Patents

Literature

113 results about "Electronic finance" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

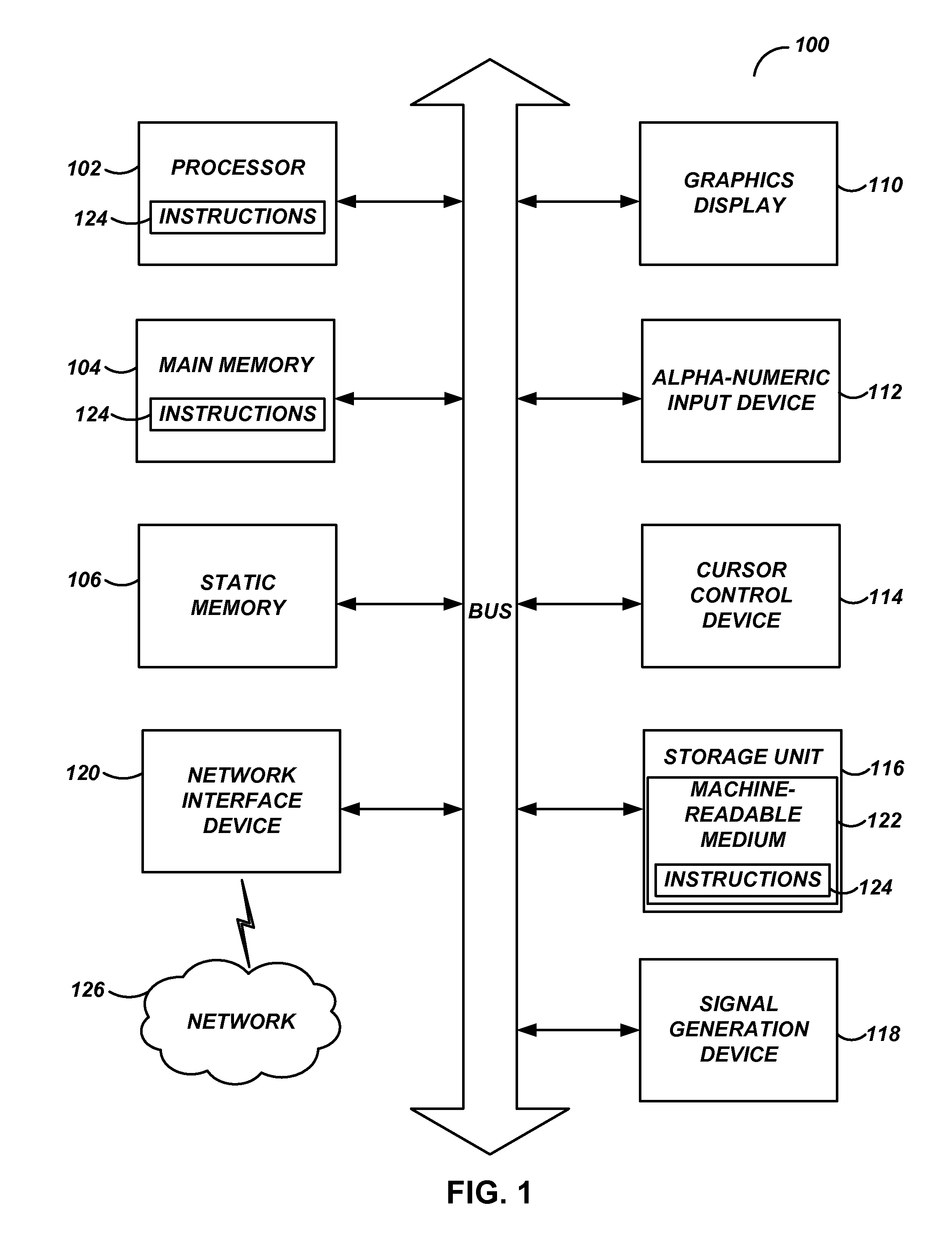

Electronic payment systems and supporting methods and devices

ActiveUS20130060690A1Efficient transferFinanceProtocols using social networksSystems designSubject matter

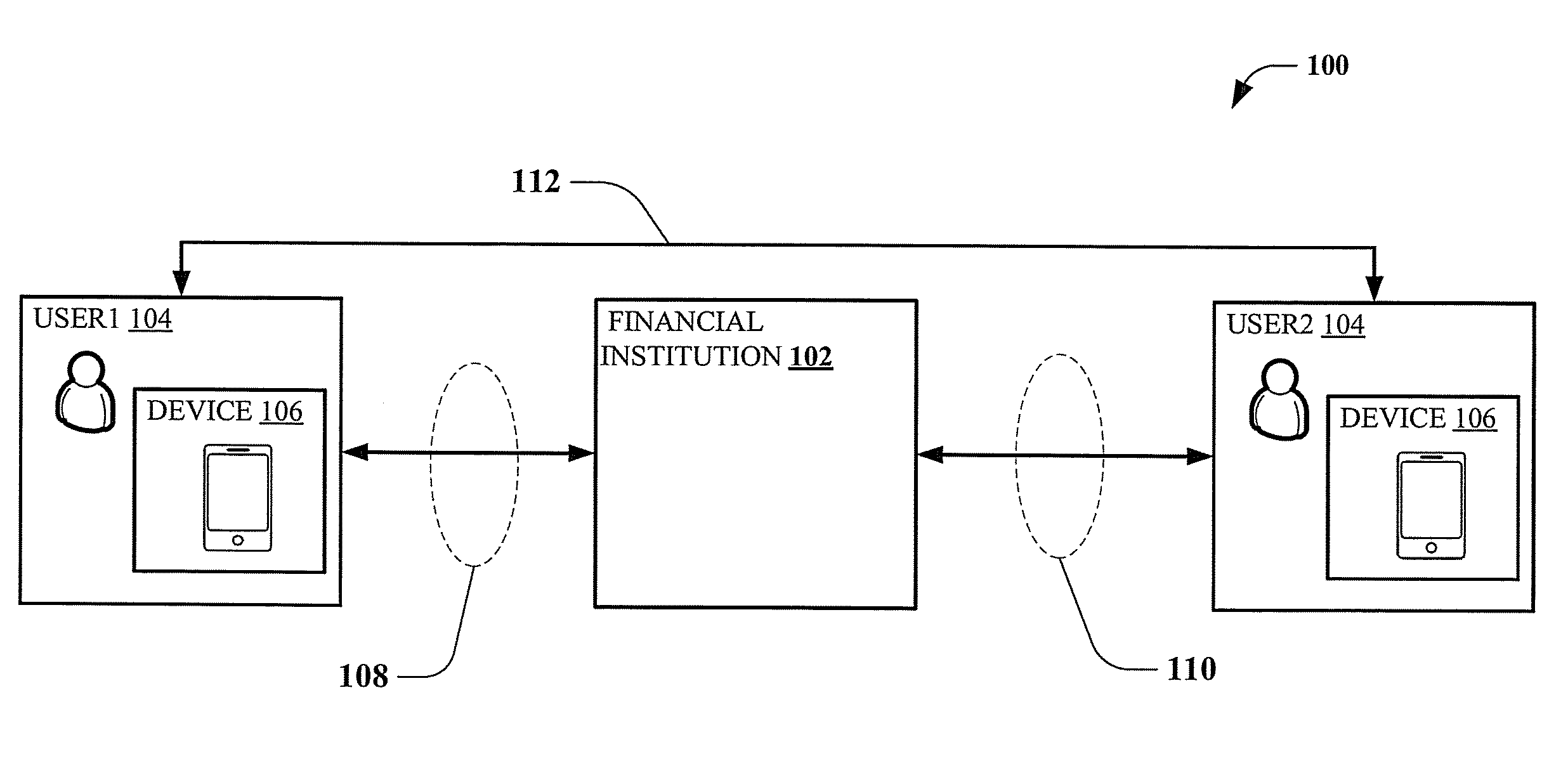

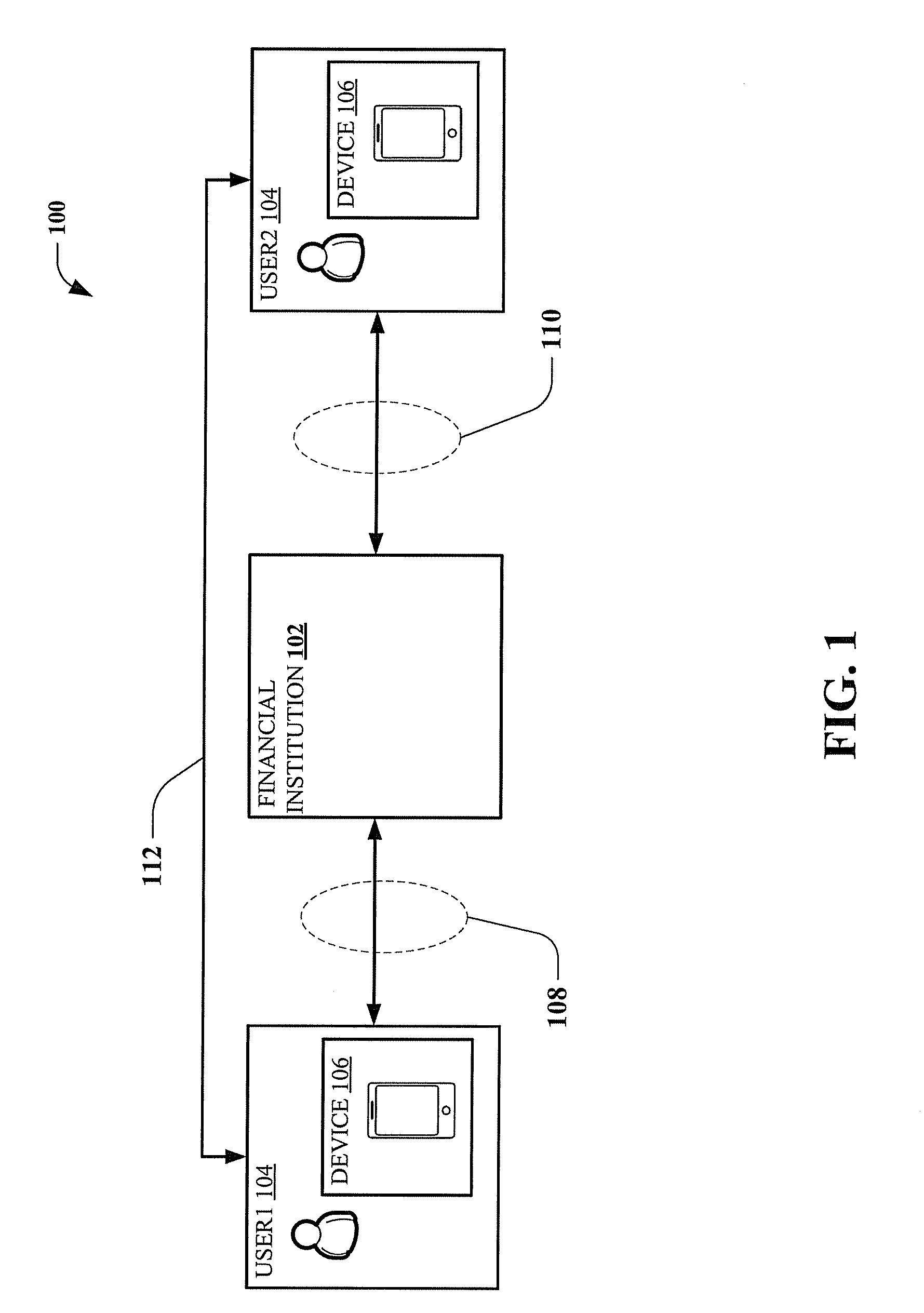

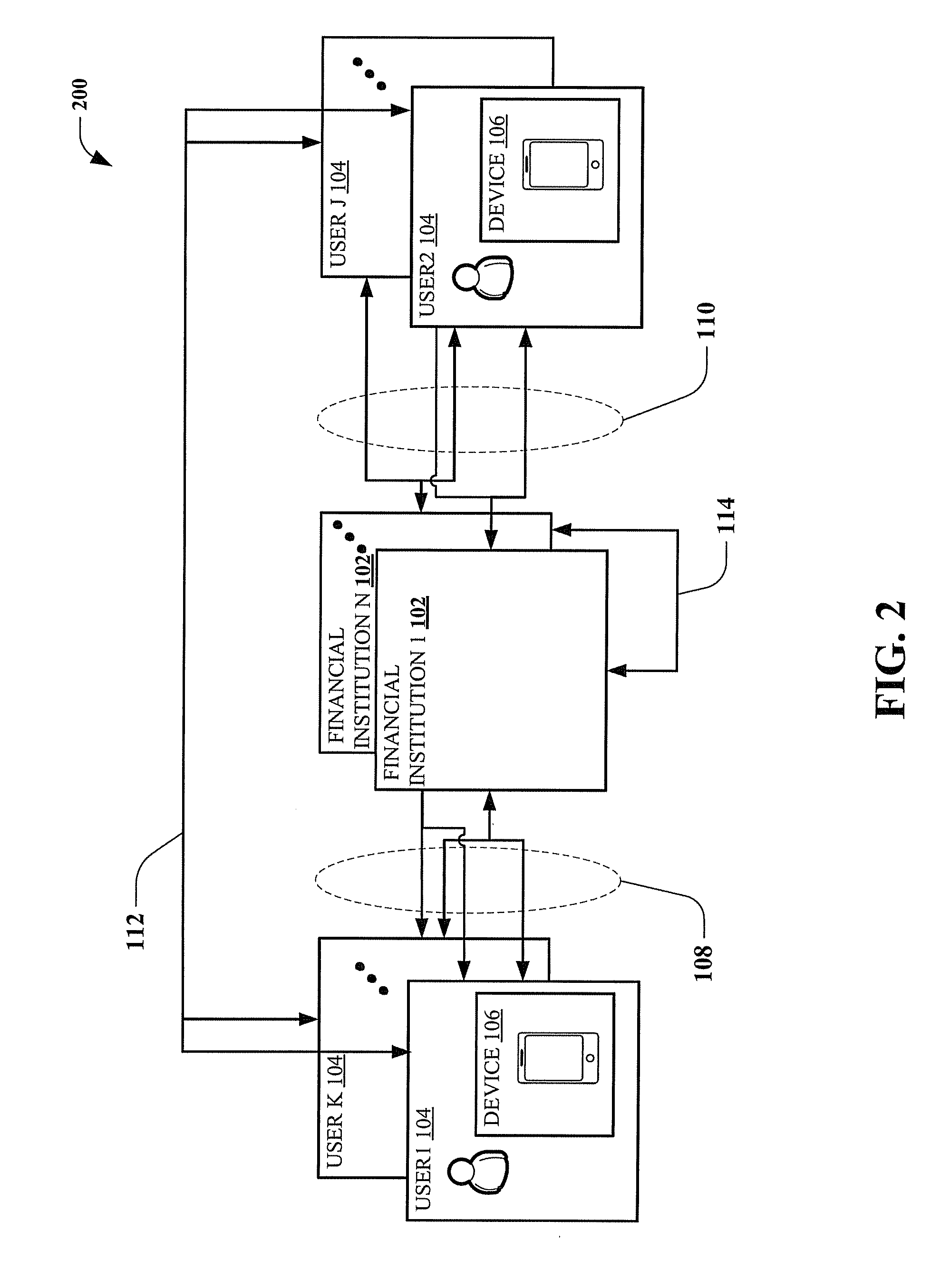

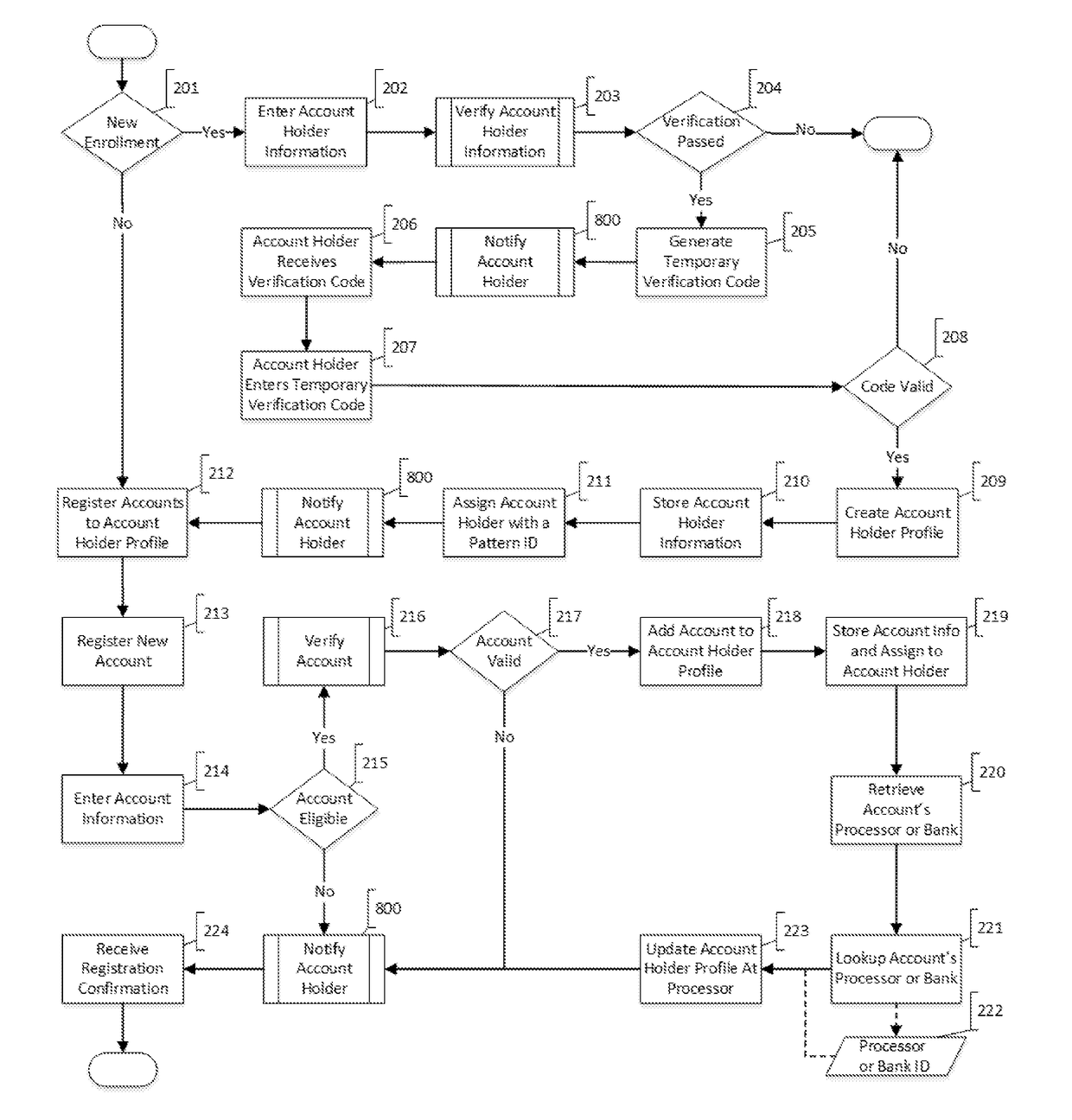

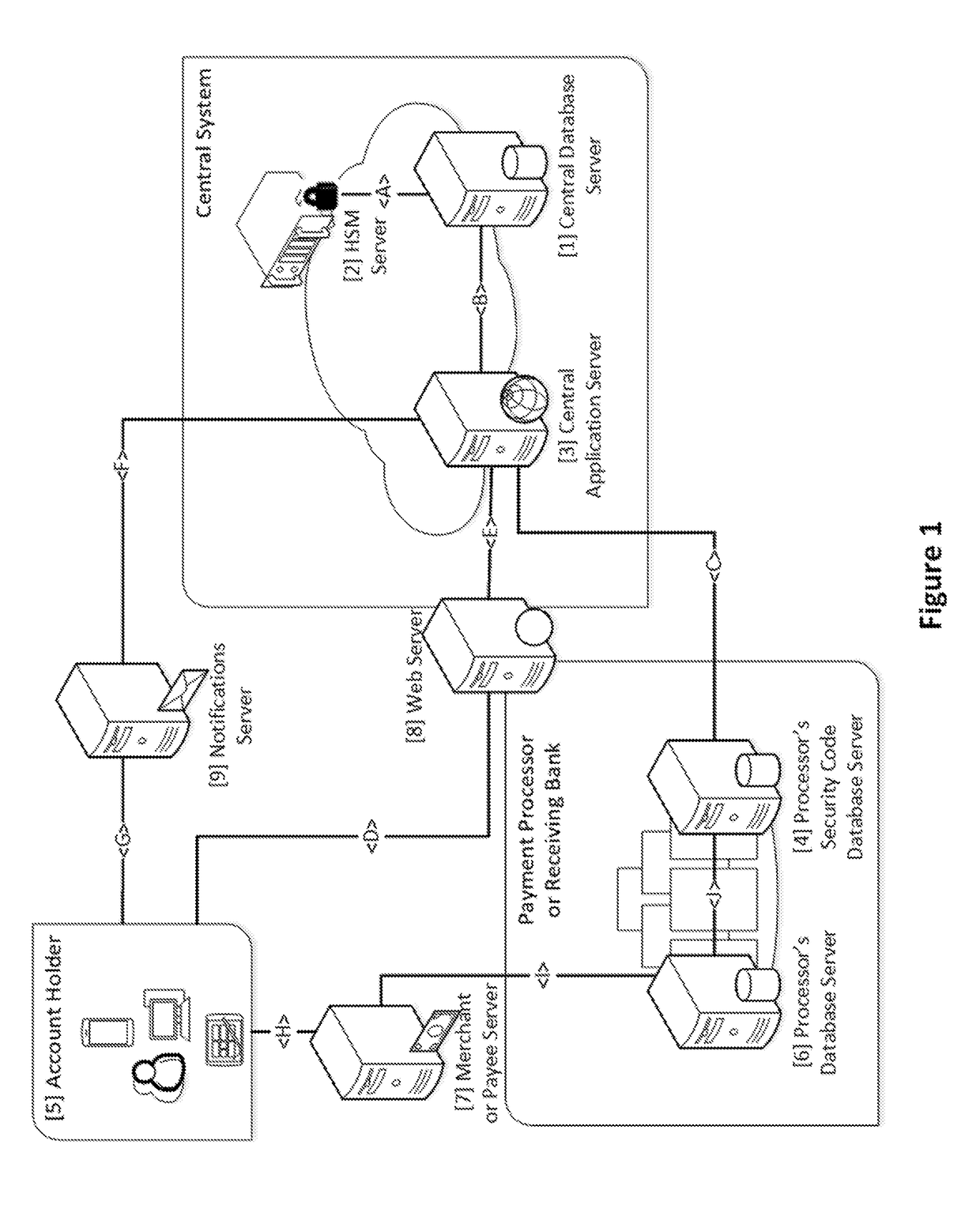

Electronic payment systems and supporting methods and devices are described. For instance, the disclosed subject matter describes aggregated transactional account functionality configured to receive electronic financial transactions associated with one or more of a set of electronic identifying information such as phone ID, email, instant message, etc. for a user and related functionality. The disclosed details enable various refinements and modifications according to system design and tradeoff considerations.

Owner:RPX CORP

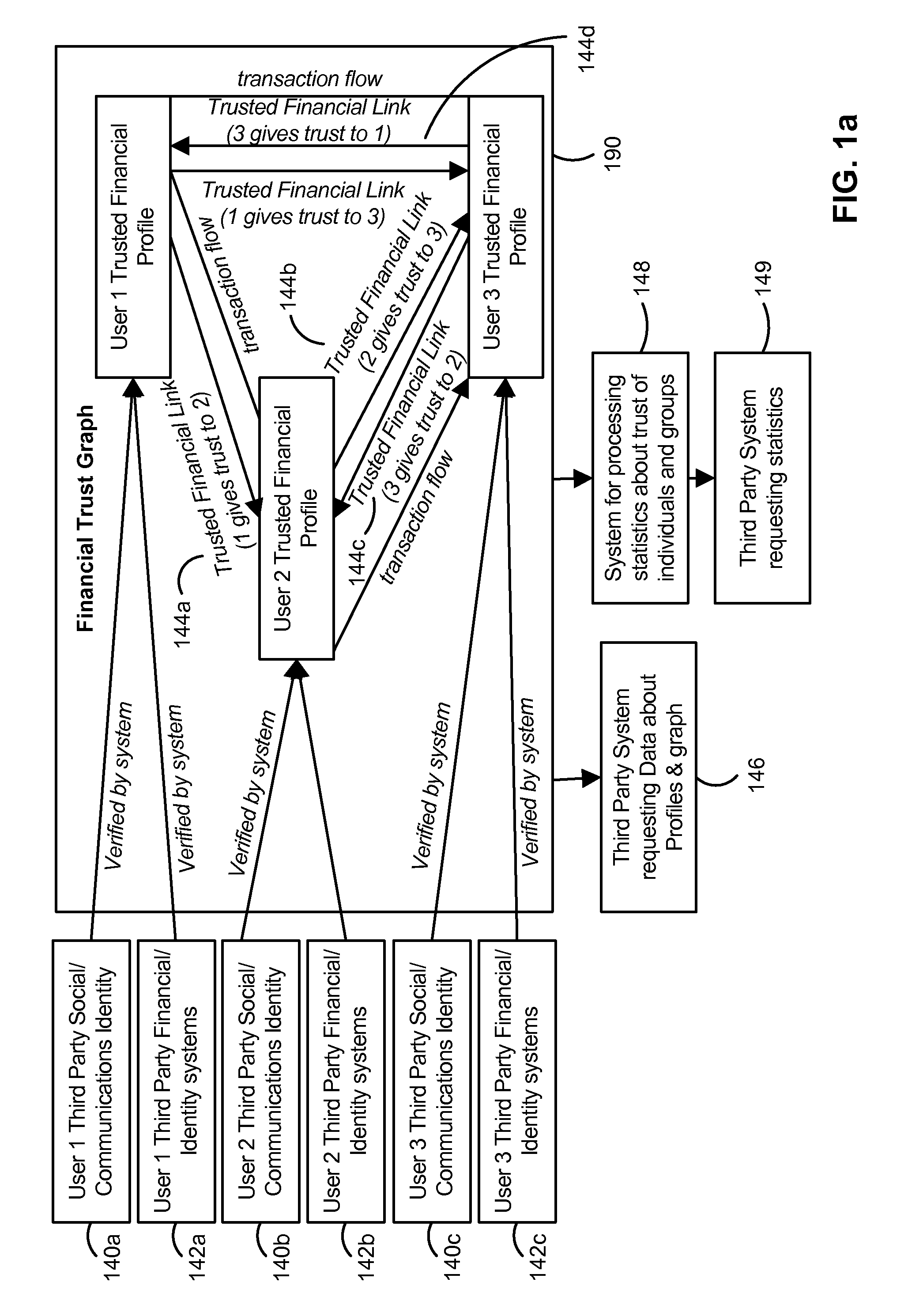

Trust Based Transaction System

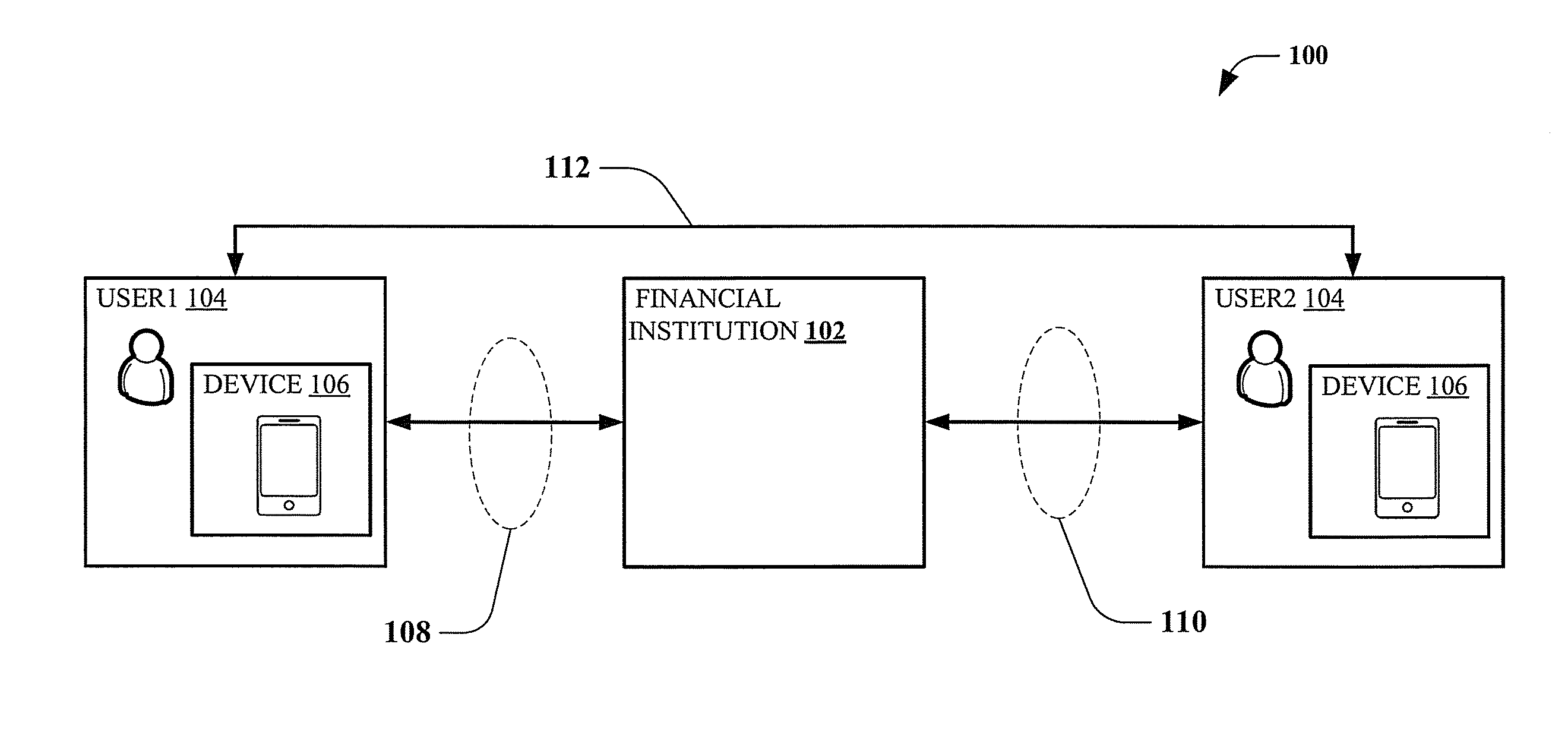

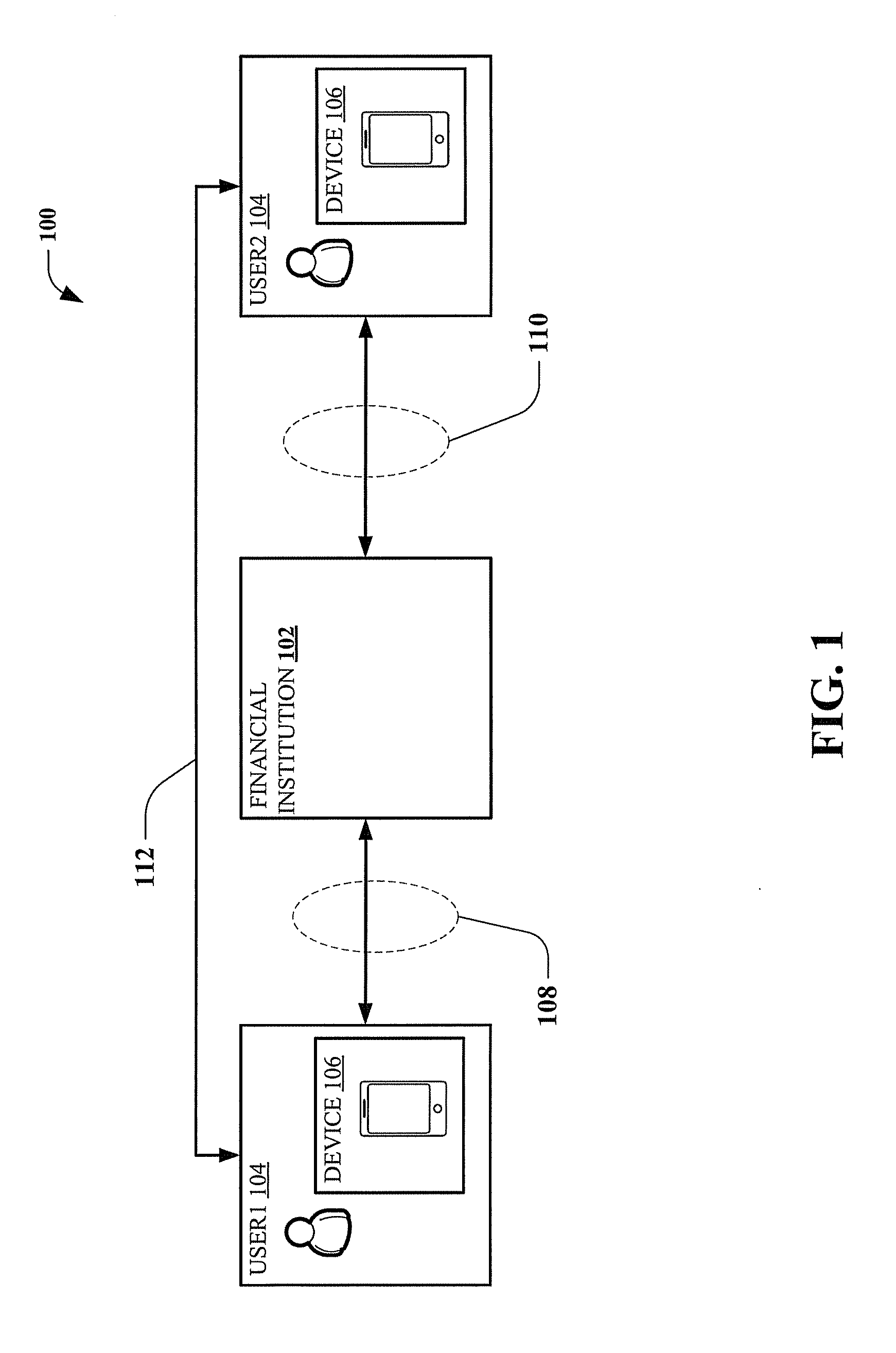

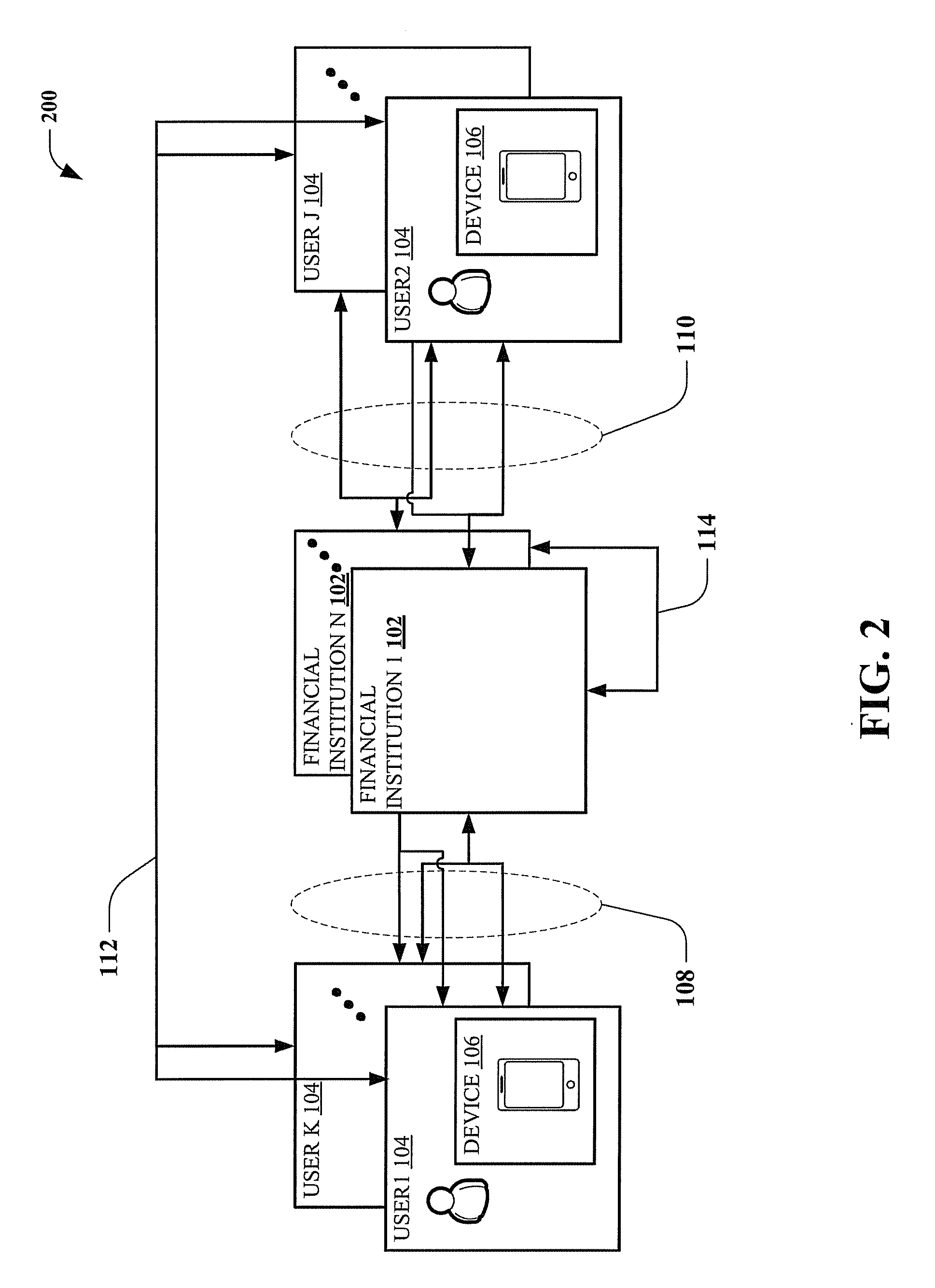

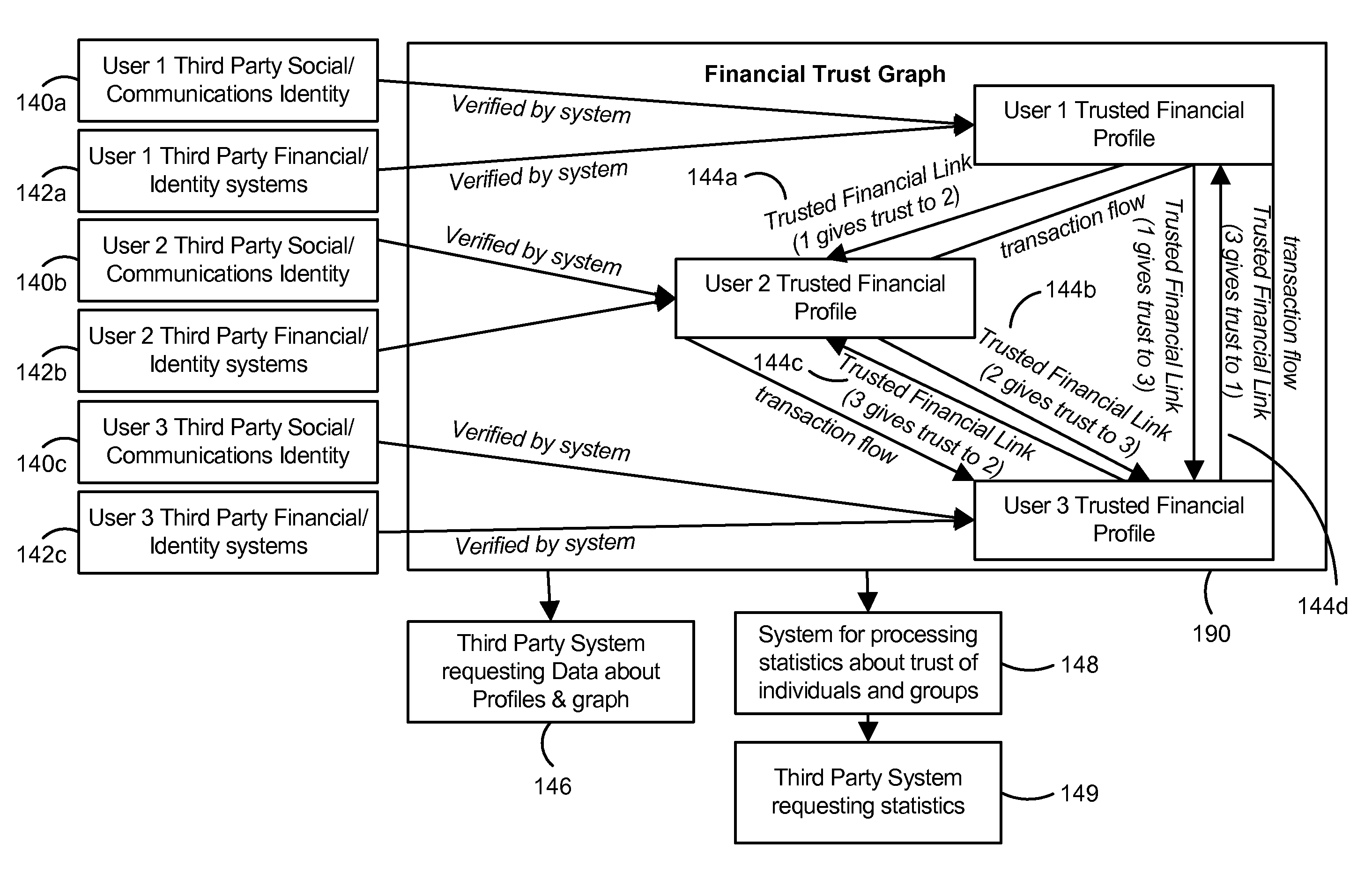

A configuration for more efficient electronic financial transactions is disclosed. Users input personal and financial information into a system that validates the information to generate trusted financial profiles. Each user can establish trusted financial links with other users. The trusted financial link provides a mechanism for the user to allow other users to withdraw money from the link provider account. The data from these relationships and the financial data flowing through the system enable a measure of trustworthiness of users and the trustworthiness of all interactions in the system. The combination of trusted financial profiles, trusted financial links, and financial transactions between users create a measurable financial trust graph which is a true representation of the trusting economic relationships among the users. The financial trust graph enables a more accurate assessment of the creditworthiness and financial risk of transactions by users with little or no credit or transaction history.

Owner:PAYPAL INC

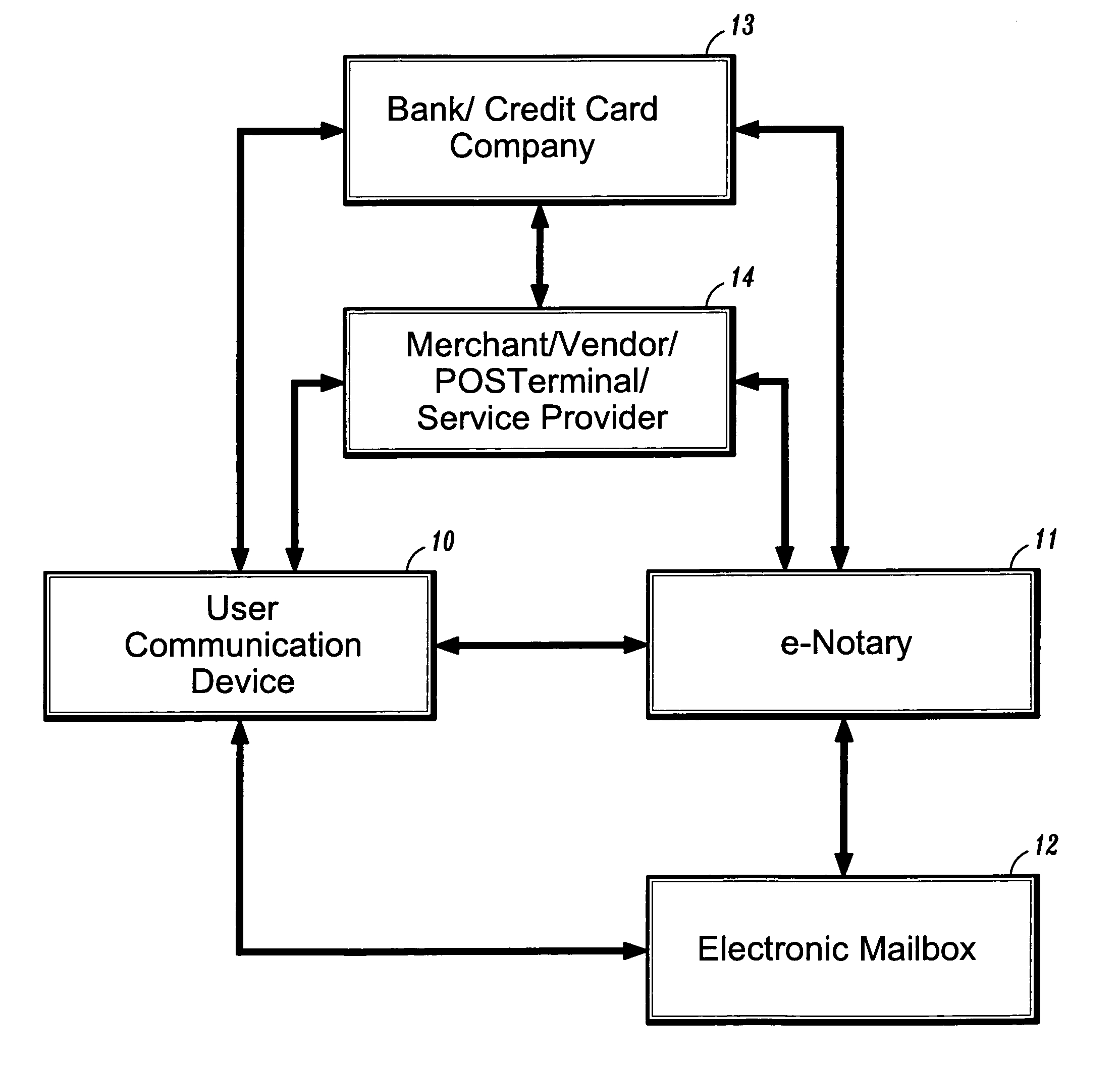

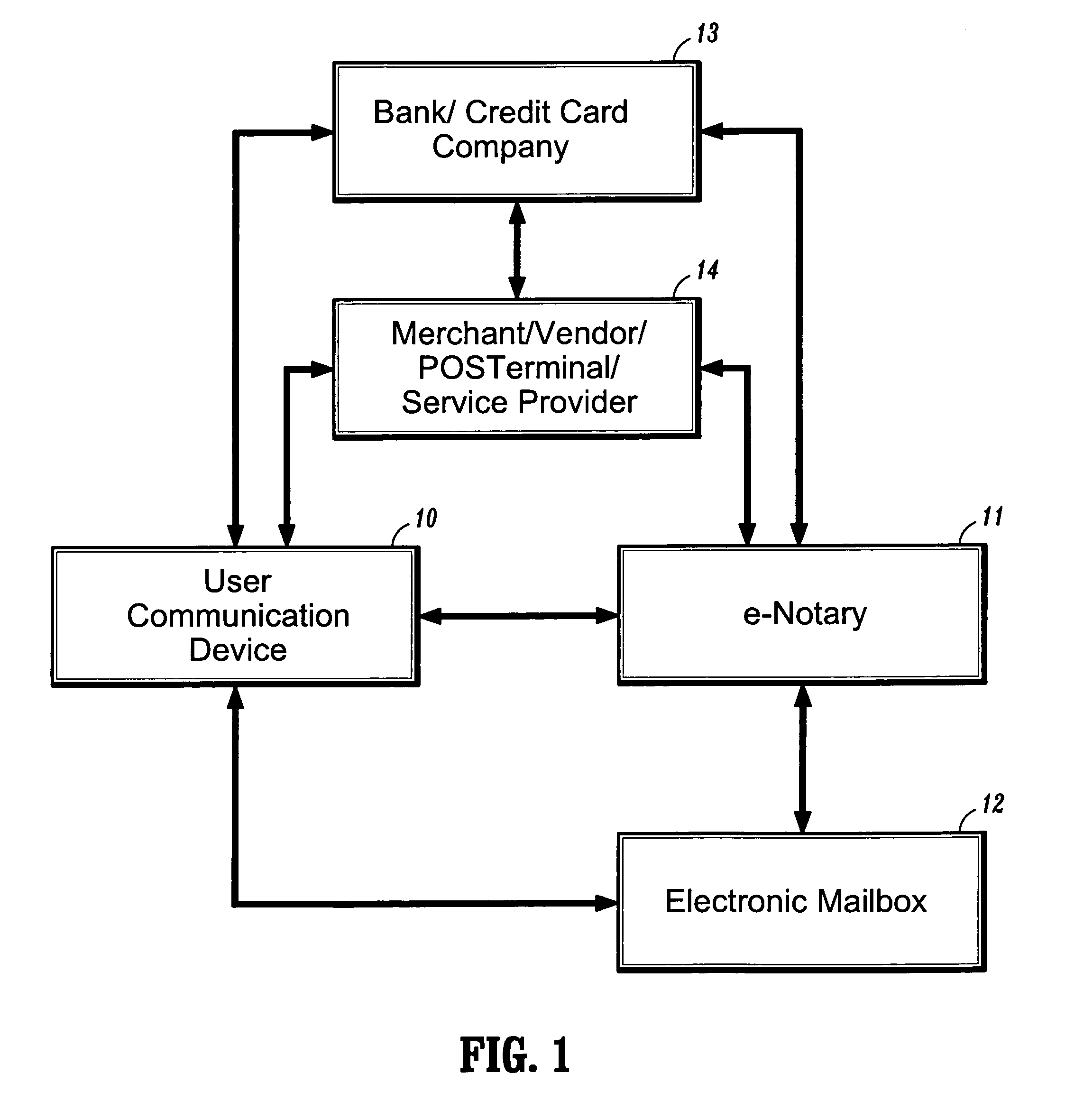

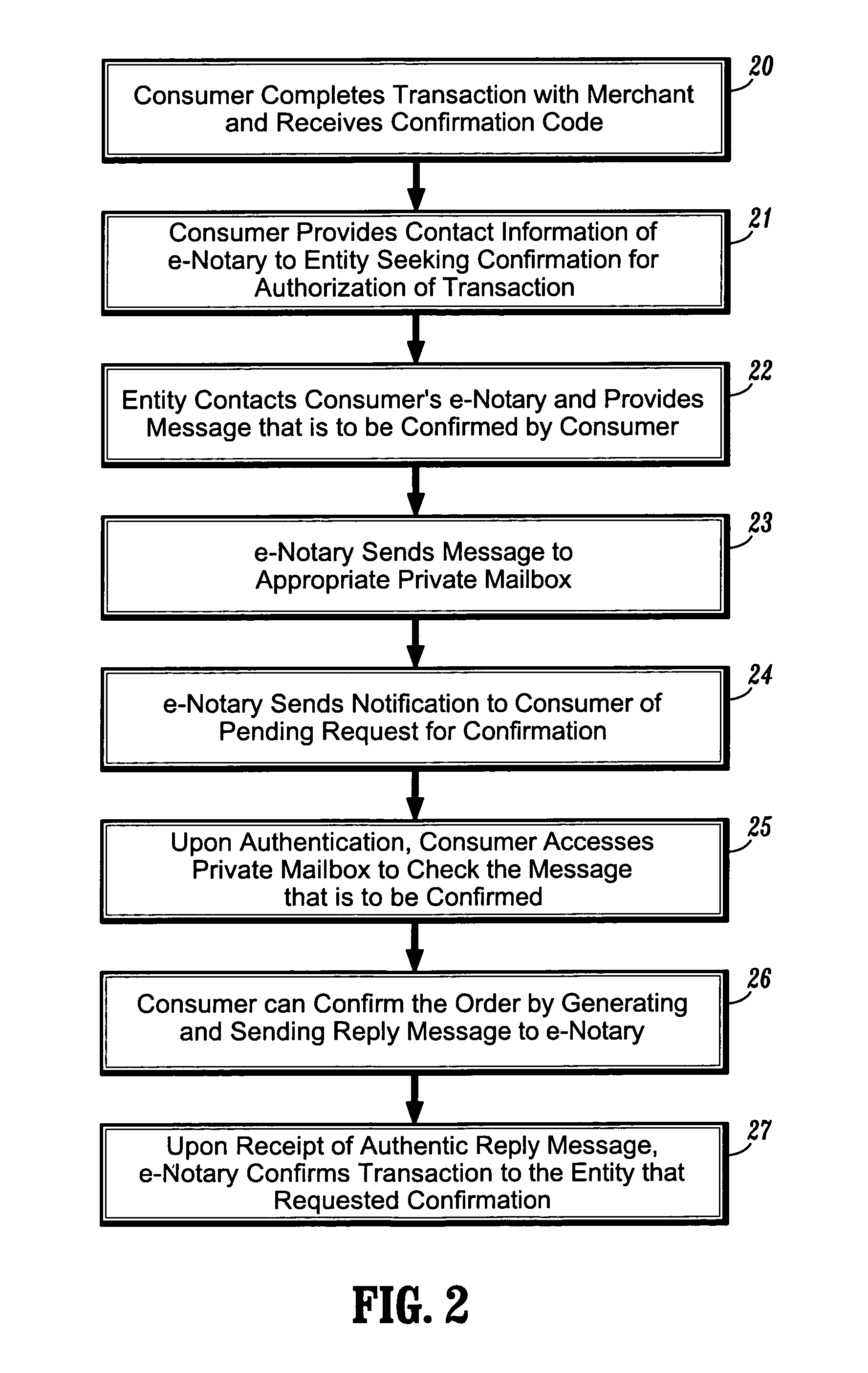

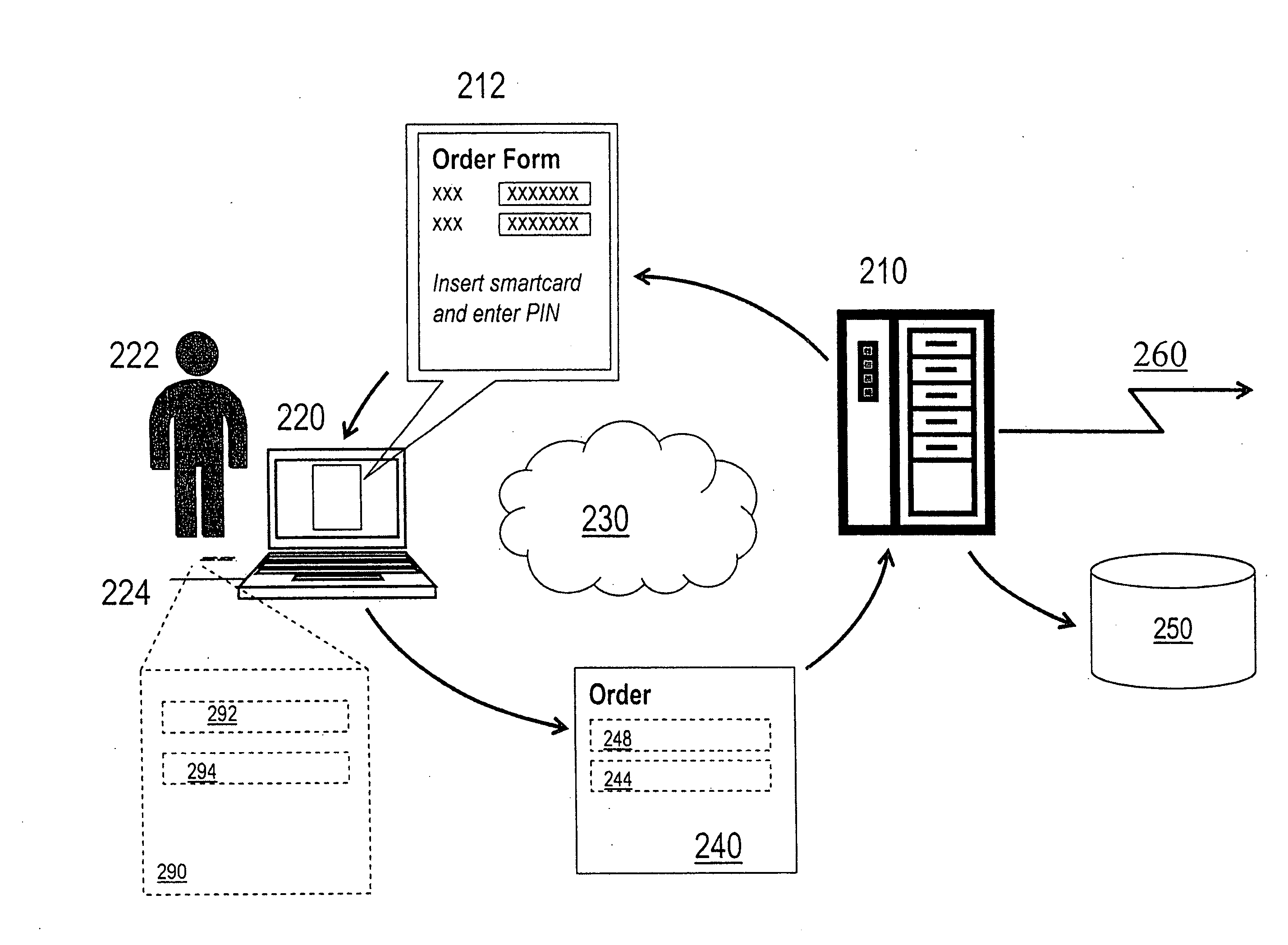

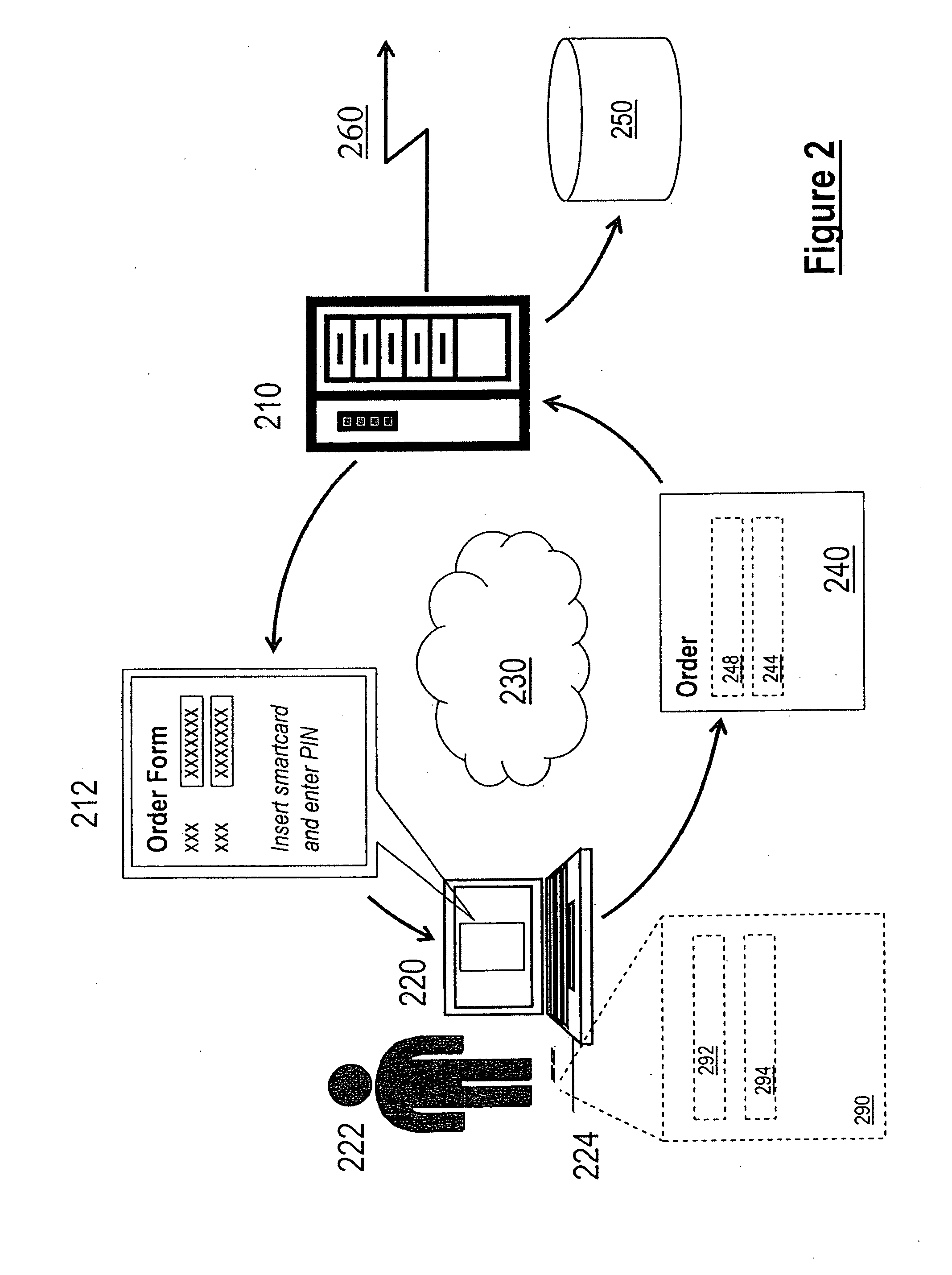

System and method for confirming electronic transactions

Systems and methods for providing user-confirmation of an electronic transaction and in particular, protocols for enabling electronic signatures and confirmation of electronic documents and transactions such as electronic financial transactions and credit card payment. In one aspect, a method for confirming an electronic transaction, comprises the steps of: performing an electronic transaction between a first party and a second party; sending, by the second party, a request for confirmation of the electronic transaction to a predetermined, private mailbox associated with the first party; accessing the private mailbox by the first party; and sending, by the first party, a reply message to the request for confirmation to thereby confirm authorization of the electronic transaction.

Owner:PHONENICIA INNOVATIONS LLC SUBSIDIARY OF PENDRELL TECH +1

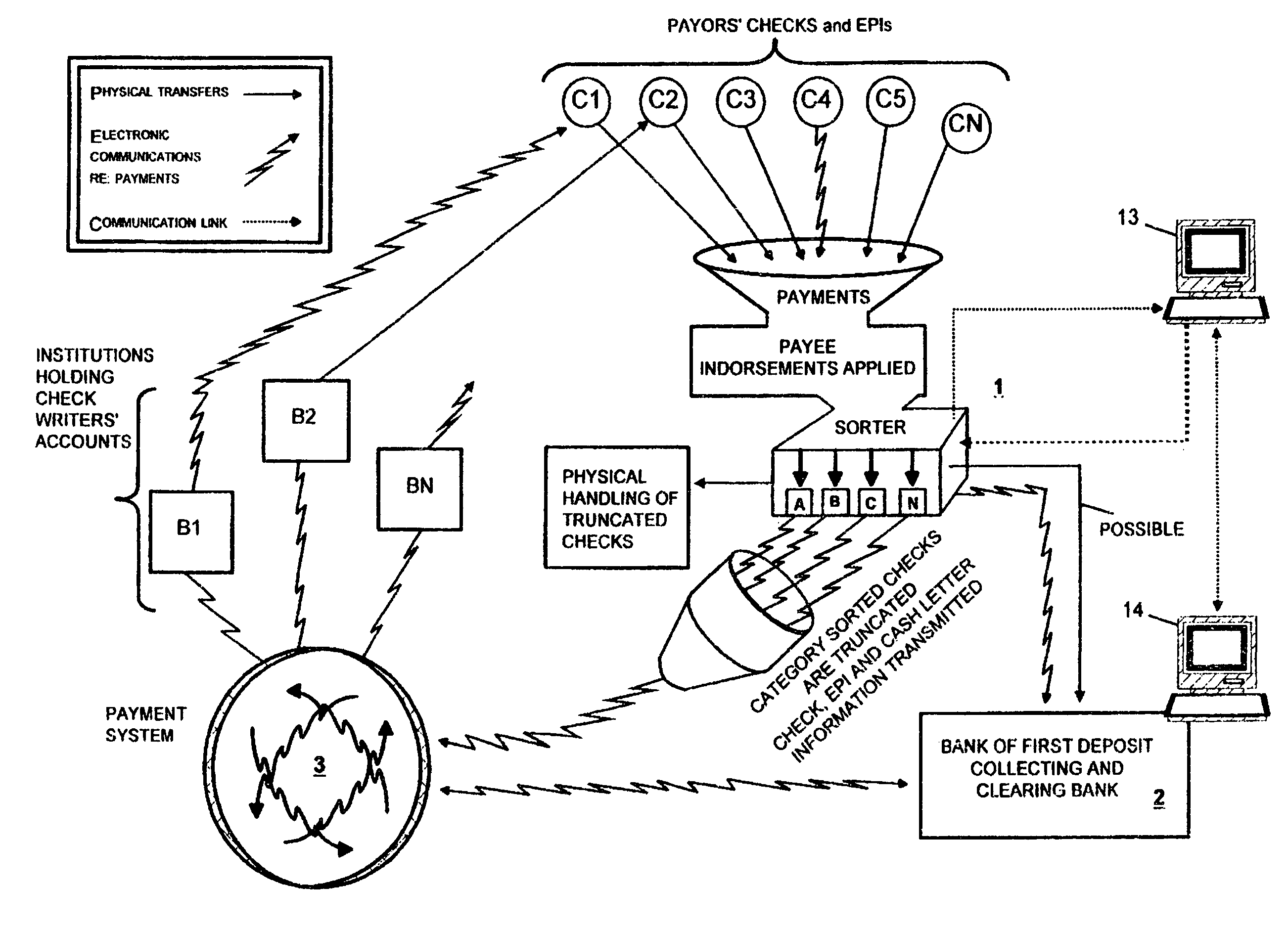

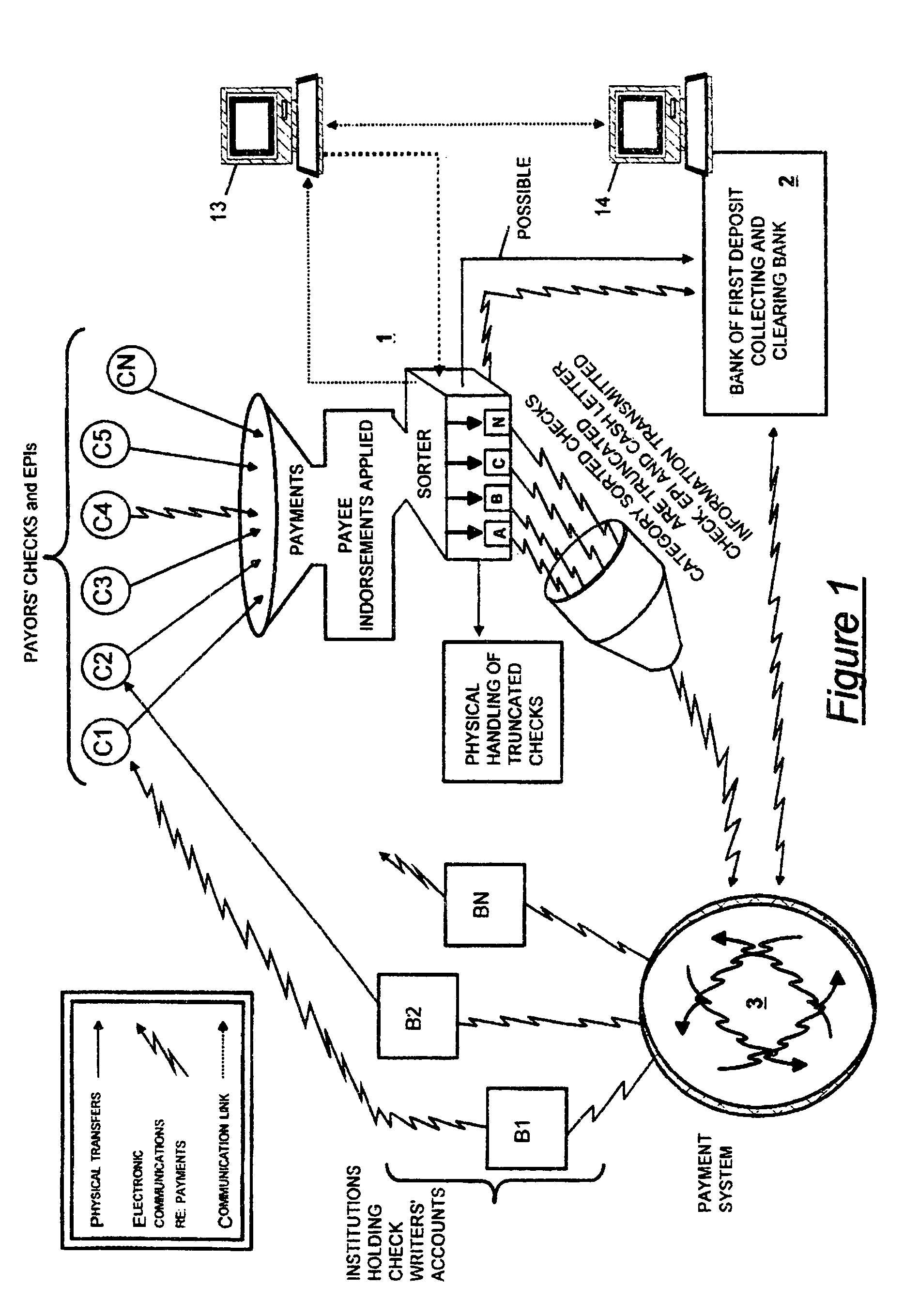

System for effecting the payment of paper and electronic financial instruments received at a payment facility

InactiveUS7512564B1Low costOptimization mechanismFinancePayment circuitsEngineeringElectronic finance

Owner:DATATREASURY CORP

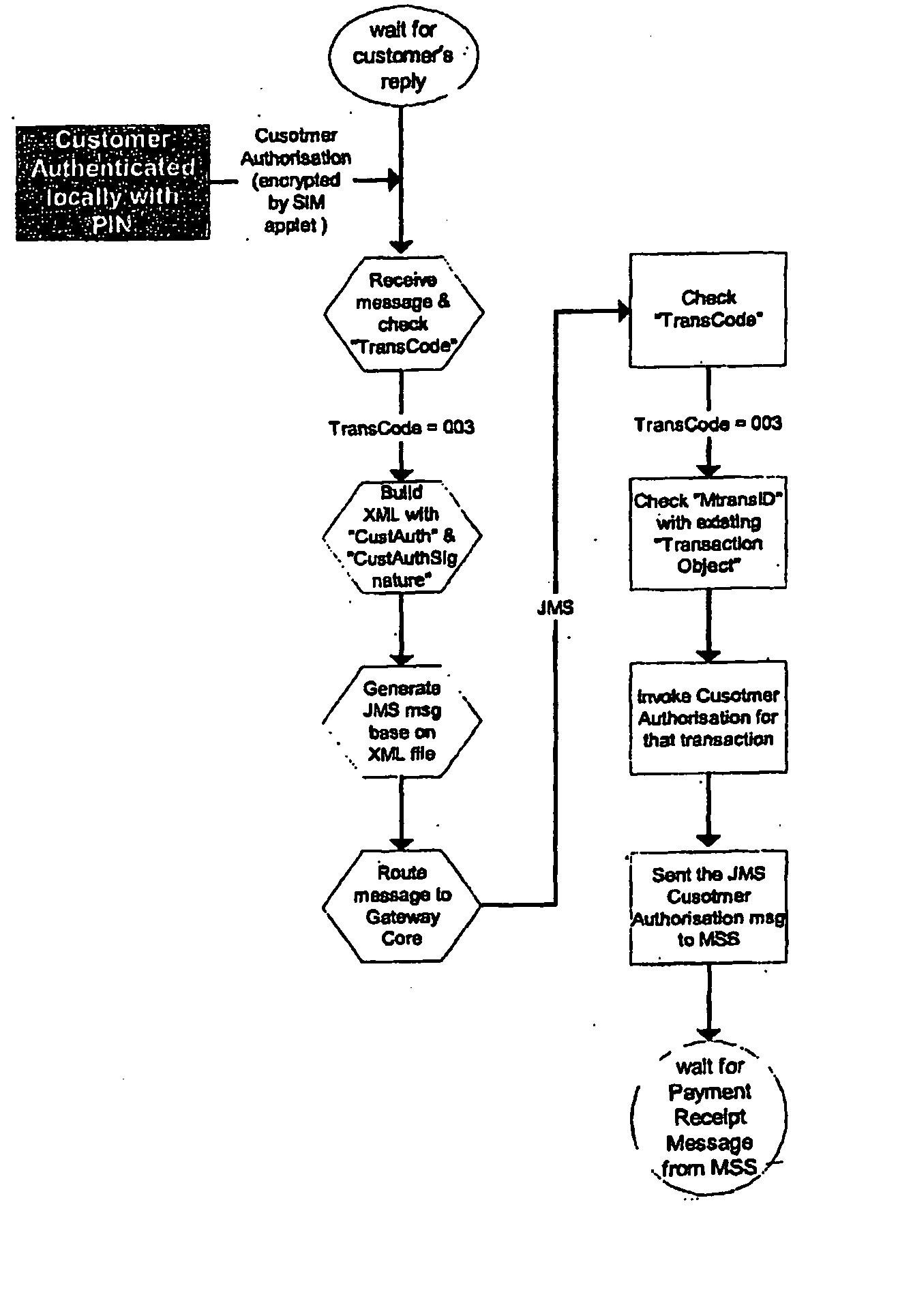

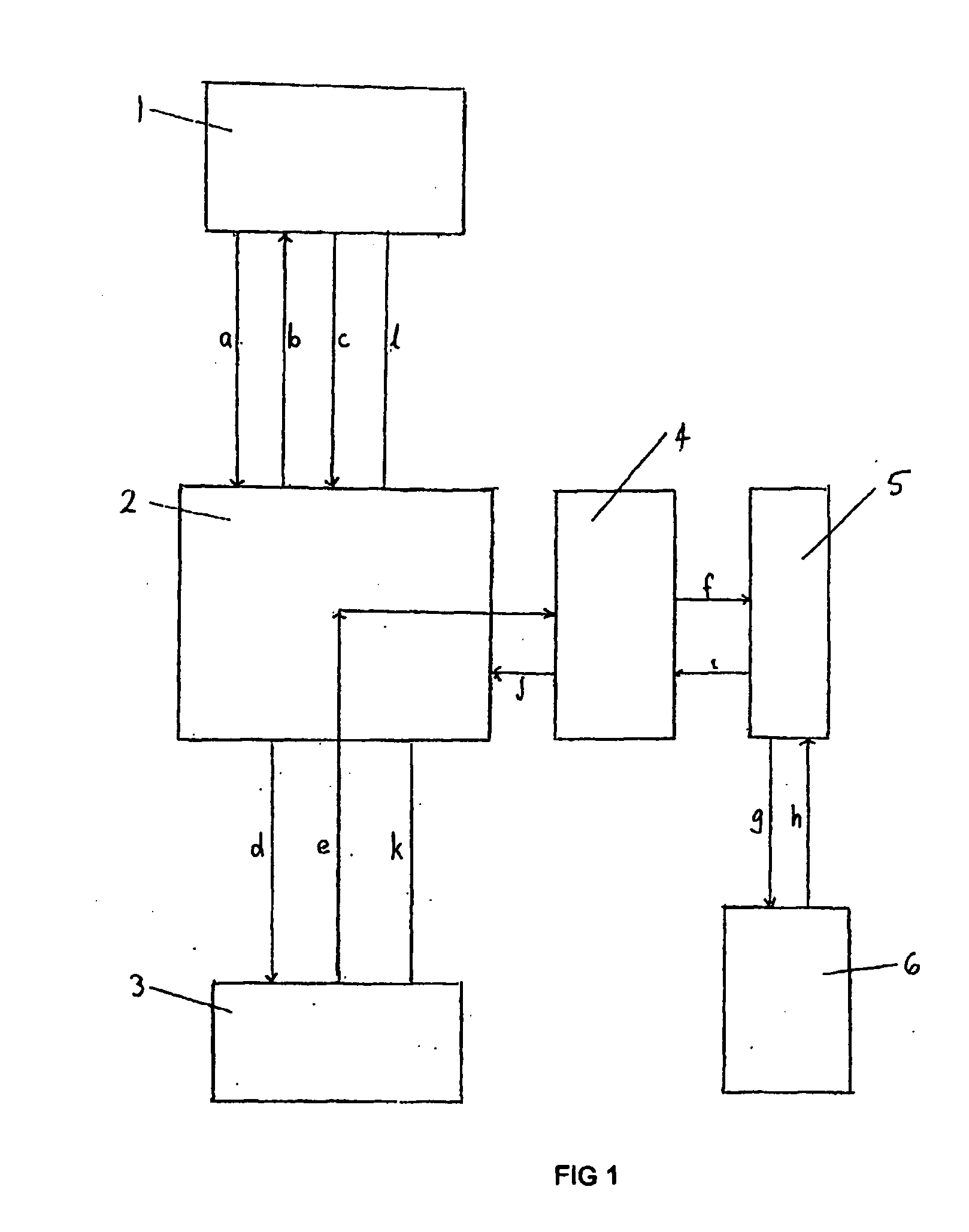

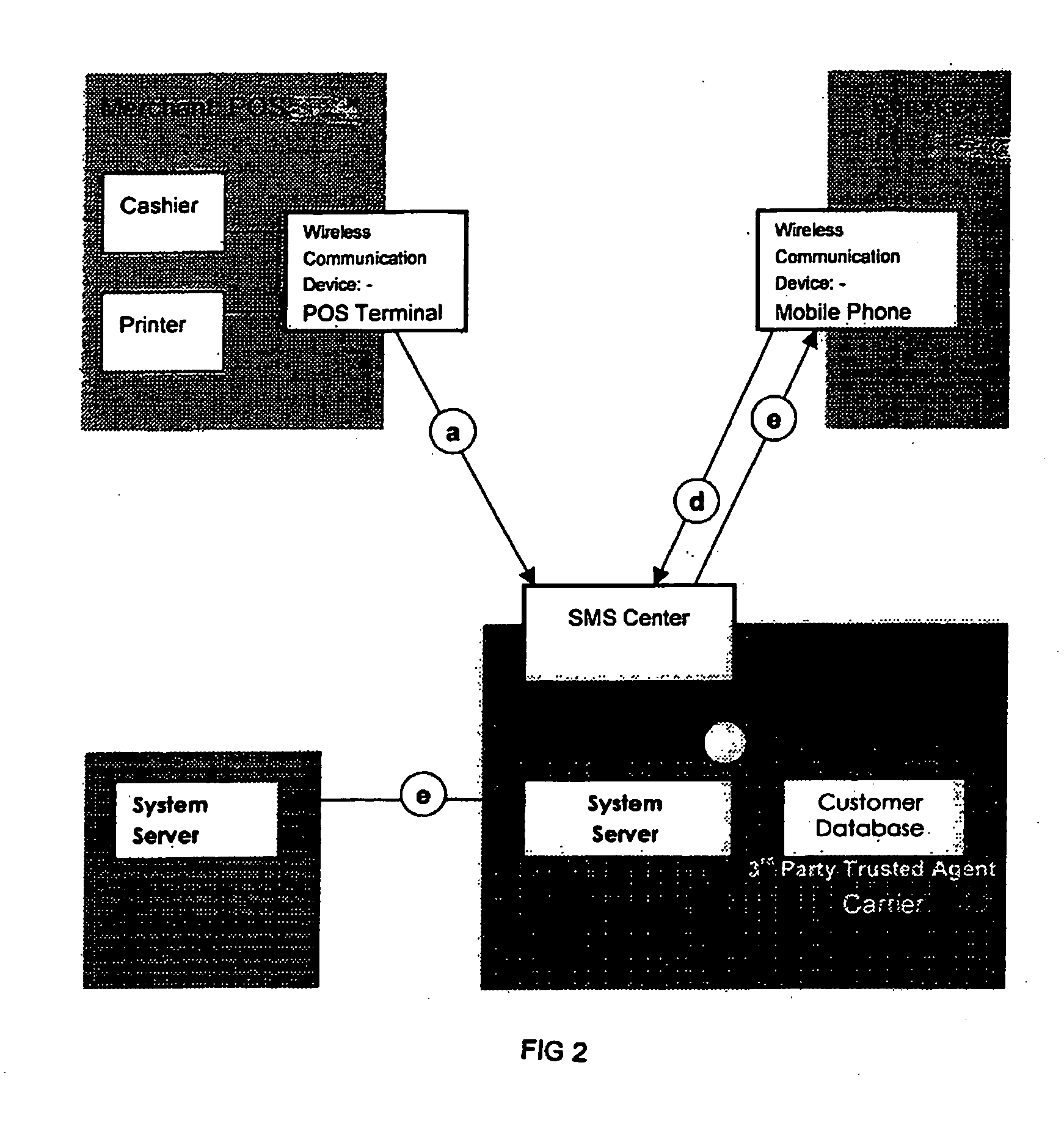

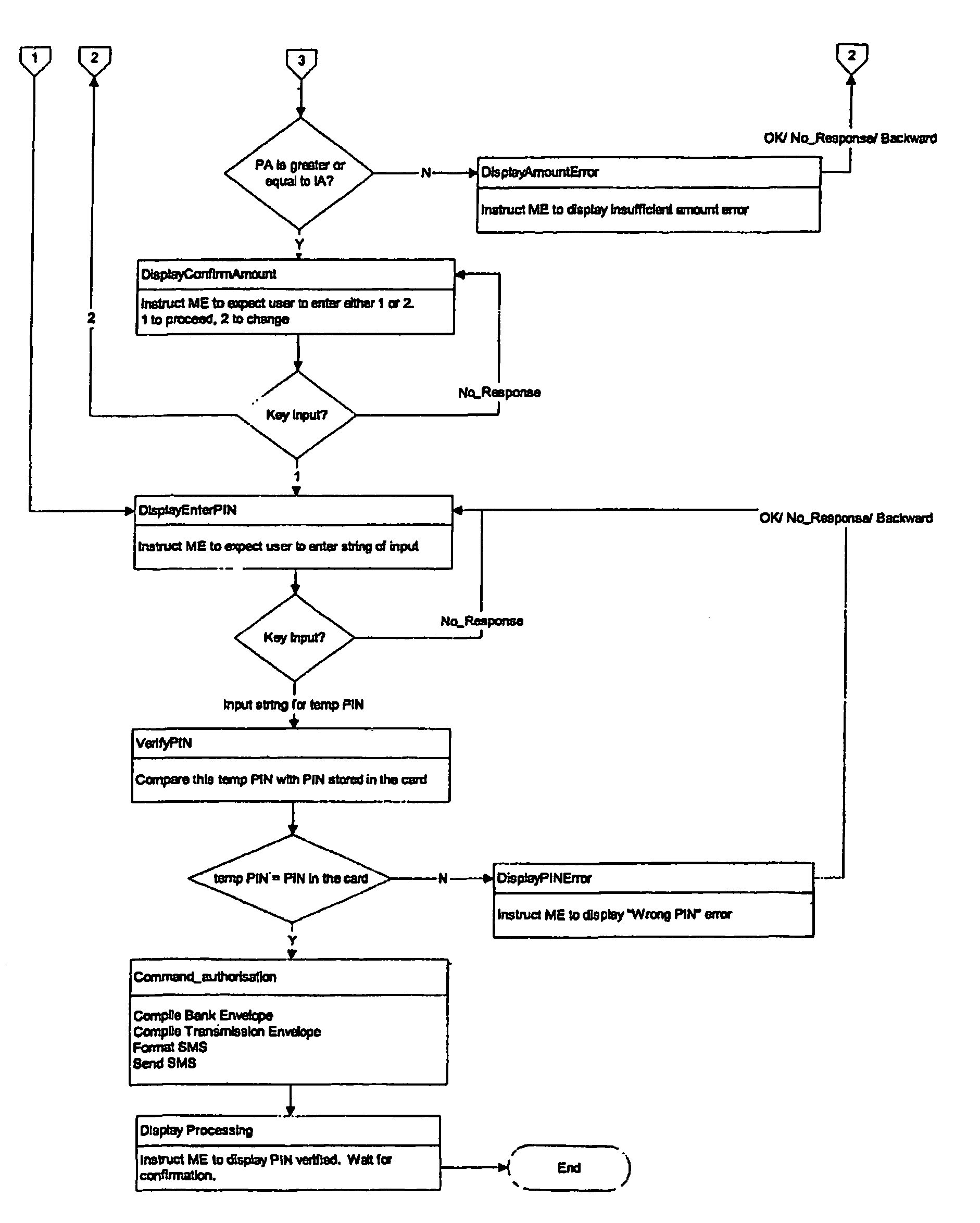

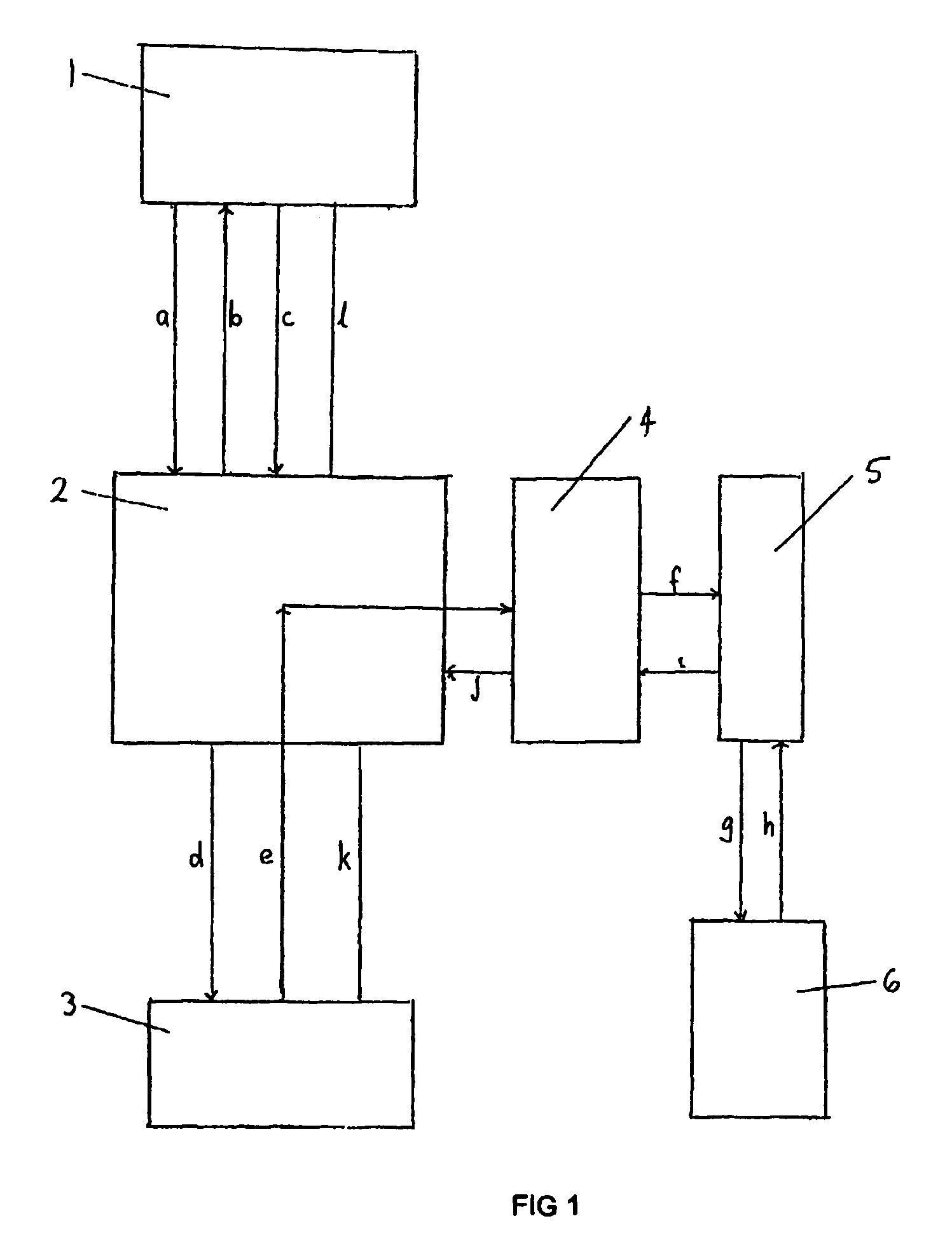

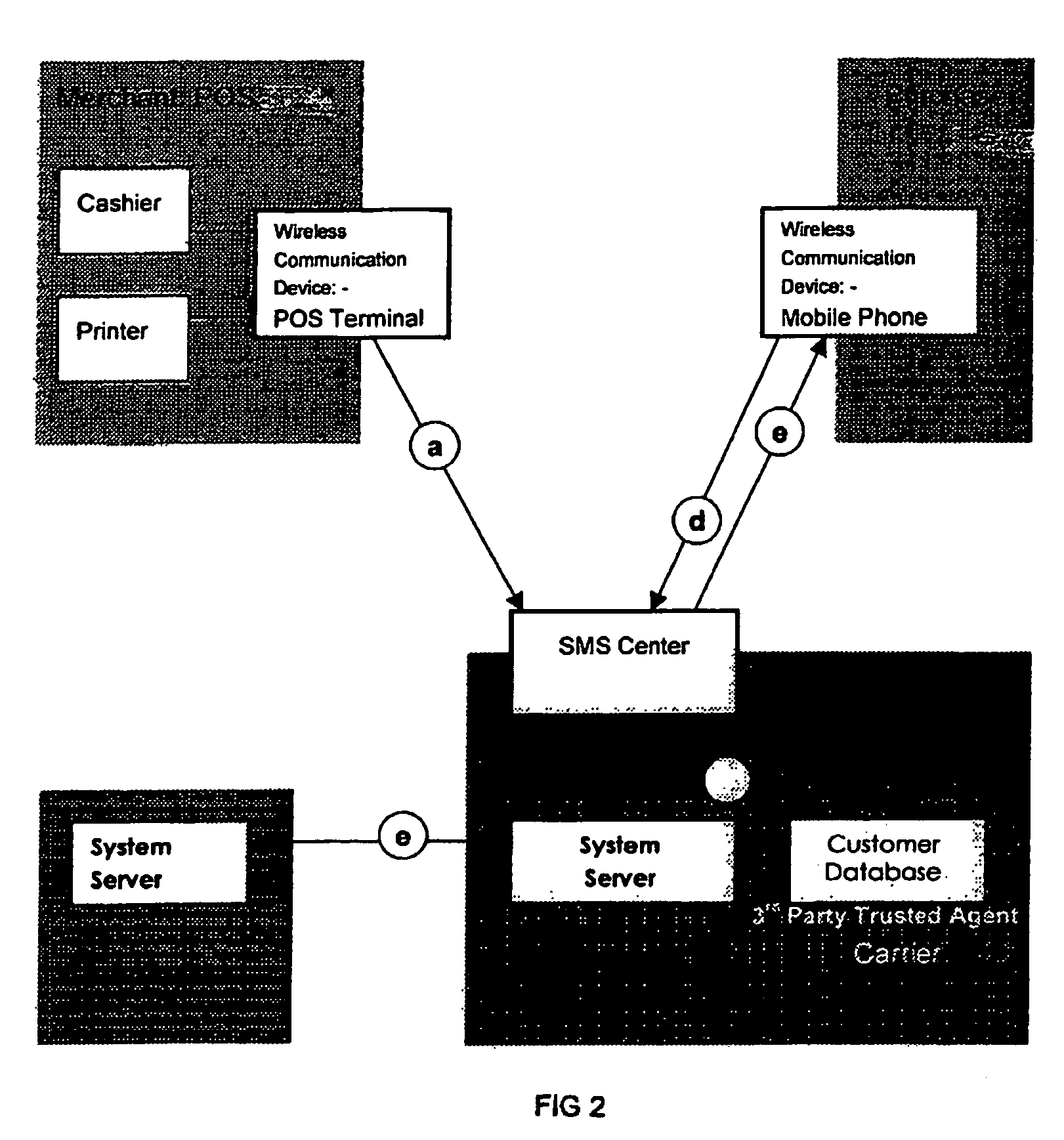

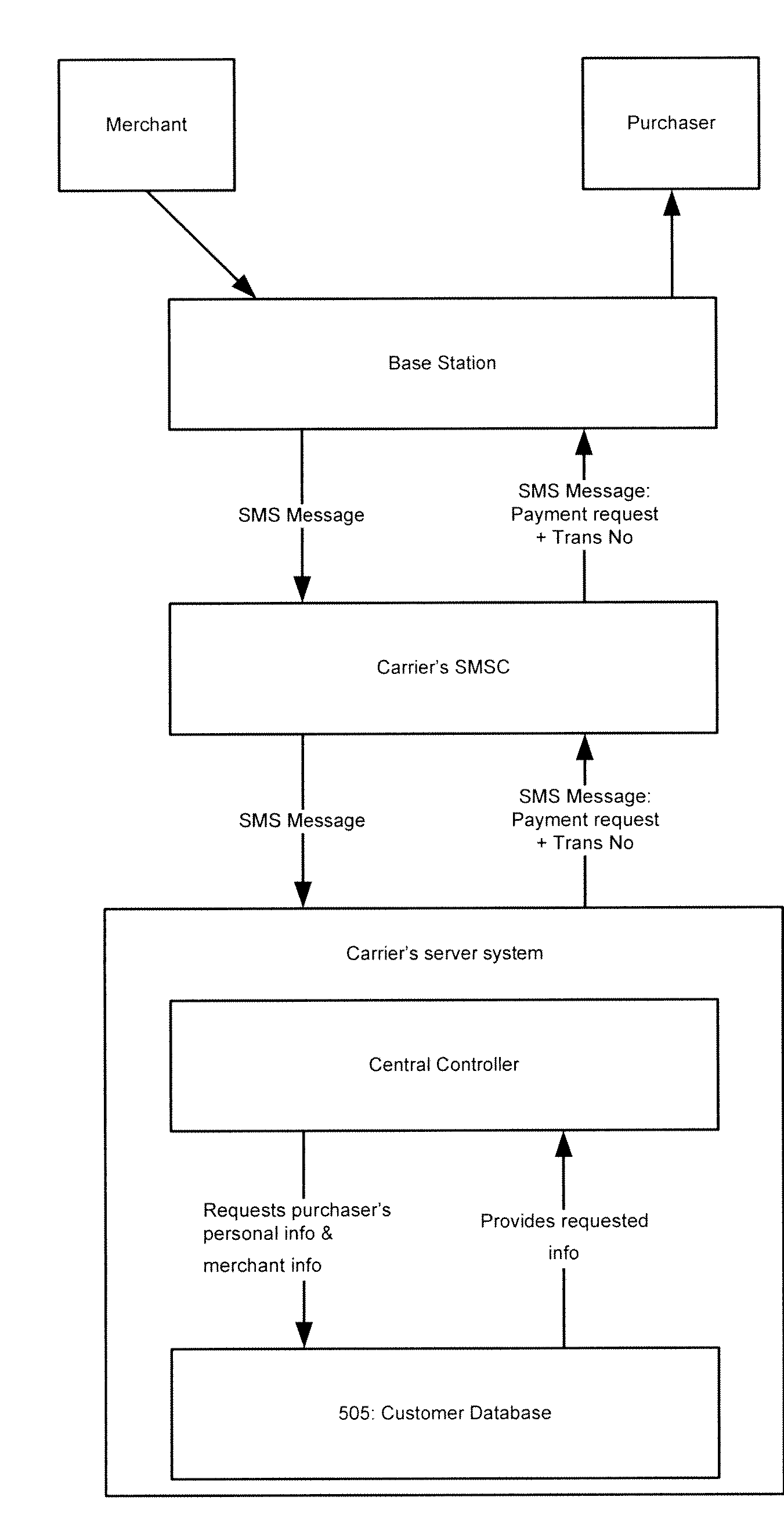

System and method for facilitating electronic financial transactions using a mobile telecommunication device

InactiveUS20050177517A1Improve securityFurther level of securityAccounting/billing servicesUser identity/authority verificationPaymentComputer module

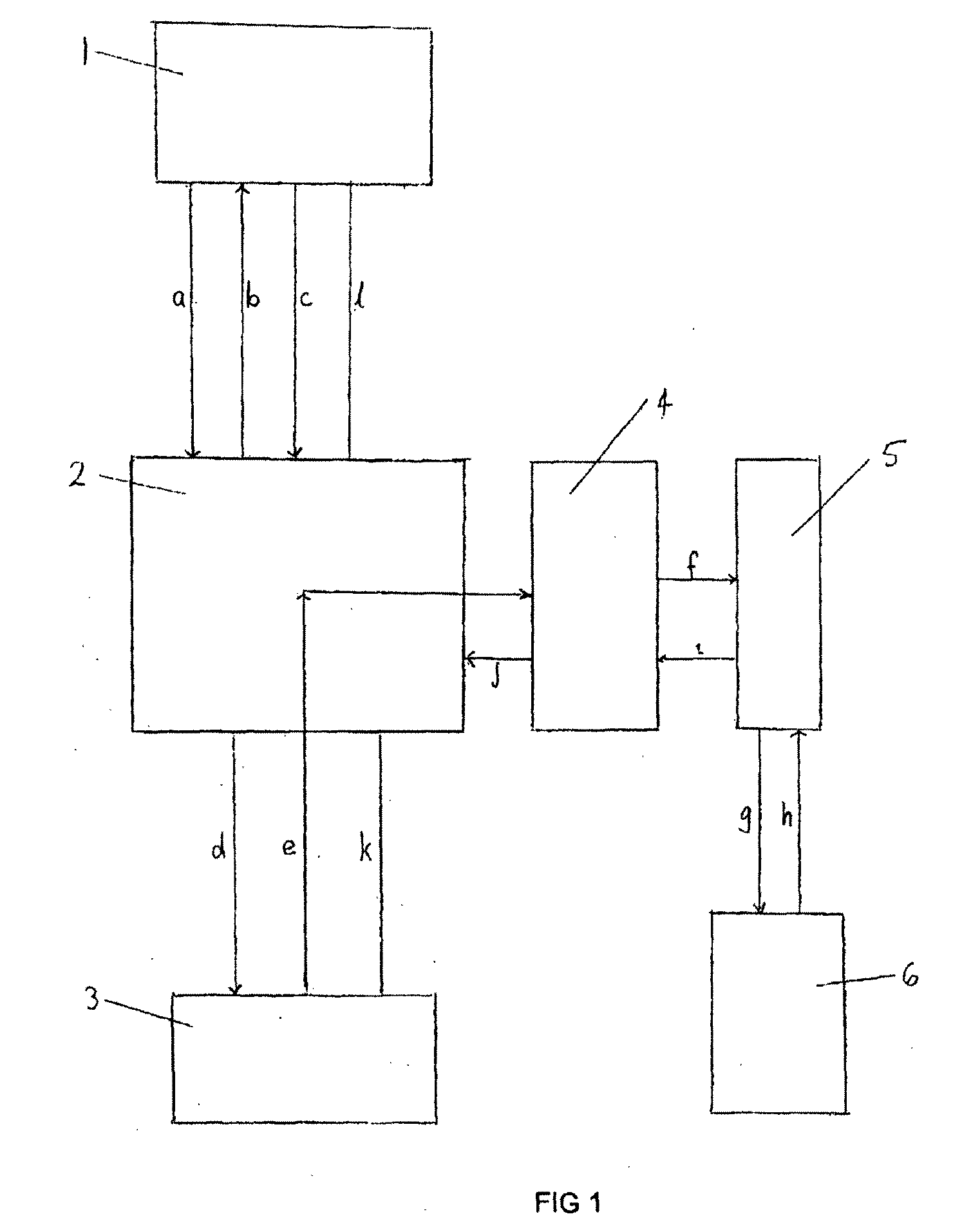

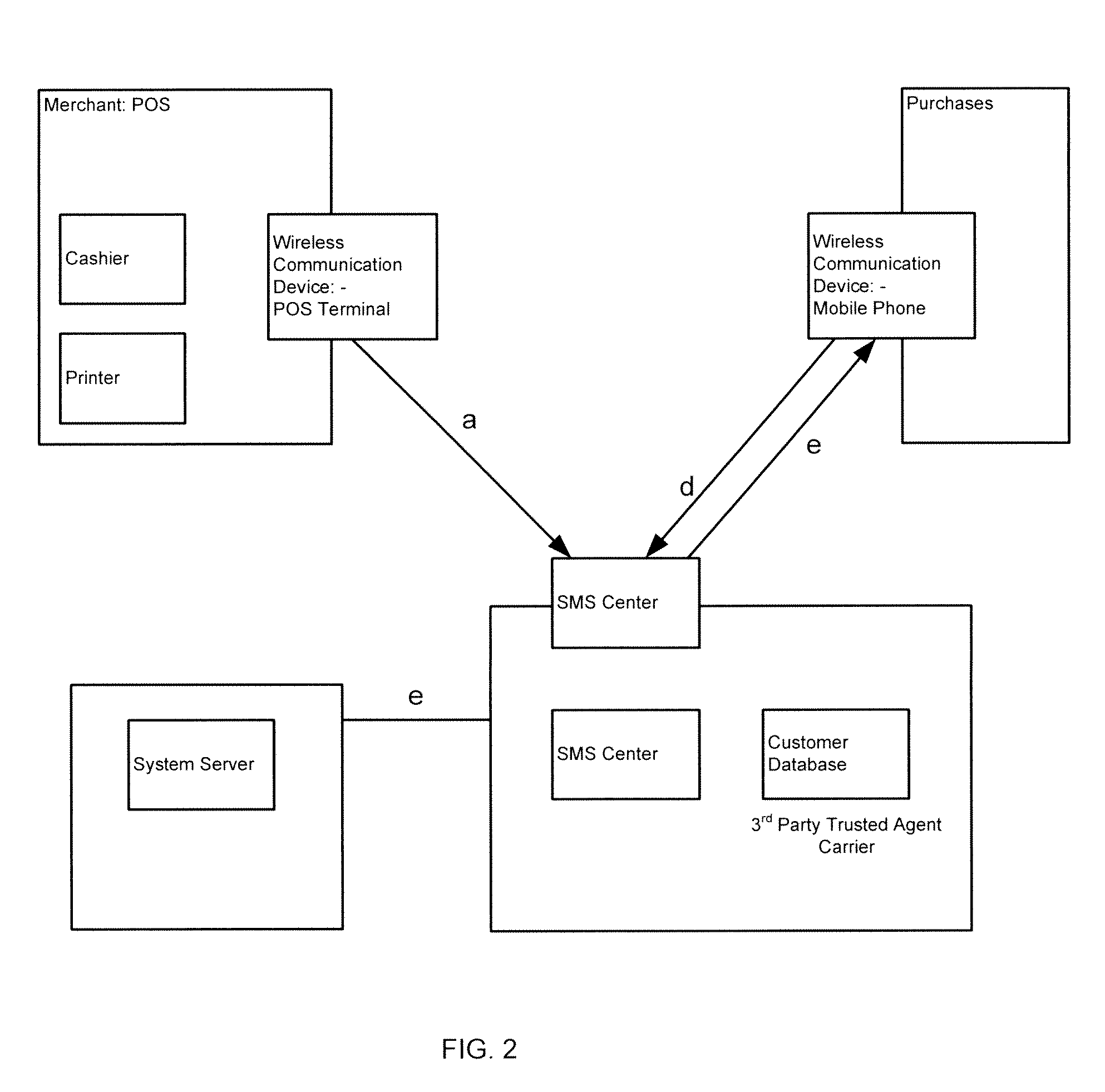

A transaction processing system for processing a transaction between a supplier and a customer, said system comprising a supplier device for initiating the transaction, a system server and a mobile communication device, said device containing a message processing program module for enabling local verification of the transaction within the mobile device, wherein a transaction message is sent from the supplier device to the system server, a message requesting payment for the transaction is sent from the system server to the mobile communication device, the transaction is authorised and verified at the mobile telecommunications device from which a verification message is sent back to the system server, and the transaction is then processed.

Owner:LEUNG GARY +7

System and method for facilitating electronic financial transactions using a mobile telecommunication device

InactiveUS7379920B2Improve securityFurther level of securityAccounting/billing servicesUser identity/authority verificationPaymentComputer module

A transaction processing system for processing a transaction between a supplier and a customer, said system comprising a supplier device for initiating the transaction, a system server and a mobile communication device, said device containing a message processing program module for enabling local verification of the transaction within the mobile device, wherein a transaction message is sent from the supplier device to the system server, a message requesting payment for the transaction is sent from the system server to the mobile communication device, the transaction is authorized and verified at the mobile telecommunications device from which a verification message is sent back to the system server, and the transaction is then processed.

Owner:LEUNG GARY +7

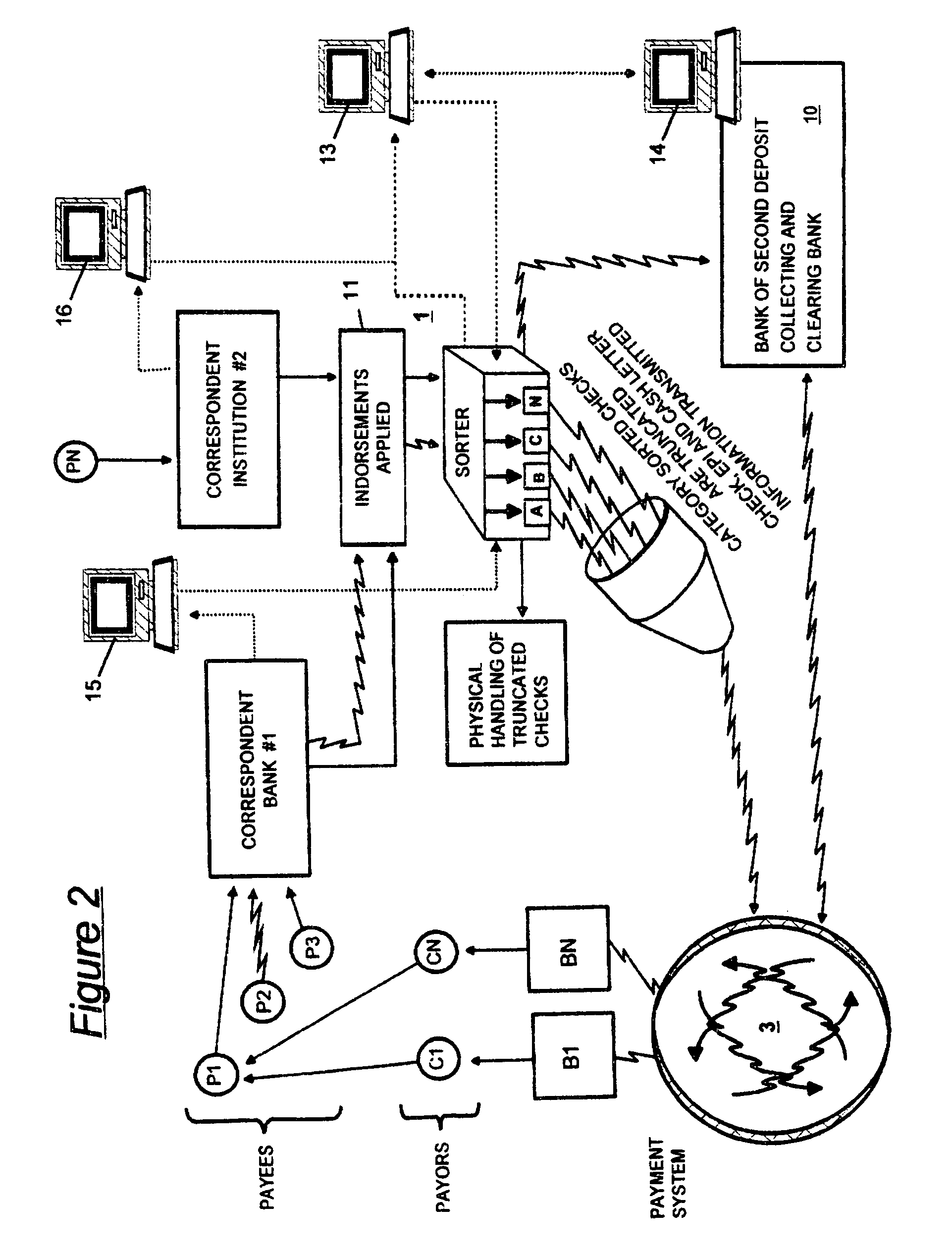

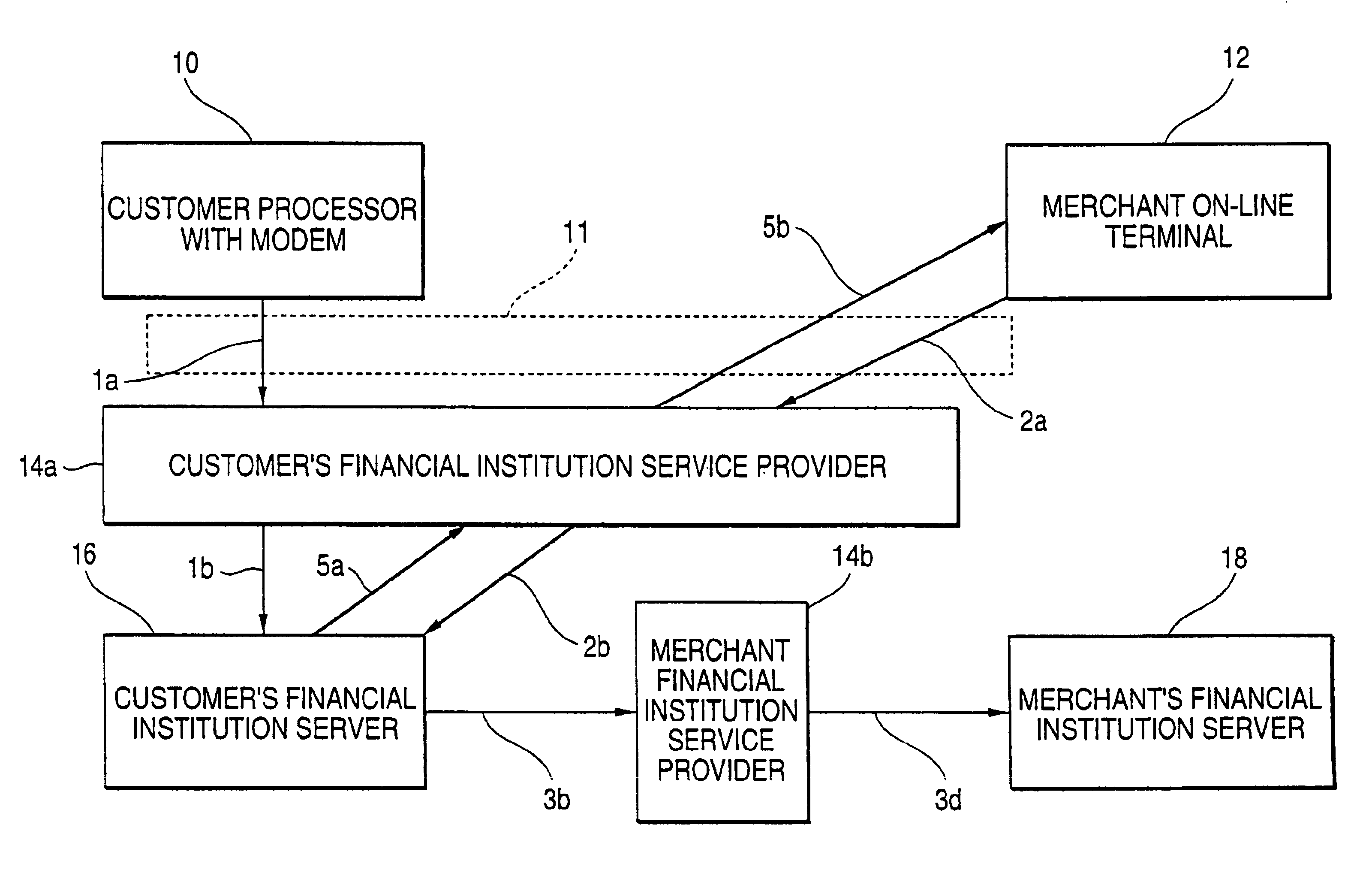

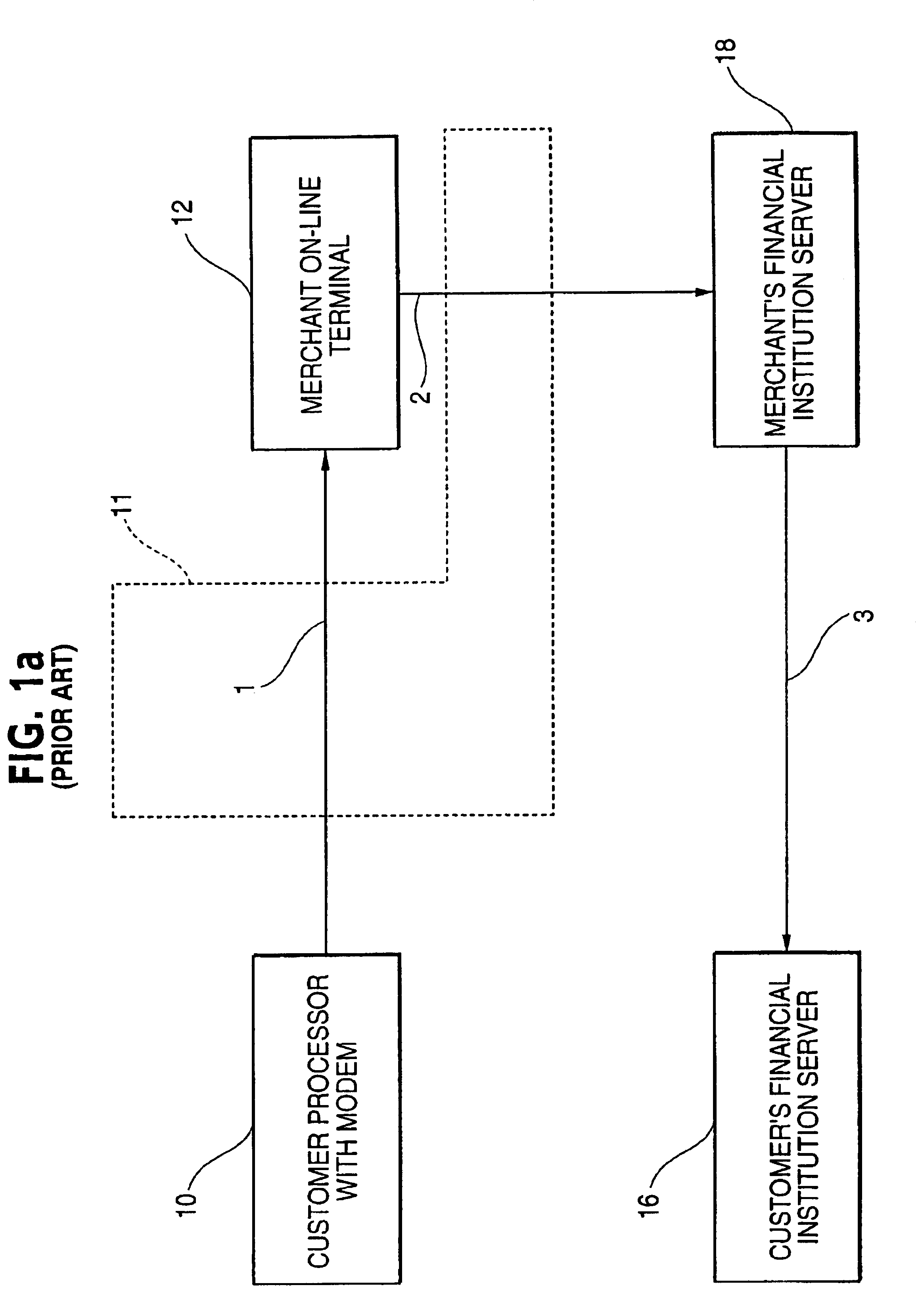

System and use for correspondent banking

InactiveUS6947908B1Reduce the amount requiredImprove Internet efficiencyComputer security arrangementsPayment circuitsFinancial transactionPersonal computer

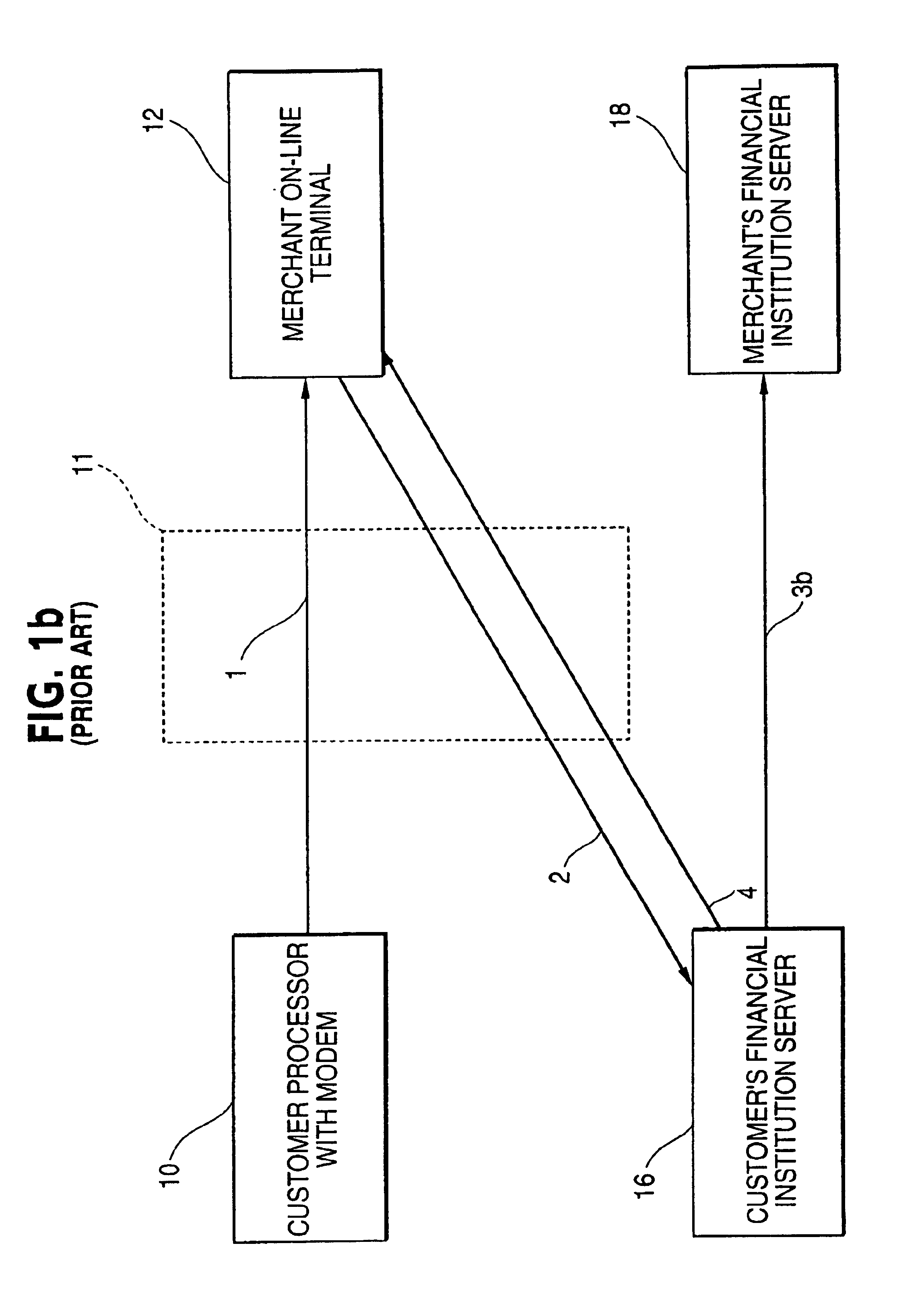

The present invention comprises a system and method for a customer and merchant to perform an on-line, and in some cases, real-time financial transaction from a personal computer or similar processing terminal over a public access communications network utilizing a universally acceptable electronic financial transaction instruction that debits a customer's selected account and notifies a merchant that a credit is due or forthcoming and a service provider. The financial transaction instruction is provided in a secured format for transactions sent over the public access communications network, which is external from any other conventional open or closed communication channels used for performing financial transactions.

Owner:CITIBANK

Financial transaction system with integrated electronic messaging, control of marketing data, and user defined charges for receiving messages

InactiveUS20050192899A1Timely controlIncrease valueComplete banking machinesFinanceData controlFinancial transaction

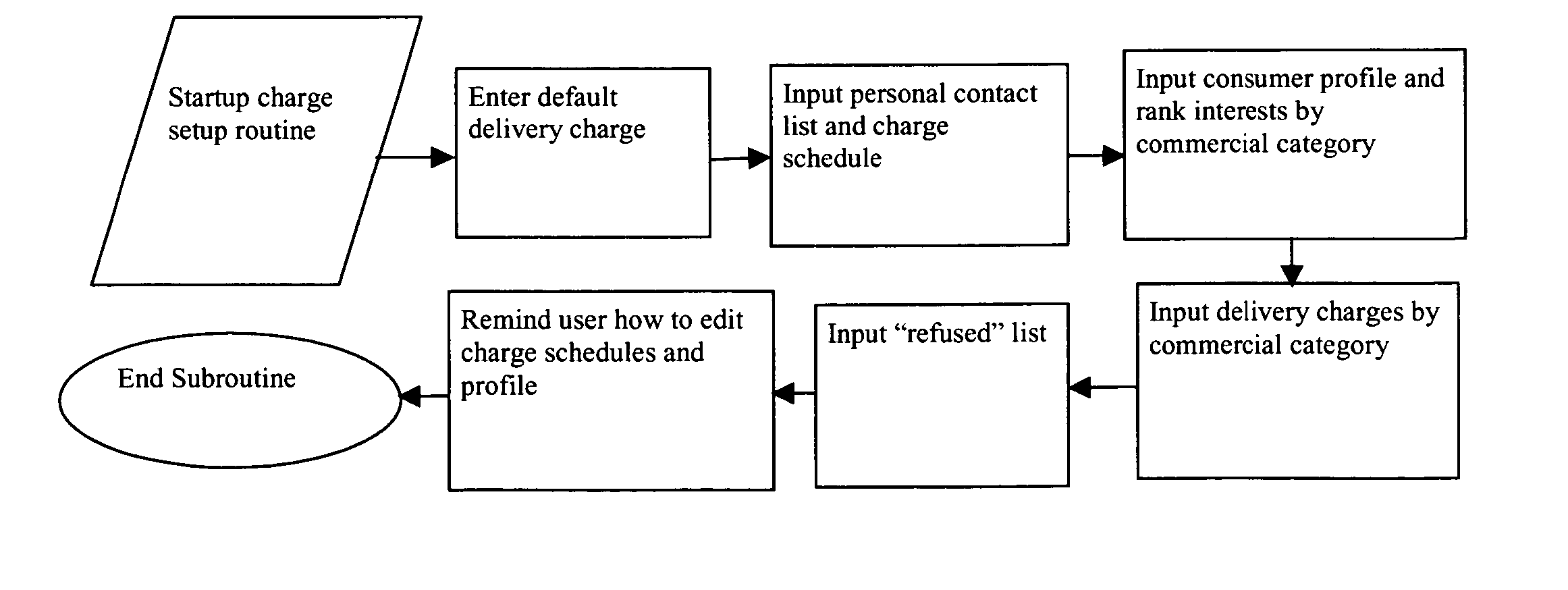

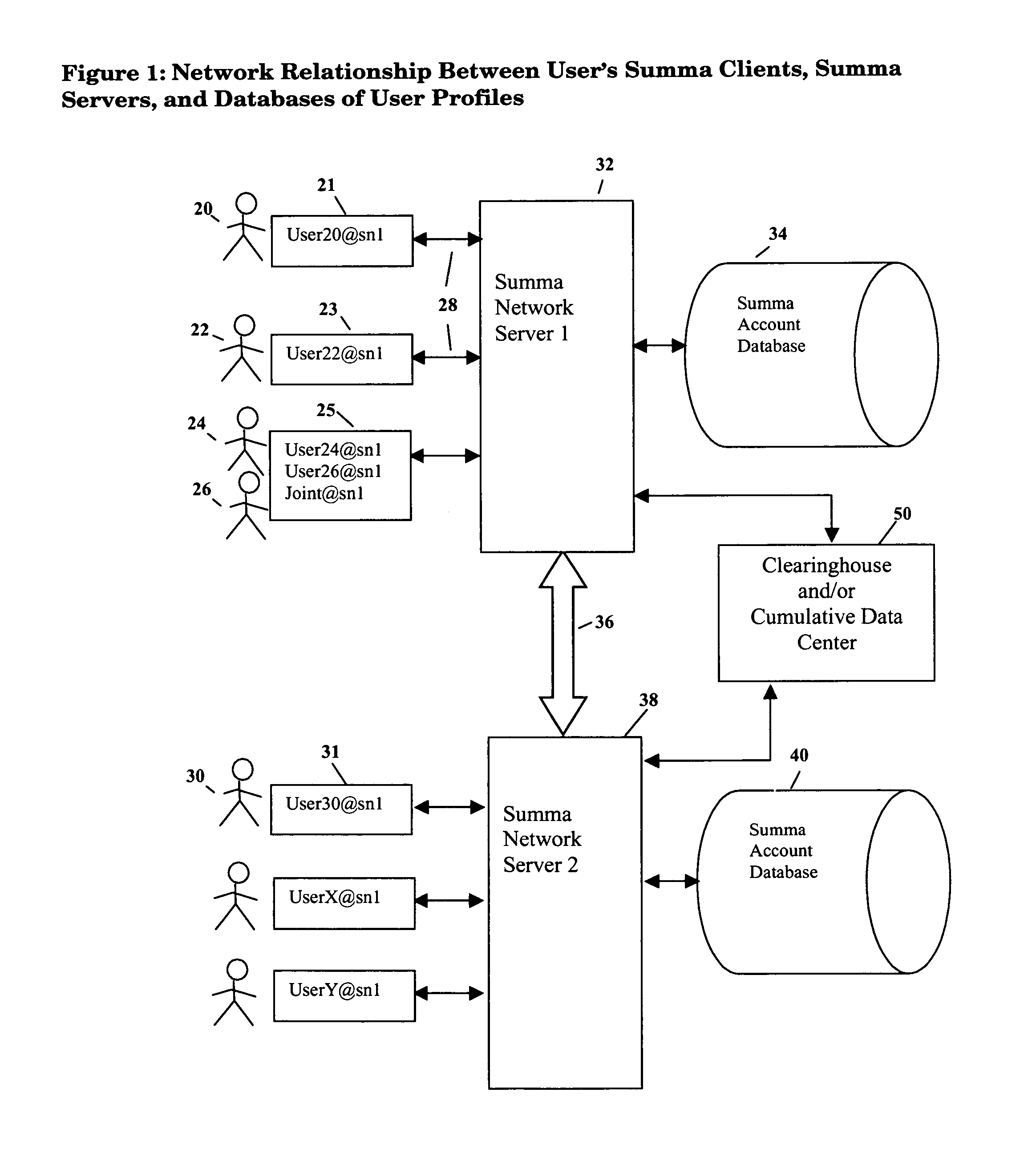

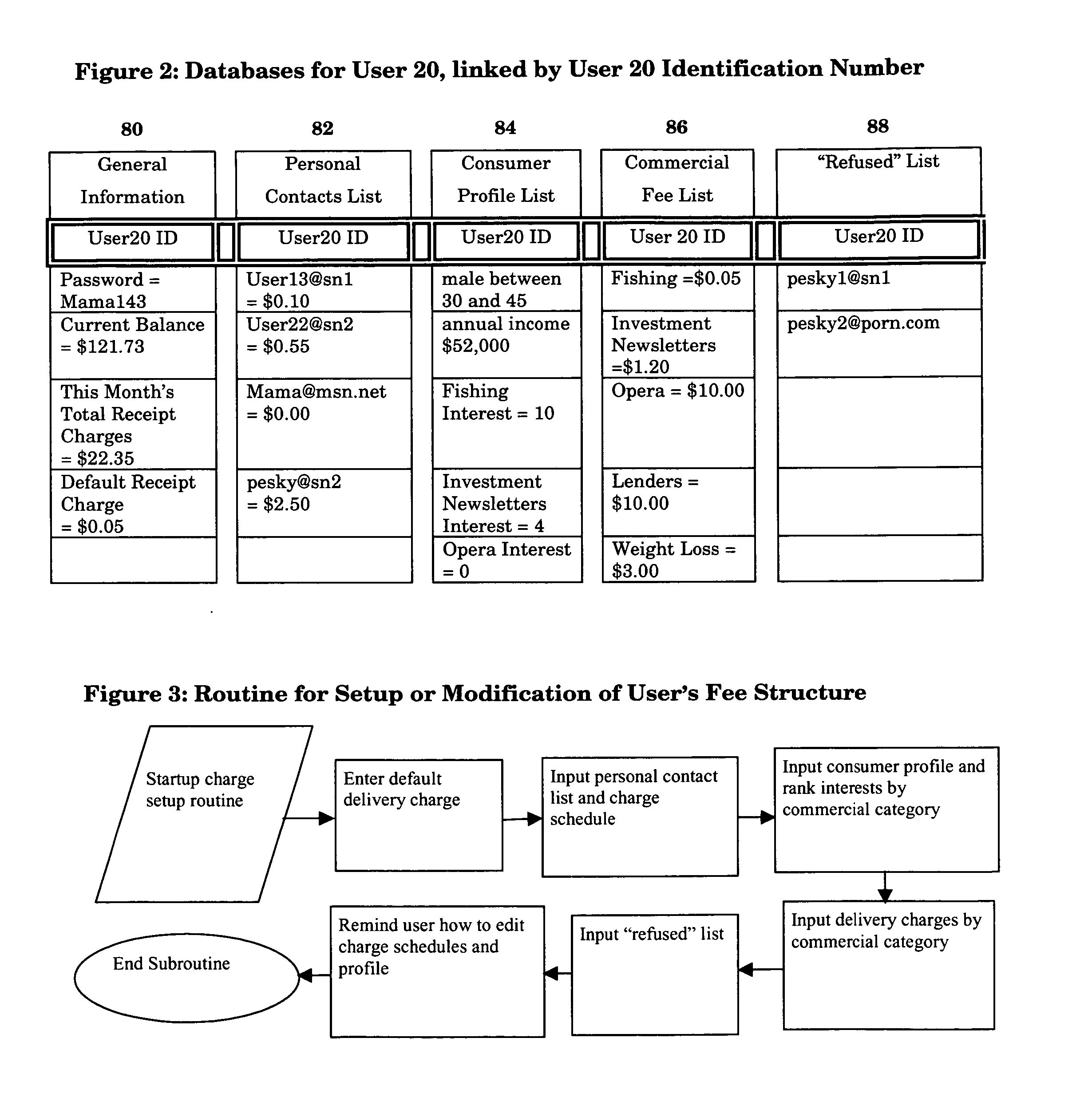

A method of performing financial transactions between users of Summa accounts, each Summa account including an electronic messaging system that provides for crediting and debiting at least one financial account associated with each Summa account. The invention also allows each user to define a schedule of receipt charges associated with the identities of other users to be charged as compensation for accepting delivery of their messages. With the user's permission, a record of purchases made from the Summa account may be maintained in a marketing database, increasing the value of use's market identity and the corresponding value of receipt charges they user may collect. Major benefits of the invention include, but are not limited to: (1) electronic financial transactions are completed in a more secure manner with appropriate tracking and verification, (2) message recipients receive income from the value of their market identities, and (3) commercial enterprises can more readily identify individuals interested in receiving their commercial offers.

Owner:REARDON DAVID C

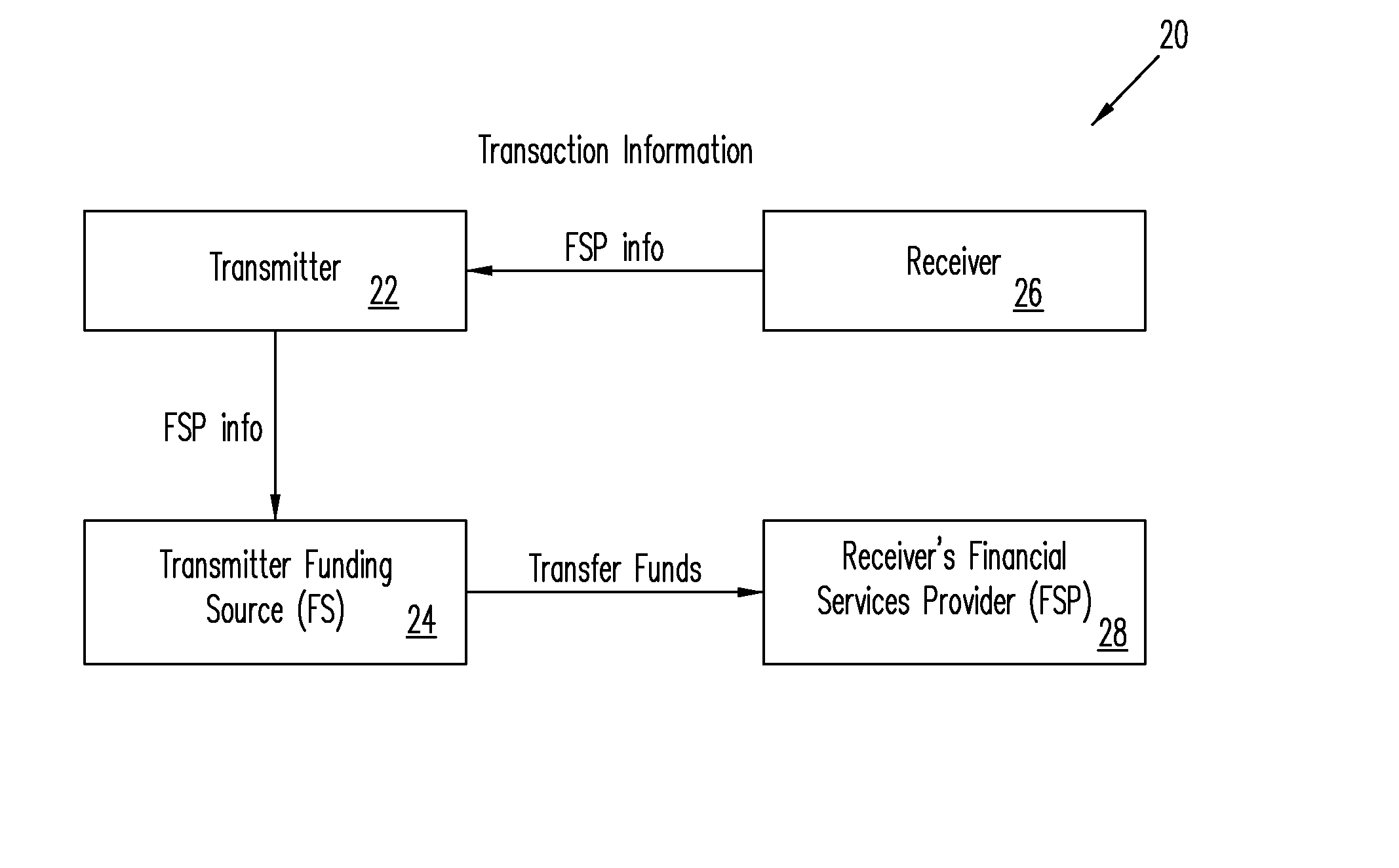

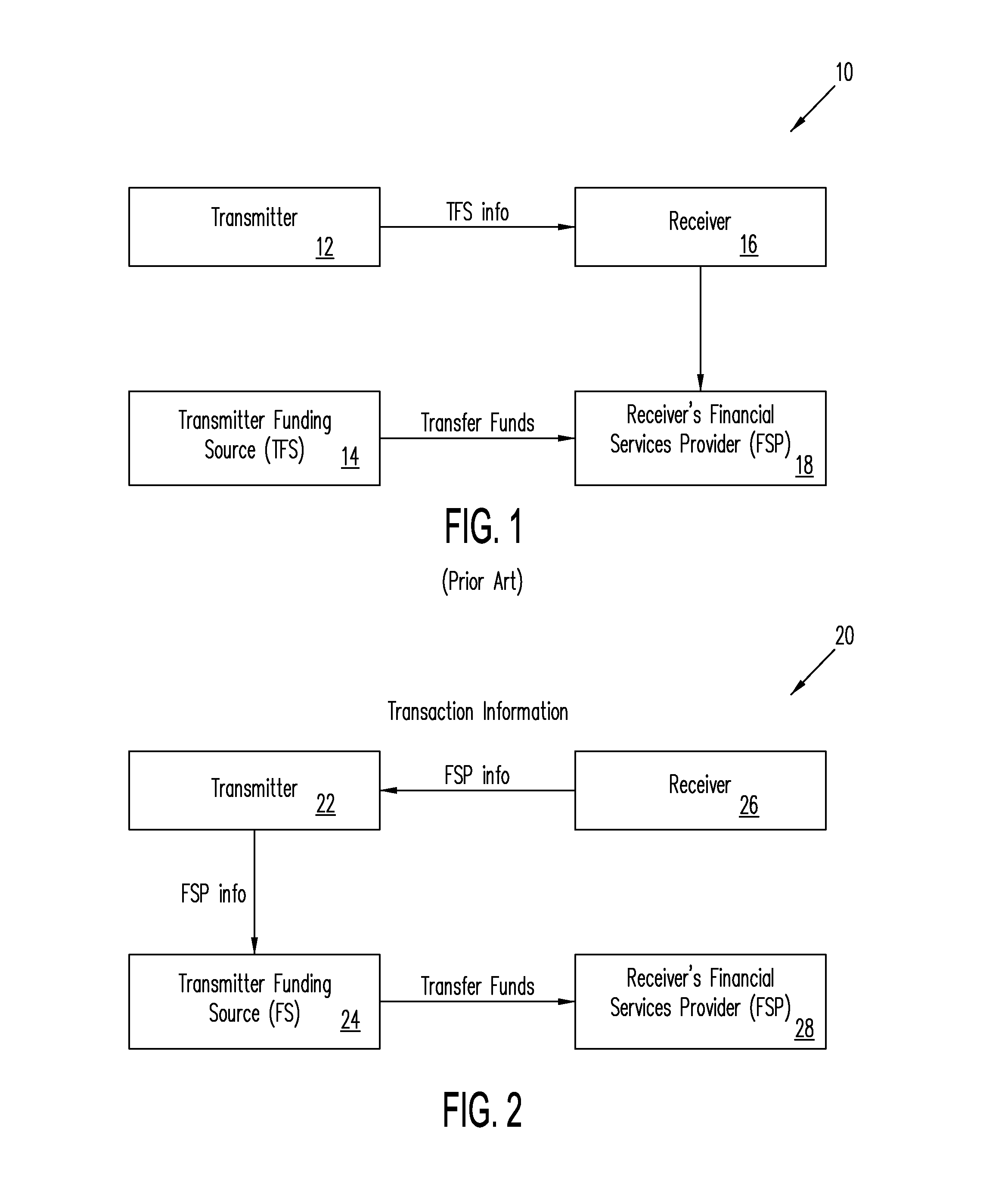

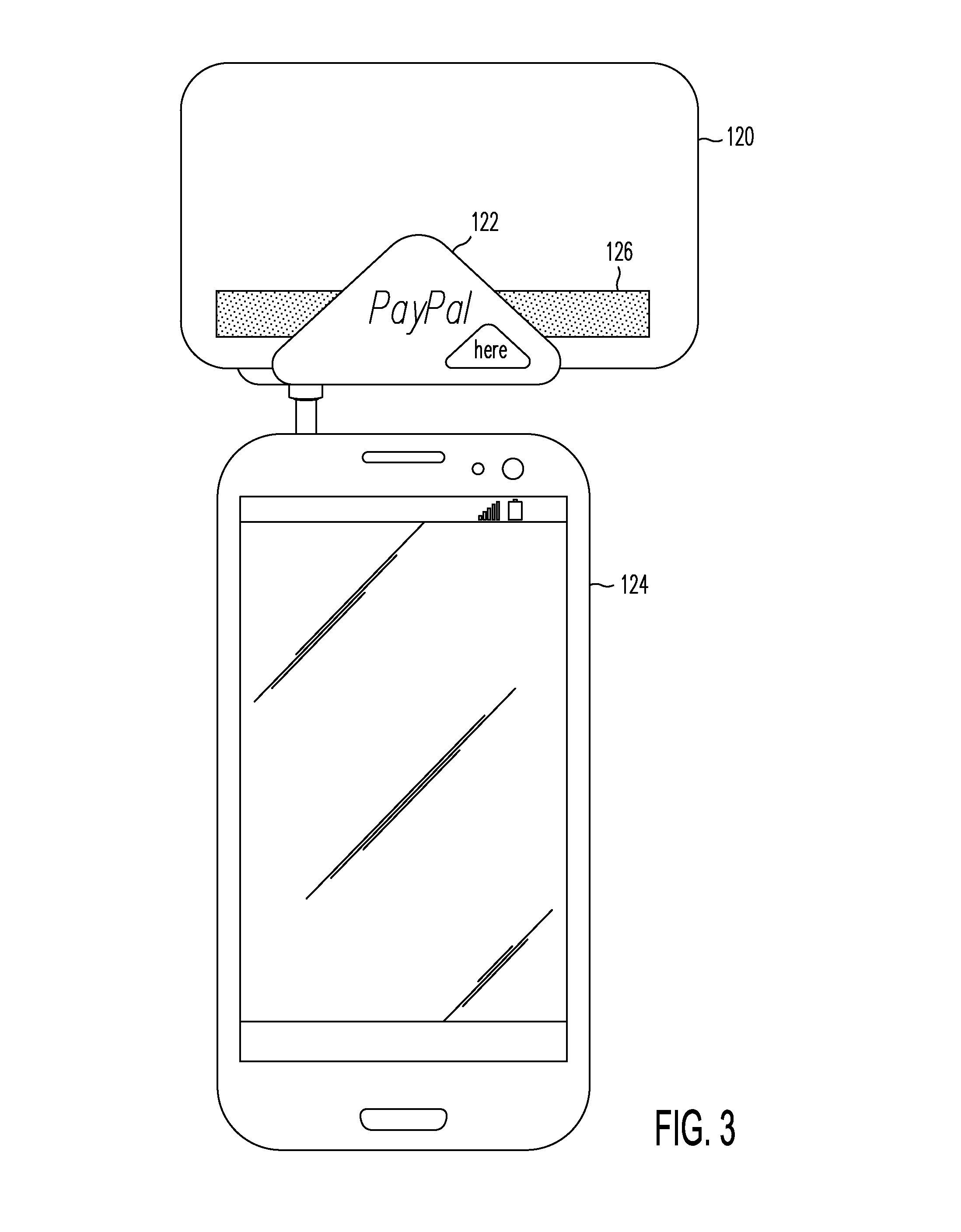

Systems, Methods, And Computer Program Products Providing Push Payments

In electronic financial transactions a receiver, or targeted recipient of funds, provides account information to a transmitter, or sender of funds. The transmitter initiates a push of funds from a transmitter funding source to the receiver's funding source processor. In some embodiments the receiver provides a payment card, similar to a credit card, which is read by an electronic device of the transmitter, such as a smart phone. In some embodiments, the receiver provides the account information by way of a bar code, such as a QR code, which is scanned and read by the transmitter's electronic device.

Owner:PAYPAL INC

System and Method for Facilitating Electronic Financial Transactions Using a Mobile Telecommunication Device

InactiveUS20080288351A1Improve securityDigital data processing detailsUser identity/authority verificationPaymentComputer module

A transaction processing system for processing a transaction between a supplier and a customer, said system comprising a supplier device for initiating the transaction, a system server and a mobile communication device, said device containing a message processing program module for enabling local verification of the transaction within the mobile device, wherein a transaction message is sent from the supplier device to the system server, a message requesting payment for the transaction is sent from the system server to the mobile communication device, the transaction is authorised and verified at the mobile telecommunications device from which a verification message is sent back to the system server, and the transaction is then processed.

Owner:CONCEPTM

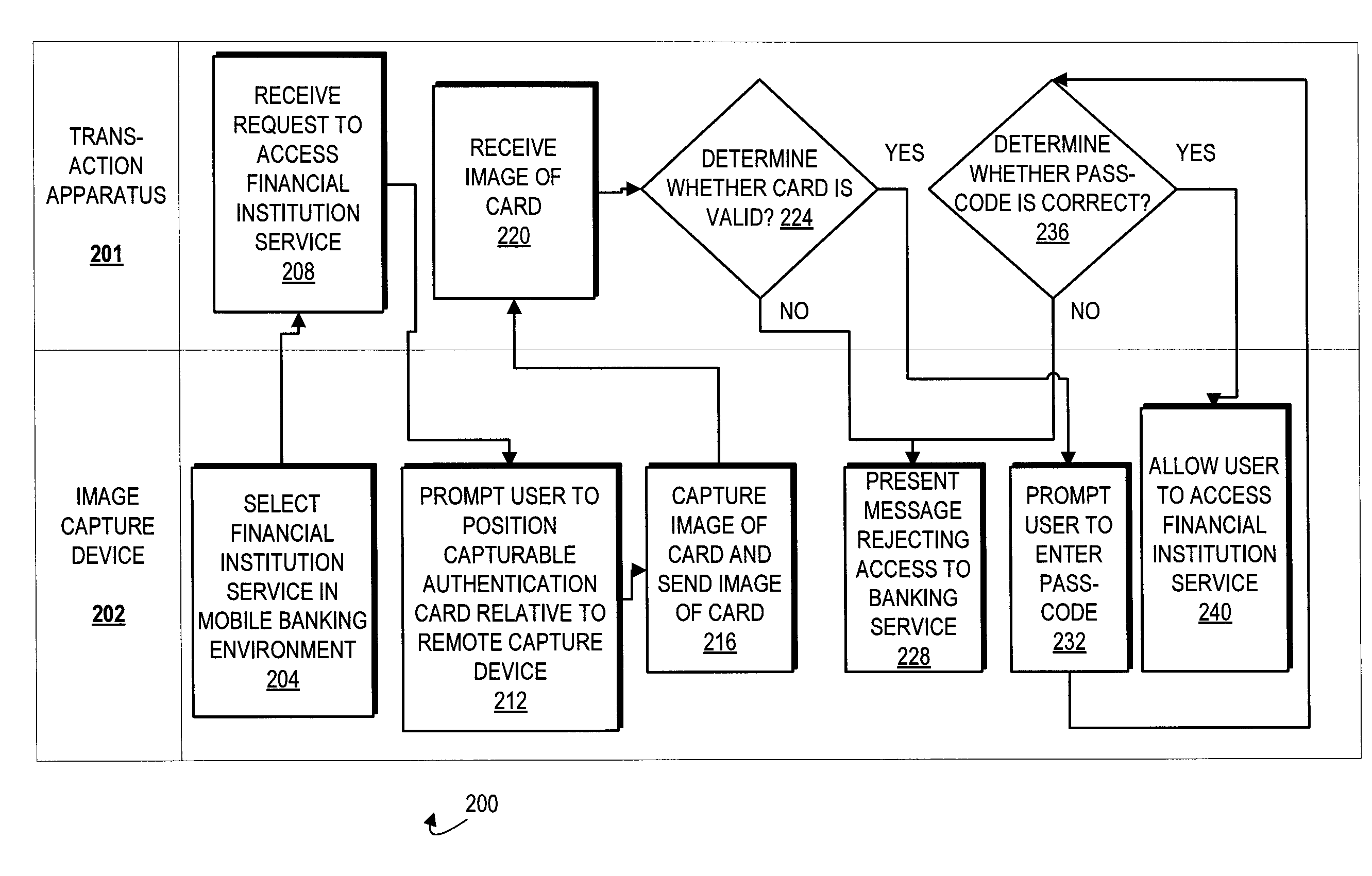

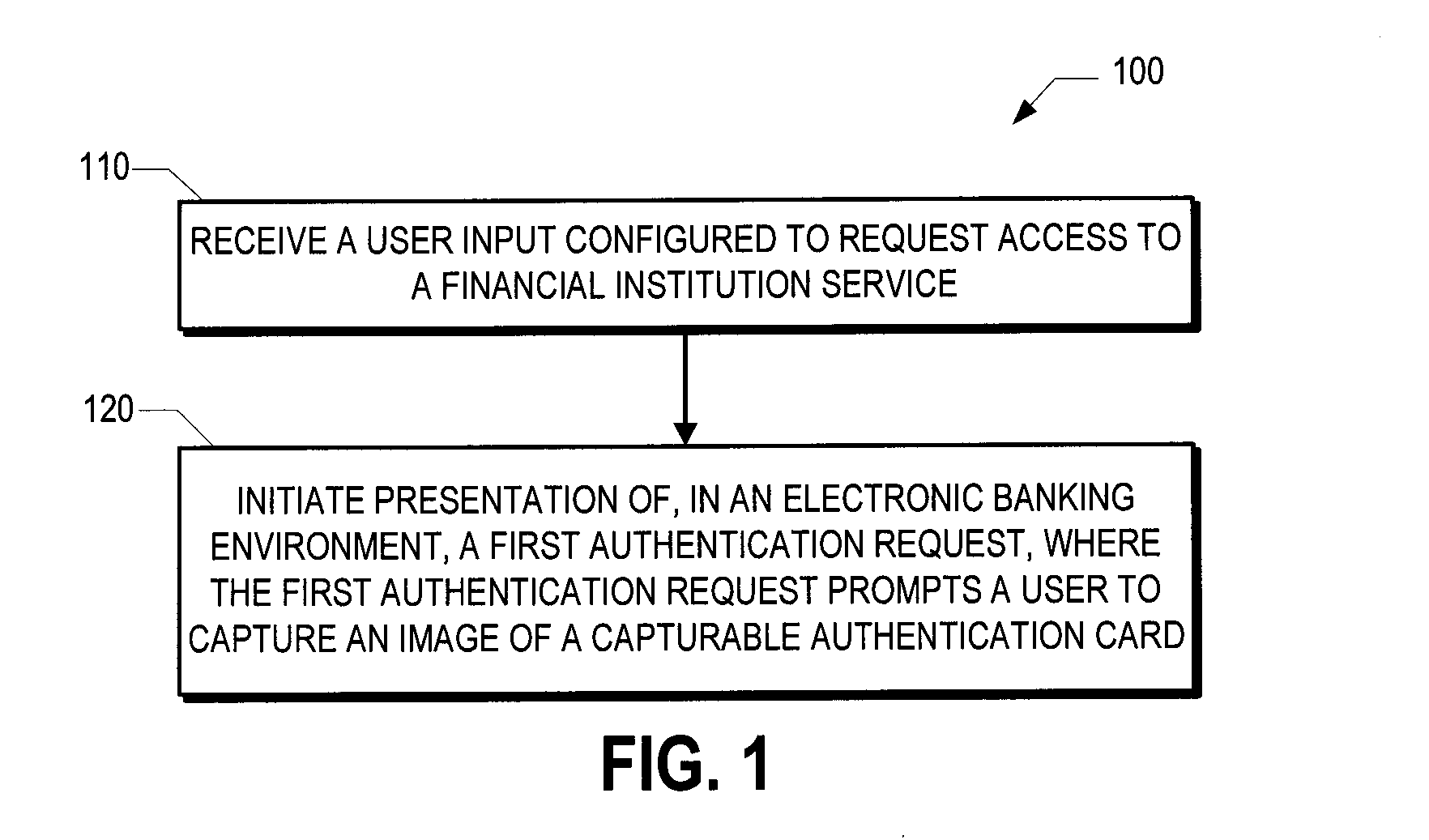

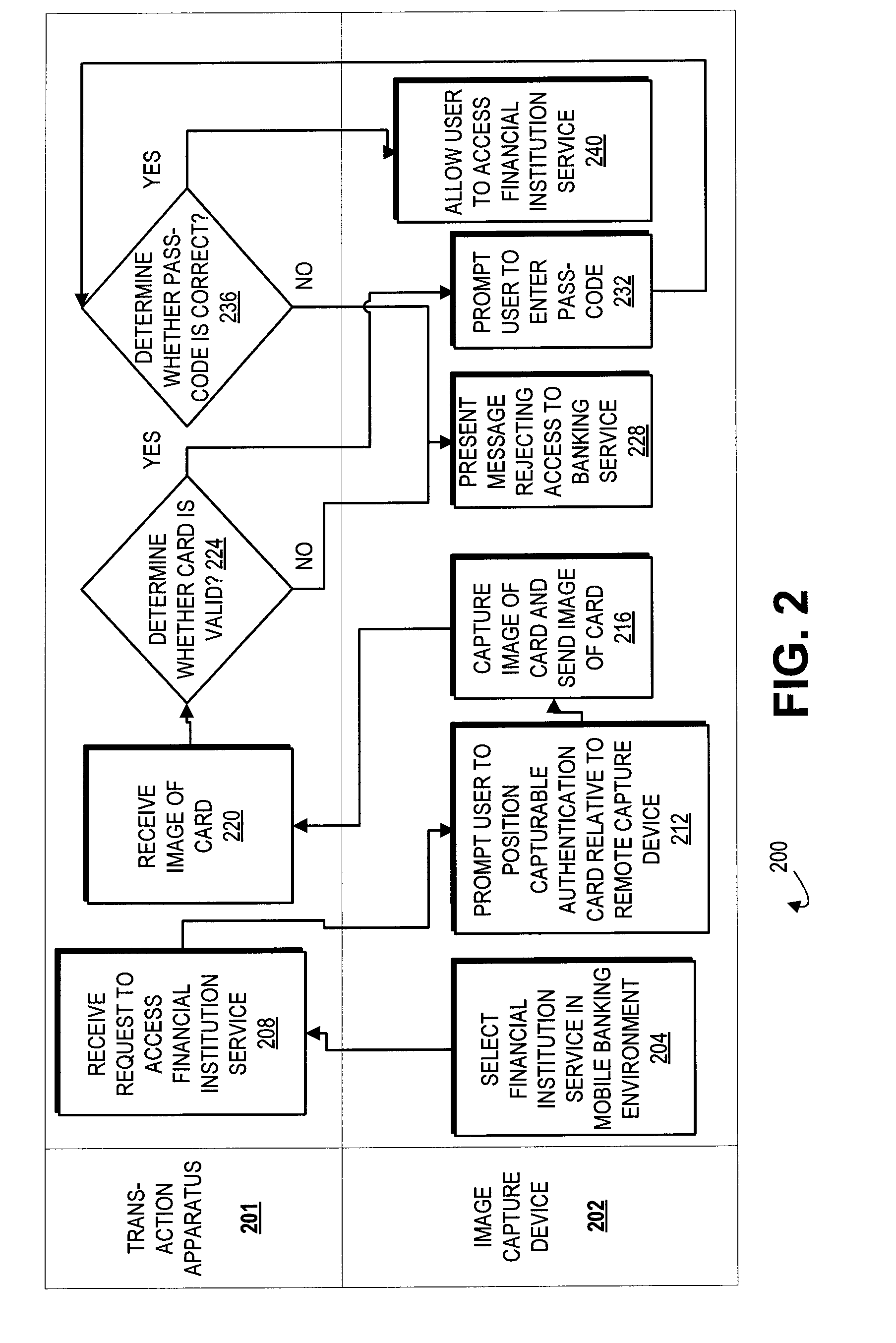

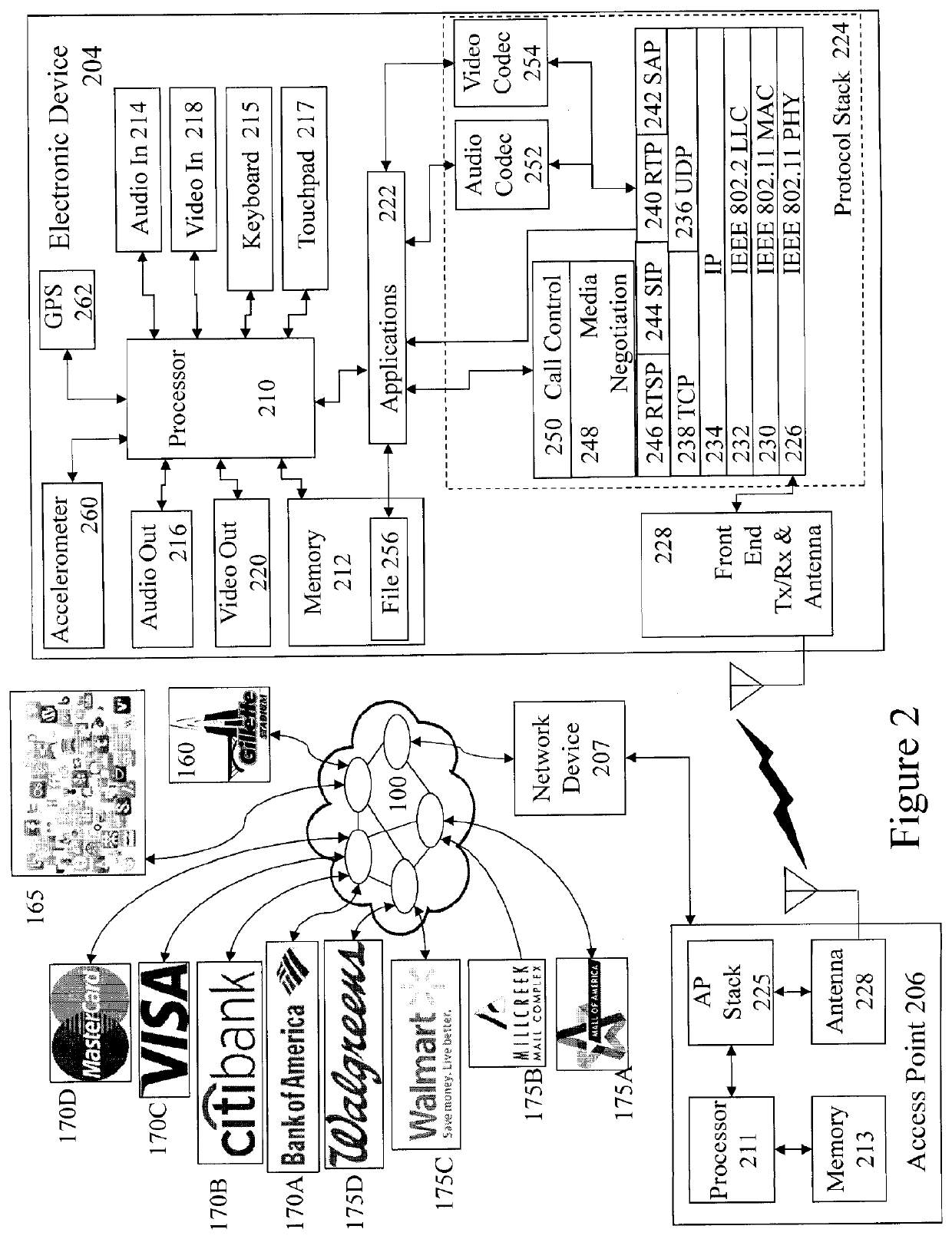

Authentication strategies for remote financial institution services

Embodiments of the invention are directed to systems, methods and computer program products for authenticating access to a financial institution service. In some embodiments, a method includes: (a) receiving a user input configured to request access to a financial institution service, and (b) initiating presentation of, using a processor, a first authentication request in an electronic banking environment, wherein the first authentication request prompts a user to initiate capture of an image of a capturable authentication card associated with the account holder. In some embodiments, the method further includes receiving the image of the capturable authentication card, and determining the capturable authentication card is a valid capturable authentication card based at least partially on information extracted from the image of the capturable authentication card. The invention allows a user to enjoy a similar authentication experience prior to accessing a financial institution service at a physical ATM when compared to accessing an electronic financial institution service via an image capture device such as a mobile computing device.

Owner:BANK OF AMERICA CORP

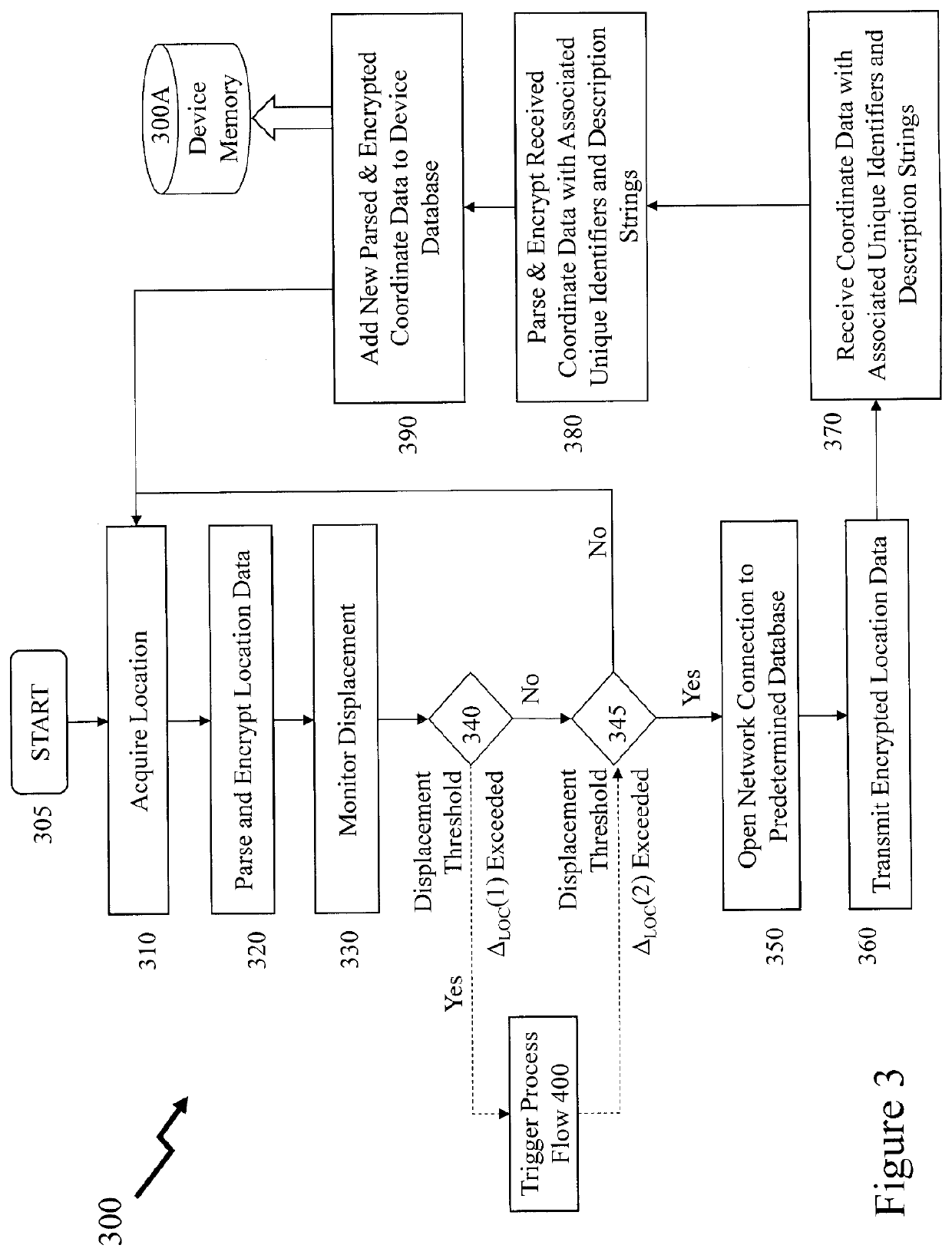

Secure location based electronic financial transaction methods and systems

Mobile payments to Point-of-Sale (PoS) terminals, kiosks, vending systems etc. as well as mobile banking are increasingly common due to the electronic devices available. However, fraud is an ongoing issue. Embodiments of the invention support increased security by applying processes which allow for easy and secure development of financial transaction services and equipment. Accordingly, the location of the consumer performing the financial transaction is included within the process. Embodiments include a consumer being physically present to authorise irrespective of authorisation of their credentials, a consumer may establish preferred locations for transactions, a retailer and consumer may perform the transaction once the consumer has left the retail location through stored location data of the user's device. Embodiments of the invention also support financial transactions without a direct PoS transaction as the user's device and the PoS terminal broker the transaction in the cloud using location data.

Owner:MURPHY JEAN LOUIS

Electronic payment systems and supporting methods and devices

InactiveUS20130060678A1Efficient transferFinanceProtocols using social networksSystems designSubject matter

Electronic payment systems and supporting methods and devices are described. For instance, the disclosed subject matter describes aggregated transactional account functionality configured to receive electronic financial transactions associated with one or more of a set of electronic identifying information such as phone ID, email, instant message, etc. for a user and related functionality. The disclosed details enable various refinements and modifications according to system design and tradeoff considerations.

Owner:RAWLLIN INT

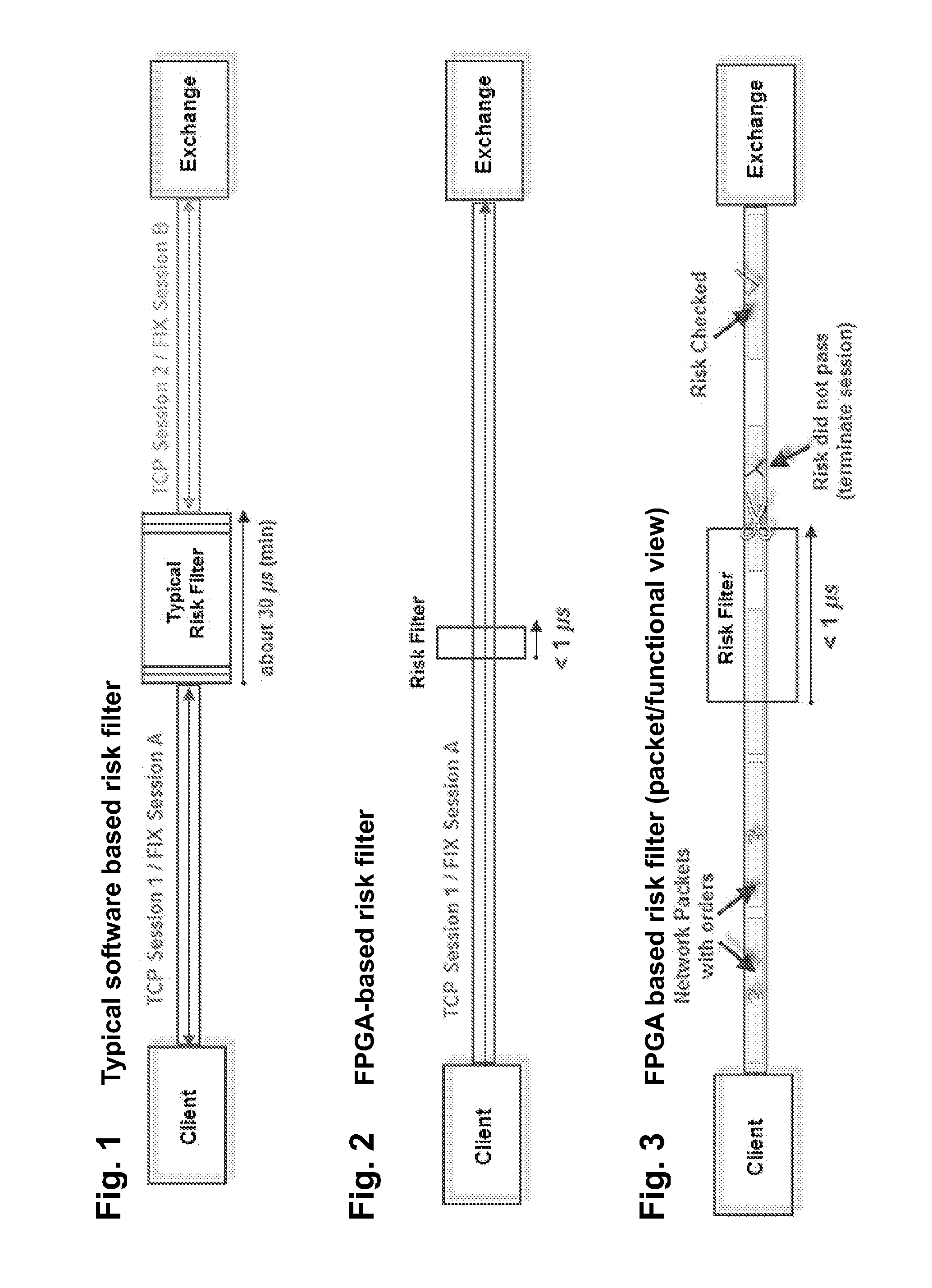

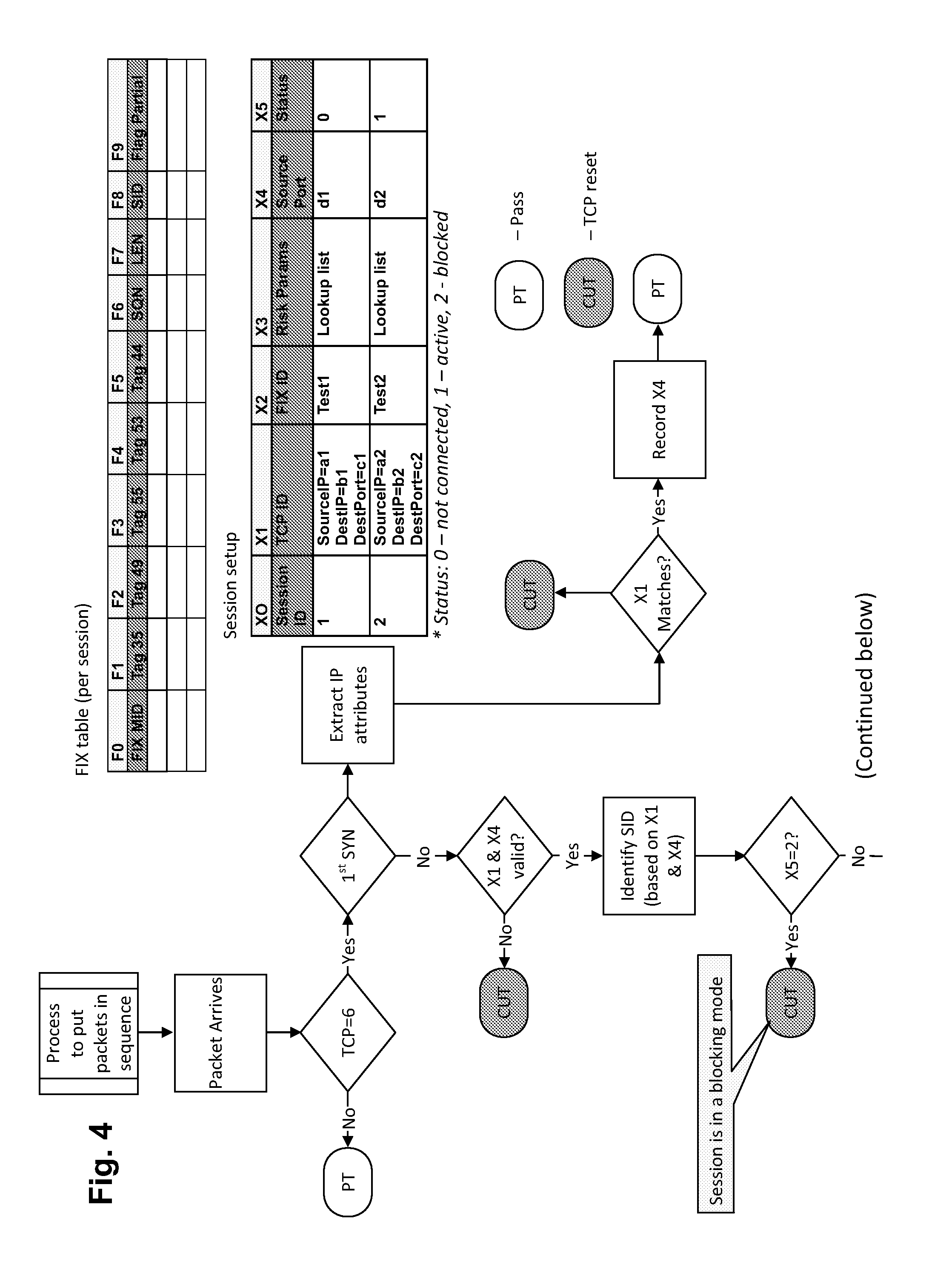

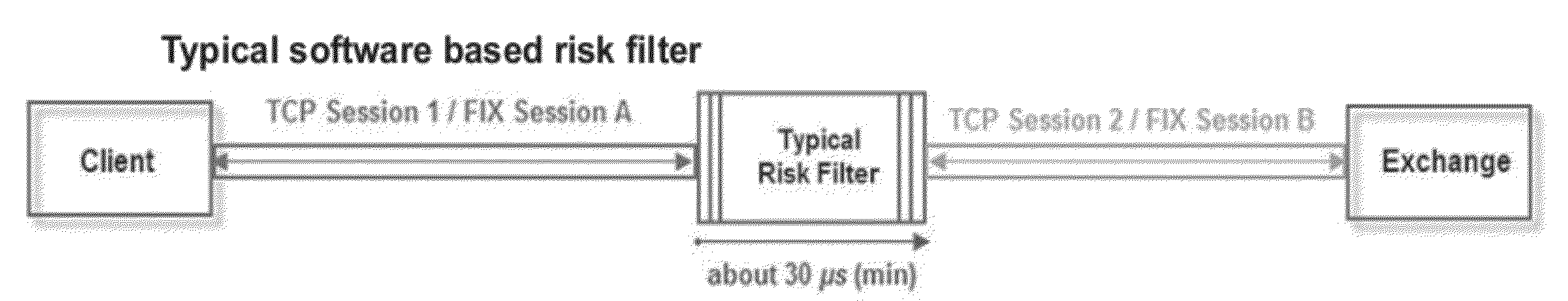

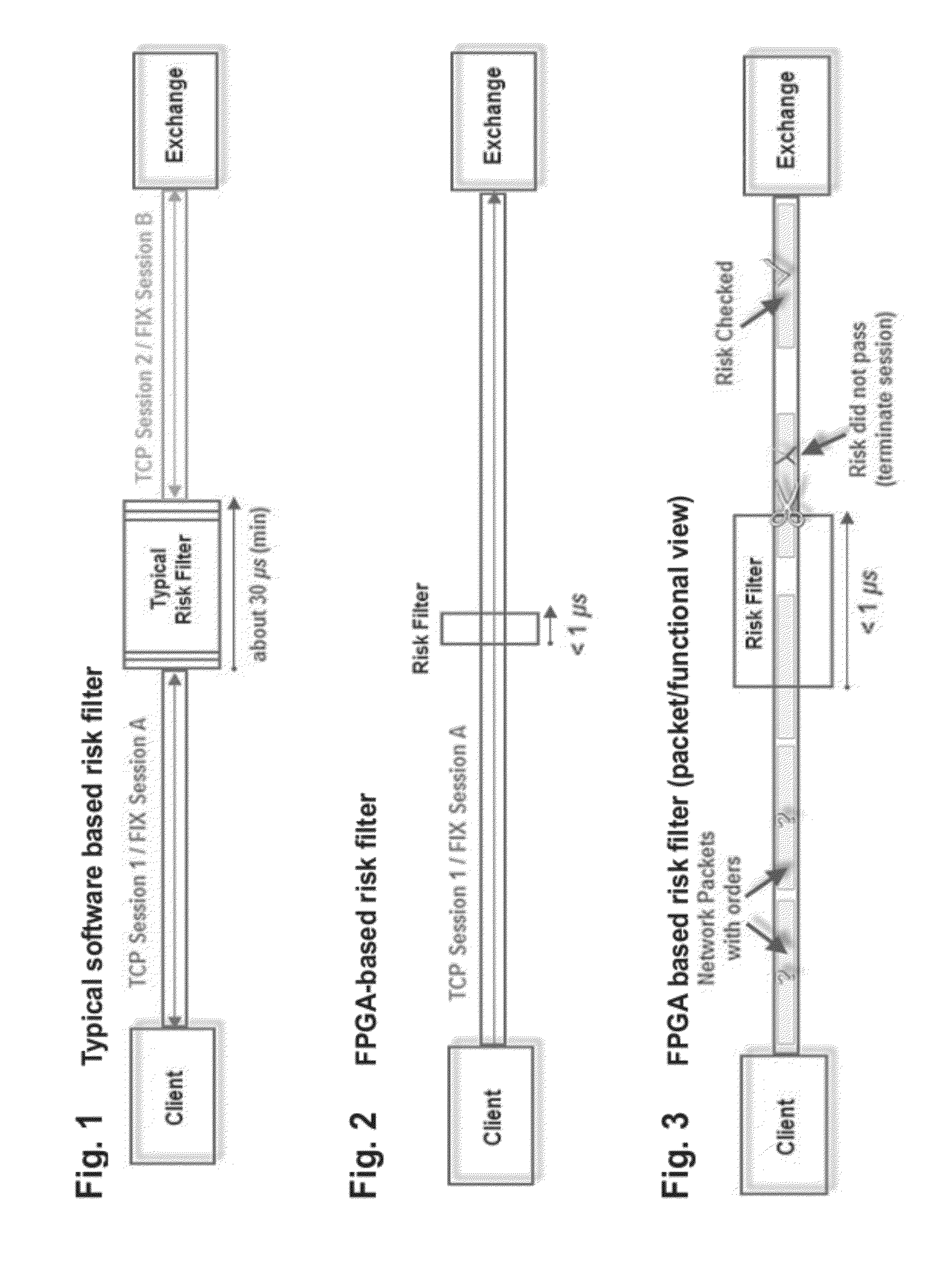

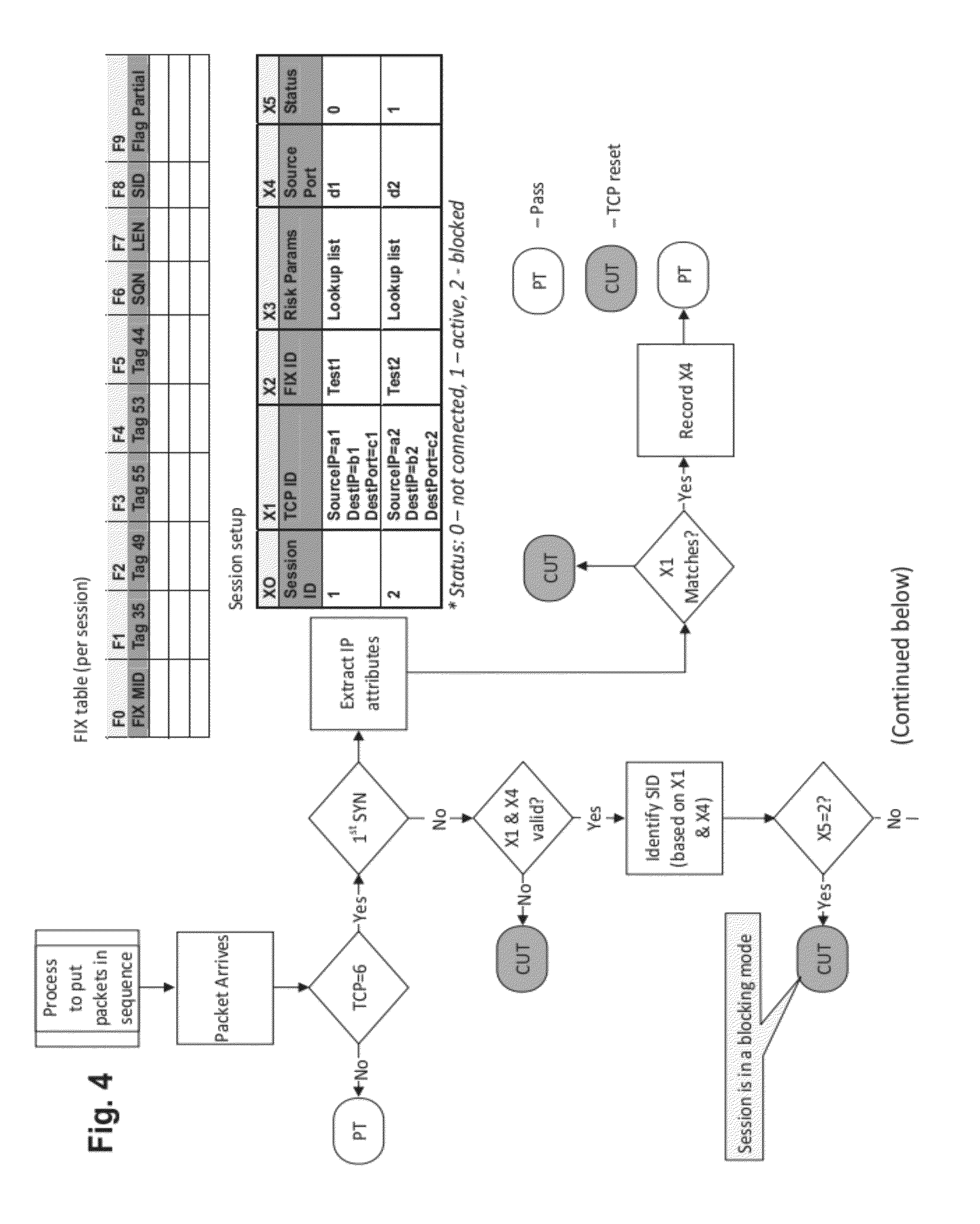

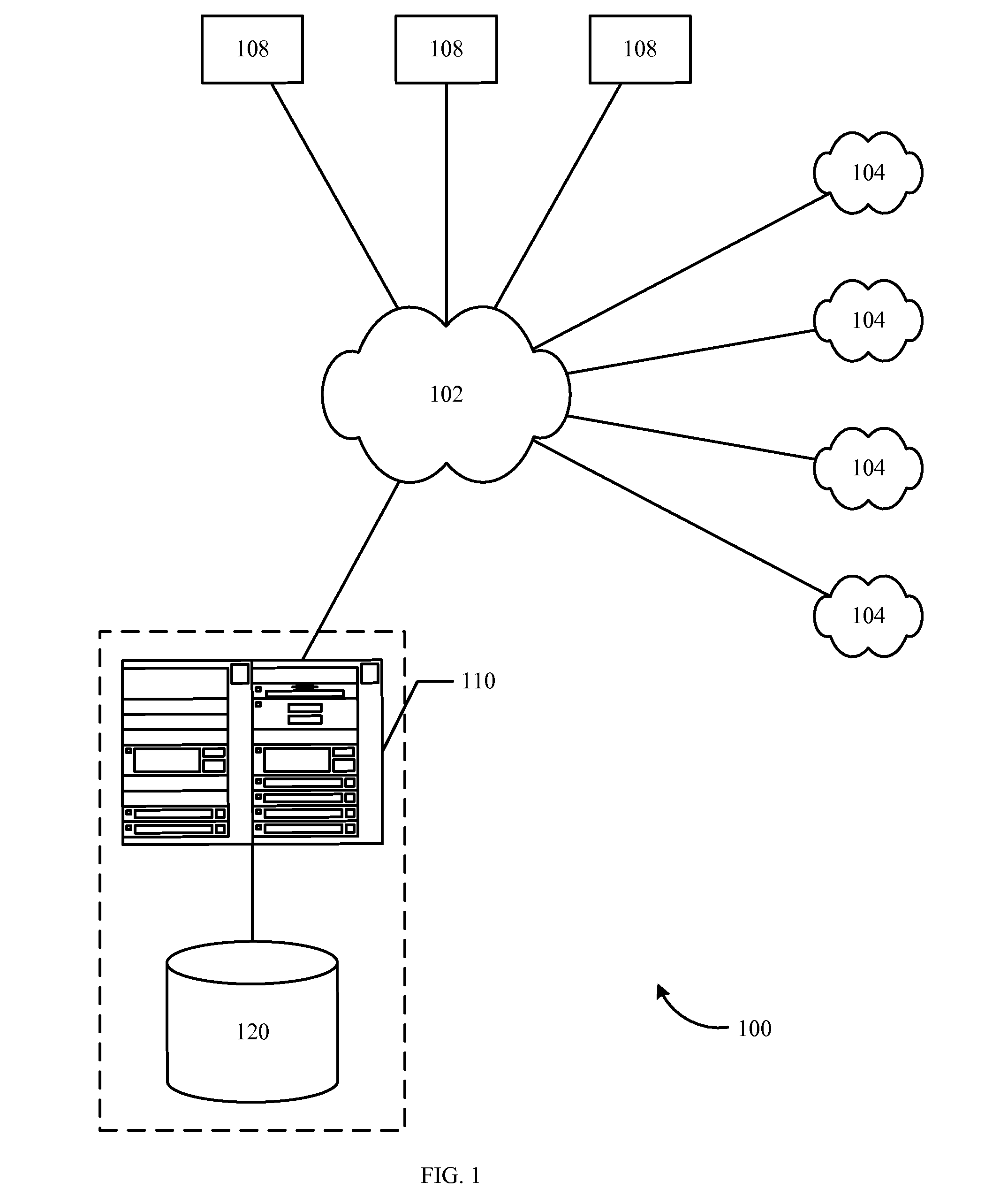

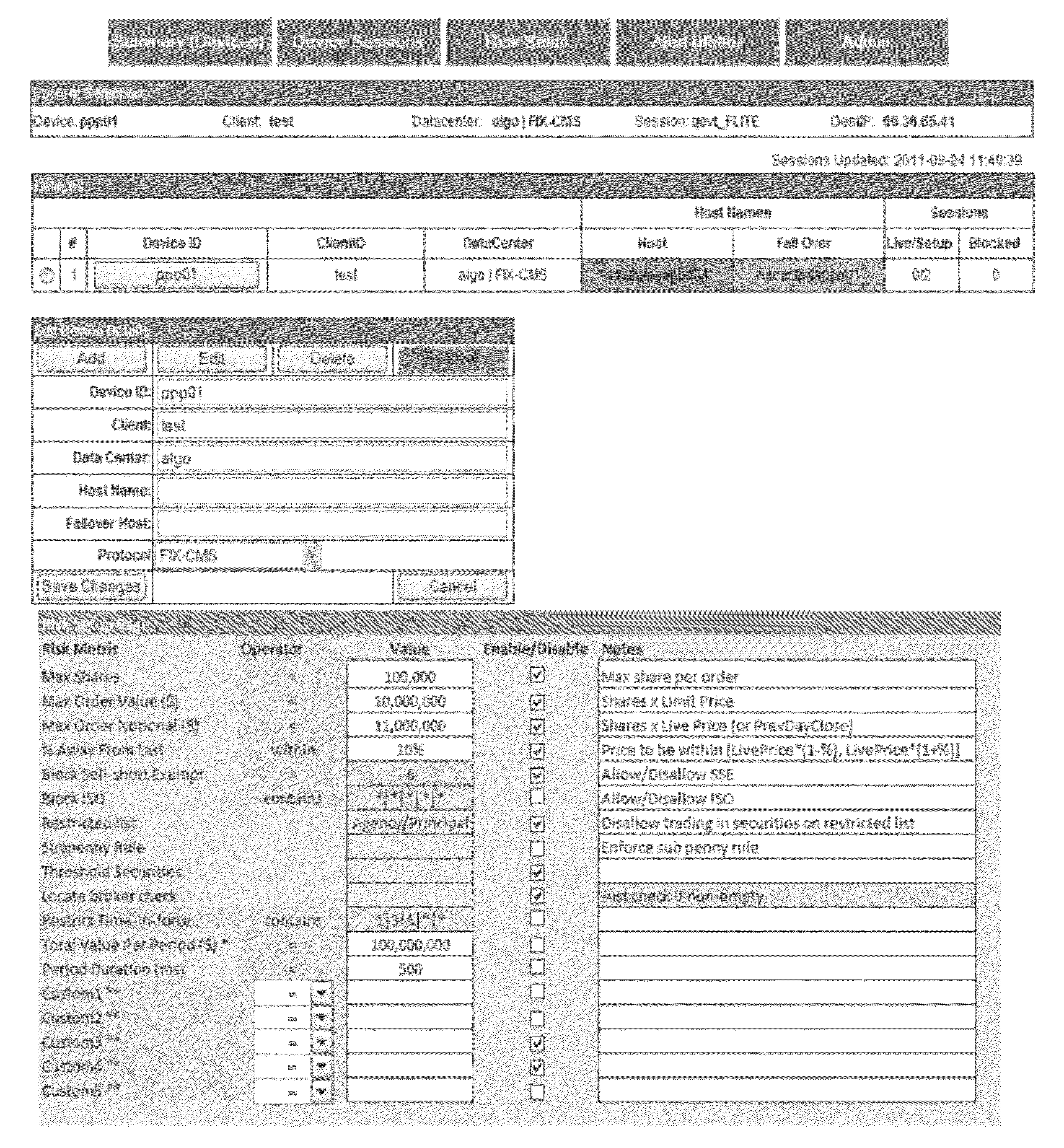

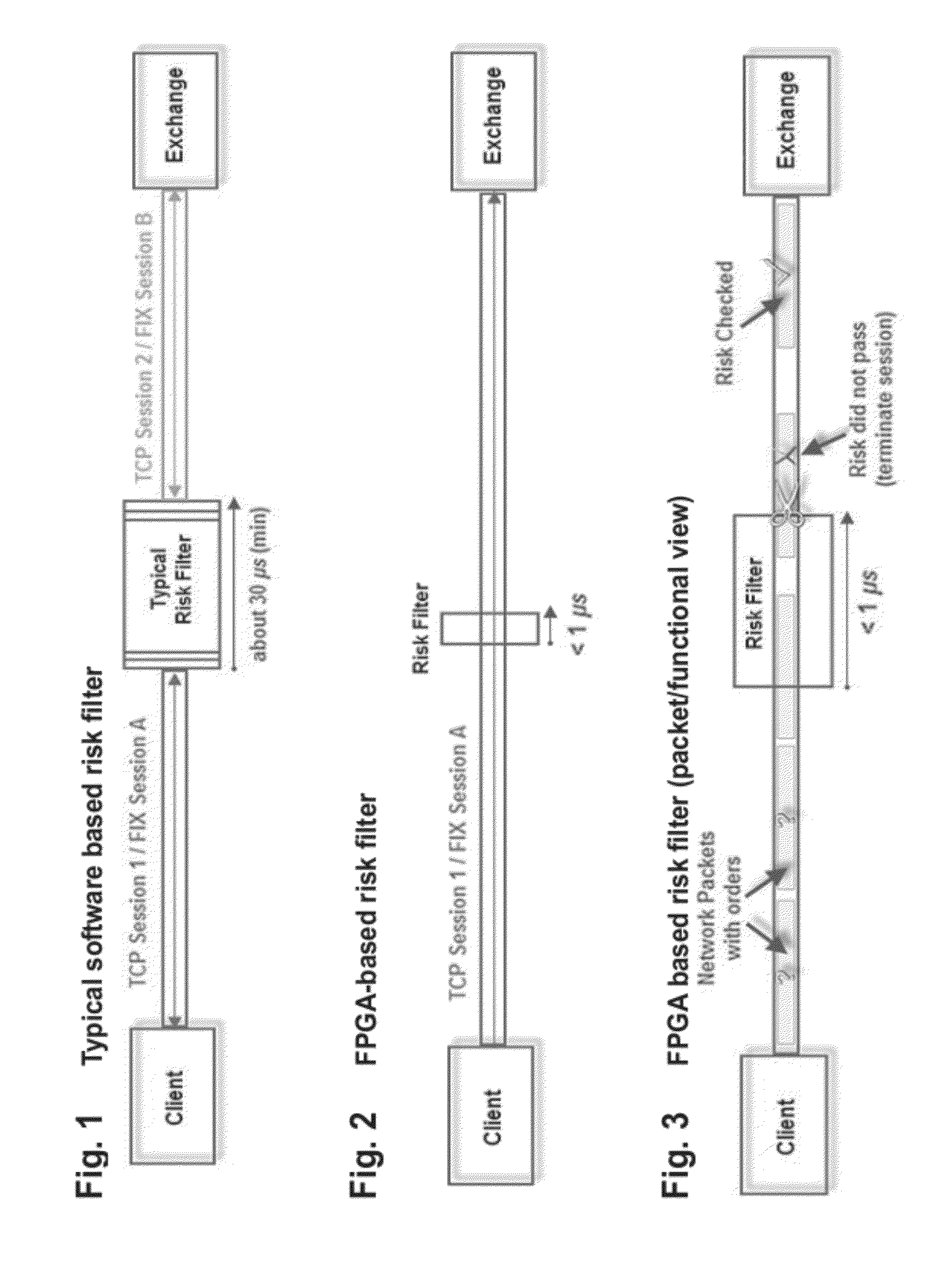

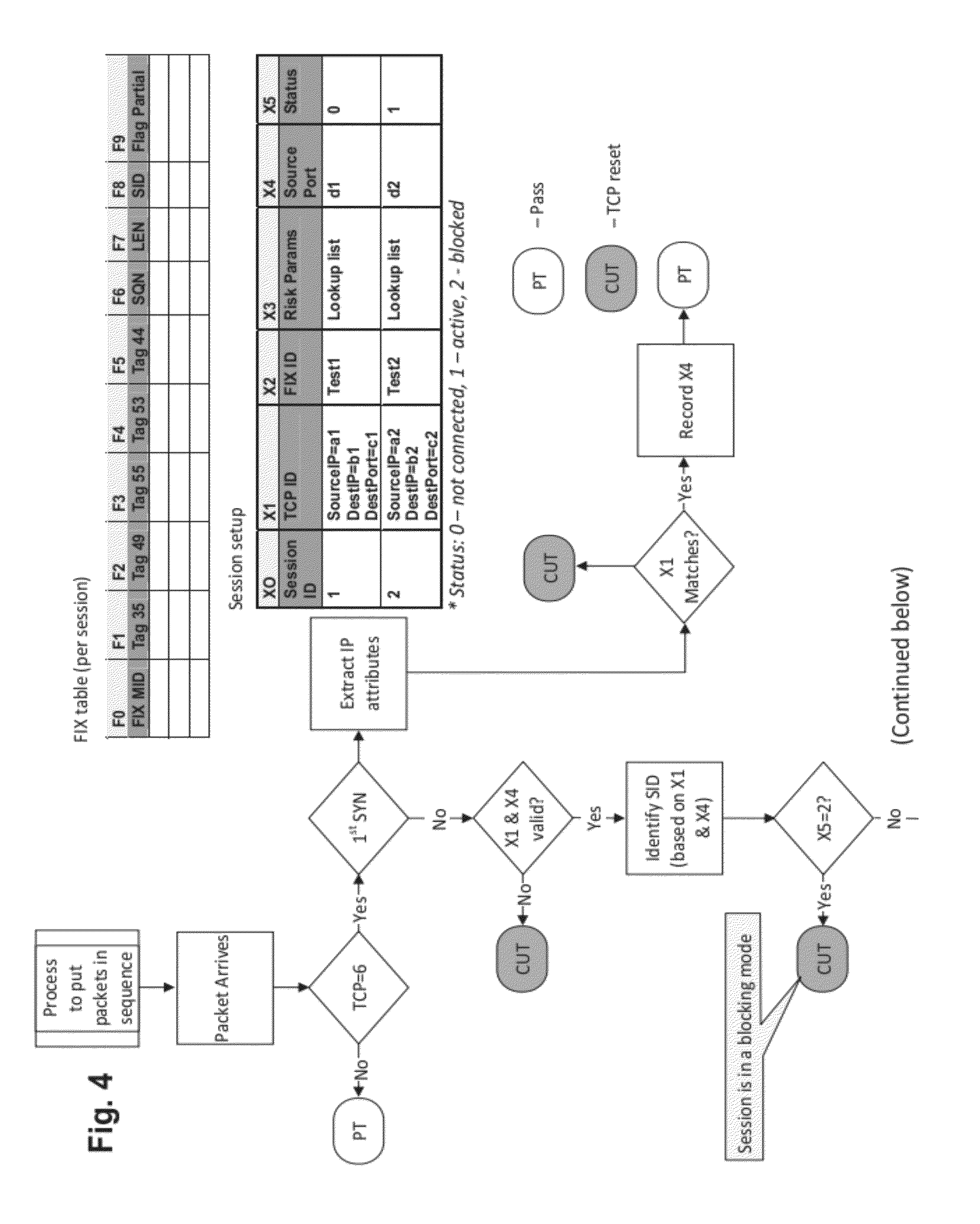

Wire Speed Monitoring and Control of Electronic Financial Transactions

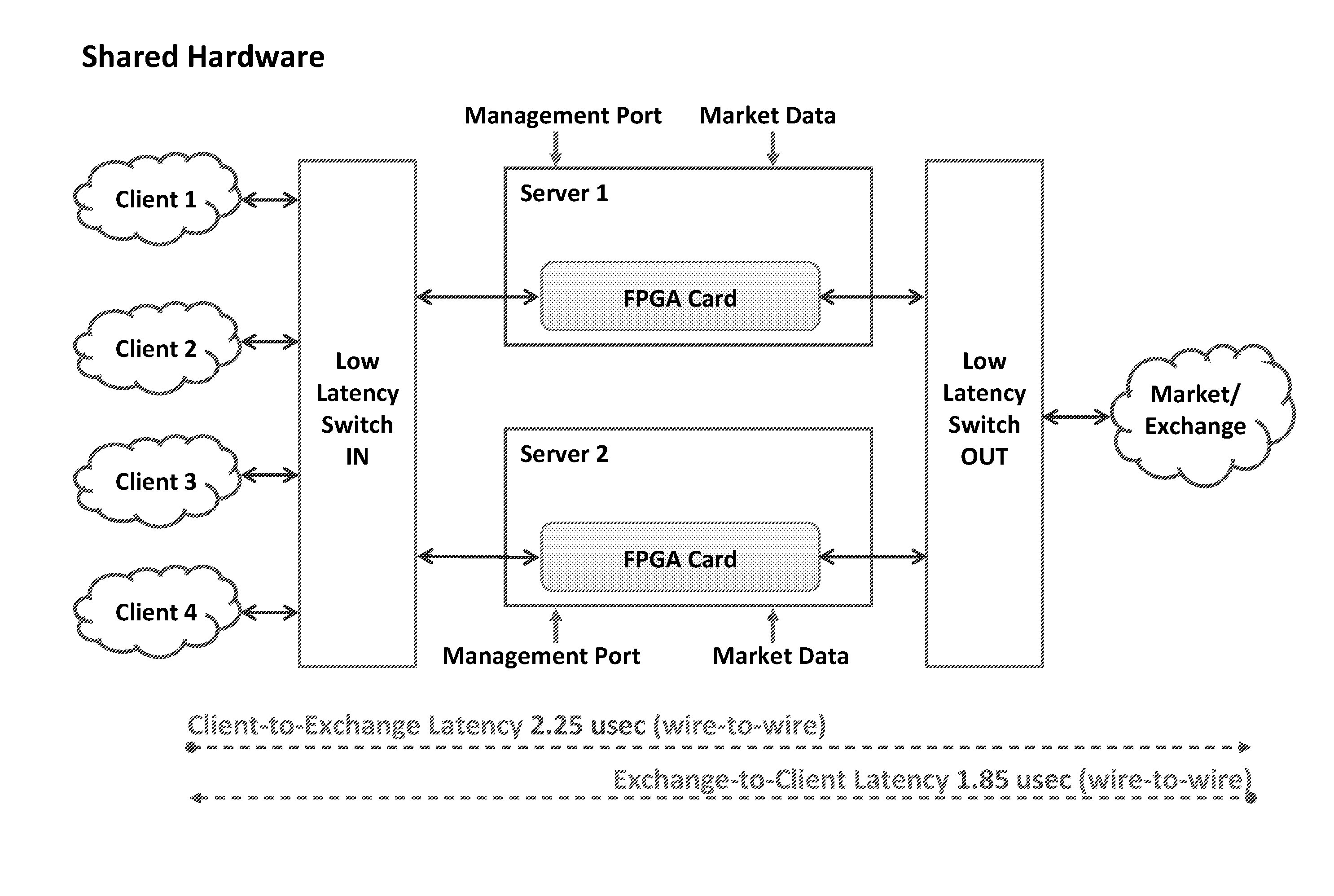

InactiveUS20140289094A1Faster message processingSpeed maximizationFinanceComputer hardwareTraffic capacity

An in-line hardware message filter device inspects incoming securities transactions. The invention is implemented as an integrated circuit (IC) device which contains computer code in the form of on-chip hardware instructions. Data messages comprising orders enter the device in exchange-specific formats. Messages that satisfy pre-determined risk assessment filters are allowed to pass through the device to the appropriate securities exchange for execution. The system functions as a passive device for all legitimate network traffic passing directly or indirectly between a customer's computer and a securities exchange's order-acceptance computer. Advantageously, the invention allows the broker-dealer to check and pass messages or orders as they come through the system without having to store the full message before making a risk assessment decision. The hardware-only nature of the invention serves to maximize the speed of order validation and to perform pre-trade checks in a cut-through or store-and-forward mode.

Owner:DEUTSCHE BANK

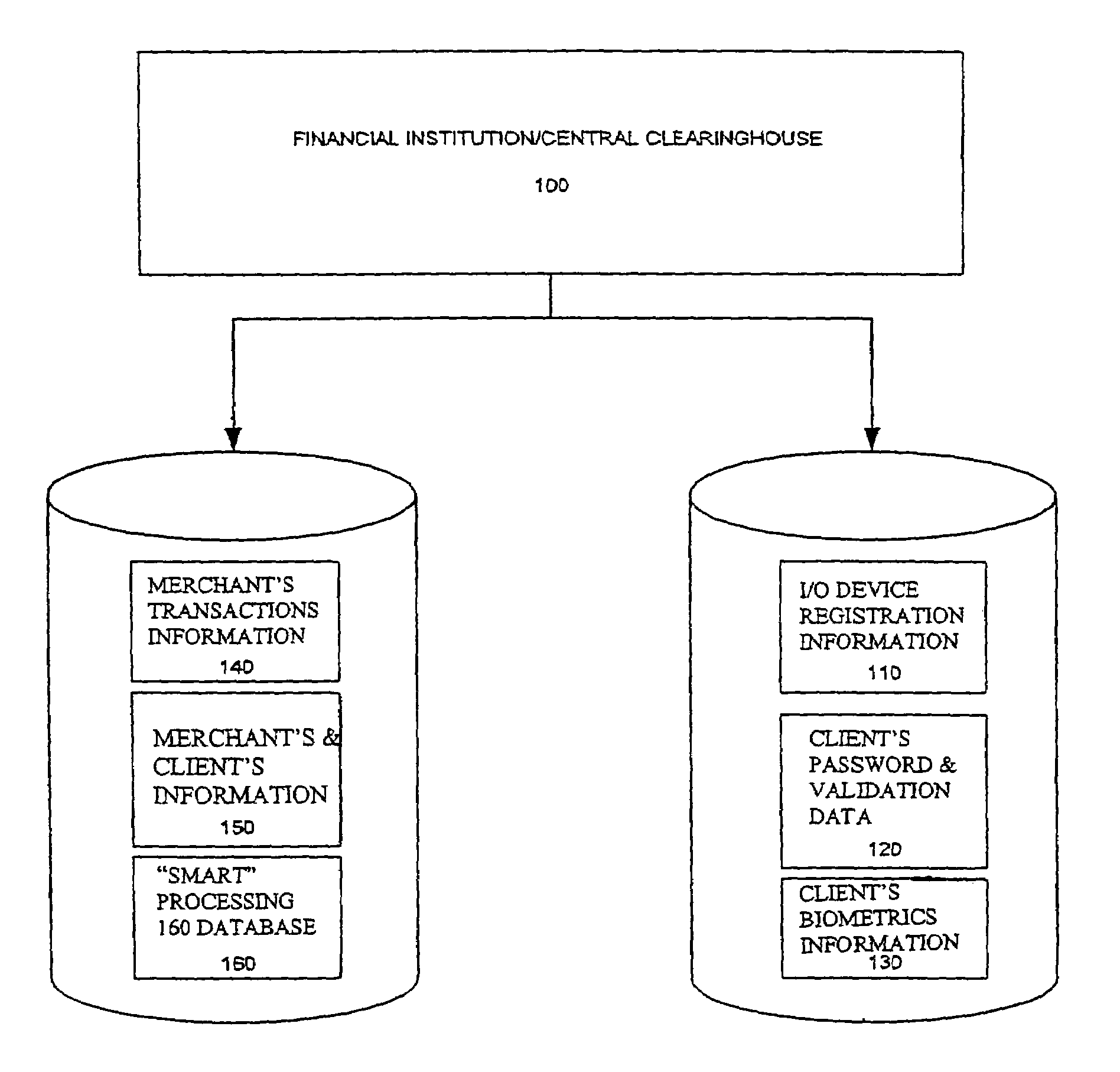

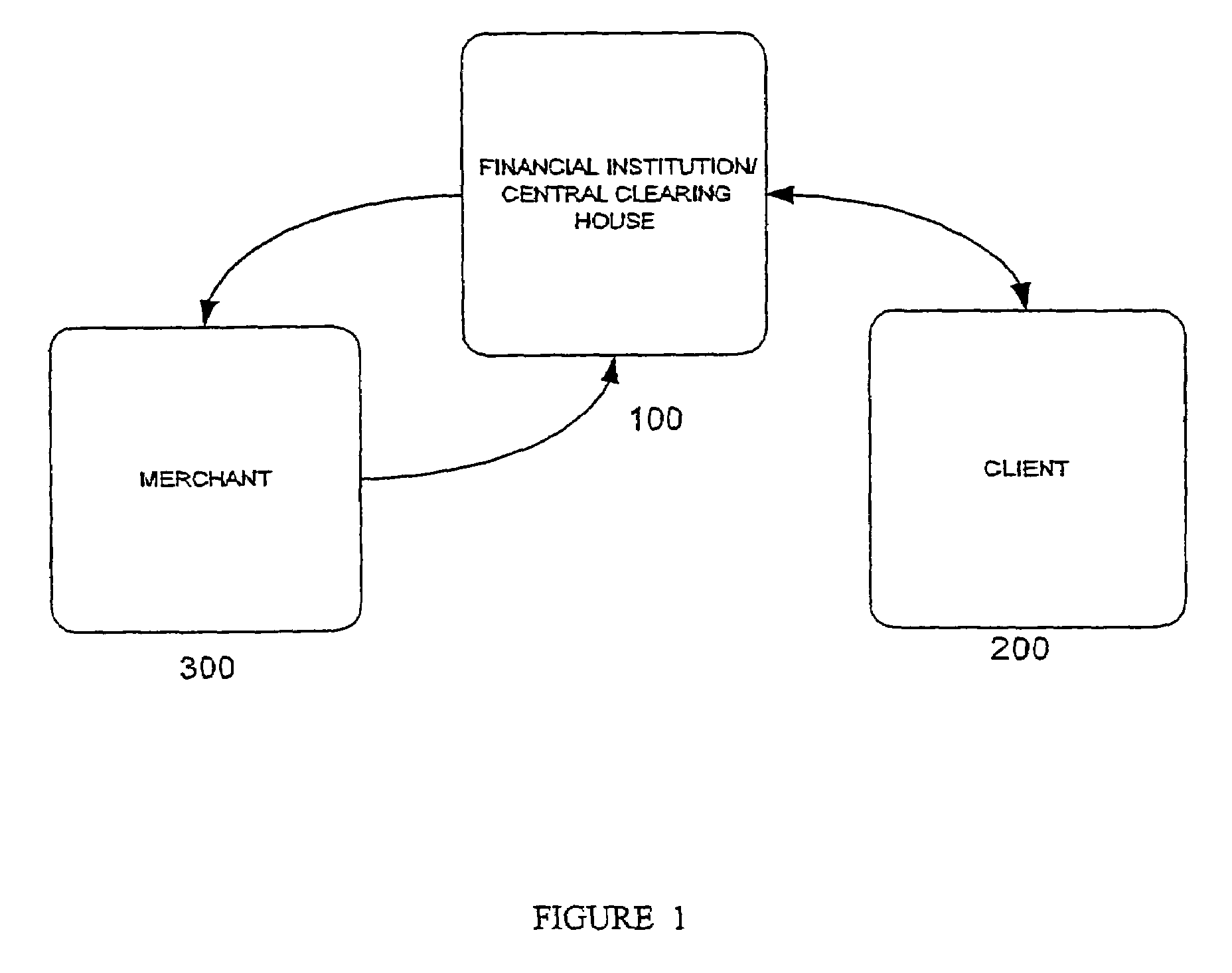

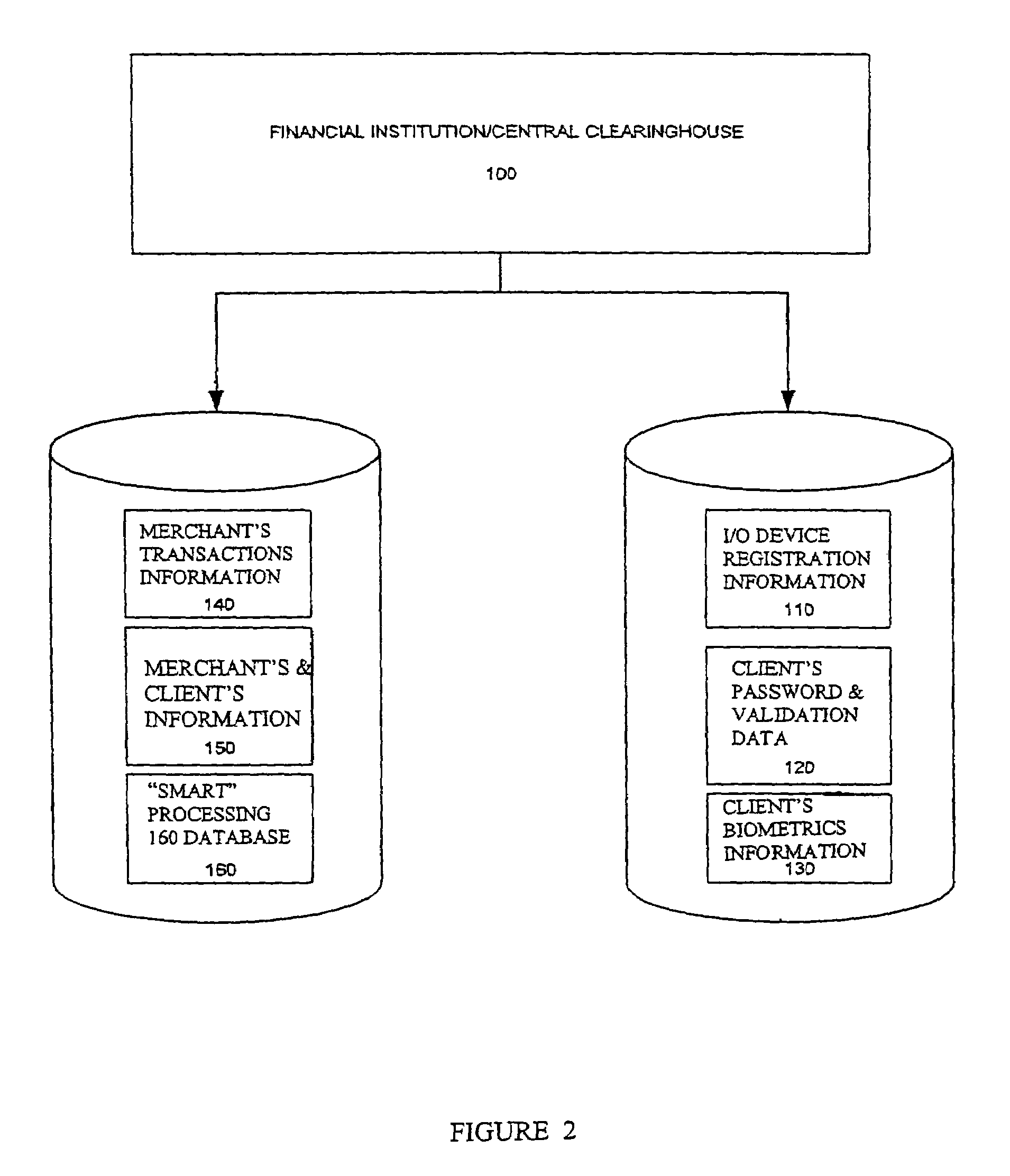

System and method for safe financial transactions in E.Commerce

A system, method and program for executing securely e-financial transactions over the Internet between merchants, clients and financial institutions using an electronic programmable device such as an electric vault, microcomputer or a smart card. The systems offers various secure options from which to make e-commerce financial transactions without entering credit card or personal financial information.

Owner:ASANI KARIM

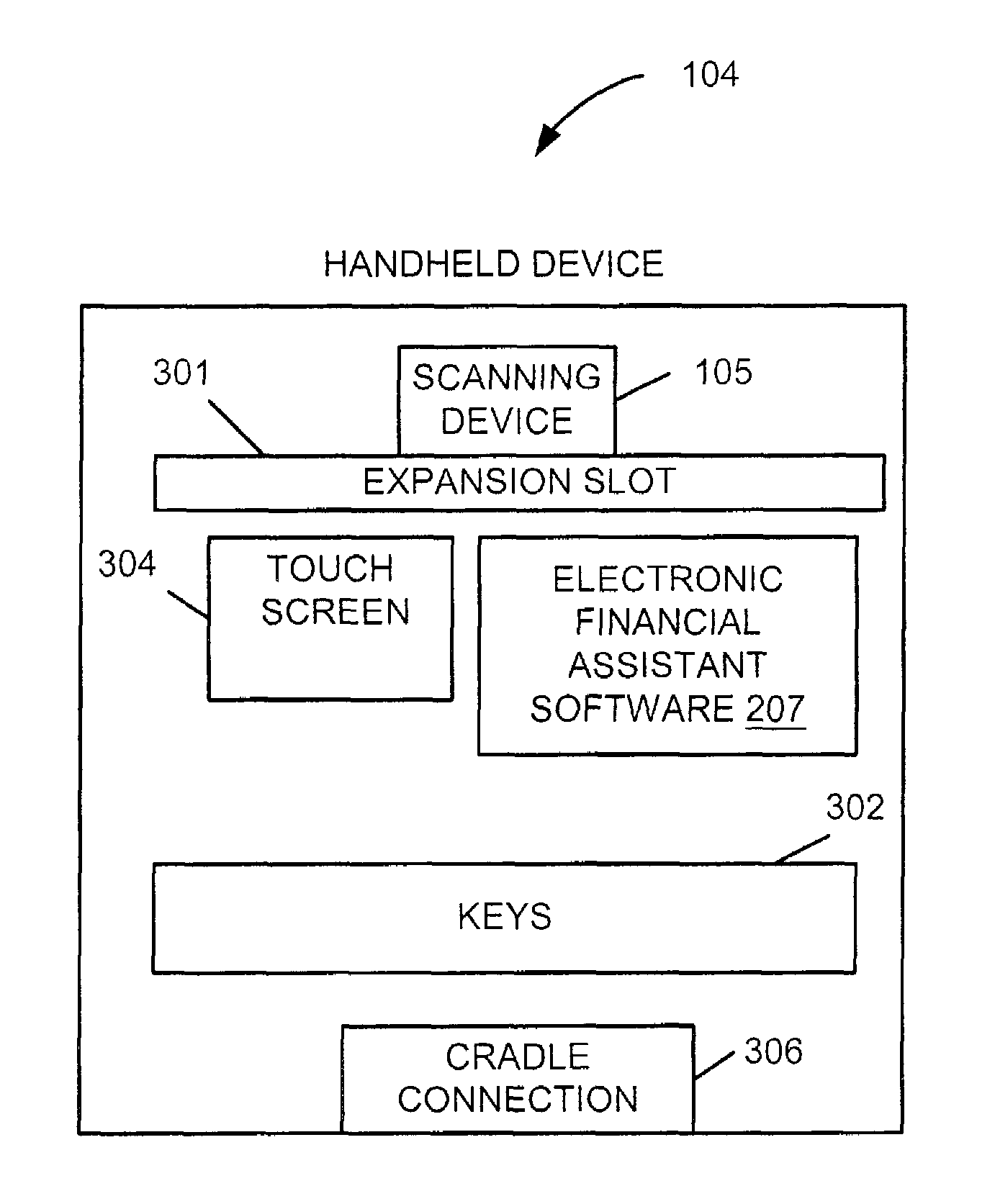

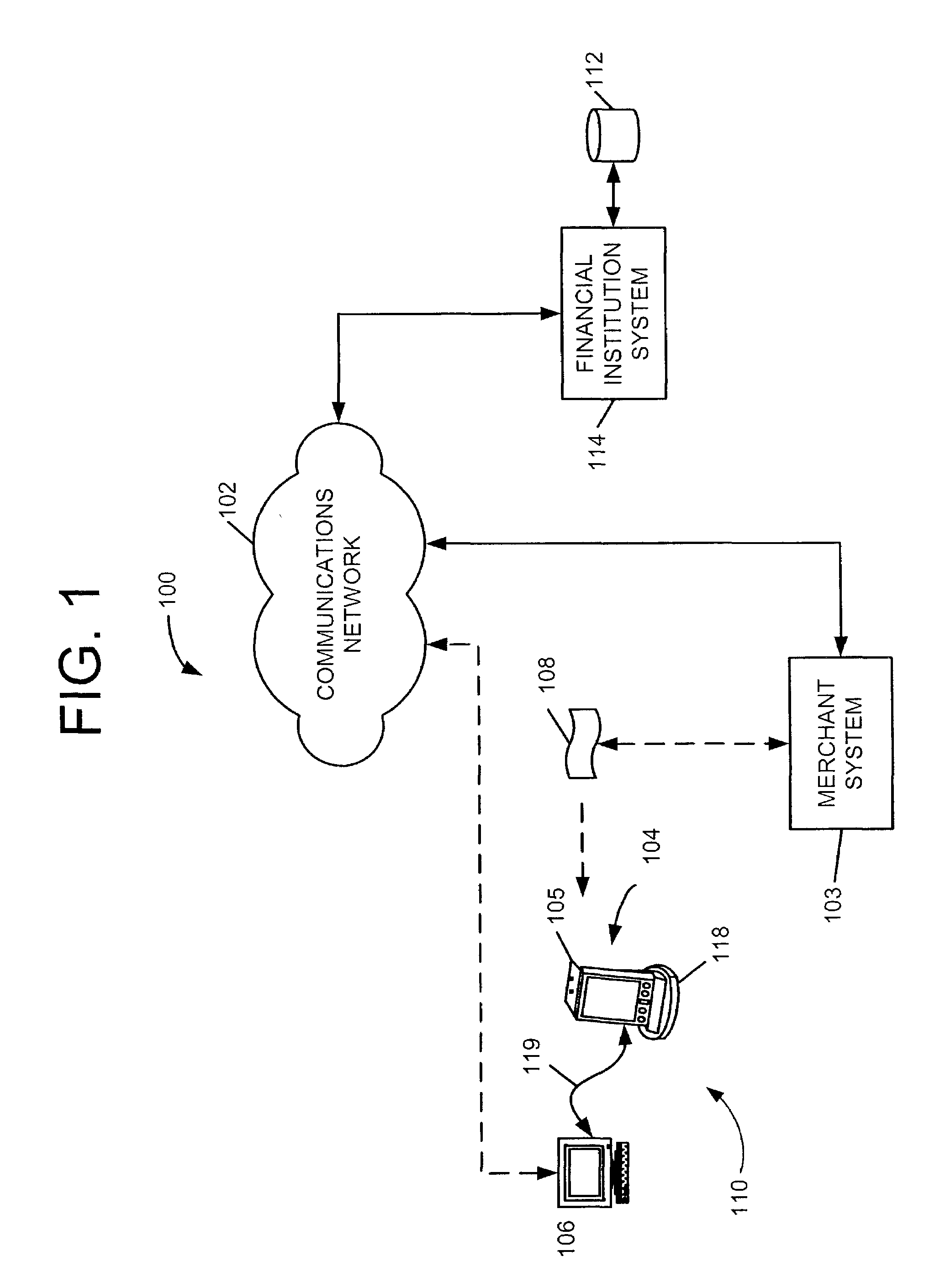

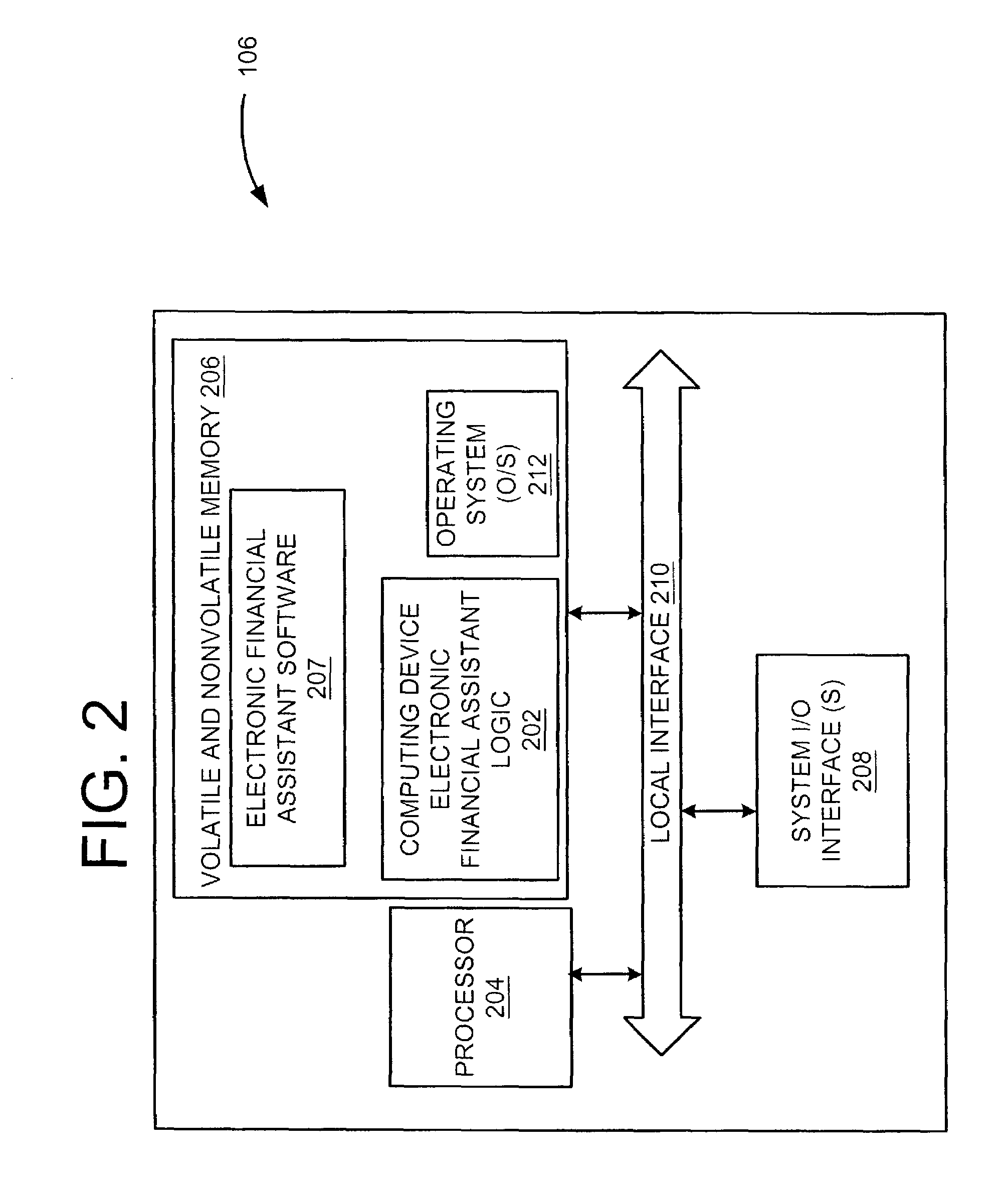

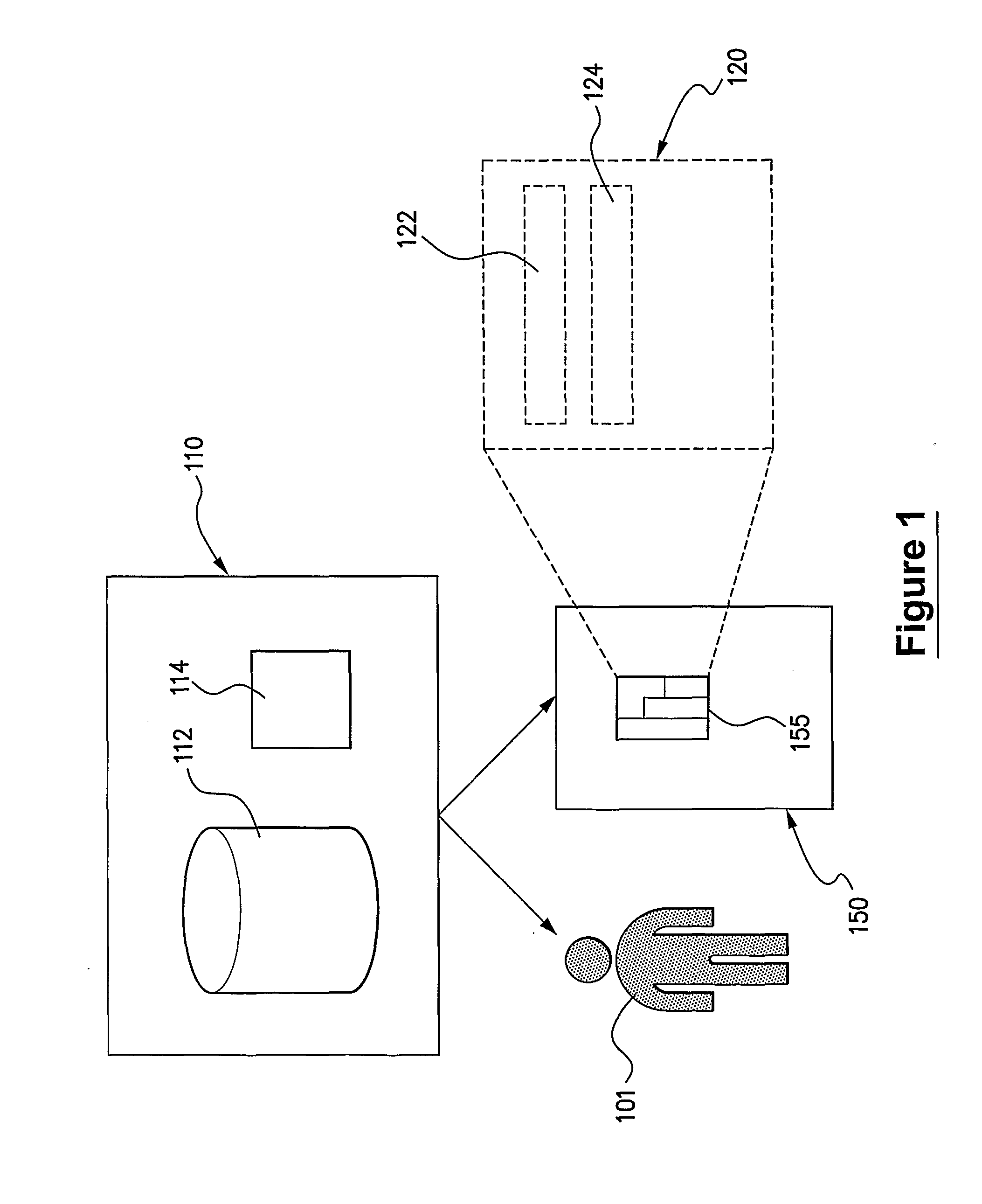

Electronic financial assistant

Preferred embodiment of electronic financial assistant systems includes a device adapted to capture information from a financial record and a computing device that is operatively coupled to the device. The computing device is adapted to compare financial transactions incurred by a user with the information captured from the financial record. Other systems and methods are also provided.

Owner:AT&T INTPROP I L P

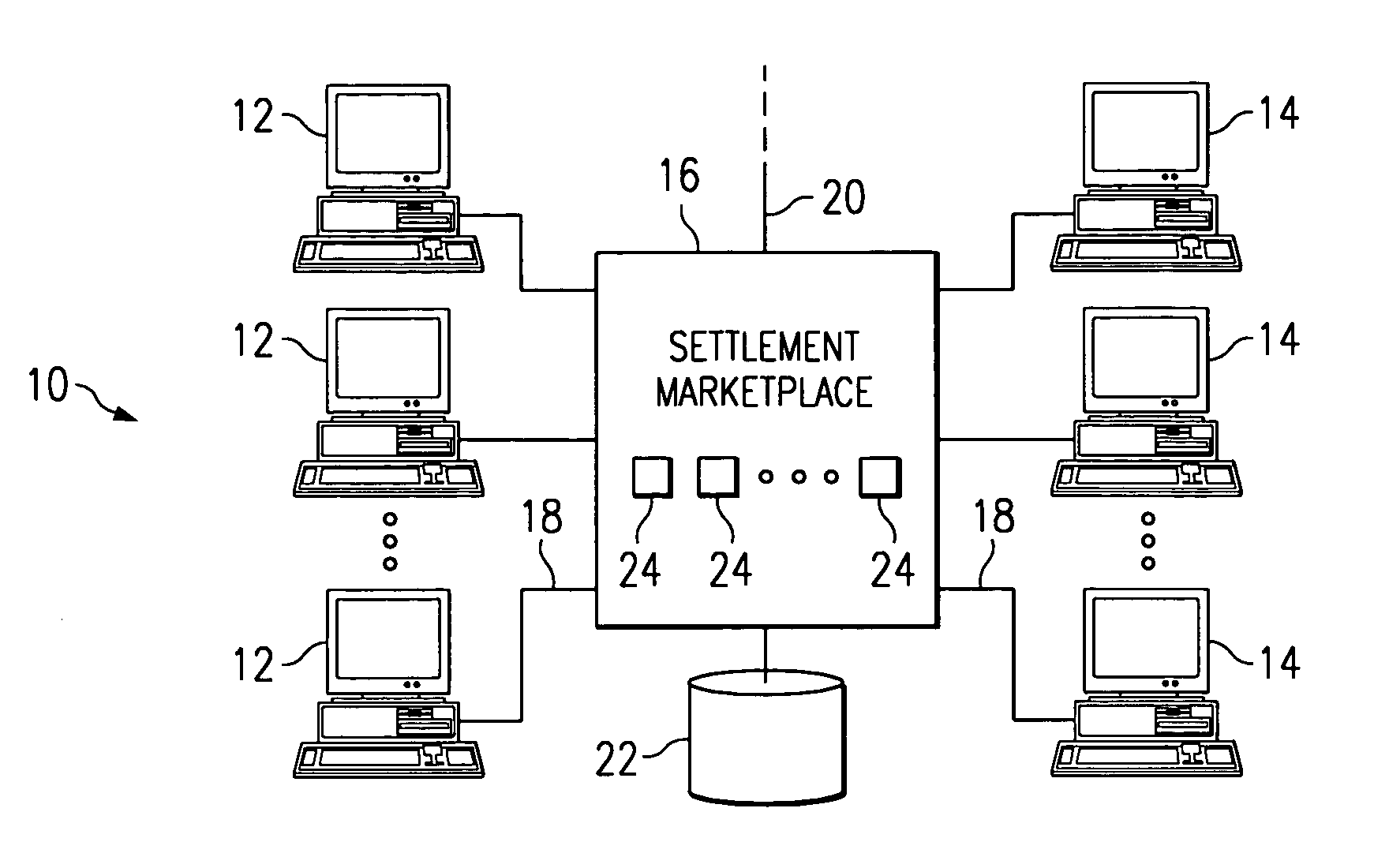

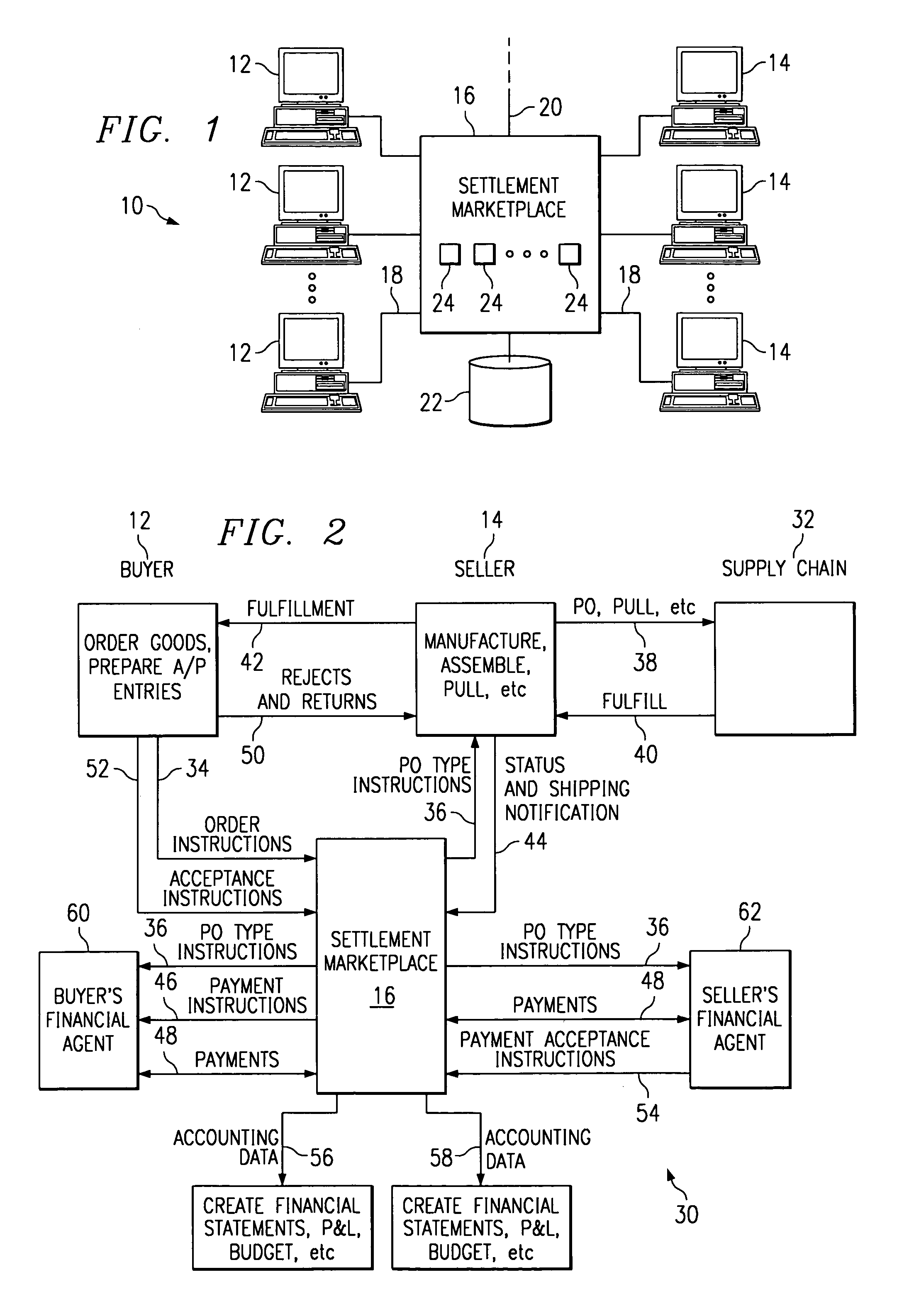

System and method for providing electronic financial transaction services

InactiveUS7698240B1Significant valuePay more quicklyFinanceDigital computer detailsFinancial transactionComputer science

A computer-implemented marketplace (16) for providing financial transaction services to participants (12, 14, 60, 62) in connection with commercial transactions involving the participants (12, 14, 60, 62) includes a database (22). The database (22) contains registration information for types of transactions available to participants (12, 14, 60, 62) and participation criteria for each participant (12, 14, 60, 62) that specifies types of transactions in which the participant (12, 14, 60, 62) is willing to participate. Processes (24) provide associated financial transaction services for the participants (12, 14, 60, 62) in connection with ongoing transactions involving the participants (12, 14, 60, 62). The marketplace (16) initiates a selected process (24) in response to a specified event associated with an ongoing transaction, according to the registration information and participation criteria, to provide a corresponding financial transaction service to at least one participant (12, 14, 60, 62) involved in the ongoing transaction.

Owner:BLUE YONDER GRP INC

Wire speed monitoring and control of electronic financial transactions

ActiveUS20120130919A1Faster message processingSpeed maximizationFinanceComputer hardwareTraffic capacity

An in-line hardware message filter device inspects incoming securities transactions. The invention is implemented as an integrated circuit (IC) device which contains computer code in the form of on-chip hardware instructions. Data messages comprising orders enter the device in exchange-specific formats. Messages that satisfy pre-determined risk assessment filters are allowed to pass through the device to the appropriate securities exchange for execution. The system functions as a passive device for all legitimate network traffic passing directly or indirectly between a customer's computer and a securities exchange's order-acceptance computer. Advantageously, the invention allows the broker-dealer to check and pass messages or orders as they come through the system without having to store the full message before making a risk assessment decision. The hardware-only nature of the invention serves to maximize the speed of order validation and to perform pre-trade checks in a cut-through or store-and-forward mode.

Owner:DEUTSCHE BANK

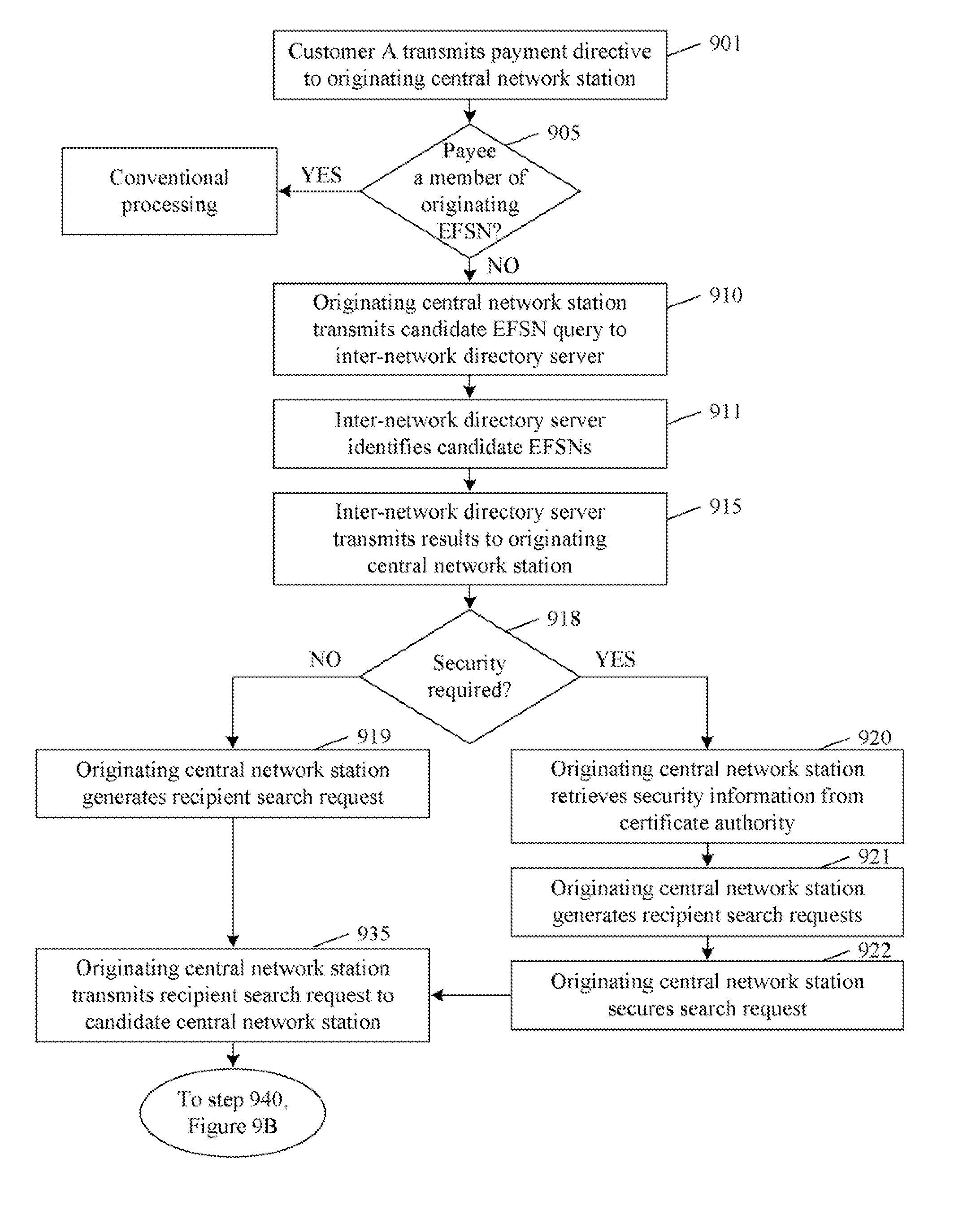

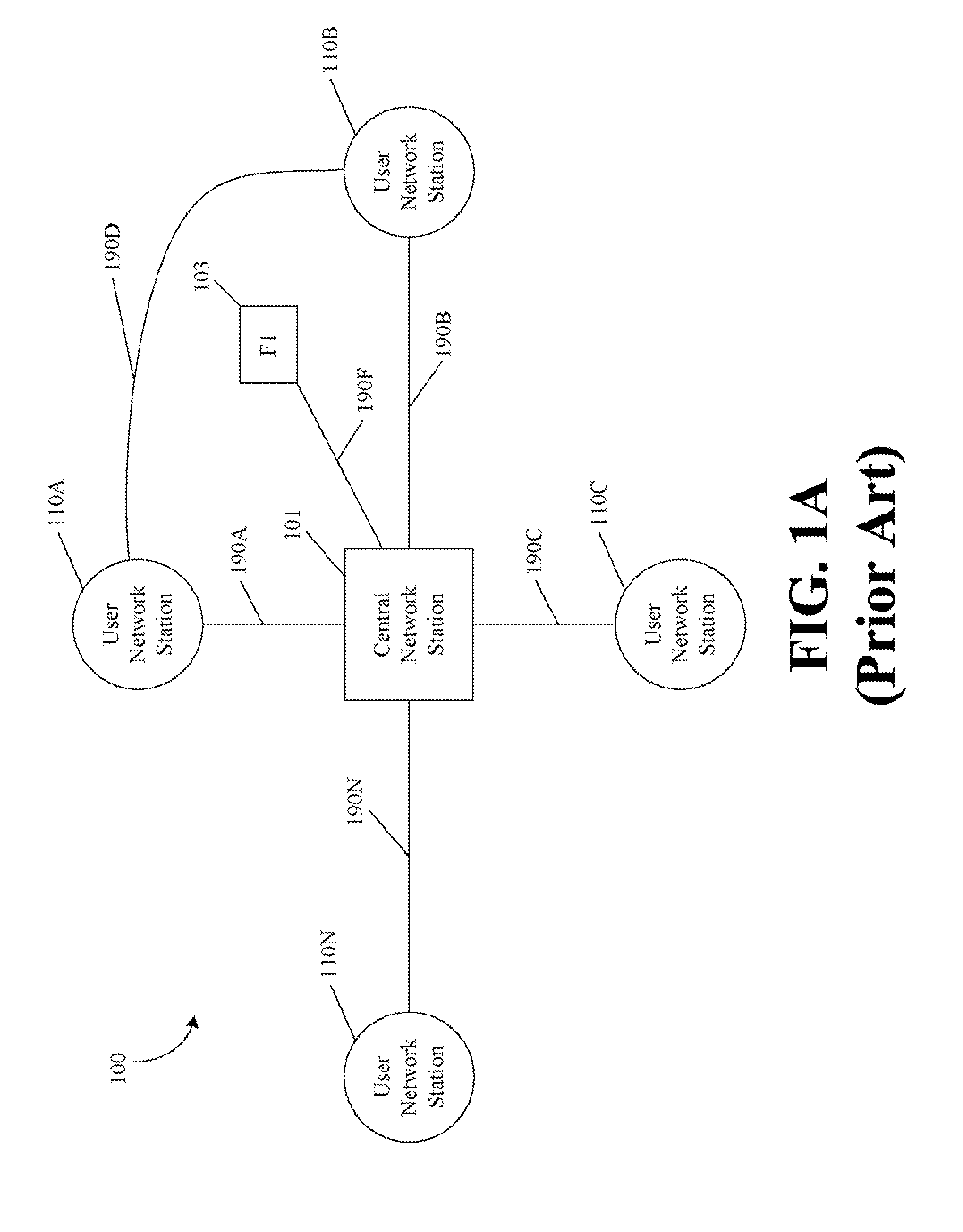

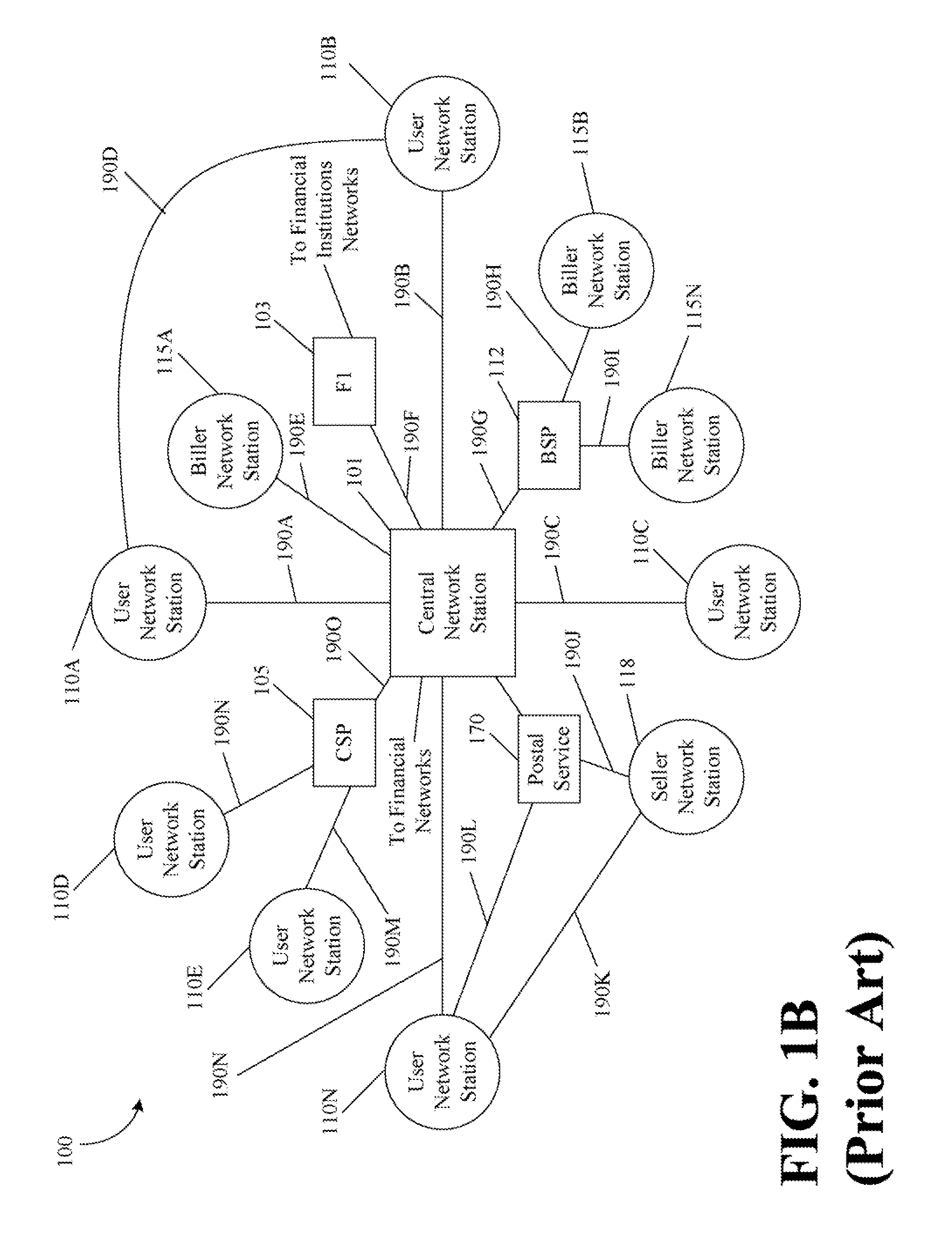

Inter-Network Electronic Billing

Owner:CHECKFREE SERVICES CORP

Authenticating electronic financial transactions

InactiveUS20110031310A1Avoid prolonged useWiden meansFinanceBuying/selling/leasing transactionsElectronic communicationPayment order

To improve security and simplify financial transactions in electronic communications environments, a cryptographic Private Key is securely stored in a storage device of a user. A Public Key Certificate corresponding to the Private Key is also created and can be stored in an online repository for merchant access. The Public Key Certificate identifies a payment card of the user, and is signed by or on behalf of a financial institution issuing the payment card. When initiating a payment card transaction with a merchant, a data item is signed using the Private Key. The signed data item and the Public Key Certificate are conveyed to the merchant, which enables the merchant to authenticate the transaction without needing to communicate with the user's financial institution, and while avoiding the inconvenience and privacy issues associated with obtaining other card details and user details.

Owner:LOCKSTEP TECH

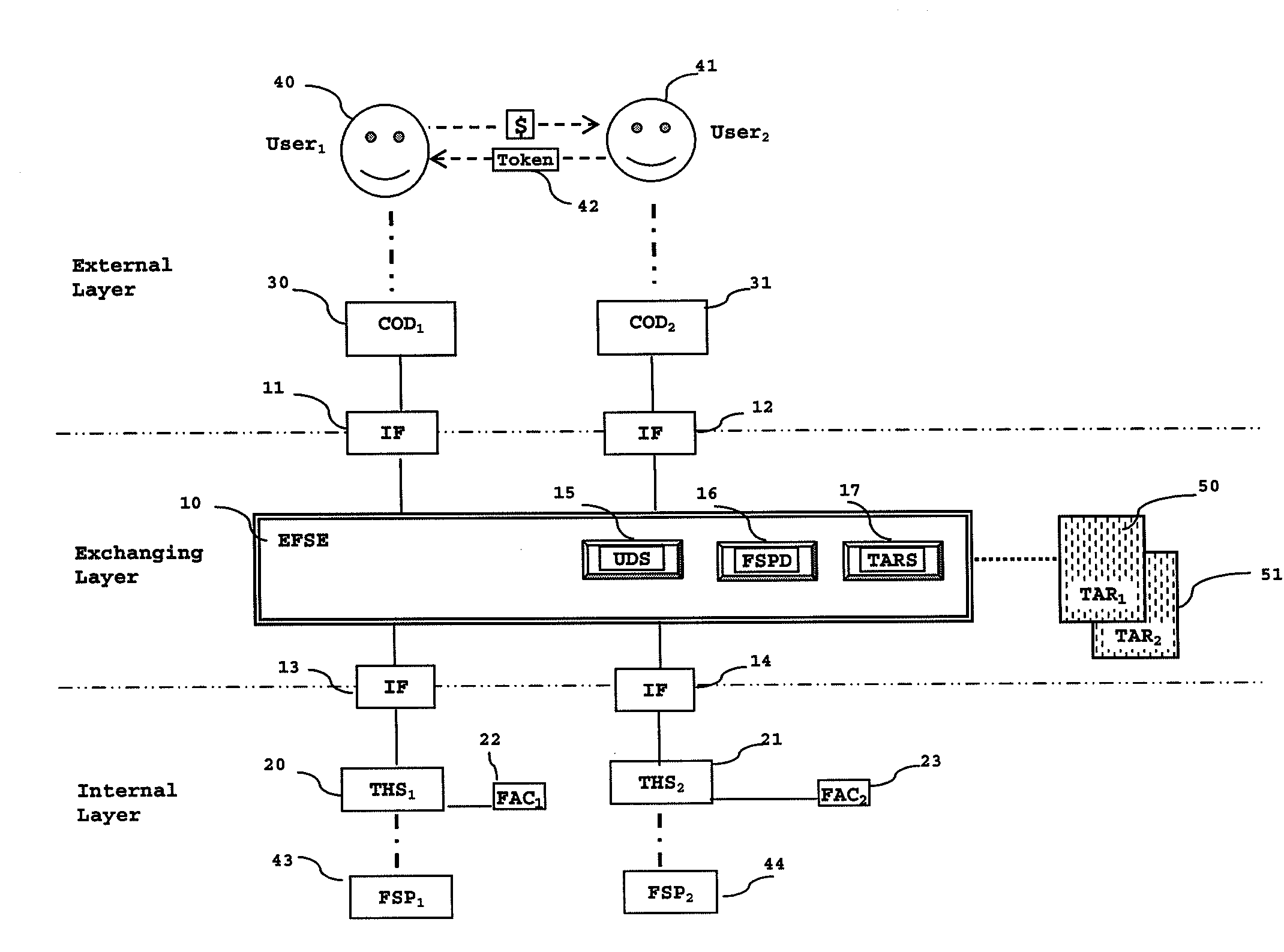

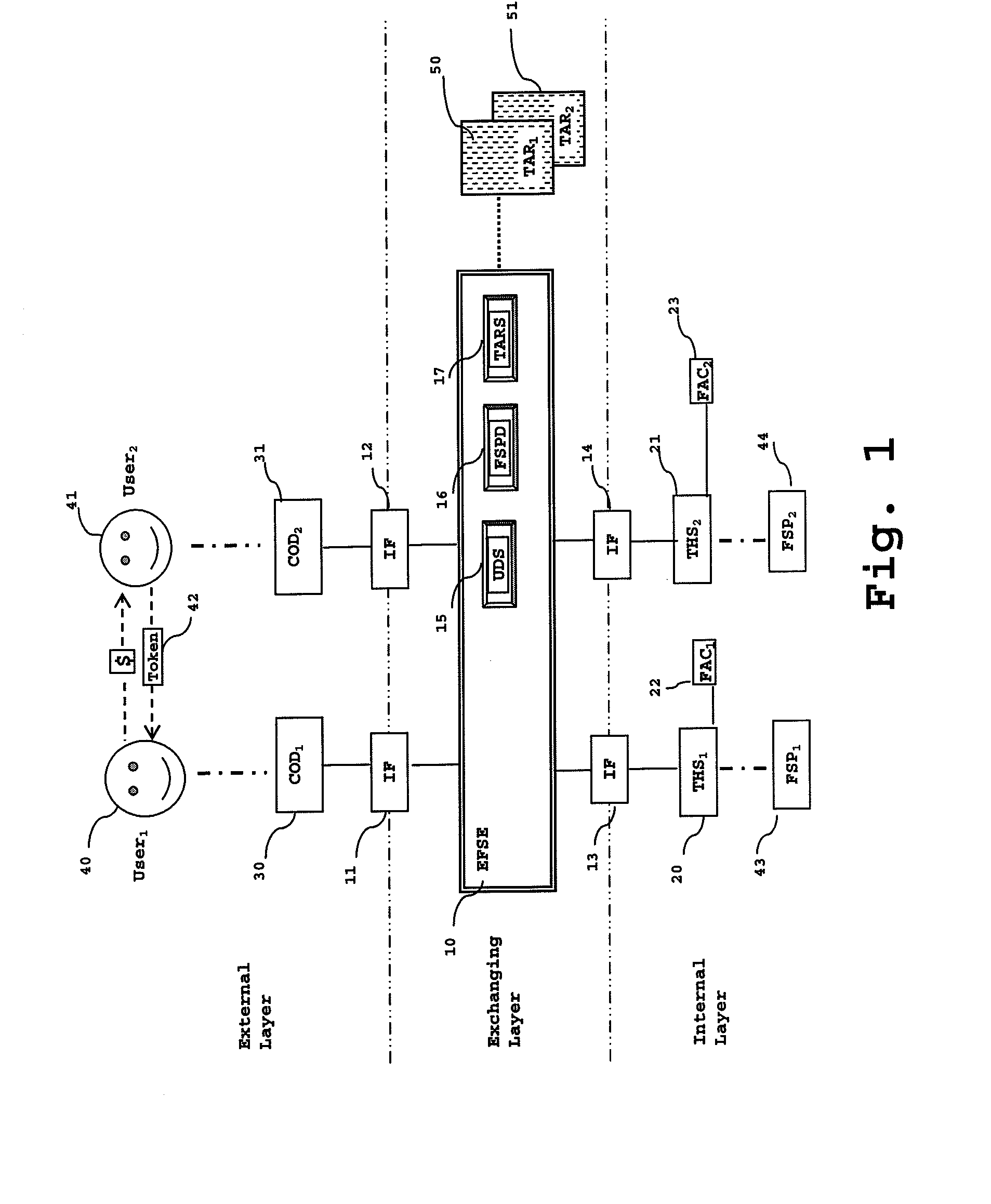

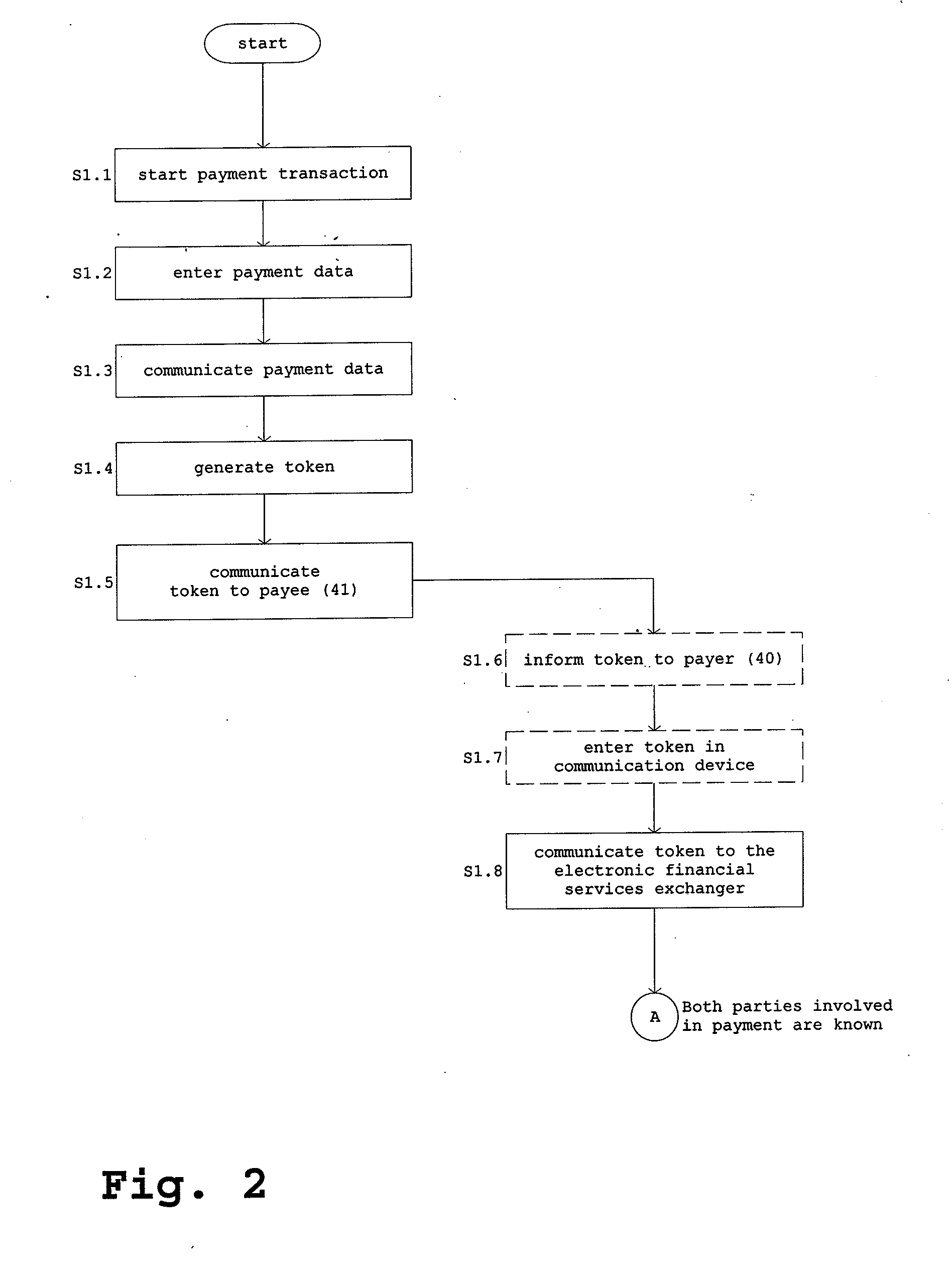

Method and system for secure handling of electronic financial transactions

InactiveUS20080077532A1Improve security levelIncrease flexibilityPayment circuitsPayments involving neutral partyCommunication linkFinancial transaction

A method of exchanging, handling and controlling electronic financial services, particularly mobile electronic financial services from various financial services providers to authorized employs a wide variety of communication devices (both stationary and mobile). The system provides for the exchange of electronic financial services in the from of a standardized platform by means of corresponding interfaces irrespective of the way in which the individual transaction handling systems are linked to the electronic financial services exchanger. The financial services exchanger permits flexible linking of differing communication devices as well as various transaction handling systems from a variety of different financial services providers. Confidential are transferred via standardized maximum-security communication links and the electronic financial services exchanger. For each financial transaction the electronic financial services exchanger generates a token which is communicated to the transaction initiator, received by the other user by an intentional transaction and returned as confirmation to the electronic financial services exchanger.

Owner:VON HEESEN CLAUDIA +1

Security for electronic transactions and user authentication

InactiveUS20180197171A1Improve user securityMinimizing adoption burdenCredit schemesDebit schemesPayment transactionFinancial transaction

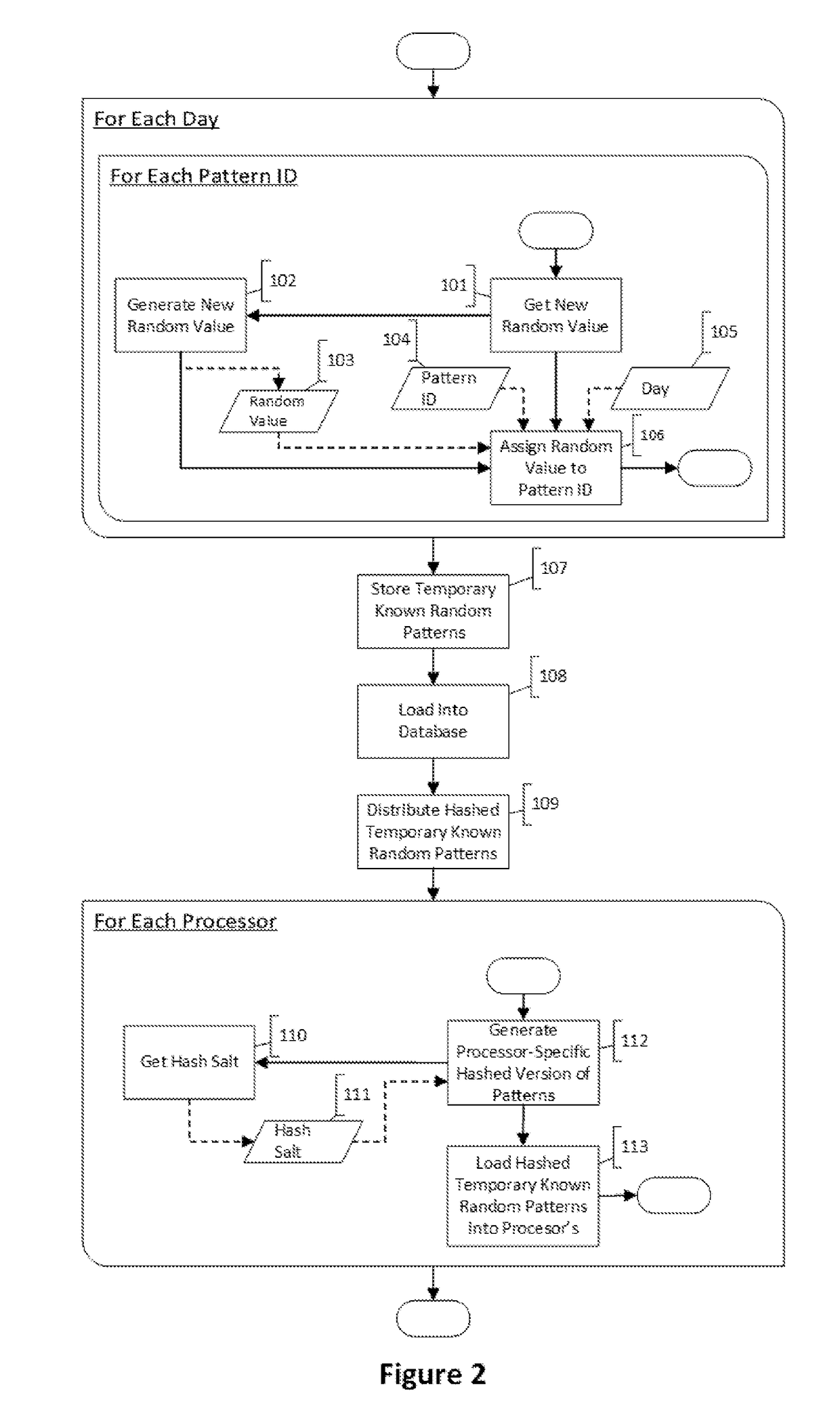

System and method for generating, disseminating, controlling, and processing limited-life security codes used to authenticate users, particularly for electronic financial transactions, such as payment transactions. Providing a user with a single security code usable across multiple accounts or other secured systems is contemplated, each security code having a limited lifetime. Each security code is a random number from a random number generator. The respective security codes for each user correspond to a respective security code validity period of limited duration. Thus, a table or matrix that associates the plurality of users with the respective sets of randomly selected security codes (each having their respective validity periods) is generated, and that matrix is provided to the respective entities to which each user requires secured access. In parallel, at least a current security code is provided to each user, and this is how the respective entities being accessed can track which code from which user is currently valid.

Owner:TENDER ARMOR LLC

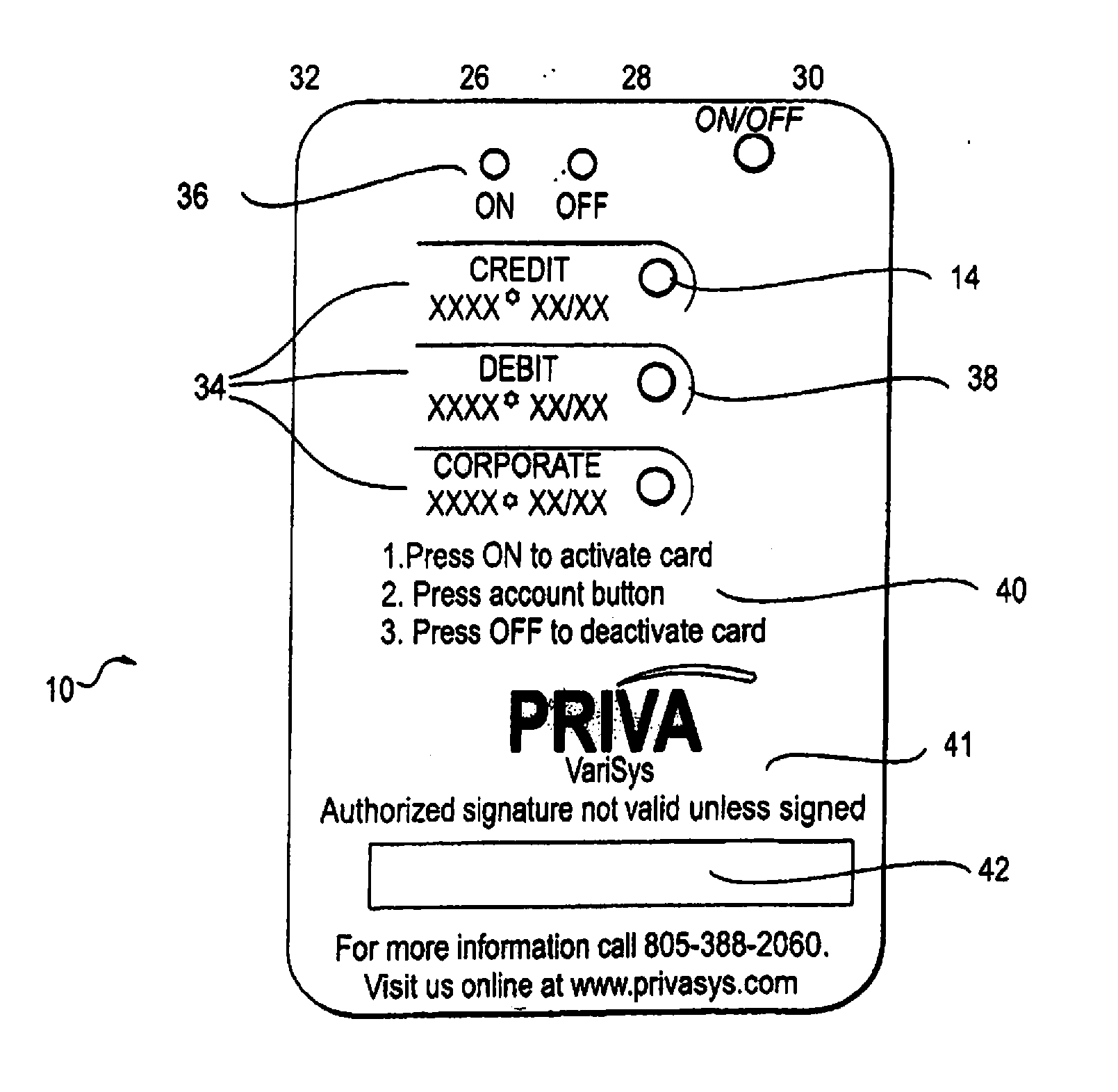

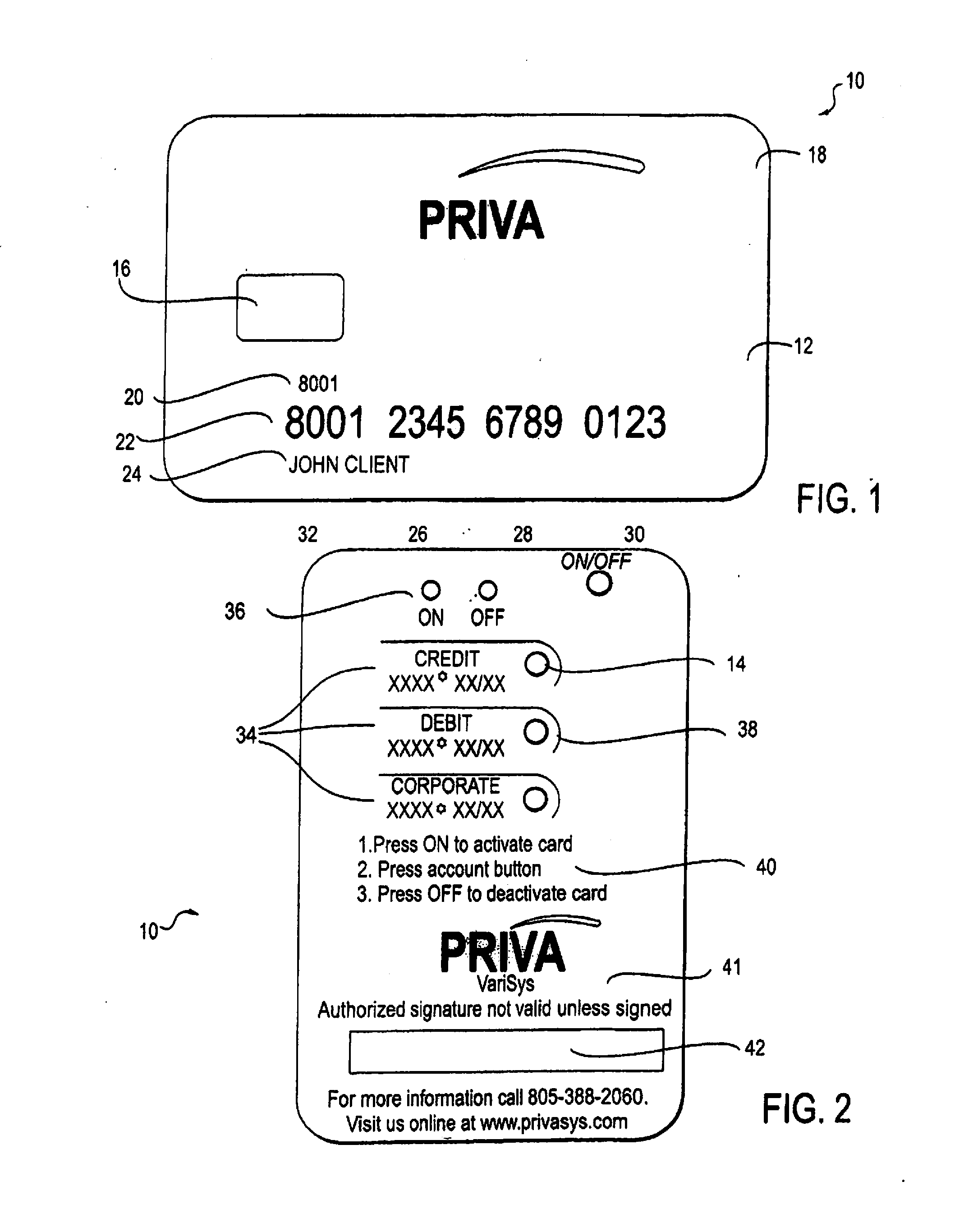

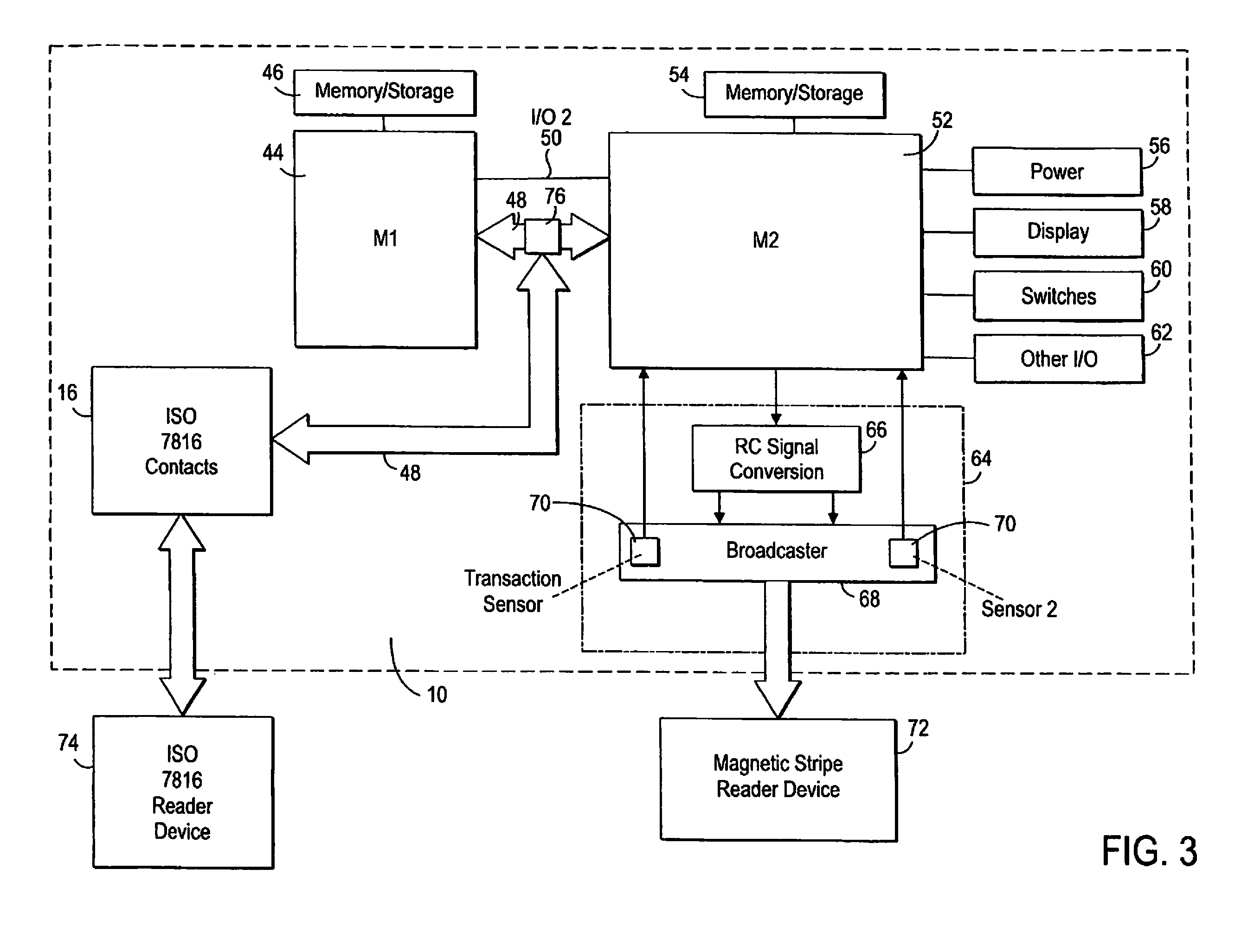

Electronic Financial Transaction Cards and Methods

ActiveUS20120205451A1Alter functionalitySensing record carriersRecord carriers used with machinesElectricityNetwork packet

An electronic card has a card body with a power source electrically coupled to a general processor which is electrically coupled to a secure processor and a broadcaster. At least one sensor sends a signal to the general broadcaster when a physical act of swiping the card body through a legacy magnetic stripe reader having a magnetic read head commences. The card is usable as a legacy mode Smart card, the broadcaster is operable to broadcast a transaction specific data packet so that it is read by the magnetic stripe reader, and the secure processor is an ISO 7816 compliant processor.

Owner:DFS SERVICES

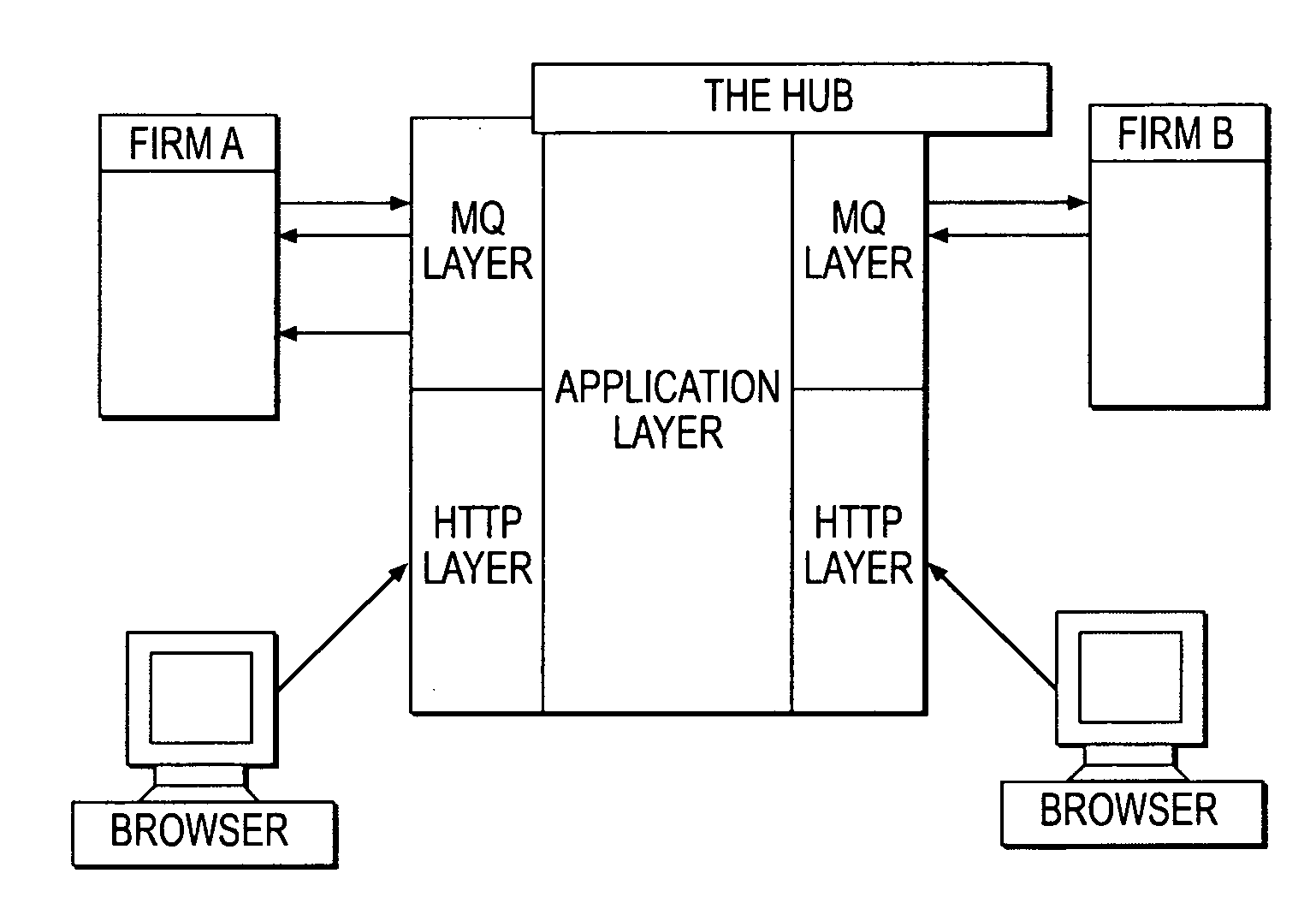

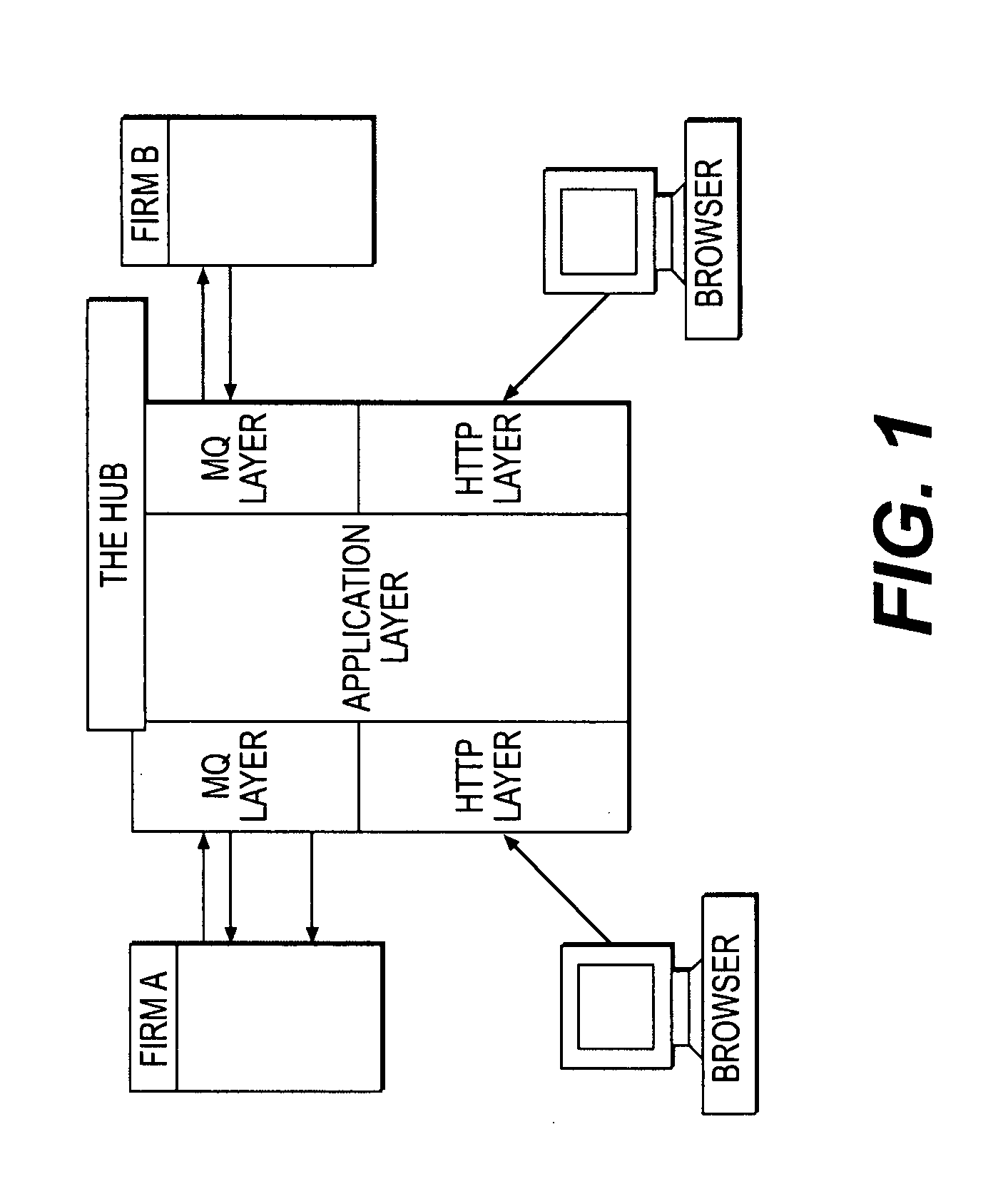

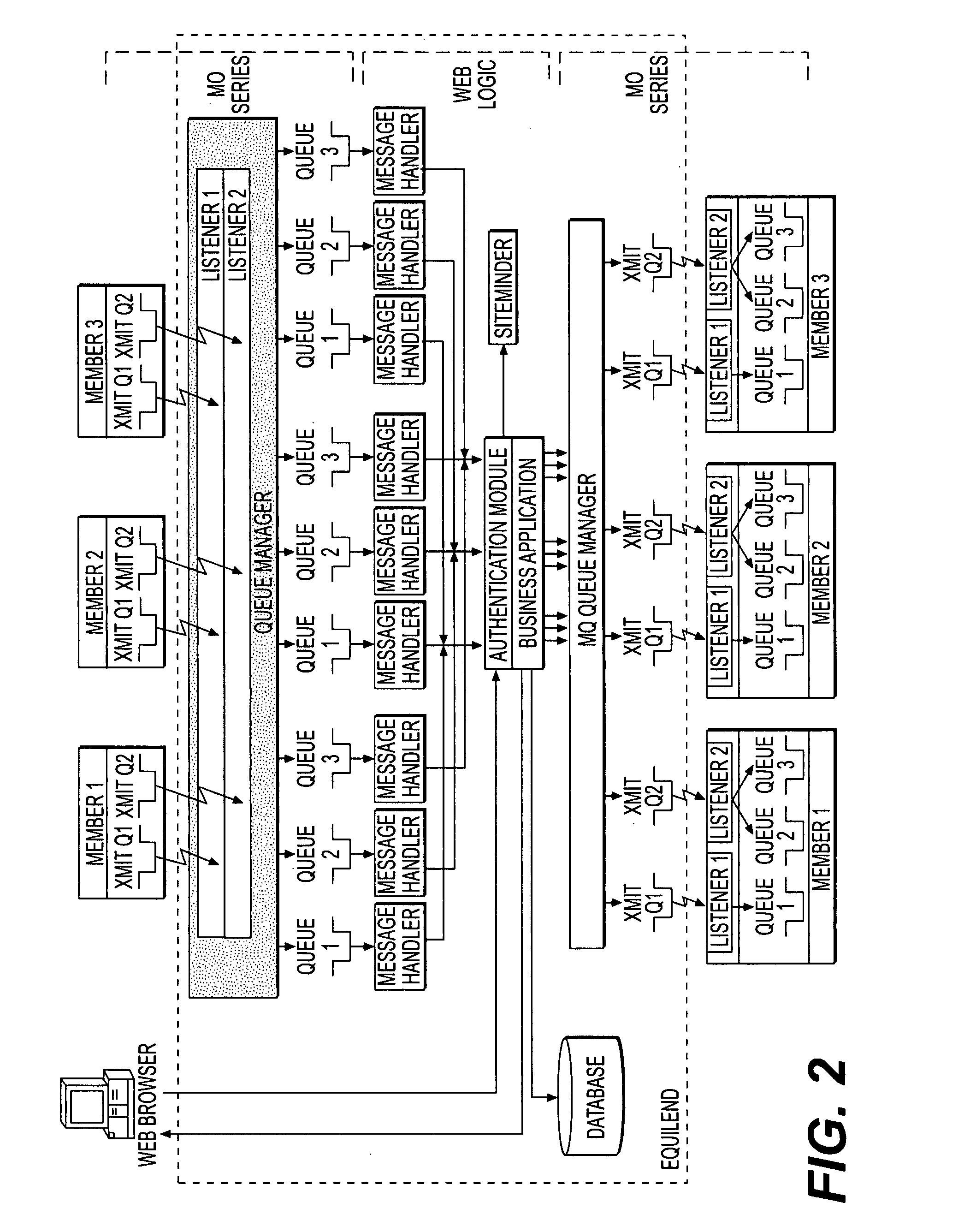

System and method for securities borrowing and lending

Disclosed is a an electronic system for equities securities lending and financing. In particular, the disclosed system provides a hub for electronic financial transactions such as securities borrowing and lending and facilitates the ability of borrowers and lenders to locate suitable counterparties and engage in direct negotiations in a securities lending transaction.

Owner:EQUILEND GLOBAL HUBCO LLC

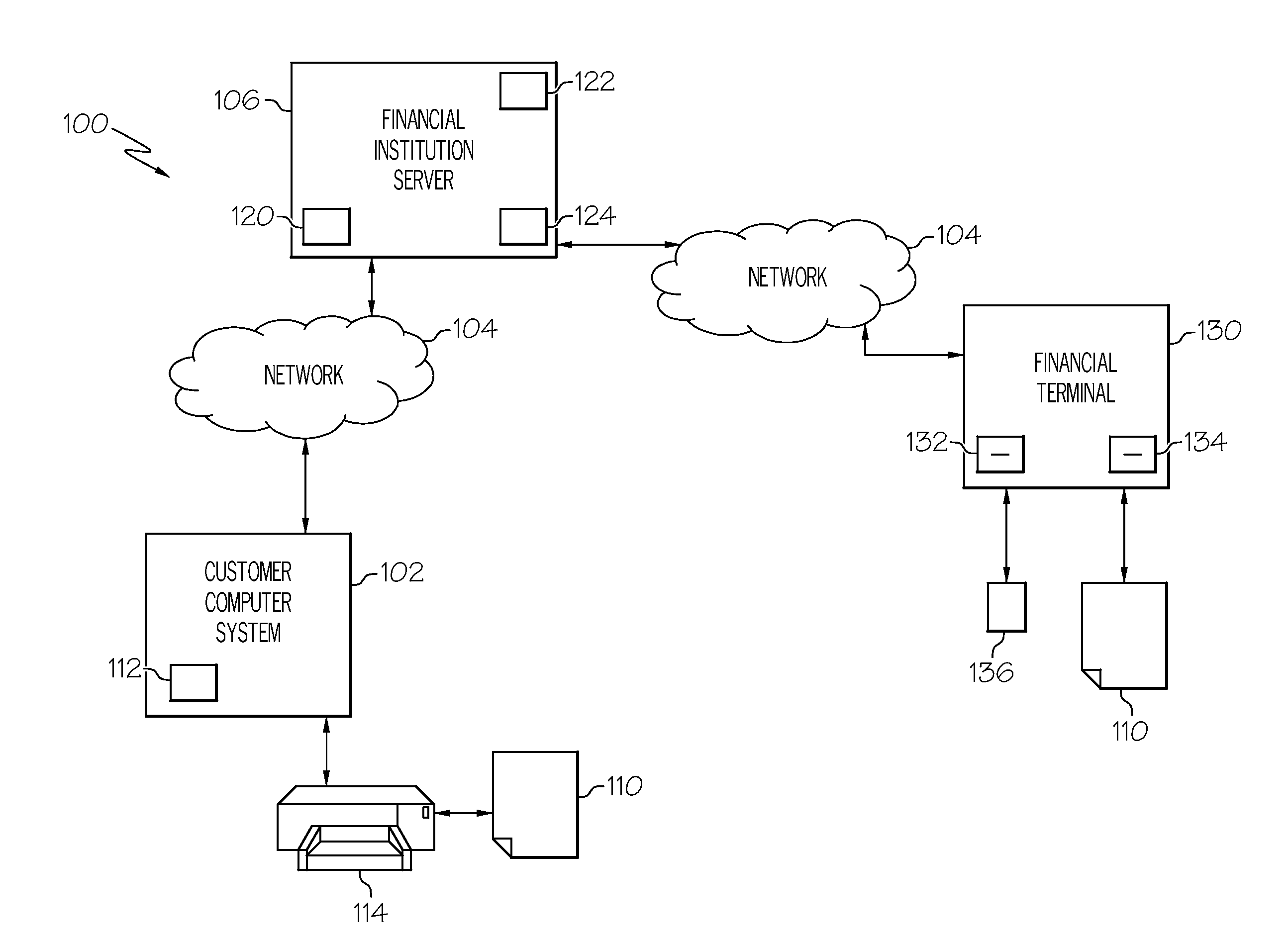

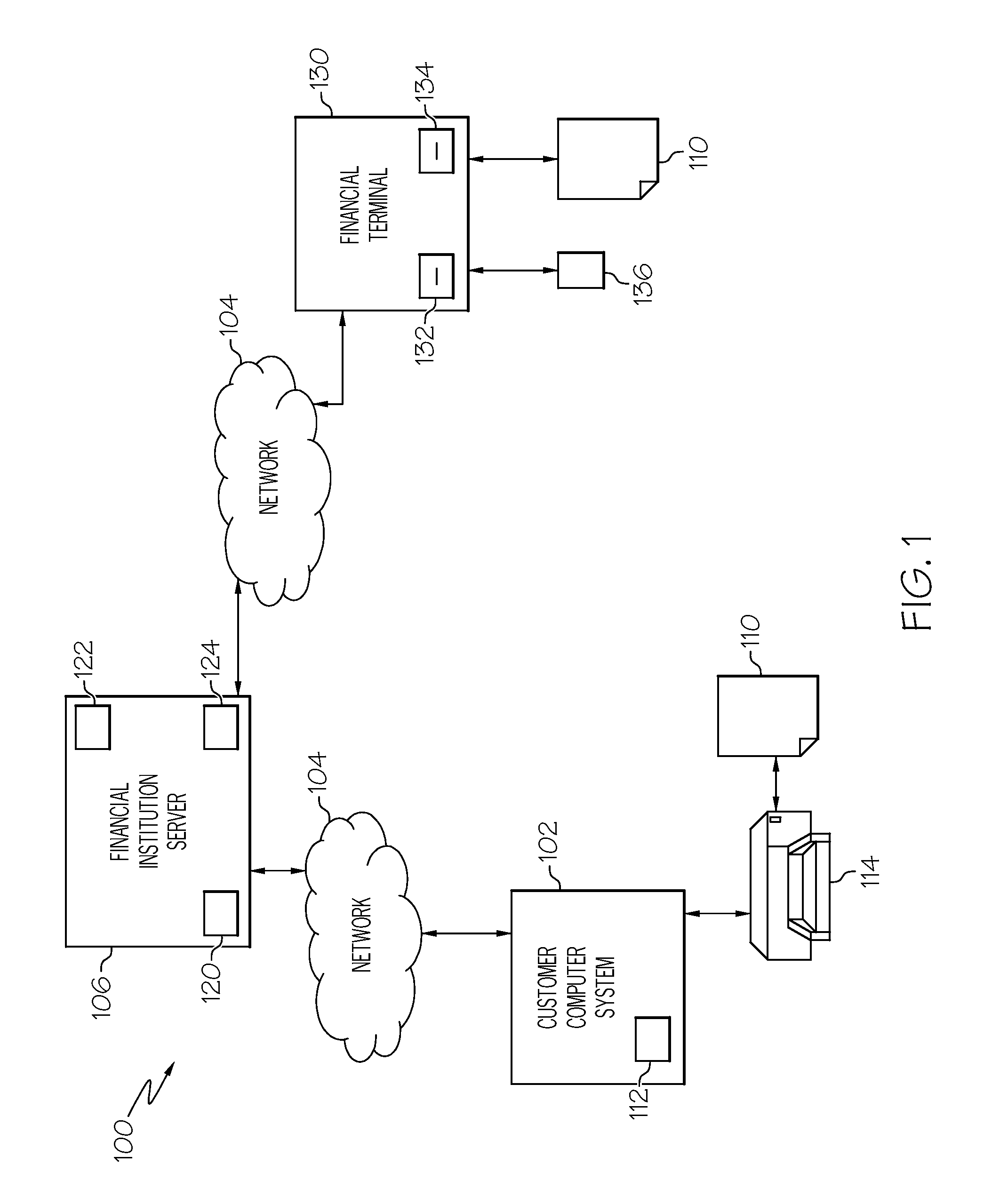

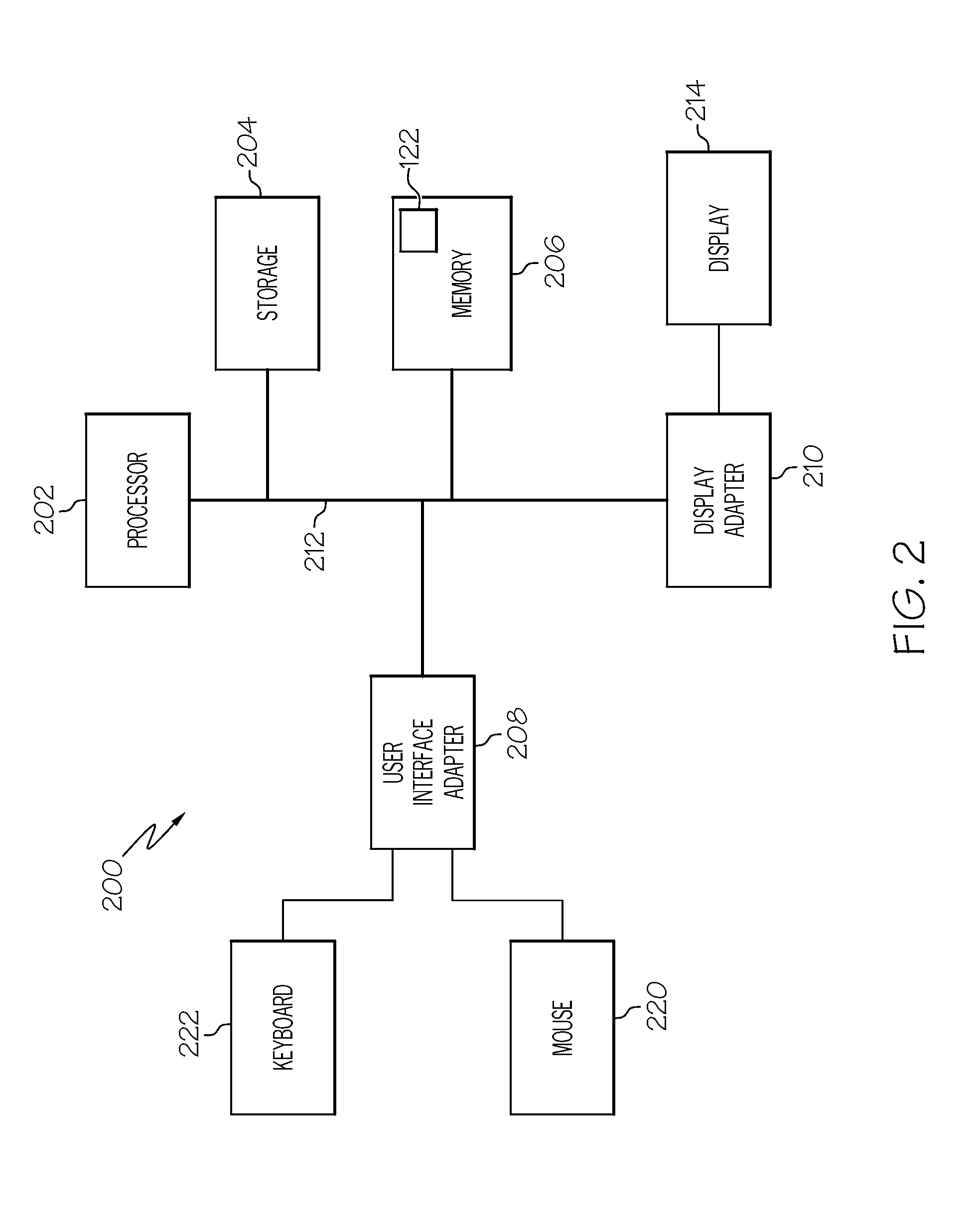

Guest limited authorization for electronic financial transaction cards

Generally speaking, methods and media for authorizing a guest to use an electronic financial transaction card, such as a credit card or debit card, are disclosed. Embodiments may include receiving information about a desired guest transaction (which may be limited in size, timeframe, nature, etc.) from a customer associated with an EFT card, generating a guest PIN number and artifact information for the guest transaction, and transmitting them to the customer. Embodiments may also include receiving from a financial terminal a PIN number and an indication of a supplied artifact associated with a proposed transaction utilizing the EFT card. Embodiments may include determining whether the proposed transaction should be authorized based on the received PIN number and the supplied artifact and, in response to determining that the proposed transaction should be authorized, transmitting approval of the proposed transaction to the financial terminal.

Owner:PAYPAL INC

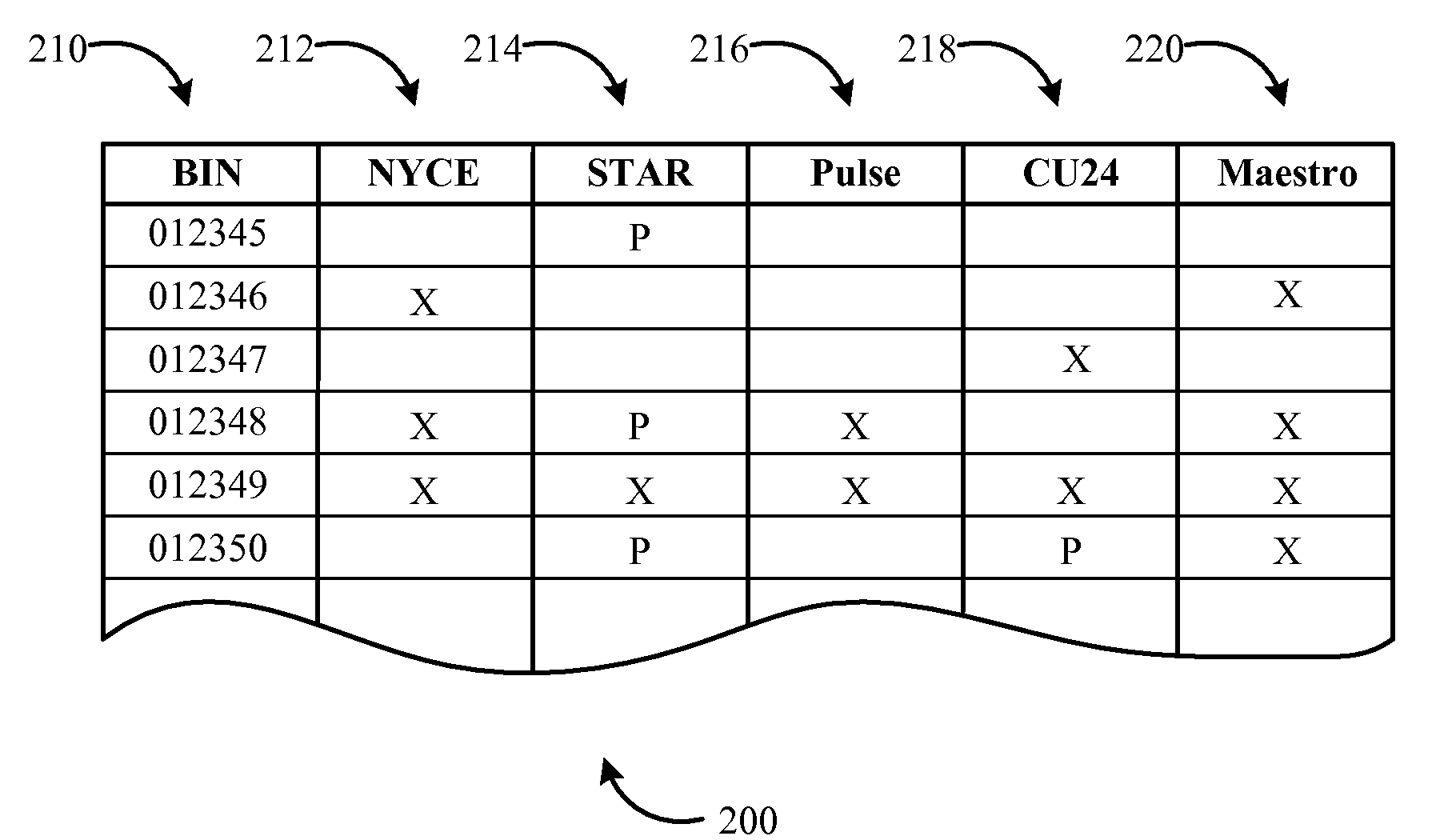

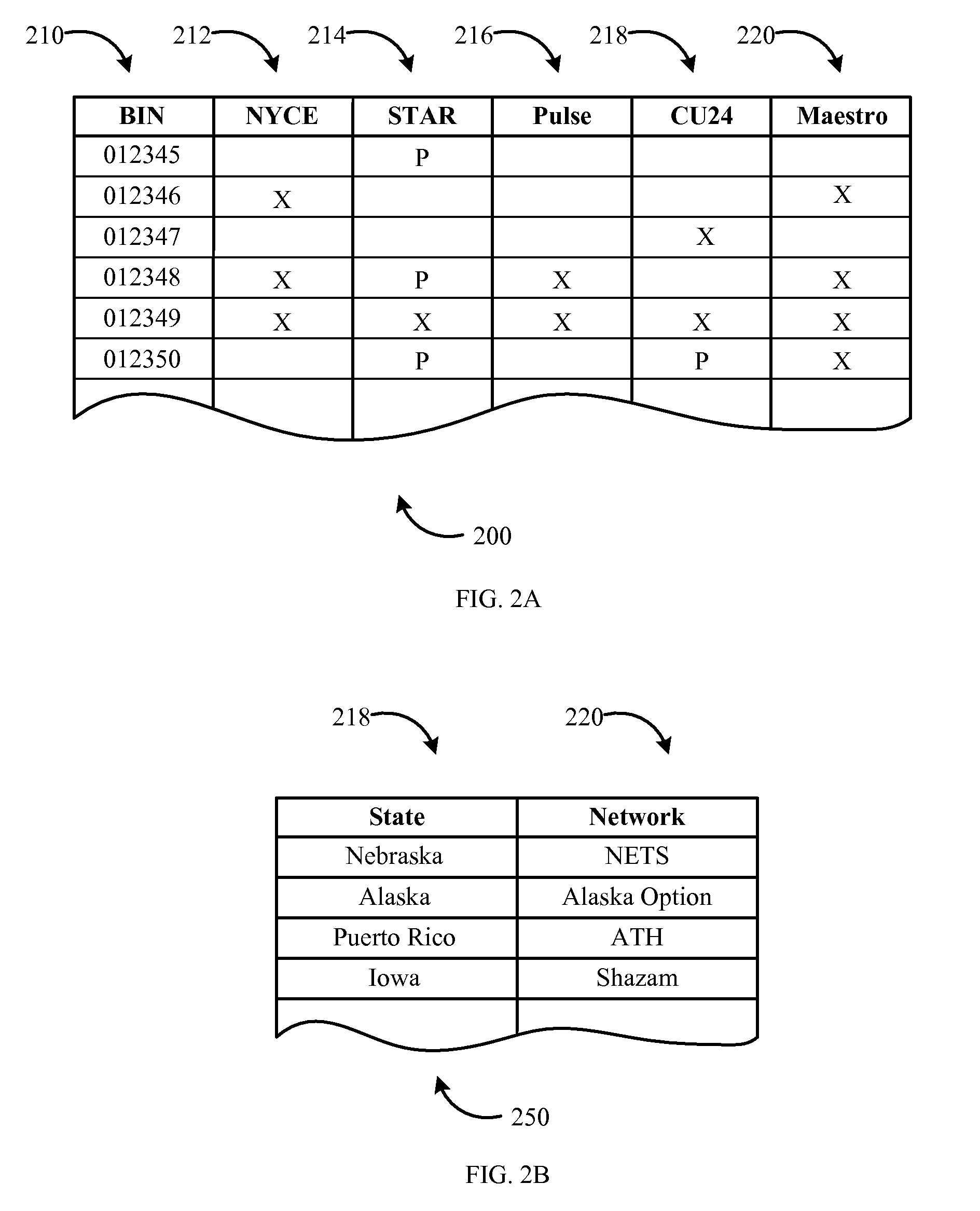

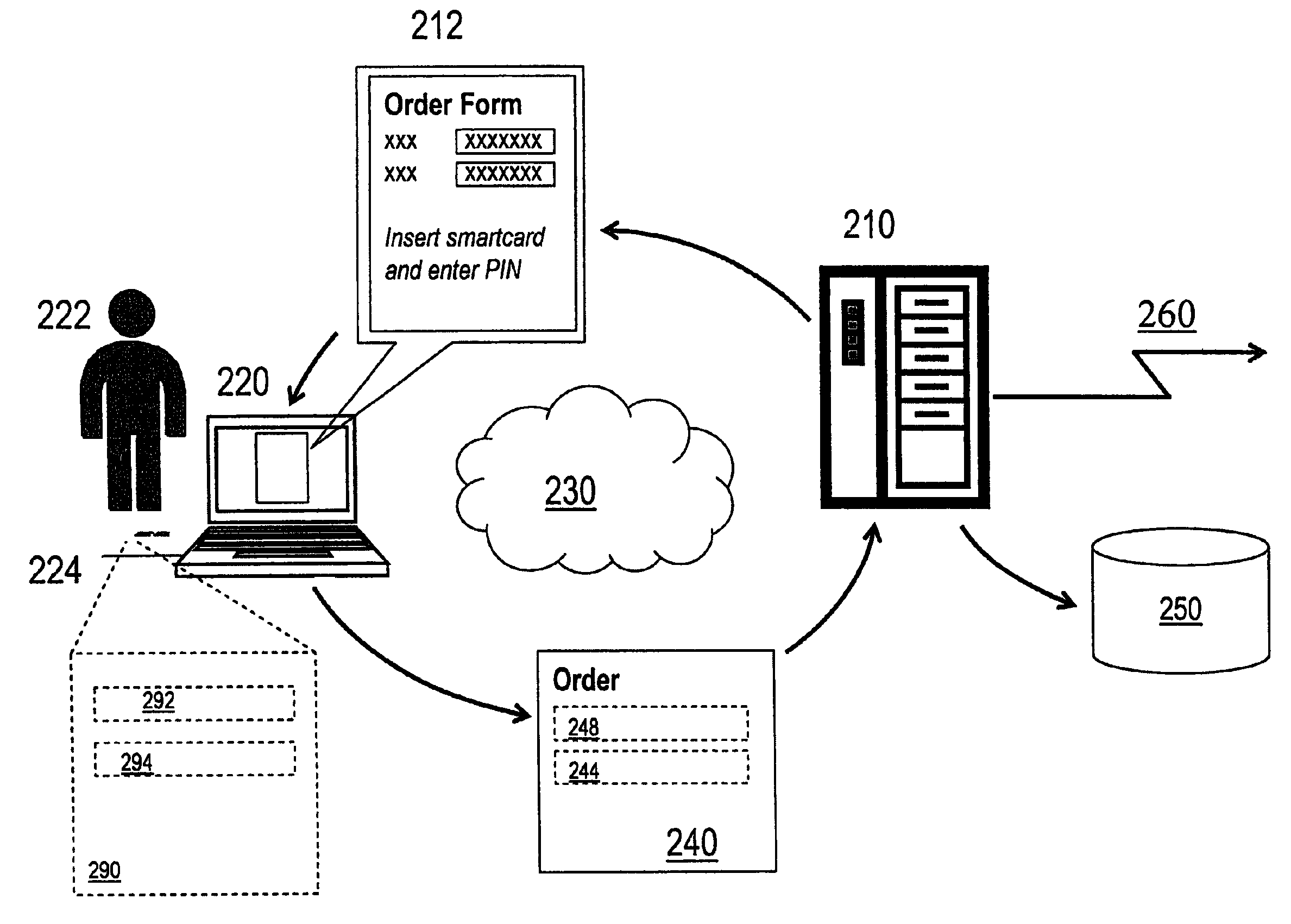

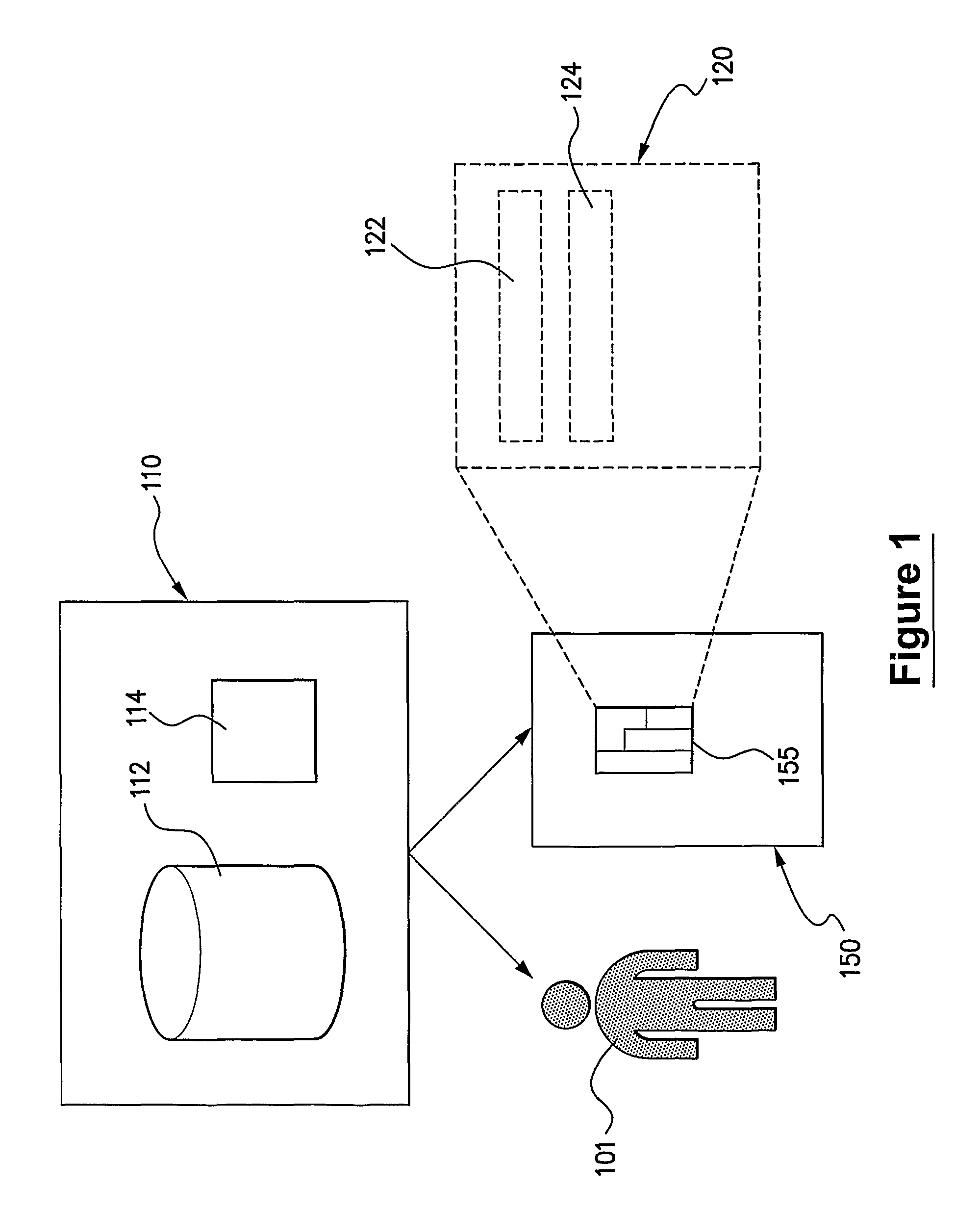

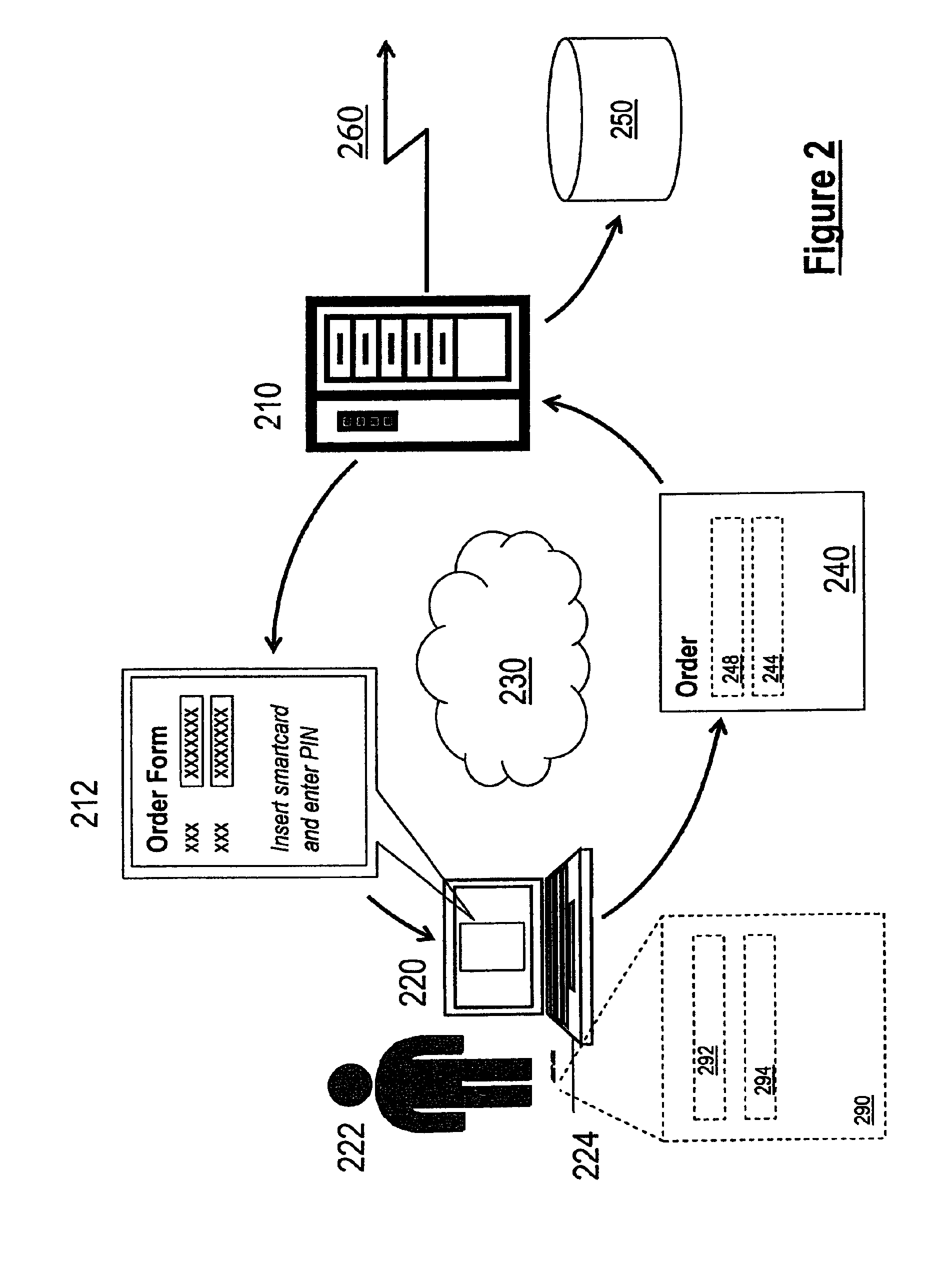

Electronic Financial Transaction Routing

InactiveUS20090070246A1Least costComplete banking machinesFinanceFinancial transactionFinancial trading

Methods and systems for determining a network for settling an electronic transaction at a financial transaction processor is disclosed according to embodiments of the invention. Certain embodiments include receiving a transaction from a merchant. The transaction may includes a bank identification number (BIN) and a geographical state identifier associated the merchant. From the BIN number, the processor can determine if one or more network flags are asserted for the BIN in the network file. If a single network flag is asserted then routing the transaction through a network associated with the network flag. For example, if a state network flag is asserted then routing the transaction through the state associated with the transaction. If a network priority flag is asserted, routing the transaction through associated network. If an issuer priority flag is asserted, routing the transaction through the network associated with the issuer.

Owner:FIRST DATA

Authenticating electronic financial transactions

InactiveUS8286865B2Avoid prolonged useWiden meansFinanceBuying/selling/leasing transactionsElectronic communicationFinancial transaction

Owner:LOCKSTEP TECH

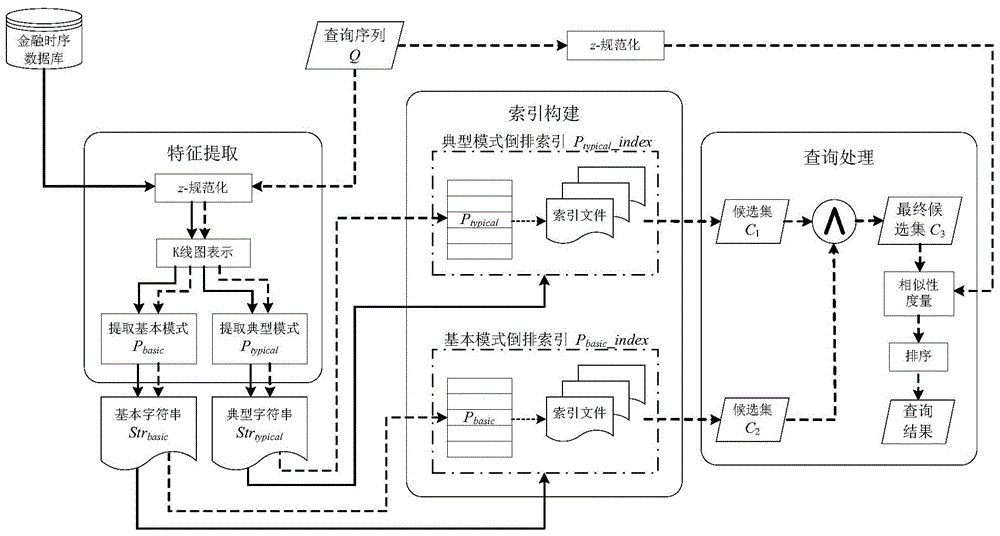

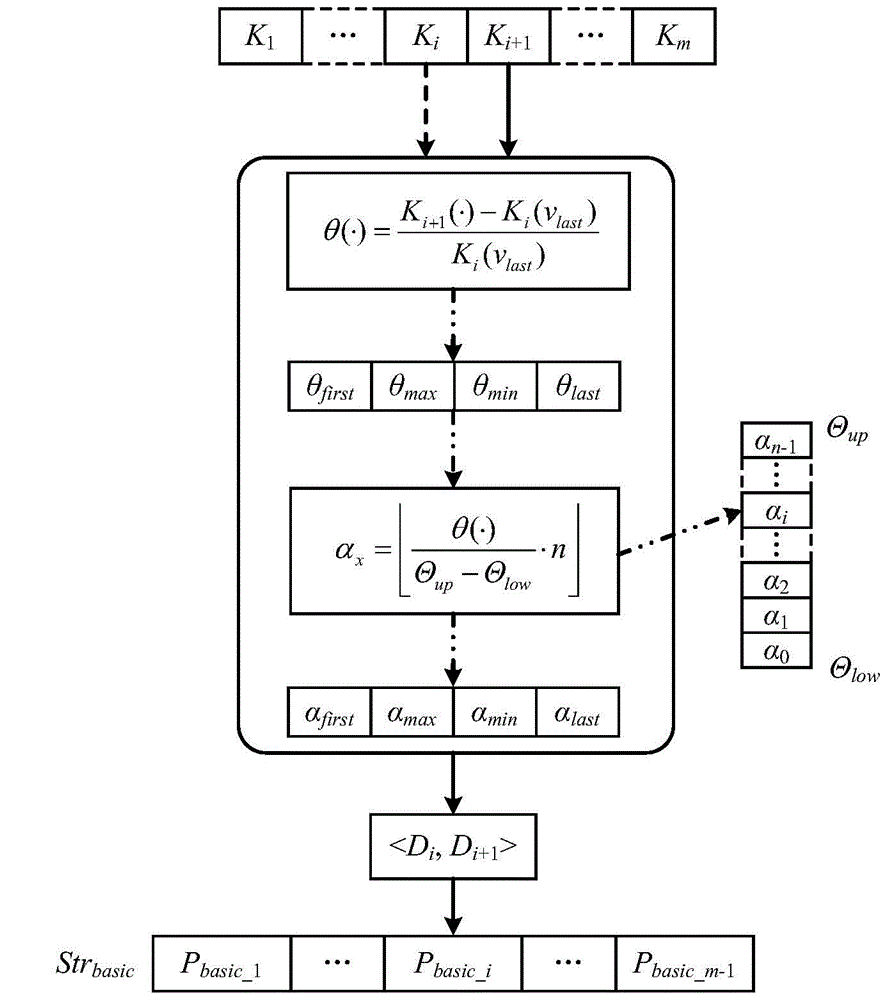

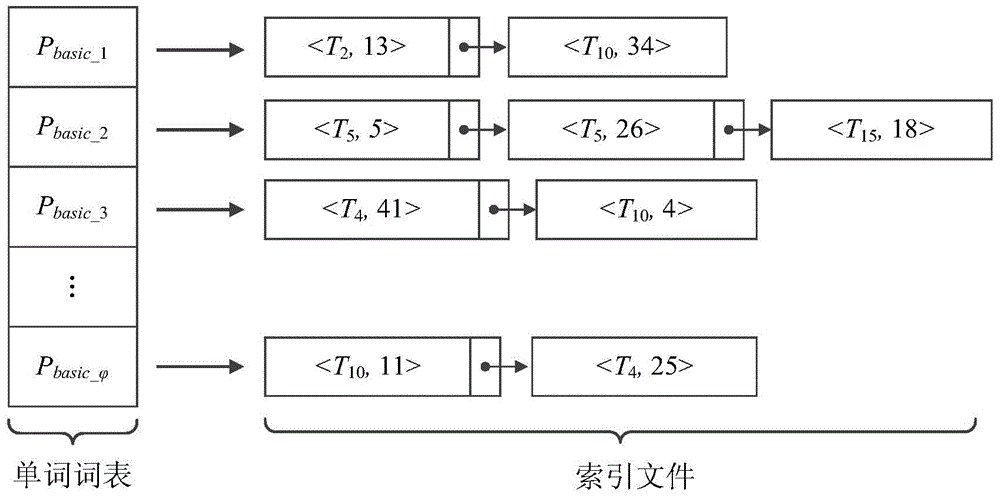

Financial time series similarity query method based on K-chart expression

InactiveCN104572886AExact similarity matchingReduce space overheadOther databases indexingSpecial data processing applicationsExtensibilityData set

The invention discloses a financial time series similarity query method based on K-chart expression. The method comprises the following steps of feature extraction, index construction and query processing. The method comprises the following concrete steps of firstly, extracting basic mode and classic mode features for a financial time series based on K-chart expression, and respectively translating the basic mode and classic mode features into a basic string and a classic string; secondly, respectively constructing reverse indexes on the basic string and the classic string; for each query sequence, after the basic mode and classic mode features are extracted through the same way, respectively querying the two constructed reverse indexes to acquire two candidate sets, and then carrying out intersection operation to obtain a final candidate set; obtaining a final query result through follow-up processing. The financial time series similarity query method based on K-chart expression can effectively realize nearest neighbor query, has higher measurement precision and query efficiency, has favorable extensibility for time series length, nearest neighbor query scale and data set scale, and can play a significant role in the widened electronic finance trade market.

Owner:ZHEJIANG UNIV

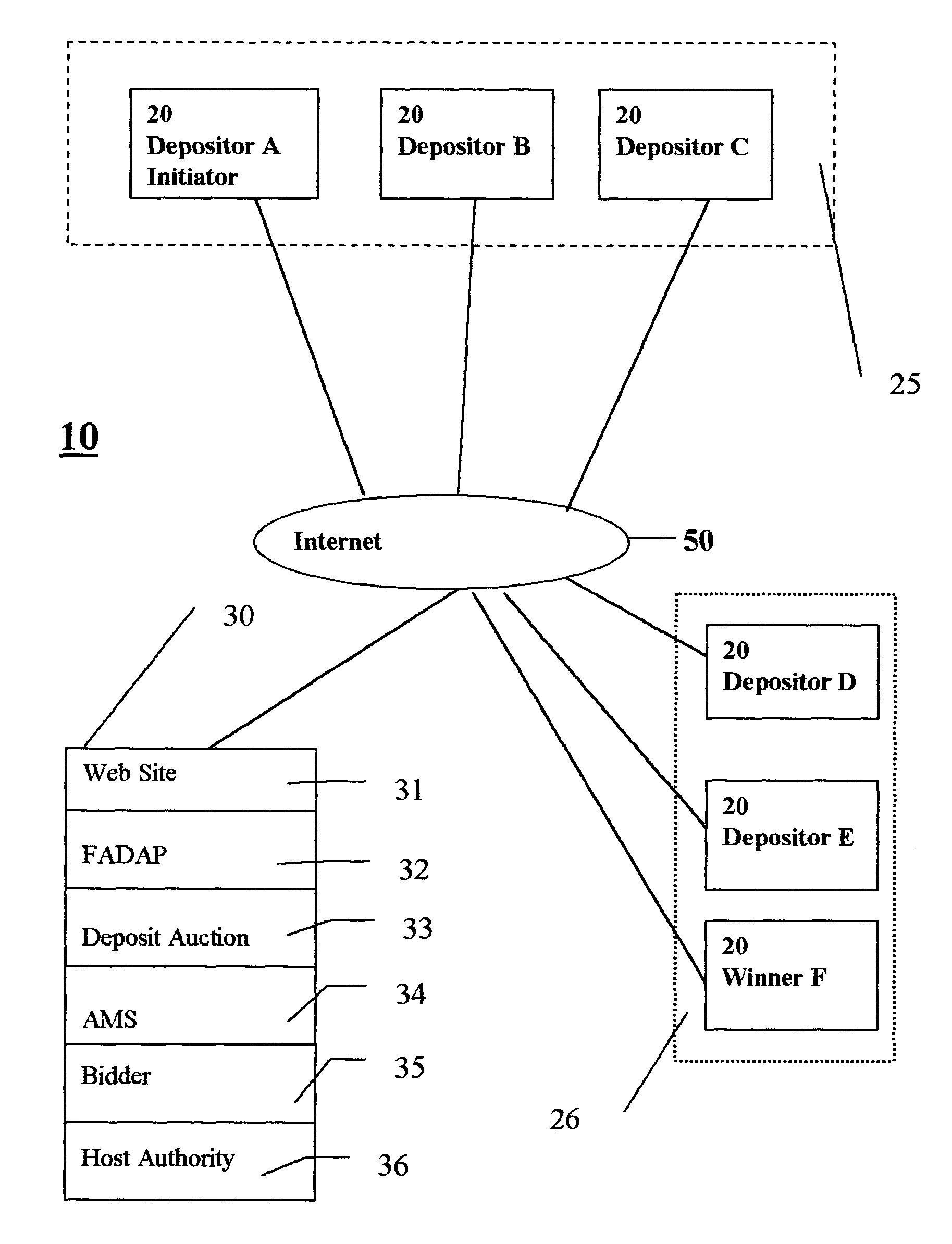

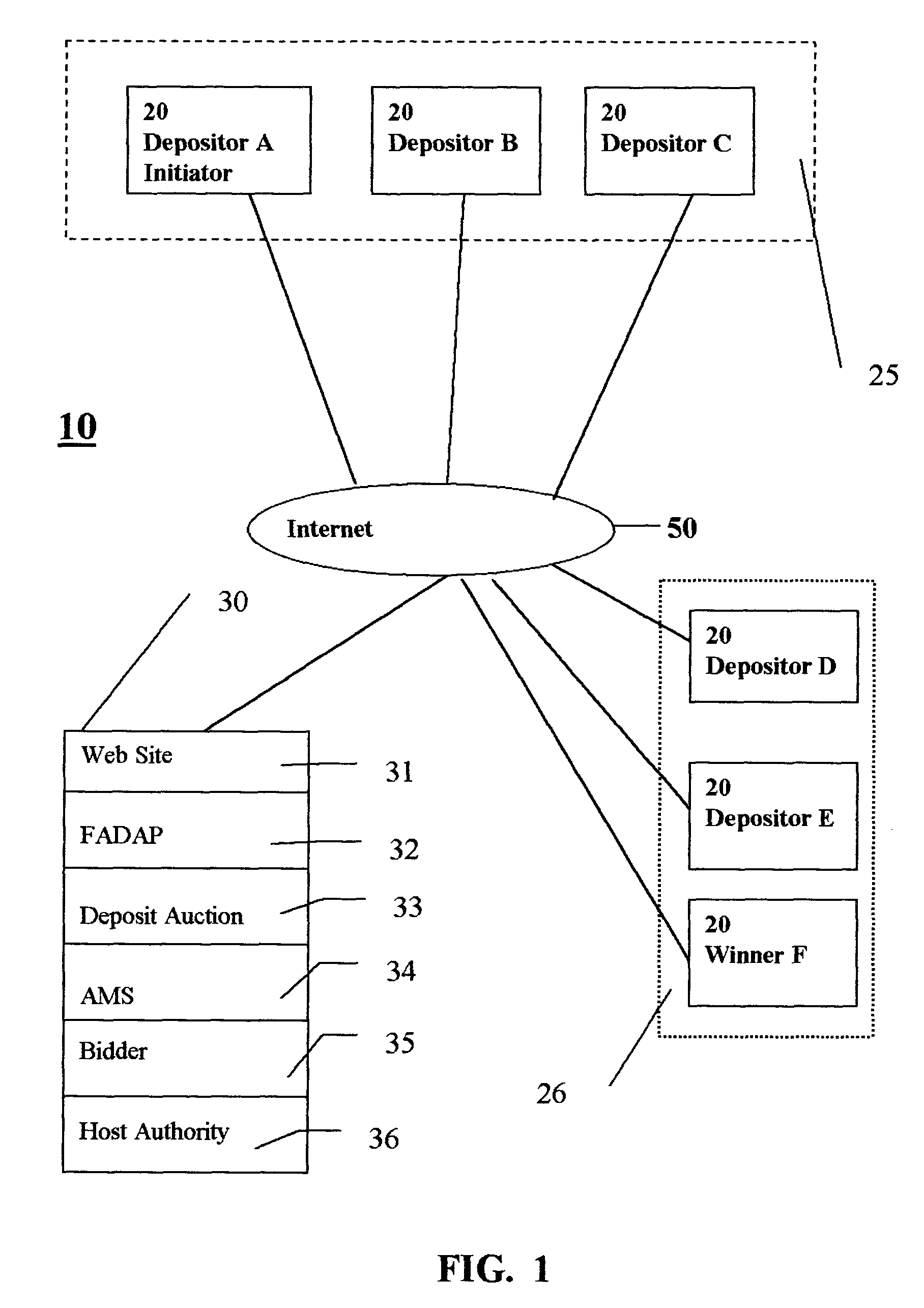

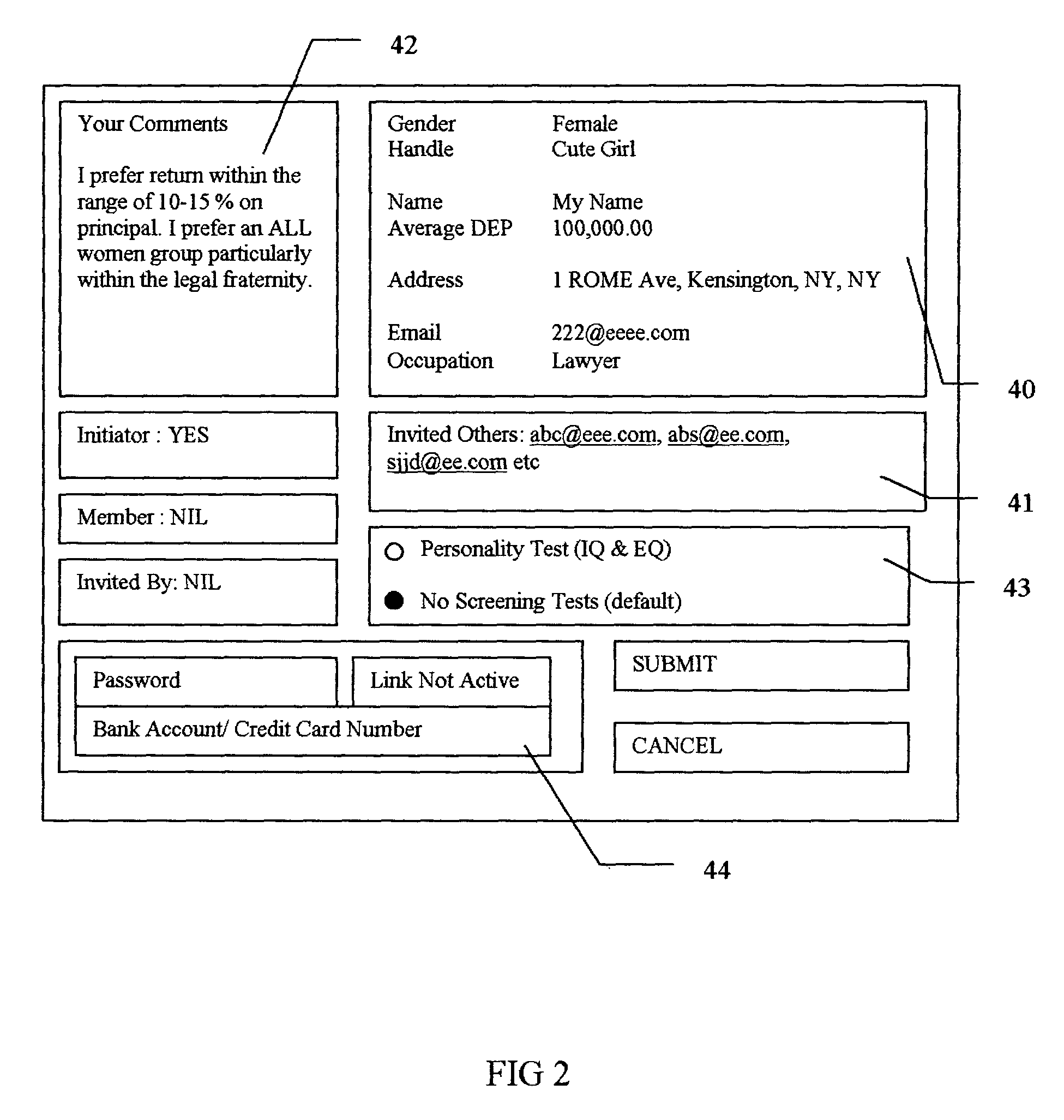

System and method for conducting an electronic financial asset deposit auction over computer network

A trusted computer system for conducting an electronic financial asset deposit auction over a computer network such as the Internet wherein invited depositor members are anonymous and bid against themselves for a number of sessions no greater than the number of depositor members. At each session, a member is declared a winner and eliminated from further sessions. The winner then collects the pooled discount deposits with repayment due in the next session payable to the winner of the said session. The aforesaid steps are repeated until one depositor is left wherein said depositor will receive the highest rate of return.

Owner:KWAN KHAI HEE

Wire speed monitoring and control of electronic financial transactions

ActiveUS8751364B2Faster message processingSpeed maximizationFinanceComputer hardwareTraffic capacity

An in-line hardware message filter device inspects incoming securities transactions. The invention is implemented as an integrated circuit (IC) device which contains computer code in the form of on-chip hardware instructions. Data messages comprising orders enter the device in exchange-specific formats. Messages that satisfy pre-determined risk assessment filters are allowed to pass through the device to the appropriate securities exchange for execution. The system functions as a passive device for all legitimate network traffic passing directly or indirectly between a customer's computer and a securities exchange's order-acceptance computer. Advantageously, the invention allows the broker-dealer to check and pass messages or orders as they come through the system without having to store the full message before making a risk assessment decision. The hardware-only nature of the invention serves to maximize the speed of order validation and to perform pre-trade checks in a cut-through or store-and-forward mode.

Owner:DEUTSCHE BANK

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com