Patents

Literature

117 results about "Electronic banking" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

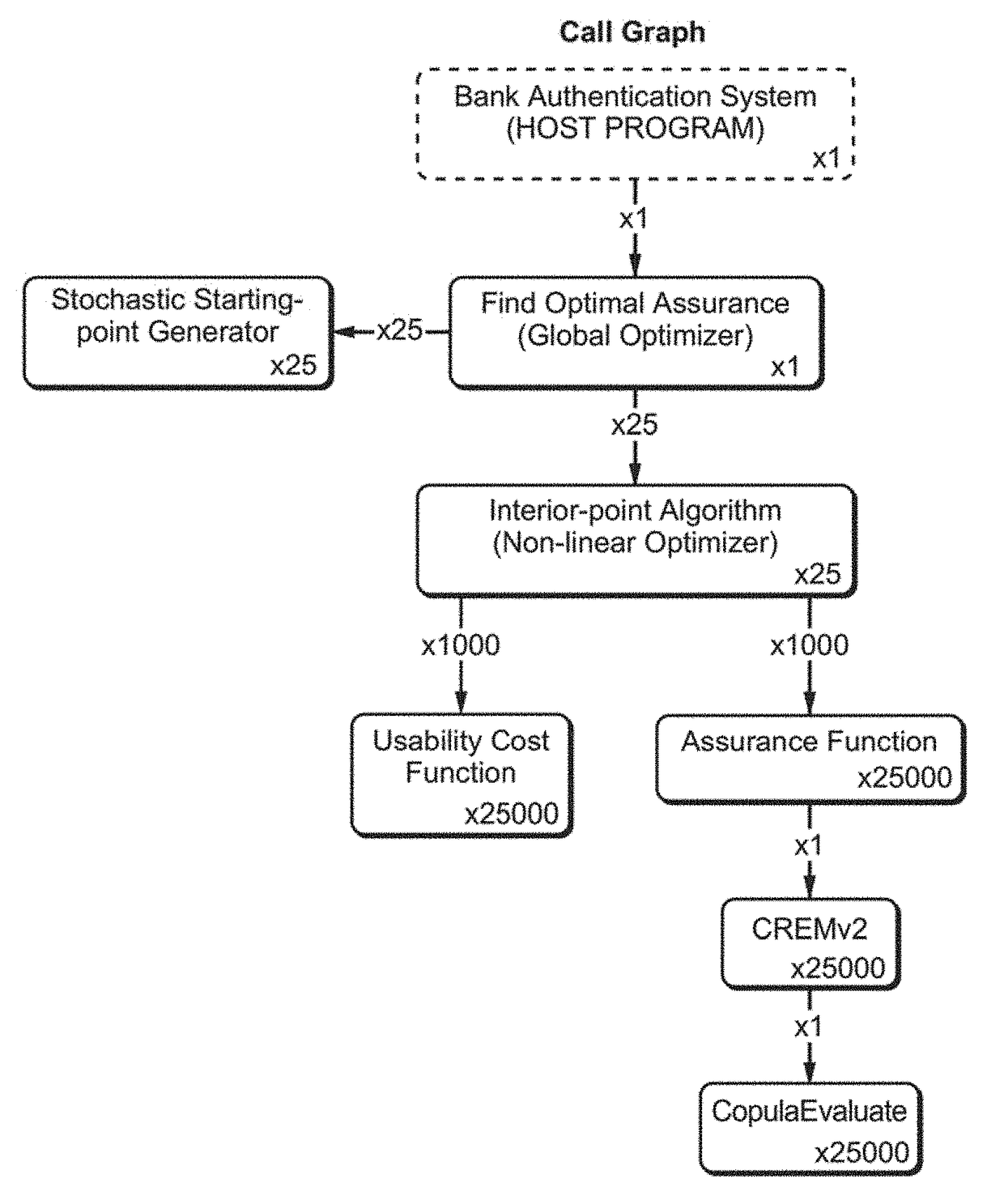

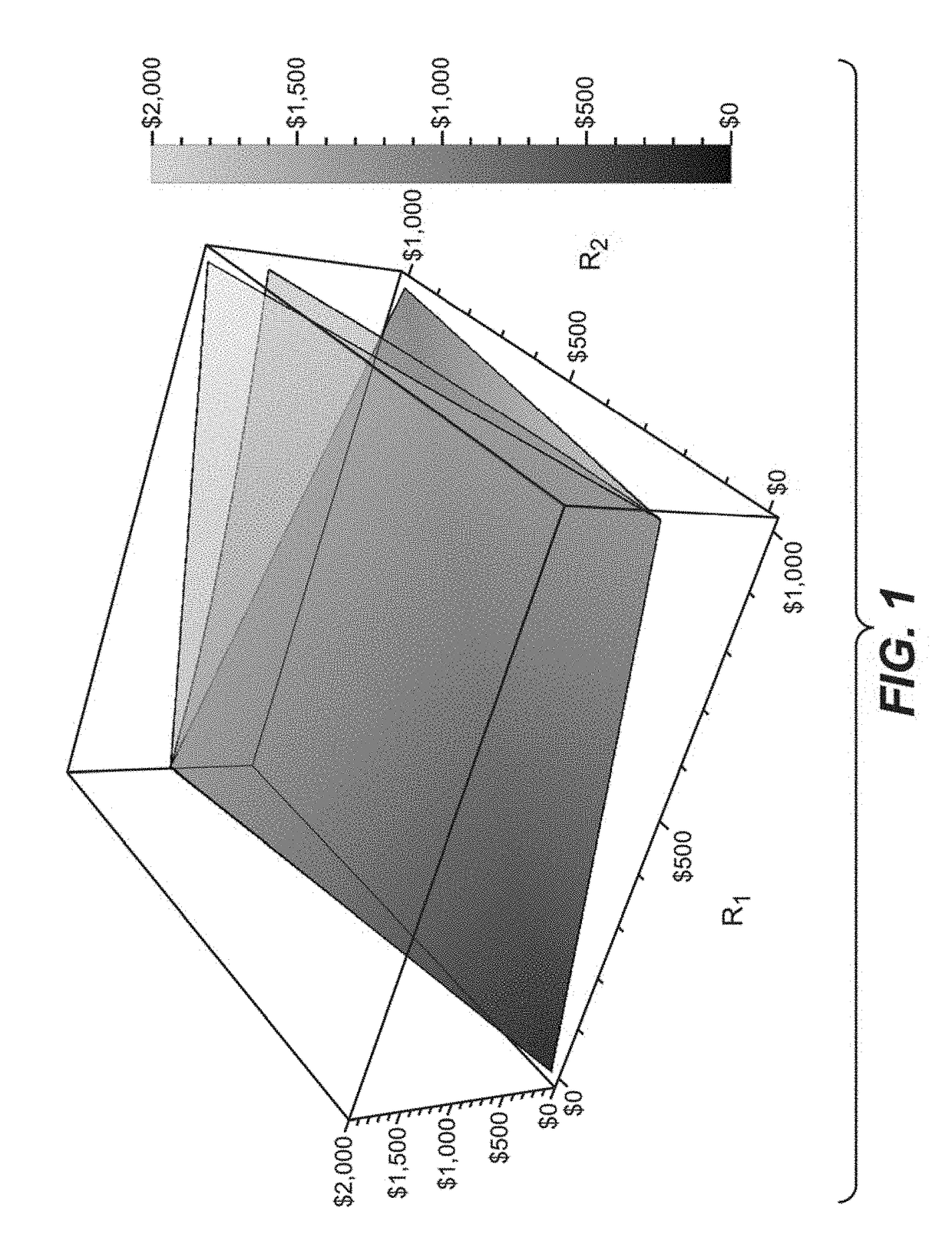

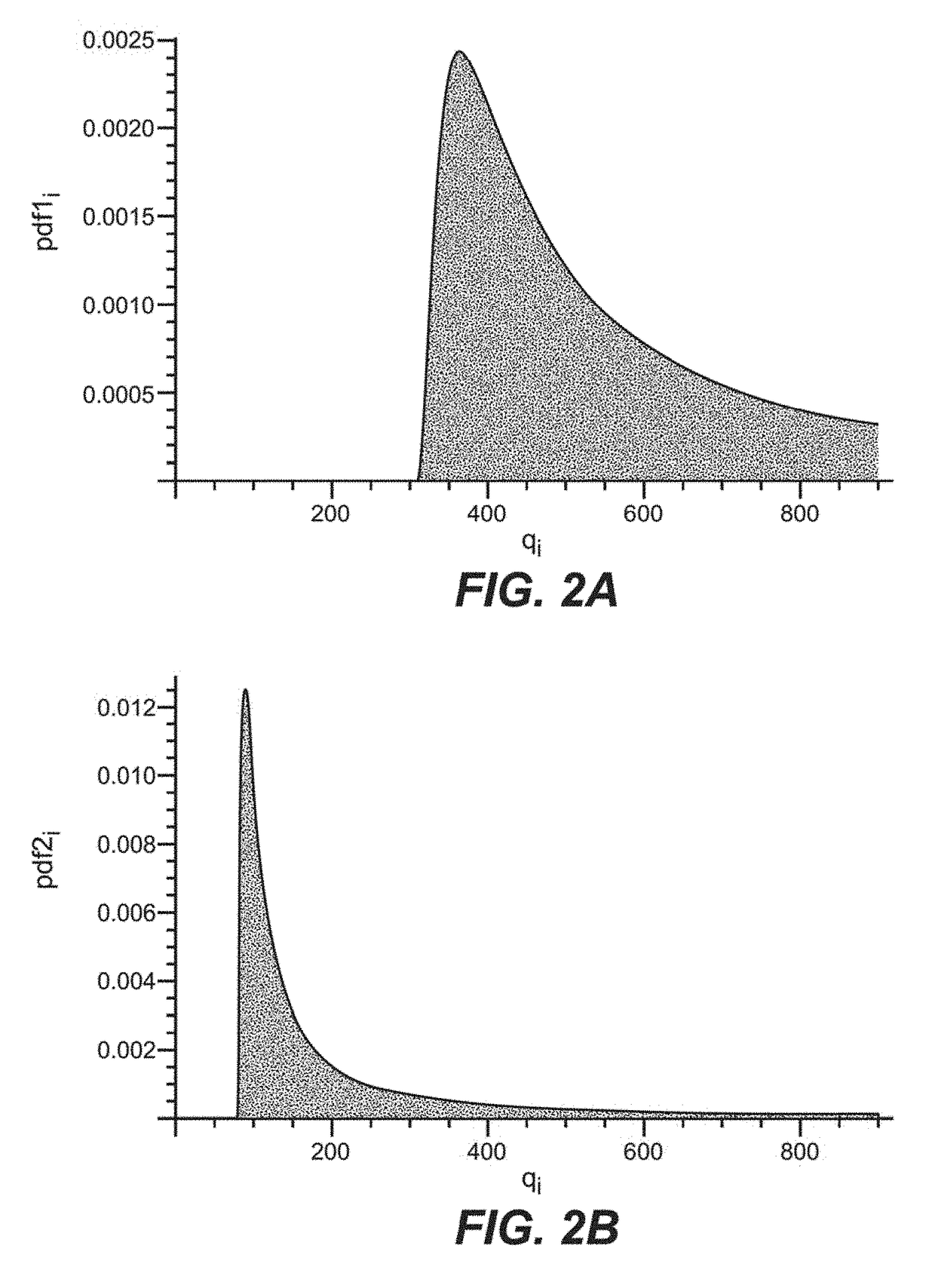

Risk-link authentication for optimizing decisions of multi-factor authentications

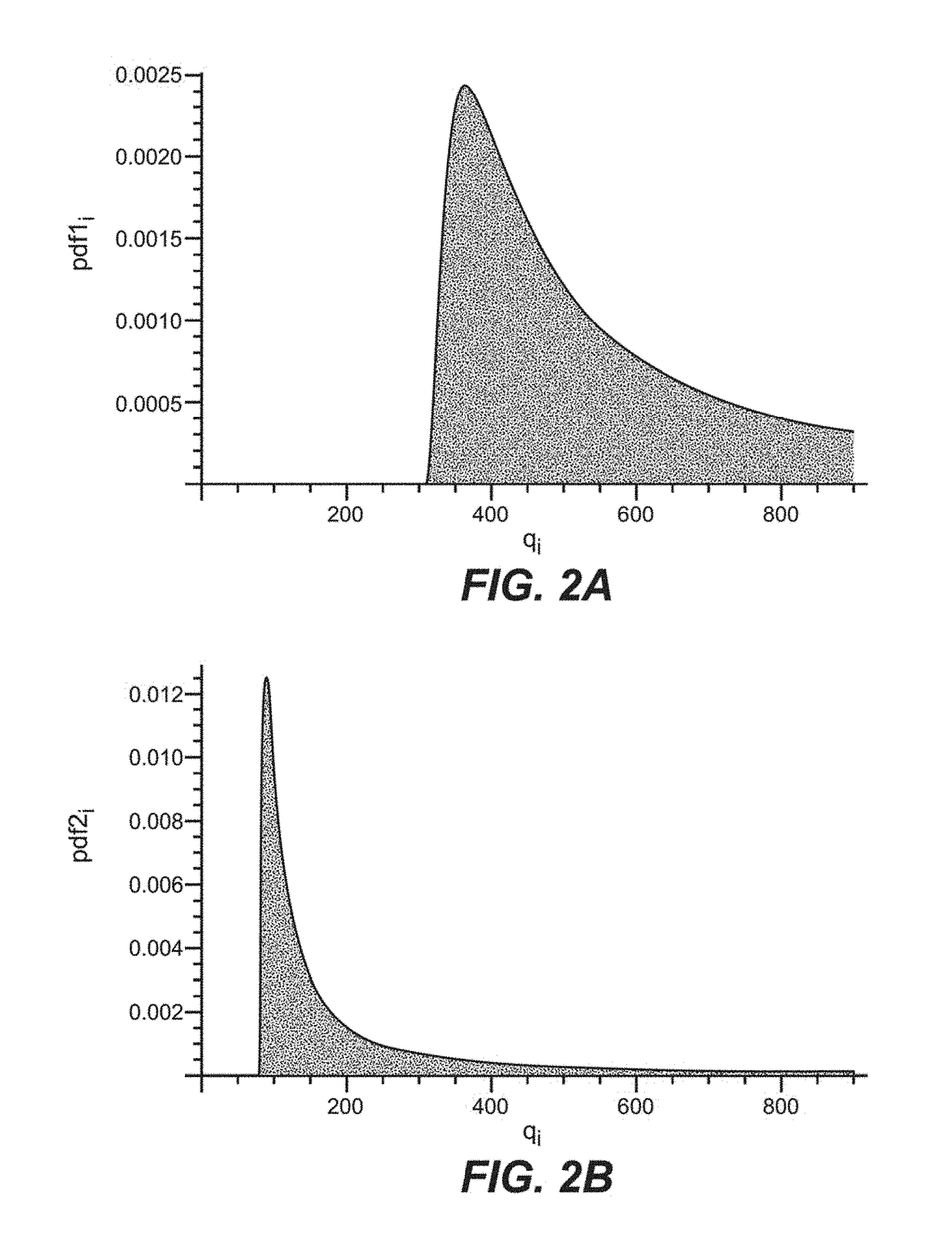

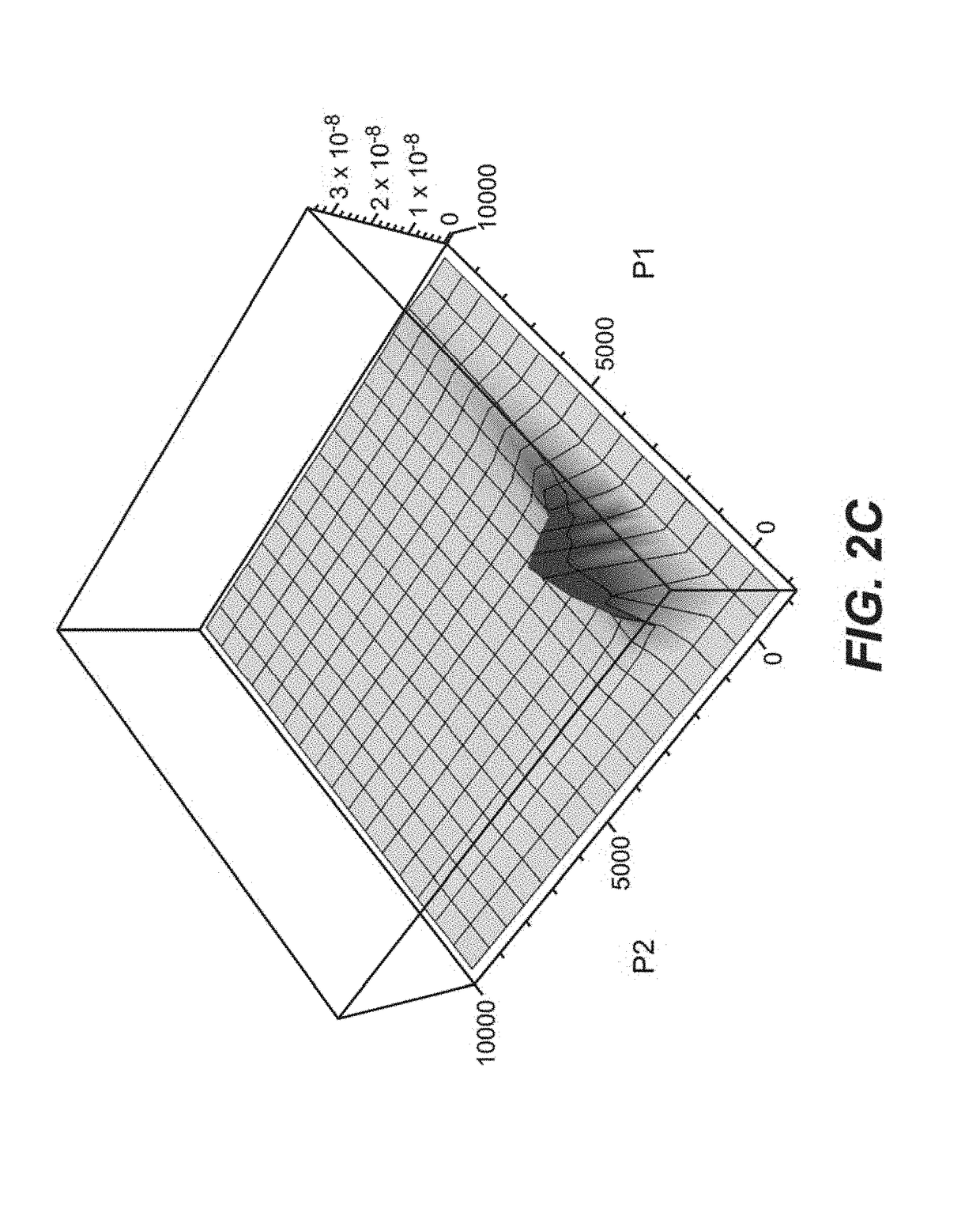

A system for evaluating risk in an electronic banking transaction by estimating an aggregated risk value from a set of risk factors that are either dependent or independent of each other, comprising: user input means for enabling an end user to provide authentication information related to a desired electronic banking transaction; financial institution authentication means for authenticating that an end user is authorized to conduct the desired electronic transaction; risk computation means for imposing authentication requirements upon the end user in adaptation to a risk value of the desired banking electronic banking transaction; transaction session means for tracking an amount of time that the desired electronic banking transaction is taking; and financial institution transaction means for storing data related to the desired electronic banking transaction.

Owner:ALNAJEM ABDULLAH ABDULAZIZ I

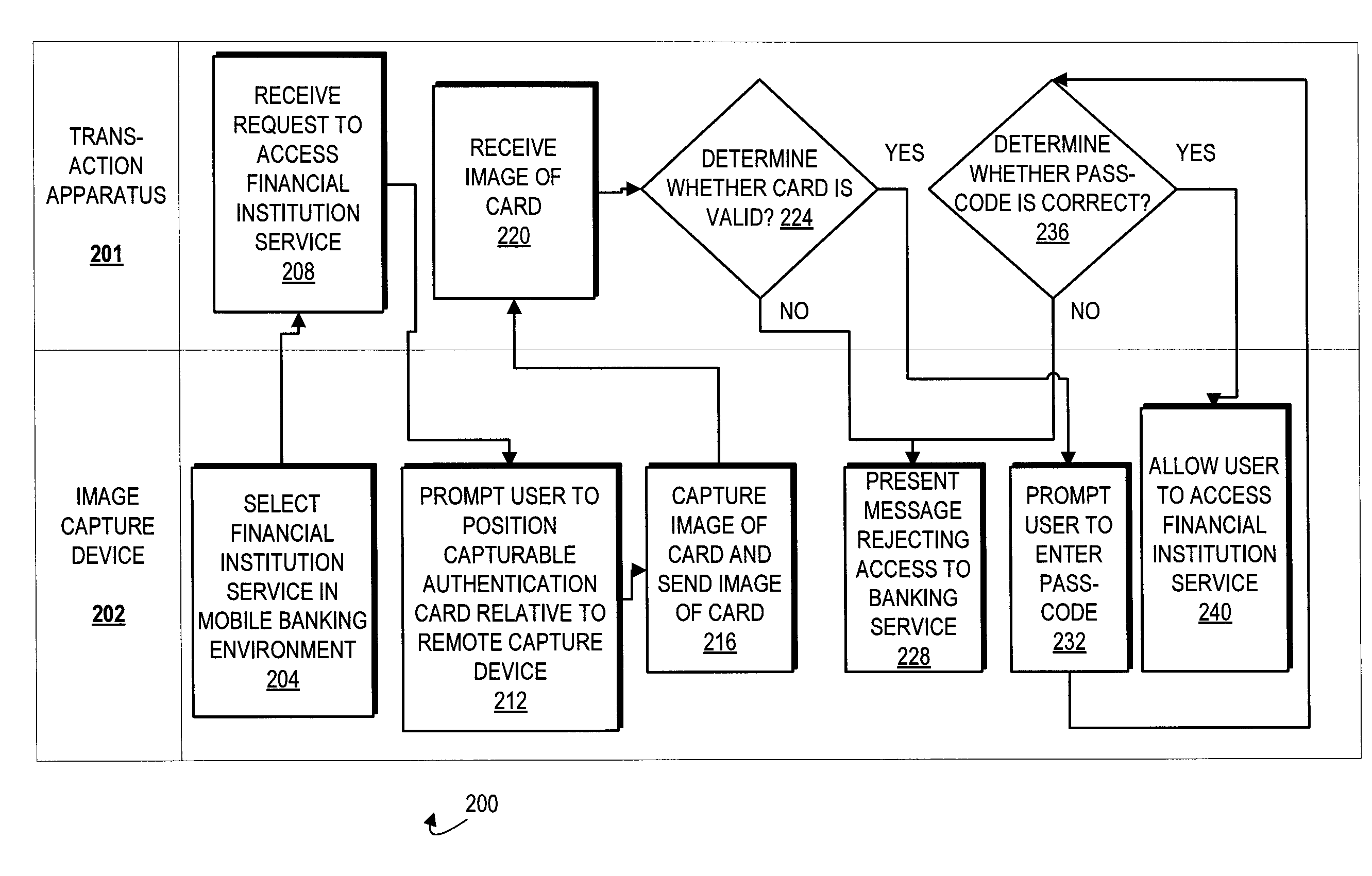

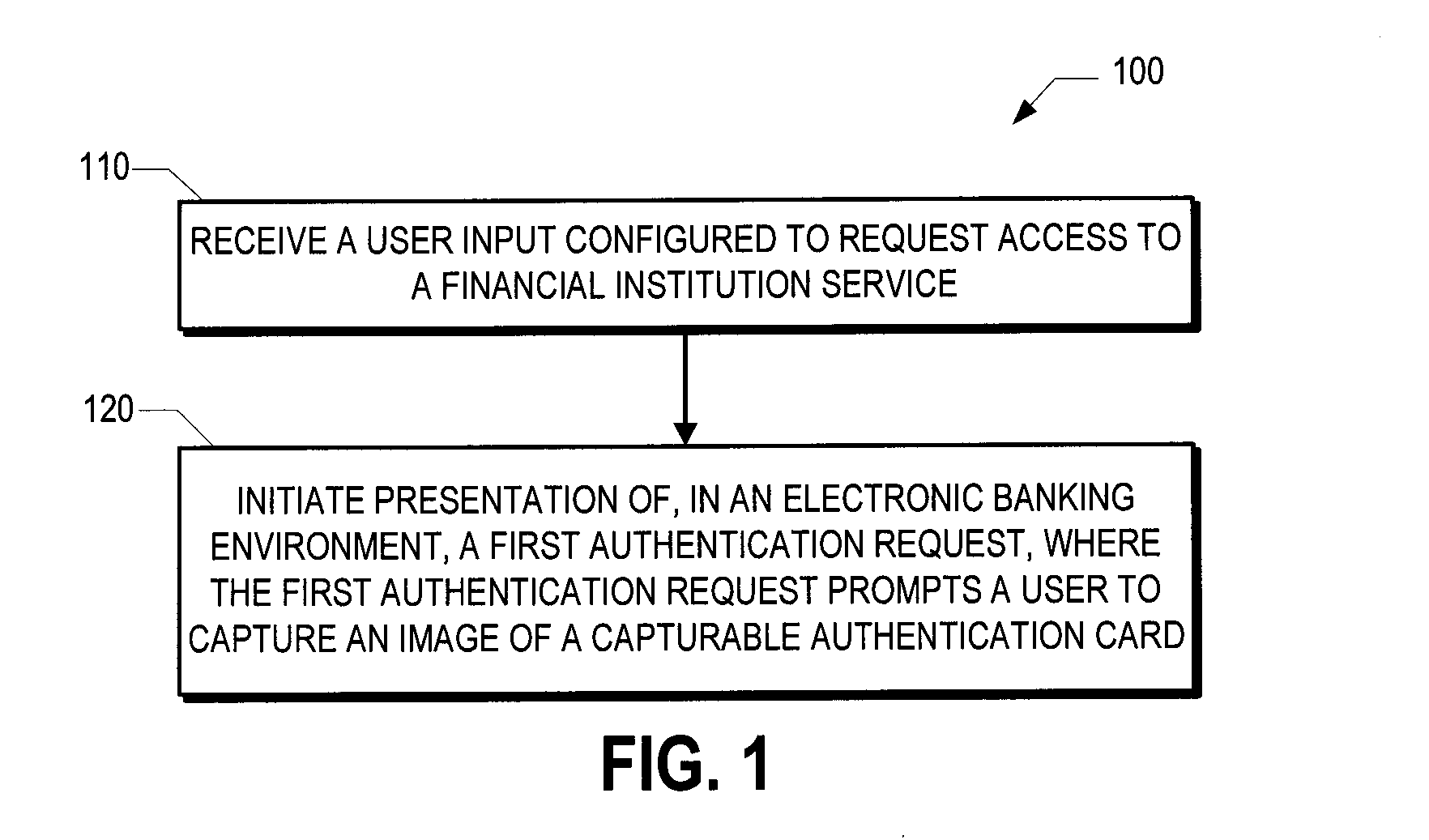

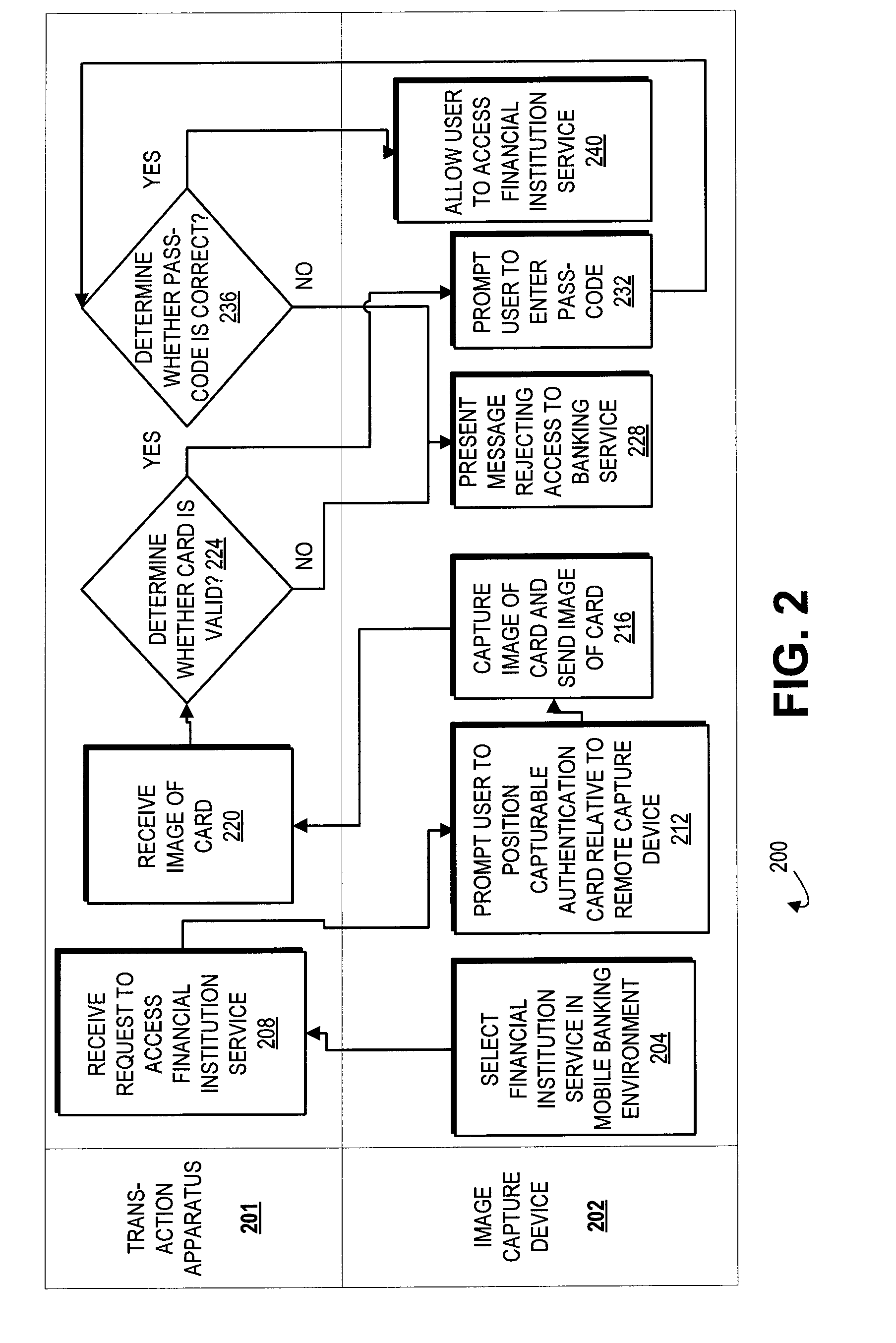

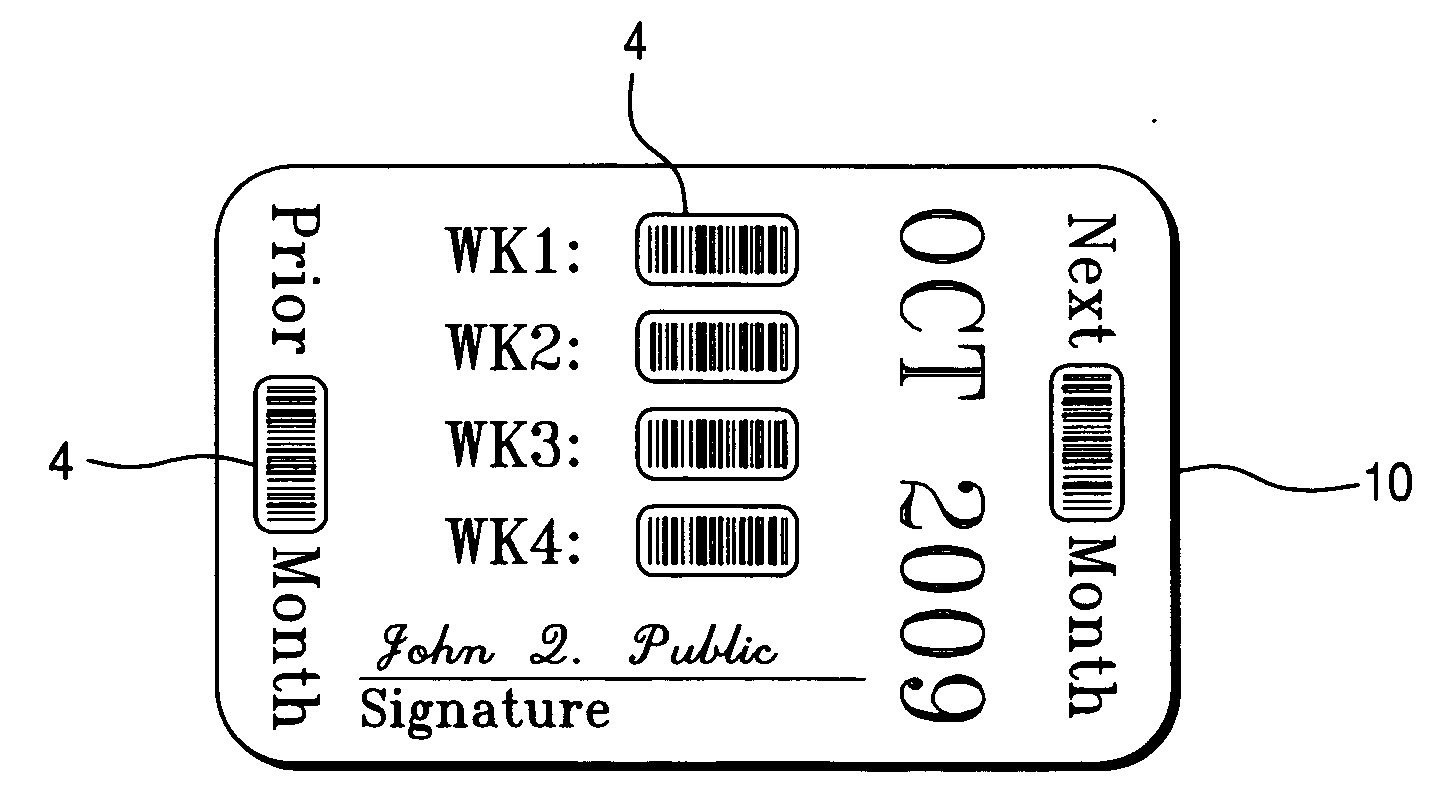

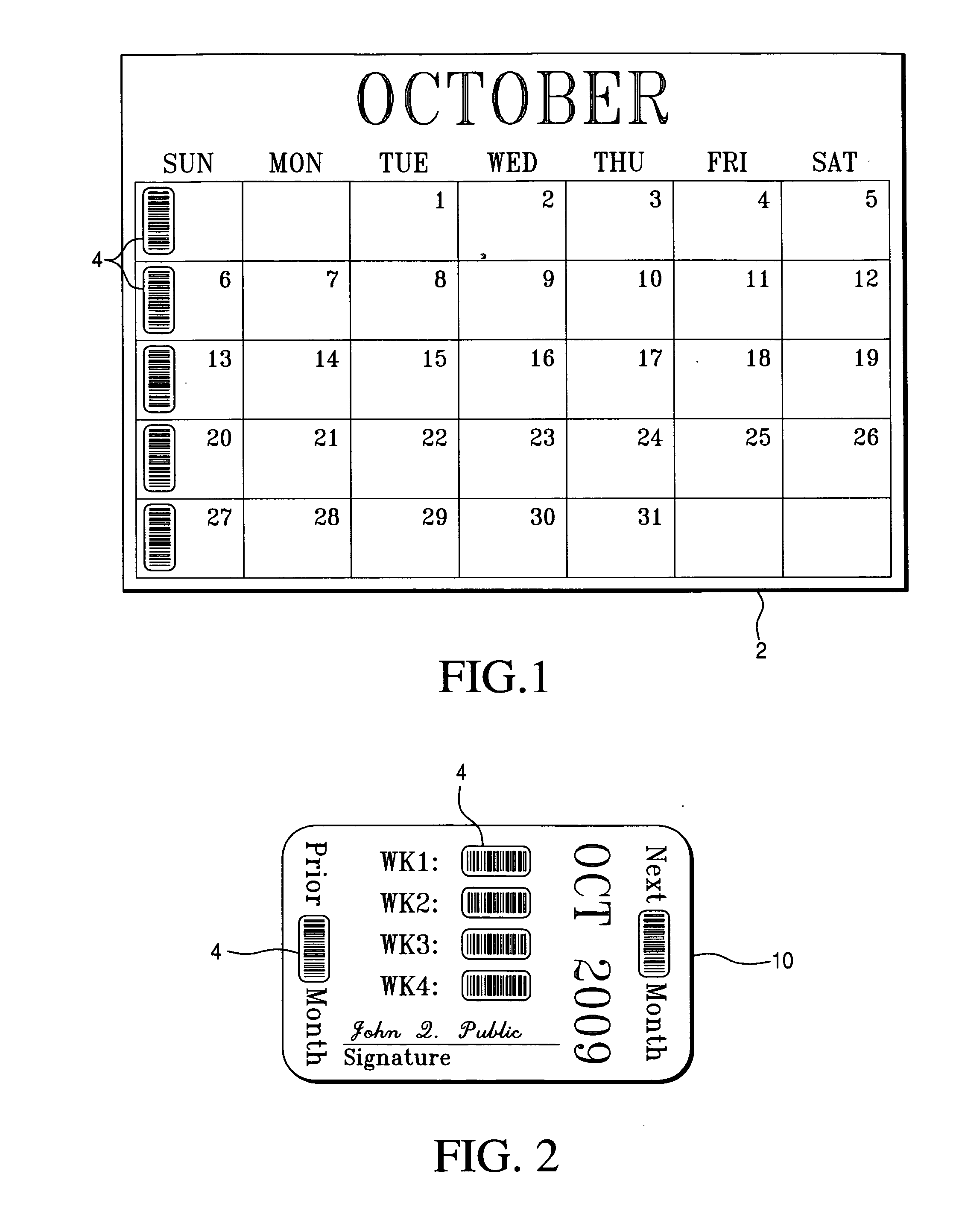

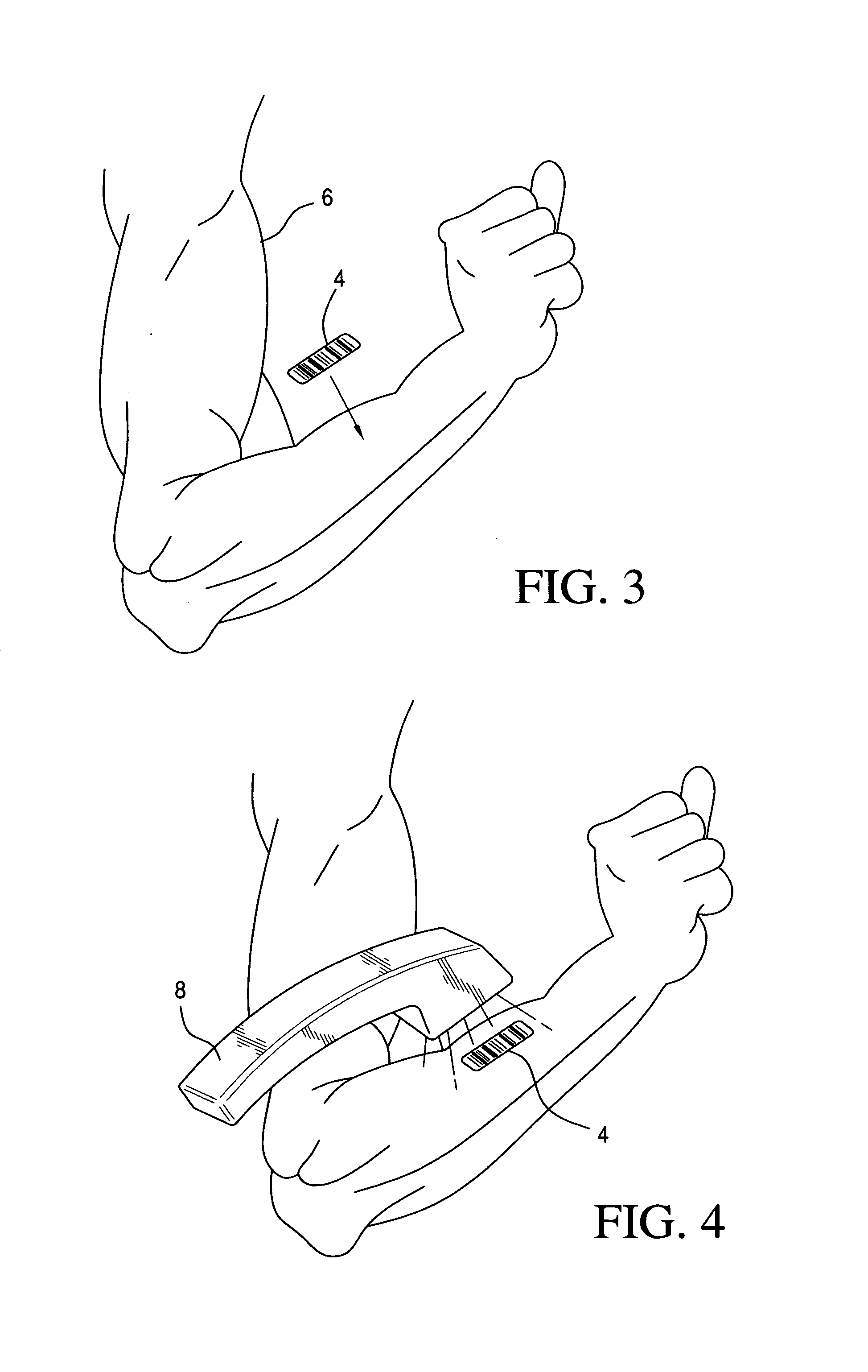

Authentication strategies for remote financial institution services

Embodiments of the invention are directed to systems, methods and computer program products for authenticating access to a financial institution service. In some embodiments, a method includes: (a) receiving a user input configured to request access to a financial institution service, and (b) initiating presentation of, using a processor, a first authentication request in an electronic banking environment, wherein the first authentication request prompts a user to initiate capture of an image of a capturable authentication card associated with the account holder. In some embodiments, the method further includes receiving the image of the capturable authentication card, and determining the capturable authentication card is a valid capturable authentication card based at least partially on information extracted from the image of the capturable authentication card. The invention allows a user to enjoy a similar authentication experience prior to accessing a financial institution service at a physical ATM when compared to accessing an electronic financial institution service via an image capture device such as a mobile computing device.

Owner:BANK OF AMERICA CORP

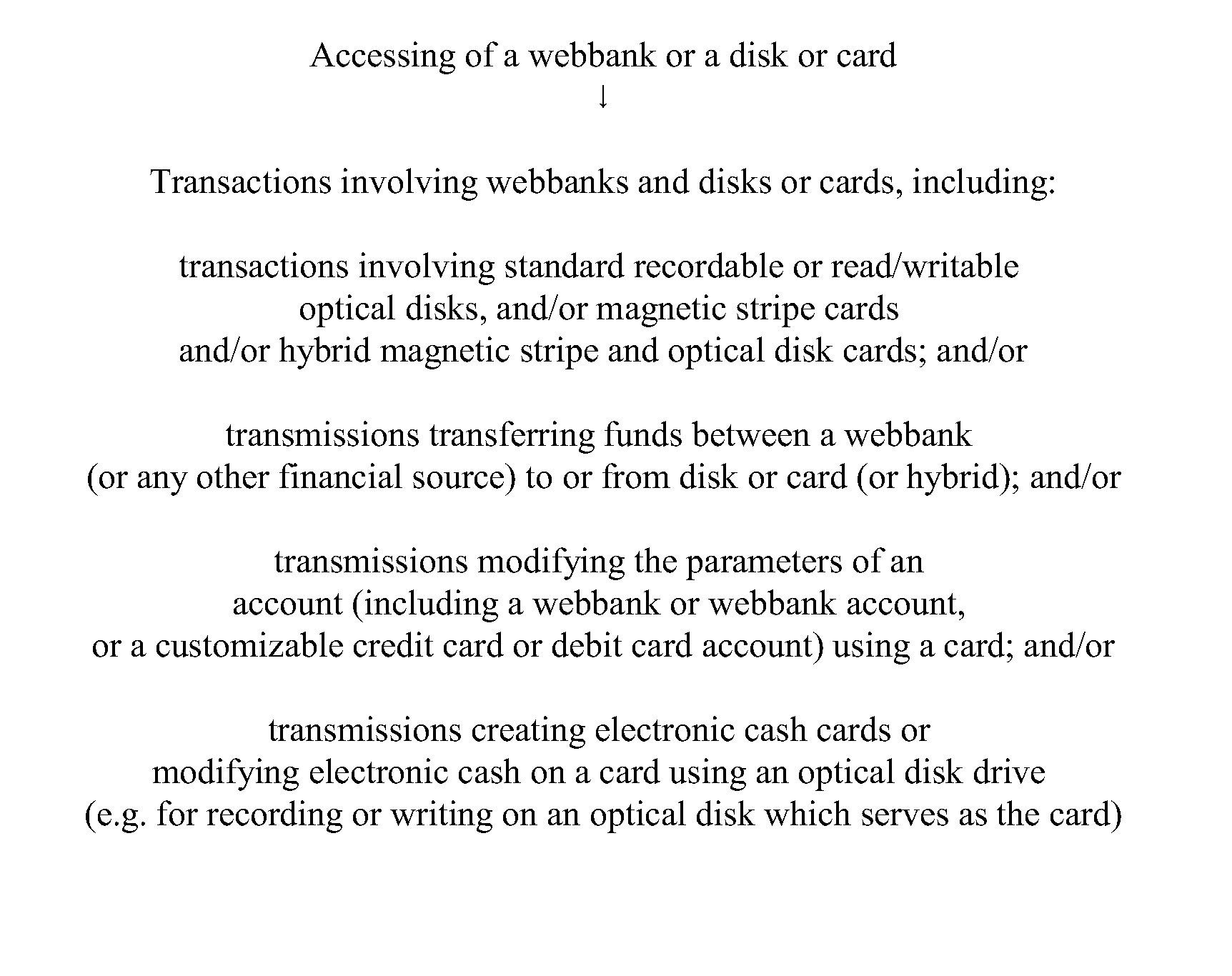

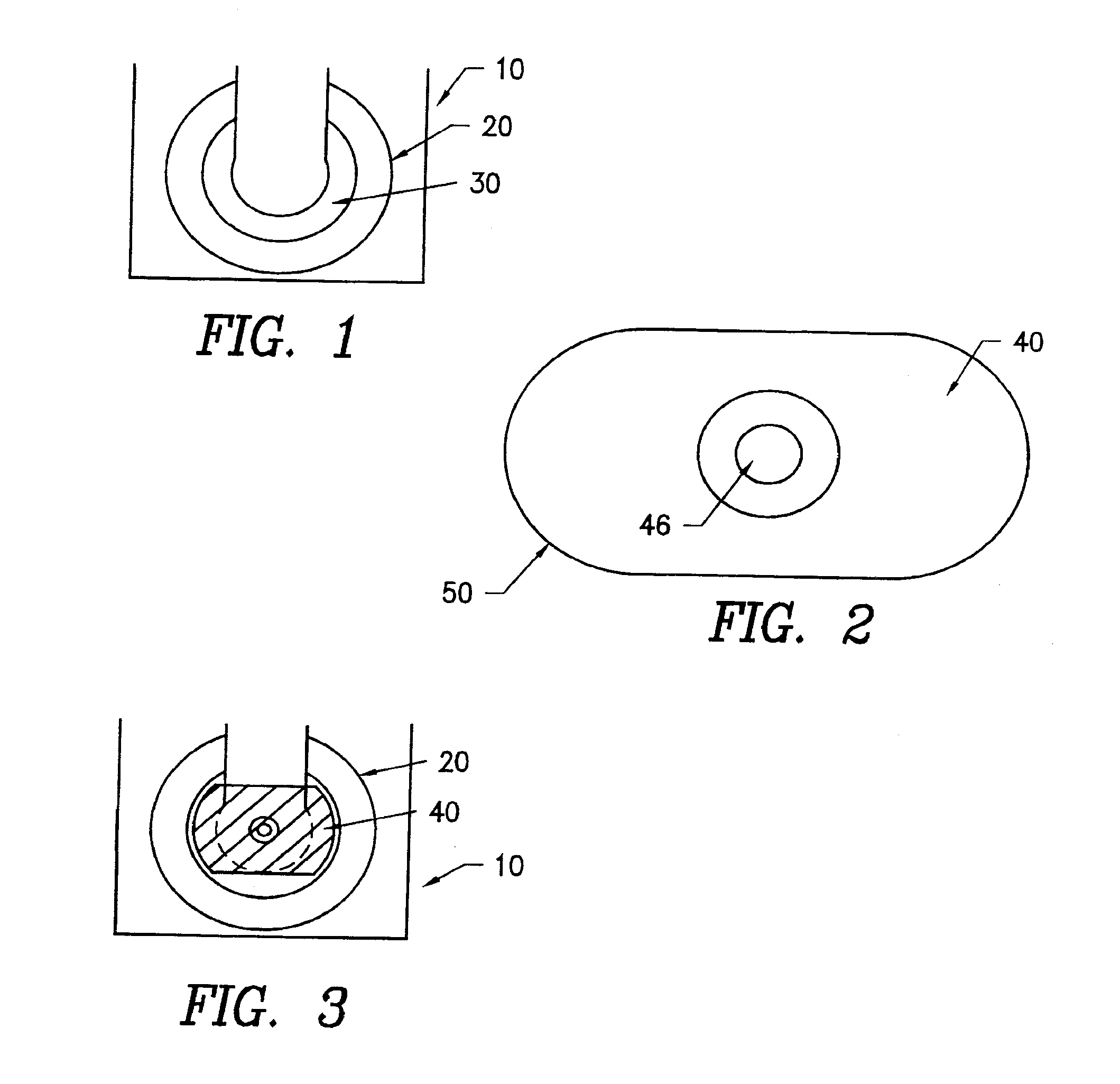

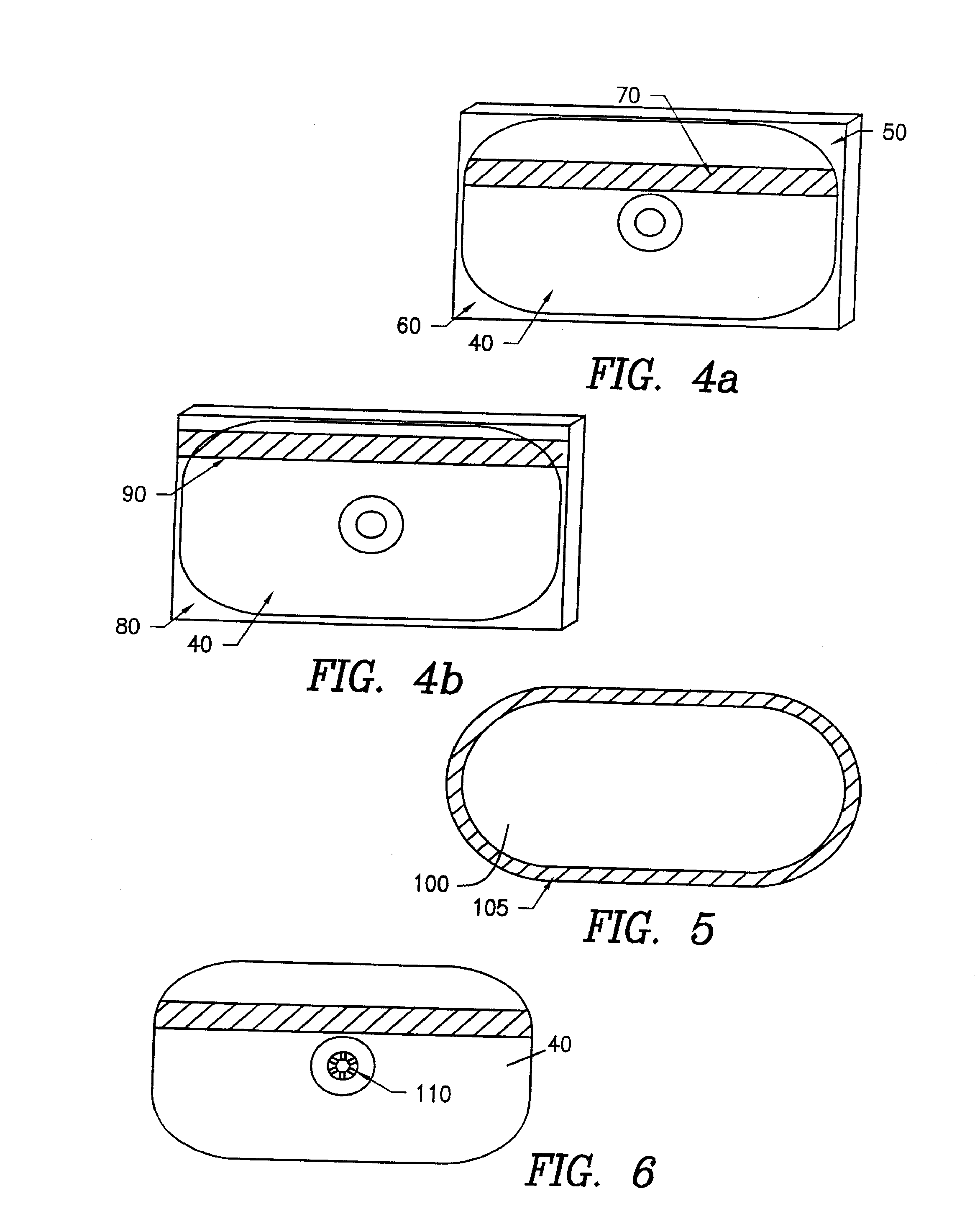

Systems for Financial and Electronic Commerce

InactiveUS20100280948A1Quickly create Programmable Credit Cards™Credit registering devices actuationFinanceFinancial transactionE-commerce

A system for electronic commerce including electronic banking tools, products and services. The system includes customizable banking products and cards, and methods and systems for conducting financial transactions and maintaining records over the Internet.

Owner:COHEN MORRIS E

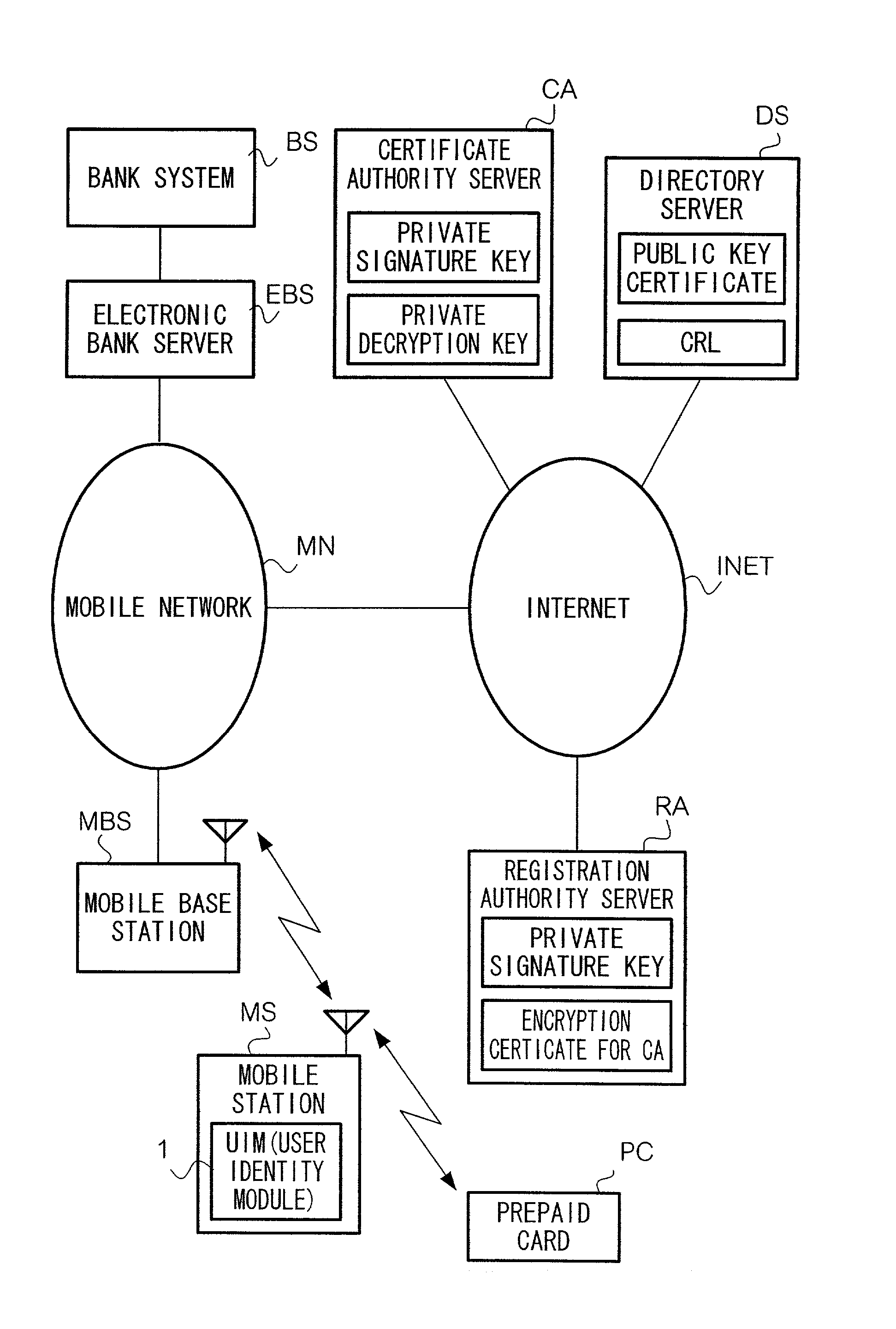

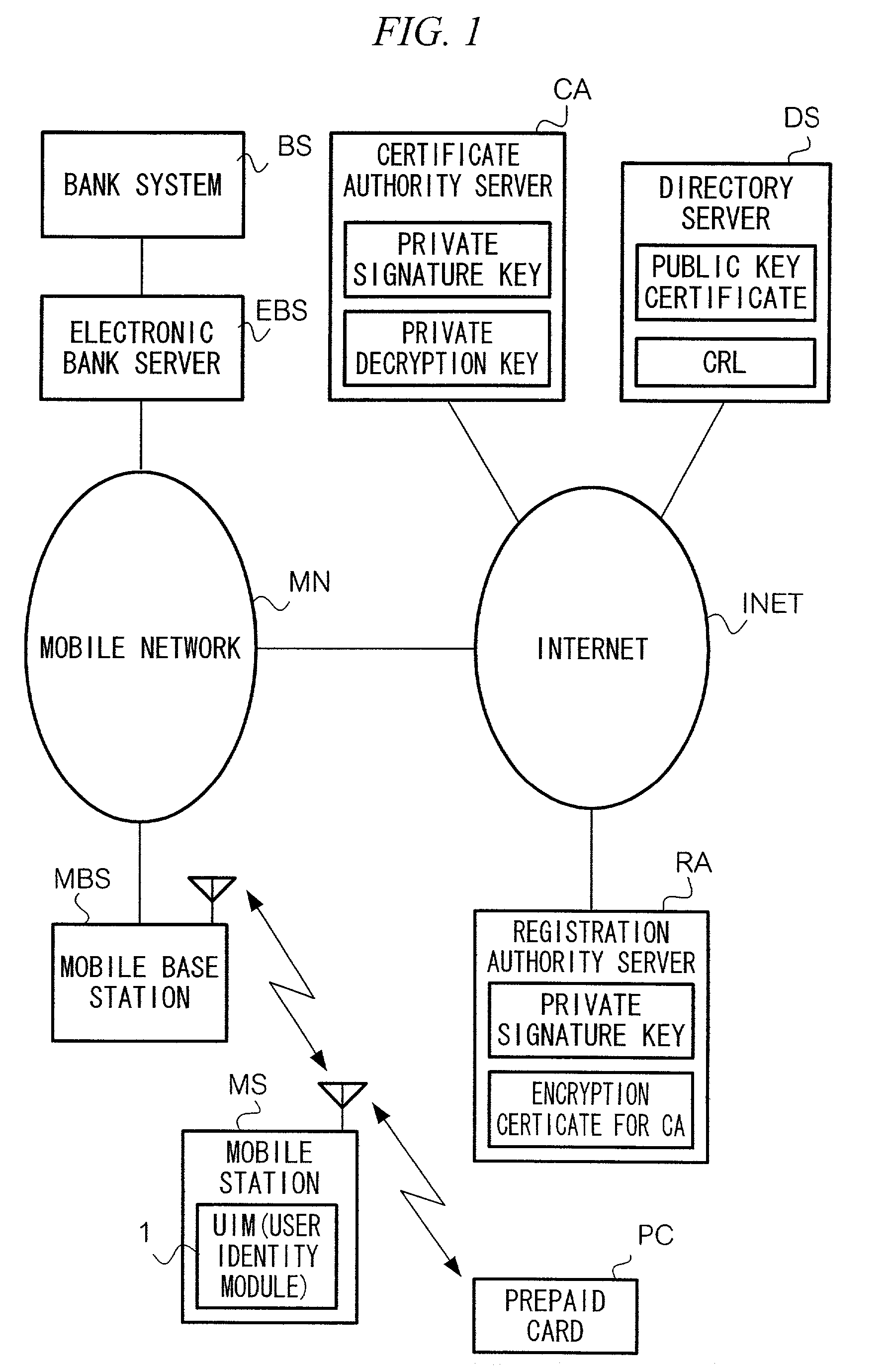

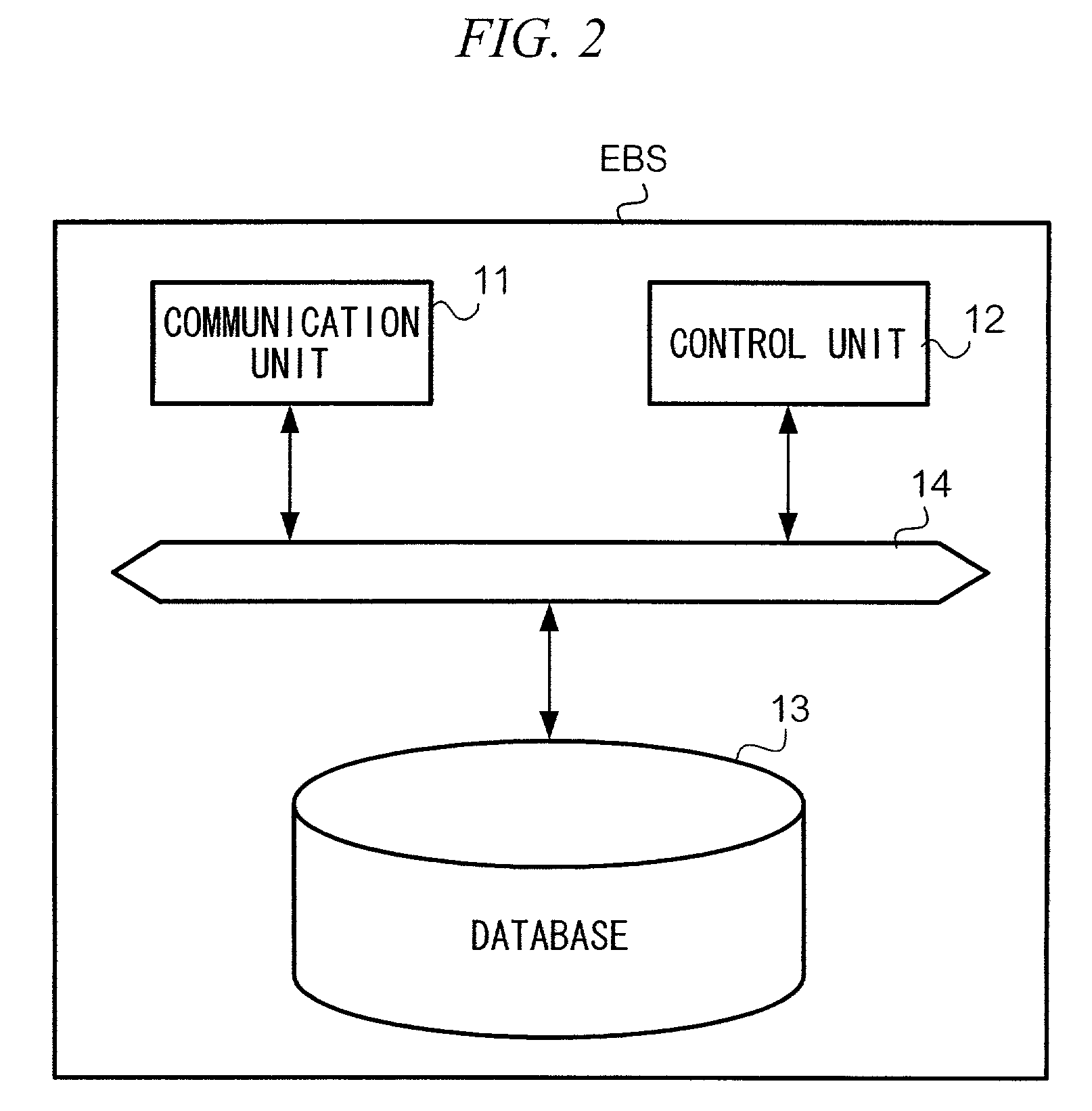

Electronic value system

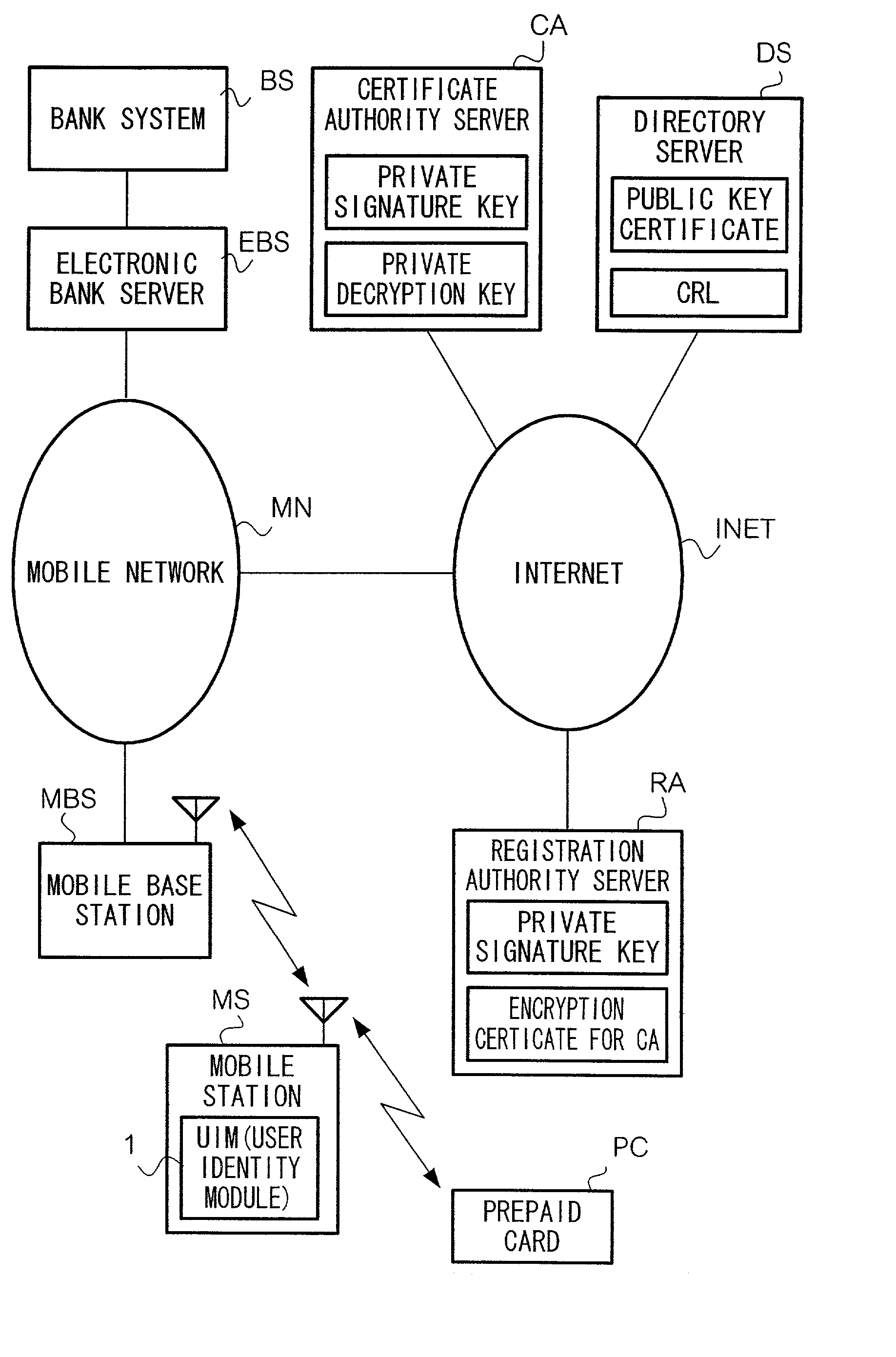

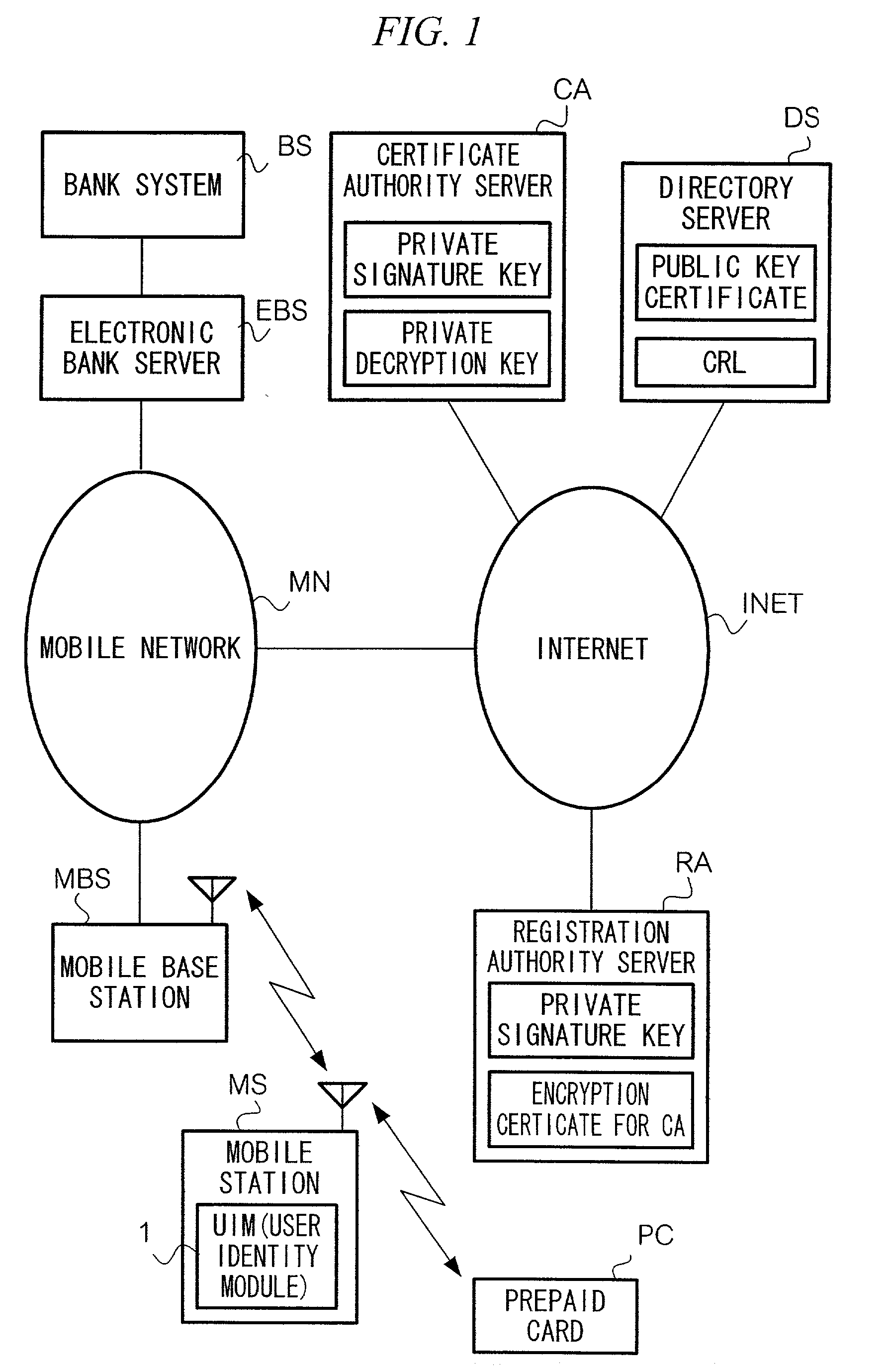

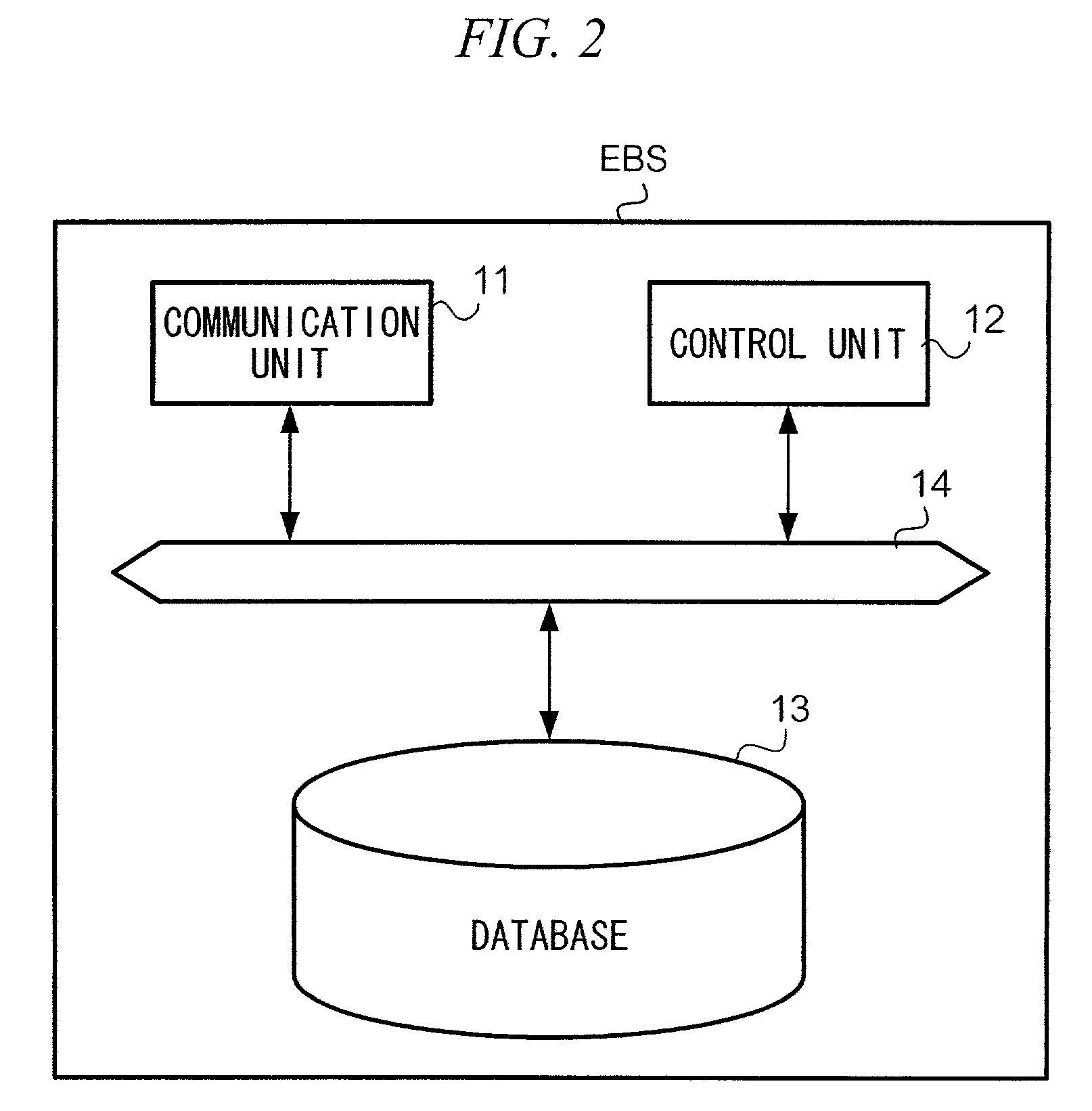

InactiveUS20020116344A1Improper retransmission is preventedCredit registering devices actuationUser identity/authority verificationBank accountMobile station

An electronic value amount of an electronic bank account and an electronic value amount stored in user identification module UIM in mobile station MS are each stored in an electronic bank server EBS, and updated by the server when either amount changes as a result of transaction.

Owner:NTT DOCOMO INC

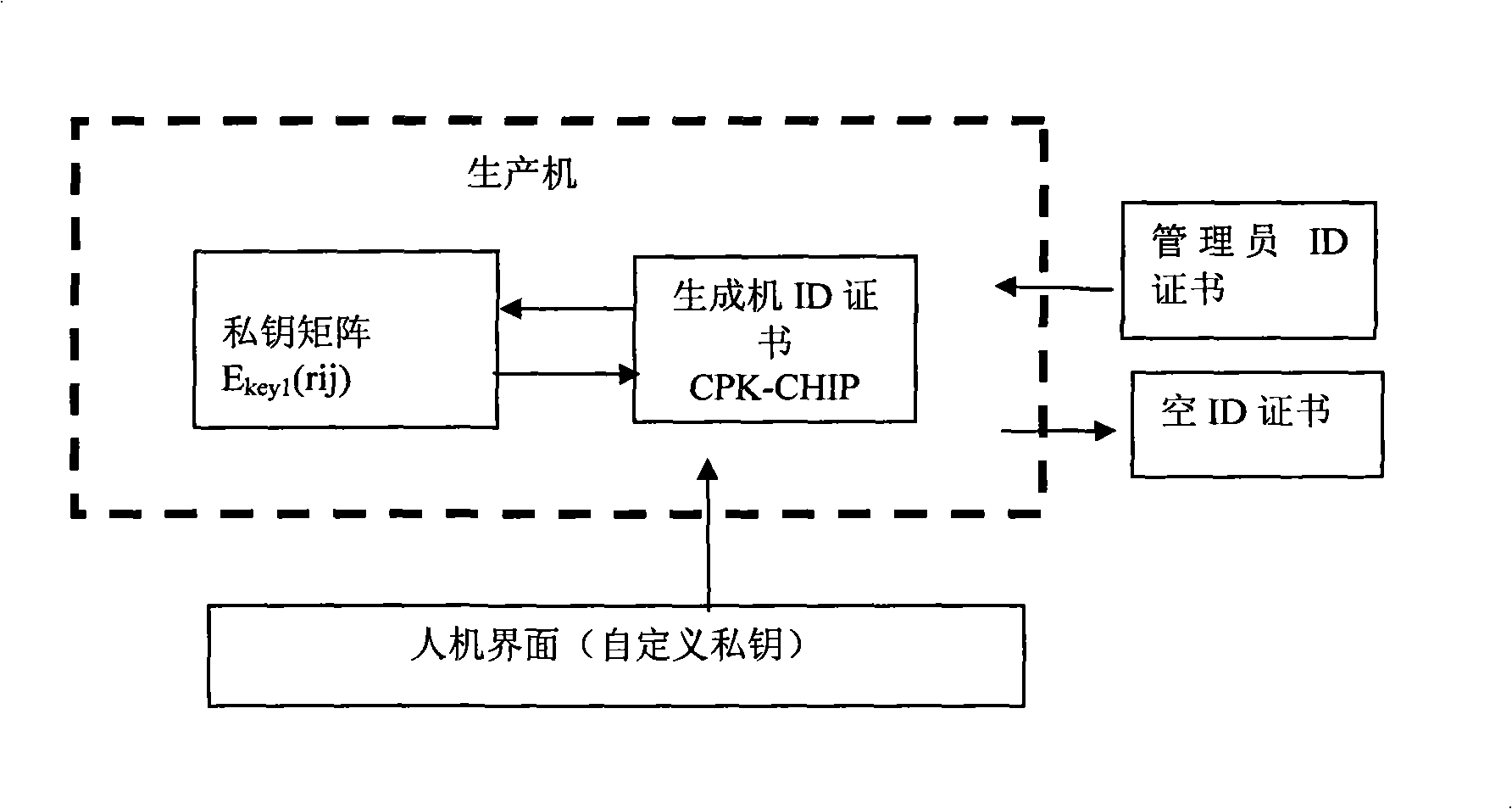

Generation method of composite public key

InactiveCN101340282AExposure that masks linear regularityCover up exposurePublic key for secure communicationUser identity/authority verificationThird partyKey exchange

Owner:BEIJING E HENXEN AUTHENTICATION TECH

Electronic value system

InactiveUS7107247B2Improve processing efficiencyConfirms the correctness of the received electronic valueCredit registering devices actuationUser identity/authority verificationBank accountComputer module

An electronic value amount of an electronic bank account and an electronic value amount stored in user identification module UIM in mobile station MS are each stored in an electronic bank server EBS, and updated by the server when either amount changes as a result of transaction.

Owner:NTT DOCOMO INC

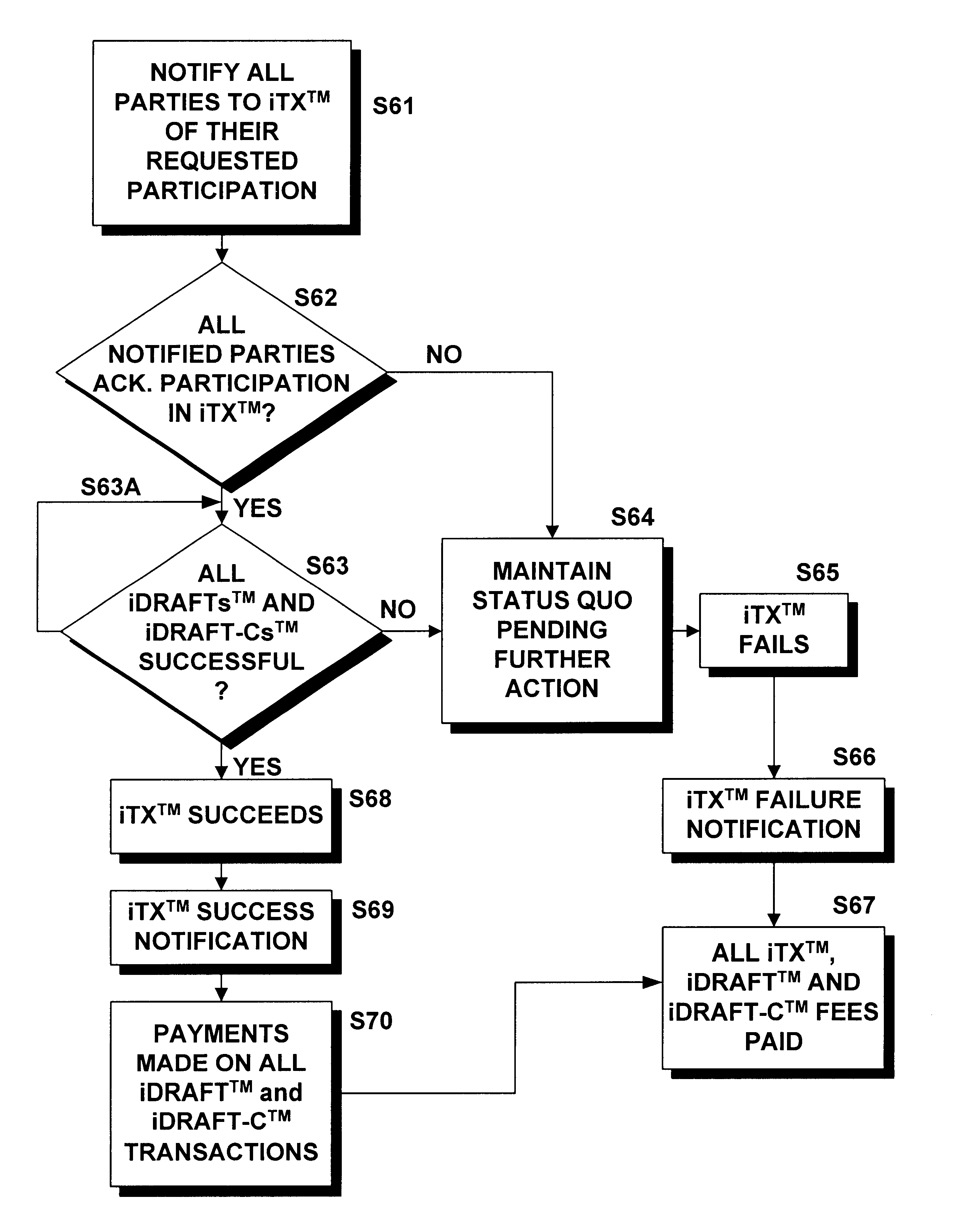

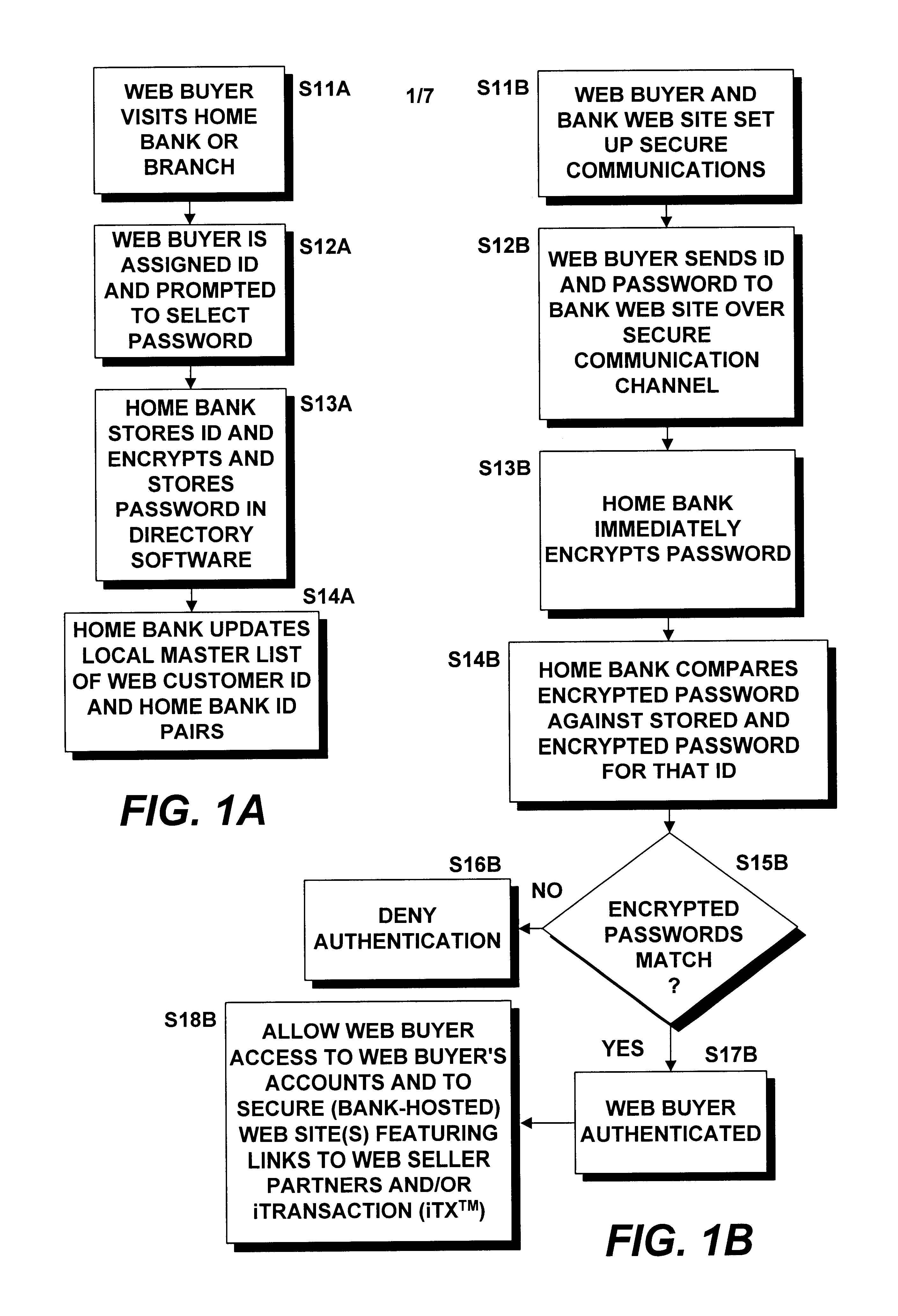

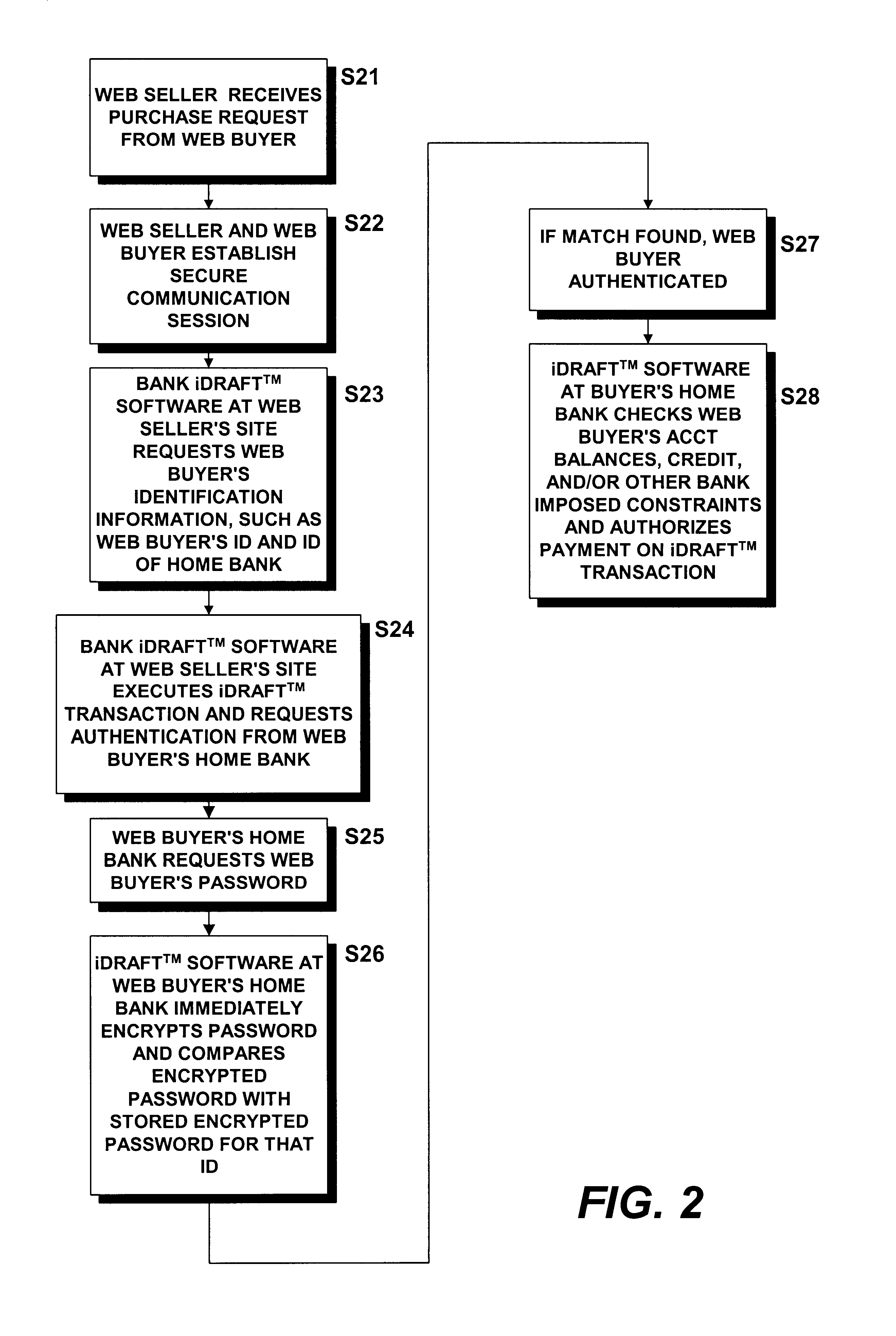

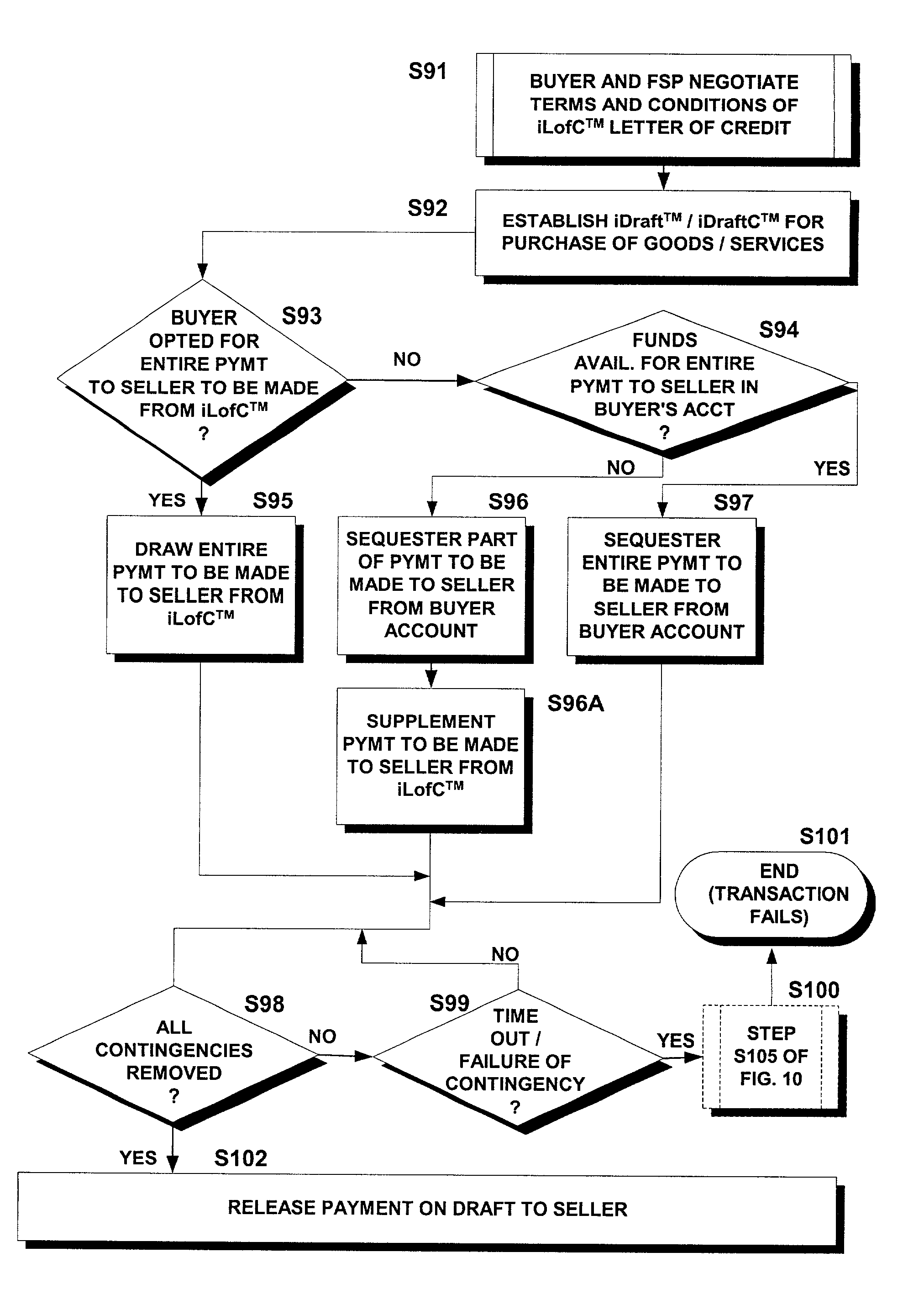

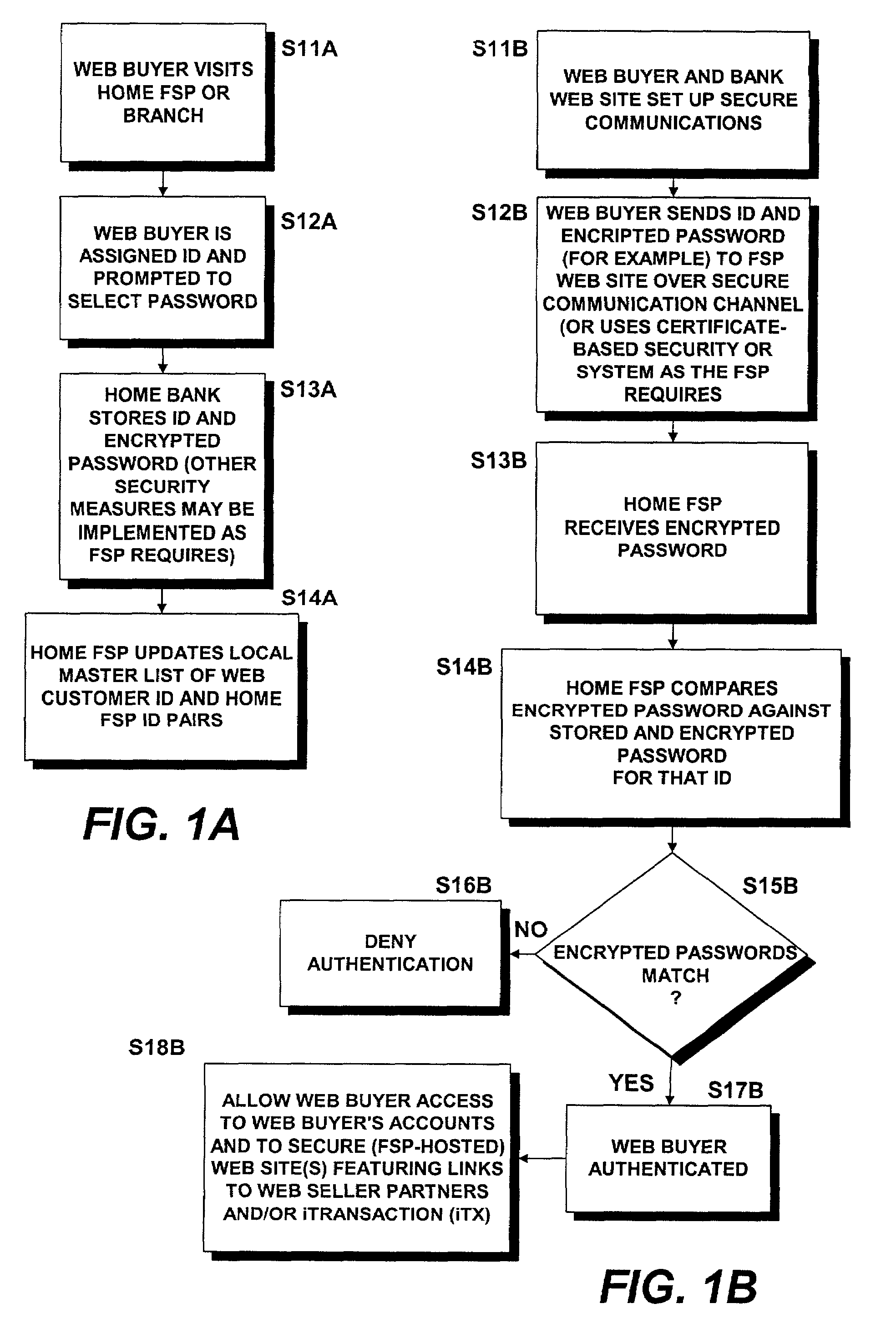

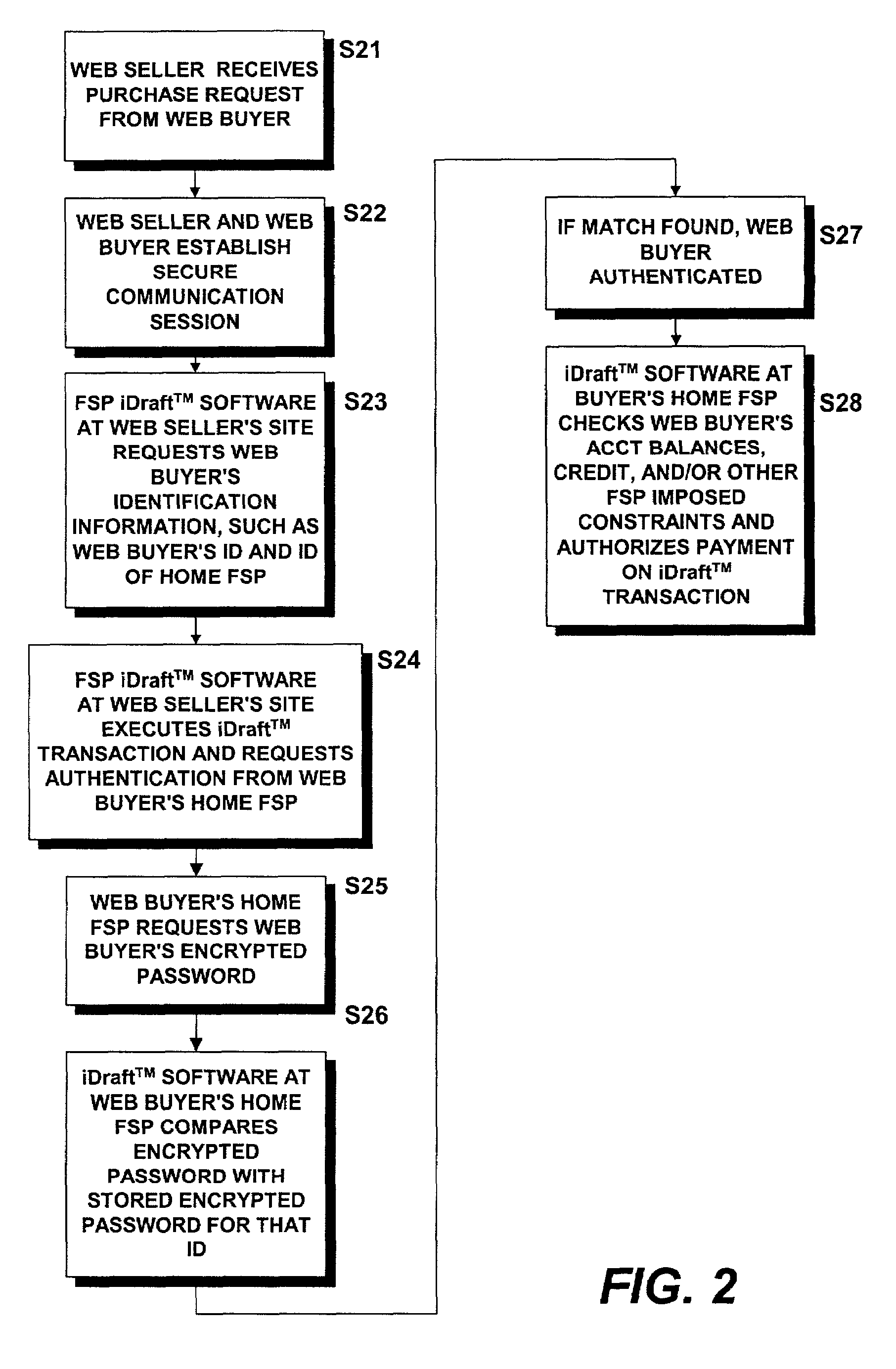

Methods and systems for carrying out directory-authenticated electronic transactions including contingency-dependent payments via secure electronic bank drafts

InactiveUS6941282B1Ensure integrityEnsure safetyFinancePayment circuitsCredit cardDocumentation procedure

Disclosed herein are computer-implemented methods and systems for securely carrying out electronic transactions including electronic drafts, wherein payment on at least one of the drafts is contingent upon the removal of an associated contingency. The method may include steps of establishing a secure computer site accessible only by authenticated parties to the transaction and by any authenticated contingency approver. The site includes a representation of the transaction that includes a representation of each of the plurality of drafts and an option to remove any contingencies associated therewith. Parties and contingency approvers requesting access to the computer site are authenticated by encrypting identification information provided by the requesting party or contingency approver over a secure channel and successfully matching the encrypted identification information with an encrypted identifier that is stored by a bank, the encrypted identifier being unique to the requesting party or contingency approver. Payment on the constituent drafts of the transaction are released by the bank only when the option to remove each contingency associated with the draft is timely exercised by an authenticated party or authenticated contingency remover that is authorized to remove the contingency. Complex transactions may thereby be carried out securely, remotely and without compromising personal and / or financial information. The invention obviates the need to disseminate identification surrogates such as credit card numbers over public networks as well as the need to rely upon in-person holographic signatures on paper documents for authentication purposes.

Owner:ORACLE INT CORP

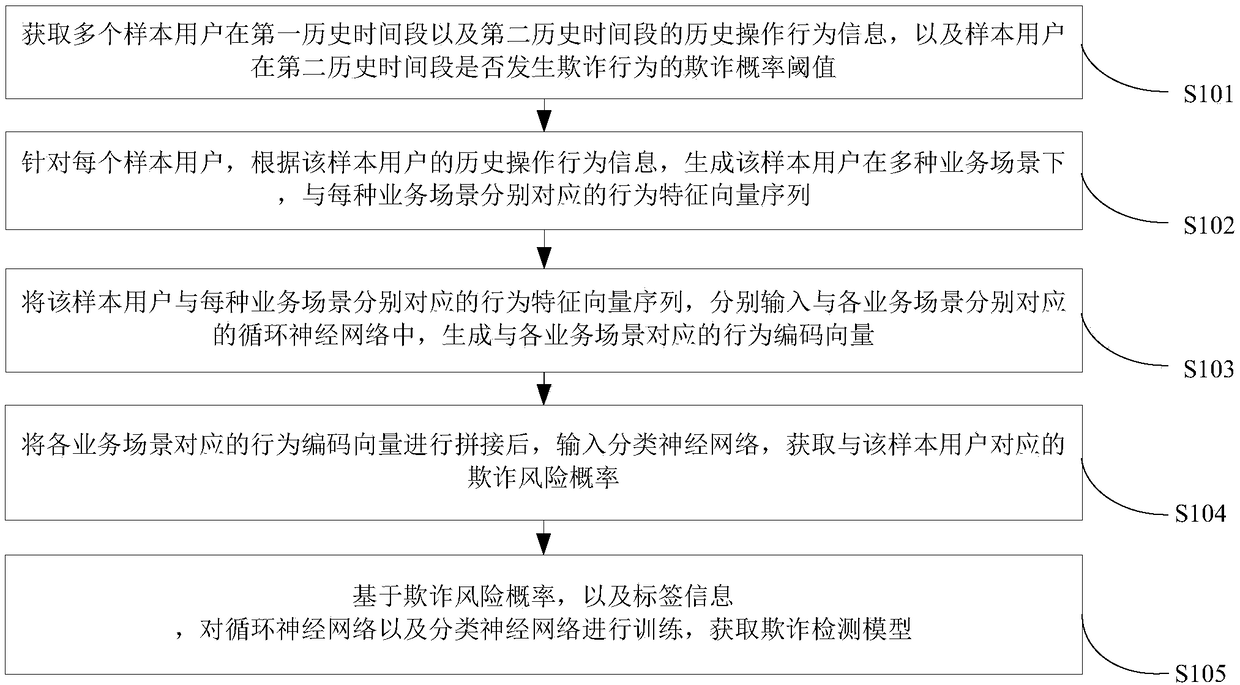

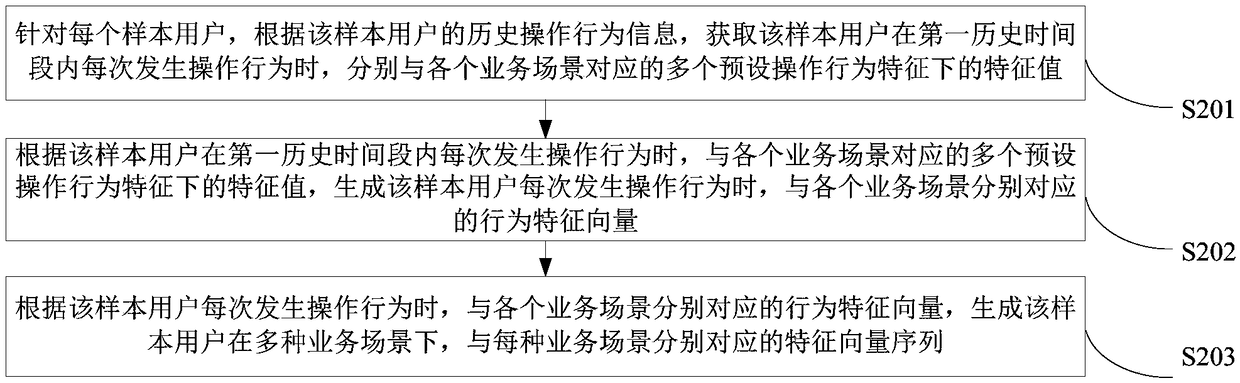

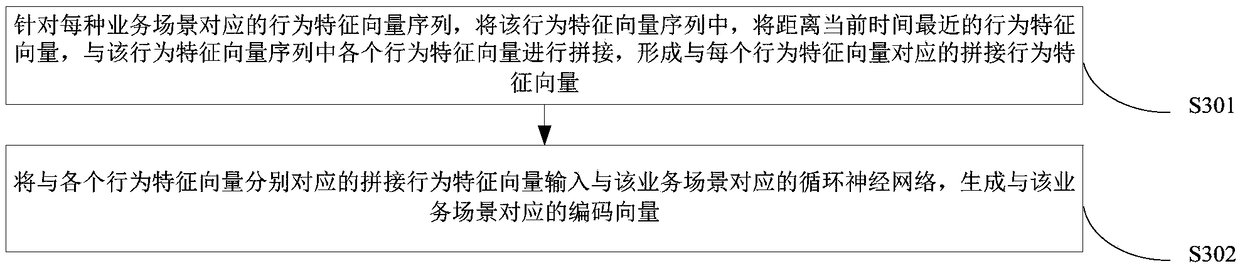

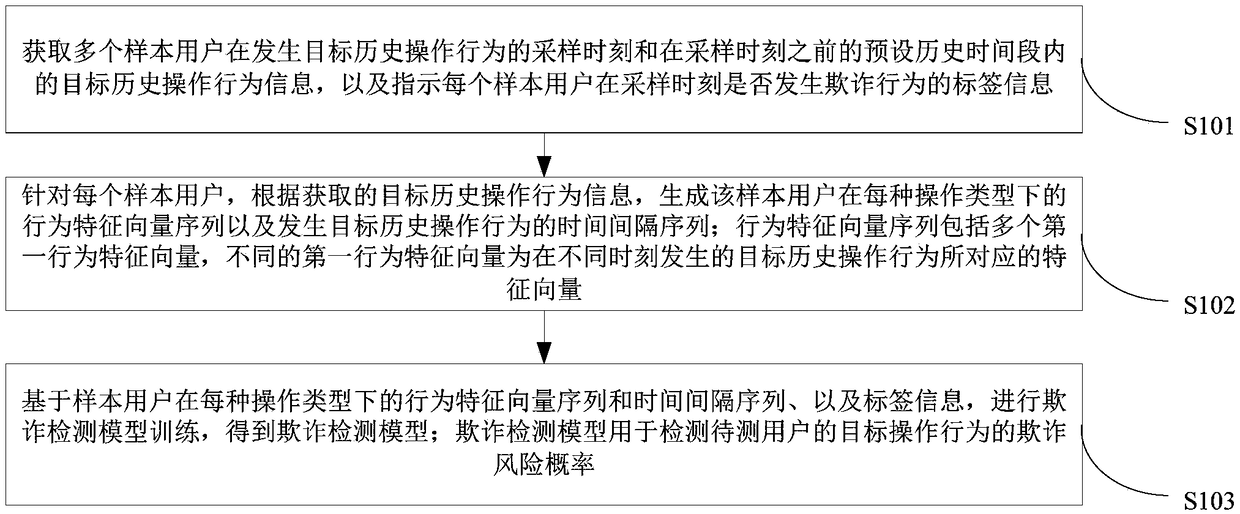

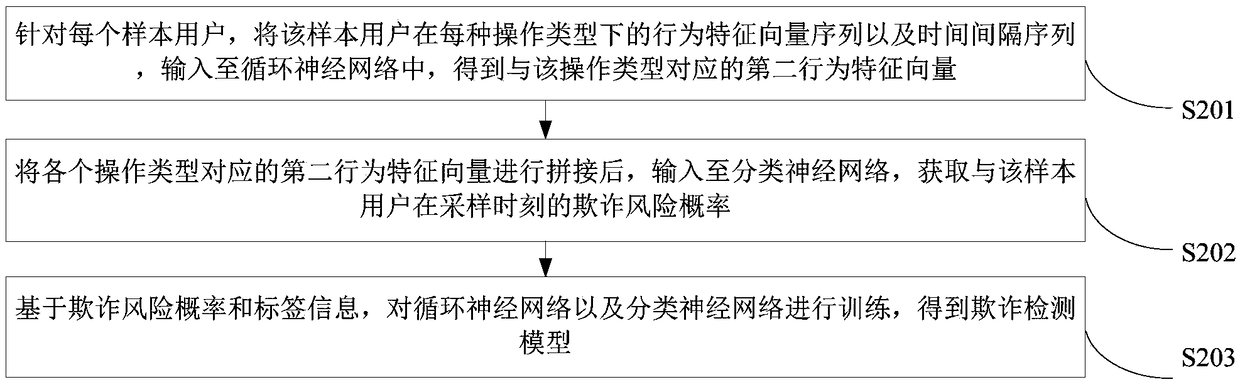

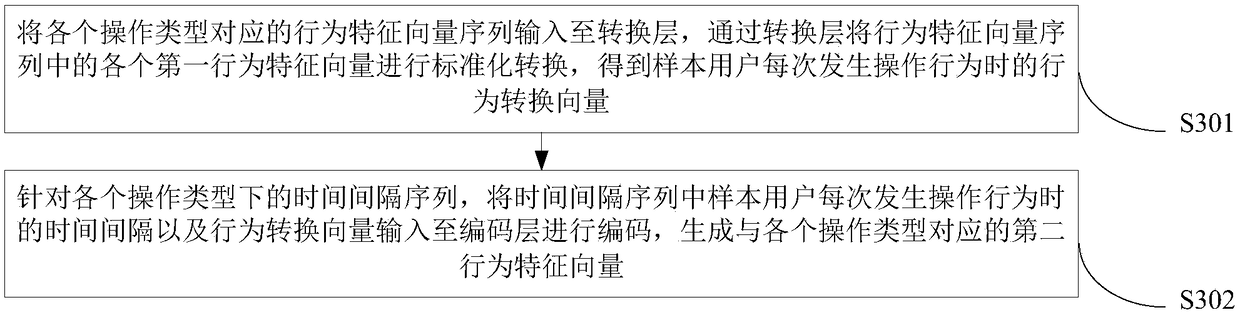

A training method and apparatus for a fraud detection model and fraud detection method and apparatus

A training method and apparatus for a fraud detection model and a fraud detection method and apparatus are provided. That method and apparatus include obtaining historical operation behavior information of a plurality of sample users in a first historical period and a second historical period, and labeling information of whether a fraud behavior of the sample user occurs in a second historical period; generating a behavior feature vector sequence corresponding to each service scenario for the sample user in a plurality of service scenarios; the behavioral eigenvector sequence is input into theloop neural network to generate the behavioral coding vector. After the behavior coding vectors corresponding to each service scenario are spliced, the classification neural network is inputted to obtain the fraud risk probability. Based on the fraud risk probability and labeling information, the circular neural network and classification neural network are trained to obtain the fraud detection model. The present application can improve the accuracy of judging whether or not the user operation behavior occurring when the user uses the electronic banking is a fraudulent behavior.

Owner:BEIJING TRUSFORT TECH CO LTD

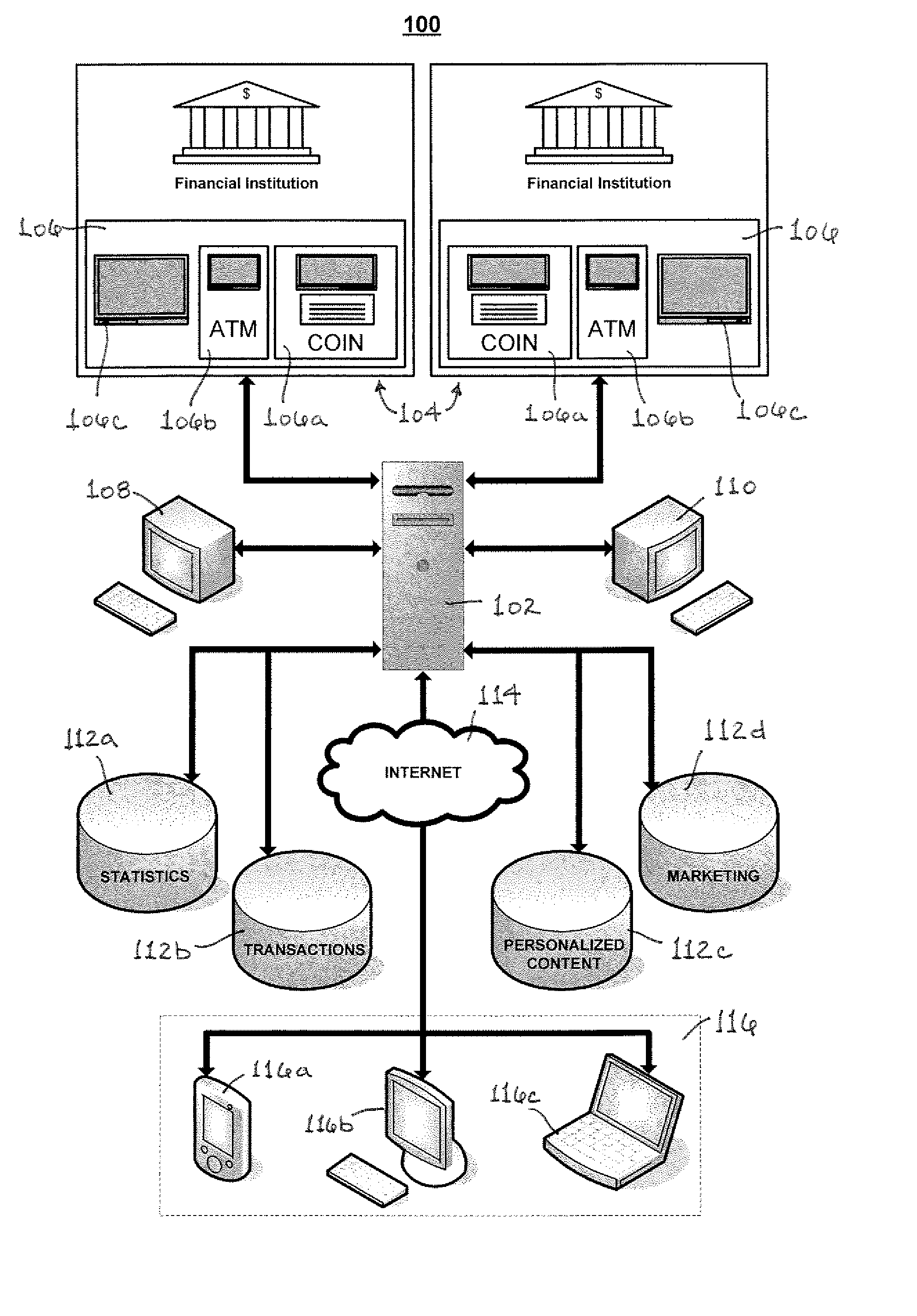

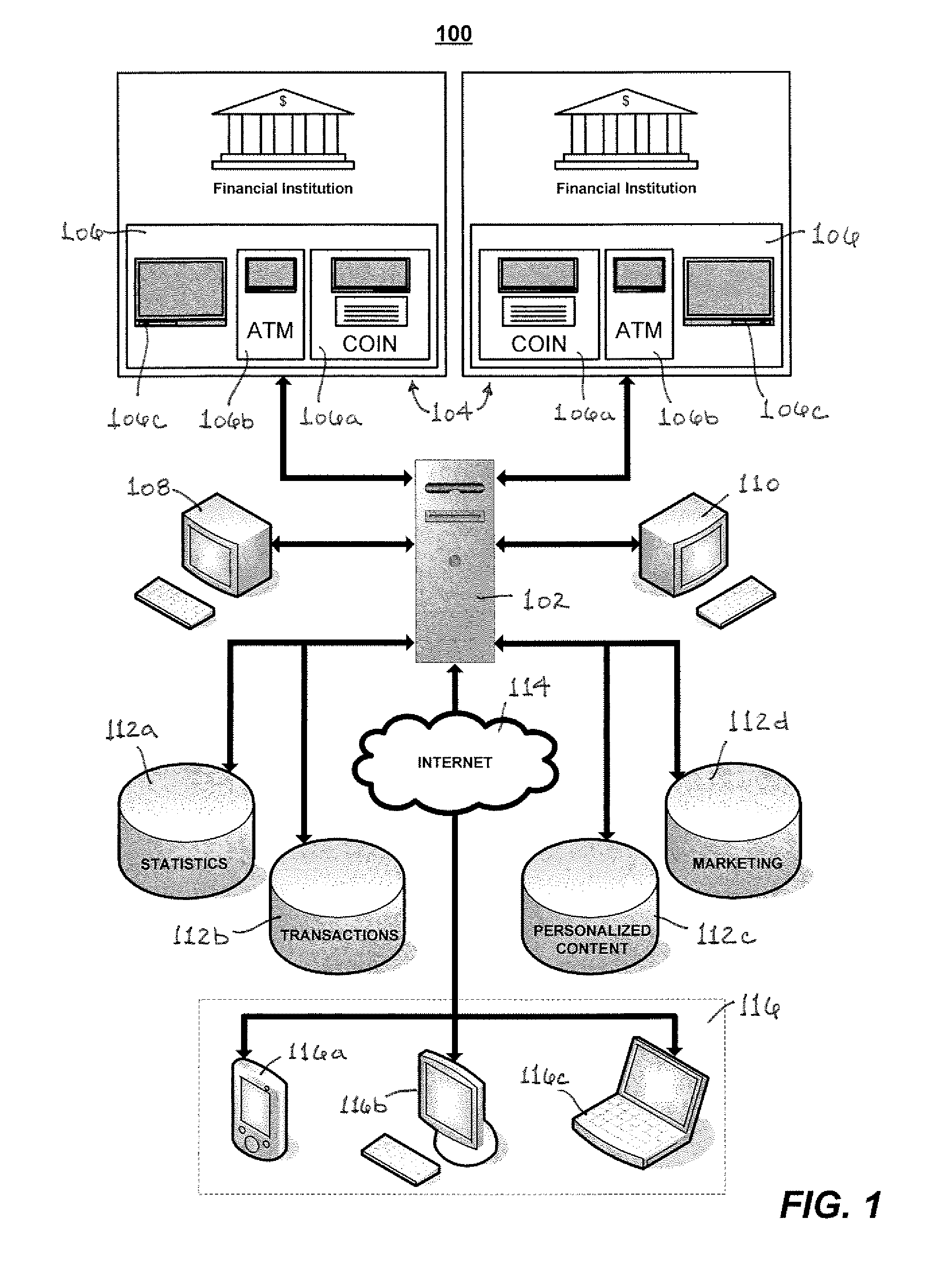

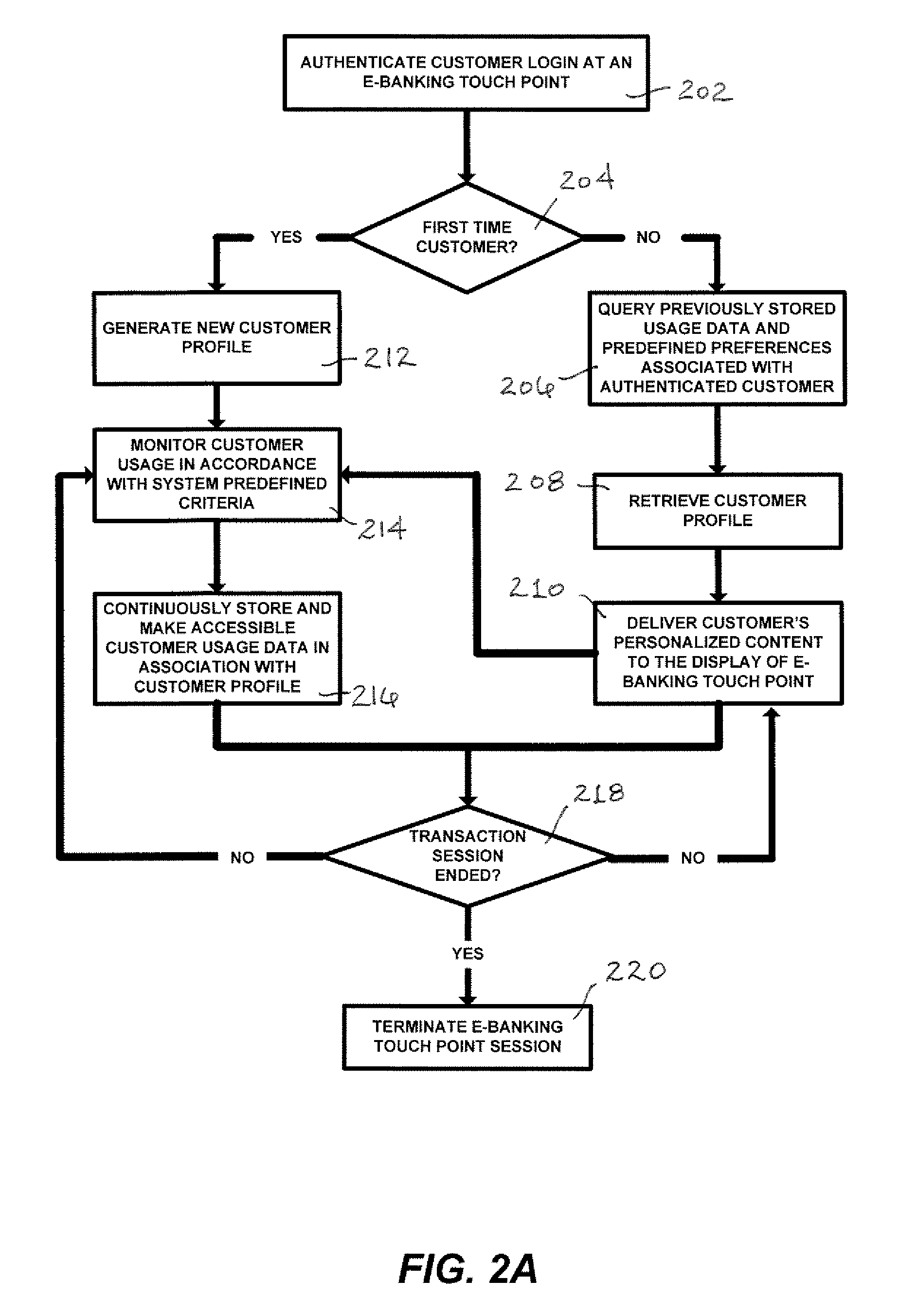

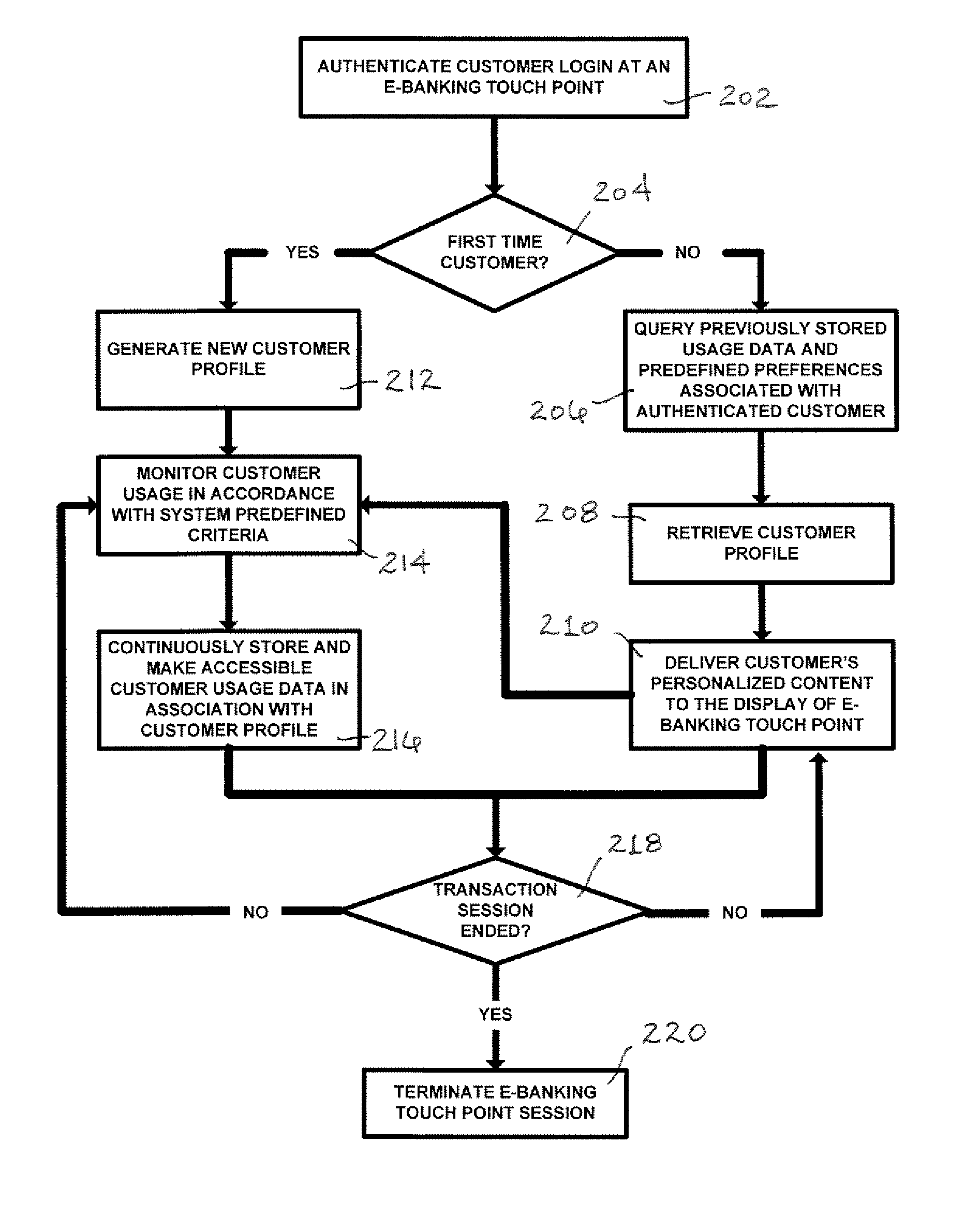

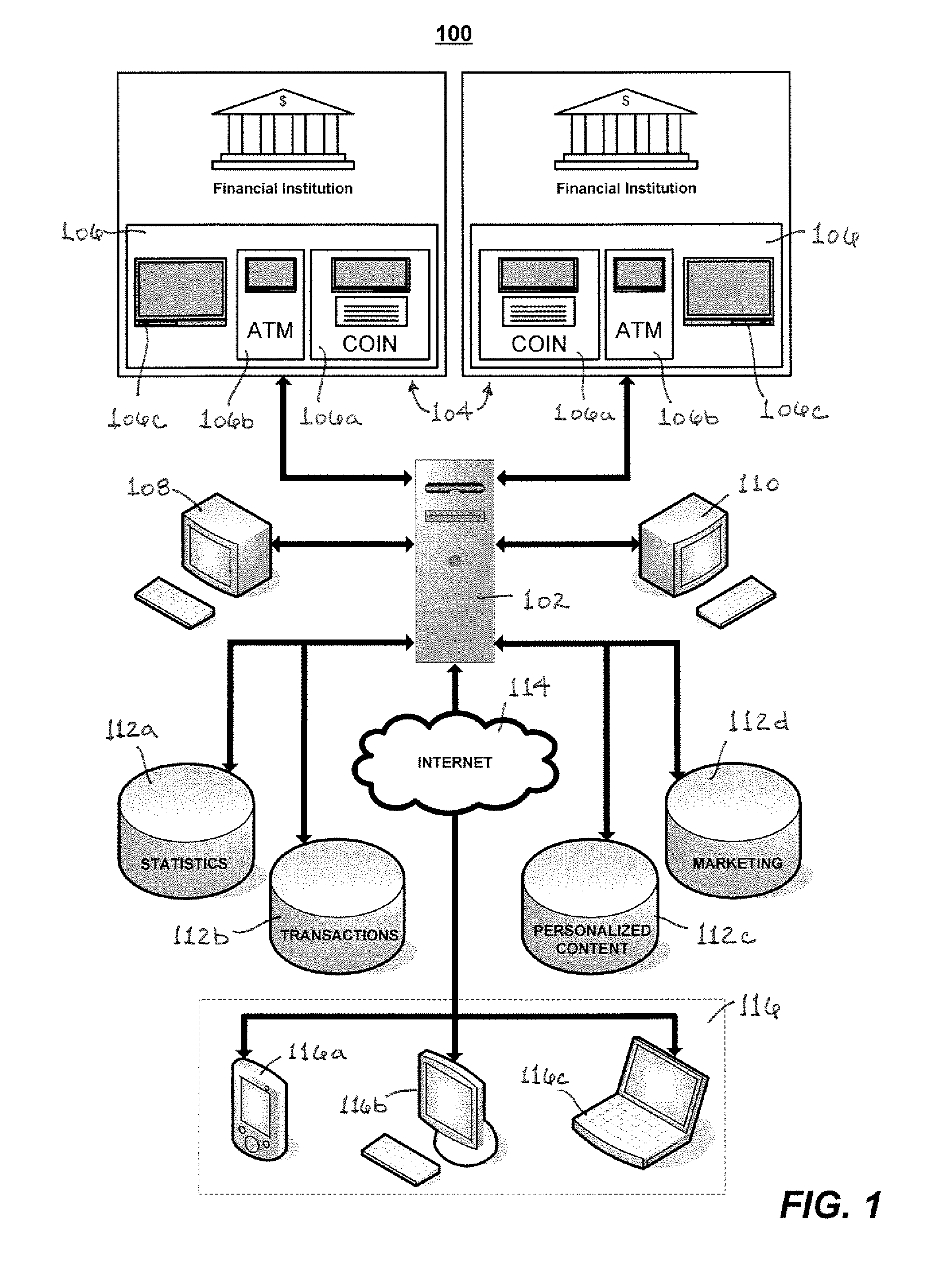

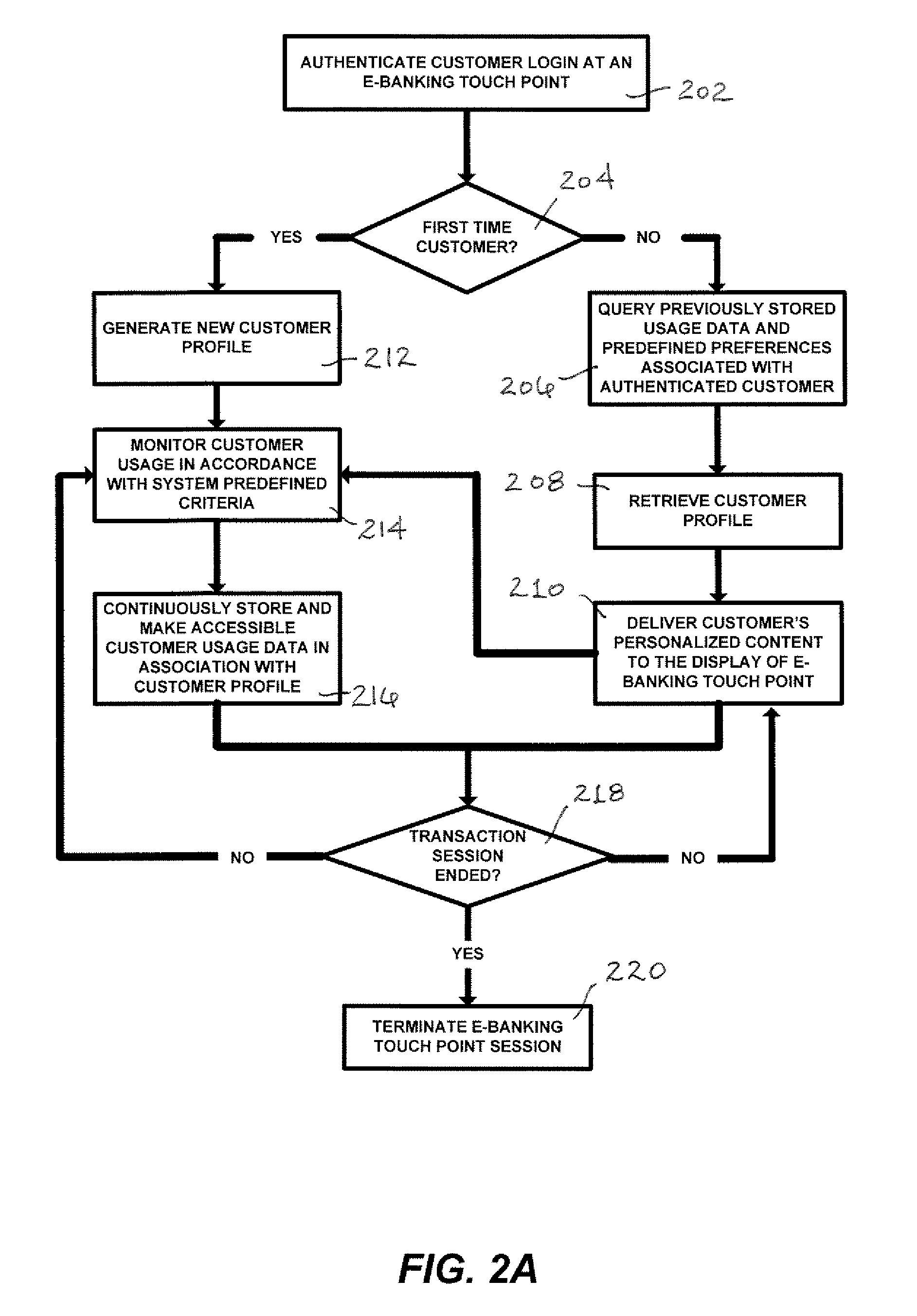

System and method for unifying e-banking touch points and providing personalized financial services

A system and method for delivering a retail banking multi-channel solution that unifies interactive electronic banking touch points to provide personalized financial services to customers and a common point of control for financial institutions is provided.

Owner:MCOM IP LLC

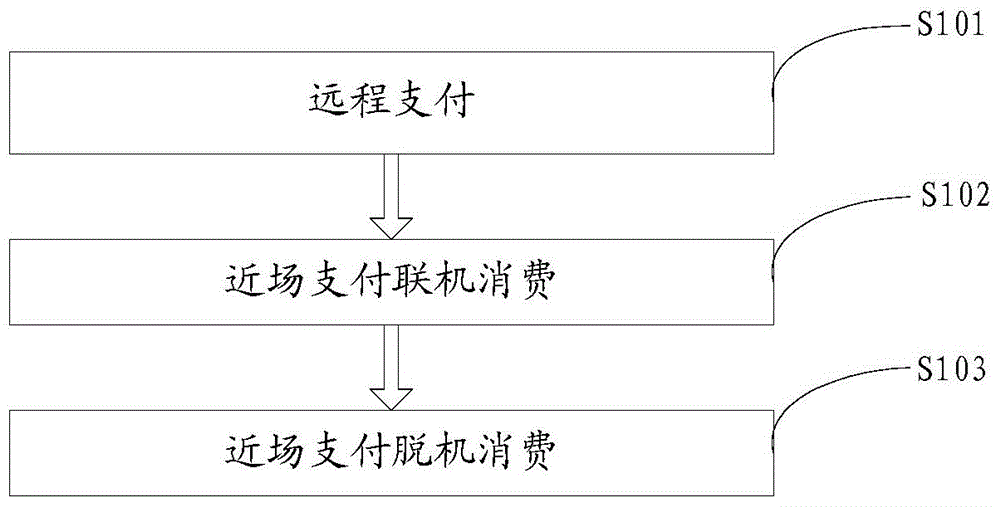

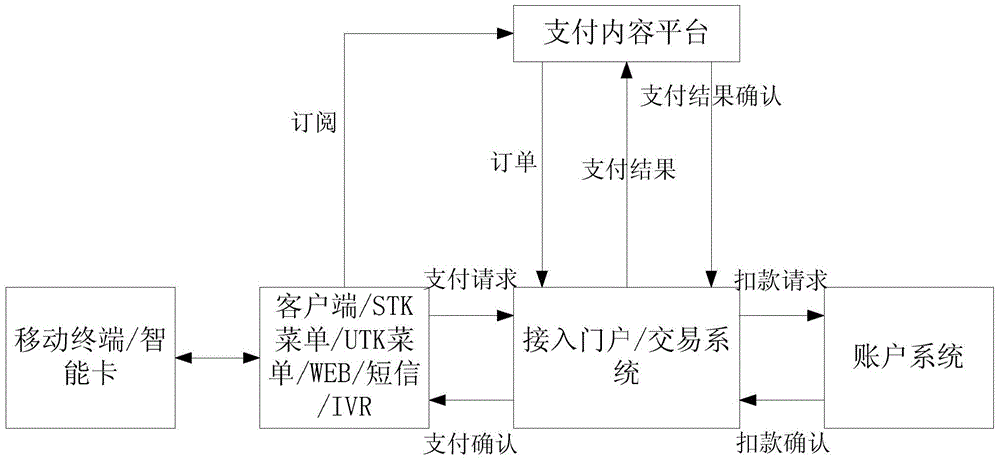

Mobile financial payment method and system based on Internet of Things under cloud platform

InactiveCN104809611AVersatileEasy to apply for transferPoint-of-sale network systemsPayments involving neutral partyCredit cardSupporting system

The invention discloses a mobile financial payment method and system based on Internet of Things under a cloud platform. The mobile financial payment method comprises remote payment, near-field payment online consumption and near-field payment offline consumption; the mobile financial payment system based on Internet of Things under the cloud platform comprises an account system, a movable terminal, a remote payment client, a field receiving terminal, a payment accessing system, a transaction system, an account settling system, a payment content platform, a commercial tenant management system and a payment supporting system. By virtue of the mobile financial payment method and system, electronic bank businesses of self-help financial services including account inquiry transacted by a cell phone bank, account transfer, remittance, investment and financing, payment, cell phone payment, credit card repayment, cell phone payment, credit and loan inquiry and the like; the mobile financial payment system is convenient to carry, can be used for simply and conveniently applying for account transfer, has abundant functions, and is safe and reliable.

Owner:王宏旭 +1

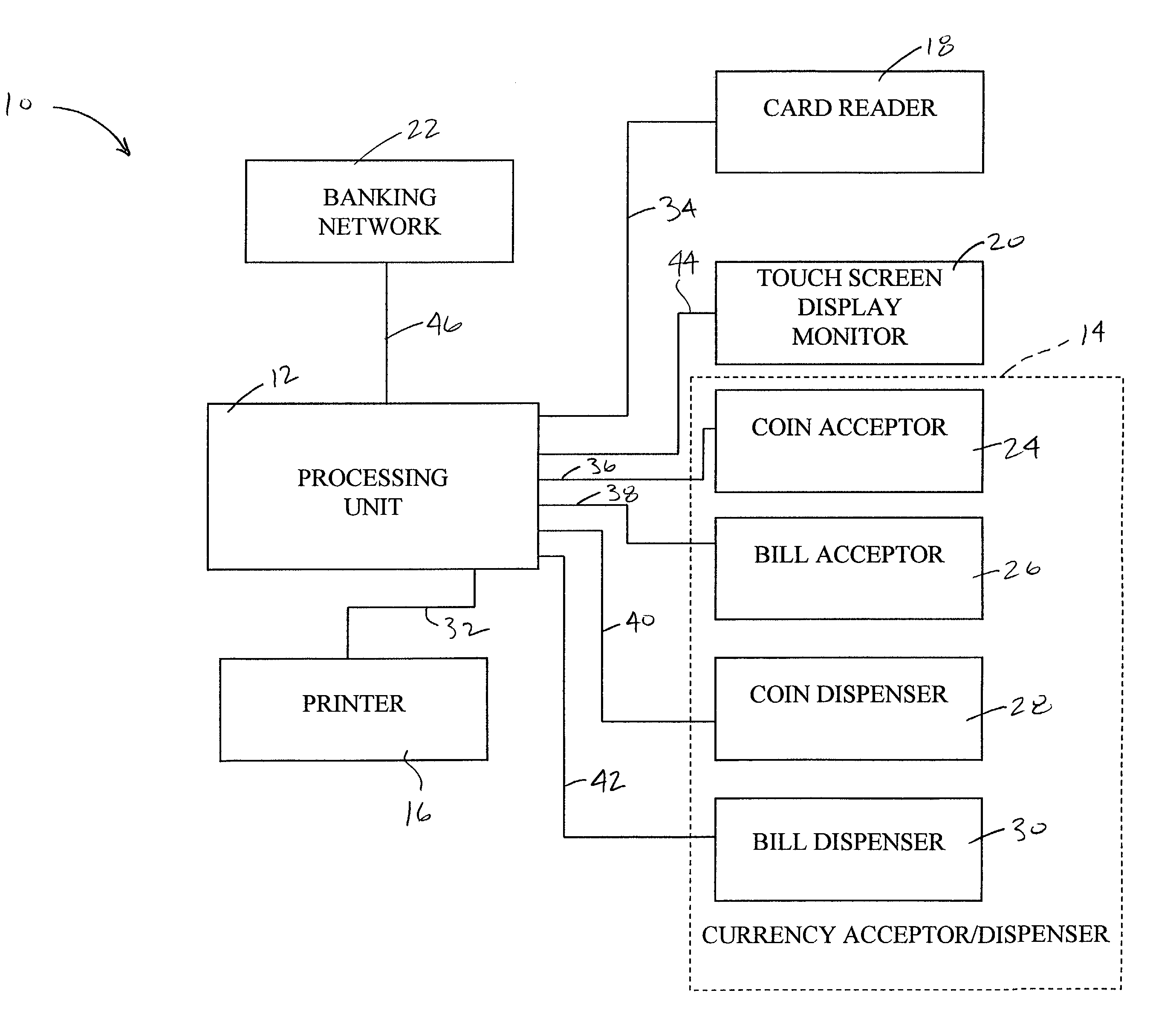

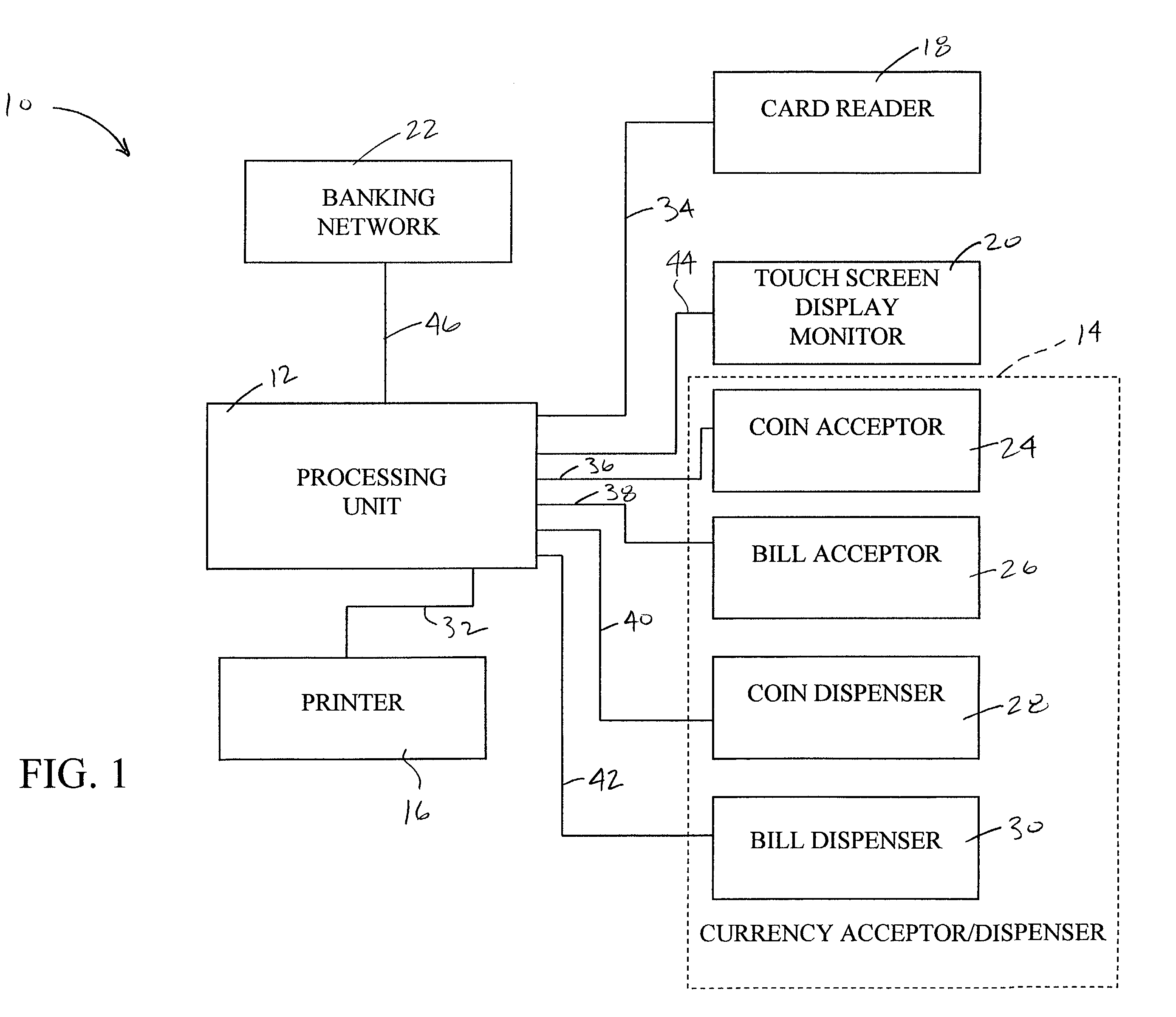

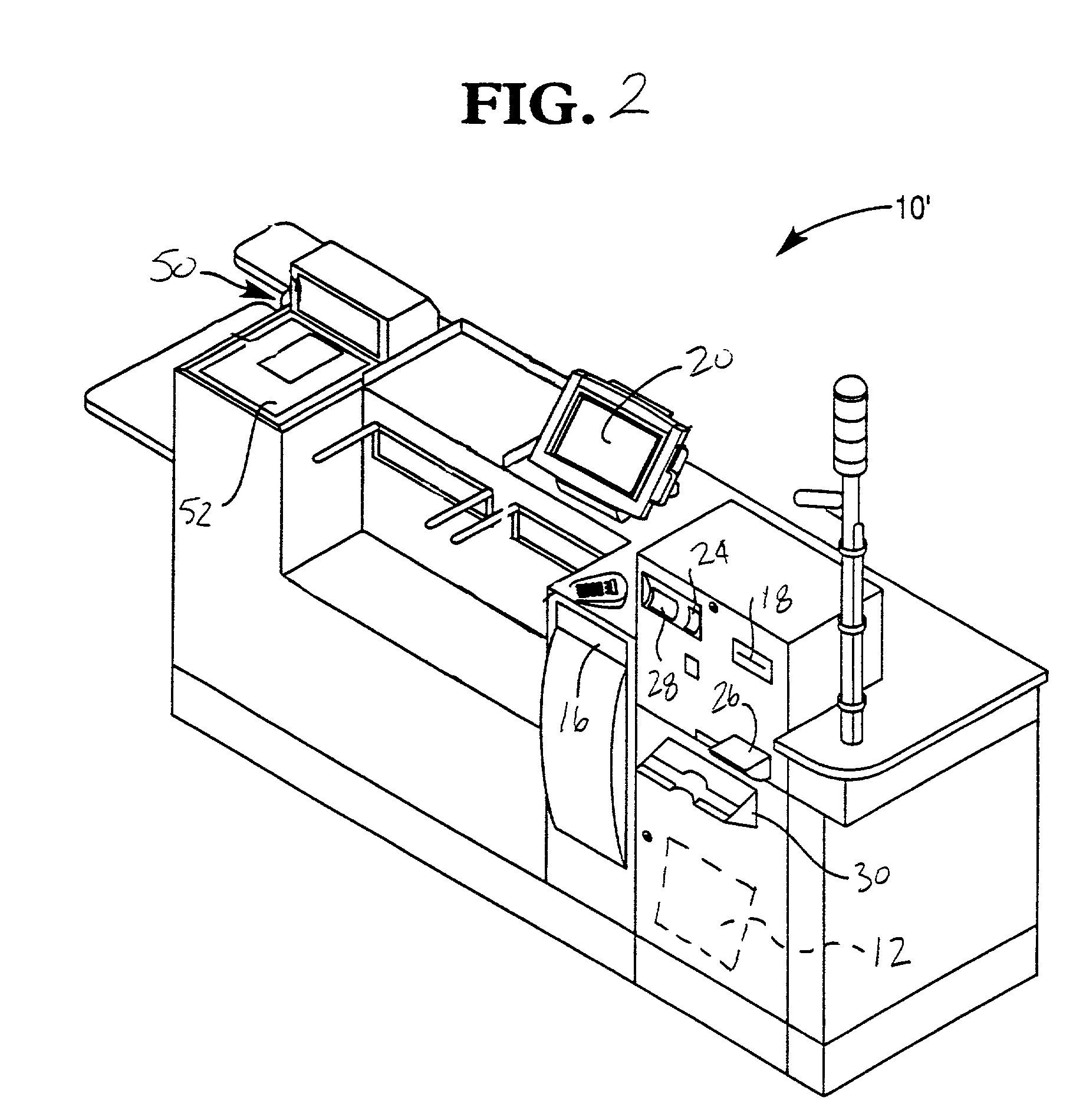

Apparatus and method for maintaining a children's automated bank account

An electronic terminal includes an input device for receiving input from a user. The electronic terminal also includes a processing unit electrically coupled to the input device. Yet further, the electronic terminal includes a memory device electrically coupled to the processing unit. The memory device has stored therein a plurality of instructions which, when executed by the processing unit, causes the processing unit to (a) permit the user to deposit funds into a banking account if the user enters either a first PIN number or a second PIN number with the input device, the first PIN number being different than the second PIN number, (b) permit the user to withdraw a first dollar amount from the banking account if the user enters the first PIN number with the input device, and (c) permit the user to withdraw a second dollar amount from the banking account if the user enters the second PIN number with the input device, wherein the first dollar amount is less than the second dollar amount. A method of operating an electronic banking terminal is also disclosed.

Owner:NCR CORP

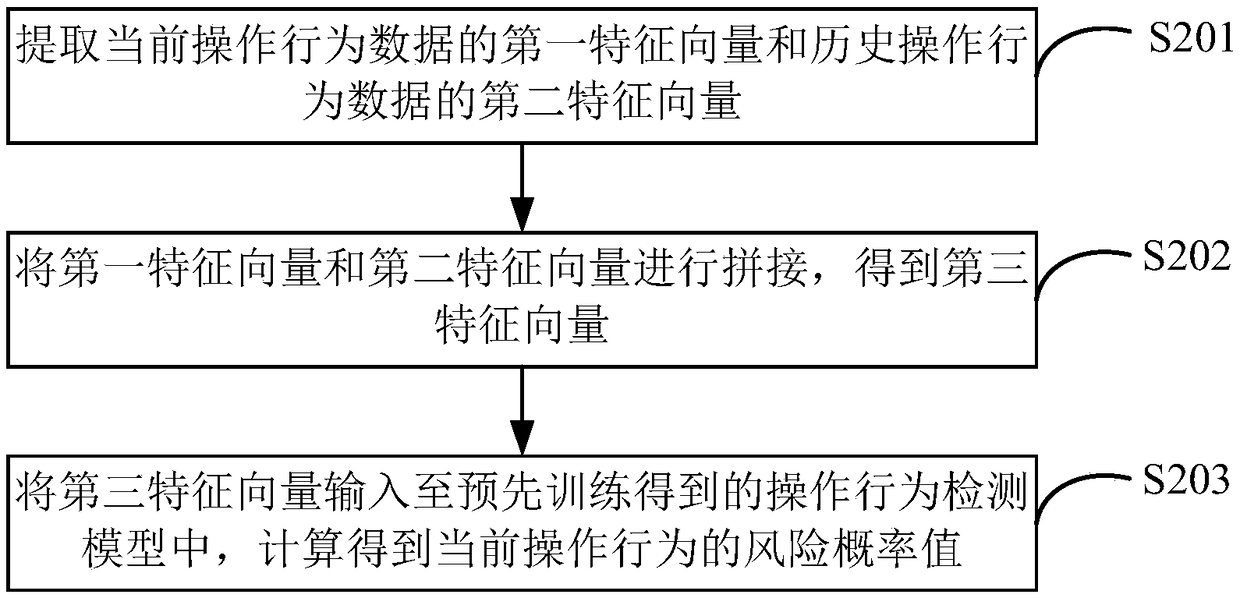

Method and apparatus for trainning a fraud detection model and a method and apparatus for fraud detection

ActiveCN109345260AAccurate judgmentImprove accuracyProtocol authorisationFeature vectorOperational behavior

A method and apparatus for trainning a fraud detection model and a method and apparatus for fraud detection are provided, includes acquiring target history operation behavior information of a plurality of sample users at a sampling time when the target history operation behavior occurs and in a preset history period before the sampling time, and label information indicating whether or not a fraudbehavior occurs at the sampling time for each sample user, and obtaining the target history operation behavior information of the sample users at the sampling time. According to the acquired historical operation behavior information of the target, the behavior feature vector sequence and the time interval sequence under each operation type are generated. Based on the sample user's behavior eigenvector sequence, time interval sequence and label information, the fraud detection model is trained to obtain the fraud detection model. The present application can analyze the current target operationbehavior of the user when using the electronic bank according to the target historical operation behavior and the current time target operation behavior, and improve the accuracy of judging whether the current target operation behavior of the user is a fraudulent behavior or not.

Owner:BEIJING TRUSFORT TECH CO LTD

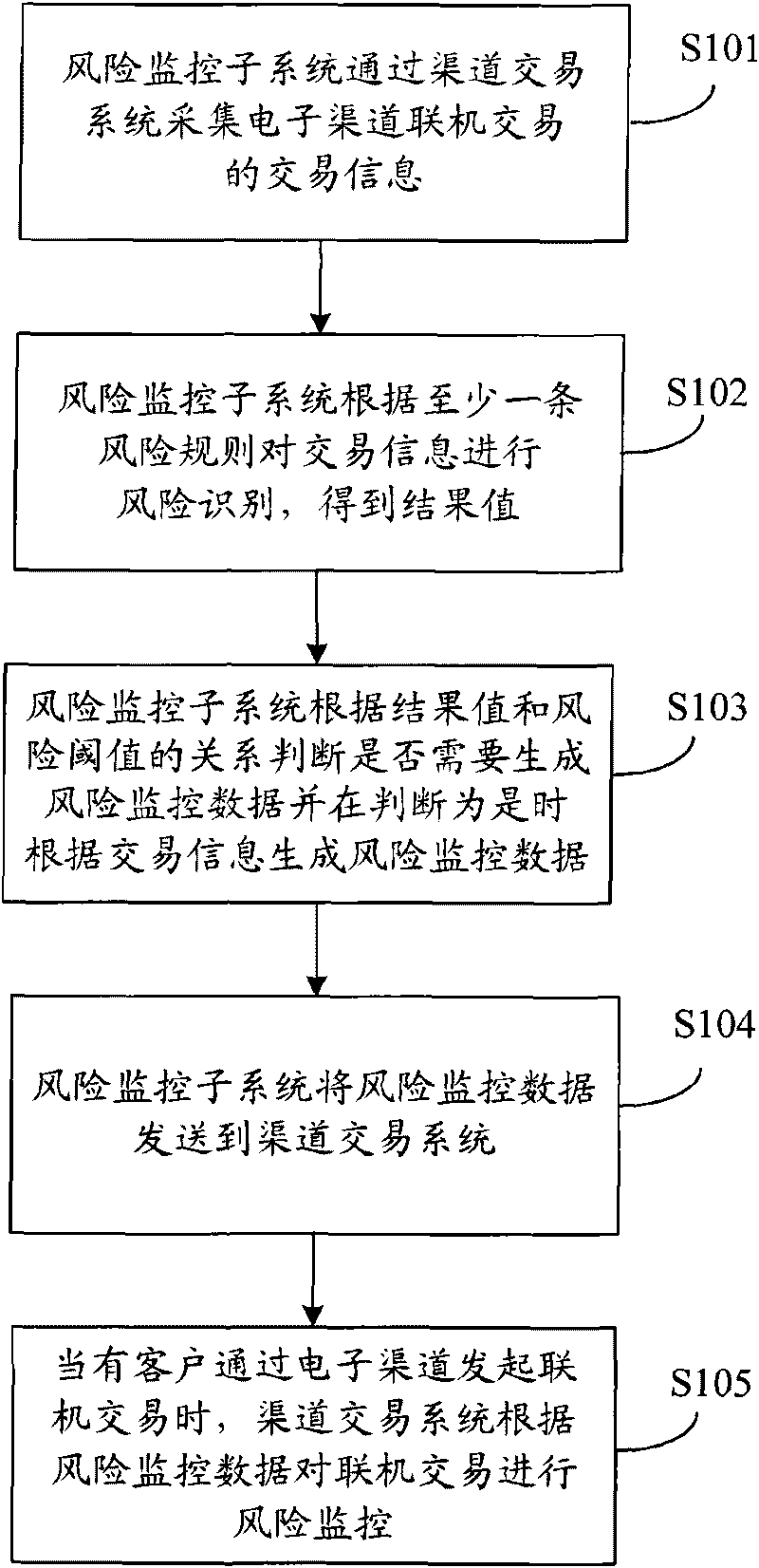

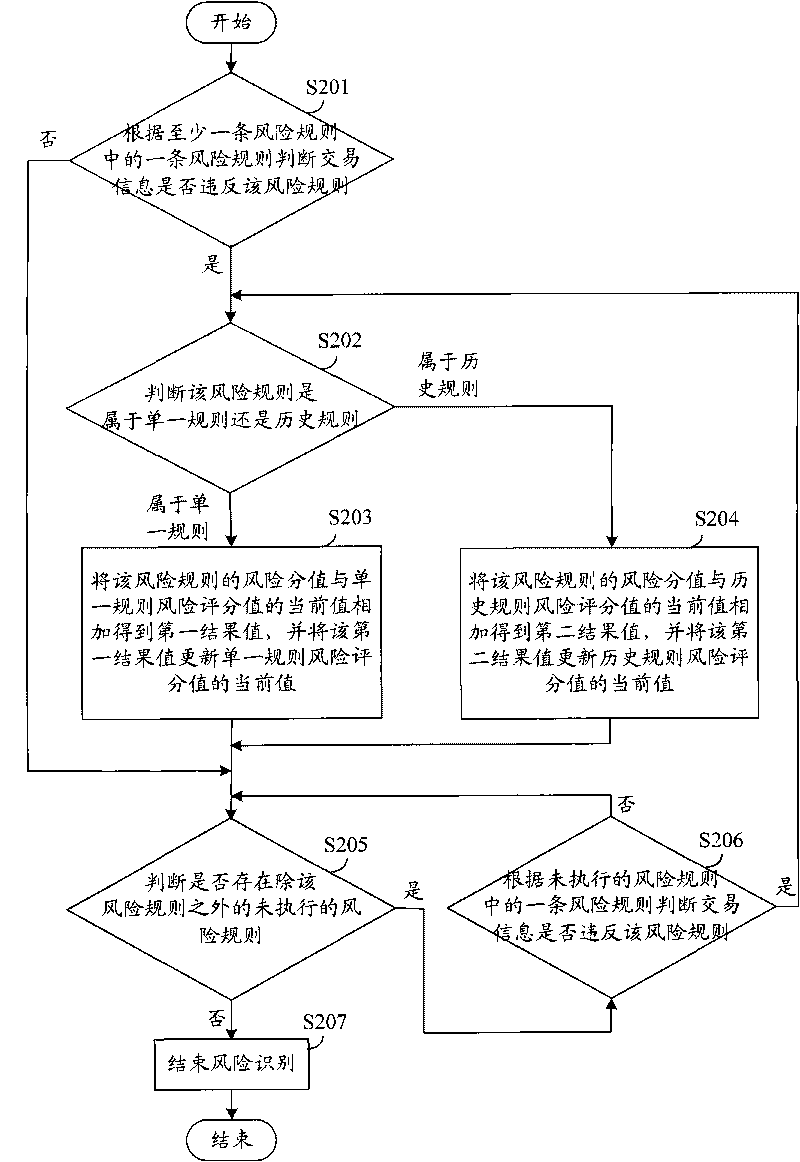

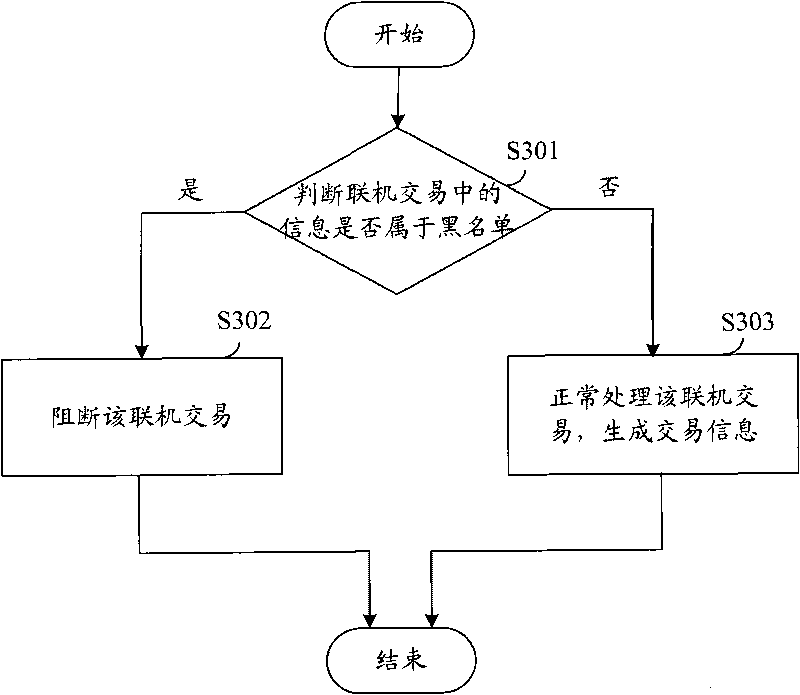

Method and system for monitoring electronic bank risks

InactiveCN101706937AReduce transaction riskImprove securityFinancePlatform integrity maintainanceRisk identificationData needs

The invention discloses a method and a system for monitoring electronic bank risks, wherein the method comprises the following steps of: collecting trading information on-line traded by an electronic channel through a channel trading system by a risk monitoring subsystem, identifying risks for the trading information according to at least a risk rule, obtaining a result value, judging whether risk monitoring data need to be generated according to the relation between the result value and a risk threshold value, and if so, generating the risk monitoring data according to the trading information and sending the risk monitoring data to the channel trading system; and when a customer initiates on-line trading through the electronic channel, the channel trading system monitors the risks of the on-line trading according to the risk monitoring data. The risk identification of the trading information for electronic banks is carried out through the risk monitoring subsystem, and real-time risk monitoring for the on-line trading is carried out through the channel trading system according to the result of risk identification, thereby reducing the trading risks of each channel of the electronic banks and enhancing the security of customer trading.

Owner:CHINA CONSTRUCTION BANK

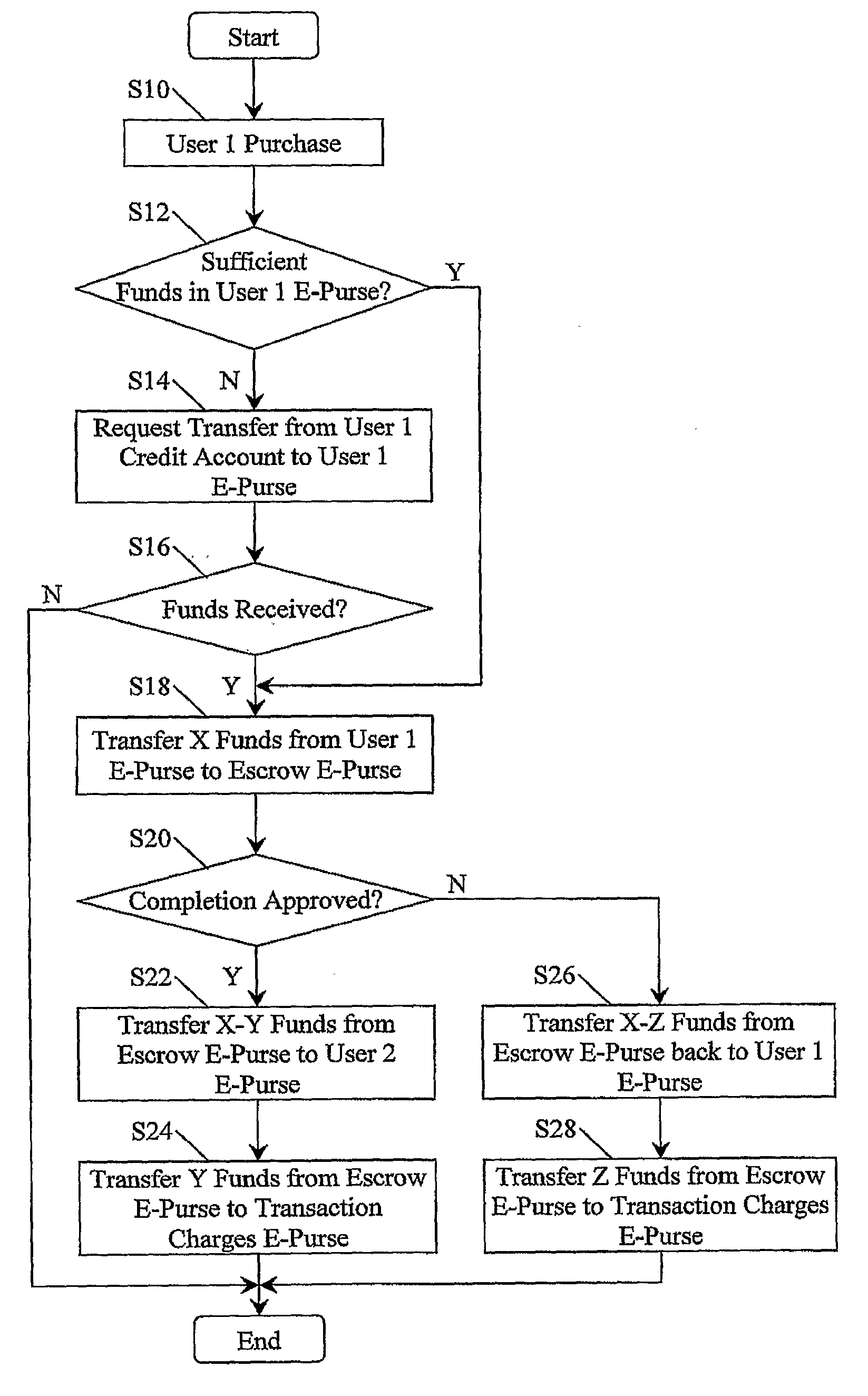

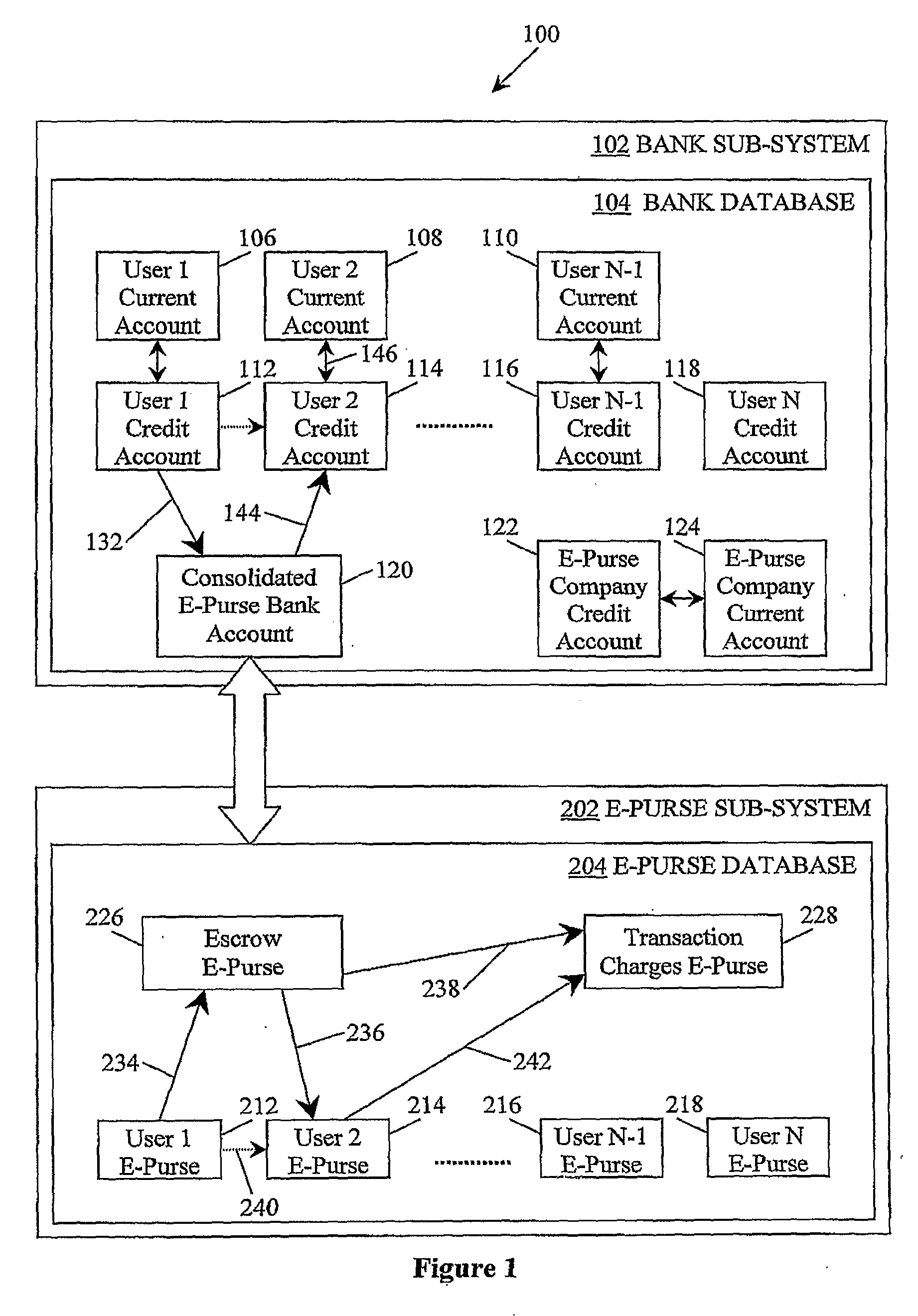

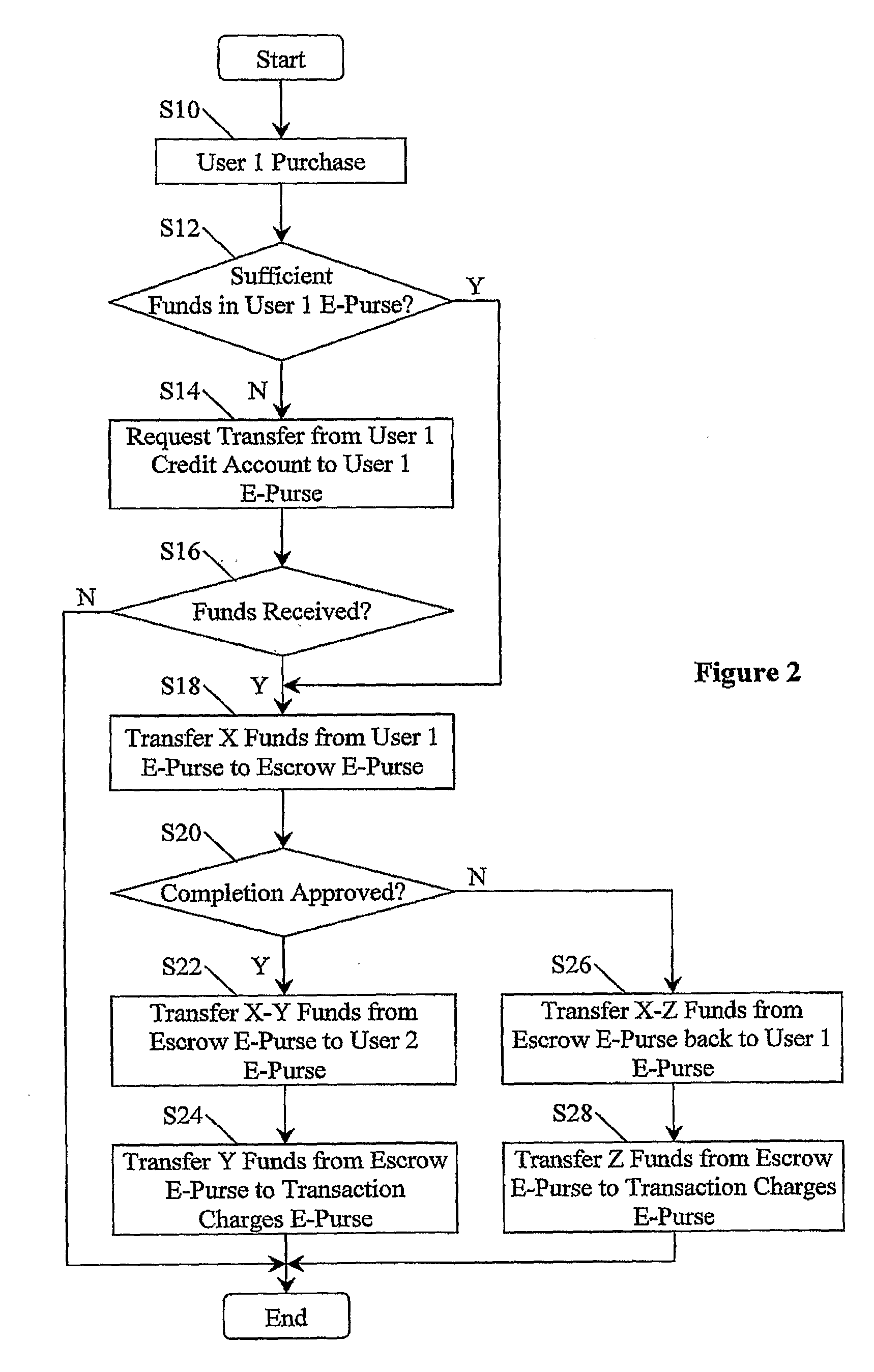

Electronic-Purse Transaction Method and System

InactiveUS20080162348A1Flexibility and speed of flowAcutation objectsFinanceBank accountPayment gateway

Users (302,403,406) of a bank (332,324)put funds into user credit account (112,114,116,118) from which the funds can be transferred to a consolidated e-purse ban account (120) within the bank (332,324). The consolidated e-pures bank account (120) i mirrored in a e-purse database (204), but with fund allocated to different e-purese (212,214,216,218,226,228) the total of all funds in the different c-purse (212,214,216,218,226,228) beeing equal to the funds in the consolidated e-purse ban account. When a first user (302) wishes to make a purchase from a second user (304), h sends an SMS message (352) to a mobile telephone payment gateway (320) indicating th second user (304) and an amount. The indicated amount of funds is removed from the fir users's e-purese (212). When the purchase is confirmed, the funds are transferred into th second user's e-purse (214), less transaction charges. These funds are immediately availabl to the second user (304).

Owner:MOBILE MONEY INT SDN BHD

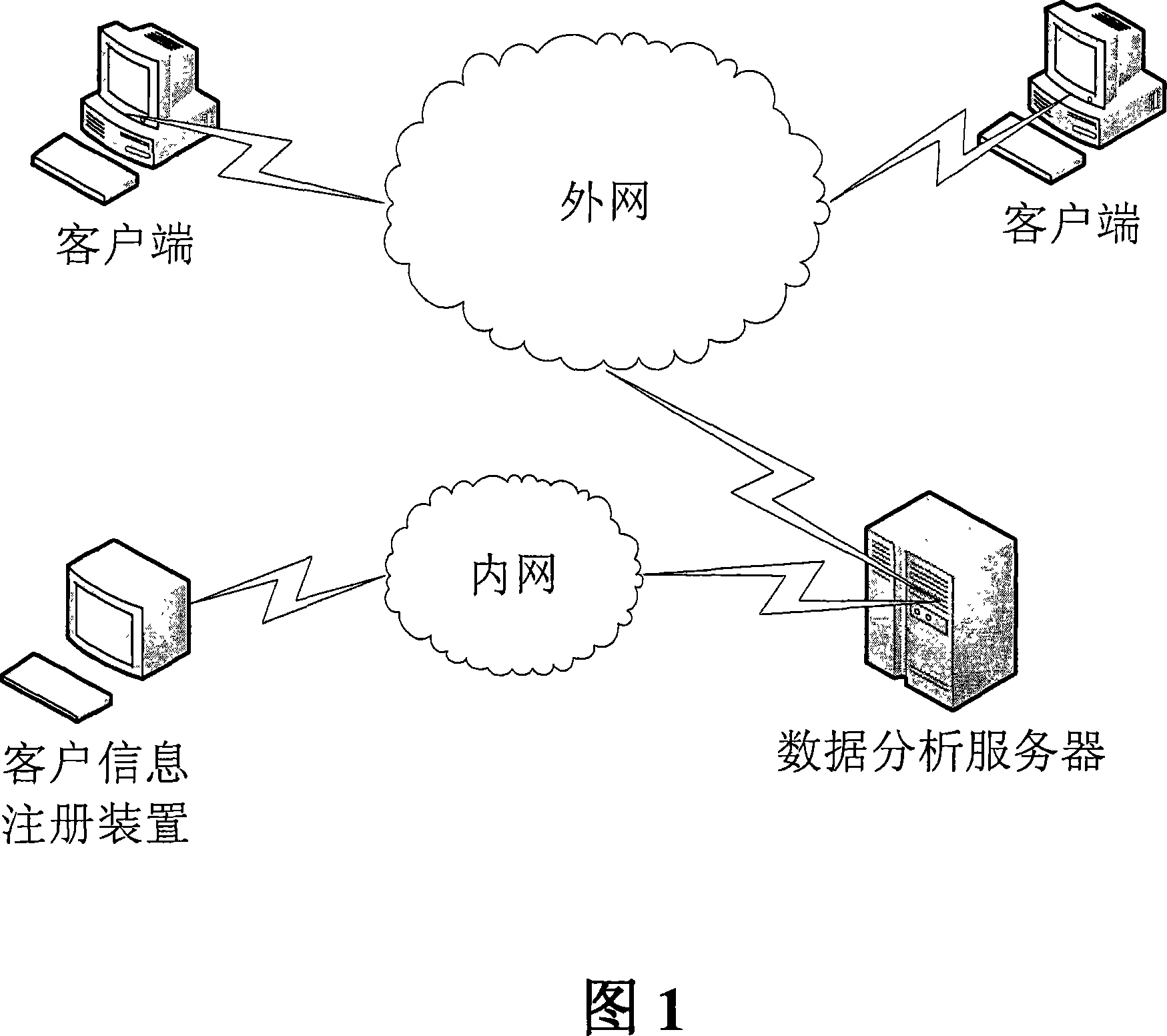

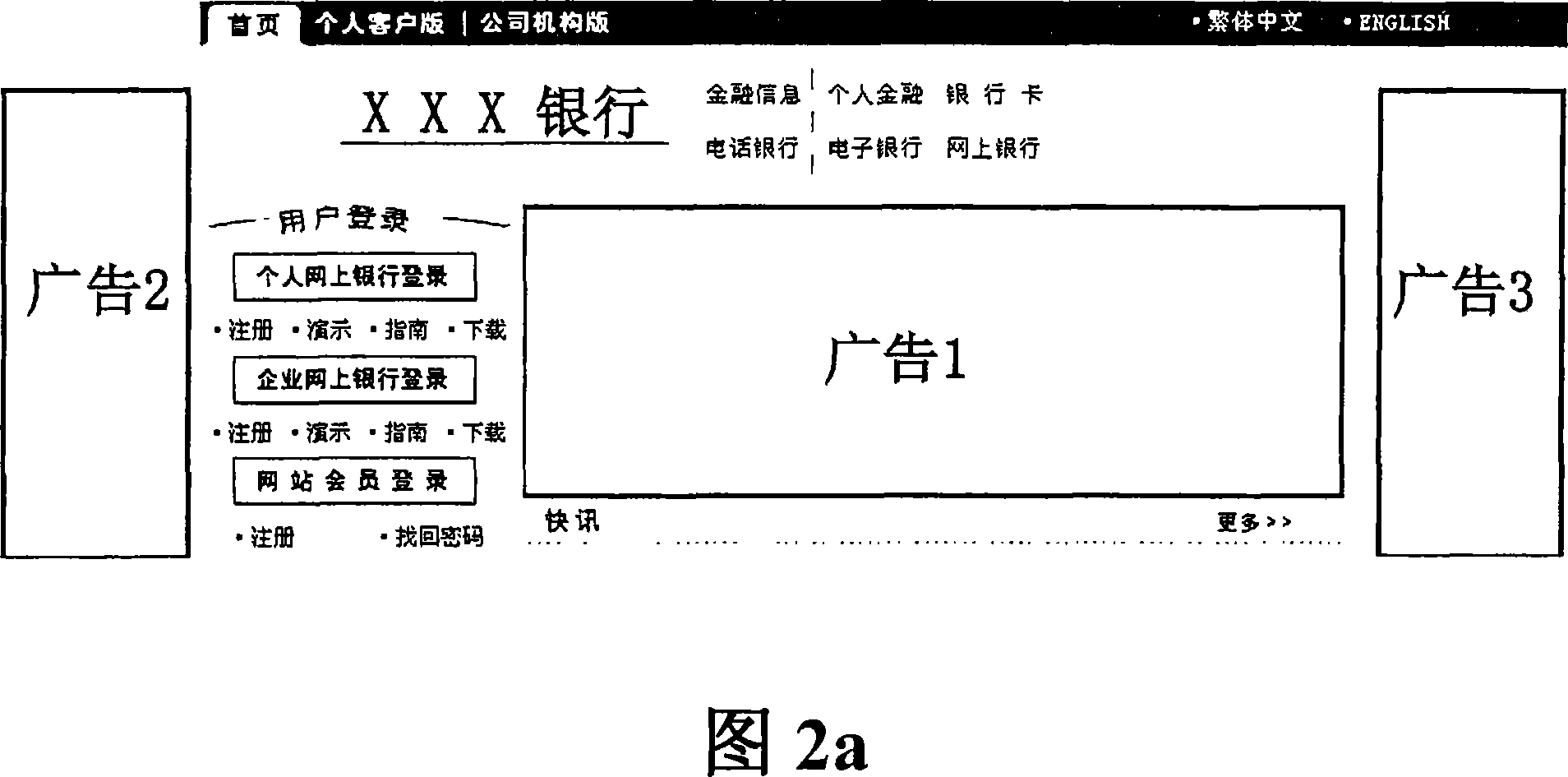

Method and system for processing electric bank website client action and information

InactiveCN101226550AFully grasp the rules of useOptimize and adjust contentCommerceSpecial data processing applicationsWeb siteBehavioral analytics

The invention provides an electronic bank website customer behaviors and information process method and a system, wherein the method comprises: obtaining log data and advertisement data of electronic bank website to get advertisement analysis data; obtaining electronic bank website log data and website structural data to get website structural analysis data; obtaining electronic bank website log data, customer register data and website structural data to get customer analysis data; outputting the obtained advertisement analysis data, website structural analysis data and customer analysis data. The invention applies statistical technique into new electronic bank field, which can quicken electronic bank construction and provides a method and a system for analyzing electronic bank customers' behaviors.

Owner:INDUSTRIAL AND COMMERCIAL BANK OF CHINA

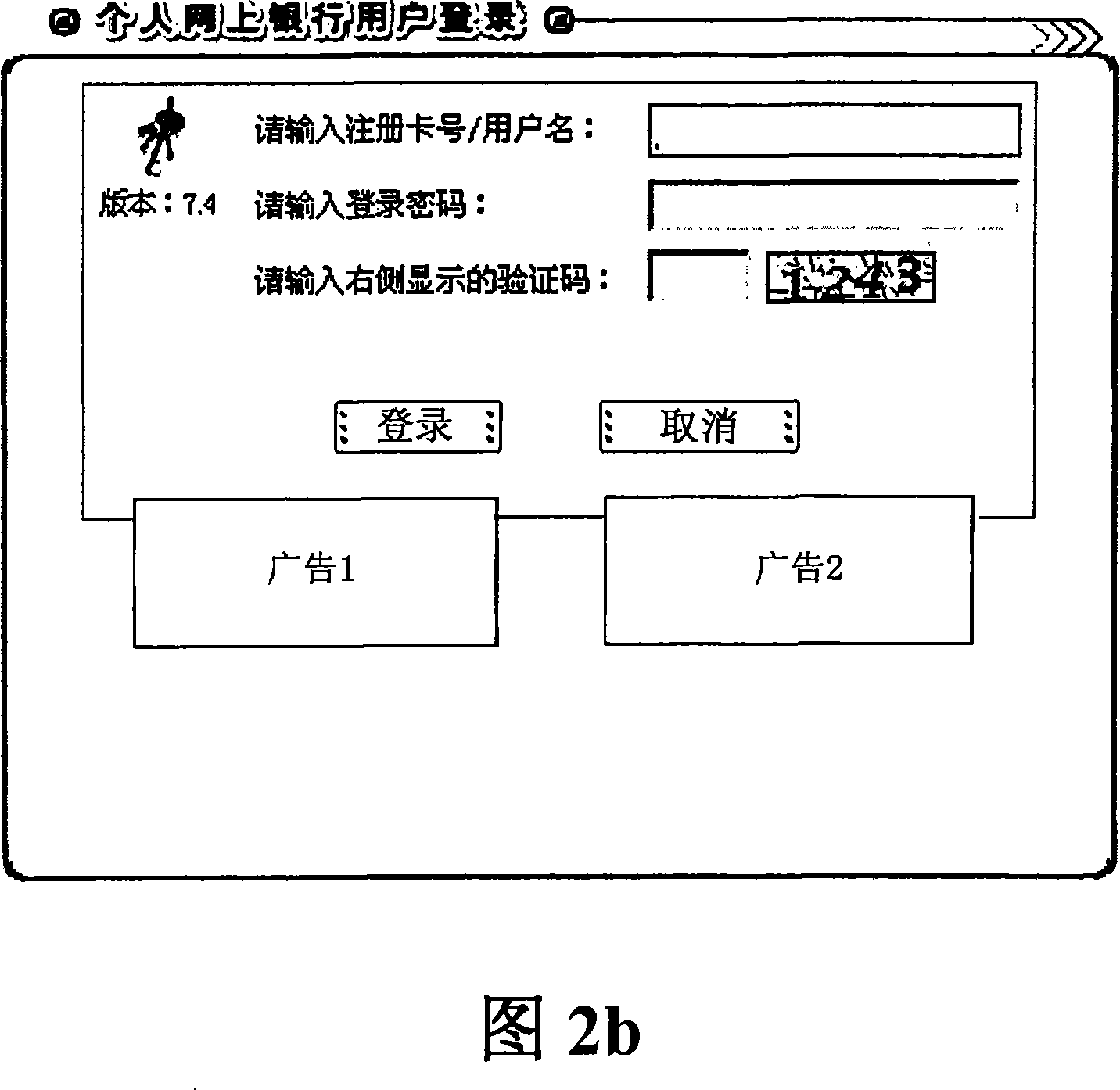

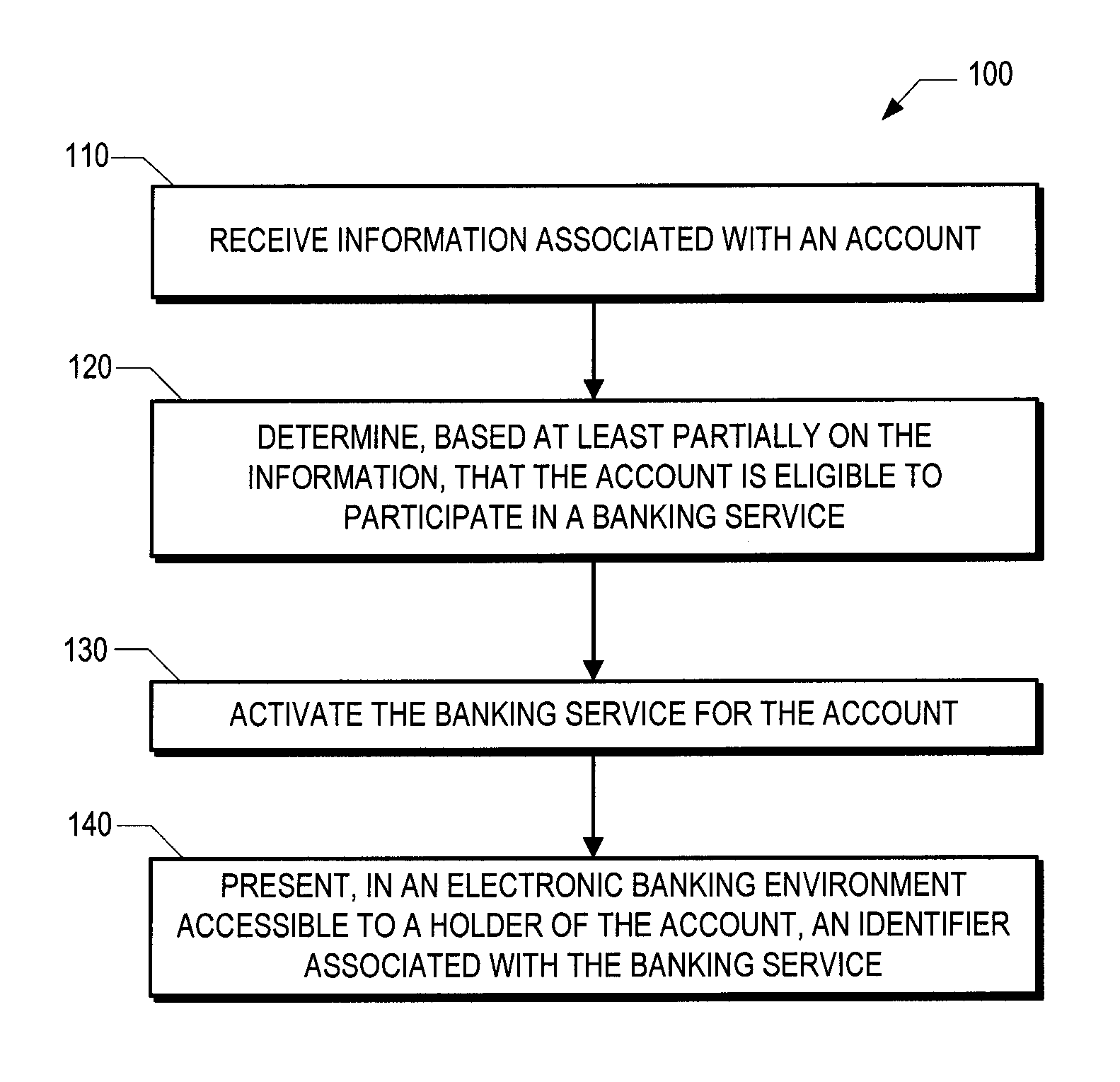

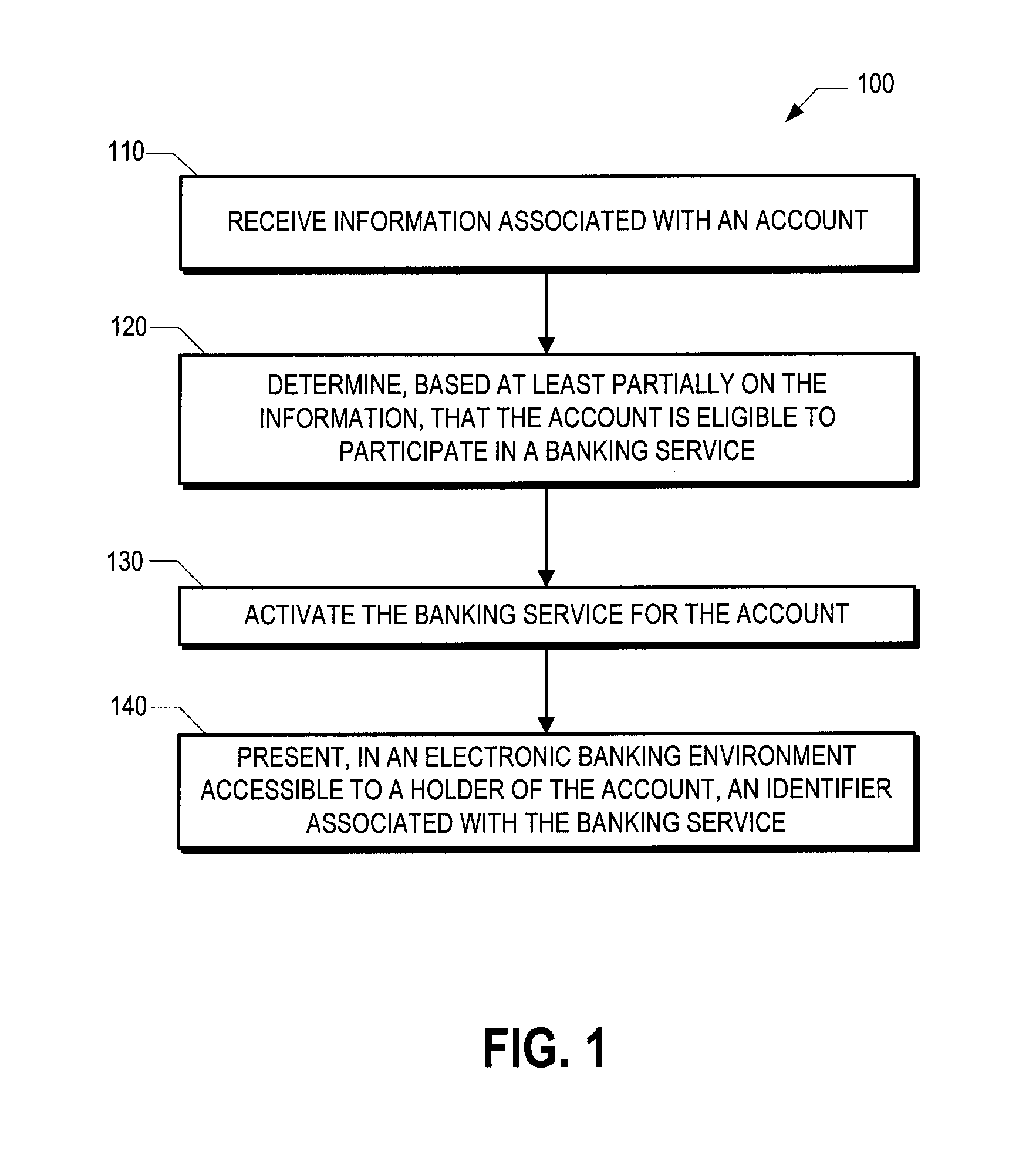

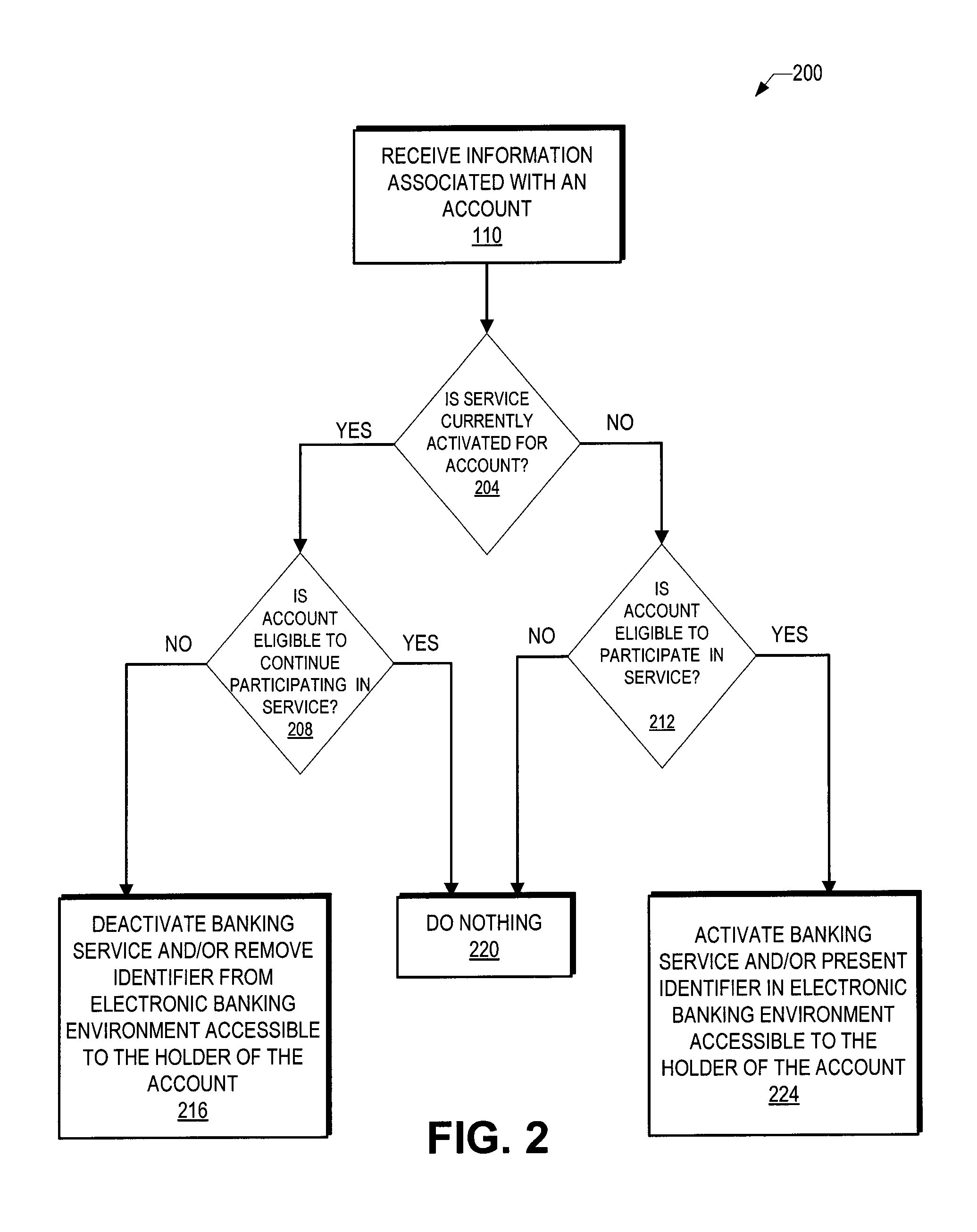

Dynamic pre-qualification

Embodiments of the invention are directed to systems, methods and computer program products for determining whether an account is eligible to participate in a banking service. In some embodiments, a method includes: (a) receiving information associated with an account; (b) determining, based at least partially on the information, that the account is eligible to participate in a banking service; and (c) presenting, in an electronic banking environment accessible to a holder of the account, an identifier associated with the banking service, where the presenting is based at least partially on the determining that the account is eligible. In some embodiments, the method further includes activating the banking service for the account. In some embodiments, the identifier is embodied as an input feature that enables the holder to enroll in the banking service. In other embodiments, the identifier is embodied as an input feature that enables the holder to use the banking service.

Owner:BANK OF AMERICA CORP

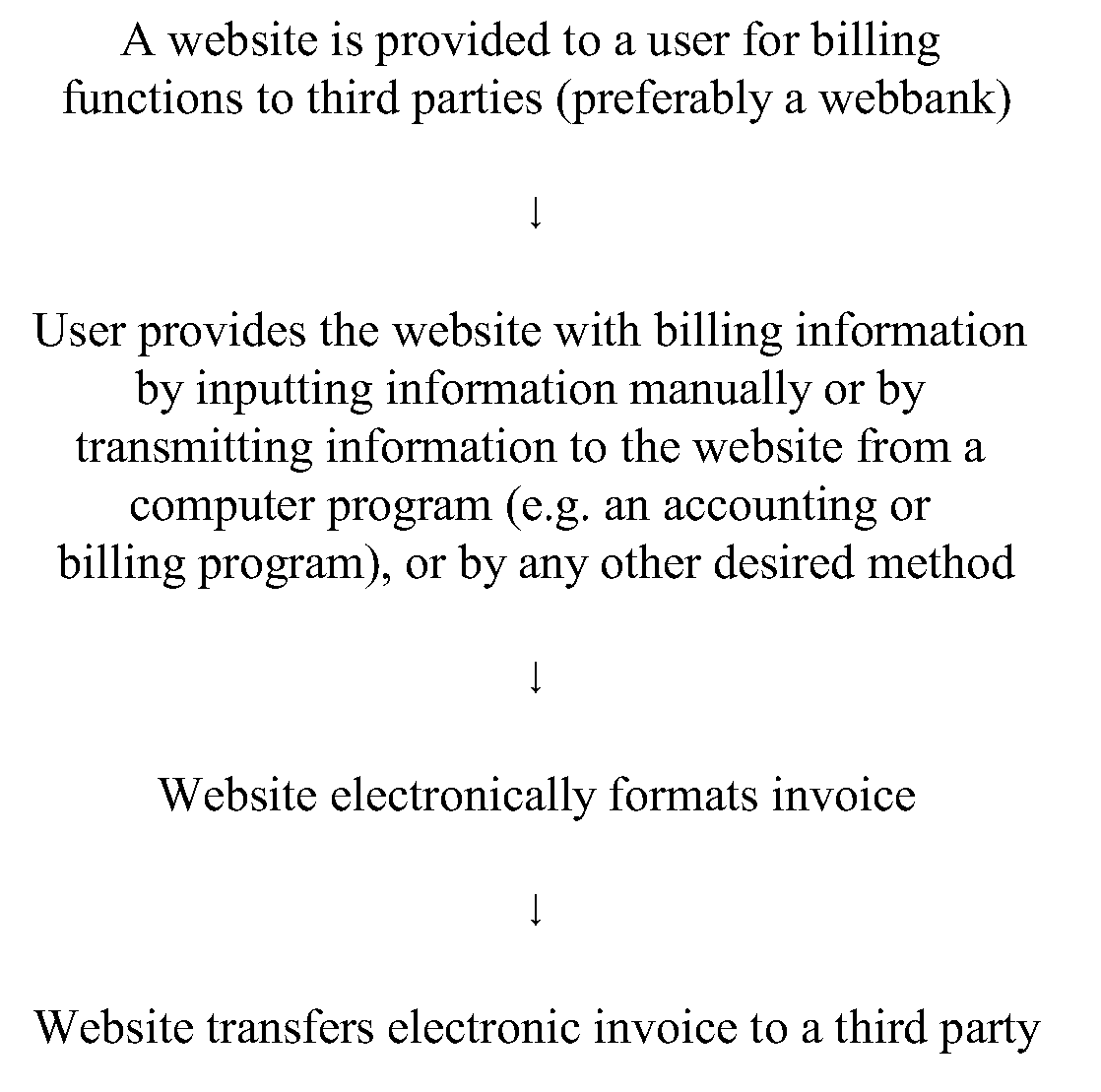

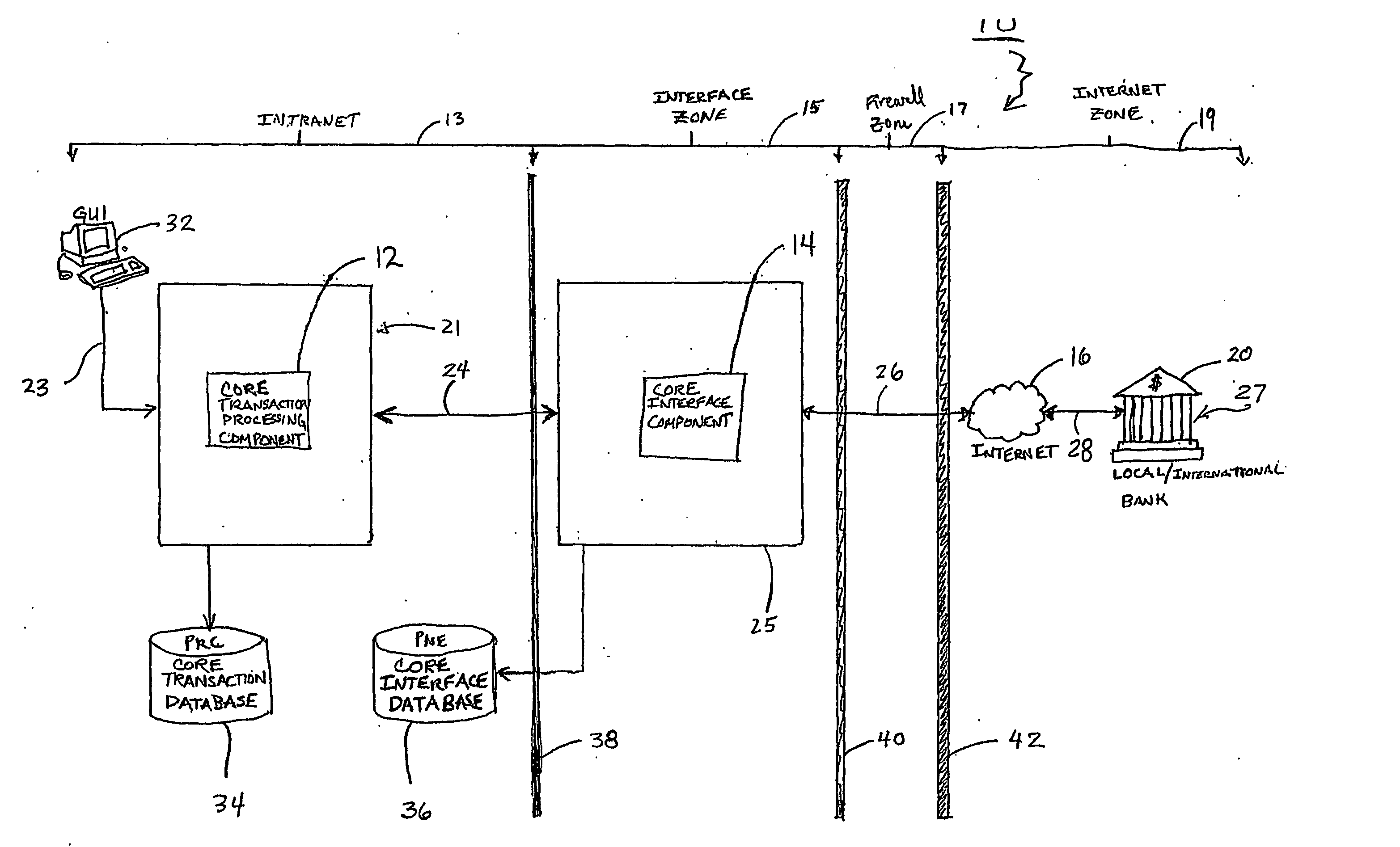

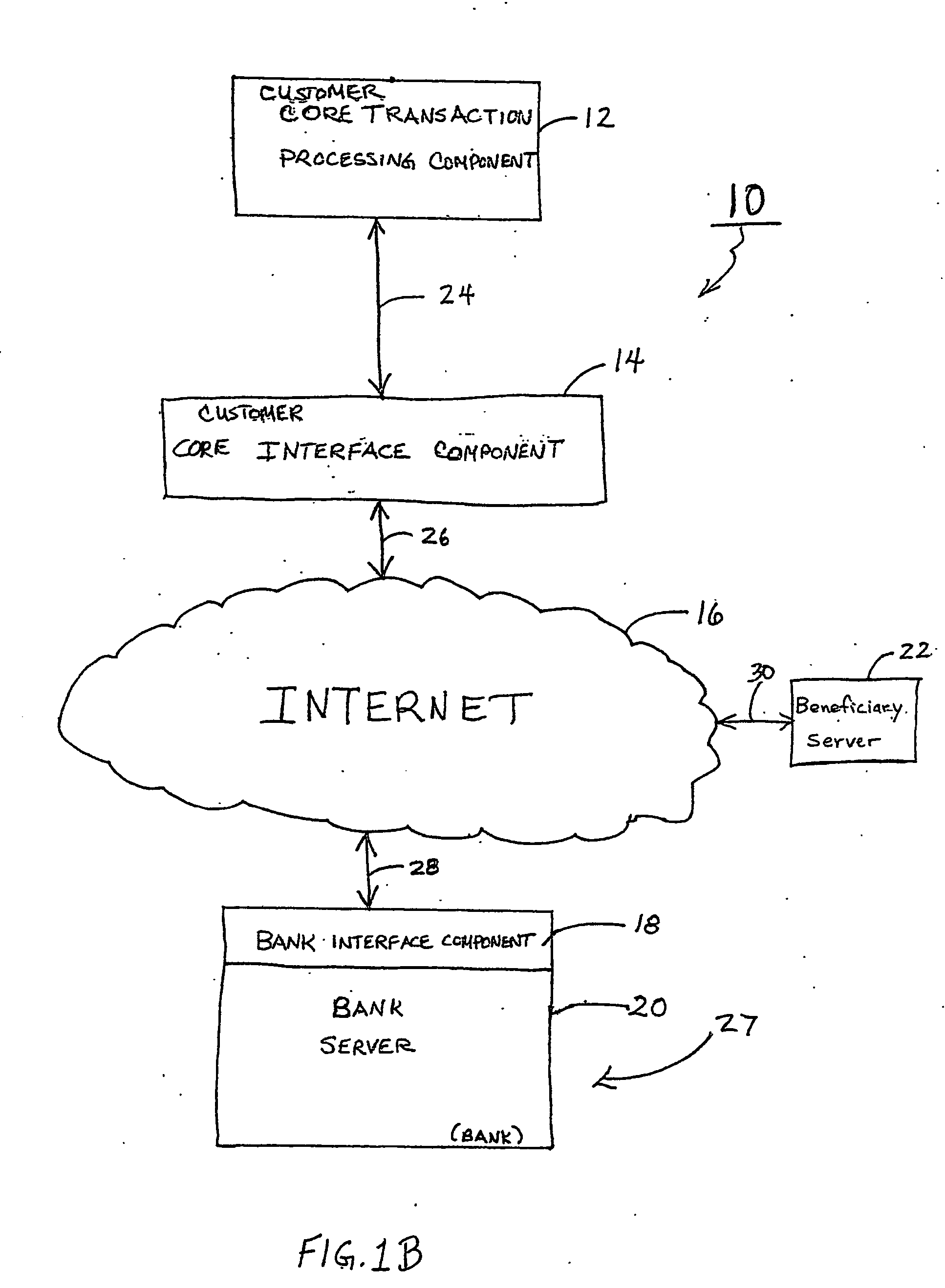

Electronic banking system

InactiveUS20060112011A1Efficient interfaceEasy to adaptFinancePayment circuitsPayment transactionComputer science

An automated electronic banking system for initiating and automatically processing monetary transactions, includes initiating means for maintaining a transaction record and permitting a remotely located customer of a bank to selectively initiate a monetary transaction request for automated processing, a bank host server adapted for automatically receiving and processing the monetary transaction request, a computer network in data communication between the bank host server means and the initiating means, for transmitting the payment transaction request from the customer's initiating means to the to bank host server, and interface means located between the initiating means and the computer network for automatically interfacing the initiating means to the bank host server, and for converting the monetary transaction request into a readable form compatible with the bank host server, wherein the customer's initiating means periodically receives in response from the bank host server confirmation data for permitting the initiating means to automatically reconcile the transaction record on a daily basis. The present invention is further directed to a method for an automatic electronic banking system for permitting a customer of a bank to remotely authorize and request a computerized monetary transaction to be made by their bank.

Owner:SAUDI ARABIAN OIL CO

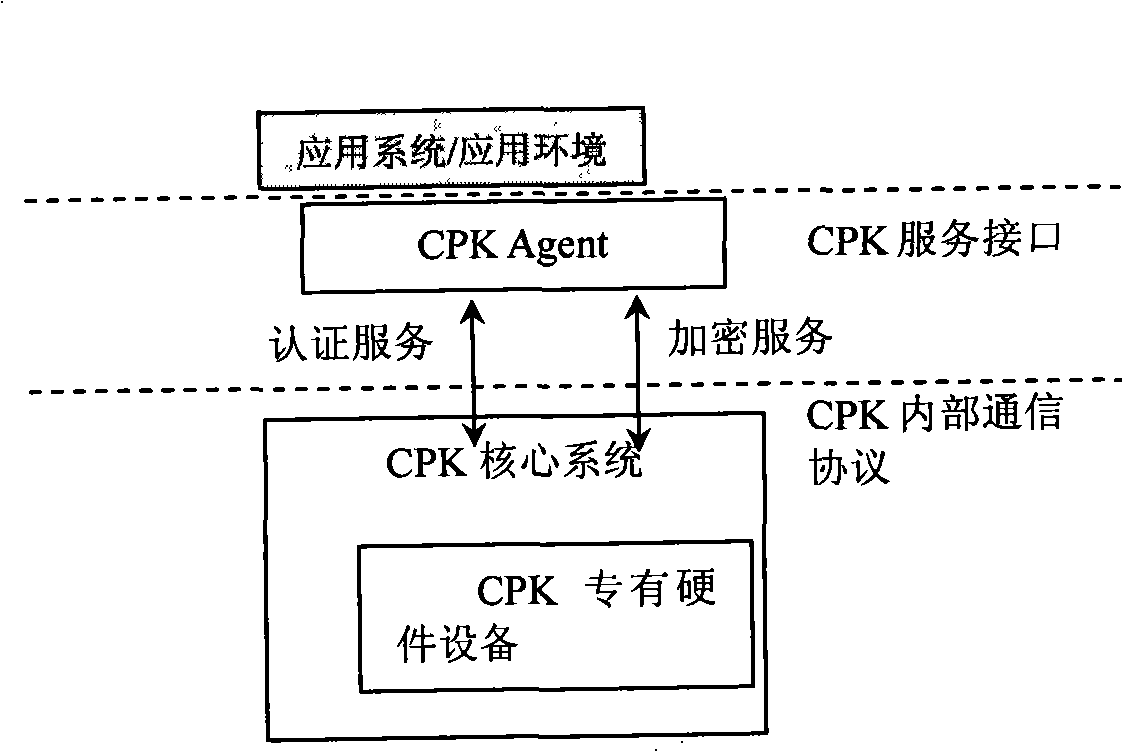

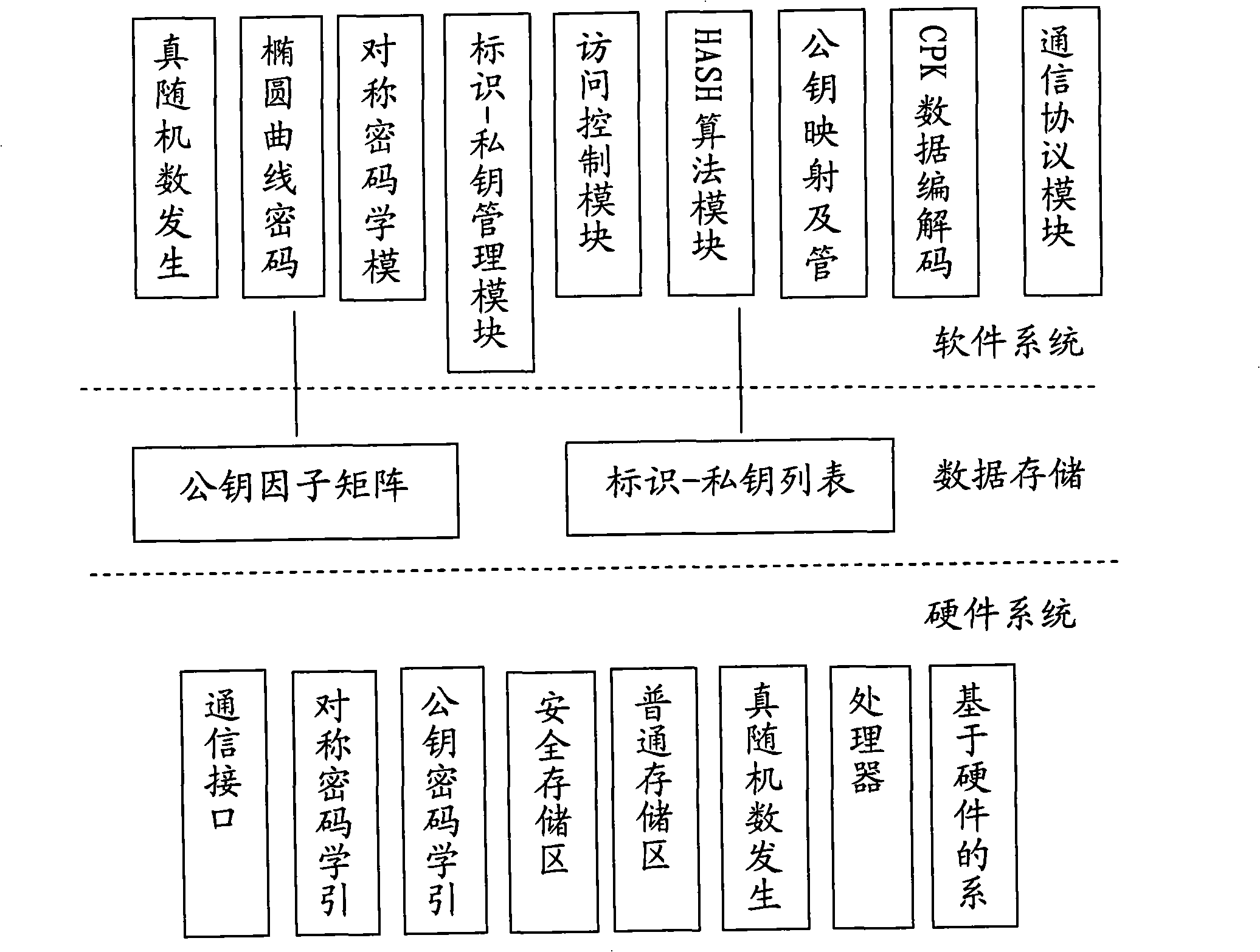

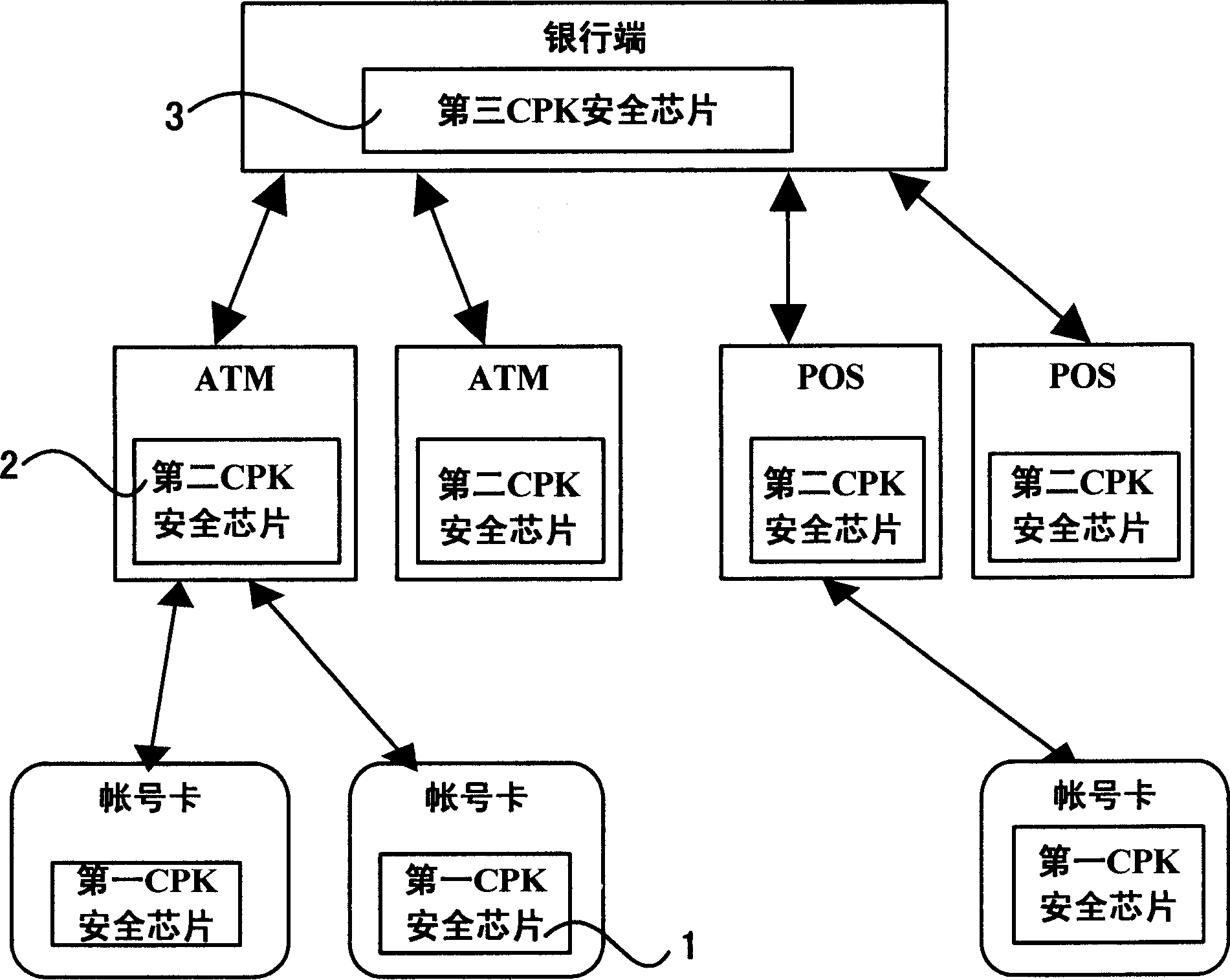

Electronic bank safety authorization system and method based on CPK

A safety certification system of electronic bank based on CPK comprises an account number card with the first CPK safety chip for obtaining system completeness code through transaction data and for using private key to make signature, client end with the second CPK safety chip for obtaining client end transaction data and system completeness code as well as signature and for generating random number to encipher data then to encipher random number, bank end with the third CPK safety chip for deciphering data from client end and for verifying signature and completeness code.

Owner:BEIJING E HENXEN AUTHENTICATION TECH

Electronic Commerce Systems

InactiveUS20150058214A1Quickly create programmable credit Cards™FinancePayment architectureE-commerceFinancial transaction

A system for electronic commerce including electronic banking tools, products and services. The system includes customizable banking products and cards, and methods and systems for conducting financial transactions and maintaining records over the Internet.

Owner:COHEN MORRIS E

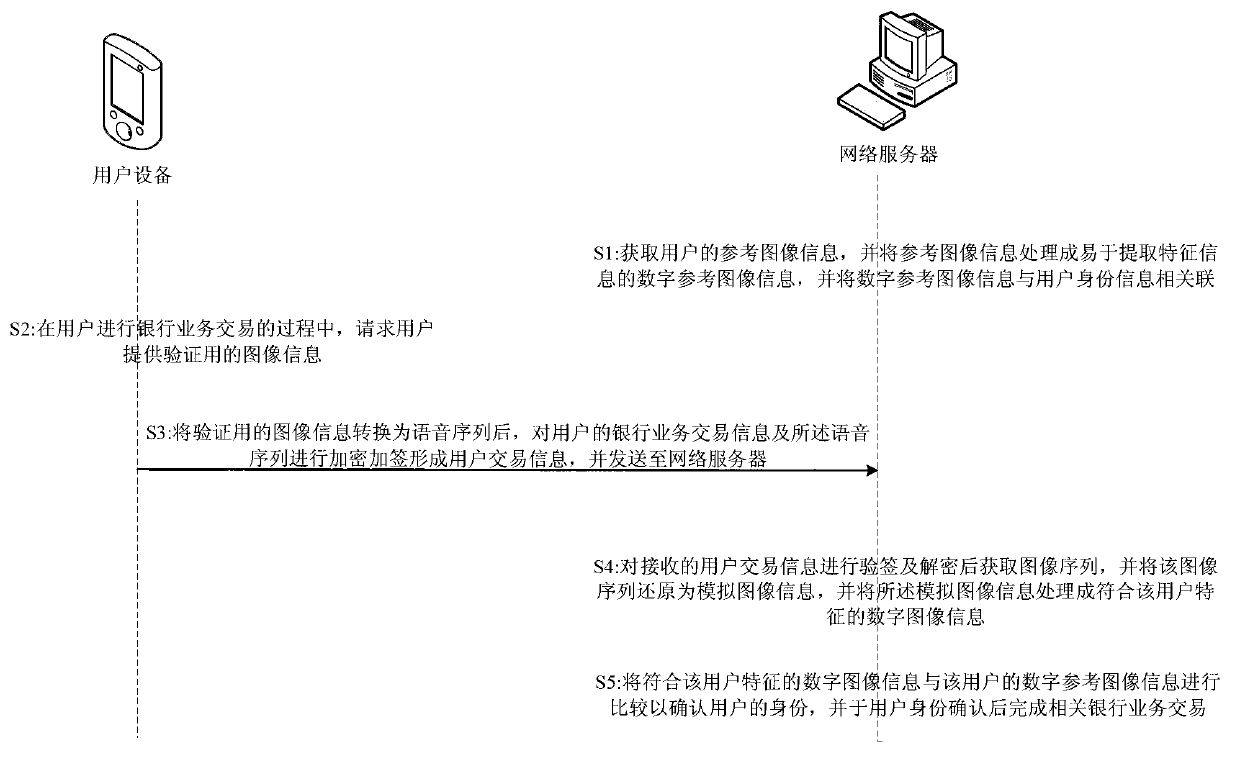

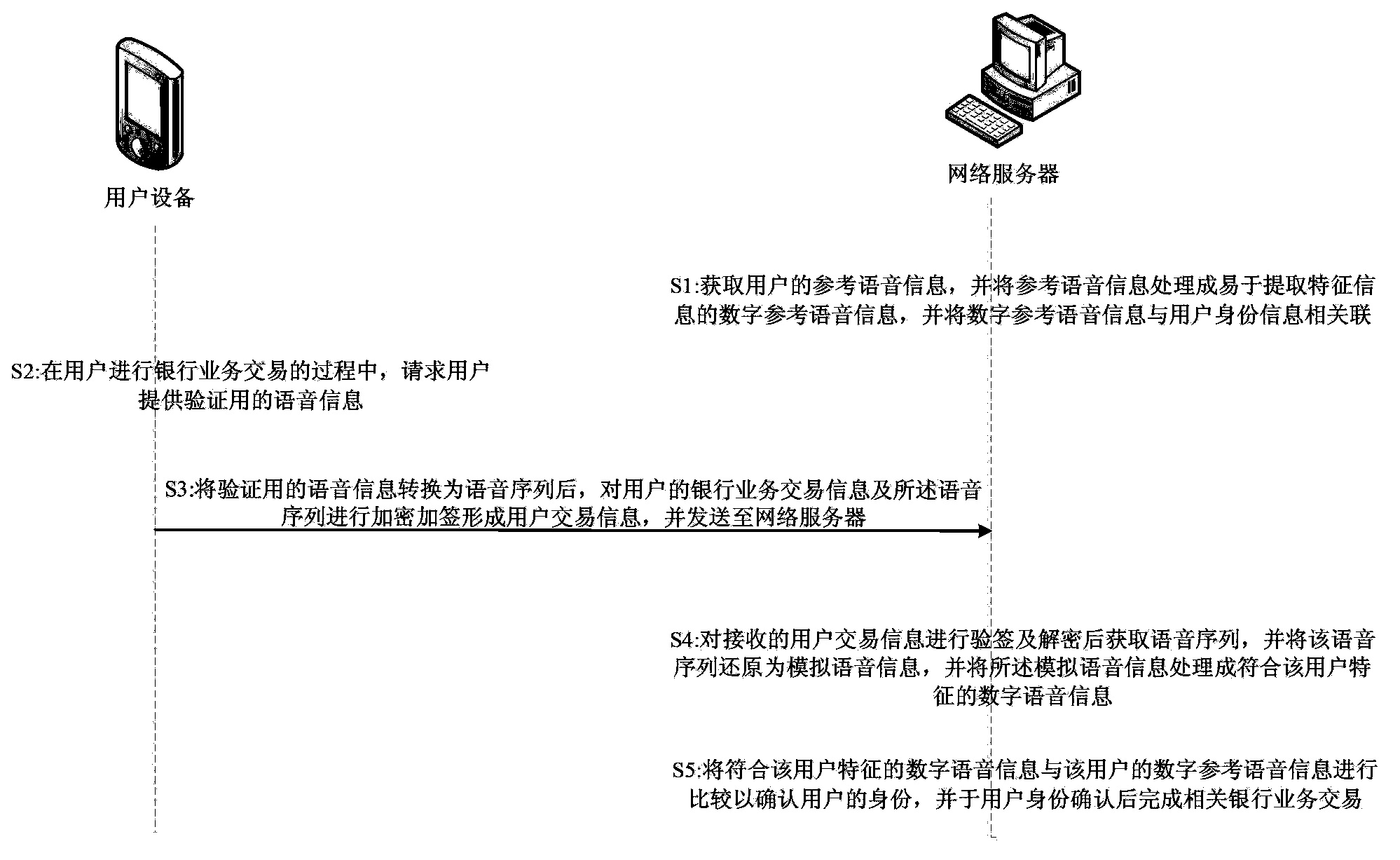

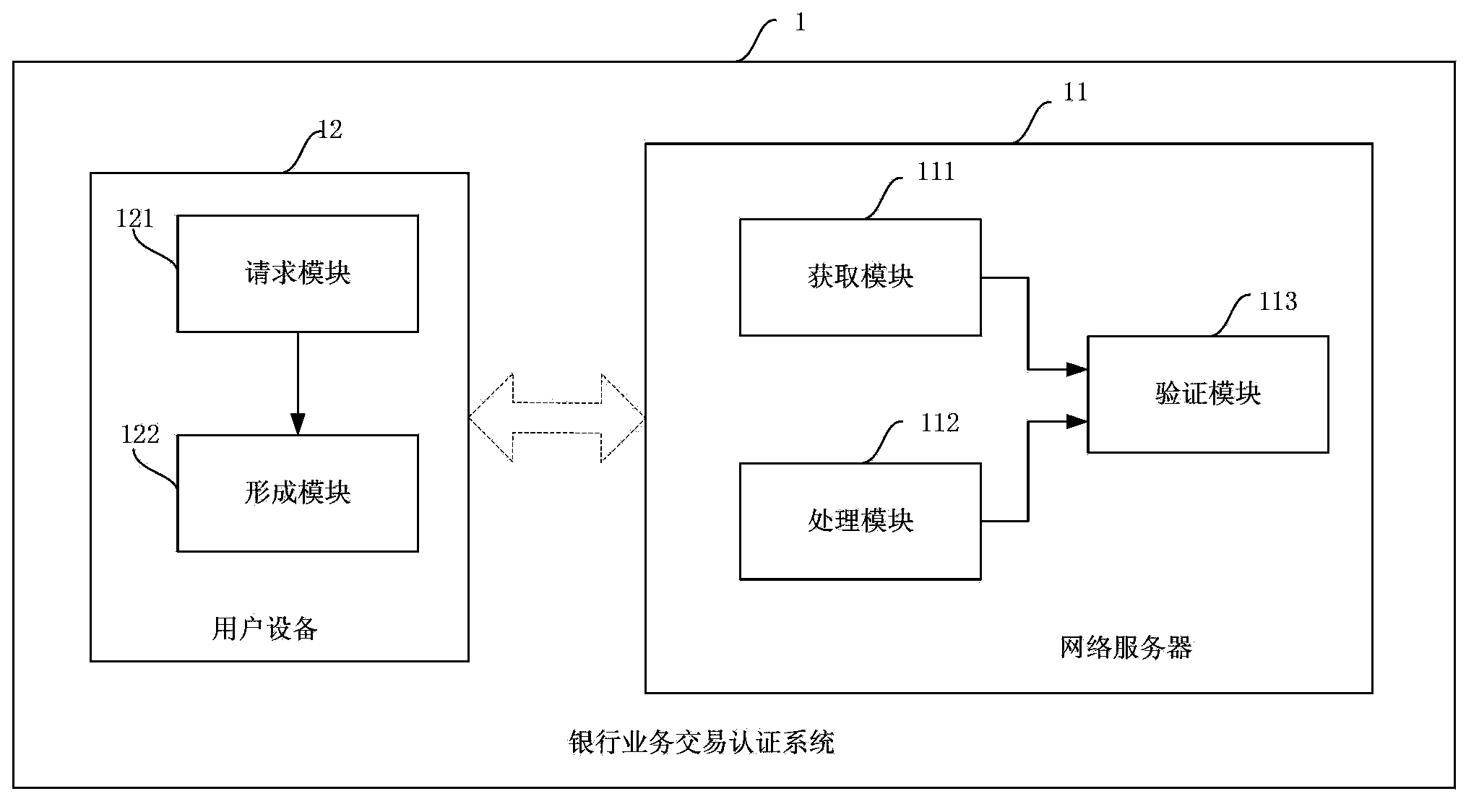

Banking transaction authentication method and system based on image authentication

InactiveCN103345703AFill in the security holesDouble guaranteeFinanceTransmissionNetwork serviceUser equipment

The invention provides a banking transaction authentication method and system based on image authentication. According to the banking transaction authentication method, a network server obtains reference image information of a user and processes the reference image information to be digital reference image information, wherein feature information of the digital reference image information can be extracted easily; in the process of banking transaction conducted by a user, user equipment requests the user to provide image information for authentication, the image information for authentication is converted to an image sequence, encryption and endorsement are conducted on banking transaction information and the image sequence, and user transaction information is formed; the network server conducts attestation and decoding on the received user transaction information and obtains the image sequence, the image sequence is restored to be analog image information, the analog image information is processed to be digital image information confirming to characteristics of the user, the digital image information is compared with the digital reference image information of the user to enable the identity of the user is confirmed, therefore, security vulnerabilities existing in electronic banking are plugged, and transaction security is improved.

Owner:上海方付通科技服务股份有限公司

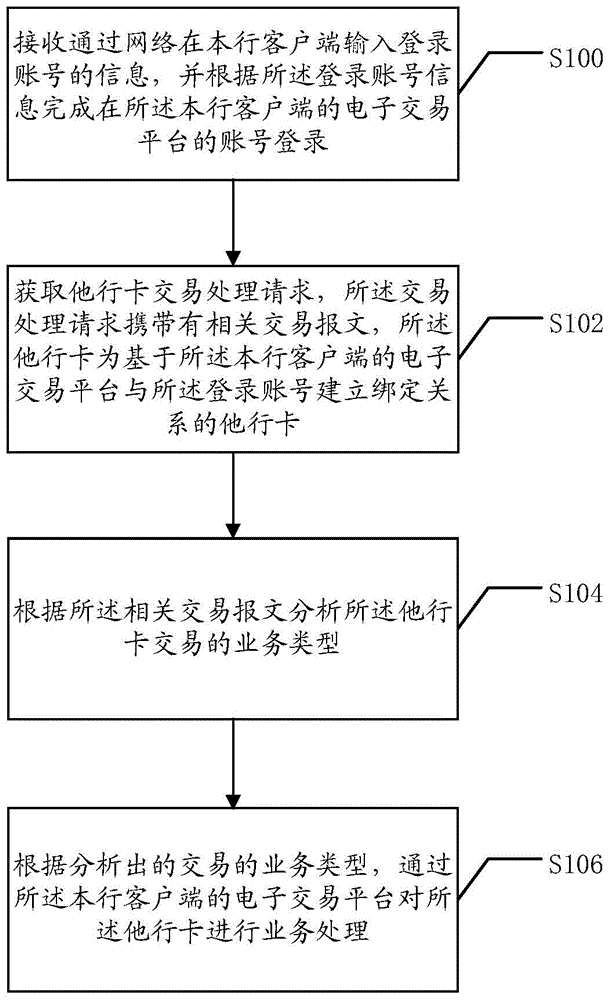

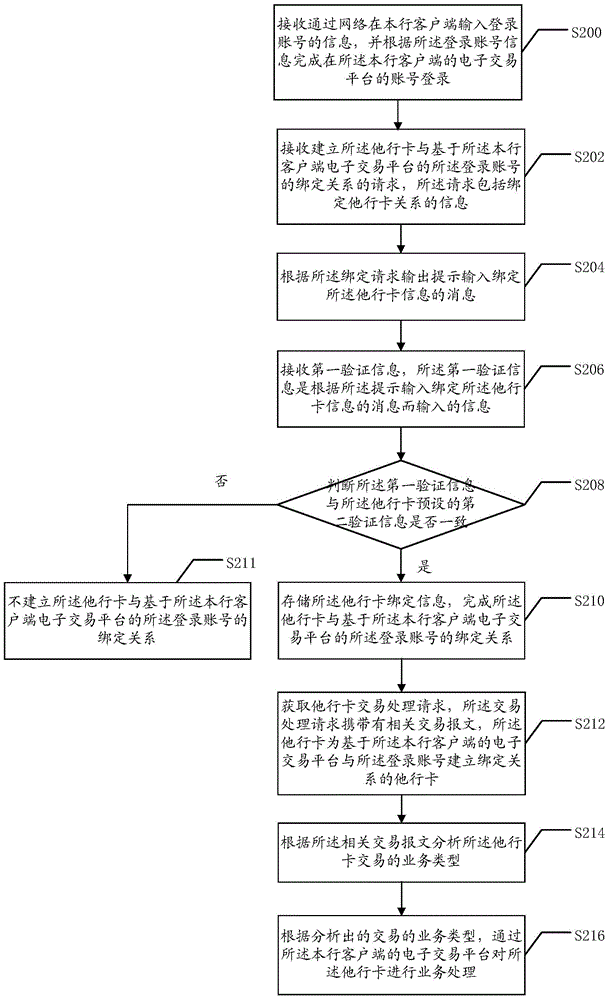

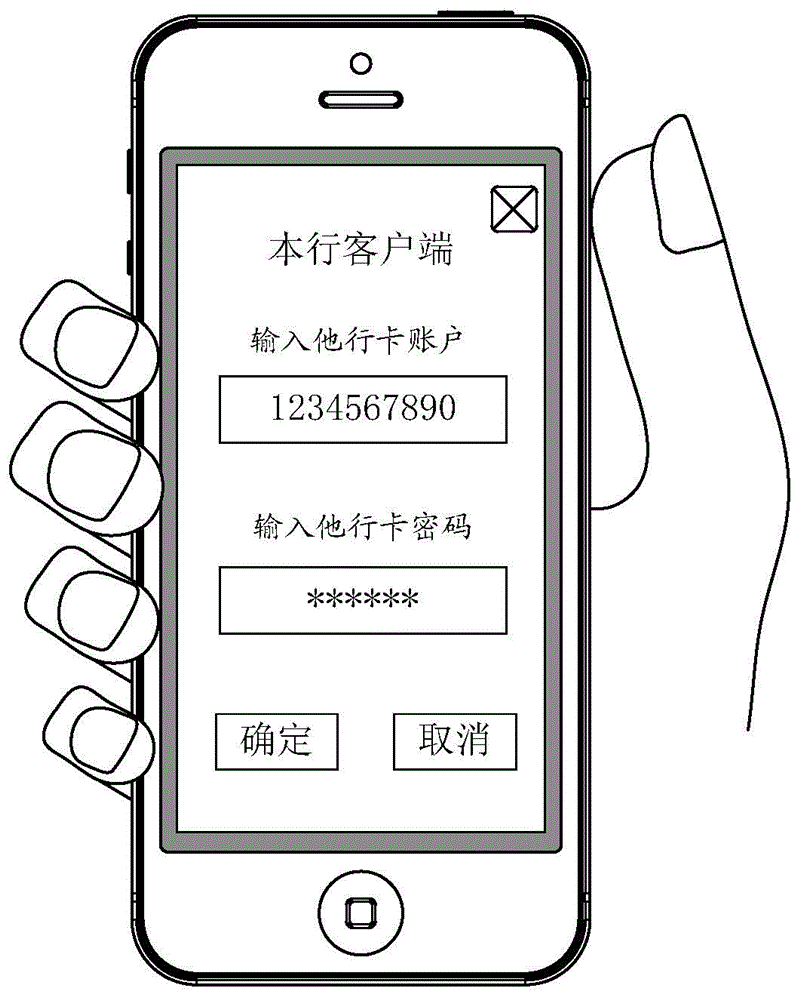

Method and system for electronic banking transactions of other bank cards

InactiveCN104408611ARealize business processingFunction increaseFinancePayment architecturePasswordFinancial transaction

The embodiments of the invention disclose a method for electronic banking transactions of other bank cards. The method comprises the following steps: receiving registration account number information input at local bank clients through networks, and according to the registration account number information, finishing account registration at the electronic transaction platforms of the local bank clients; obtaining transaction processing requests of other bank cards, wherein the transaction processing requests carry correlation transaction packets, and other bank cards are other bank cards which establish binding relations with registration account numbers on the basis of the electronic transaction platforms of the local bank clients; according to the correlation transaction packets, analyzing service types of the transactions of other bank cards; and according to the analyzed service types of the transactions, performing service processing on other bank cards through the electronic transaction platforms of the local bank clients. By using the method and system provided by the invention, the function of processing services of other bank cards through a local bank electronic channel type transaction system is realized, and the trouble generated when users hold and keep safety shields of multiple banks and memorize user names and passwords of multiple E-banks or mobile phone banks is reduced.

Owner:CHINA CONSTRUCTION BANK

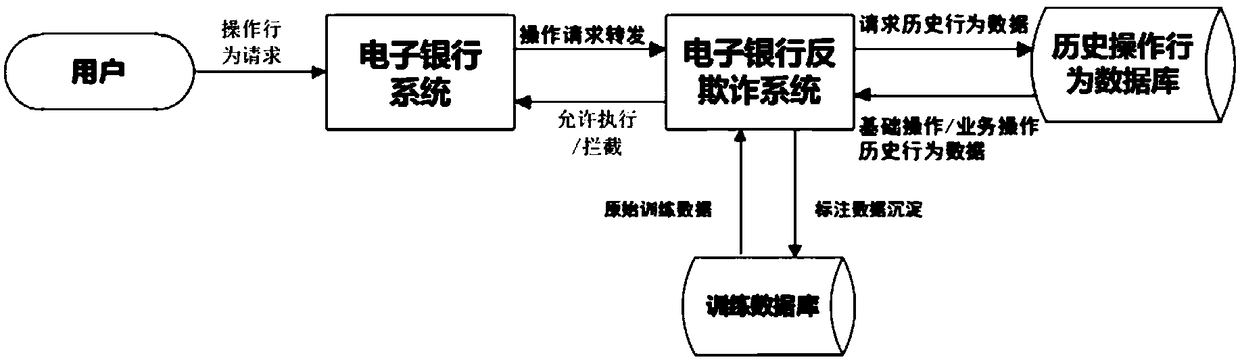

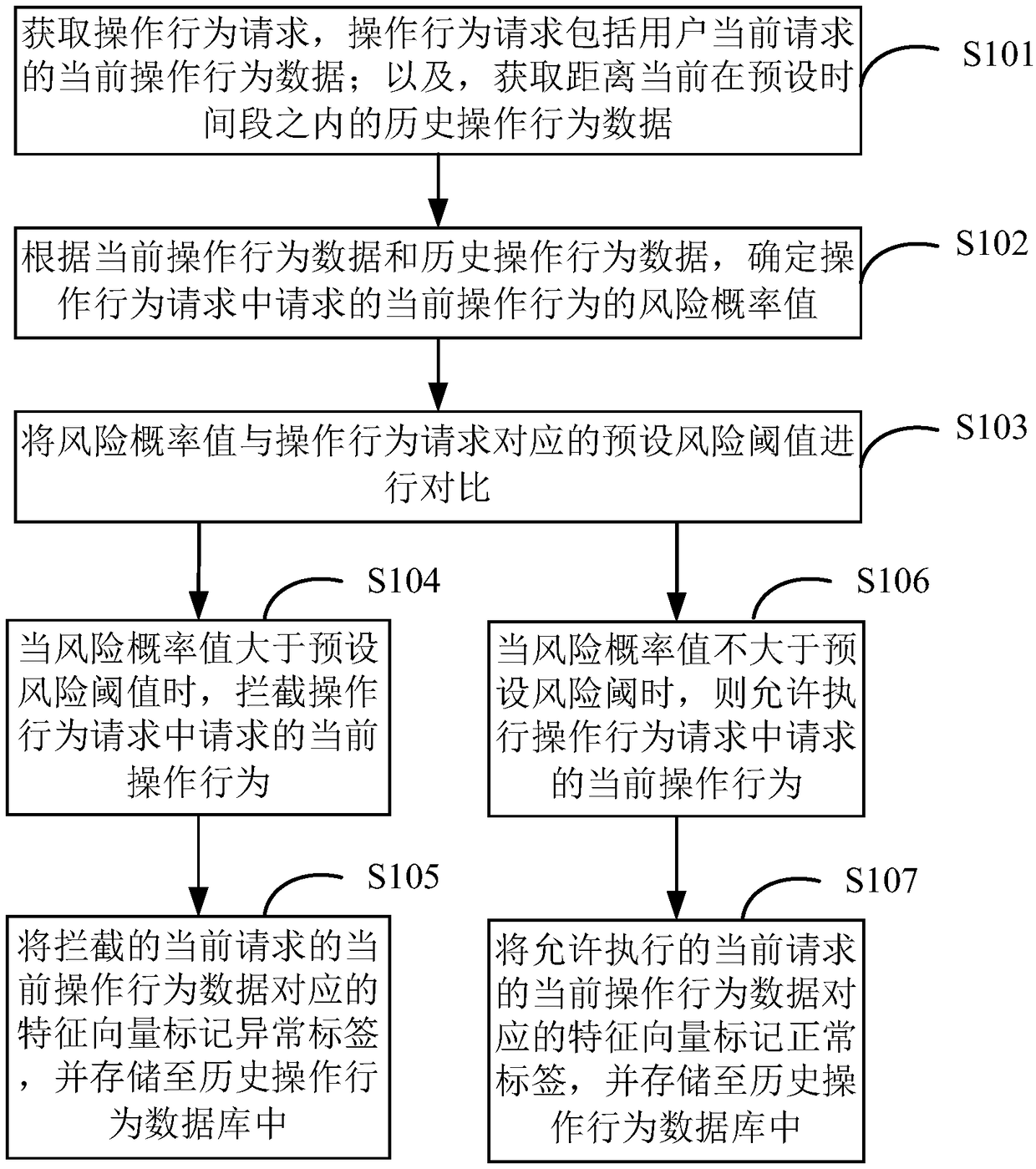

Electronic banking anti-fraud method and device

InactiveCN109191136AEnsure safetyImprove accuracyProtocol authorisationElectronic bankingIndustrial engineering

The present application provides an electronic banking anti-fraud method, which comprises the following steps: obtaining an operation behavior request, the operation behavior request including the current operation behavior data currently requested by a user; and acquiring historical operation behavior data that is currently within a preset time period; determining a risk probability value of thecurrent operation behavior requested in the operation behavior request according to the current operation behavior data and the historical operation behavior data; comparing the risk probability valuewith the preset risk threshold value corresponding to the operation behavior request; When the risk probability value is greater than the preset risk threshold, the current operation behavior requested in the operation behavior request is intercepted. The present application combines the current operation behavior data and the historical operation behavior data to judge whether the current operation behavior requested in the user operation behavior request is normal or not, so as to improve the accuracy of judging whether the user operation behavior is normal or not, and ensure the account safety of the user.

Owner:BEIJING TRUSFORT TECH CO LTD

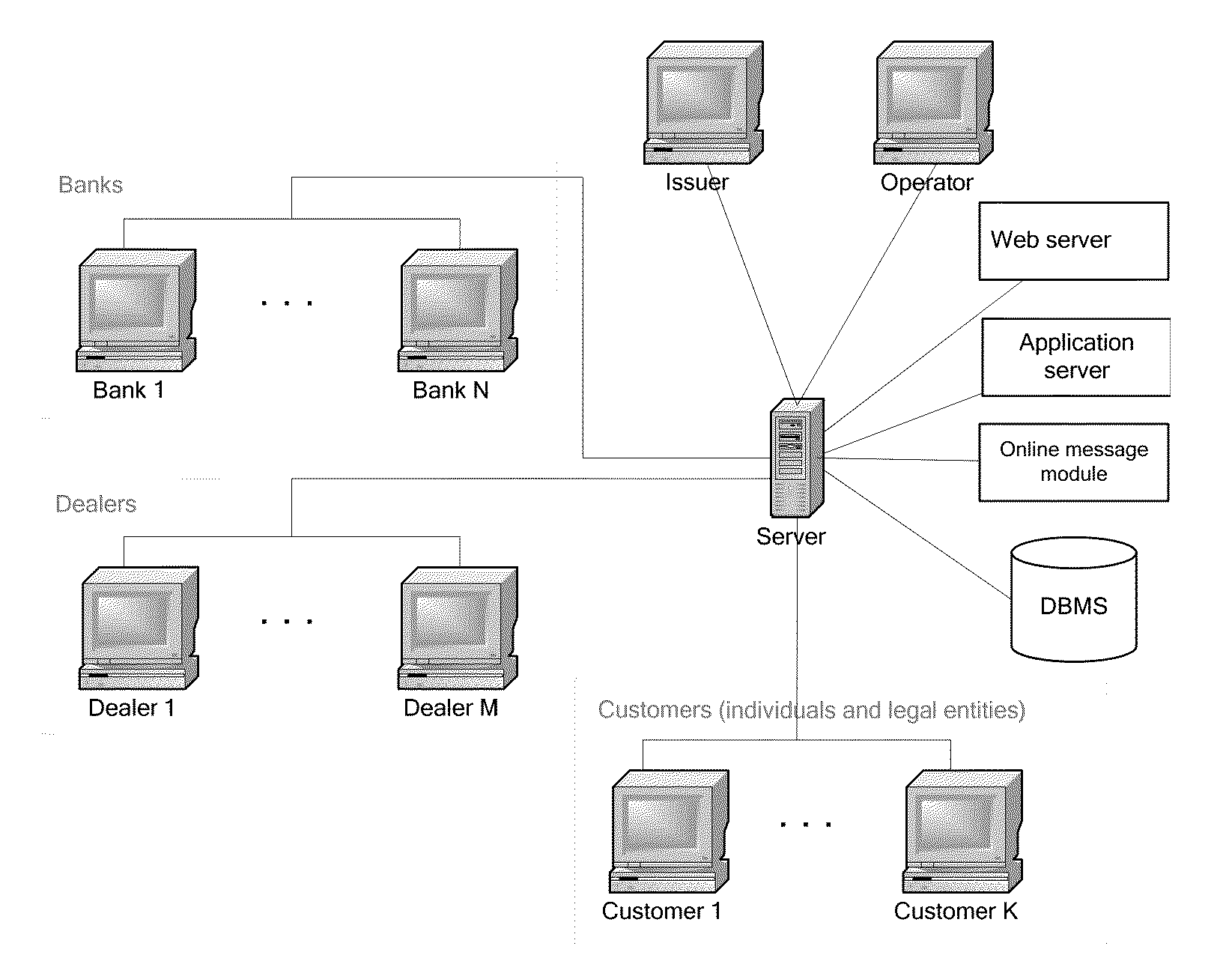

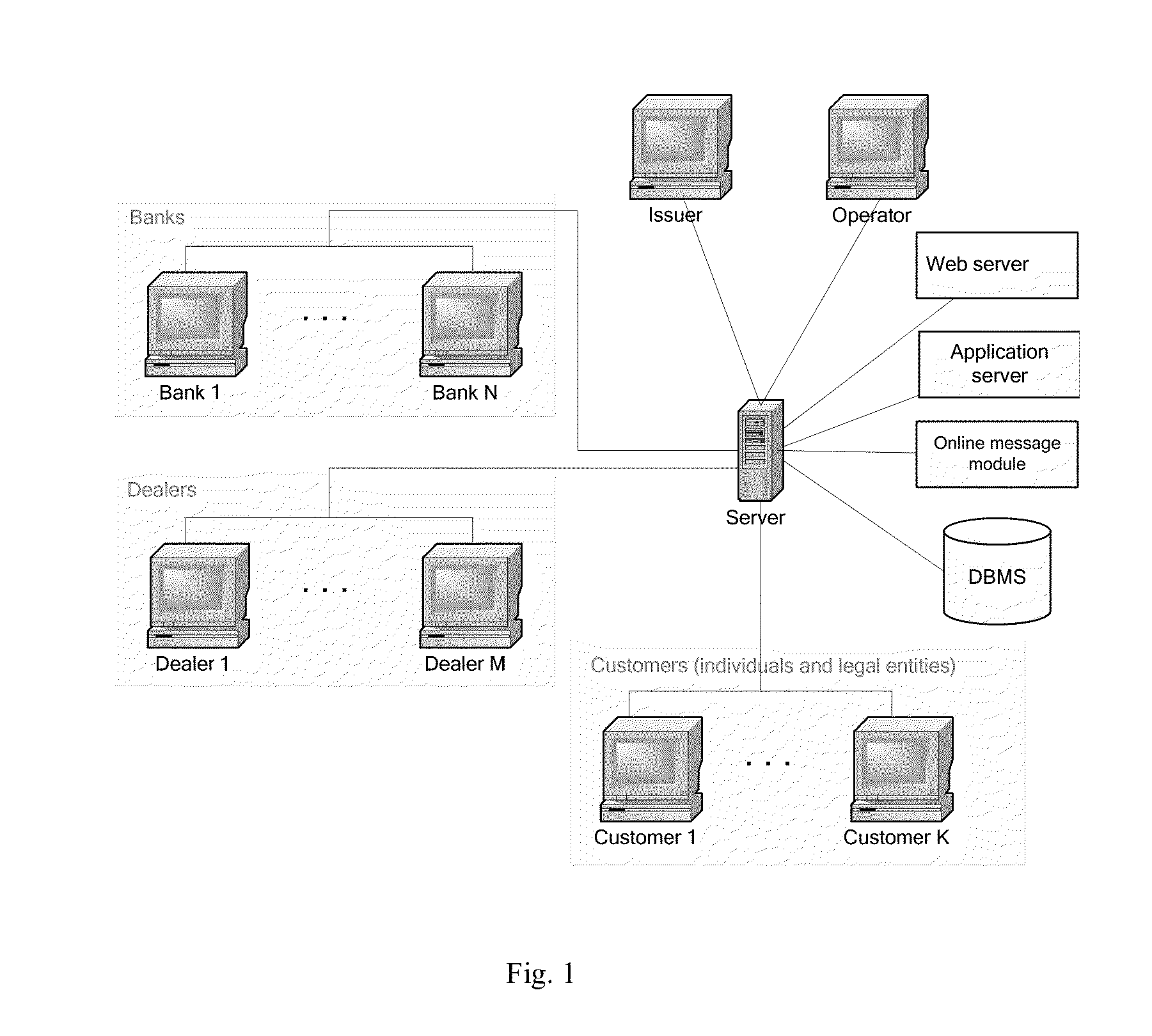

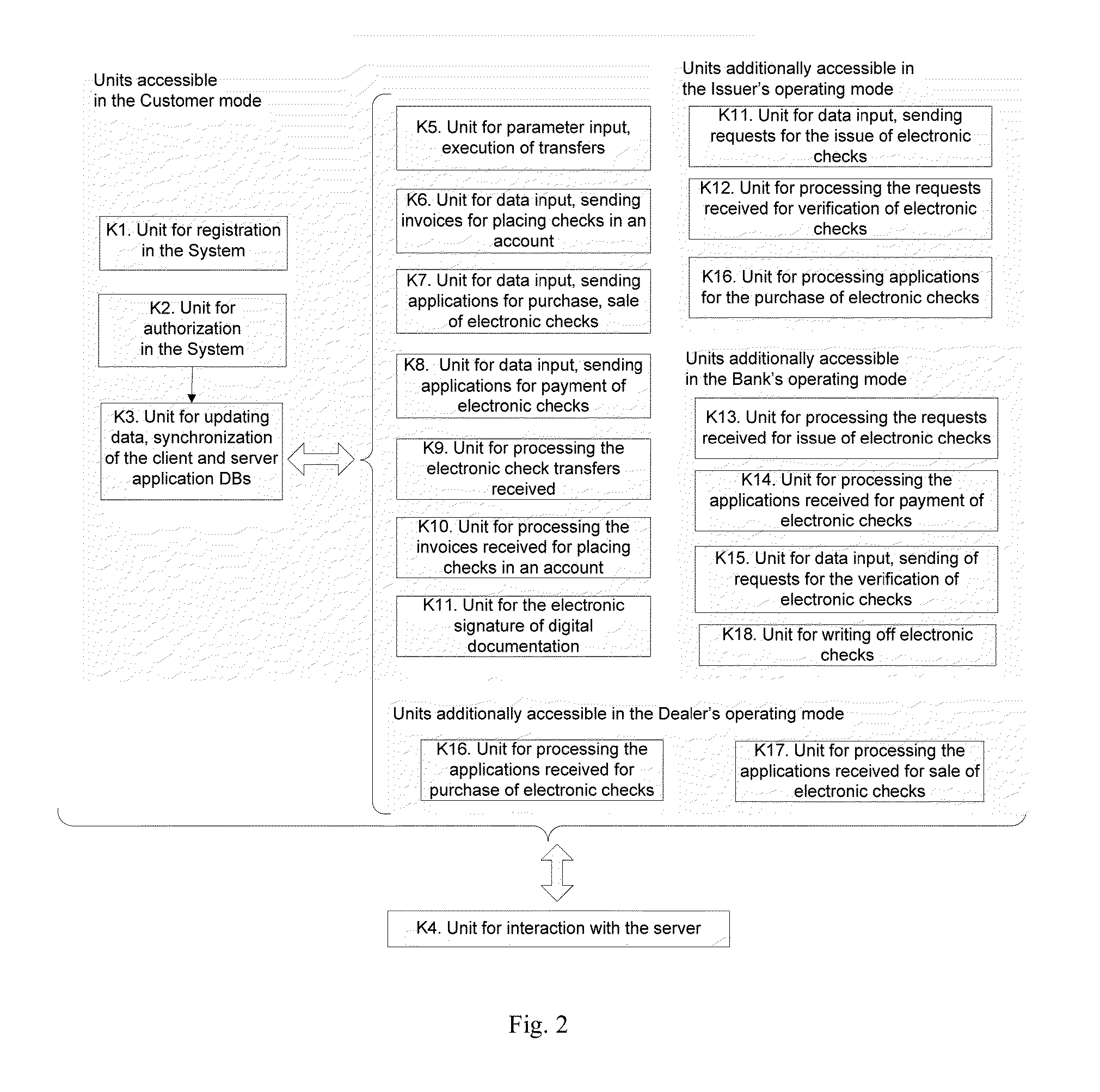

Electronic check-based payment system and methods for issuing, transferring, paying and verifying electronic checks

The invention relates to the sphere of information technologies, in particular, to electronic systems and monetary-fund circulation methods and can be used for solving problems of mutual settlements between participants of the electronic payment system in real-time mode. In doing so, the analogue of monetary funds in the invention presented are electronic bank bearer checks complying with bank regulations and the requirements of applicable legislation. The client application units are rendered as grouped into modules by categories corresponding to the user status determined by the unit of authorization of the client and server applications, with provision of the possibility of pre-setting a group of check circulation parameters for each category. The issue of checks is accompanied by the creation of legally-valid documents and reflection of transactions in the check register.

Owner:MY PARTNERS & GLOBAL STARS INVESTMENTS MP&GSI

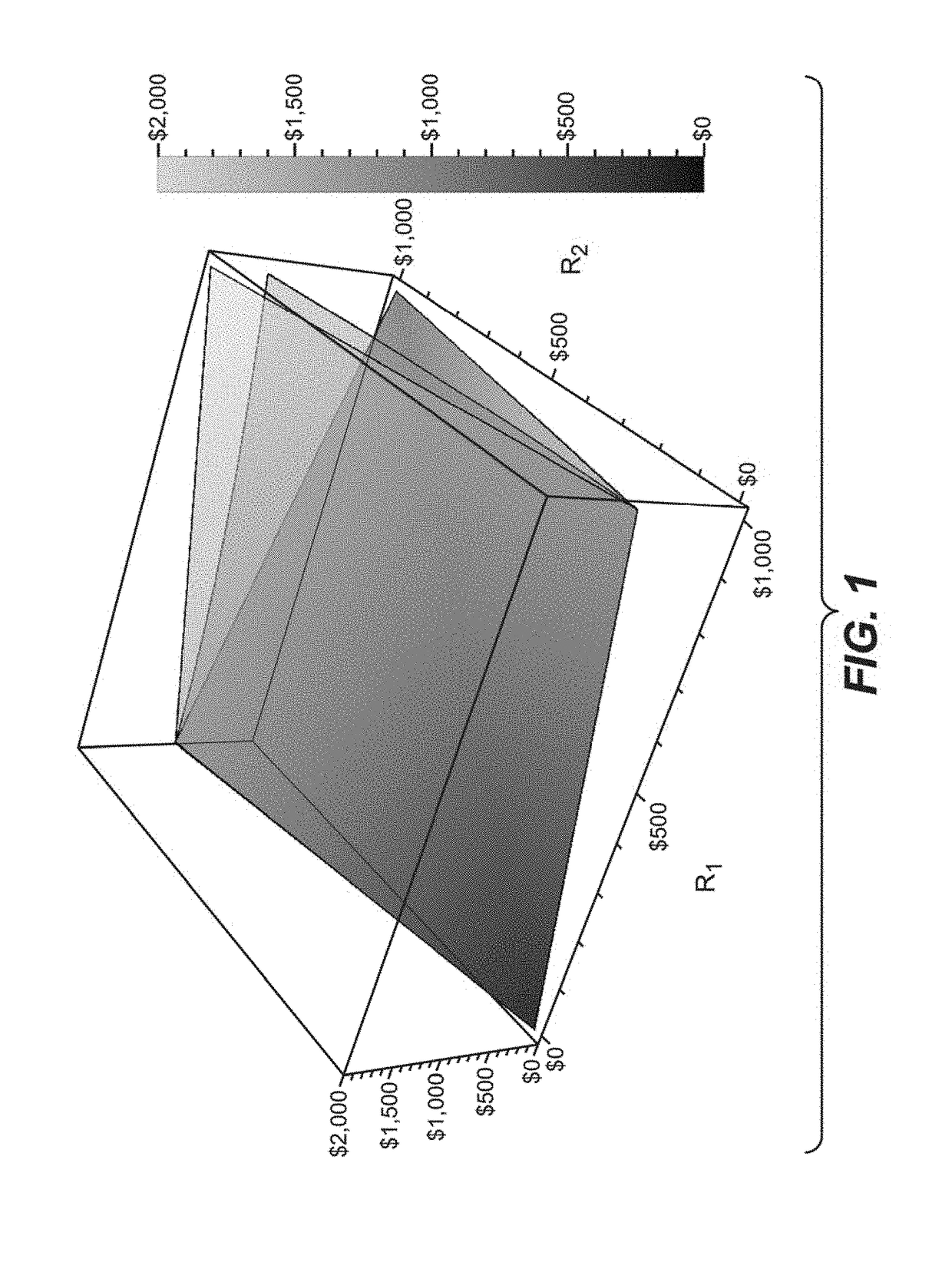

Risk-link authentication for optimizing decisions of multi-factor authentications

A system for evaluating risk in an electronic banking transaction by estimating an aggregated risk value from a set of risk factors that are either dependent or independent of each other, comprising: user input means for enabling an end user to provide authentication information related to a desired electronic banking transaction; financial institution authentication means for authenticating that an end user is authorized to conduct the desired electronic transaction; risk computation means for imposing authentication requirements upon the end user in adaptation to a risk value of the desired banking electronic banking transaction; transaction session means for tracking an amount of time that the desired electronic banking transaction is taking; and financial institution transaction means for storing data related to the desired electronic banking transaction.

Owner:ALNAJEM ABDULLAH ABDULAZIZ I

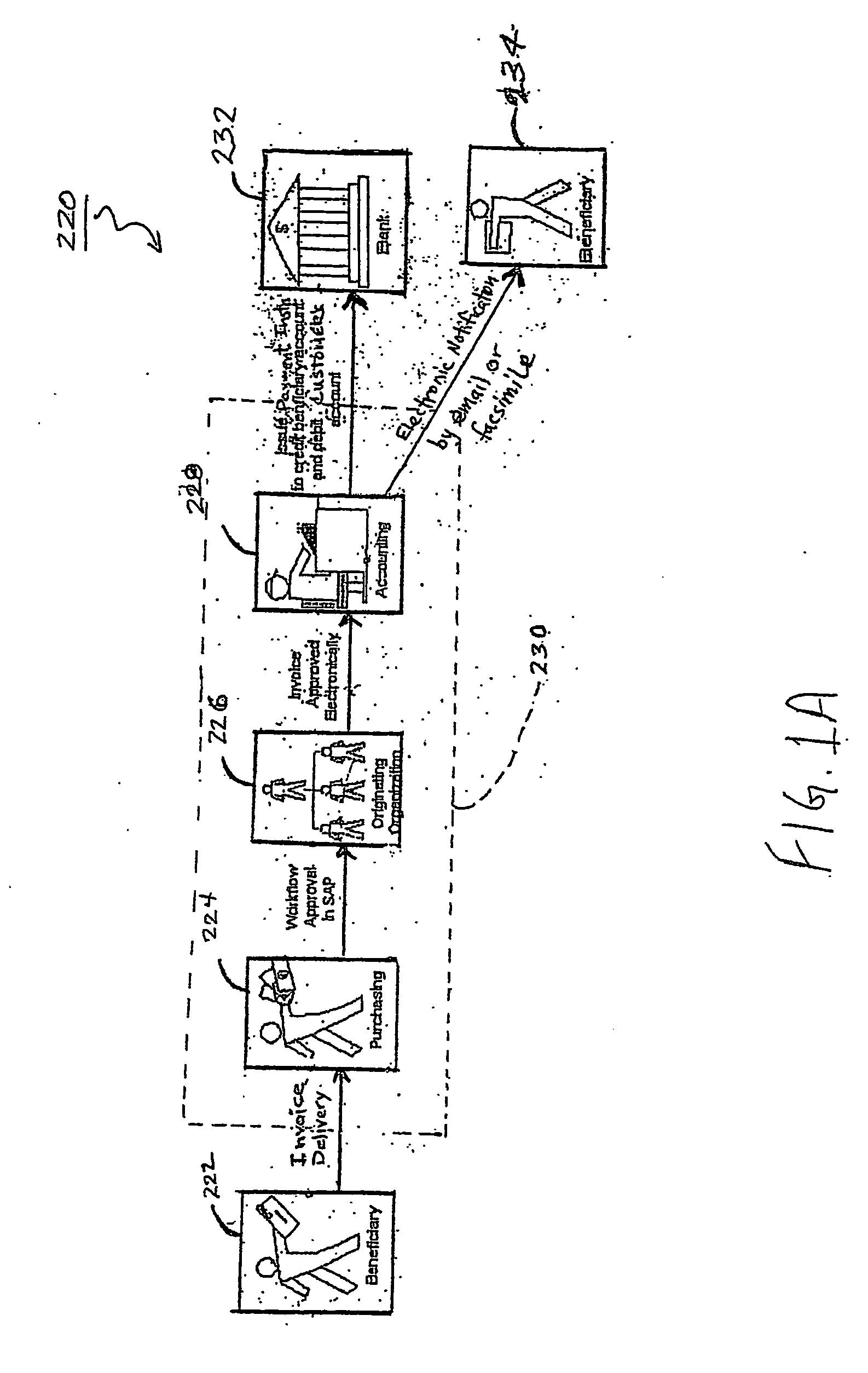

Methods and systems for carrying out contingency-dependent payments via secure electronic bank drafts supported by online letters of credit and/or online performance bonds

Methods of carrying out an electronic transaction that includes payment via a secure electronic draft, include steps of establishing a secure computer site that includes a representation of the draft, the site being controlled by a financial service provider and accessible only to authenticated parties to the transaction; creating a first online letter of credit linked to a drawer of the draft and including predetermined terms, satisfaction of the terms being a precondition to the financial service provider extending credit to the drawer; authenticating each party to the draft requesting access to the draft represented at the computer site, and releasing payment on the draft to a drawee of the draft. At least a portion of the released payment may originate from the credit extended to the drawer. An online performance bond may define liquidated damages to be paid to a drawer upon non-performance of the drawee or to the drawee upon non-performance of the drawer. The payment may be released to the drawee of the draft when both drawer and drawee perform, or the liquidated damages may be paid to the drawer upon non-performance of the drawee or to the drawee upon non-performance of the drawer. The online letter of credit may be the basis for modeling all trade finance products, including various types of letters of credit, performance bonds and insurance in a variety of instances. iDraft™ contingencies plus terms and conditions may define all payment connected trade finance products. Individual products may be defined through proper configuration of the present iDraftC™ functionality and software.

Owner:ORACLE INT CORP

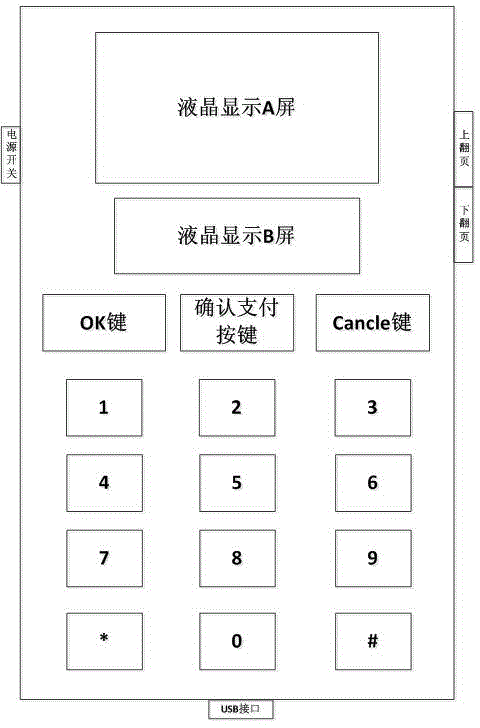

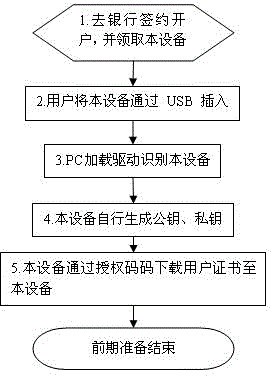

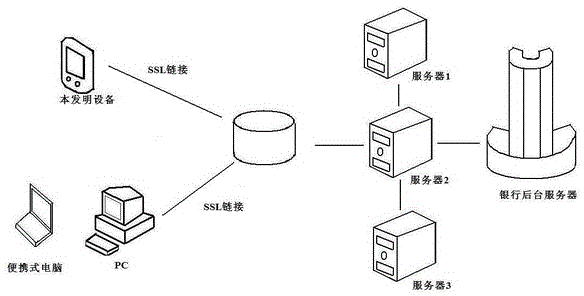

Authenticated encryption equipment and method with wireless communication function

ActiveCN103152180ASolve the inconvenienceRealize the transactionUser identity/authority verificationSecurity arrangementTerminal equipmentCommunication link

The invention relates to the technical field of identity authentication, and particularly relates to authenticated encryption equipment and method with a wireless communication function. According to the authenticated encryption equipment with the wireless communication function provided by the invention, various terminal users are connected with a bank server by using special safe authenticated encryption equipment. The authenticated encryption equipment with the wireless communication function provided by the invention has a direct working mode and an indirect working mode. The direct working mode refers to a mode that the equipment provided by the invention and terminal equipment are respectively connected with the bank server to form two different SSL (Secure Sockets Layer) communication links. The indirect working mode refers to a mode that the equipment provided by the invention is provided with a USB (Universal Serial Bus) interface, and is connected with the terminal equipment through a USB data wire, so as to form an SSL communication link. The equipment provided by the invention not only can ensure the security of an electronic bank transaction, but also is adaptive to various terminals simultaneously, so that the safe authentication of the electronic bank transaction is unrelated to the terminal type. The authenticated encryption equipment with the wireless communication function provided by the invention has the advantages that not only can the long-distance audit be realized by using the direct working mode, but also the near-distance audit can be realized by using the indirect working mode. The problem that the conventional safe authenticated encryption equipment is inconvenient to use can be solved. The authenticated encryption equipment with the wireless communication function provided by the invention has the beneficial effects that the problem that an E-bank transaction is unrelated to the terminal type can be solved on the premise of the safe transaction; and the strong applicability is realized.

Owner:上海阳扬电子科技有限公司

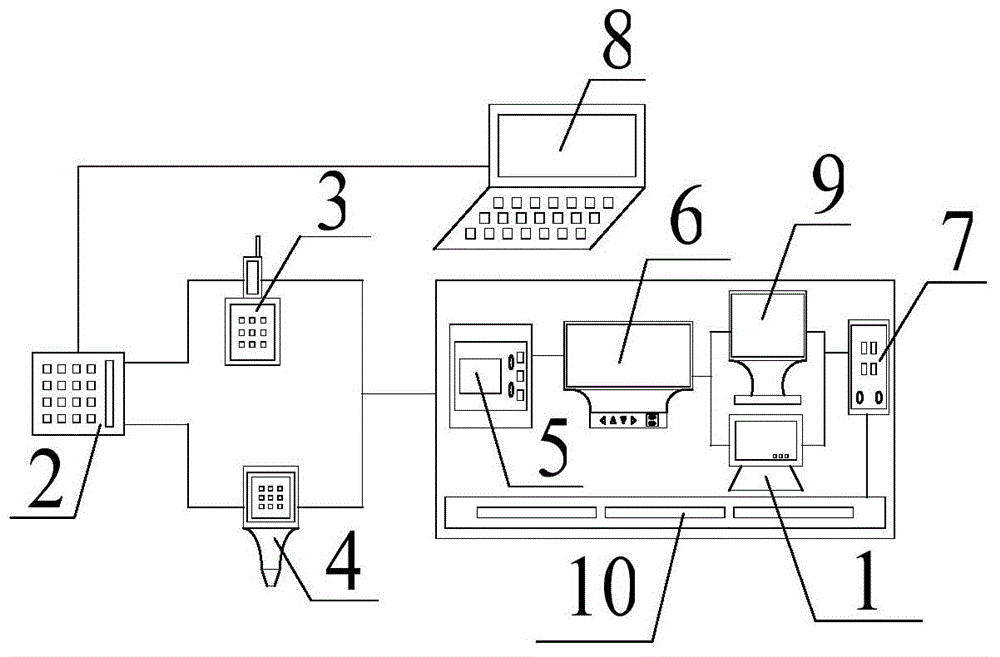

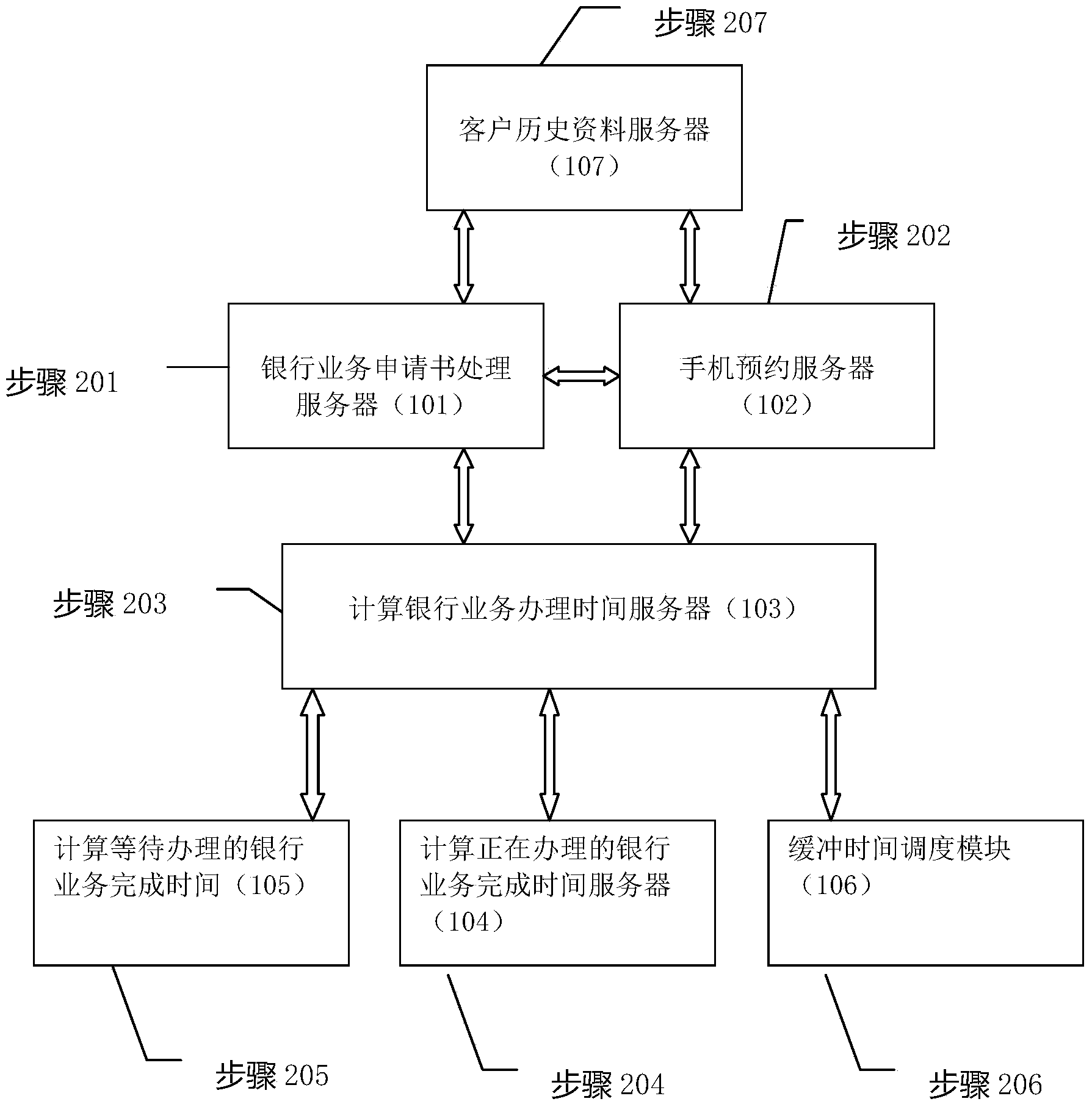

Method and system for calculating banking business handling time based on application for banking businesses

The invention discloses a method and system for calculating banking business handling time based on application for banking businesses. The system comprises a server (101) for processing the application for the banking businesses, a mobile phone appointment server (102), a server (103) for calculating banking business handling time, a server (104) for calculating time for completing the handling banking businesses, a server (105) for calculating time for completing the banking businesses to be handled, a buffer time scheduling module (106) and a client historical data server (107). The method includes the steps that the system receives application for electronic banking businesses, time for completing the handling banking businesses, the calculated time for completing the banking businesses to be handled and buffer time, then calculates time of a possessor of the application for the electronic banking businesses for waiting to handle the businesses in client zero-wait business handling channels in banks, the client zero-wait service handling channel with the minimum waiting time is selected, and then a queuing number bar is printed.

Owner:谭希韬

Banking transaction authentication method based on video verification, and banking transaction authentication system based on video verification

ActiveCN103353973AFill in the security holesDouble guaranteeFinanceUser identity/authority verificationNetwork serviceAuthentication system

The invention provides a banking transaction authentication method based on video verification and a banking transaction authentication system based on video verification. The banking transaction authentication system based on video verification comprises step that a network server acquires reference voice information of a user and processes the reference voice information into digital reference voice information that is easy to extract characteristic information; then during a process of banking transaction by the user, user equipment makes a request for voice information for verification provided by the user, and after converting the voice information for verification into a voice sequence, the user equipment encrypts and endorses the banking transaction information and the voice sequence of the user to form user transaction information; and the network server examines the endorsement of the received user transaction information, acquires the voice sequence after decryption and recovers the voice sequence to analog voice information, and then after processing the analog voice information into digital voice information in accord with user characteristics, the network server compares the digital voice information with the digital reference voice information of the user so as to confirm the identity of the user. Therefore, security holes in electronic banks are filled, and transaction security is improved.

Owner:上海方付通科技服务股份有限公司

Electronic sales method

ActiveUS20120223137A1Easy to changeReduce riskCharacter and pattern recognitionCash registersCredit cardBank account

Owner:HEETER THOMAS W

System and method for unifying e-banking touch points and providing personalized financial services

A system and method for delivering a retail banking multi-channel solution that unifies interactive electronic banking touch points to provide personalized financial services to customers and a common point of control for financial institutions is provided.

Owner:MCOM IP LLC

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com