Microloan system based on big data intelligent risk control and microloan method thereof

A big data and loan technology, applied in the field of Internet finance, can solve the problems of high operating cost of small loans, difficult to protect the interests of lenders, and high cost of human and material resources, so as to reduce the risk of small loans, achieve high risk prediction accuracy, Comprehensive effect of data audit

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0028] The following examples are used to illustrate the present invention, but are not intended to limit the scope of the present invention.

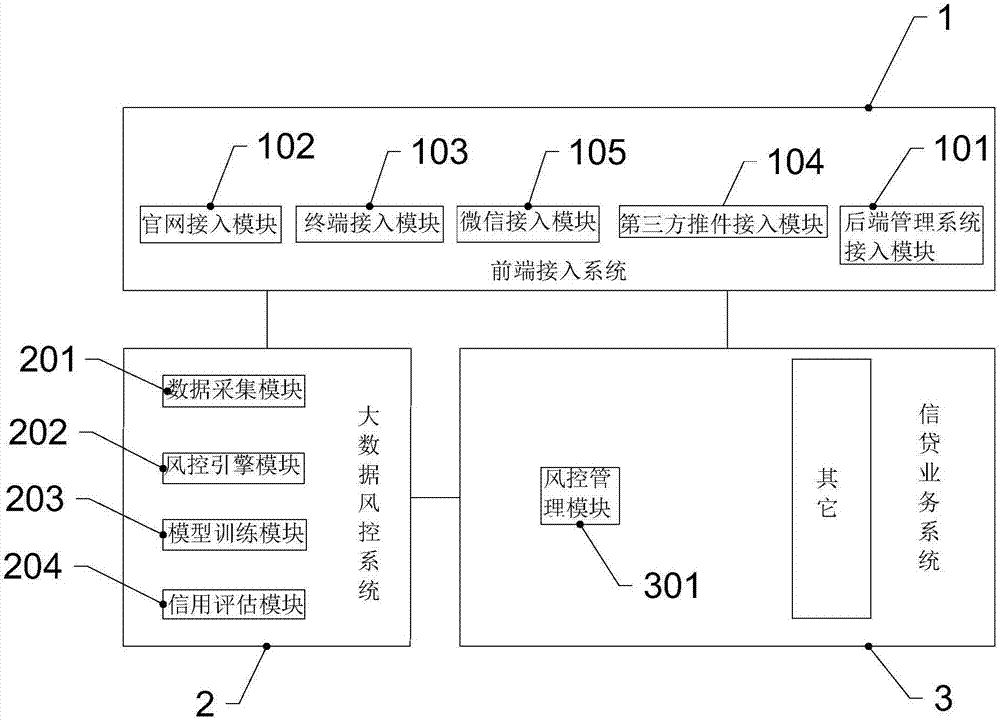

[0029] Such as figure 1 As shown, a small loan system based on big data intelligent risk control, the small loan system includes a background management server, and the background management server includes a front-end access system 1, a big data risk control system 2, and a loan business system 3;

[0030] The front-end access system 1 includes a background management system access module 101, an official website access module 102, a terminal access module 103, and a third-party push piece access module 104; the background management system access module 101 is used to realize the microcredit system business management; the official website access module 102 is used to realize the data connection between the micro-loan system and the official website; the terminal access module 103 is used to realize the data connection between the mi...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com