Method and insurance platform for self-interest-rate investment-oriented whole-life insurance

An interest rate and lifetime technology, applied in the direction of instruments, finance, data processing applications, etc., can solve the problems of no space for consumer autonomy, lack of information symmetry, and lack of savings benefits in whole life insurance to achieve the effect of expanding credit

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

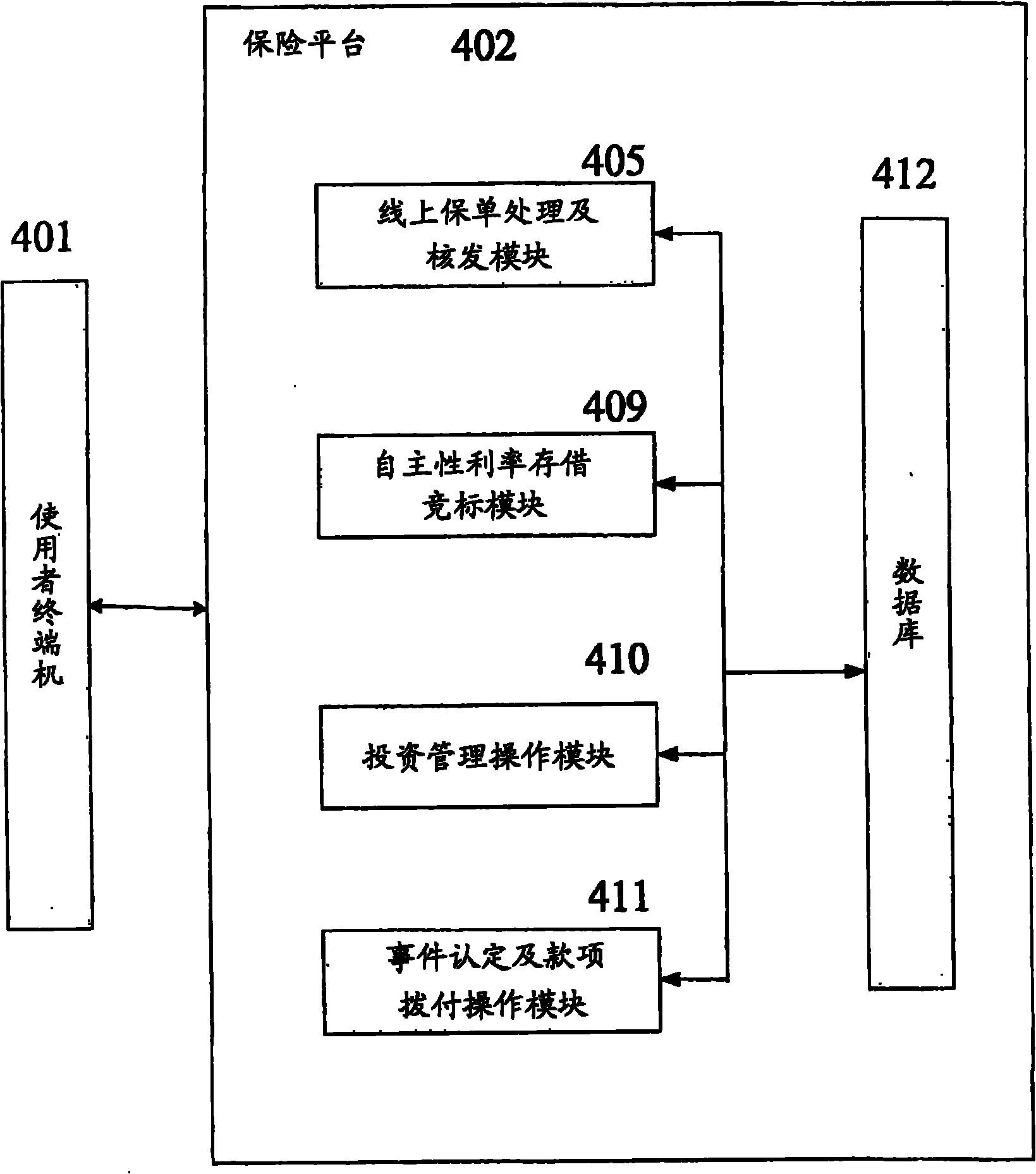

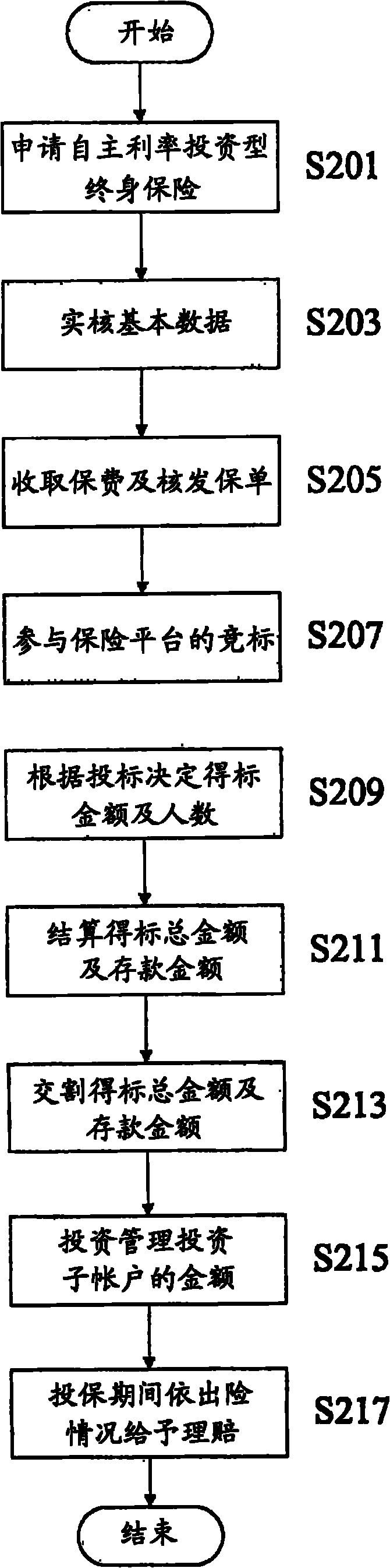

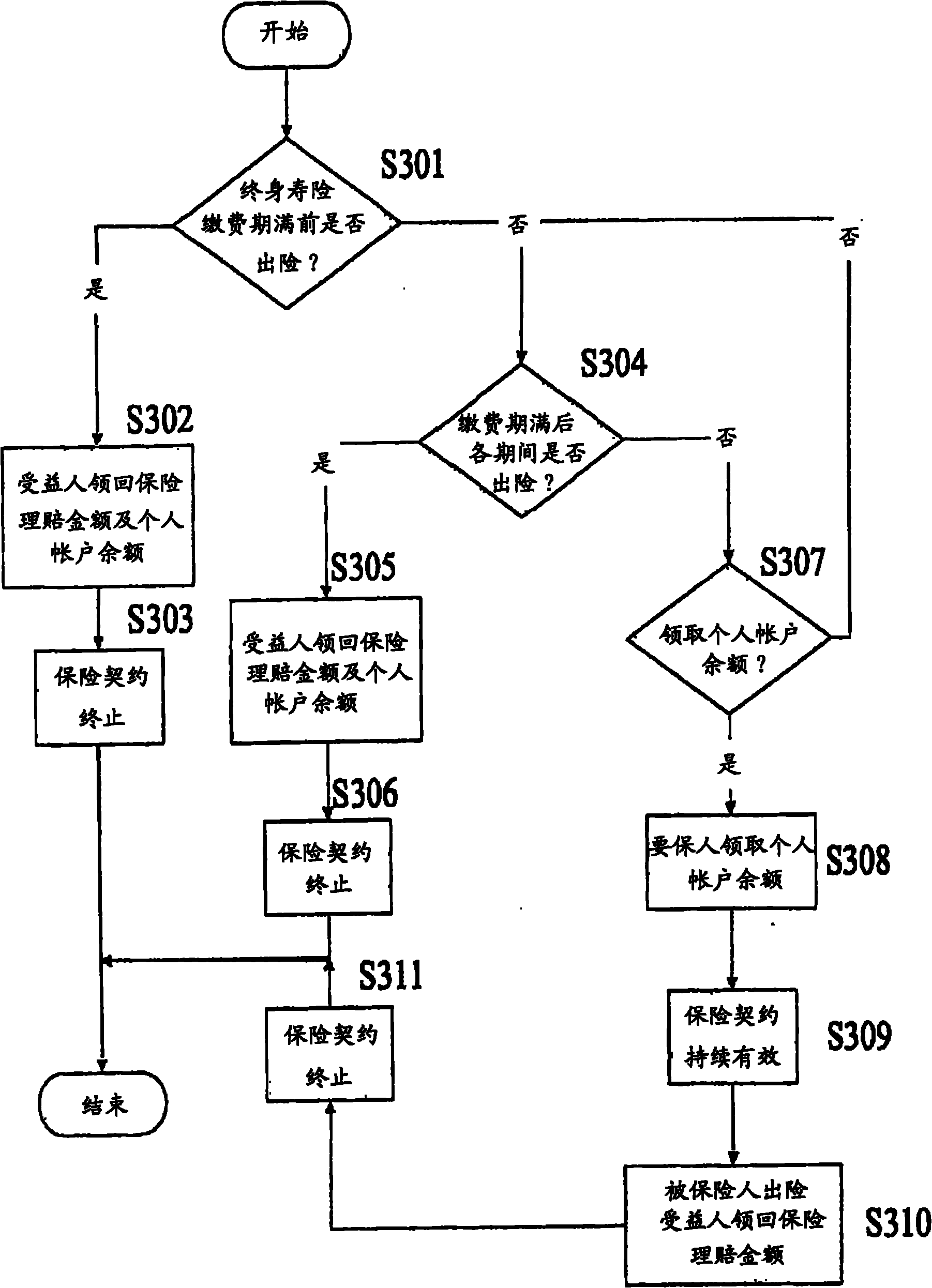

[0039] This invention uses the Taiwan patent application No. 096116081 "method and system for constructing an online autonomous interest rate deposit and loan platform" to create a fund bidding platform based on the law of large numbers, so that the client participating in the platform can According to self-investment judgment, use the fund bidding mechanism of the platform to raise funds to expand credit and increase investment; the client can also adopt a conservative strategy and not participate in the bidding, and only earn interest; financial institutions use the role of platform services to earn formalities fee.

[0040] The insurance platform created by the present invention provides opportunities for insurance companies and consumers to interact, and under the platform fund bidding flow mechanism, a single insurance product can meet the needs of various risk preference groups.

[0041] In order to make the present invention concretely implement, the following specific ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com