Patents

Literature

31 results about "Self-insurance" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Self-insurance is a situation in which a person or business does not take out any third-party insurance, but rather a business that is liable for some risk, such as health costs, chooses to bear the risk itself rather than take out insurance through an insurance company.

Method for optimizing insurance estimates utilizing Monte Carlo simulation

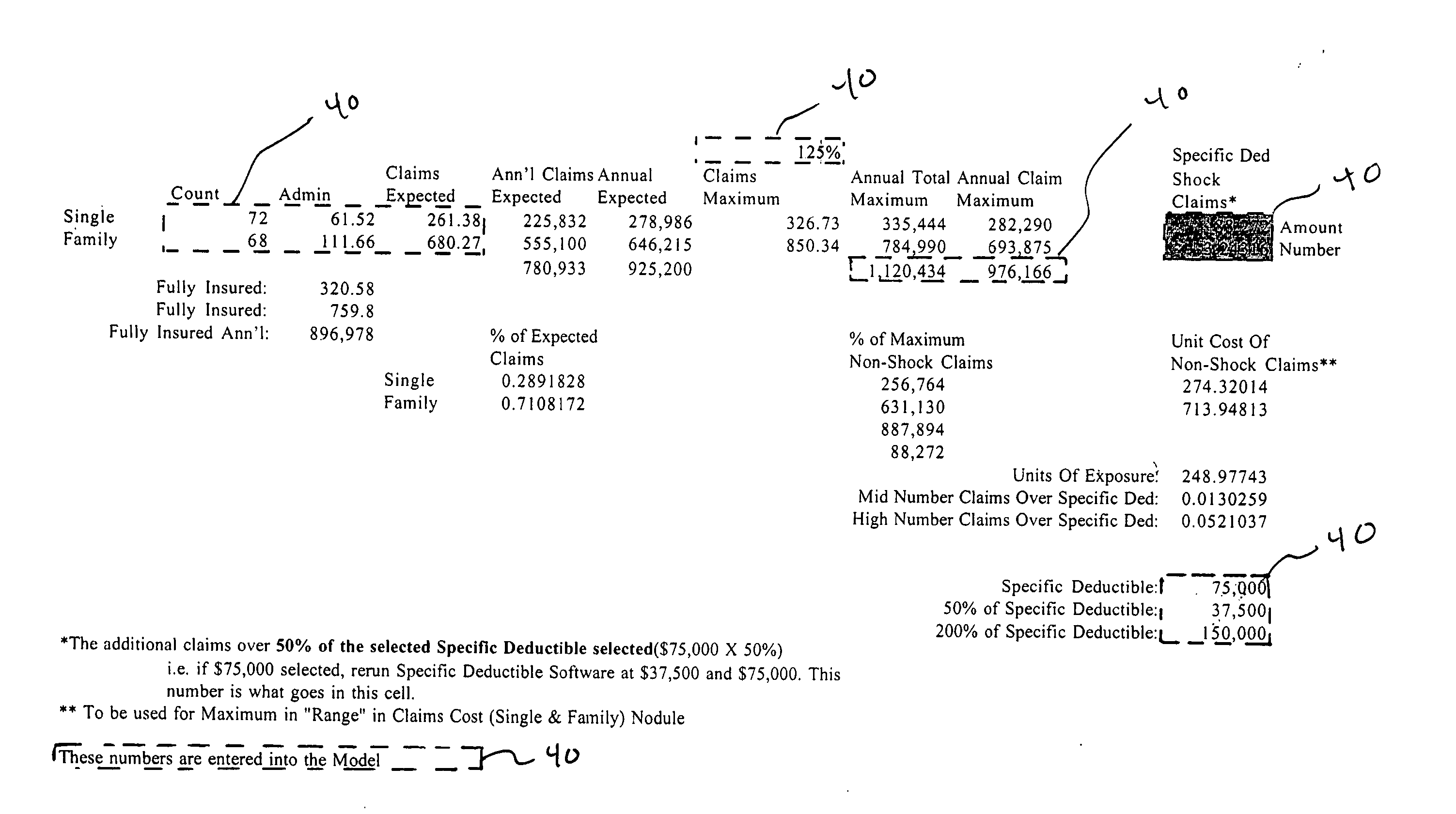

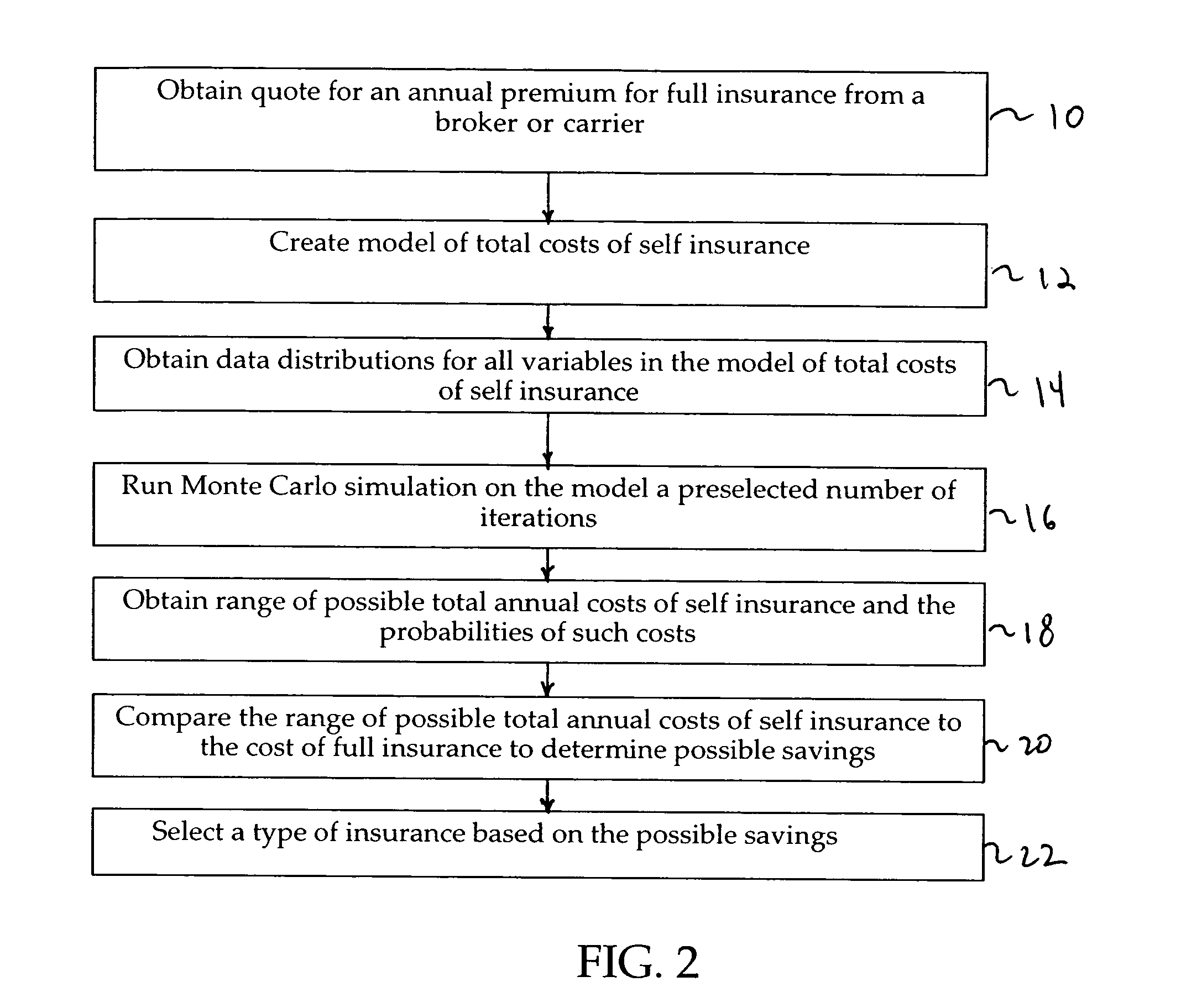

A method for optimizing insurance estimates utilizing Monte Carlo simulation includes the steps of ascertaining the total number of potential insured units and obtaining a quote for full insurance based on the total number of potential insured units. The method further includes creating a model of total costs of self insurance for the potential insured units, obtaining data distributions for all variables in the model of total costs of self insurance and running a Monte Carlo simulation on the model a preselected number of iterations. A range of range of possible total costs of self-insurance and the probabilities of such costs is then obtained facilitating a selection between full insurance and self-insurance.

Owner:GIANANTONI RAYMOND J

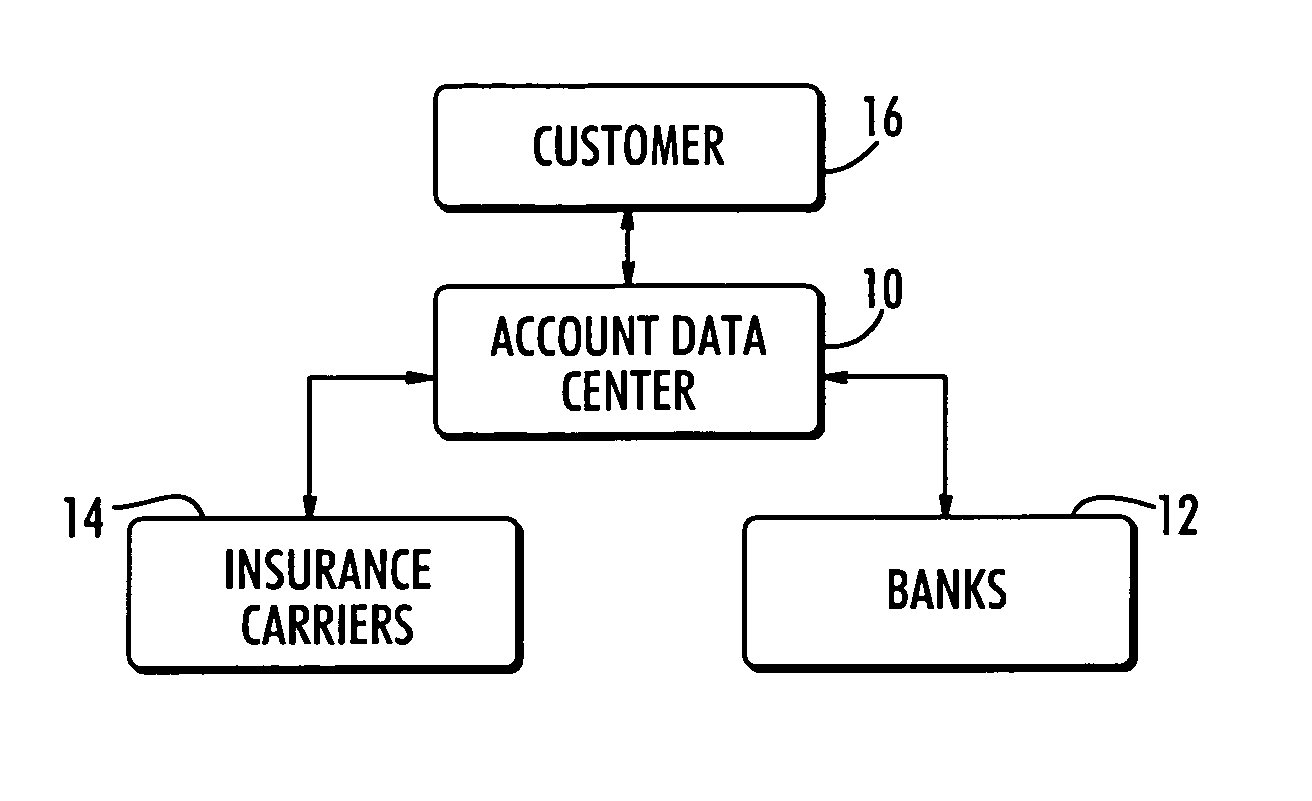

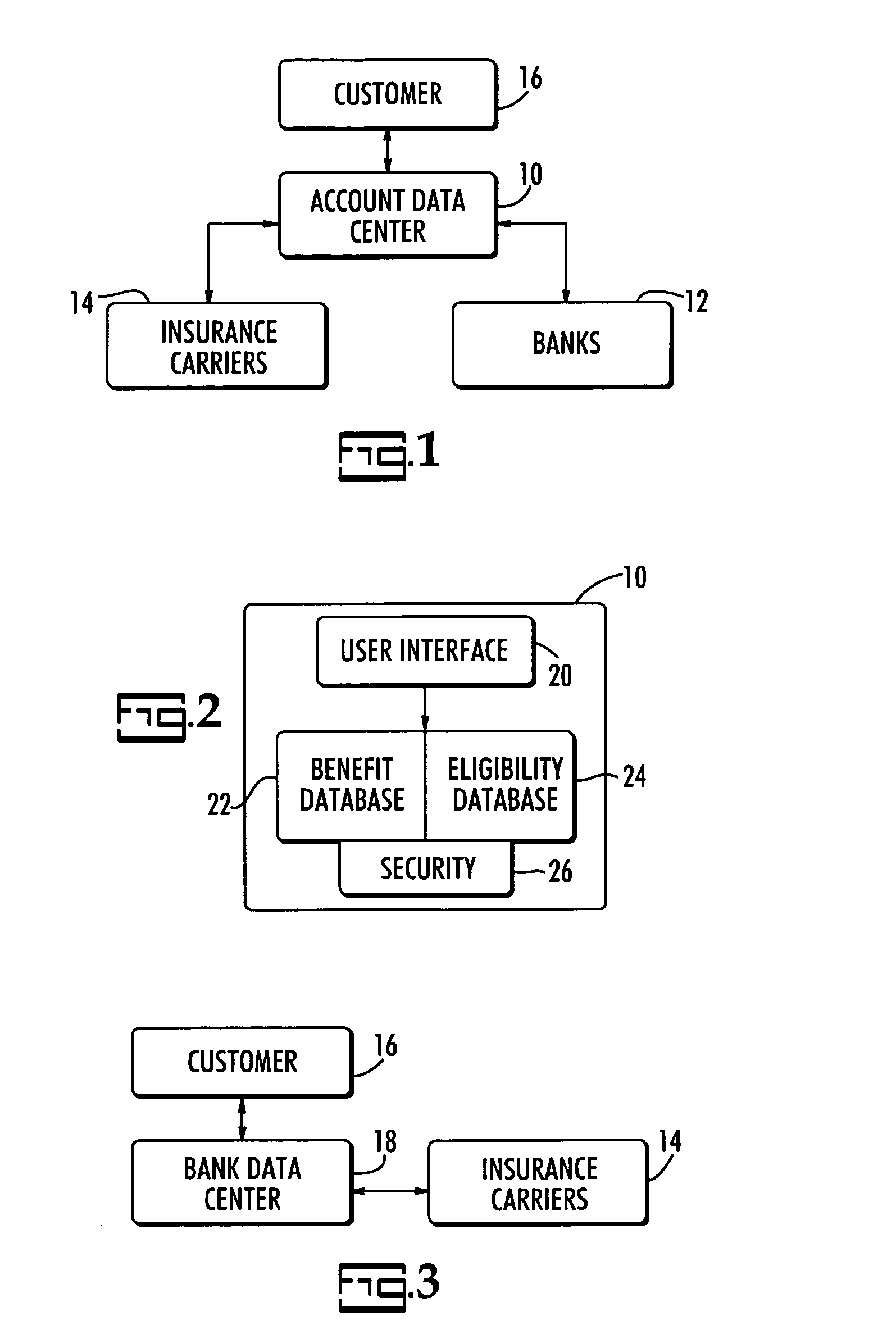

Consumer directed checking account coverage system

InactiveUS7182253B1Lower Coverage CostsIncreased deposit levelComplete banking machinesFinanceSelf-insuranceInsurance life

A system and method that includes the use of a bank checking account that can be connected to insurance coverage. In particular, a banking consumer can purchase insurance coverage for unexpected events that may affect the historical deposits and withdrawals relating to the checking accounts. Additionally, insurance coverage other than that of the checking account itself can be included, such as life insurance, so long as the account remains active. Accordingly, the present invention can integrate the negative insurance sell into a positive banking experience.

Owner:CRITICAL POINT GROUP

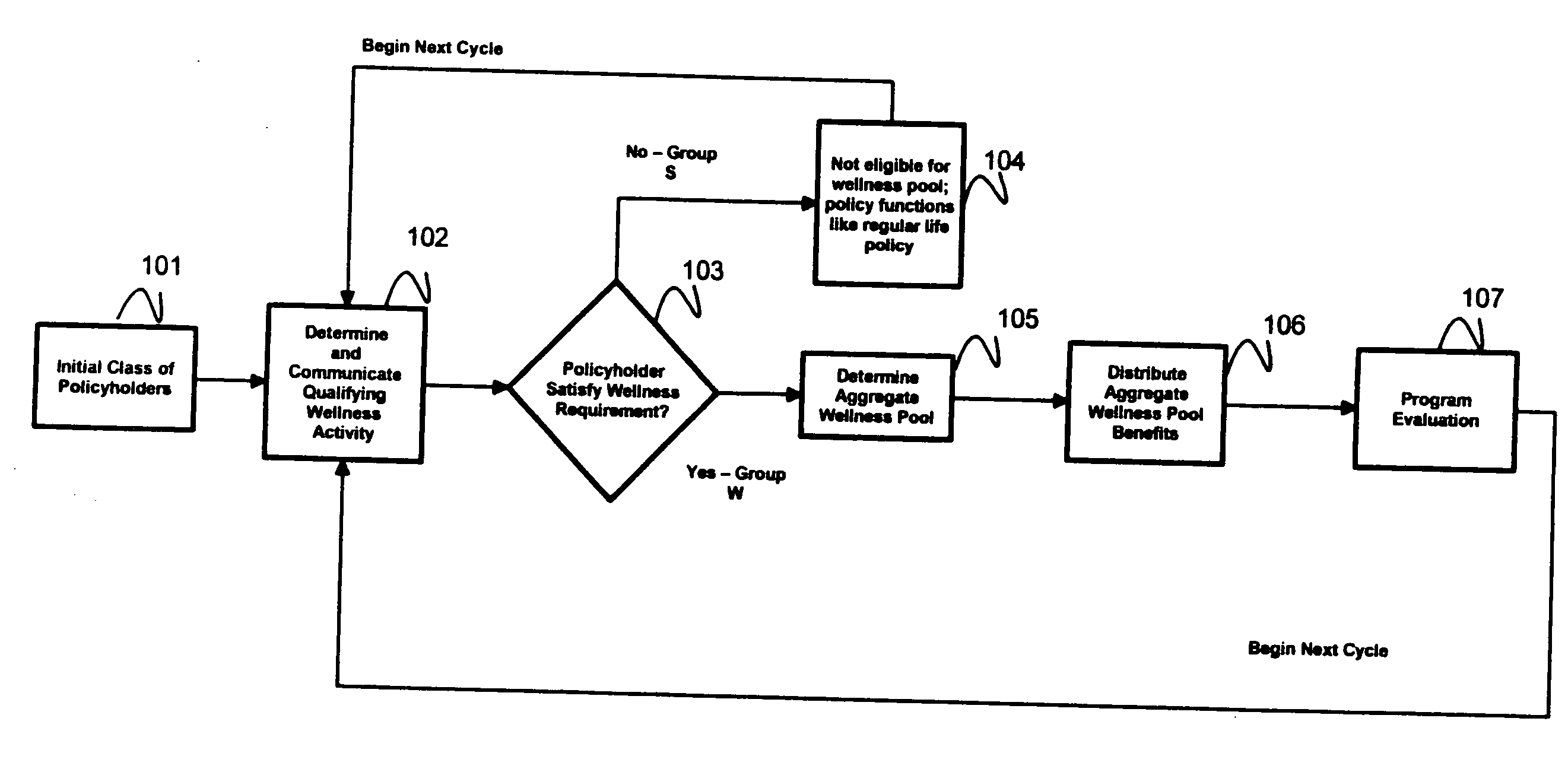

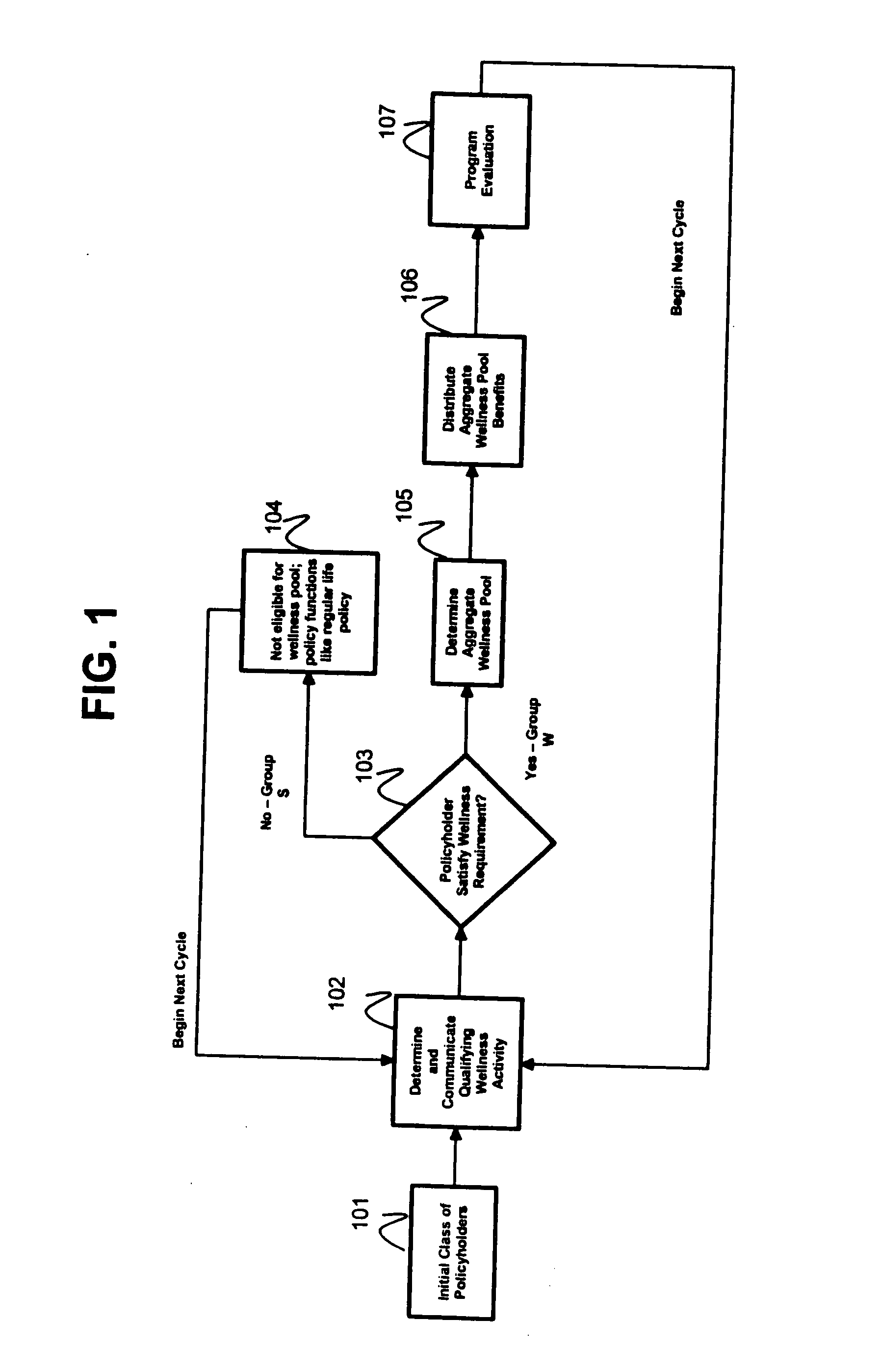

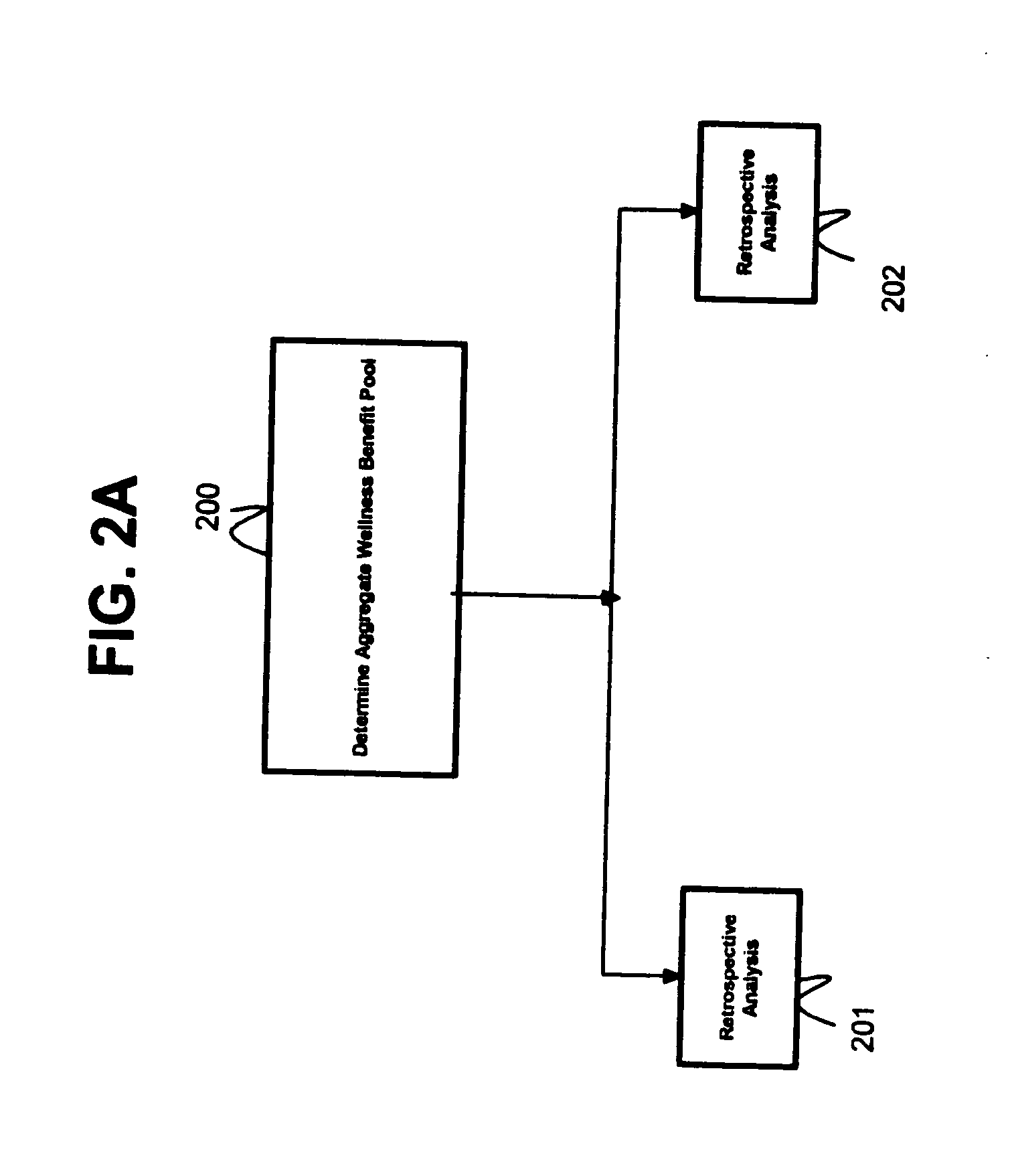

Contingent wellness benefits for life insurance

ActiveUS20080109263A1Improving individual 's healthEncouraging preventative wellness activityFinanceData acquisition and loggingMultiple formsSelf-insurance

A method for rewarding life insurance policy holders who satisfy requirements relating to insured individuals' wellness includes segmenting a group of insured individuals into a W group that qualifies for a wellness benefit and a S group that does not qualify for the wellness benefit. Qualification for the wellness benefit is based on compliance with one or more of said requirements relating to insured individuals' wellness. An aggregate wellness benefit pool available for distribution to members of the W group is then determined. The wellness benefits may be distributed in several forms or combinations thereof, such as cash dividends, reductions in premiums, free additional insurance coverage for a specified time period, credits towards policy cash value or increases in other benefits. The requirements relating to an insured individual's wellness may include one or more existing health (results-based) conditions or activity-based requirements, or a combination thereof.

Owner:AVIVA USA CORP

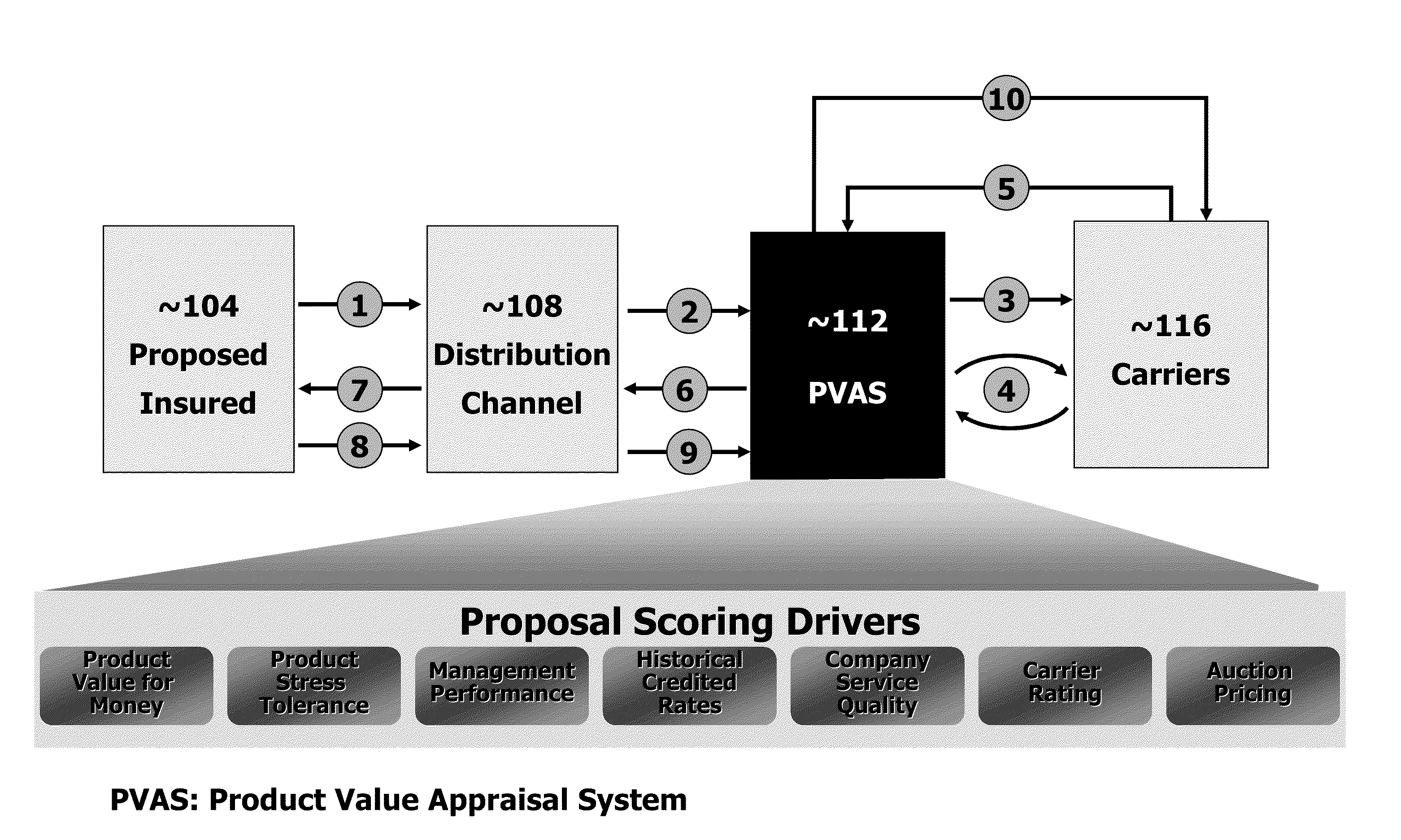

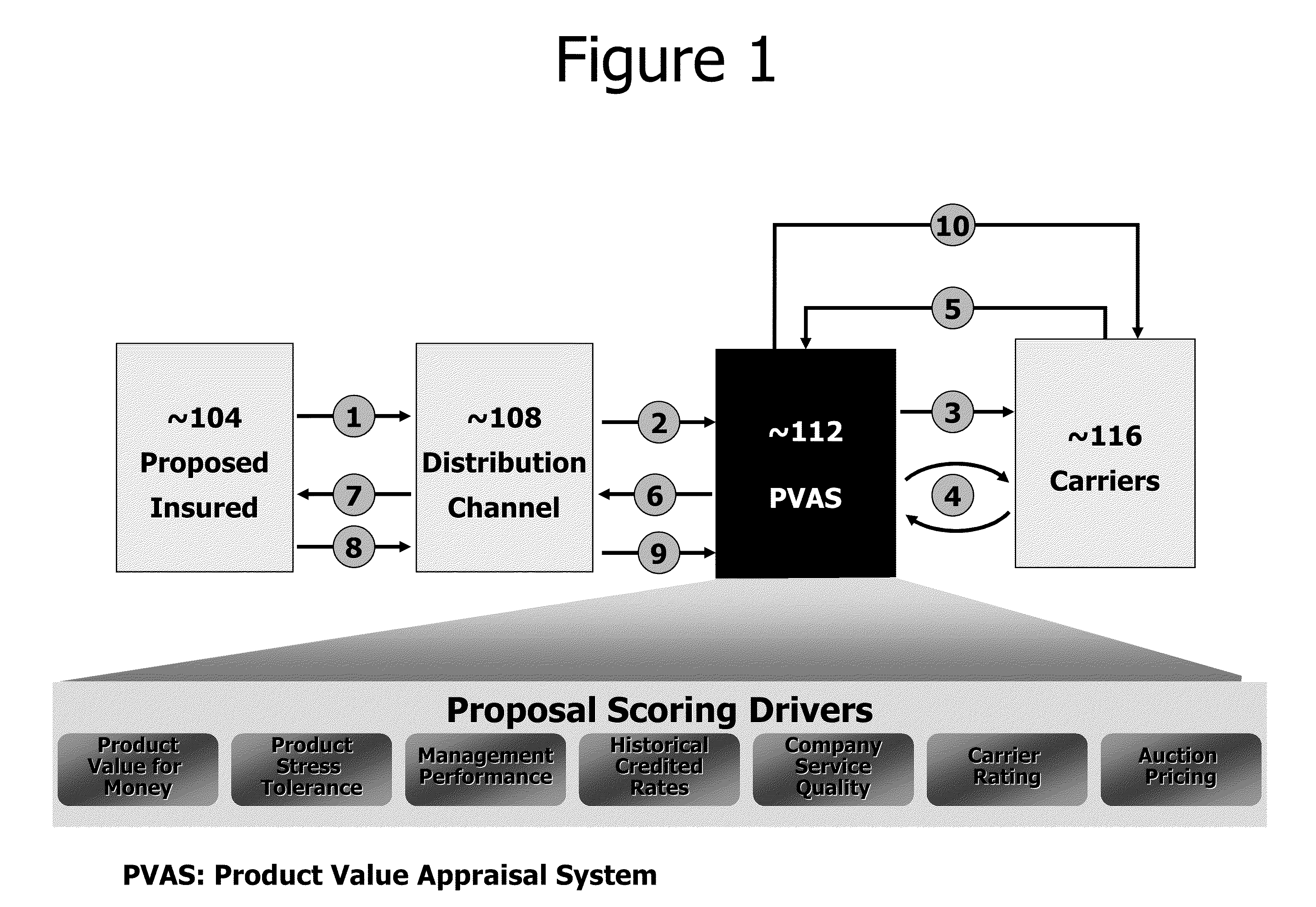

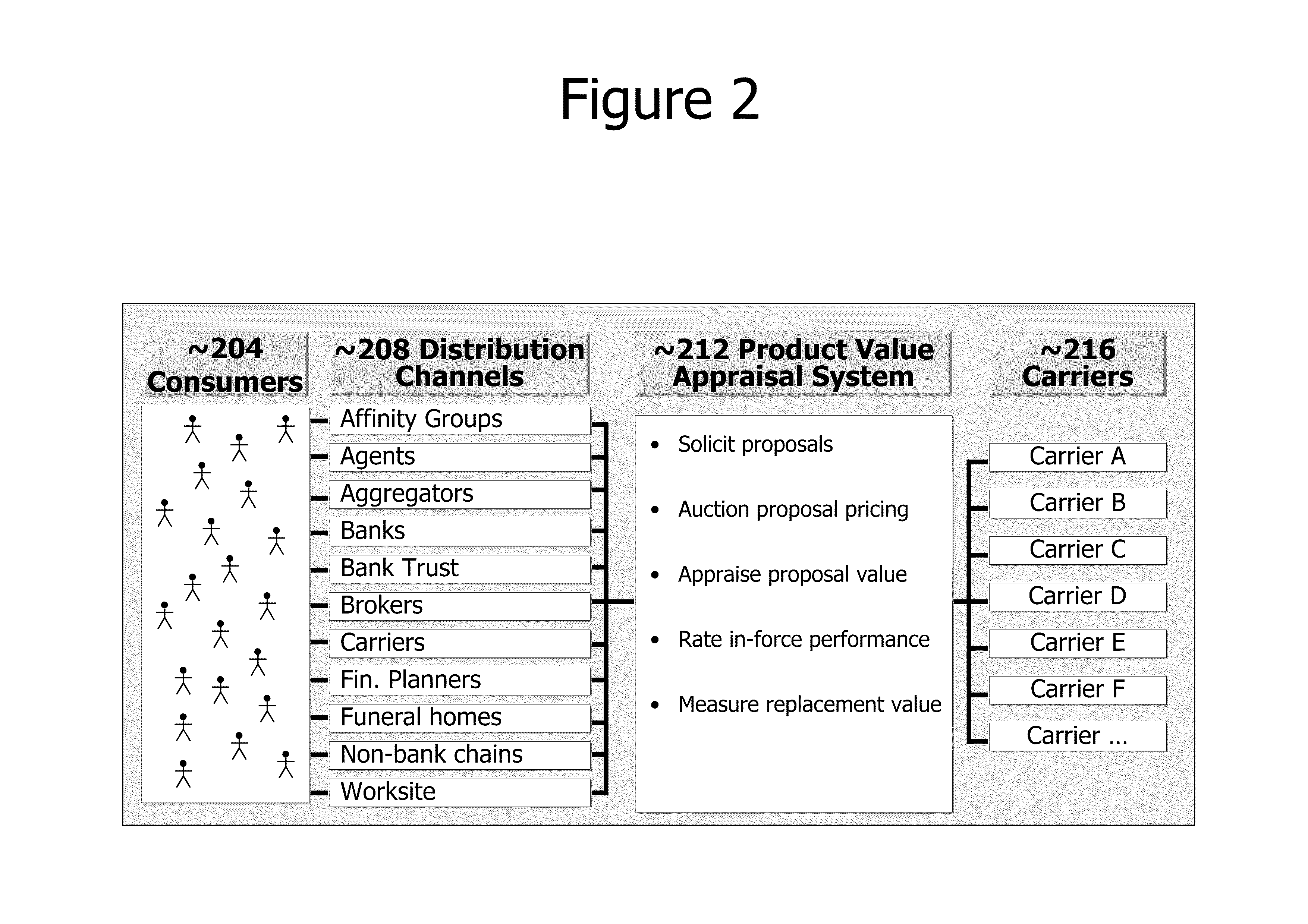

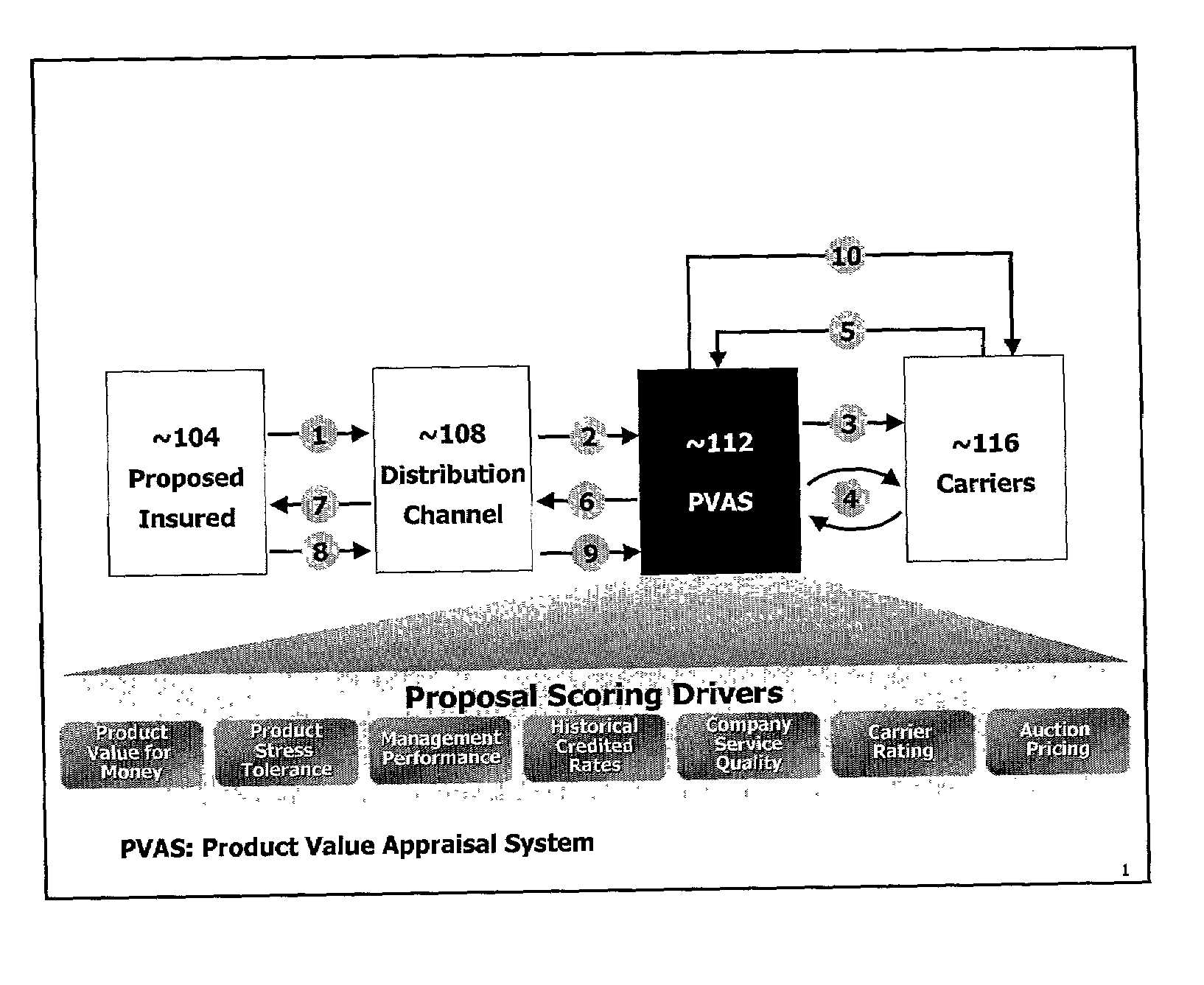

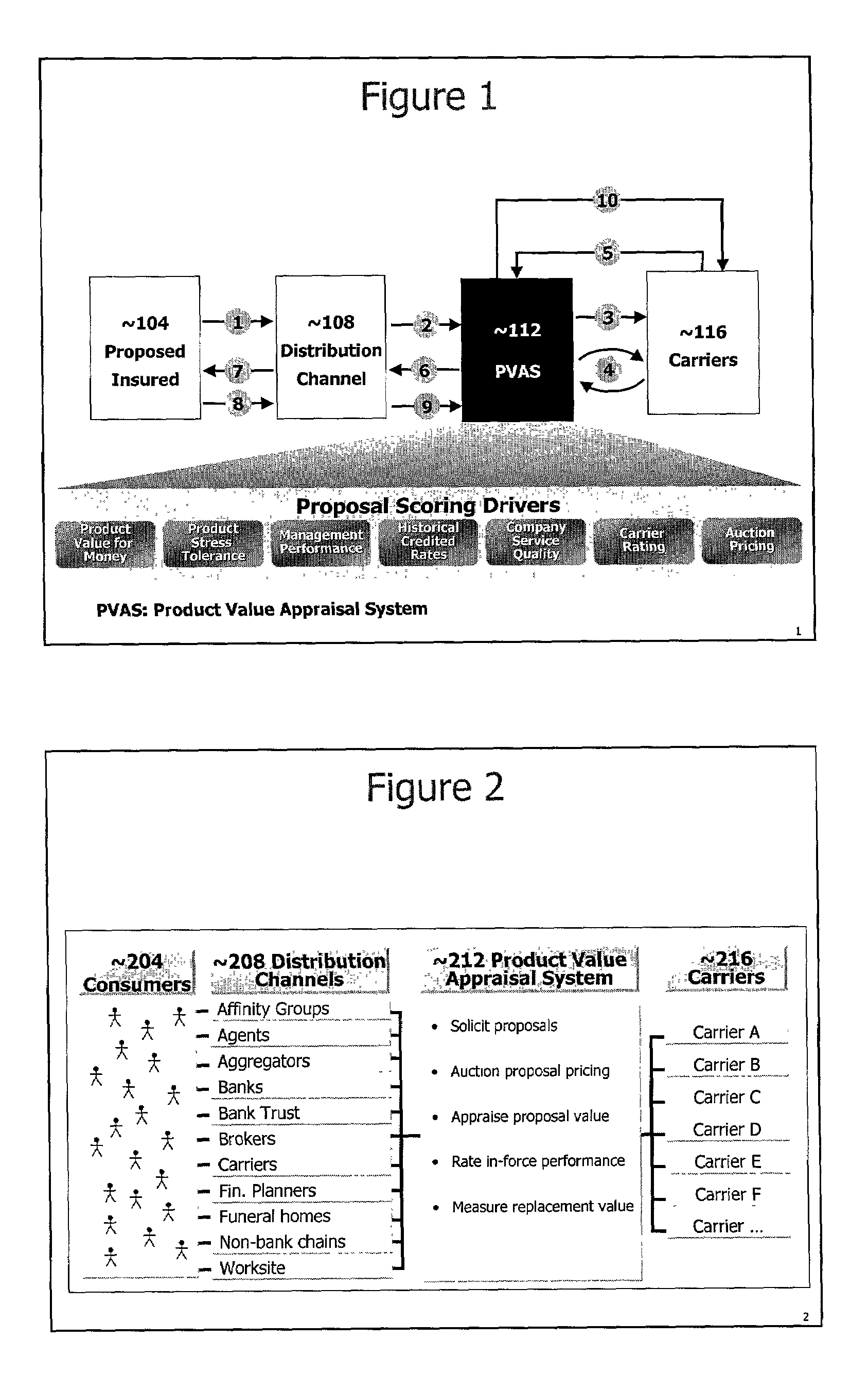

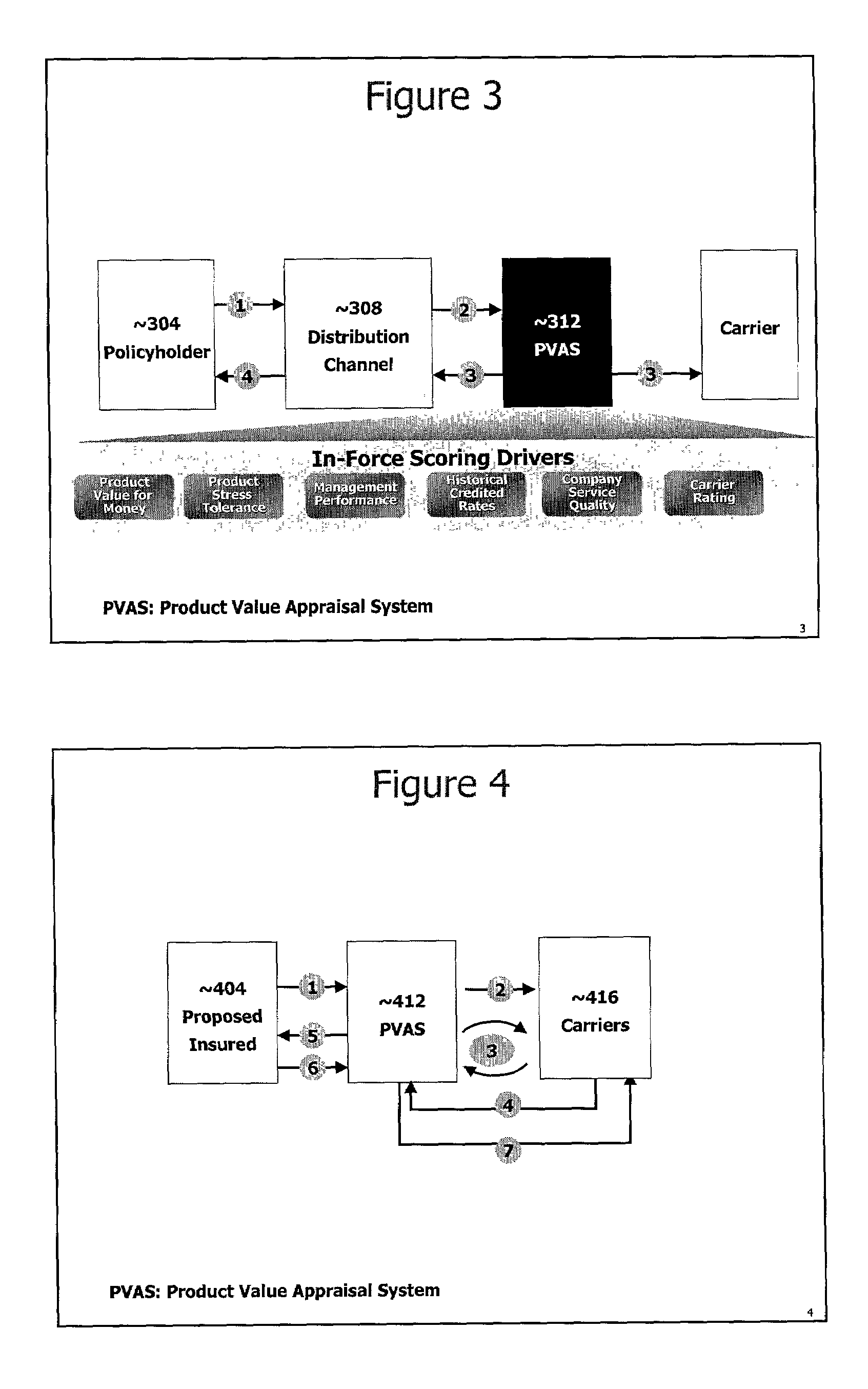

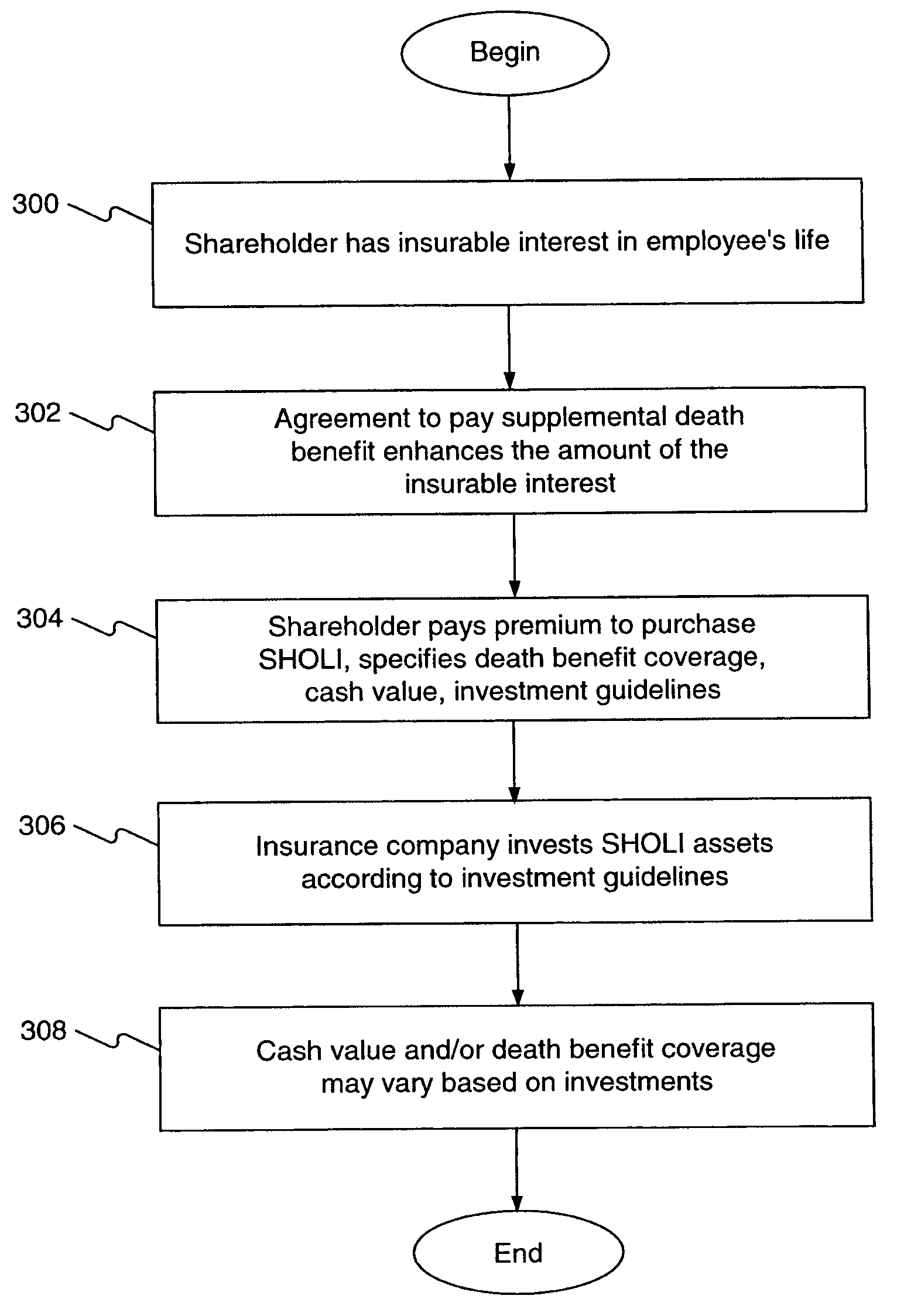

System for apparaising life insurance and annuities

A method and system of appraising a life insurance or annuity product includes receiving a request for a life insurance or annuity product and information about a party requesting the life insurance or annuity product; preparing a bid solicitation for the life insurance or annuity product based on the request and information and transmitting the bid solicitation to a plurality of product carriers; a plurality of product carriers submitting initial proposals for providing the life insurance or annuity product; generating ratings for the initial proposals, respectively; and generating appraisals for the initial proposals; and informing the product carriers of the decision.

Owner:EFFICIENT MARKETS

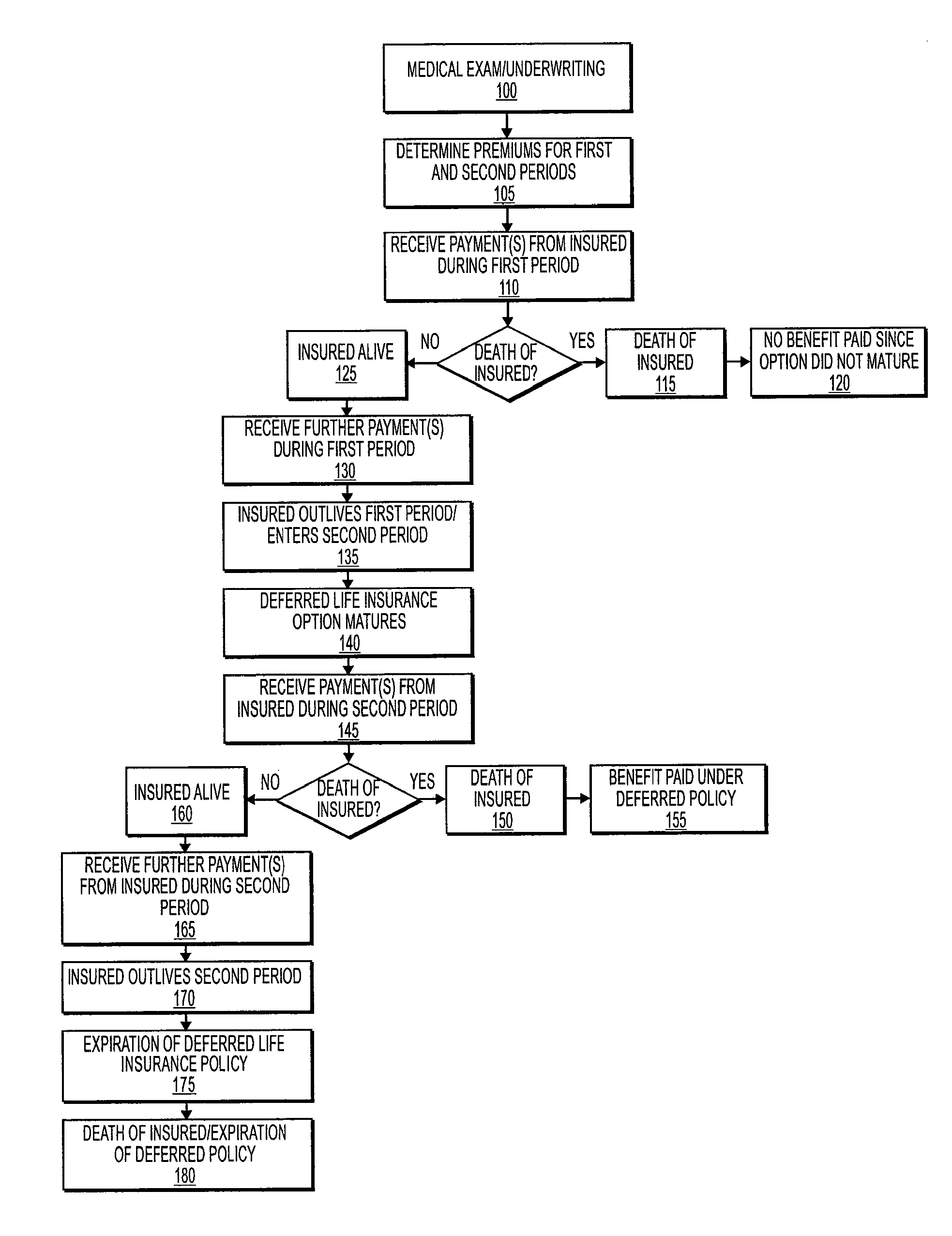

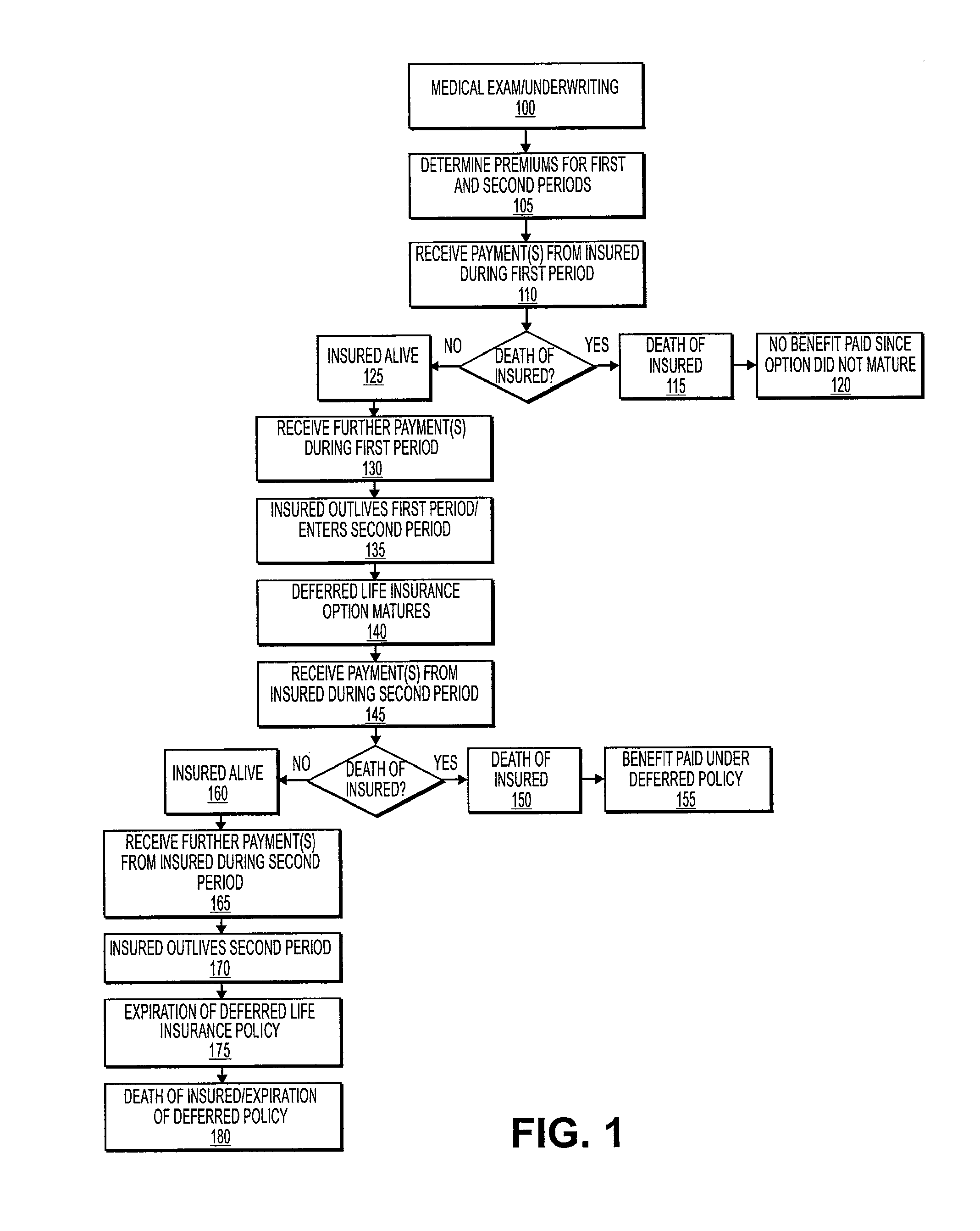

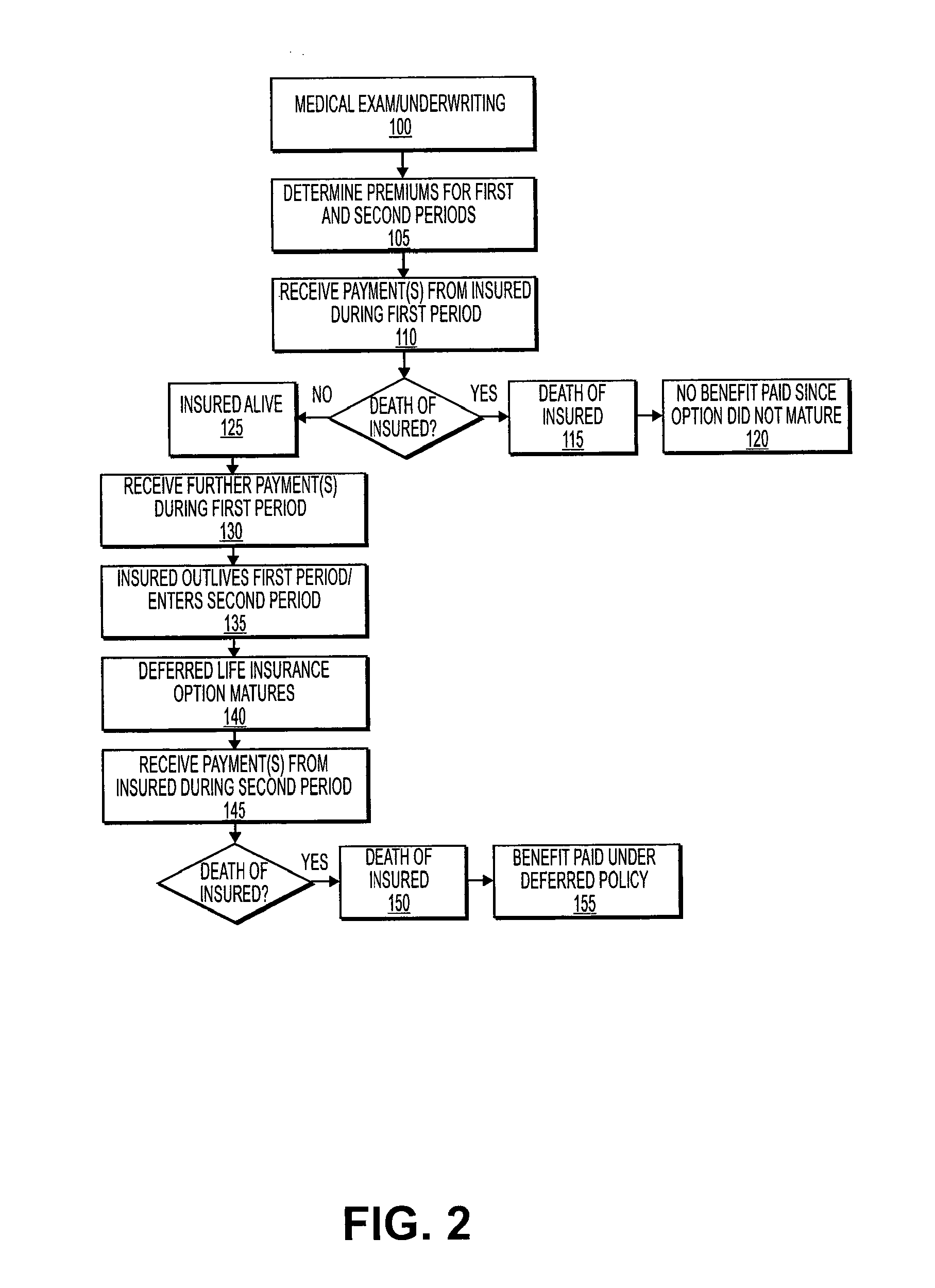

Life insurance option

A method of providing deferred life insurance through a life insurance option. The deferred life insurance becomes effective later in the life of an insured after the option matures. The insured pays at least one payment during a first period for the deferred life insurance policy option. The deferred life insurance policy is inactive during the first period, and becomes effective at the beginning of the second period when the option matures. The insured pays at least one payment during a second period, which follows the first period, for the deferred life insurance policy, assuming the insured lives this long. The insured is entitled to a benefit based on the deferred term life insurance policy only in the event of death of the insured occurs during the second period. Payments for the life insurance option can be made by a person who is the insured or on behalf of another person who is the insured, such as a child or other third party. The individual payments and sum of payments can be structured to suit the insured's financial objectives, while providing incoming funds to an insurance company. The deferred life insurance policy can be used in conjunction with a conventional life insurance policy, such as conventional term and whole life insurance policies.

Owner:INSAMCO HLDG

System for appraising life insurance and annuities

A method and system of appraising a life insurance or annuity product includes receiving a request for a life insurance or annuity product and information about a party requesting the life insurance or annuity product; preparing a bid solicitation for the life insurance or annuity product based on the request and information and transmitting the bid solicitation to a plurality of product carriers; a plurality of product carriers submitting initial proposals for providing the life insurance or annuity product; generating ratings for the initial proposals, respectively; and generating appraisals for the initial proposals; and informing the product carriers of the decision.

Owner:EFFICIENT MARKETS

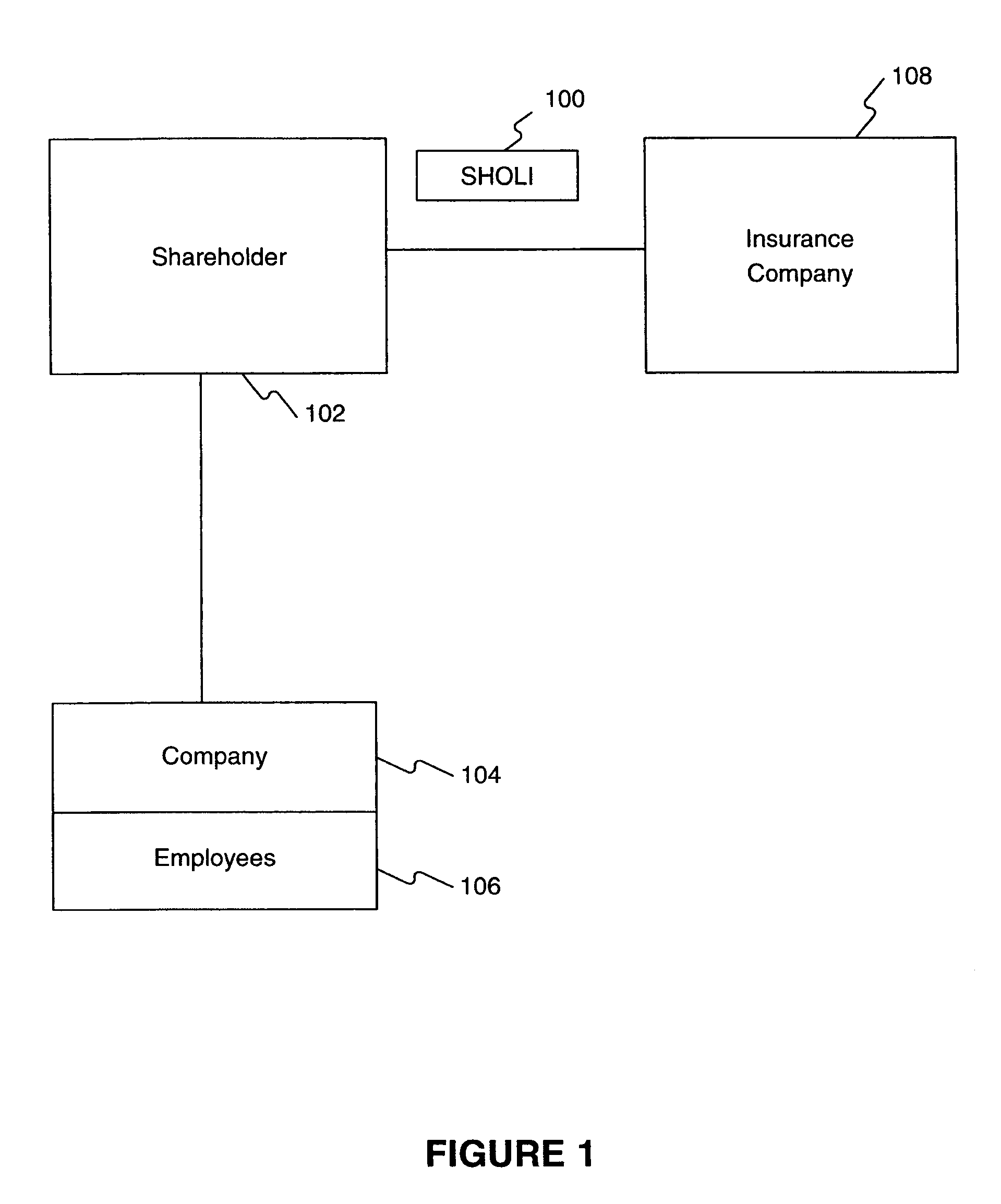

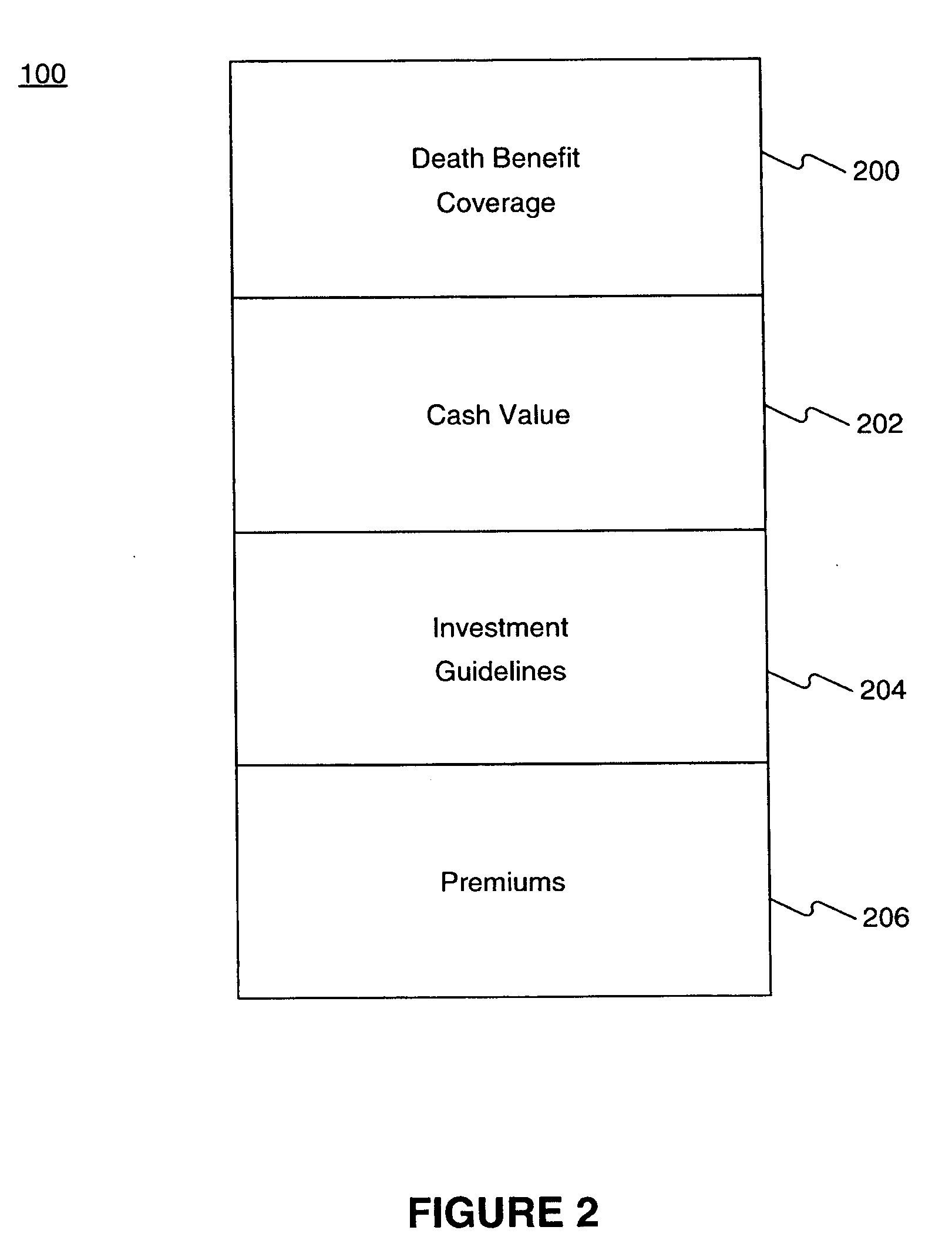

Shareholder-owned life insurance system and method

Systems and methods provide a shareholder-owned life insurance product enabling a shareholder in a small or closely held company to purchase a large-scale life insurance product, independent of the limited operating budget of his company, in which he can invest a large sum of private wealth. The shareholder can control risk exposure, obtain the tax benefits typically associated with an individual beneficiary life insurance policy, and achieve the cost savings of a large-scale corporation owned life insurance transaction, while avoiding the underwriting restrictions and costs associated with individual insureds and policies with large face amounts.

Owner:WINKLEVOSS

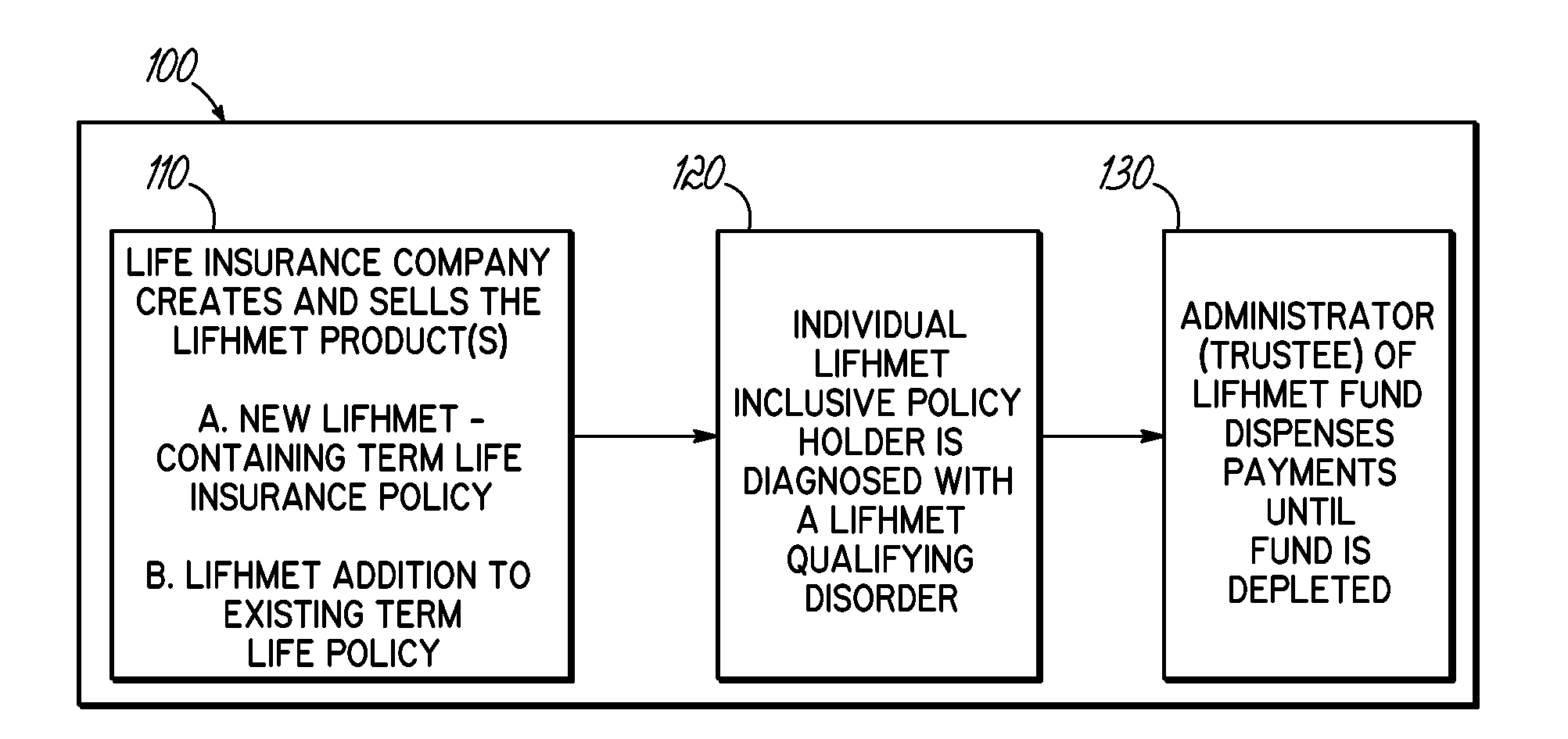

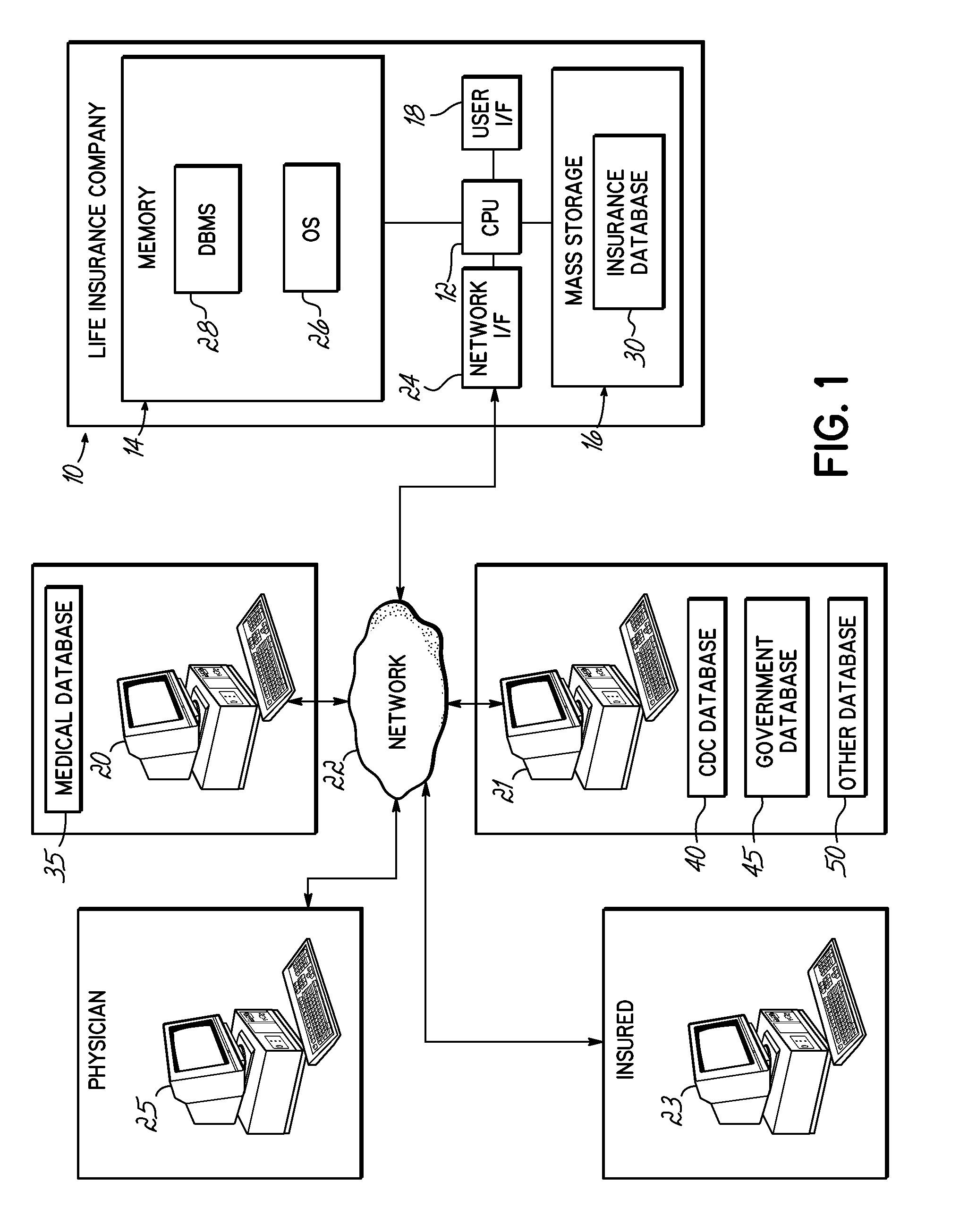

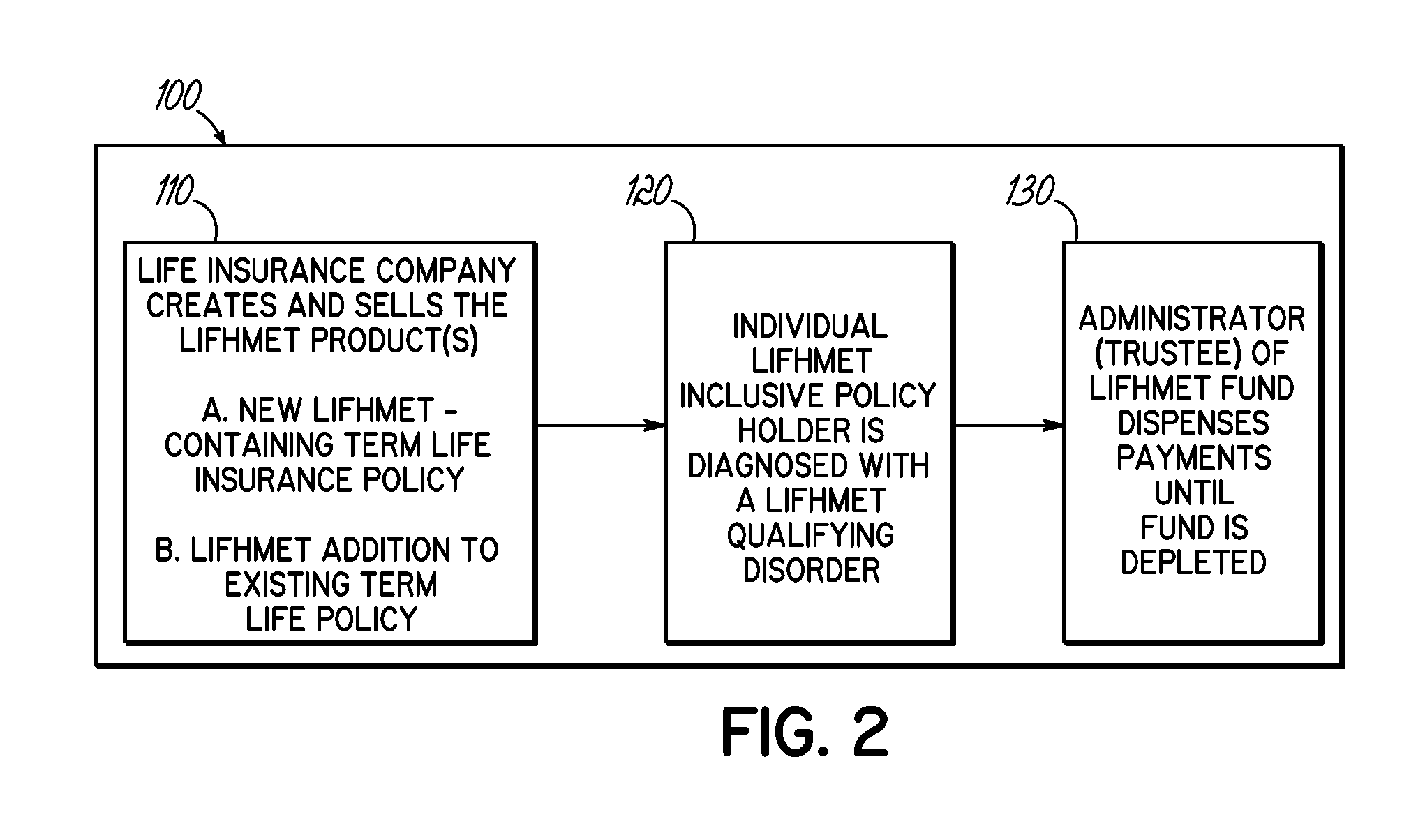

Life insurance funded heroic medical efforts trust feature

InactiveUS20100088112A1Prolong lifeDelay paymentFinanceHealth-index calculationSelf-insuranceInsurance life

Owner:KATEN & ASSOCS

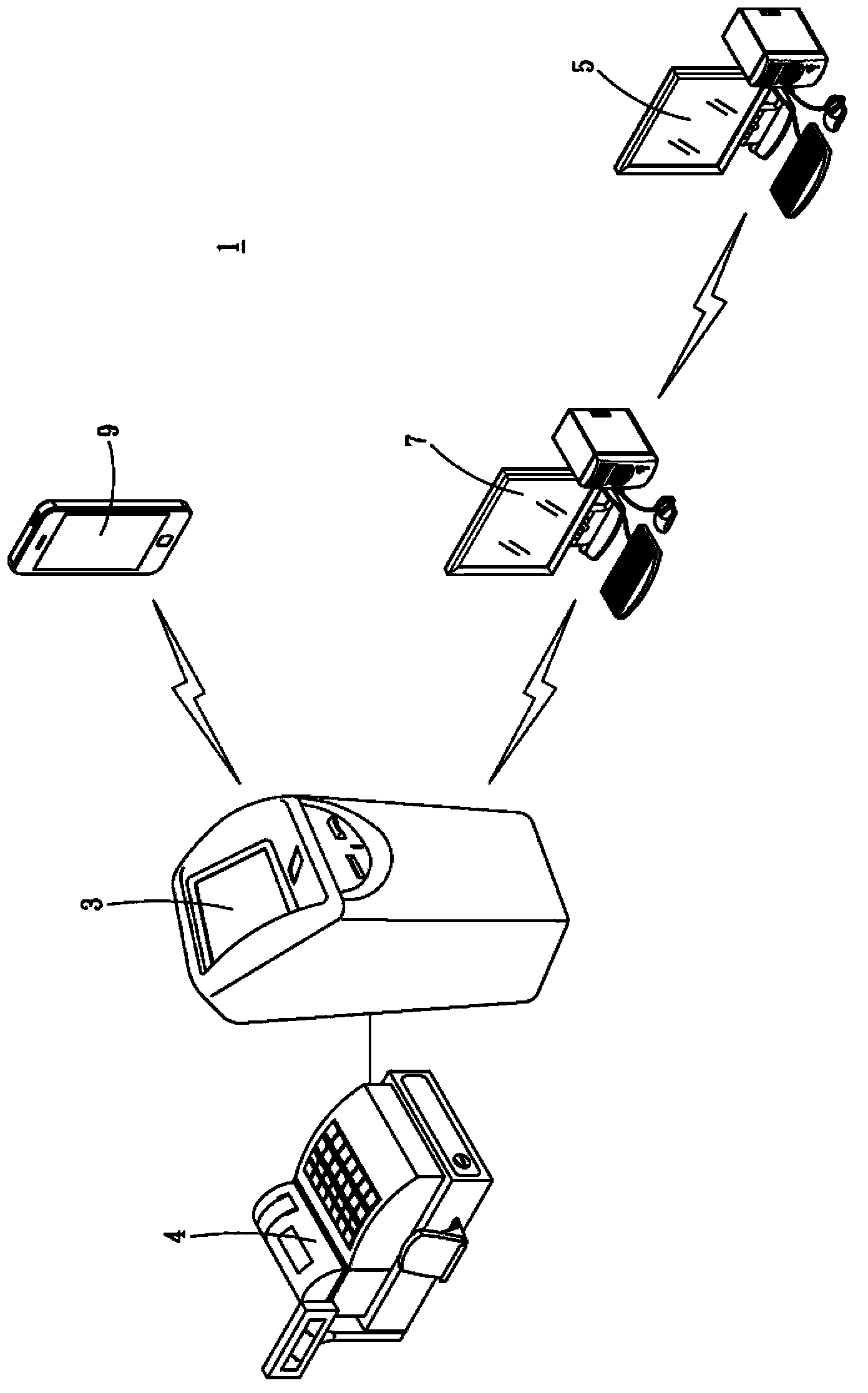

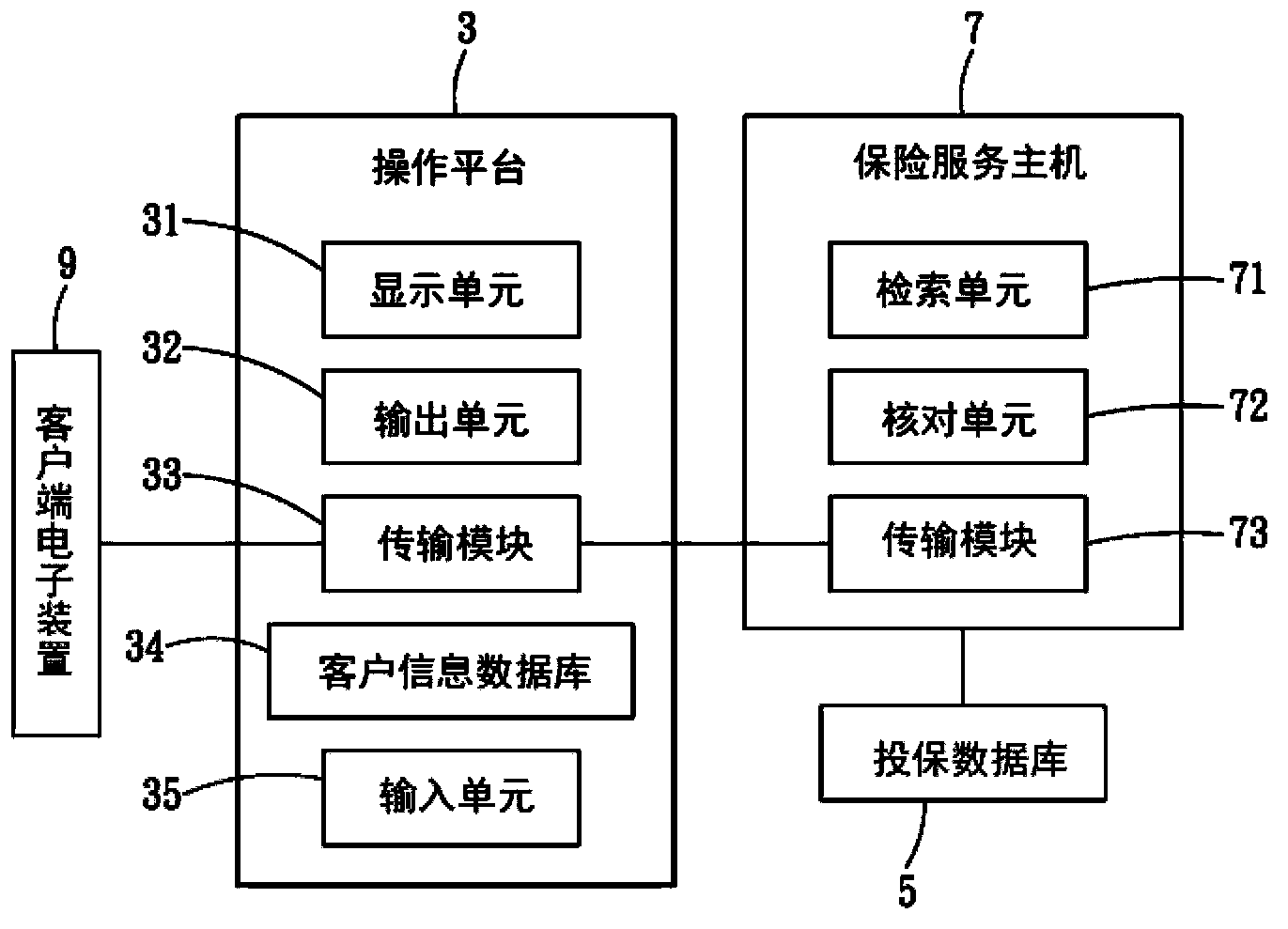

Travel insurance fast insuring device and method

The invention discloses a travel insurance fast insuring device and method. The insuring method includes the following steps: insuring information is received by an operating platform, wherein the insuring information includes insurant information and travel information; the insuring information is transferred to an insurance service host; an insuring database is retrieved according to the insurant information and the travel information to check whether the insuring information comforms to the insuring condition to generate a check result; the check result is transferred to the operating platform; the check result is displayed; and if the check result is the approval of insuring, insurance cost information and insured information are outputted.

Owner:ZHONG BAO INSURANCE SERVICE

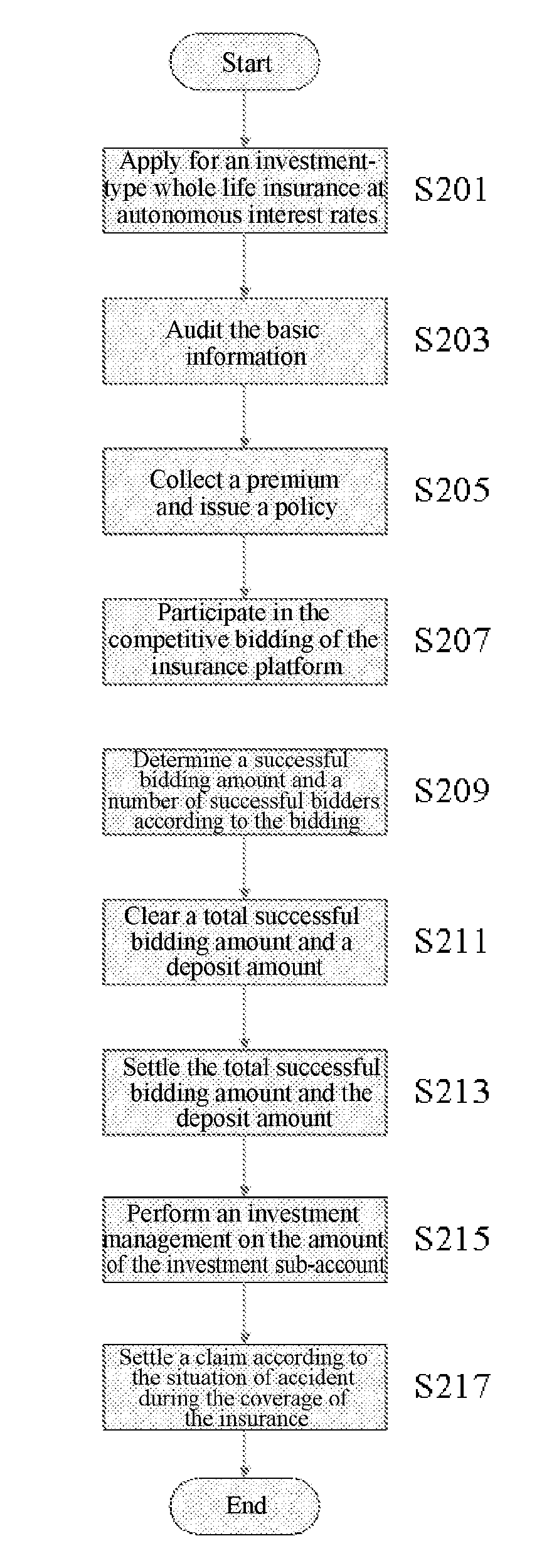

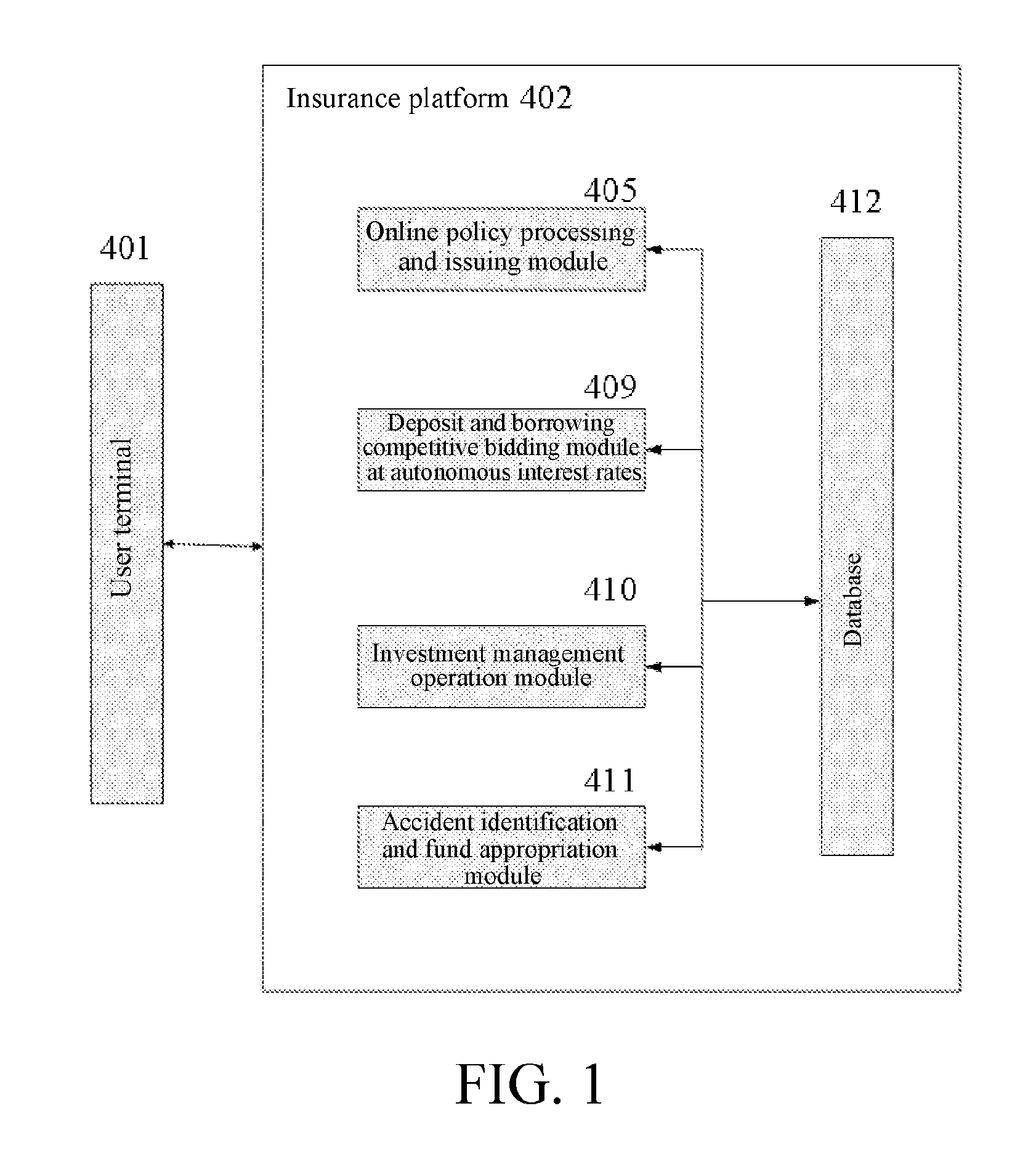

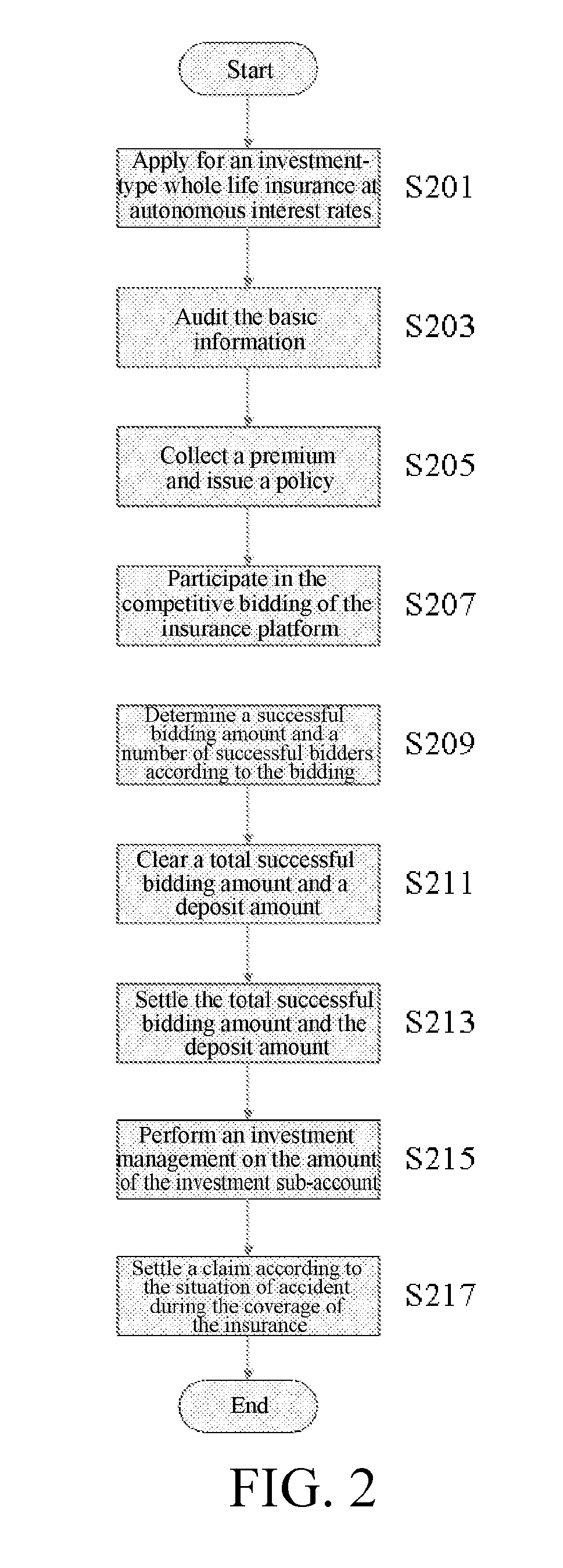

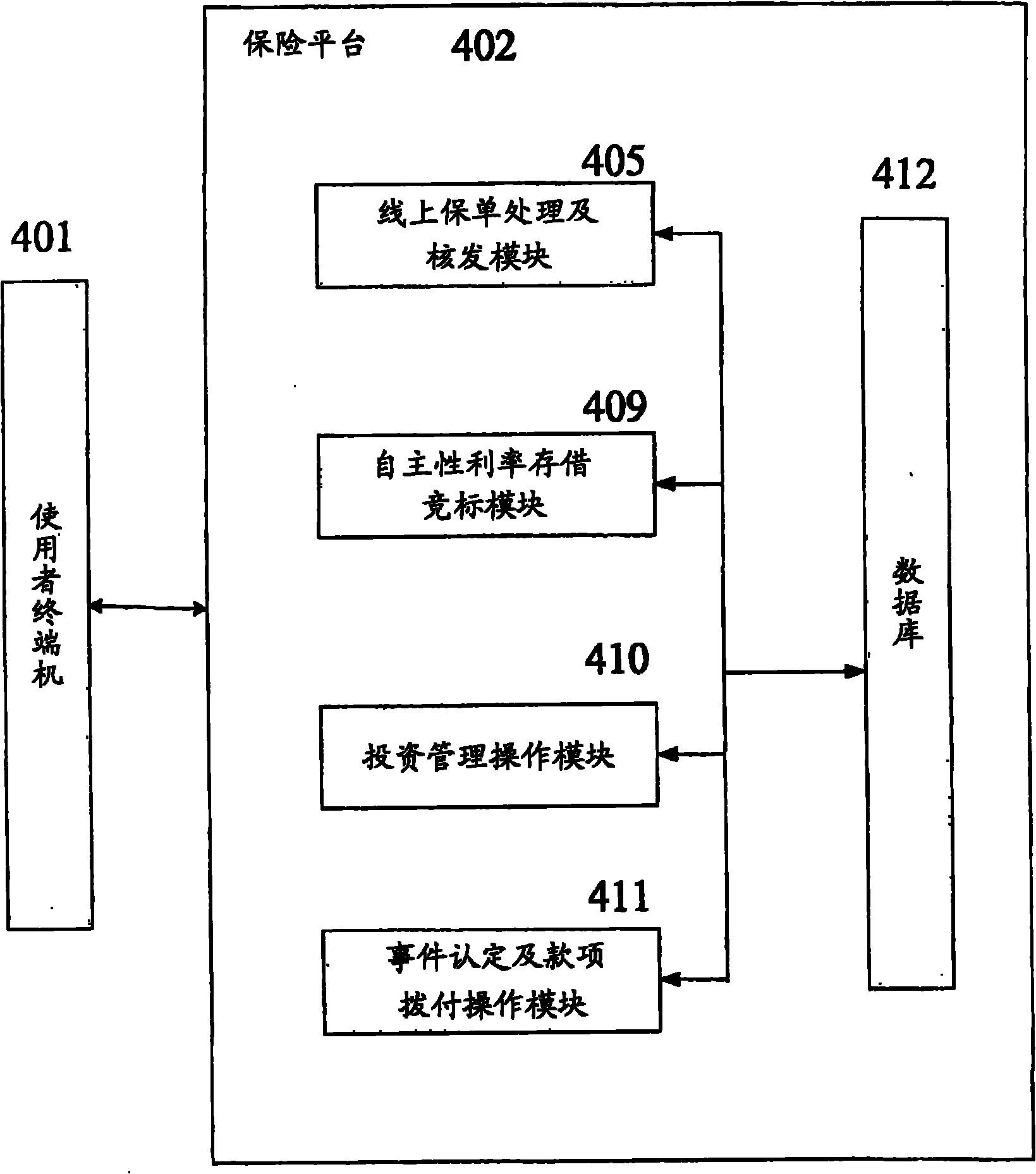

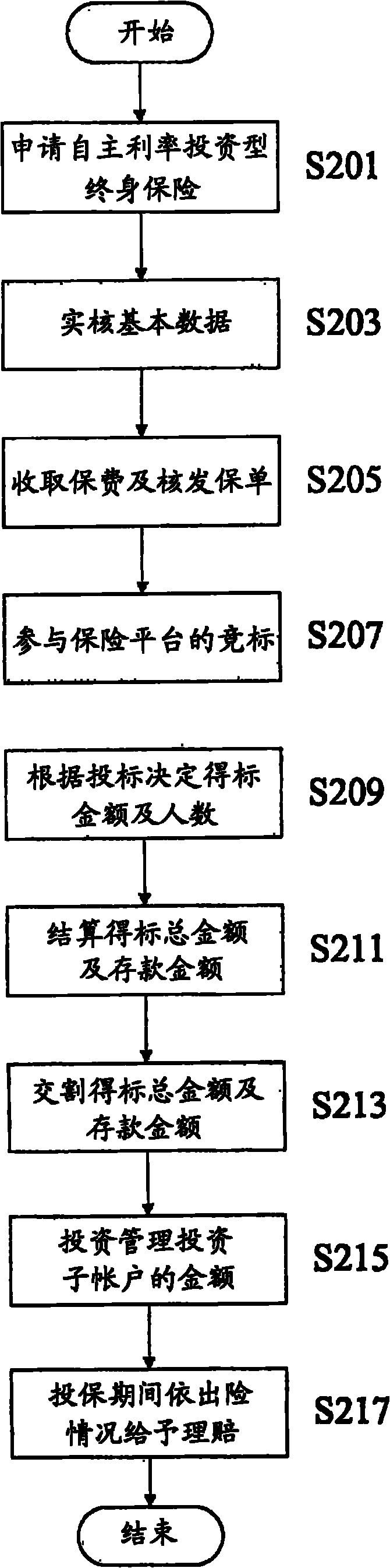

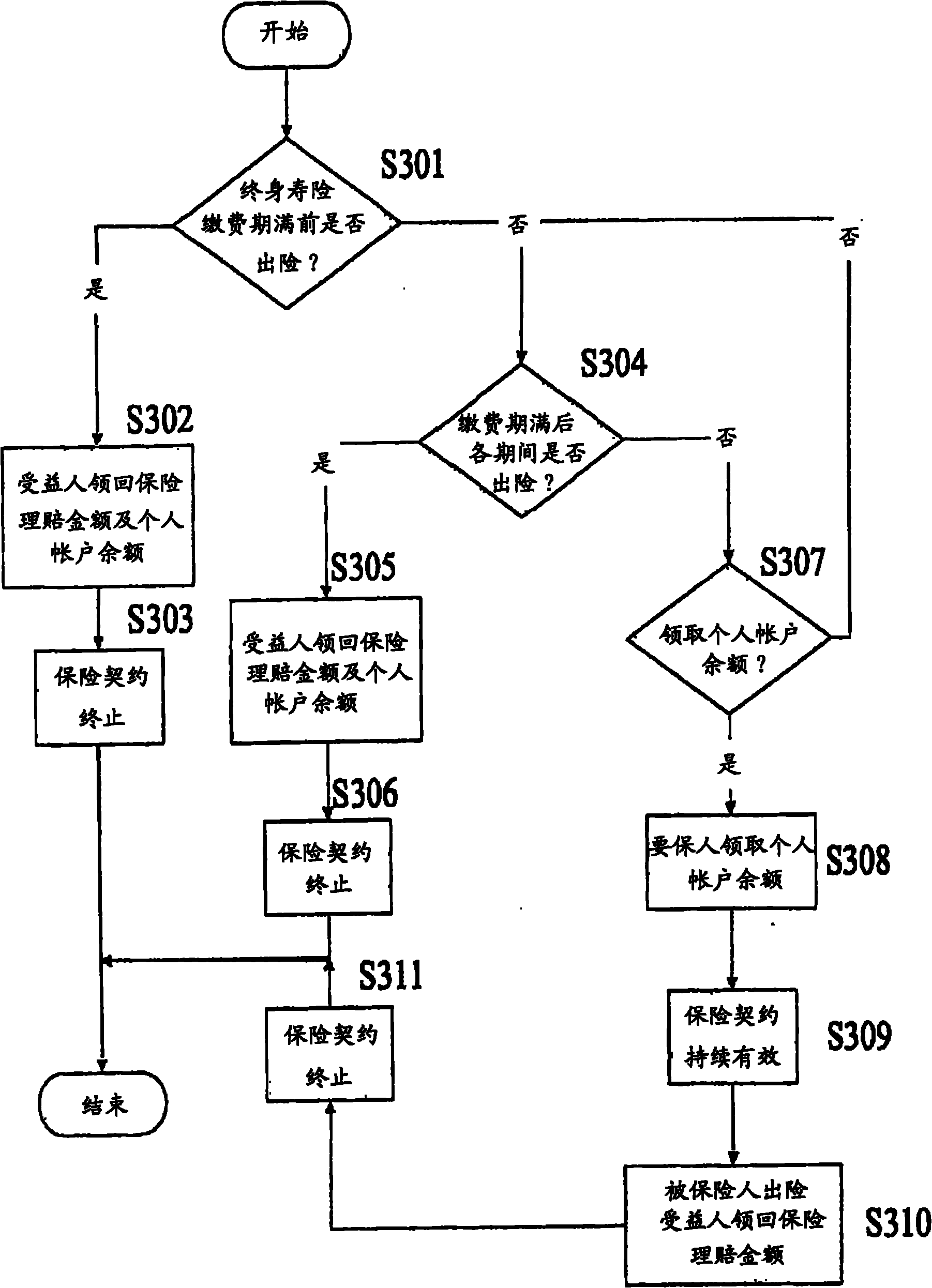

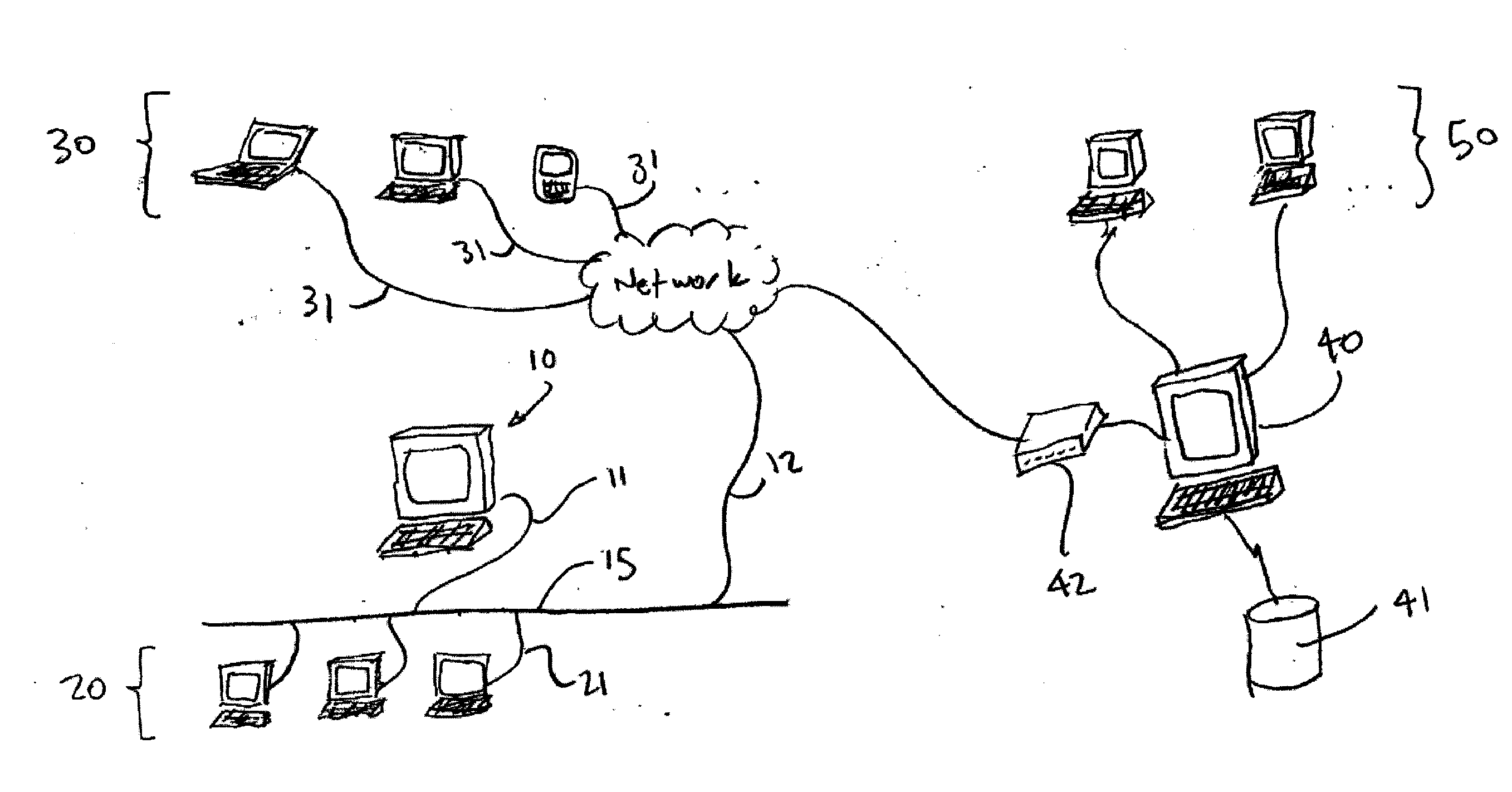

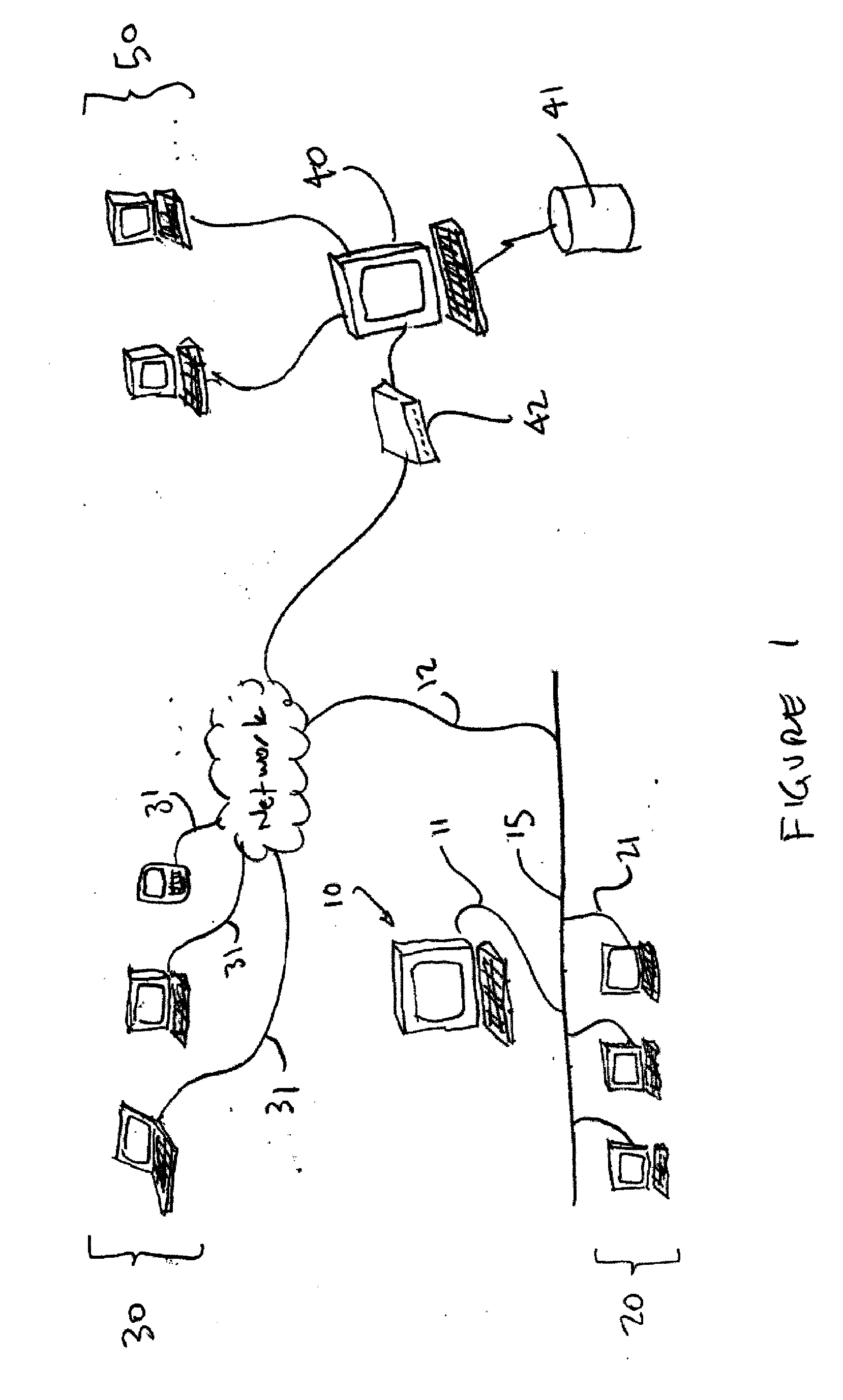

Method and insurance platform for investment-type whole life insurance at autonomous interest rates

ActiveUS20090089103A1Avoid interest rate spread riskFairer and more reasonable financial productFinanceSelf-insuranceInsurance life

A method and insurance platform for whole life insurance implemented in the insurance field of financial e-commerce is provided. The present invention reflects the interactivity between a consumer and a platform provider in the age of network technology, and creates an insurance platform to enable the consumer to expand his / her credit on the platform and increase investment opportunities according to his / her own risk preference.The present invention provides the insurance platform to replace the savings block of the whole life insurance, such that information symmetry is created between an insurance company and the consumer and the closure of the conventional insurance product is broken to enable the insurance products to compete on the active market of financial products.

Owner:SHACOM COM

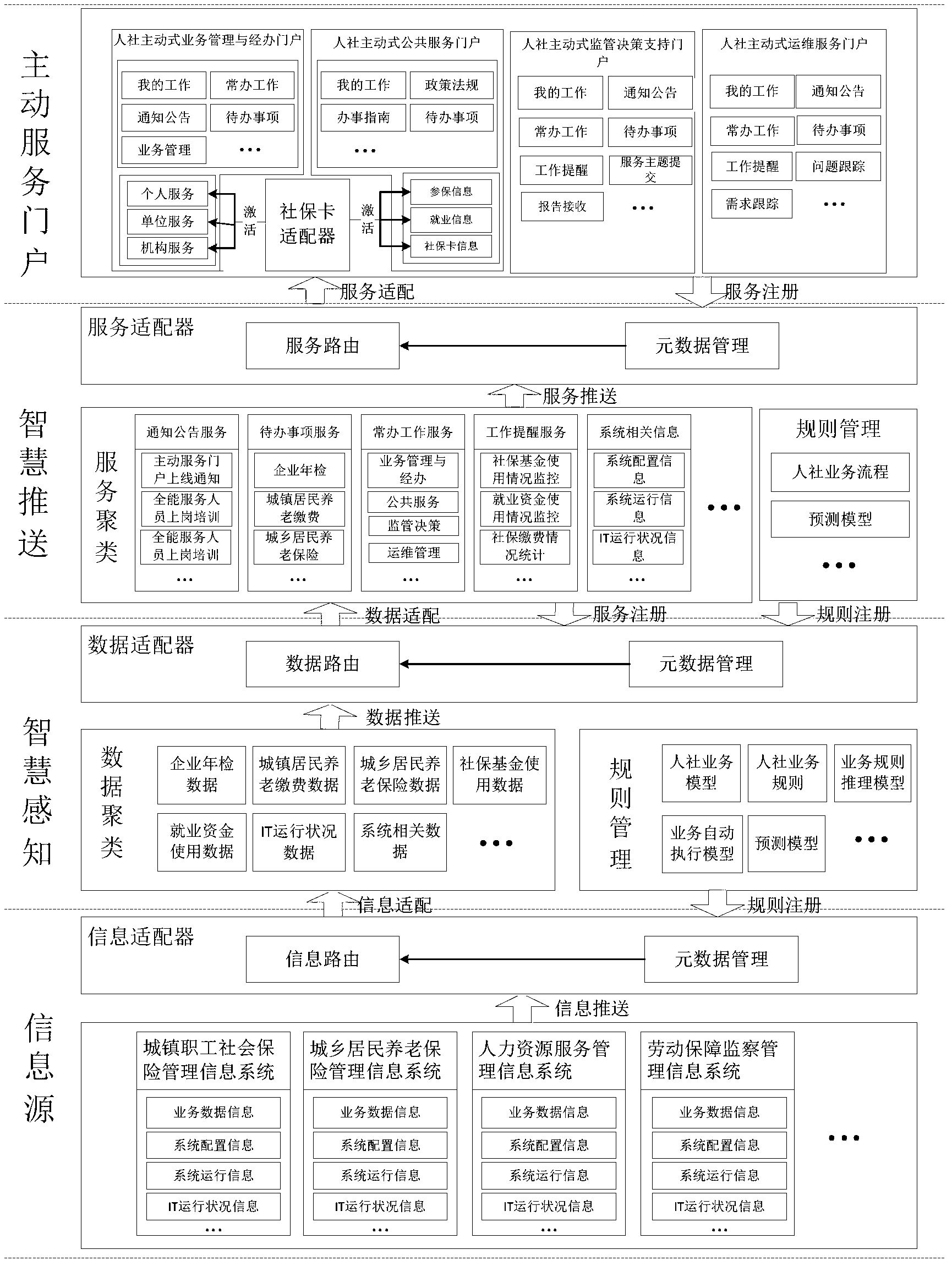

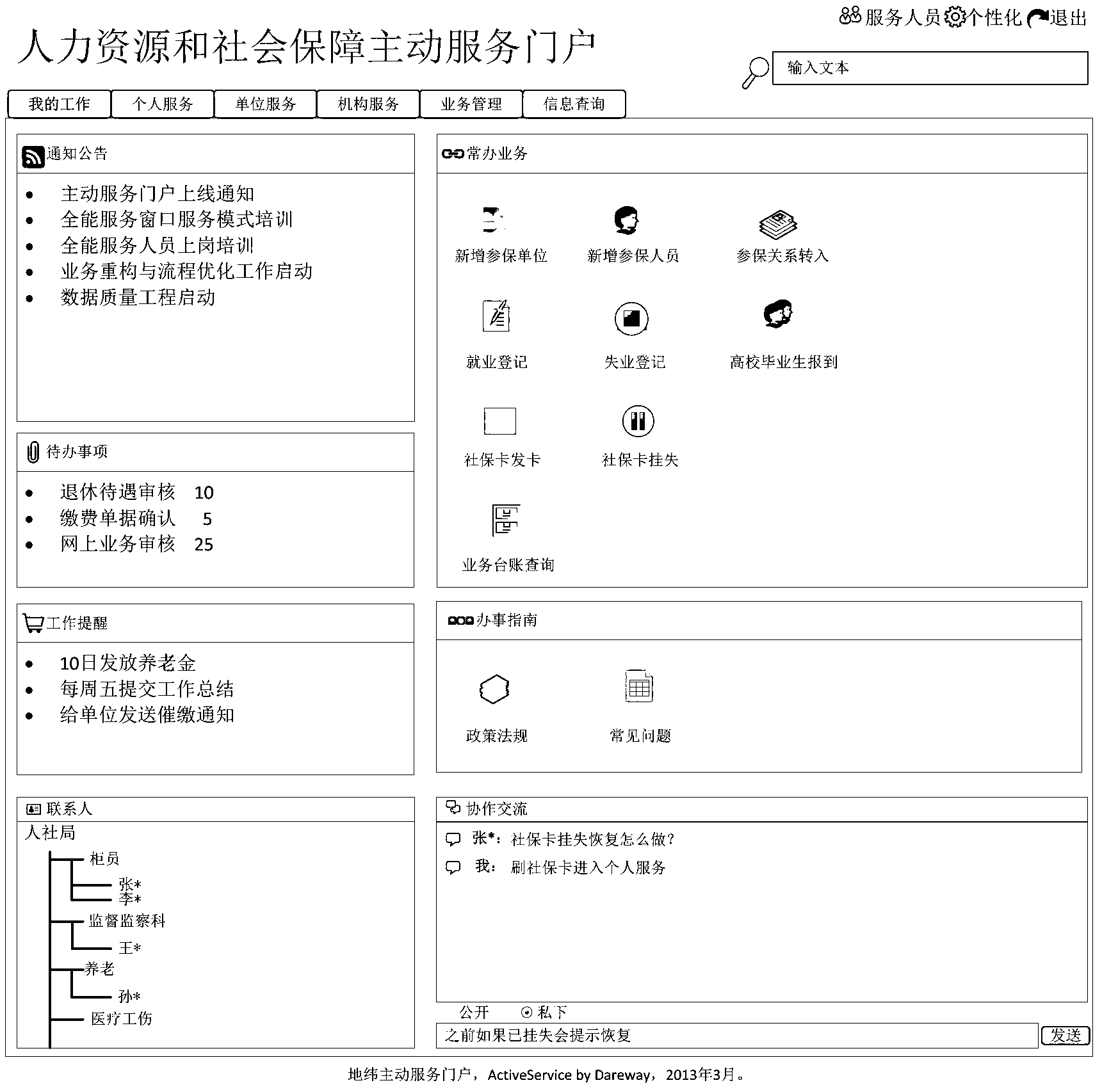

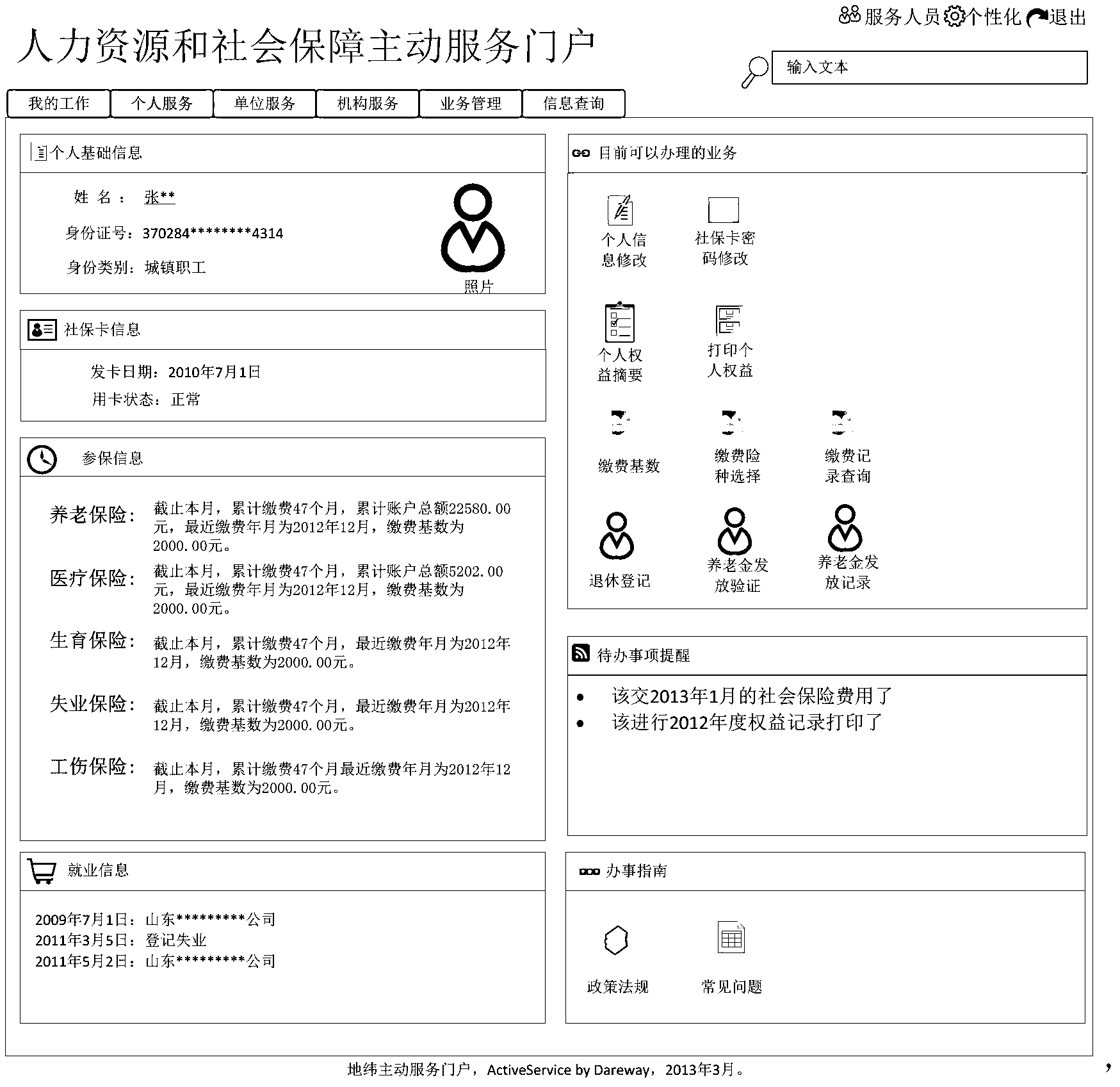

Active service system in field of human resources and social insurance

InactiveCN103246927ACapable of all business servicesData processing applicationsTransmissionSelf-insuranceData class

The invention provides an active service system in the field of human resources and social insurance. The system mainly comprises an intelligent sensing module, an intelligent transmission module and an active service portal, wherein the intelligent sensing module is used for instantly acquiring information from each human resource and social insurance information system, and intelligently assembling the information into theme-definite data classes; the intelligent transmission module is used for packaging theme-definite data into service, and intelligently transmitting the service to the active service portal; and the active service portal is used for enabling different human resource and social insurance users to customize personalized portals according to own needs and to enjoy the actively transmitted service. The system can be used for enabling different human resource and social insurance users to timely know matters to be handled to realize active handling, active service, active supervision, active decision making, active notification and active operation and maintenance.

Owner:DAREWAY SOFTWARE

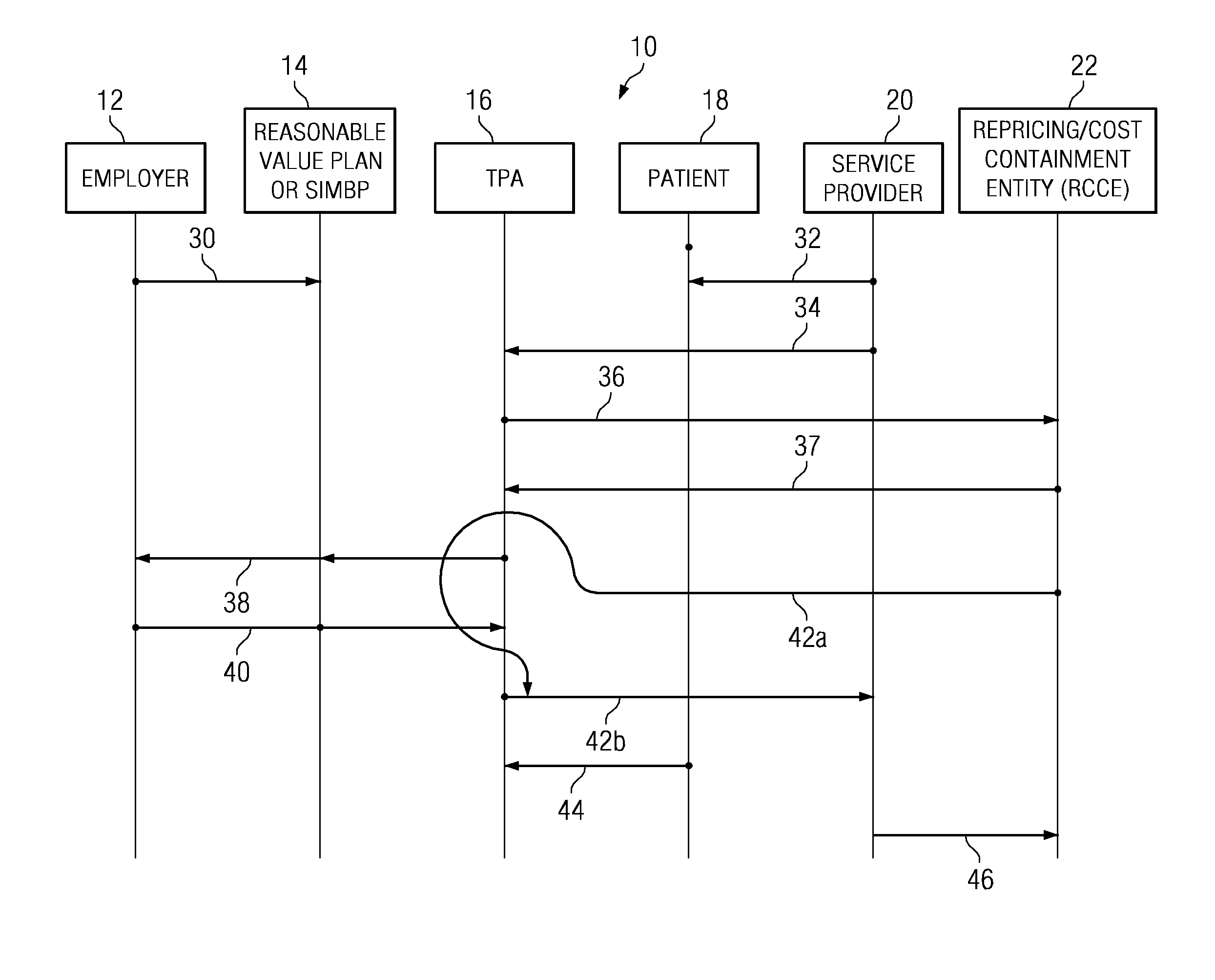

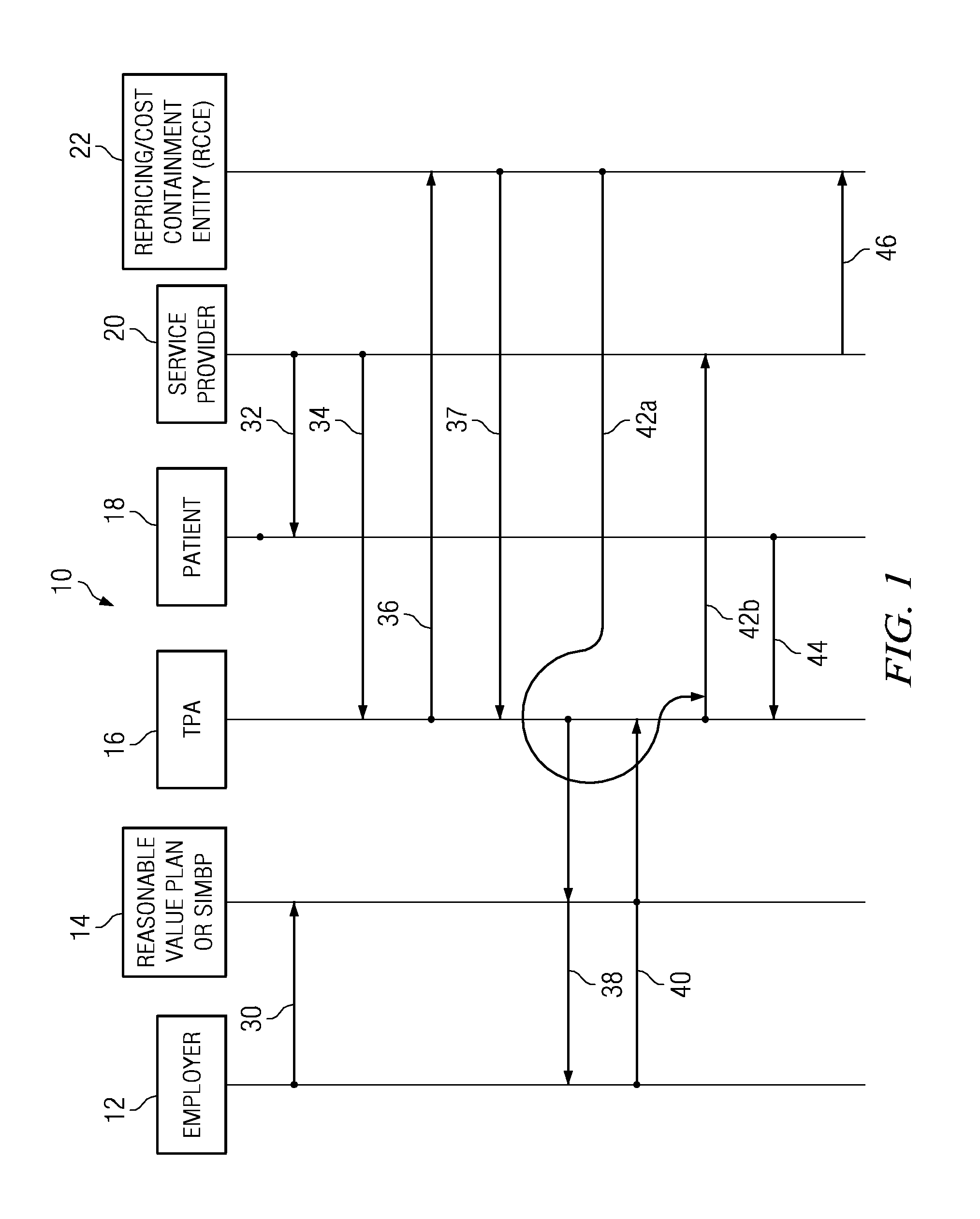

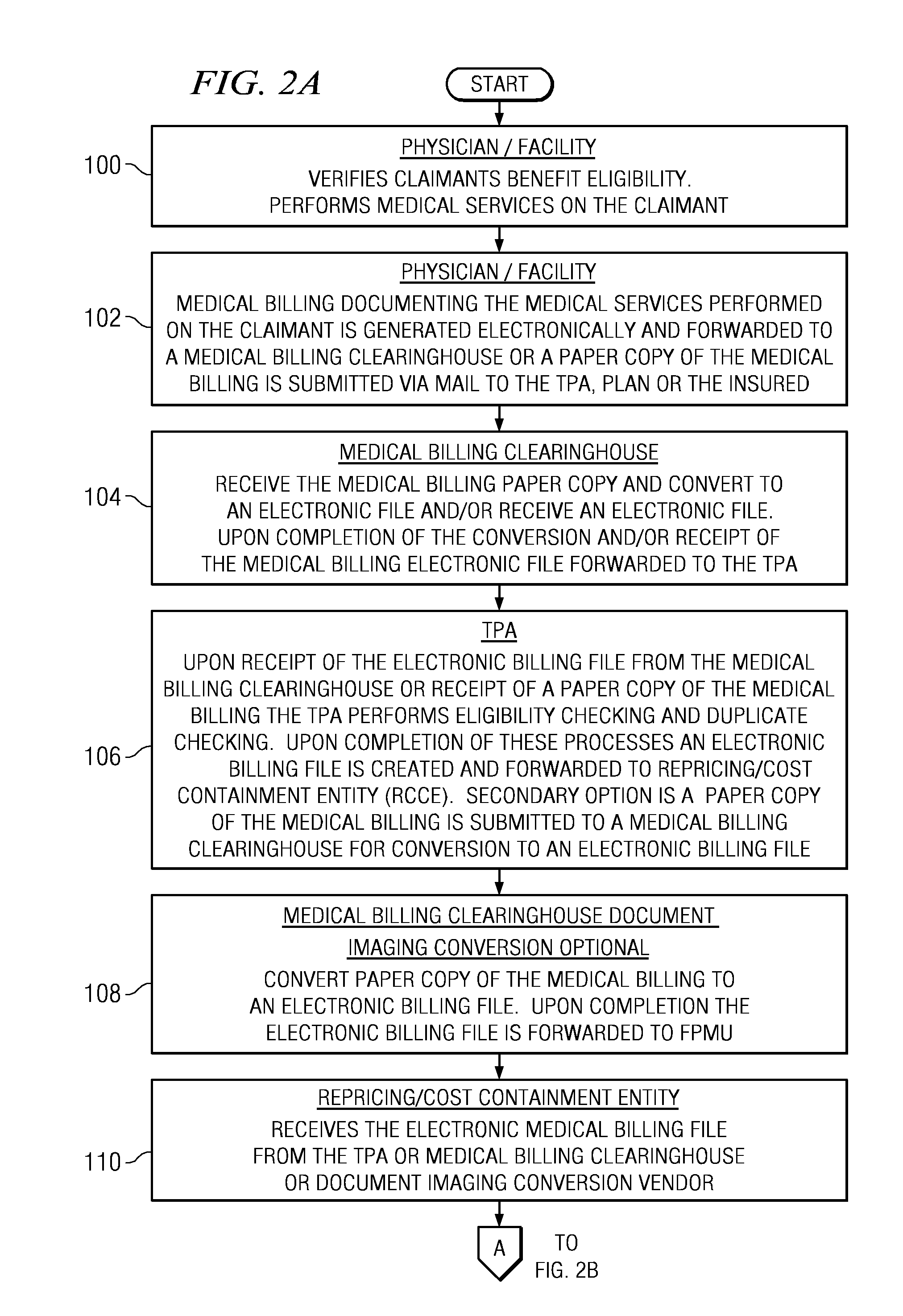

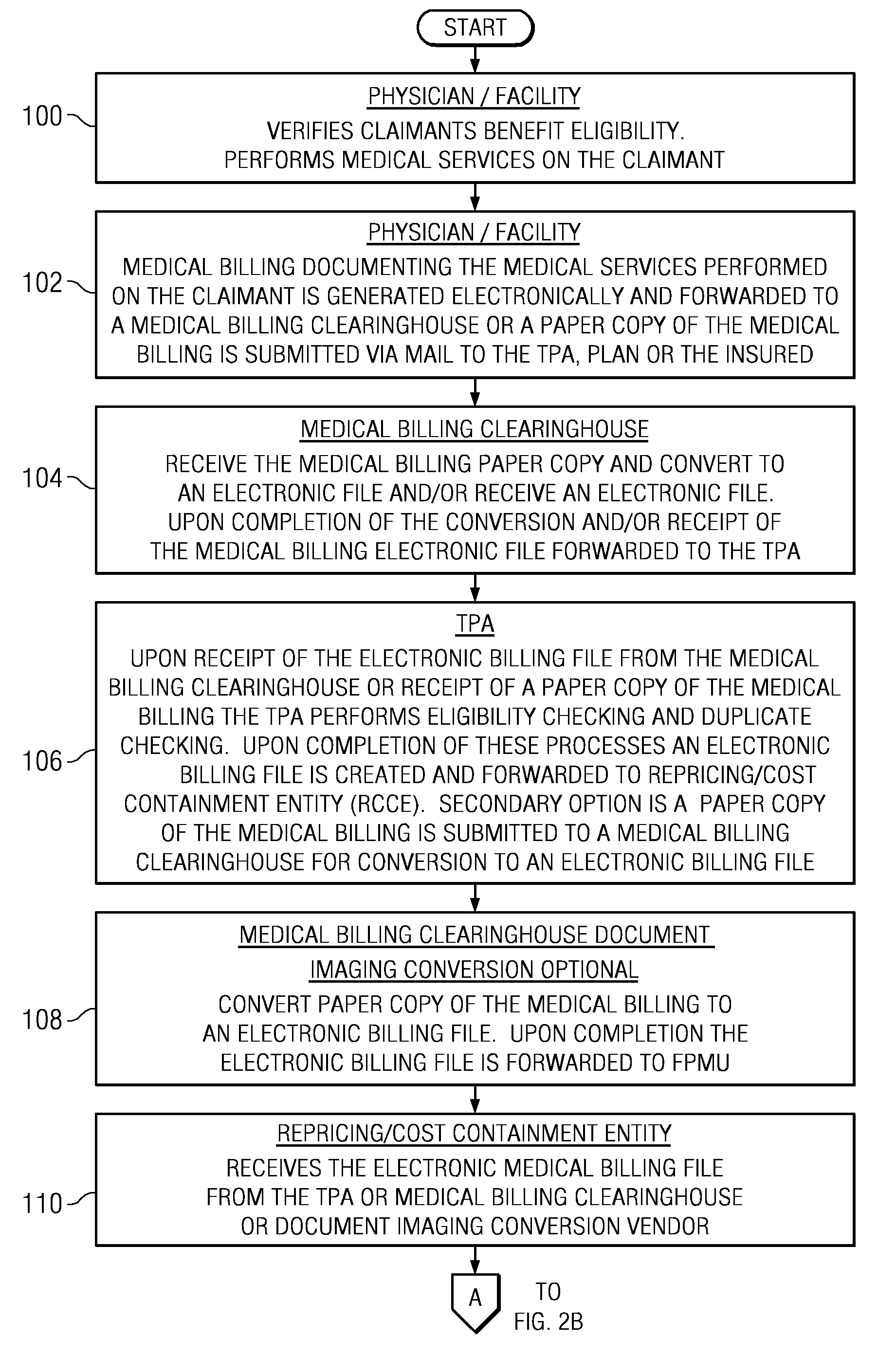

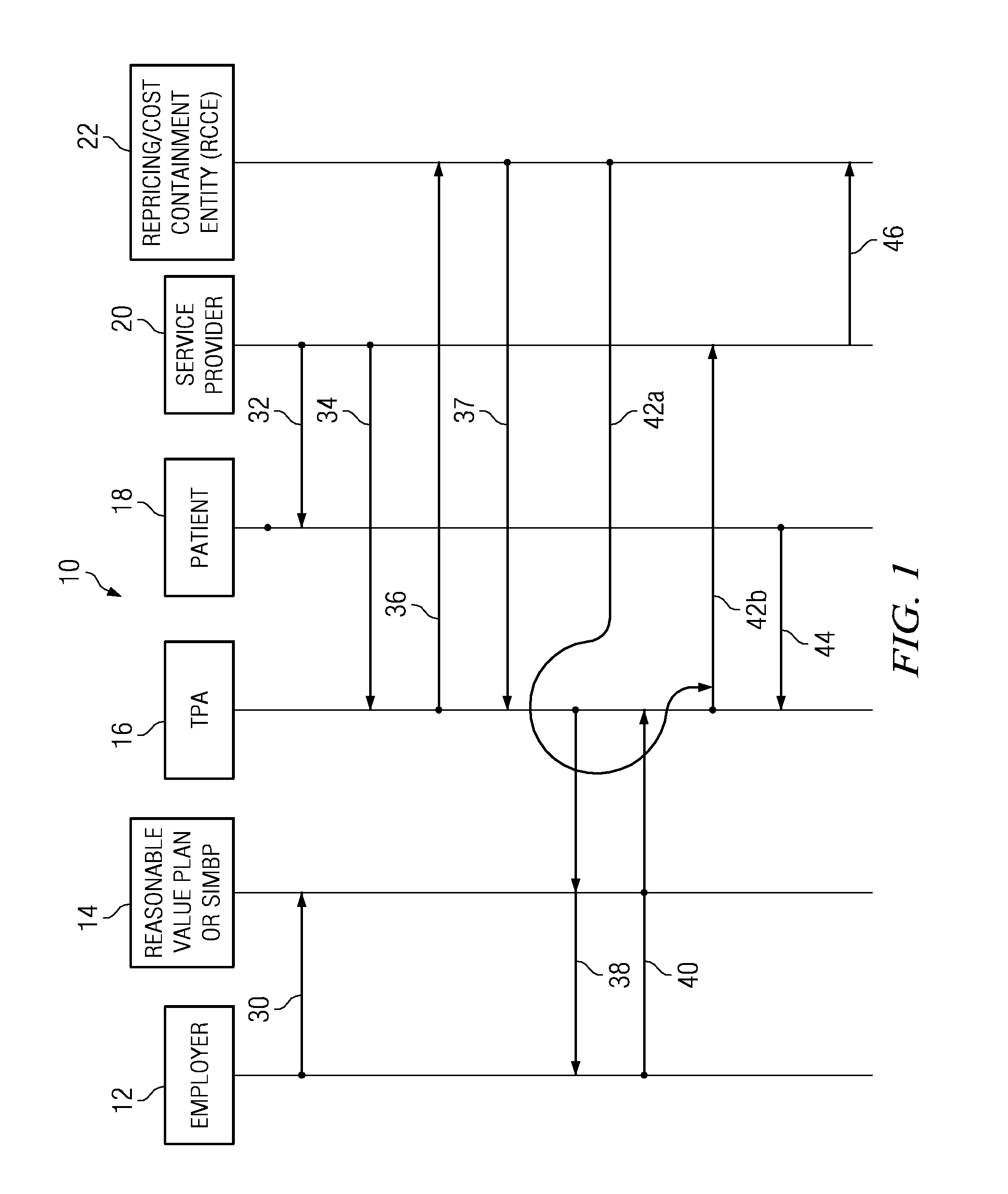

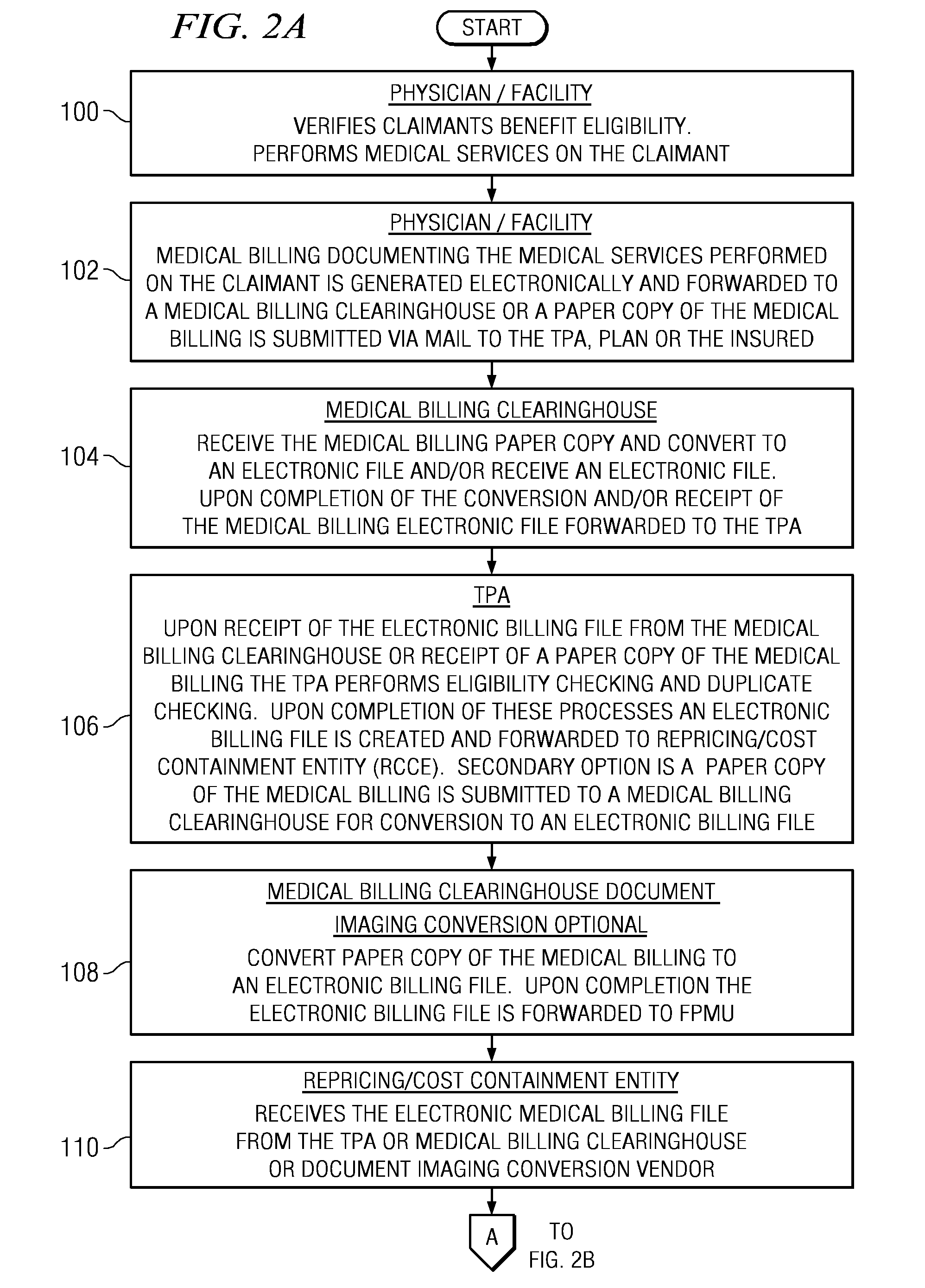

Reasonable value self insured medical benefit plan

A self-insured or self funded medical benefit plan is provided by an employer wherein the self-insured medical benefit plan is governed by ERISA, and wherein the employer who is providing the medical benefit plan is 100 percent responsible for payment for medical services provided to an employee, receiving the benefit of the medical benefit plan, to a medical service provider for covered medical services and products. The medical benefit plan and method for providing the medical benefit plan determines a reasonable value for the medical services provided by a medical service provider to a participant of the plan, reprices a bill or claim from the medical service provider, and protects the participant / employee under ERISA from attempted collections of additional moneys that a medical service provider may believe is owed for the medical services but were not paid by the exemplary self insured medical benefit plan.

Owner:MITCHELL INT INC

Yield insurance claiming method based on spatial big data

The invention belongs to the technical field of agricultural insurance, and especially relates to a yield insurance claiming method based on spatial big data, which carries out analysis and processingby using spatial big data. The method includes the following steps: (1) creating target data, rising trend monitoring data, remote sensing yield estimation data and meteorological data interfaces ona big data platform; (2) acquiring yield estimation data according to a target, and formulating a data analysis model; (3) inputting the target, rising trend monitoring data and meteorological data tothe analysis model; (4) obtaining yield estimation data according to model data; and (5) making compensation according to the difference between the yield estimation data and the contract yield dataand the standard of compensation grades. The yield data of a target can be evaluated, the compensation standard can be formulated according to the yield data, the risk to the target can be evaluated according to the data statistics in big data, and whether the target is to be insured can be judged. Therefore, the risk to insurance companies is reduced, and profit is increased.

Owner:中科光启空间信息技术有限公司

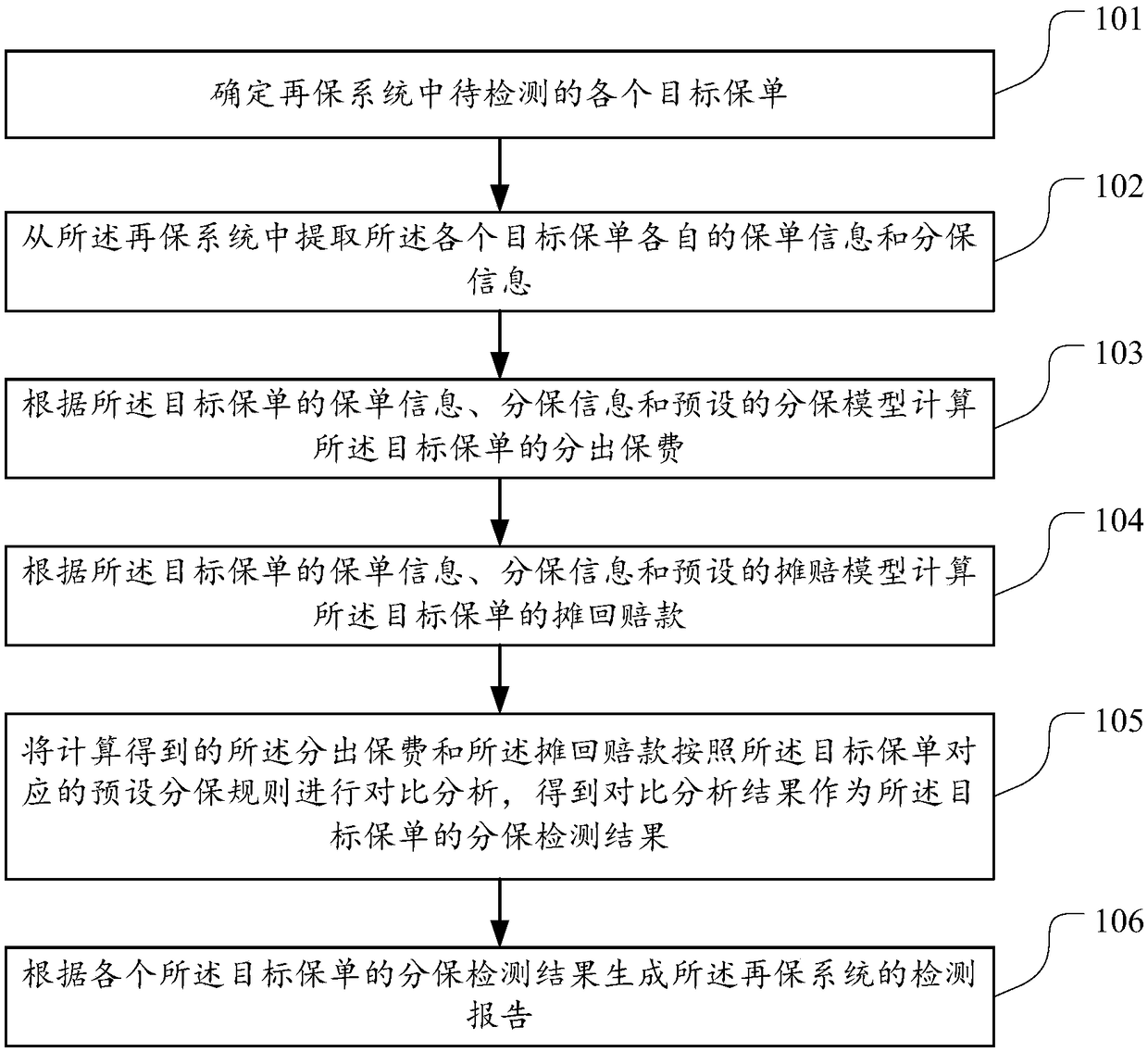

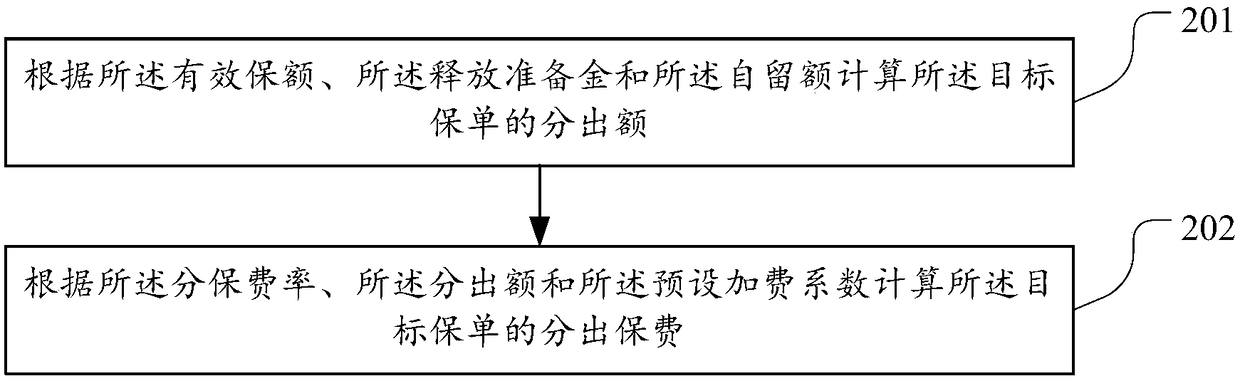

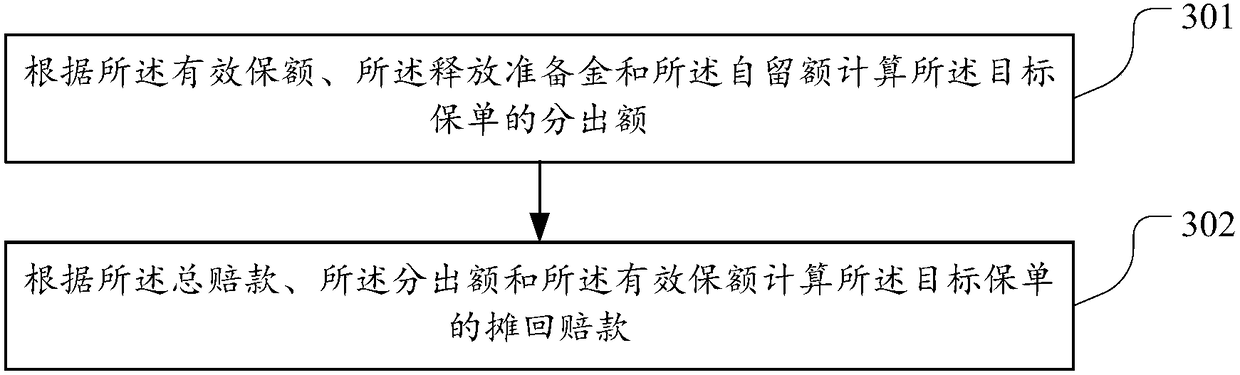

Reinsurance system detection report generation method and device

The embodiment of the invention discloses a reinsurance system detection report generation method, and is used for solving the problems of low processing efficiency of the monthly statement detectionmethod of the present reinsurance system and error of the data in the monthly statement detection report. The method comprises the steps that each target insurance policy to be detected in the reinsurance system is determined; the respective insurance policy information and the cede insurance information of each target insurance policy are extracted from the reinsurance system; the cede-out premium and the recovered claim of the target insurance policy are respectively calculated according to the insurance policy information and the cede insurance information of the target insurance policy andthe preset cede insurance model and the recovered claim model; comparative analysis is performed on the calculated cede-out premium and the recovered claim according to the preset cede insurance rules of the target insurance policy so as to obtain the comparative analysis result to act as the cede insurance detection result of the target insurance policy; and the detection report of the reinsurance system is generated according to the cede insurance detection result of each target insurance policy. The embodiment of the invention also provides a reinsurance system detection report generationdevice.

Owner:PING AN TECH (SHENZHEN) CO LTD

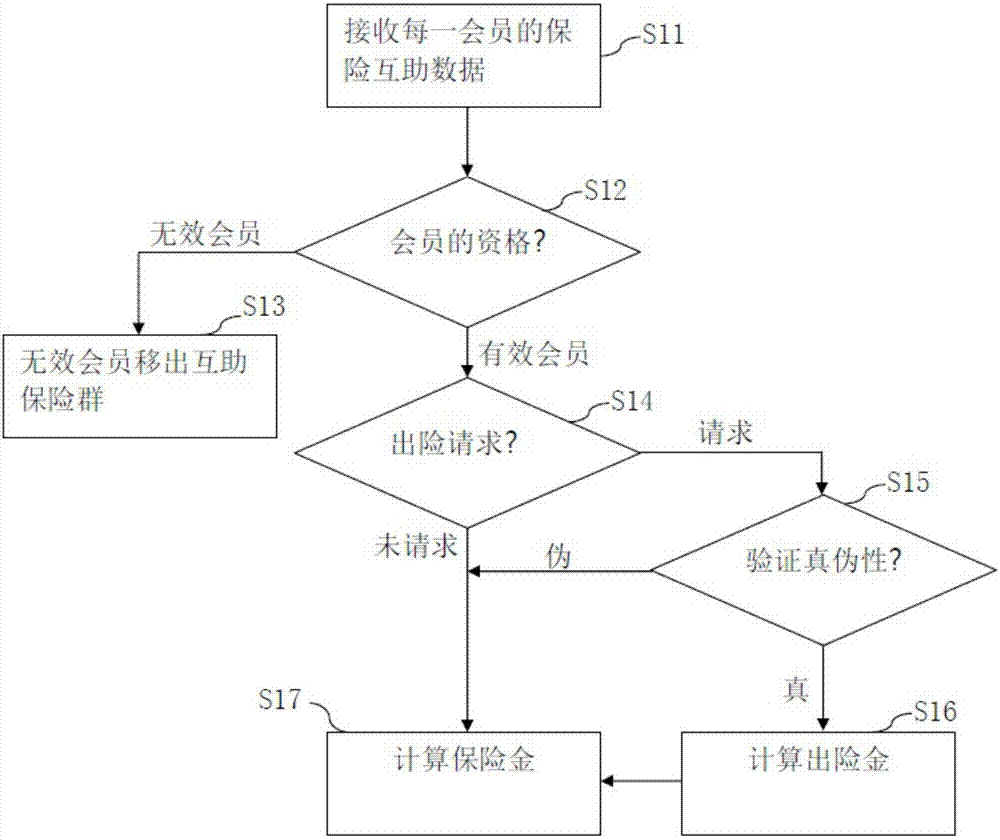

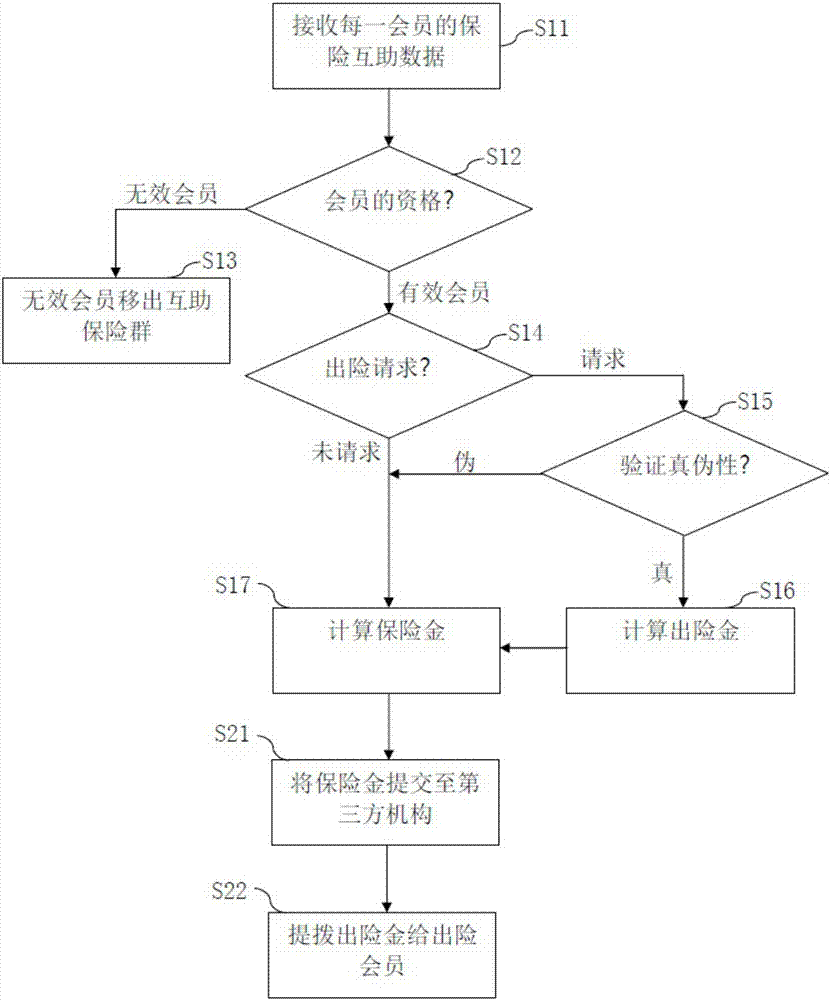

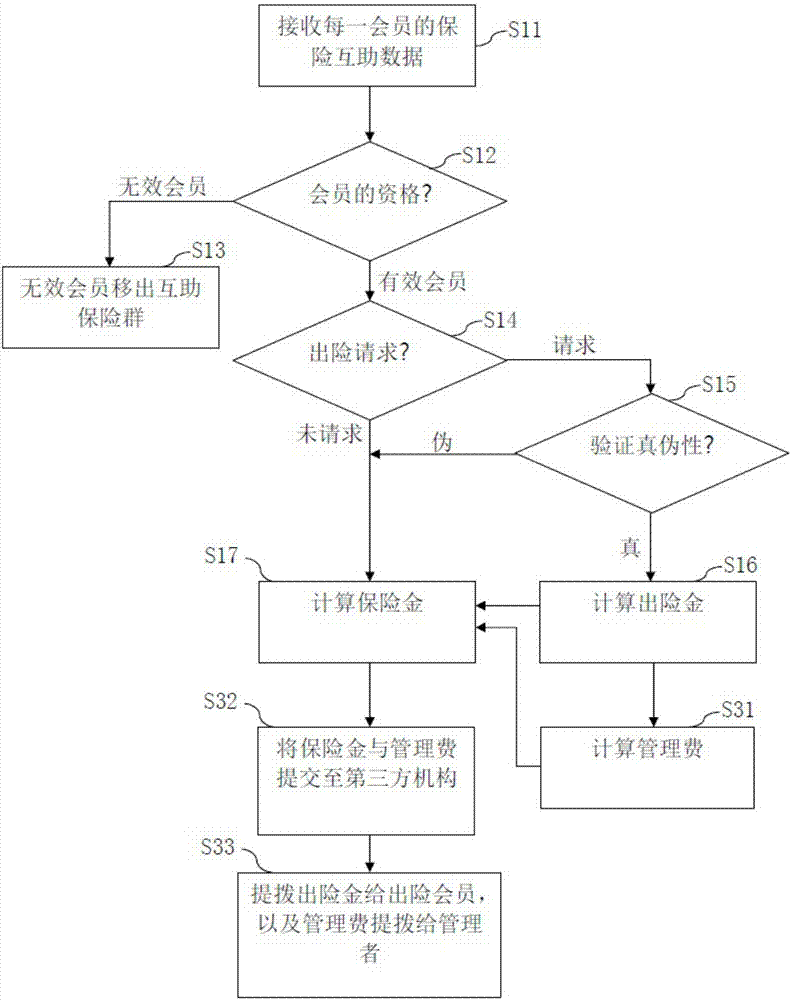

Mutual-help type insurance method and mutual-help type insurance system

The invention provides a mutual-help type insurance method, which is used for insurance mutual assitance for multiple members in a mutual-help insurance group, each member in terms of membership beingat least one from a valid member, an invalid member and an insured member. The method includes the following steps: (a) receiving insurance mutual-help data of the members; (b) determining membershipof the members by self insurance mutual-help materials; (c) removing invalid members out of a mutual-help insurance group; (d) judging risk claims made by valid members; (e) verifying whether the risk claims are true or fake; (f) calculating risk money of the insured members; and (g) calculating premiums on the basis of the total number of valid members in the mutual-help insurance group. In addition, the invention also provides a mutual-help type insurance system.

Owner:马梅铨

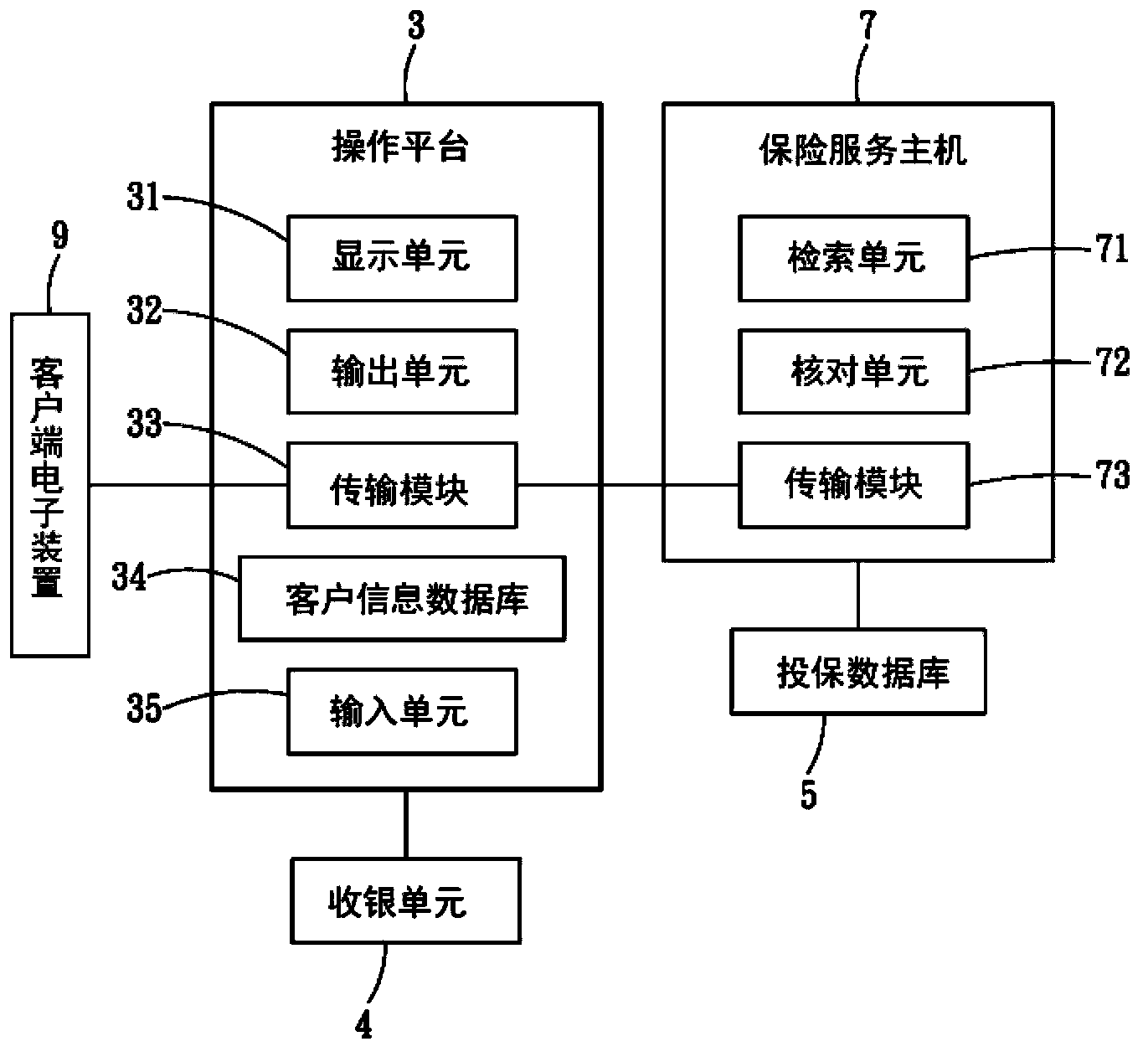

Method and insurance platform for self-interest-rate investment-oriented whole-life insurance

The invention relates to a method and an insurance platform for self-interest-rate investment-oriented whole-life insurance, belonging to the method and the insurance platform for whole-life insurance implemented in the field of insurance of financial e-commerce. The invention reflects the interaction of a consumer and a platform provider in the era of Internet technology, creates the insurance platform for consumers to expand credit with each other on the platform according to self-risk preferences of the consumers, and increases investment opportunities. Moreover, the invention provides the insurance platform to substitute the whole-life insurance storage block, thereby generating information symmetry between insurance companies and the consumers, and breaking the closure of traditional insurance products so that the insurance products can compete on the active market of financial products.

Owner:SHACOM COM

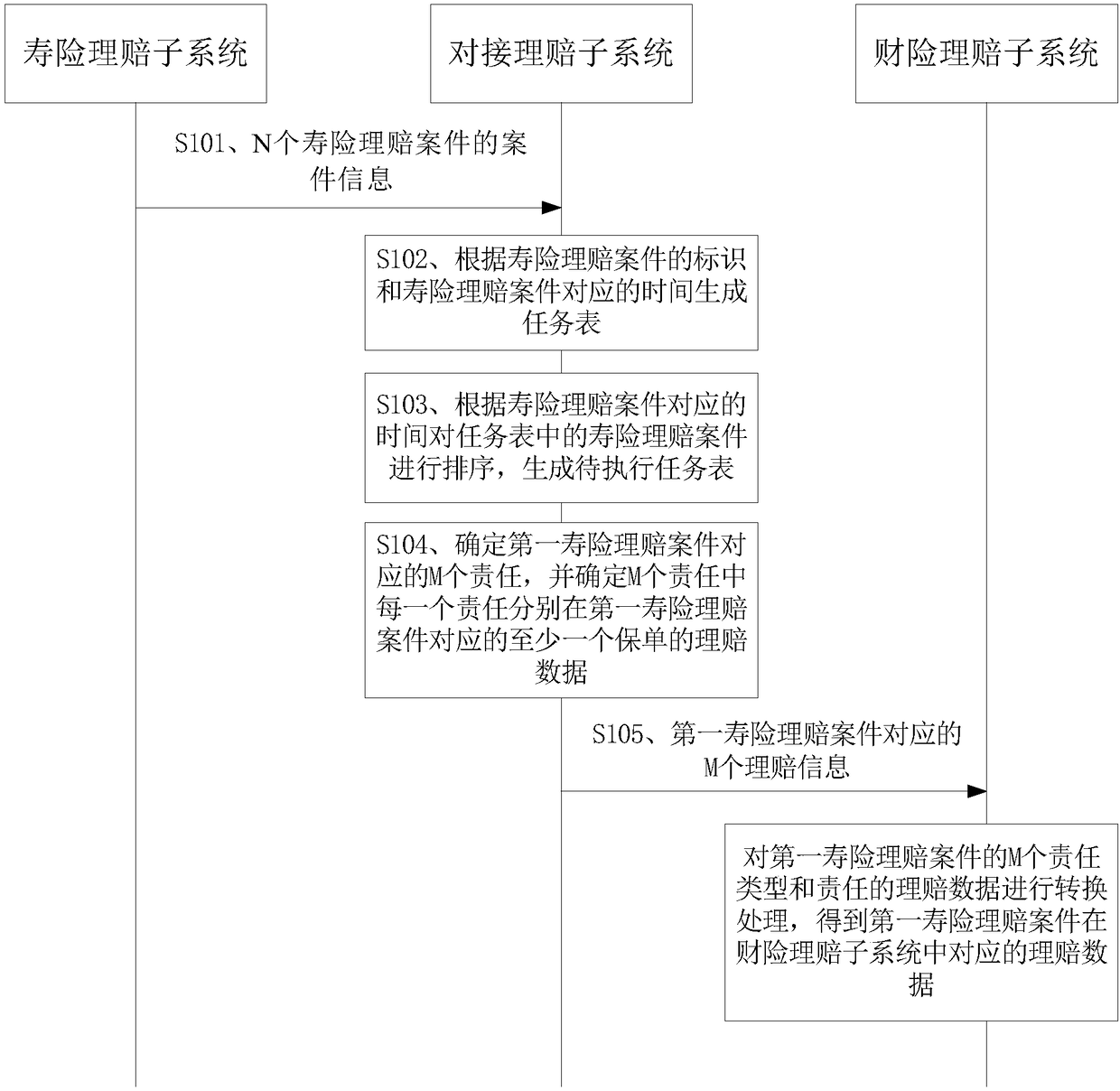

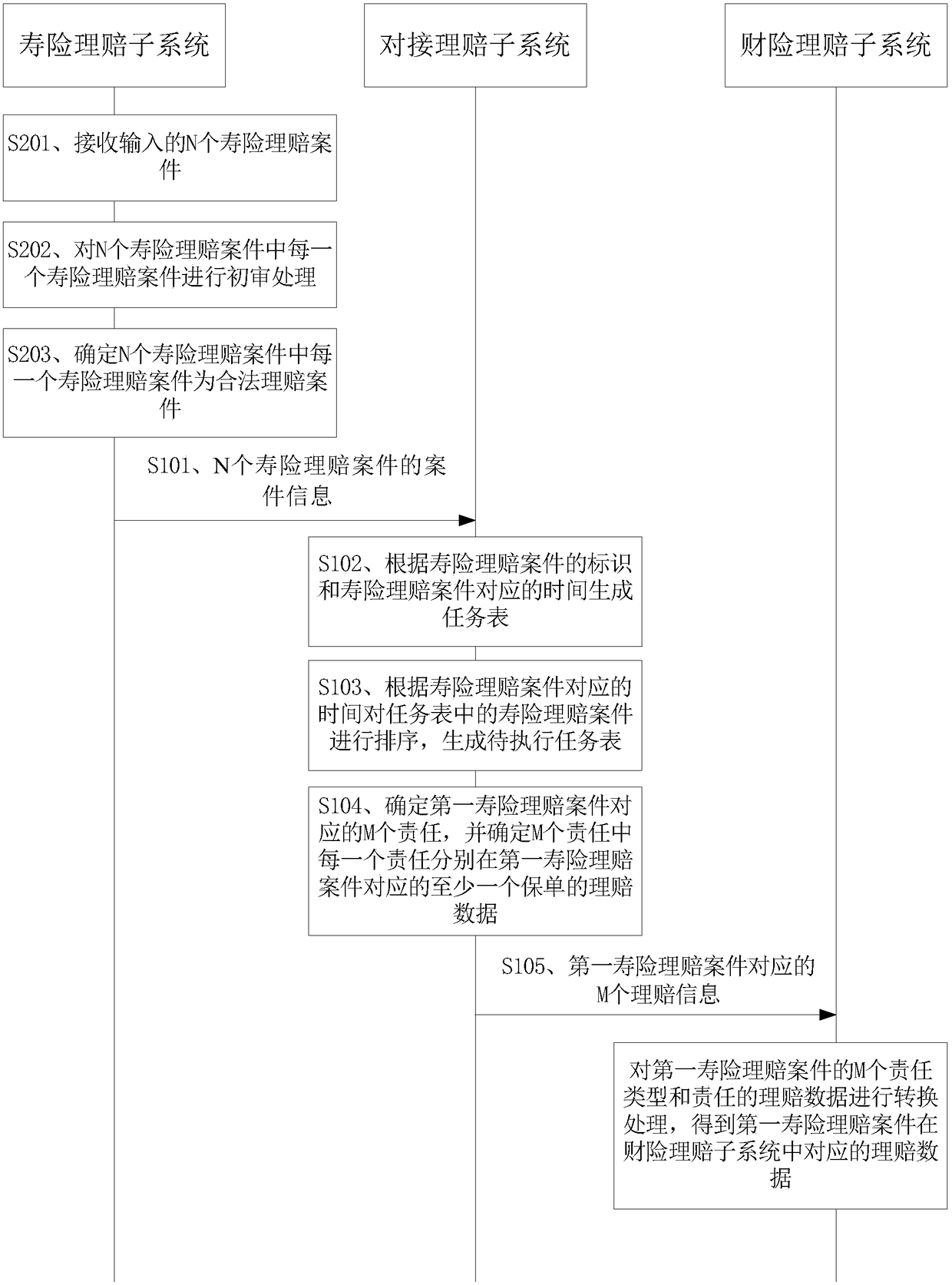

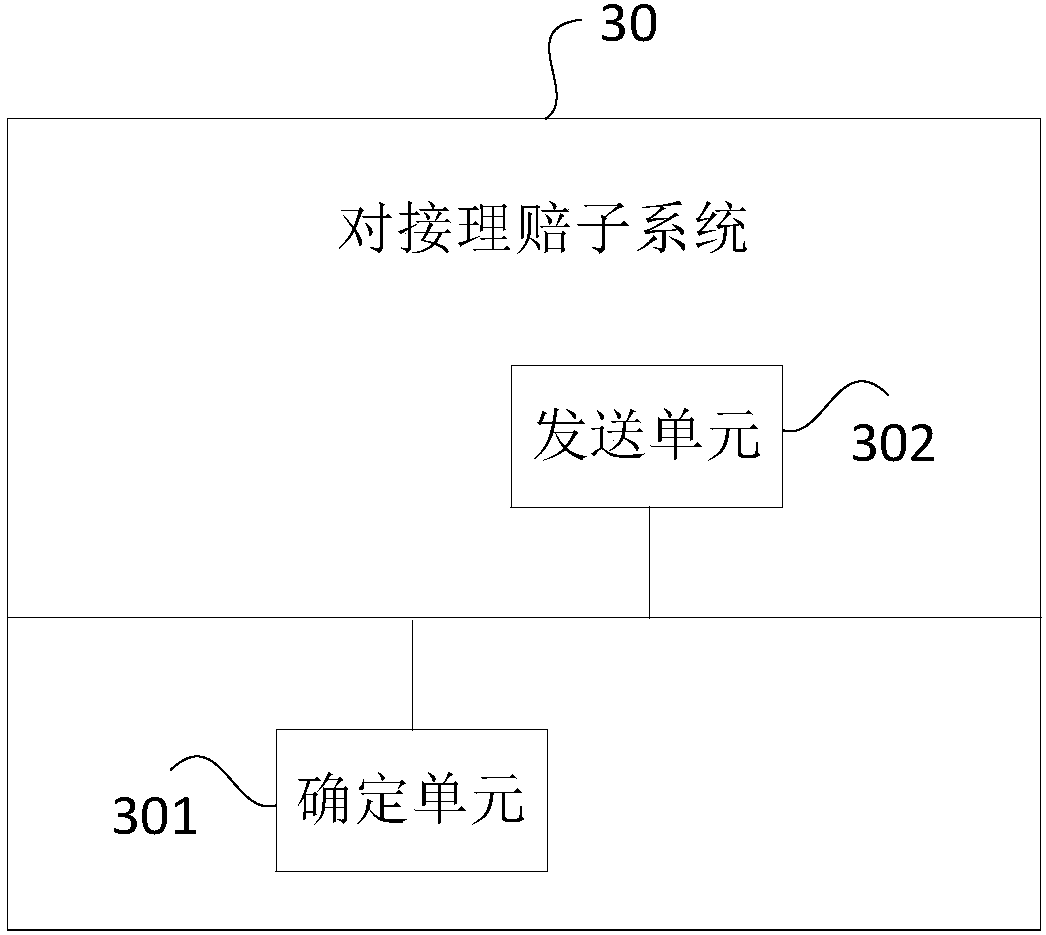

Claim settlement data acquisition method, linking claim settlement subsystem, medium and electronic equipment

The embodiment of the invention provides a claim settlement data acquisition method, a linking claim settlement subsystem, a medium and electronic equipment. The method comprises the steps that the linking claim settlement subsystem determines claim settlement information corresponding to each life insurance claim settlement case according to identification of each life insurance claim settlementcase and an insurance policy corresponding to the life insurance claim settlement case in case information of N life insurance claim settlement cases; the linking claim settlement subsystem sends theclaim settlement information corresponding to each life insurance claim settlement case to a property insurance claim settlement subsystem, the property insurance claim settlement subsystem converts aduty type and duty claim settlement data of each life insurance claim settlement case accordingly, and claim settlement data corresponding to each life insurance claim settlement case in the propertyinsurance claim settlement subsystem is obtained. According to the claim settlement data acquisition method, the linking claim settlement subsystem, the medium and the electronic equipment, the loadcapacity of the property insurance claim settlement subsystem is lowered.

Owner:TAIKANG LIFE INSURANCE CO LTD +1

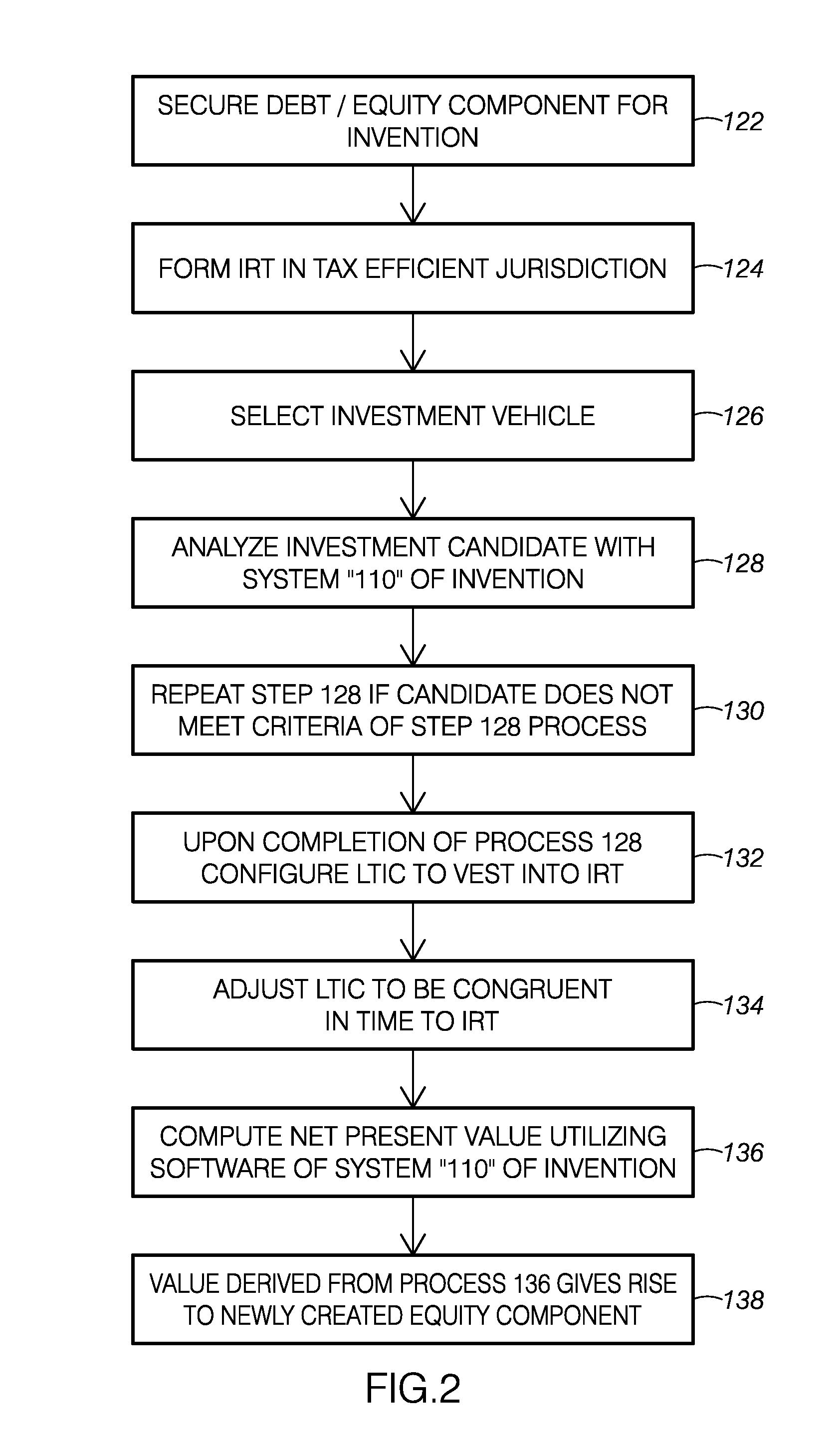

Method and apparatus using debt or equity for making financial transactions economic

A business method and system work to create an observable, verifiable and tangible result that can prevent the default of financial transactions by creating a separate income generating Private Equity Portfolio Asset Base that can be financially relied upon prior to a financial default. The self-insured, income generating Private Equity Portfolio is created contemporaneously by the select equity creator plus (SECP) at the time of the underlying transaction's closing, providing contemporaneous liquidity upon the execution of the underlying transaction. Once the underlying transaction is secured, the additional value created by the SECP, vis-à-vis the Private Equity Portfolio, may be used for other financial purposes unrelated to the original underlying transaction. The user of the SECP has a direct and additional financial benefit from the Private Equity Portfolio Asset Base in tandem with the counterparty to the financial transaction.

Owner:IANNAZZO VINCENT PAUL

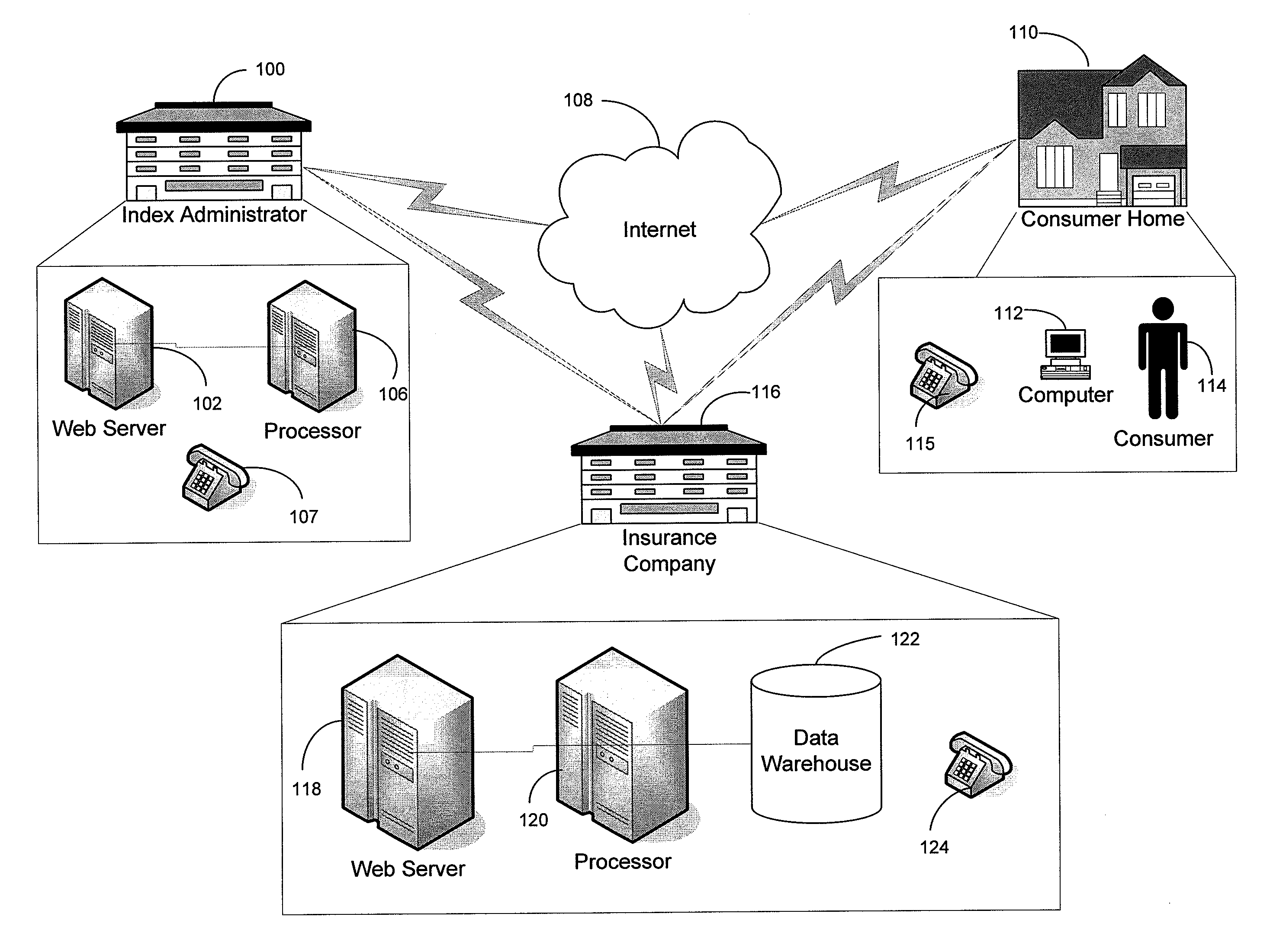

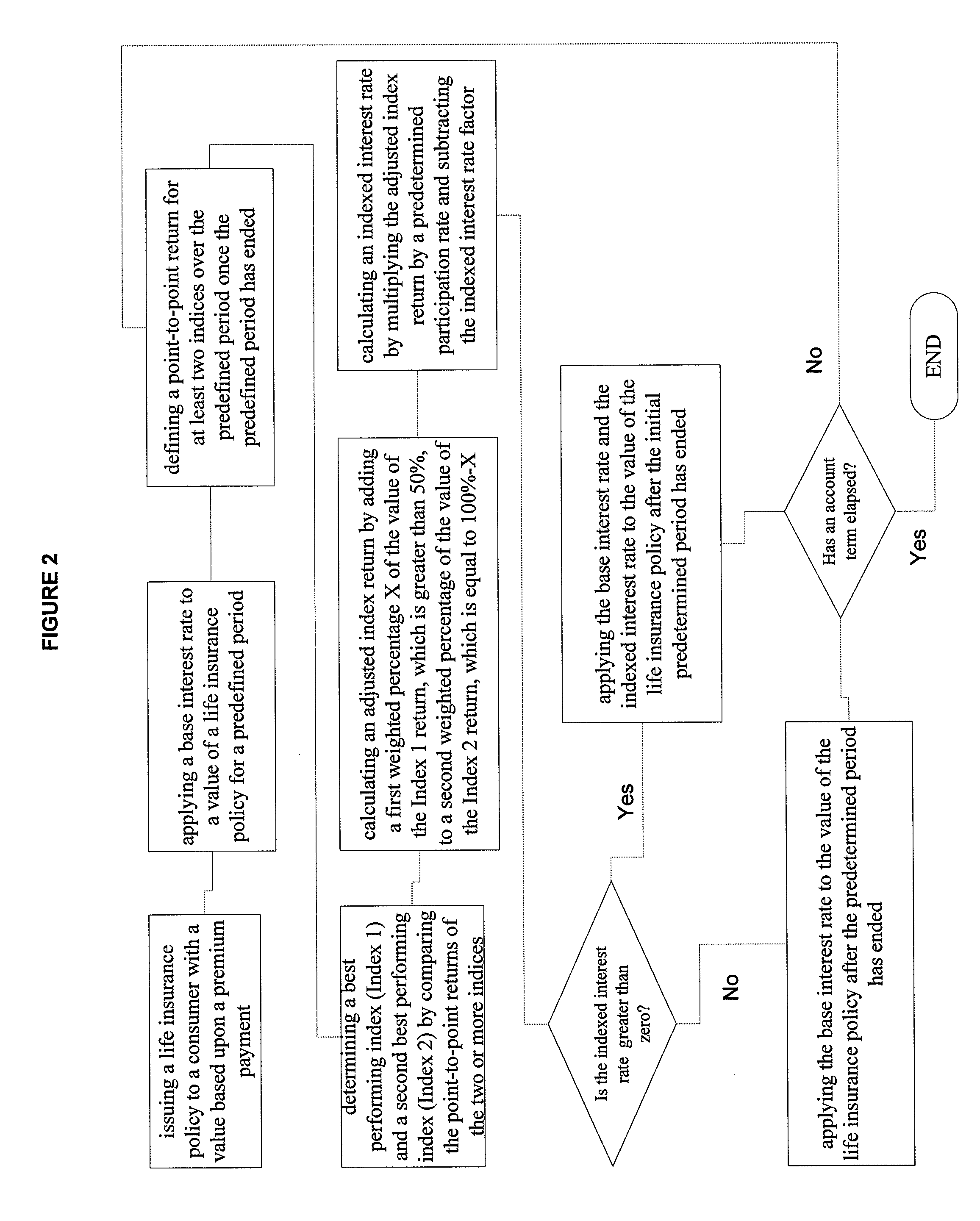

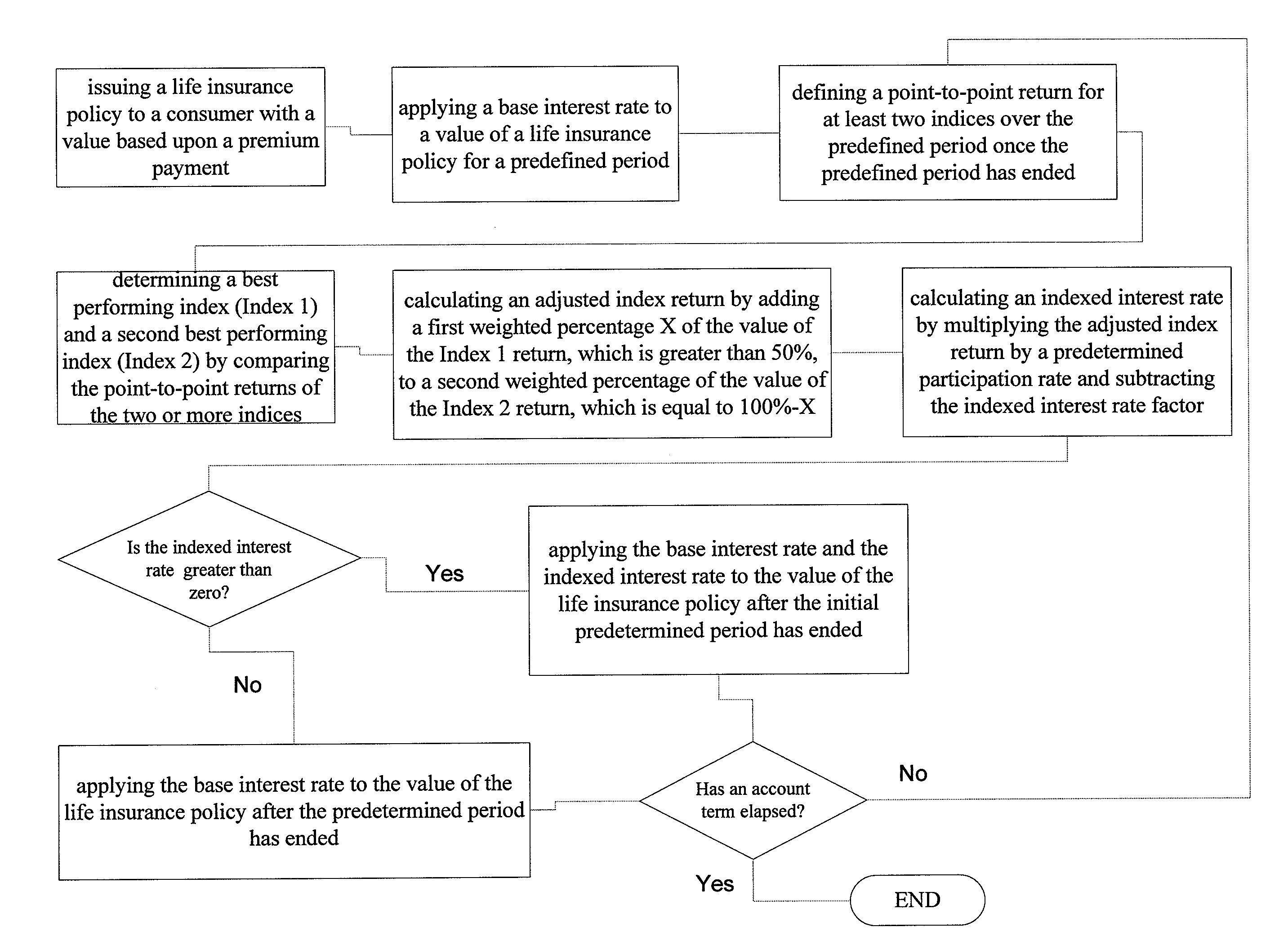

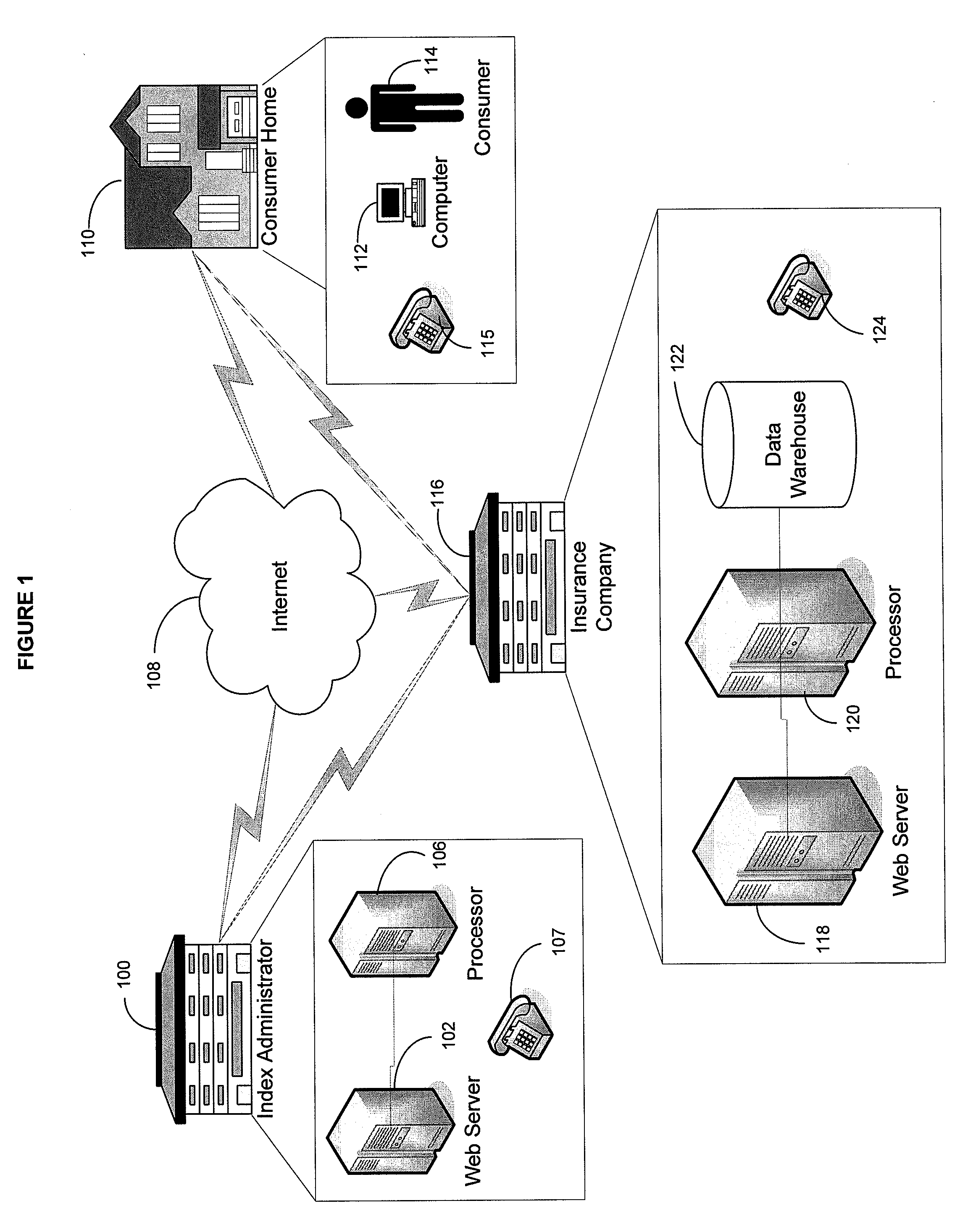

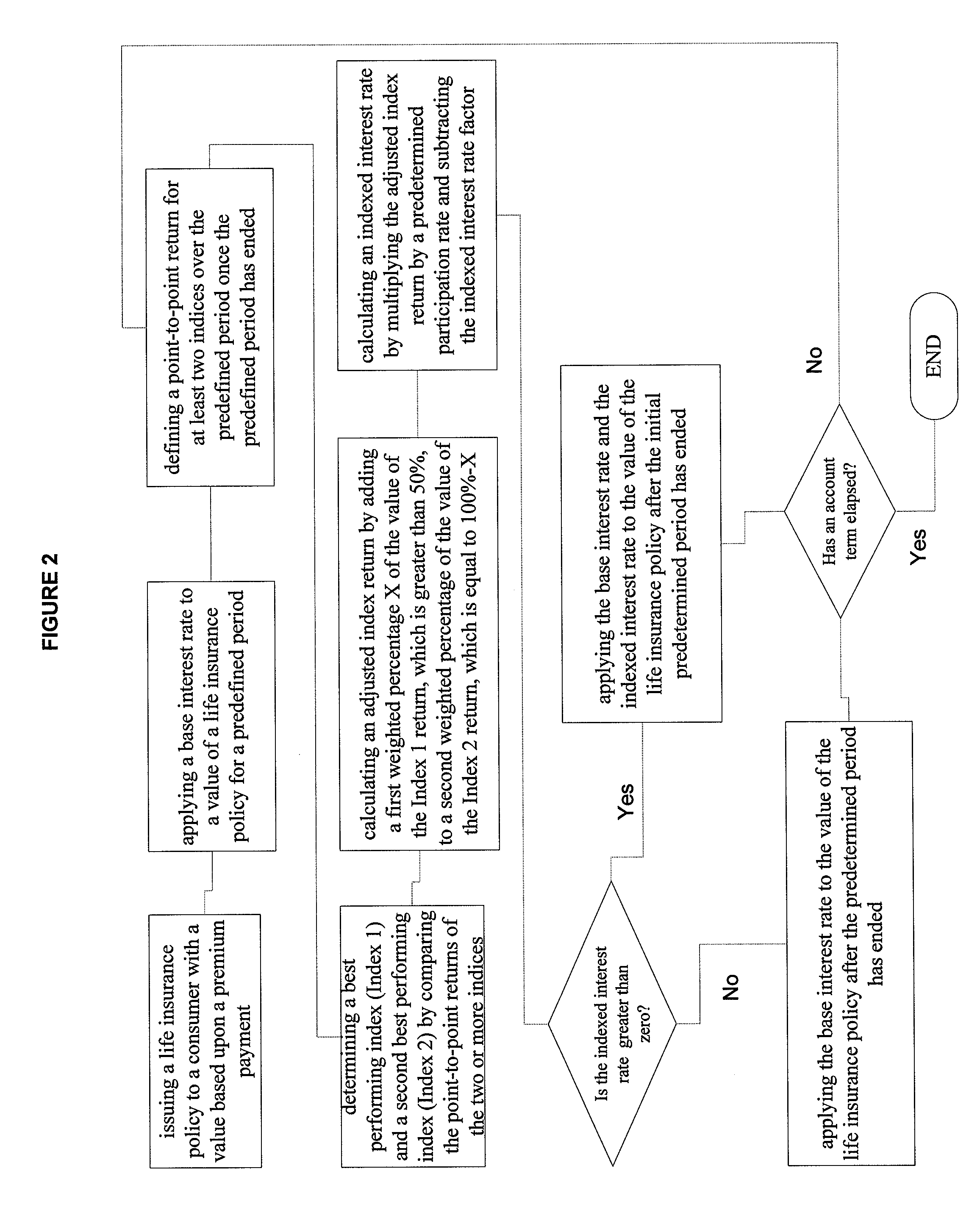

Methods and systems for administering indexed life insurance

Disclosed is a system and method for administering a life insurance policy to provide increased interest based on specifically weighted linkage to multiple equity indices that typically may include Standard & Poor's 500 Composite Price Index, Dow Jones EURO STOXX 50, the Hang Seng Index, and / or derivatives thereof wherein the leading-performing index during a look back period is weighted more heavily than any other index. Also disclosed is a computer system using at least one administration component to implement a series of steps associated with administering an equity indexed-interest universal life insurance policy.

Owner:SECURITY LIFE OF DENVER INSURANCE

Reasonable value medical benefit plan

A self-insured or self funded medical benefit plan is provided by an employer wherein the self-insured medical benefit plan is governed by ERISA, and wherein the employer who is providing the medical benefit plan is 100 percent responsible for payment for medical services provided to an employee, receiving the benefit of the medical benefit plan, to a medical service provider for covered medical services and products. The medical benefit plan and method for providing the medical benefit plan determines a reasonable value for the medical services provided by a medical service provider to a participant of the plan, reprices a bill or claim from the medical service provider, and protects the participant / employee under ERISA from attempted collections of additional moneys that a medical service provider may believe is owed for the medical services but were not paid by the exemplary self insured medical benefit plan.

Owner:MITCHELL INT INC

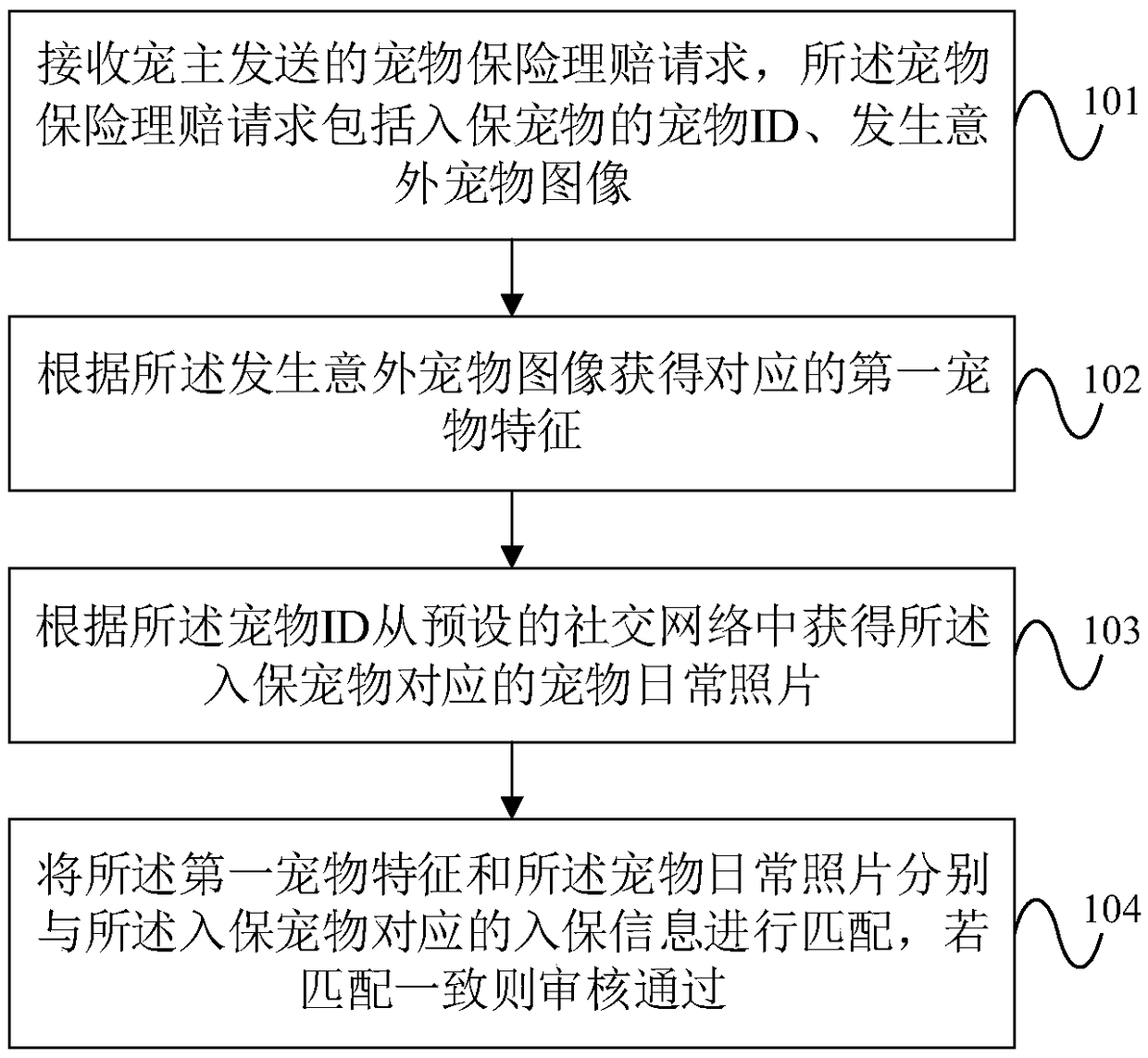

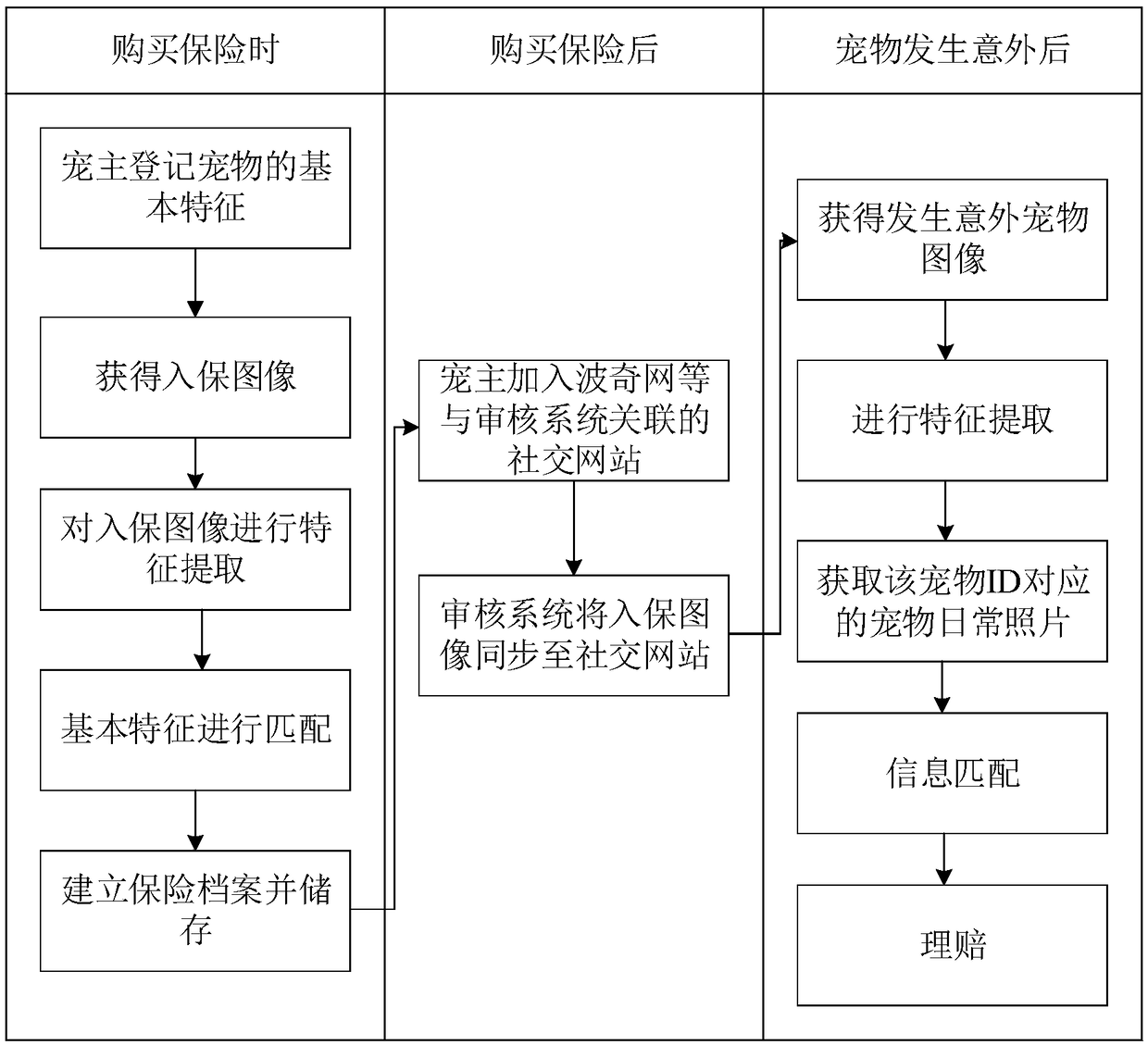

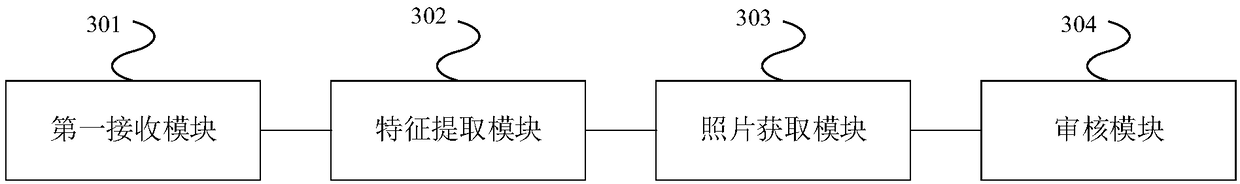

Method and system for auditing pet insurance claims

InactiveCN109035044AAccurate reviewReduce insurance fraudFinanceCharacter and pattern recognitionSelf-insuranceSocial network

The embodiment of the invention provides a method and a system for auditing pet insurance claim settlement. The method comprises the following steps: receiving a pet insurance claim settlement requestsent by a pet owner, wherein the pet insurance claim settlement request comprises a pet ID of the insured pet, and an accident pet image is generated; obtaining a corresponding first pet feature according to an unexpected pet image; obtaining a daily pet photograph corresponding to the insured pet from a preset social network according to the pet ID; the first pet characteristics and the pet daily photos being matched with the insured pets corresponding to the insured pets respectively, and if the matches are consistent, the pet characteristics and the pet daily photos are approved. The system is configured to perform the method described above. The embodiment of the invention matches the first pet characteristic and the pet daily photograph with the insured information corresponding to the insured pet respectively, and if the matching is consistent, the insured information is approved, so that when the pet owner needs to settle the insurance claim for his pet, the insured pet can bechecked accurately, and the occurrence of insurance fraud is reduced.

Owner:波奇(上海)信息科技有限公司

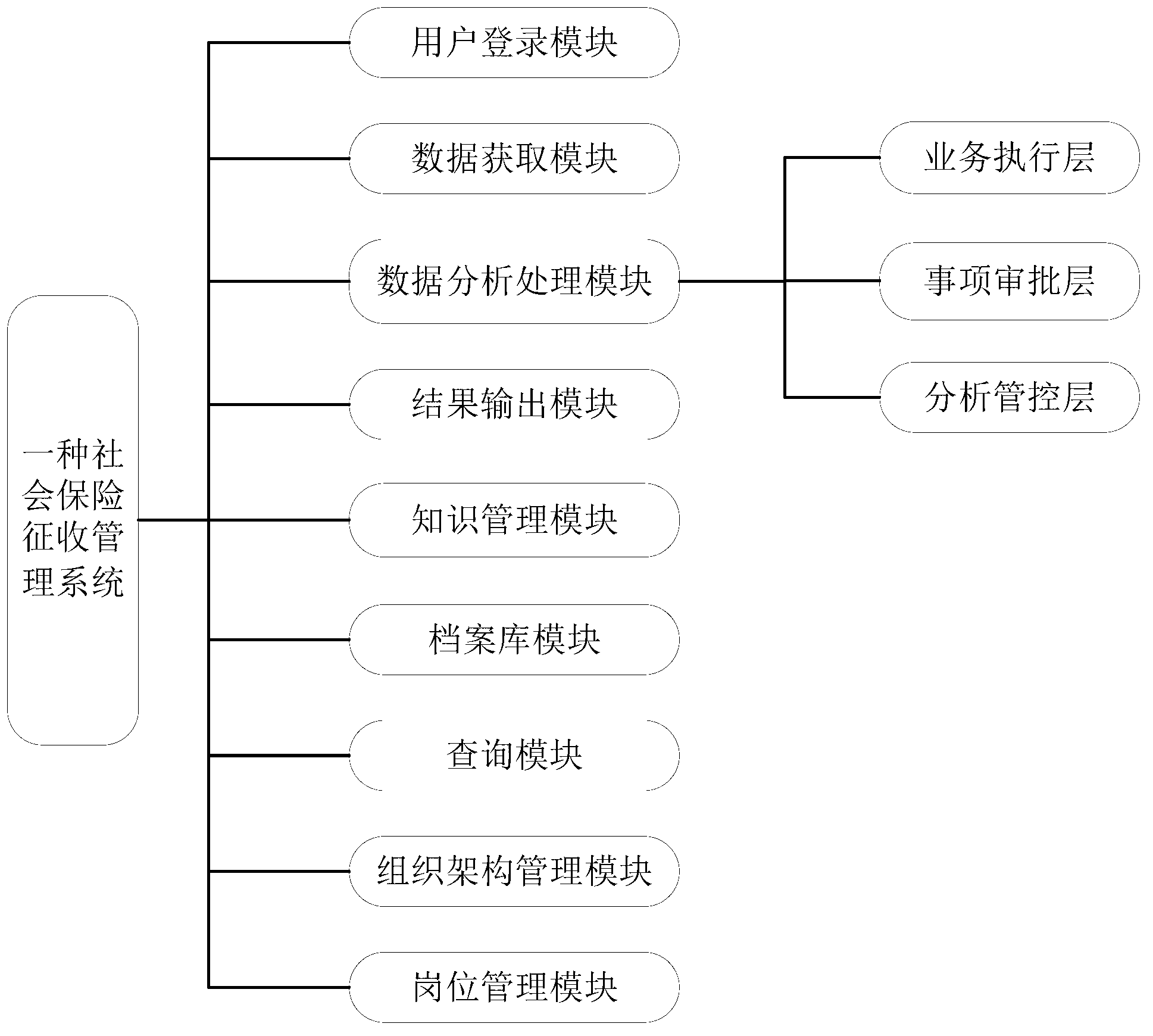

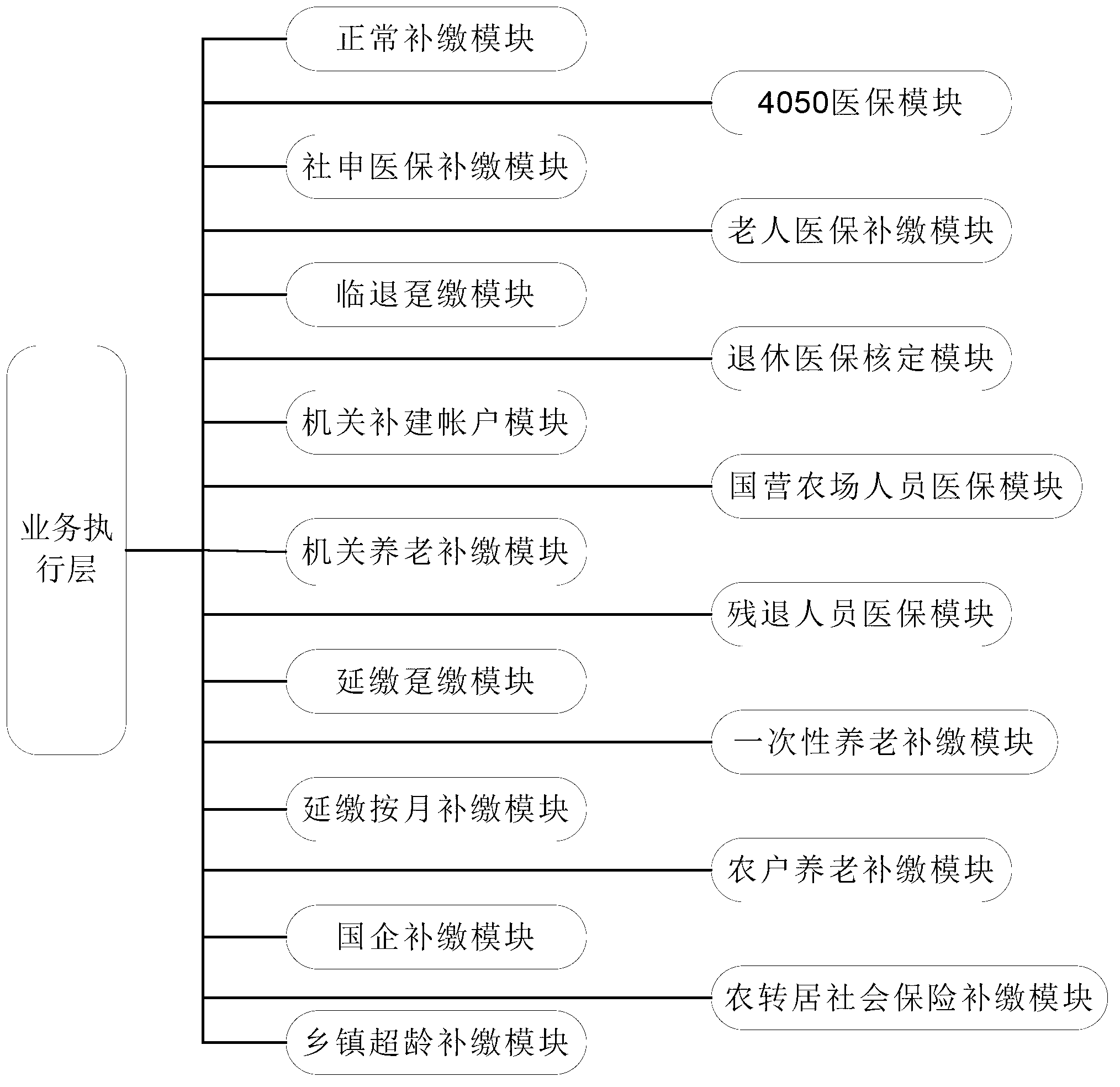

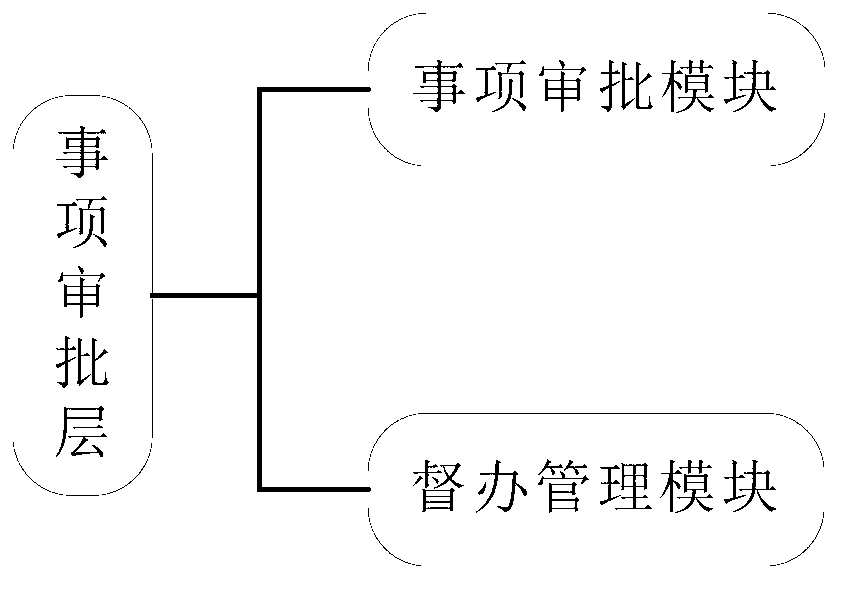

Social insurance collecting and managing system

InactiveCN103268564AImproving the level of social insurance businessAvoid complicatedFinanceSelf-insurancePayment

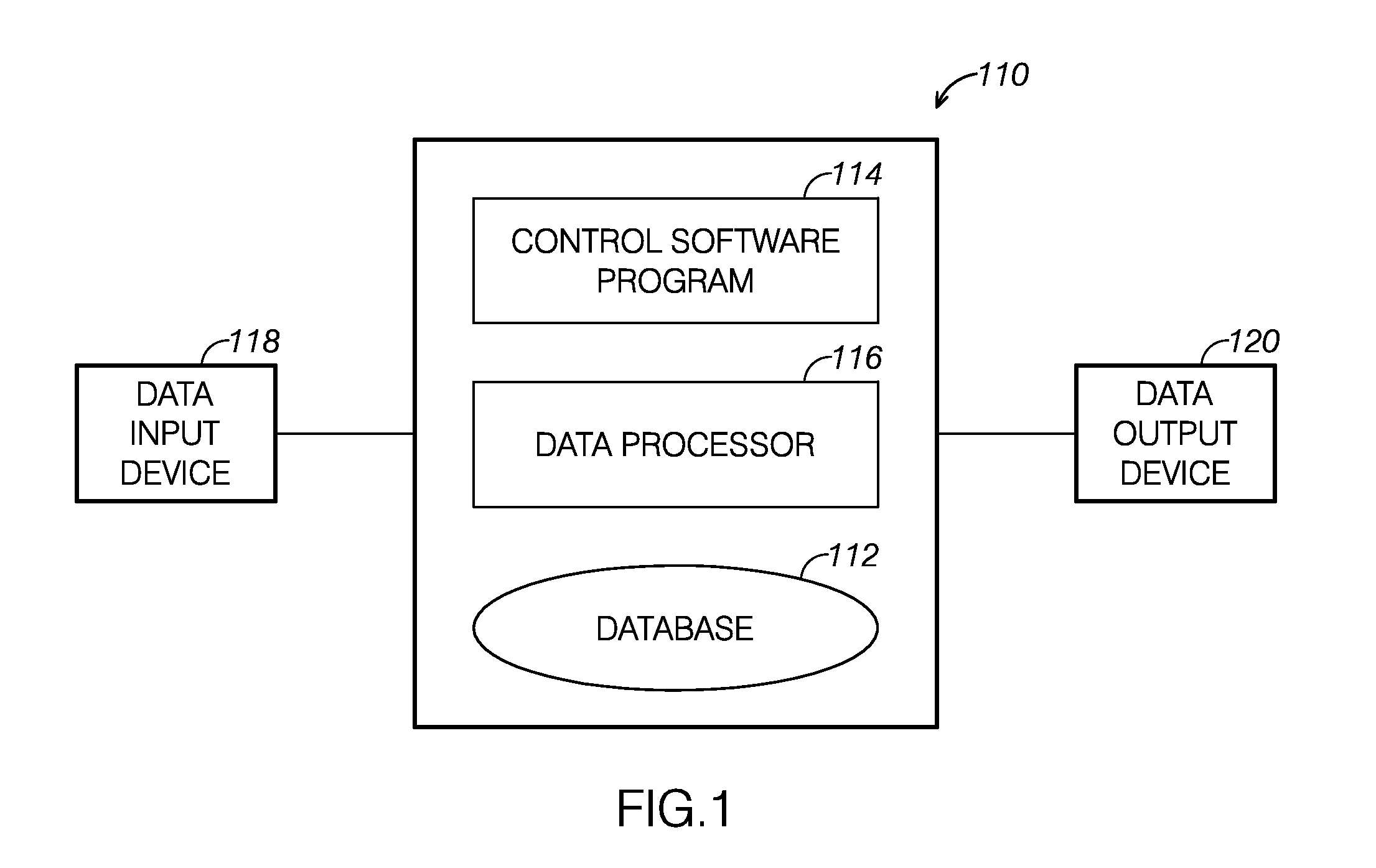

The invention provides a social insurance collecting and managing system. The social insurance collecting and managing system comprises a user login system, a data acquisition module, a data analyzing and processing module and a result output module. The user login module is used for enabling a user to login the system, and the data acquisition module is used for inputting and storing data related to social insurance and needing to be provided of a social insurance payment unit when the social insurance payment unit deals with the social insurance business in the managing process of a social insurance collecting unit. The data analyzing and processing module is used for analyzing and processing data acquired by the data acquisition module, and the result output module is used for outputting a result obtained by analyzing and processing the data acquired by the data acquisition module through the data analyzing and processing module. The data analyzing and processing module further comprises a service executive layer, an item examination and approval layer and an analyzing and control layer. Through the mentioned modules, the streamlining and standardization management of the all the related social insurance business in the social insurance collecting unit is achieved.

Owner:广东源恒软件科技有限公司

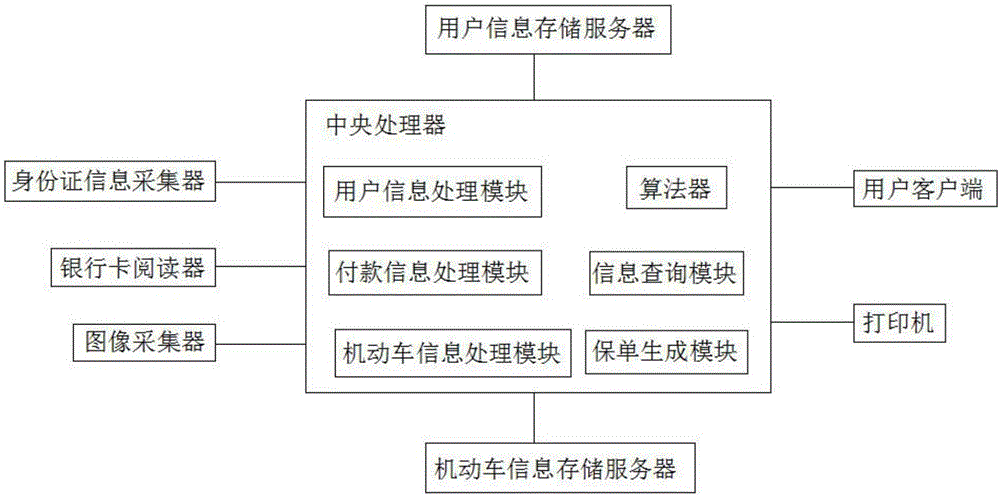

Motor vehicle insurance self-insurance system

InactiveCN106296410AConvenient self-purchaseConvenient and quick self-purchaseFinanceSelf-insuranceCard reader

The invention discloses a motor vehicle insurance self-insurance system. The system comprises an identity card information gatherer, an image gather, a bank card reader, a central processor, a user information storage server, a motor vehicle information storage server, a user client and a printer. The user identity card information is acquired through the identity card information gatherer, the image information of a user driving certificate is acquired through the image gather, the information of a user and an insurance application vehicle are stored through the bank card reader, the user information storage server and the motor vehicle information storage server, all the acquisition data and the user input information are processed through the central processor, insurance and payment are accomplished by the user through the user client and the bank card reader, an insurance list is printed through the printer, remote operation of motor vehicle self-insurance is realized, the system is simple in structure, is convenient to use and enables the user to conveniently purchase motor vehicle insurance by himself / herself, and a motor vehicle insurance purchase channel is greatly expanded.

Owner:合肥奇也信息科技有限公司

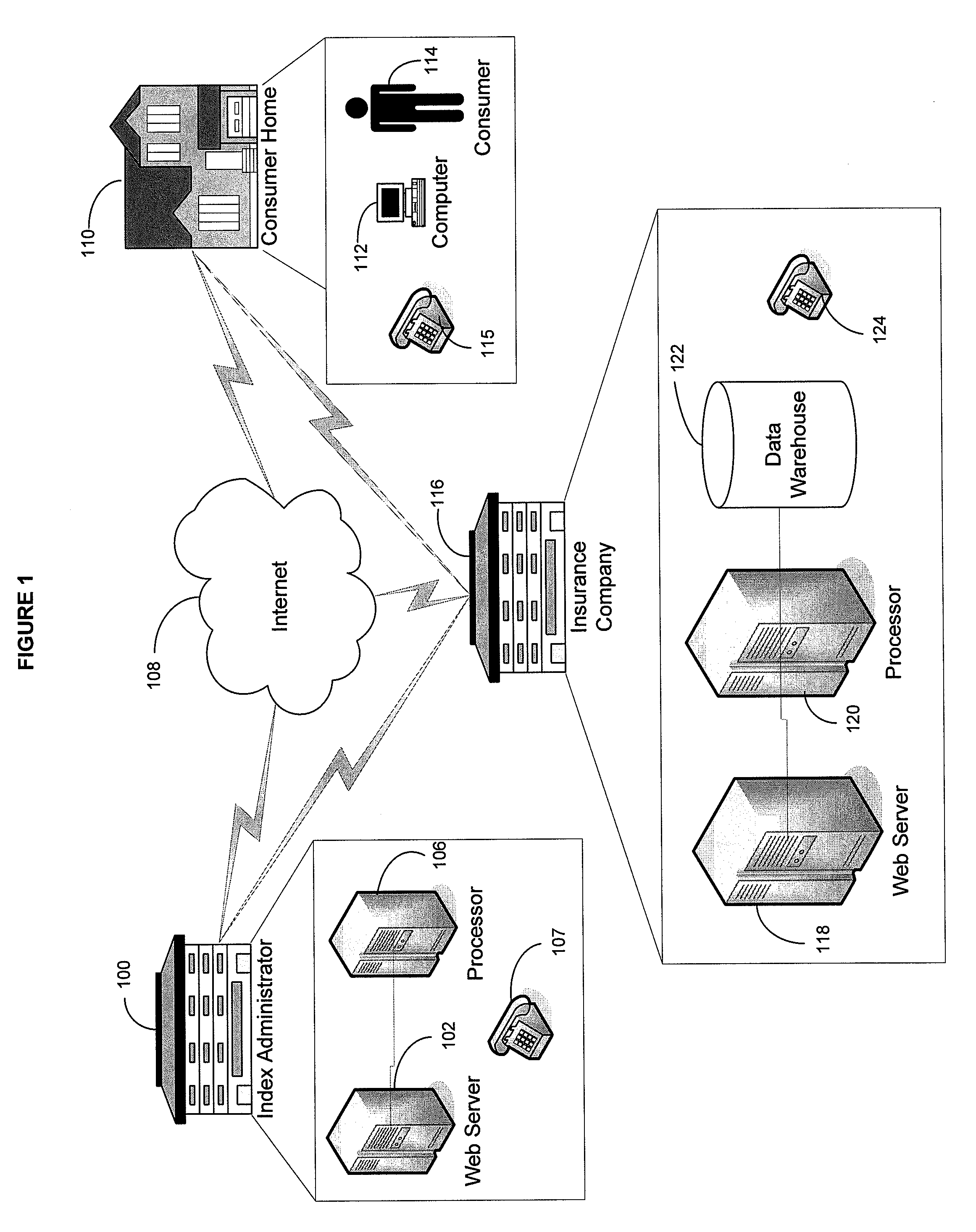

Methods and systems for administering indexed life insurance

Disclosed is a system and method for administering a life insurance policy to provide increased interest based on specifically weighted linkage to multiple equity indices that typically may include Standard & Poor's 500 Composite Price Index, Dow Jones EURO STOXX 50, the Hang Seng Index, and / or derivatives thereof wherein the leading-performing index during a look back period is weighted more heavily than any other index. Also disclosed is a computer system using at least one administration component to implement a series of steps associated with administering an equity indexed-interest universal life insurance policy.

Owner:SECURITY LIFE OF DENVER INSURANCE

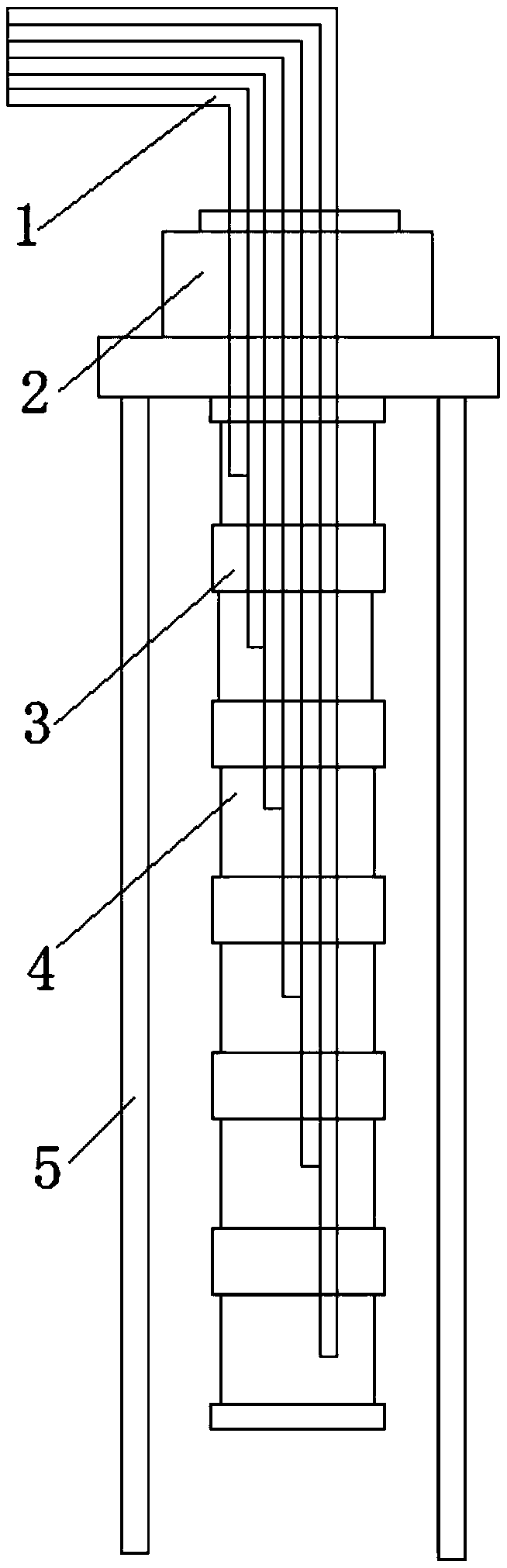

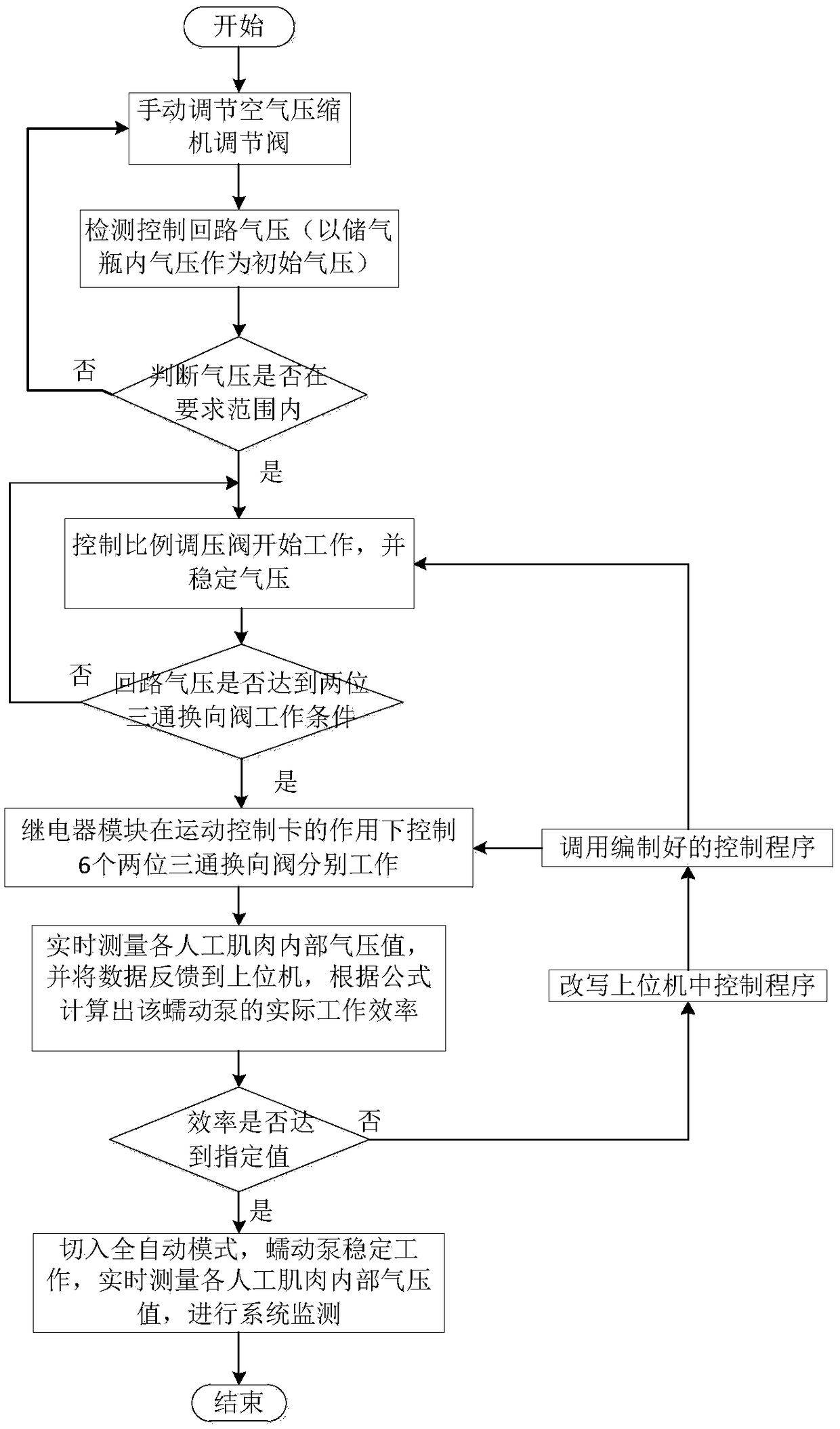

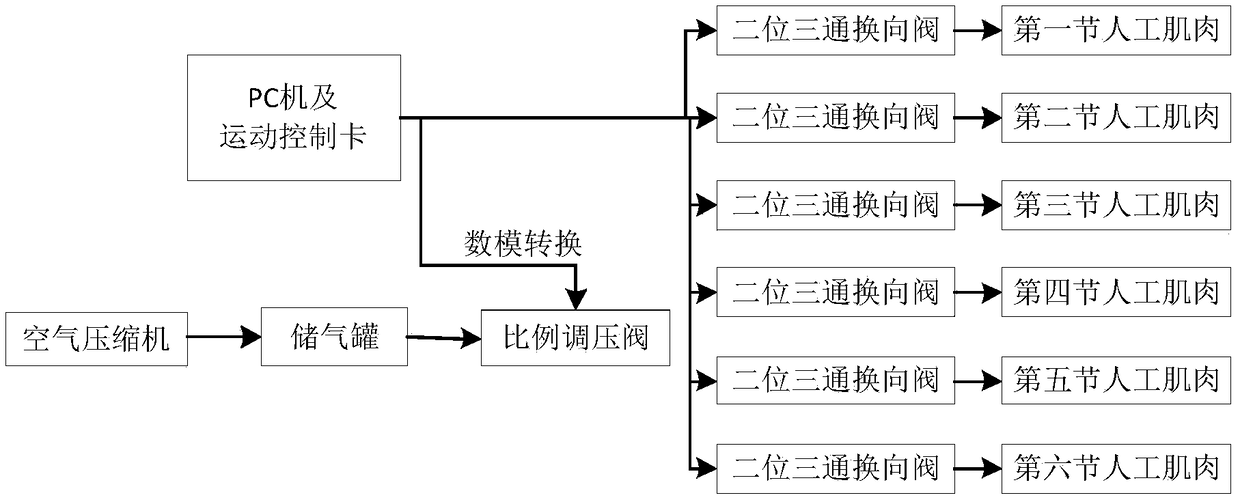

Regulating and control method based on novel peristaltic pump

ActiveCN109139435ASo as not to damageWith self-protection mechanismFlexible member pumpsPump controlPeristaltic pumpSelf-insurance

The invention relates to a regulating and control method based on a novel peristaltic pump. The peristaltic pump adopts pneumatic artificial muscles as an actuator and comprises a pump cover assembly,artificial muscle expansion components, flanges and air pipelines. A regulated and controlled control system comprises an air compressor, an air storage bottle, a motion control card, a relay module,a proportional pressure-regulating valve, two-position two-way reversing valves and a pressure sensor. Modules of the control system are connected from the air compressor, the air storage bottle, theproportional pressure-regulating valve, the two-position two-way reversing valves and the artificial muscle expansion components to a mechanical mechanism. During regulating and control, the output air pressure of the air compressor, the air pressure of the air storage bottle, the air pressure of a control loop, the working air pressure of the proportional pressure-regulating valve and the working air pressure of the pneumatic artificial muscles are verified sequentially, and the detection results are fed back. The peristaltic pump can transport a fluid medium and is provided with a self-insurance mechanism, and thus a pump body is not damaged during long-time working; the space occupied by the peristaltic pump is saved, and outdoor using is facilitated; the control system is stable and orderly; and the peristaltic pump works with the optimal efficiency, and the production efficiency is improved.

Owner:NANJING INST OF TECH

Voluntary Benefits Outsourcing Systems and Methods

Voluntary benefits outsourcing systems and methods may be used to provide voluntary benefits to employees. An employee may choose to select any number of voluntary benefits from a menu of voluntary benefits available to that employee through the voluntary benefits system. Available voluntary benefits may include, but are not limited to, automobile insurance, homeowners insurance, life insurance, accident insurance, critical illness insurance, disability insurance, healthcare insurance, dental insurance, long term care insurance, pet care insurance and legal services insurance, discounts on computers, movie tickets, auto financing, educational testing, telephones, travel, child care, and a host of other work / life offerings, for example. The voluntary benefits systems and methods include calculating a single payroll deduction based upon the selection of the voluntary benefits by the employee. In this manner, the employee may receive a pay check with only one deduction for all selected voluntary benefits.

Owner:MARCIA PETER

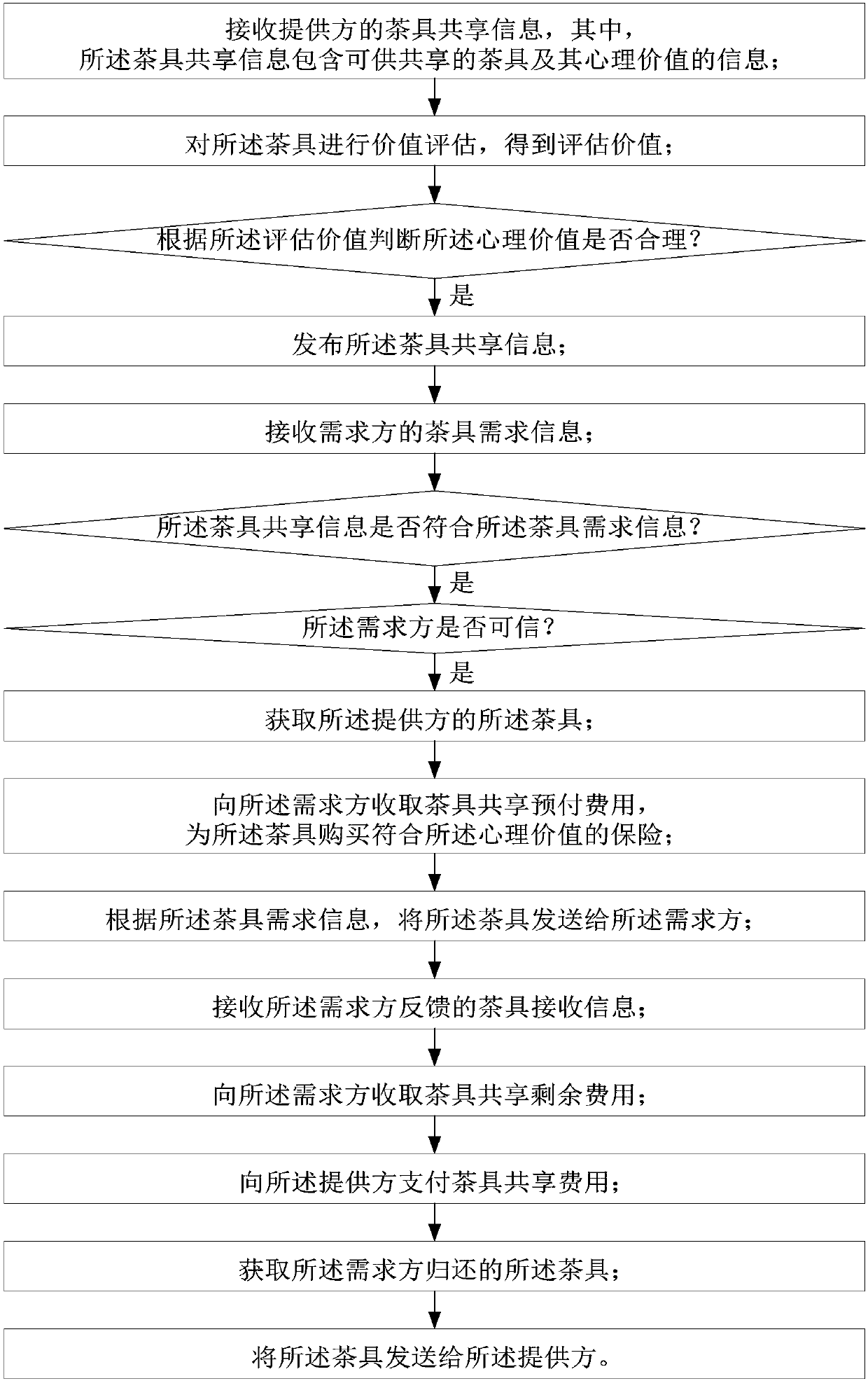

Teaware sharing method

InactiveCN107808321ASafe sharingWide audienceApparatus for meter-controlled dispensingBuying/selling/leasing transactionsSelf-insuranceInformation sharing

The invention relates to a teaware sharing method. The method comprises the following steps of receiving teaware sharing information of a provider; performing value assessment on teaware to obtain anassessed value; according to the assessed value, judging whether a psychological value is reasonable or not, and if yes, executing the subsequent steps; releasing the teaware sharing information; receiving teaware demand information of a demander; judging whether the teaware sharing information conforms to the teaware demand information or not, and if yes, executing the subsequent steps; judging whether the demander is trusted or not, and if yes, executing the subsequent steps; obtaining the teaware of the provider; collecting a teaware sharing prepaid expense from the demander, and purchasingan insurance conforming to the psychological value for the teaware; according to the teaware demand information, sending the teaware to the demander; receiving teaware receiving information fed backby the demander; collecting a teaware sharing residual expense from the demander; paying a teaware sharing expense to the provider; obtaining the teaware returned by the demander; and sending the teaware to the provider. Therefore, teaware sharing can be realized.

Owner:惠州市洛玛科技有限公司

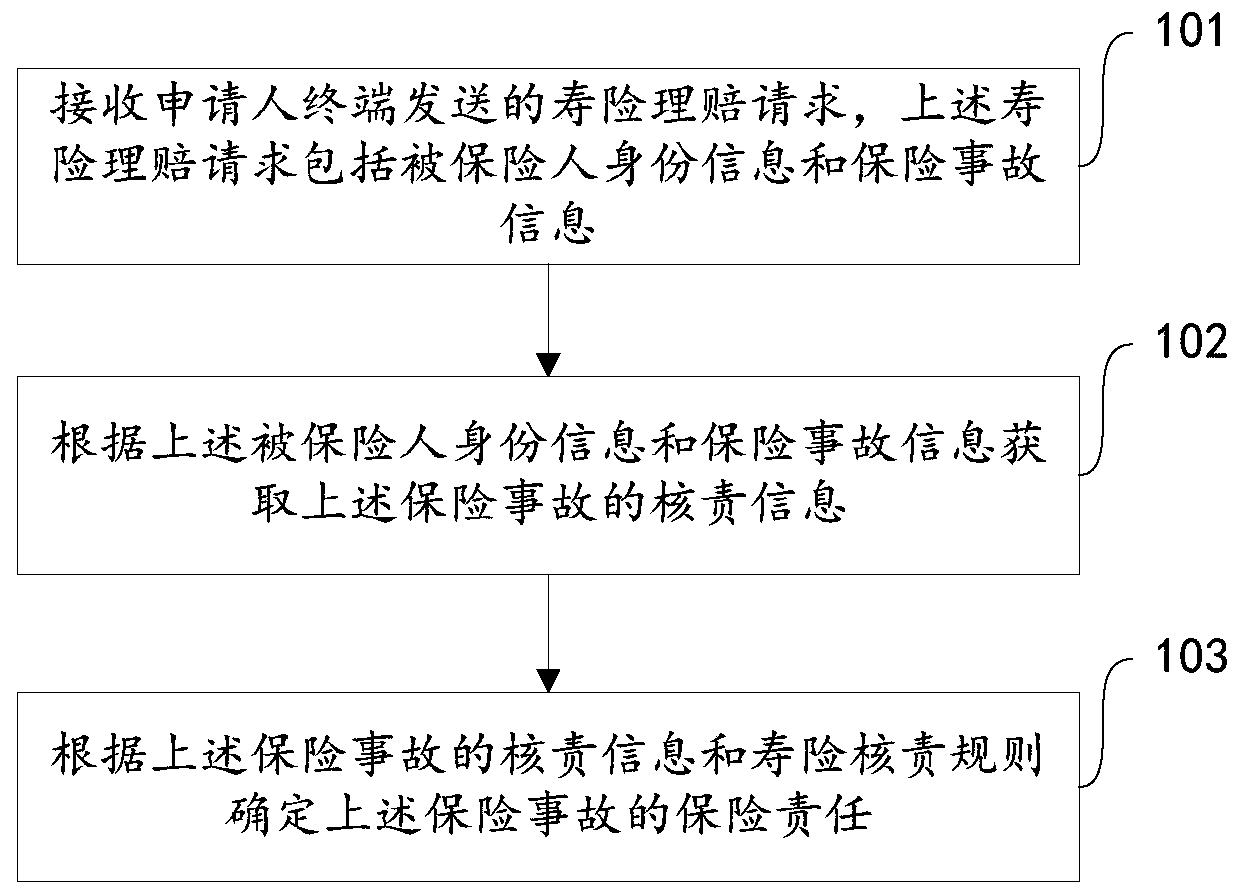

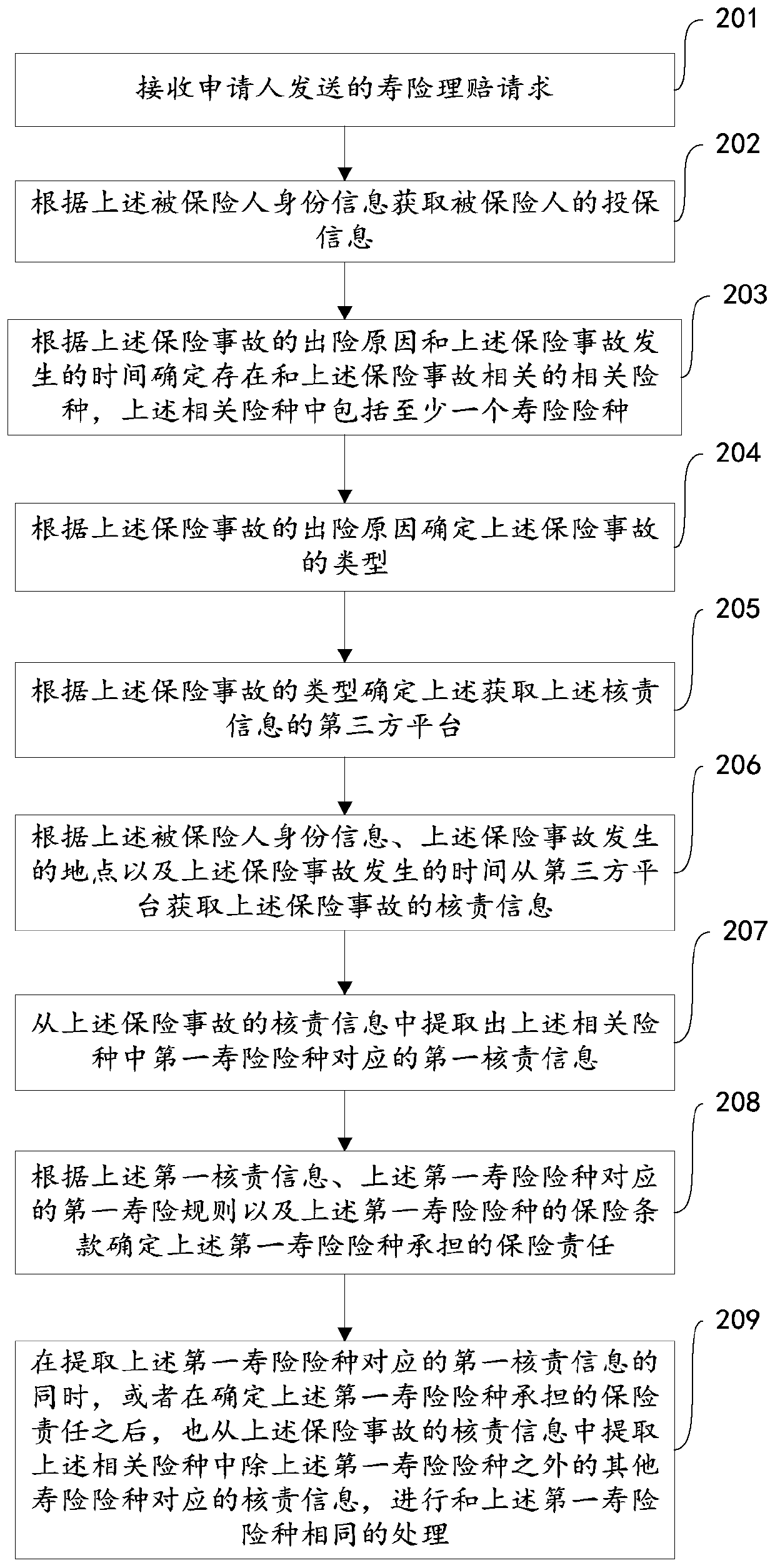

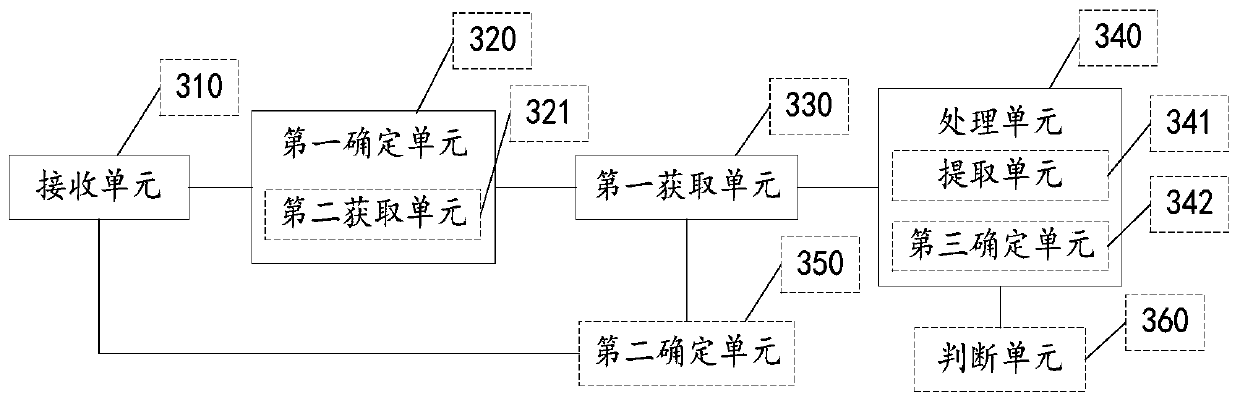

Life insurance checking responsibility data processing method, server and computer readable medium

The embodiment of the invention discloses a life insurance checking responsibility data processing method, a server and a computer readable medium, and relates to analysis and processing of life insurance checking responsibility data, the method comprises the following steps: receiving a life insurance claim settlement request sent by an applicant terminal, the life insurance claim settlement request comprising insured person identity information and insurance accident information; When it is determined that an insurance accident corresponding to the life insurance claim settlement request meets life insurance claim settlement application conditions according to the insured person identity information and the insurance accident information, obtaining checking responsibility information ofthe insurance accident according to the insured person identity information and the insurance accident information; And determining the insurance responsibility of the insurance accident according tothe checking responsibility information of the insurance accident and the life insurance checking responsibility rule. Through the embodiment of the invention, the working efficiency of life insuranceclaim responsibility checking can be effectively improved, the labor cost is saved, the responsibility checking standard is unified, and the deviation caused by artificial subjective factors in the responsibility checking process is avoided.

Owner:深圳平安医疗健康科技服务有限公司

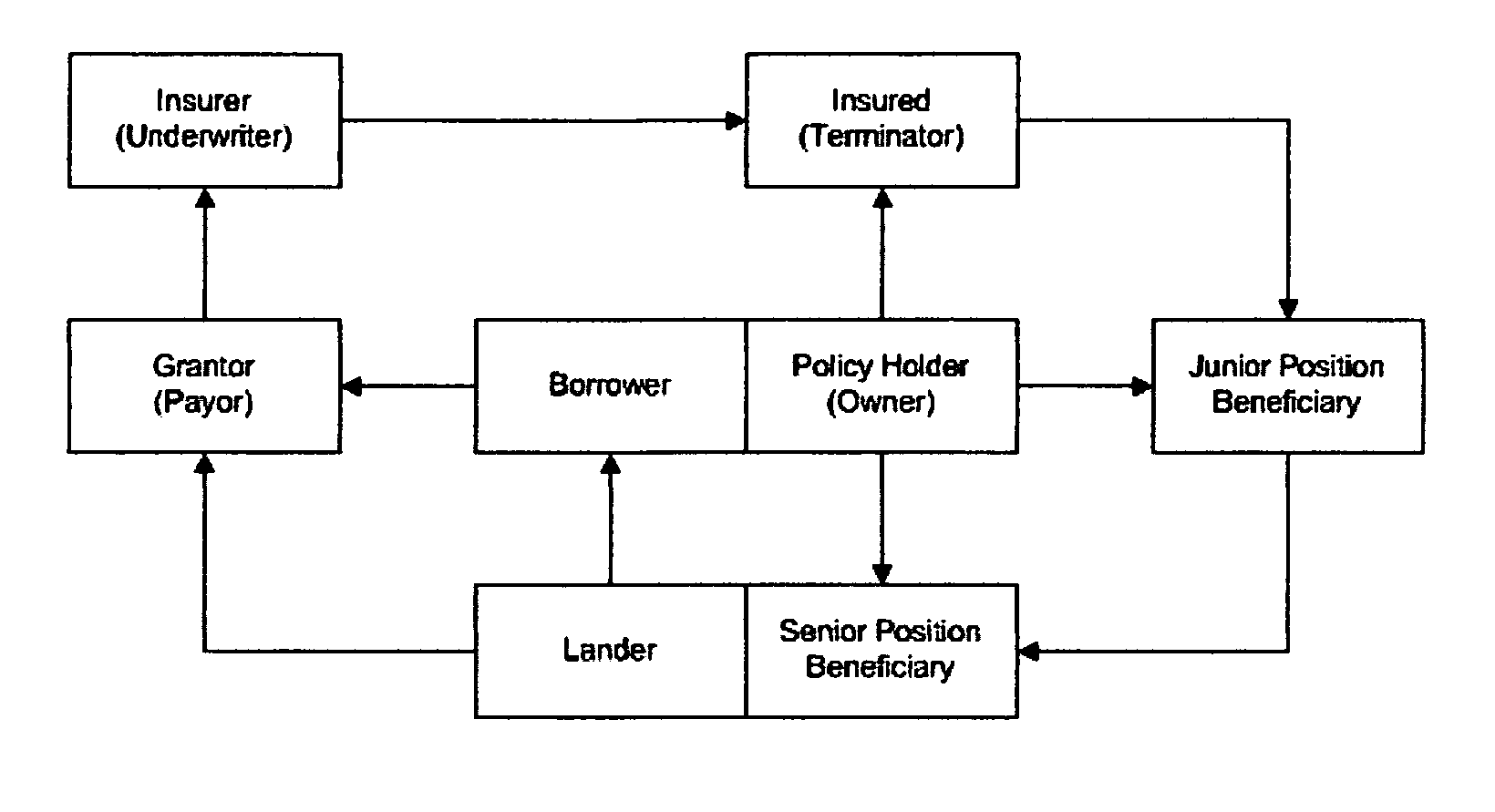

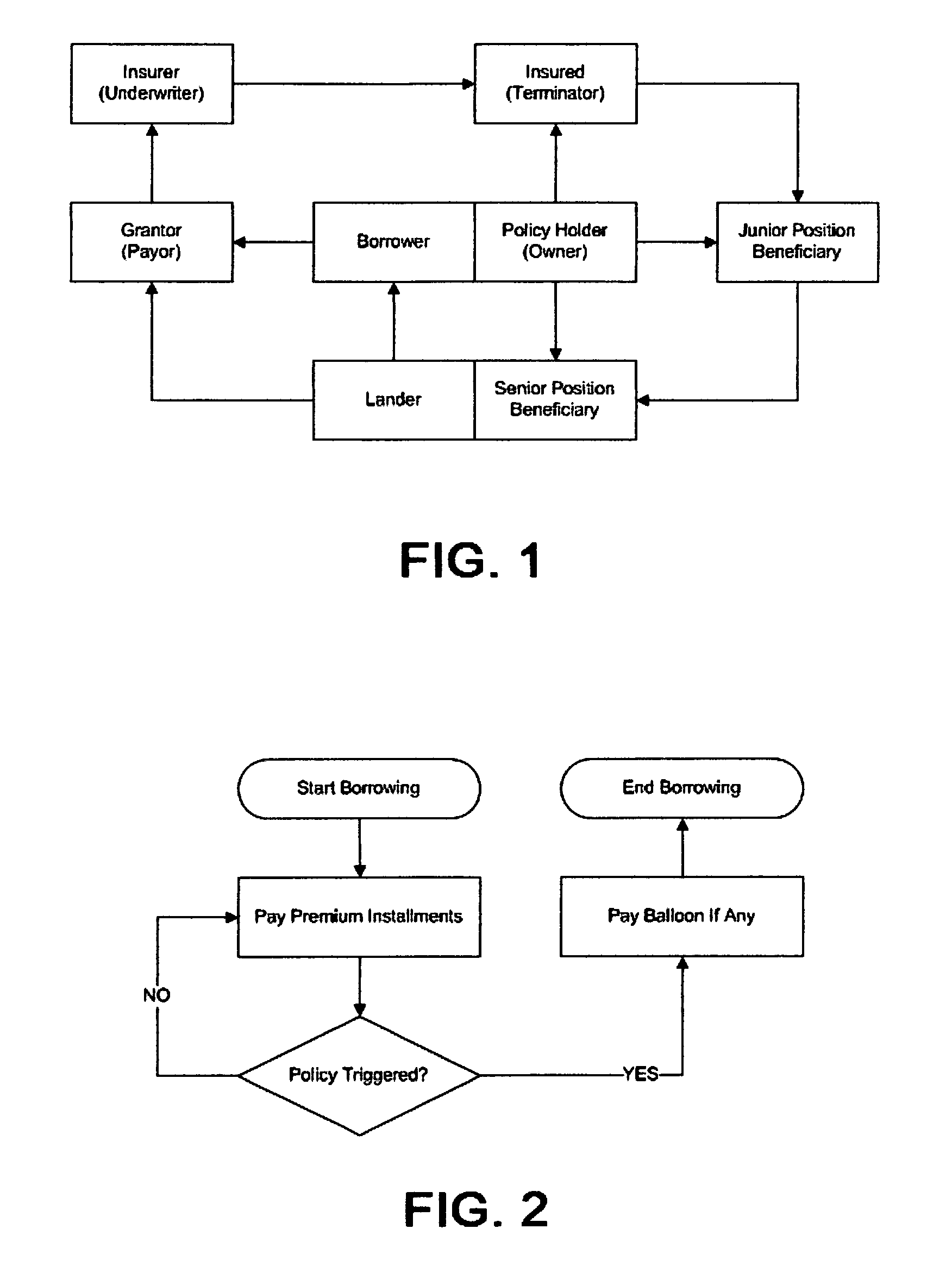

Life insurance with borrowed premium

InactiveUS20160078549A1Contributes to economic growthReduce chanceFinanceSelf-insuranceInsurance life

Disclosed is a method, comprising lending for life insurance policy premium payments paid by a lender to the insurer, collateralized by seigniorage beneficiary of the lender, nominated by the policy owner as grantor of the premium payments, whereas upon the policy termination by a specified terminal event, occurred accidentally in the life of the insured, a predefined substantial part of the benefits are paid by the insurer to the lender, before other beneficiaries receive any further benefits, while, instead of the owner, the lender is allowed be the grantor. Also, a method, comprising lender buyout of the policy at instant surrender value, and lender paying annuities to the owner until the policy is terminated by the triggering event. Lander thereby continuously invests in a zero coupon bond of indeterminate but deterministic expiration date.

Owner:DOKHANIAN BIJAN

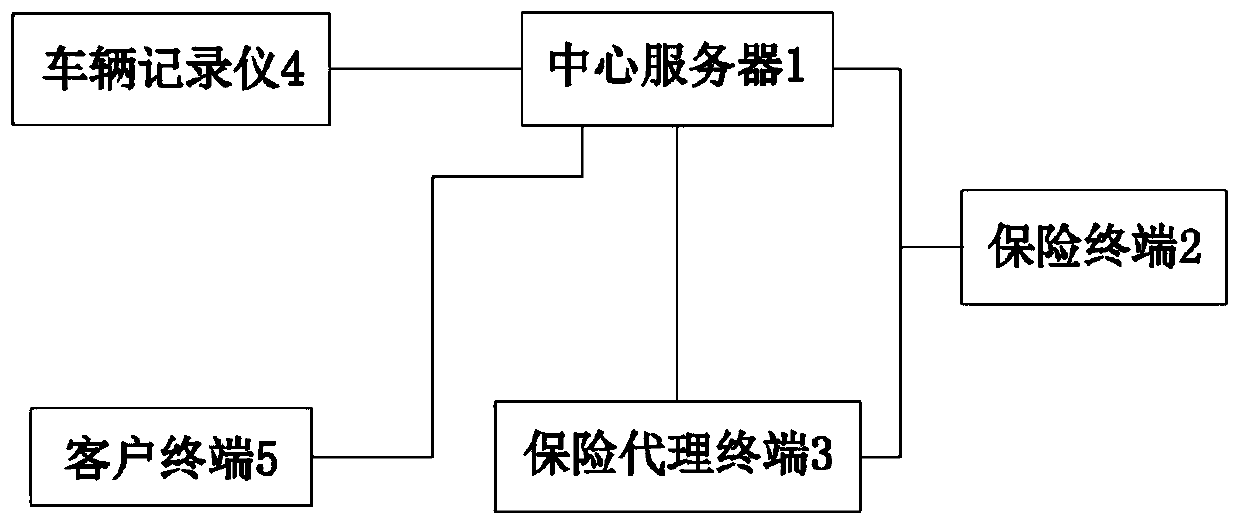

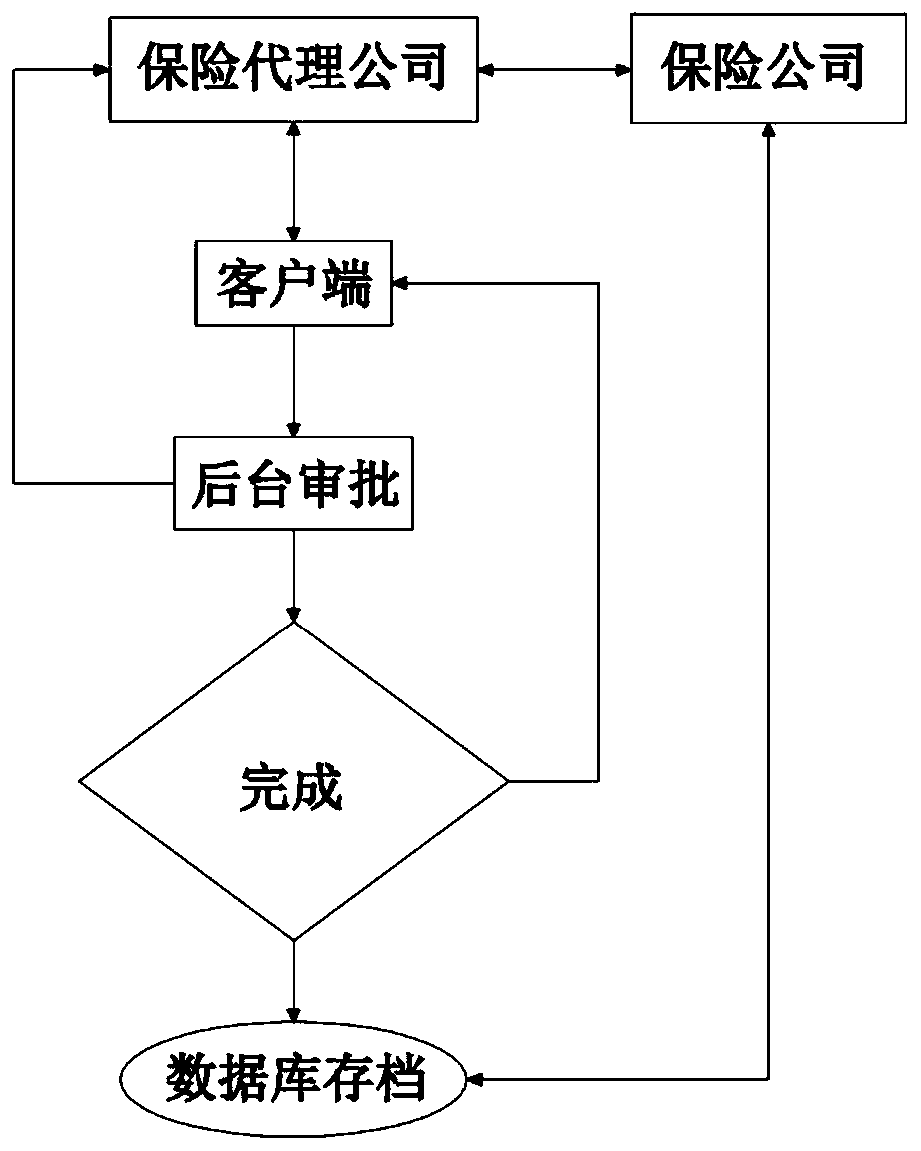

Property right vehicle multi-state insurance charging system based on Internet-of-things

The invention discloses a property right vehicle multi-state insurance charging system based on Internet-of-things, and relates to the technical field of the Interent-of-things. The system comprises acentral server which is used for receiving identity information, the static time of a vehicle, insurance information and a contract, the cost generated by the running time of the vehicle is calculated, and a result is fed back; an insurance terminal which transmits the vehicle insurance record and the insurance contract to the central server; an insurance proxy terminal which is used for receiving the information of the central server and transmitting the user identity information and insurance premium to the insurance terminal and the central server; a vehicle recorder which is mounted on the vehicle and used for recording identity information of the vehicle, parking time of the property right vehicle and running time of the property right vehicle; and a client terminal which is used forreceiving the related insurance expense use condition of the central server, paying and feeding back payment information to the central server. The method is reasonable in design, the automobile insurance expense can be charged according to the actual use condition of the automobile of the user, the charging mode is fair and reasonable, and the user experience is effectively improved.

Owner:HANGZHOU FOREST TECH

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com