Patents

Literature

309 results about "Banking industry" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

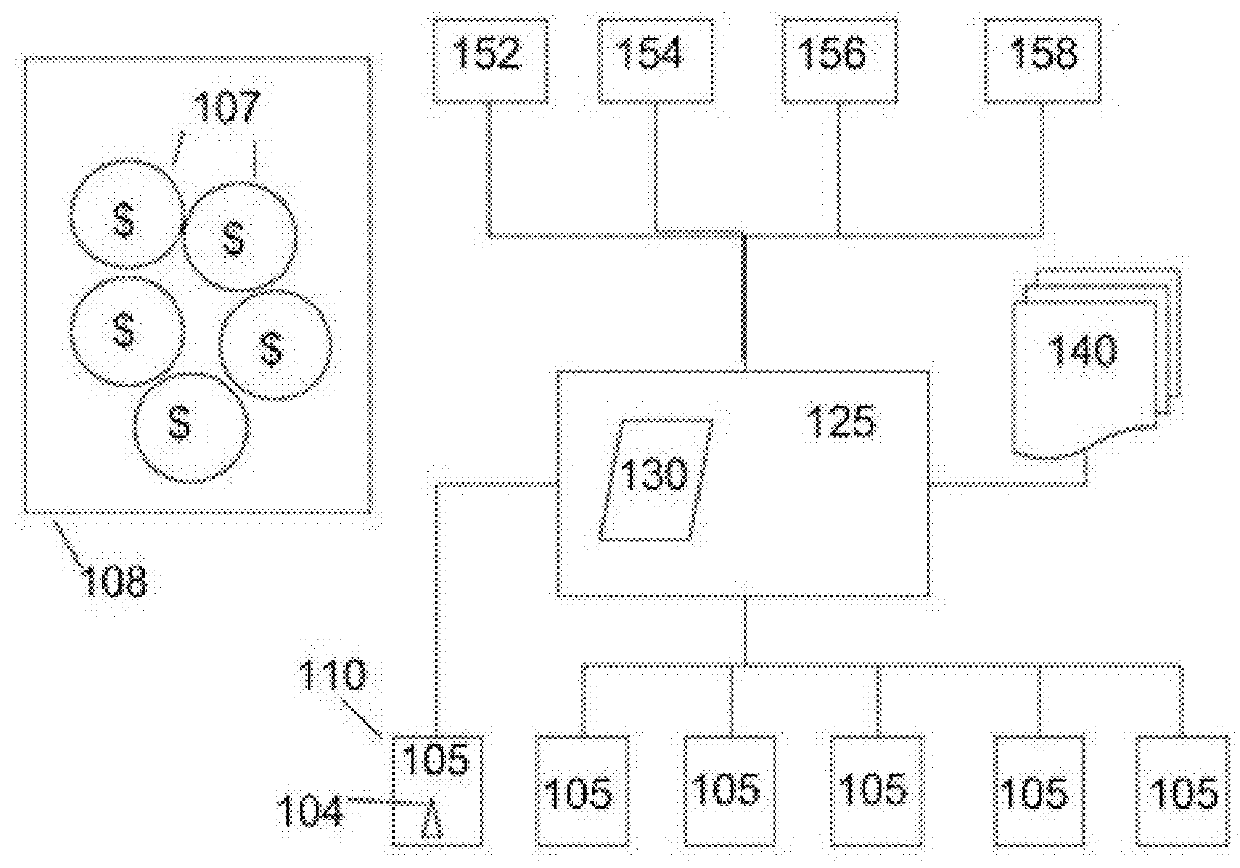

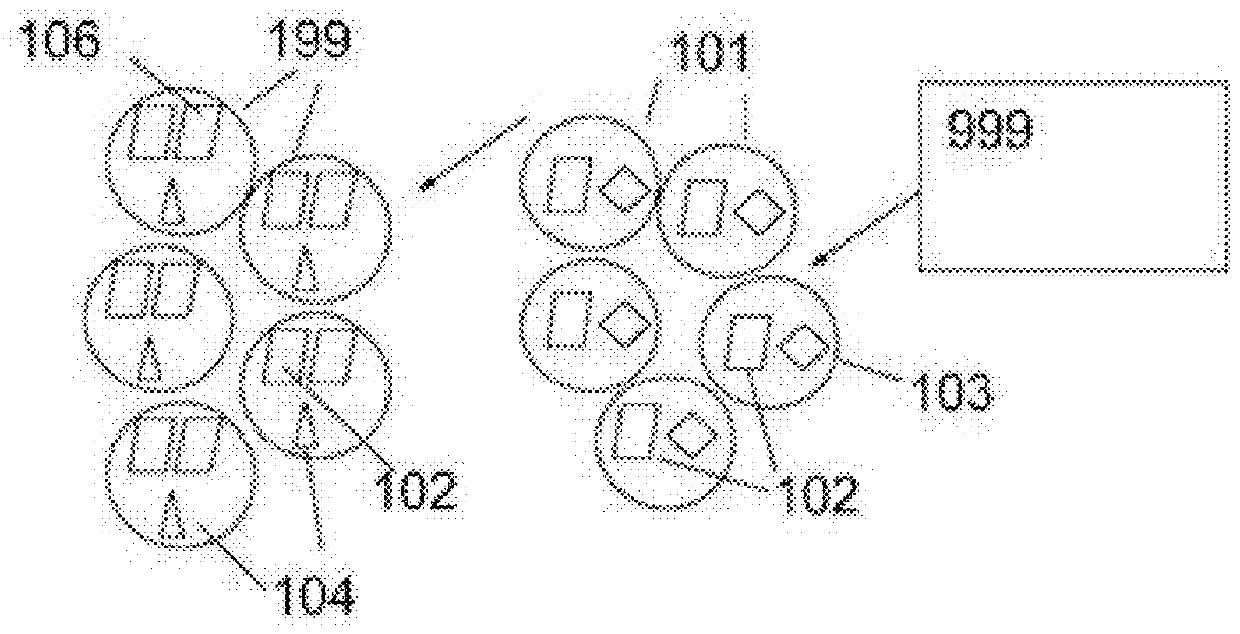

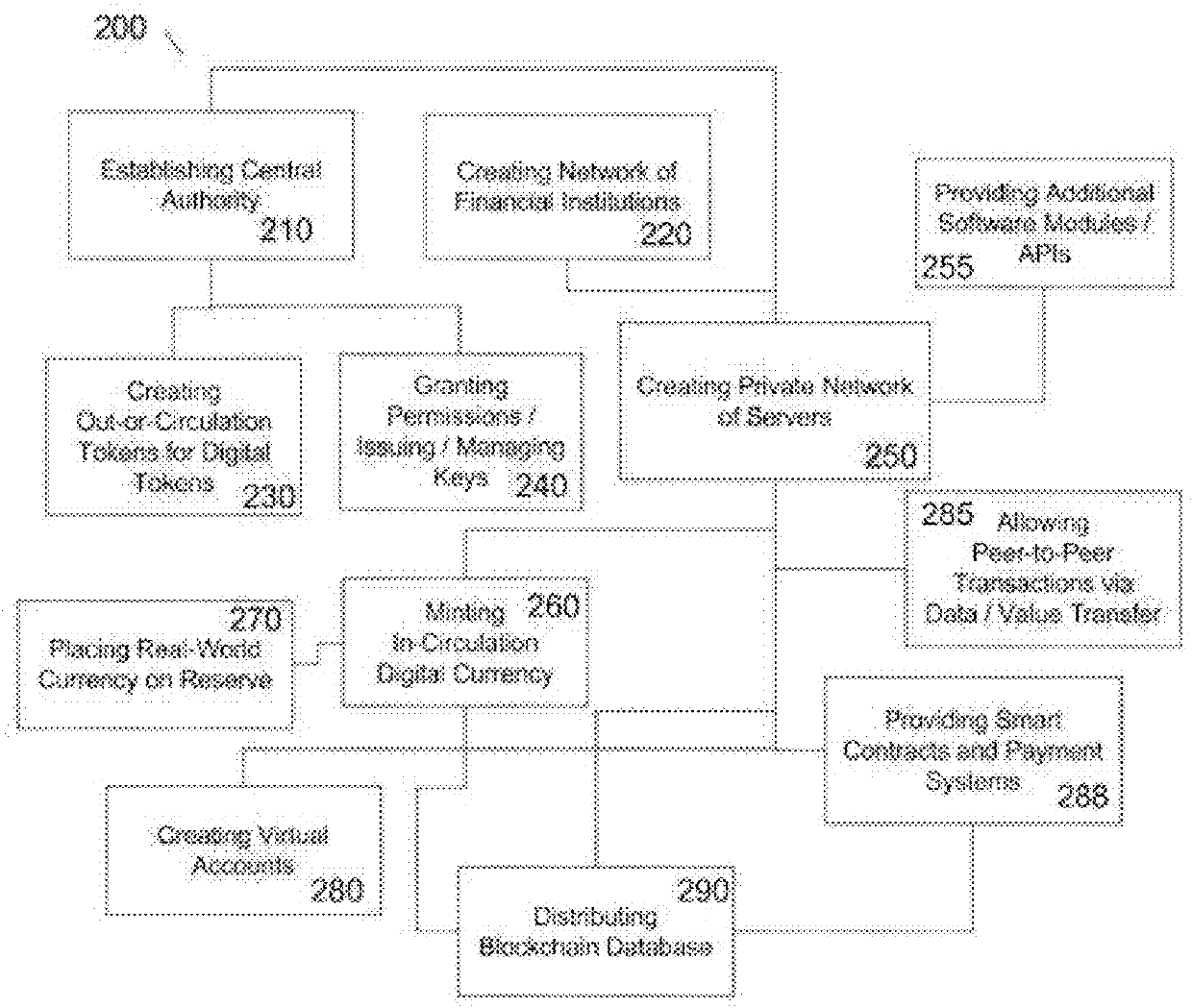

Blockchain digital currency: systems and methods for use in enterprise blockchain banking

PendingUS20180268382A1Enhance security and traceability and authenticityPayment protocolsPayment circuitsDigital currencyFinancial transaction

Methods and systems for using blockchain digital currency are provided herein. The methods and systems comprise a blockchain digital currency that is created and utilized on a permission-based network of financial institutions. The blockchain digital currency is created by a central authority and minted into circulation by banks within the network, and is backed by reserves of real world currency of any country. The digital currency can be used for any type of financial transaction, and the system provides security, trust, traceability and a detailed audit trail for all transactions.

Owner:WASSERMAN STEVEN VICTOR

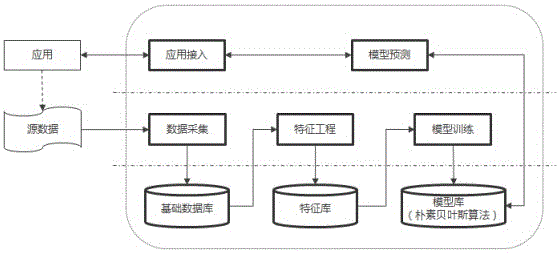

Real-time recommendation system and method of financial products of banks based on Naive Bayesian classification

InactiveCN106600369AImprove experienceIncrease stickinessMathematical modelsFinanceData setData mining

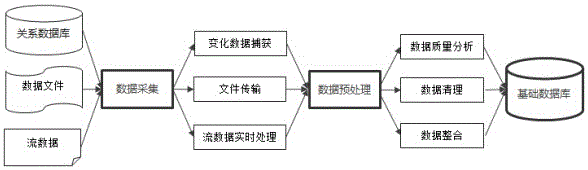

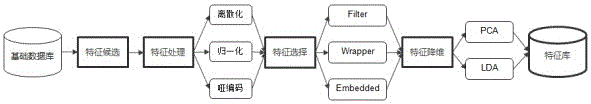

The invention discloses a real-time recommendation system and method of financial products of banks based on Naive Bayesian classification wherein the method comprises: acquiring the data of a bank business system, a peripheral system, and an internet / mobile internet; processing and storing the data in a basic database; conducting characteristic processing to the data attributes of the customers in a certain area; converting for data characteristics to develop a characteristic database; classifying the data in the characteristic database as a training data set and a verification data set which are used respectively for the training and estimating of a Naive Bayesian classification algorithm model; obtaining a model base after several times of iteration; identifying the characteristics of customers and in combination with the Naive Bayesian classification algorithm model base, matching the customers with the financial products they are mostly likely to purchase in real time; and recommending to the customers the financial products that are forecasted and matched by the models. The recommendation system and method of the invention are capable of helping customers to find out suitable products, therefore, increasing the user experience and the bonding effect of the customers to the financial products, lifting up the transferring rate of the products and making the bank more competitive.

Owner:广东奡风科技股份有限公司

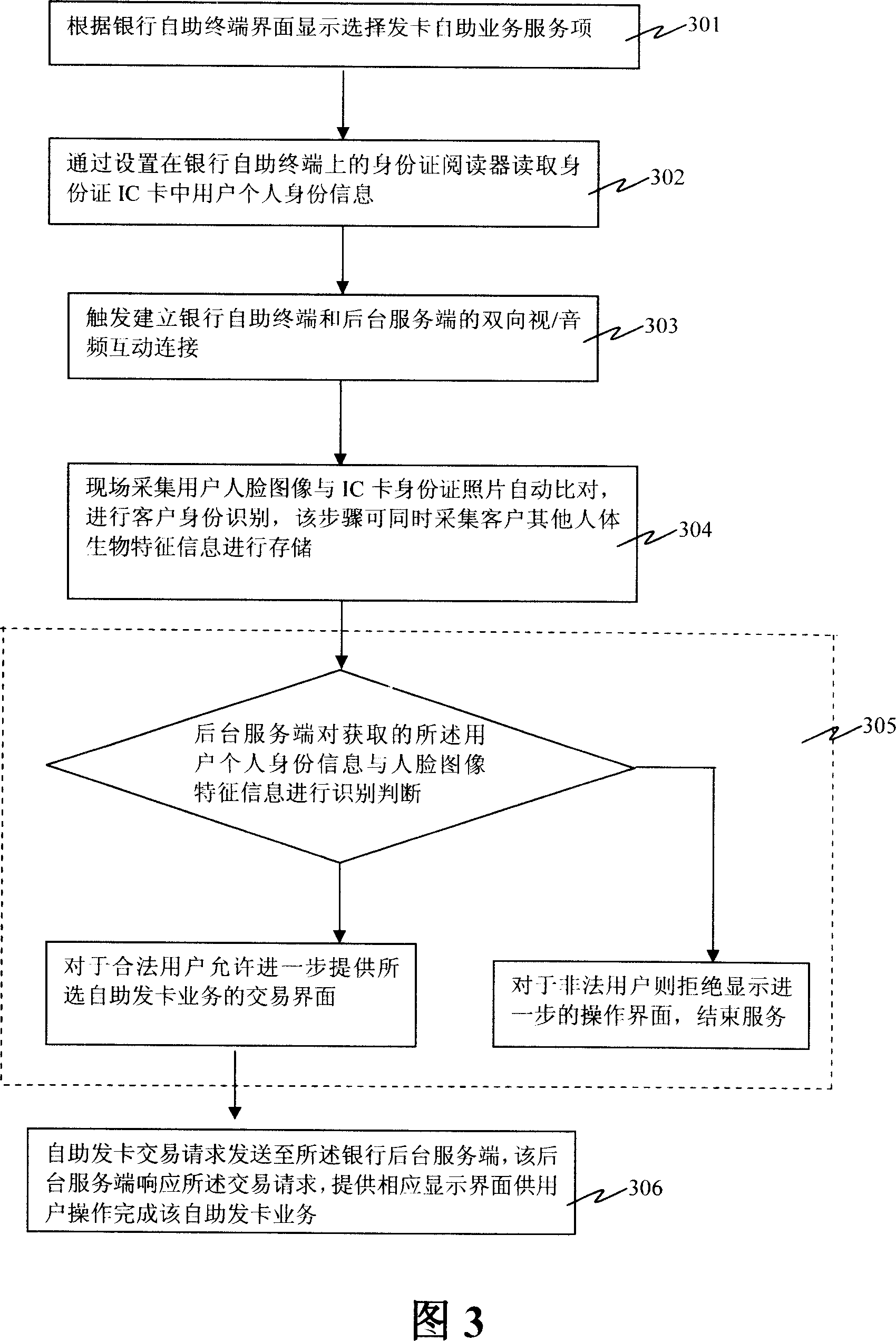

Self service system and method

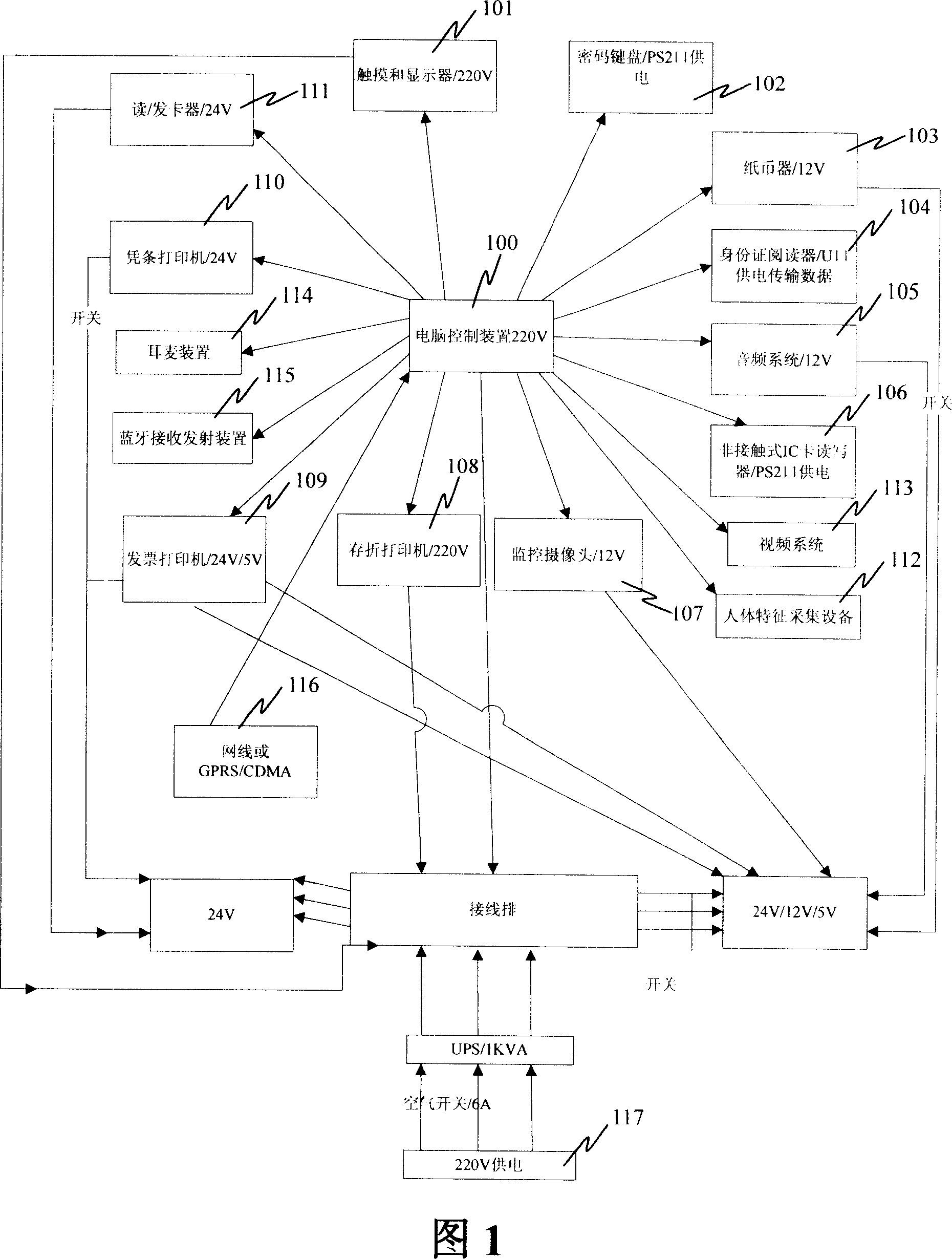

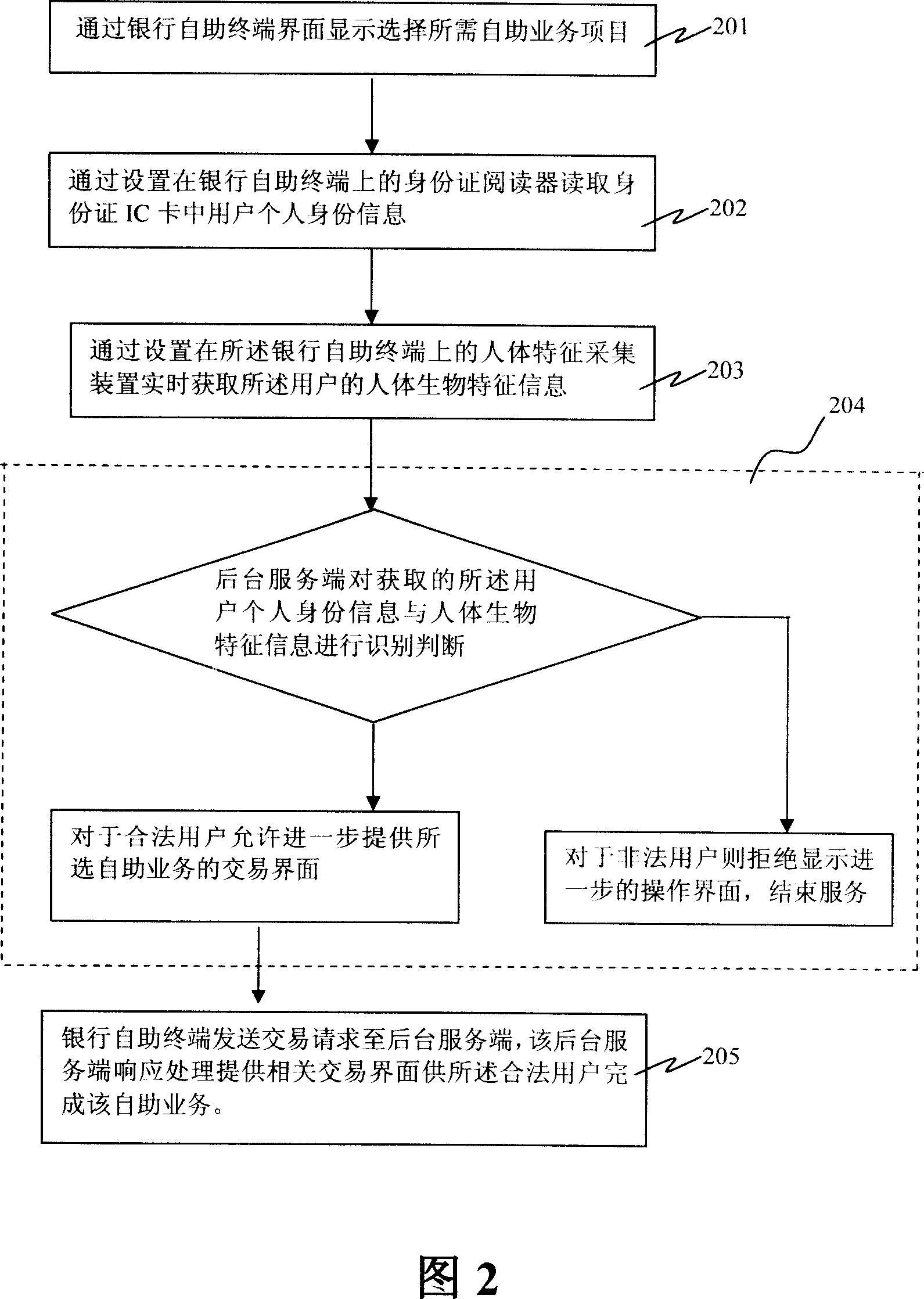

InactiveCN101000702ARealize the function of cardless business applicationEasy to useComplete banking machinesCoded identity card or credit card actuationHuman bodyWeb service

A method for carrying out self-service includes selecting self-service item through bank self-service terminal boundary, fetching user personal status information in IC card by status reader on bank terminal, obtaining user human body biological character by human body character collection unit on bank terminal, carrying out identification and judgment on obtained status information and obtained character information by WEB server, allowing user to finish self-service business if it is judged to be a legal user or otherwise refusing any further self-service operation.

Owner:BEIJING ORIENT XINGHUA TECH DEV CO LTD

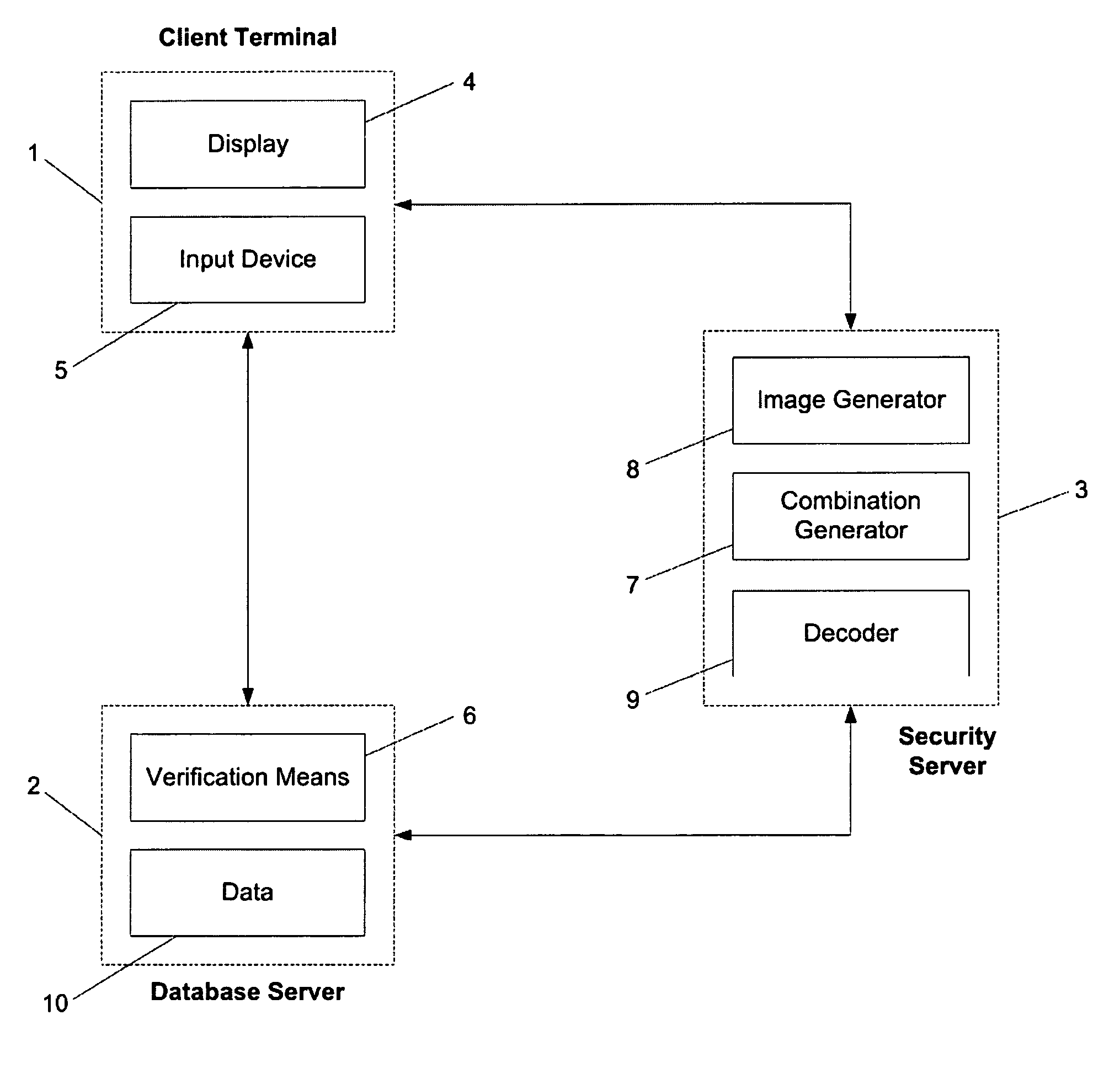

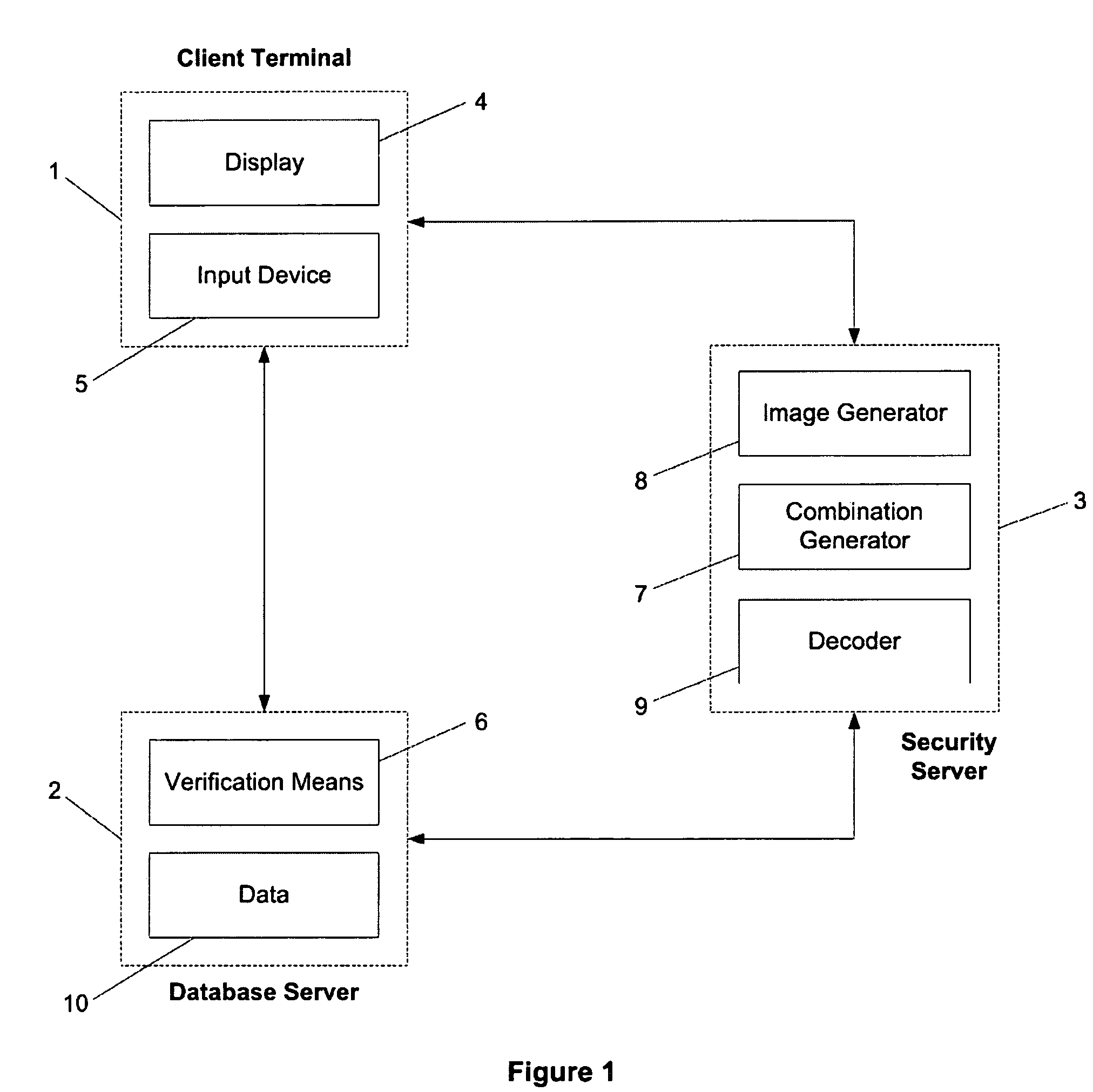

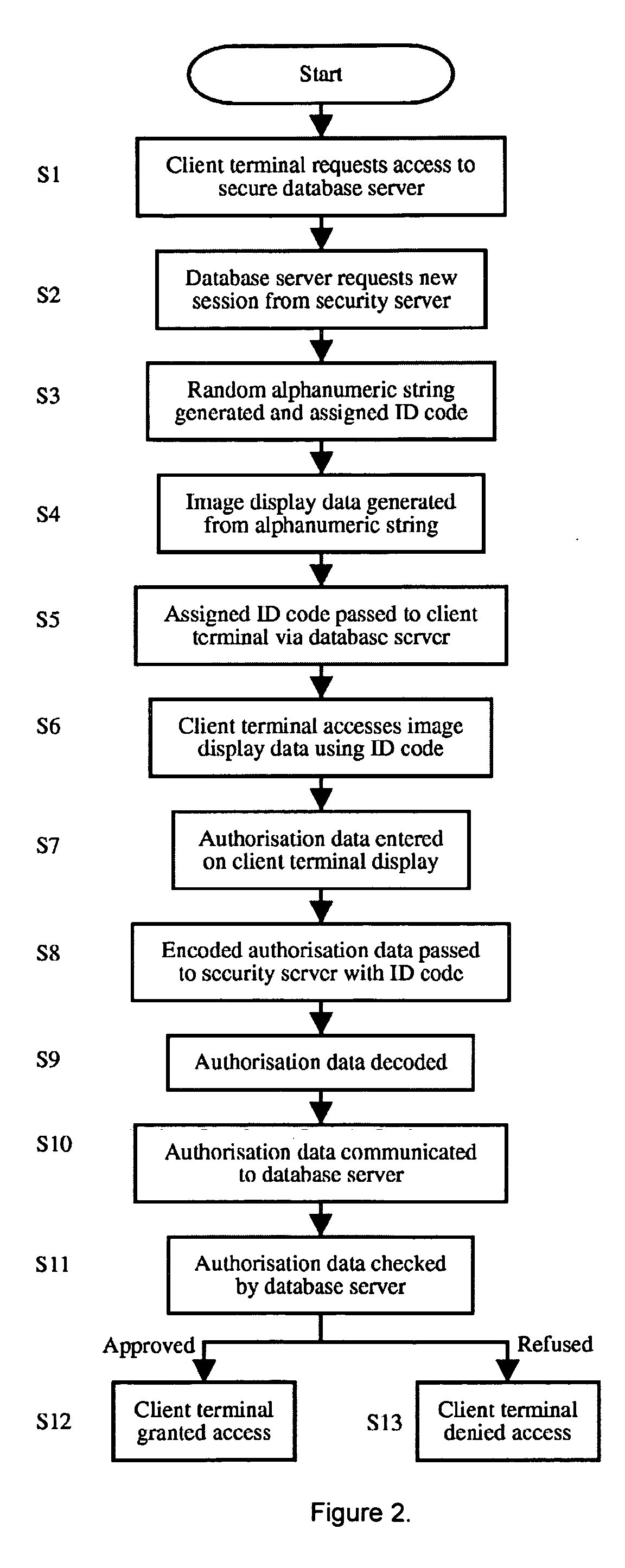

Method of secure data communication

ActiveUS20060037067A1Reduce the possibilityComplete banking machinesDigital data processing detailsTelecommunications linkBanking industry

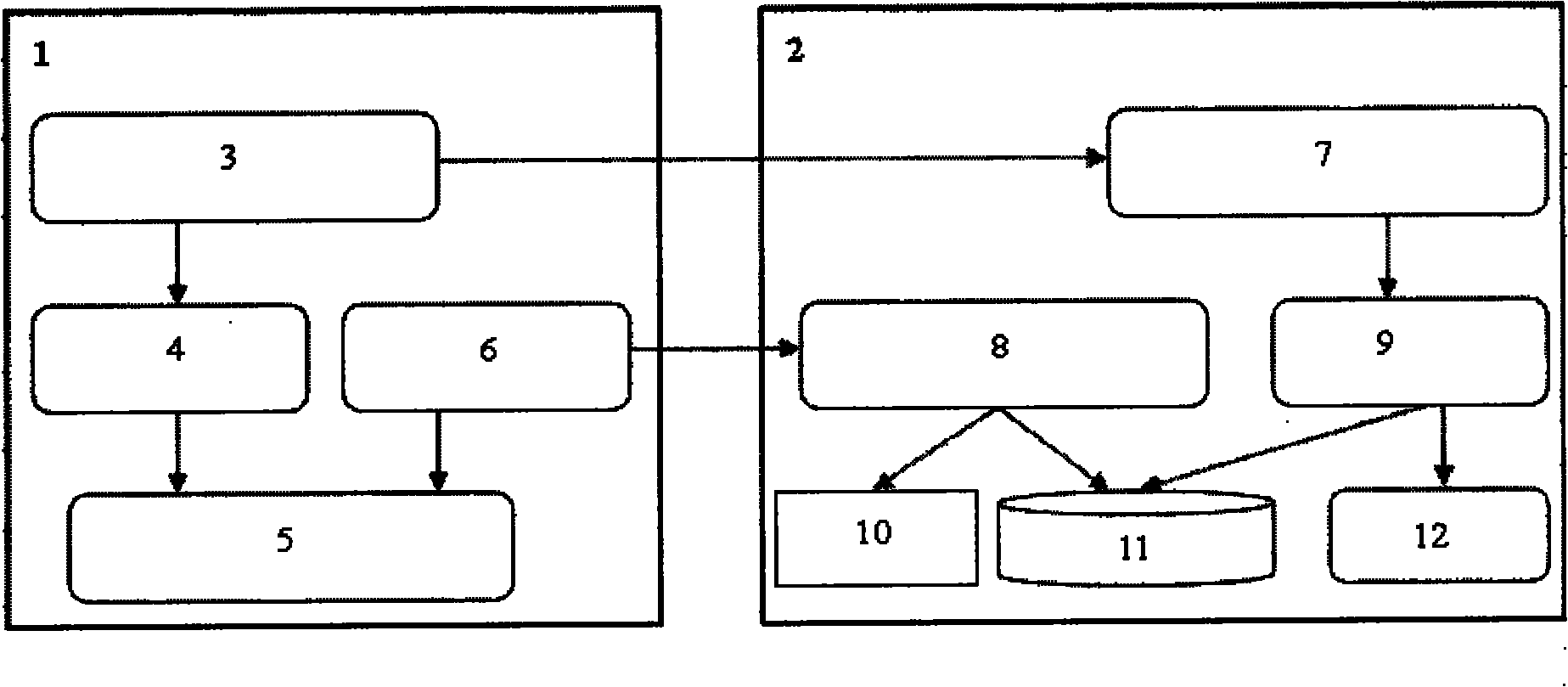

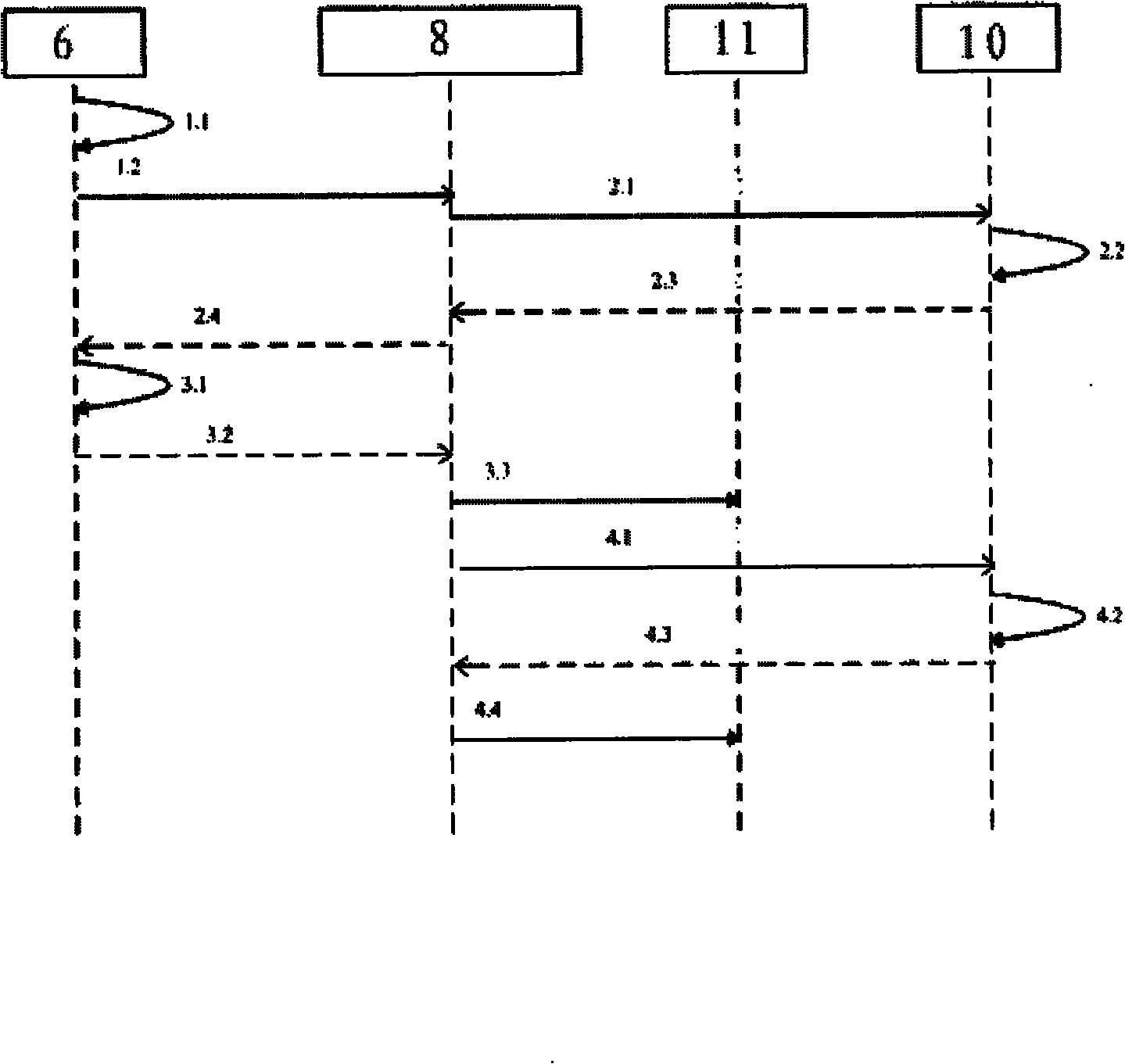

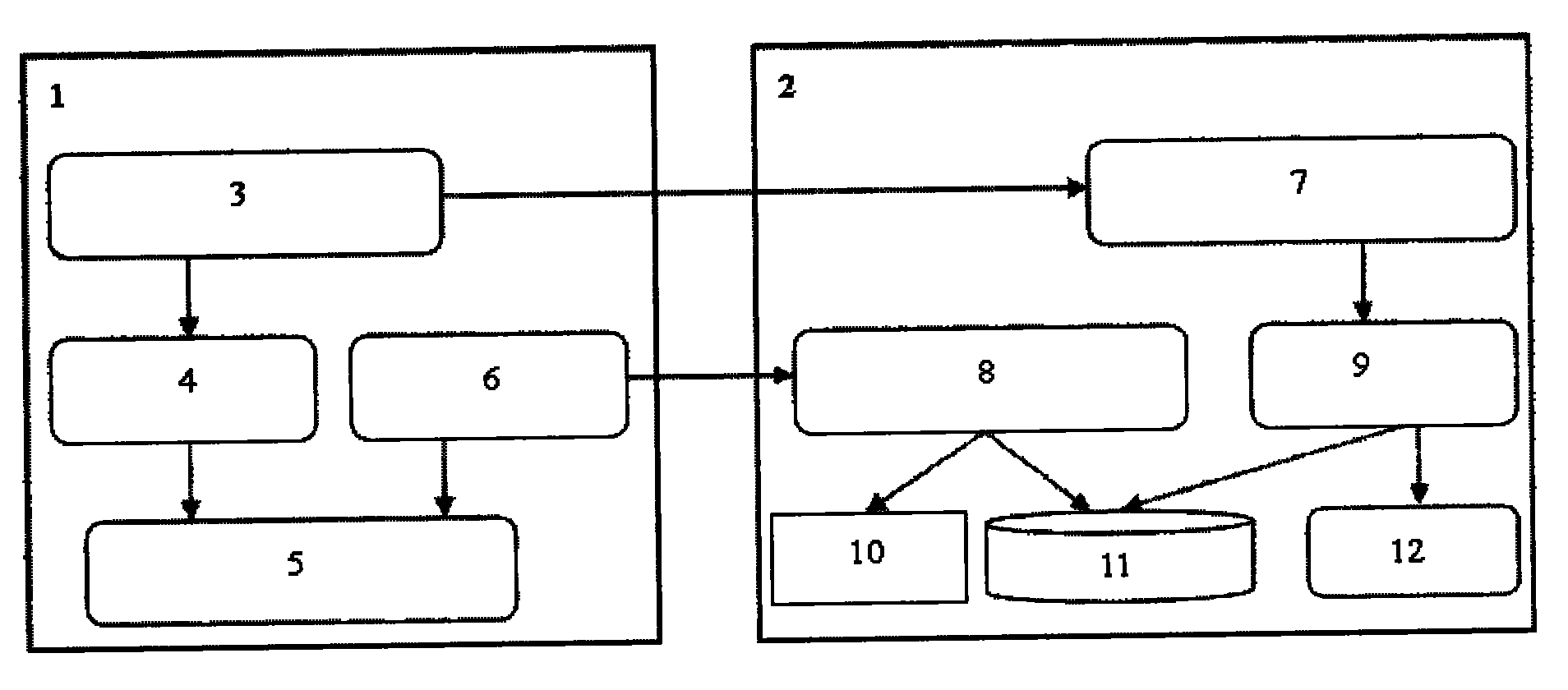

In an exchange of data between a client terminal (1) and a secure database server (2) the data is encoded using positional information generated by a combination generator (7) in a separate security server (3). The positional information is used to produce an image specific to a communication event which is accessed by the client terminal (1) and is the basis for the entry of sensitive data at the client terminal (1). The three-way communication link between the client terminal, database server and security server greatly increases the difficulty of successfully intercepting and decoding the data entered at the client terminal. This method of secure data communication is particularly suited to the communication of password data for example in the banking industry.

Owner:TRICERION LTD

Key management system and method for bank terminal security equipment

InactiveCN101877157AImprove development efficiencySave human resourcesComplete banking machinesMultiple keys/algorithms usageComputer terminalManagement system

The invention relates to a key management system and a key management method for bank terminal security equipment. The system comprises a bank service terminal and a bank service background; the bank service terminal comprises the bank terminal security equipment and a key management agent component; and the bank service background comprises a KMC, a key database, an encoder and a service application system server, wherein the key management agent component is used for acquiring a working key from the KMC and writing the working key into the bank terminal security equipment; and the KMC provides registration service, key transmitting service and automatic key update service for the bank terminal security equipment. The key management system and the key management method for the bank terminal security equipment can effectively realize key management of the bank terminal security equipment, and separate the key management from a bank service application system at the same time so that each service application system does not need to implement complex key management logics any more and the implementing complexity of the service application system is reduced.

Owner:戴宇星

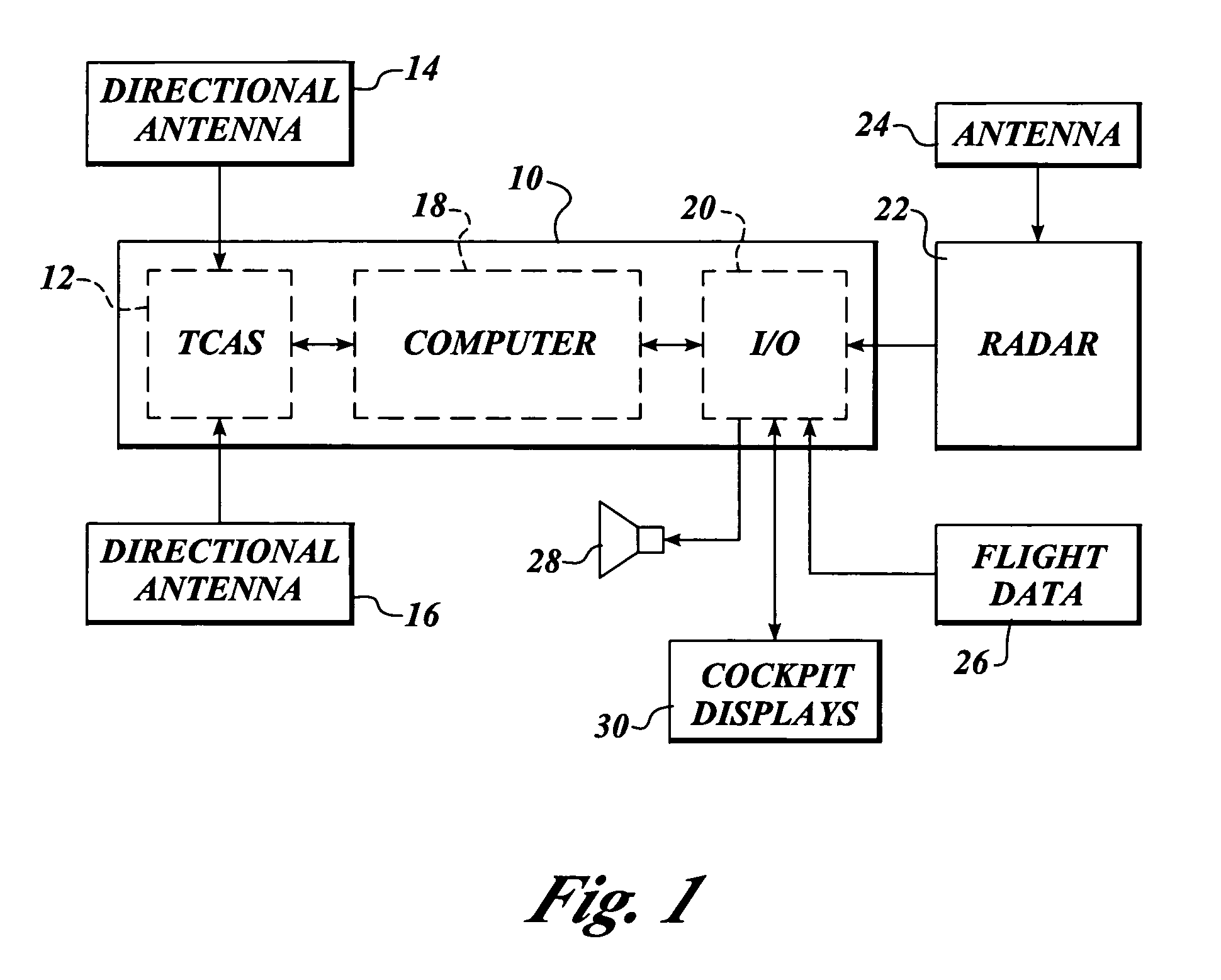

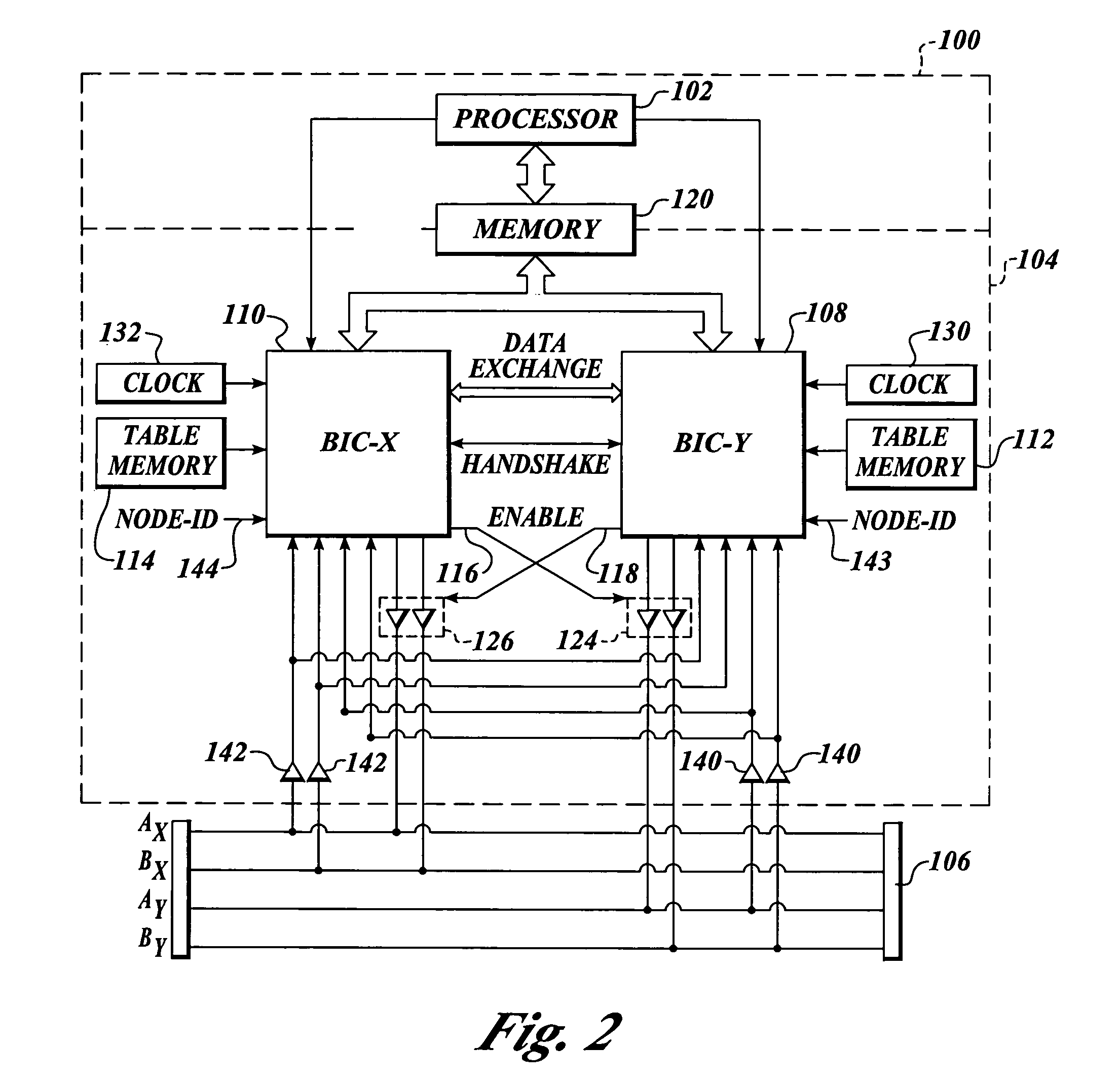

Fault tolerant data communication network

The present invention provides a fault tolerant bus architecture and protocol for use in an Integrated Hazard Avoidance System of the type generally used in avionics applications. In addition, the present invention may also be used in applications, aviation and otherwise, wherein data is to be handled with a high degree of integrity and in a fault tolerant manner. Such applications may include for example, the banking industry or other safety critical processing functions, including but not limited to environmental control.

Owner:ALLIED SIGNAL INC

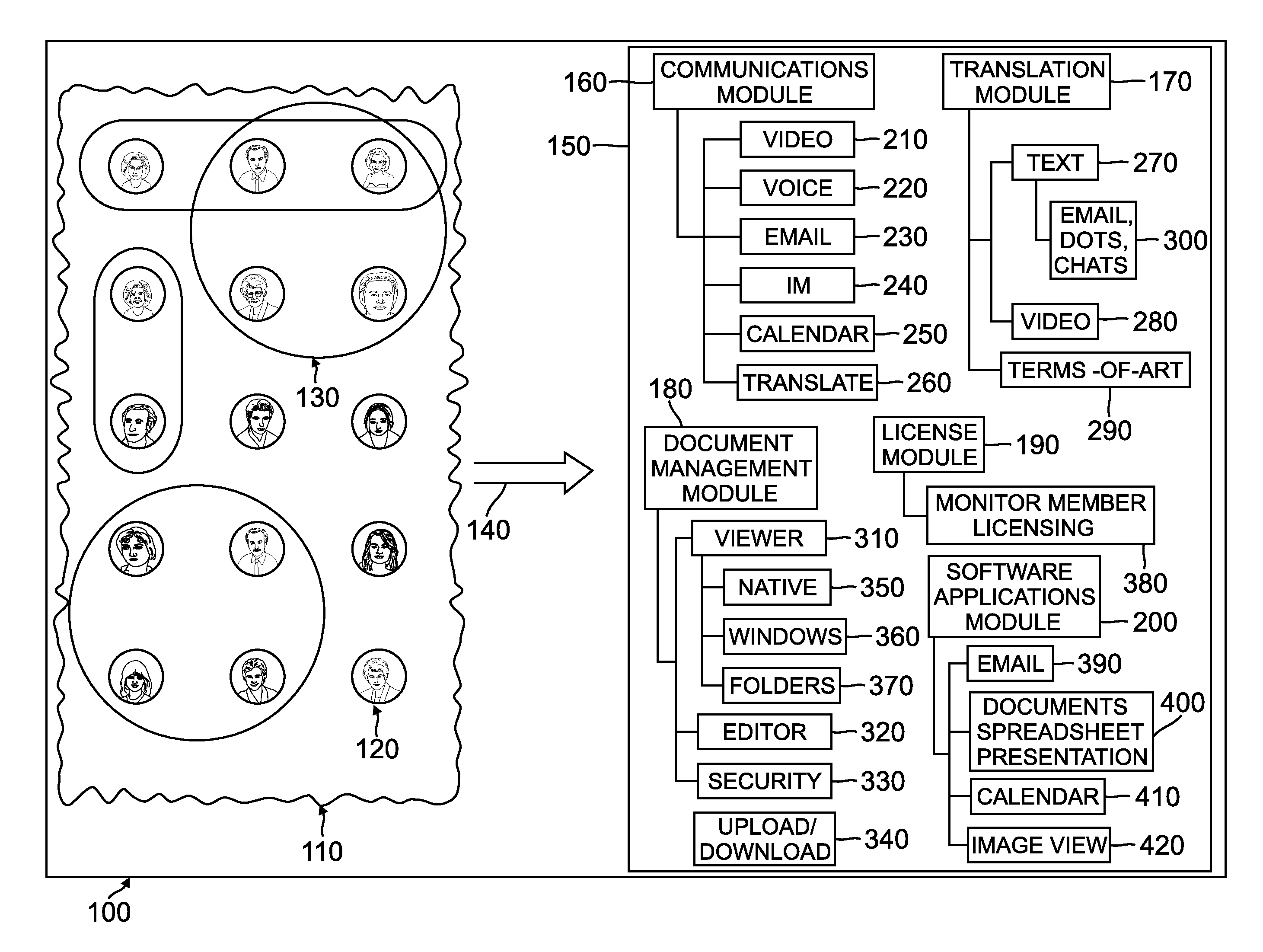

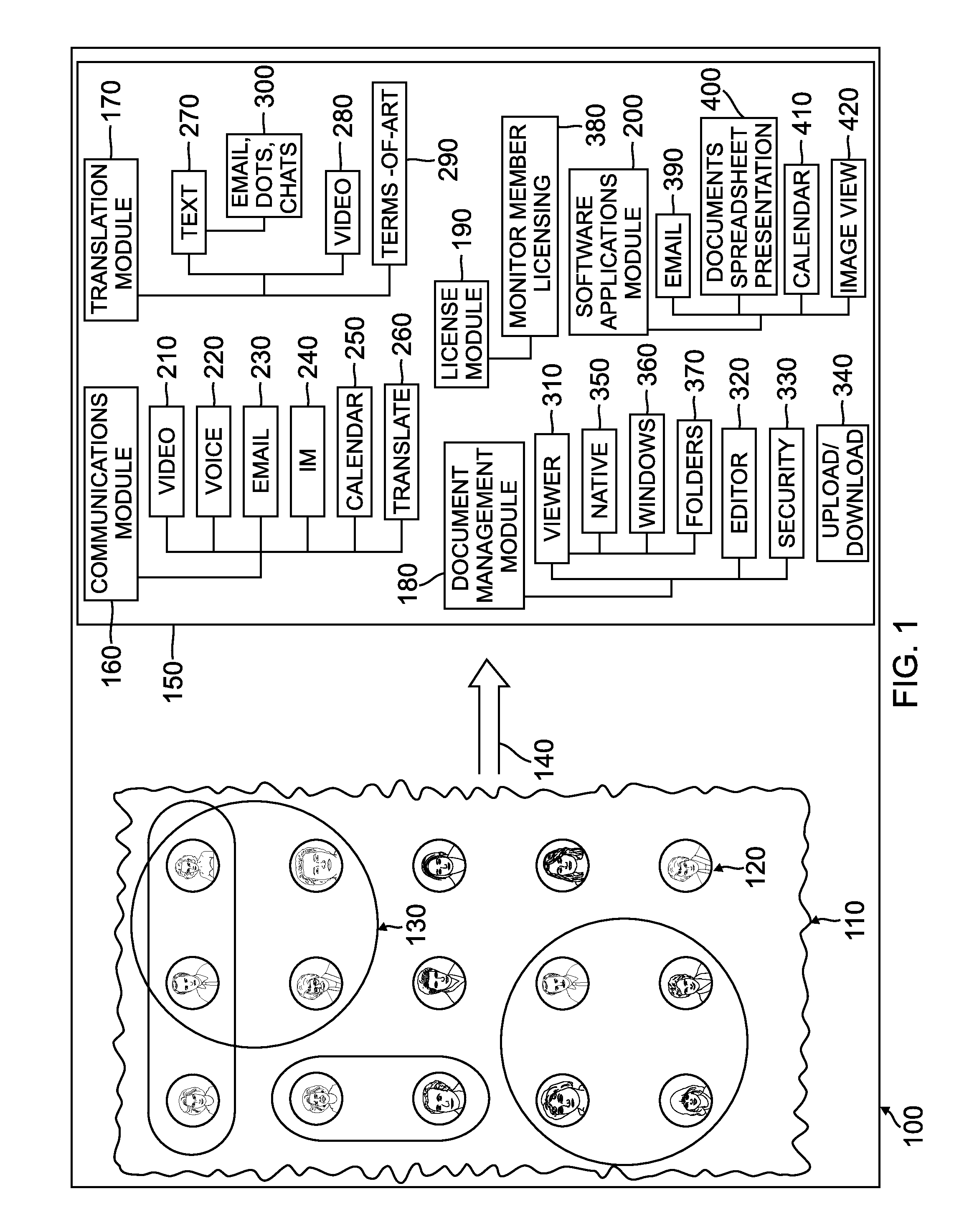

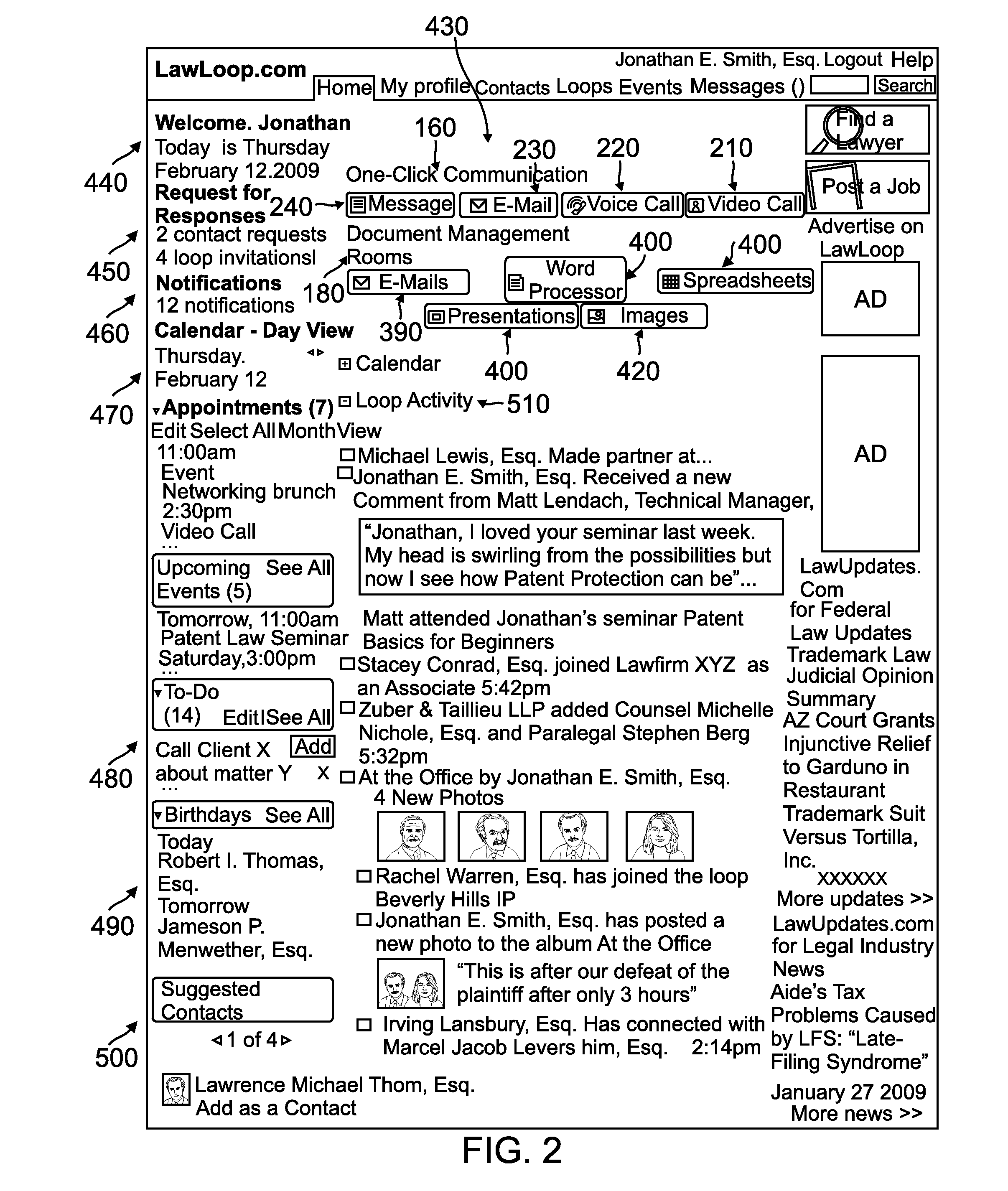

Method for interactively collaborating across online social networking communities

InactiveUS20120084188A1Eliminate needComplete banking machinesFinanceBanking industryPersonal details

A method for interactively collaborating across several related but independent online social networking communities. Members of each networking communities share a common background or profession, such as being part of the medical, legal or banking industries. Each member has a profile associated with his or her networking community, by which they can interact with other members of the networking community to share contacts, documents, or other productivity functionalities. Members can also interact across networking communities via their networking profile. For example, a doctor who can use his profile from the medical networking community to interact with a lawyer who has a profile on the legal networking community. By promoting cross-community interaction, each group is able to increase their ability to communicate or share ideas and work product via the plurality of networking communities.

Owner:ZUBER THOMAS

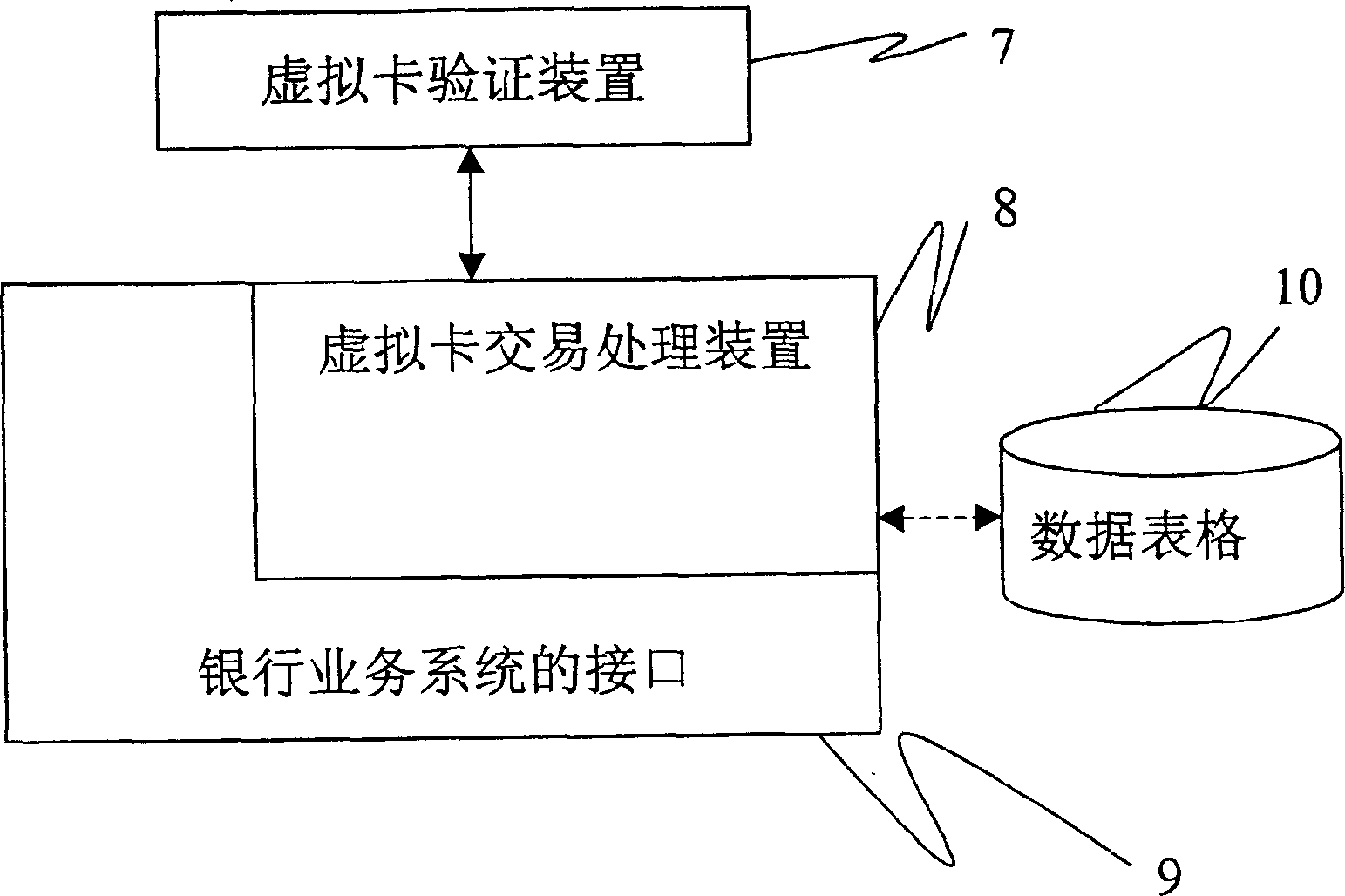

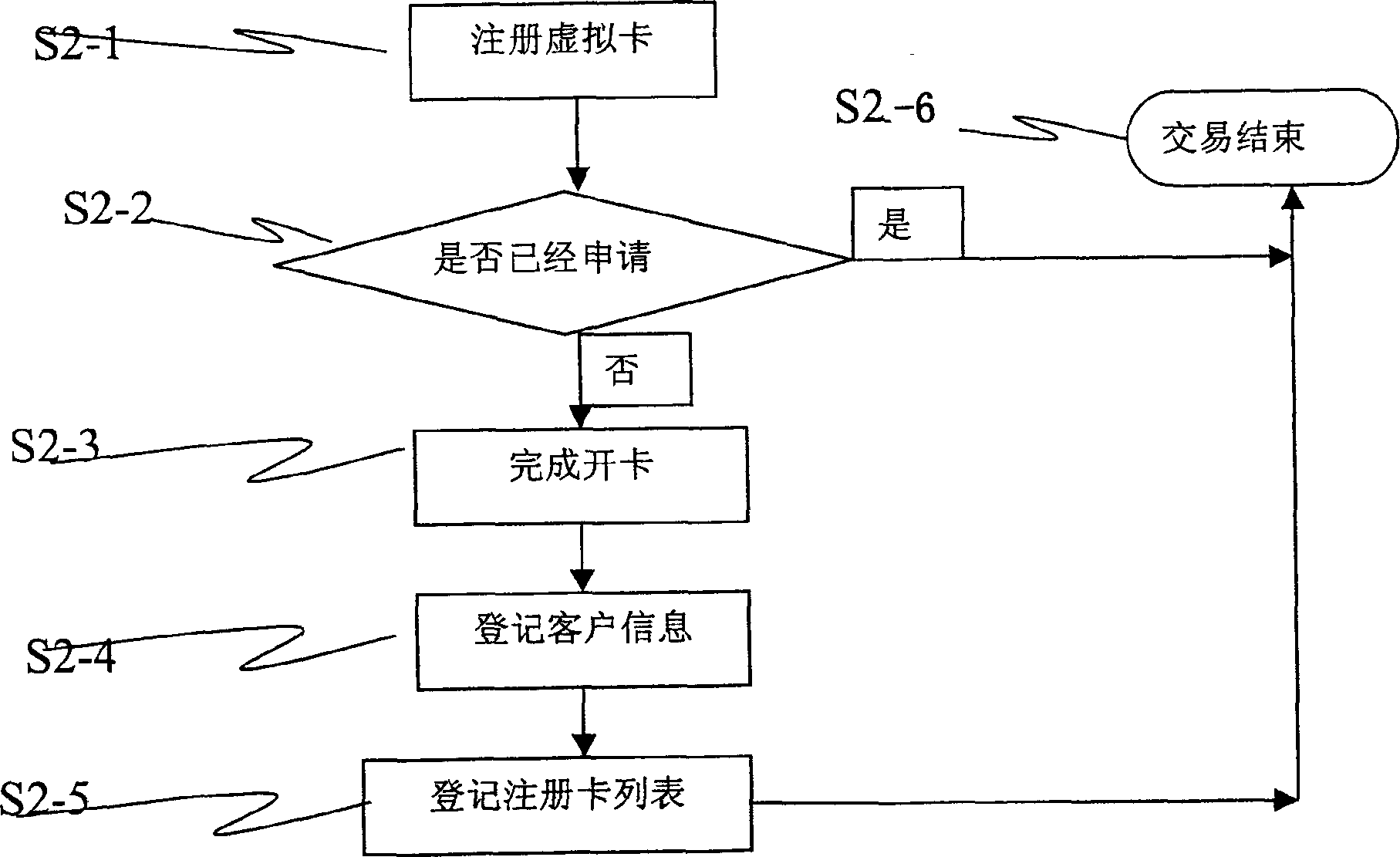

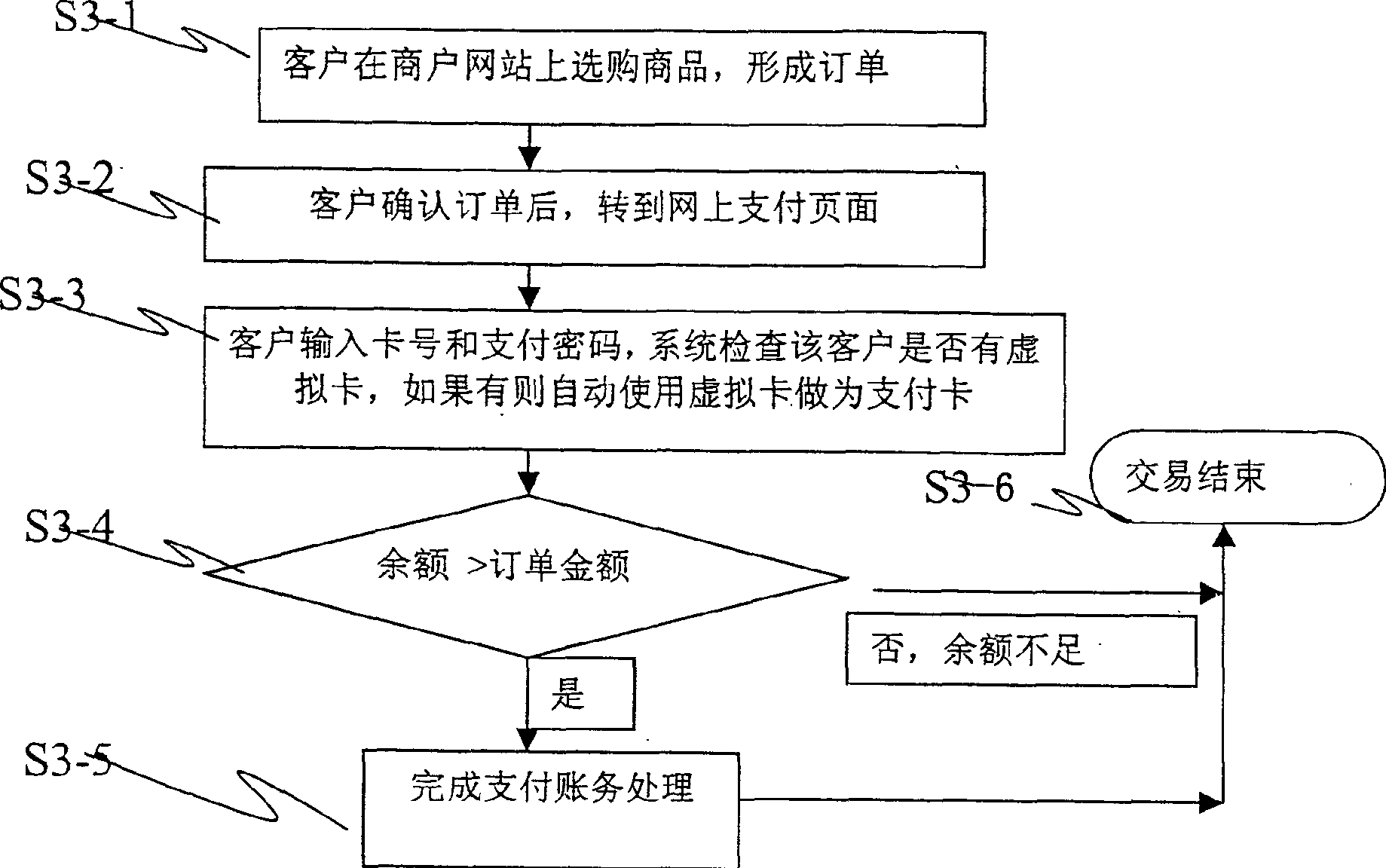

Card data business system used for payment on net and its method

InactiveCN1619560AImprove confidentialityThere is no problem of lossComplete banking machinesSpecial data processing applicationsService systemData transmission

The present invention relates to the field of data transmission technology. In the concrete, it is a card data transaction system for payment on net and its method. Said system includes data table, virtual card verification device, virtual card transaction, processing device and interface of bank service system. Said invention also provides the steps for implementing said method.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

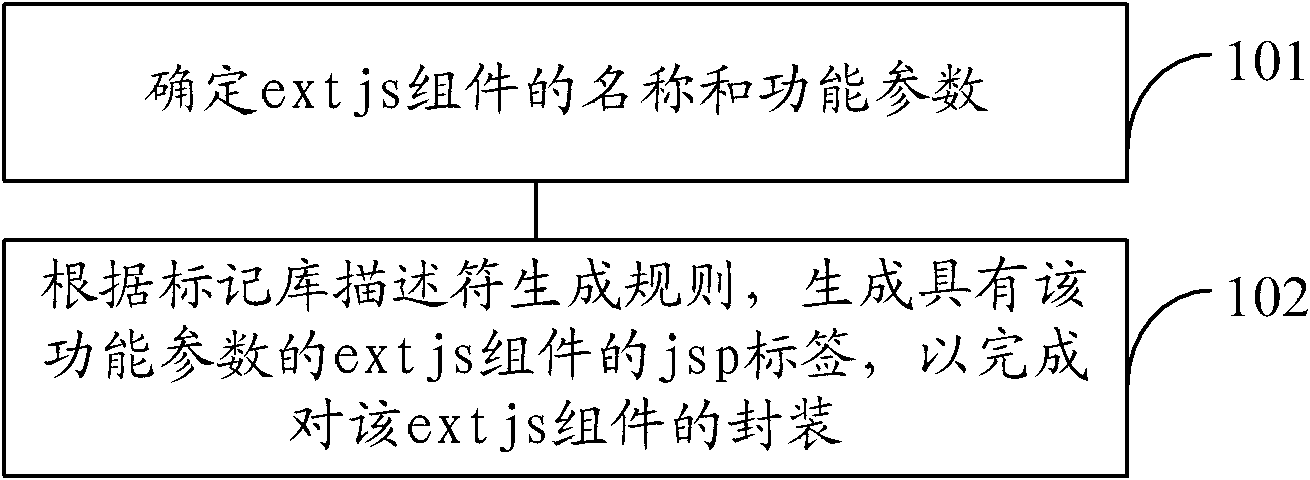

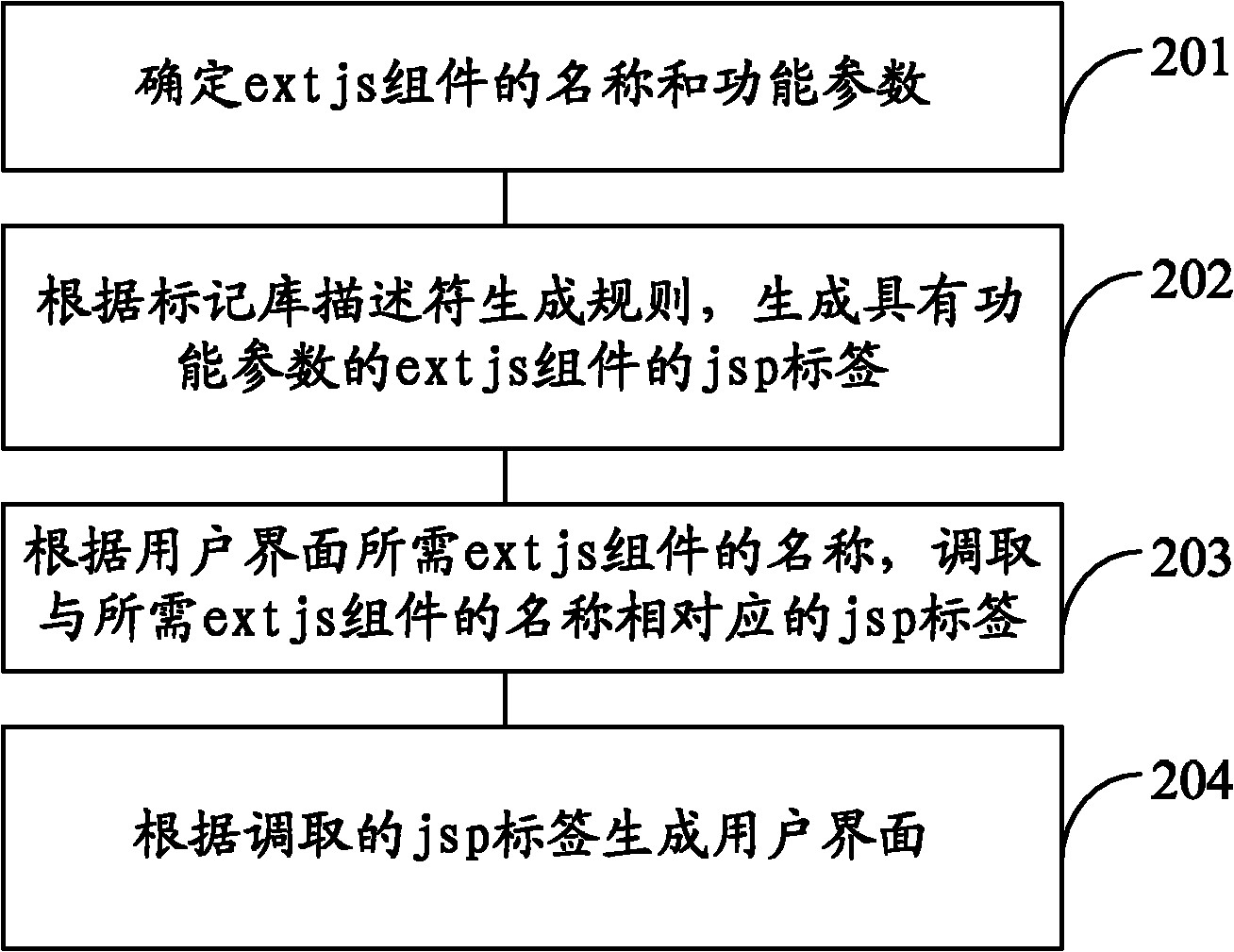

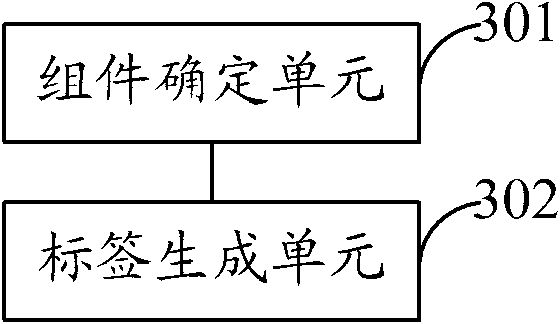

Method and device for encapsulating extjs component, and method and system for generating user interface

ActiveCN102043626ARealize multiplexingMeet the needs of interface displaySpecific program execution arrangementsBanking industryUser interface

The invention provides a method and a device for encapsulating an extjs component, and a method and a system for generating a user interface. The method for encapsulating the extjs component comprises the following steps of: determining a name and a functional parameter of the extjs component; and according to a tag library descriptor generating rule, generating a jsp (java server pages) tag of the extjs component with the functional parameter so as to encapsulate the extjs component, wherein the name of the jsp tag corresponds to the name of the extjs component. In the embodiment of the invention, the complex extjs component is encapsulated to be the simple and easy-to-use jsp tag by generating the jsp tag corresponding to the extjs component; and a complex page logic code is encapsulated, so that the code can be reused simply. The invention is convenient to use and easy to understand, meets complex and changeful interface display requirements of application systems such as banking industry and the like, saves development time, reduces development difficulty and completely supports the front-end development of information systems.

Owner:AGRICULTURAL BANK OF CHINA

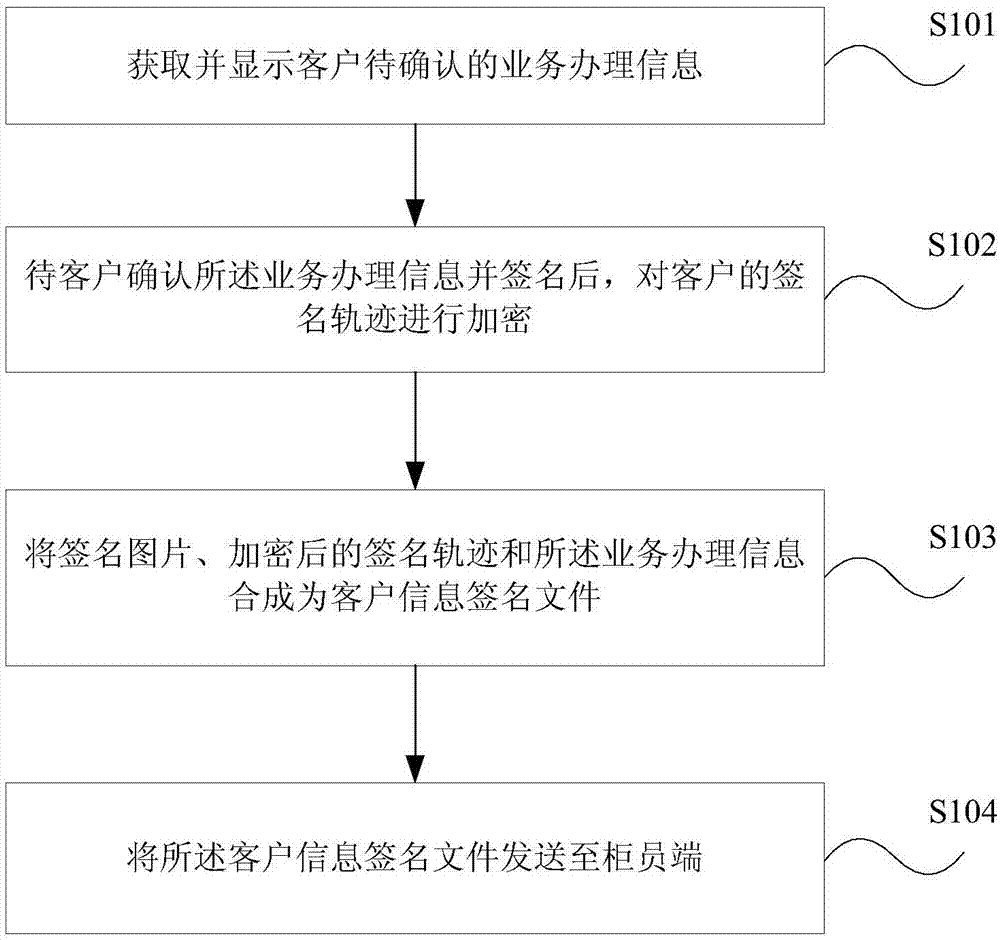

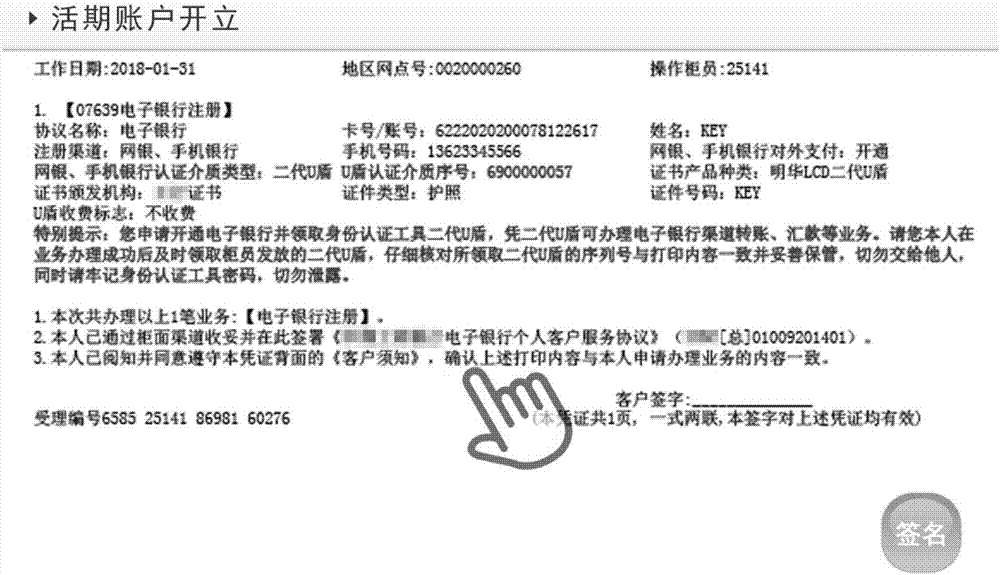

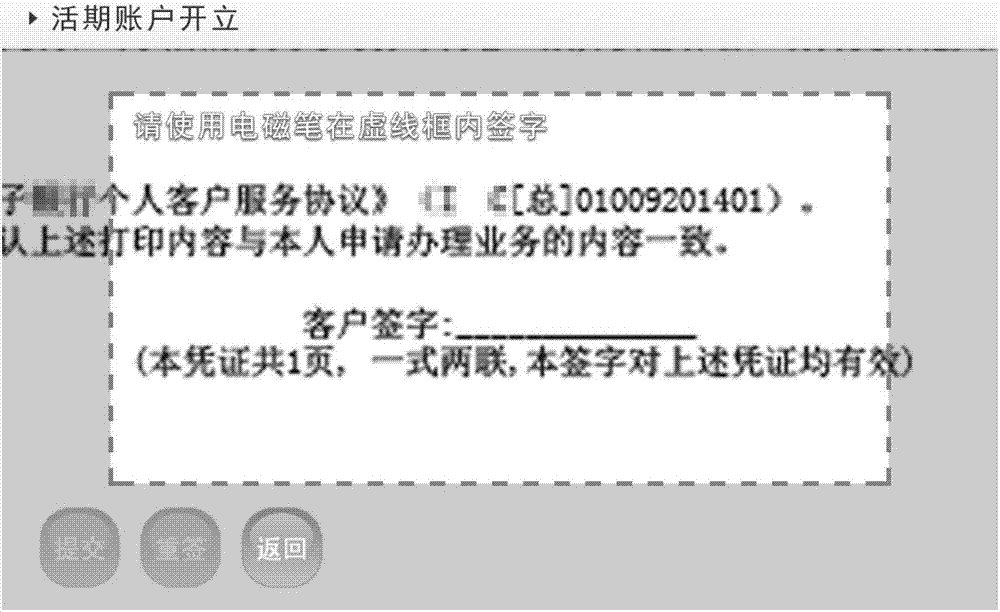

Counter information processing method and terminal and business handling system

PendingCN107316381ARealize electronicImprove service experienceComplete banking machinesCredit registering devices actuationInformation processingBank teller

The invention relates to the field of bank business processing and provides a counter information processing method and terminal and a business handling system. The counter information processing method includes the steps that business handling information to be confirmed by a client is acquired and displayed; after the client confirms the business handling information and signs, a signature track of the client is encrypted; a signature picture, the encrypted signature track and the business handling information are synthesized into a client information signature file; the client information signature file is sent to a bank teller side. It can be achieved that business application and processing results are synchronously displayed to the client, the client is guided to participate in business processing through voice and characters, the business handling result is confirmed through an electronic handwritten signature, the terminal is used for completing U shield handover, transparency and electronization of the whole business handling process are achieved, therefore, the client service experience is improved, the counter processing efficiency is improved, the product marketing effect is promoted, the bank operating cost is reduced, operating risk prevention and control are enhanced, counter hardware facilities are integrated, and branch operating environments are beautified.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

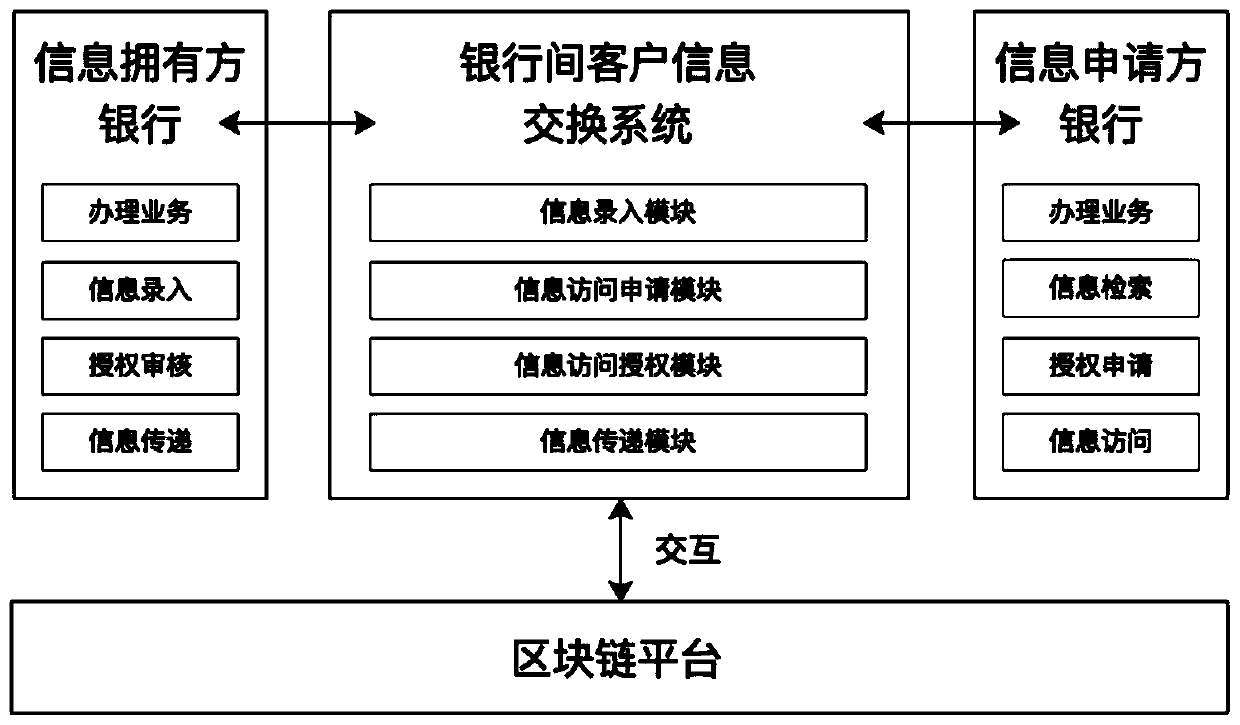

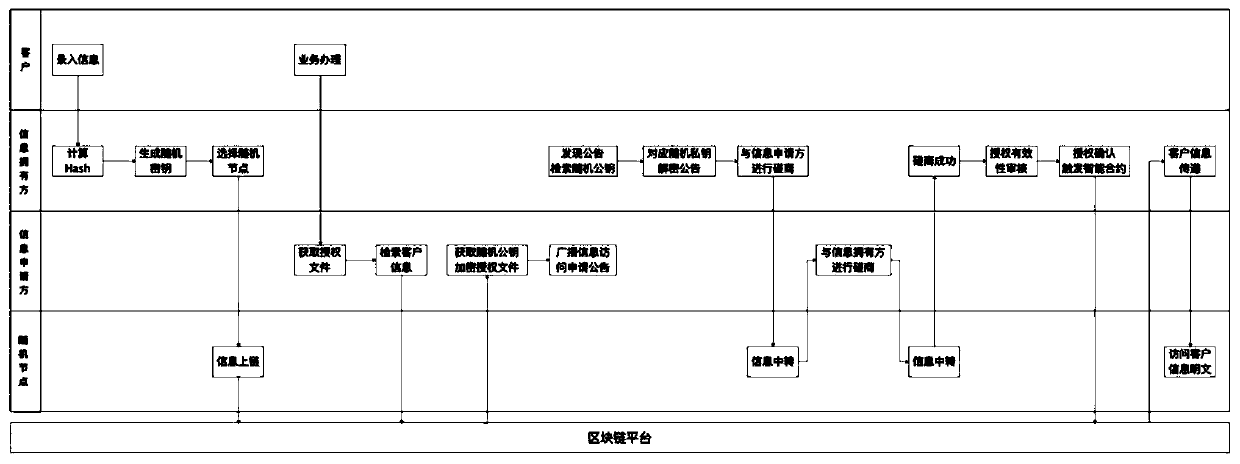

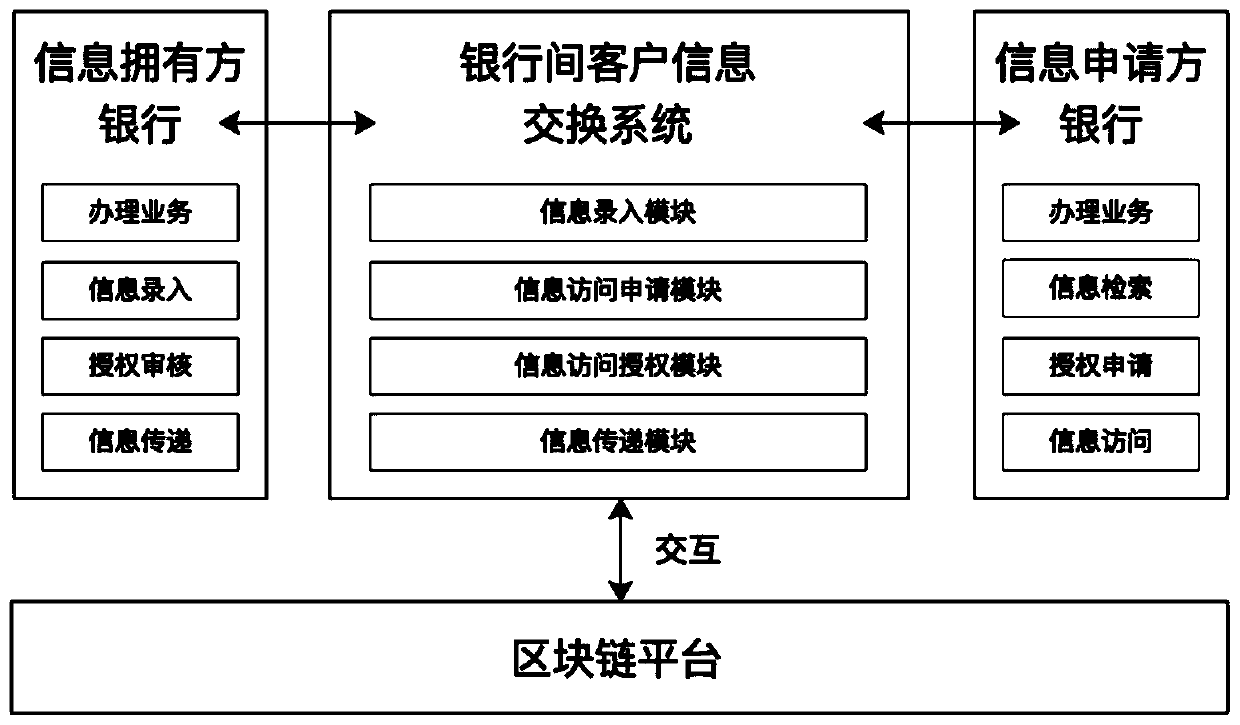

Inter-bank customer information exchange system based on block chain

ActiveCN111179067AReduce switching costsQuality improvementFinancePayment protocolsBanking industryInformation transmission

The invention discloses an inter-bank customer information exchange system based on a block chain. The system comprises the following functional modules: a client information input module, which enables a client to input information data and then forward the information data to a random node by a proxy bank and then uplinks the data to ensure that other banks cannot identify actual business proxybanks; an client information access application module which is used for initiating an information access application announcement after an information applicant bank searches a target client; a client information access authorization module which is used for obtaining a client authorization file and completing authorization confirmation after the client authorization file is verified by an information owner bank; and a client information transmission module which is used for authorizing confirmation information to trigger an intelligent contract to start an information transmission process and automatically transmitting client data through an off-chain network. The invention provides a solution for protecting data privacy among banks and simultaneously carrying out specific data sharing,the bank industry customer information quality is integrally improved by utilizing a block chain technology, and a system for acquiring other bank data at low cost and improving the KYC working efficiency is realized.

Owner:HANGZHOU QULIAN TECH CO LTD

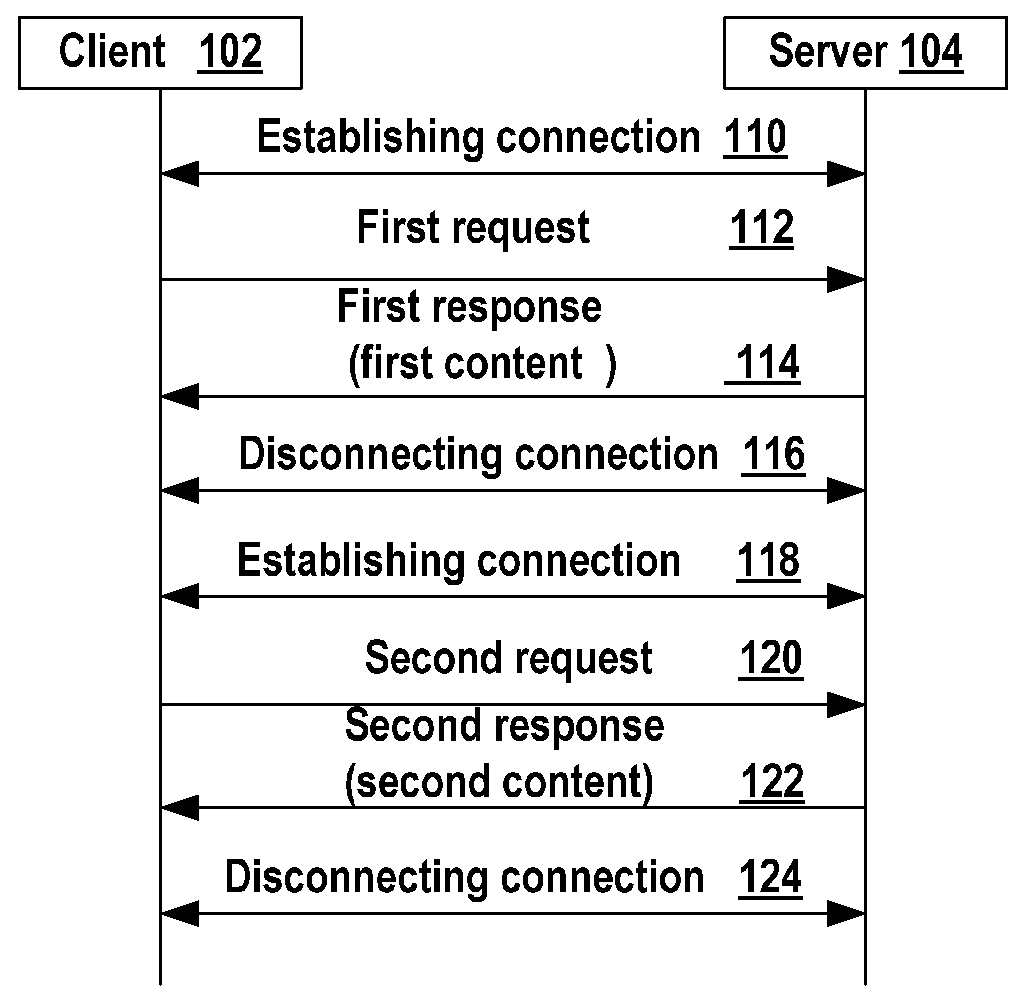

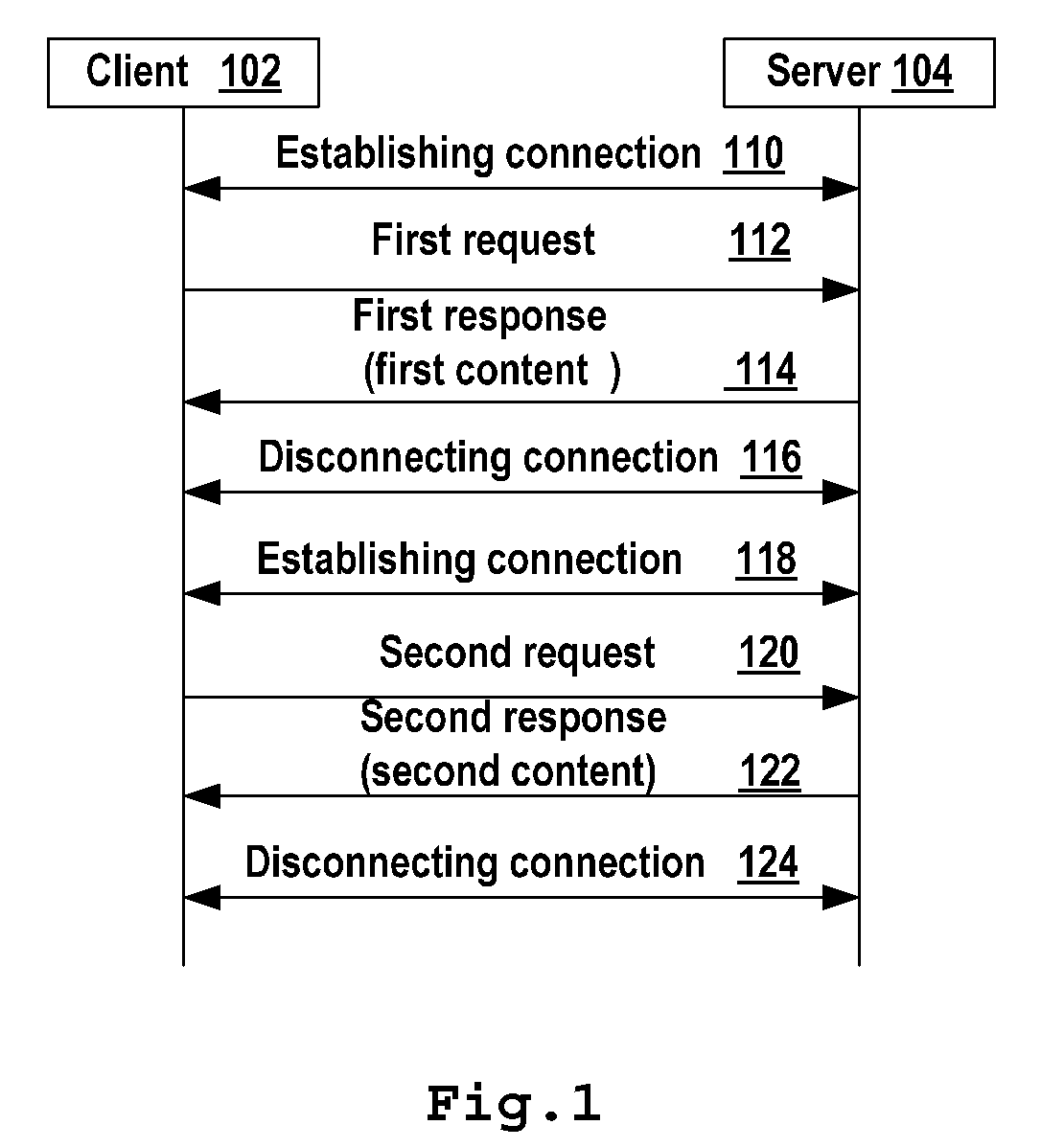

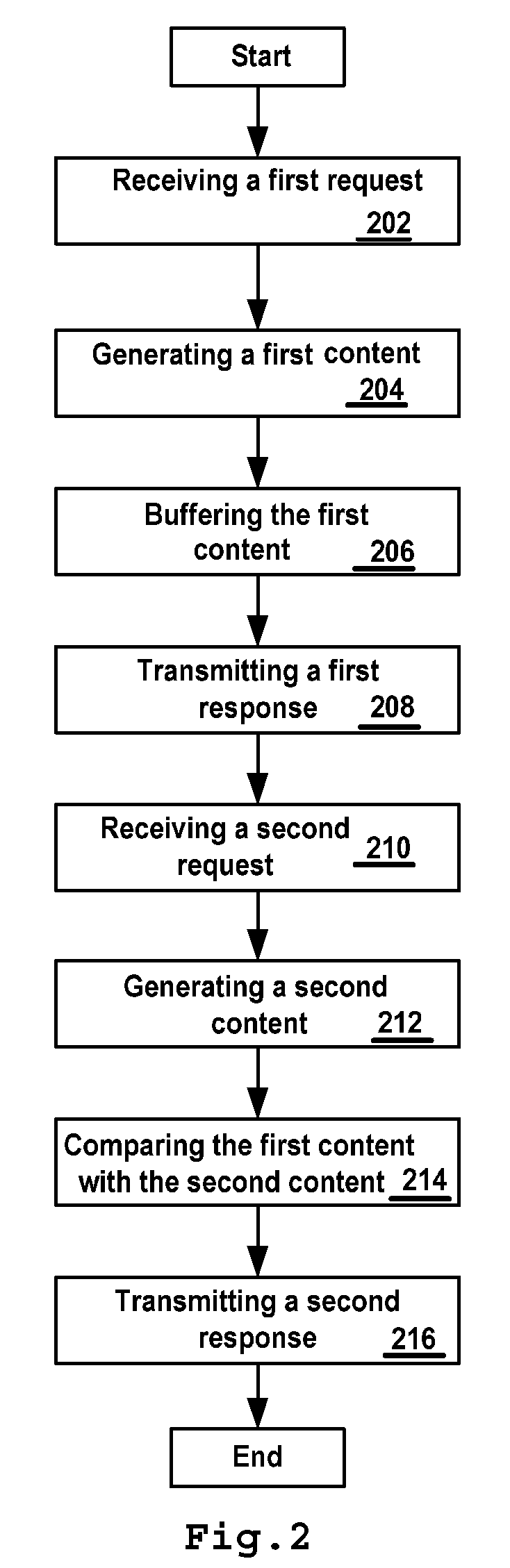

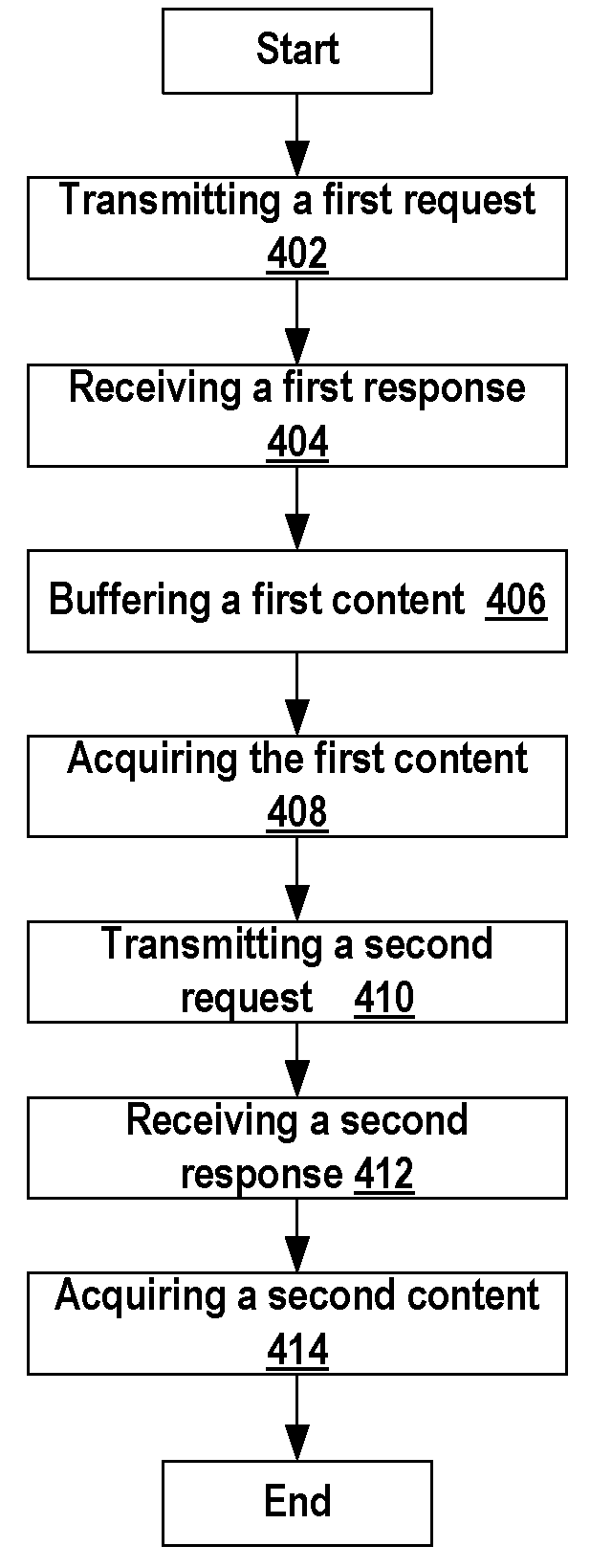

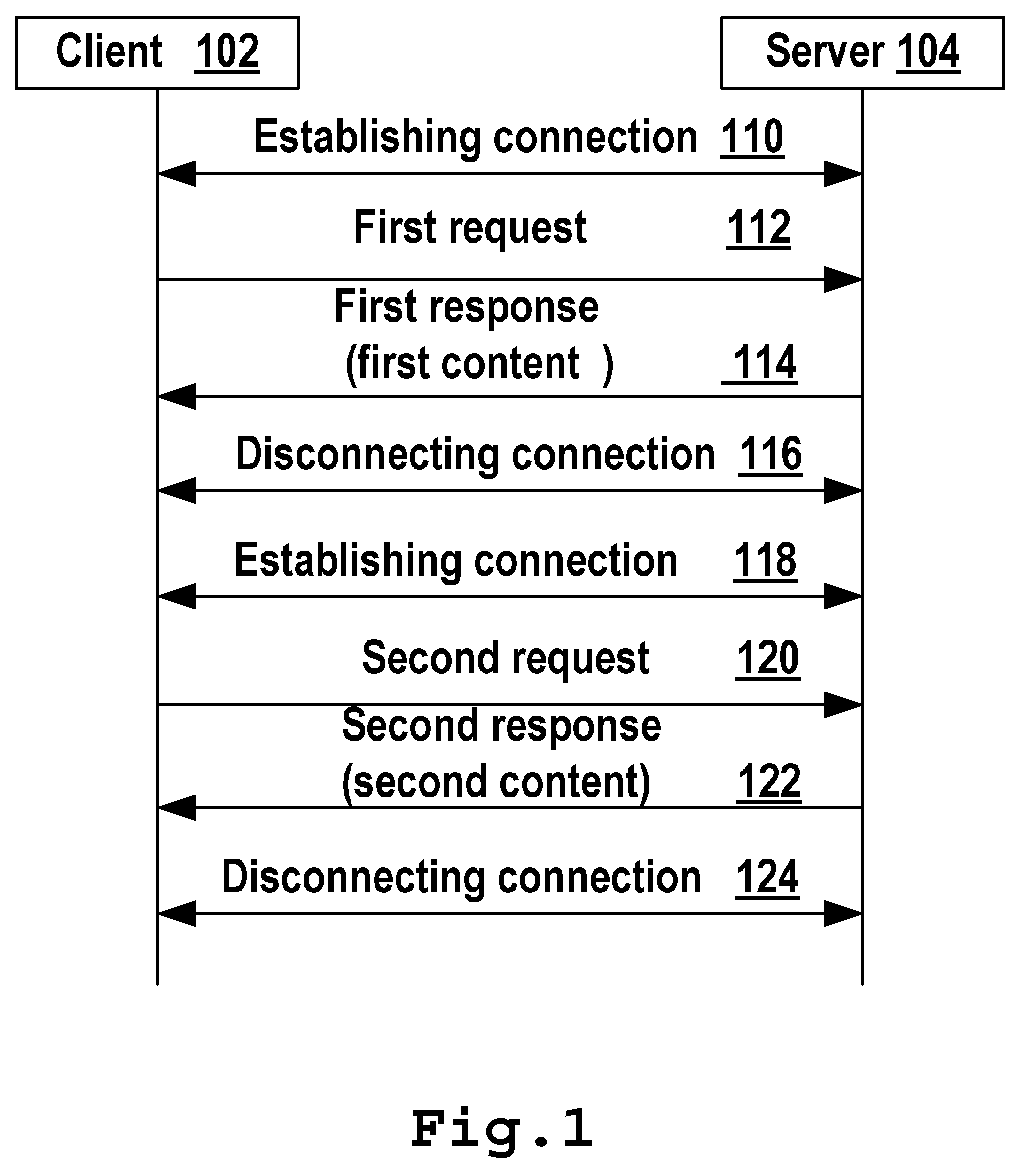

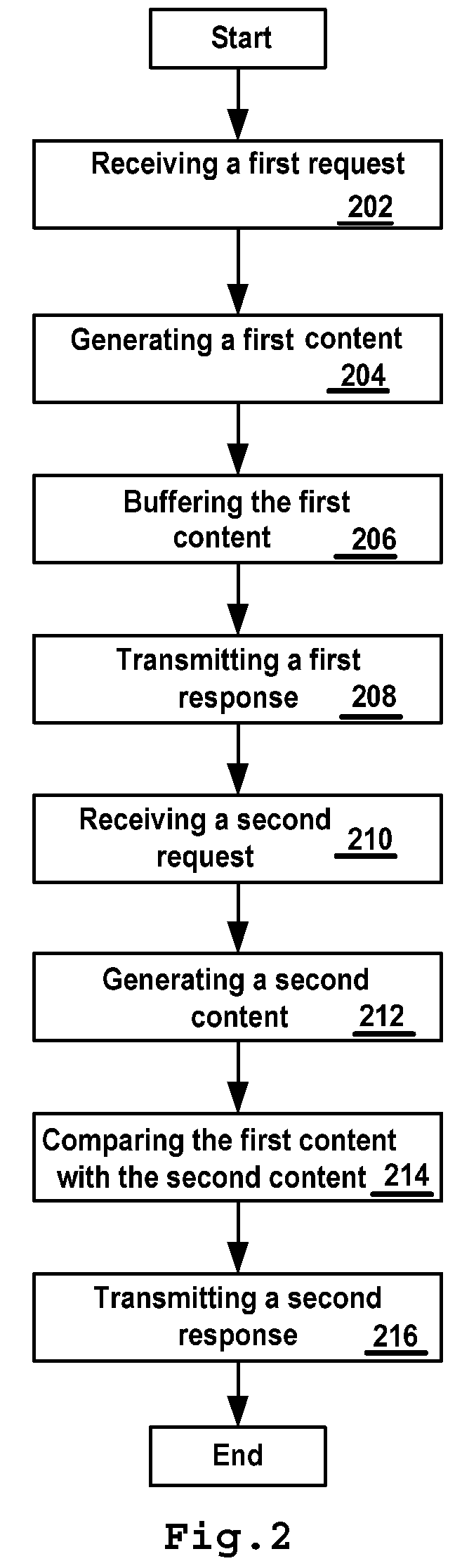

Method for content responding and content requesting, content responder and content requestor

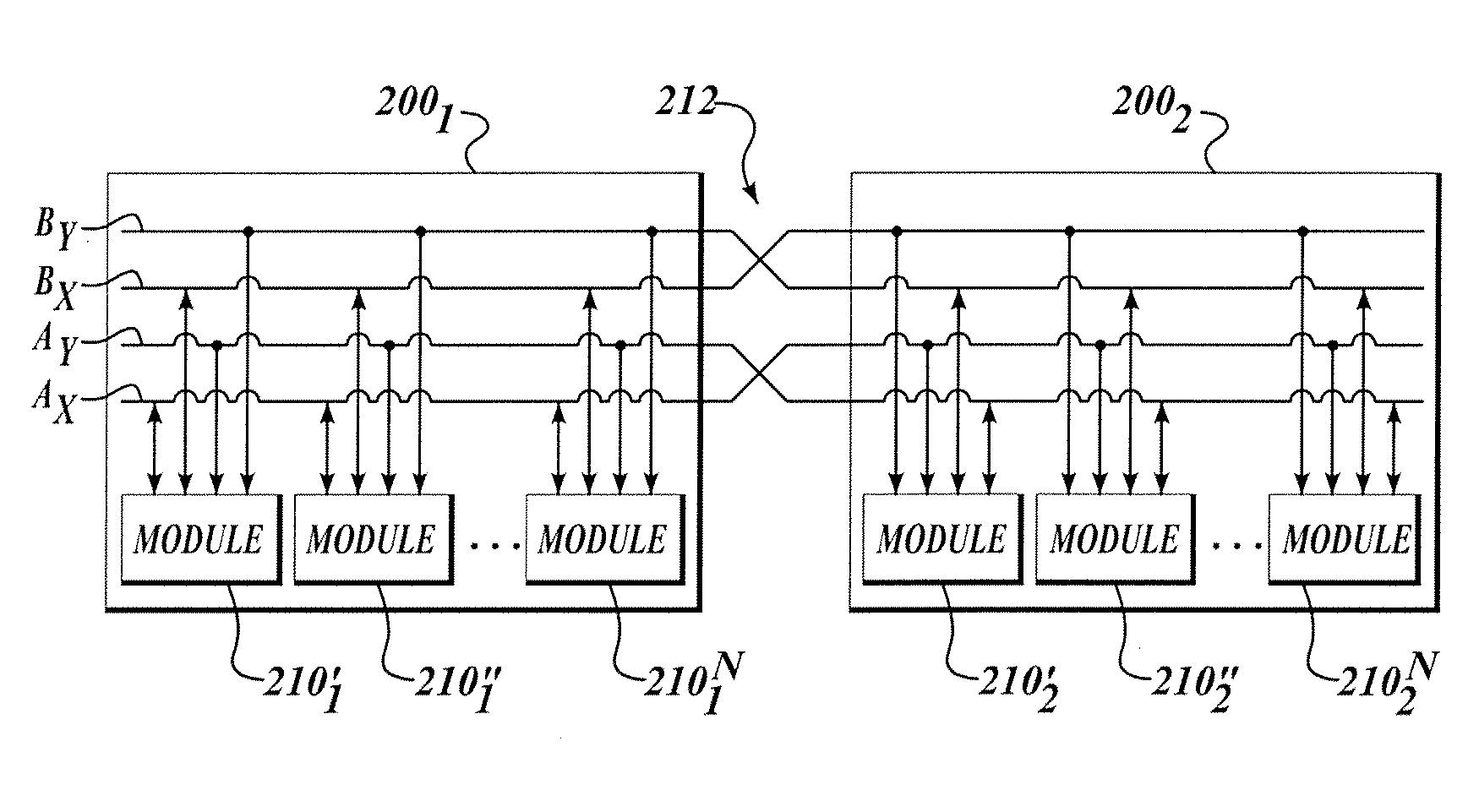

InactiveUS20080133811A1Reduce occupancyReduce waiting timeMultiple digital computer combinationsTransmissionBanking industryWorld Wide Web

The present invention sets forth a method for content responding, a method for content requesting, a content responder and a content requester. A content responder receives a first request from a content requester via a network. Then, the content responder generates a first content based on the first request. Then the content responder receives a second request from the content requester via the network. Then, the content responder generates a second content based on the second request. Next, the content responder compares the second content with the first content. After that, the content responder transmits a second response with regard to the second request to the content requester via the network. The second response is generated based on the result of comparison. According to the invention, if there is a very small difference between the first content and the second content, network bandwidth can be saved, the transmitting time of content will be reduced, and thus the waiting time of the user to view content will be reduced. The present invention is particular beneficial to the existing industries (for example, the banking industry) that adopt narrow band network widely.

Owner:IBM CORP

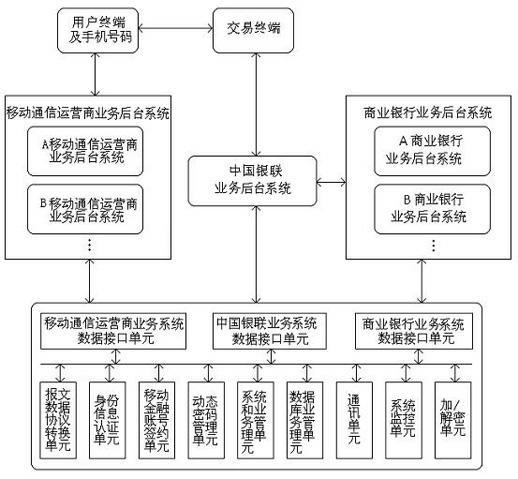

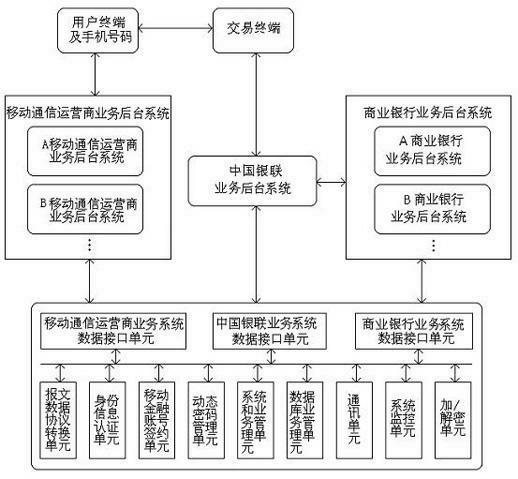

Mobile financial service system and method thereof

InactiveCN102496109AExpanding Financial Services Business CapabilitiesPayment architectureMobile Telephone NumberData processing system

The invention discloses a mobile financial service system and a method thereof. The system at least comprises a user terminal and a mobile phone number, a transaction terminal, one or more mobile communication operator business background systems, one or more commercial bank service background systems, a China UnionPay service background system, and a mobile financial service data processing system, wherein the mobile financial service data processing system communicates with the mobile communication operator business background systems, the commercial bank service background systems and the China UnionPay service background system respectively through a data circuit special line, and communication is carried out between the commercial bank service background systems and the China UnionPay service background system through the data circuit special line. The method is realized based on the system. The system and the method have the advantages of convenient use of a user, a powerful service function, and easy popularization and application in a large area.

Owner:HUNAN COMM IND SERVICE

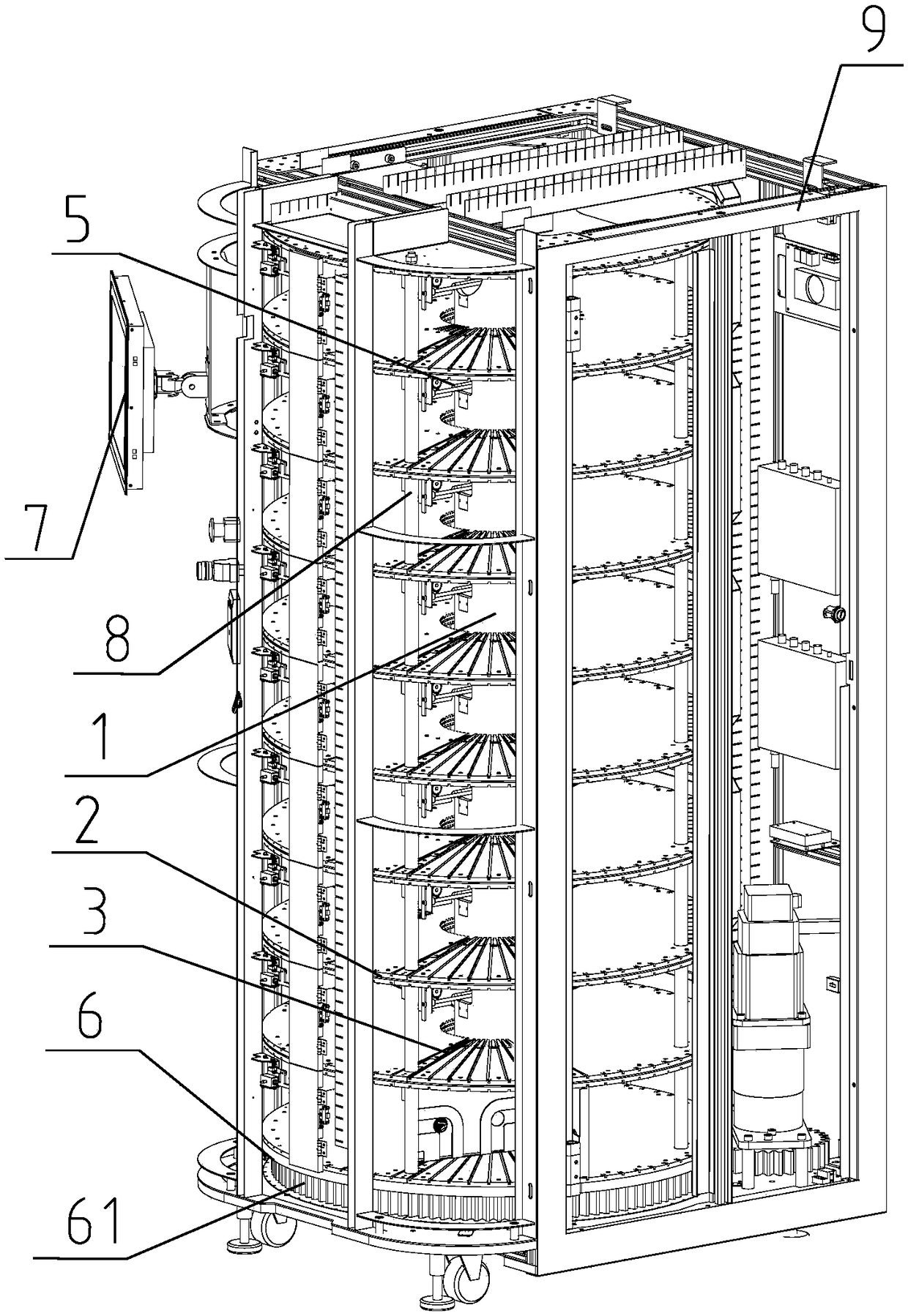

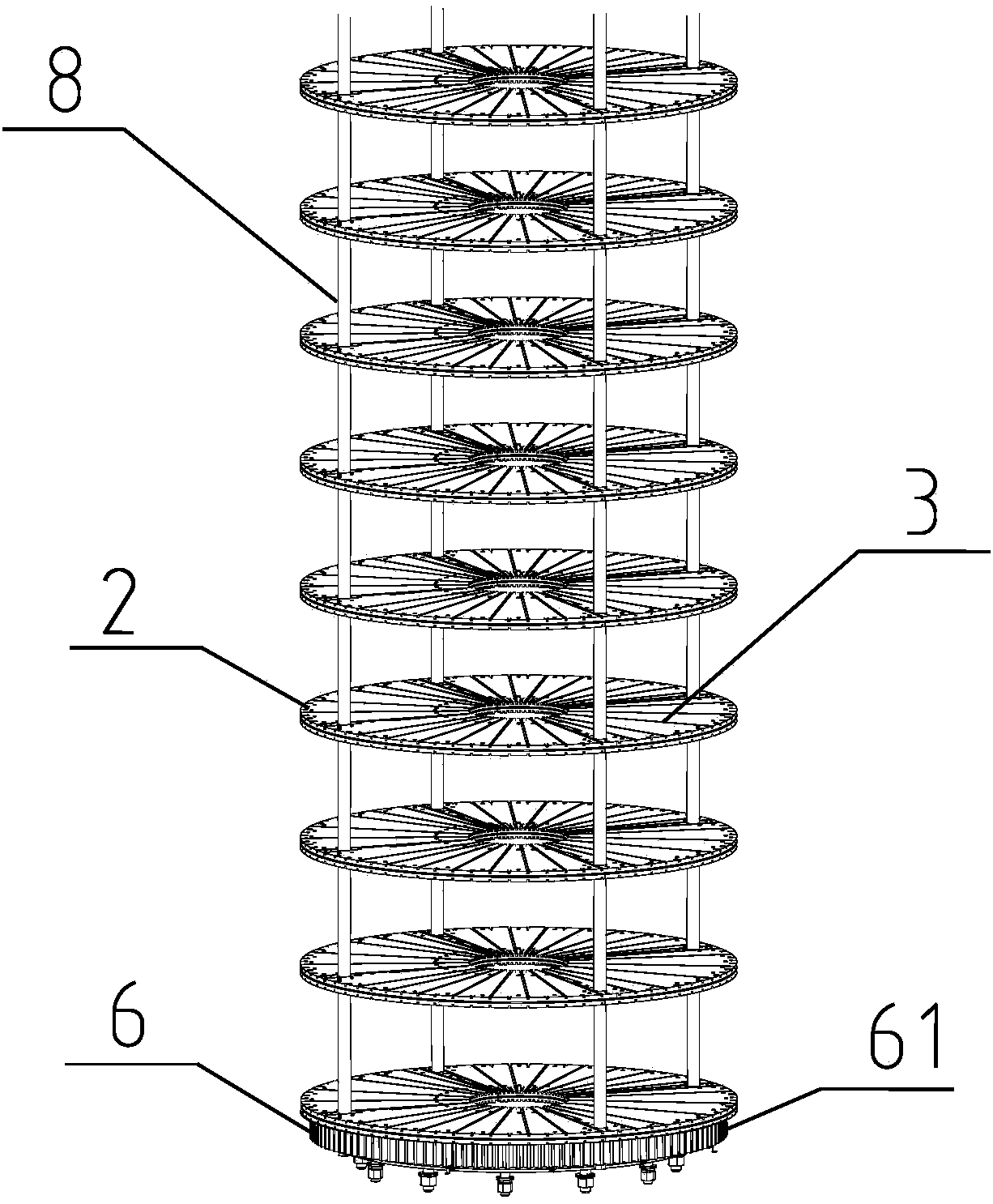

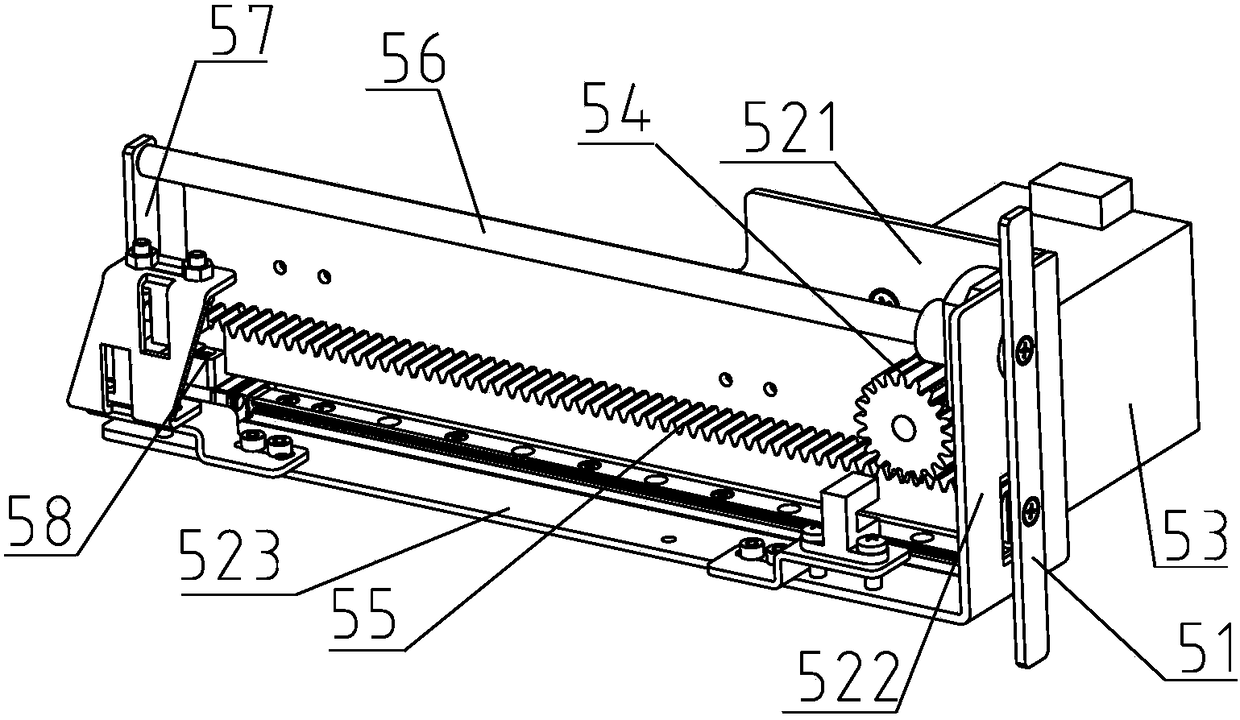

Signature card cabinet and signature card automatic checking method

PendingCN108477865ASave search timeImprove work efficiencyBook cabinetsCo-operative working arrangementsBanking industryEngineering

The invention provides a signature card cabinet and a work method thereof. A vertical fixing shaft is arranged, a rotary wheel disc is arranged on the fixing shaft to drive the fixing shaft to rotate,a plurality of round bearing plates horizontally fixed to the fixing shaft through a center are arranged, a circle of radial guide rails are evenly distributed on each bearing plate in the circumferential direction, the guide rails are in sliding fit with drawer boxes, and signature cards are arranged in the drawer boxes. The signature card cabinet is provided with an RFID radio-frequency antennaused for receiving RFID electronic tag information of signature cards, and the RFID radio-frequency antenna faces the movement path of the drawer boxes rotating along with a rotary assembly. The signature card cabinet can be used for automatically checking the signature cards and monitoring the flow conditions of the signature cards in real time, accordingly time for searching the reserved signature cards is greatly saved in the banking industry, the working efficiency is improved, and good economic and social significances are achieved.

Owner:SHANGHAI GOOAO ELECTRONIC TECHNOLOGY CORP

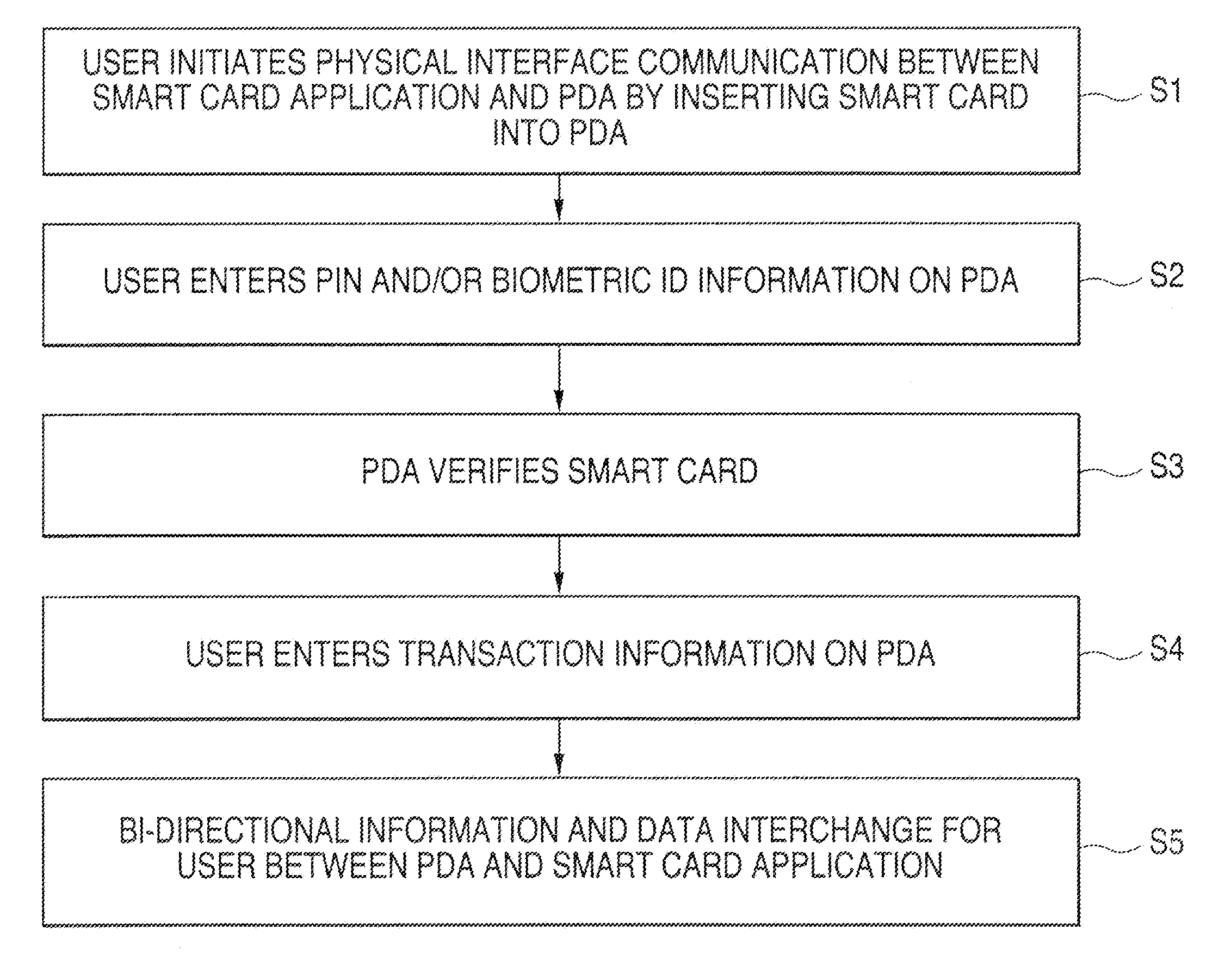

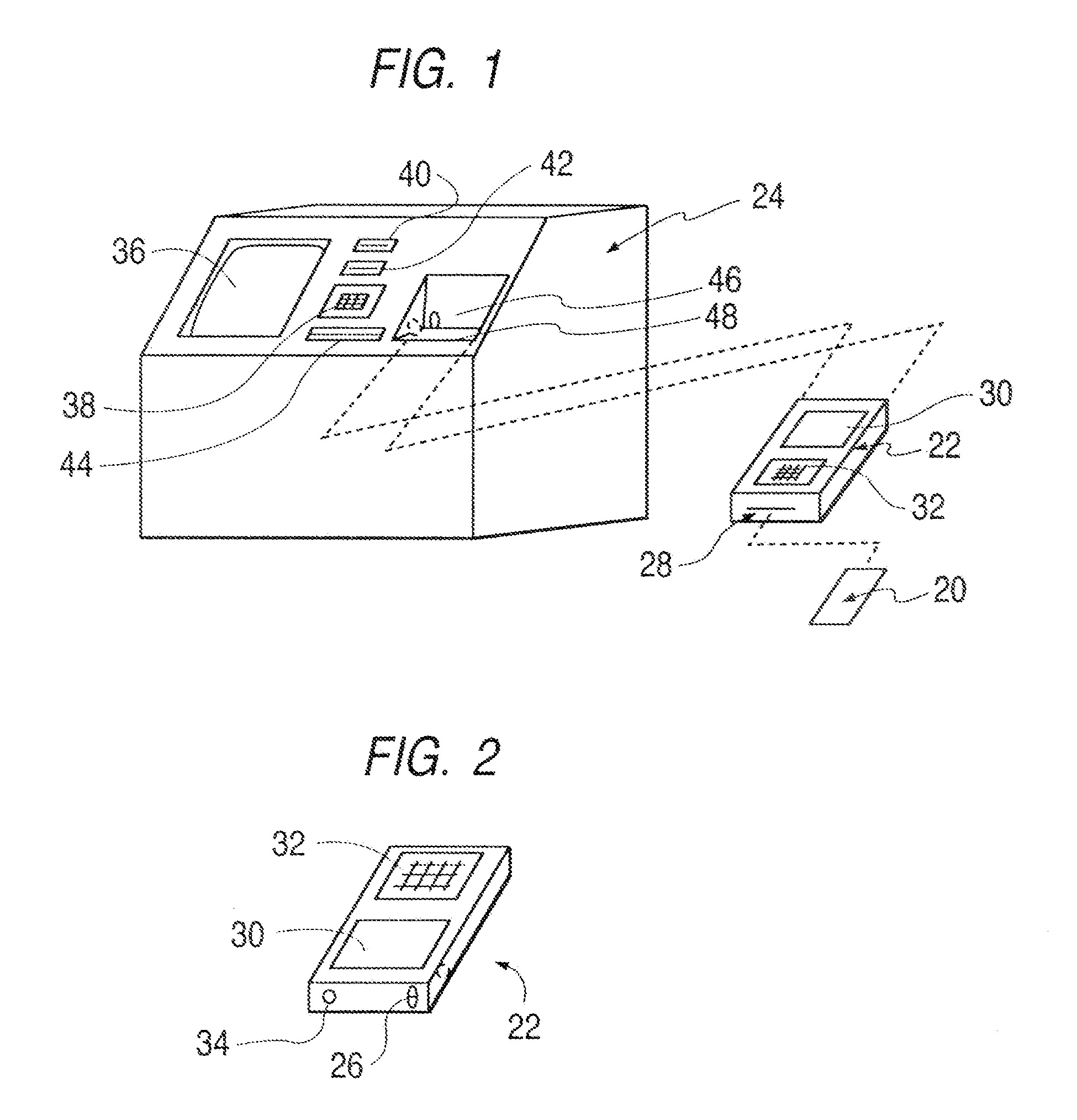

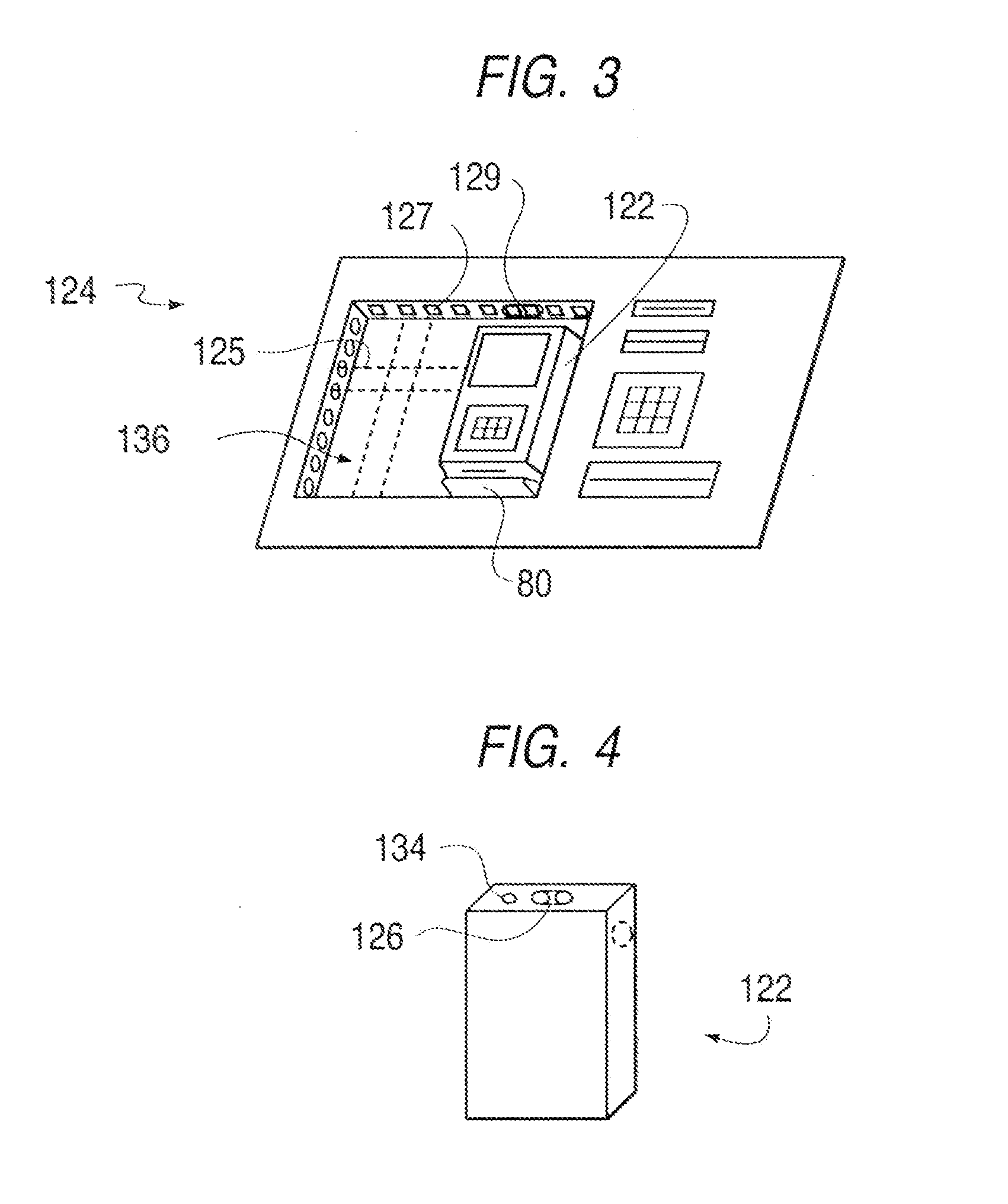

Method and system of contactless interfacing for smart card banking

InactiveUS20110173121A1Increase costIncreased durabilityComplete banking machinesFinanceCommunication interfaceTransceiver

A method and system of smart card banking utilizes a contactless communication interface, such as infrared or a wireless or radio frequency interface, including, for example, a proximity interface. A contactless communication is initiated for a smart card user between a smart card application and the on-line system of a financial institution, such as a bank, the system verifies authorization for the communication, the information is communicated for the user to the on-line system. The contactless communication is initiated, and the information is communicated, for example, between a contactless interface transceiver of a personal data assistant, into which the smart card is inserted, and the contactless interface transceiver of an on-line terminal. Alternatively, the contactless communication is initiated, and the information is communicated between a contactless interface transceiver of the smart card and the contactless interface transceiver of the terminal.

Owner:CITICORP CREDIT SERVICES INC (USA)

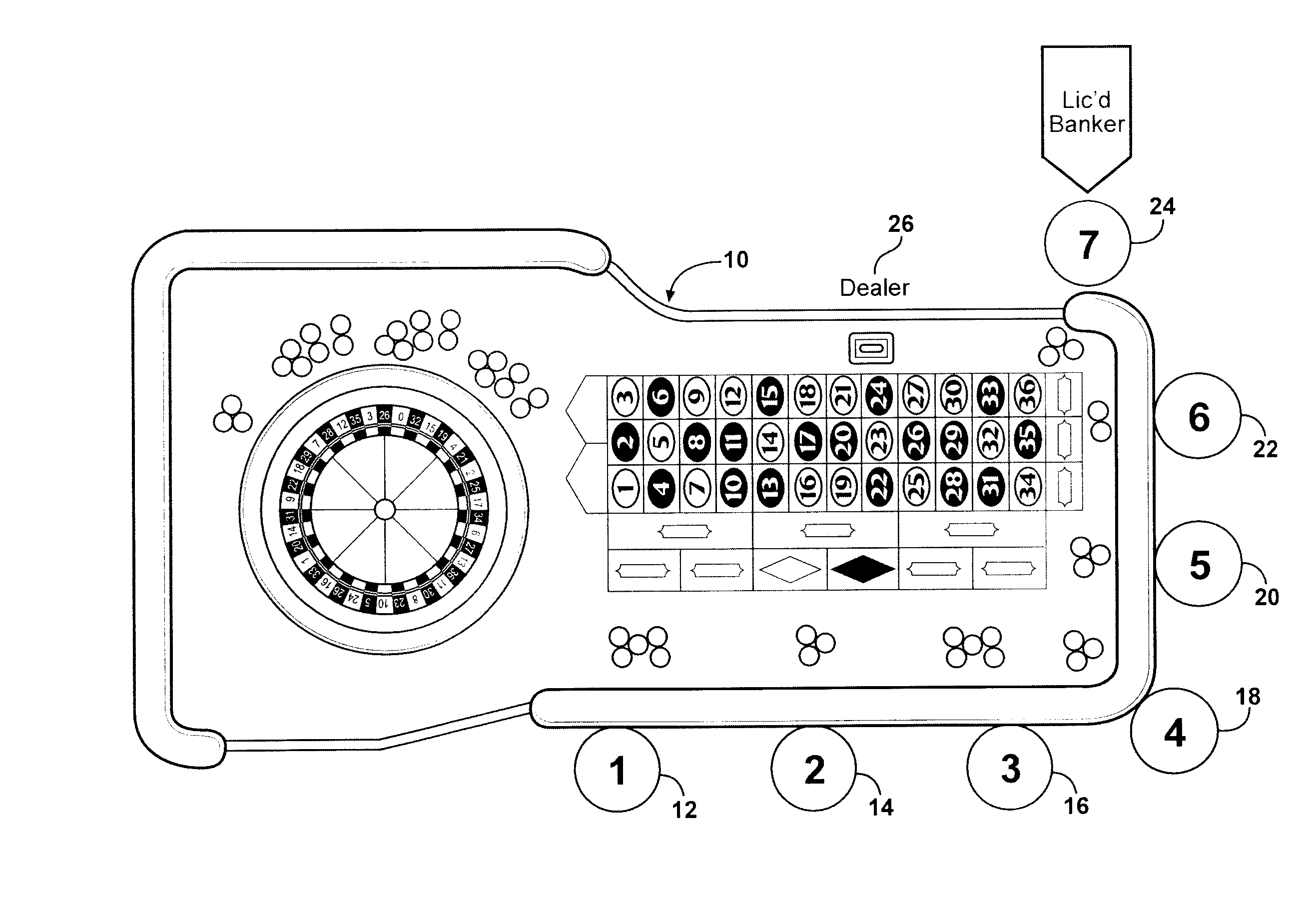

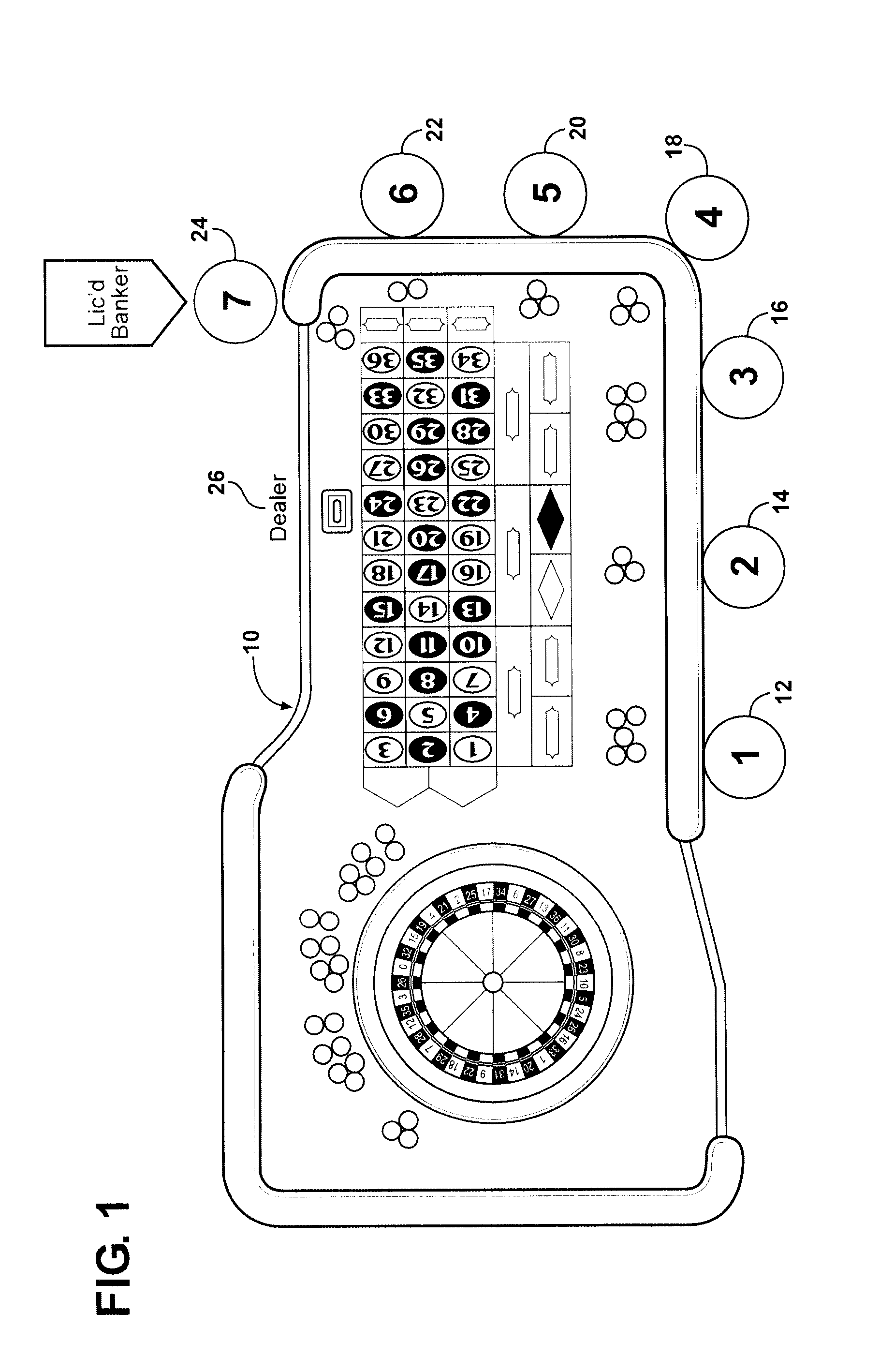

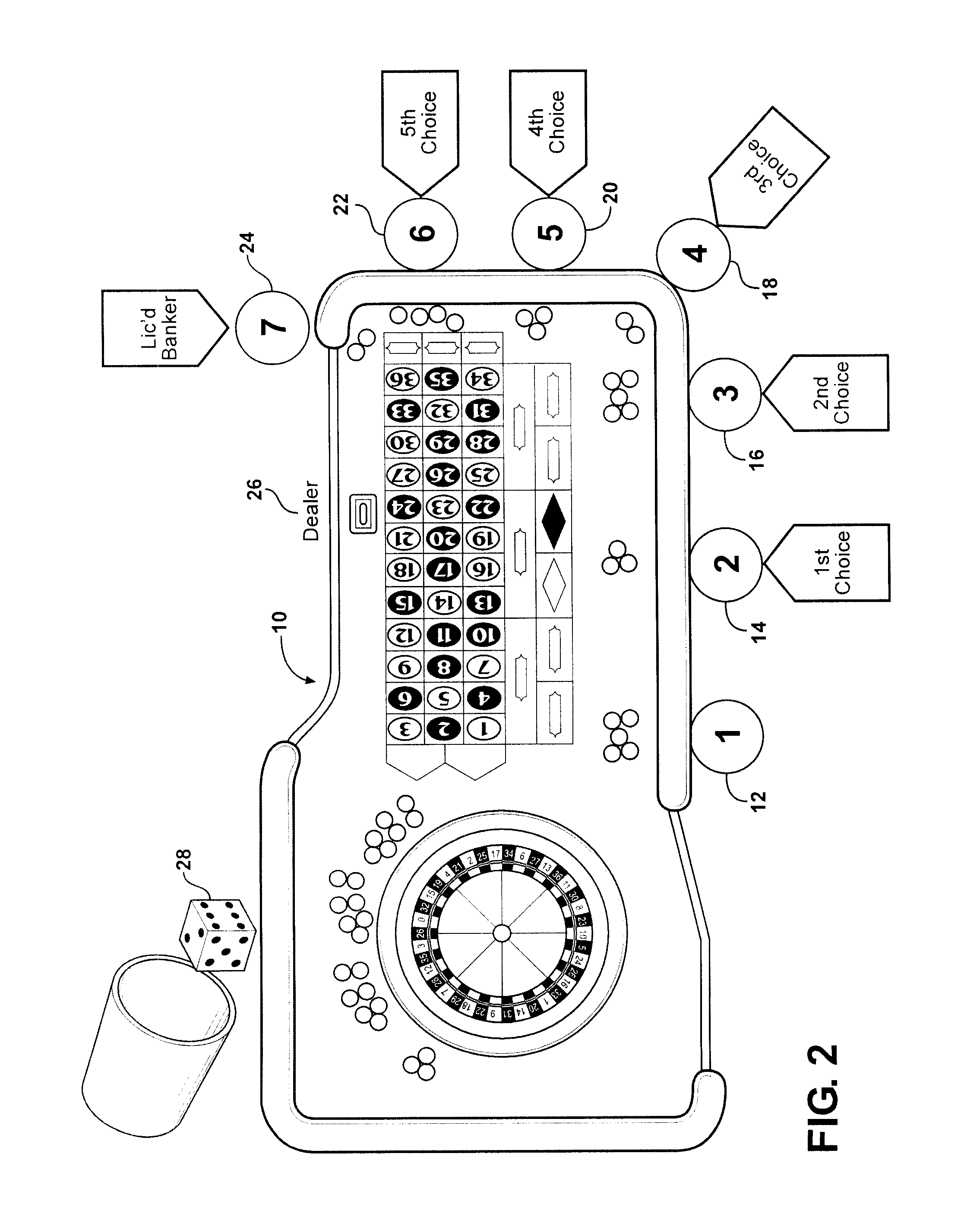

Method of assigning a temporary banker for a game of chance

ActiveUS8042810B2Overcomes shortcoming and disadvantageBoard gamesCard gamesGame playBanking industry

A roulette-style game of chance which is played using a player-banked system. The role of temporary Banker is randomly offered to one of the player positions (12-22). If a player is not available or willing to accept the role, a licensed Banker is appointed as temporary Banker and game play begins. Once a game decision is reached, wagers are resolved according to pre-established wager resolution priorities with pay-outs being resolved before collections. In situations where a player acts as temporary Banker, other players may bank behind the temporary Banker by placing supplemental value at risk. A player acting as temporary Banker, and any players banking behind the temporary Banker, are not permitted to pay out and collect more than the aggregated amount of value they have placed at risk. Once a pre-determined number of games of chance have been played and resolved in this manner, the role of temporary Banker is offered to another player so that all players have an equal chance of participating in the role of temporary Banker.

Owner:MARK HAMILTON JONES & SHERYLE LYNN JONES FAMILY TRUST DATED NOVEMBER 7 2013

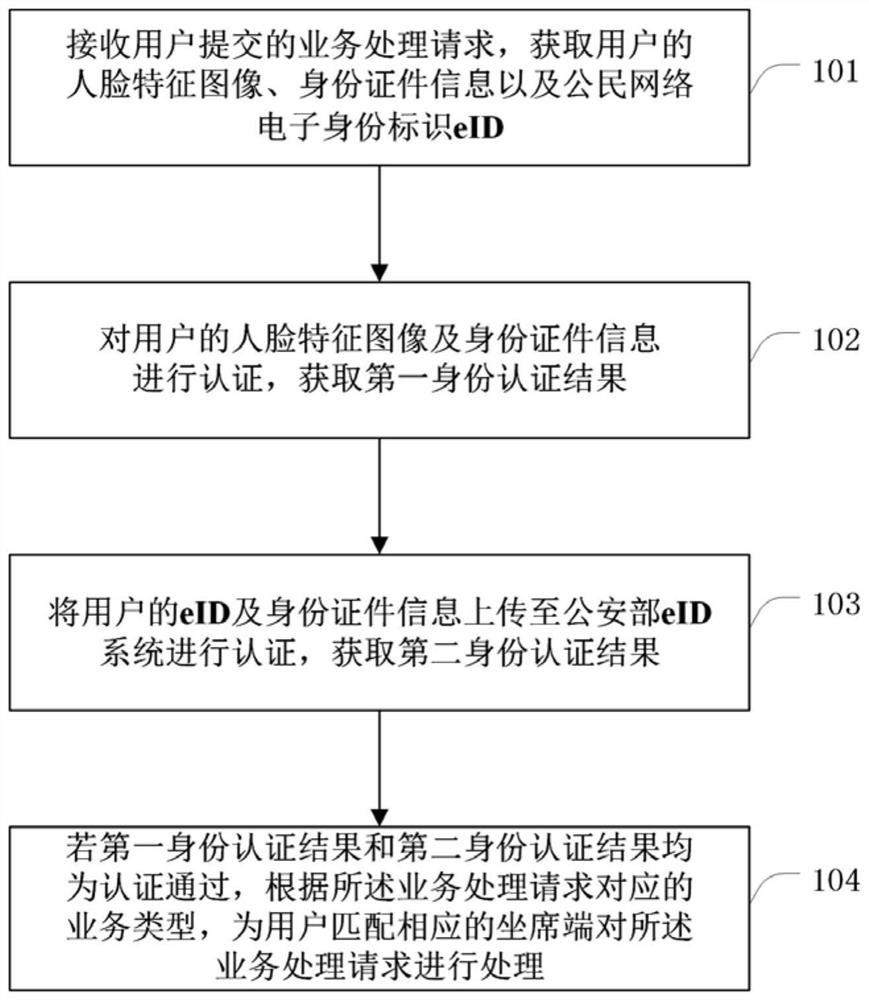

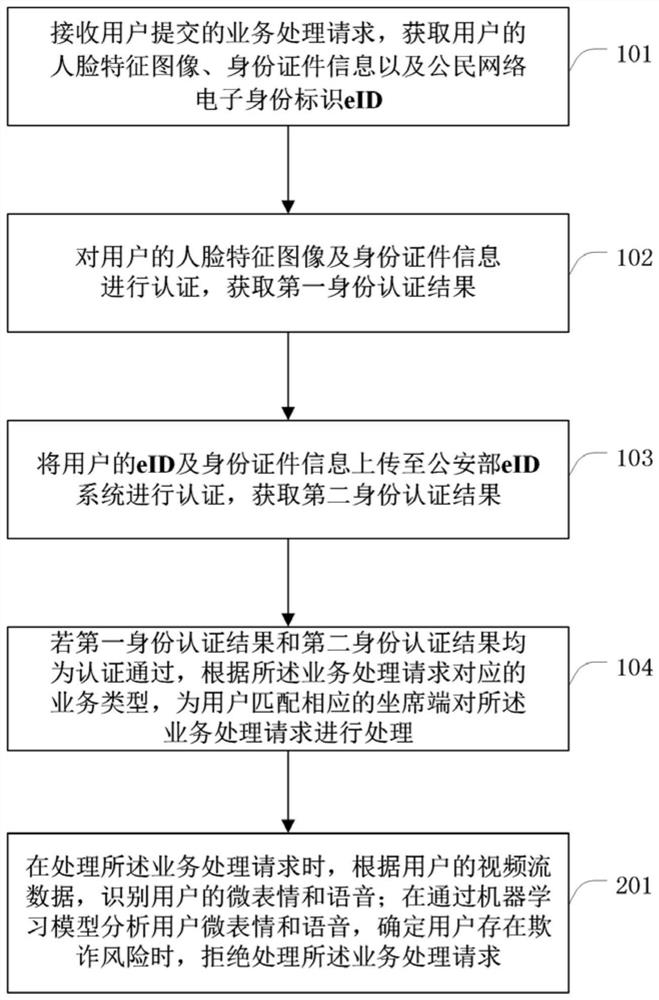

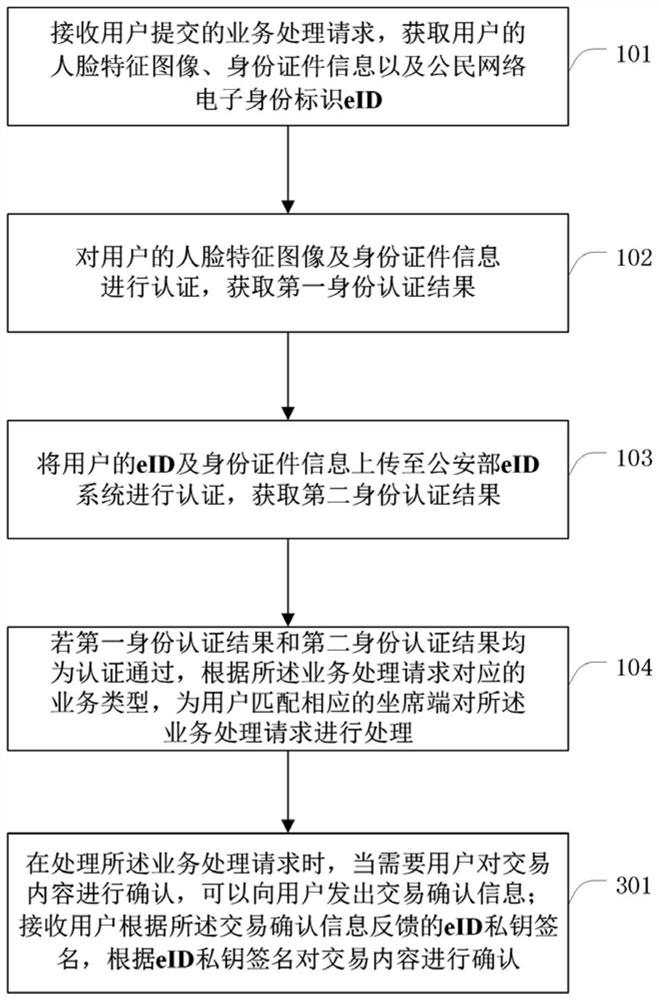

Air banking business processing method and device

PendingCN111754234AImprove experienceAccurate identificationFinanceTransmissionBanking industryEngineering

The invention discloses an air banking business processing method and device, and the method comprises the steps: receiving a business processing request submitted by a user, and obtaining a face feature image, identity document information and a citizen network electronic identity label eID of the user; authenticating the face feature image and the identity document information of the user to obtain a first identity authentication result; uploading the eID and identity document information of the user to an eID system of the Ministry of Public Security for authentication, and obtaining a second identity authentication result; if both the first identity authentication result and the second identity authentication result indicate that the authentication is passed, matching a corresponding agent end for the user to process the service processing request according to the service type corresponding to the service processing request. According to the invention, various businesses can be handled remotely under the condition of confirming that the user identity is reliable, the problems that a client needs to go to a banking outlet to handle complex businesses and the time and convenienceof the client are greatly limited are solved, and the user experience is further improved.

Owner:BANK OF CHINA

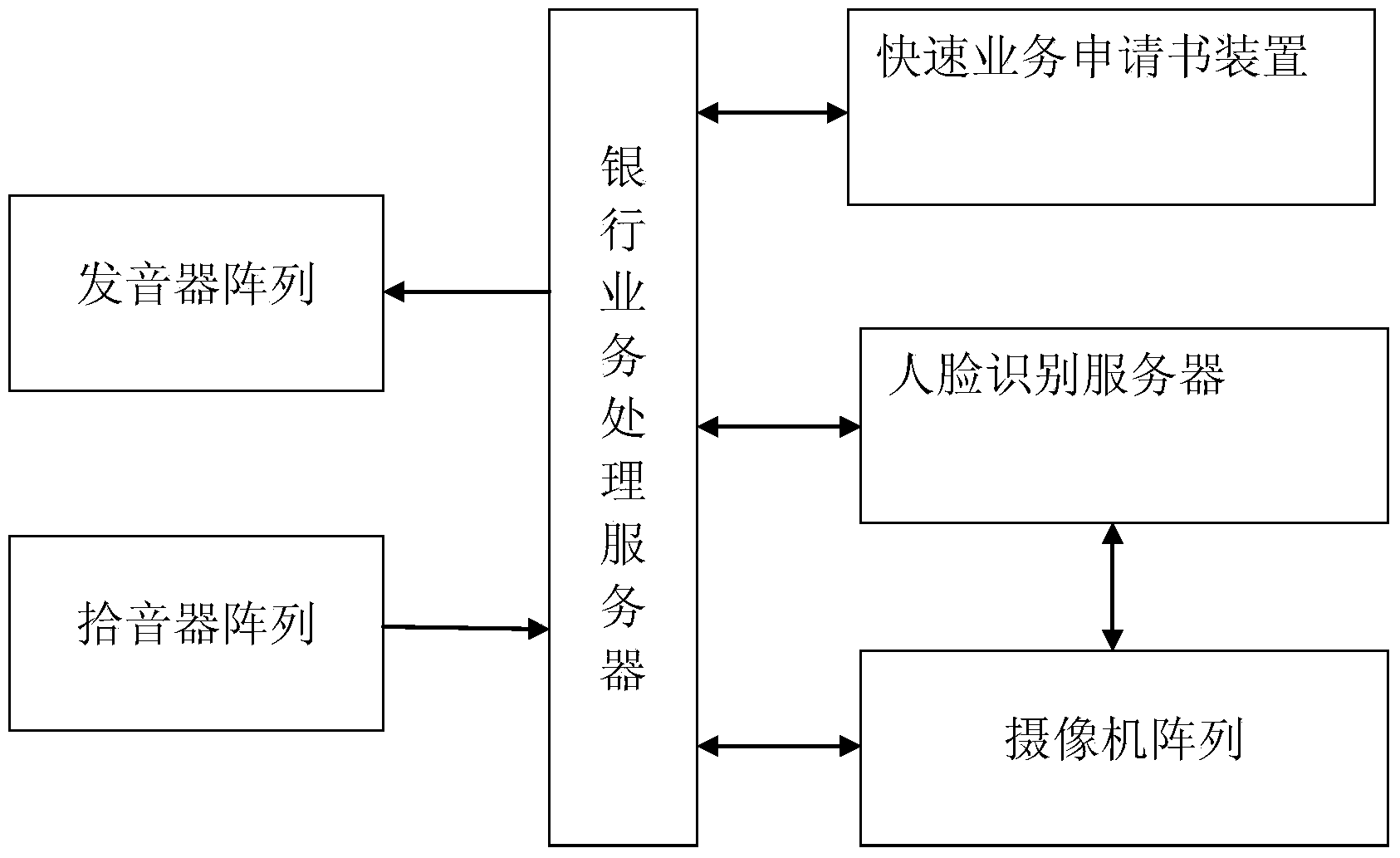

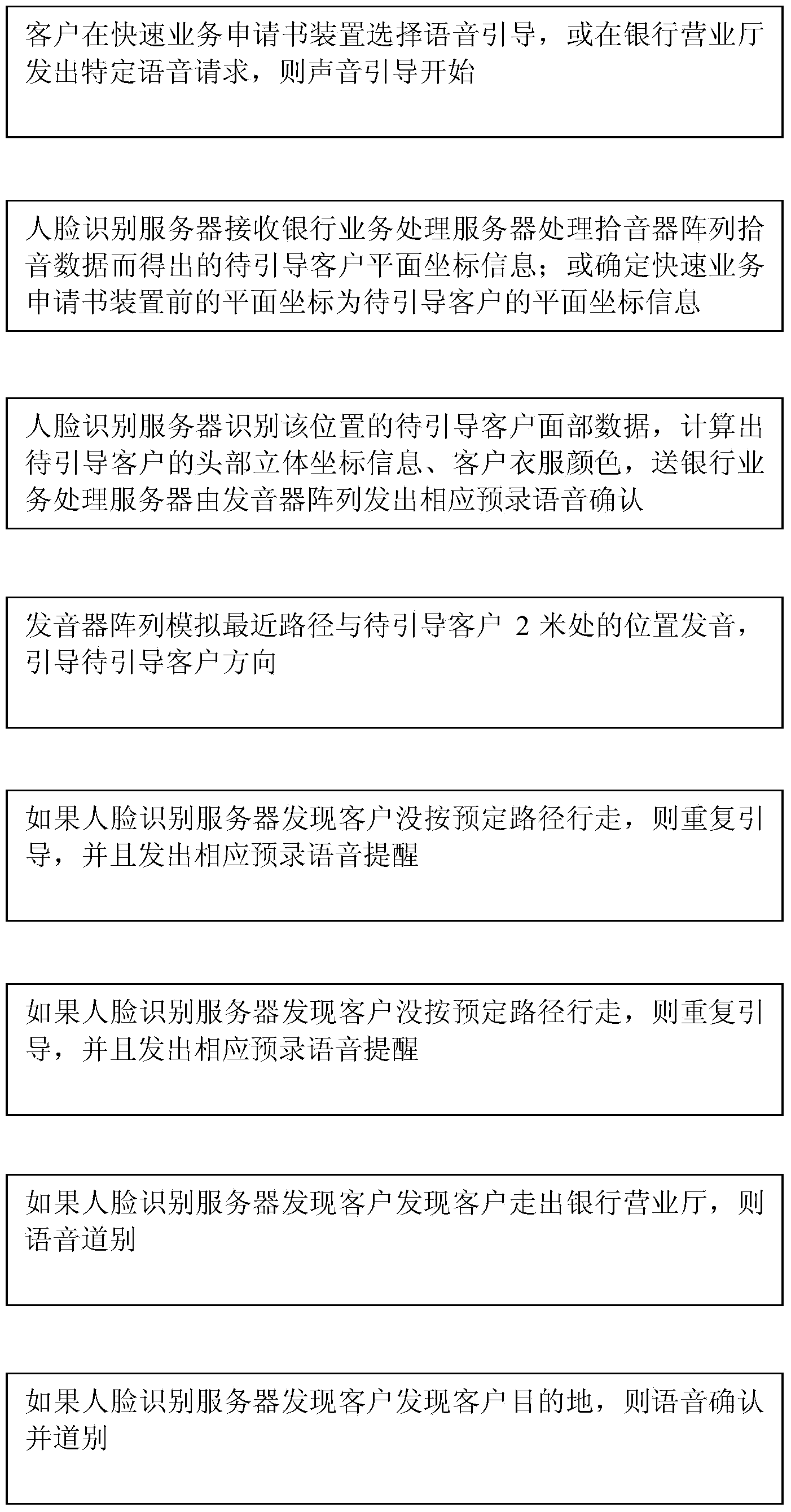

Face recognition and sound guide method and system of bank business hall

InactiveCN103955672ASolve Boot IssuesCharacter and pattern recognitionInformation controlBanking industry

The invention discloses a face recognition and sound guide method and system of a bank business hall. The face recognition and sound guide system of the bank business hall comprises a banking business processing server, a tone generator control array, a face recognition server, a tone generator array, a sound pickup array and a camera array, wherein the banking business processing server is used for obtaining plane coordinate information of clients to be guided from the sound pickup array and a rapid business application device, transmitting the plane coordinate information to the face recognition server for processing and obtaining head three-dimensional coordinate information of the clients to be guided through the processing of the face recognition server; the tone generator control array simulates specific positions to make a sound; the face recognition server is used for processing face recognition data, receiving the plane coordinate information of the clients to be guided and determining the head three-dimensional coordinate information of the clients to be guided; the tone generator array receives a control signal emitted out by the banking business processing server and simulates the preset sound locating effect; the sound pickup array receives a sound signal of the tone generator array, transmits the sound signal to the banking business processing server for judging whether the sound guide is accurate or not, and is used for receiving a sound instruction; a plurality of cameras work simultaneously and are used for collecting the face recognition data and uploading the face recognition data to the face recognition server.

Owner:王美金

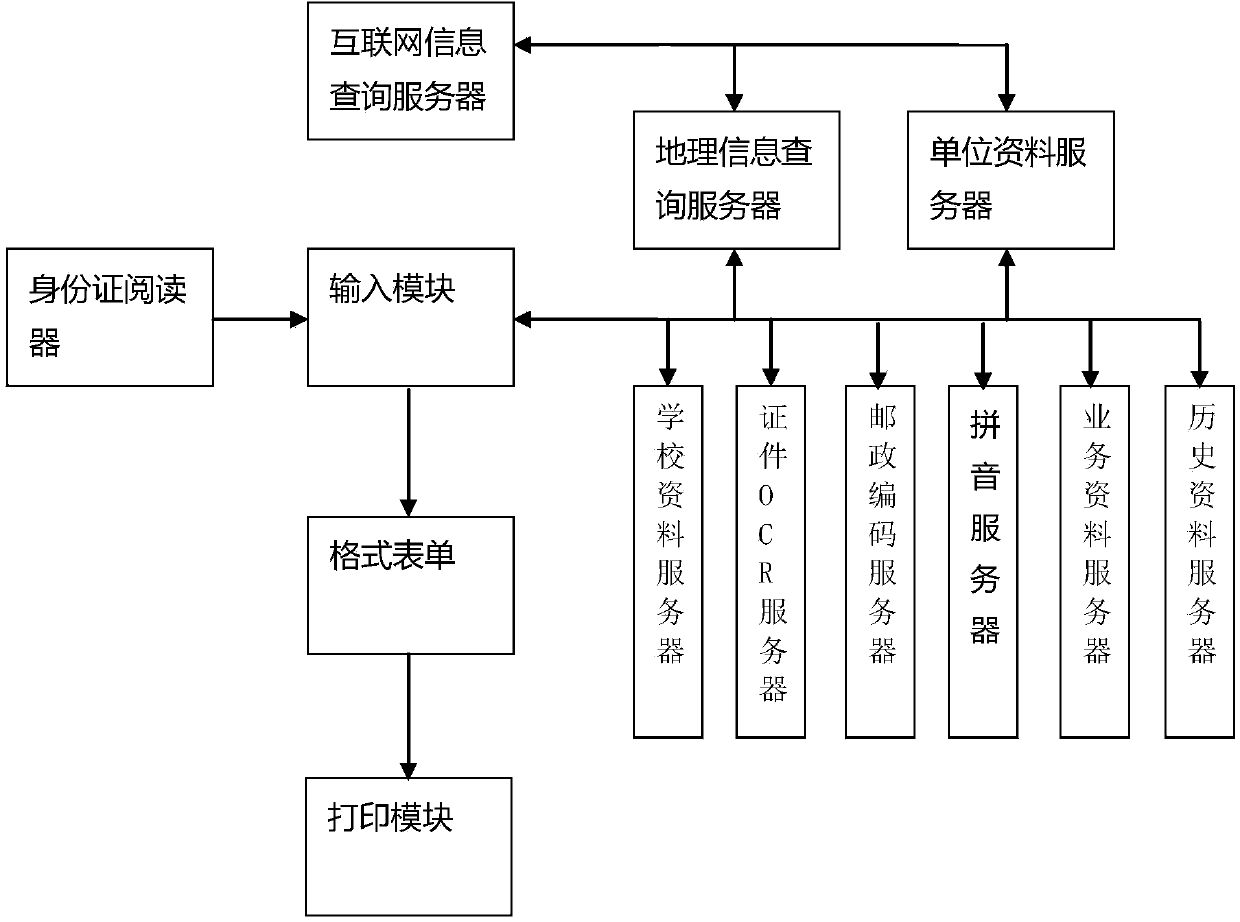

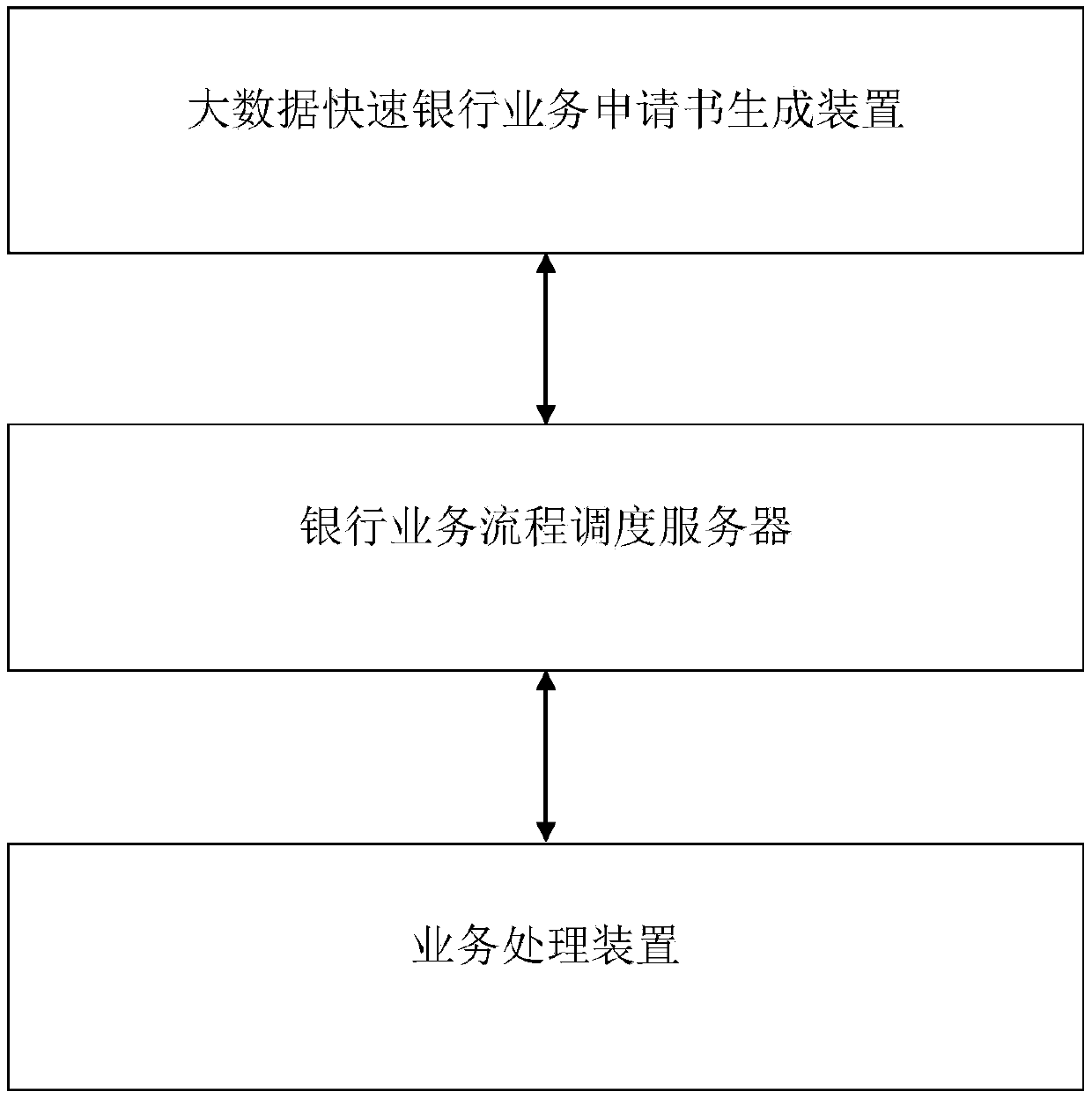

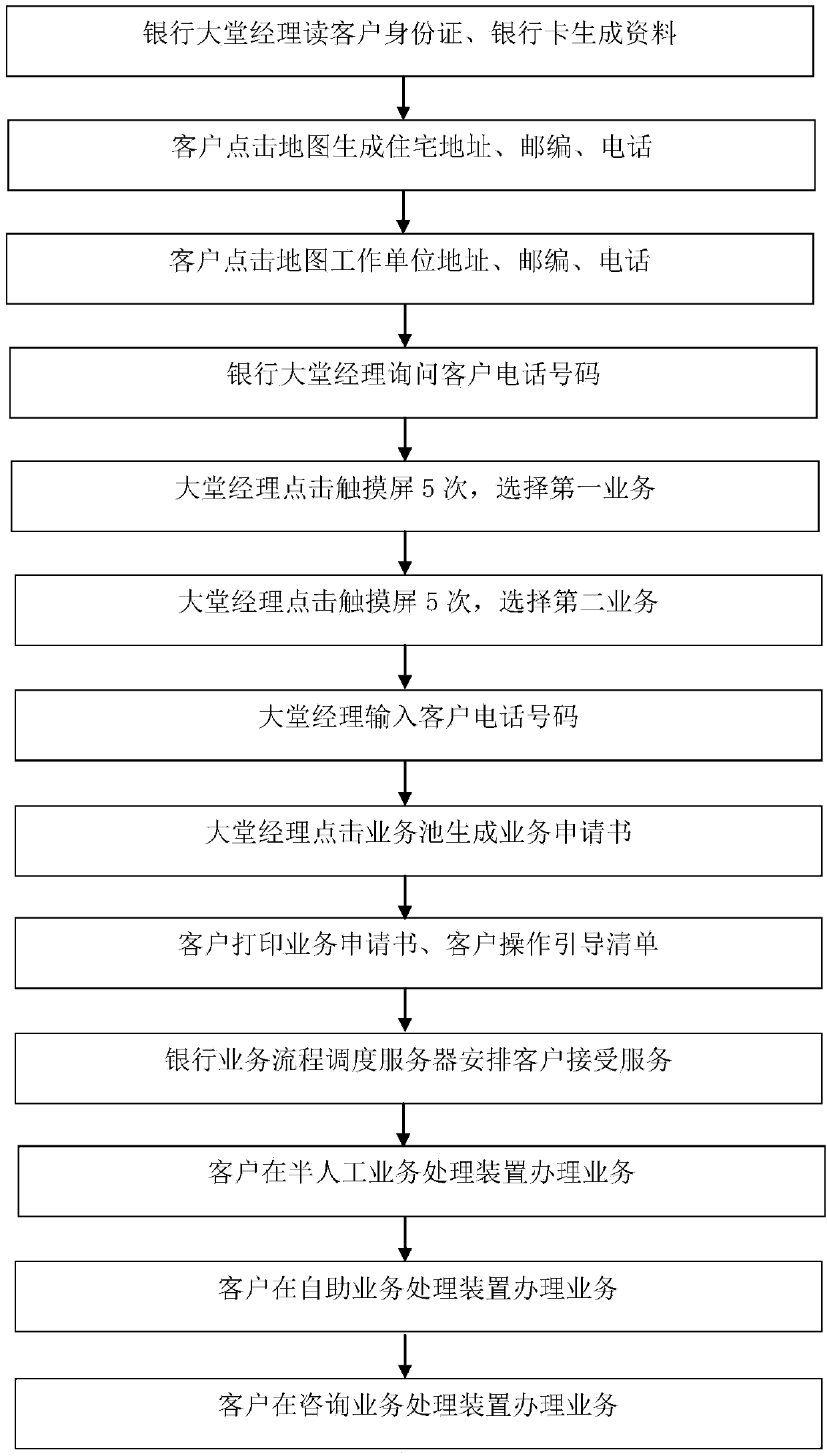

Method and system for rapidly generating banking service application

The invention discloses a method and system for rapidly generating banking service application. The system is formed by an internet information query server, an input module, a format form and a printing module. The internet information query server is used for inquiring information needed by banking services, such as geographic information and longitude and latitude inforemation from the Internet; the input module is formed by an input form, an identification card reader, a geographic information query server, a unit information server, a school information server, a certificate OCR server, a post code server, a pinyin server, a service information server and a historical data server. The system utilizes various query servers to realize rapid bank service filling, so that various banking service applications can be printed after one second when an identification card of an old client is read with a " di " sound and after ten seconds when an identification card of a new client is read with a " di " sound. The system can overcome the problems that currently, filling the banking service application is complex, the banking service application filling cannot be electronized and self-helped.

Owner:王美金

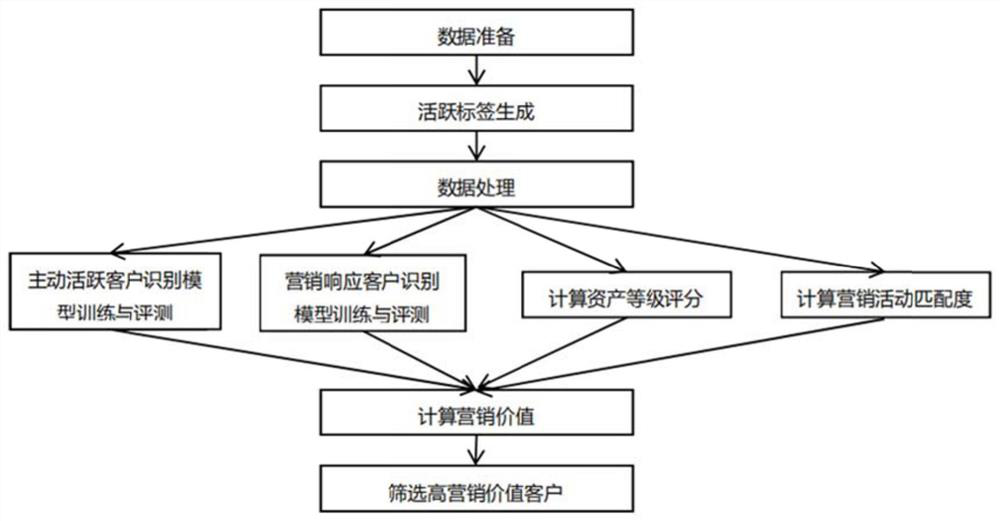

Mobile banking marketing customer screening method fusing multiple machine learning models

PendingCN111626766AIncrease profit contribution valuePrecise screeningFinanceEnsemble learningBanking industryPrecision marketing

The invention discloses a mobile banking marketing customer screening method fusing multiple machine learning models, relates to the technical field of financial data screening processing, and solvesthe technical problem of insufficient precision degree of a data processing method for mobile banking activity promotion precision marketing in the existing banking industry, and the mobile banking marketing customer screening method comprises the following steps of S1, carrying out data preparation; s2, generating an active label; s3, enabling the data to meet the requirements of entering the model; s4, performing training, testing and predicting by adopting an active customer identification model and a marketing response customer identification model; s5, calculating the matching degree of the customer asset grade score and the marketing activity; s6, calculating a customer marketing value in combination with the active activity probability, the marketing response probability, the assetlevel and the marketing activity matching degree; s7, sorting the clients according to the marketing values of the clients from high to low, and screening out the clients with high marketing values. Customer data with high marketing value can be accurately screened out.

Owner:深圳索信达数据技术有限公司

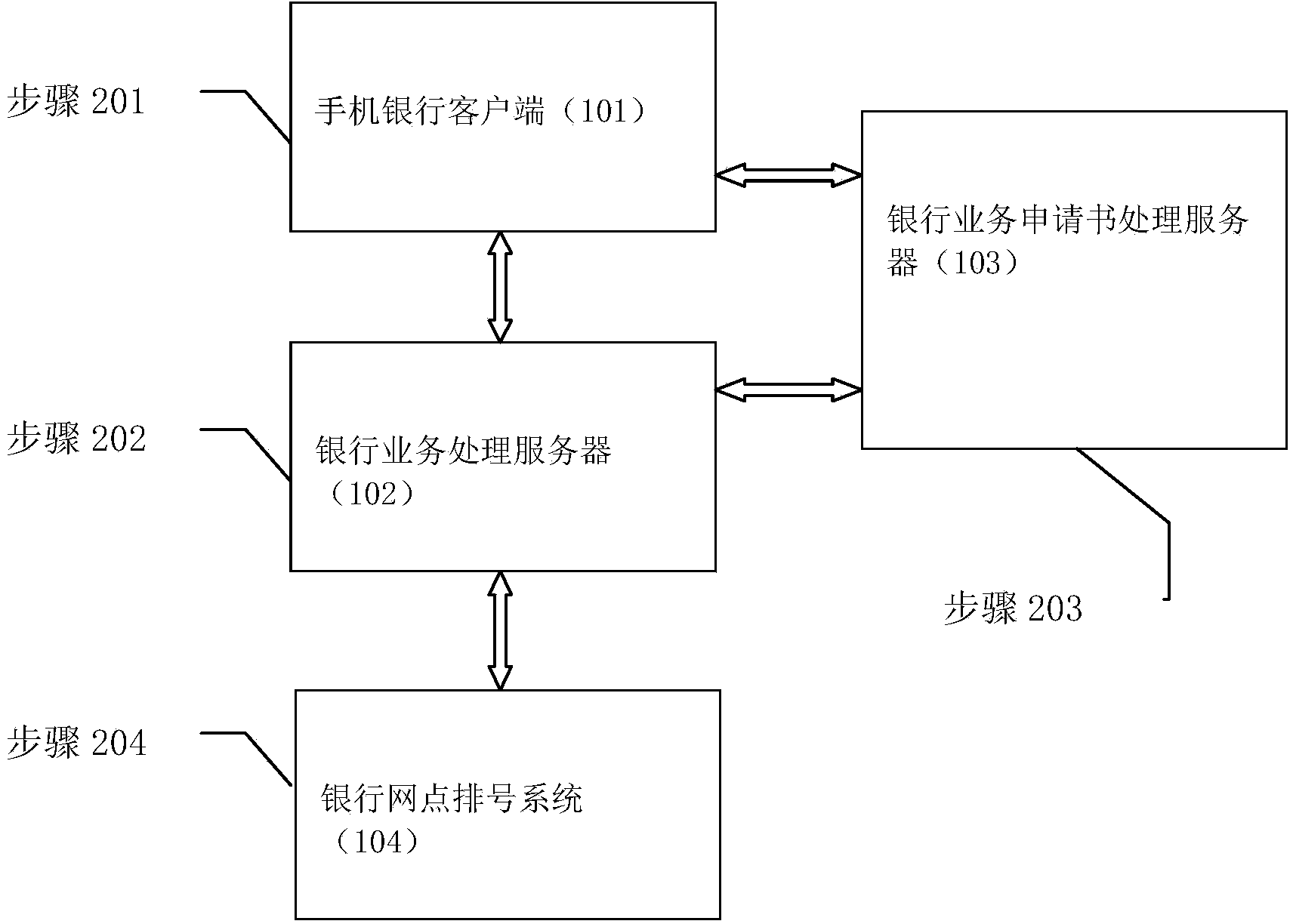

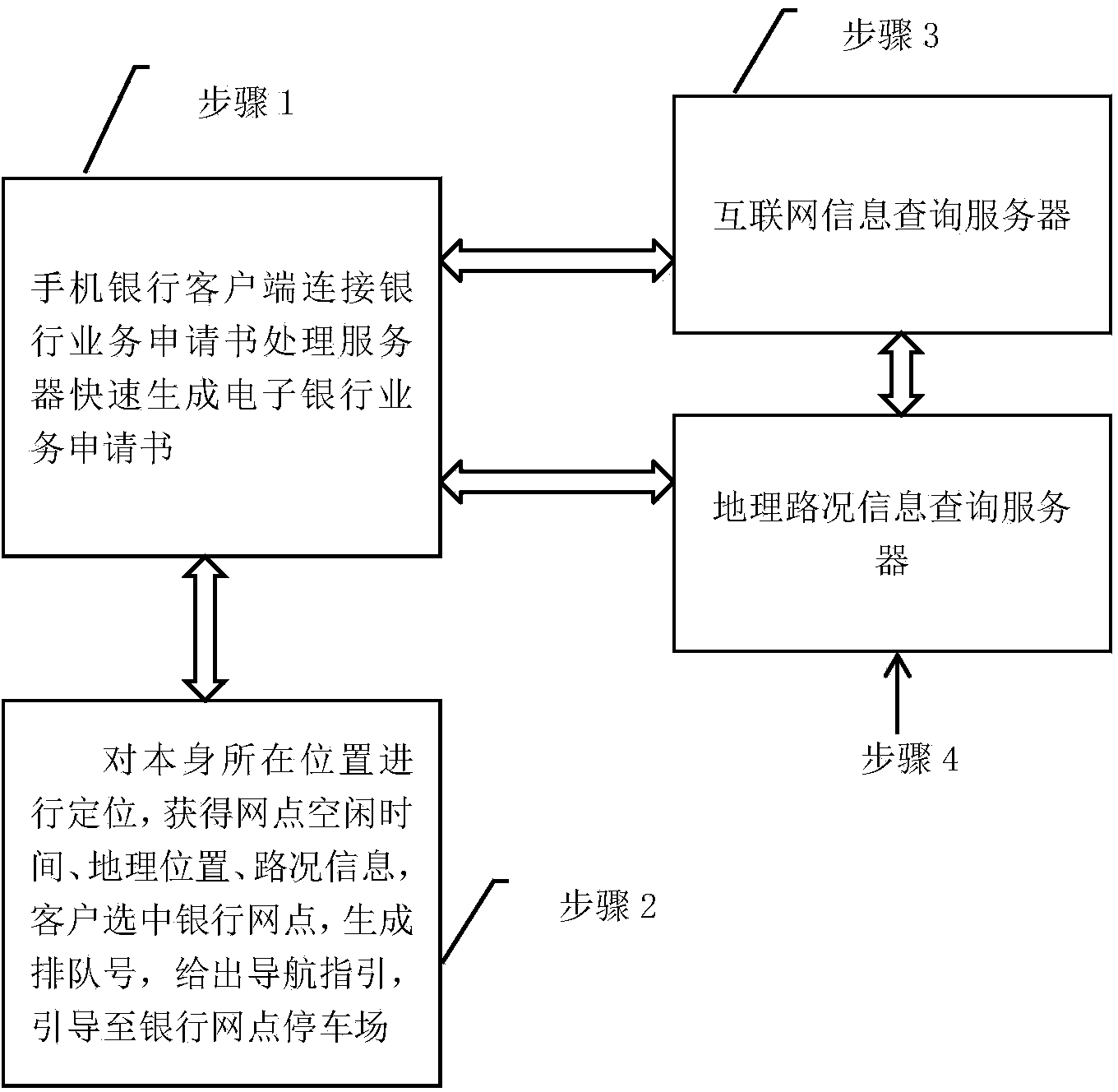

Method and system for making an appointment and handling banking business through mobile phone

The invention discloses a method and system for making an appointment and handling banking business through a mobile phone. The system comprises a mobile phone bank client side (101), a banking business processing server (102), a banking business application form processing server (103) and a banking outlet number queuing system (104). Electronic banking business application forms can be rapidly generated, and various electronic banking business application forms can be generated within one second for a regular customer and within ten seconds for a new customer. The mobile phone is used for obtaining a queuing number in real time between a mobile phone bank and an outlet number queuing machine, and the defects that the customer waits too long and uncertainly in an outlet are overcome. The customers can use the mobile phone bank to obtain the queuing number beyond the network site, accurately inquire the waiting condition and select an idle time section to go to the bank outlet to handle the banking business according to the condition, zero waiting is achieved, the system is convenient to use for the customer, besides, working efficiency of banks is improved, and social resources are greatly saved.

Owner:谭希韬

Method and system for bank business flow based on computers and big data

According to the method and the system, bank business flow is changed from the characteristic of taking employees as the center to the characteristic of taking computers and big data as the center. Computers and big data technology are utilized to help to generate bank business application, client operation lists and bank employee operation lists, a manual handling part and a computer handling part in bank business are analyzed and processed separately, and thus the business processing efficiency is improved by 20 times. Bank employees concentrate to confirm client demands, and other business are processed by computers. A visual tracking technology is utilized for guiding clients to use self-service equipment with same guiding effect of an employee, and thus the utilization rate of the self-service equipment is substantially improved. Based on a same seven-employee location, the daily reception capability is improved from 200 person times to 5000 person times by utilizing the method and the system, so that a two-employee location and a three-employee location can be realized, which are cannot be realized by a conventional location with the characteristic of taking employees as the center; and the normal daily business processing capability of the three-employee location can reach 200 deals, and is far more than that of a conventional seven-employee location.

Owner:何文秀

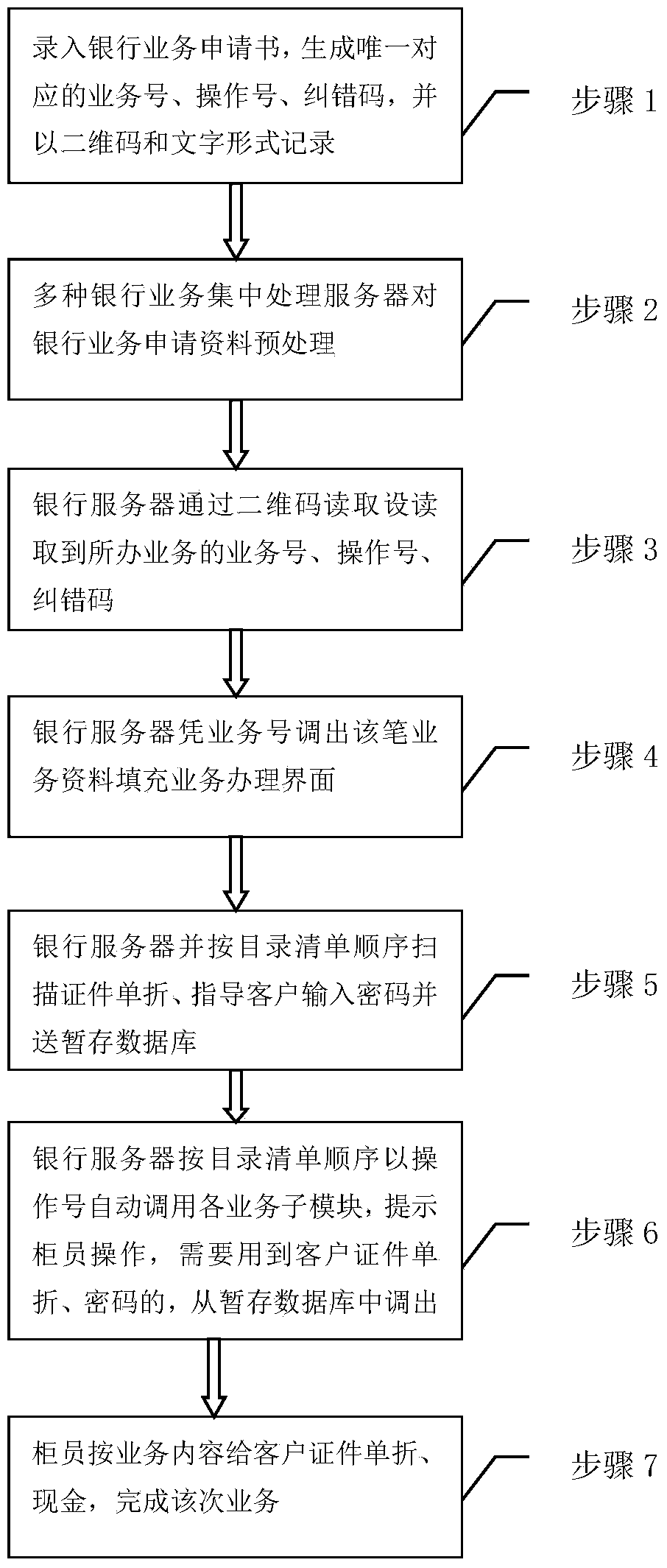

Banking service two-dimension code entering method and banking service two-dimension code entering system

ActiveCN103714483ASolve the problem of long processing timeReduce errorsFinanceBanking industryEngineering

The invention discloses a banking service two-dimension code entering method and a banking service two-dimension code entering system, and 80% of service handling time can be saved. The method comprises the following steps: step 1, a banking service application form processing server generates an electronic banking service application form, uploads the electronic banking service application form to a multiple banking service centralized-processing server, generates a unique corresponding service number, operation number and error correcting code and records the service number, the operation number and the error correcting code in the form of two-dimension code and text; step 2, a bank server scans a two-dimension code to obtain the service number, the operation number and the error correcting code of a handled service; step 3, the bank server calls out an information filling service handling interface of the service according to the service number; step 4, a teller scans a certificate single fold according to a directory list sequence, guides a customer to enter a password and sends the password to a temporary storage database; and step 5, the bank server automatically calls service sub modules with the use of the operation number according to the directory list sequence, reminds the teller to carry out operation and completes the service. The customer certificate single fold and the password are called out from the temporary storage database as required.

Owner:广西迈联科技股份有限公司

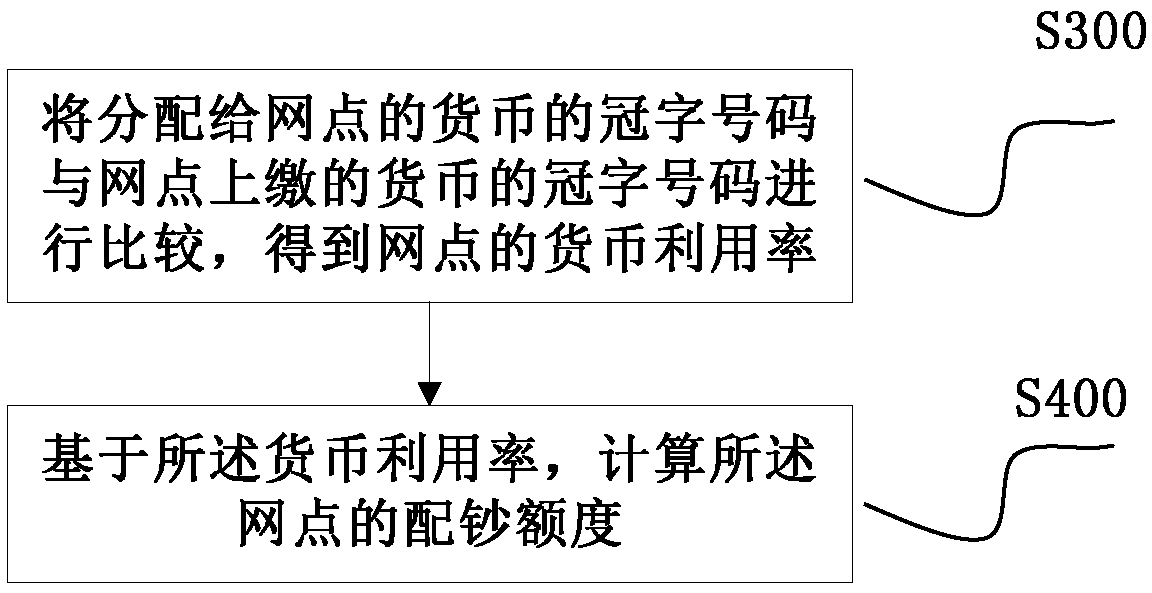

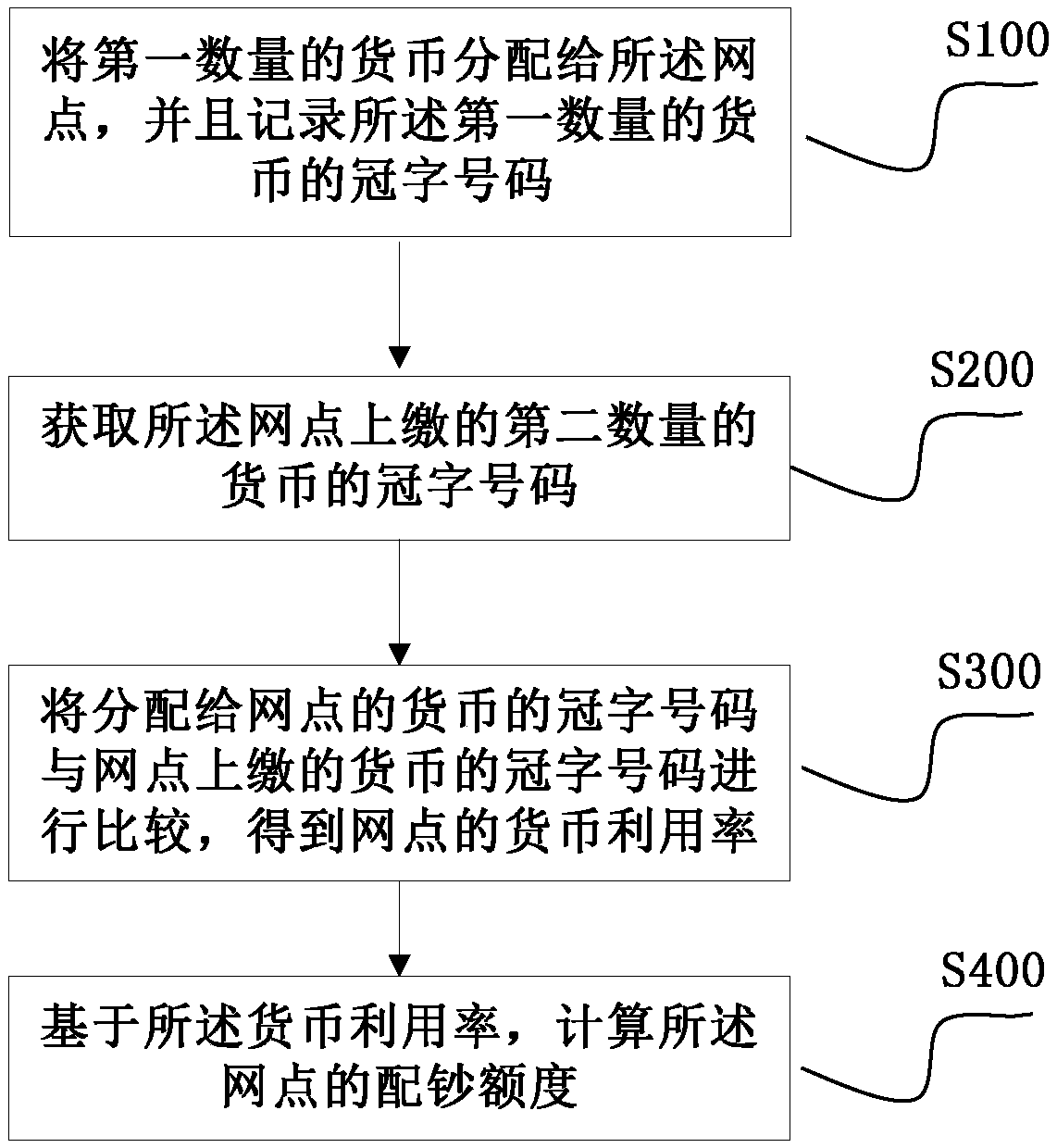

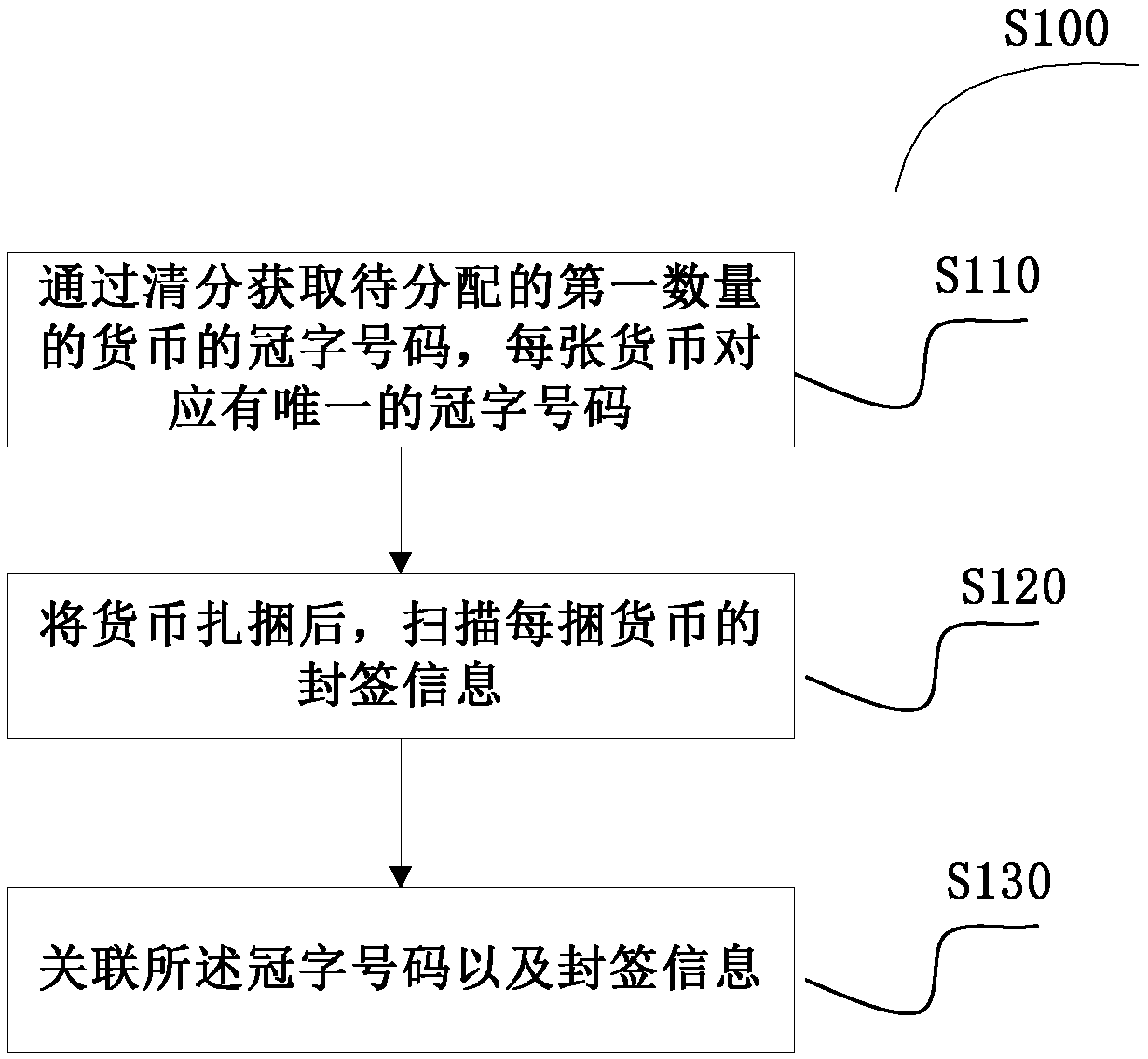

Accurate banknote matching method and device based on crown word number

The invention discloses an accurate banknote matching method and device based on a crown word number. The method comprises the following steps of comparing the crown word number of a currency distributed to a branch with the crown word number of the currency turned in from the branch, and acquiring the currency utilization rate of the branch; and based on the currency utilization rate, calculatingthe banknote matching limit of the branch. In the method, crown word number big data is taken as a basis, the inline banknote matching of a banking industry is analyzed, experience-based banknote matching is converted into data-based banknote matching, the cash utilization rate of the branch is effectively supervised, the accurate banknote matching of the branch and a self-service device terminalis realized, and obvious informatization support is formed for reducing a commercial bank inventory.

Owner:北京磁云唐泉金服科技有限公司

Method for content responding and content requesting, content responder and content requestor

InactiveUS8543731B2Easy to understandMultiple digital computer combinationsTransmissionBanking industryWorld Wide Web

The present invention sets forth a method for content responding, a method for content requesting, a content responder and a content requester. A content responder receives a first request from a content requester via a network. Then, the content responder generates a first content based on the first request. Then the content responder receives a second request from the content requester via the network. Then, the content responder generates a second content based on the second request. Next, the content responder compares the second content with the first content. After that, the content responder transmits a second response with regard to the second request to the content requester via the network. The second response is generated based on the result of comparison. According to the invention, if there is a very small difference between the first content and the second content, network bandwidth can be saved, the transmitting time of content will be reduced, and thus the waiting time of the user to view content will be reduced. The present invention is particular beneficial to the existing industries (for example, the banking industry) that adopt narrow band network widely.

Owner:INT BUSINESS MASCH CORP

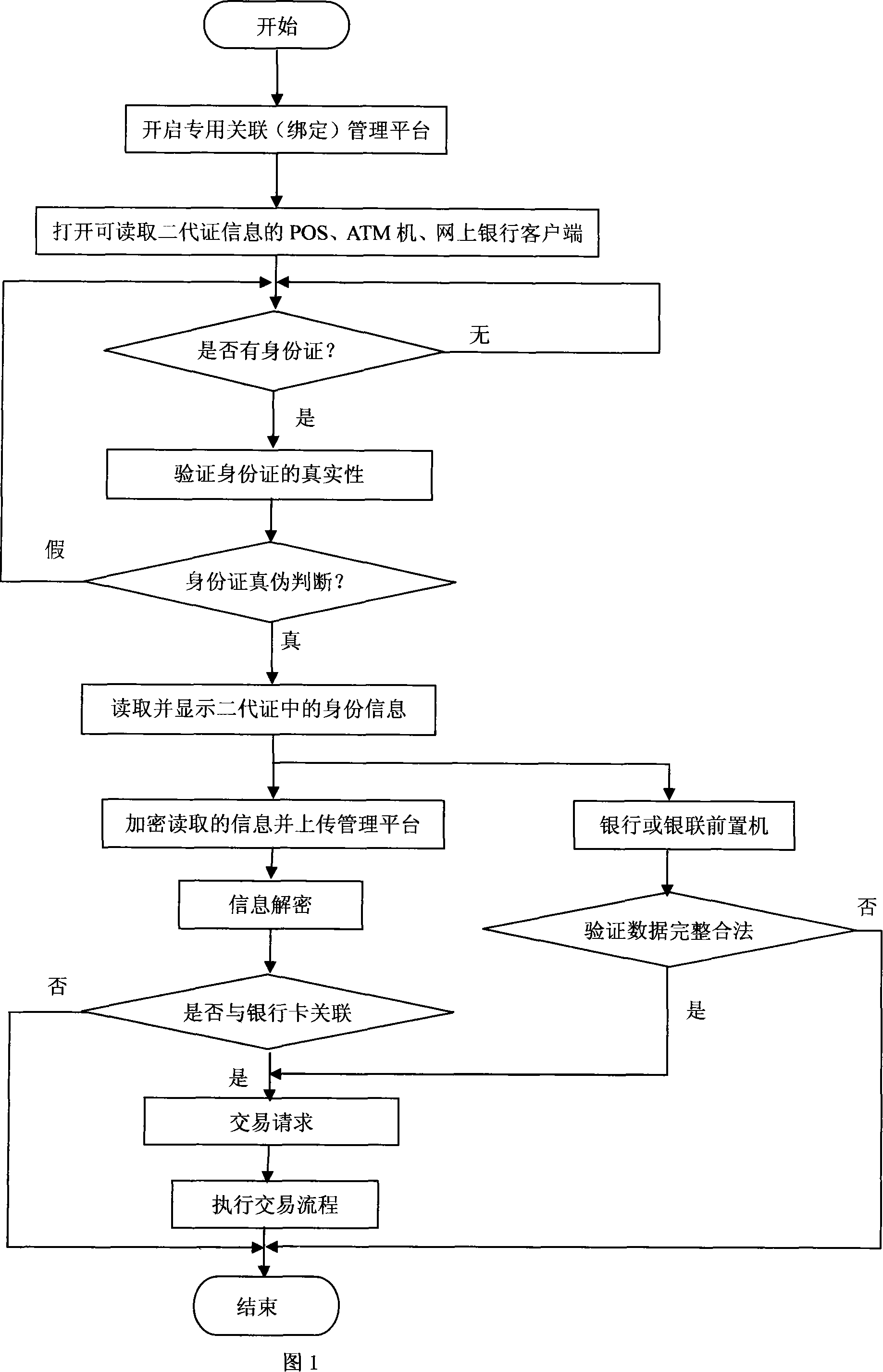

Method for associating (binding) bank card for payment adopting the second generation identity card

InactiveCN101145229AImprove security and confidentialityGuarantee the safety of fundsFinanceCo-operative working arrangementsInformation functionPayment

Owner:宋弋希

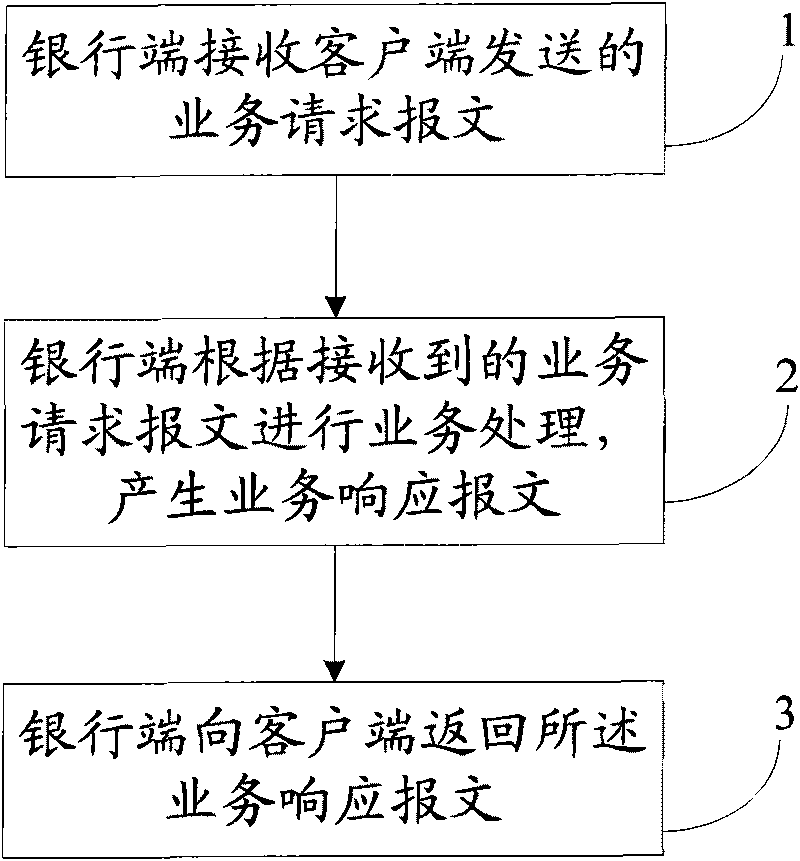

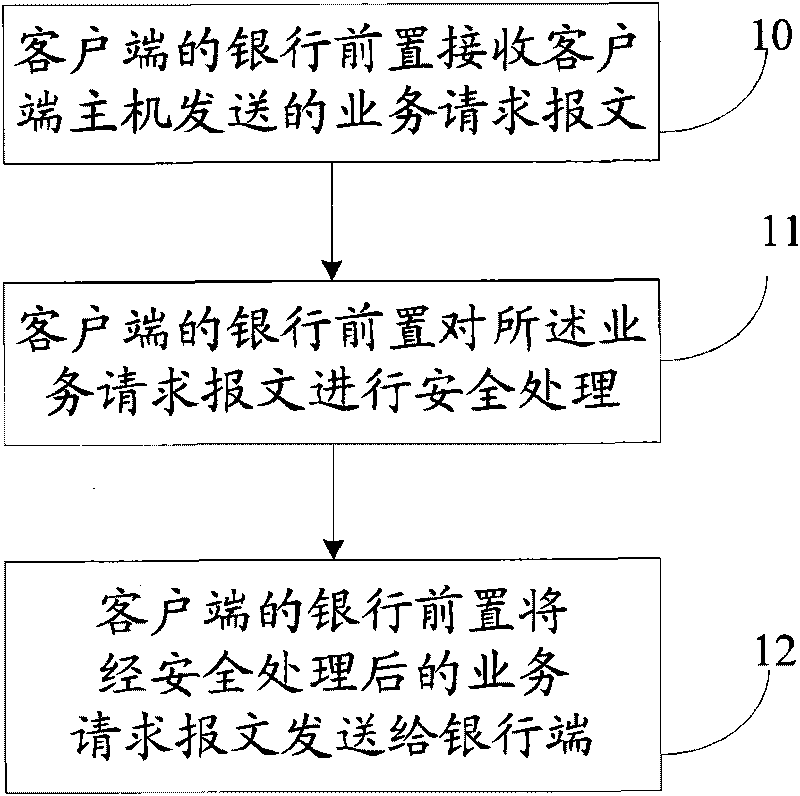

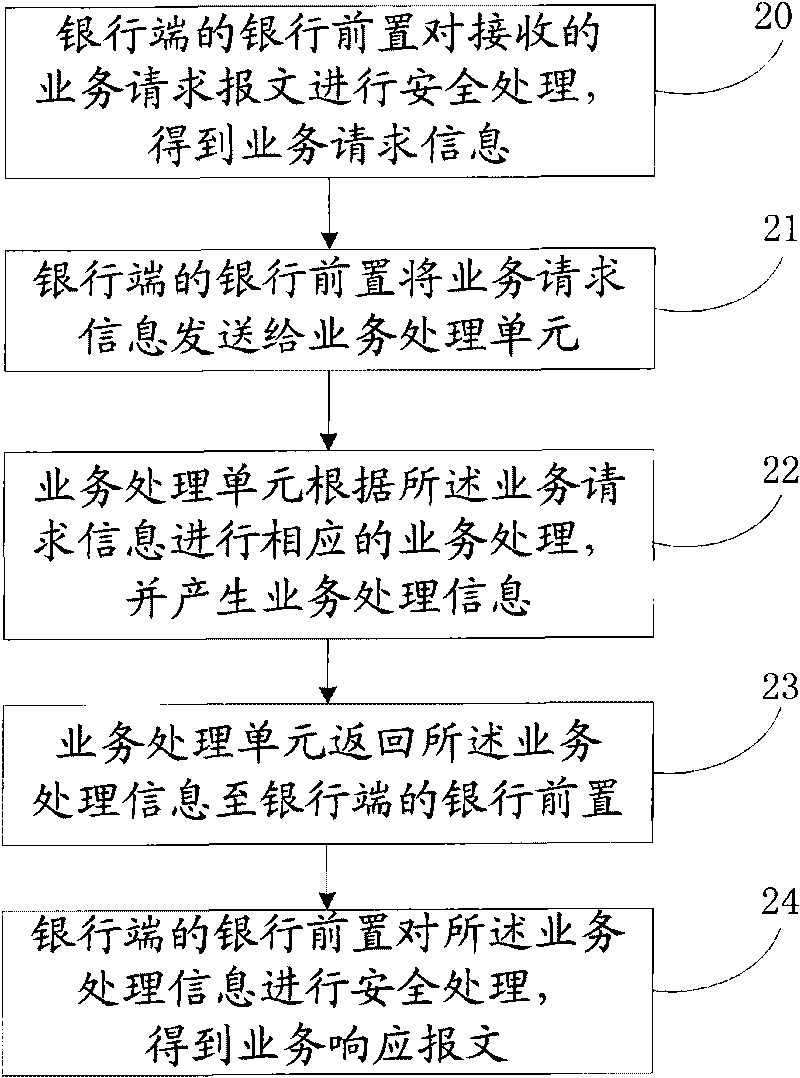

Method and system for processing automotive financial bank businesses

The invention discloses a method for processing automotive financial bank businesses, comprising the following steps: a. a bank side receives a business request message sent by a client side; b. the bank side processes the business according to the received business request message to generate business response message; and c. the bank side returns the business response message to the client side. Accordingly, the invention also discloses a system for processing automotive financial bank businesses. By implementing the invention, an automotive financial corporation service system platform sends the business request to the bank system for business process in a form of message, so that the automotive financial corporation service system platform is accessed to the bank side, thus the business processing efficiency is effectively improved, the manual cost is reduced, and the business data information is safer and more reliable, thereby being beneficial to the development of the automotive financial corporations.

Owner:CHINA CONSTRUCTION BANK

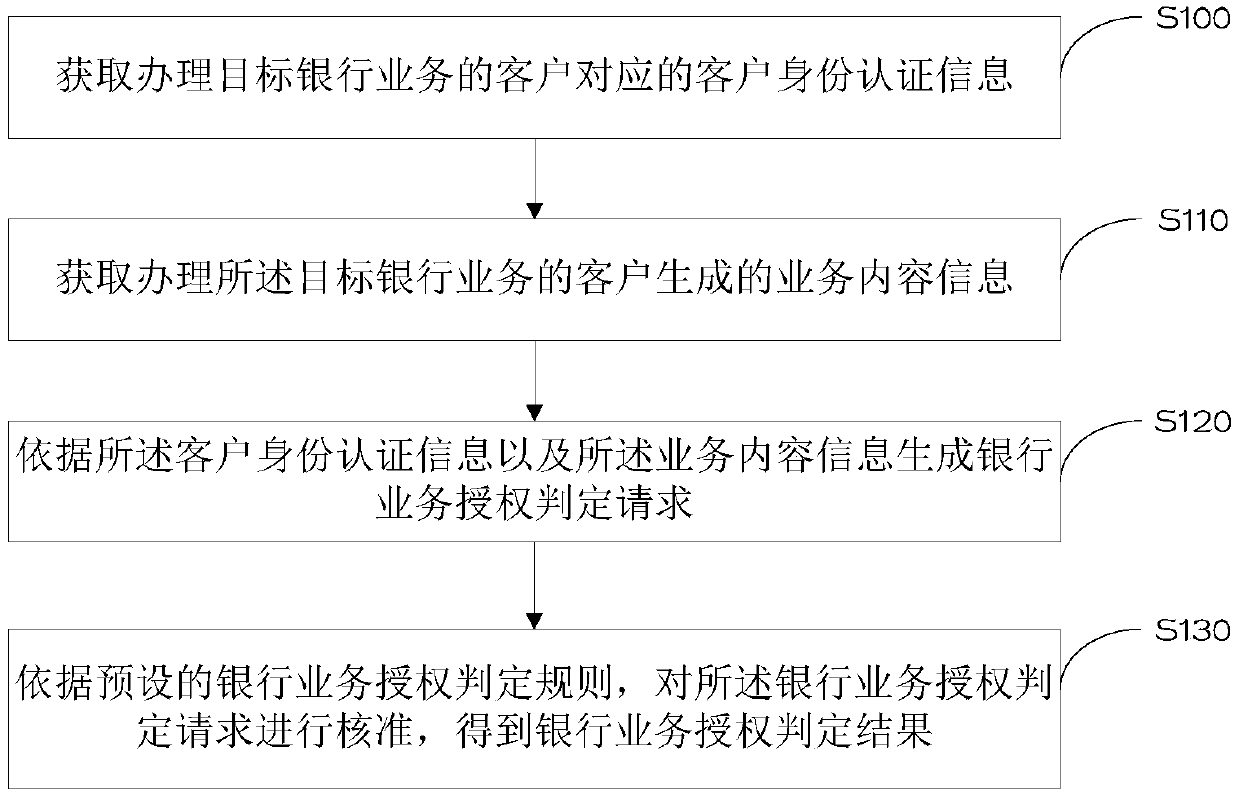

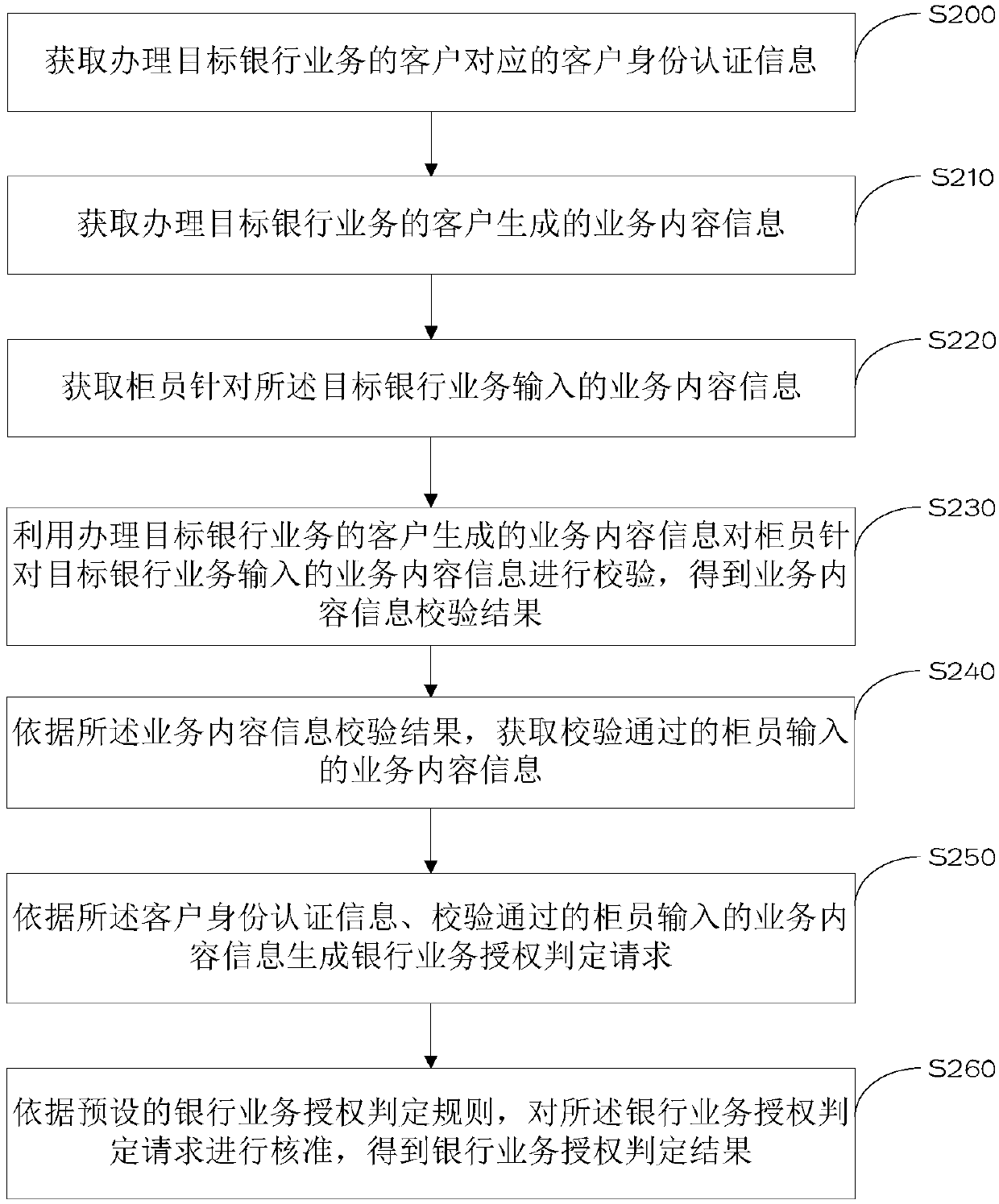

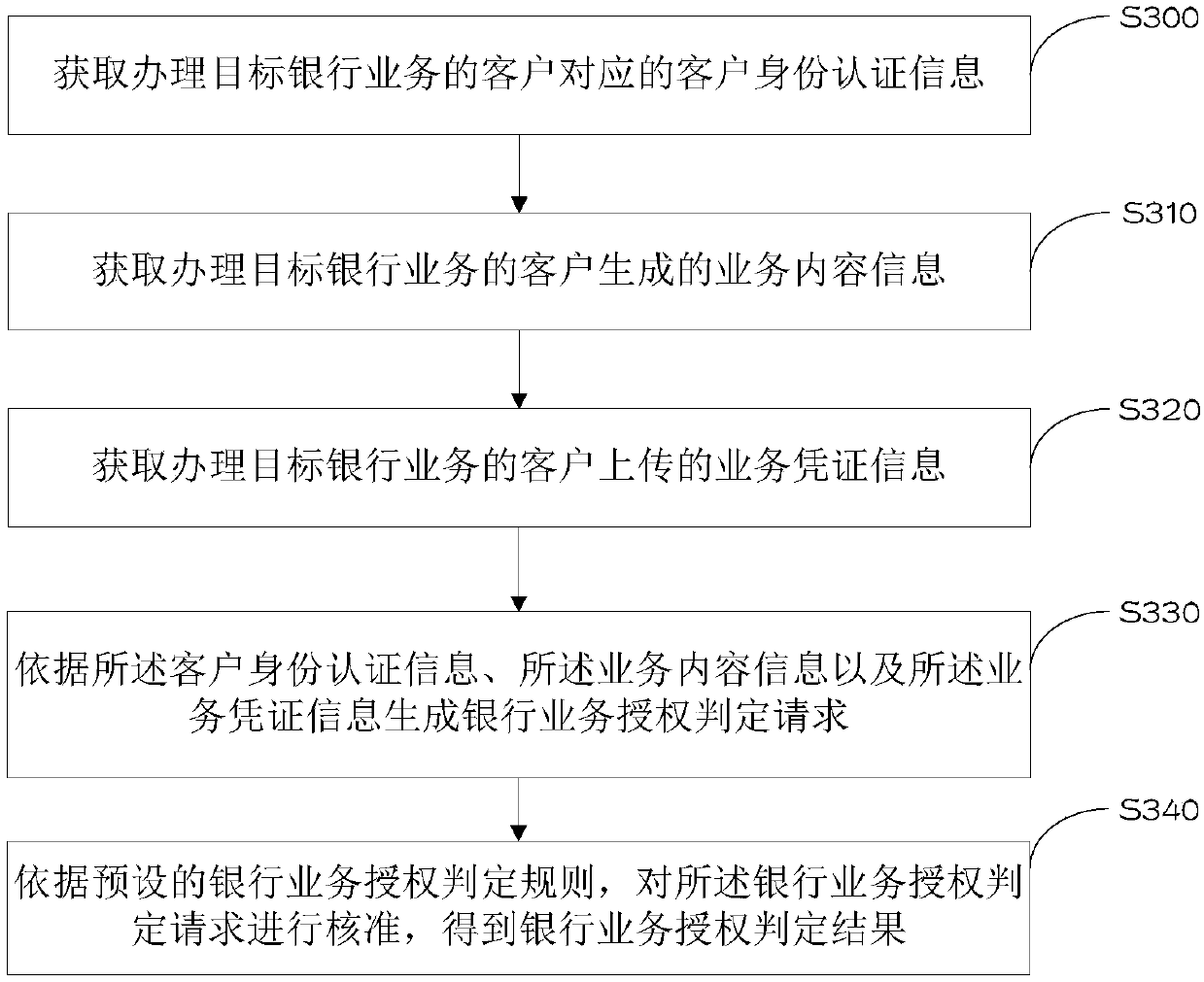

Bank service authorization judgment method and system

PendingCN109657964AImprove accuracyFinanceDigital data authenticationBanking industryInternet privacy

The invention discloses a bank service authorization judgment method and system. The method comprises the steps of obtaining client identity authentication information corresponding to a client who handles a target bank service; Obtaining service content information generated by a client who handles the target bank service; Generating a bank service authorization judgment request according to theclient identity authentication information and the service content information; And according to a preset bank service authorization judgment rule, the bank service authorization judgment request is approved, and a bank service authorization judgment result is obtained. Due to the fact that the bank service authorization judgment request can be automatically approved according to the preset bank service authorization judgment rule, manual participation is not needed in the authorization approval process, and the accuracy of the bank service authorization judgment result is improved.

Owner:BANK OF CHINA

Method and system for automatically guiding customers to banking outlets with smaller number of services

The invention provides a method and a system for automatically guiding customers to banking outlets with a smaller number of services. The method comprises the following steps: a banking service application form processing server can quickly generate an electronic banking service application form and accurately calculate the waiting time of a customer, wherein an electronic banking service application form can be generated one second after the identity card of an old customer is sensed or 10 seconds after the identity card of a new customer is sensed; and a mobile phone banking client locates the position thereof, acquires idle time periods of banking outlets in a predefined range from the banking service application form processing server, queries geographic location traffic information from a geographic traffic information query server, carrying out calculation to obtain an outlet capable of handling a service in the shortest time among the nearest banking outlet and the banking outlet which is idle in the shortest time, gives out 10 options for service handling time of different banking outlets, and generates a queue number, gives out navigation guide and guides a customer to the parking lot of a banking outlet after the customer selects the banking outlet.

Owner:谭希妤

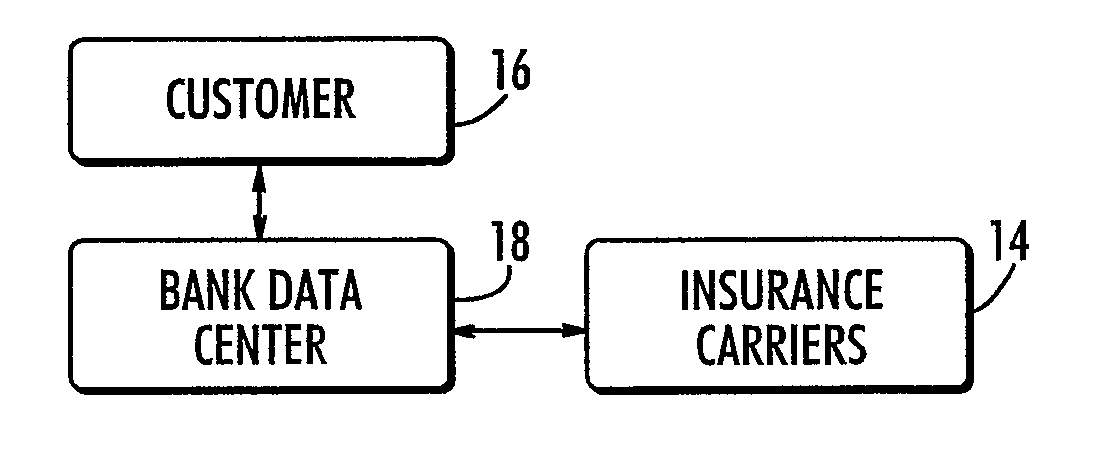

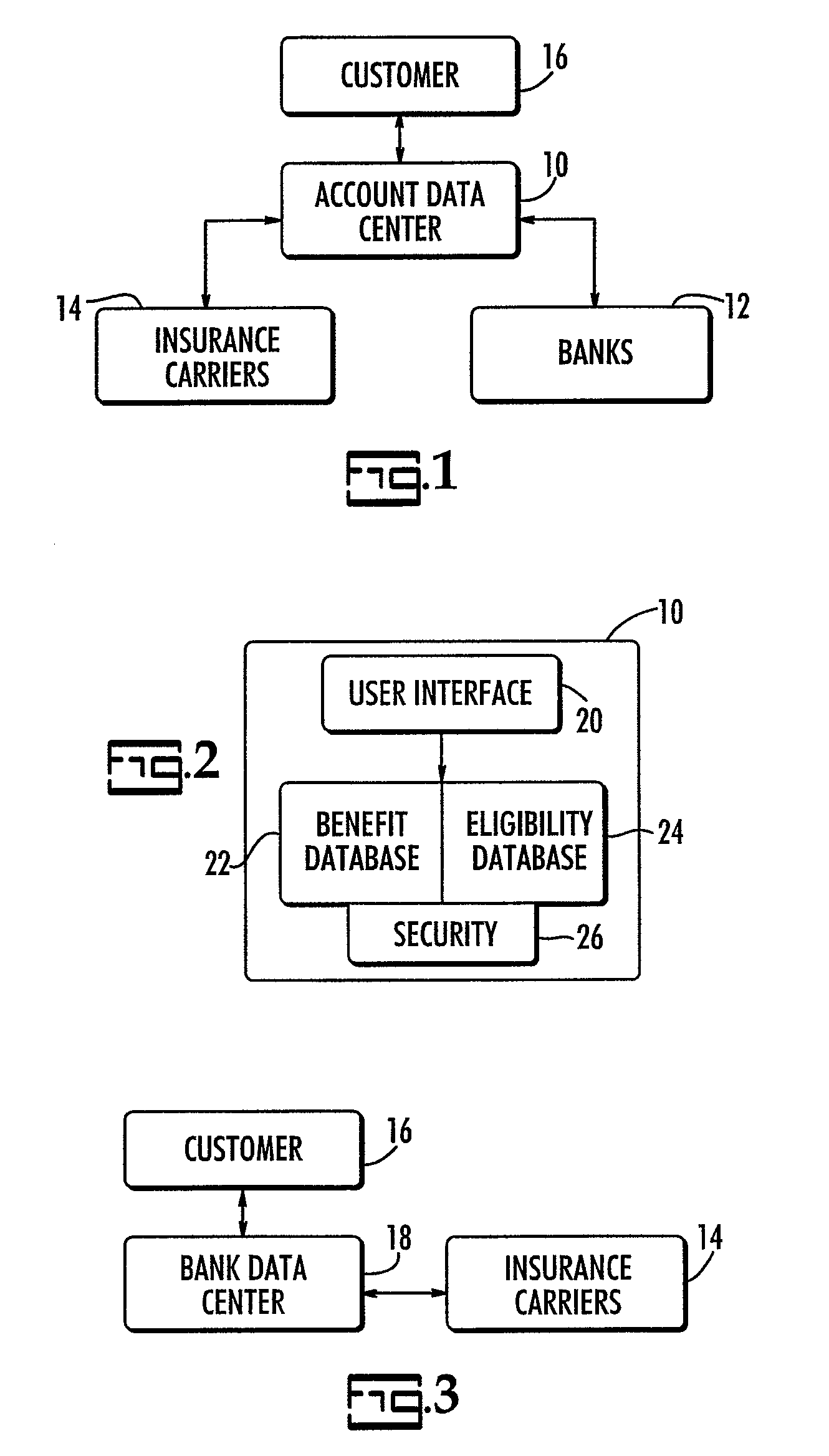

Consumer directed checking account coverage system

InactiveUS7533803B2Lower Coverage CostsImprove the level ofComplete banking machinesFinanceBanking industryInsurance life

A system and method that includes the use of a bank checking account that can be connected to insurance coverage. In particular, a banking consumer can purchase insurance coverage for unexpected events that may affect the historical deposits and withdrawals relating to the checking accounts. Additionally, insurance coverage other than that of the checking account itself can be included, such as life insurance, so long as the account remains active. Accordingly, the present invention can integrate the negative insurance sell into a positive banking experience.

Owner:CRITICAL POINT GROUP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com