Card data business system used for payment on net and its method

An online payment and transaction system technology, applied in the field of online payment card data transaction system, can solve the problems of user fund loss, hidden safety hazards, restrictions on online business development, etc., and achieve the effect of great confidentiality

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

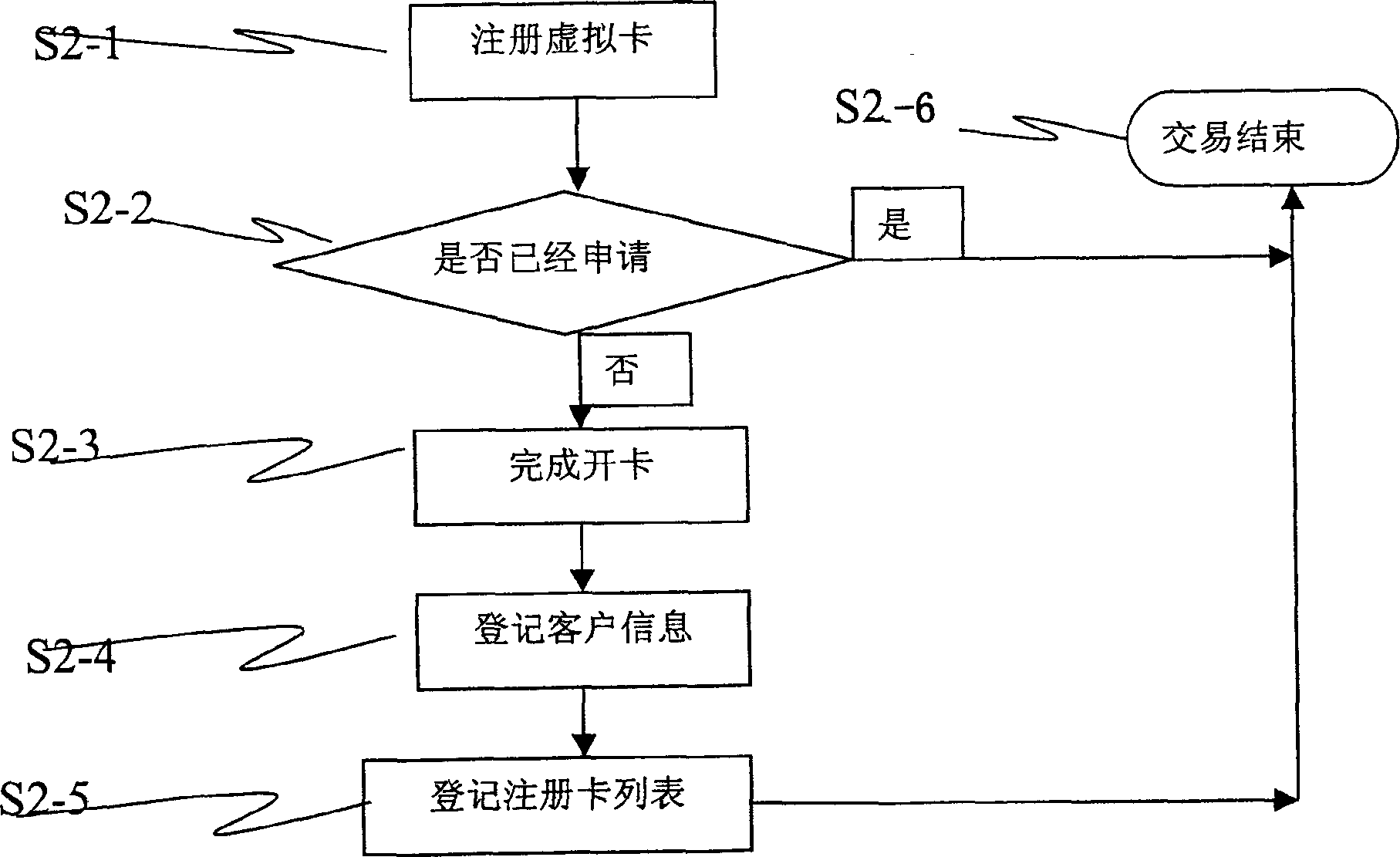

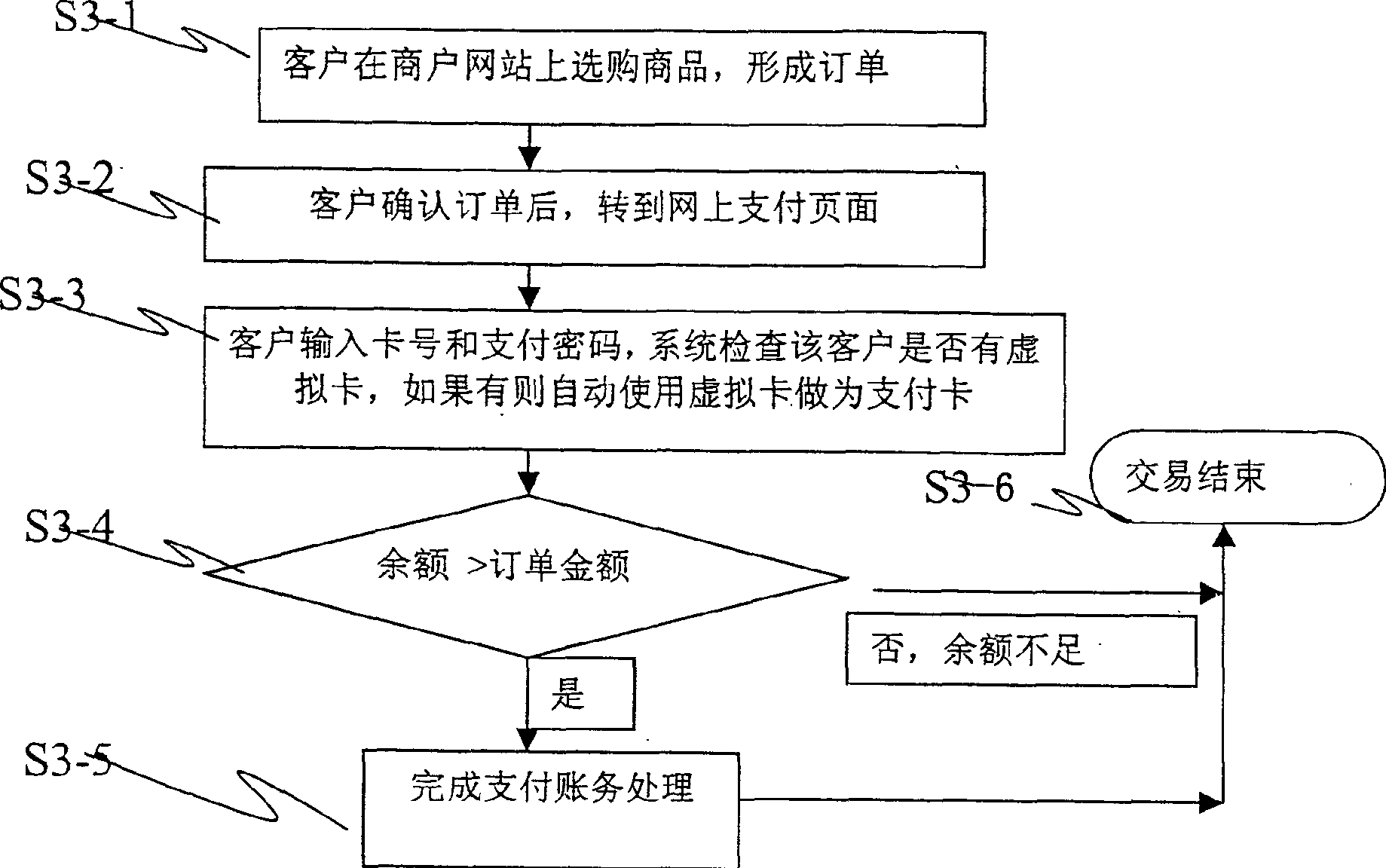

[0029] This embodiment illustrates the application of virtual cards in online banking, such as Figure 1-5 shown.

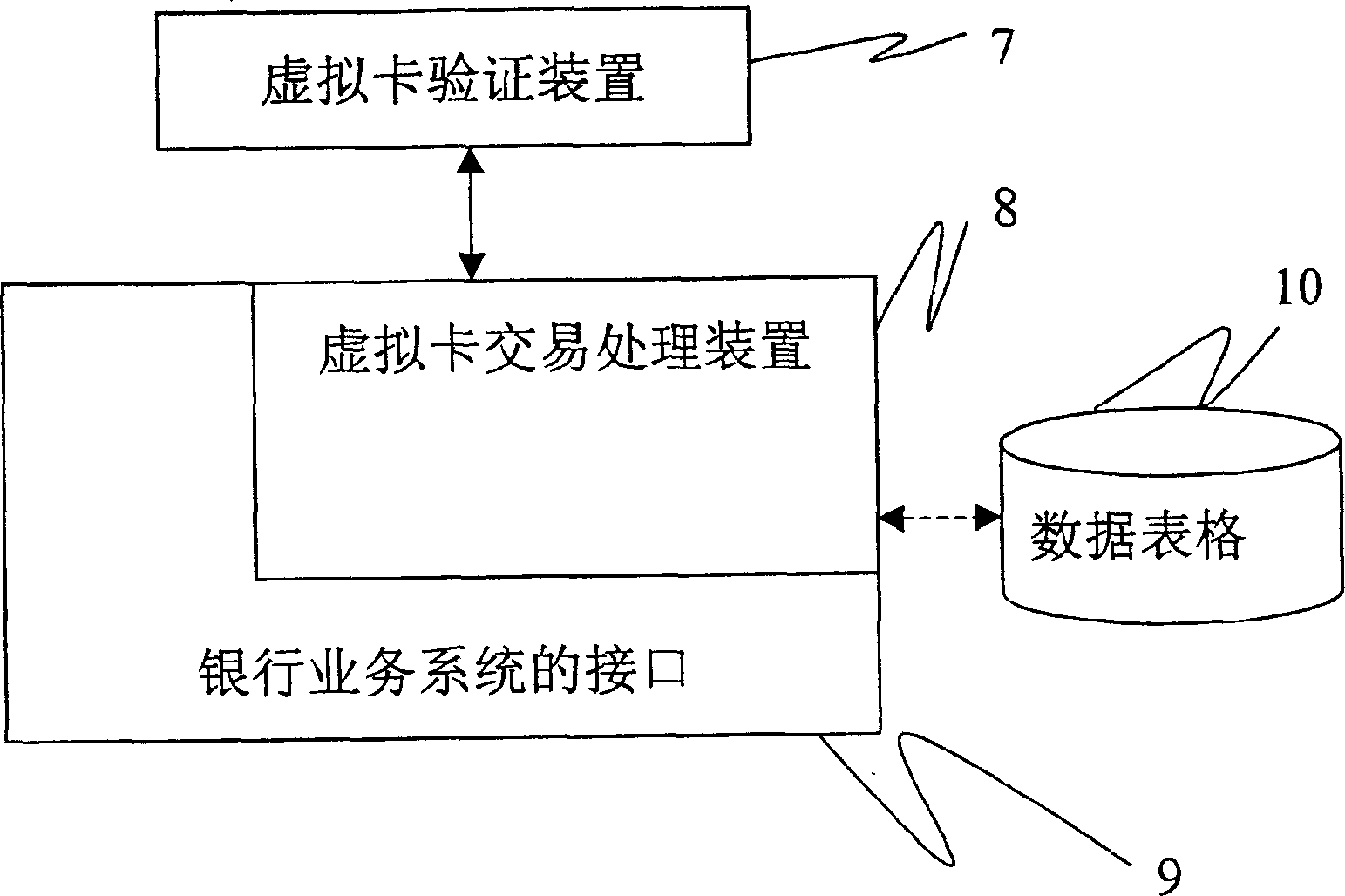

[0030] figure 1 device equivalent to Figure 4 The virtual card subsystem in 3. in:

[0031] 7. The virtual card verification device is used to verify the legitimacy of the virtual card;

[0032] 8. A virtual card transaction processing device, used to complete the business processing requested by the user;

[0033] 9. The interface with the banking system, used to connect the banking system and complete the transaction;

[0034] 10. The data form records the constituent elements of the virtual card and the designated bank account number, and the virtual cardholder information is consistent with the owner information of the bank account number.

[0035] The virtual card verification device 7 is connected to the virtual card transaction processing device 8 , and the virtual card transaction processing device 8 is connected to the banking system interface 9 a...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com