System and Method for Facilitating Electronic Financial Transactions Using a Mobile Telecommunication Device

a mobile telecommunication device and electronic financial transaction technology, applied in the field of system and method for facilitating electronic financial transactions, can solve the problems of low security level, transmission over the system, and significant risk for users of such a system

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

example

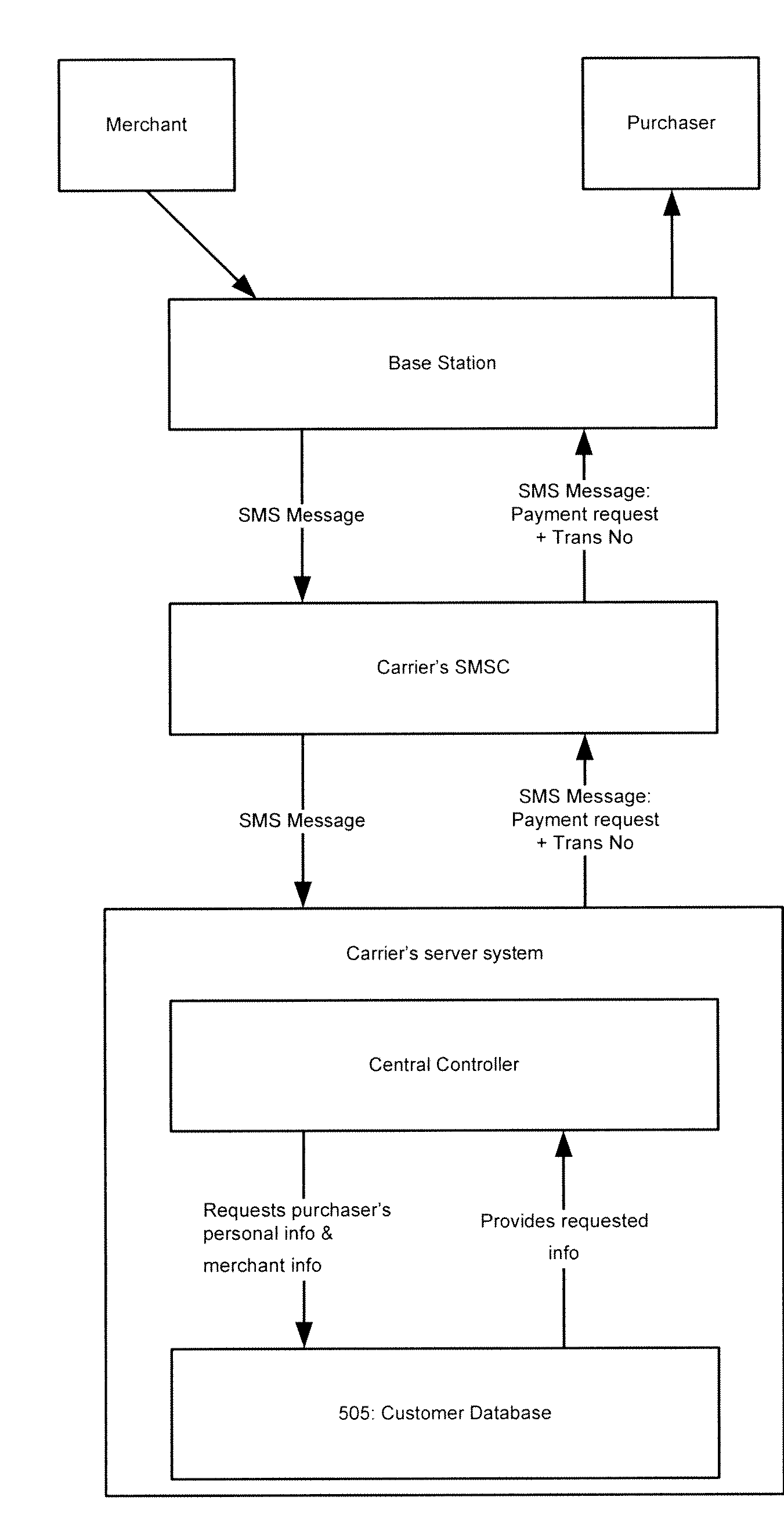

[0273]FIGS. 9 to 14 are logic flow diagrams showing the flow of messages within the system of this invention. The steps shown in a hexagonal border are performed within the Gateway Receiver and steps contained in rectangular borders are performed in the Gateway Core. The system server receives a request from the supplier device (“M Payment Request Initialisation Tool”) to initiate a transaction. The message then undergoes certain checks within the carrier server. A transaction identifier (“MTransID”) is added to the message and the message can then be sent.

[0274]Alternatively (as shown in FIG. 9), before the message is sent, the system server can check on the availability of any benefits (eg coupons, product / service offerings and the like) being offered by the supplier. In order to do this, the system server checks its database records and if a particular benefit is found, then the processing steps are implemented.

[0275]The benefit processing steps are shown in FIGS. 10 and 11. If a...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com