System for apparaising life insurance and annuities

a life insurance and annuity technology, applied in the field of computer-based value appraising system, can solve the problems of inefficient life insurance product market for both insurance product proposals and in-force insurance products, inability to exchange information between consumers, lack of real-time auction market, etc., to improve industry-wide profitability, product market efficiency, and better service to customers

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

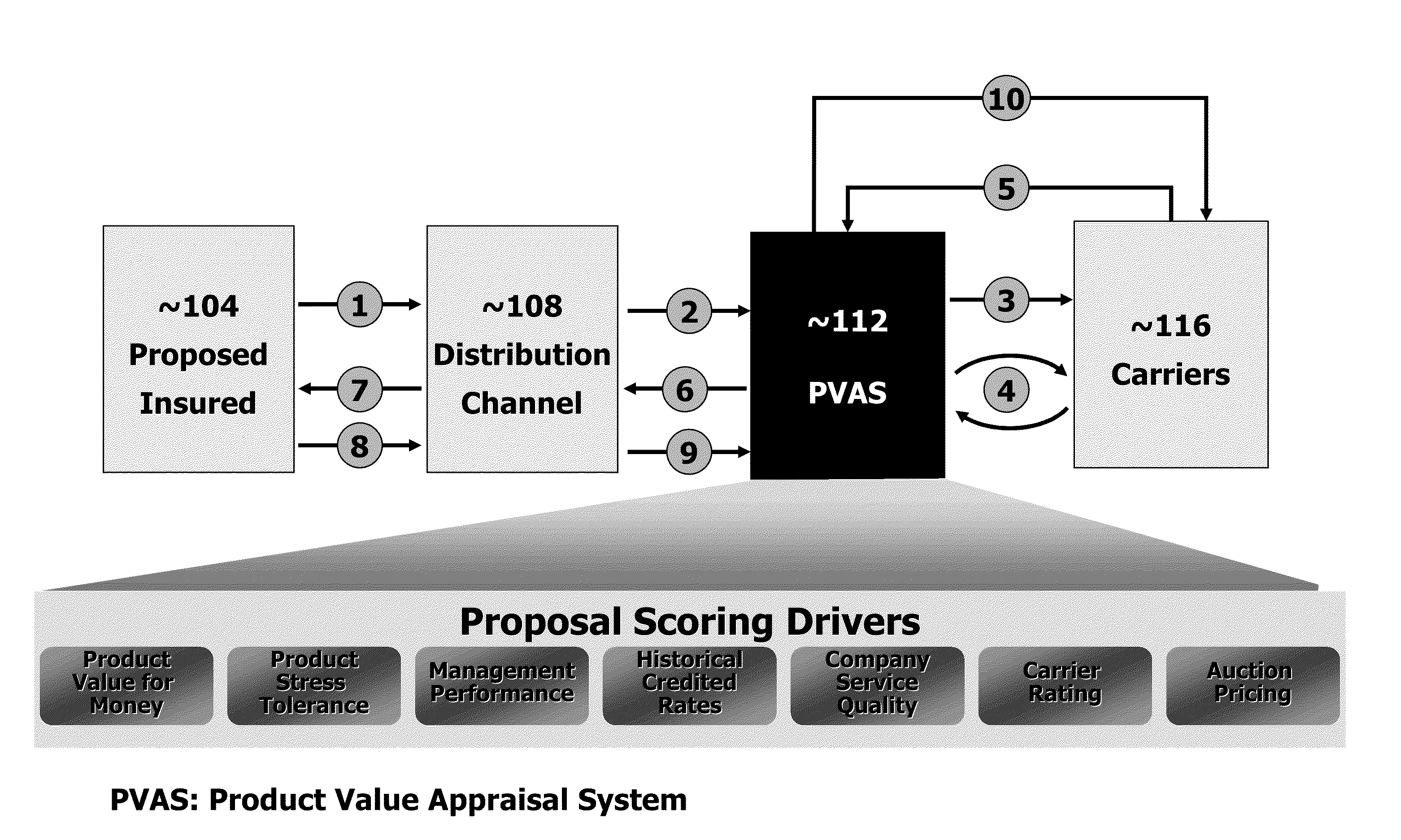

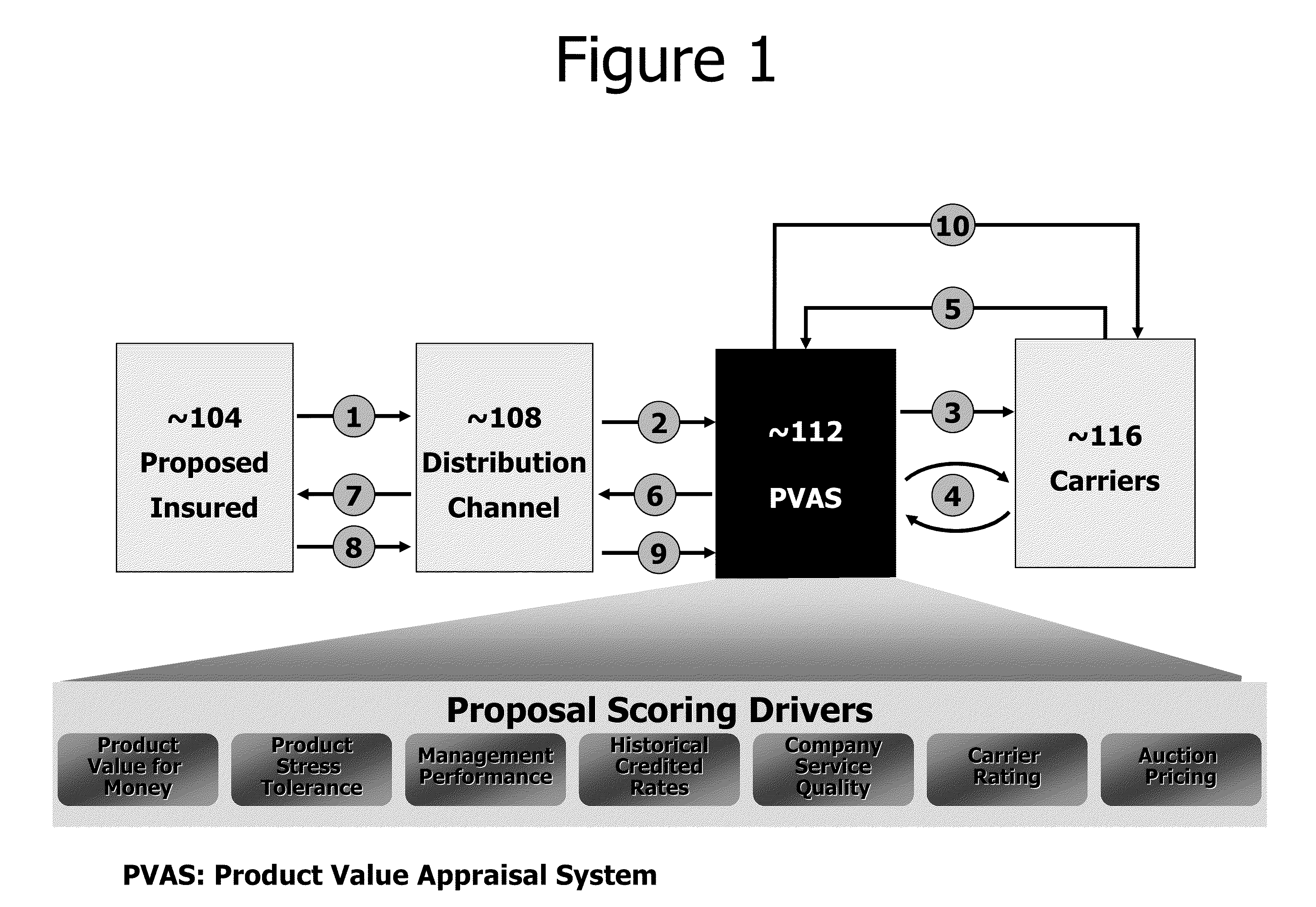

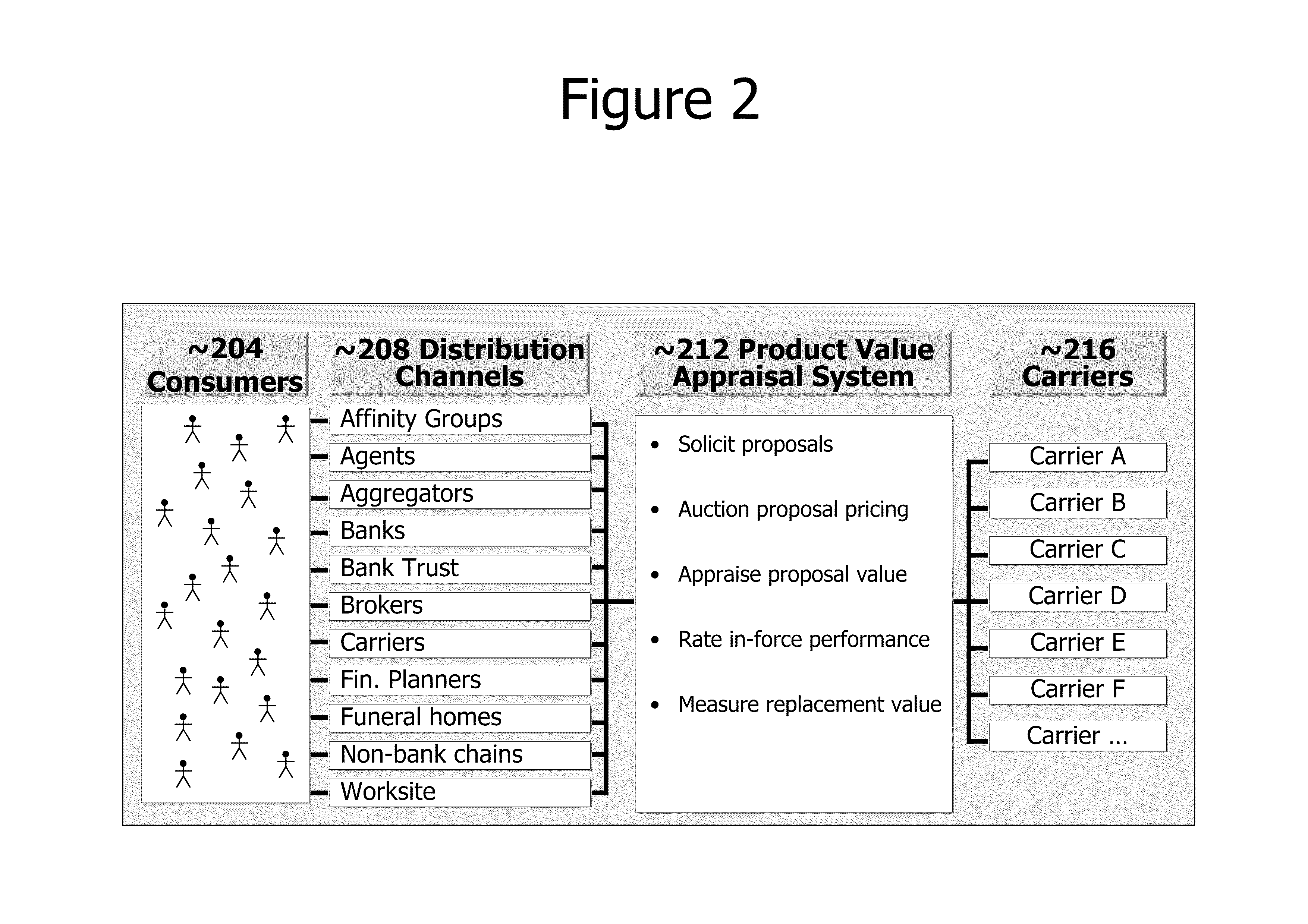

[0035]Reference will now be made in detail to the preferred embodiments of the present invention, examples of which are illustrated in the accompanying drawings.

[0036]The present invention relates to an evaluating system for a life insurance or annuity product under consideration for purchase, the ongoing value of a life insurance or annuity product already owned, or replacing a life insurance or annuity product. In addition, either as a separate process or in conjunction with this process, the product value appraisal system of the present invention enables an on-line, real-time auction process for pricing life insurance and annuity products. The present invention provides a system for appraising a life insurance or annuity product's total value proposition to the consumer. The product value appraisal system operates preferably via the Internet, but may be configured to work off-line or via a closed network or Intranet. The system is configured to support all categories of insurance...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com