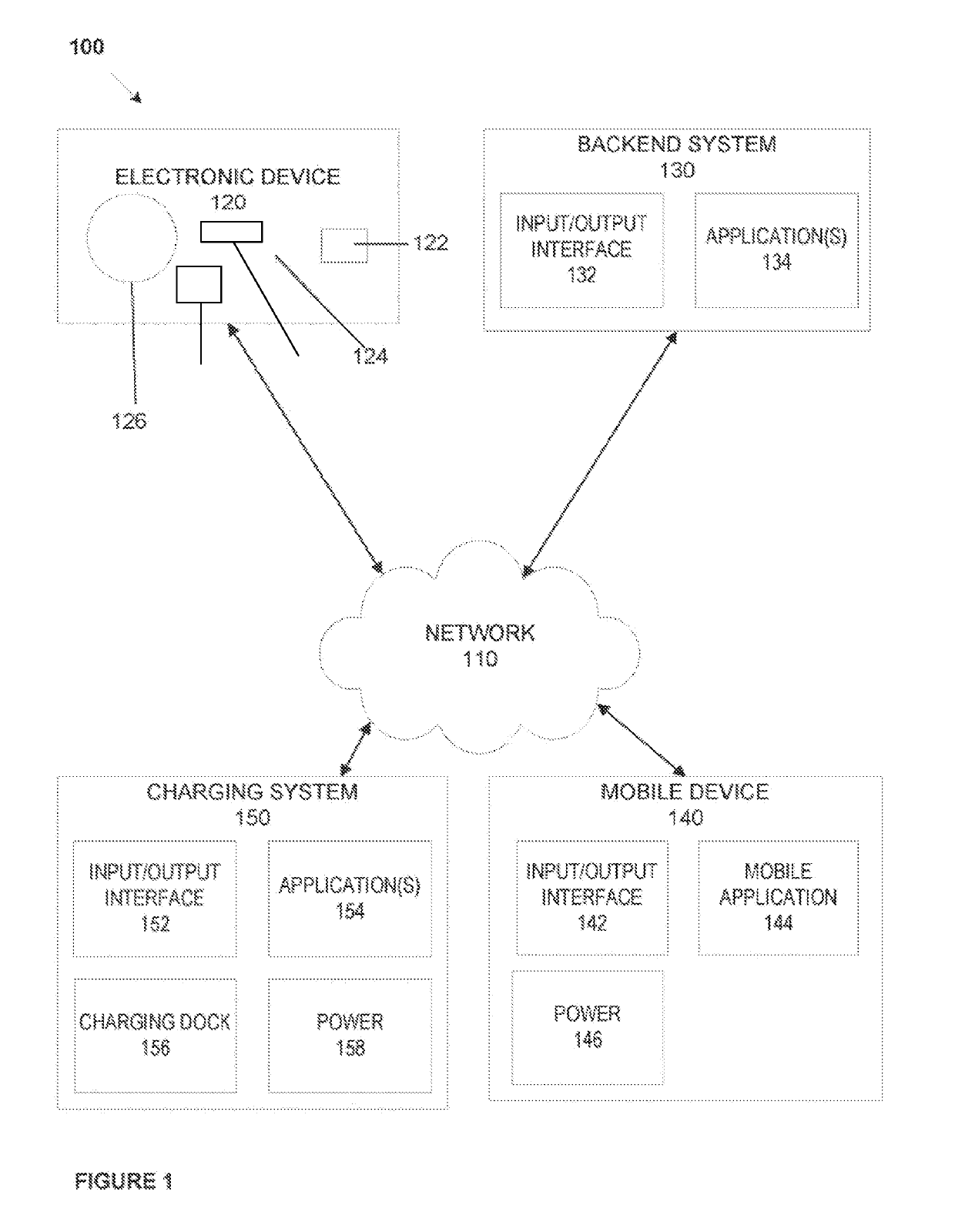

Dynamic transaction card power management

ActiveUS20160308371A1Fast timeLower levelBatteries circuit arrangementsAc-dc network circuit arrangementsEngineeringComputer terminal

A printed circuit board (“PCB”) with a power source. The PCB and power source combination may be inserted into a small electronic device, such as a dynamic transaction card, which may include a dynamic transaction card or a EuroPay-MasterCard-Visa (“EMV”) card. For example, a PCB may be manufactured to attach a battery as a power source to one side of a PCB such that the integrated battery directly connects with at least a portion of the PCB side. A rapid energy storage device may also be utilized as a power source. Energy may be harvested from an EMV terminal to charge or recharge a dynamic transaction card or EMV card powered by a rapid energy storage device when the card is inserted into the terminal.

Owner:CAPITAL ONE SERVICES

Integrated point of sale (POS) mobile device and methods of manufacture

In one example aspect, an integrated point of sale (POS) mobile device includes a mobile-device processor; a secure payment processor; a memory, coupled to the mobile device-processor and the secure payment processor, for storing executable instructions that comprise a mobile-device payment system and a set of payment data; a glass film film (GFF) touch sensor, wherein the GFF touch sensor can be drivers by a secure-touch integrated circuit (IC) that encrypts any touch data going to the secure payment processor; an EMV (Europay, MasterCard, and Visa) card reader system; an NFC (Near field communication) reader system; a Magnetic stripe reader (MSR); a housing comprising the mobile-device processor, the secure payment processor; the memory, the EMV (Europay, MasterCard, and Visa) card reader system, the NFC (Near field communication) reader system, the Magnetic stripe reader (MSR); a mobile-device payment system receiving input from the EMV card reader system, the MSR system, and the NFC reader system; and a security mesh comprising the secure payment processor.

Owner:SAEED FAISAL +2

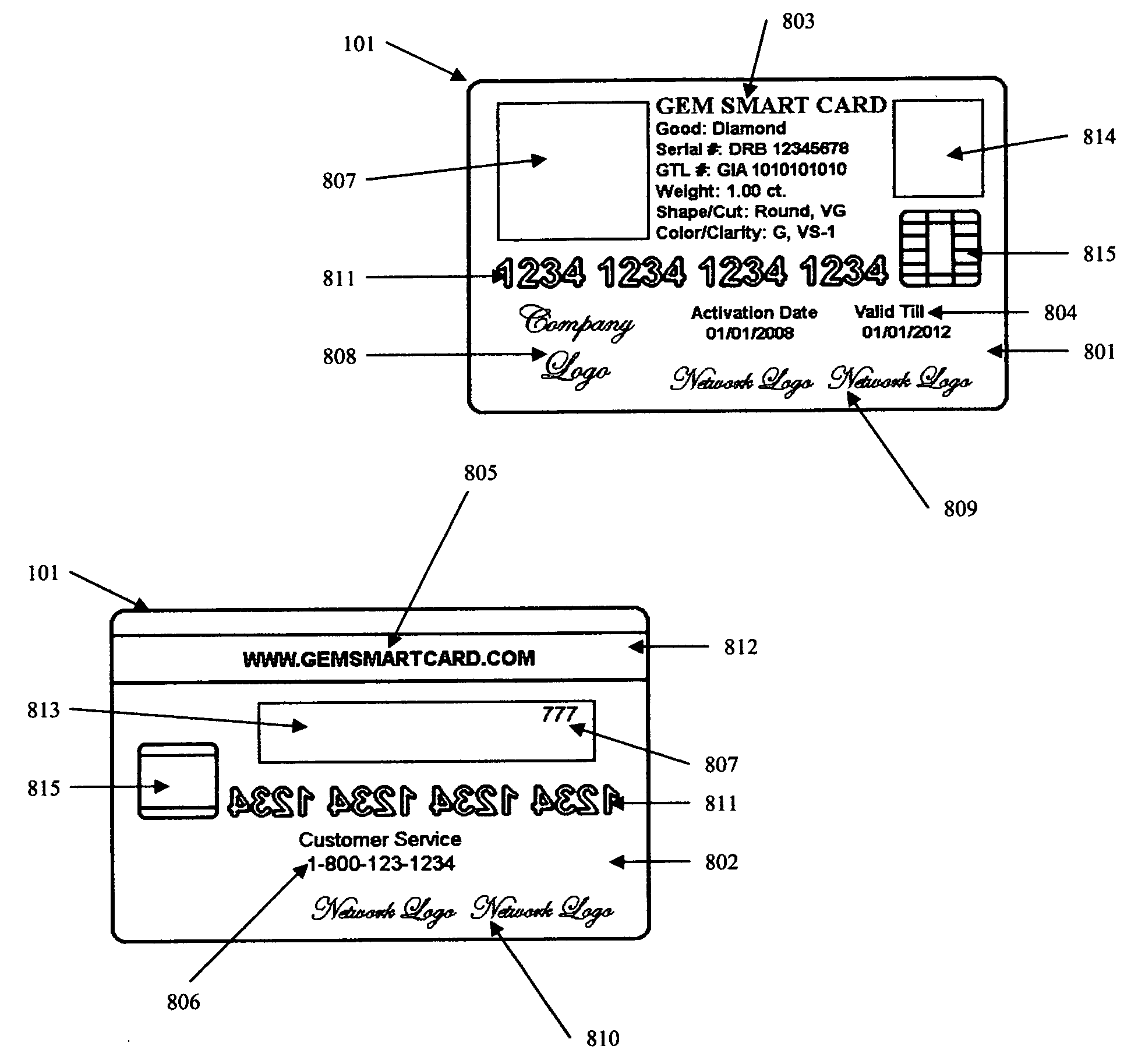

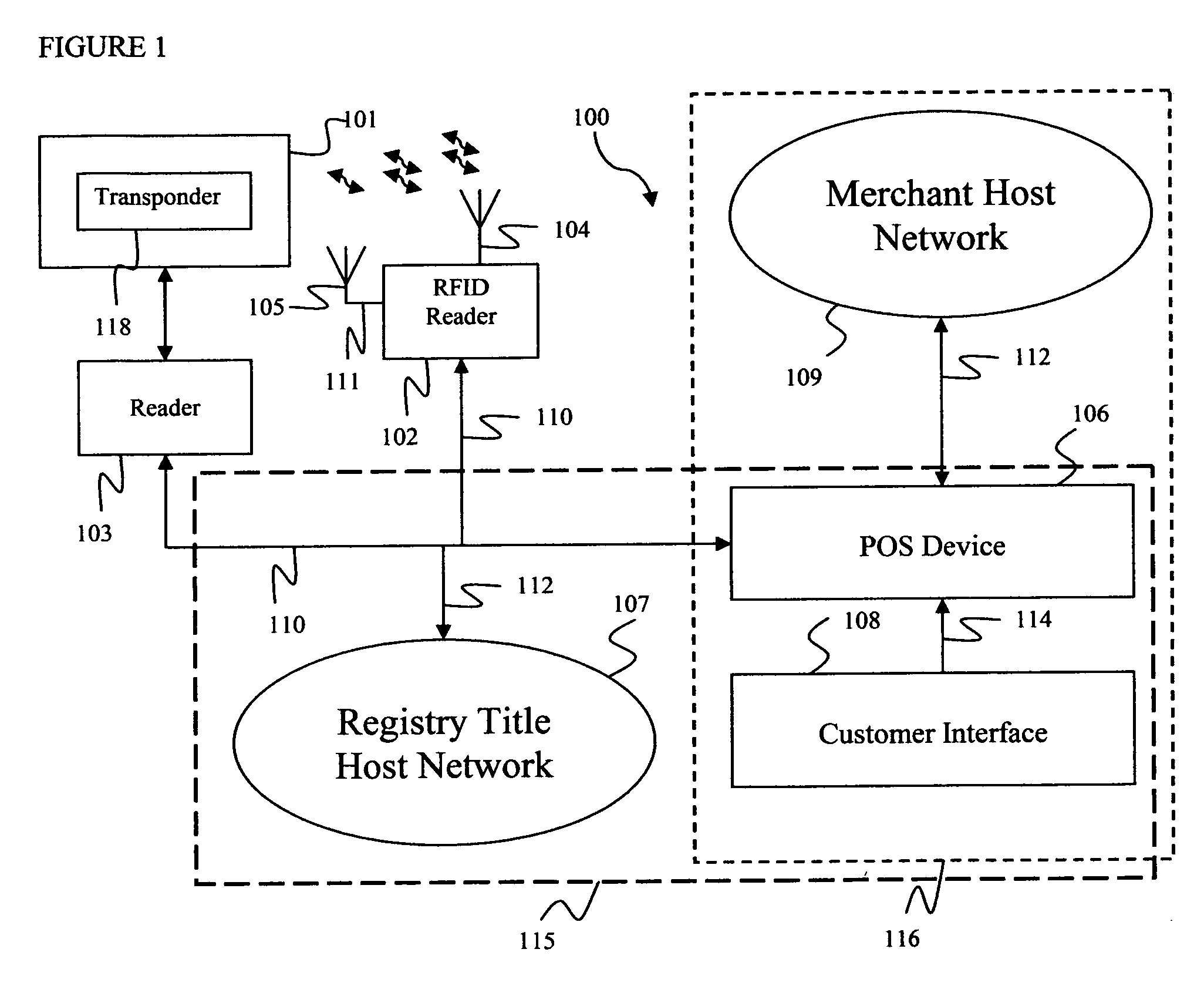

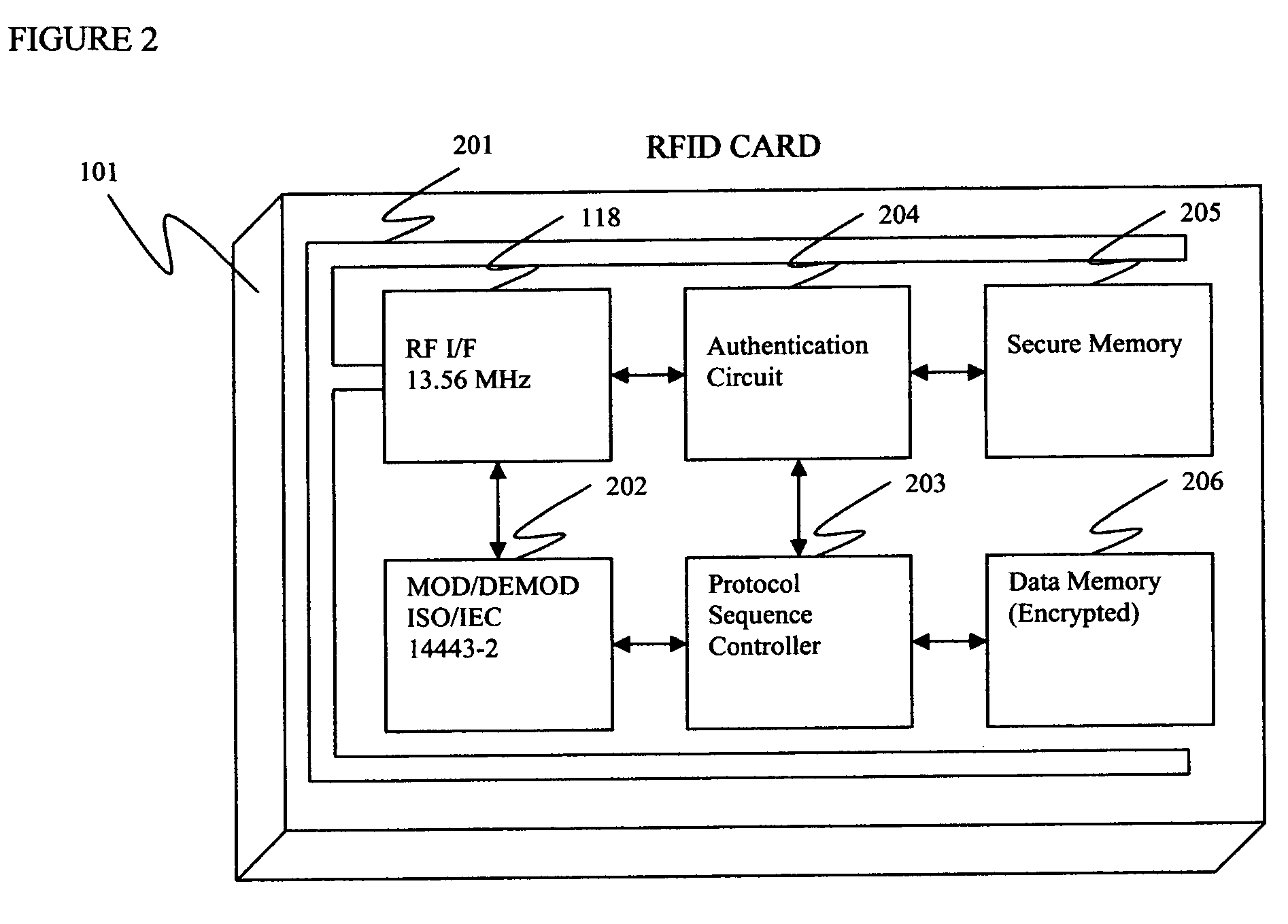

Multi-use durable goods card and system

InactiveUS20090289107A1Payment architectureRecord carriers used with machinesCredit cardComputer hardware

A card, system, and methods for the present invention: the Multi-Use Durable Goods (MDG) Card having multiple features, such as integrated circuit chips, RFID circuitry, magnetic stripe, holographic foil, photograph and text; provides a customer with a primary use as a registry title card which can be further activated to have a secondary use as a credit card. The MDG card can be activated as a registry title card, registering title, monitor ownership equity and brand equity to durable goods; and as a transaction card with a credit card feature. Activation of the MDG card as a registry title card, allows the customer to purchase unique and documented durable goods (for example a gemstone with Gemological Trade Laboratory Report) from a vendor to establish transfer of ownership of the durable good, maintain provenance, documentation, equity values and credit. Activation of the MDG card credit feature allows the customer to interact with any merchant that accepts traditional credit cards such as VISA®, MASTERCARD®, AMERICAN EXPRESS®, or DISCOVER®. The combination of MDG card features allows a customer to purchase a durable good, maintain provenance, equity and credit, upon the activation of both manners described above; and the Multi-Use Durable Goods (MDG) Card is a security financial instrument.

Owner:PRENTICE WAYNE DOUGLAS

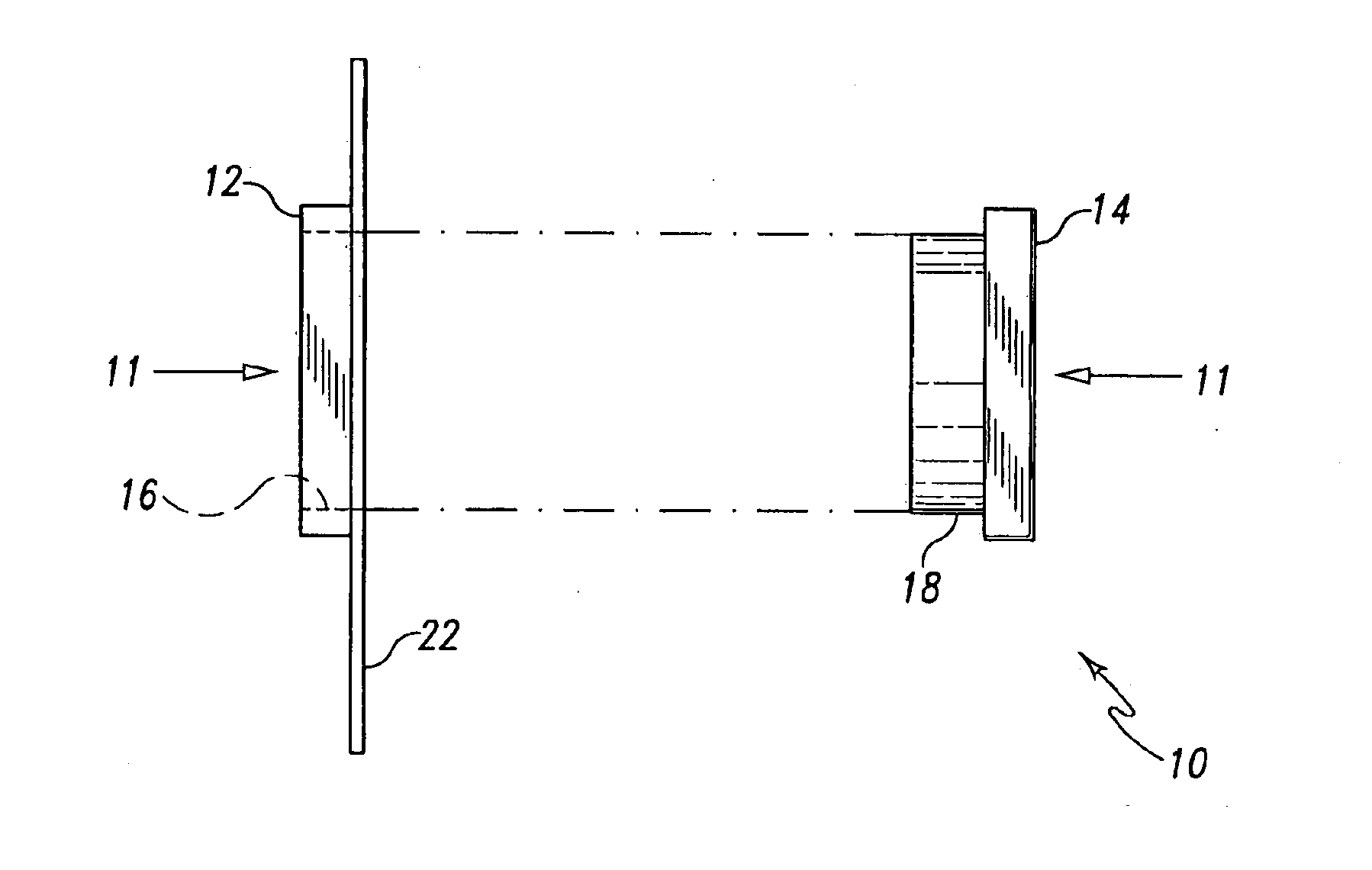

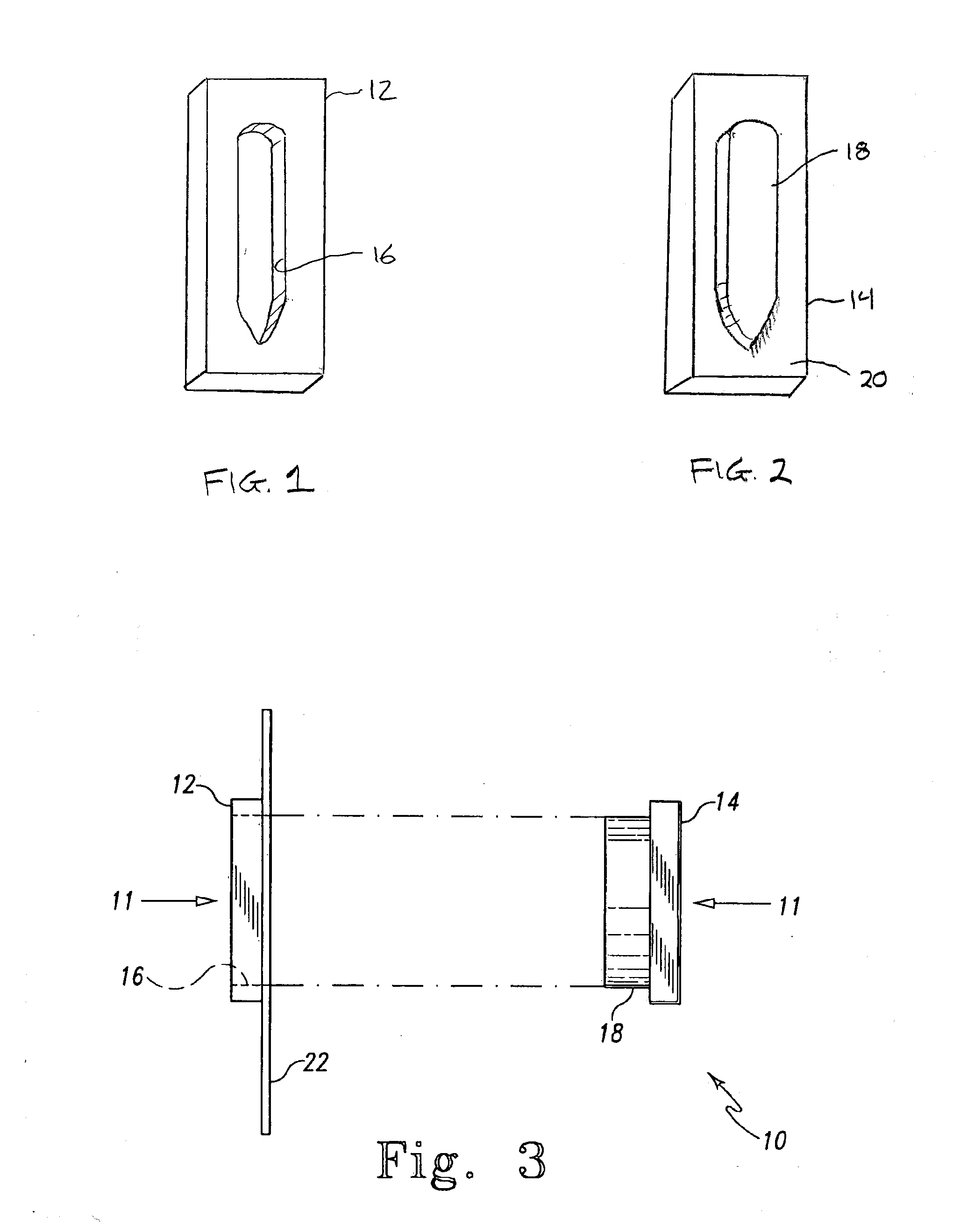

Method of producing collar stays from identification cards

The present invention comprises a method of using a punch for cutting one or more collar stays directly from an identification card. The punch includes a holding portion positioned on one side of the identification card and a die or blade portion aligned with the held identification card. The holding portion has a corresponding recess formed therein in the shape of a collar stay. When the punch is aligned with the recess in the holding portion and the two halves are brought together with an identification card therebetween, a collar stay is punched out of the identification card material. The identification card may be positioned such that the resultingly produced collar stay prominently displays a portion of the identification card logo (i.e. Visa®, Mastercard®, or the like), includes the security hologram, includes the name of the card holder, etc. In this way, the collar stay may be customized or made to have a pleasing design element.

Owner:PICK PUNCH

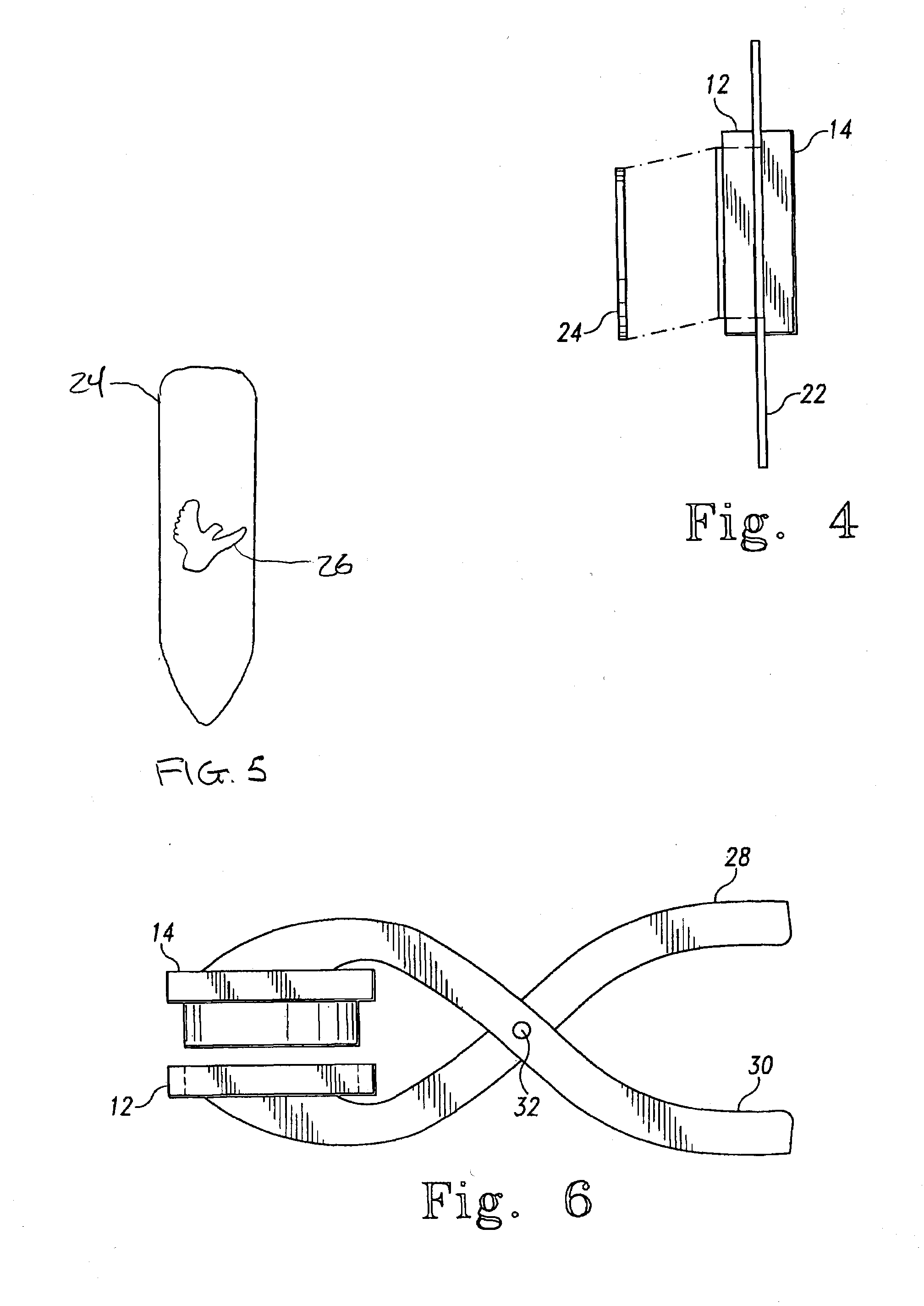

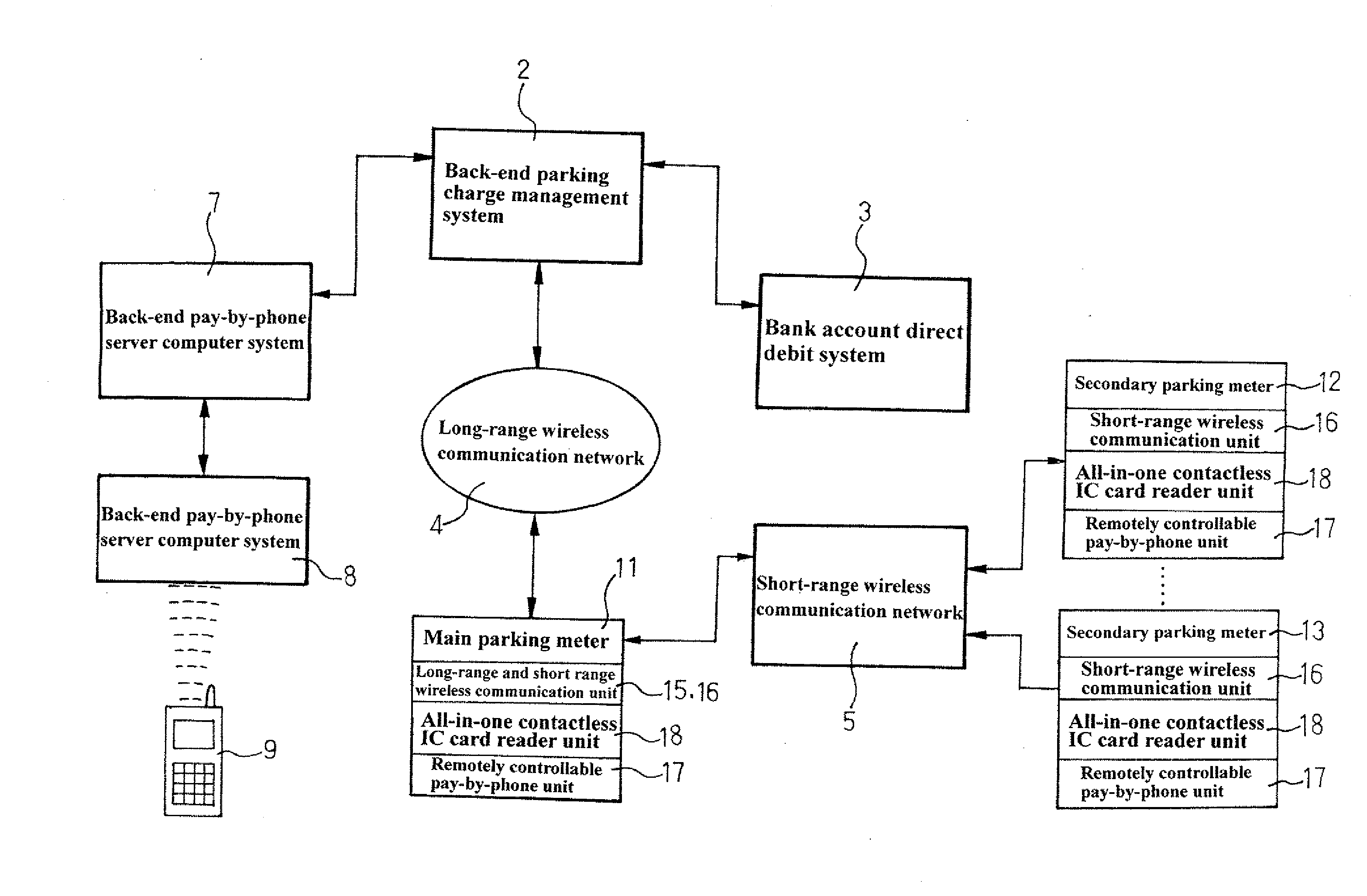

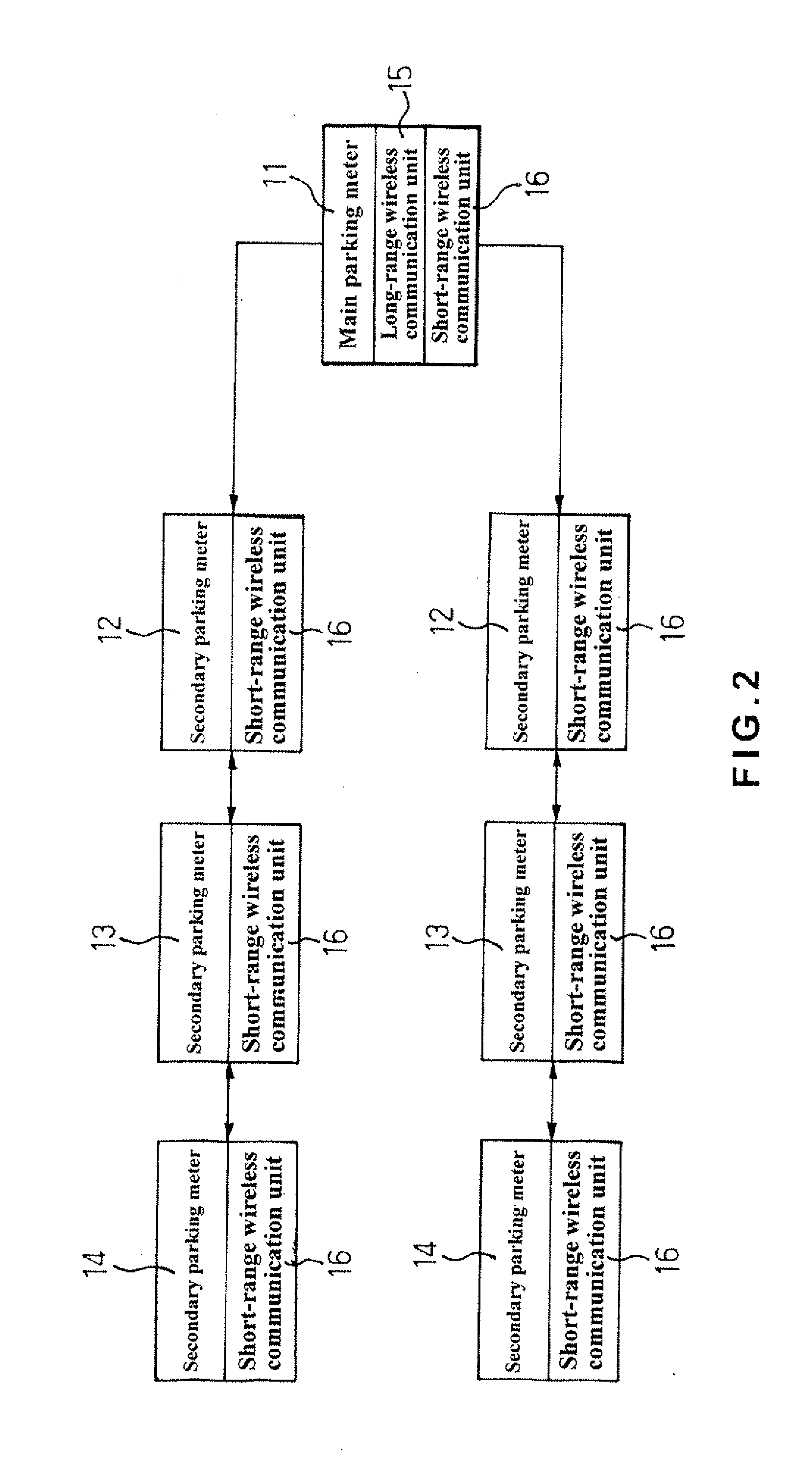

On-street parking meter system supporting multiple payment tools and signal transmission method thereof

InactiveUS20120284146A1Reduce power consumptionReduce labor costsEnergy efficient ICTTicket-issuing apparatusCommunication unitElectrical battery

In an on-street parking meter system supporting multiple payment tools and signal transmission method thereof, parking meters spaced along streets are divided into multiple groups, each of which includes a main parking meter and multiple secondary parking meters, all of which are equipped with an all-in-one contactless card reader unit compatible with prepaid card, Visa Wave card and MasterCard PayPass card, and a remotely controllable pay-by-phone unit allowing a user to pay by phone. In each group, the main parking meter is provided with both long-range and short-range wireless communication units for bidirectional communication with a back-end parking charge management system and the secondary parking meters, respectively; while the secondary parking meters each are provided with only a short-ranged wireless communication unit for bidirectional communication with the main parking meter. Therefore, the parking meters have small size and reduced power consumption to enable reduced labor cost for replacing batteries thereof.

Owner:WONG YE PING

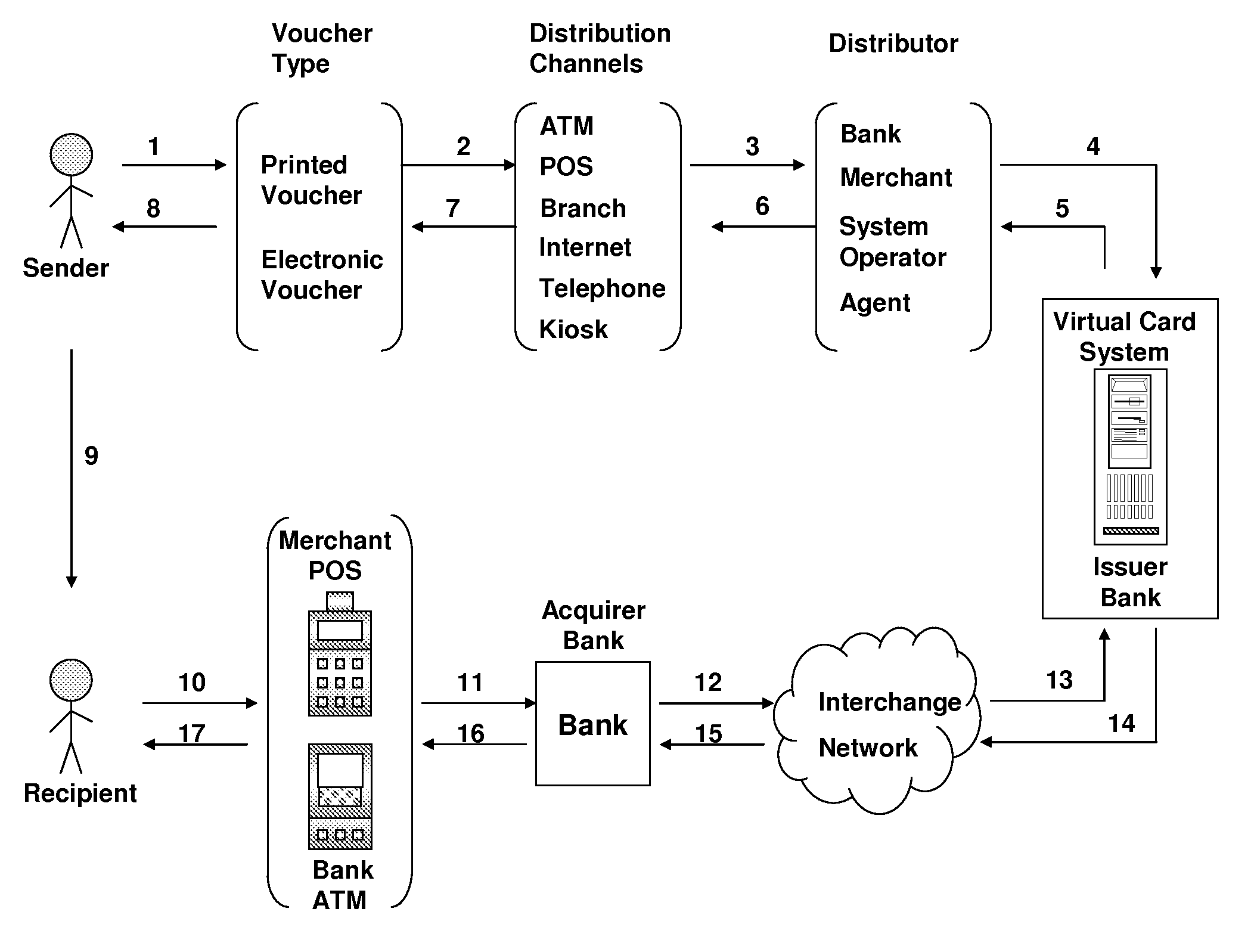

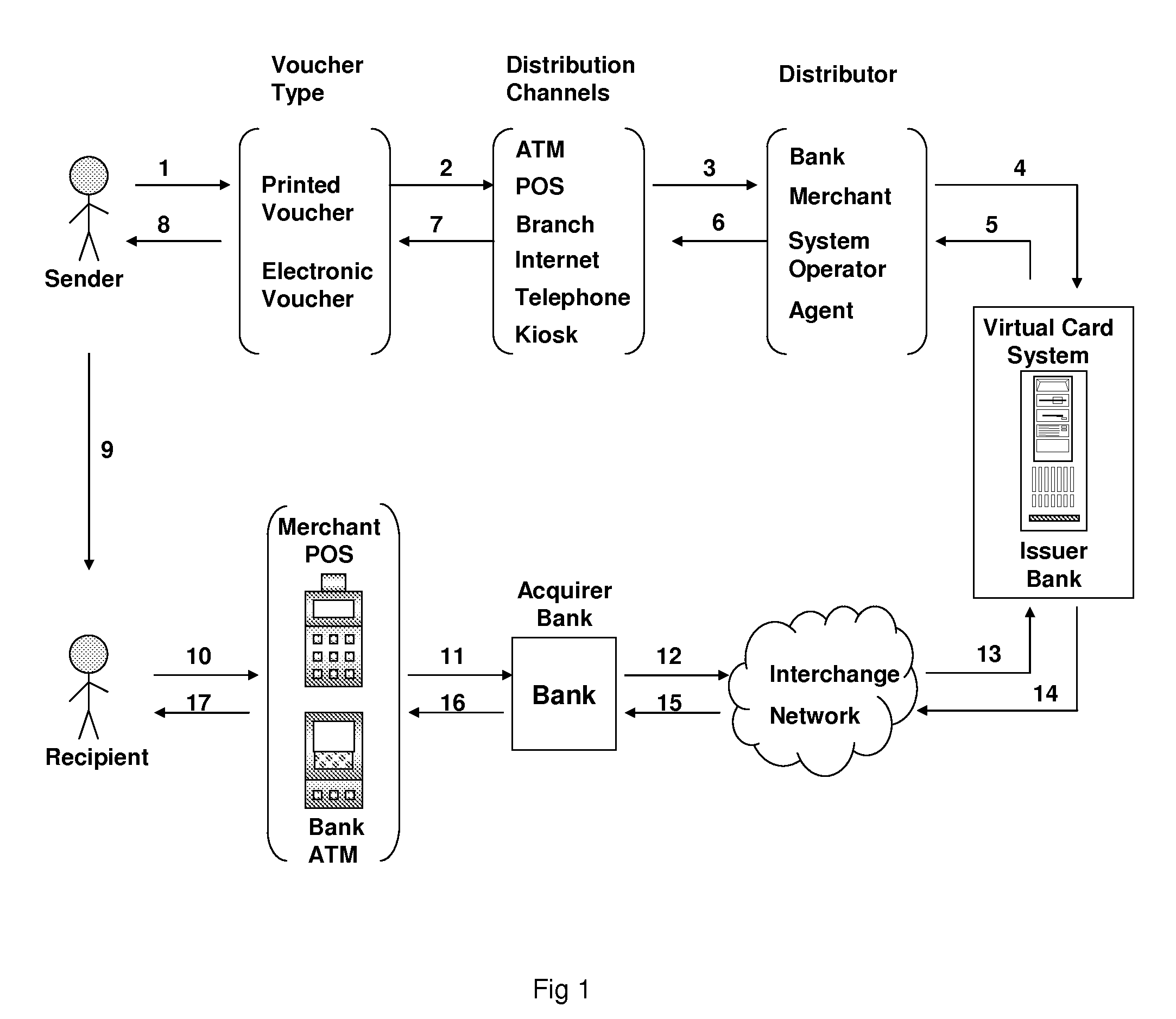

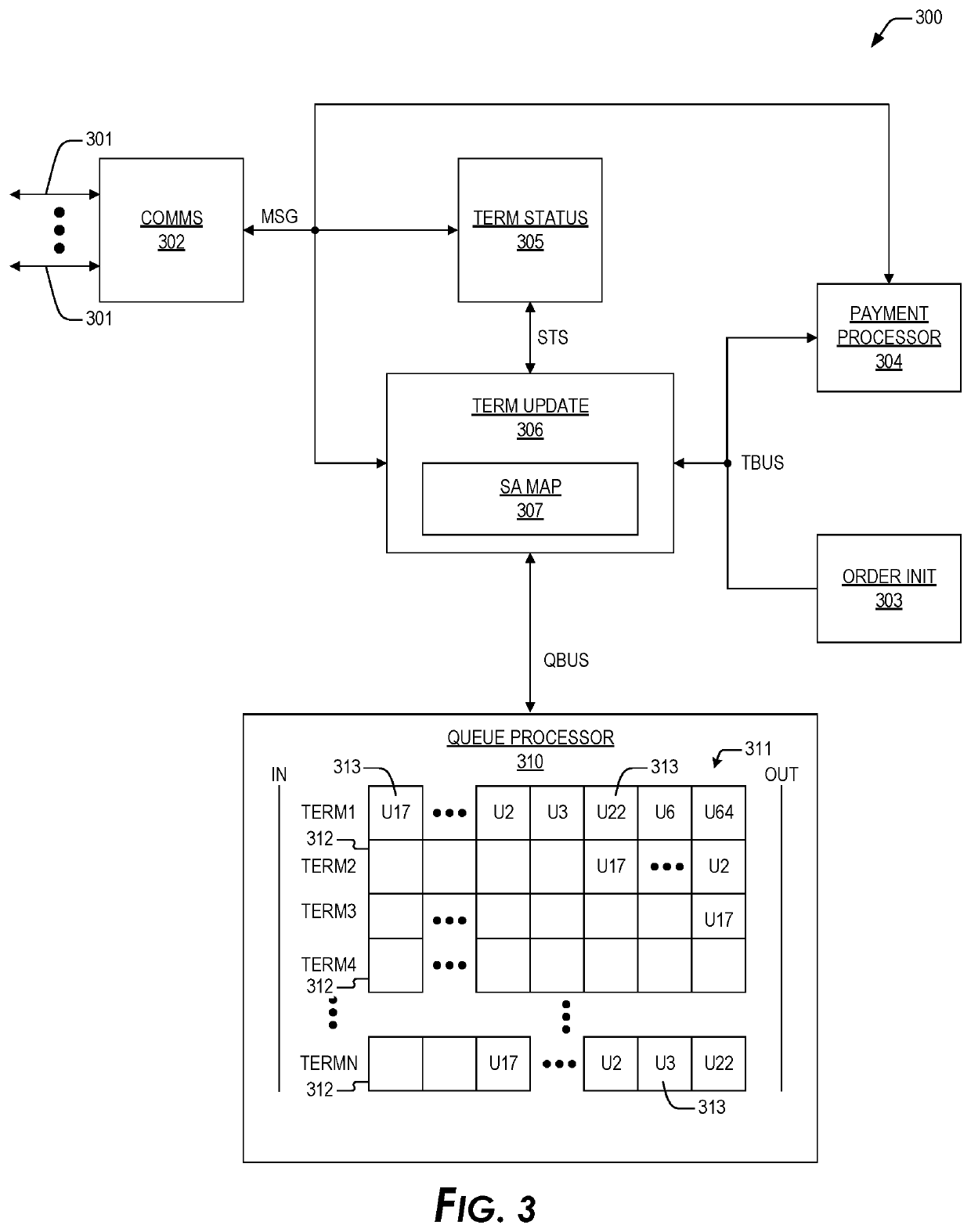

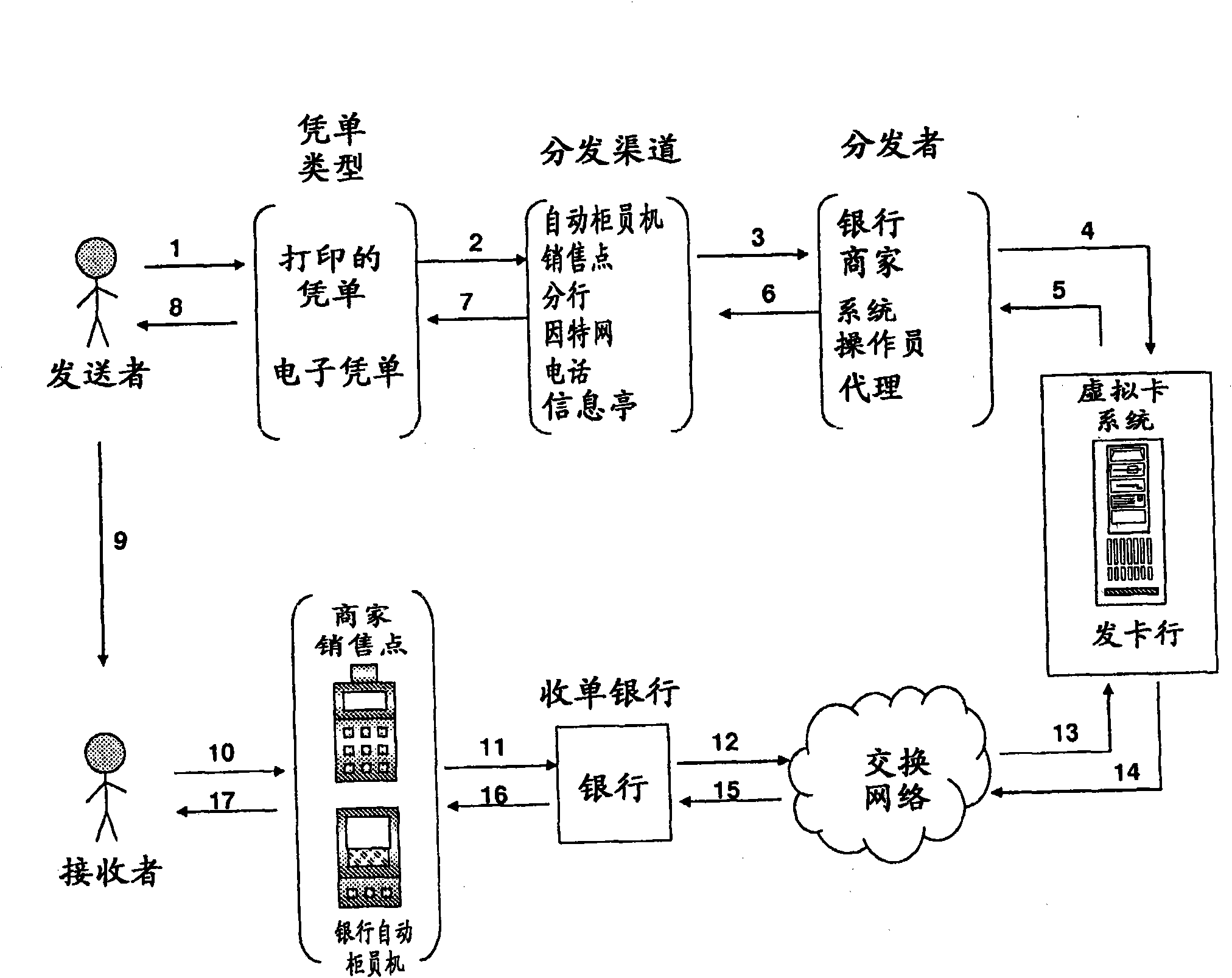

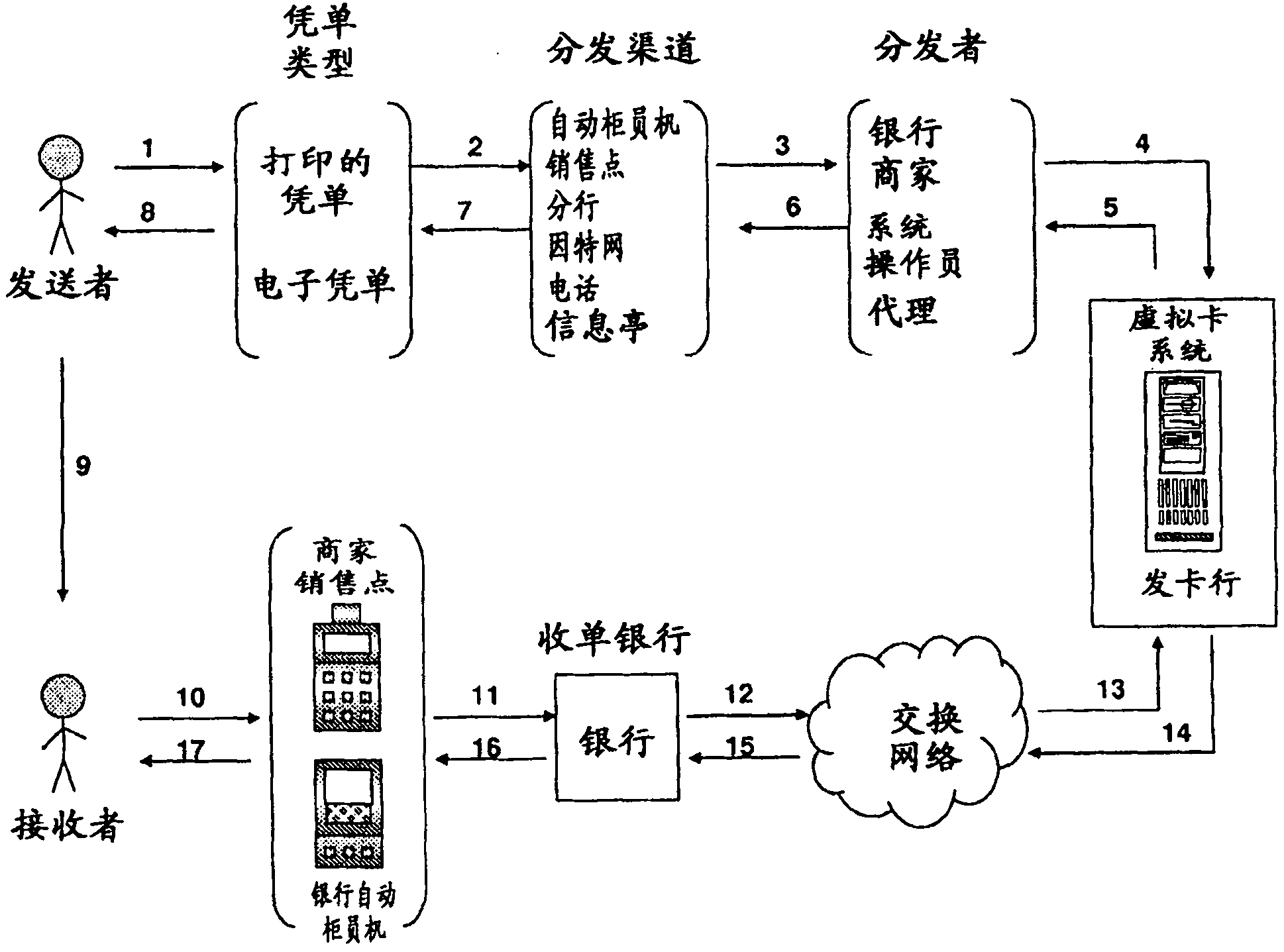

System and method for sending money to a recipient

InactiveUS20100332334A1Complete banking machinesAcutation objectsComputer hardwareFinancial transaction

The invention provides a system and method for sending money, locally or internationally, which method includes the steps of, issuing a sender of money with a virtual (credit or debit) card number and a card expiry date, communicating to the intended recipient of the money the virtual card number and card expiry date, presenting the virtual card number and, optionally, the card expiry date, to any merchant with a point-of-sale terminal that is capable of processing credit and / or debit card transactions, processing a key-entered purchase or cash-back transaction, on the point-of sale terminal by keying in the virtual card number provided by the recipient into the point-of-sale, optionally together with the card expiry date and the amount, processing, also known as authorizing, settling and clearing, with a virtual card system, the key-entered transaction by credit and / or debit card transaction clearing means so that the funds are cleared as available to the merchant, and the merchant paying the cleared amount to the recipient, optionally less a processing fee charged to the recipient. The credit and / or debit card accepting terminal also accepts Visa, MasterCard, American express, Diners Club, Discover, JCB, Relation Card and / or CUP credit or debit cards.

Owner:TRANWALL HLDG LIMITED CHANG LEUNG HUI & LI CPA +1

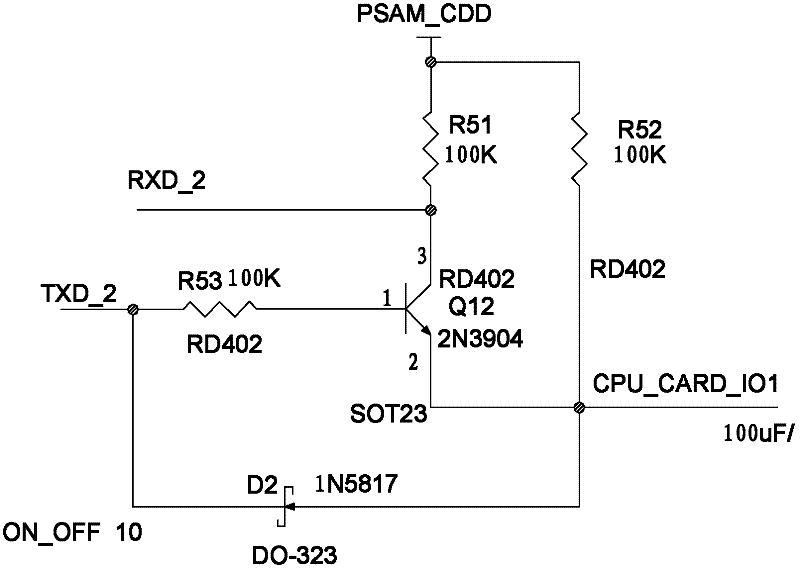

Method for realizing ISO7816 protocol with UART (universal asynchronous receiver/transmitter) of low-cost MCU (micro-control unit)

Owner:FUJIAN XINO COMM TECH

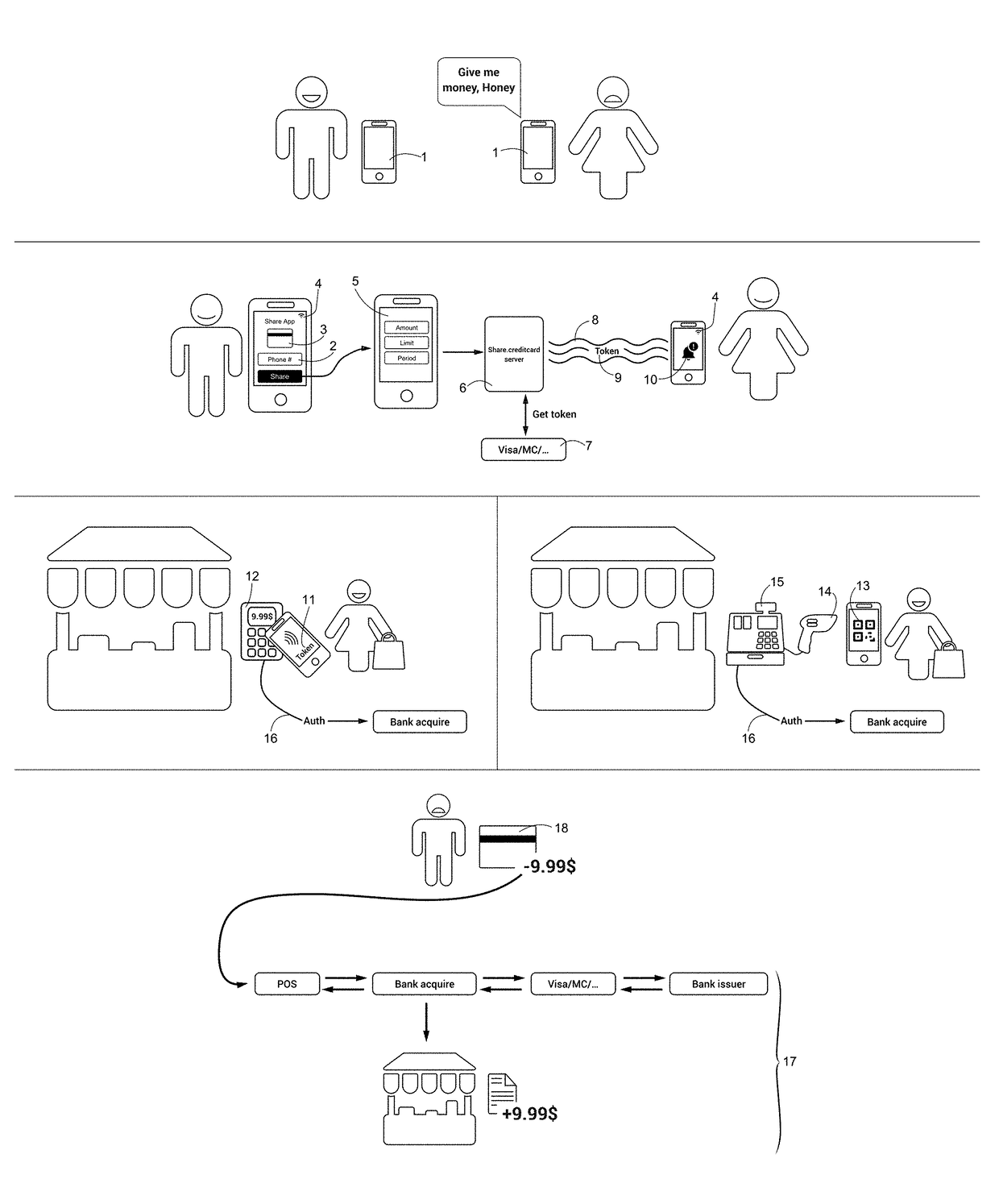

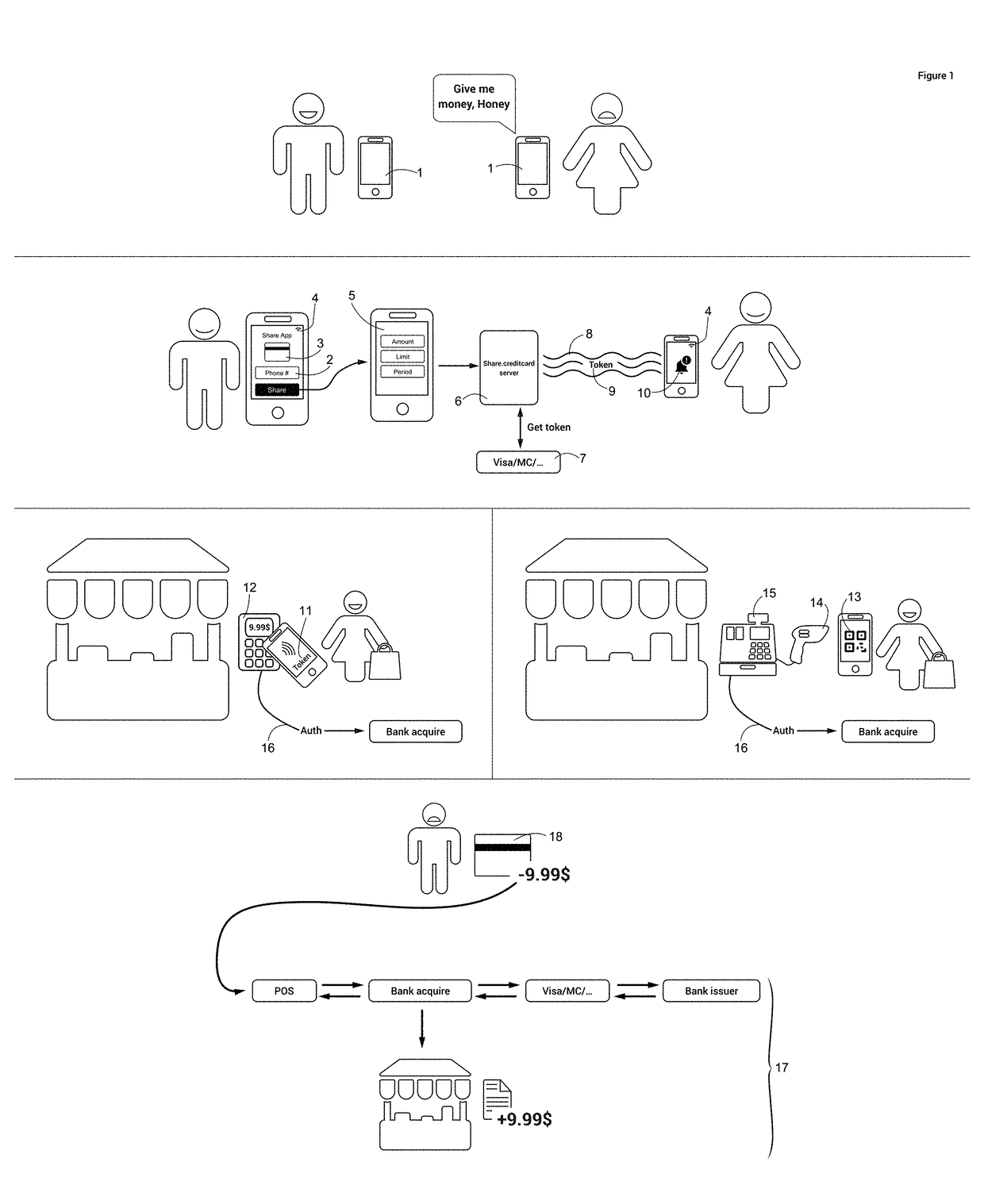

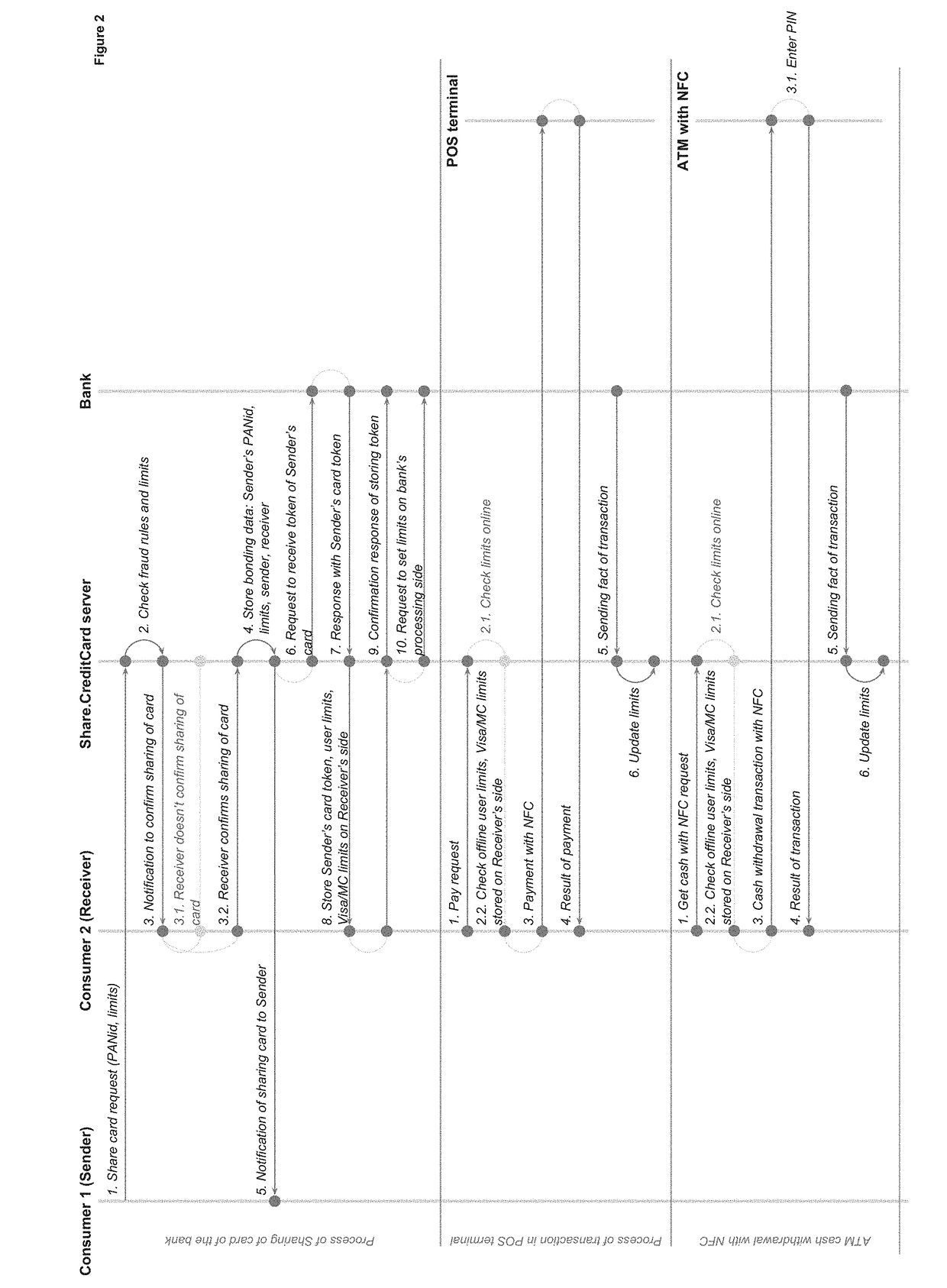

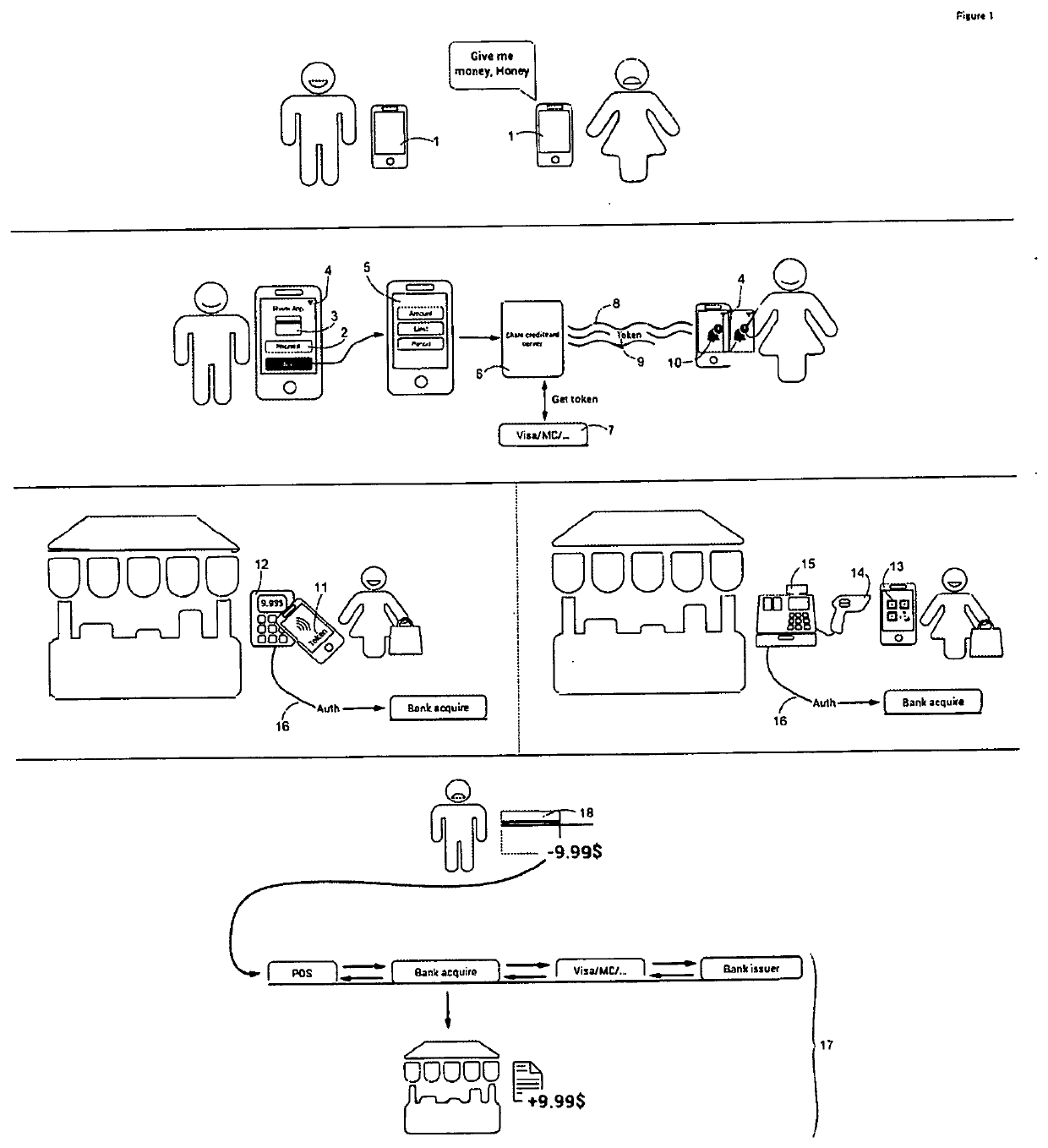

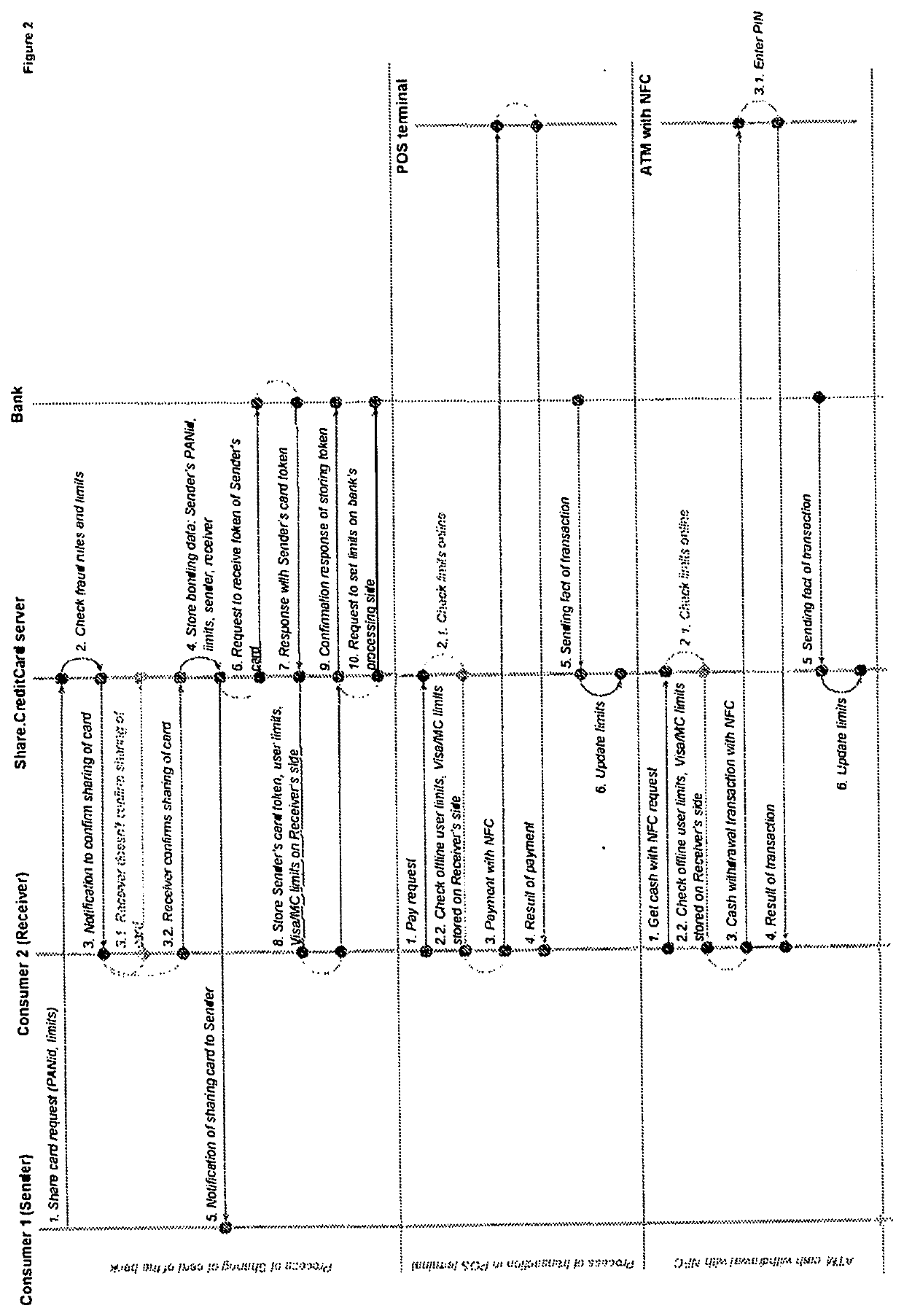

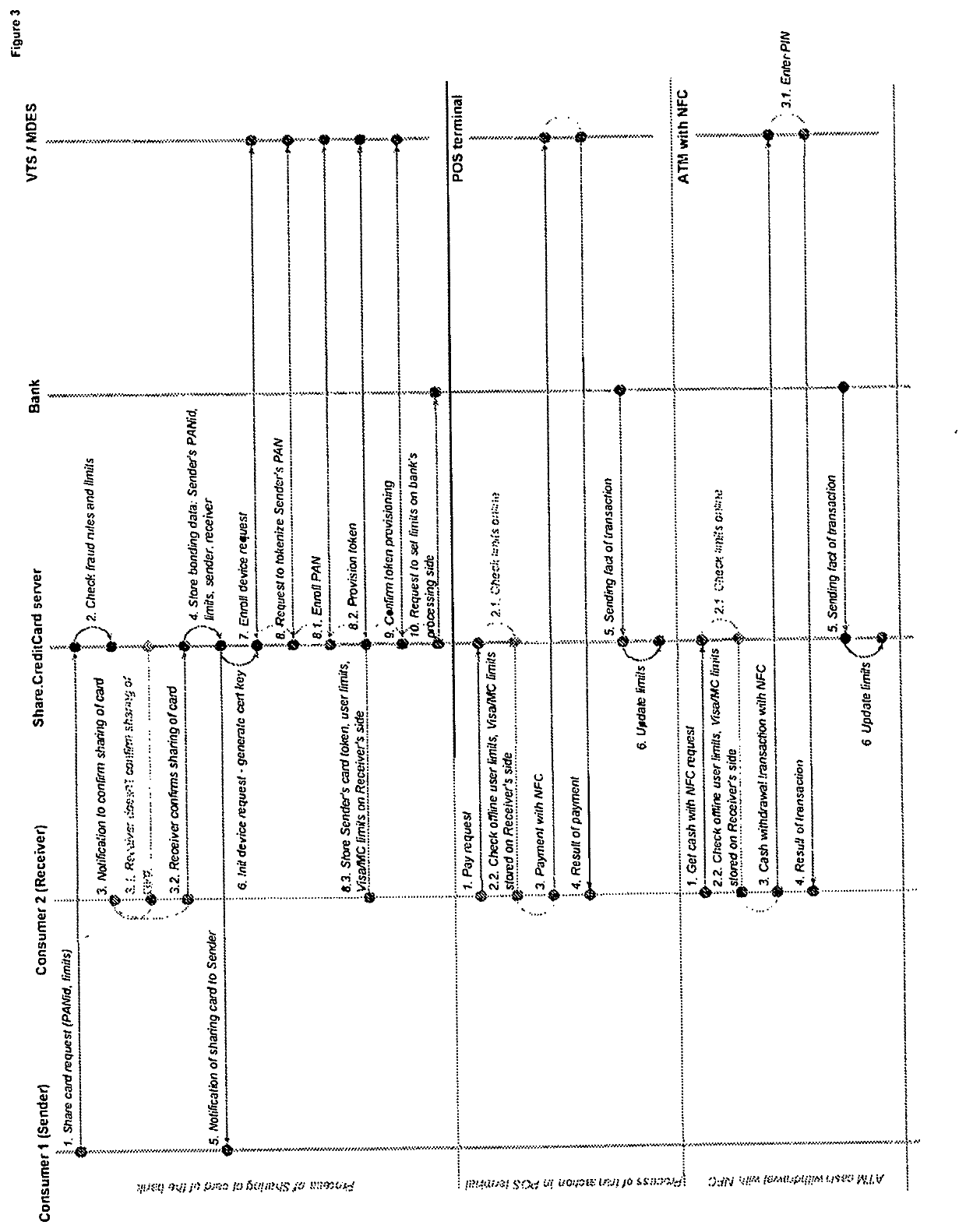

Automated digital method and system of providing or sharing access

ActiveUS20180144335A1Avoiding payment feeAvoid delayComputer security arrangementsPoint-of-sale network systemsBank accountPayment order

Advantageously, the invention is a true competitor for money transfer systems, such as Western Union, Bitcoin, Swift, Visa, MasterCard, etc. The invention is the example of the economy going cashless and killing money transfers as a class. Conventional digital transactions facilitate electronic payment, such as money transfers, payment card charges, e-commerce transactions and any other types of transaction. However, in multiple circumstances, payees may be unbanked people (e.g. children that need money to buy something) or may have no payment card (e.g. may lost card), while payment card fund transfers may be expensive, time-consuming, and cumbersome for financial institutions. Thus, there is need for an improved approach. The invention discloses an automated digital method of providing or sharing access to a payment card and / or similar financial account or a non-payment card and / or similar non-financial account or non-card product, transacts between individuals or legal entities without physical transmission of a payment card, non-payment card, non-card product or its credentials, even without a recipient of an access having a payment card and / or financial account or a non-payment card and / or similar non-financial account or non-card product, particularly by providing or sharing access to a payment card and / or similar financial account or a non-payment card and / or similar non-financial account or non-card product of a sender.

Owner:MIDDLEWARE INC

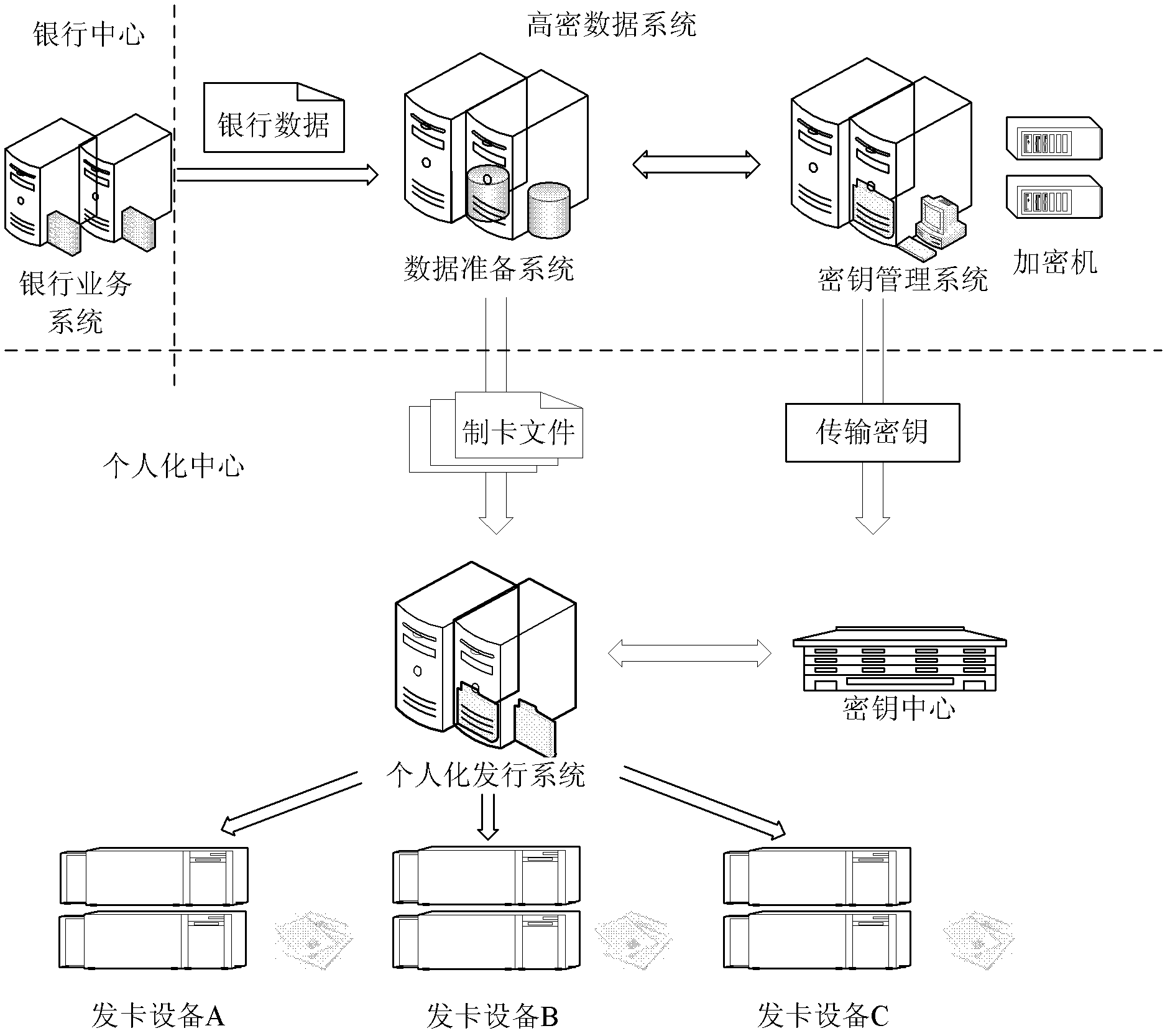

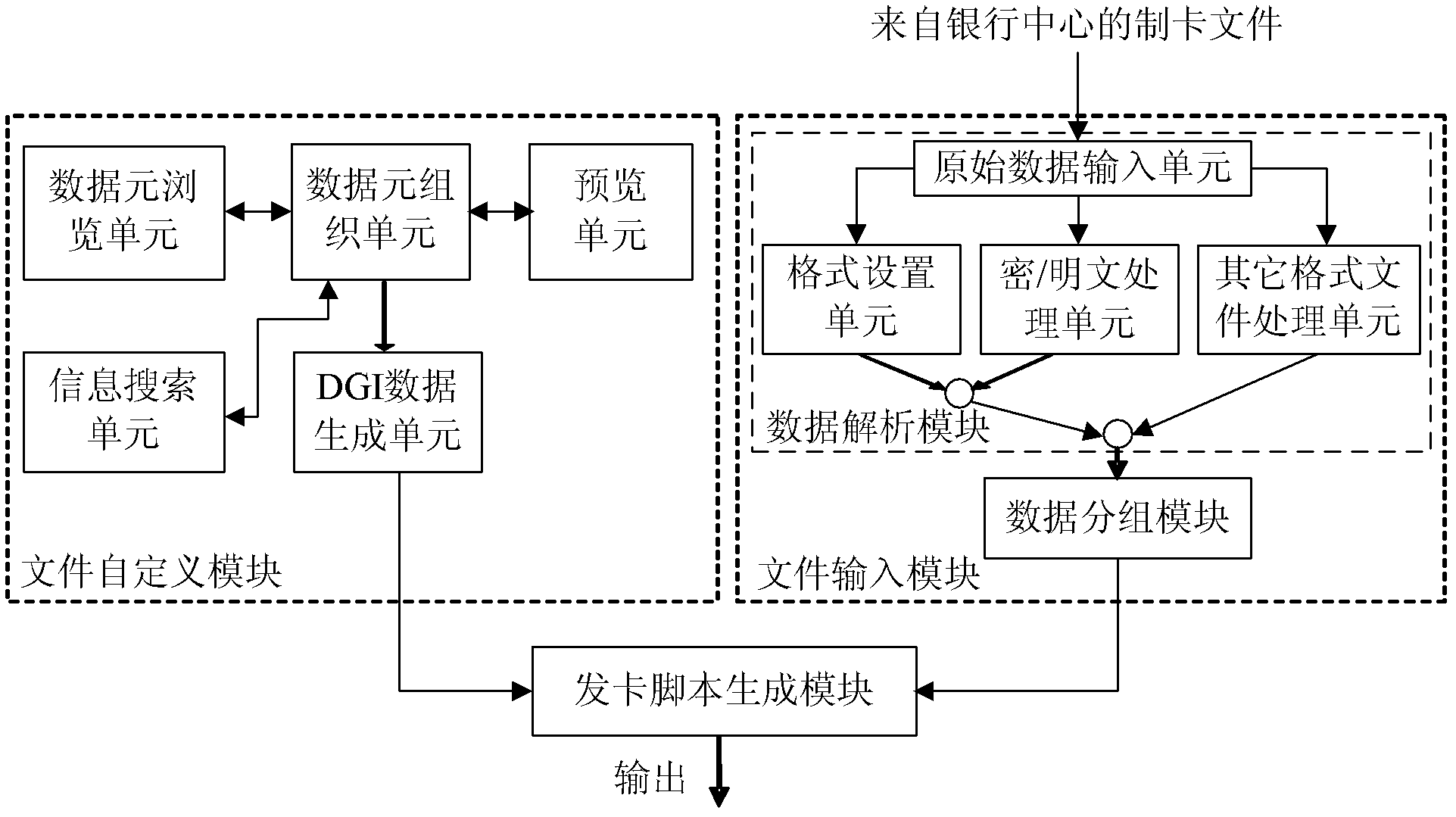

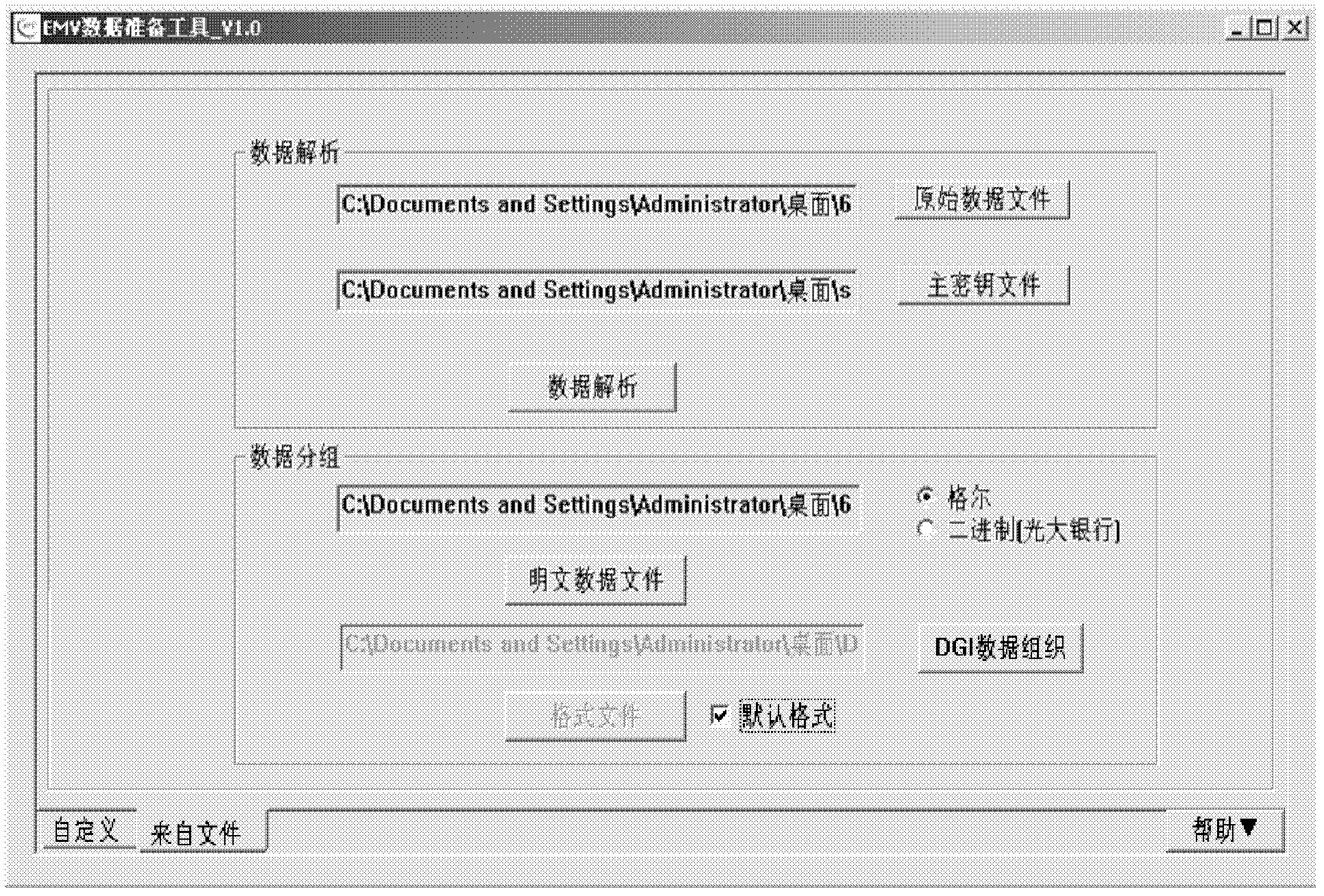

Personalized IC (integrated circuit) card issuing device and method

ActiveCN102521551AMeet individual data needsOrganization Simplification and InterfaceDigitally marking record carriersComputer moduleIntegrated circuit layout

The invention discloses a personalized IC (integrated circuit) card issuing device and a method. The device comprises a file input module and a card issuing script generating module, wherein the file input module is used for performing corresponding analysis and reconstitution operation of data elements for different inputted card making files according to EMV (Europay, Mastercard and VISA) personalized specifications, and generating and outputting data in a data packet identification format according to the personalized data elements to be written into IC cards, and the card issuing script generating module generates and outputs card issuing scripts according to the data outputted by the file input module, wherein the data are in the data packet identification format. The personalized data of the IC cards are processed into the format with unified specifications, accordingly, work efficiency and quality are greatly improved, simultaneously, the personalized data are organized simply in an interface manner, provided issuing functions are complete, operation is flexible, operation results are accurate, and card writing requirements of clients of banks are greatly met.

Owner:DATANG MICROELECTRONICS TECH CO LTD

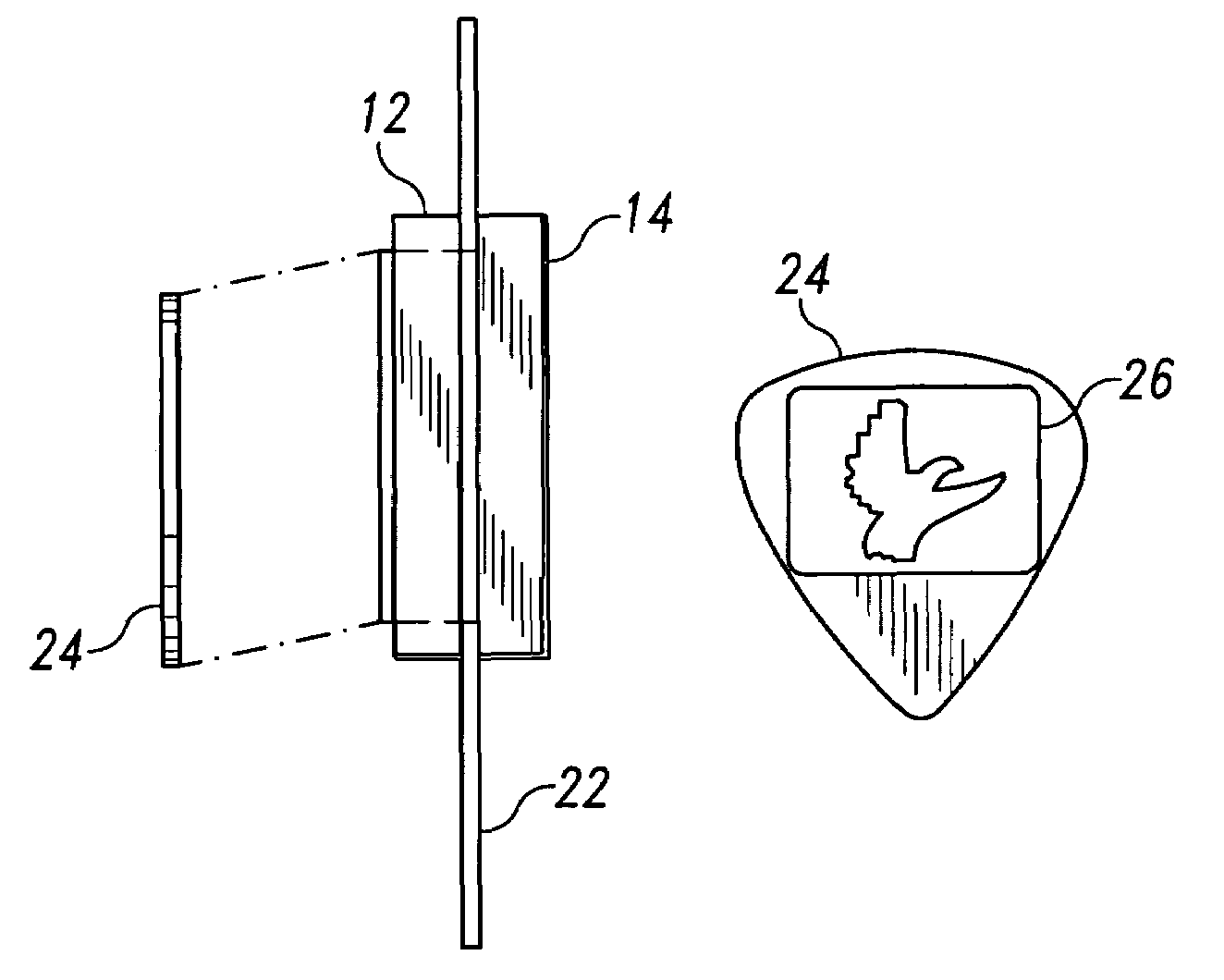

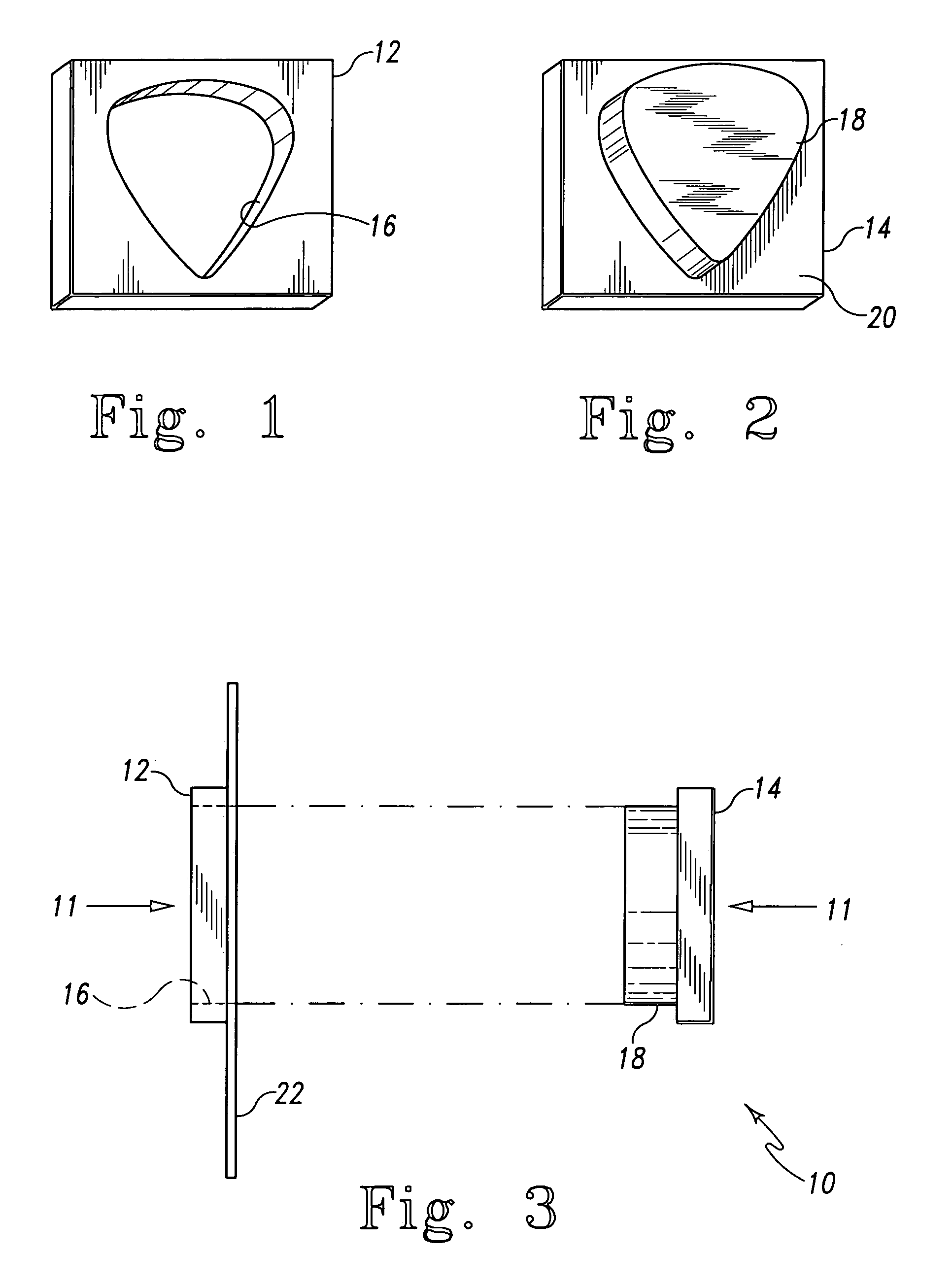

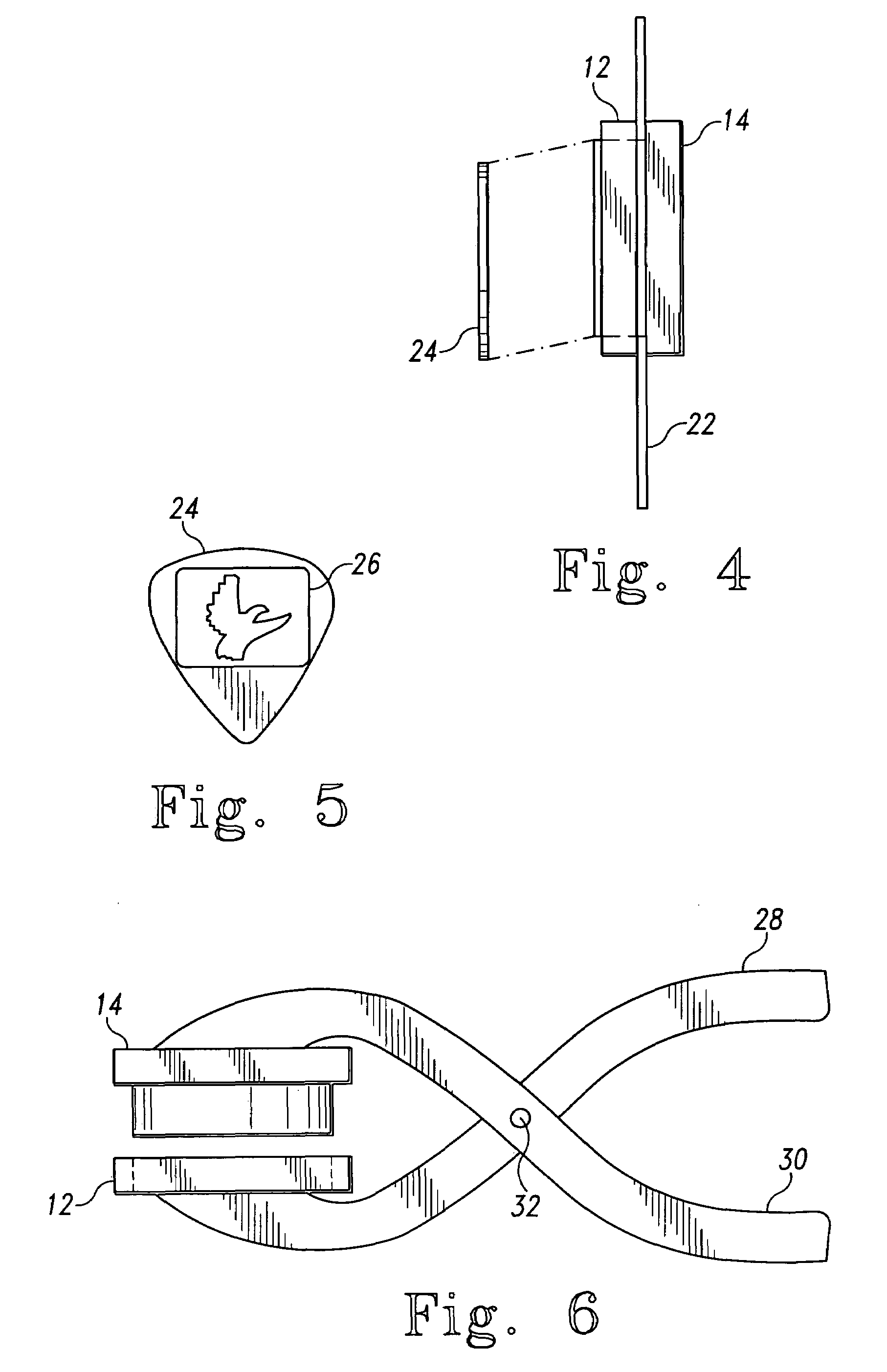

Method of producing guitar picks from identification cards

The present invention comprises a method of using a punch for cutting one or more guitar picks directly from an identification card. The punch includes a holding portion positioned on one side of the identification card and a die or blade portion aligned with the held identification card. The die or blade portion has the shape of a guitar pick. The holding portion has a corresponding recess formed therein in the shape of a guitar pick. When the punch is aligned with the recess in the holding portion and the two halves are brought together with an identification card therebetween, a guitar pick is punched out of the identification card material. The identification card may be positioned such that the resultingly produced guitar pick prominently displays a portion of the identification card logo (i.e. Visa®, Mastercard®, or the like), includes the security hologram, includes the name of the card holder, etc. In this way, the guitar pick may be customized or made to have a pleasing design element.

Owner:PICK PUNCH

Point of sale (POS) docking station system and method for a mobile barcode scanner gun system with mobile tablet device or stand alone mobile tablet device

ActiveUS9881292B2Robust designConsistencyCash registersVisual presentationDocking stationProgrammable read-only memory

A mobile scanner gun system processes a POS sale transaction and performs real-time daily store level inventory management. The system includes a main body portion extending toward a handle portion and forms an interior cavity and an aperture with a lens. A plurality of Universal Serial Bus (USB) mobile input devices are attached to the mobile scanner gun, including a barcode scanner and payment card input devices including a “Magnetic Stripe Reader” (MSR) and a “Europay, MasterCard and Visa” (EMV) reader, both with USB access to a PIN Entry Device (PED) and a “Near Field Communications” (NFC) reader through a specialized universal serial bus wiring harness. The specialized universal series bus wiring harness is adapted to be attached to and communicate with the mobile tablet device for communicating with a system integrated therein that enables store level real-time inventory management and a fully functioning POS capability for selling merchandise in a retail sales environment. A main Printed Circuit Board (PCB) having a previously programmed Electrically Erasable Programmable Read-Only Memory (EEPROM) controlling all MSR, EMV or NFC operations through the corresponding payment card input devices of each. When a customer payment card is swiped through the MSR slot or dipped into EMV reader or tapped on the NFC reader for payment card processing, customer payment is processed through the proper secured bank card processing network.

Owner:RETAIL TECH

Automated digital method and system of providing or sharing access

ActiveUS20200051060A1Digital data protectionPoint-of-sale network systemsInternet privacyBank account

Advantageously, the invention is a true competitor for money transfer systems, such as Western Union, Bitcoin, Swift, Visa, MasterCard, etc. The invention is the example of the economy going cashless and killing money transfers as a class. Conventional digital transactions facilitate electronic payment, such as money transfers, payment card charges, e-commerce transactions and any other types of transaction. However, in multiple circumstances, payees may be unbanked people (e.g., children that need money to buy something) or may have no payment card (e.g., may lost card), while payment card fund transfers may be expensive, time-consuming, and cumbersome for financial institutions. Thus, there is need for an improved approach. The invention discloses an automated digital method of providing or sharing access to a payment card and / or similar financial account or a non-payment card and / or similar non-financial account or non-card product, transacts between individuals or legal entities without physical transmission of a payment card, non-payment card, non-card product or its credentials, even without a recipient of an access having a payment card and / or financial account or a non-payment card and / or similar non-financial account or non-card product, particularly by providing or sharing access to a payment card and / or similar financial account or a non-payment card and / or similar non-financial account or non-card product of a sender.

Owner:MIDDLEWARE INC

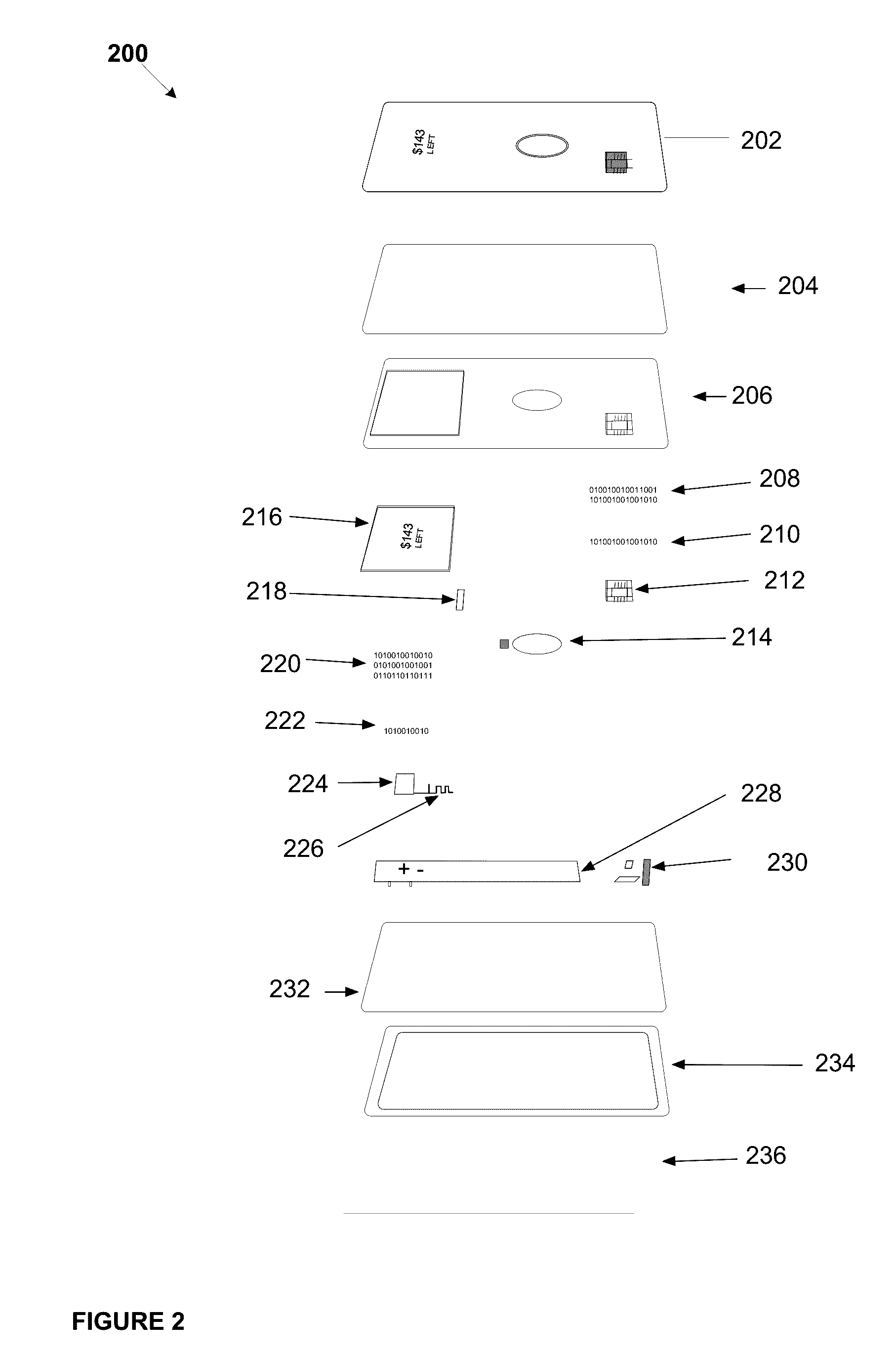

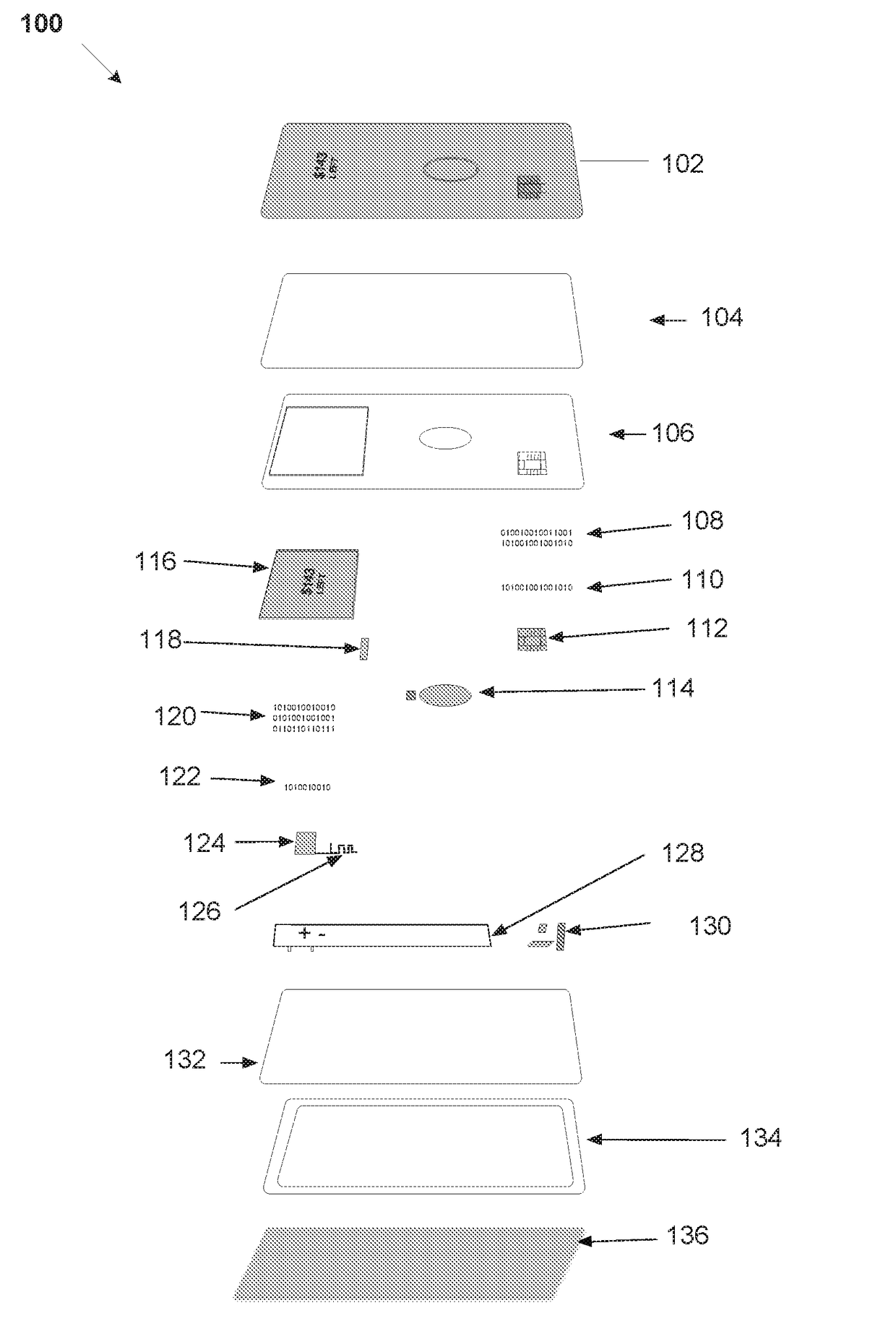

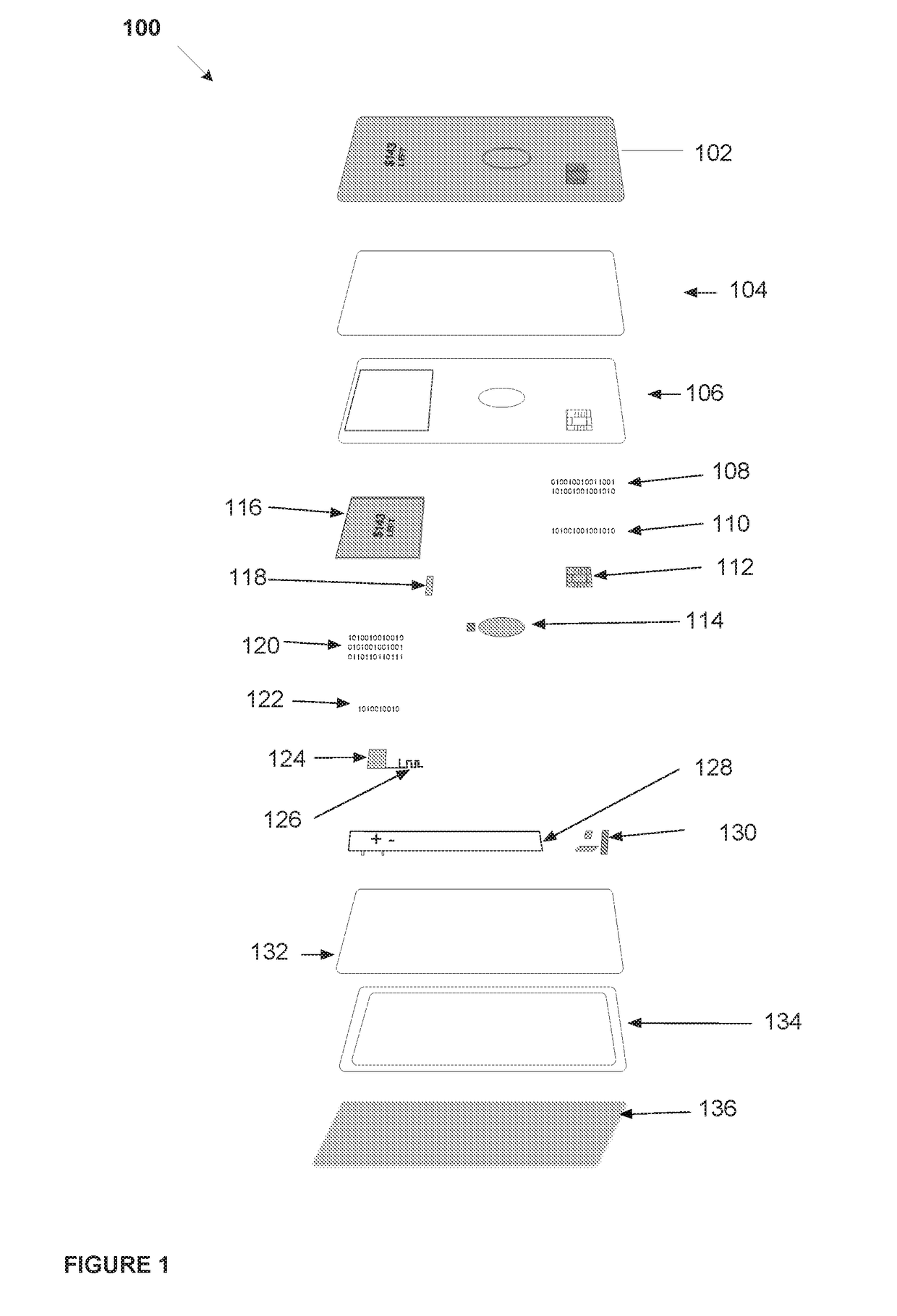

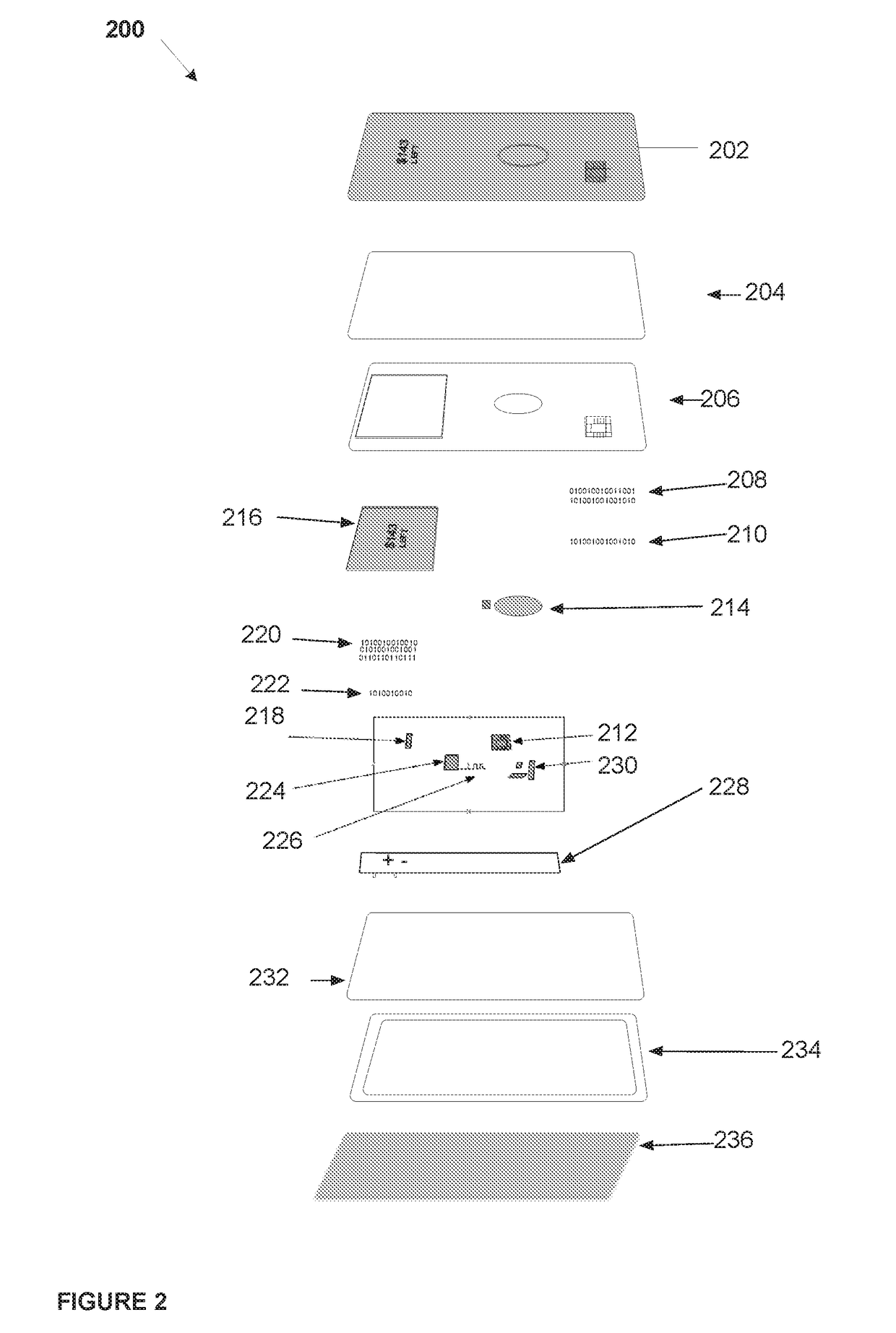

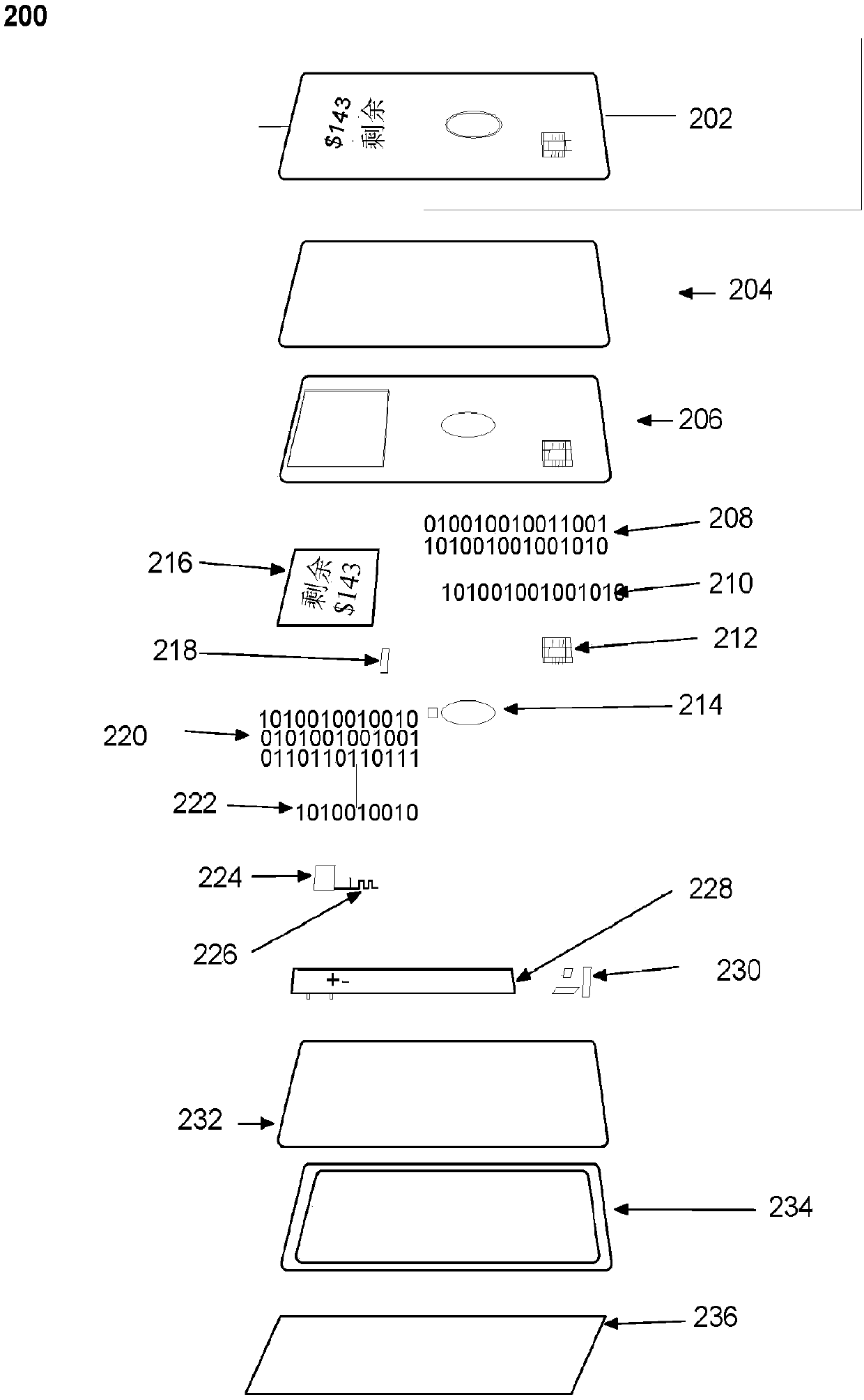

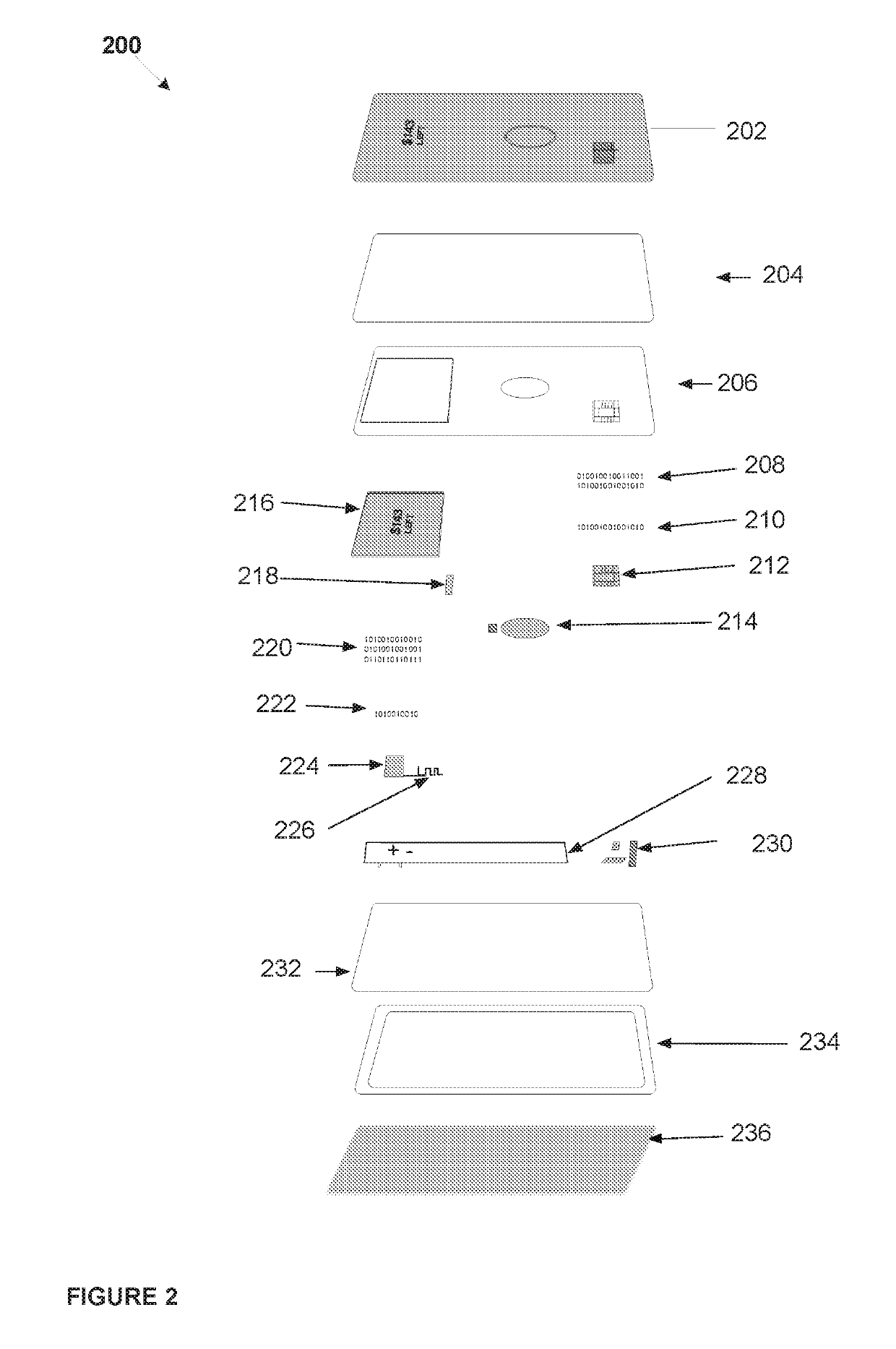

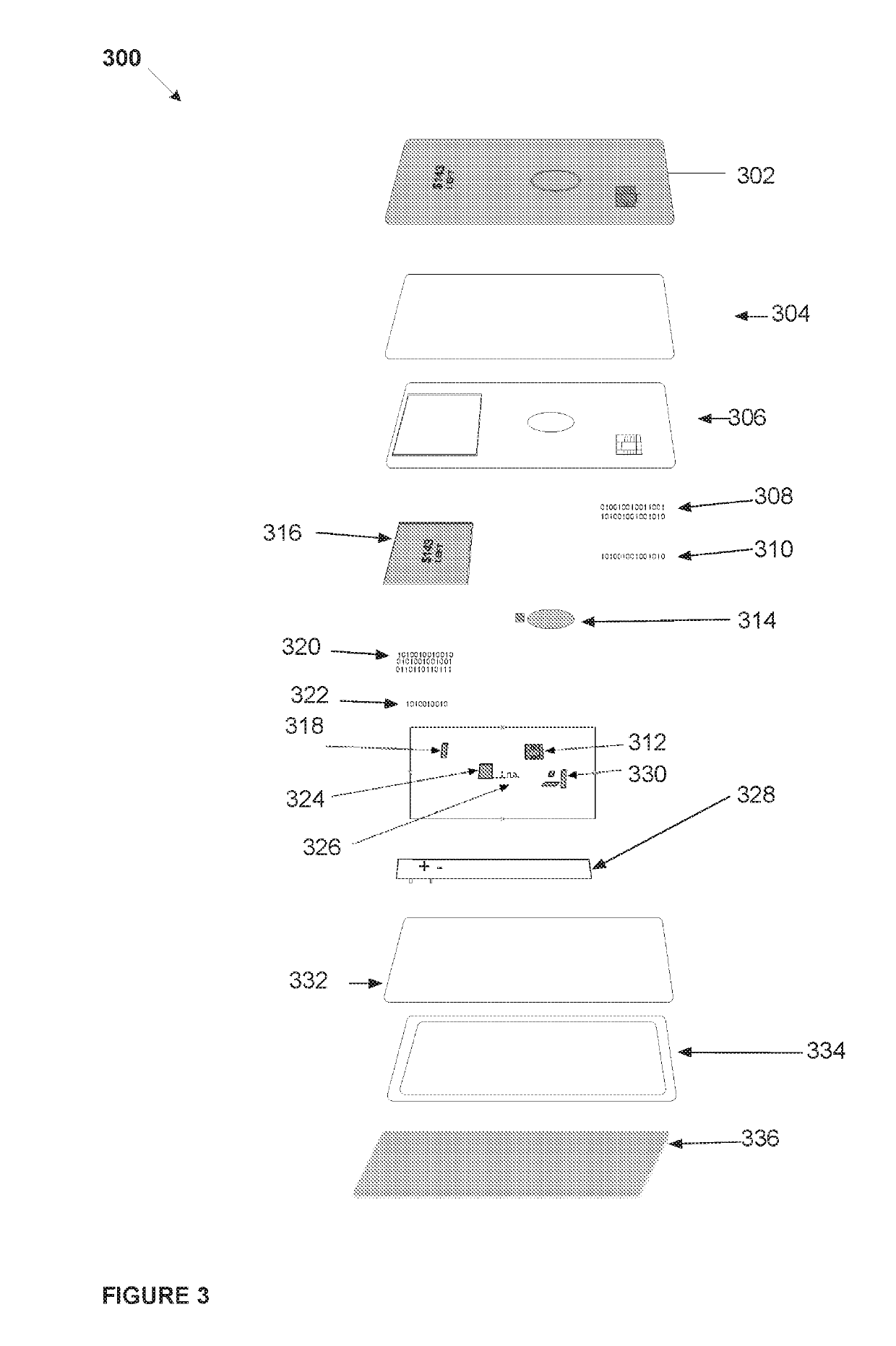

Dynamic transaction card with emv interface and method of manufacturing

ActiveUS20180190060A1Additional componentPayment architectureRecord carriers used with machinesSurface mountingPrinted circuit board

A dynamic transaction card with EuroPay-Mastercard-Visa (“EMV”) technology that includes an EMV interface connecting EMV contacts and an EMV processor to enable a multifunctional dynamic transaction card. A method of manufacturing a dynamic transaction card with an EMV interface connecting EMV contacts and an EMV processor. A dynamic transaction card with an EMV interface may be manufactured using a separate printed circuit board (PCB) layout with EMV contact patterns placed into the top surface of a molding to create the dynamic transaction card. The edges of the EMV contact patterns would be incorporated through holes, which are trimmed to scallops, to allow for surface mounting. The EMV interface may then include a connection between the EMV contact patterns and the EMV microprocessor such that the EMV microprocessor does not have to be placed directly beneath the EMV contact patterns.

Owner:CAPITAL ONE SERVICES

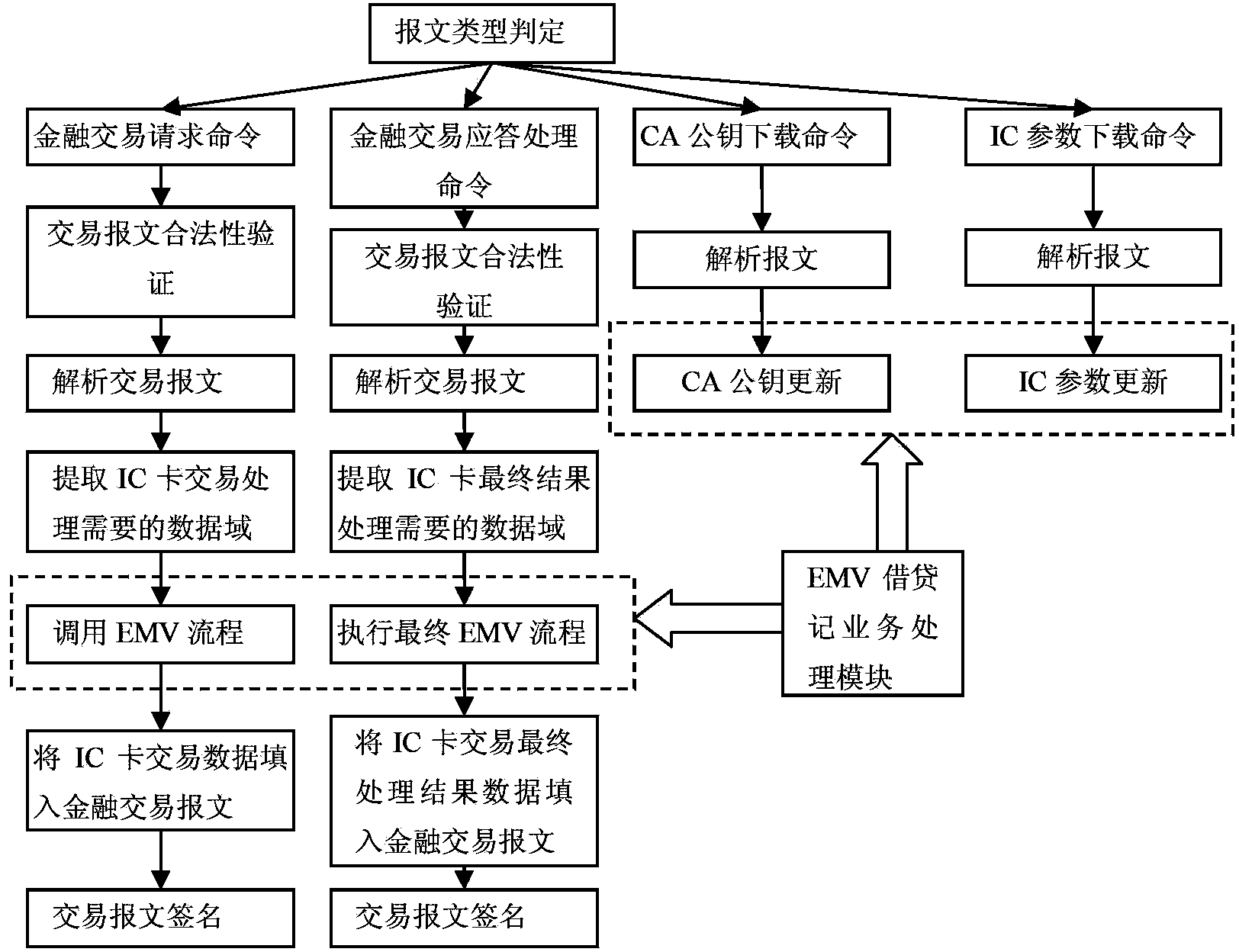

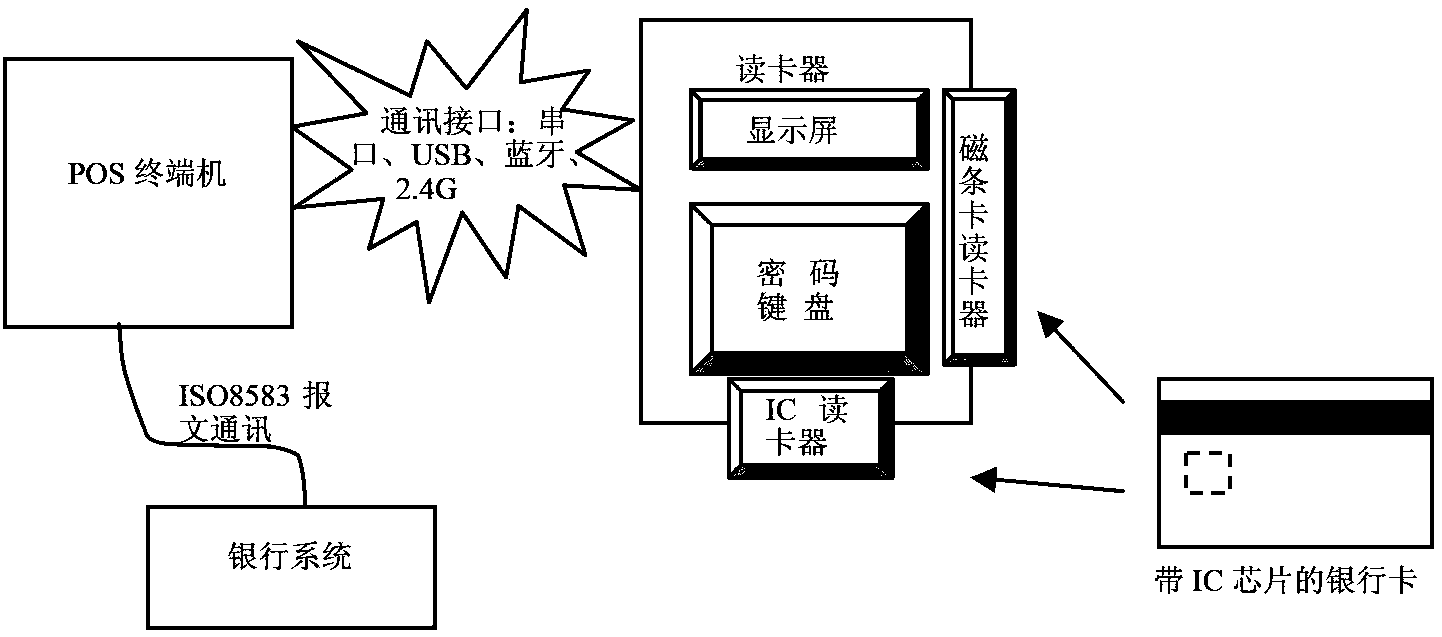

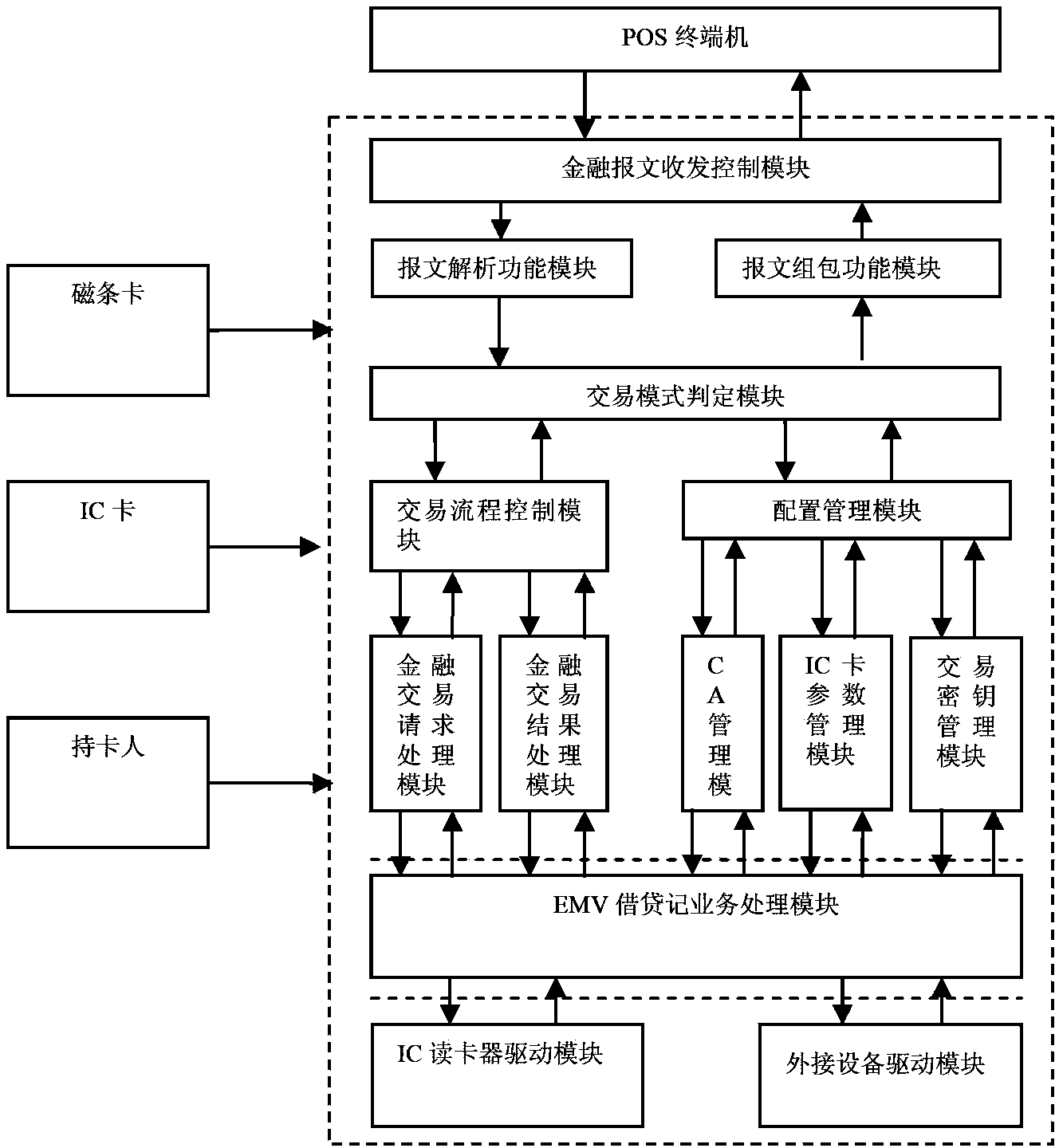

Intelligent financial card-reading system

ActiveCN102930670BReduce development difficultySolve the retrofit problemSensing record carriersPersonal identification numberCard reader

The invention provides an intelligent financial card-reading system. A point-of-sale (POS) terminal acquires transaction information which comprises transaction type, transaction amount and transaction serial number, and combines the transaction information into a corresponding bank card transaction request message; the message does not comprise card information, the personal identification number (PIN) of a bank card, Europay, MasterCard and VISA (EMV) migration relevant data and message authentication code (MAC) signature information; the information can be acquired by swiping the bank card and inputting the PIN on the basis of cooperation of all modules of the intelligent financial card-reading system, and filling a complete transaction request message; a card reader returns processed transaction request data to the POS terminal; the POS terminal continuously communicates with a bank system and is required to forward a response message which is returned by the bank system to the card reader; and the card reader judges whether transaction succeeds. By adoption of the intelligent financial card-reading system, the POS terminal can be simplified to a great extent, the development difficulty of the POS terminal is reduced, and reforming of EMV migration is realized with low cost.

Owner:FUJIAN XINO COMM TECH

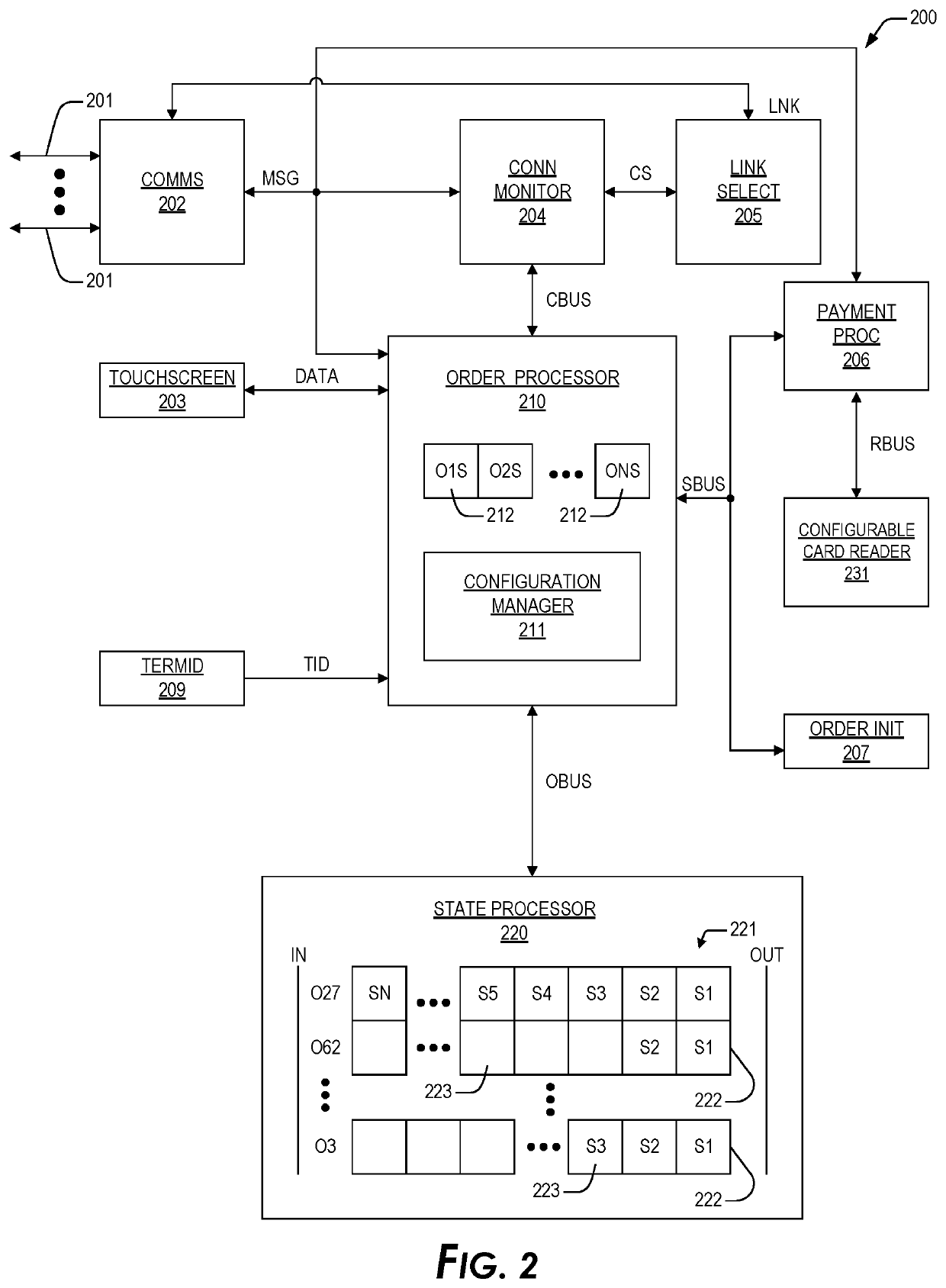

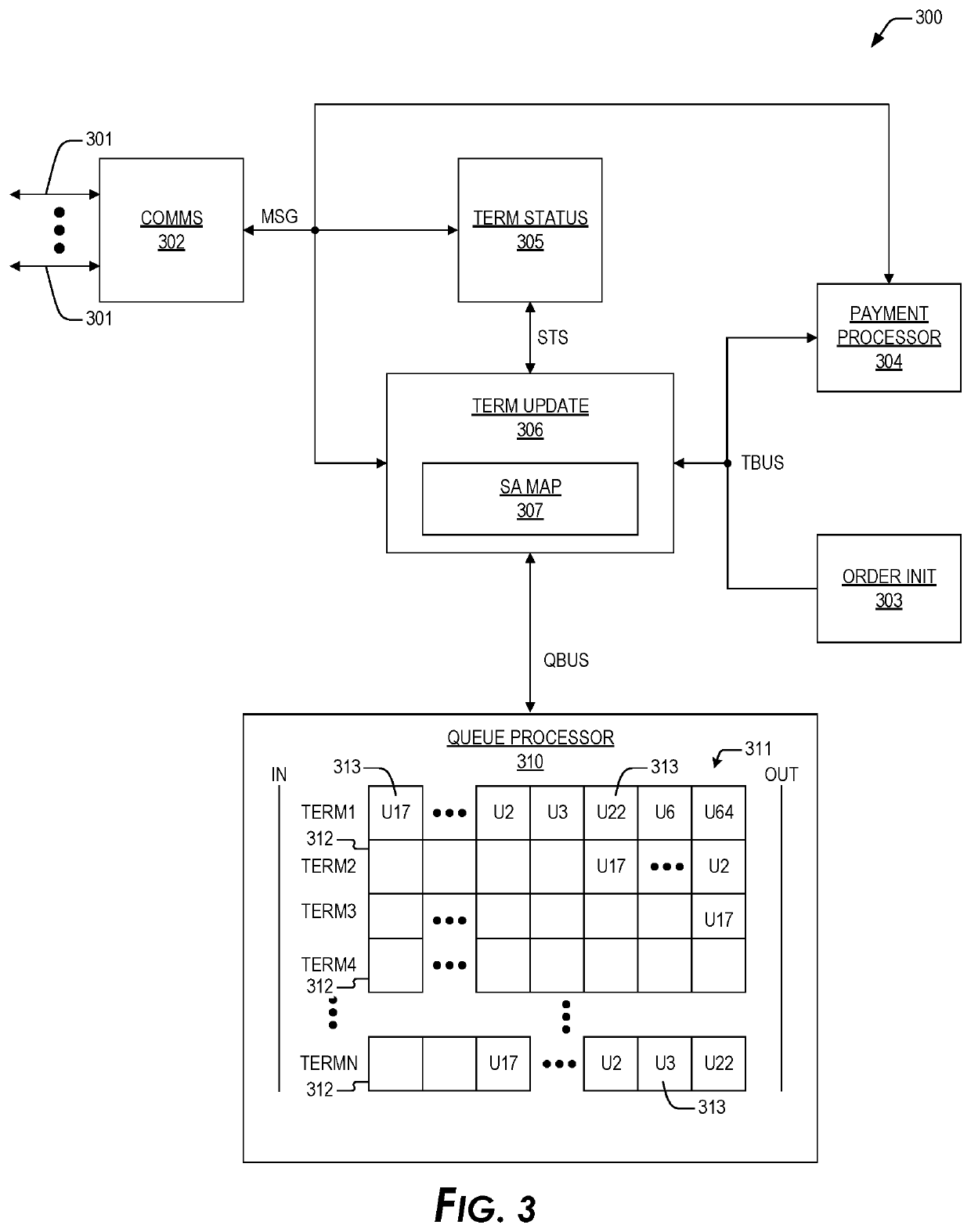

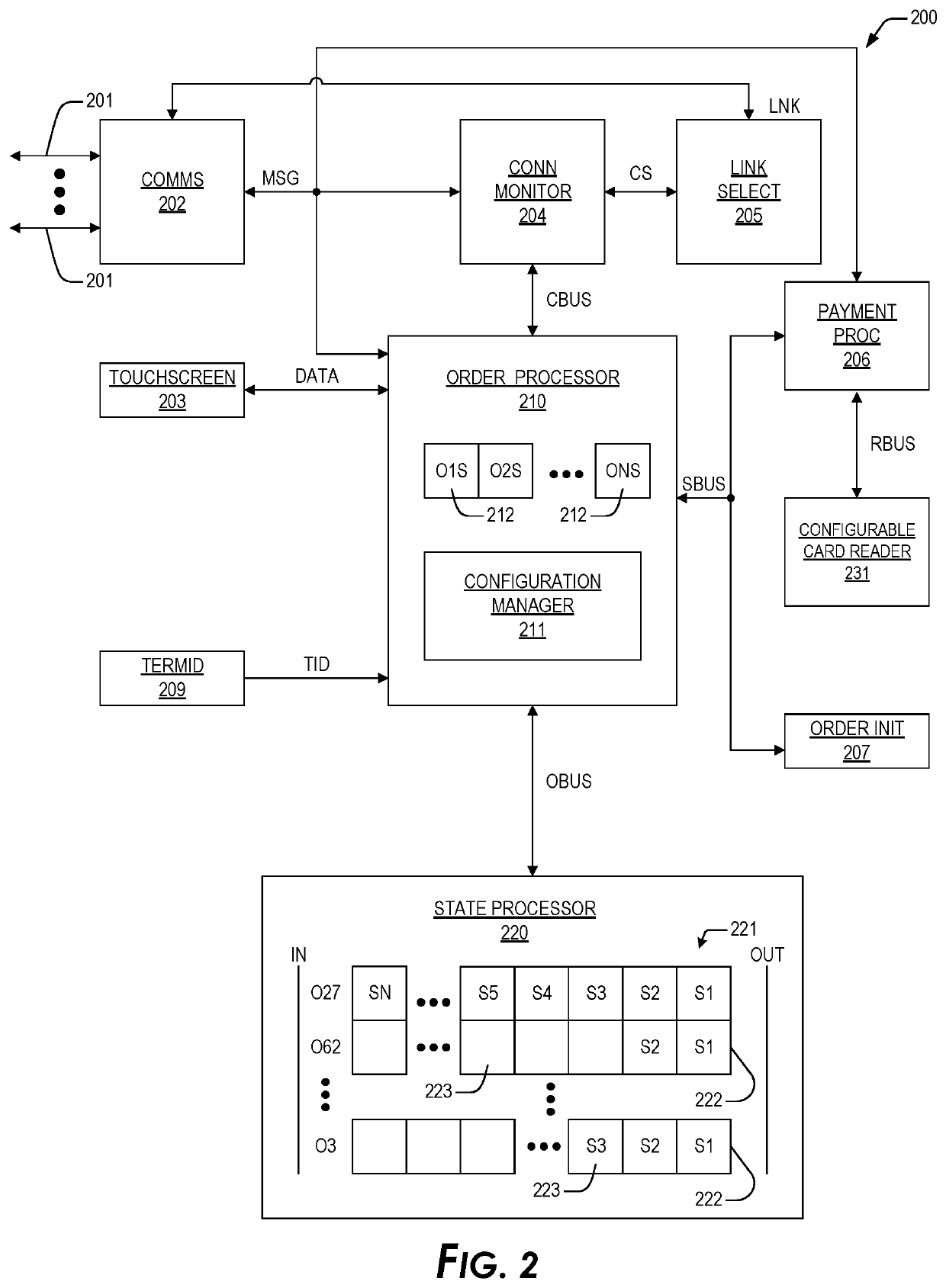

Configurable credit card device

ActiveUS10748369B1Credit registering devices actuationConveying record carriersSoftware engineeringMechanical engineering

A credit card reader that is configurable for use is provided that includes a first assembly and a second assembly. The first assembly has a mag stripe card reader. The second assembly has a Europay Mastercard Visa (EMV) reader. The second assembly is coupled to the first assembly, where the first assembly rotates about an axis perpendicular to a plane in which the assemblies are disposed to one of a plurality of angular positions, the plurality of angular positions indicating an offset angle of the first assembly relative to the second assembly.

Owner:TOAST INC

Dynamic transaction card power management

InactiveCN108027891AIncrease energy densityFast discharge/charge timeBatteries circuit arrangementsCells structural combinationFinancial transactionPrinted circuit board

A printed circuit board ("PCB") with a power source. The PCB and power source combination may be inserted into a small electronic device, such as a dynamic transaction card, which may include a dynamic transaction card or a EuroPay-MasterCard-Visa ("EMV") card. For example, a PCB may be manufactured to attach a battery as a power source to one side of a PCB such that the integrated battery directly connects with at least a portion of the PCB side. A rapid energy storage device may also be utilized as a power source. Energy may be harvested from an EMV terminal to charge or recharge a dynamic transaction card or EMV card powered by a rapid energy storage device when the card is inserted into the terminal.

Owner:CAPITAL ONE SERVICES

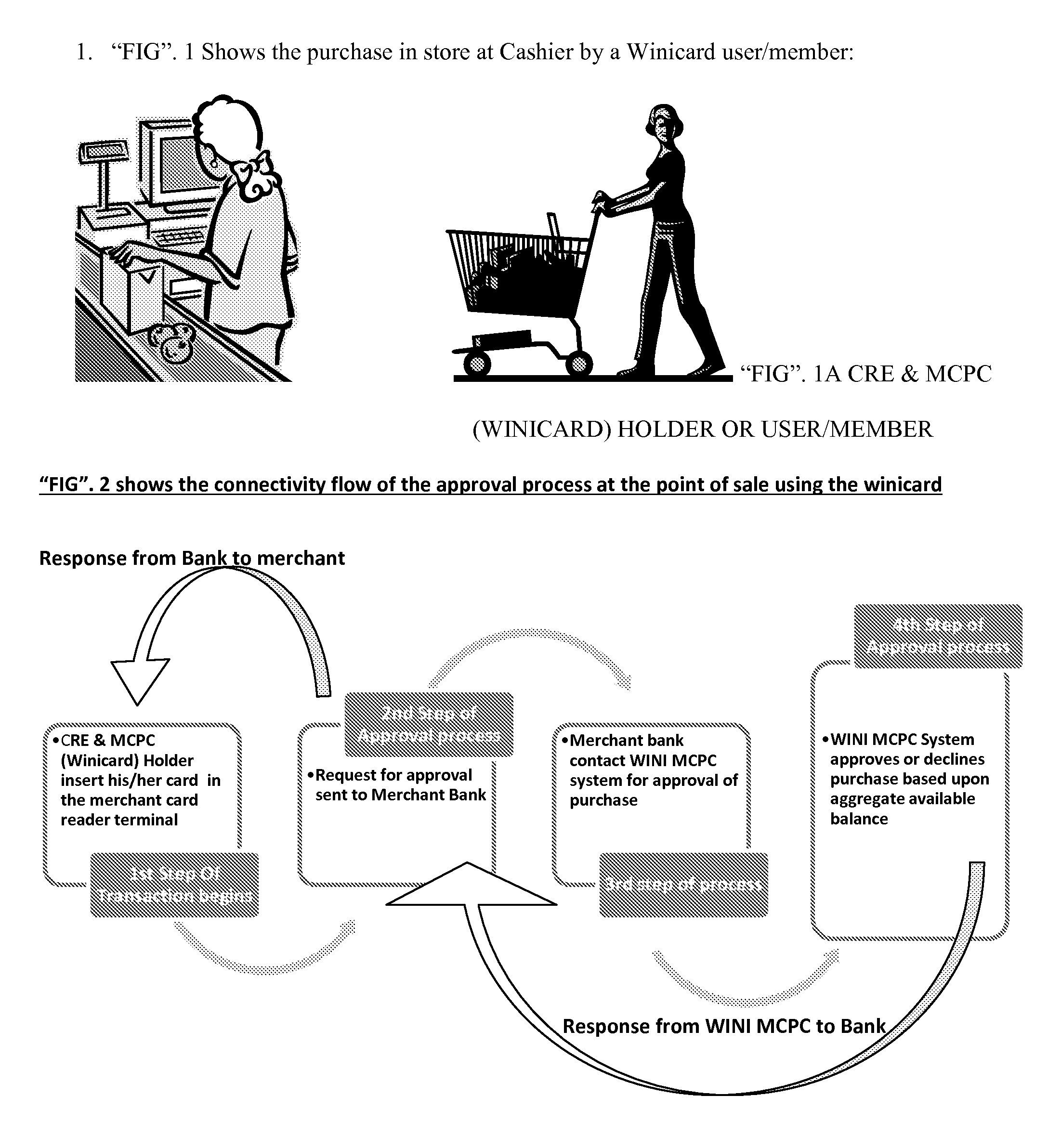

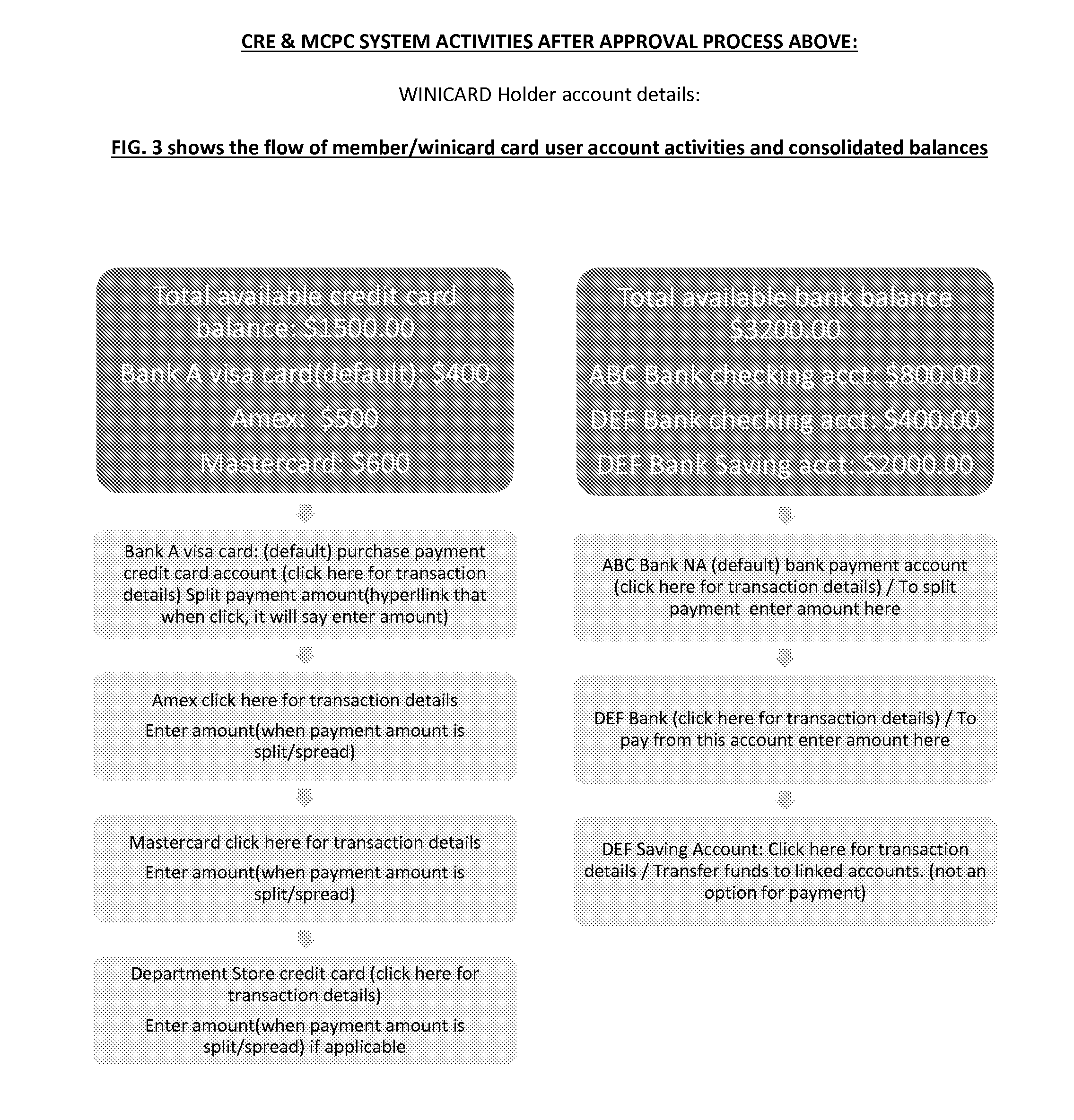

CRE & MCPC Software & Website

My pin driven CRE & MCPC system will consolidate rewards and credit & debit cards of each member into a single high security micro chip personal card that can be used at all vendors where these credit & debit cards are accepted. The CRE & MCPC card will be used as a traditional credit / debit card by inserting it into the card terminal at any vendor that accepts credit / debit card, enter their 5 digit pin; select the card from their account to charged the purchase to (ie: 1=AMEX; 2=VISA; 3=MASTERCARD; 4=DISCOVER and so on for local store credit cards.) This MCPC system will give each member the option to split up the payment of a single purchase with more than one card in their CRE & MCPC account.Members will also manage other aspect of rewards and credit / debit cards. Bill payment

Owner:OLSON ERIC WILFRED

Dynamic transaction card power management

InactiveUS20190220719A1High energy density fast discharge/charge timeLow level of heatingBatteries circuit arrangementsCells structural combinationEngineeringComputer terminal

A printed circuit board (“PCB”) with a power source. The PCB and power source combination may be inserted into a small electronic device, such as a dynamic transaction card, which may include a dynamic transaction card or a EuroPay-MasterCard-Visa (“EMV”) card. For example, a PCB may be manufactured to attach a battery as a power source to one side of a PCB such that the integrated battery directly connects with at least a portion of the PCB side. A rapid energy storage device may also be utilized as a power source. Energy may be harvested from an EMV terminal to charge or recharge a dynamic transaction card or EMV card powered by a rapid energy storage device when the card is inserted into the terminal.

Owner:CAPITAL ONE SERVICES

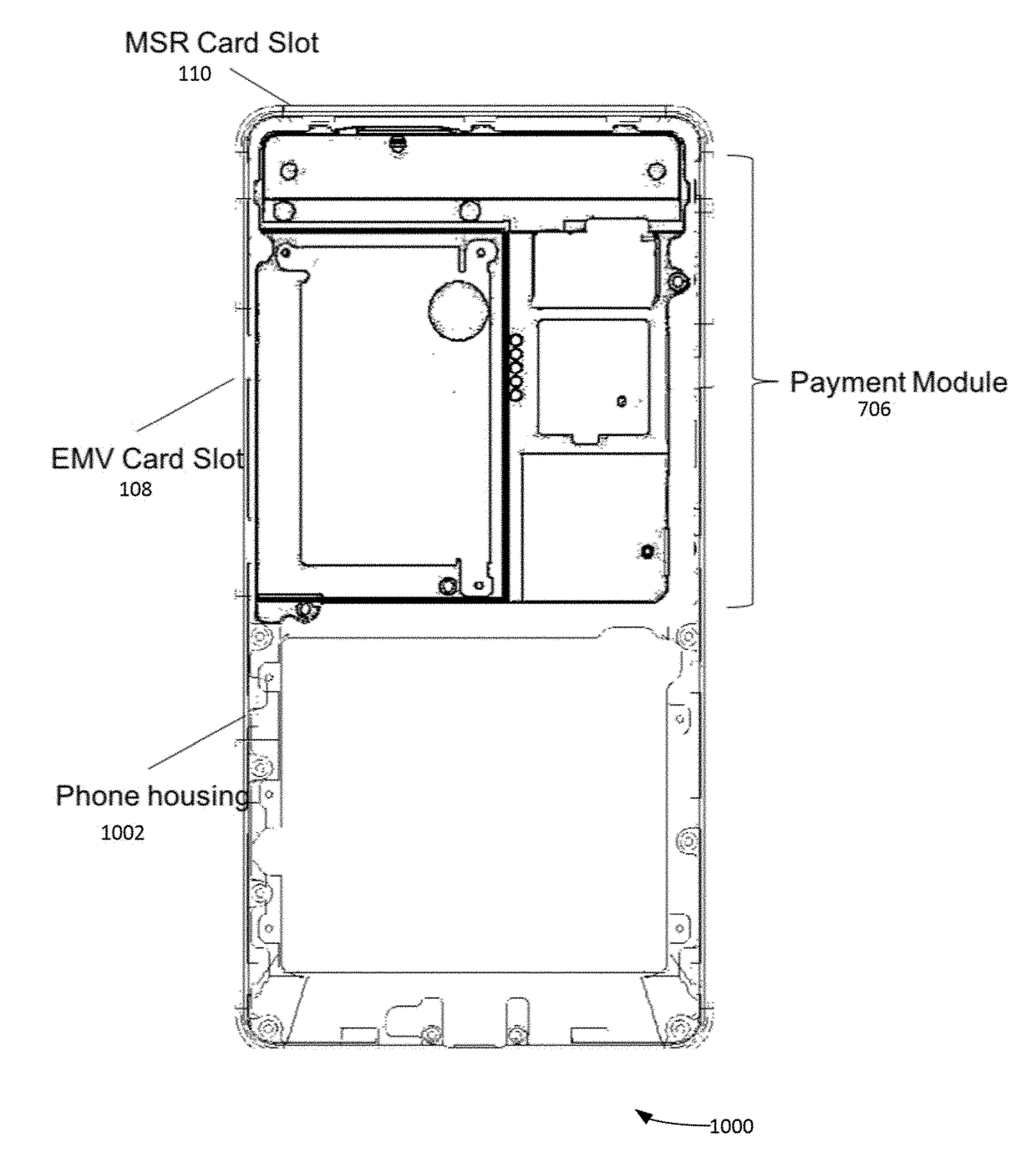

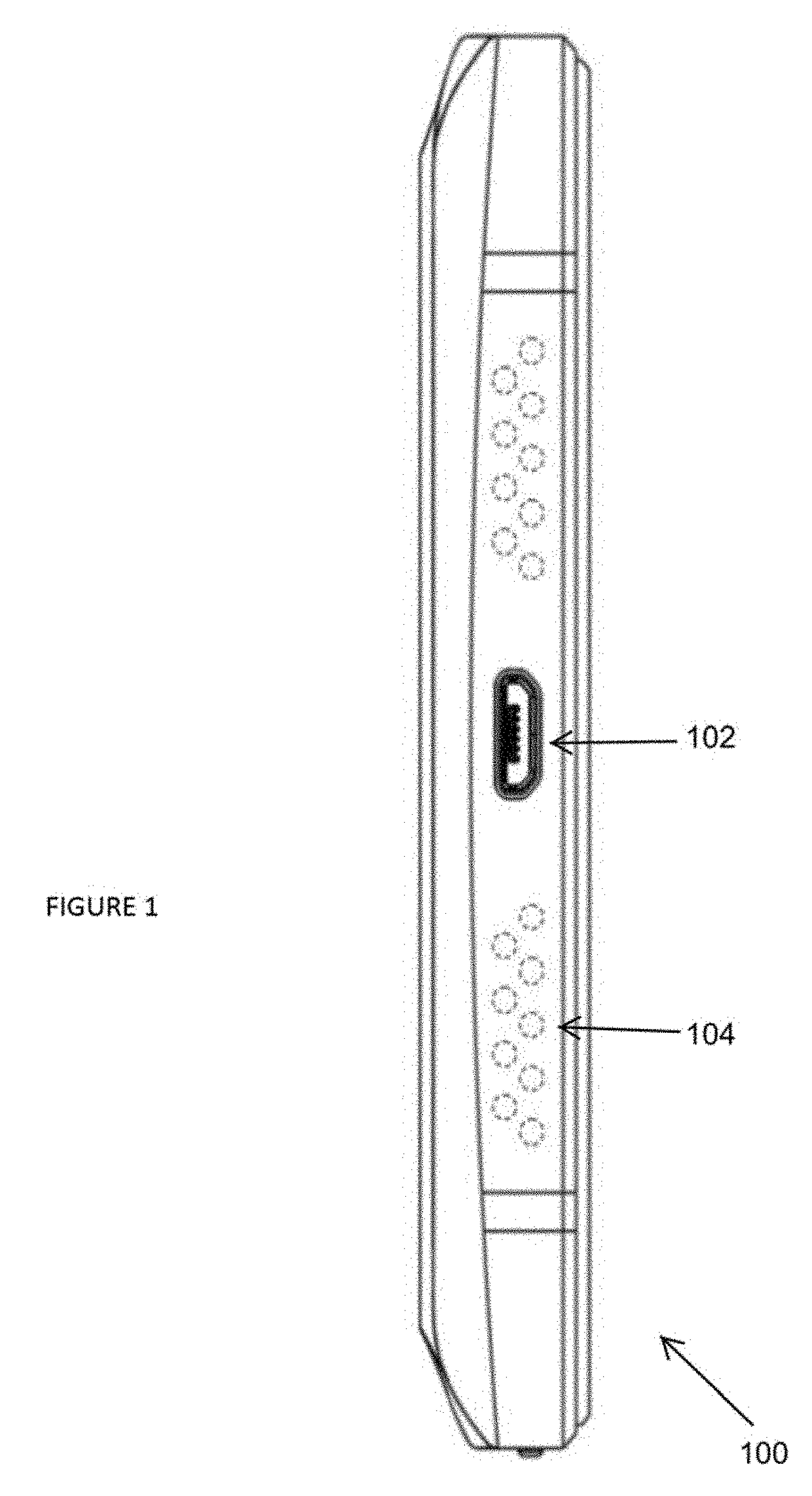

Handheld point-of-sale terminal with configurable credit card device

ActiveUS10755515B1Good techniqueConfigurable for useCredit registering devices actuationCash registersDisplay deviceEngineering

A handheld point-of-sale (POS) terminal) is provided that has a housing, a touchscreen display on a face of the housing, and a credit card reader that is configurable for use disposed within the housing, the credit card reader including a first assembly comprising a mag stripe card reader and a second assembly comprising a Europay Mastercard Visa (EMV) reader, where the second assembly is coupled to the first assembly. The first assembly rotates about an axis perpendicular to a plane in which the assemblies are disposed to one of a plurality of angular positions, the plurality of angular positions indicating an offset angle of the first assembly relative to the second assembly, where the credit card reader is disposed within the housing in the one of the plurality of positions, and where the housing is configured to allow for access to credit card insertion points on the credit card reader.

Owner:TOAST INC

System and method for sending money to a recipient

InactiveCN101918964ACredit registering devices actuationPayment circuitsComputer hardwareComputer science

The invention provides a system and method for sending money, locally or internationally, which method includes the steps of, issuing a sender of money with a virtual (credit or debit) card number and a card expiry date, communicating to the intended recipient of the money the virtual card number and card expiry date, presenting the virtual card number and, optionally, the card expiry date, to any merchant with a point-of-sale terminal that is capable of processing credit and / or debit card transactions, processing a key-entered purchase or cash-back transaction, on the point-of sale terminal by keying in the virtual card number provided by the recipient into the point-of-sale, optionally together with the card expiry date and the amount, processing, also known as authorizing, settling and clearing, with a virtual card system, the key-entered transaction by credit and / or debit card transaction clearing means so that the funds are cleared as available to the merchant, and the merchant paying the cleared amount to the recipient, optionally less a processing fee charged to the recipient. The credit and / or debit card accepting terminal also accepts Visa, MasterCard, American express, Diners Club, Discover, JCB, Relation Card and / or CUP credit or debit cards.

Owner:TRANWALL HLDG

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com