A multi-channel customized credit card intelligent application system

A credit card and multi-channel technology, applied in data processing applications, sales/lease transactions, finance, etc., can solve the problems of inconvenient storage and management of paper documents, long development cycle, and difficult system monitoring, etc., to achieve convenient and efficient online card application Experience, reduce the cost of manpower and material resources, and improve the effect of supervision ability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0038] The present invention will be described in detail below in conjunction with the accompanying drawings and specific embodiments.

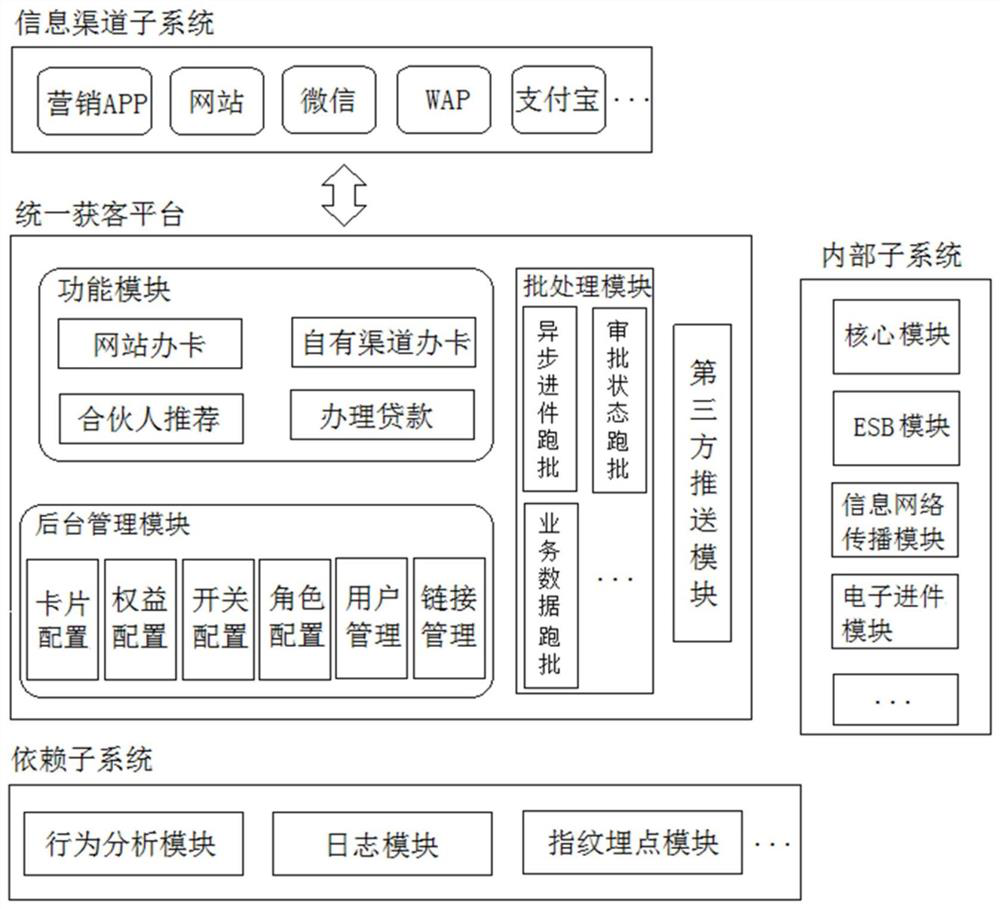

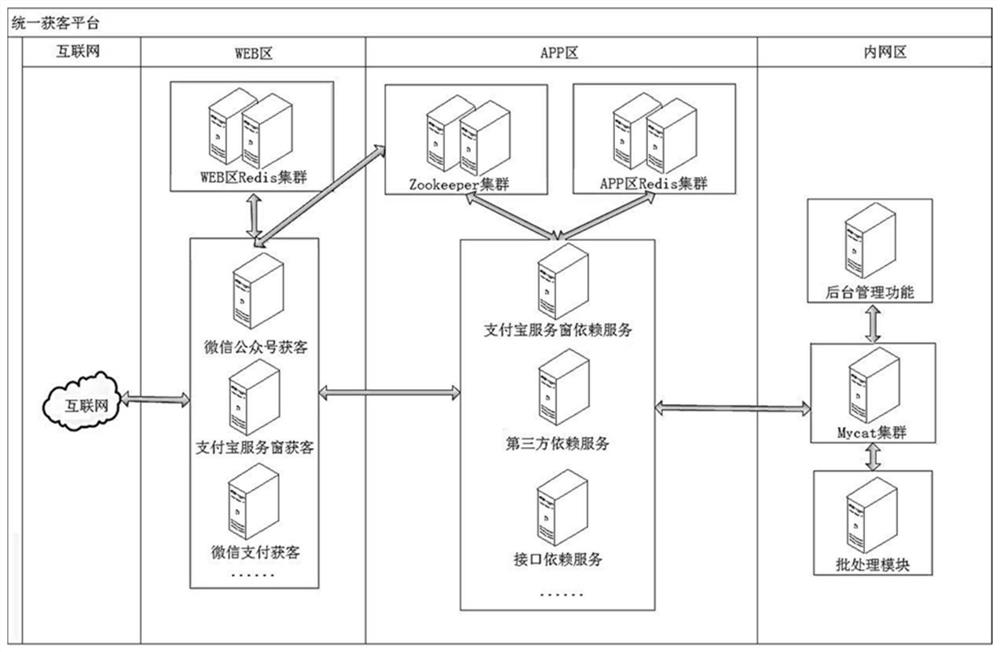

[0039] Such as figure 1 As shown, the present invention relates to a multi-channel customized credit card intelligent application system, including an information channel subsystem, a unified customer acquisition platform, an internal subsystem and a dependent subsystem. The information channel subsystem realizes information interaction with the unified customer acquisition platform; the unified customer acquisition platform is connected with dependent subsystems and internal subsystems respectively.

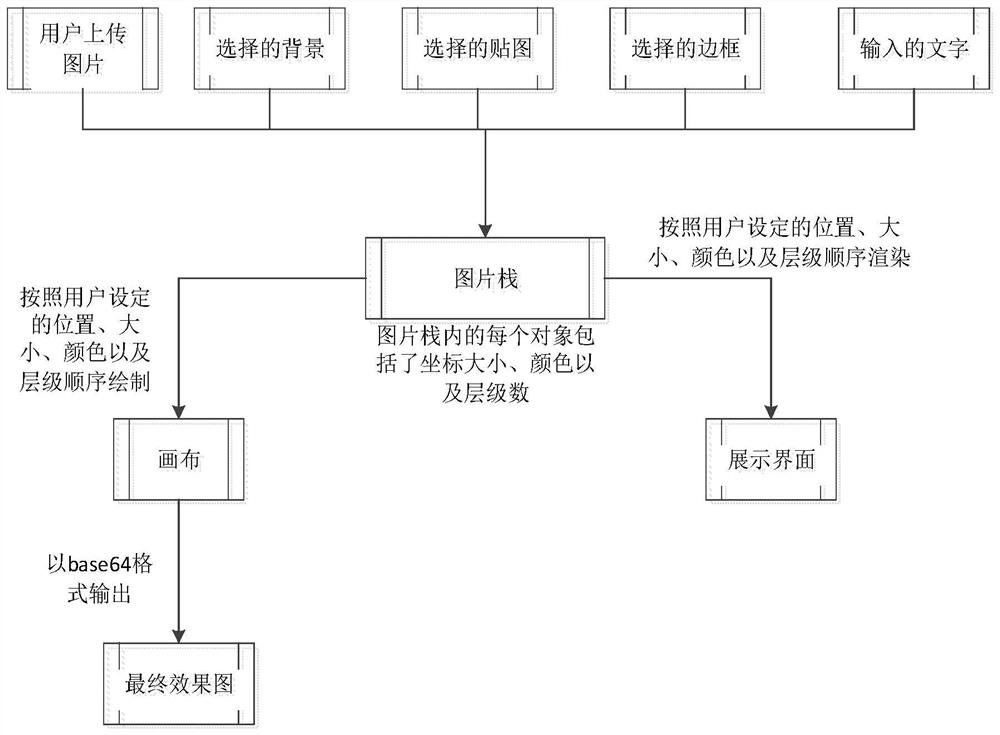

[0040] The information channel subsystem includes a variety of online card application data sending units and online payment units. The online card application data sending unit includes the bank’s own website, WeChat official account, banking APP, marketing APP, WeChat applet, partners and other channels. It can support the field configuratio...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com