Enterprise loan automatic approval method and device, storage medium and electronic device

An automatic approval, enterprise technology, applied in data processing applications, finance, instruments, etc., can solve the problems of limited financing channels for small and micro enterprises, difficulties in the real economy, and high financing costs

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

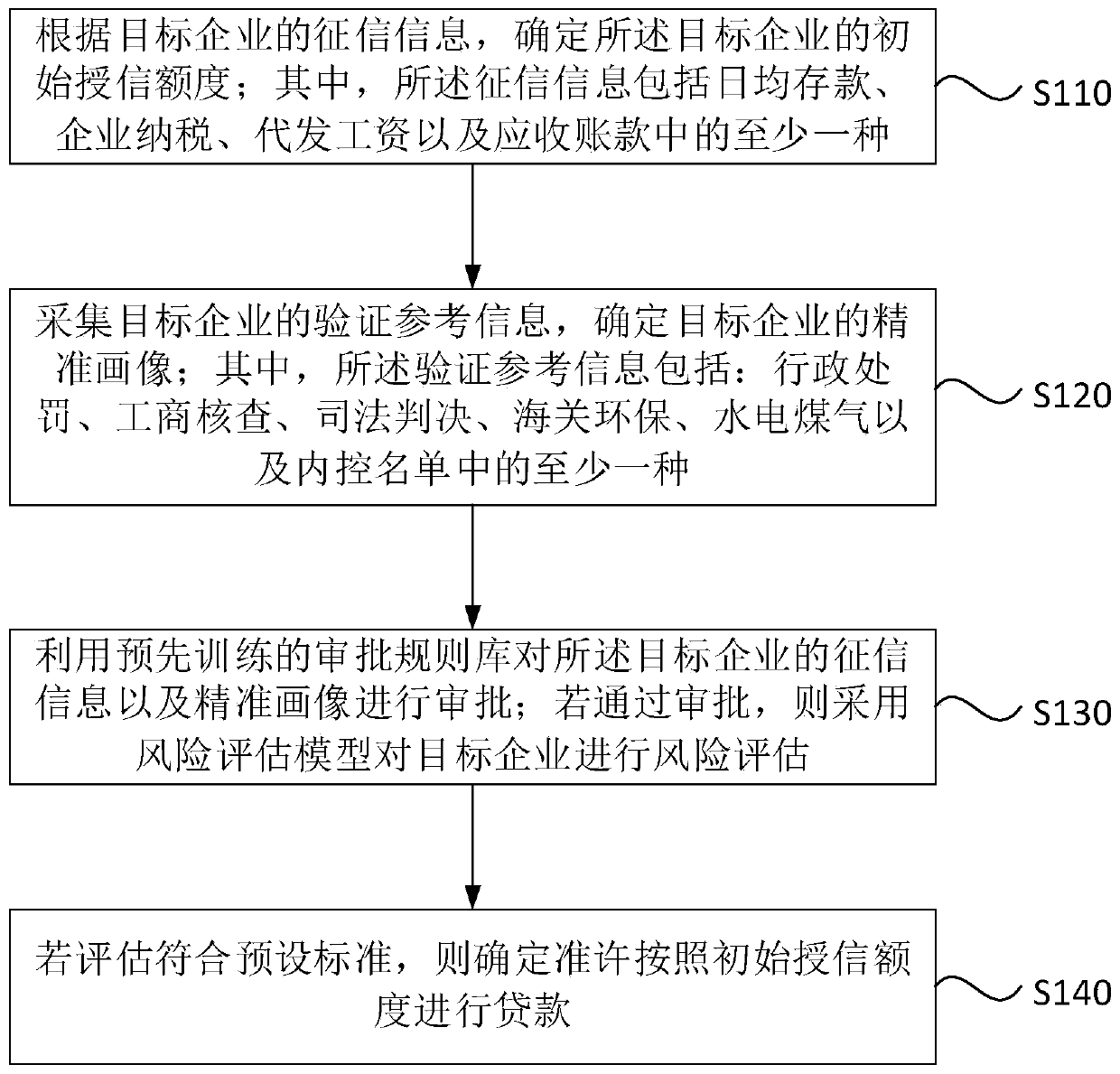

[0052] figure 1 It is a flow chart of the enterprise loan automatic approval method provided in Embodiment 1 of this application. This embodiment can be adapted to the situation of automatic approval of enterprise loans. This method can be executed by the enterprise loan automatic approval device provided by this application embodiment. The device can be realized by means of software and / or hardware, and can be integrated into electronic devices such as smart terminals.

[0053] Such as figure 1 As shown, the methods for automatic approval of enterprise loans include:

[0054] S110. Determine the initial credit line of the target company according to the credit information of the target company; wherein, the credit information includes at least one of daily average deposits, corporate tax payments, agency salary payment, and accounts receivable.

[0055] Among them, the target enterprise can be an enterprise applying for a loan, or a small and micro enterprise, but for mediu...

Embodiment 2

[0079] In order to enable those skilled in the art to understand the technical solution provided by the application more accurately, the application also provides a preferred implementation manner.

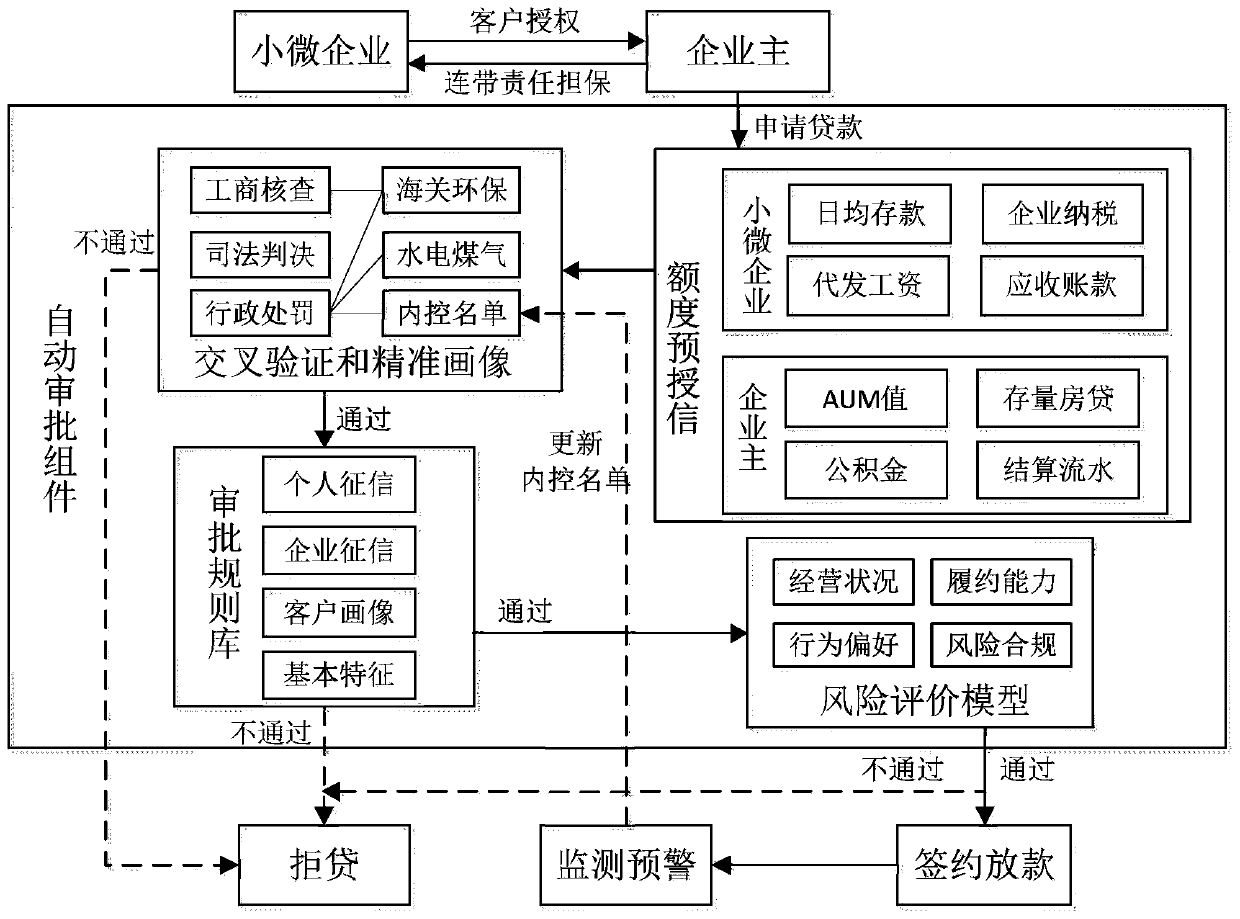

[0080] figure 2 It is a schematic diagram of the automatic approval principle provided in Embodiment 2 of the present application. Such as figure 2 As shown, the working principle of the automatic loan approval method for small and micro enterprises is as follows: When a customer applies for a loan for a small and micro enterprise, firstly, according to the data of the small and micro enterprise and the owner's financial assets, settlement flow, financing situation, etc., as well as internal and external credit conditions, the client is established Unify the credit system, and pre-credit the amount for customers. Then use multi-dimensional data such as administrative penalties, industrial and commercial inspections, judicial decisions, customs environmental protection, water, ...

Embodiment 3

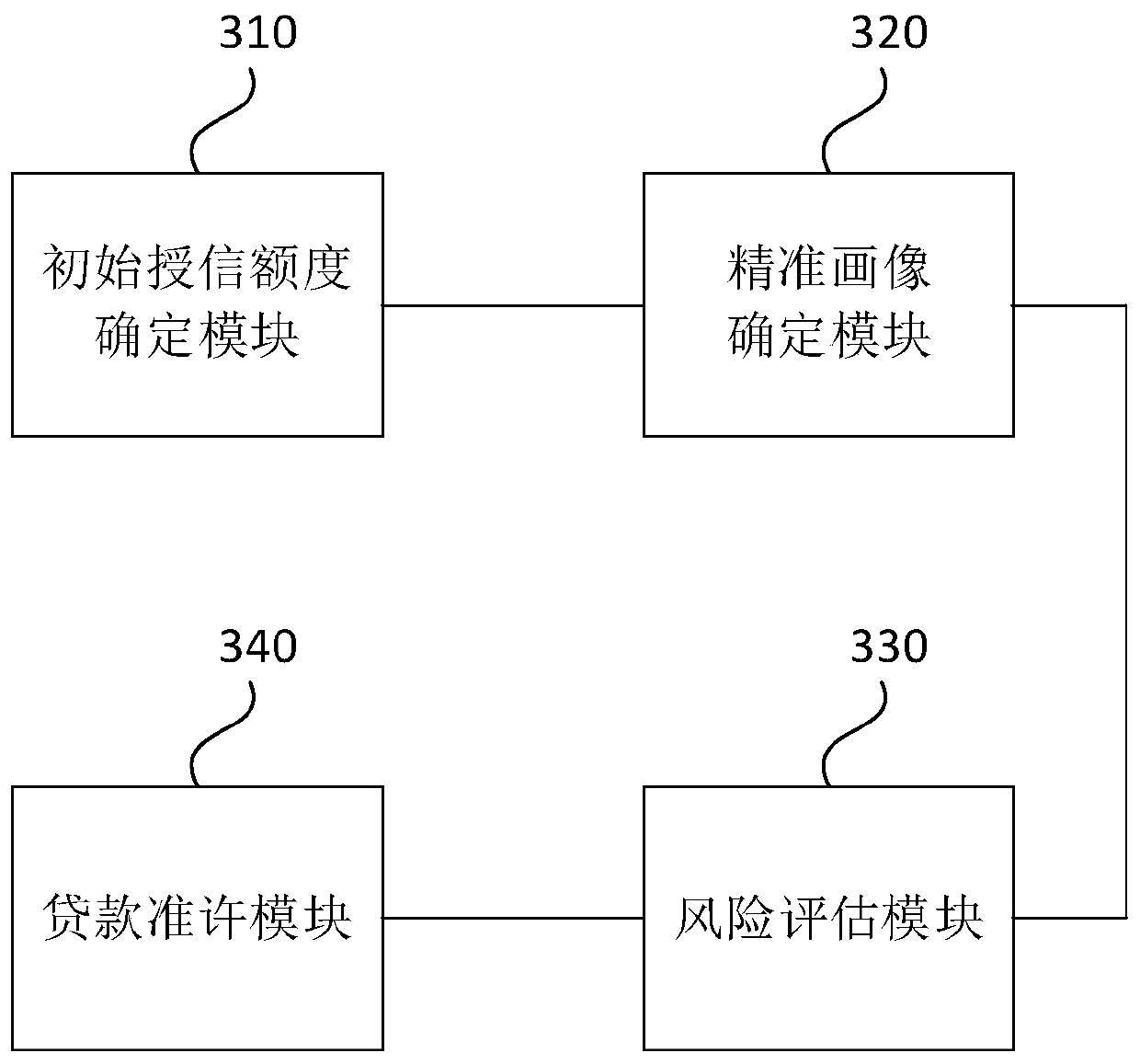

[0111] image 3 It is a schematic structural diagram of the enterprise loan automatic approval device provided in Embodiment 3 of the present application. Such as image 3 As shown, the enterprise loan automatic approval device includes:

[0112] The initial credit line determination module 310 is configured to determine the initial credit line of the target enterprise according to the credit information of the target enterprise; wherein, the credit information includes daily average deposits, corporate tax payments, agent payment of wages, and accounts receivable at least one of;

[0113] The precise portrait determination module 320 is used to collect the verification reference information of the target enterprise and determine the precise portrait of the target enterprise; wherein, the verification reference information includes: administrative punishment, industrial and commercial inspection, judicial judgment, customs environmental protection, water, electricity and gas...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com