Patents

Literature

117 results about "Customer acquisition" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

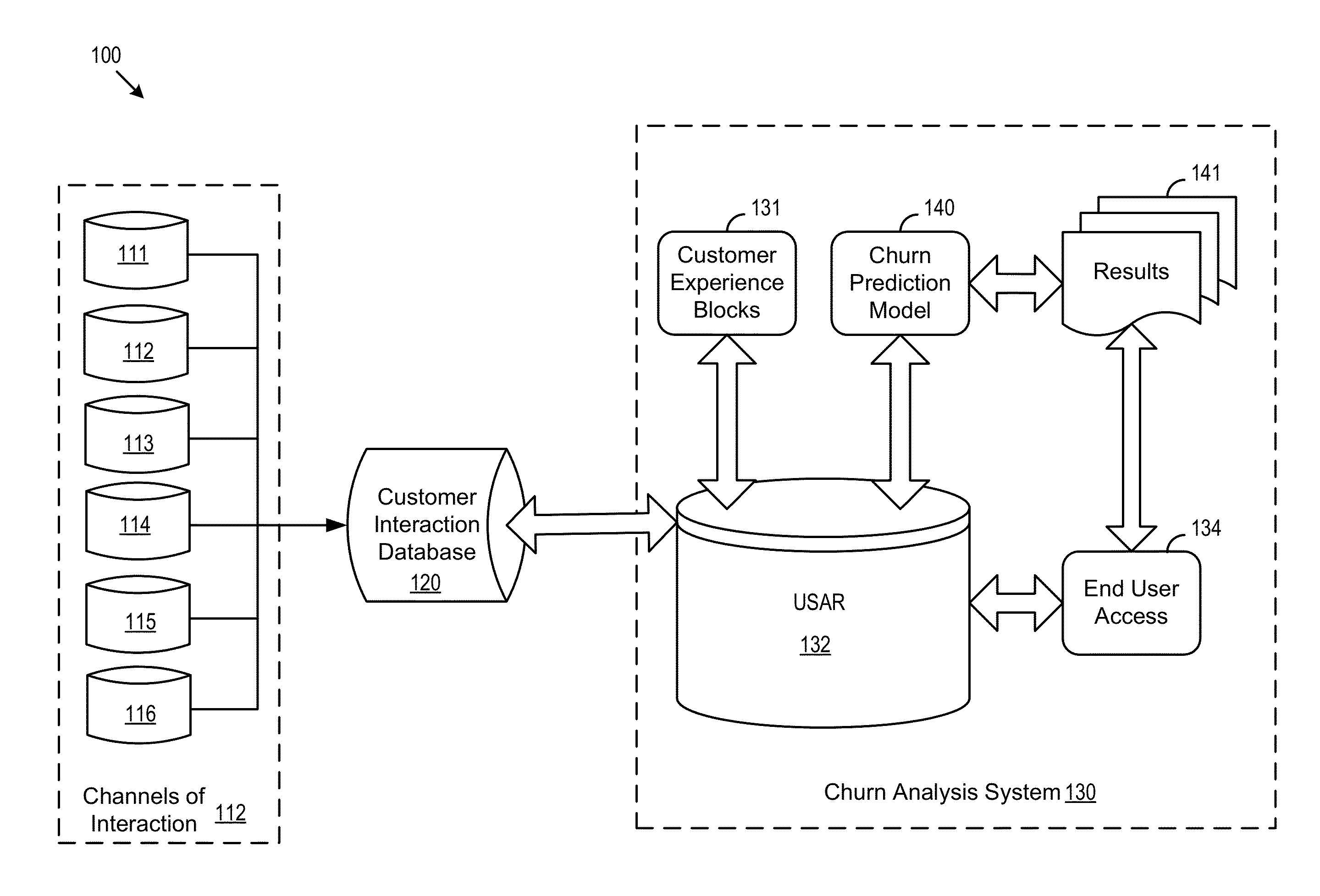

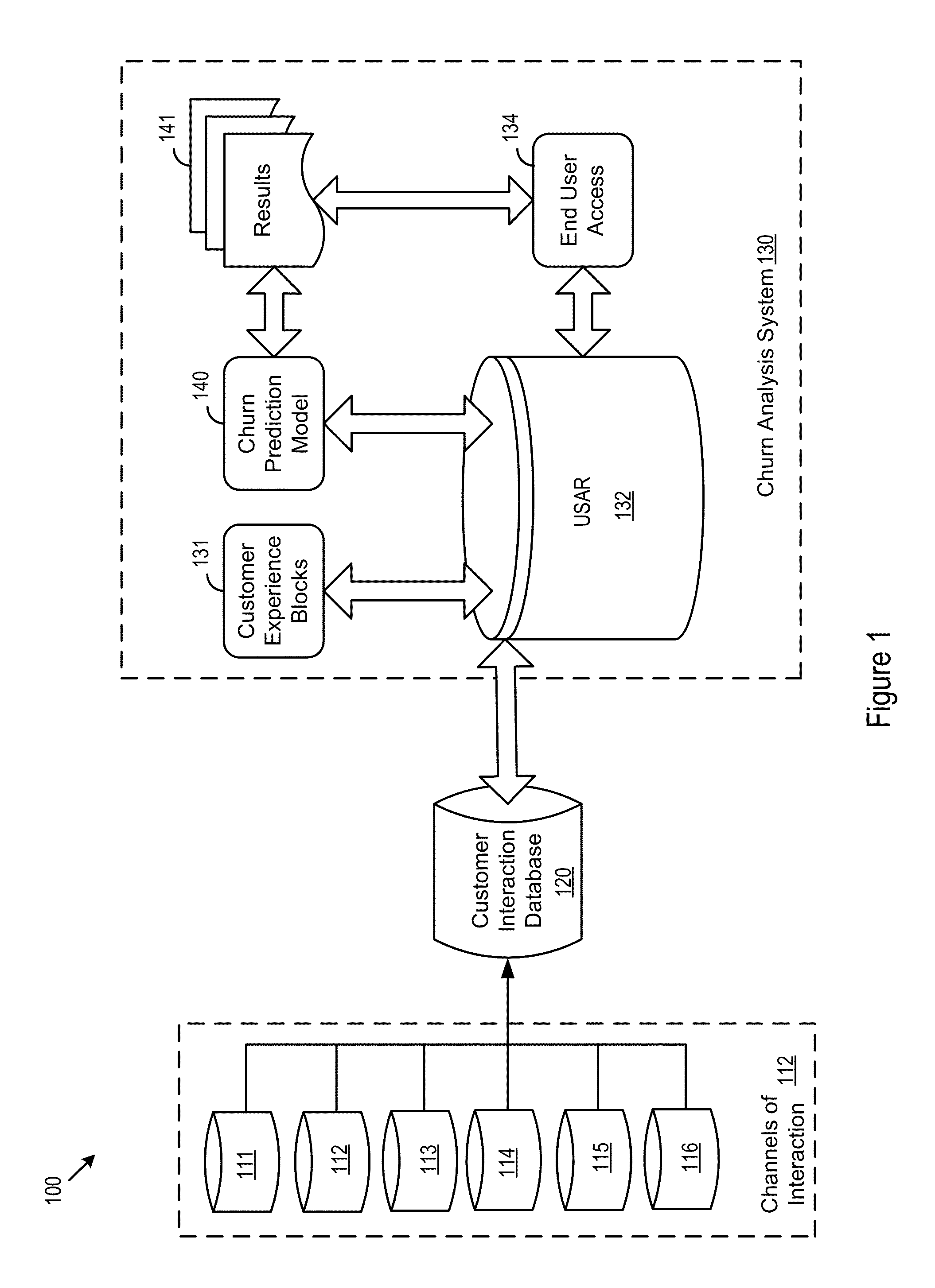

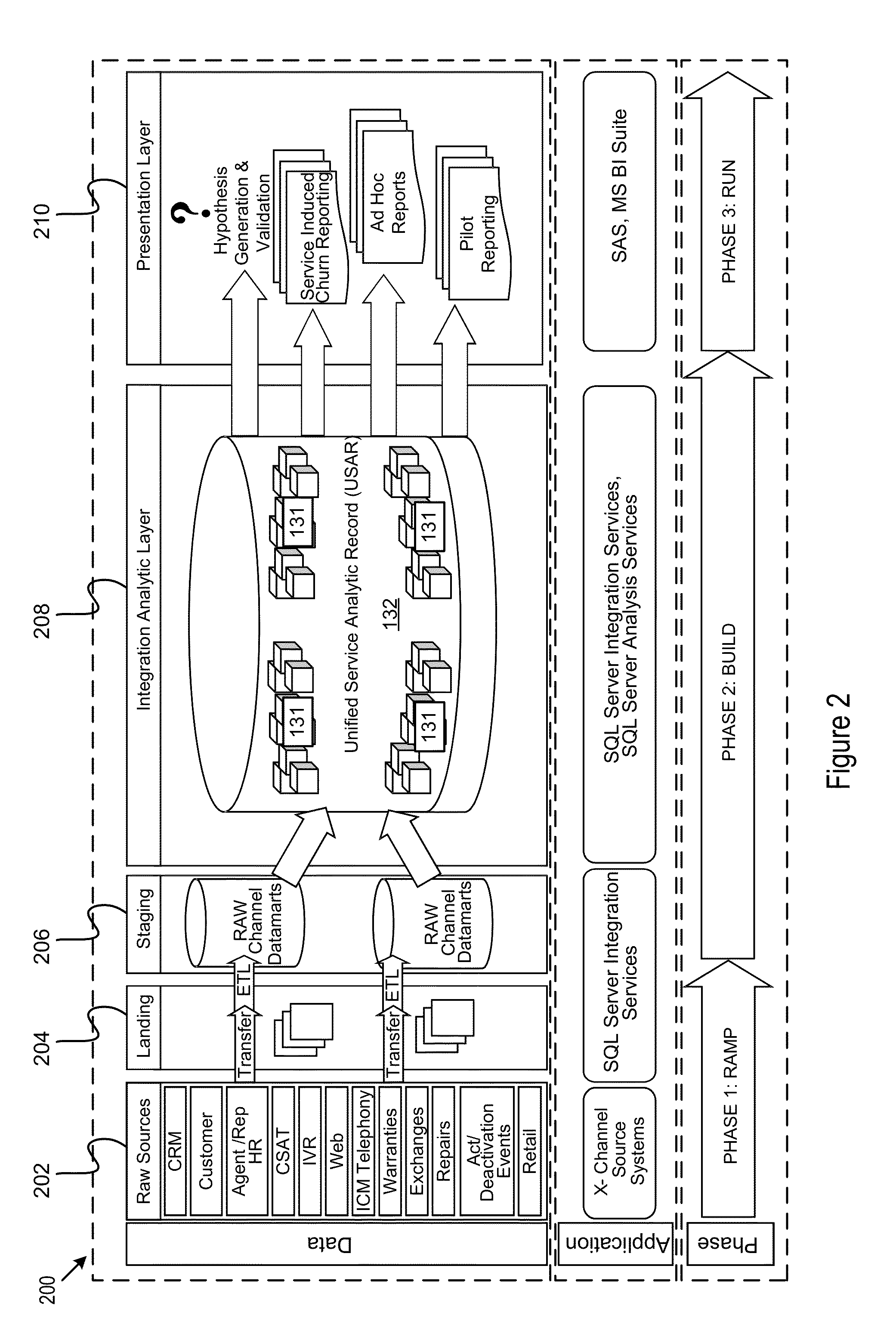

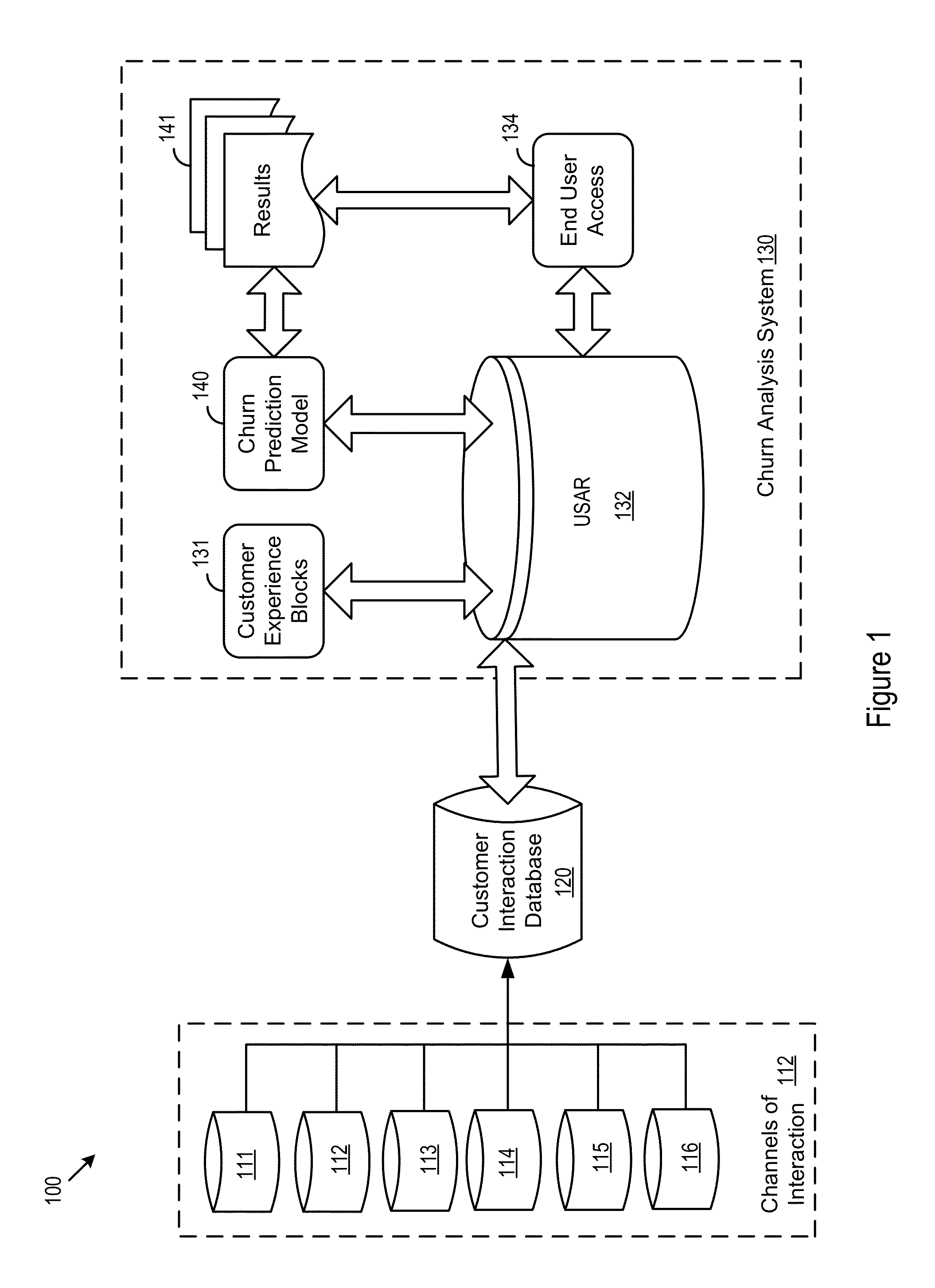

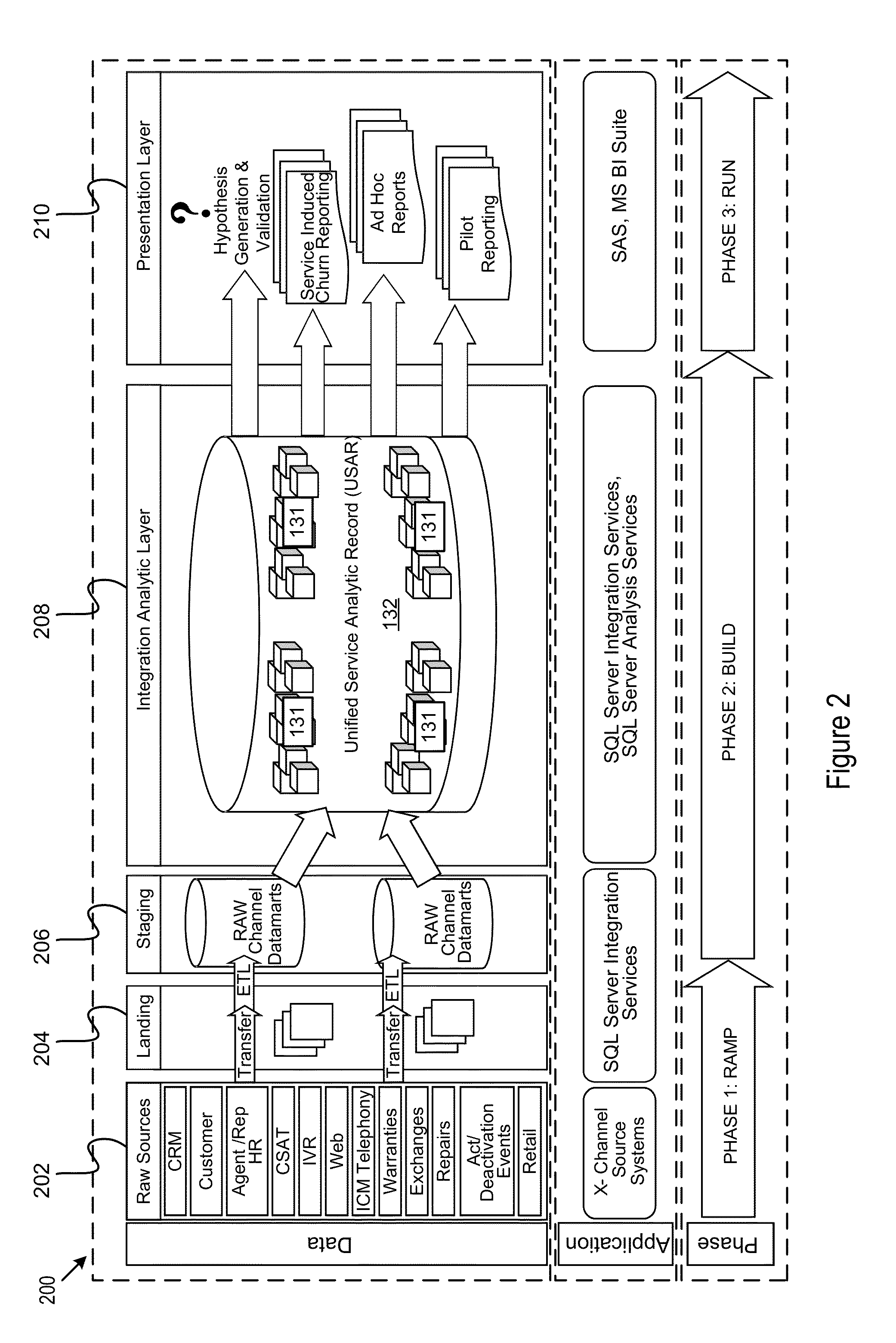

Churn analysis system

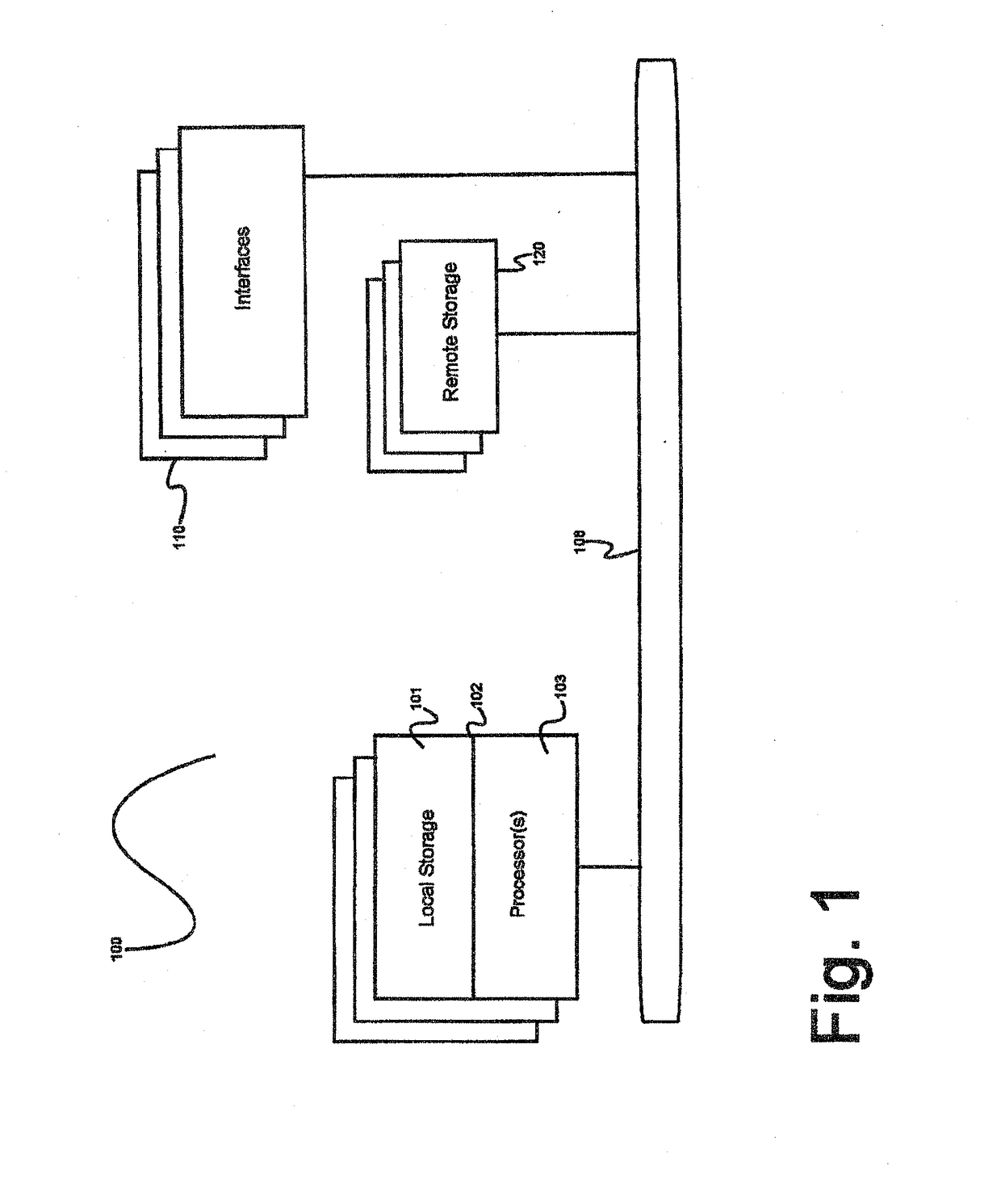

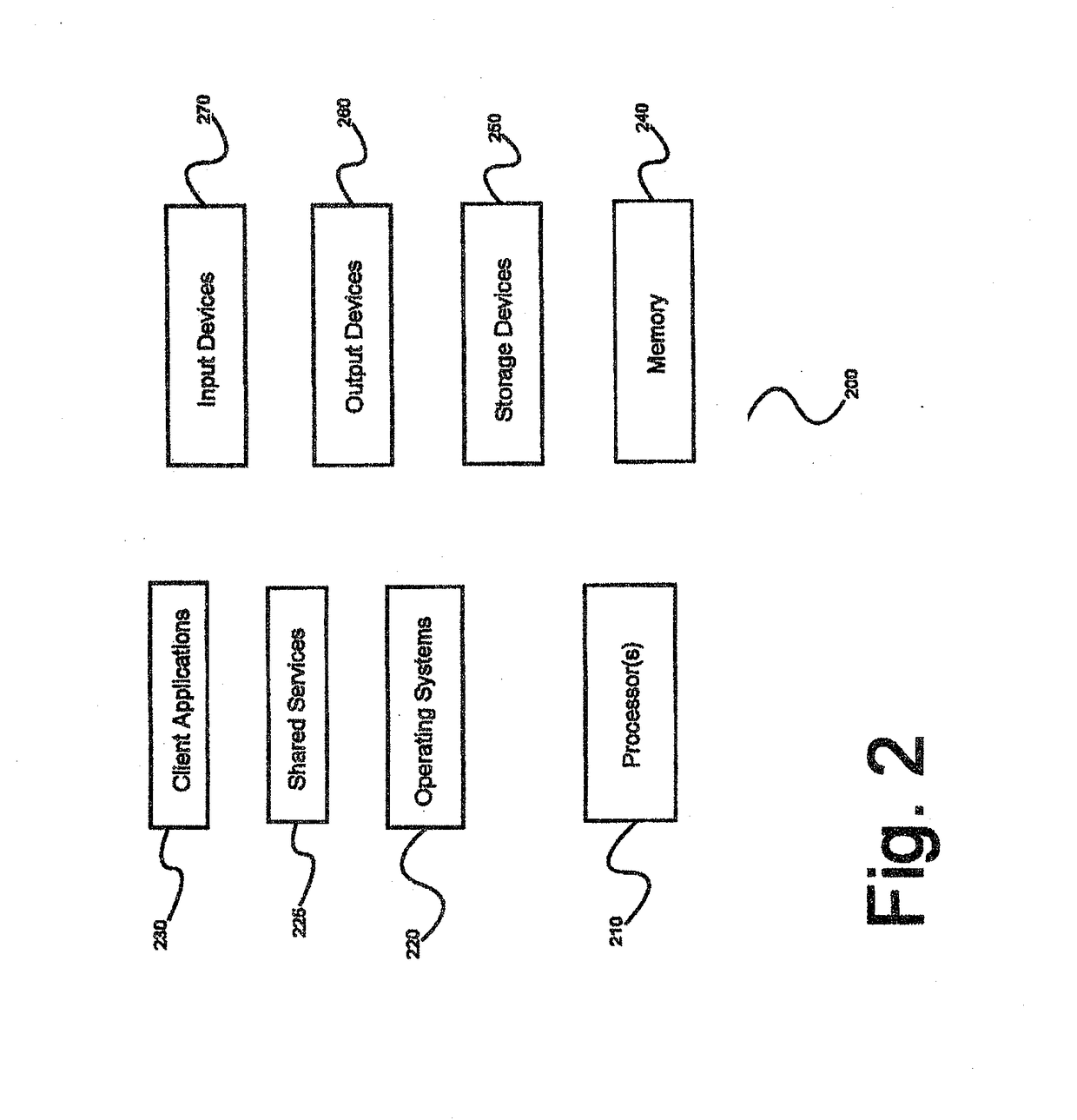

A churn analysis system helps a business analyze, predict, and reduce customer churn. The system analyzes customer experiences by using an insightful block level approach to correlate customer experience with customer churn. Through the block level approach, the system is able to more accurately predict and effectively reduce future customer churn. As a result, businesses are able to reduce customer acquisition costs and improve customer retention rates.

Owner:ACCENTURE GLOBAL SERVICES LTD

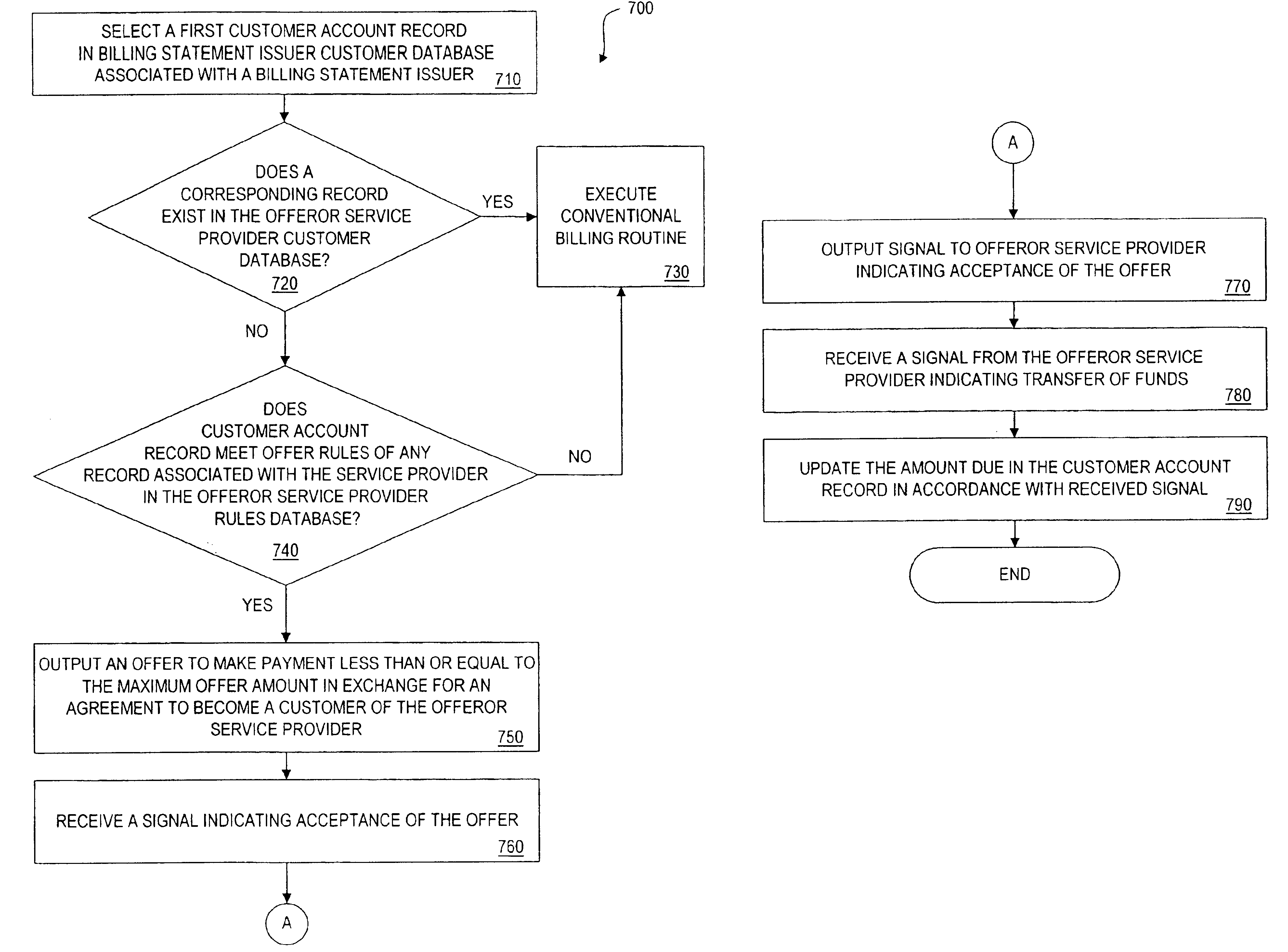

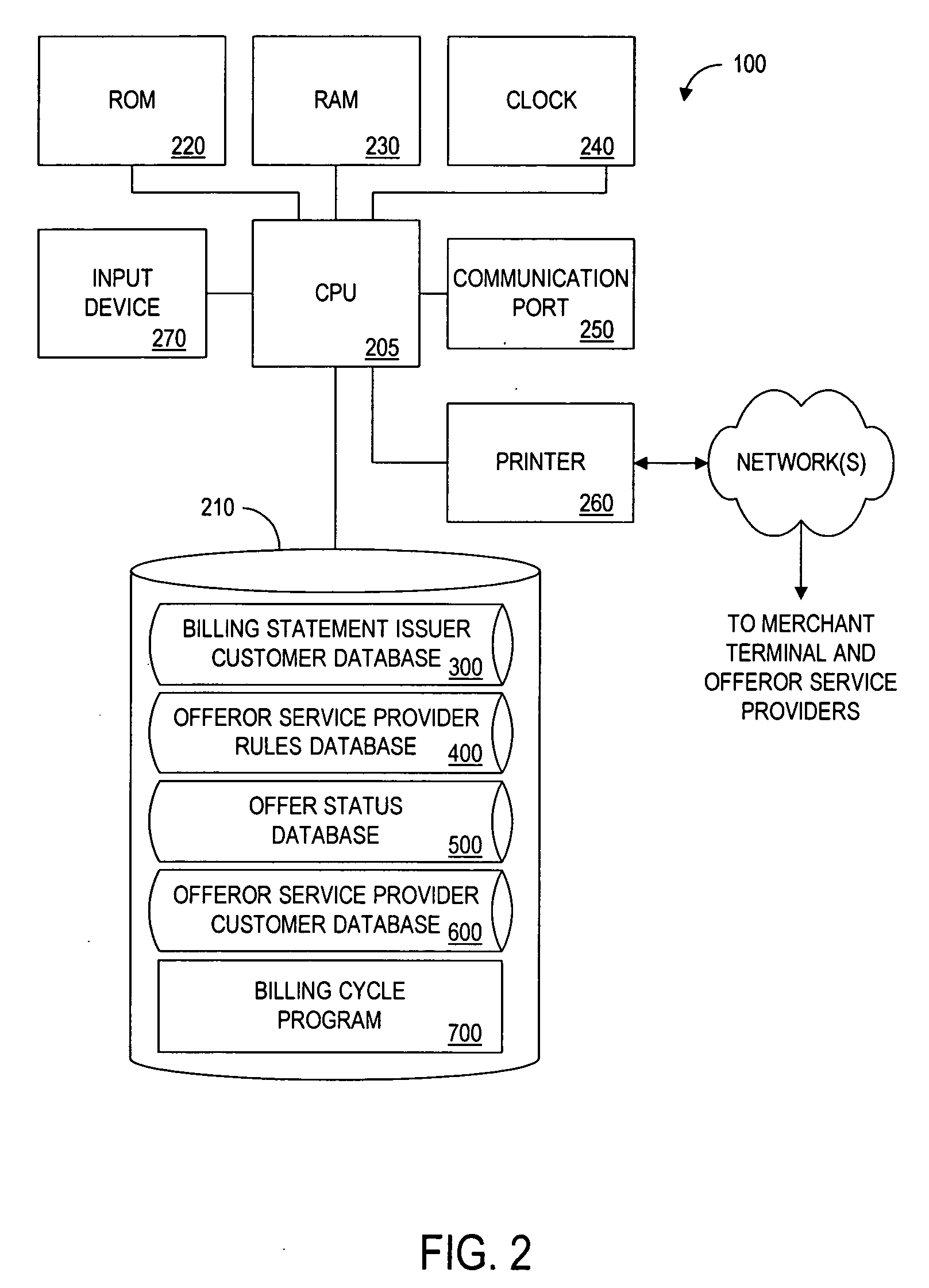

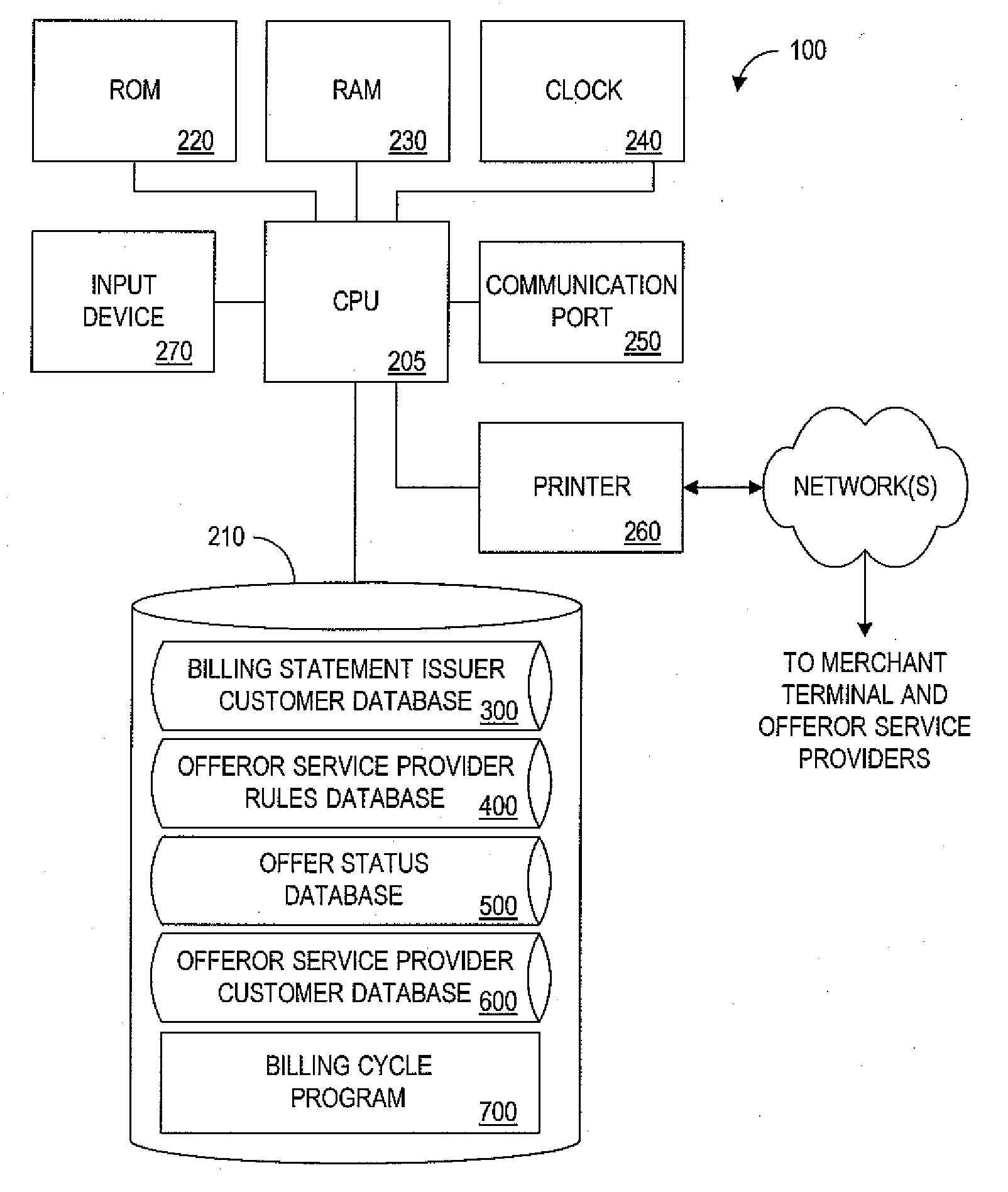

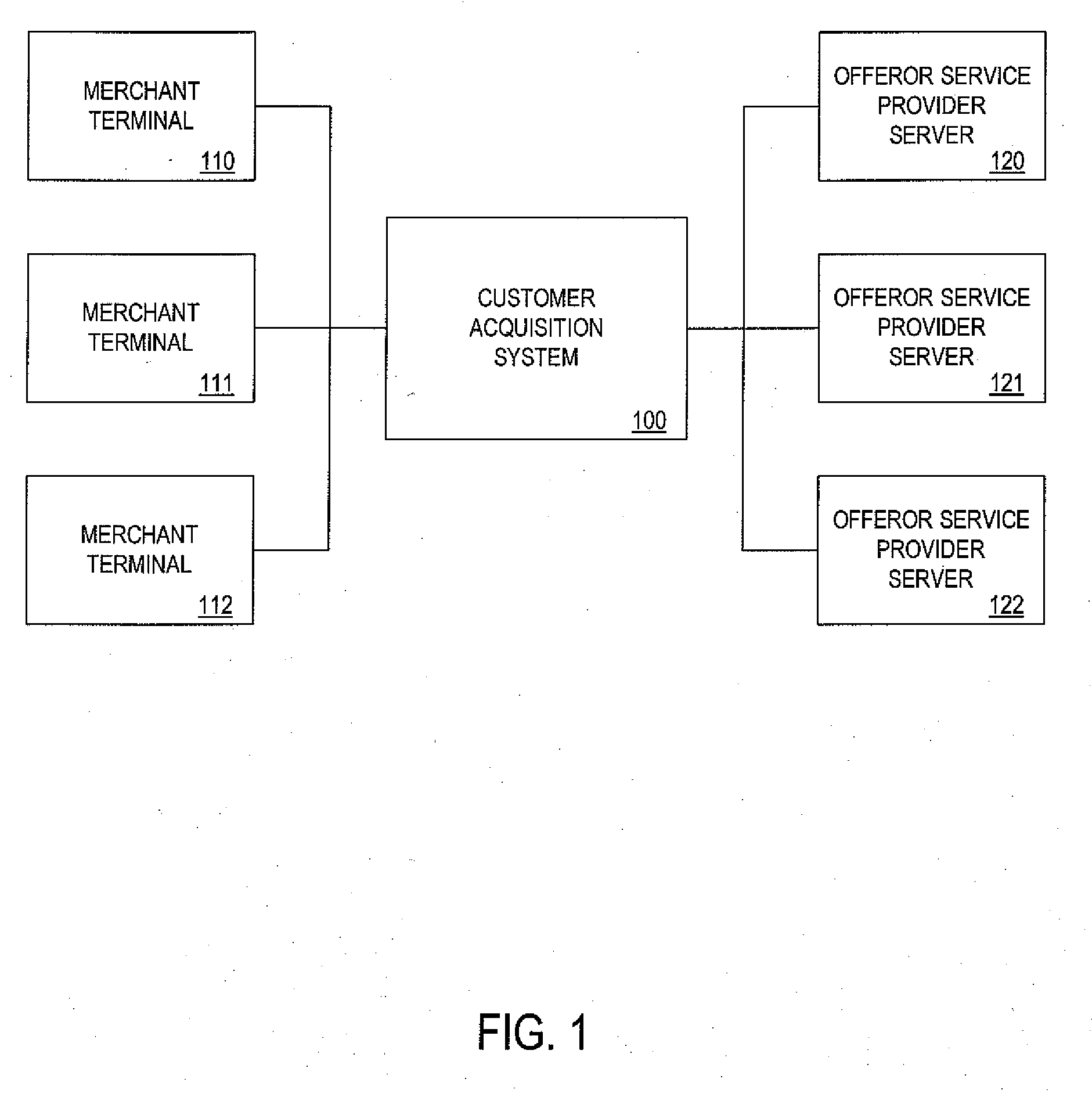

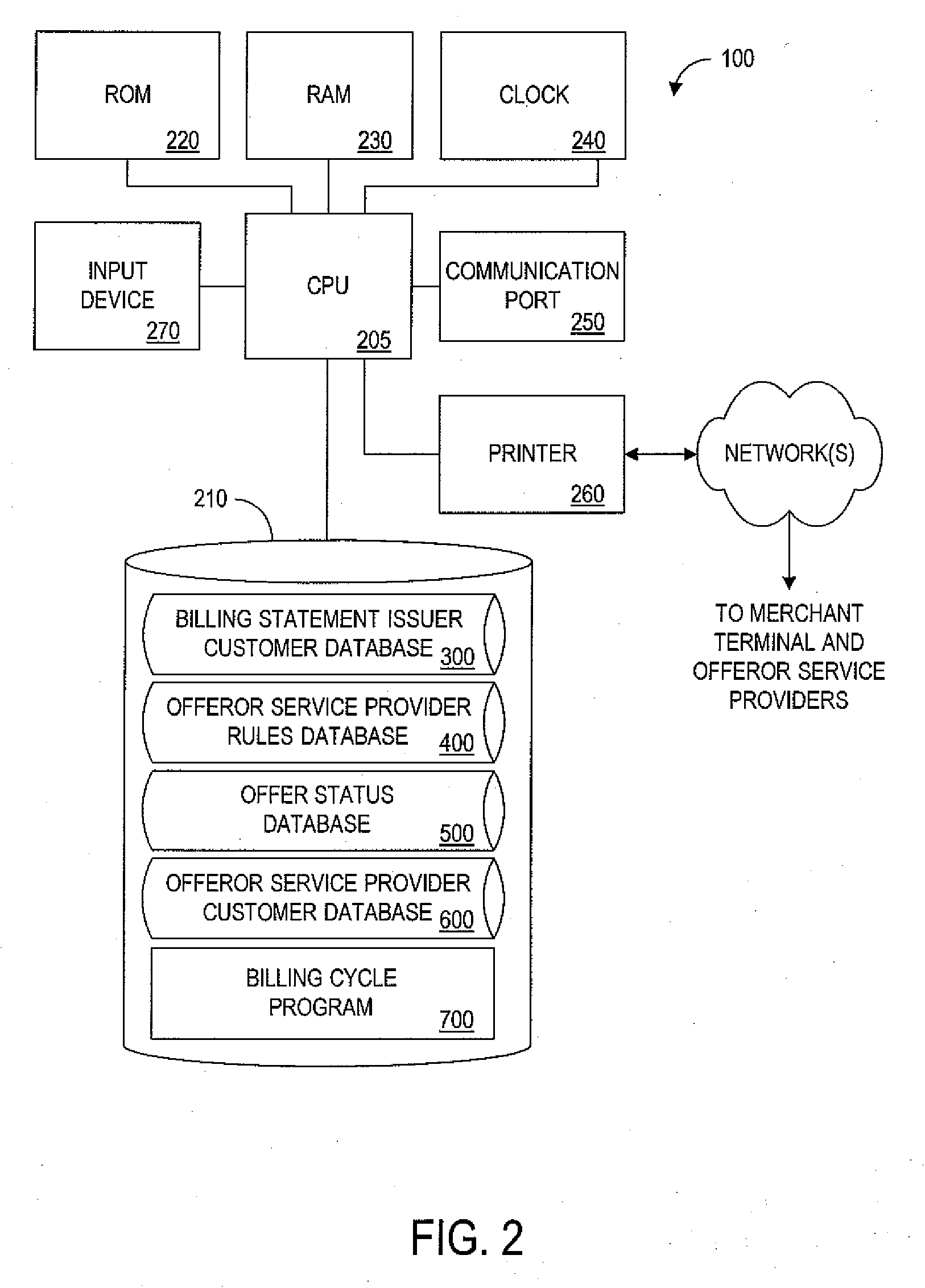

Billing statement customer acquistion system

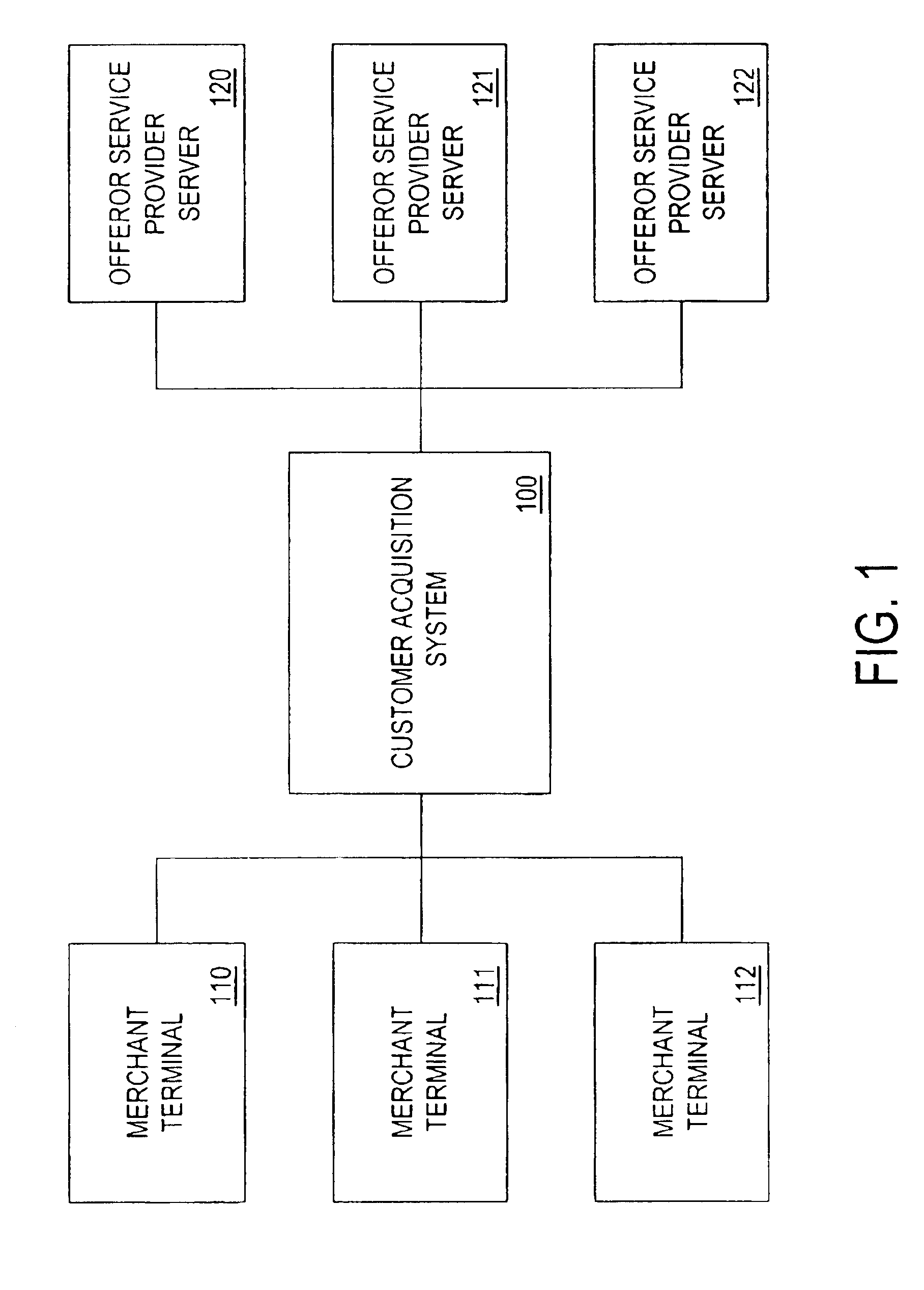

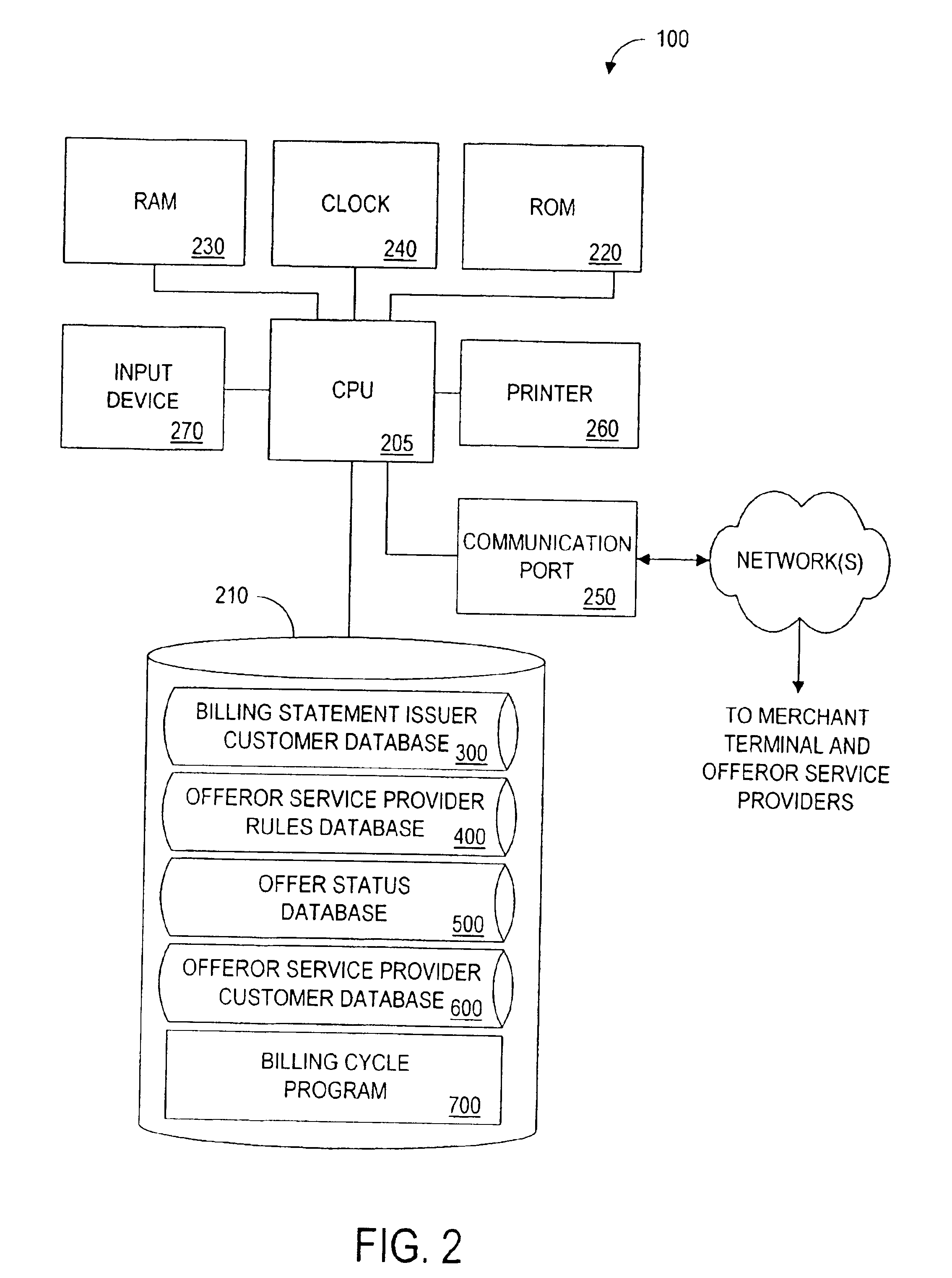

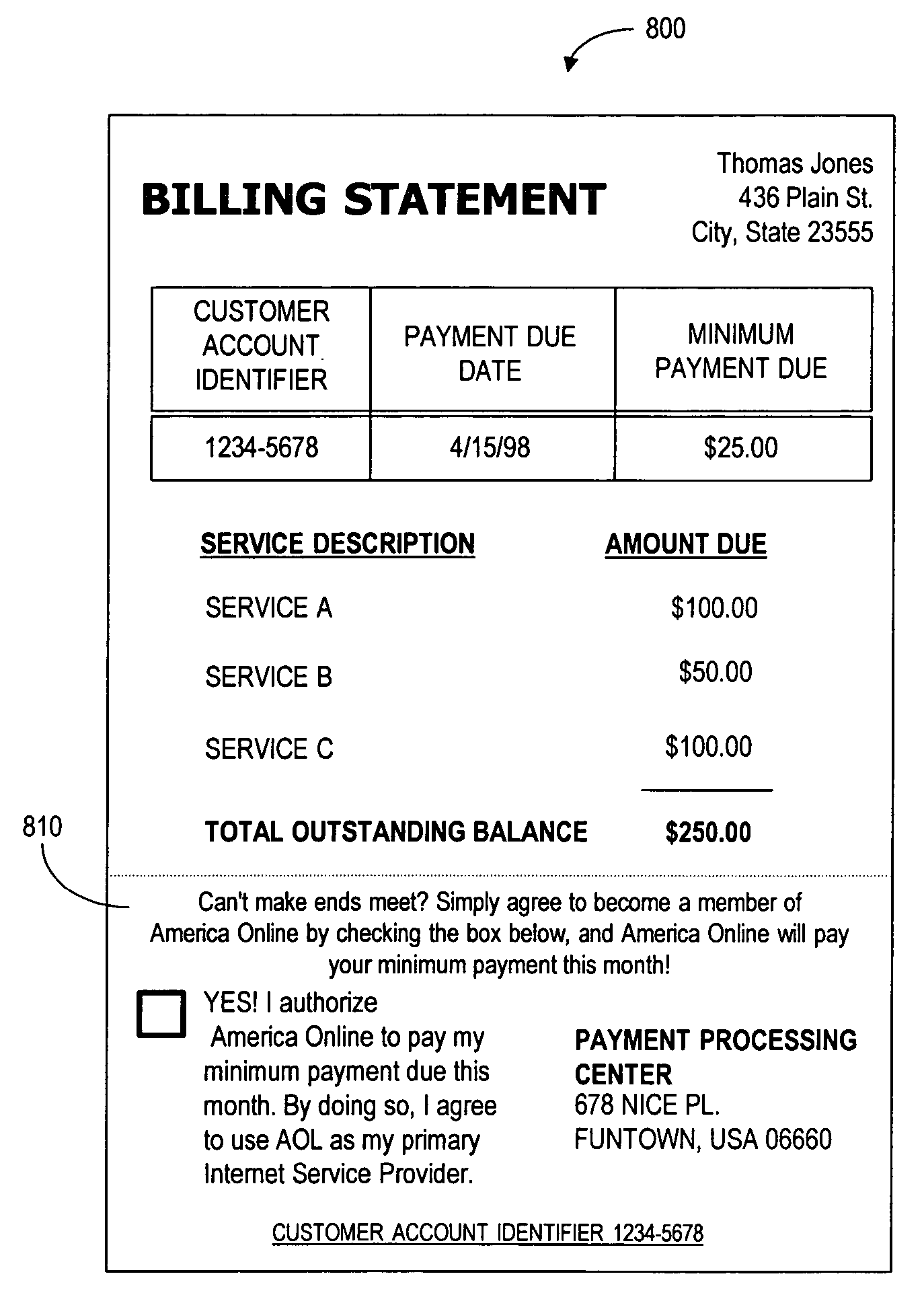

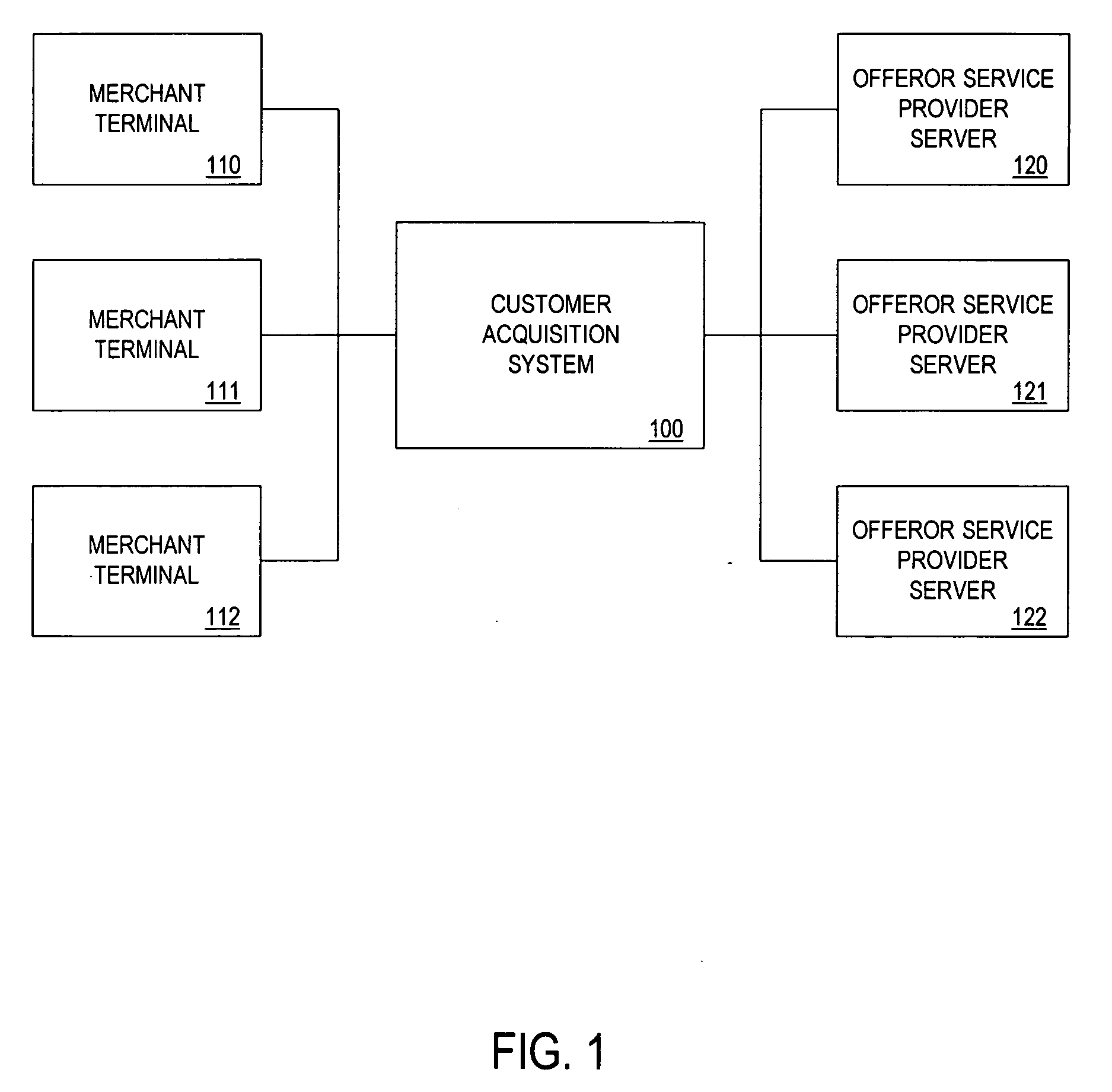

A customer acquisition system is disclosed that allows an offeror service provider to acquire new customers by making acquisition offers to customers through the billing statements of other businesses (“billing statement issuers”). An “acquisition offer” is an offer by the offeror service provider to pay an amount owed by the customer to the billing statement issuer, or a portion thereof, provided the customer agrees to become a customer of the offeror service provider. Predetermined criteria are used to automatically include an acquisition offer for eligible potential new customers of the offeror service provider with a billing statement or on associated promotional materials, and allows the customer to accept the acquisition offer using the billing statement. The customer acquisition system optionally ensures that the customer is not an existing customer of the offeror service provider before extending an acquisition offer. The acquisition offers can be tailored to the amount owed by the customer, and targeted to customers based on financial, geographic or historical data.

Owner:WALKER ASSET MANAGEMENT PARTNERSHIP +1

Billing statement customer acquisition system

A customer acquisition system is disclosed that allows an offeror service provider to acquire new customers by making acquisition offers to customers through the billing statements of other businesses (“billing statement issuers”). An “acquisition offer” is an offer by the offeror service provider to pay an amount owed by the customer to the billing statement issuer, or a portion thereof, provided the customer agrees to become a customer of the offeror service provider. Predetermined criteria are used to automatically include an acquisition offer for eligible potential new customers of the offeror service provider with a billing statement or on associated promotional materials, and allows the customer to accept the acquisition offer using the billing statement. The customer acquisition system optionally ensures that the customer is not an existing customer of the offeror service provider before extending an acquisition offer. The acquisition offers can be tailored to the amount owed by the customer, and targeted to customers based on financial, geographic or historical data.

Owner:PAYPAL INC

Billing statement customer acquistion system

A customer acquisition system is disclosed that allows an offeror service provider to acquire new customers by making acquisition offers to customers through the billing statements of other businesses (“billing statement issuers”). An “acquisition offer” is an offer by the offeror service provider to pay an amount owed by the customer to the billing statement issuer, or a portion thereof, provided the customer agrees to become a customer of the offeror service provider. Predetermined criteria are used to automatically include an acquisition offer for eligible potential new customers of the offeror service provider with a billing statement or on associated promotional materials, and allows the customer to accept the acquisition offer using the billing statement. The customer acquisition system optionally ensures that the customer is not an existing customer of the offeror service provider before extending an acquisition offer. The acquisition offers can be tailored to the amount owed by the customer, and targeted to customers based on financial, geographic or historical data.

Owner:PAYPAL INC

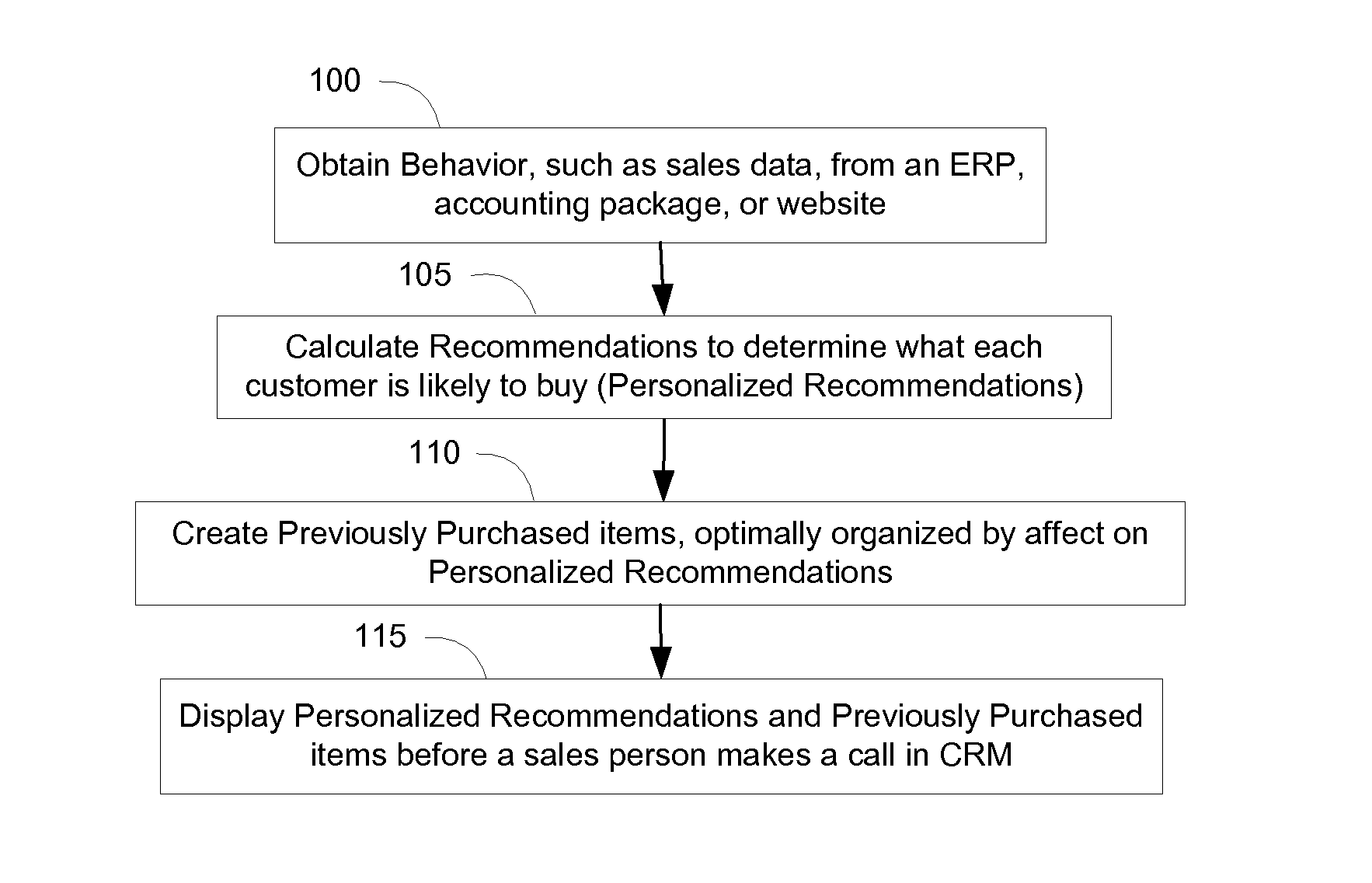

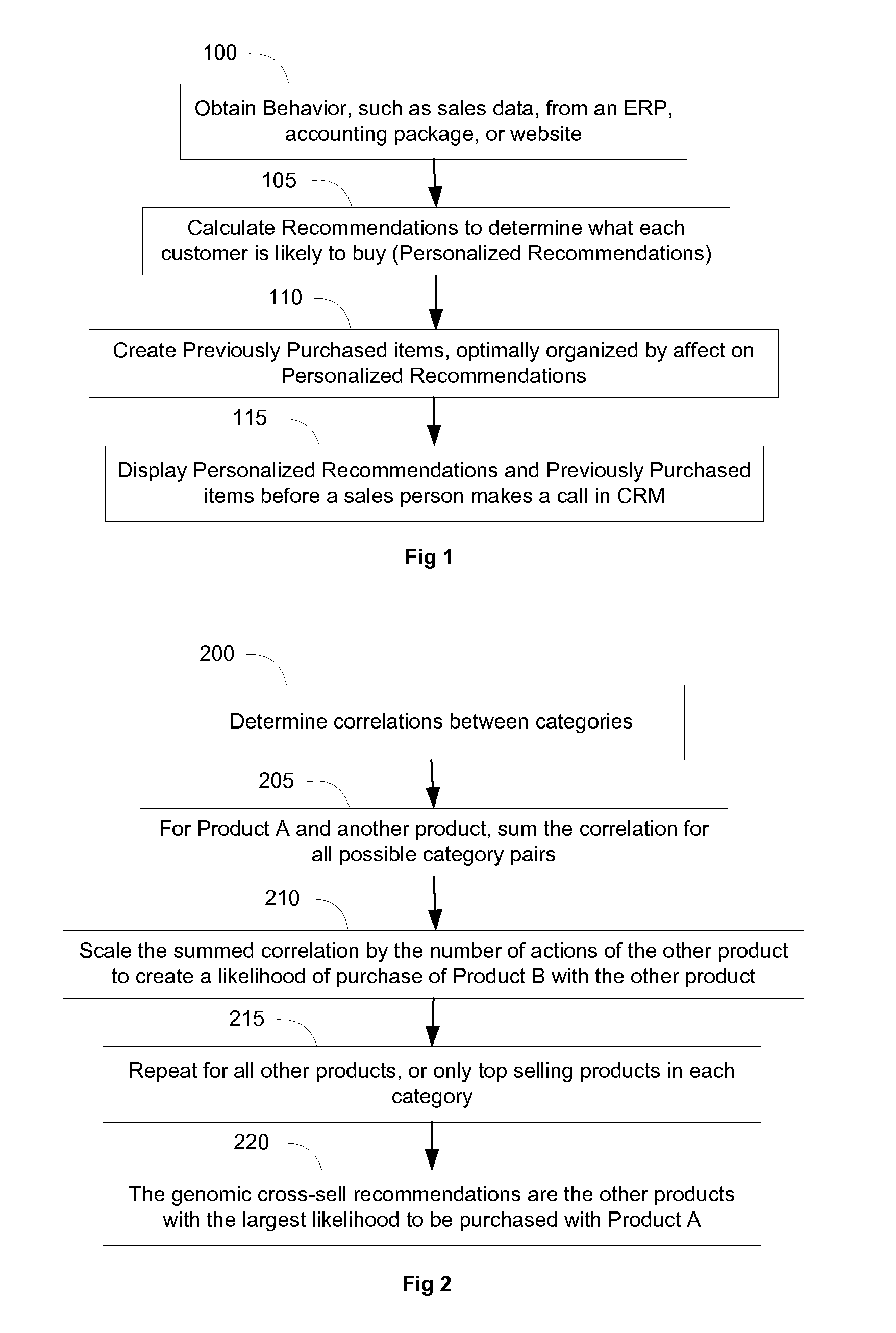

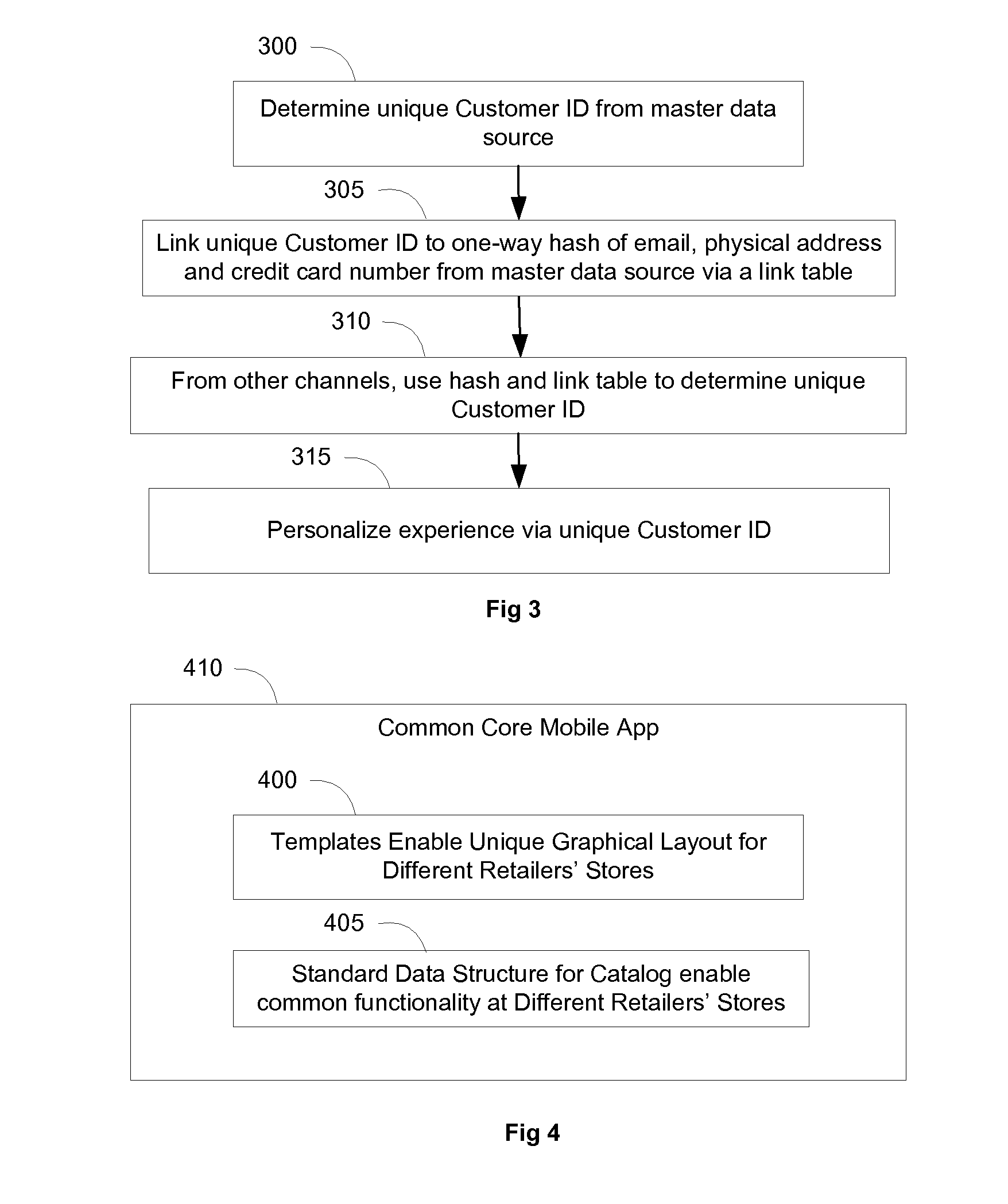

Next Generation Improvements in Recommendation Systems

ActiveUS20140172627A1Easy to optimizeImprove the level ofBuying/selling/leasing transactionsMarketingPersonalizationMobile apps

This invention deals with the next generation improvements in recommendation systems. Retailers want to grow their business and increase sales. One embodiment displays recommendations for inside sales during calls to prospects via a CRM. Another embodiment improves genomic cross-sell by summing correlations between attributes. A third embodiment improves cross-channel personalization by linking personal information, preferably via a one-way hash, to a unique customer ID. A fourth embodiment enables a common core mobile app for different retailers. A fifth embodiment identifies a shopper before purchase to provide personal recommendations while shopping. A sixth embodiment utilizes a market place with shared customers for customer acquisition. A seventh embodiment utilizes customers' preferences and characteristics and sales data to influence recommendations. The characteristics can be combined into a shopper psychographic persona to generate recommendations. An eight embodiment is a market place for customers to shop, which is used for customer acquisition for participating retailers. A ninth embodiment shows how to improve search results based upon analysis of purchase data, and correlation of clicks on search results and search terms. A tenth embodiment calculates a buy index based upon value of products purchased versus products viewed to segment shoppers to determine discounts and re-marketing. An eleventh embodiment automates the creation of a dynamic website, usually for responsive design.

Owner:B7 INTERACTIVE LLC

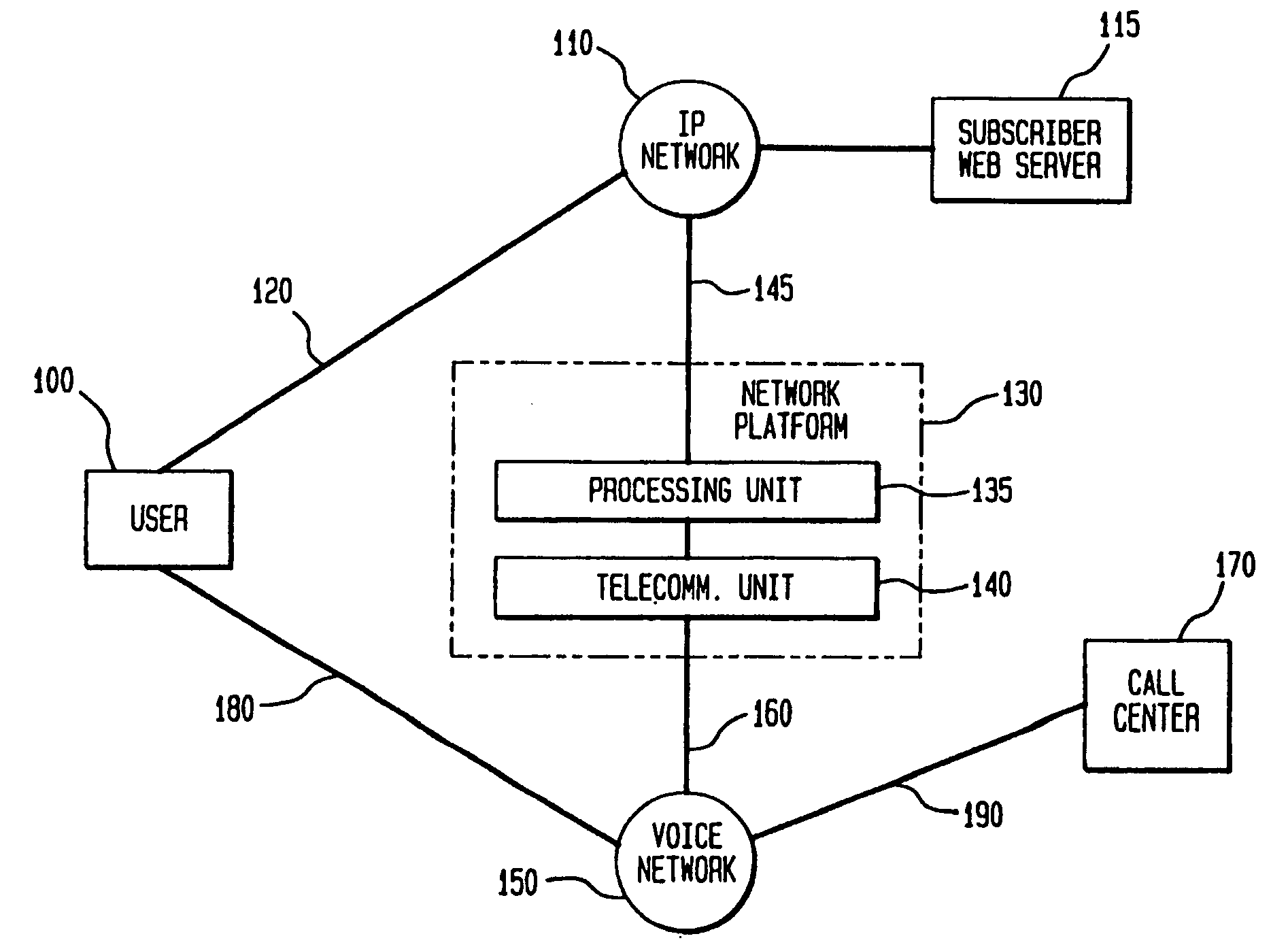

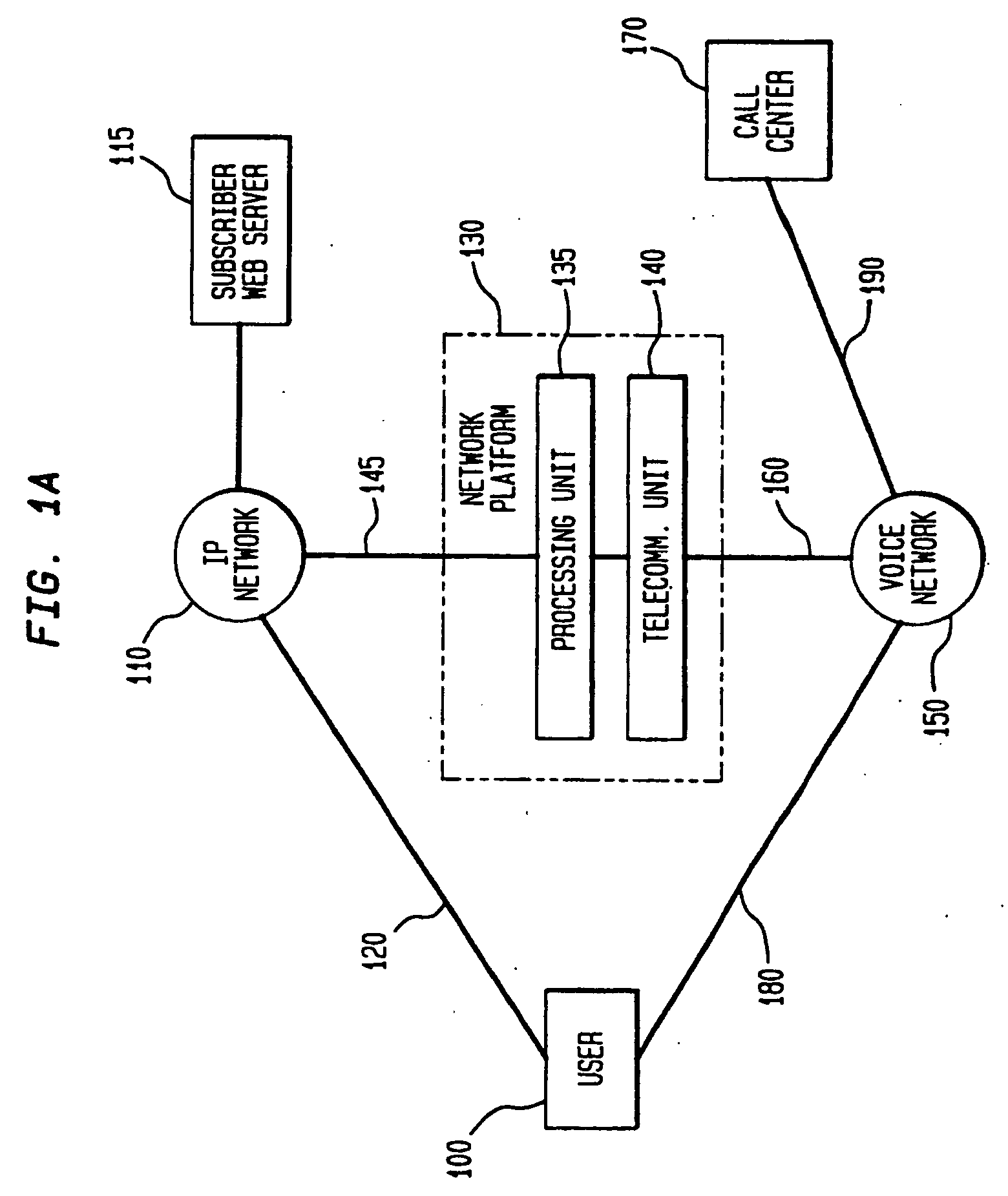

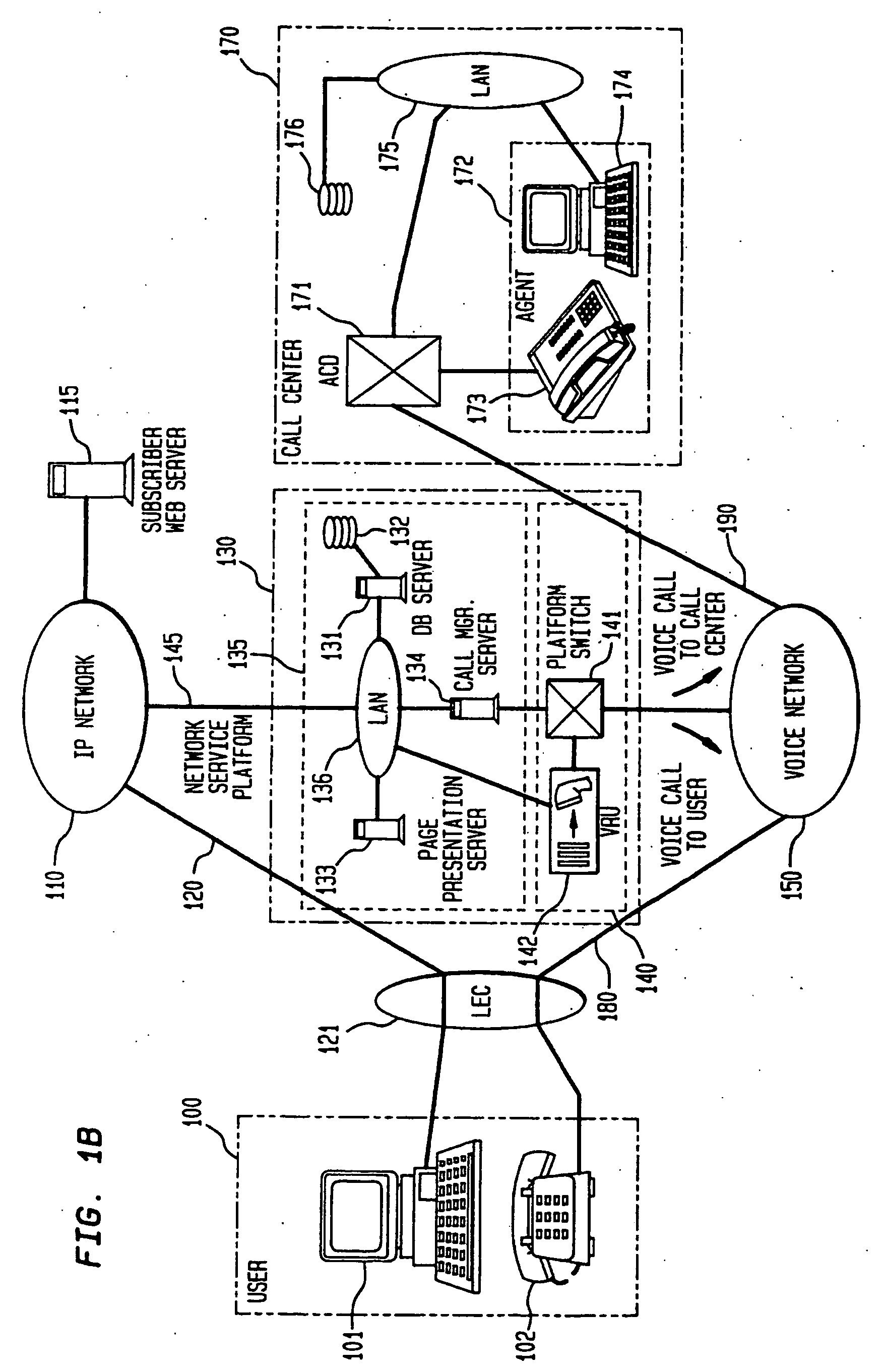

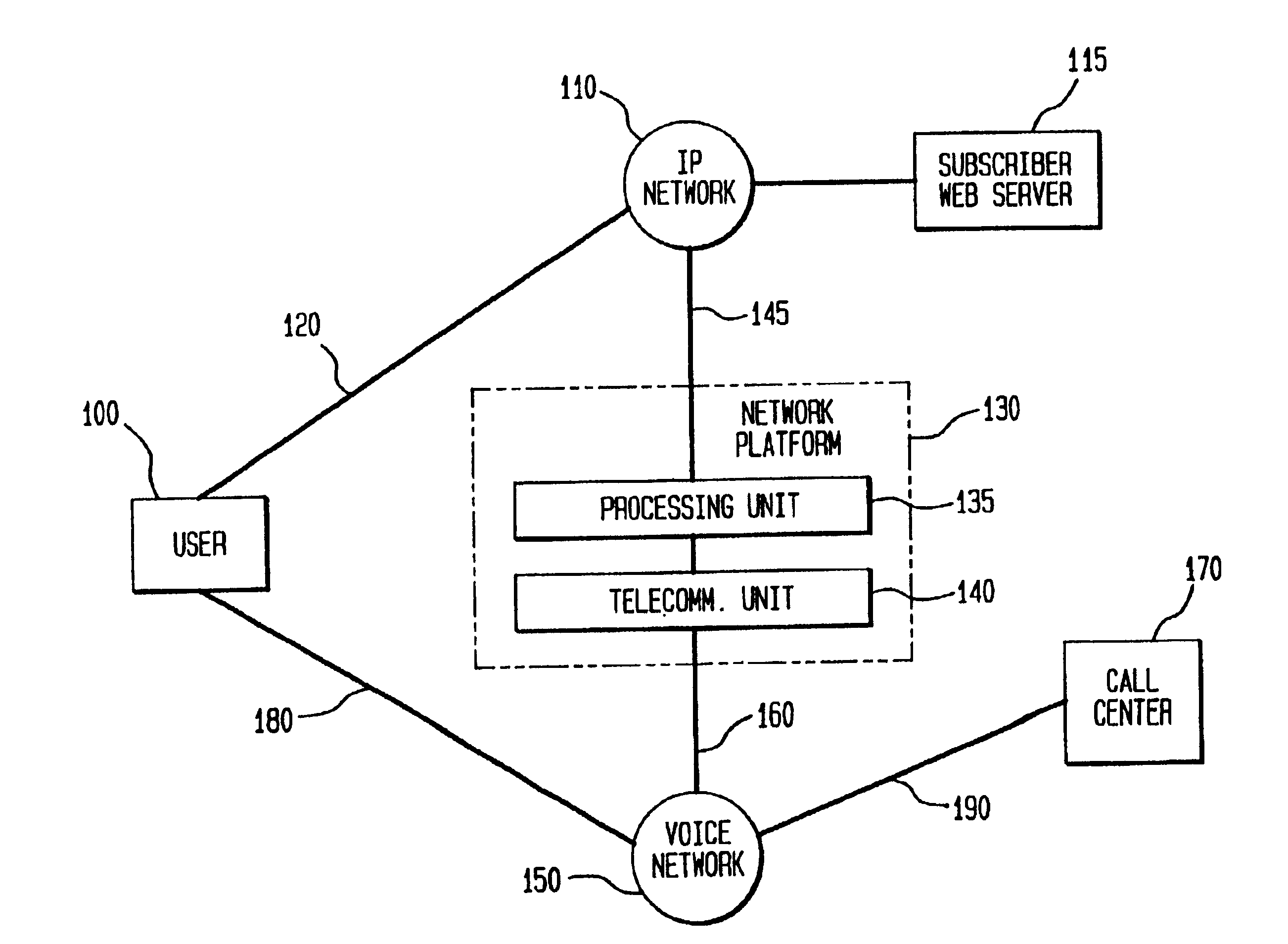

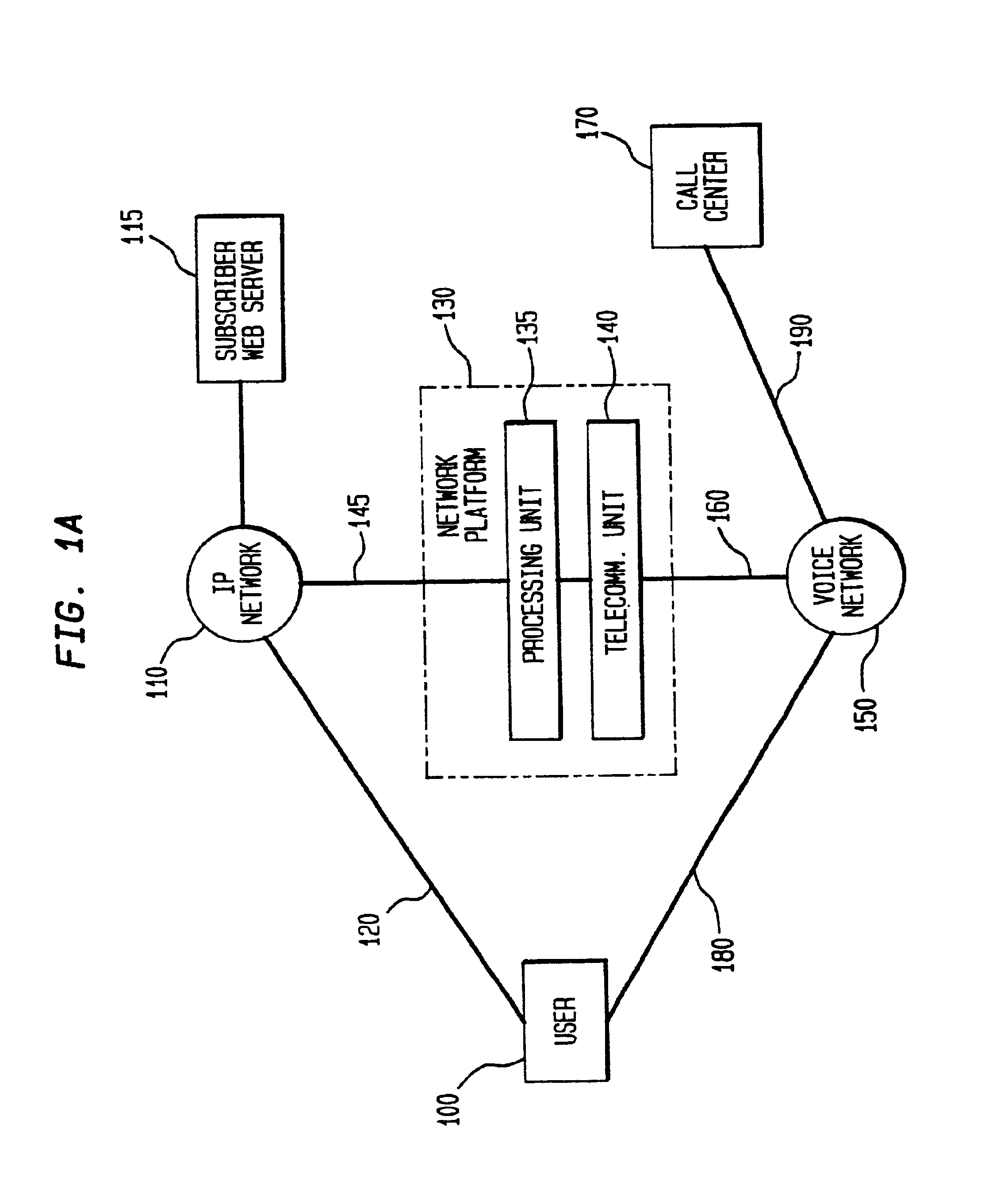

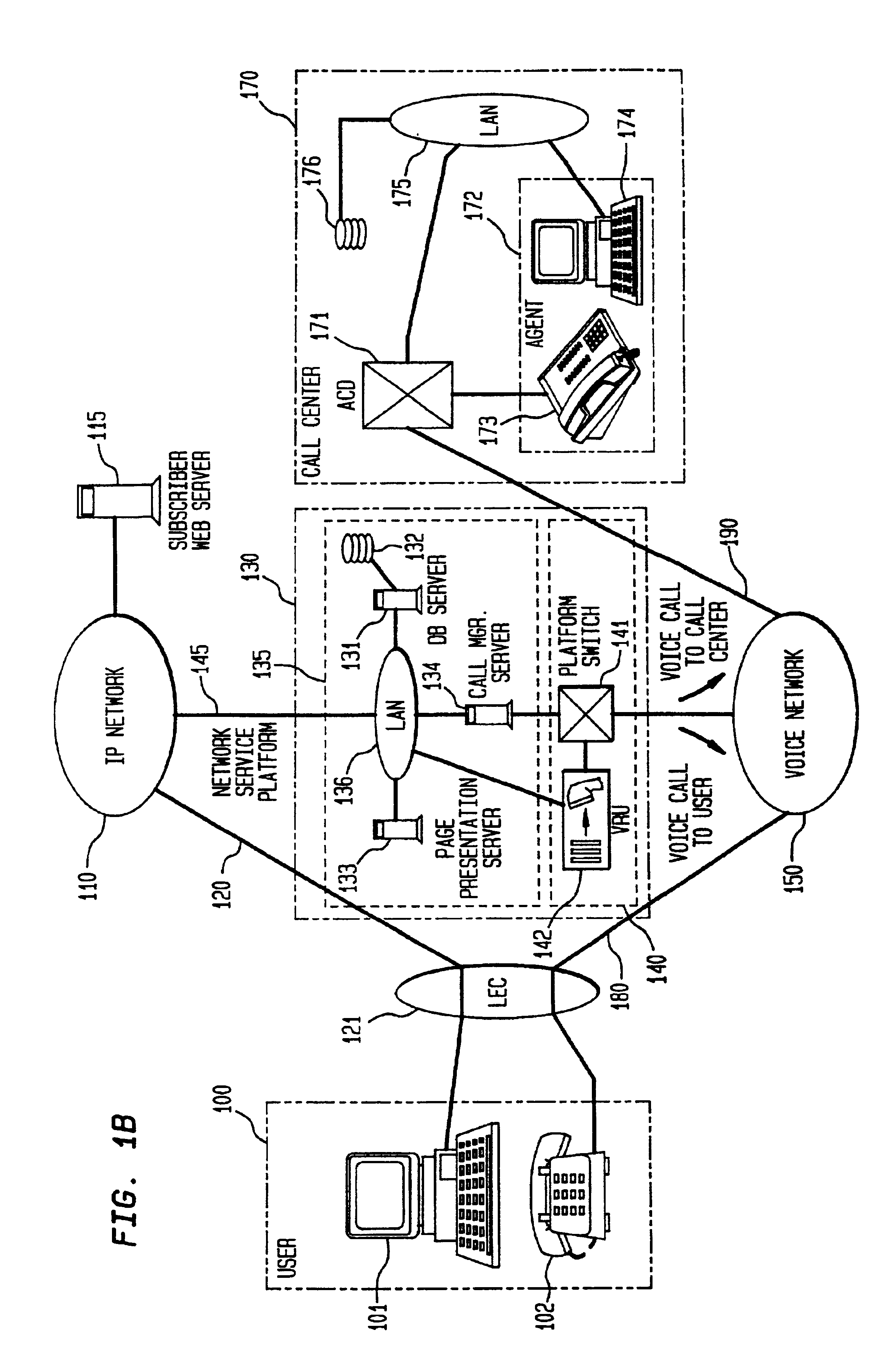

Correlating information between Internet and call center environments

InactiveUS20070011337A1Highly integratedImprove efficiencyMultiplex system selection arrangementsSpecial service for subscribersWeb siteTelecommunications network

Coordination of information at the network-based level between call centers connectable over a telecommunications network, such as the telephone network, and a packet network, such as the Internet, creates improved integration of and bonding between a customer's interaction with a Web site and with a call center. Information about the customer and the customer's Web interaction are delivered to the call center agent along with the call, leading to increased productivity and efficiency in call handling as well as improved call routing. Calls may be routed to existing call centers based upon information from the Web experience, and information from the user's Web interaction is shared with the call center. Web interaction information is passed to existing call centers using known call center external control methods, such as DNIS signaling. Information about the Web experience may also be “whispered” to the call center agent, and an agent may “push” Web pages for review by the customer. As a result, customer acquisition and sales tools more powerful than a mere click-to-callback tool can be made available with a combined marketing approach using the Web and call centers.

Owner:AT&T INTPROP II L P

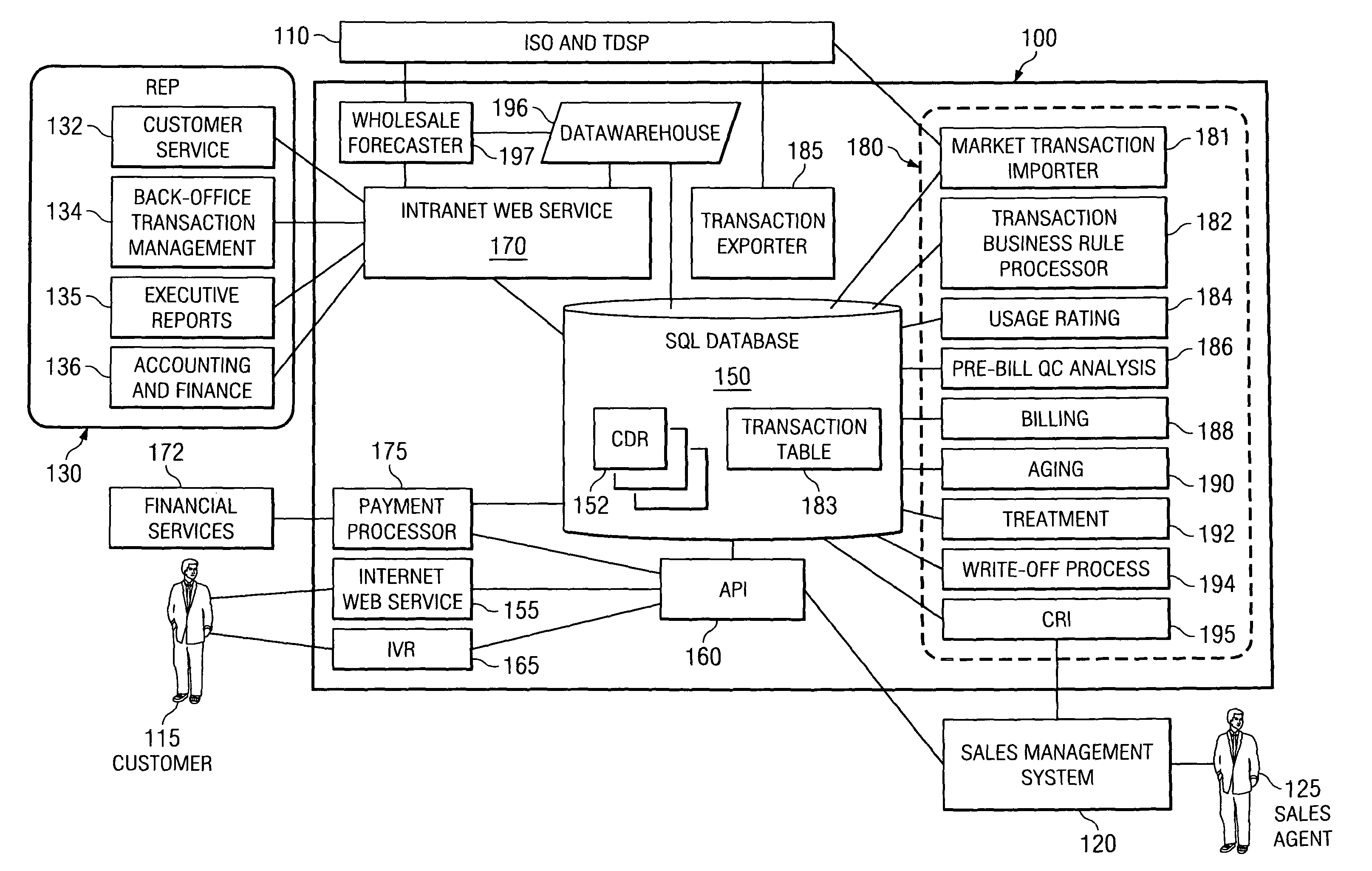

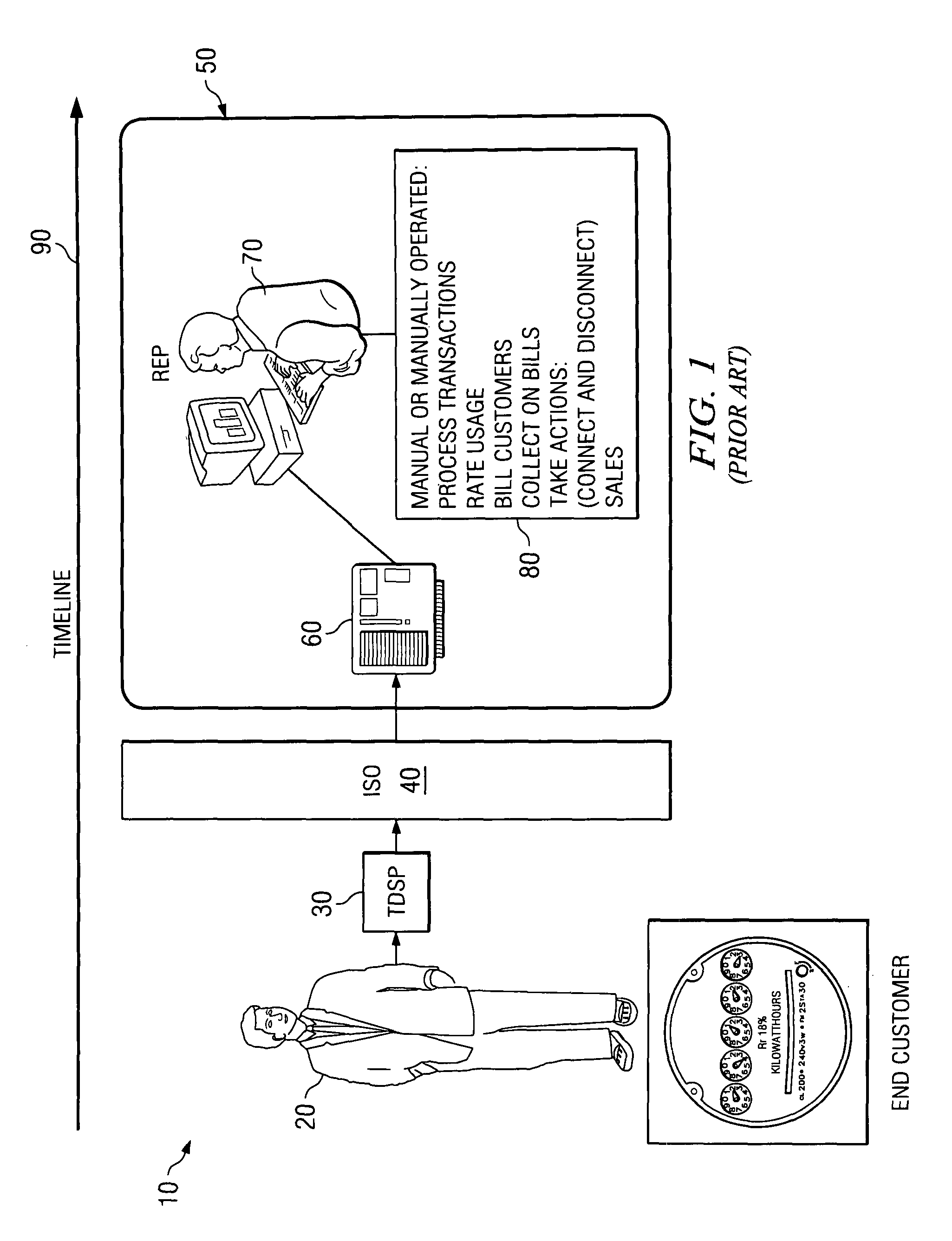

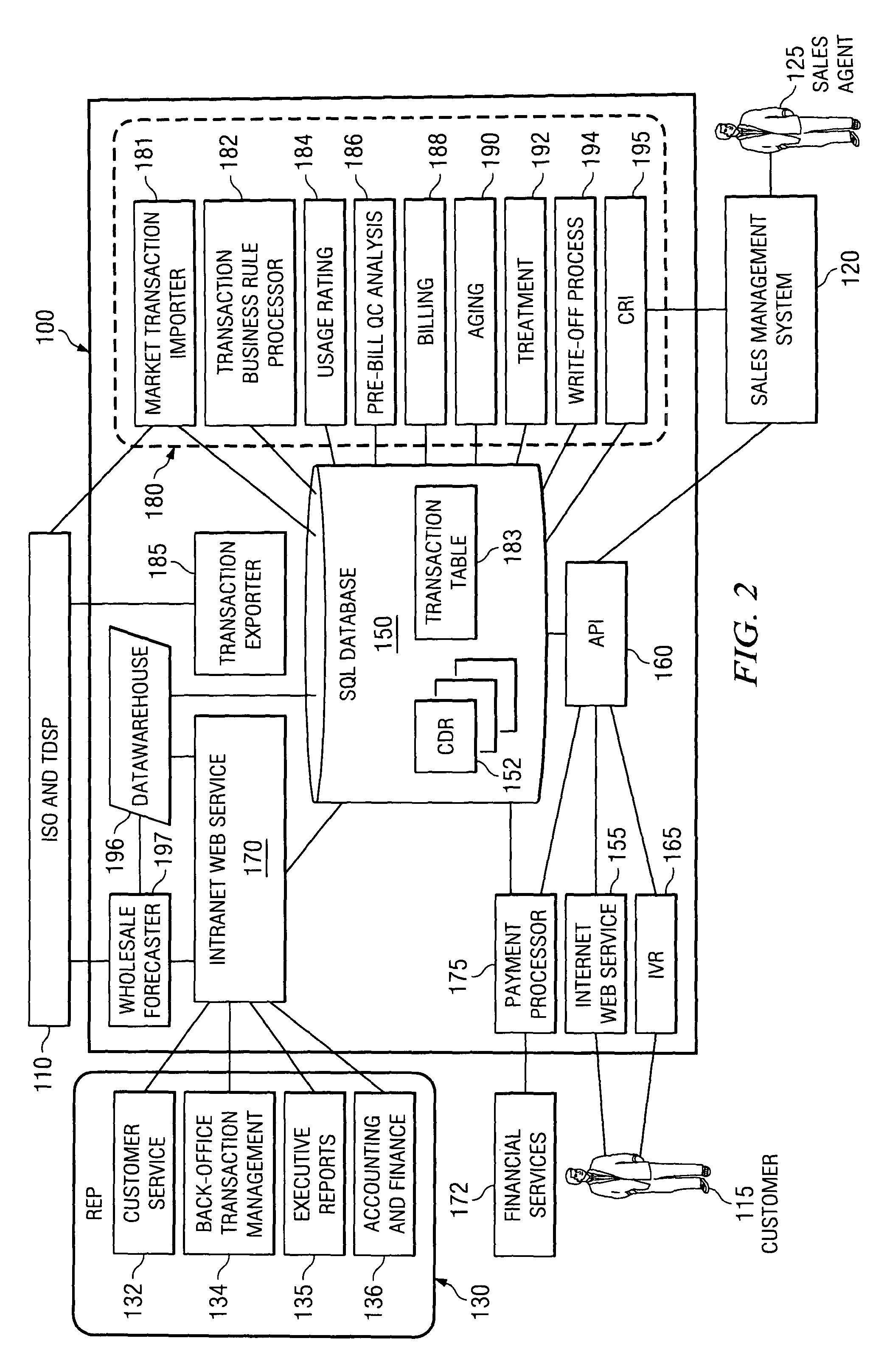

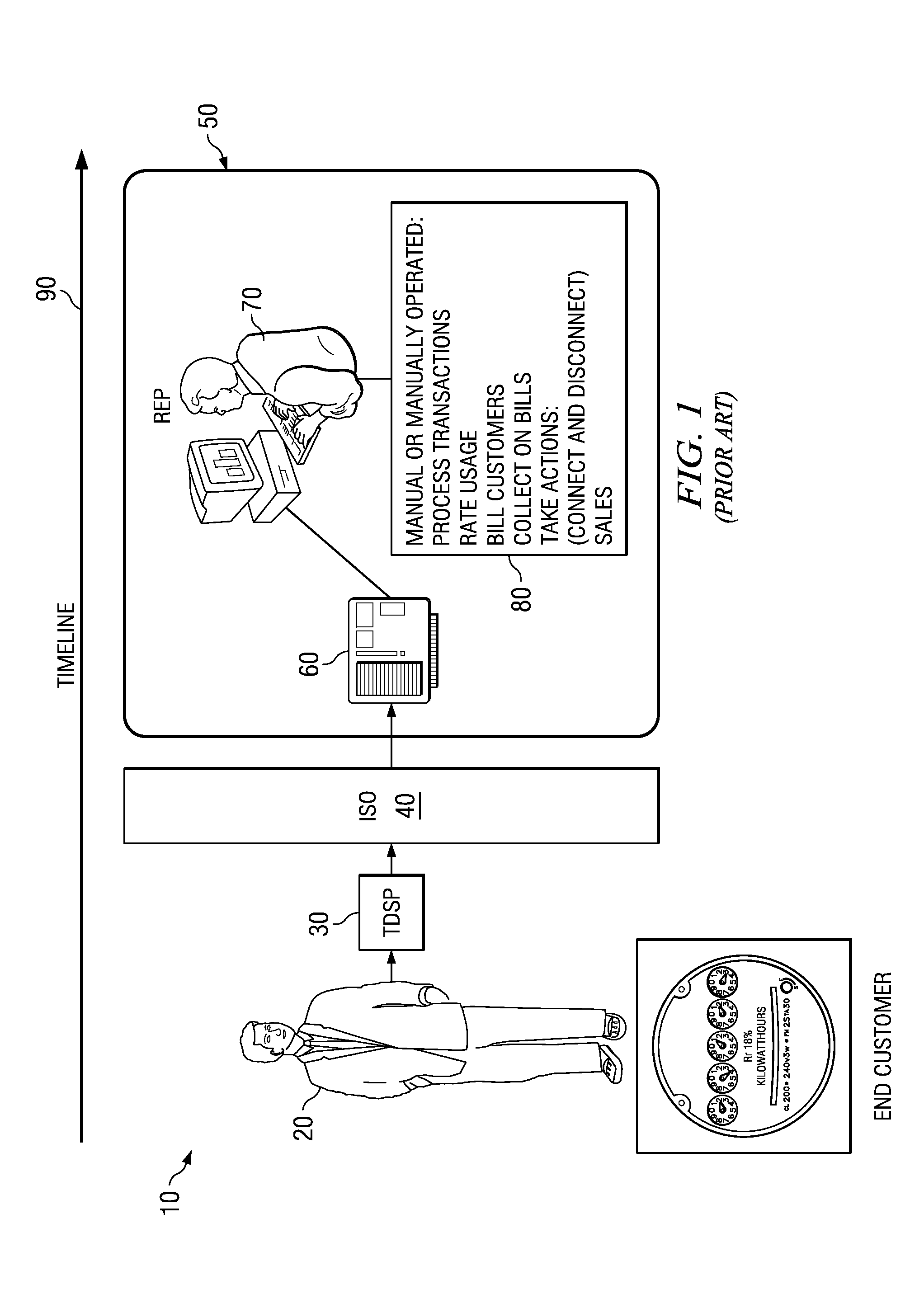

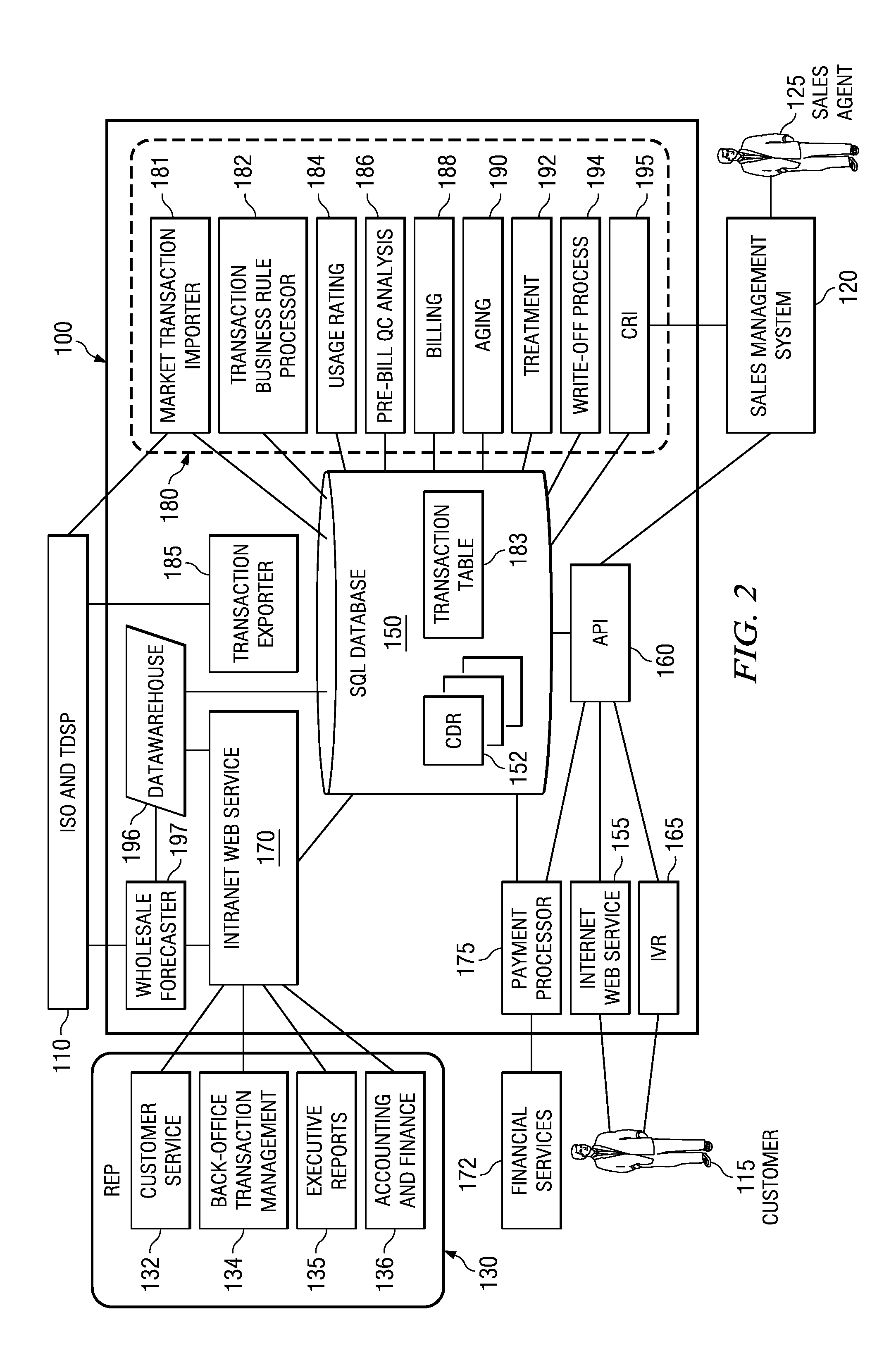

Energy distribution and marketing backoffice system and method

ActiveUS8442917B1Reduce human workload requirementLower requirementElectric devicesSpecial tariff metersWeb serviceInteractive voice response system

A retail energy provider system comprising a market transaction manager, business rules and requirements processor, usage rater, customer analysis and quality control auditor, customer billing processor and collection manager, customer payment processor, third party sales and marketing application programming interface, customer acquisition and residual income interface, having a wholesale forecaster, interactive voice response system, intranet web services, internet web services and network based external customer service and executive management systems and financial services functions, all said functions and systems interacting with a robust SQL database engine for which the novel database schema is taught herein.

Owner:BLUENET HLDG LLC

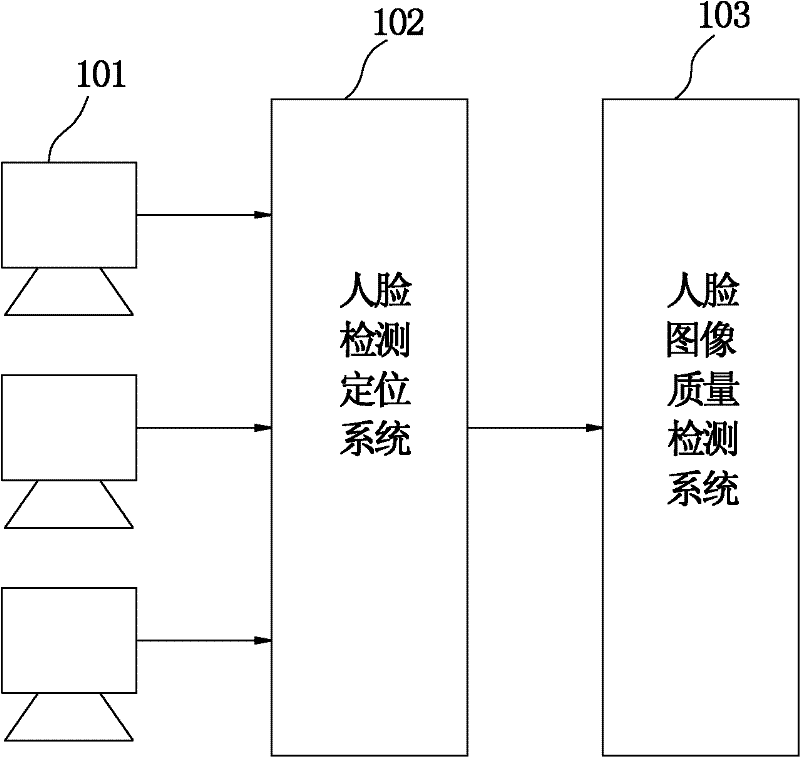

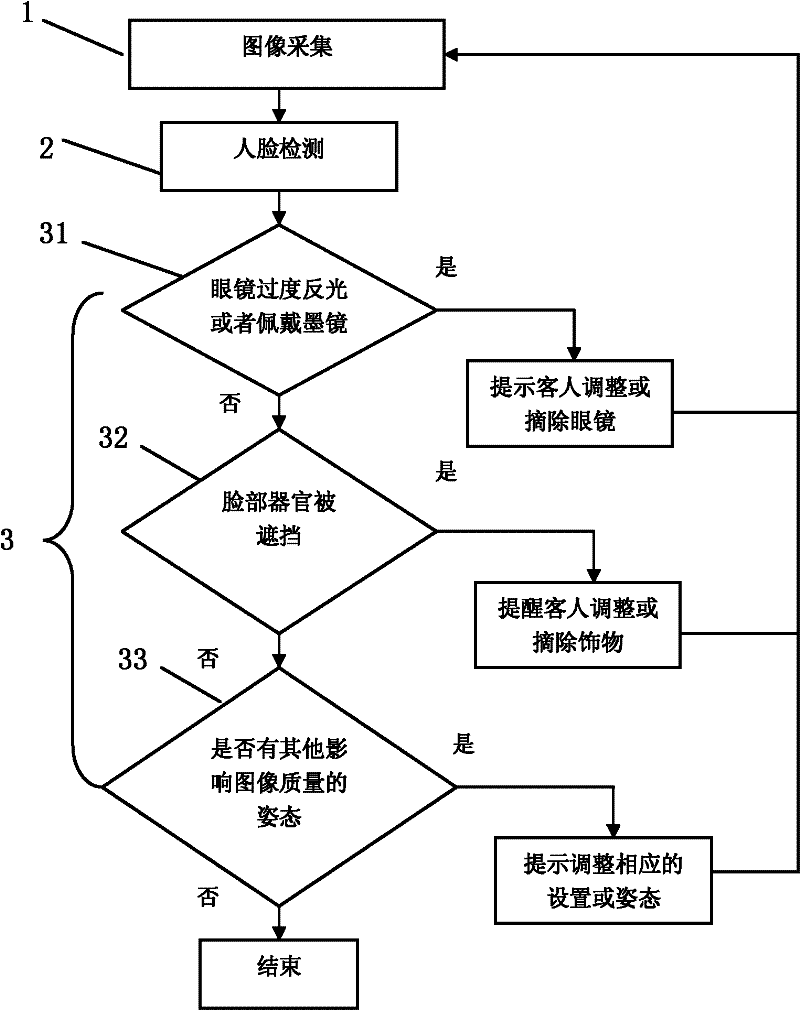

Real-time monitoring method for face image quality of customer collection terminal

InactiveCN102262727AGuaranteed expression accuracyGuaranteed reliabilityCharacter and pattern recognitionFace detectionPattern recognition

The invention discloses a method for real-time monitoring of the face image quality of a customer collection terminal, comprising the following steps: Step 1, face image collection; Automatically detect and segment the exact position of the face in the face image; step 3 comprehensively evaluates the face quality, and performs intelligent prompts and real-time intelligent monitoring of the image quality through the face image quality detection system for the acquisition process of the client's face image. The invention can effectively improve the accuracy of subsequent image comparison and reduce the false alarm rate (False Alarm Rate), thereby ensuring the reliability of identification information and making the intelligent monitoring system based on face recognition truly practical.

Owner:CHANGZHOU RUICHI ELECTRONICS TECH

Measuring customer experience value

InactiveUS20150051957A1Effective assessmentResourcesOperational costsCustomer relationship management

A disclosed method includes determining a customer experience value (CXV) of an entity by a server computer. The CXV may be determined by calculating a customer acquisition value of the entity, calculating a customer retention value of the entity, and calculating an operation efficiency value of the entity. The customer acquisition value may be based on at least one of a measure of acquisition performance of the entity or a measure of operational performance of the entity. The customer retention value may be based on at least one of a measure of customer retention or a measure of service quality. The operation efficiency value may be based on at least one of a measure of operating costs of the entity or a measure of strategic costs of the entity. The method includes using, by a customer relationship management application, the determined CXV to indicate a measure of customer satisfaction.

Owner:ORACLE INT CORP

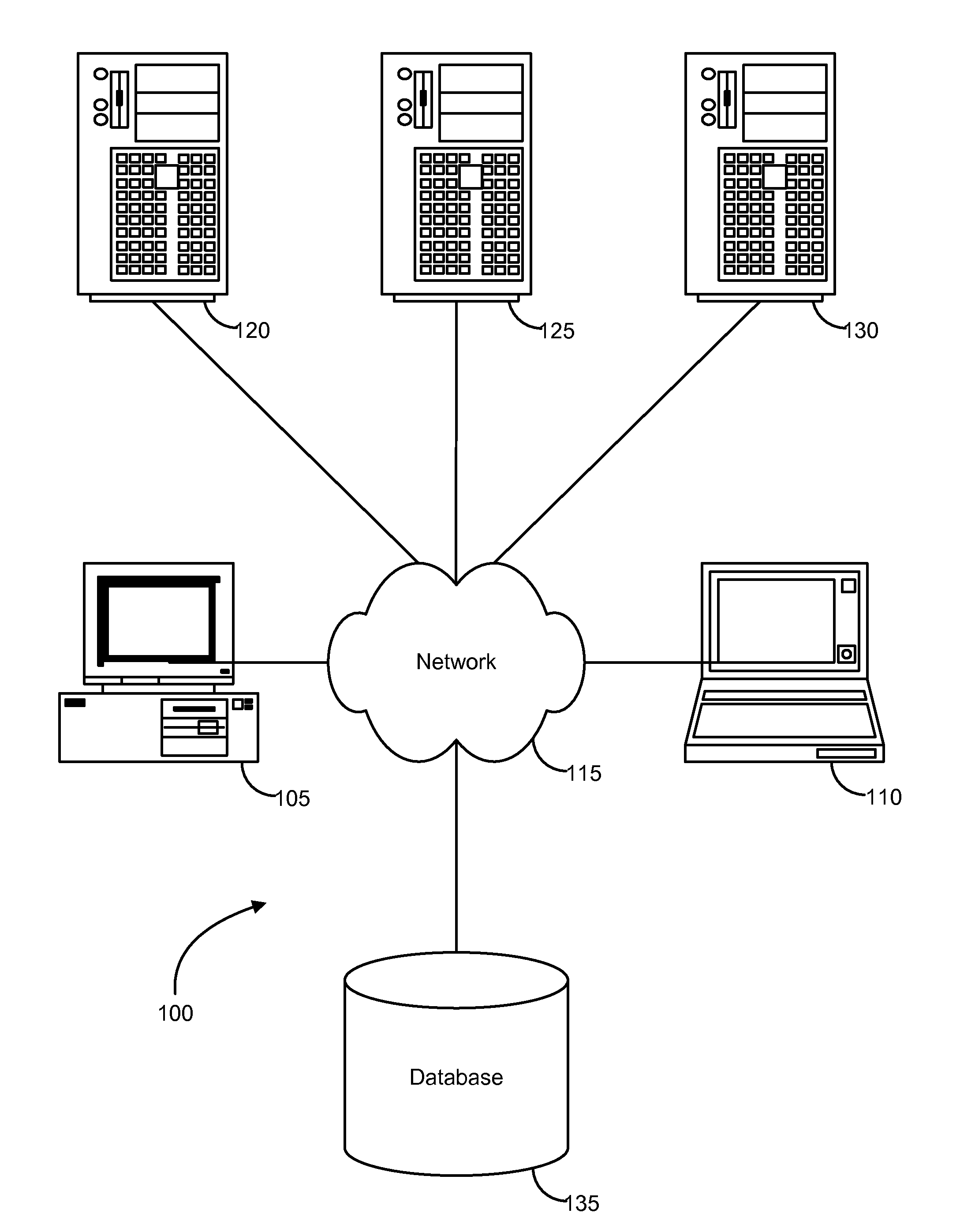

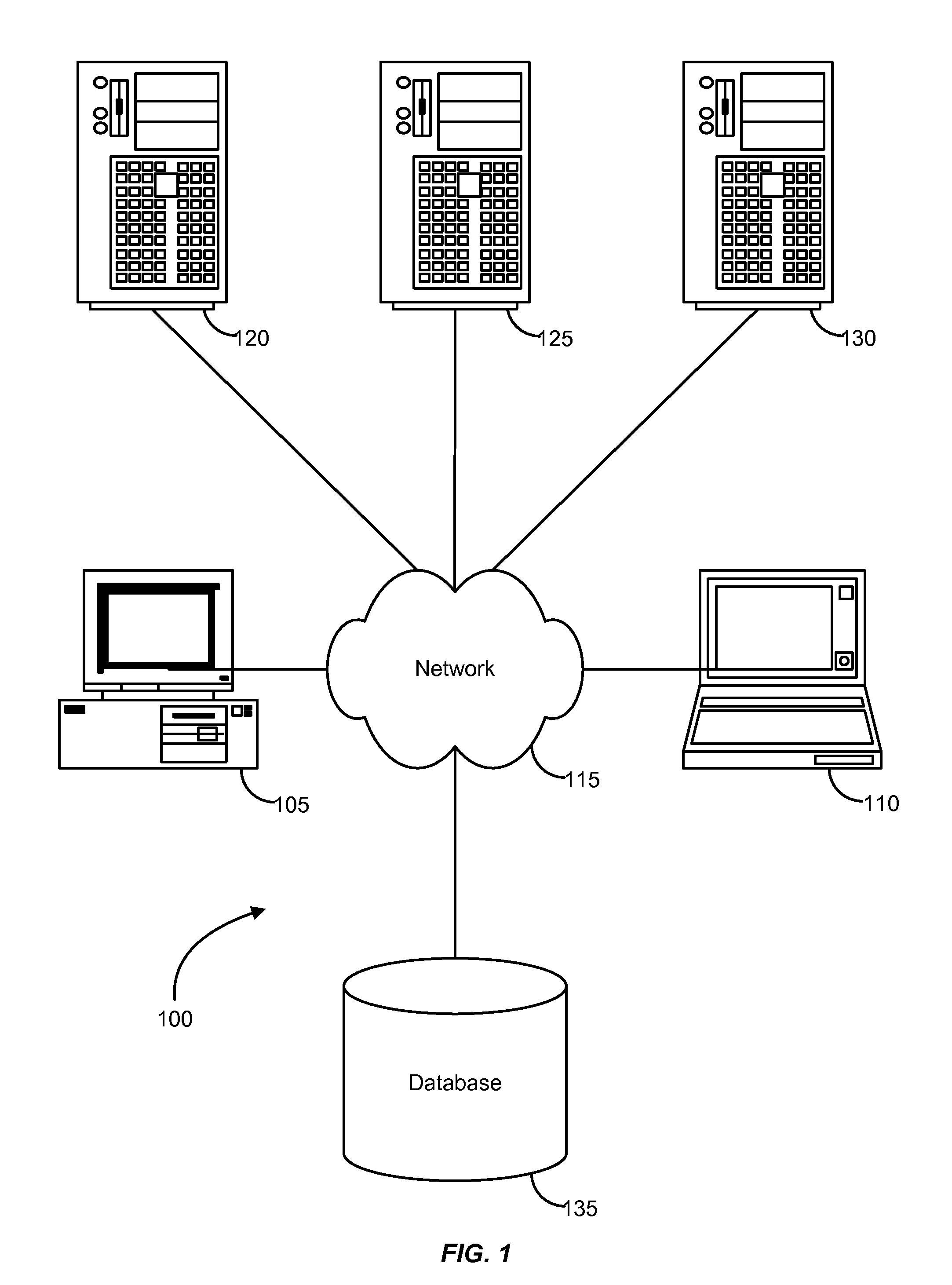

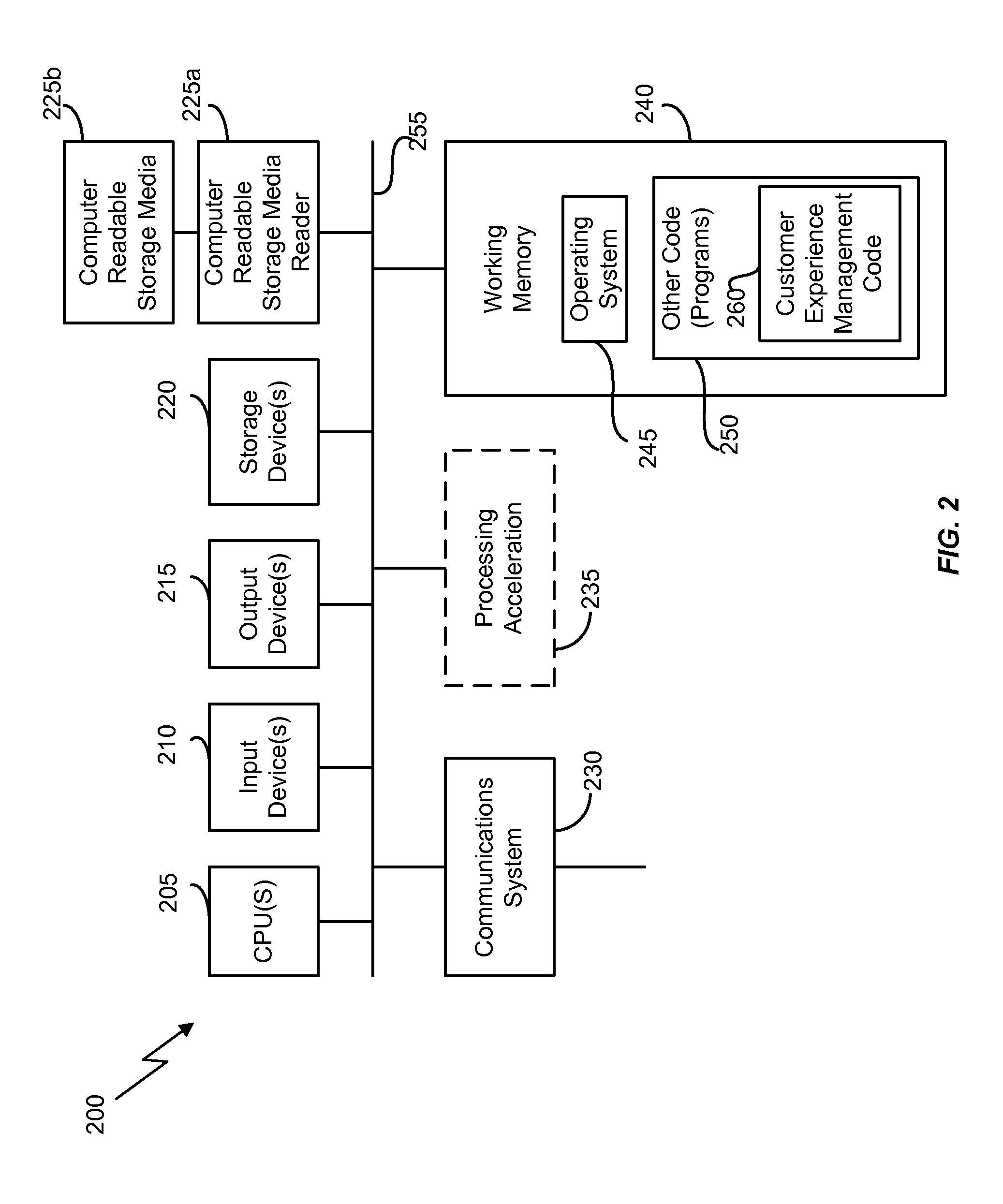

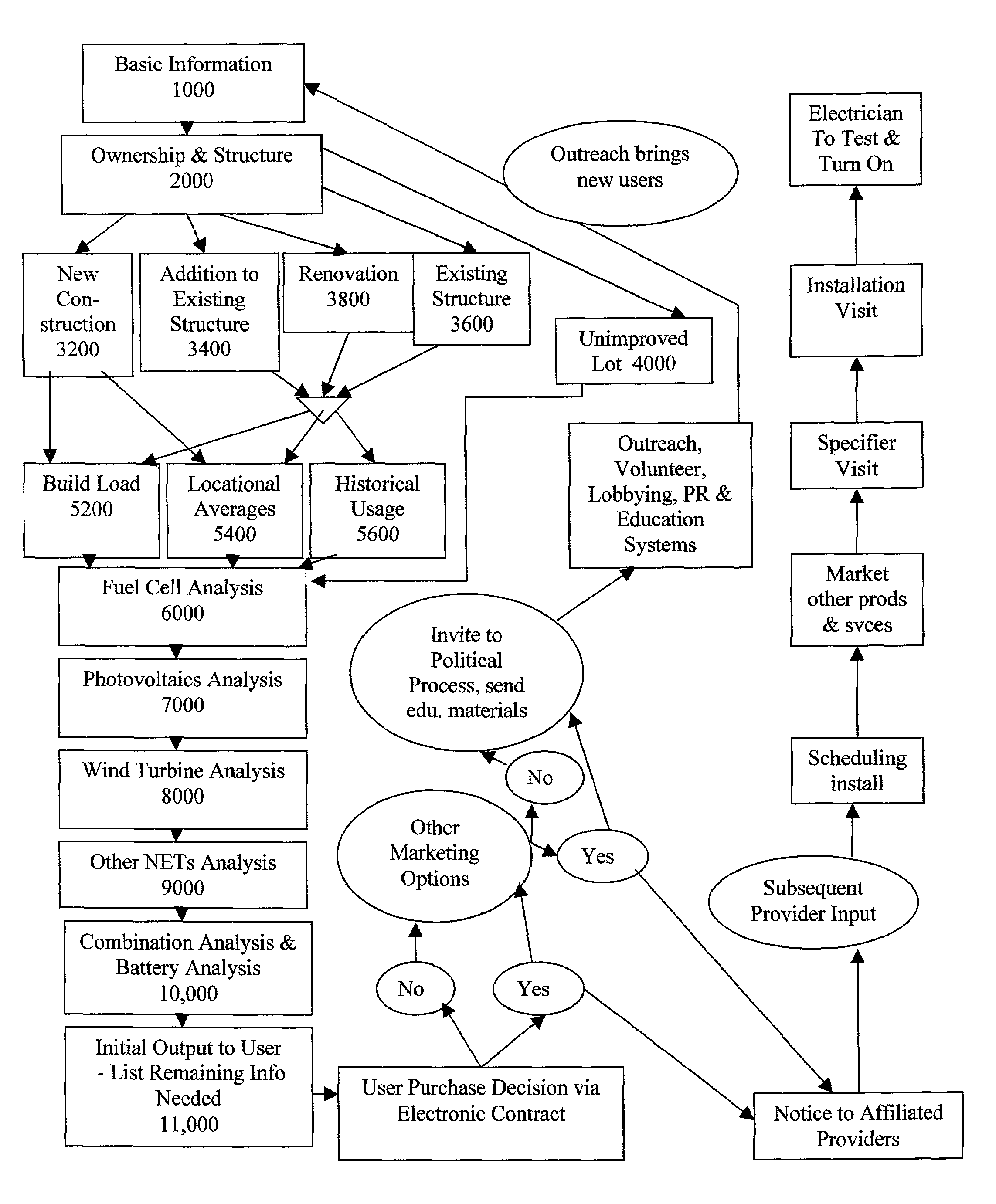

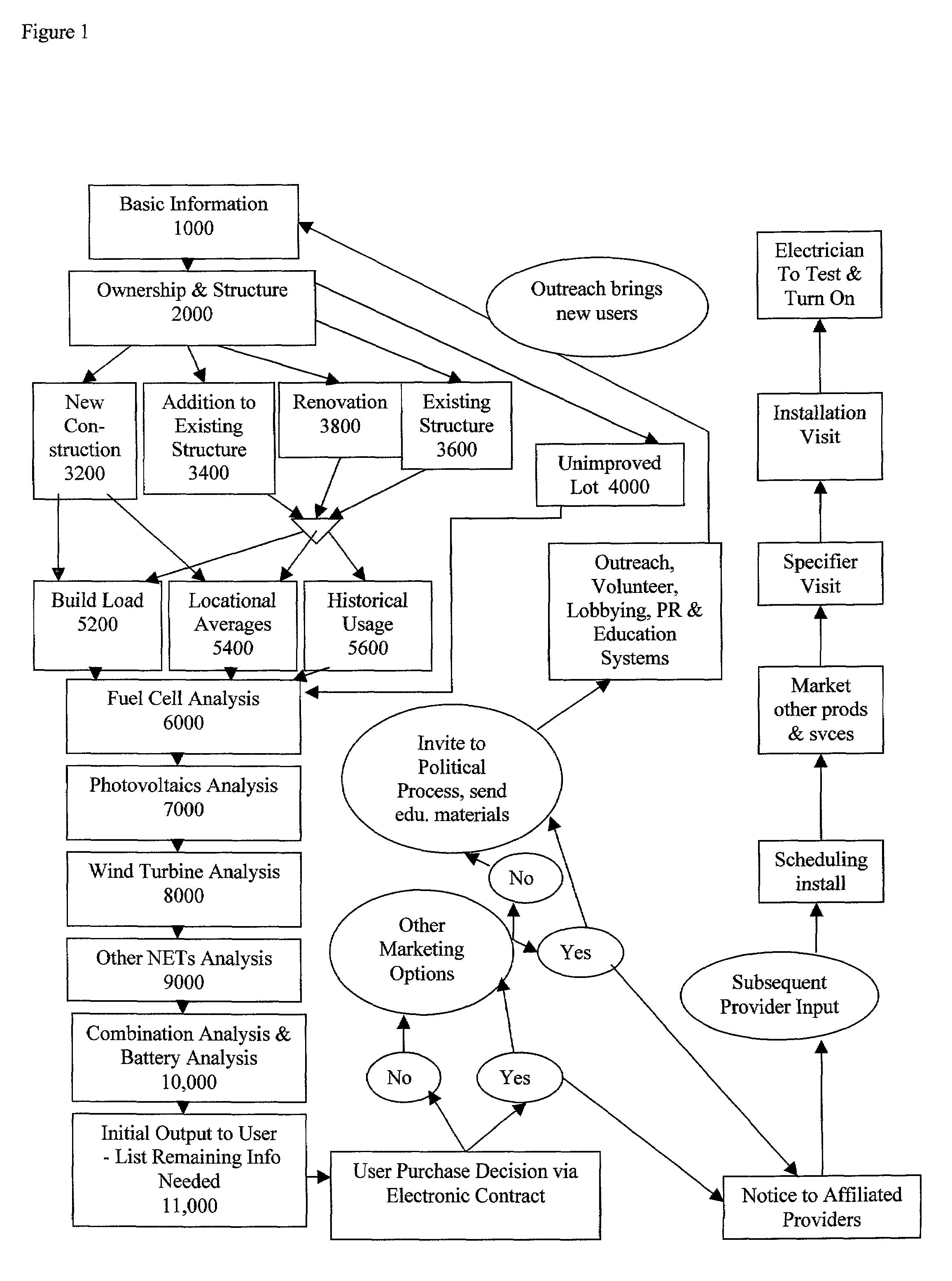

Automated new energy technology consulting and demand aggregation system and method

InactiveUS7512540B2Expanding outreachLow costElectric devicesSpecial tariff metersViral marketingNew energy

An automated energy consulting system and method is provided comprising an interactive input system linked to calculation algorithms and databases of energy-related products and services, affiliated service providers, and climate, financing and regulatory criteria. The system generates proposals of available energy-related products, services and financing options, and obtains and aggregates customer commitments to allow discounted purchasing of the components. Customers can earn referral commissions to encourage customers and volunteers to virally disseminate the access information. For customers not eligible for beneficial products and services because of regulatory deficiencies, the system automates the customer education process to encourage them to advocate politically for the changes that will make them eligible. The automation of the energy consulting and marketing process, mass customization, demand aggregation, and viral marketing reduce customer acquisition and component purchasing costs and reduce the price to consumers, creating new economically viable markets for environmentally friendly energy-related products and services.

Owner:GLUCK DANIEL S +1

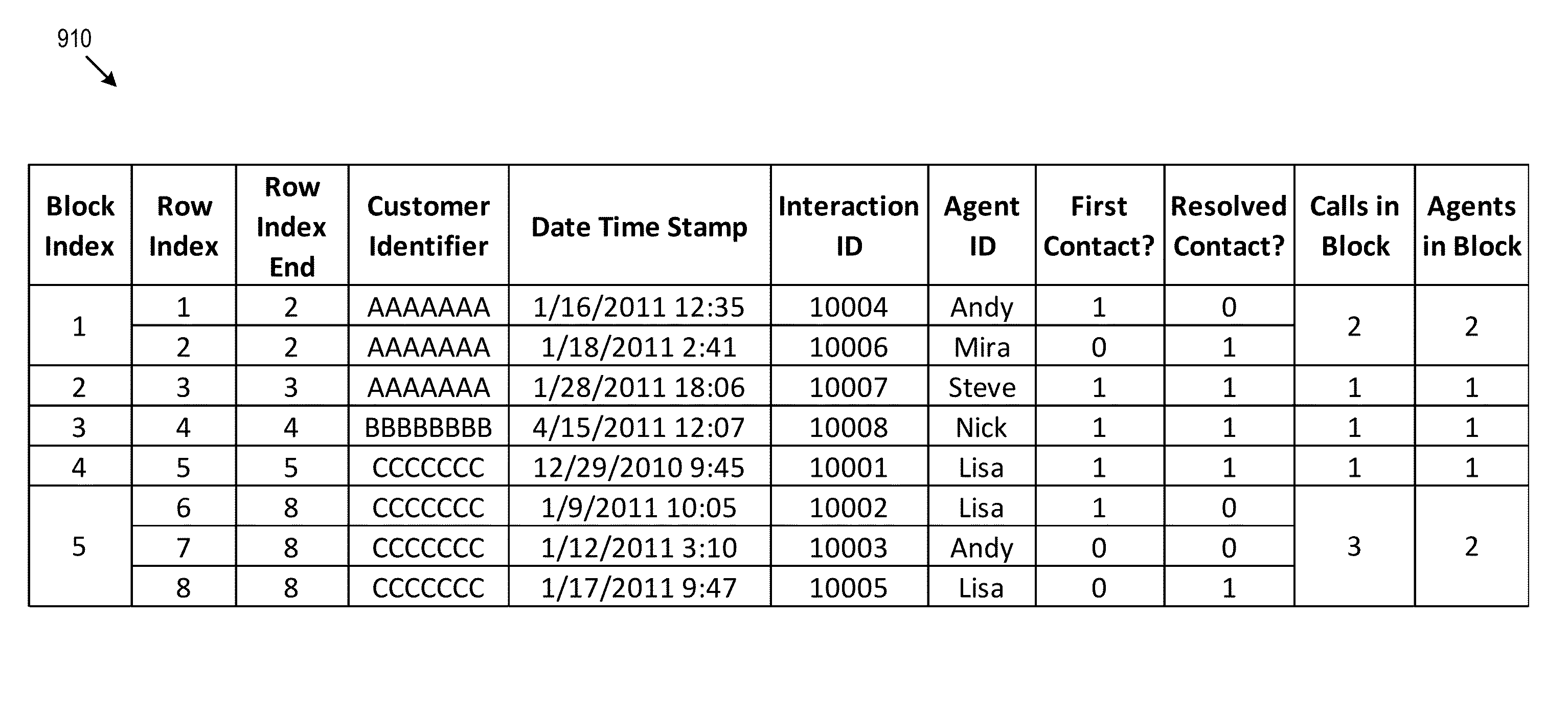

Churn analysis system

A churn analysis system helps a business analyze, predict, and reduce customer churn. The system analyzes customer experiences by using an insightful block level approach to correlate customer experience with customer churn. Through the block level approach, the system is able to more accurately predict and effectively reduce future customer churn. As a result, businesses are able to reduce customer acquisition costs and improve customer retention rates.

Owner:ACCENTURE GLOBAL SERVICES LTD

Correlating information between internet and call center environments

InactiveUS7127495B2Highly integratedImprove efficiencyMultiplex system selection arrangementsSpecial service for subscribersWeb siteTelecommunications network

Coordination of information at the network-based level between call centers connectable over a telecommunications network, such as the telephone network, and a packet network, such as the Internet, creates improved integration of and bonding between a customer's interaction with a Web site and with a call center. Information about the customer and the customer's Web interaction are delivered to the call center agent along with the call, leading to increased productivity and efficiency in call handling as well as improved call routing. Calls may be routed to existing call centers based upon information from the Web experience, and information from the user's Web interaction is shared with the call center. Web interaction information is passed to existing call centers using known call center external control methods, such as DNIS signaling. Information about the Web experience may also be “whispered” to the call center agent, and an agent may “push” Web pages for review by the customer. As a result, customer acquisition and sales tools more powerful than a mere click-to-callback tool can be made available with a combined marketing approach using the Web and call centers.

Owner:AT&T INTPROP II L P

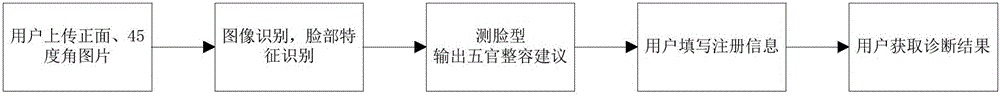

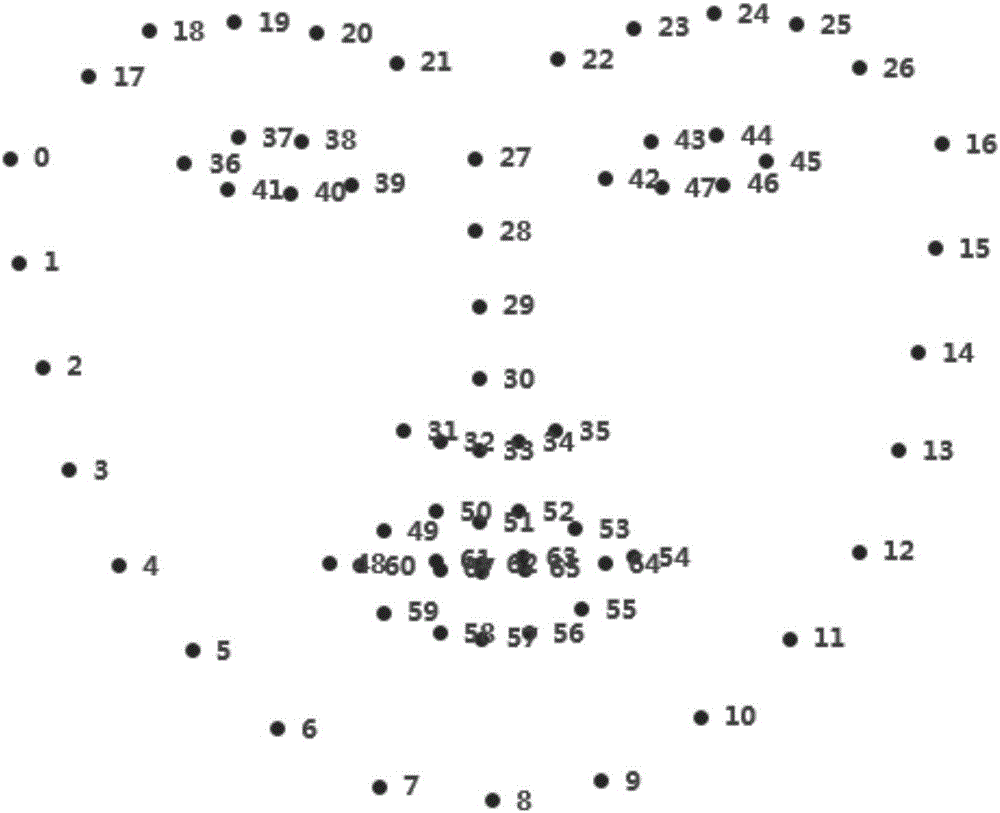

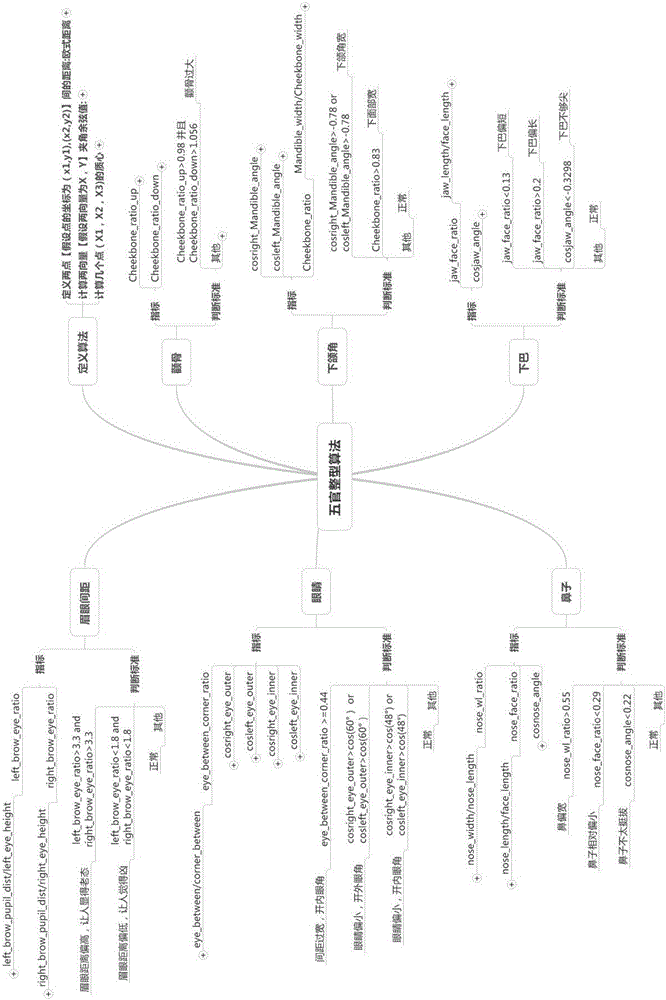

Method for giving plastic surgery advices according to face image

InactiveCN106548156AGood effectImprove the efficiency of cosmetic adviceCharacter and pattern recognitionPattern recognitionImage diagnosis

The invention relates to a method for giving plastic surgery advices according to a face image. The method is implemented mainly by embedding a writing algorithm into program software. A cosmetic expert gives an experience reference value, and the threshold values of the five sense organs conforming to the standard of 'beauty' are determined based on the aesthetic standard and through a data analysis method. Then, face images at multiple angles input by a user are acquired, the feature points of the face are extracted through a face recognition model, calculation is performed according to the values of the feature points and the threshold values, and plastic surgery and make-up advices are given. Through the technical scheme provided by the invention, the efficiency of giving plastic surgery advices according to an image is improved. By embedding the technology into websites, APPs or other media, the interestingness and transmissibility are improved, the cost of customer acquisition is reduced, and the conversion rate is improved. By assisting in image diagnosis through pattern recognition and the data analysis methods, digital diagnosis is realized.

Owner:江西瓷肌电子商务有限公司

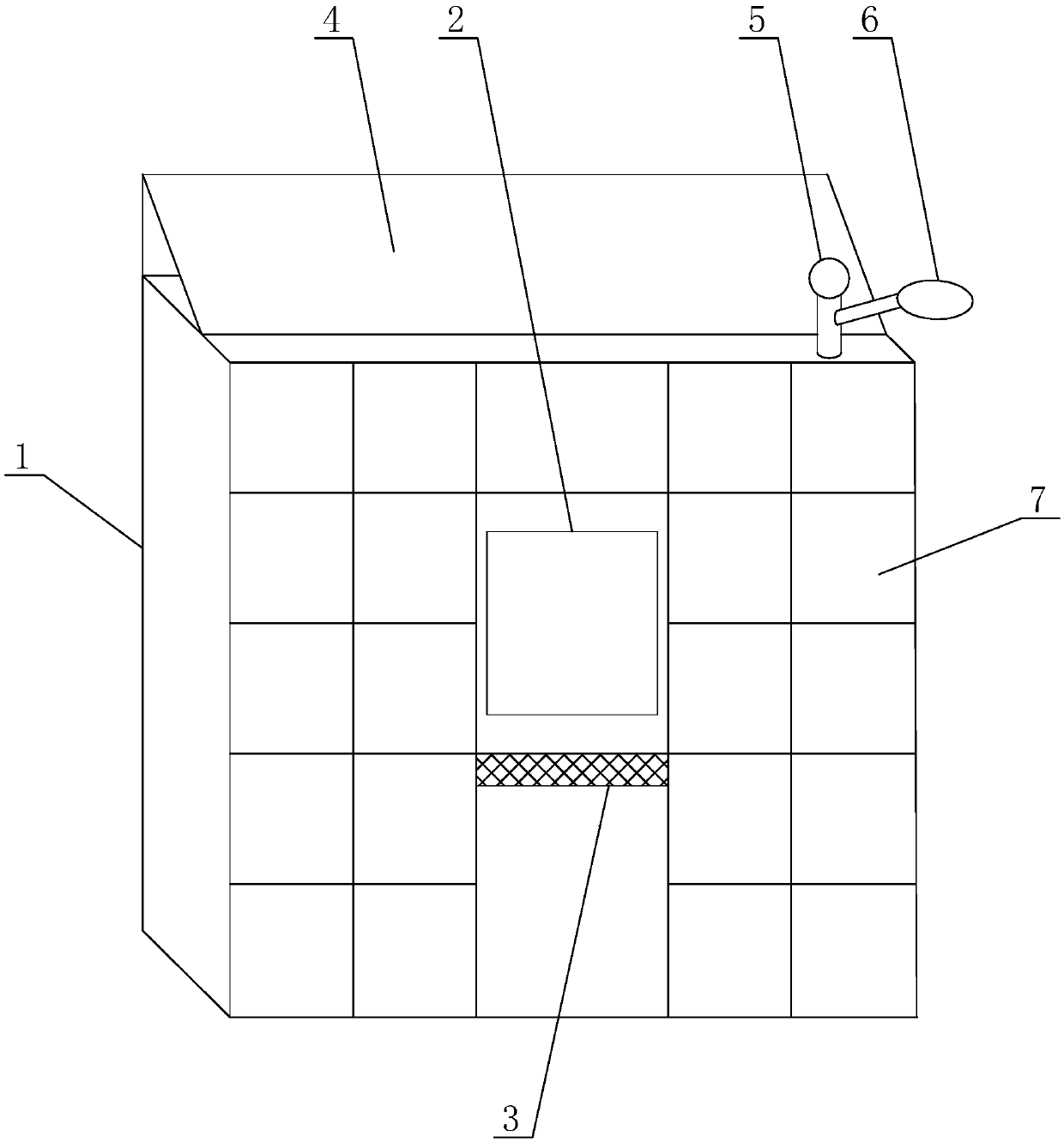

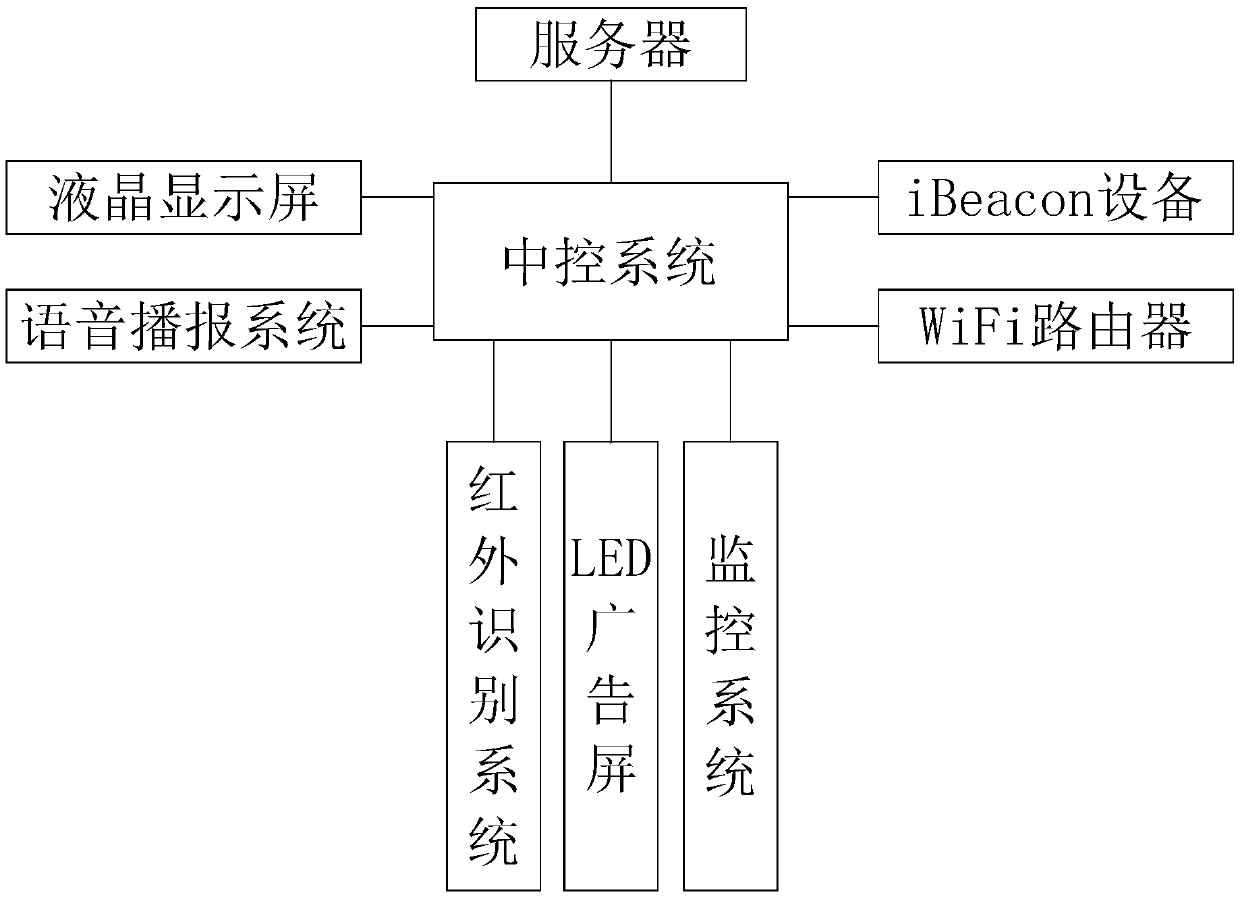

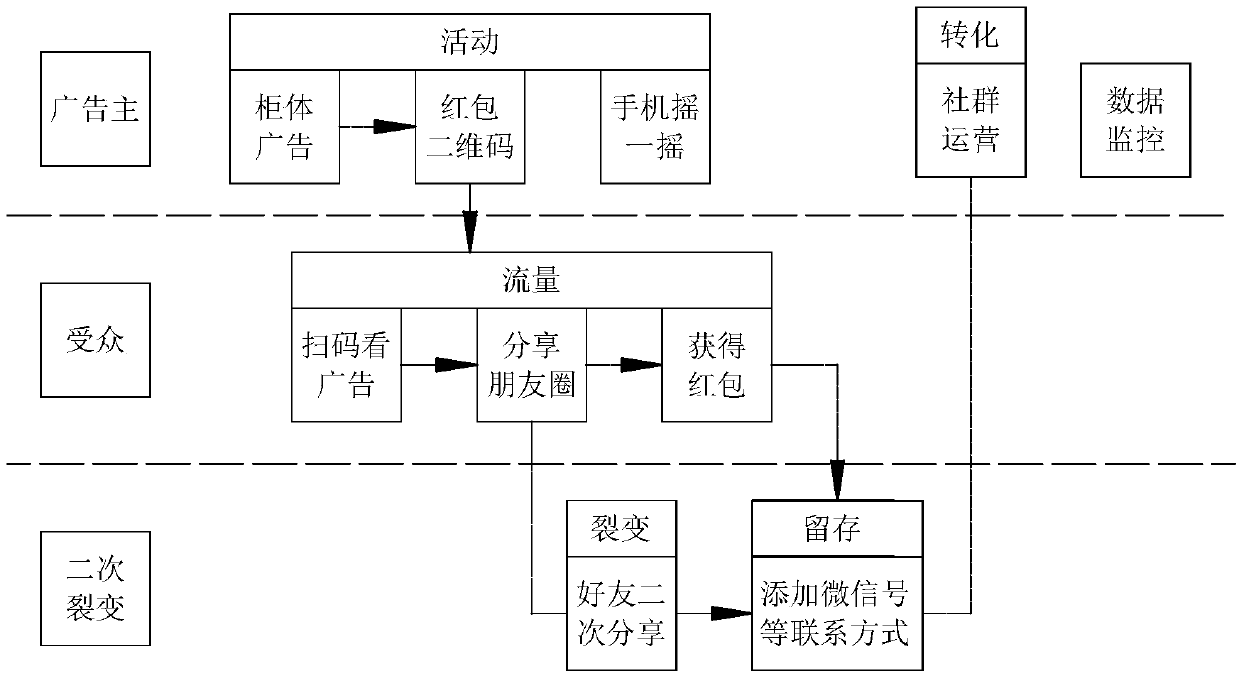

Interactive advertisement putting device and method for intelligent express cabinet

PendingCN108682082AEnsure safetyReduce power consumptionApparatus for meter-controlled dispensingInformation technology support systemLiquid-crystal displayControl system

The invention discloses an interactive advertisement putting device and method for an intelligent express cabinet, and mainly relates to the technical field of mobile internet marketing. The interactive advertisement putting device comprises a server and the intelligent express cabinet, a central control system, a liquid crystal display and a voice broadcast system are arranged on the intelligentexpress cabinet, a solar photovoltaic panel is arranged at the top of the intelligent express cabinet, a storage battery and a solar electric supply complementary controller are arranged in the intelligent express cabinet, an infrared recognition system and a monitoring system are arranged at the top of the intelligent express cabinet, iBeacon equipment used for putting advertisements is arrangedin the intelligent express cabinet, and an LED advertising screen is arranged on the outer wall of the intelligent express cabinet. The device and the method have the beneficial effects that the conversion rate and the participation degree of marketing campaigns can be effectively improved, the credibility and the reputation of the marketing campaigns can be effectively improved, meanwhile the average customer acquisition cost can be greatly lowered, and offline display and online spread can be carried out.

Owner:山东刑天网络科技有限公司

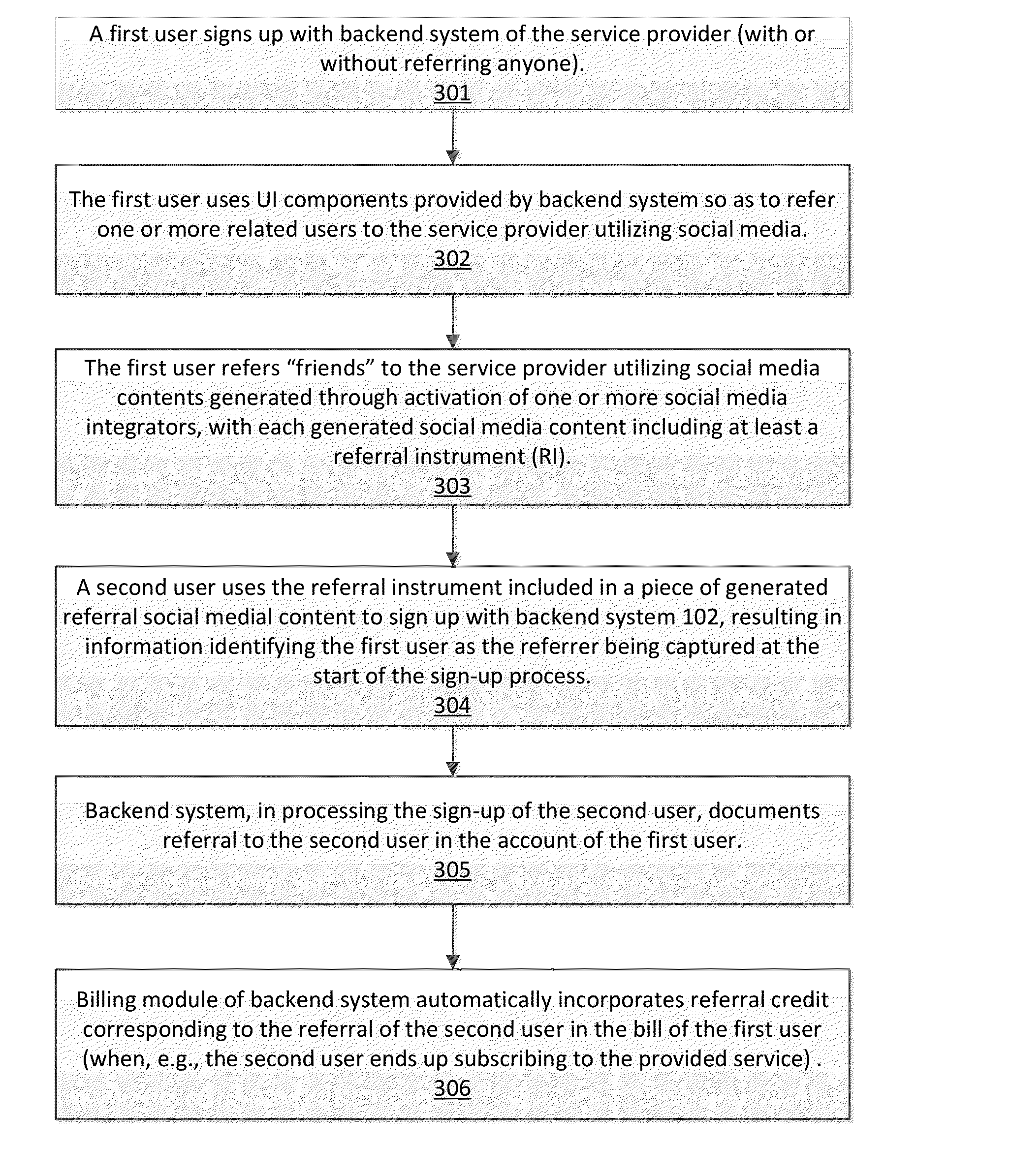

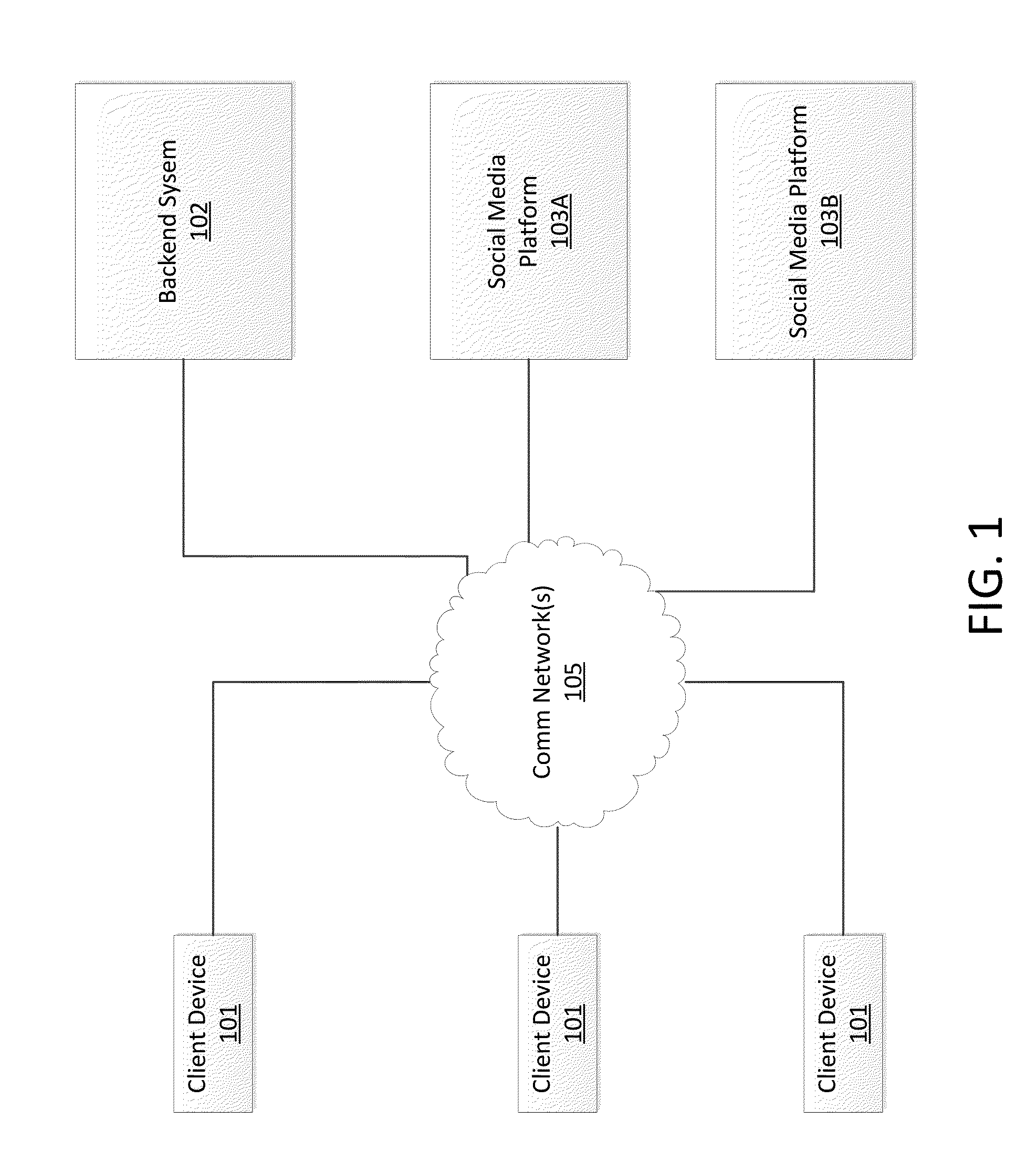

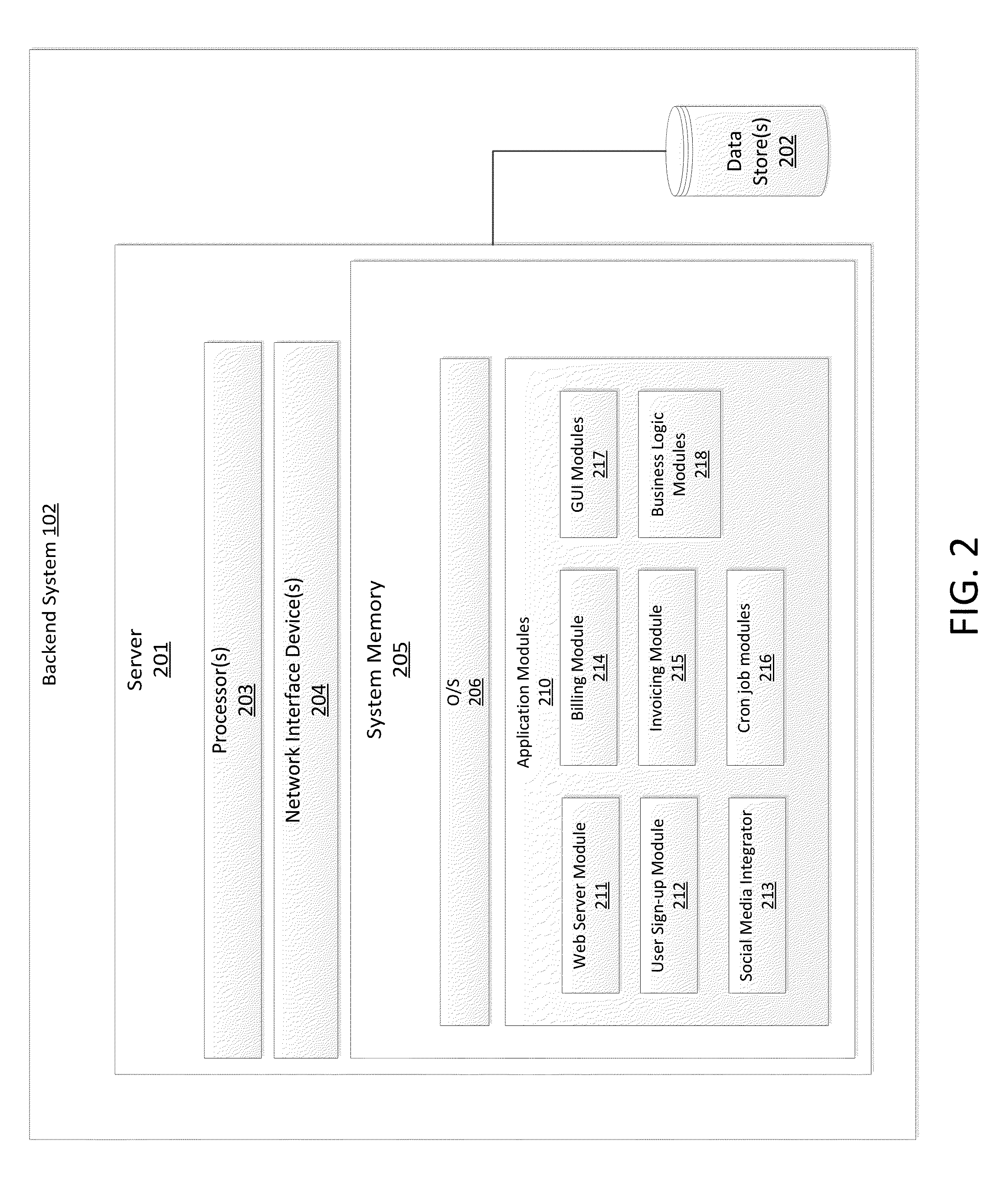

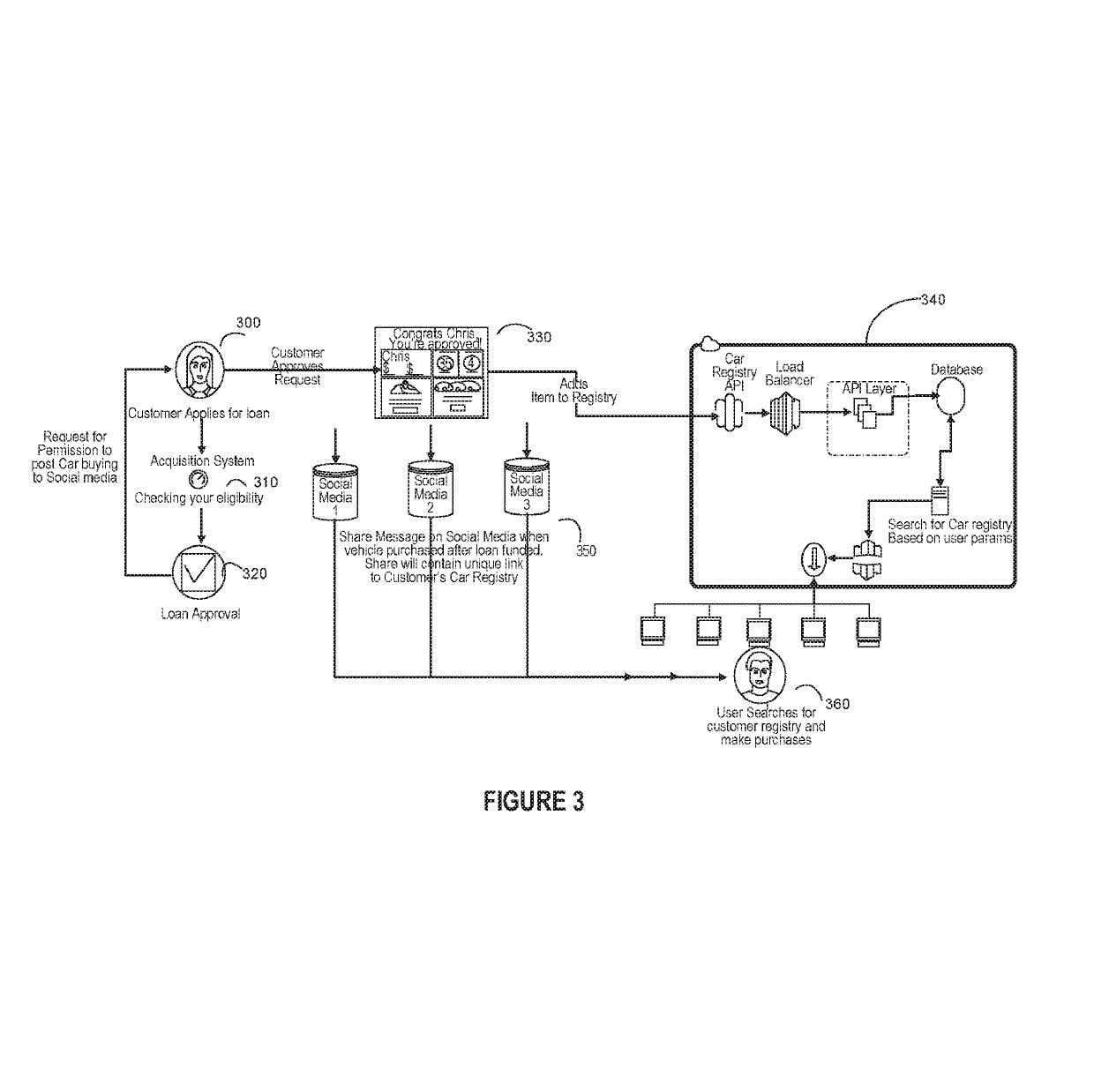

System and Method of Customer Acquisition Leveraging Social Media and Automating Billing Reflecting Rewards for Customer Acquisition

A system and method of acquiring new customer is provided. A first user activates a UI component such that a custom-created content is disseminated to a social media platform. The custom-created content contains content referring a featured service of a service provider and a referral instrument. A second user activates the referral instrument via the social media platform. The activation directs the second user to initiate a sign-up process with a backend system of the service provider and enables the backend system to capture information identifying the first user as a referrer at the start of the referee's sign-up process. The backend system provides referral credits to the first user following the signing-up of the second user. A billing module of the backend system automatically generates a bill for the second user reflecting referral credits awarded to the first user for the referral of the second user.

Owner:NGO TIMOTHY +1

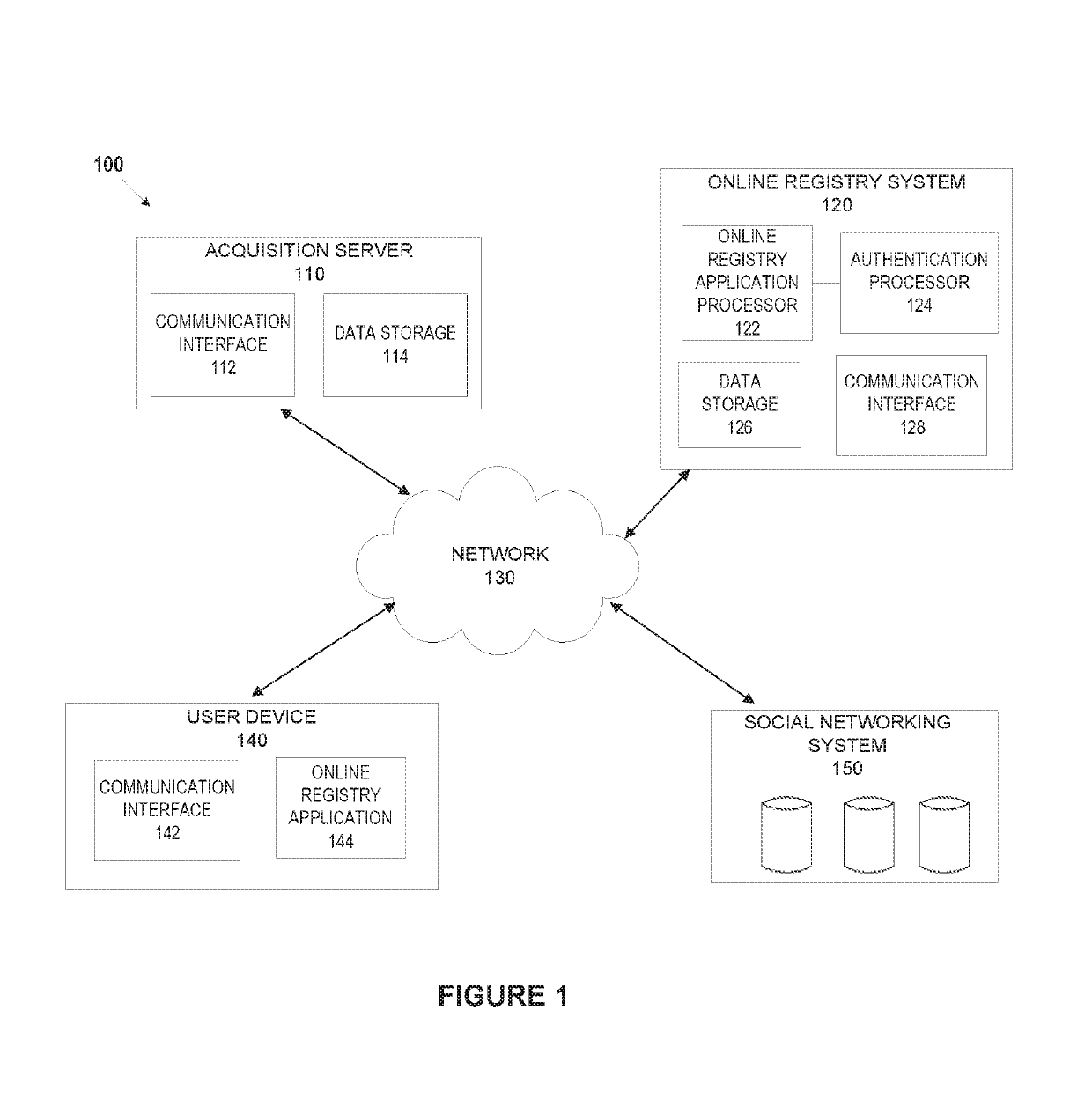

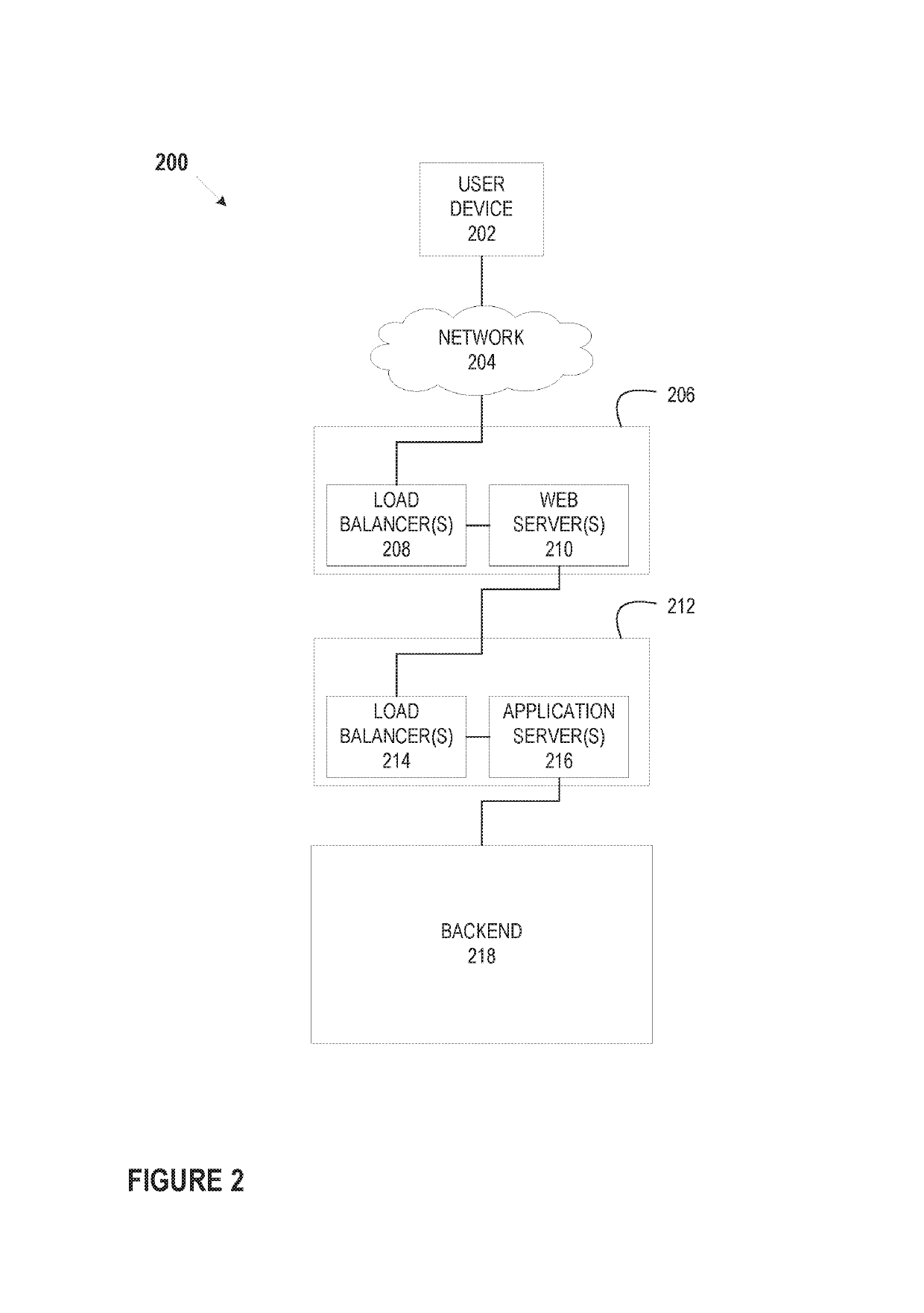

System and method for generating enhanced distributed online registry

ActiveUS10284541B1Promote generationEnhanced distributed online registryData processing applicationsConnection managementApplication processorWindows Registry

A system for generating an enhanced distributed online registry that utilizes an interoperable framework, and machine learning and natural language processing technologies to automatically provide compatible registry items. A persistent secure connection across distributed systems facilitates automatic synchronization of the generated online registry items across the distributed systems and devices accessing those systems. The online registry application processor utilizes machine learning and natural language technologies to generate an acquisition trending model which may be utilized to generate an enhanced distributed online registry that may determine and provide registry items that are compatible with the customer acquisition. Utilizing a persistent bi-directional connection, the online registry application processor may automatically synchronize the enhanced distributed online registry in real time as registry items are added and purchased.

Owner:CAPITAL ONE SERVICES

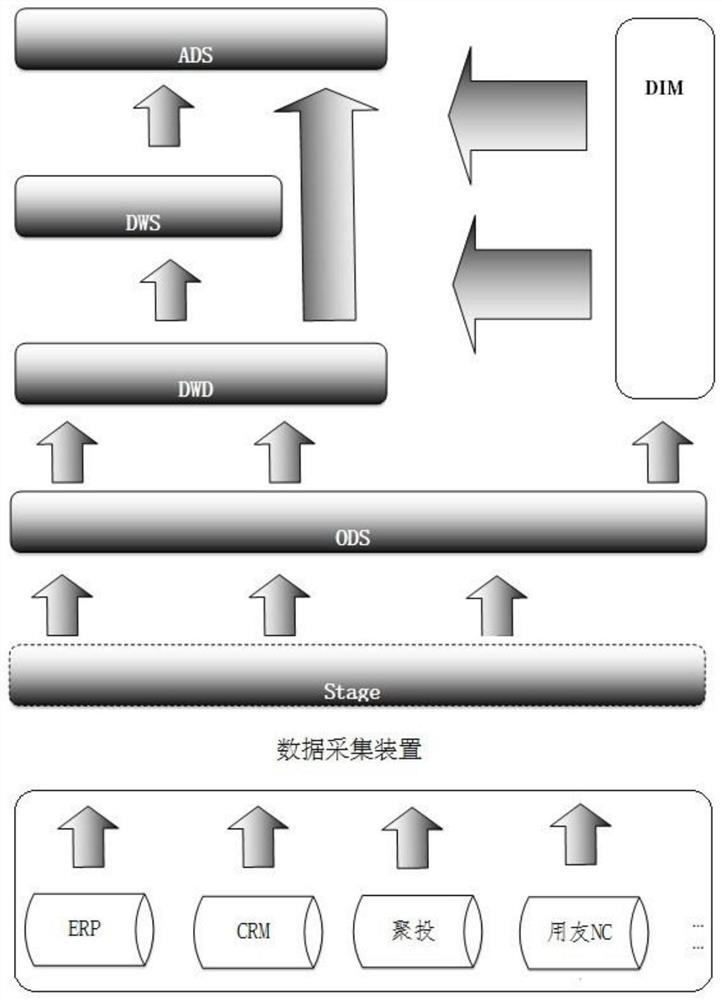

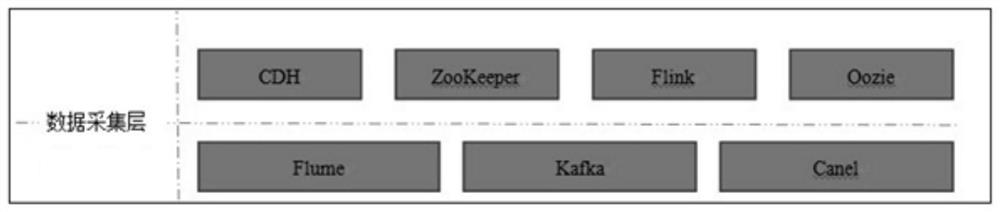

Service data processing system and method based on data middle platform

PendingCN112199430AAvoid delayGuaranteed real-timeDatabase management systemsForecastingData processing systemData acquisition

The invention discloses a service data processing system and method based on a data middle platform. The system comprises the data middle platform and a data acquisition device, The data acquisition device is used for acquiring data source information of at least one service platform; the data middle platform analyzes and processes the acquired data source information to generate a data source inthe same service scene; and the data sources under the same service scene are taken as service data for the foreground to respond to the service requirements of the foreground. According to the scheme, logic packaging is carried out on multi-source mass data to form the data middle platform, and standardization of service data is achieved; by use of the data middle platform technology, data islands are broken, data structures are integrated, data exits are unified, a data closed loop is formed, various data such as client acquisition, medium channel management, marketing links, operation conditions and financial management are connected in series, and the situation that data drives business development can be formed.

Owner:苏州龙盈软件开发有限公司

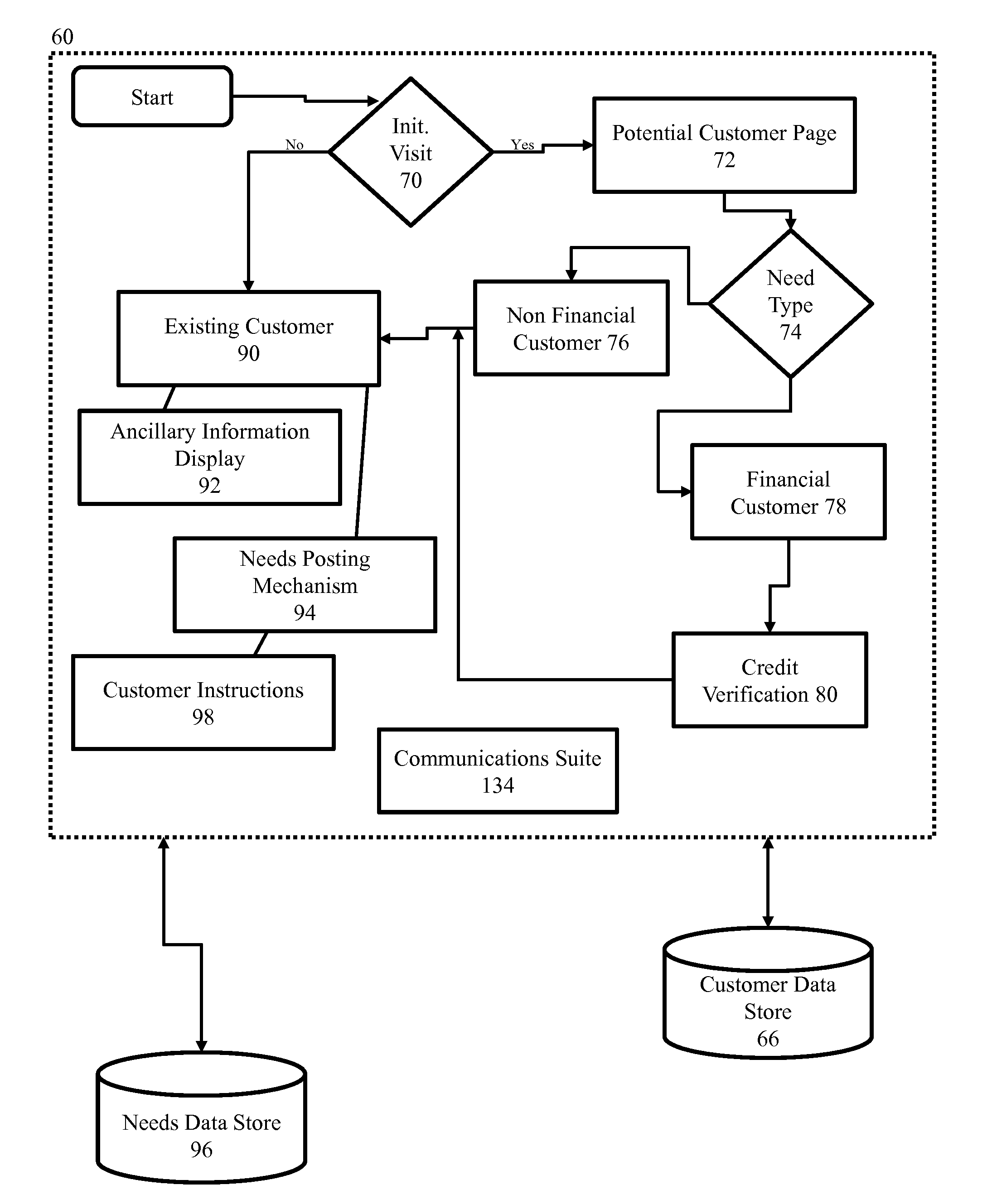

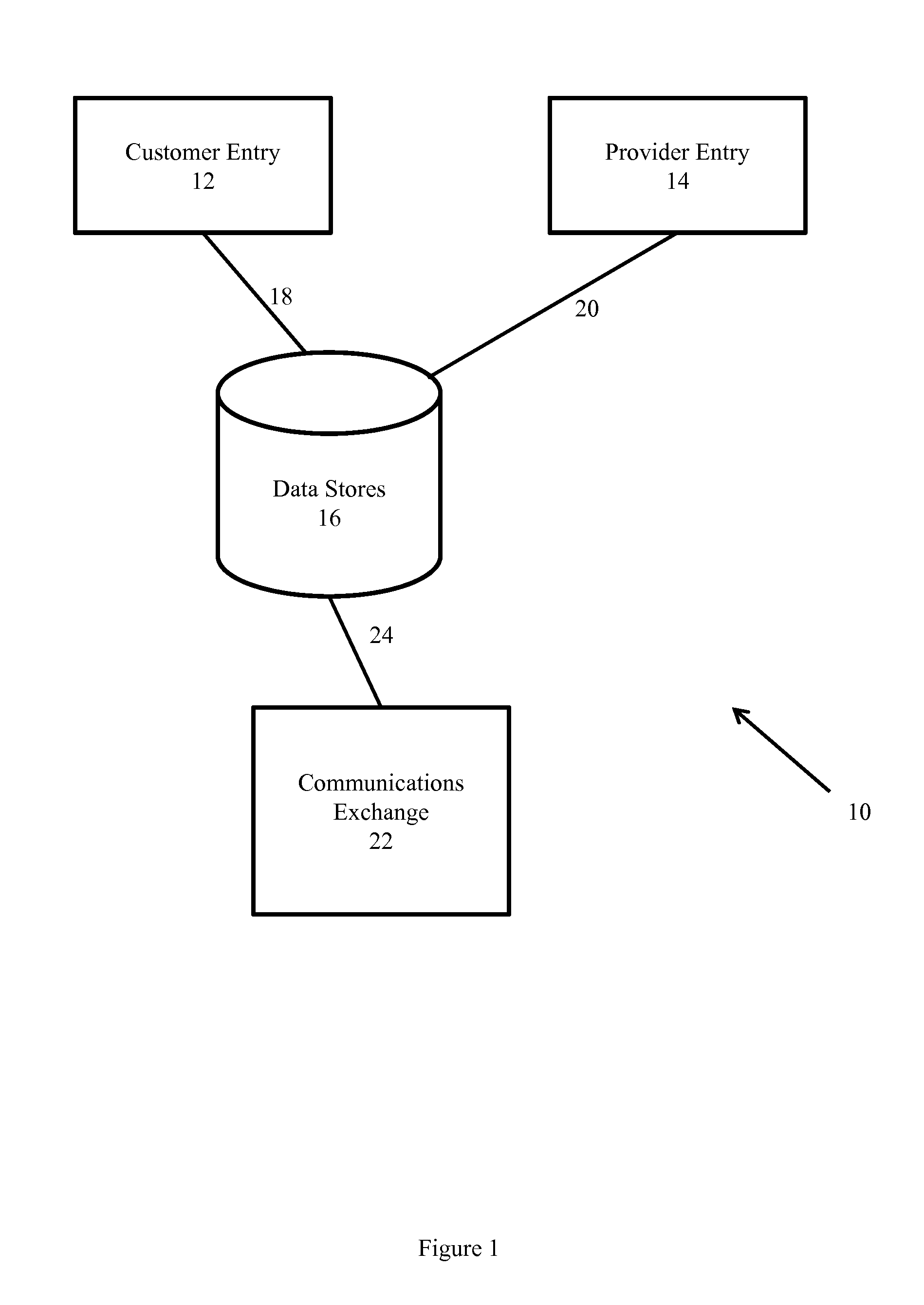

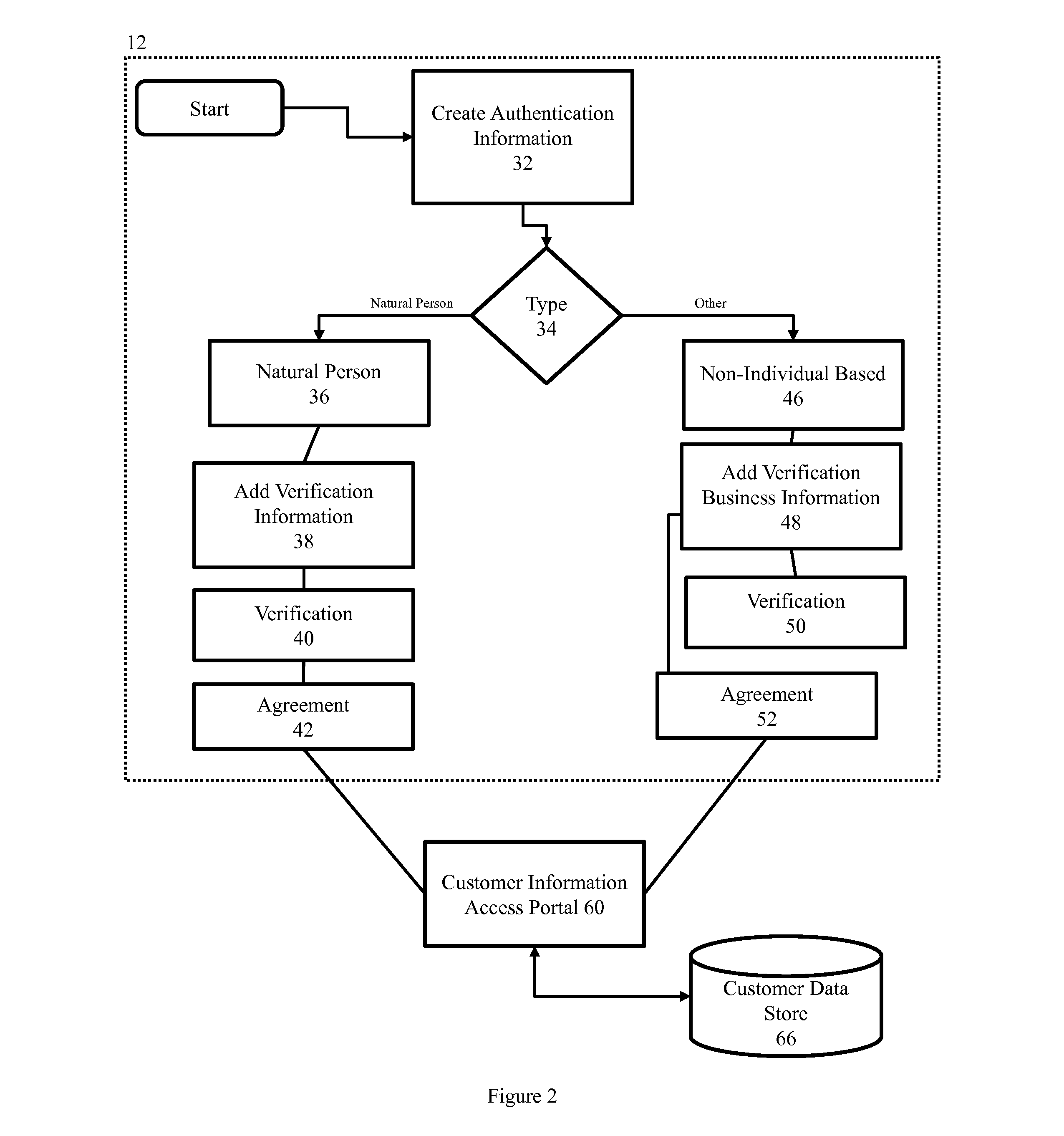

System and method of exchanging financial services information and of communication between customers and providers

One embodiment of the invention is a financial services information service that allows financial service customers to securely post their financial needs and to impart instructions pertaining to suppliers of financial services reviewing said needs. Intending to identify new transactions and acquire new customers, financial service providers review needs posted by costumers in the customer database. Providers select the entries of interest and can purchase the legal names of customers associated with specific needs. Business method intends fee charges to be attractive to providers of financial services in view of typical customer acquisition costs and to promote selectivity and to avoid abuses by providers. For additional fees providers can also send high customized messages to potential customers in order to maximize attractiveness of initial contact. Invention also creates a ratings and review method intended to differentiate providers and reward financial services providers worldwide committed to excellent service. Customers remain empowered during the process by selecting and excluding providers accessing information about their posted needs and ultimately deciding which providers will obtain their contact information. The system provides a method for the customers and providers to communicate and for third parties to advertise.

Owner:ORTEGA MARGARET D

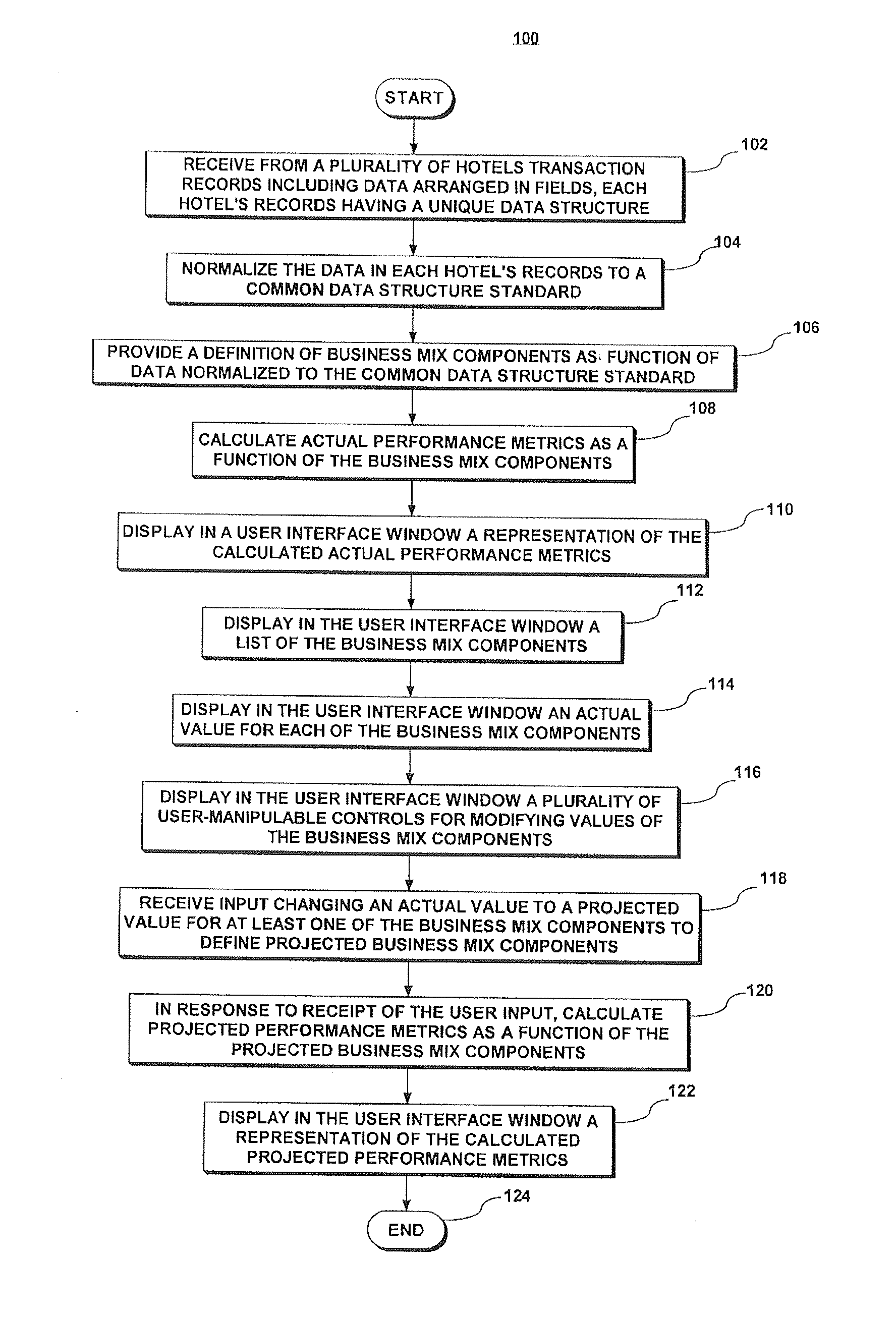

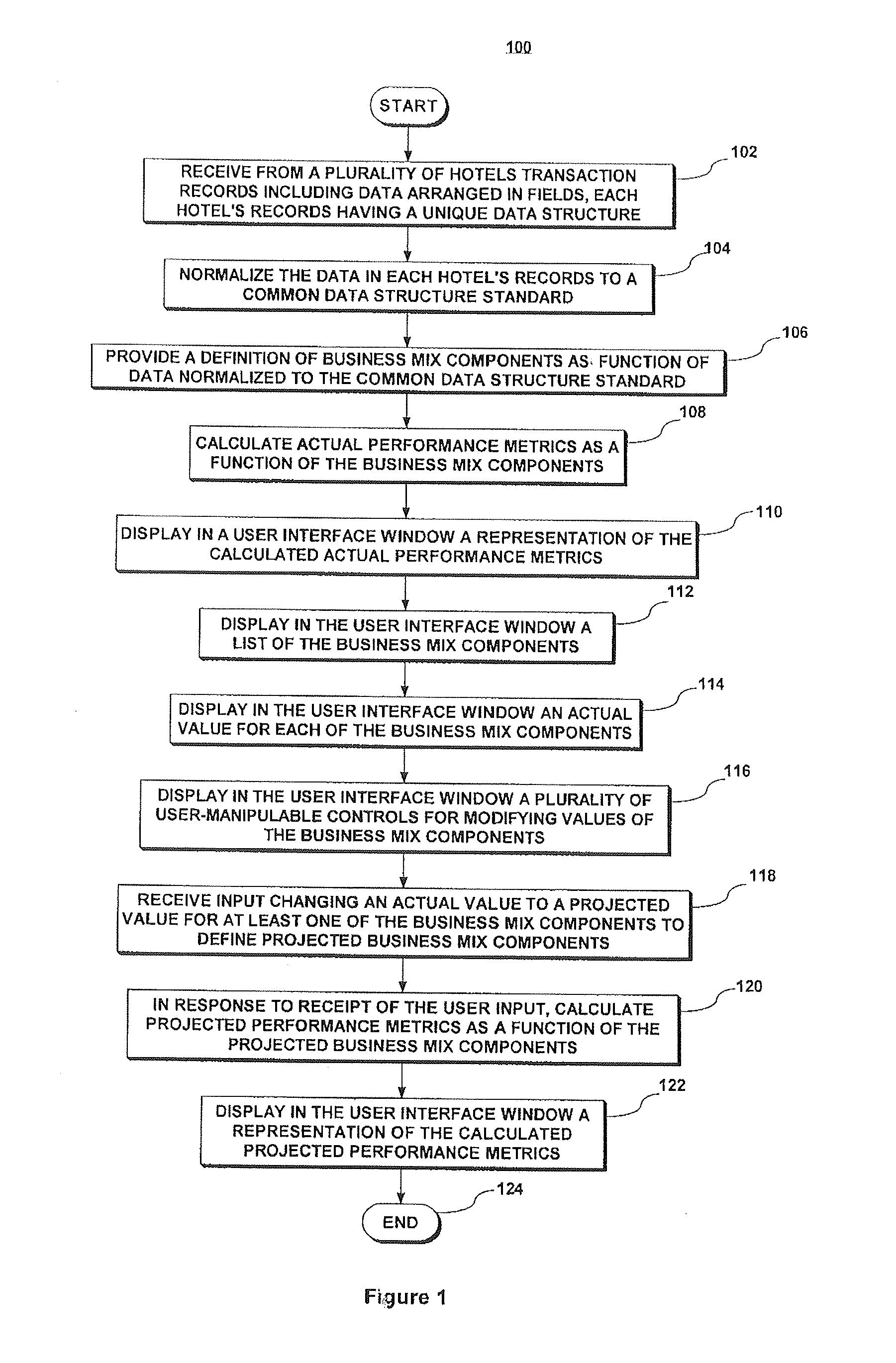

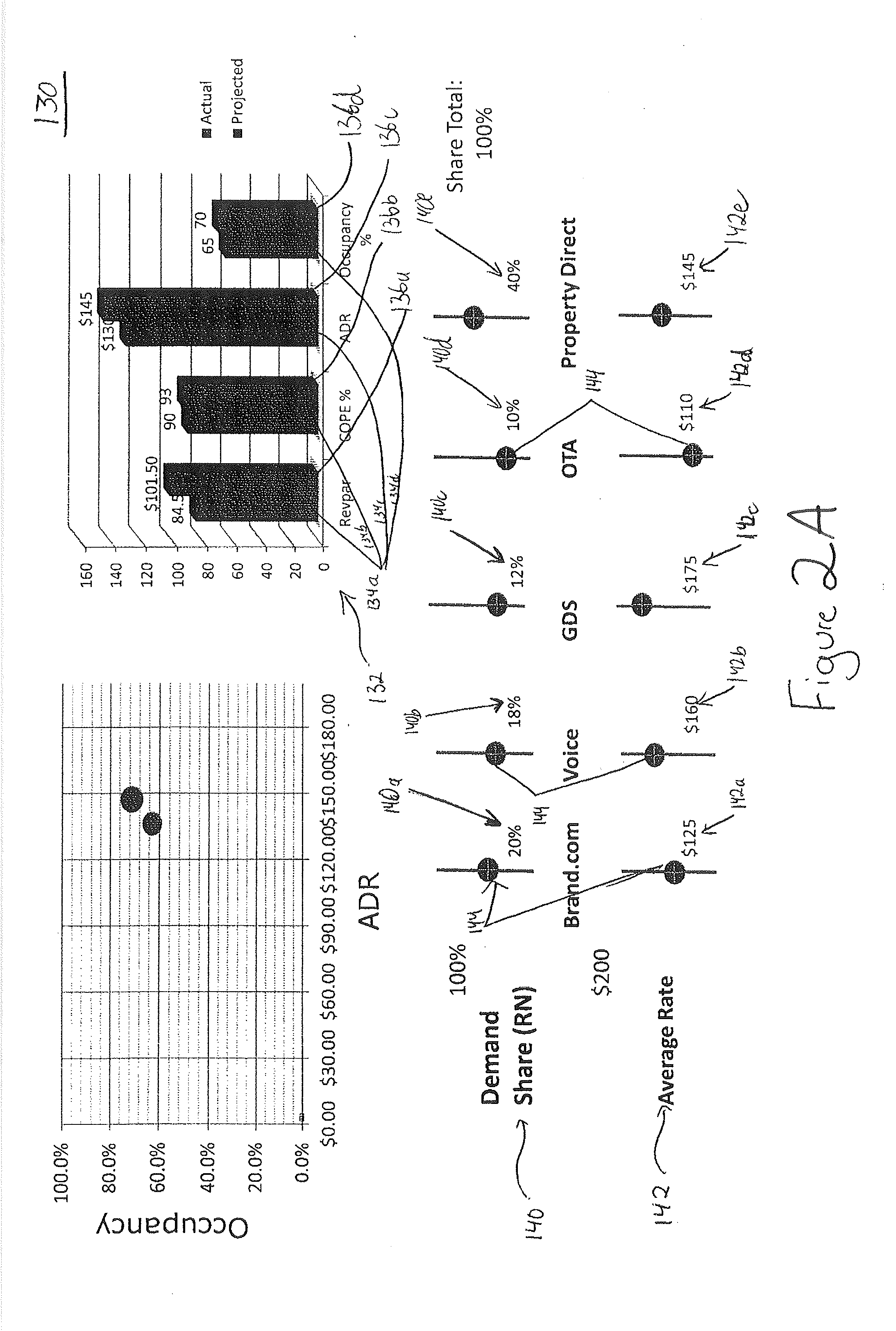

System and method for analyzing hospitality industry data and providing analytical performance management tools

Hospitality customer acquisition and retention costs are analyzed on a per-channel, channel-agnostic, and aggregated basis. Hotel performance is analyzed by examining net revenue by channel (accounting for each channel's contribution to operating expenses and profits), net revenue in aggregate (via net revPAR and revPAR capture metrics), and the relative benefit of sales and marketing expenses by quantifying net sales and marketing efficiency. Conceptually, this differentiation parses the relevant business into a revenue performance evaluation and a return on investment evaluation, in terms that are specific to the hospitality environment. Transaction data is analyzed from multiple hotels and each hotel's costs are mapped to a common data structure to allow for hotel-to-industry comparisons. Graphical user interfaces are provided for reporting data and comparisons, and for receiving input to initiate what-if analyses to determine projected impacts to performance metrics as a result of changes made to business mix components.

Owner:KALIBRI LABS

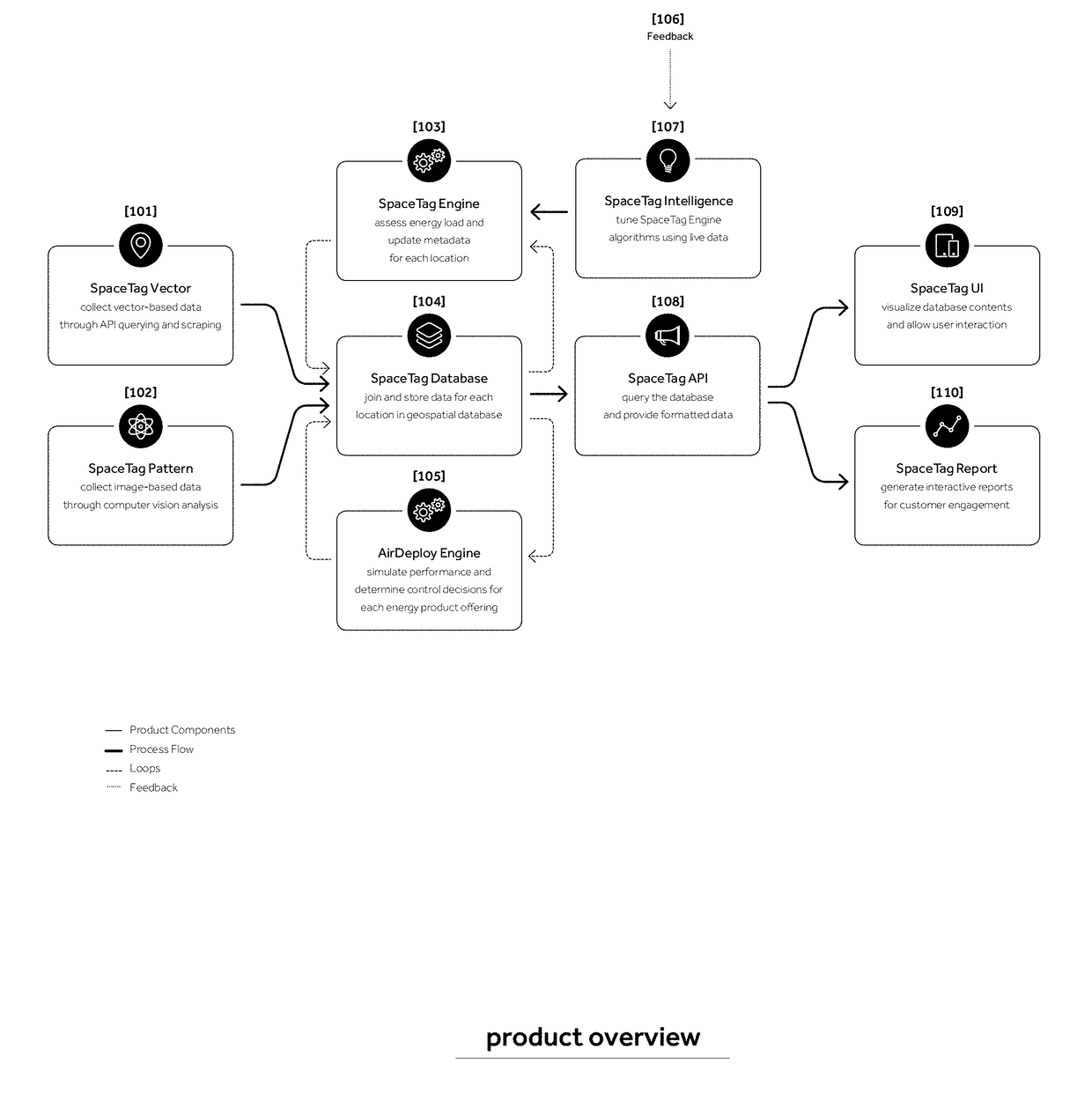

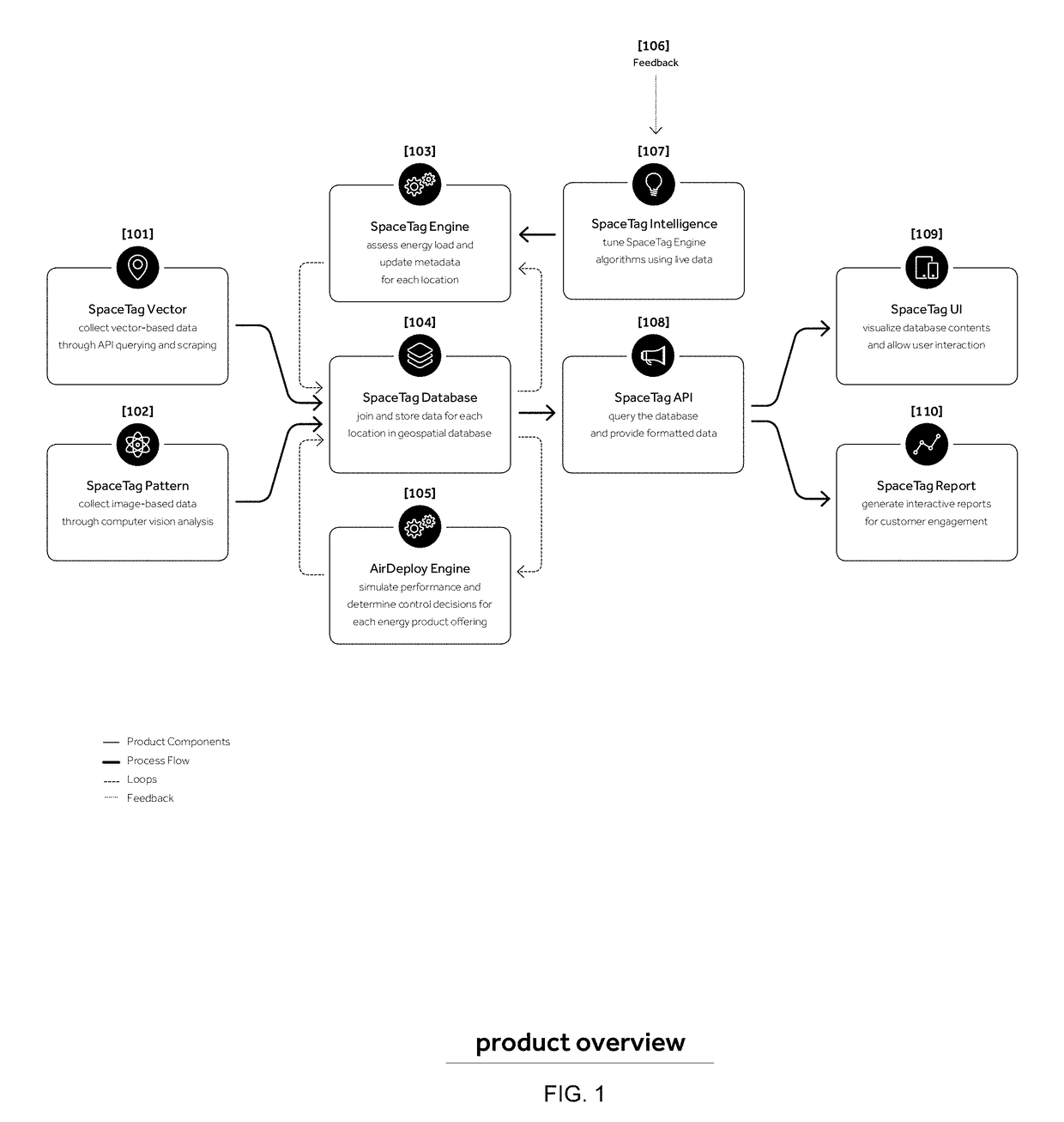

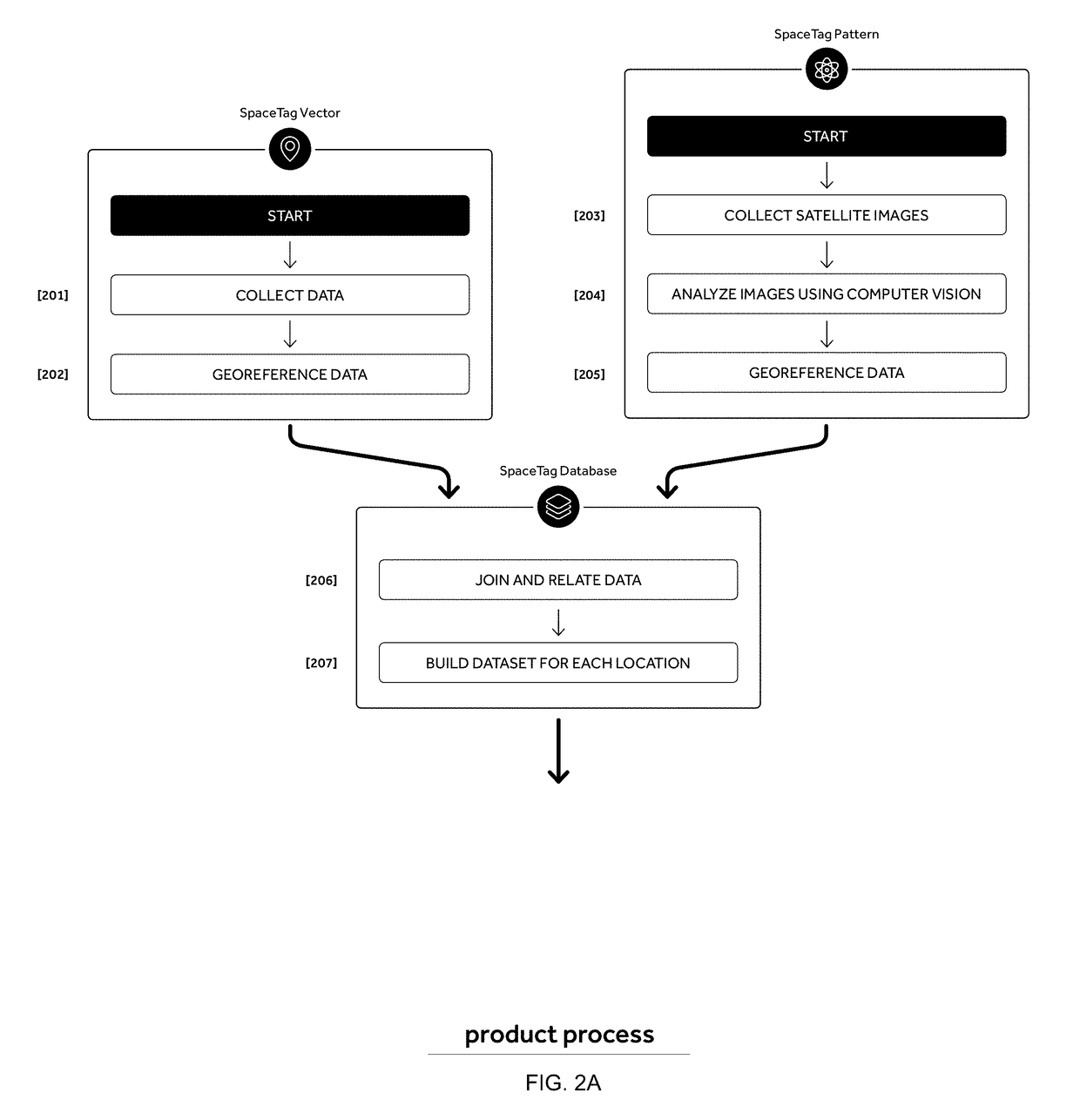

Method and system for determining energy management strategies

In one aspect, a Customer Acquisition method and system are provided to identify target customers and market sizing based on forecasting a customer's energy usage and determining a customized set of energy product offerings to satisfy a customer's energy needs. In another aspect, an Energy Resource Management method and system are provided to select and place energy products to meet the requirements of a particular objective function for a utility, power provider and / or customer. Objective functions can comprise of peak usage reduction, bill or cost minimization, deferred utility upgrades, emissions reduction, efficiency increases, and energy conservation. In still another aspect, an Energy Resource Management method and system are provided for anticipating and estimating implementation costs, optimizing installation strategy and product placement for the purposes of customer cost savings and budgeting.

Owner:STATION A INC

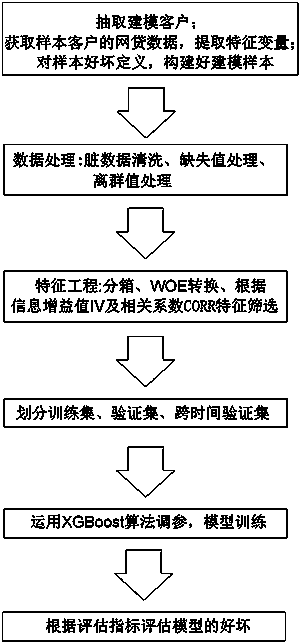

Internet financial risk control model based on XGBoost

The invention provides an Internet financial risk control model based on XGBoost. The Internet financial risk control model based on XGBoost comprises the following steps: S1, extracting an appropriate modeling sample client; s2, obtaining online loan data of a sample client, and extracting a feature variable corresponding to the online loan data; s3, defining 'good ' and 'bad' of the modeling sample according to the repayment behavior of the customer, the quality of the target customer group and the product type; s4, data processing, including dirty data cleaning, missing value processing andabnormal value processing; s5, feature engineering including feature construction and feature screening; s6, data set division: randomly or cross-time dividing a training set and a verification set;s7, performing training by applying an XGBoost algorithm, and performing model parameter adjustment; and S8, evaluating the model: evaluating the quality of the model according to the evaluation indexes. On one hand, third-party data are additionally used, the dimensionality of risk identification is increased, and meanwhile, the efficiency and robustness of a model algorithm are optimized throughan XGBoost algorithm with high prediction capability; on the other hand, the accuracy of the model is continuously optimized through XGBoost algorithm parameter adjustment and model evaluation, and the method is more suitable for the demand of big data risk control.

Owner:百维金科(上海)信息科技有限公司

Automated method for allocation of advertising expenditures to maximize performance through look-alike customer acquisition

InactiveUS20180068350A1Maximize acquisitionImprove performanceMarket predictionsThe InternetAutomated method

Systems and methods for optimizing allocation of advertising expenditures for online commerce, comprising dividing a population of users of an online game or service into a number of logical segments for analysis and optimization, linking said users to the other Internet locations where the advertisements were placed that led those users to the online game or service being optimized, automatically evaluating the value of those users from those Internet sources, identifying the most valuable users, determining which sources deliver those users, increasing the advertising efforts that deliver high-value users, decreasing the advertising efforts that deliver lower-value users, and thereby automatically improving the overall performance of the game or service.

Owner:SCI REVENUE

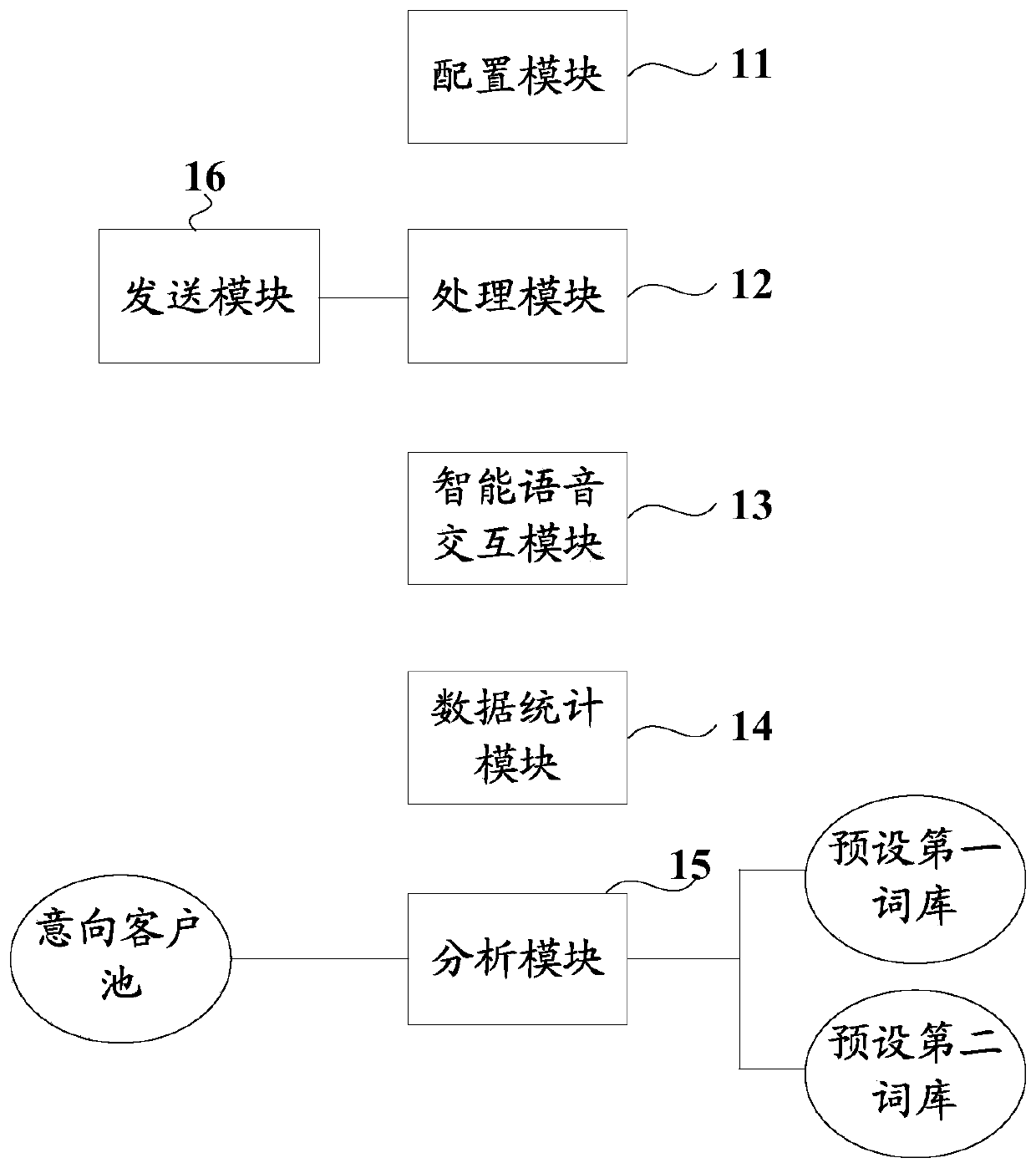

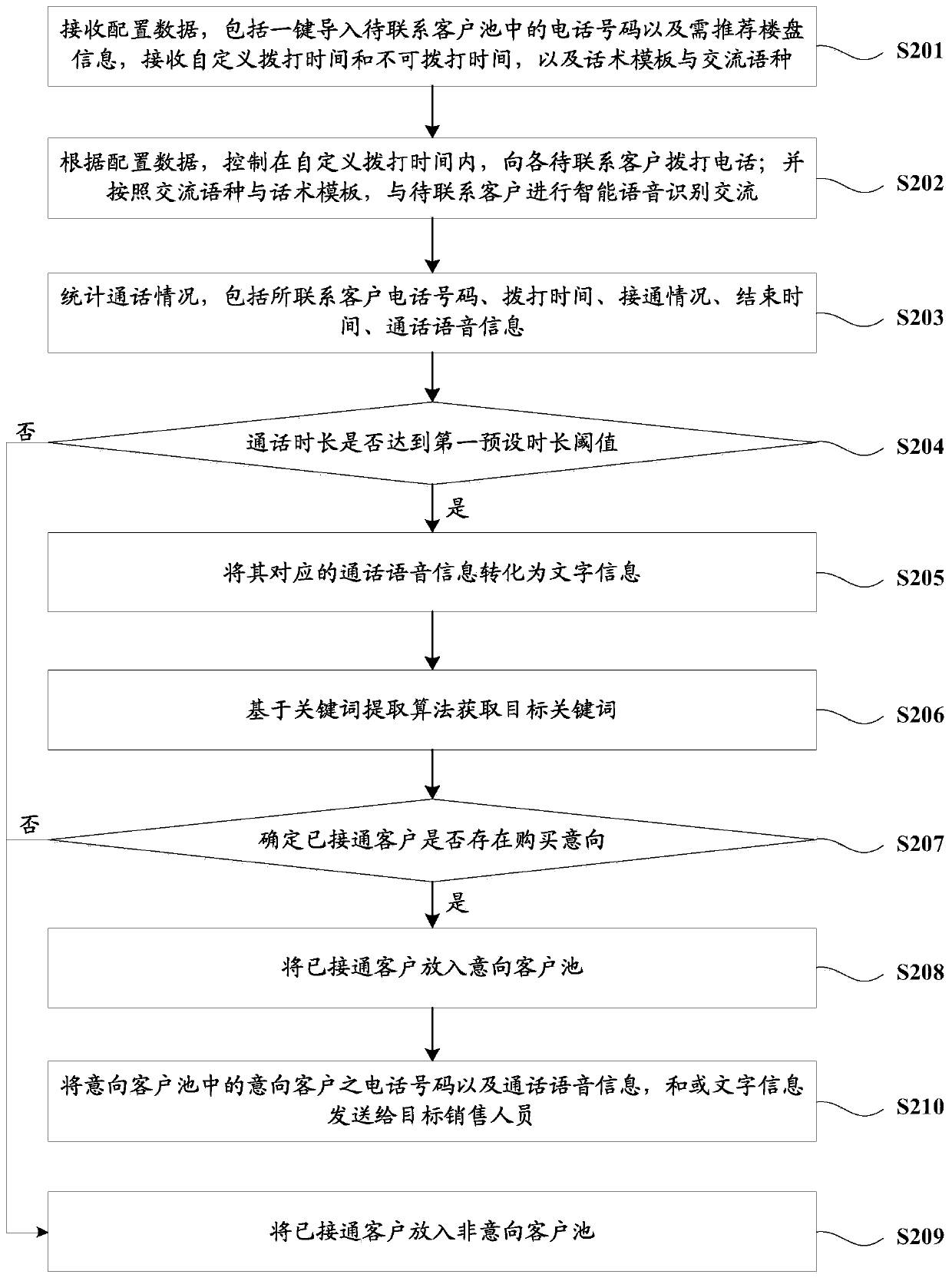

Artificial intelligence telephone customer developing marketing management system and method

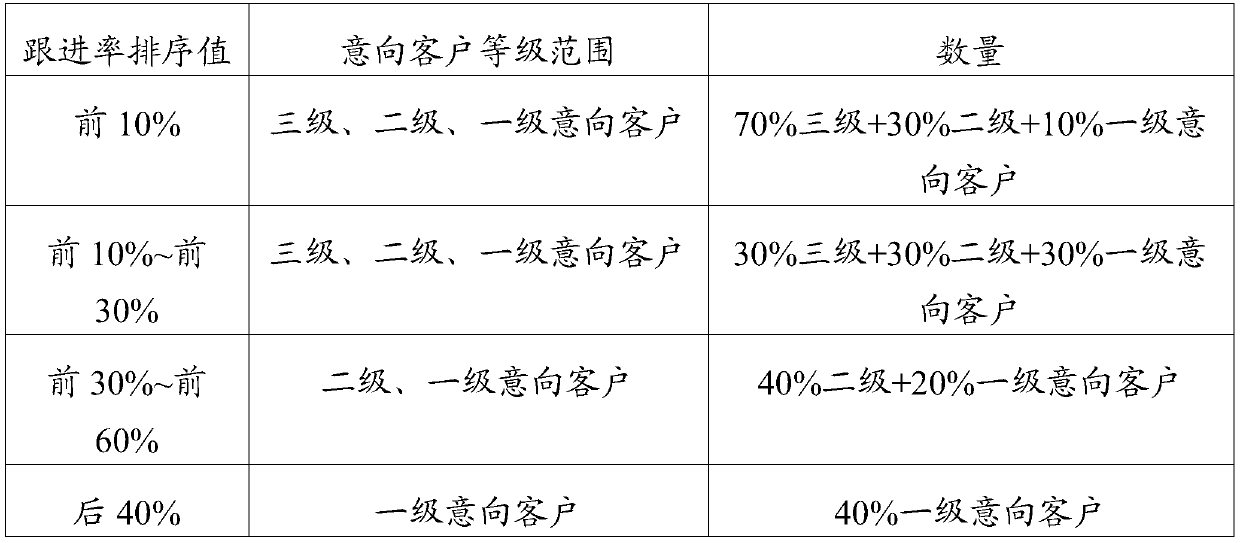

ActiveCN110990545ASolve efficiency problemsSolve the conversion rateDigital data information retrievalBuying/selling/leasing transactionsData controlSpeech sound

The invention provides an artificial intelligence telephone customer developing marketing management system and method. The method comprises the following steps: receiving configuration data, controlling intelligent voice recognition communication with a to-be-contacted customer according to the configuration data, counting call conditions, analyzing the call conditions, acquiring call duration ofthe answered customer, and if the call duration is judged to reach a first preset duration threshold value, converting call voice information corresponding to the call duration into text information,and acquiring target keywords based on a keyword extraction algorithm; according to the extracted target keywords, determining whether the answered customer has a purchase intention or not; when it is determined that the answered customer has a purchase intention, putting the answered customer into a potential customer pool; and sending the telephone number, the call voice information and / or thetext information of the potential customer in the potential customer pool to a target salesman. The system and the method of the invention overcome the problems of low working efficiency and low conversion rate due to the fact that a large amount of time is wasted in the screening process of potential customers in the traditional mass customer developing process using manual telemarketing.

Owner:重庆锐云科技有限公司

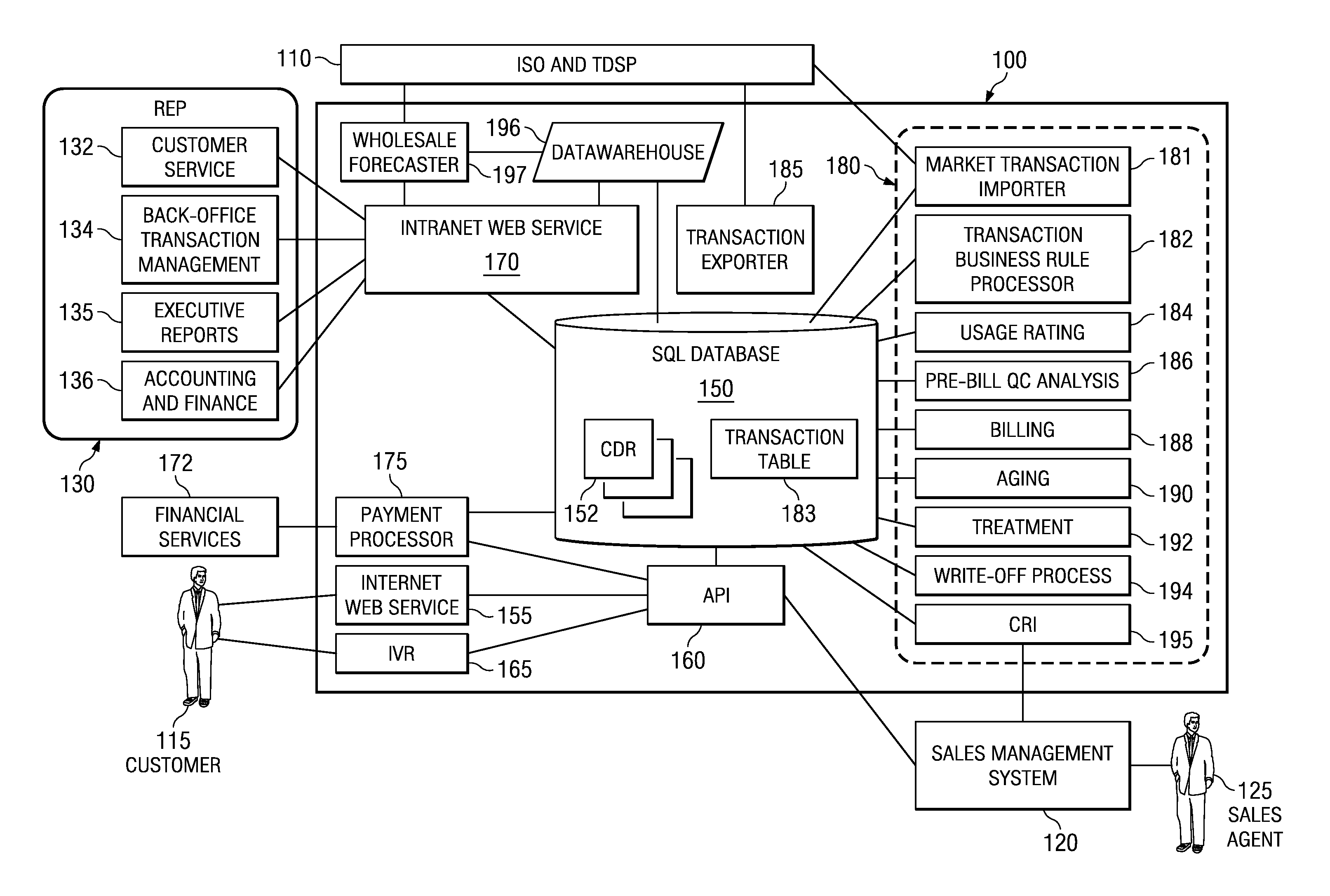

Energy distribution and marketing backoffice system and method

ActiveUS20130246257A1Reduce human workload requirementLower requirementFinancePayment architectureWeb serviceInteractive voice response system

A retail energy provider system comprising a market transaction manager, business rules and requirements processor, usage rater, customer analysis and quality control auditor, customer billing processor and collection manager, customer payment processor, third party sales and marketing application programming interface, customer acquisition and residual income interface, having a wholesale forecaster, interactive voice response system, intranet web services, internet web services and network based external customer service and executive management systems and financial services functions, all said functions and systems interacting with a robust SQL database engine for which the novel database schema is taught herein.

Owner:BLUENET HLDG LLC

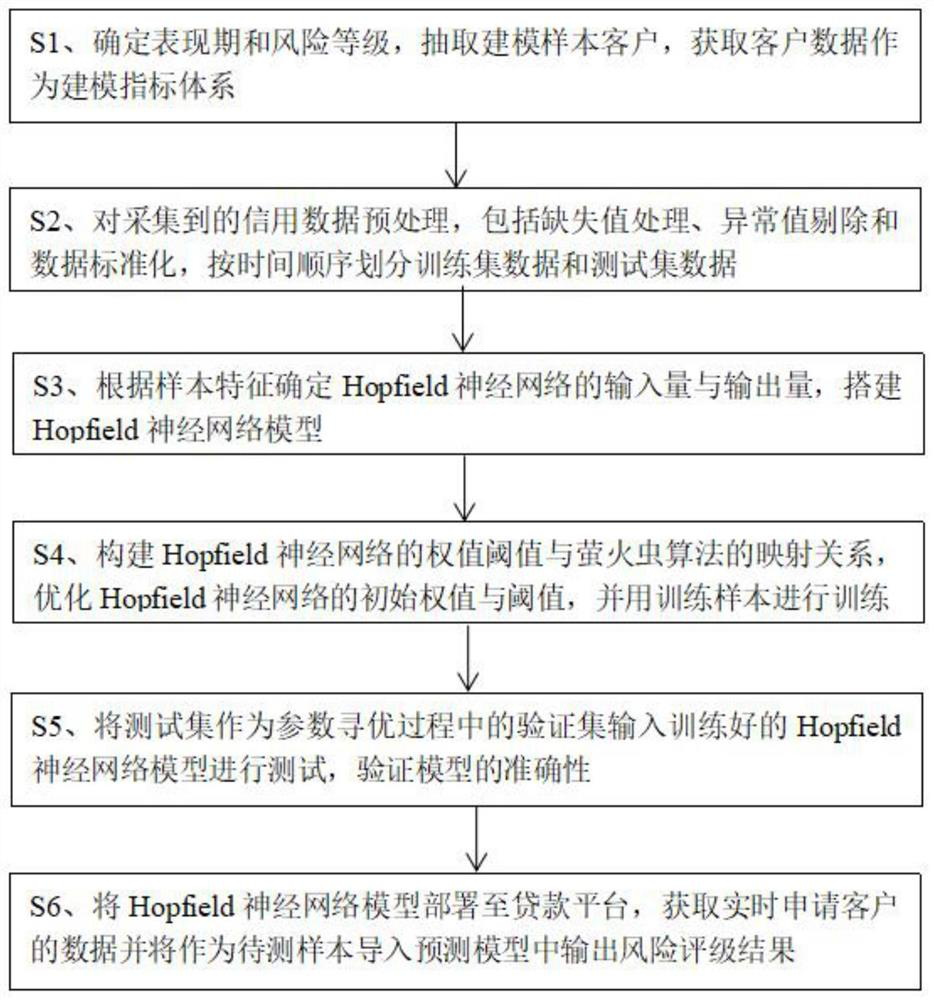

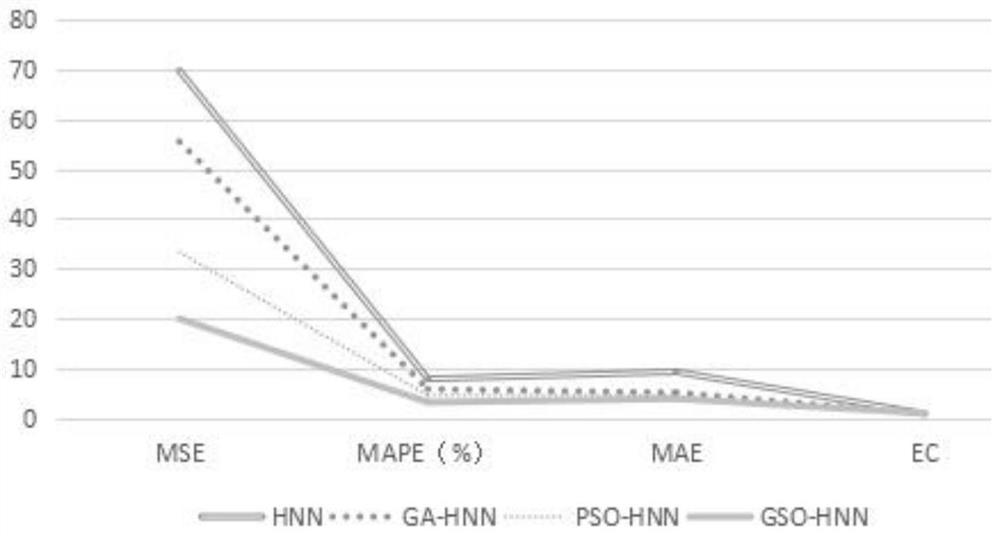

Risk rating method for optimizing Hopfield neural network based on firefly algorithm

PendingCN113538125APowerful Nonlinear MappingStrong parallel computing abilityFinanceCharacter and pattern recognitionData packAlgorithm

The invention discloses a risk rating method for optimizing a Hopfield neural network based on a firefly algorithm, and the method comprises the following steps: firstly, determining a performance period and a risk level, extracting a modeling sample customer, and obtaining customer data as a modeling index system, the customer data comprising the risk level and credit data affecting repayment performance; preprocessing the credit data, and randomly segmenting a training set and a test set; constructing a Hopfield neural network topological structure according to the data features of the modeling sample, determining the parameters of the network, and initializing the weight and threshold of the Hopfield neural network; and constructing a mapping relation between the weight and the threshold of the Hopfield neural network and a firefly algorithm, obtaining an optimal weight and an optimal threshold through the firefly algorithm, and training the Hopfield neural network by using the training set. According to the method, the optimal weight and threshold of the Hopfield neural network are determined by using the firefly algorithm, the convergence speed of the neural network is accelerated, the accuracy of the prediction model is improved, and the requirement of real-time evaluation of Internet financial credit can be met.

Owner:百维金科(上海)信息科技有限公司

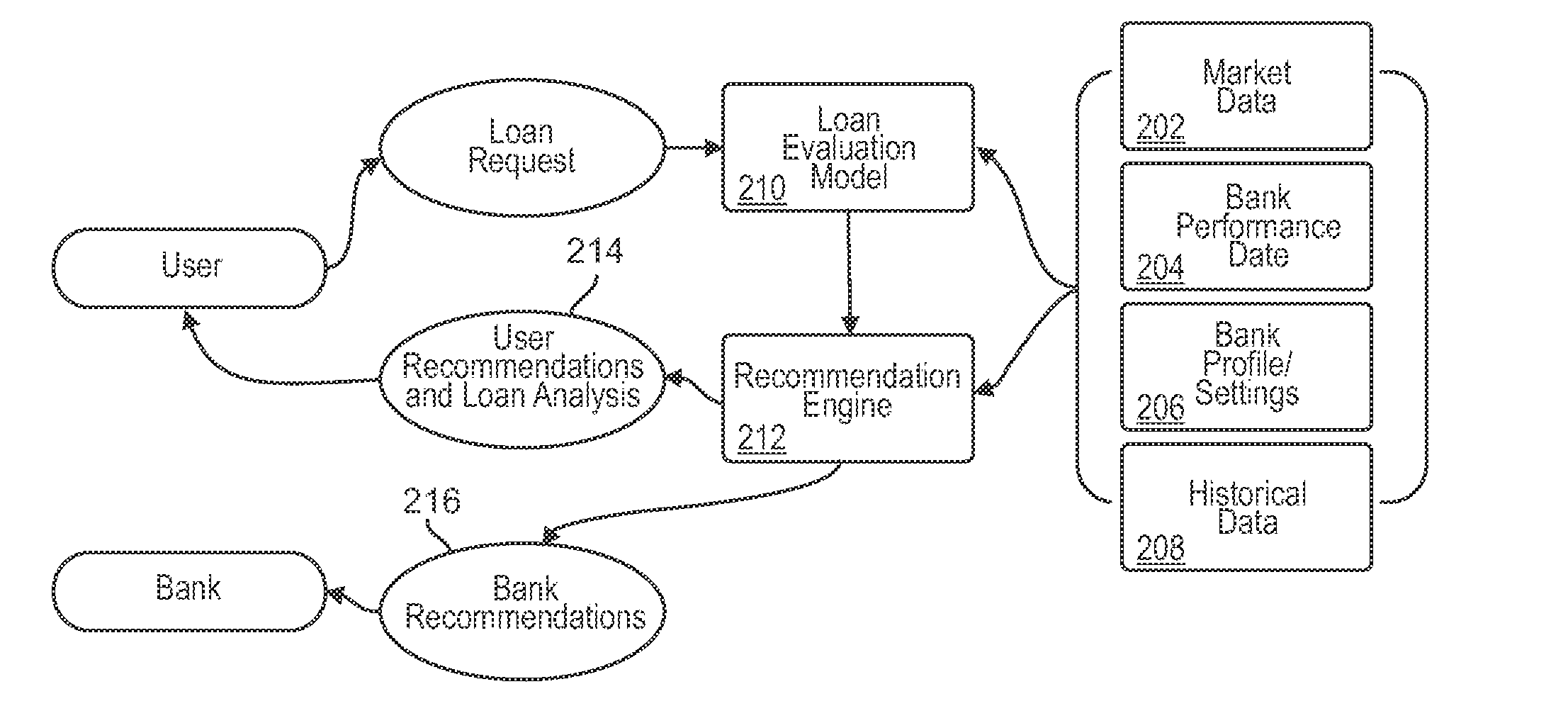

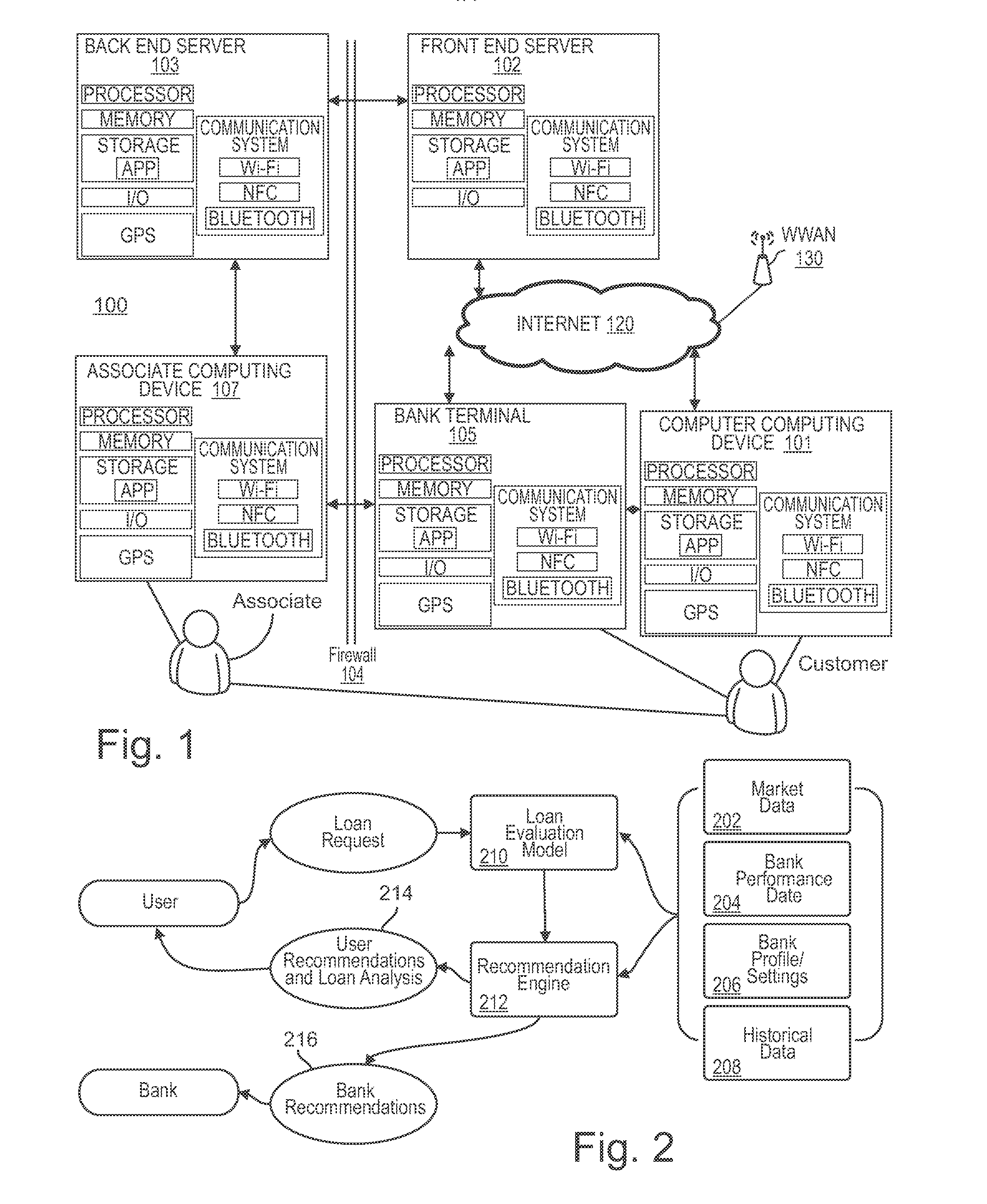

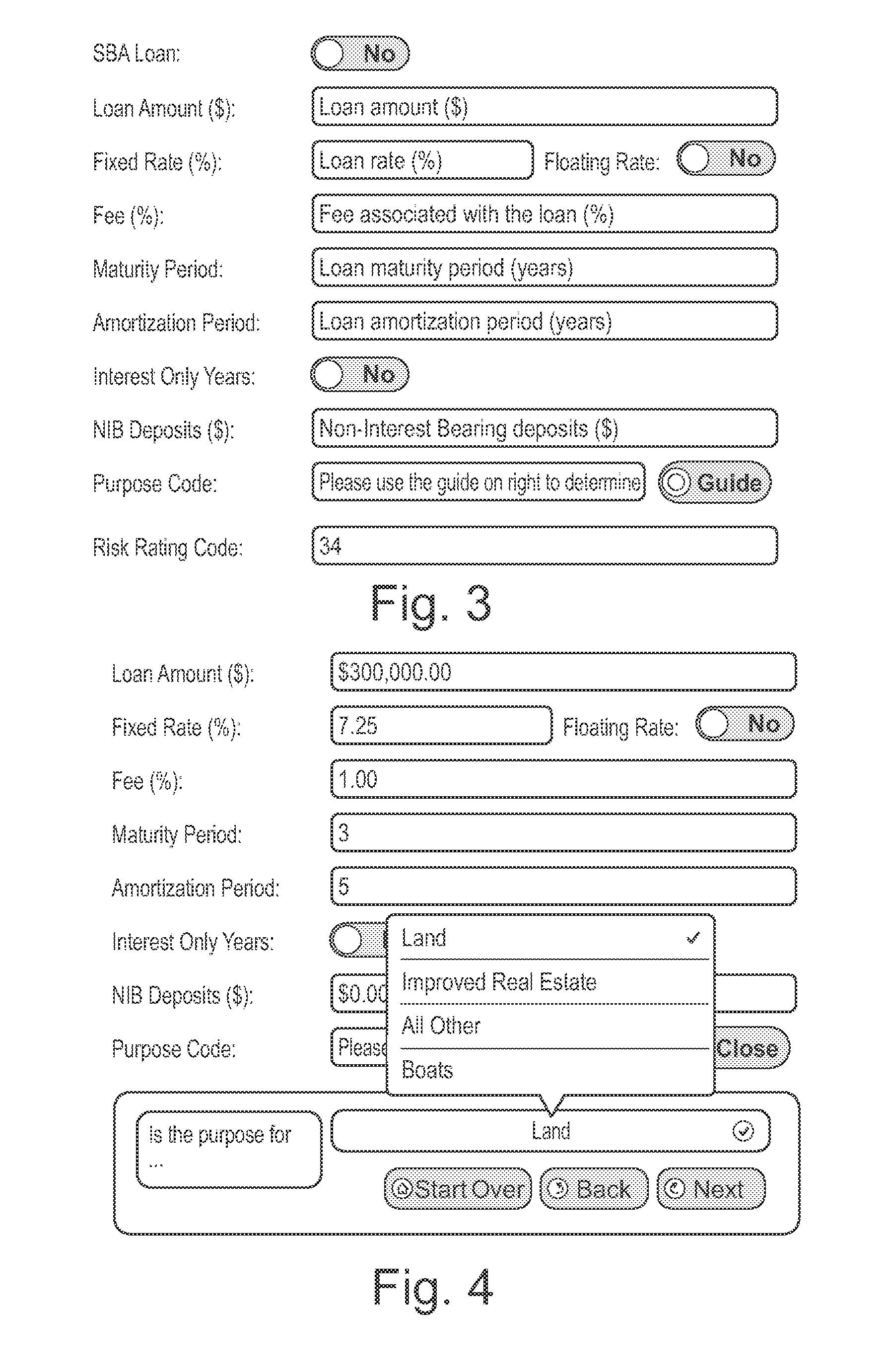

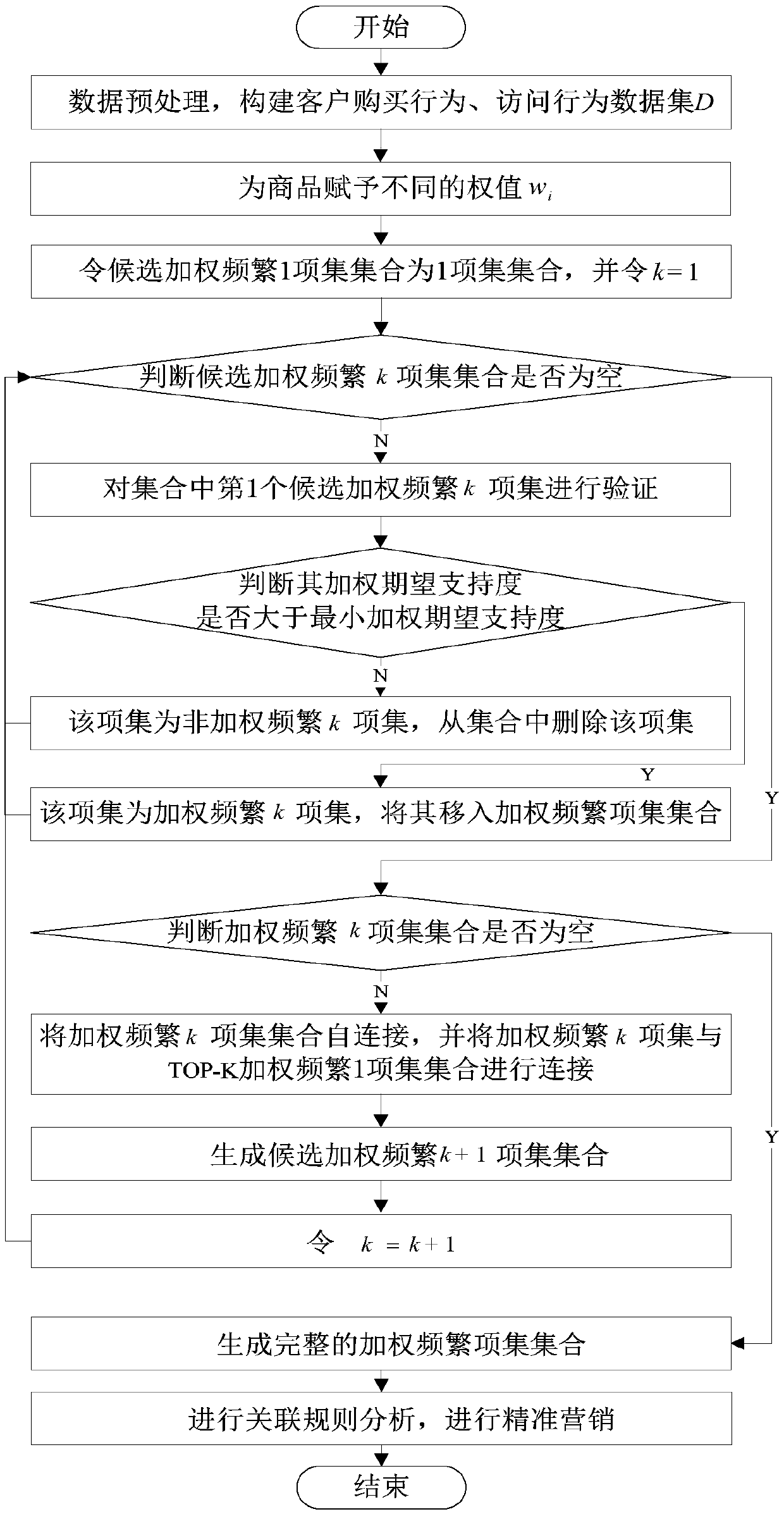

System and method for dynamic customer acquisition probability and risk-adjusted return-on-equity analysis

Disclosed is a method of processing a user's loan request to a bank and making recommendations to the user and the bank. The invention includes using a computer code that evaluates user submitted loan data, public bank data, and private bank data to calculate a bank's risk-adjusted return-on-equity and customer acquisition probability on a given loan. The bank's private data may include bank profile settings and bank historical data. The bank's public data may include UBPR and bank call reports. Also, the method may be utilized to analyze the bank's performance over time.

Owner:BANK OF OZARKS

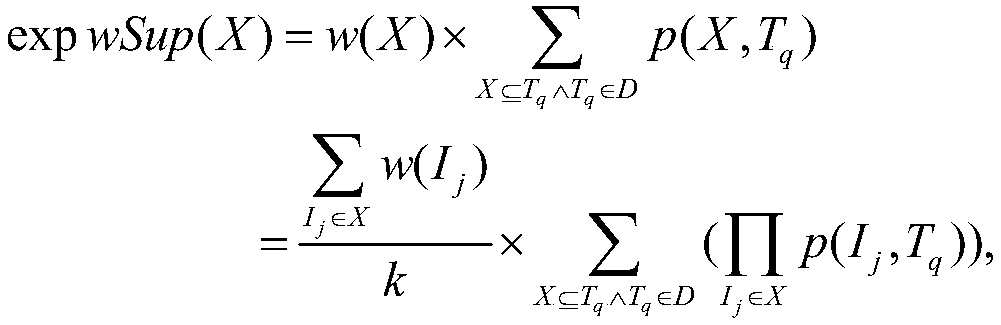

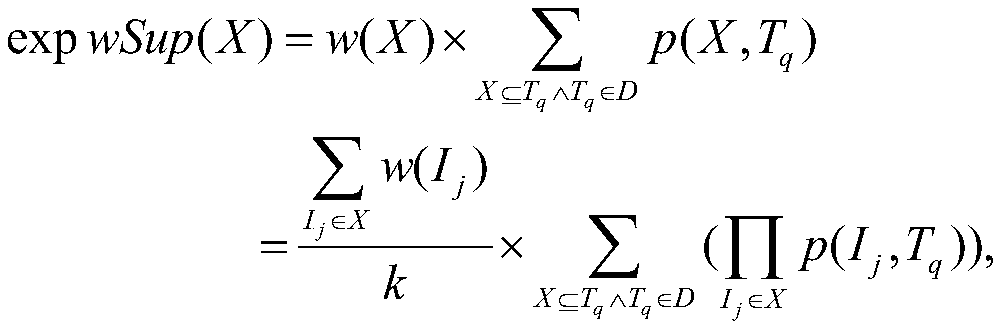

Weighted frequent item set mining algorithm for precision marketing

PendingCN109558435ANarrow down the search spaceReduce in quantityDigital data information retrievalSpecial data processing applicationsE-commercePrecision marketing

The invention provides a weighted frequent item set mining algorithm for precision marketing. According to the invention, firstly, aiming at the problem that a marketing strategy of a sales enterprisehas difficulty in finding a client and the problems of the high customer acquisition cost, the low operation efficiency and the like, the early purchase behaviors of customers and the access behaviors of the customers on an e-commerce platform are analyzed, and different purchase probability values are given to behaviors of purchasing commodities, clicking and browsing, collecting commodities, joining shopping carts and the like so as to reflect preference degrees of the users for different projects; secondly, by endowing the commodity with different weights according to the proportion of theprofit of the commodity to the profit of the enterprise, the importance degree of different commodities to the enterprise are reflected. According to the method, the time efficiency of the algorithmis improved, the frequent item set information with important significance to users can be quickly mined from massive uncertain data, and the accurate marketing is achieved.

Owner:NANJING UNIV OF POSTS & TELECOMM

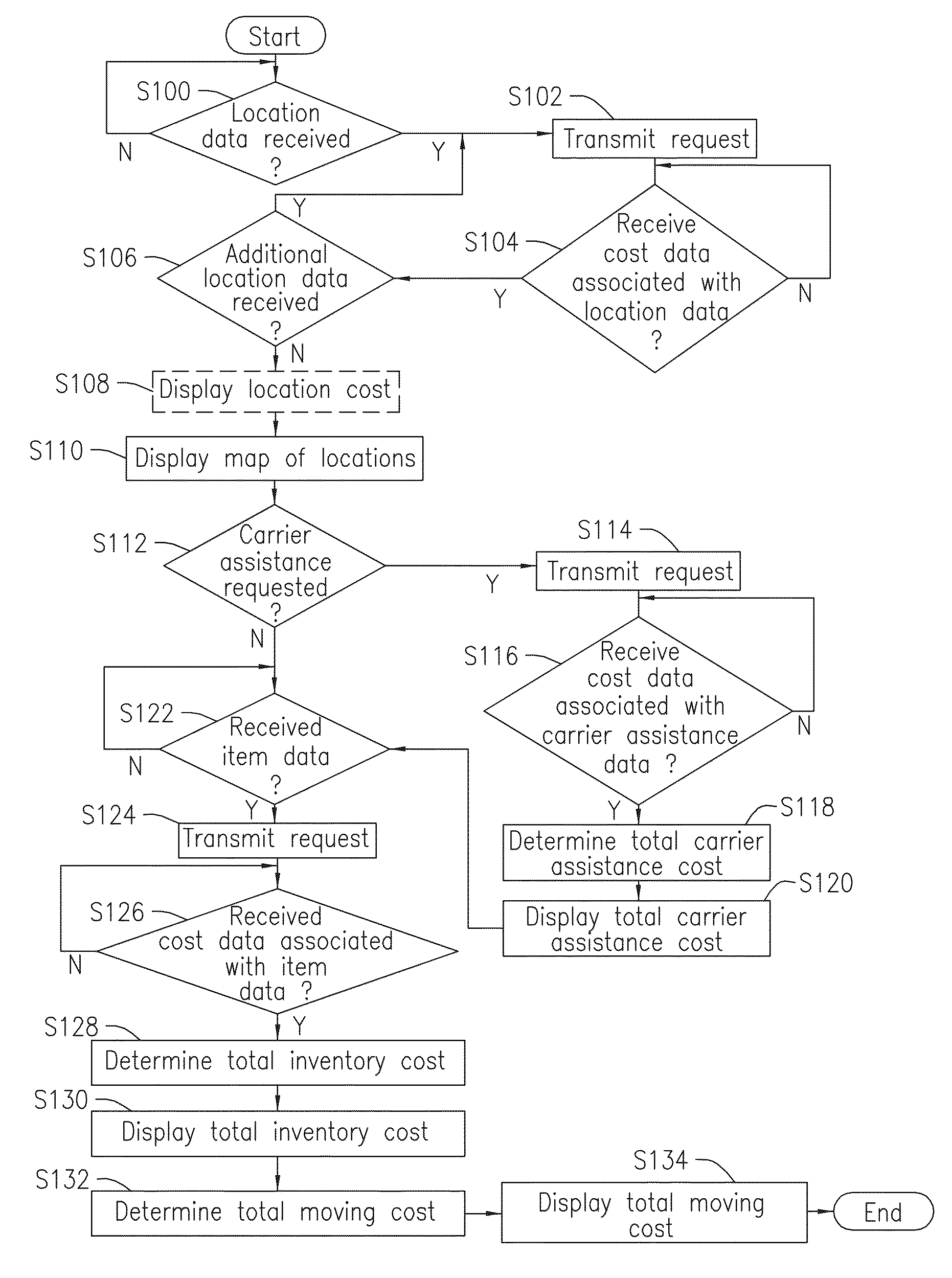

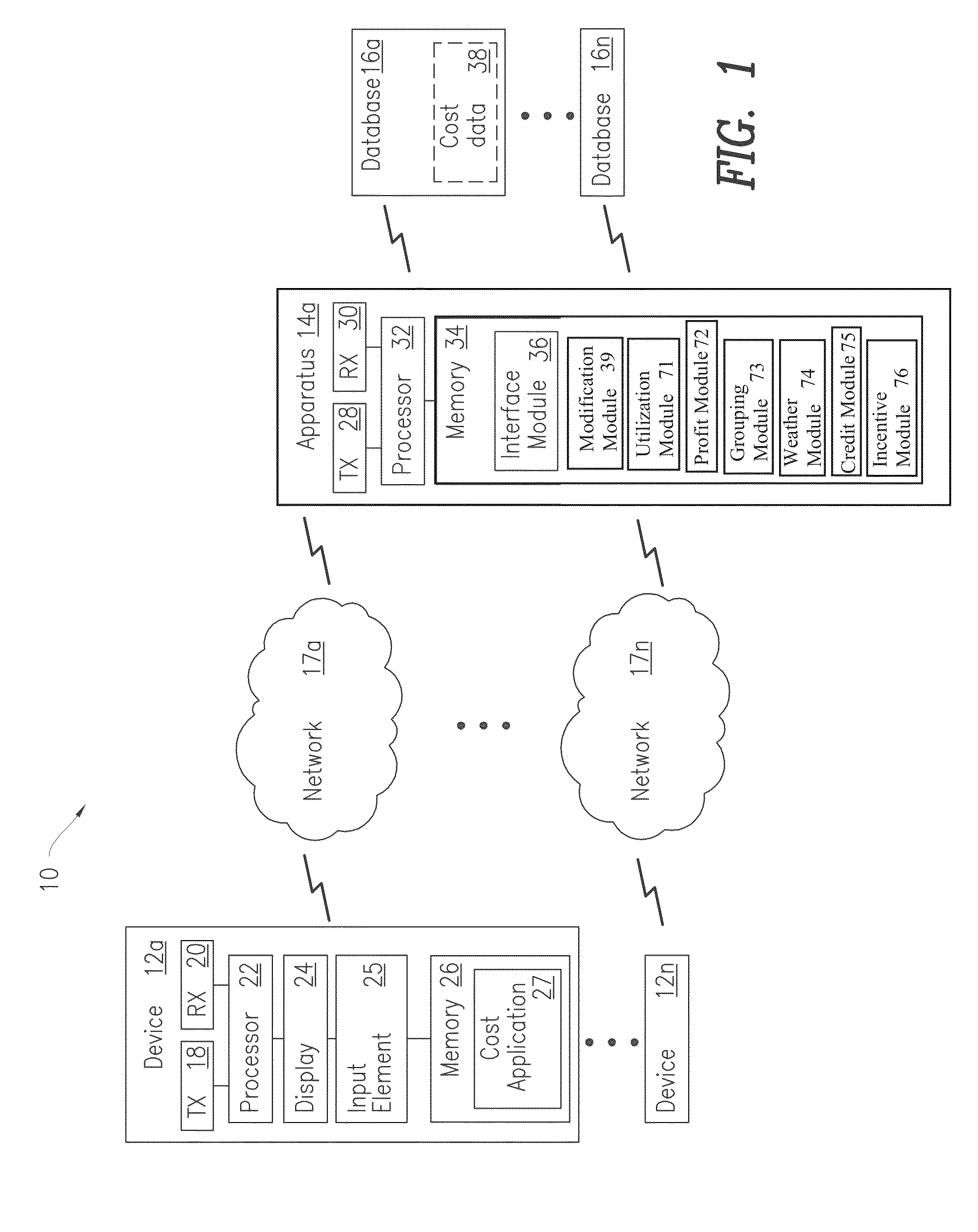

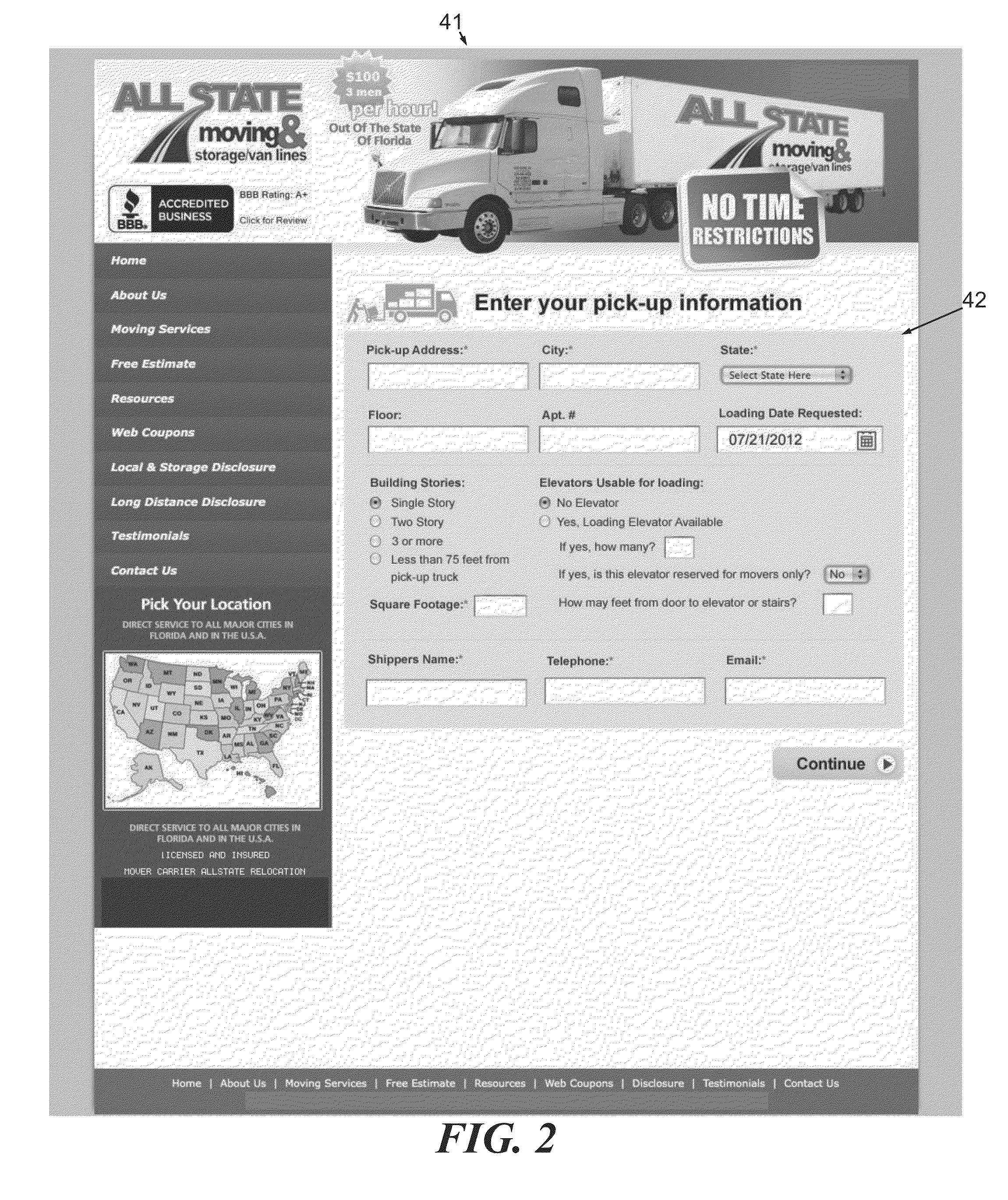

Method and system for optimization of customer acquisition, resource utilization, and profits for a moving company

A method is provided. User input data corresponding relocating a plurality of items is received at a user interface. An initial cost for the moving company to relocate the plurality of items is determined. Availability data is requested. The availability data indicates whether moving resources of the moving company are available for use during a time frame for relocating the plurality of items. Resource utilization of moving resources of the moving company during the time frame is determined based at least in part on the availability data. A determination is made whether the resource utilization meets a predefined threshold. The initial cost is modified based on whether the resource utilization meets the predefined threshold. A determination is made whether the user accepted the modified initial cost. The relocation of the plurality of items is scheduled by reserving at least some of the moving resources during the time frame.

Owner:FREE MOVING PRICE COM

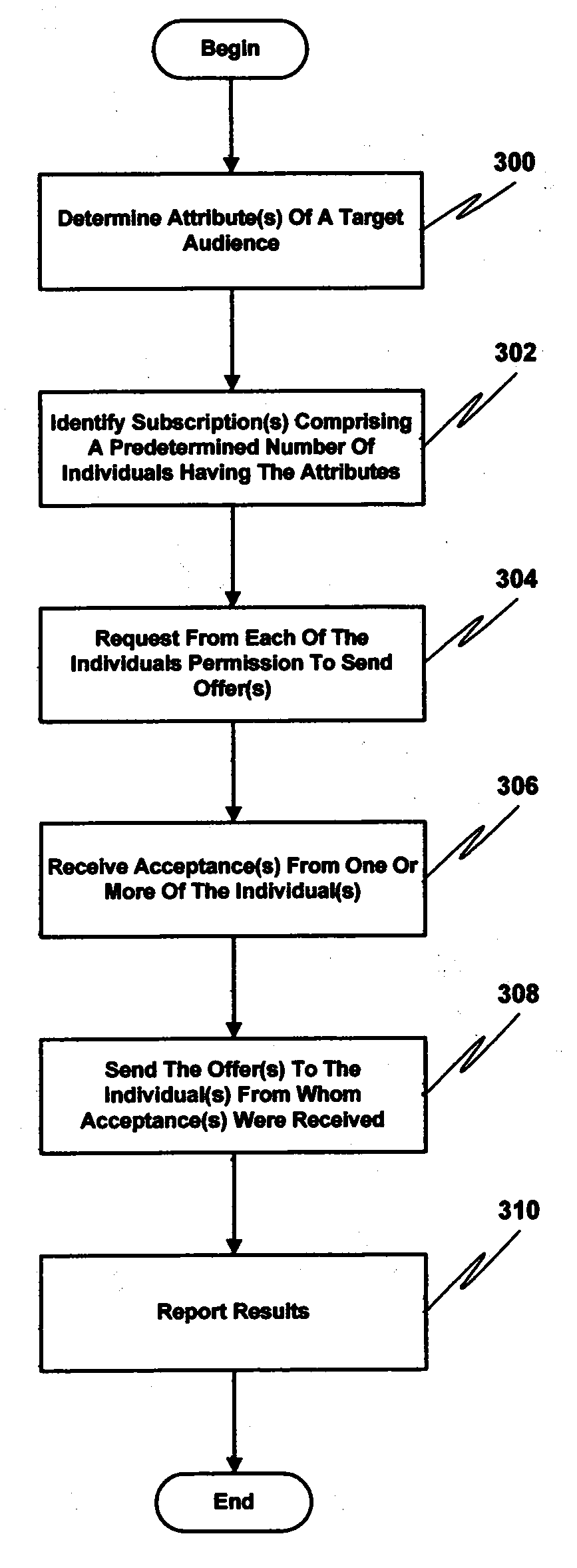

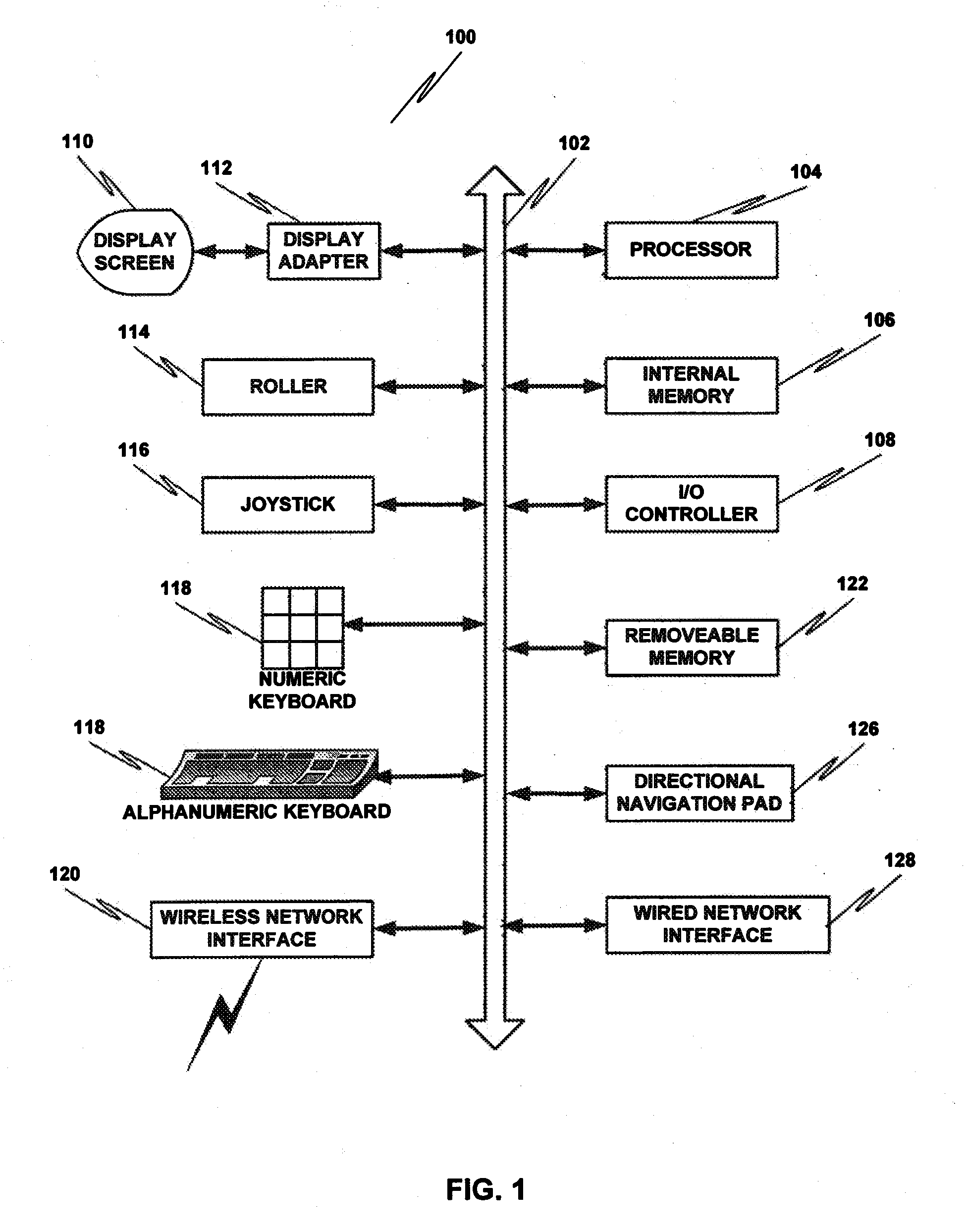

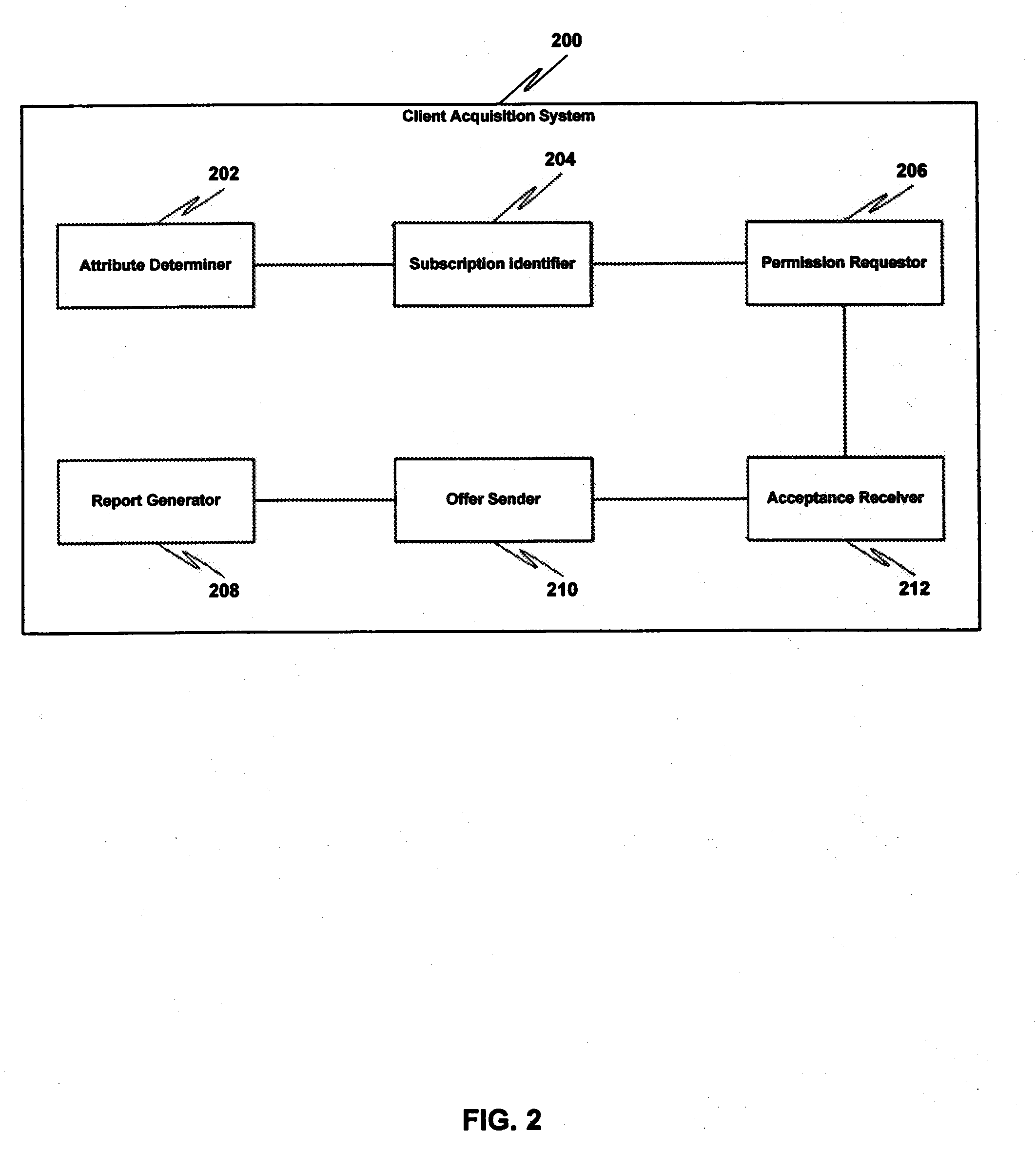

Verticalized automated customer acquisition

Owner:ACQUIREWEB

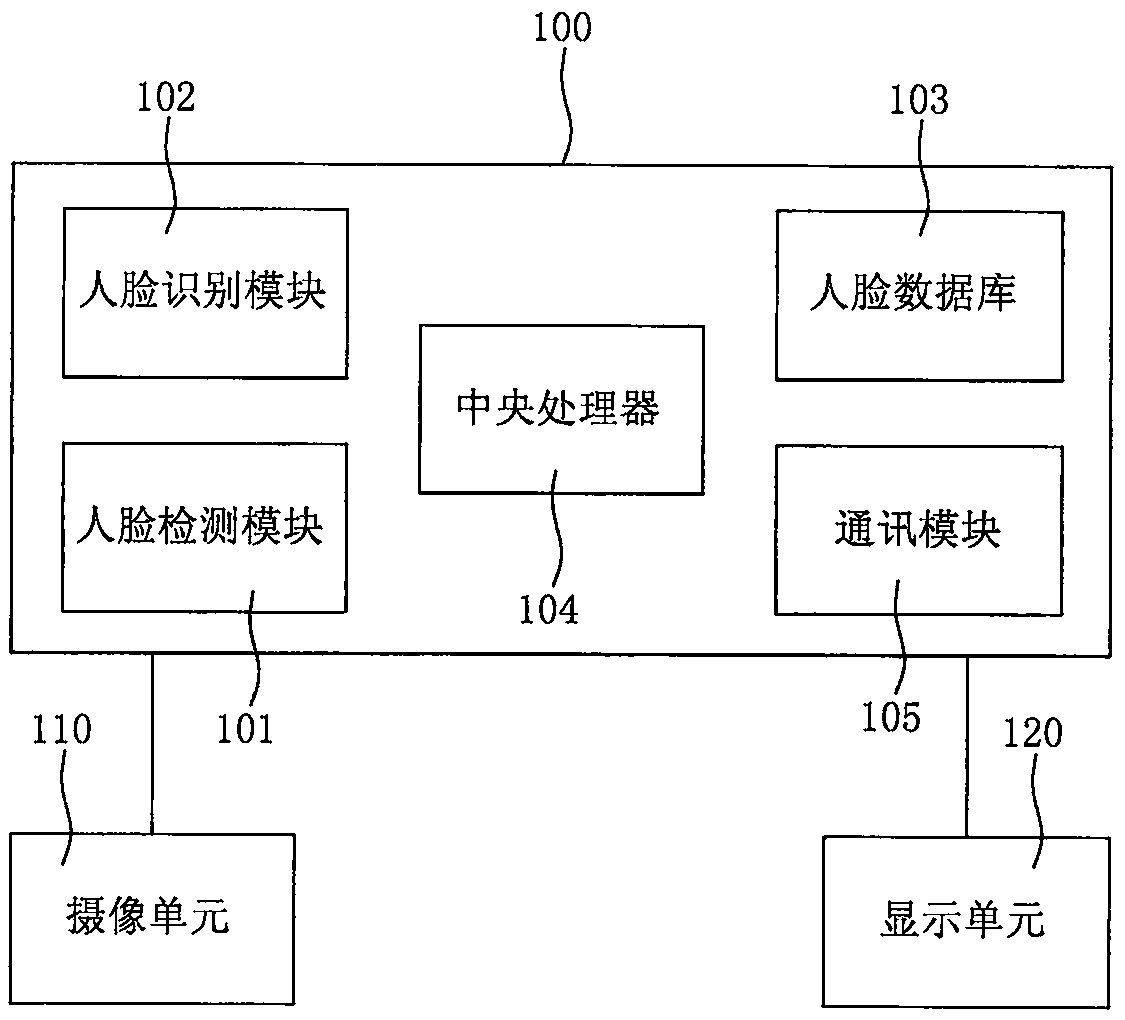

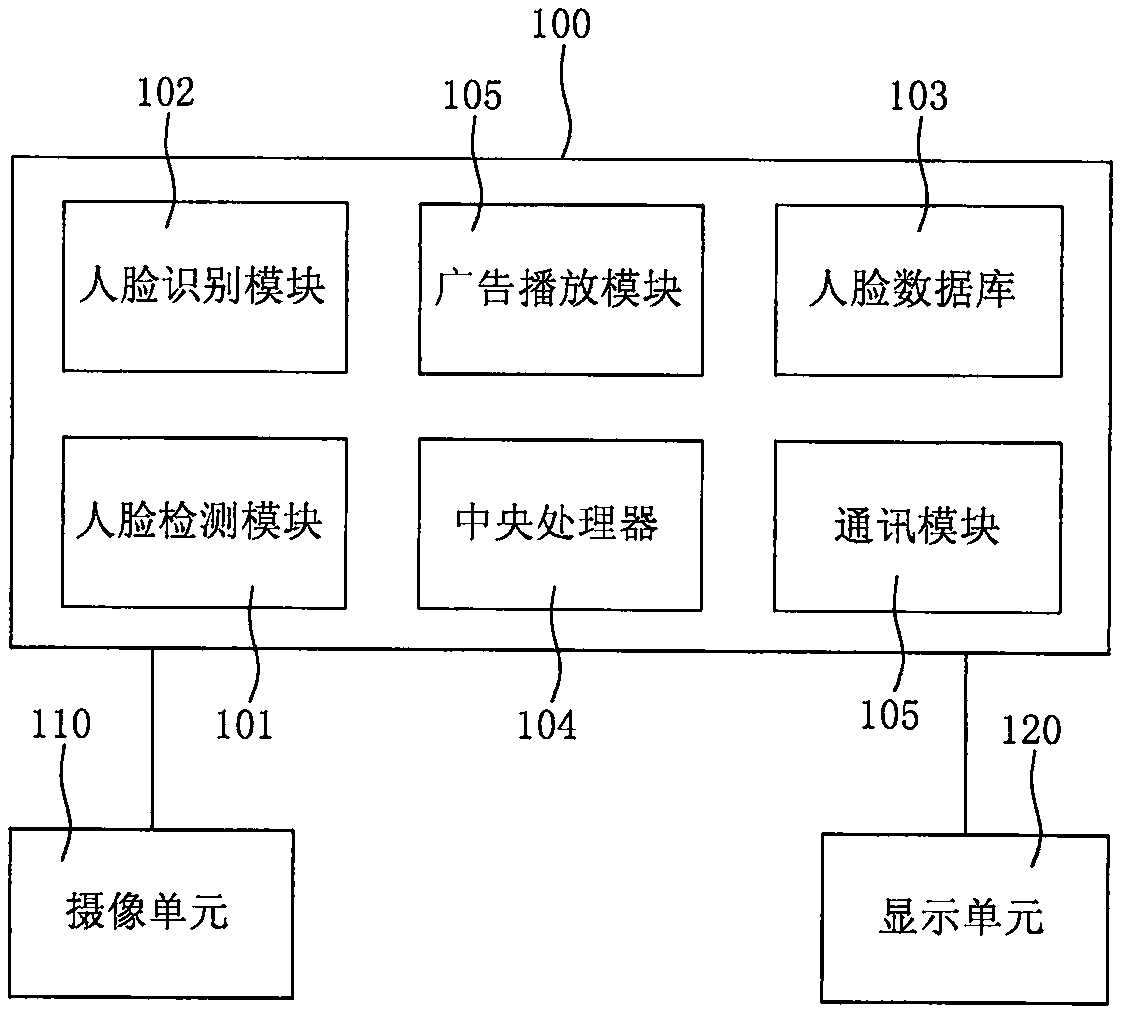

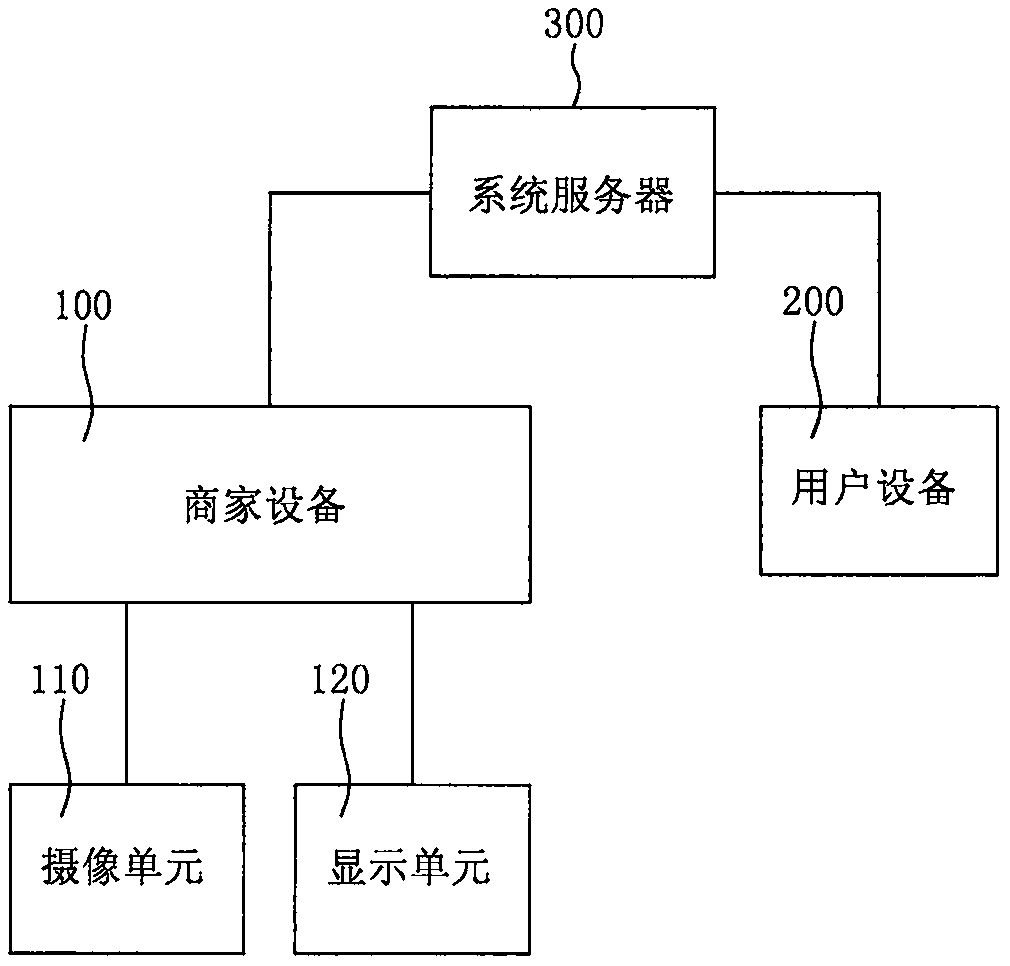

Customer acquisition drainage and interaction method and system based on face recognition

PendingCN110033333AIncrease stickinessImprove retentionCharacter and pattern recognitionMarketingFace detectionFeature data

The invention relates to a customer acquisition drainage and interaction method and system based on face recognition. The system comprises merchant equipment, a camera shooting unit and a display unit. A face image of a current user is acquired through a camera unit of merchant equipment. A face detection module extracts face feature data, and the face recognition module recognizes and compares the face characteristic data with face characteristic data in a system face database to determine whether the face characteristic data are registered users or not, displays head portraits of unregistered users through a display unit and pushes red packets or discount information or AR virtual media to the unregistered users, so that the unregistered users download and install client APPs to get andbecome registered users. In addition, red envelopes or discount information or AR virtual media are pushed to registered users and unregistered users entering the store through the display unit in a social interaction mode, and customer acquisition drainage and social interaction are further achieved.

Owner:金德奎

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com