Patents

Literature

110 results about "Customer attrition" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Customer attrition, also known as customer churn, customer turnover, or customer defection, is the loss of clients or customers. Banks, telephone service companies, Internet service providers, pay TV companies, insurance firms, and alarm monitoring services, often use customer attrition analysis and customer attrition rates as one of their key business metrics (along with cash flow, EBITDA, etc.) because the cost of retaining an existing customer is far less than acquiring a new one. Companies from these sectors often have customer service branches which attempt to win back defecting clients, because recovered long-term customers can be worth much more to a company than newly recruited clients.

Churn prediction and management system

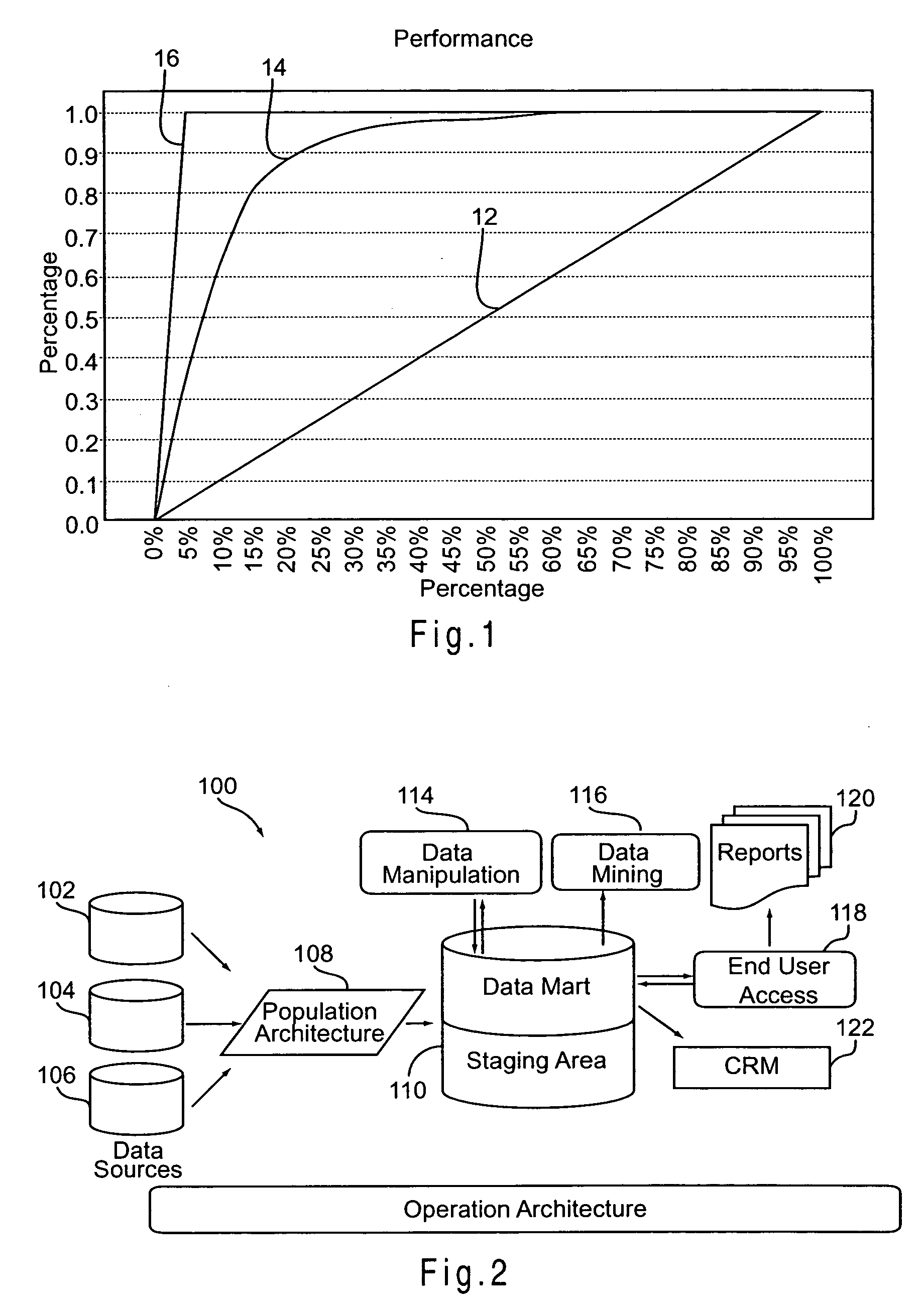

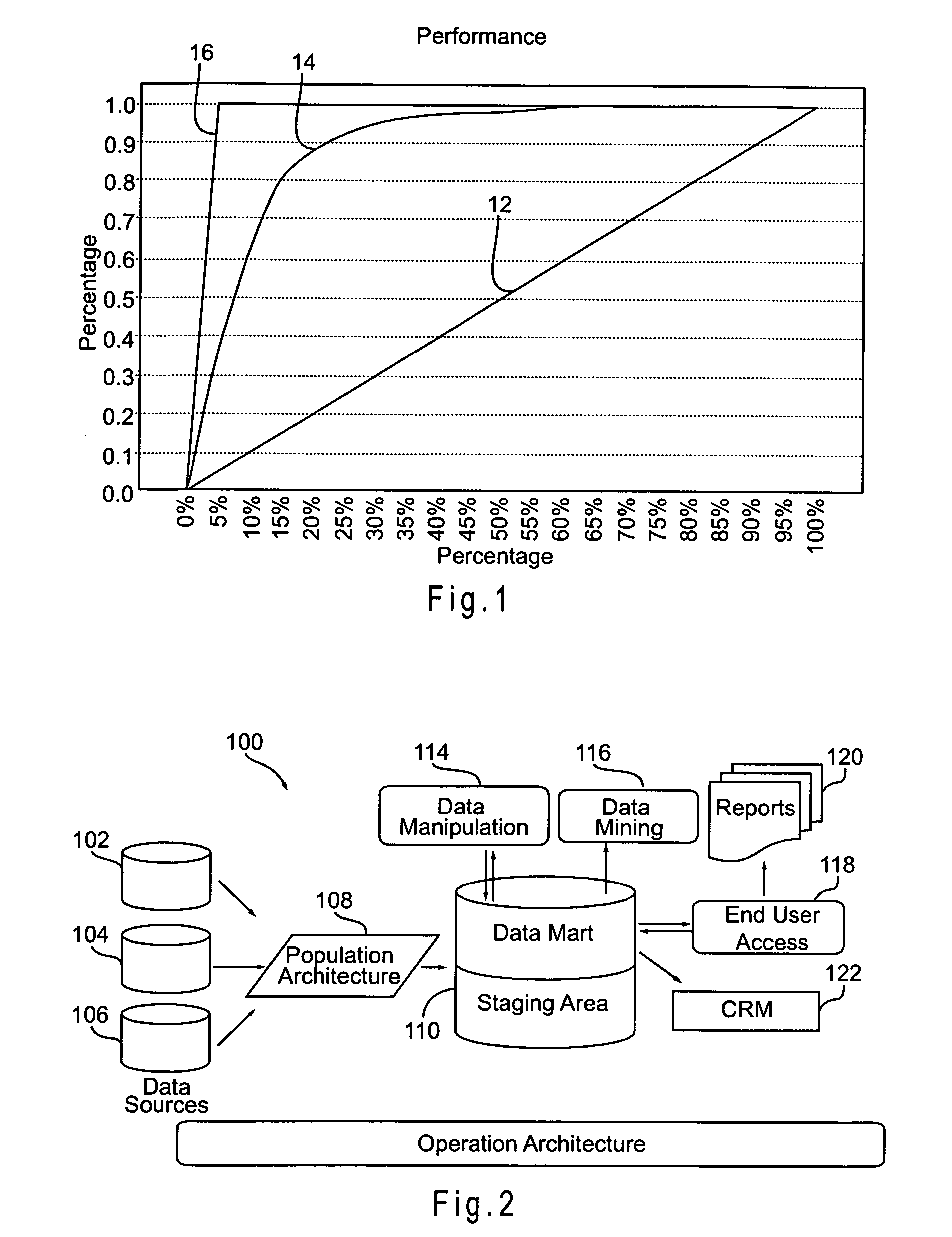

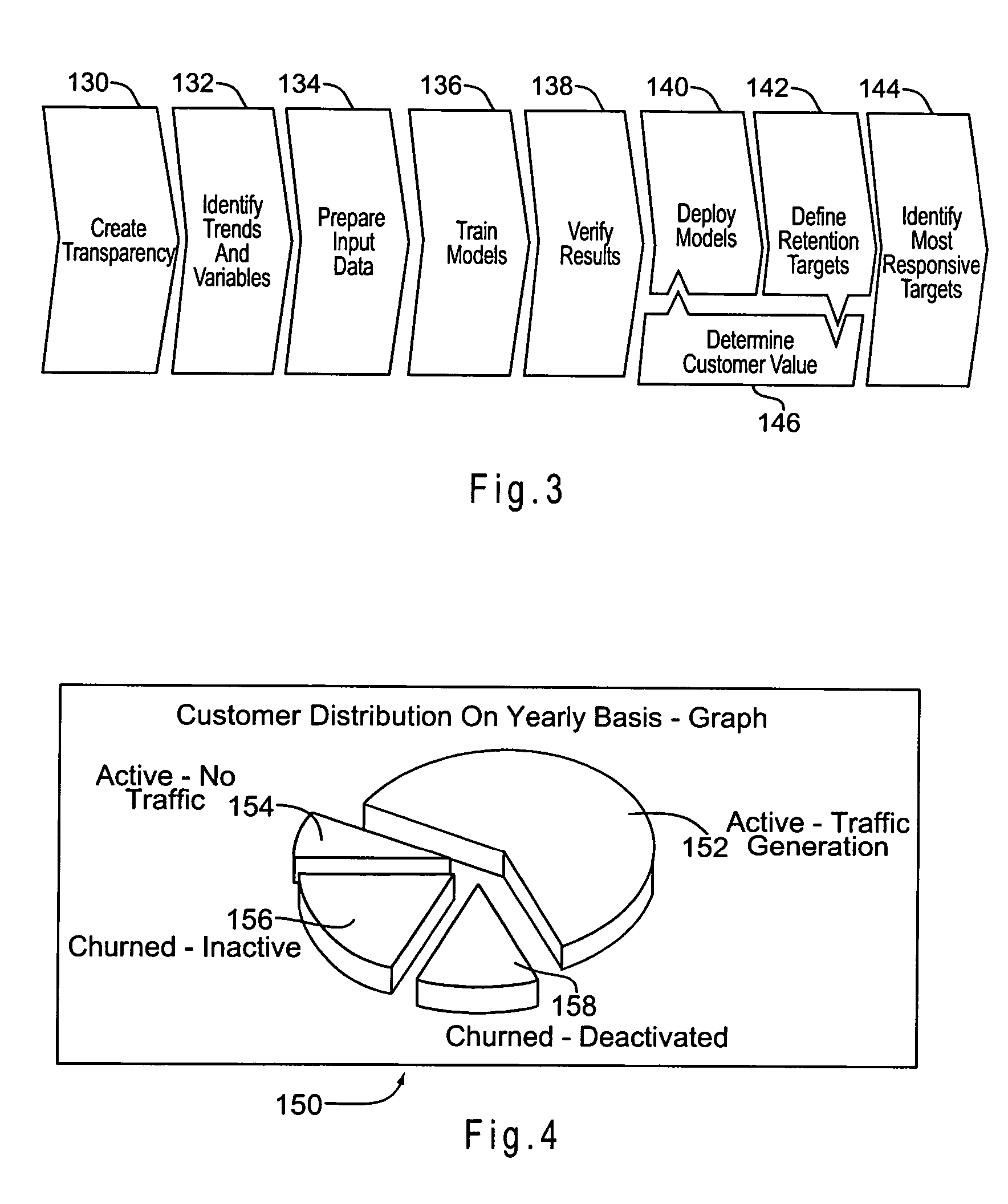

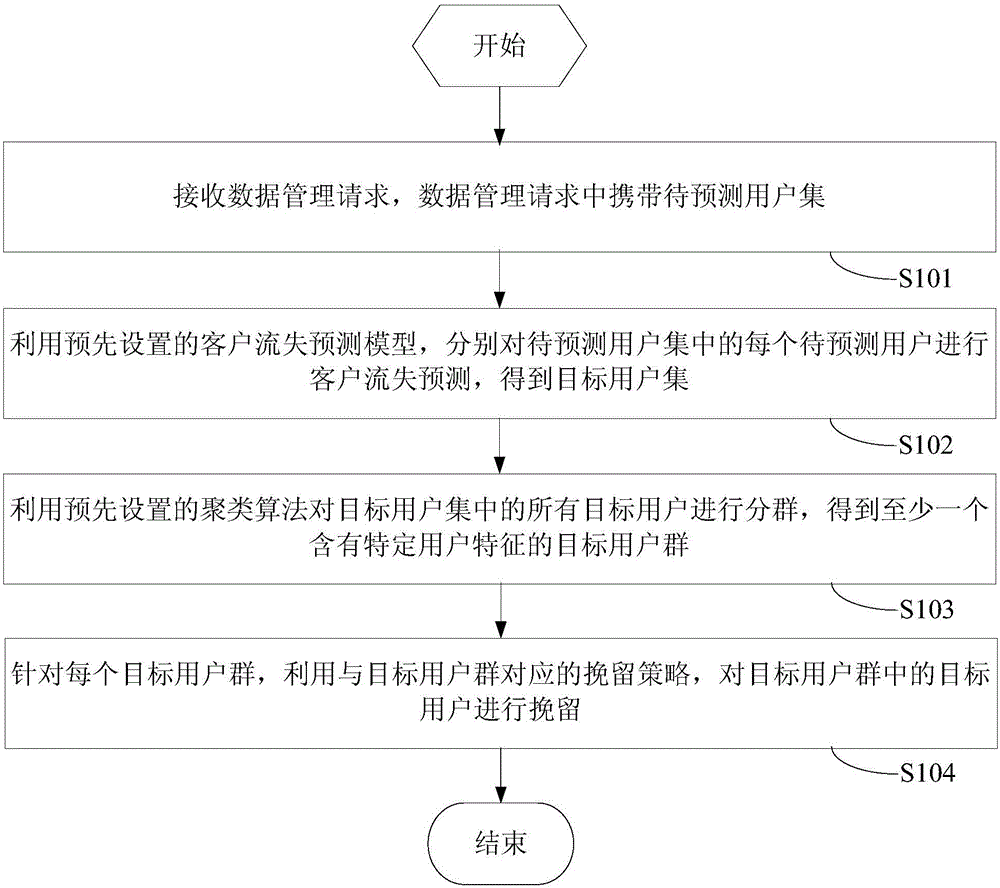

ActiveUS20070156673A1Avoid erosionFacilitates efforts to retain high profitability customersSpecial data processing applicationsMarketingCustomer attritionData operations

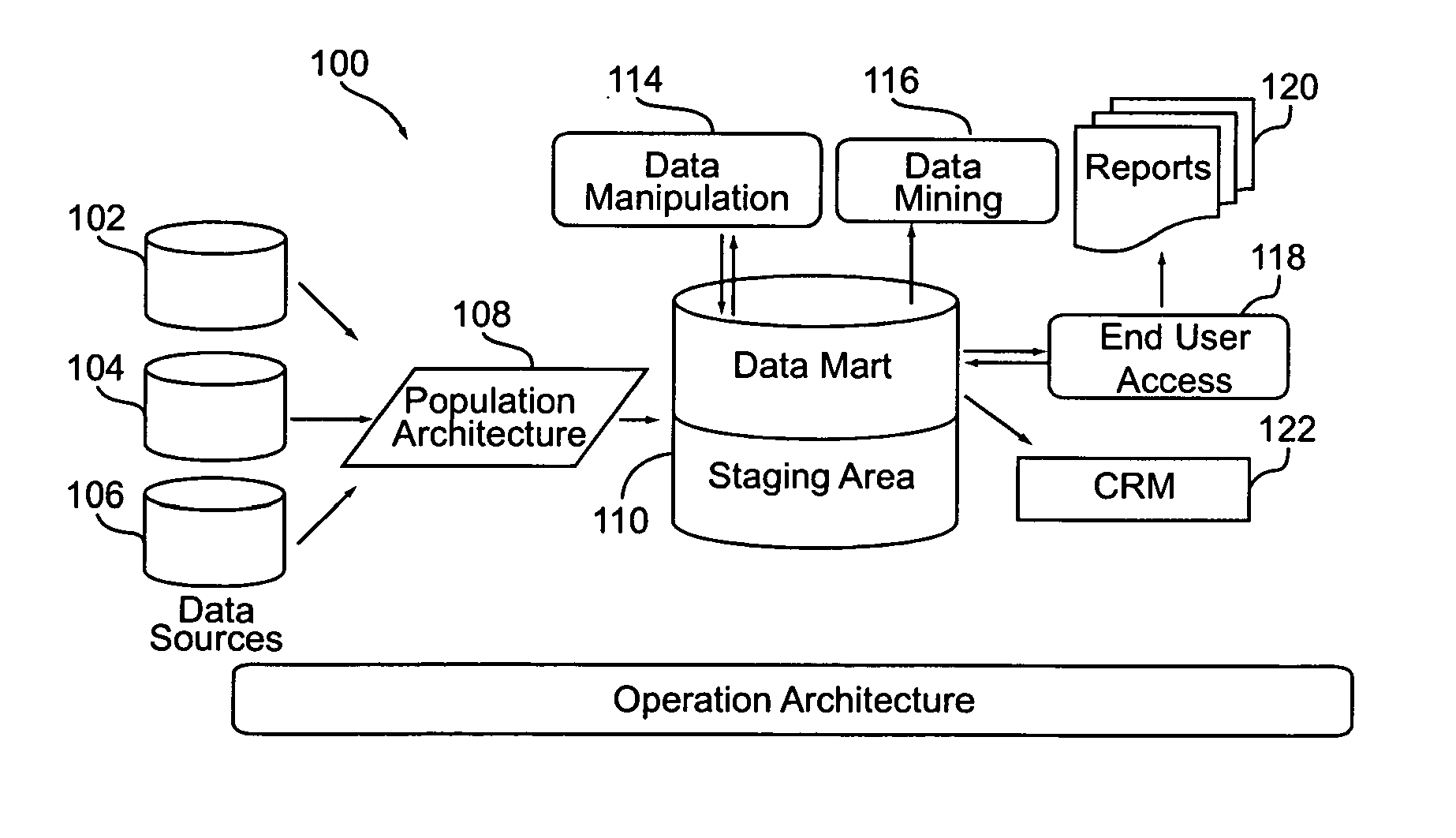

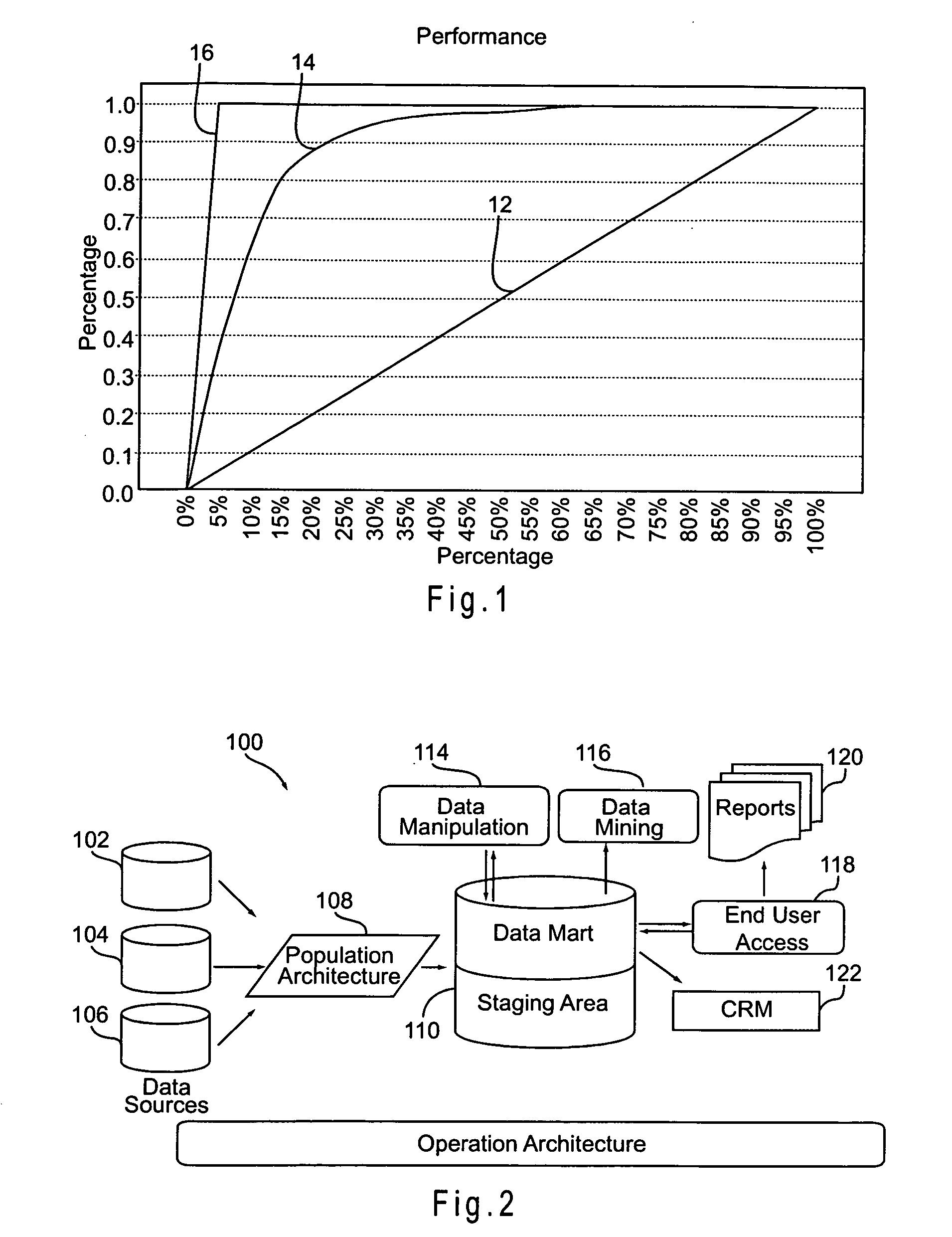

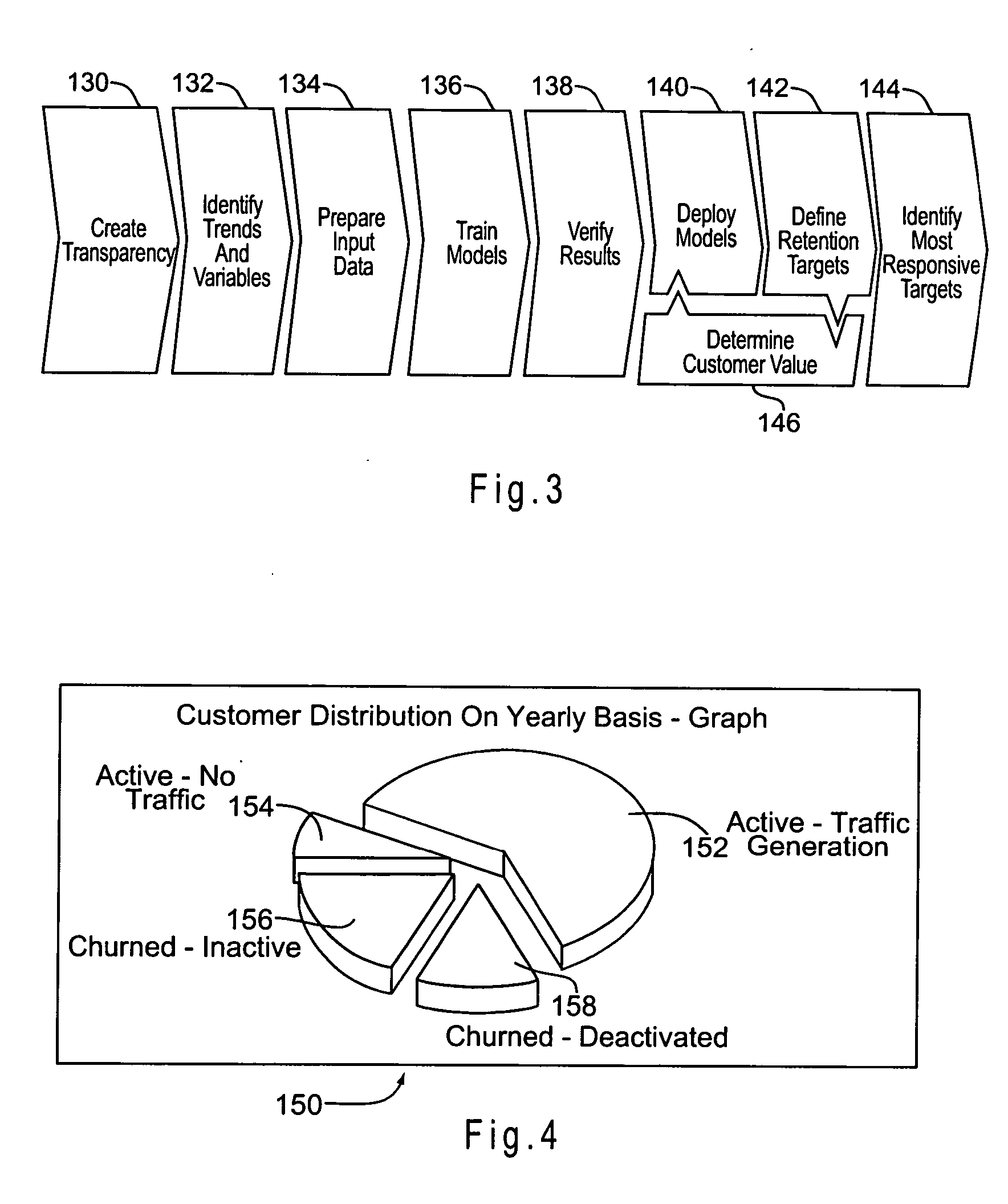

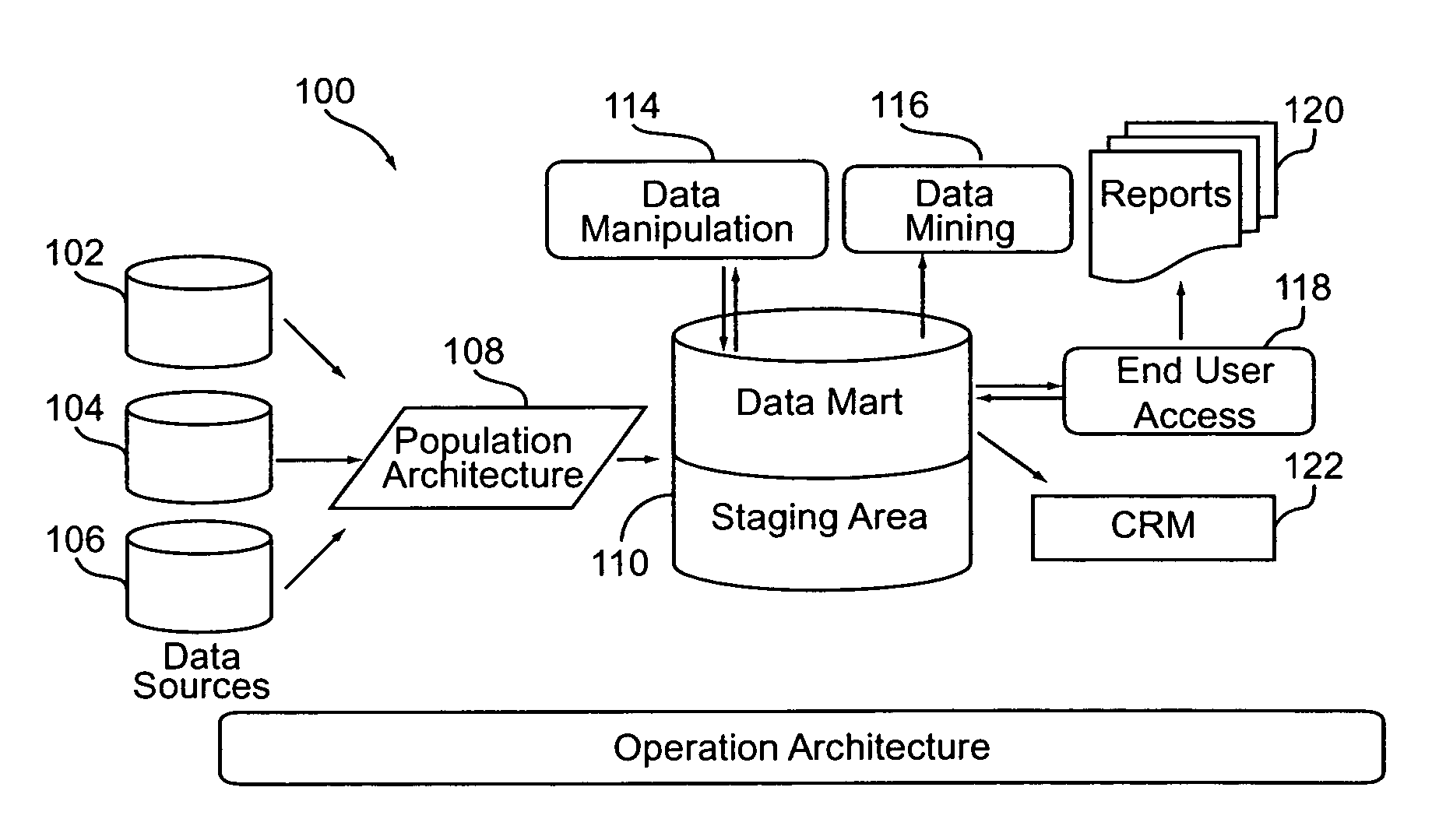

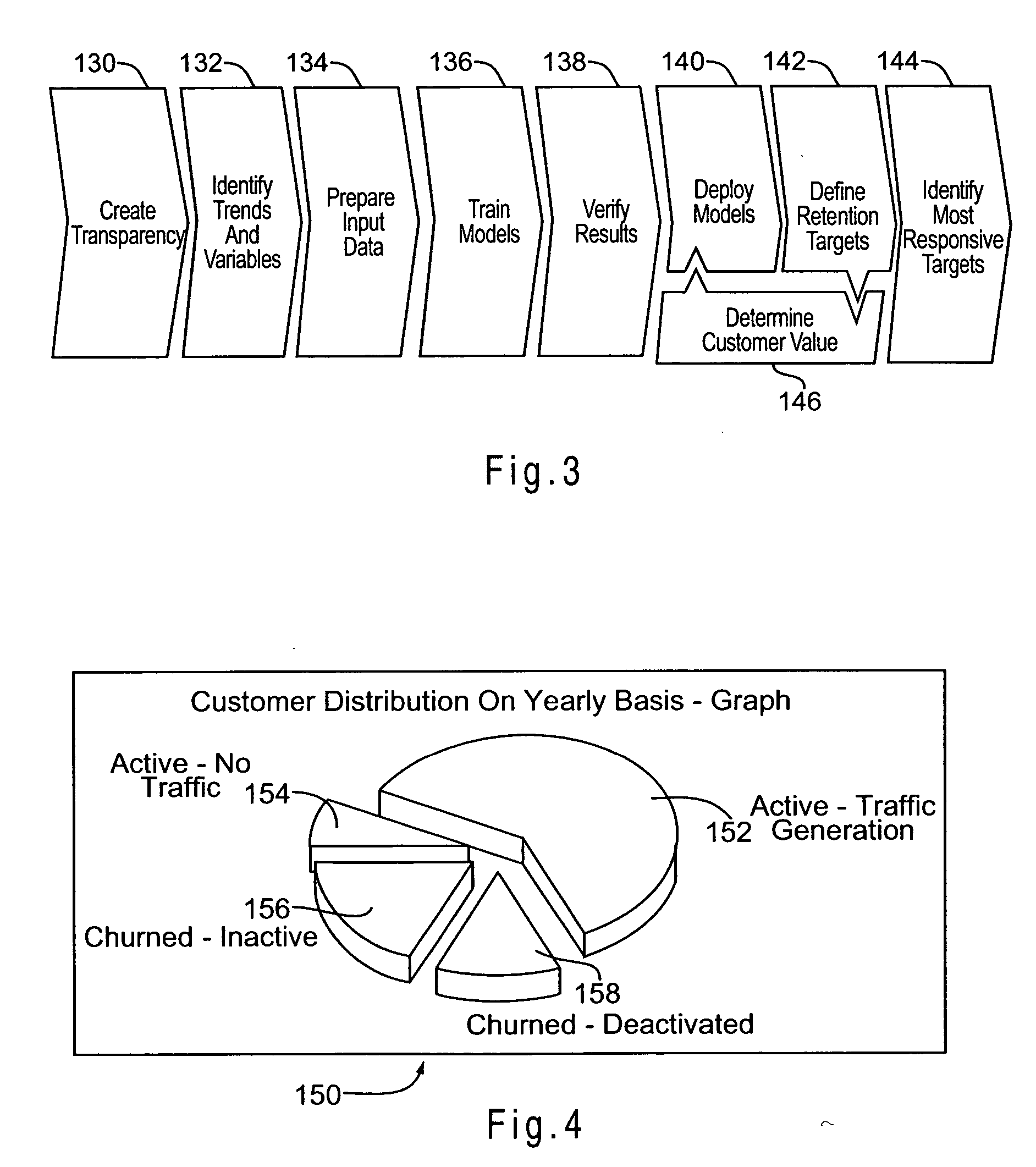

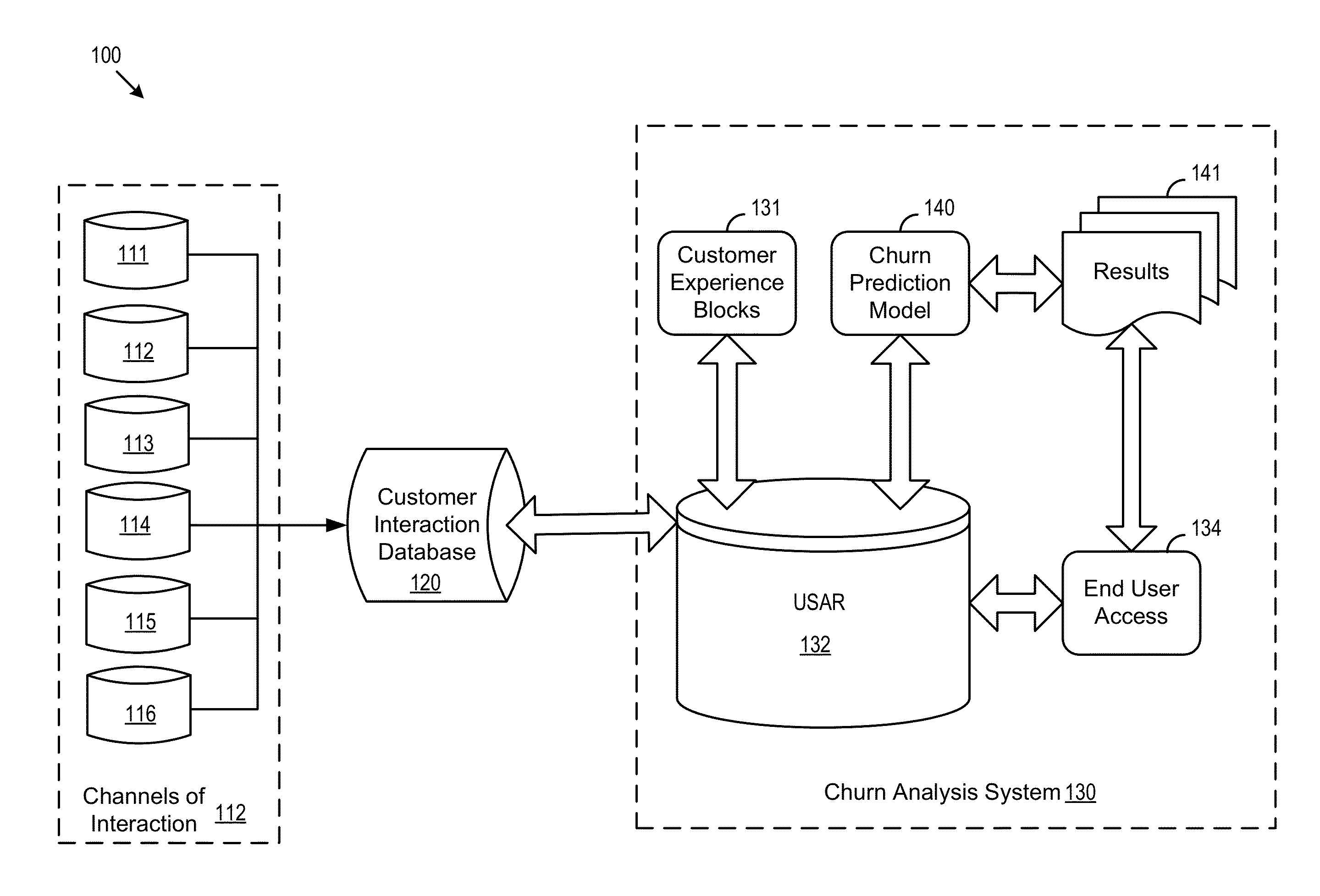

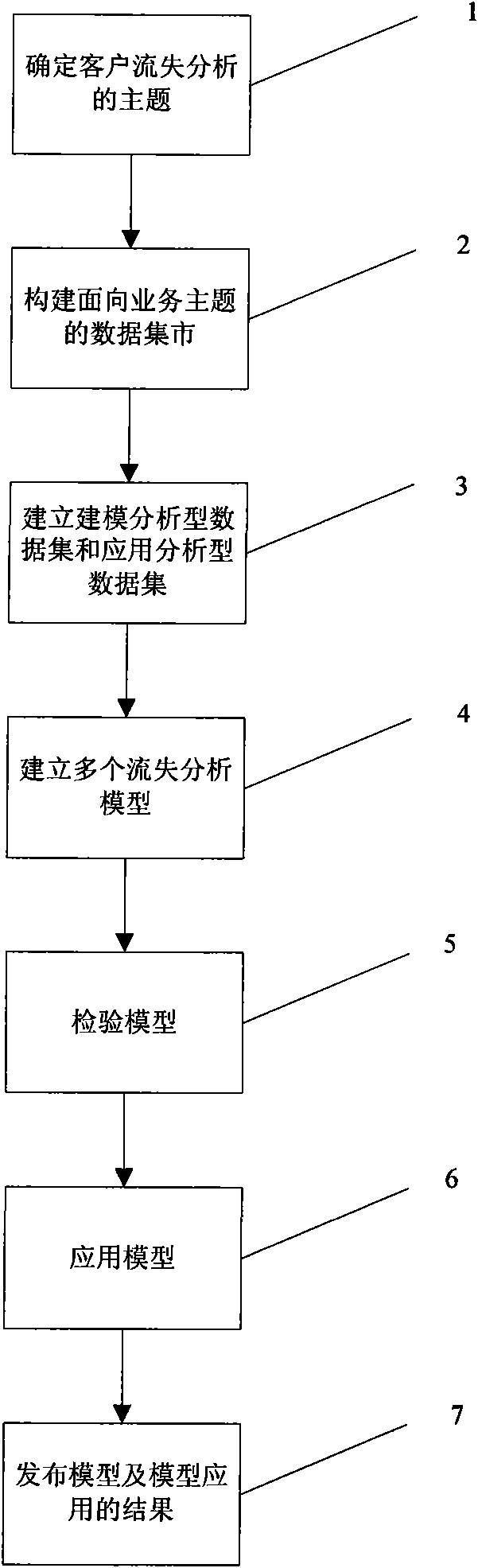

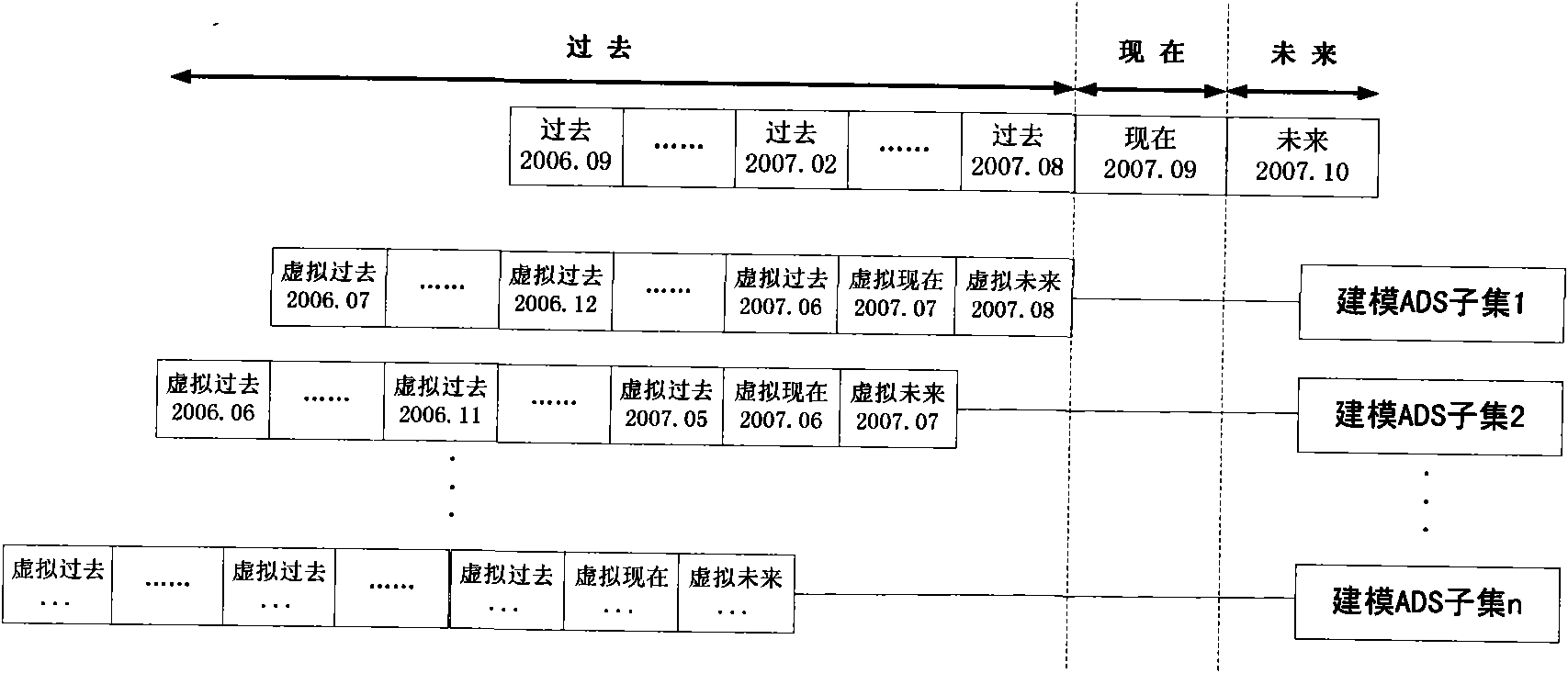

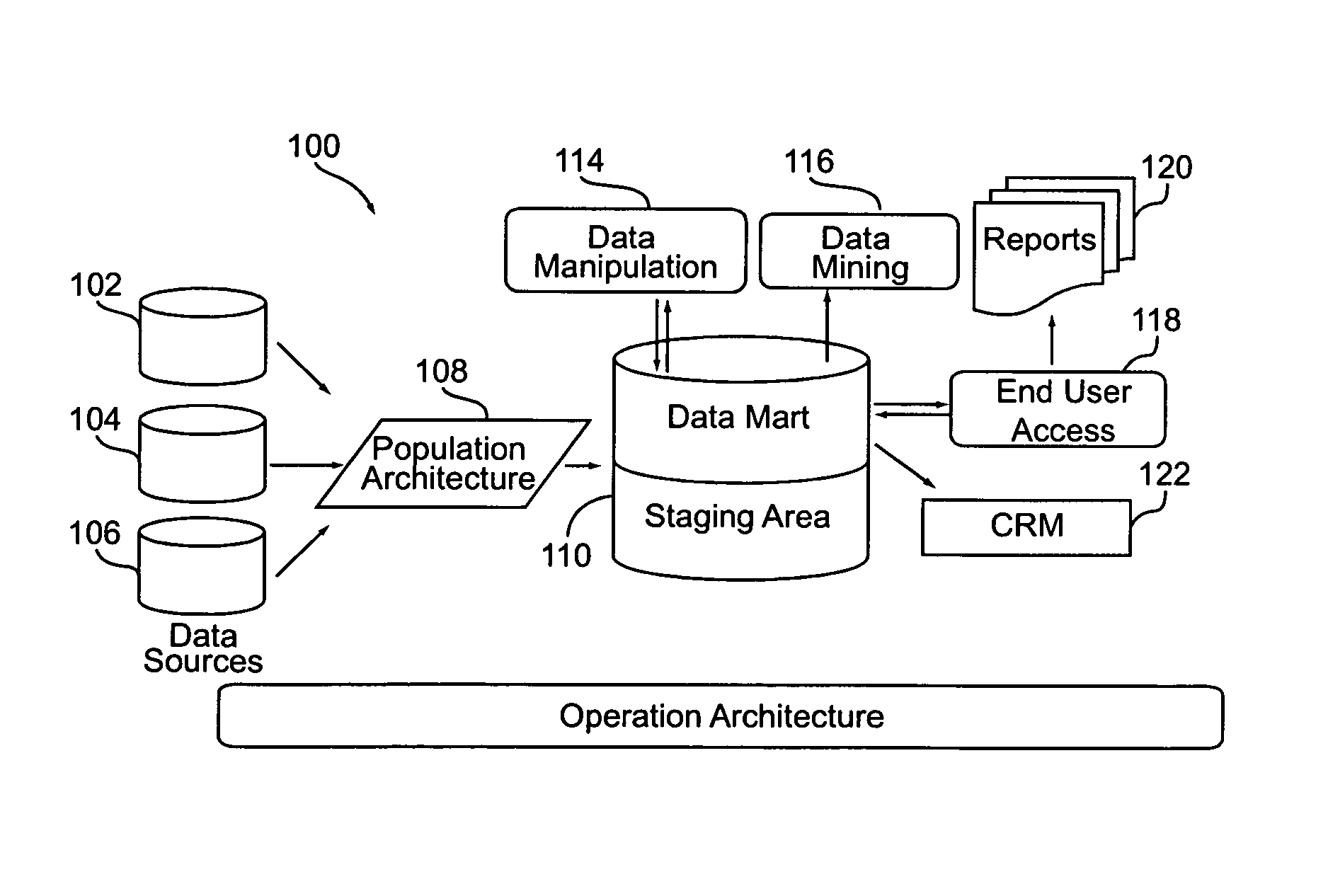

A system and method for managing churn among the customers of a business is provided. The system and method provide for an analysis of the causes of customer churn and identifies customers who are most likely to churn in the future. Identifying likely churners allows appropriate steps to be taken to prevent customers who are likely to churn from actually churning. The system included a dedicated data mart, a population architecture, a data manipulation module, a data mining tool and an end user access module for accessing results and preparing preconfigured reports. The method includes adopting an appropriate definition of churn, analyzing historical customer to identify significant trends and variables, preparing data for data mining, training a prediction model, verifying the results, deploying the model, defining retention targets, and identifying the most responsive targets.

Owner:ACCENTURE GLOBAL SERVICES LTD

Statistical modeling methods for determining customer distribution by churn probability within a customer population

InactiveUS20070185867A1Avoid erosionFacilitates efforts to retain high profitability customersDatabase queryingMarketingData dredgingCustomer attrition

A system and method for managing churn among the customers of a business is provided. The system and method provide for an analysis of the causes of customer churn and identifies customers who are most likely to churn in the future. Identifying likely churners allows appropriate steps to be taken to prevent customers who are likely to chum from actually churning. The system included a dedicated data mart, a population architecture, a data manipulation module, a data mining tool and an end user access module for accessing results and preparing preconfigured reports. The method includes adopting an appropriate definition of churn, analyzing historical customer to identify significant trends and variables, preparing data for data mining, training a prediction model, verifying the results, deploying the model, defining retention targets, and identifying the most responsive targets.

Owner:ACCENTURE GLOBAL SERVICES LTD

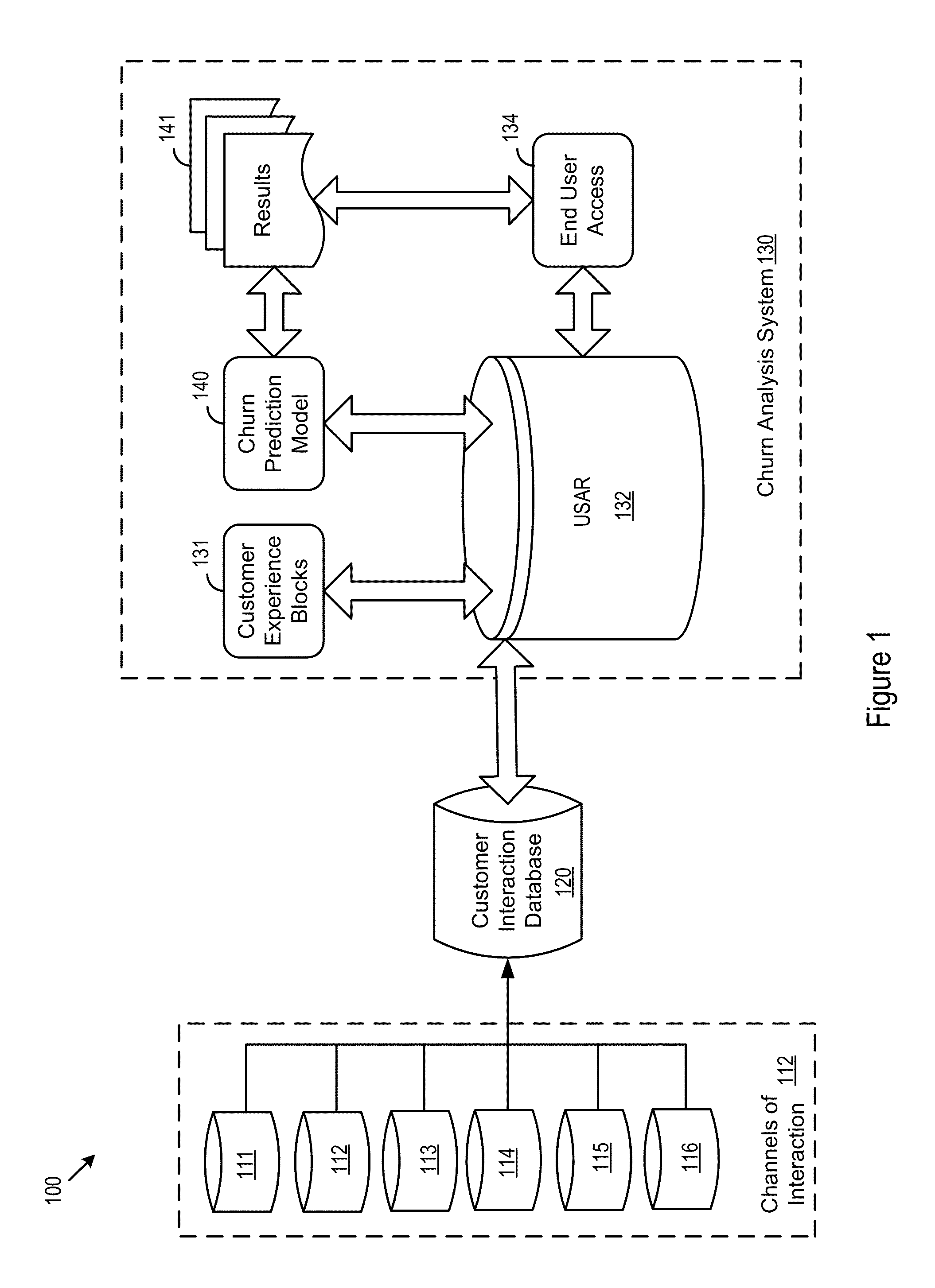

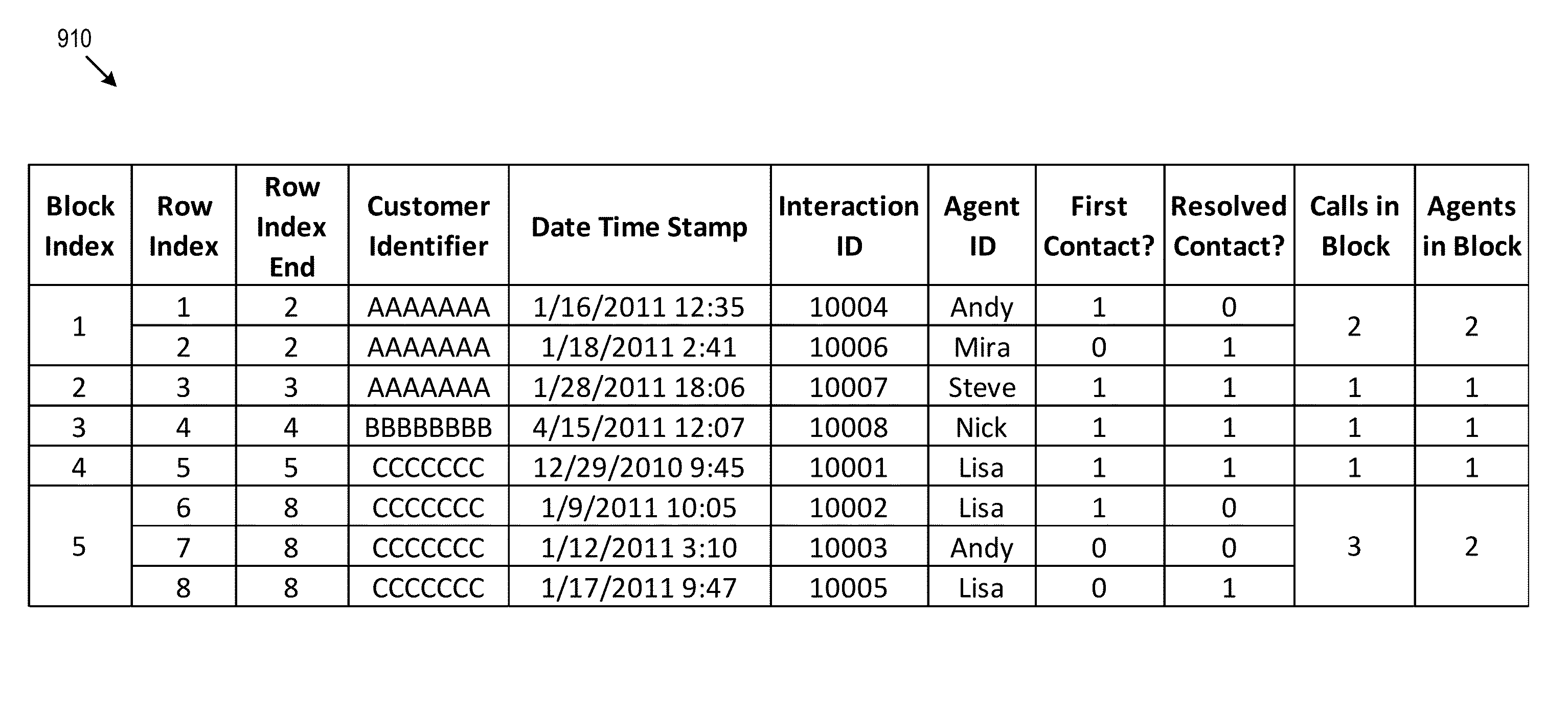

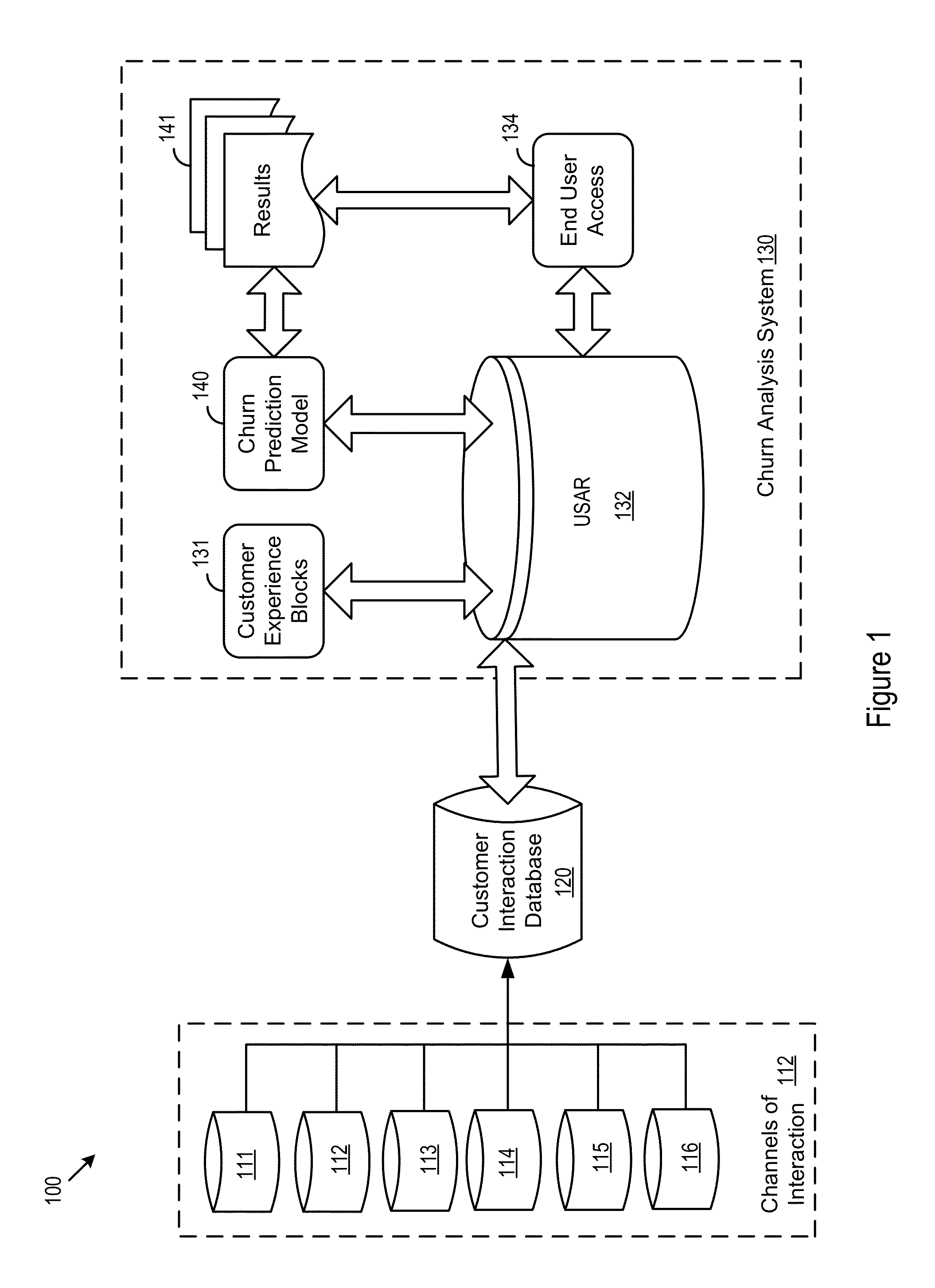

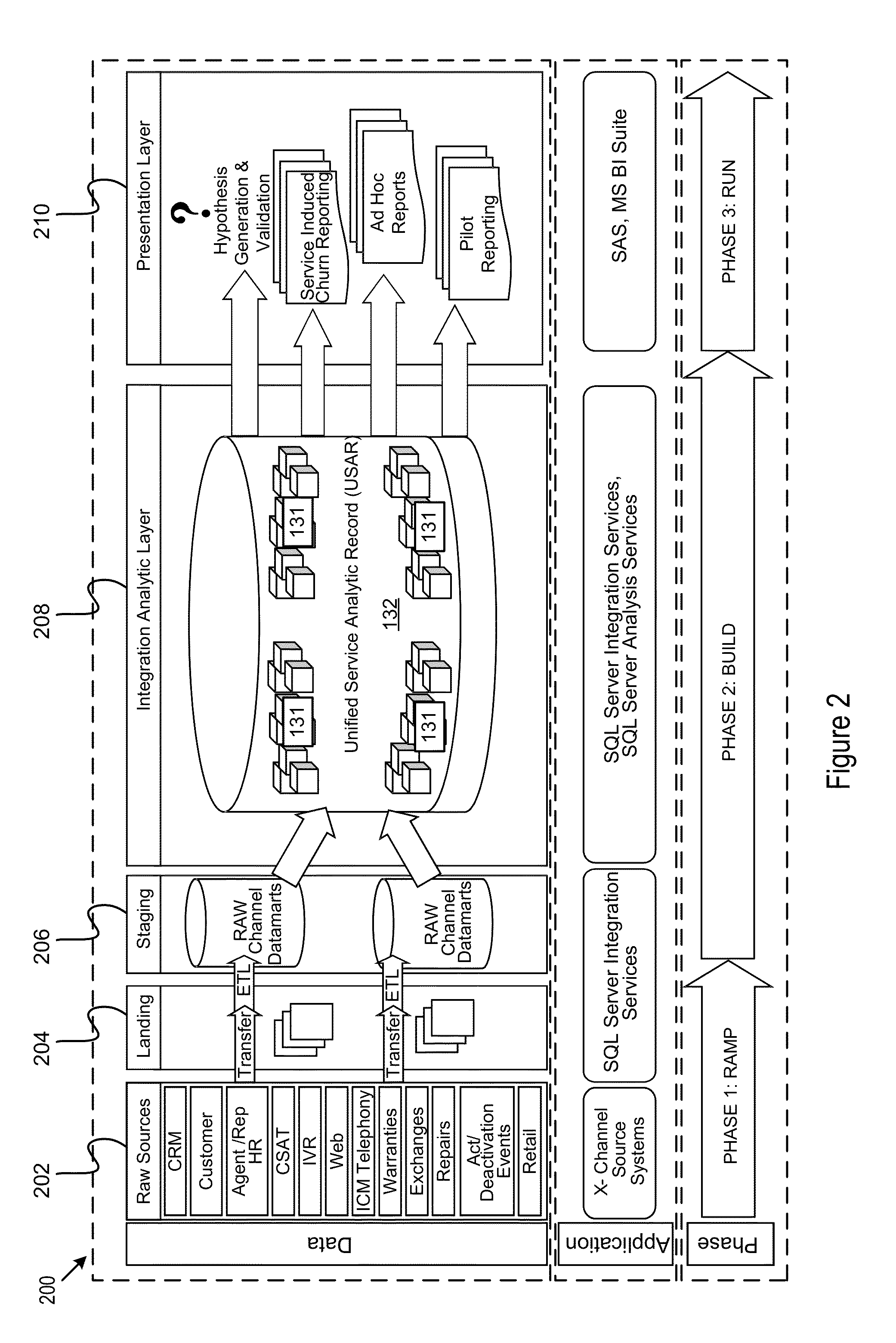

Churn analysis system

A churn analysis system helps a business analyze, predict, and reduce customer churn. The system analyzes customer experiences by using an insightful block level approach to correlate customer experience with customer churn. Through the block level approach, the system is able to more accurately predict and effectively reduce future customer churn. As a result, businesses are able to reduce customer acquisition costs and improve customer retention rates.

Owner:ACCENTURE GLOBAL SERVICES LTD

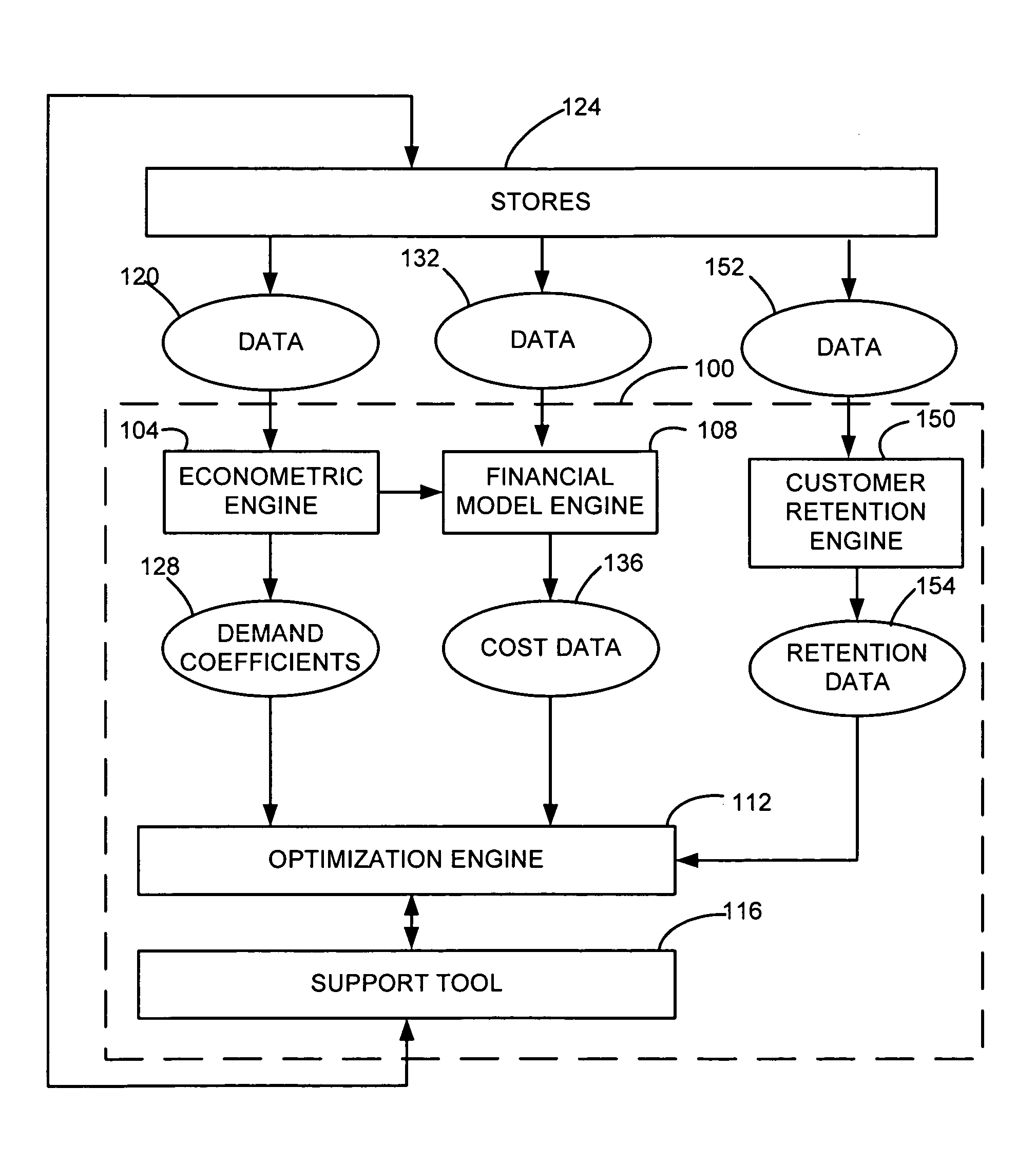

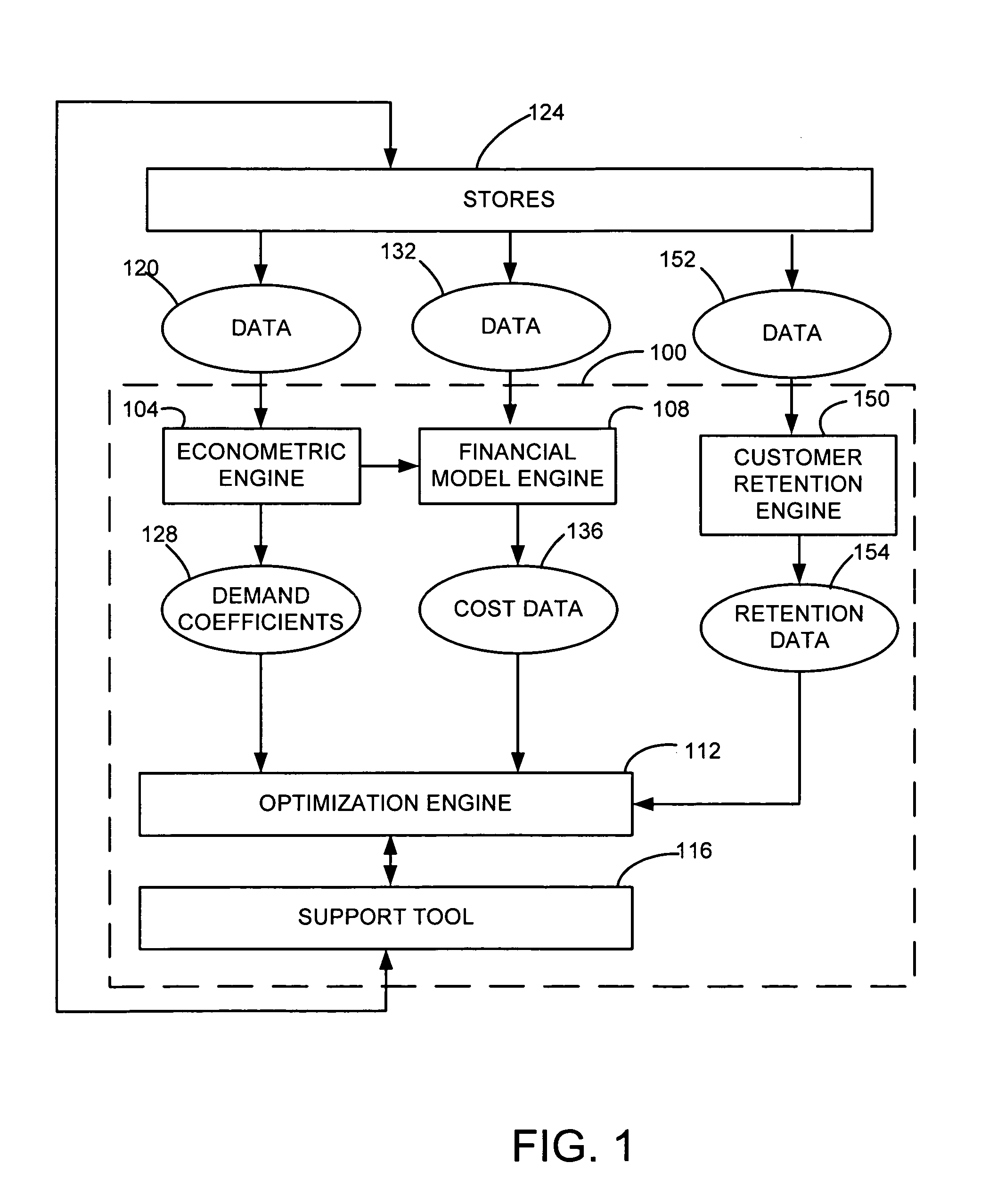

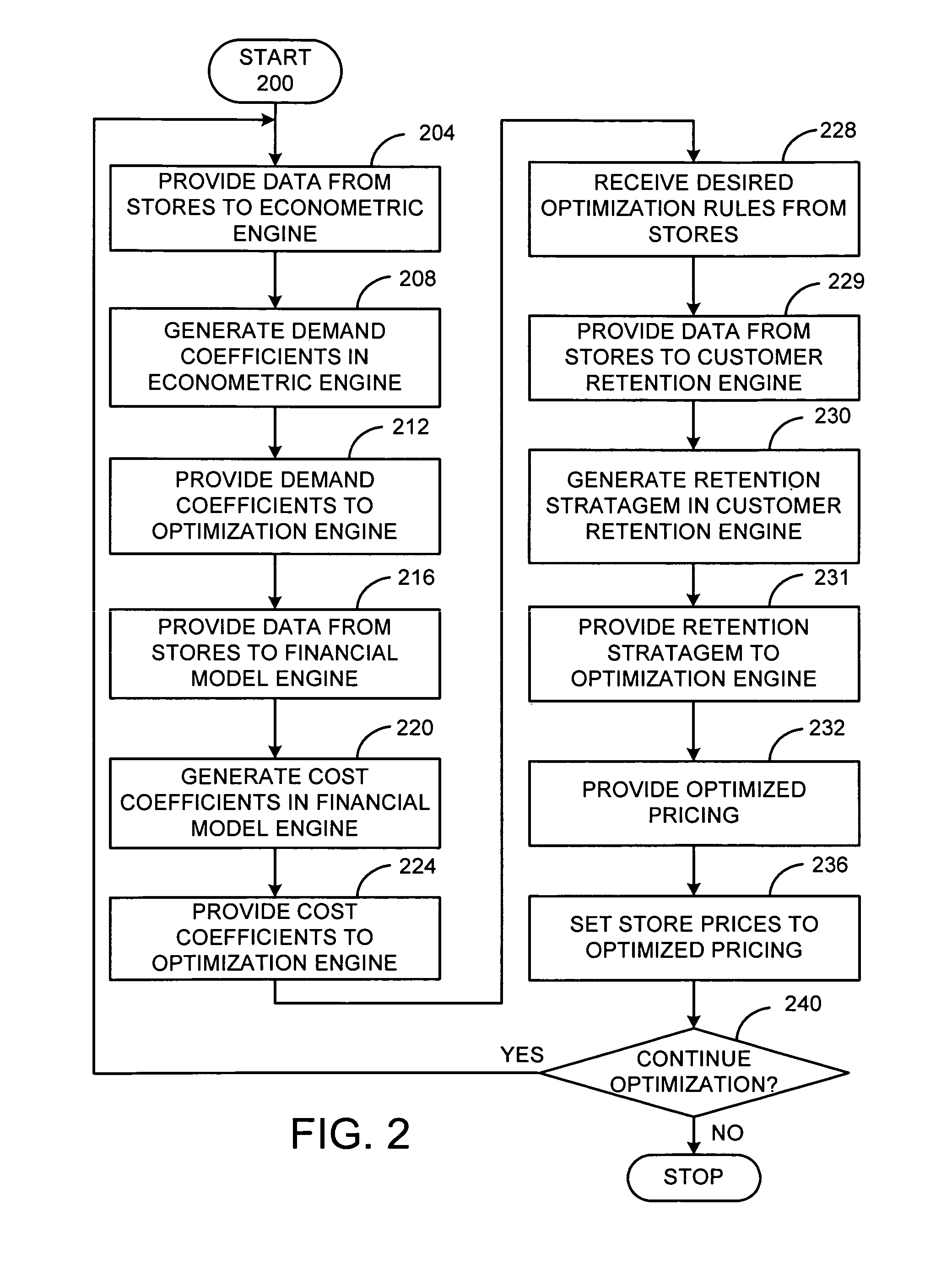

System and Method for Predicting Likelihood of Customer Attrition and Retention Measures

InactiveUS20090276289A1Reduce customer lossEasy to measureForecastingResourcesCustomer attritionCombined use

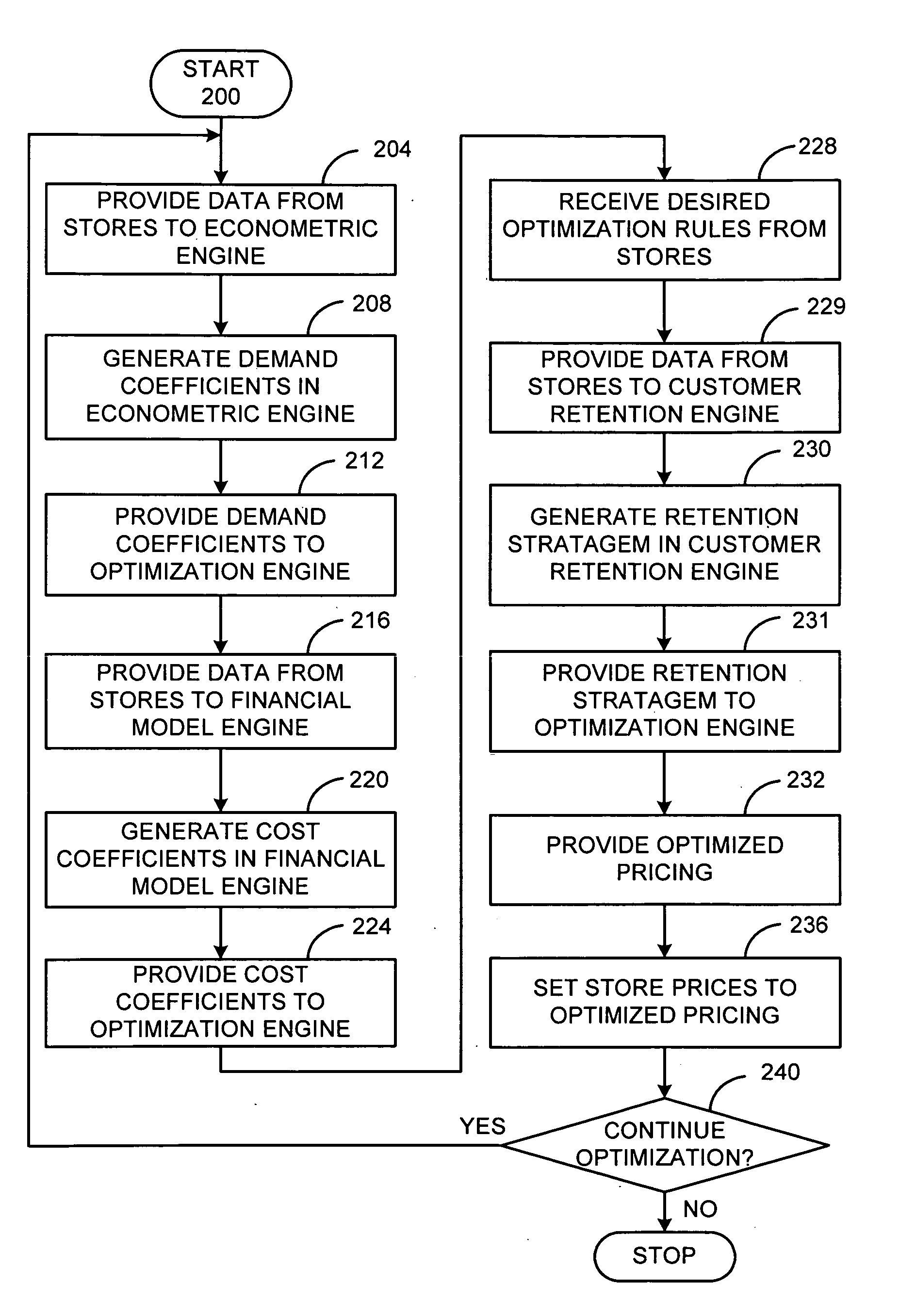

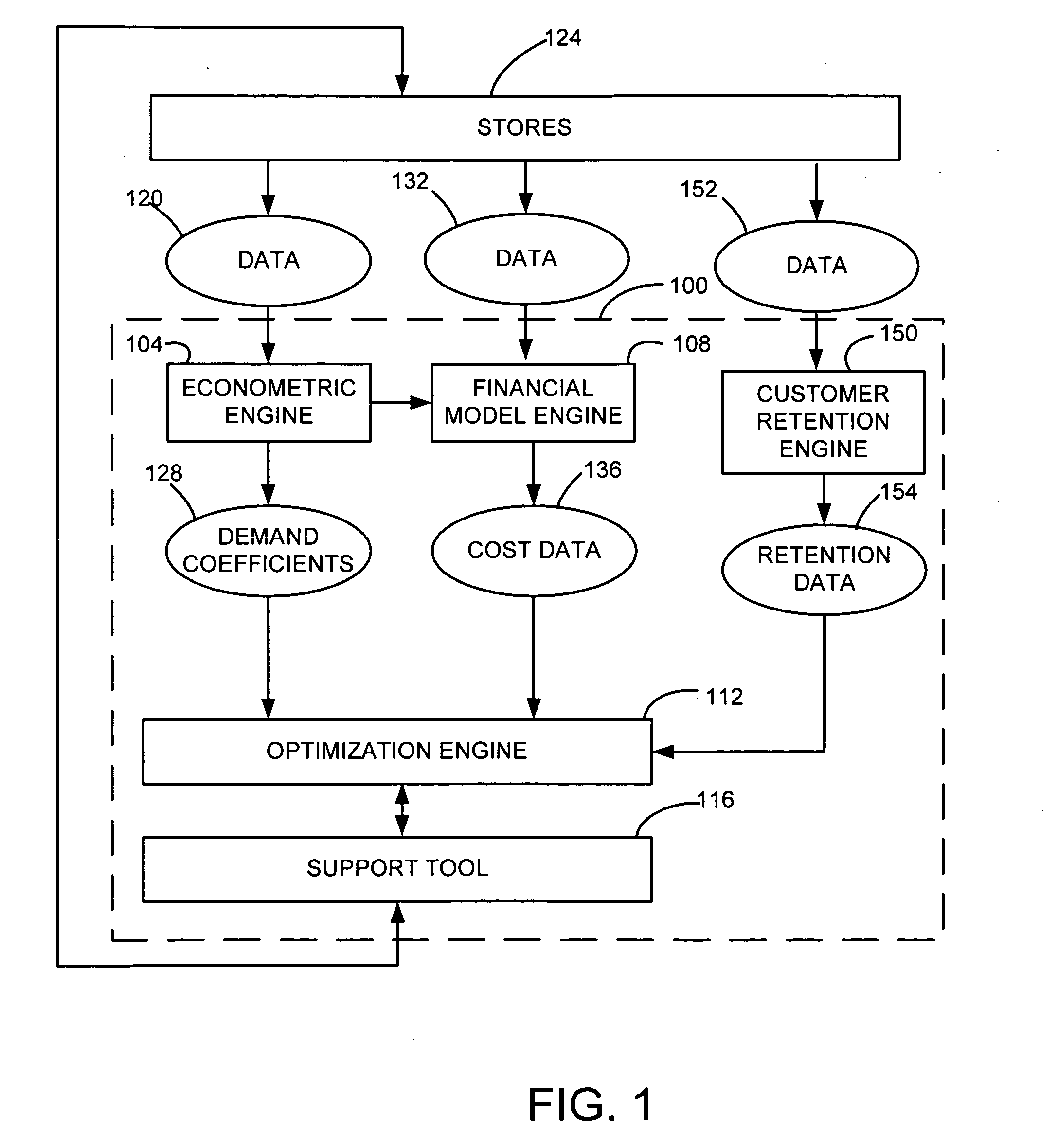

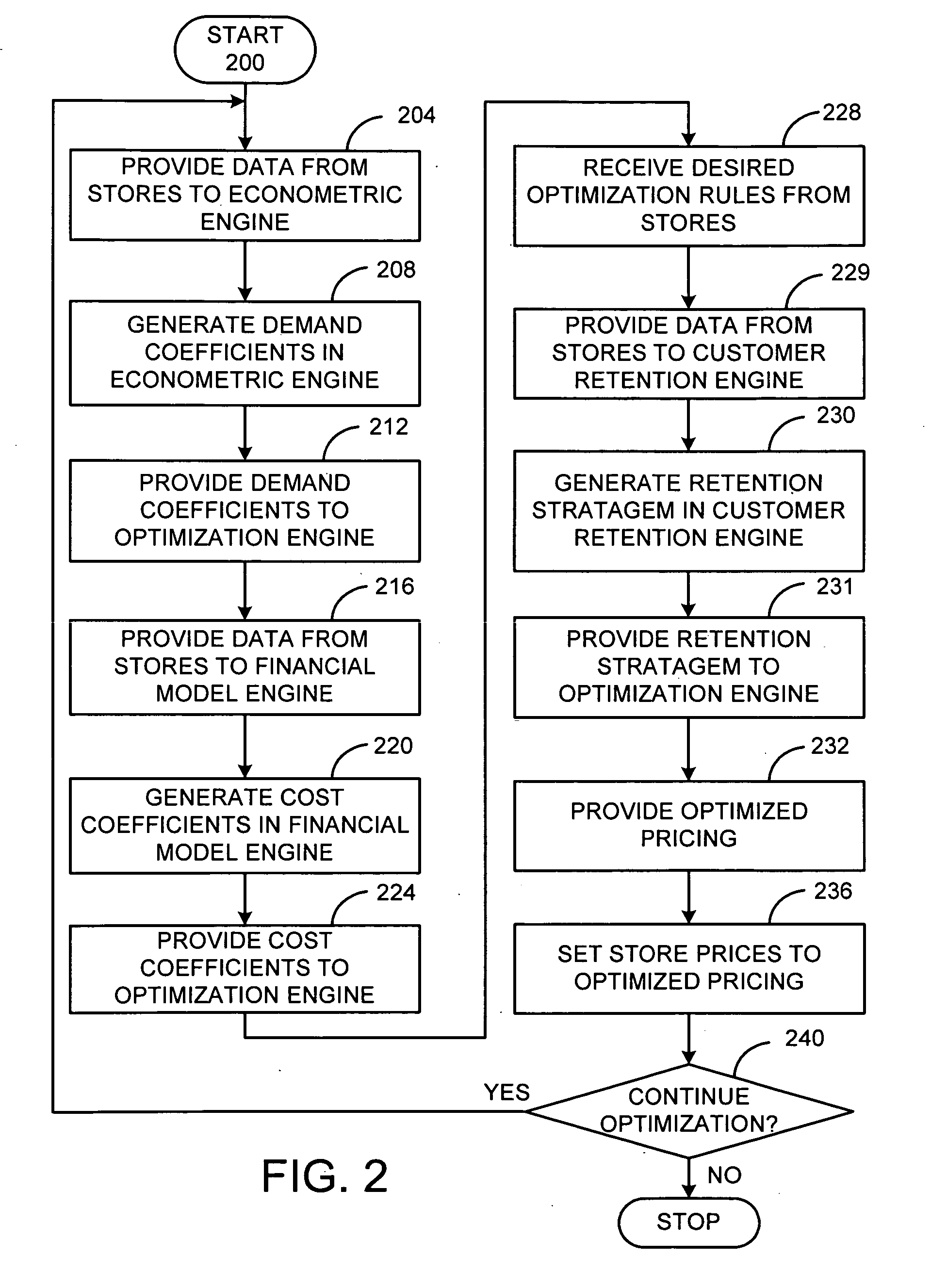

The present invention relates to a system and method for customer retention. Historical transaction and customer data may be received from stores. Likewise, recent customer transaction data may be received from the stores. The transactions are linked to each customer. Attriters, historical customers who discontinued shopping, are identified. Next, risk factors for attrition may be identified by examining the attriters' transaction history for commonalities. From the risk factors a loss model may be generated. The loss model may be used, in conjunction with current transaction data, to generate the likelihood of loss for each of the current customers, which may then be reported. Retention measures may be generated for each customer by comparing the customer's transactions to the loss model and the risk factors. The retention measures may be outputted to the stores, and a price optimization system. Likewise, the retention measures may be validated by comparing actual customer loss to the loss model.

Owner:ACOUSTIC LP

Method for evaluating customer valve to guide loyalty and retention programs

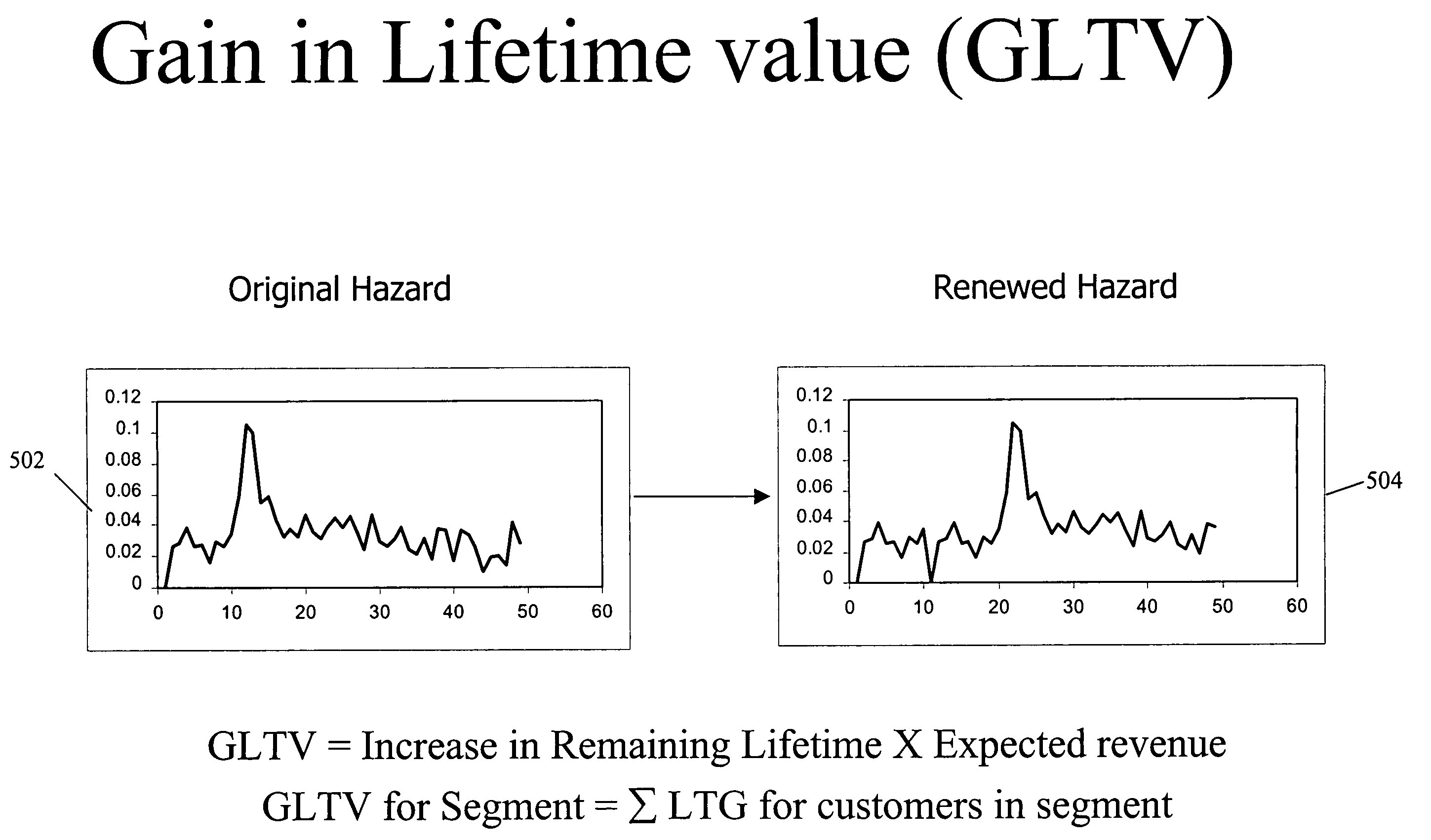

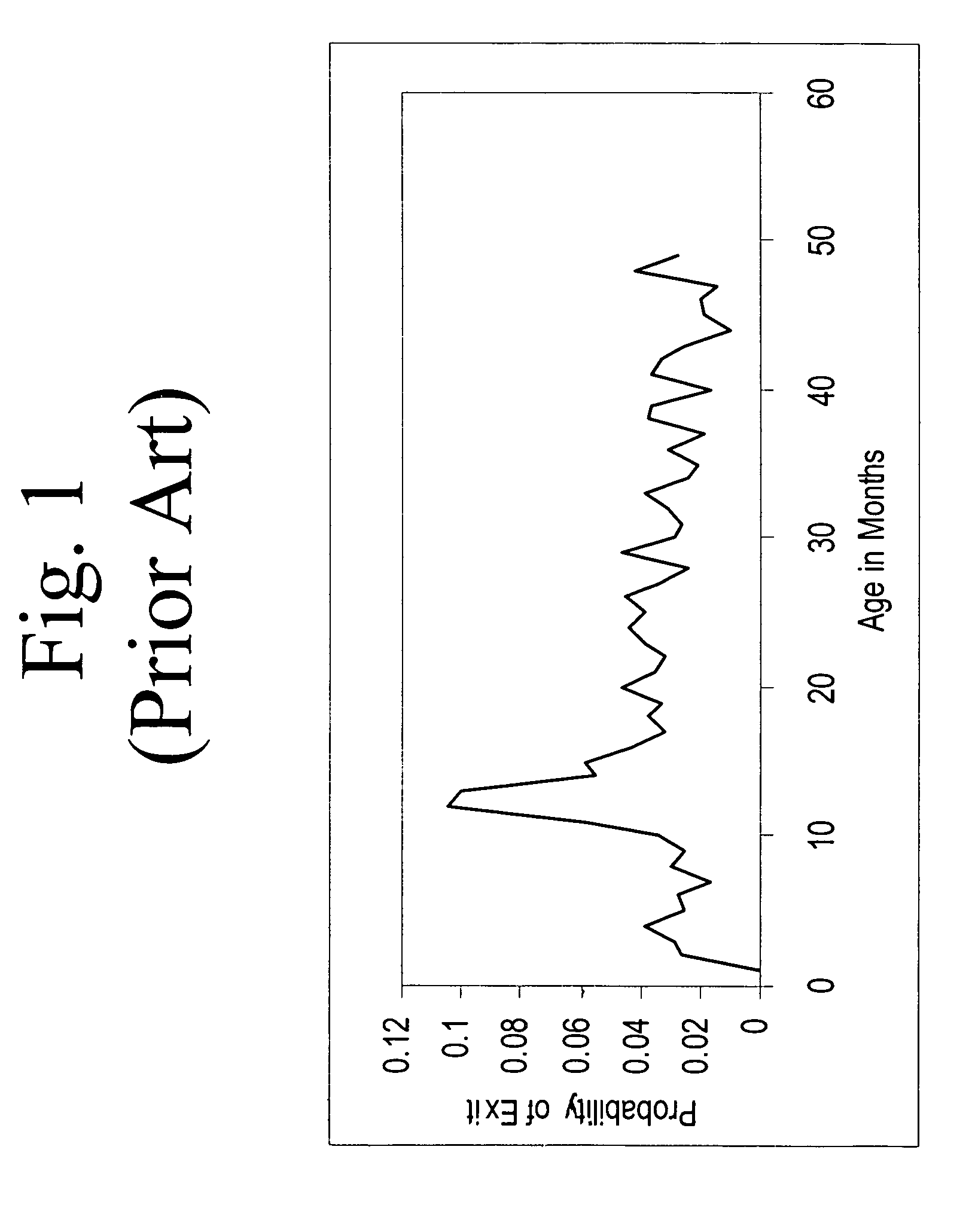

A method and apparatus for training a neural network to compute hazard functions for customers and analyzing hazard functions, both for an individual customer, and for set of customers to focus marketing techniques. The hazard function represents the likelihood of churn for a particular customer. The gain in lifetime value is also calculated for each customer which incorporates the present value of the customer with the future value of the customer if a new contract is entered. The overall shape of the hazard function, combined with the gain in lifetime value, specifies what marketing techniques are to be applied together with what additional incentives are to be offered to the customer in order prevent churn.

Owner:VERIZON LAB

System and method for predicting customer churn

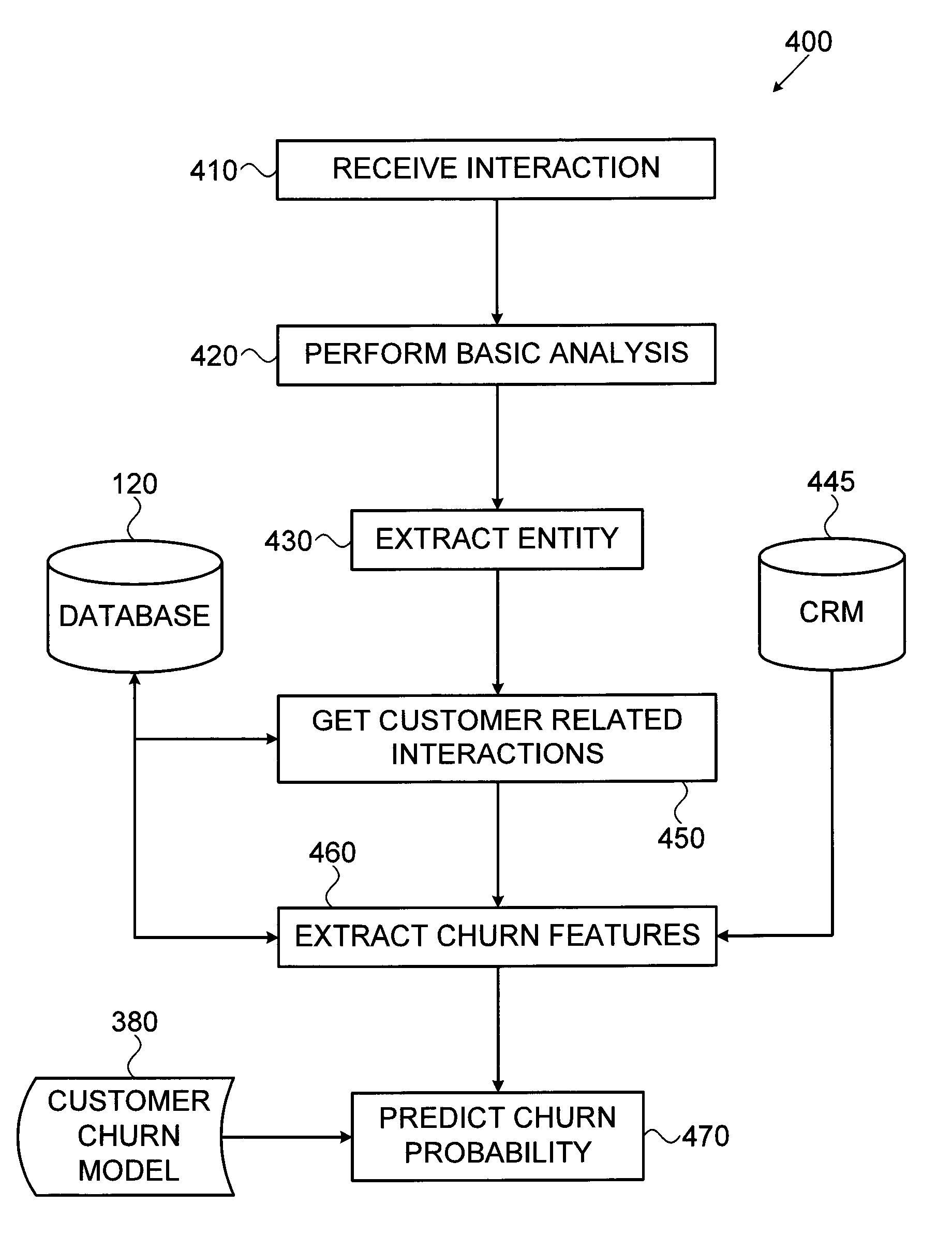

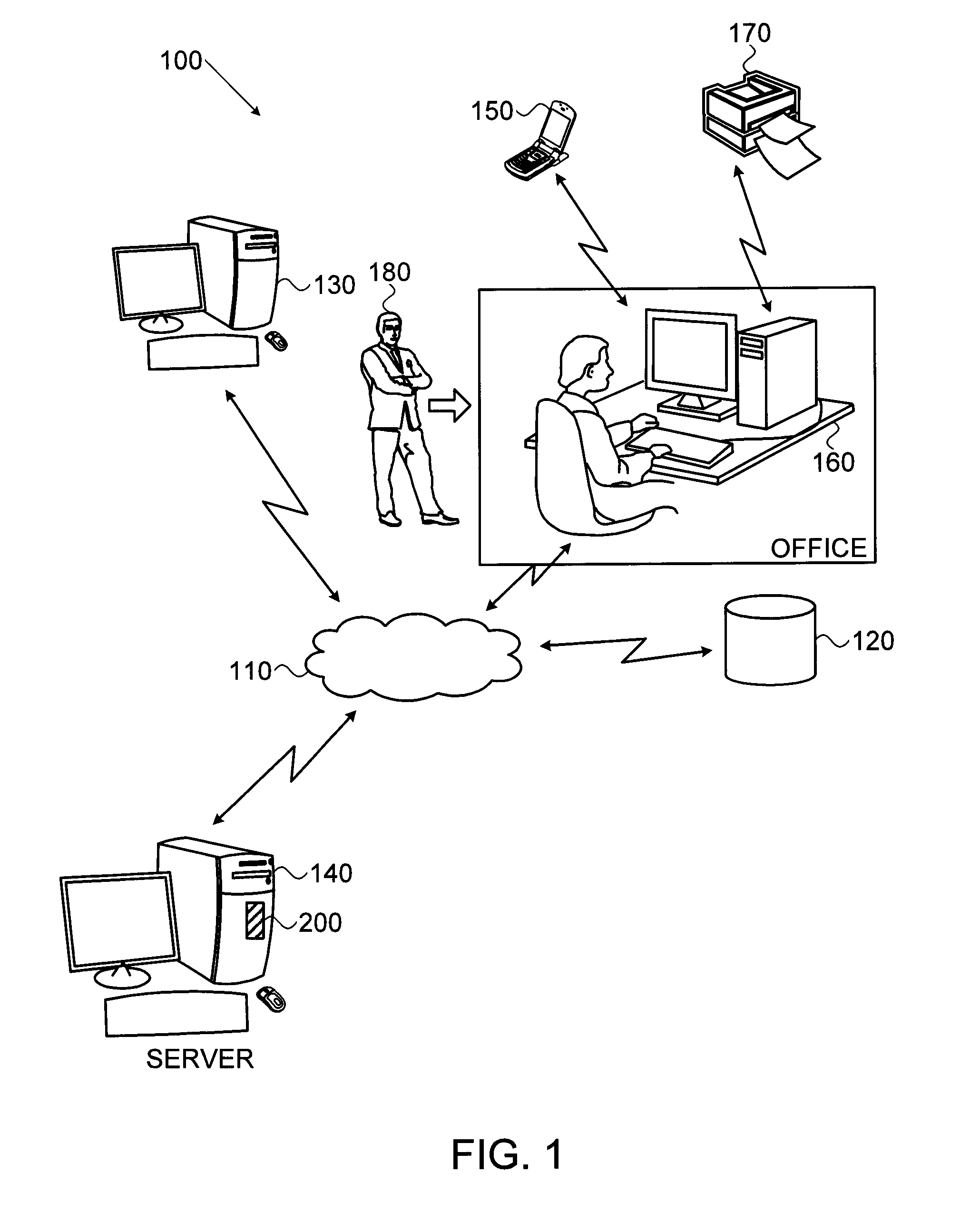

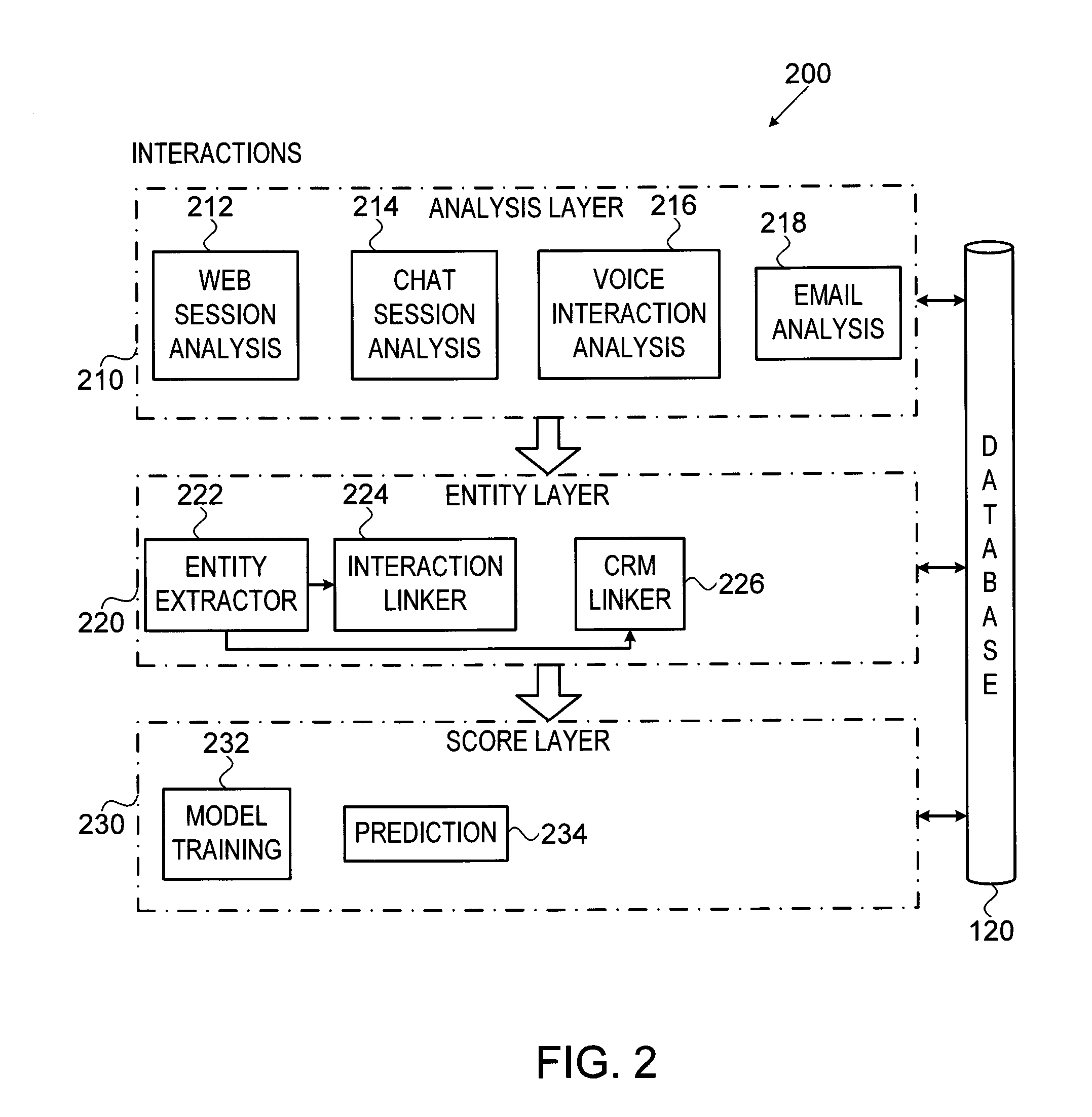

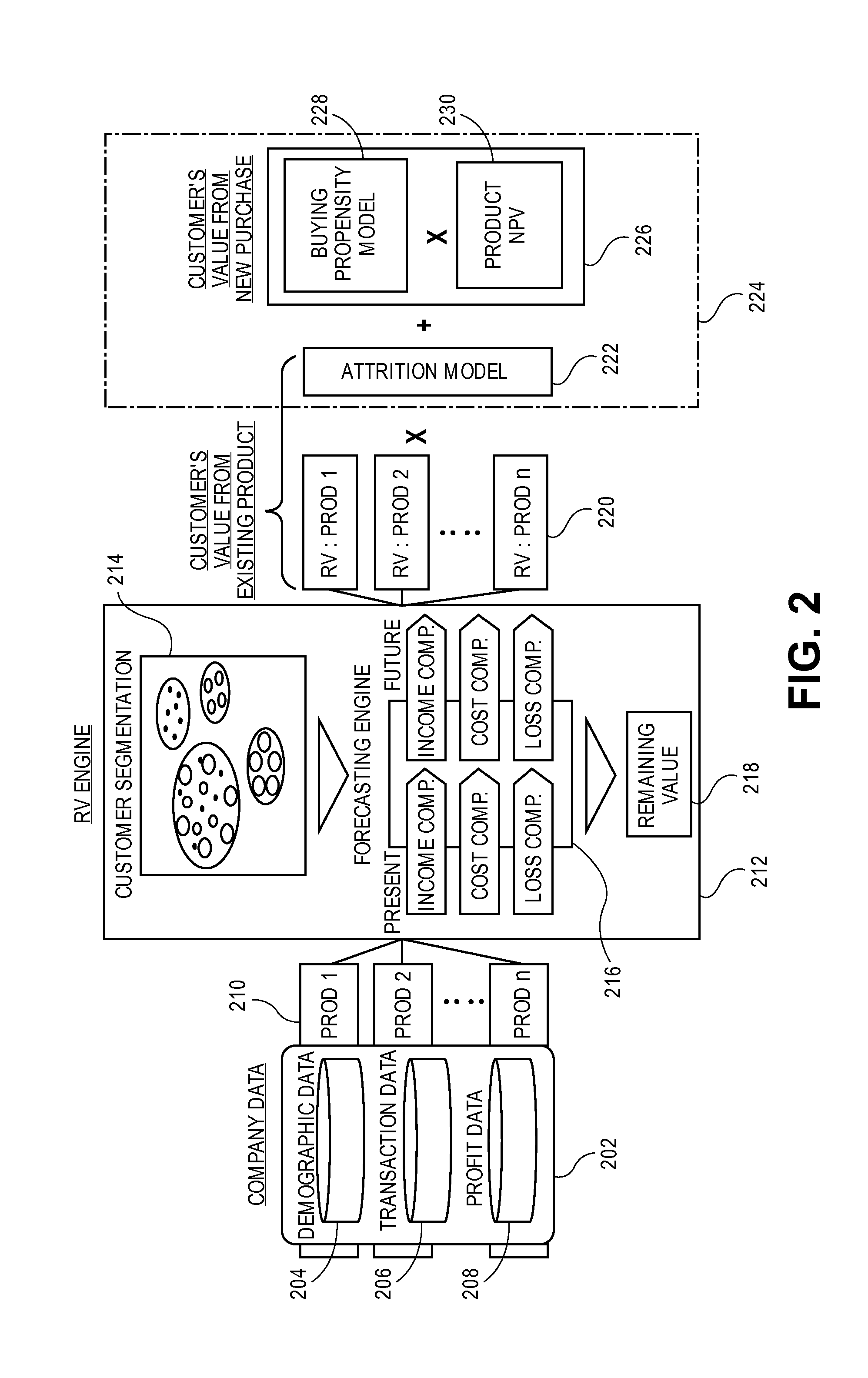

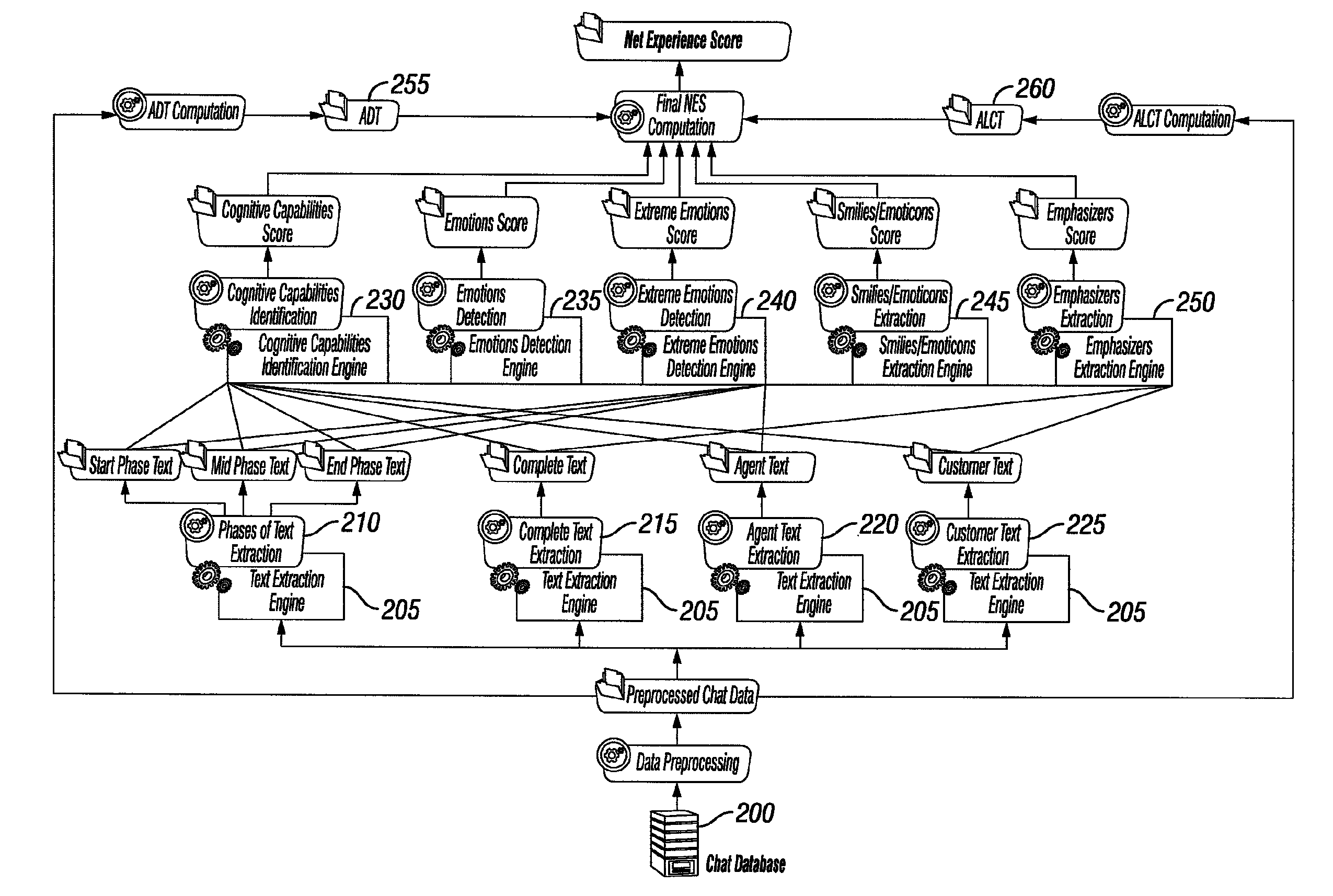

A computerized method of predicting customer churn from an organization, including: receiving at a computer server a recorded customer interaction with an agent of the organization; analyzing the received customer interaction to extract basic features that provide an indication regarding the churn probability of the customer; extracting the entity information of the customer from the recorded interaction; retrieving from a database accessible by the server previous interactions for the same entity and extracting advanced features that provide an indication regarding the churn probability of the customer by comparing multiple interactions of the same entity; predicting a churn probability for the received interaction by applying a statistical customer churn model to the extracted basic features and extracted advanced features; and wherein the interaction and the previous interactions are recordable from more than one type of communication channel by which the customer can communicate with the organization.

Owner:NICE SYSTEMS

Method for analyzing customer churn of mobile communication service

InactiveCN101620692AChurn AnalysisSpecial data processing applicationsMarketingPaymentCustomer attrition

The invention relates to a method for analyzing customer churn of a mobile communication service. The method comprises the following steps of: connecting a data warehouse; scheduling a data mining tool to analyze information such as calling in the past period of time, customer service complaints or payment and the like of a churned customer; extracting behavior characteristics of the churned customer or a customer with the churning tendency; building a customer churn prediction model; applying the model to an actual customer service; acquiring customer churn prediction information; and providing support for the management decisions of enterprises. Compared with the prior art, the method can well analyze the customer churn for the mobile communication industry.

Owner:上海全成通信技术有限公司

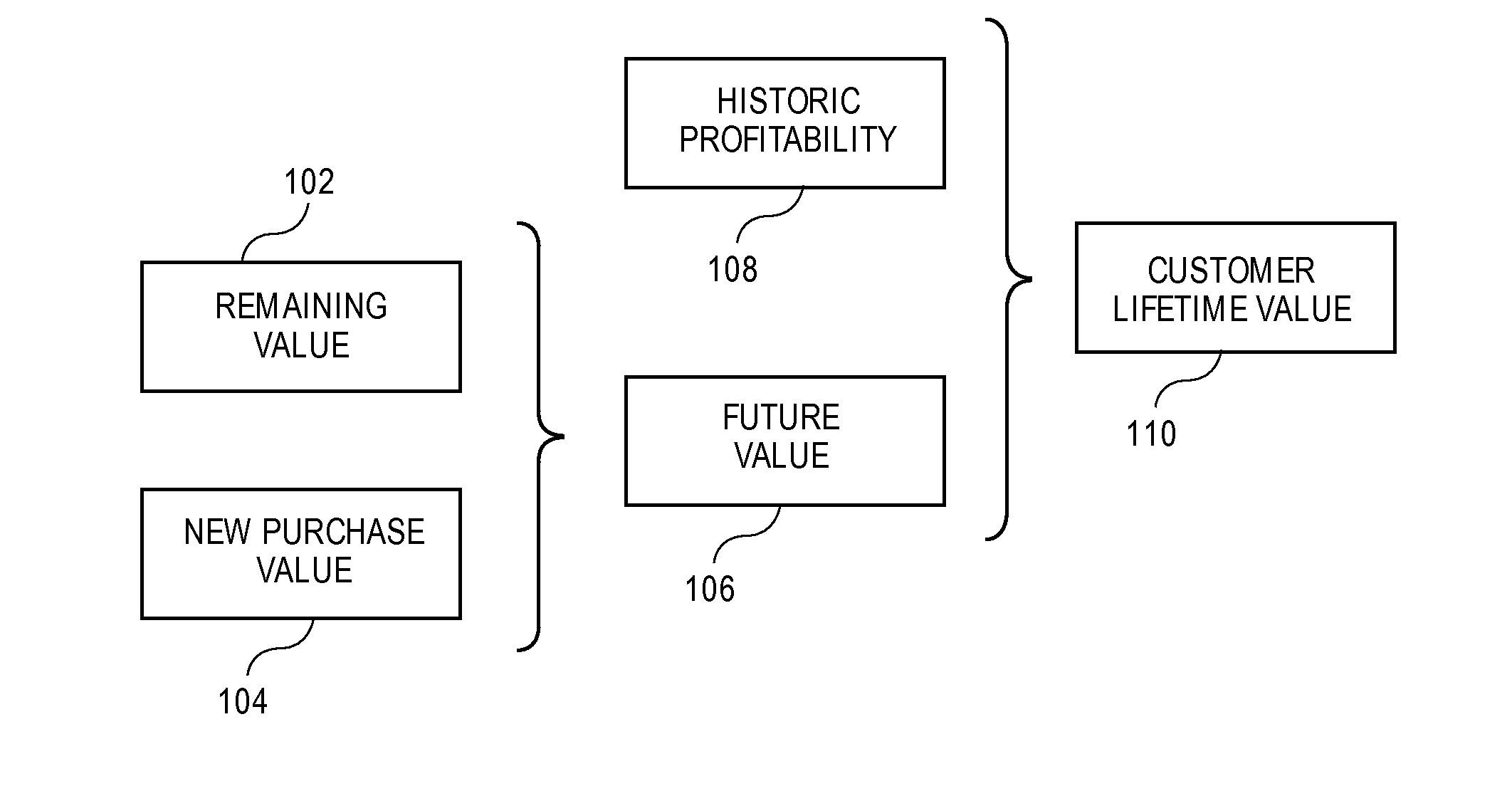

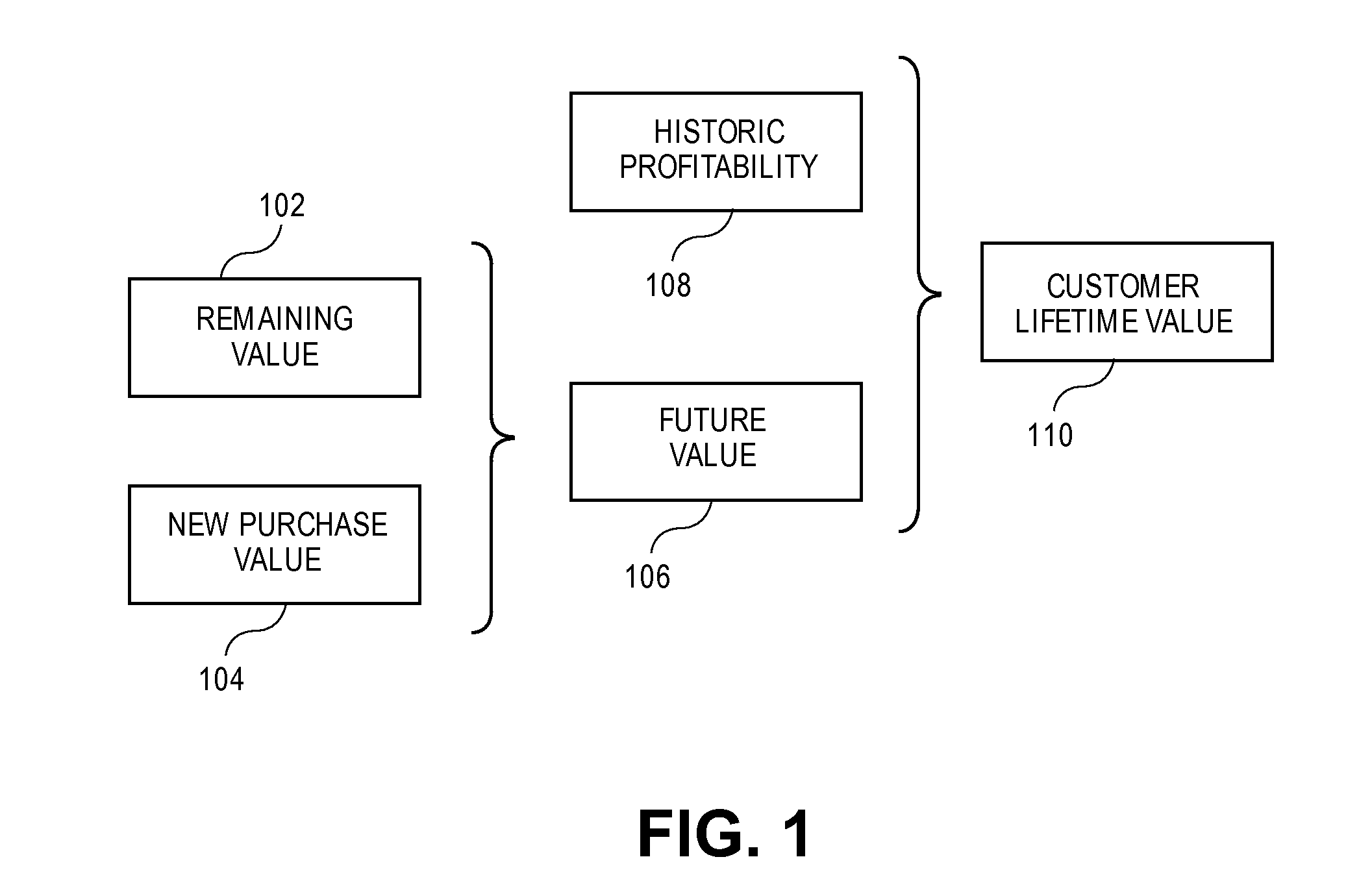

System and method for estimating customer lifetime value with limited historical data and resources

The present invention generally relates to estimating a customer's lifetime value to a company. The customer's lifetime value to the company can be based on remaining value of existing products and one or both of new purchase value and historic profitability. The remaining value and new purchase value for the customer may be estimated based on the customer's current customer segment and the customer's predicted future migration to a different customer segment. In addition, the remaining value may be estimated based on expected customer attrition, and the new purchase value may be estimated based on expected individual customer purchases.

Owner:ACCENTURE GLOBAL SERVICES LTD

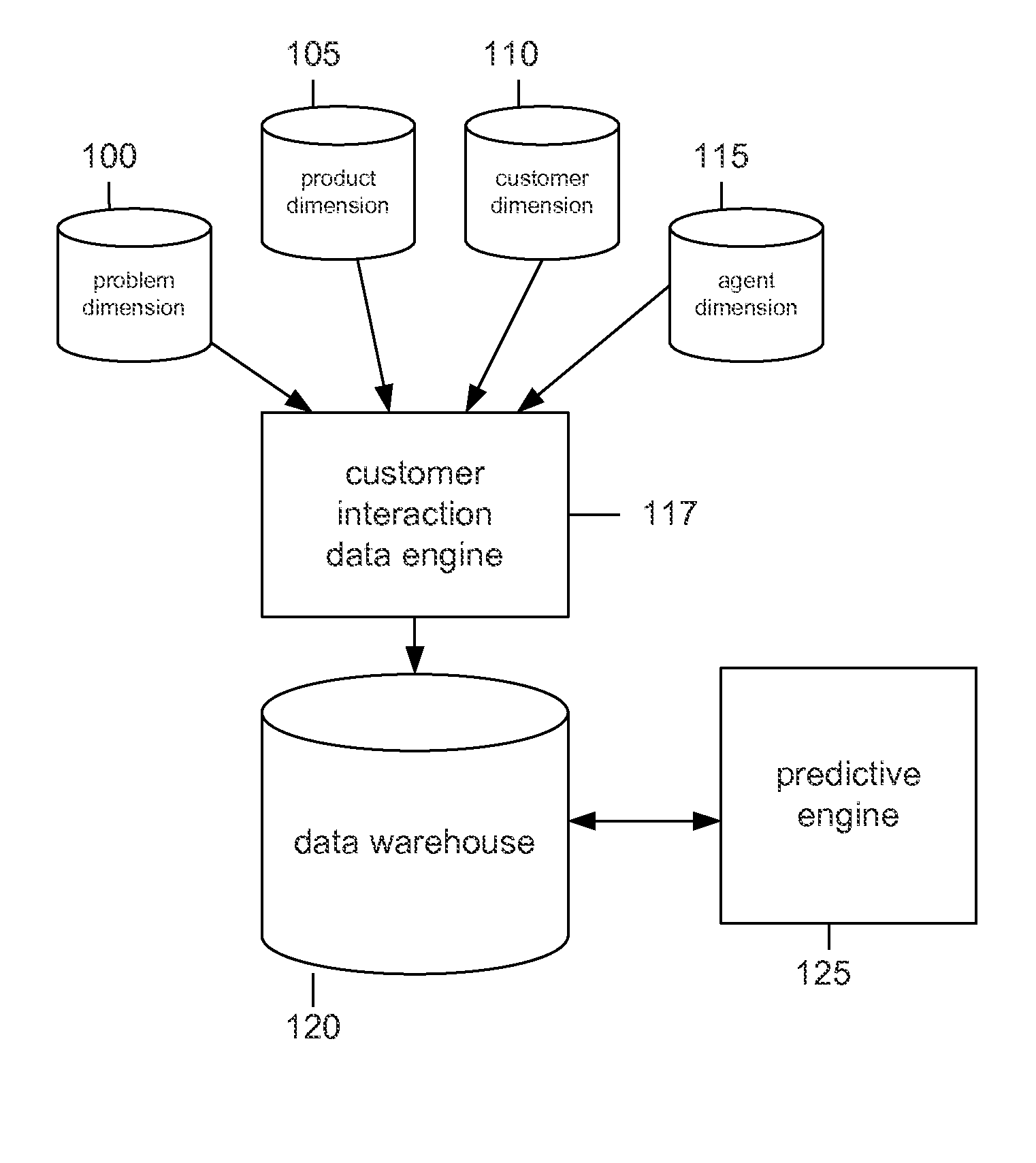

Apparatus and method for predicting customer behavior

ActiveUS9129290B2Low costImprove customer experienceFuzzy logic based systemsResourcesCustomer attritionData warehouse

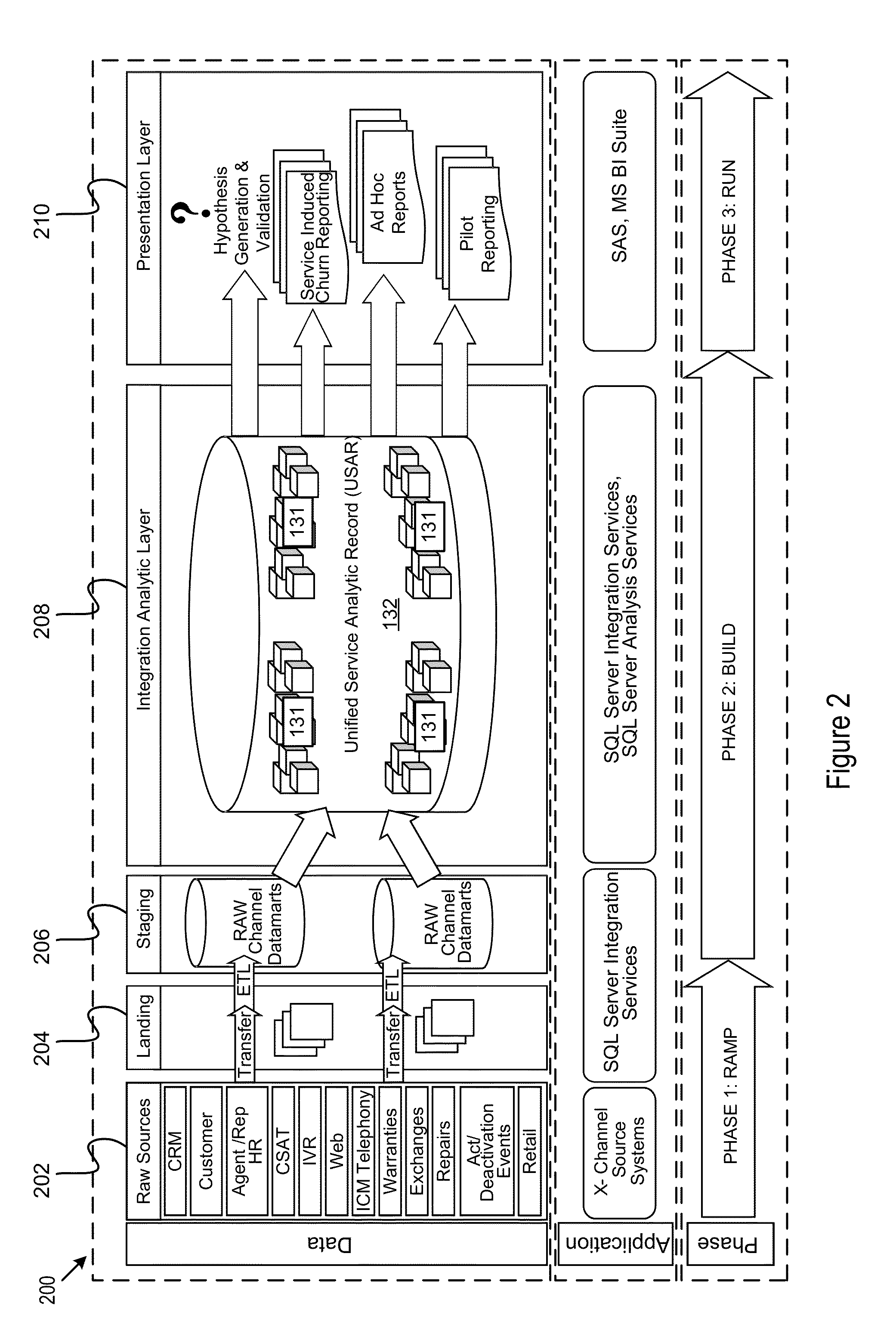

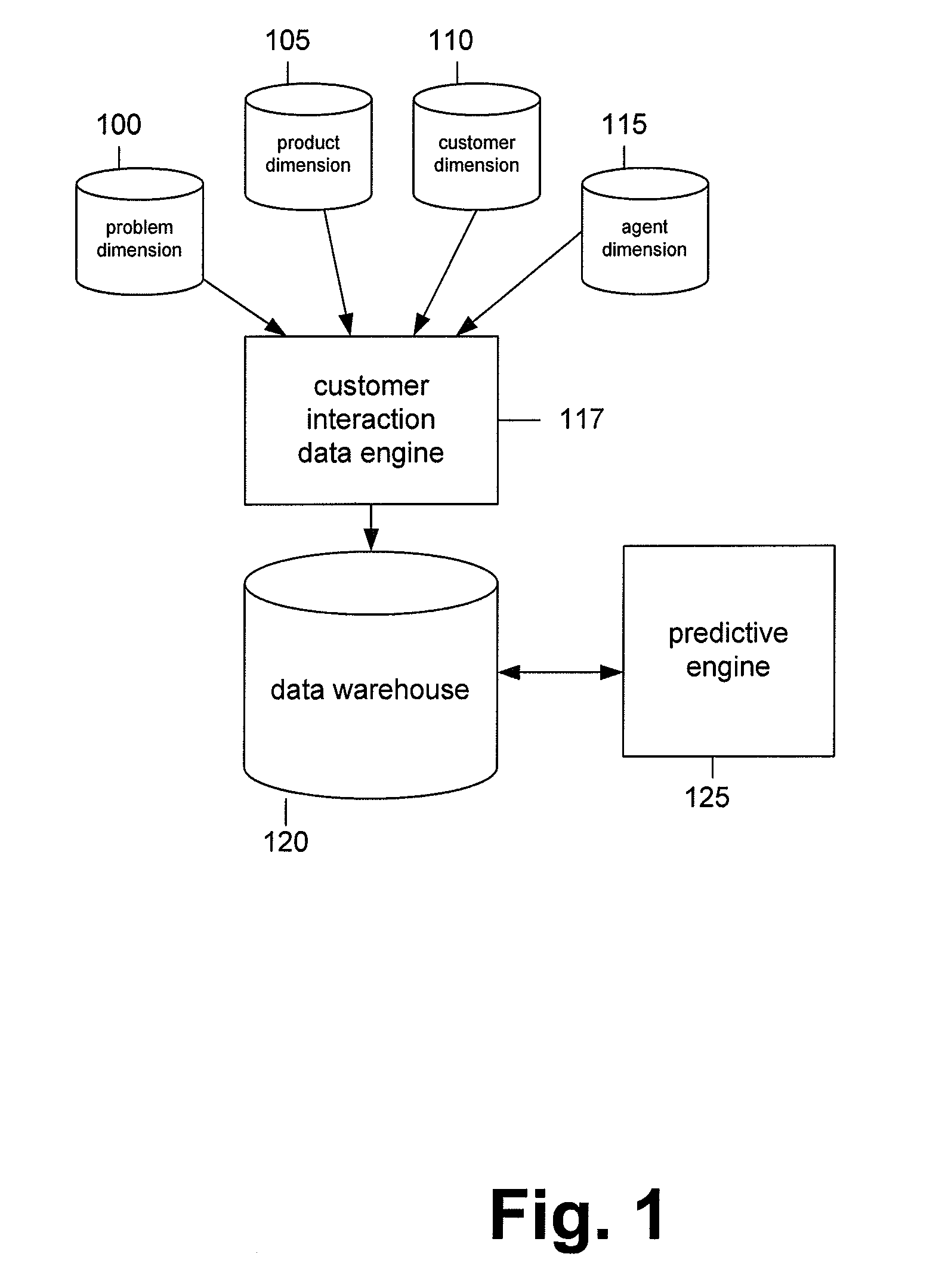

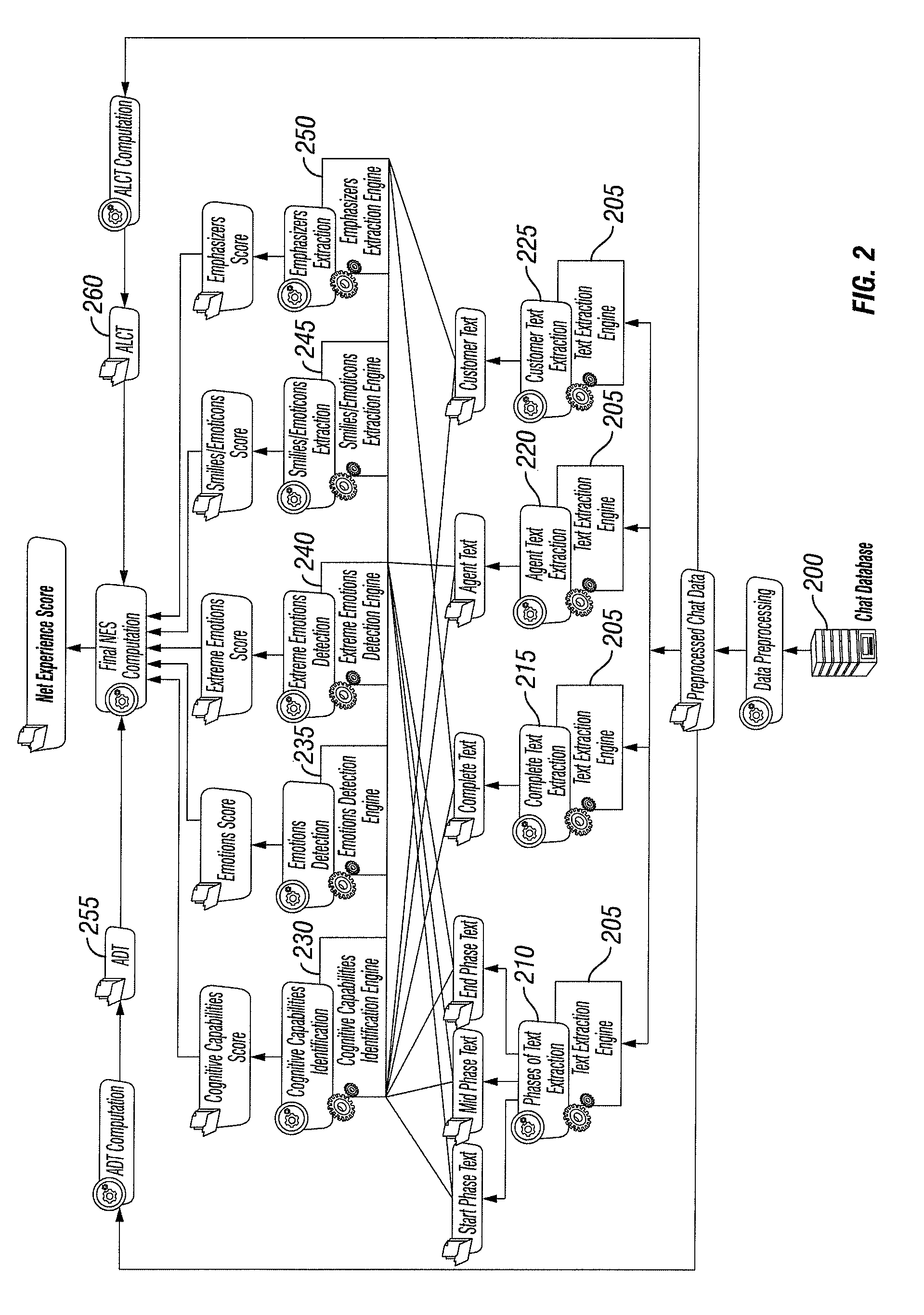

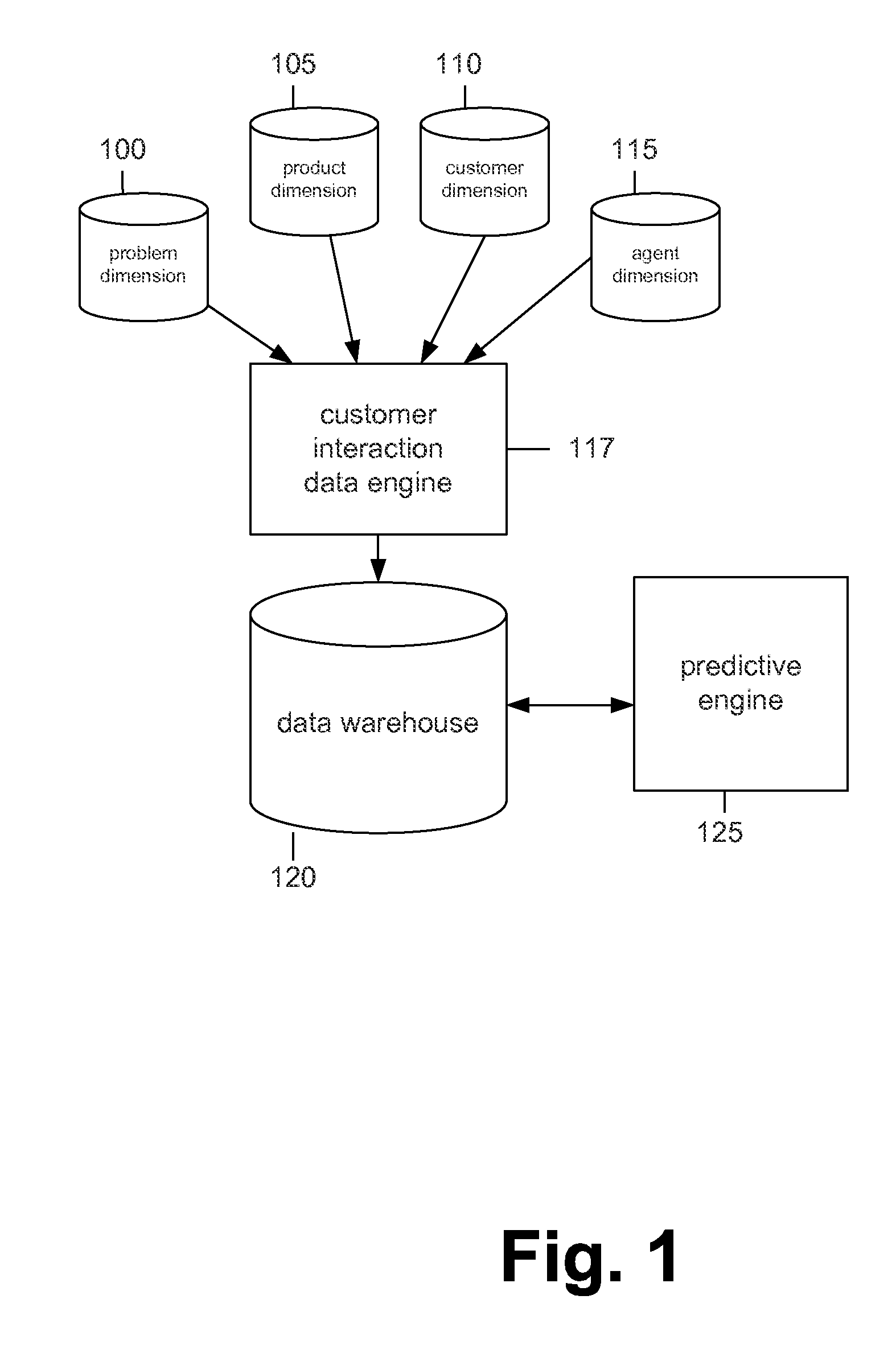

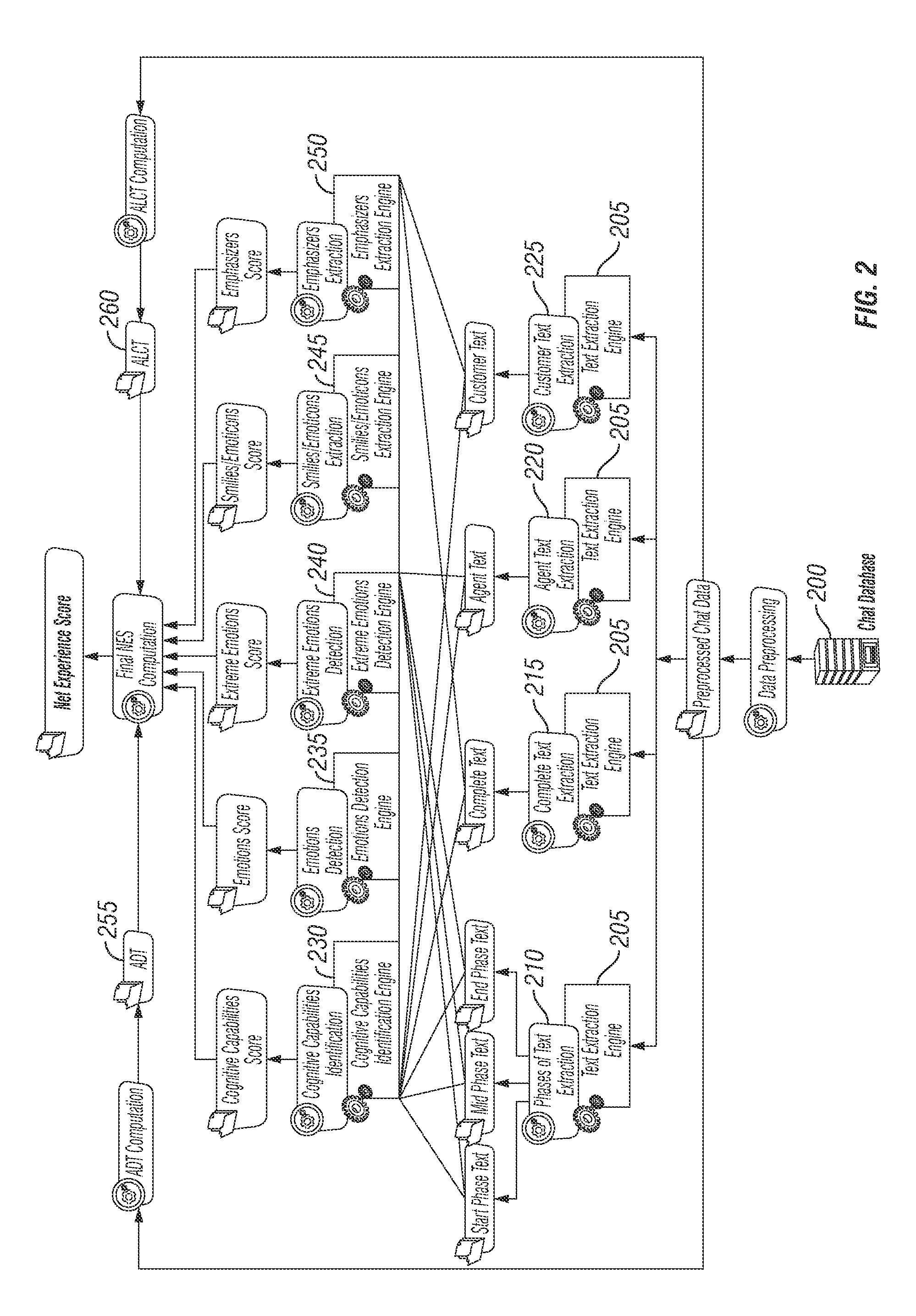

A predictive model generator that enhances customer experience, reduces the cost of servicing a customer, and prevents customer attrition by predicting the appropriate interaction channel through analysis of different types of data and filtering of irrelevant data. The model includes a customer interaction data engine for transforming data into a proper format for storage, data warehouse for receiving data from a variety of sources, and a predictive engine for analyzing the data and building models.

Owner:24 7 AI INC

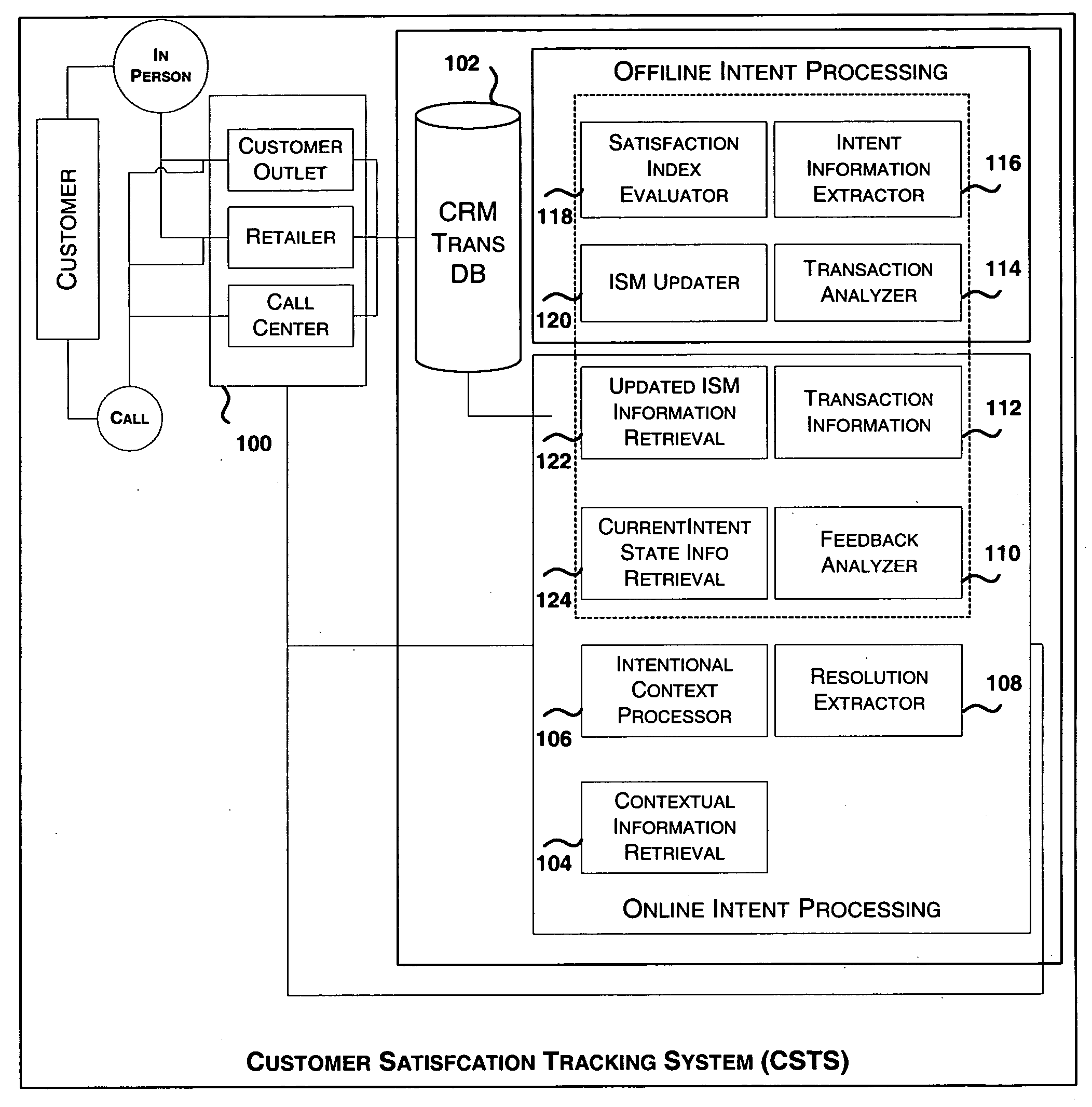

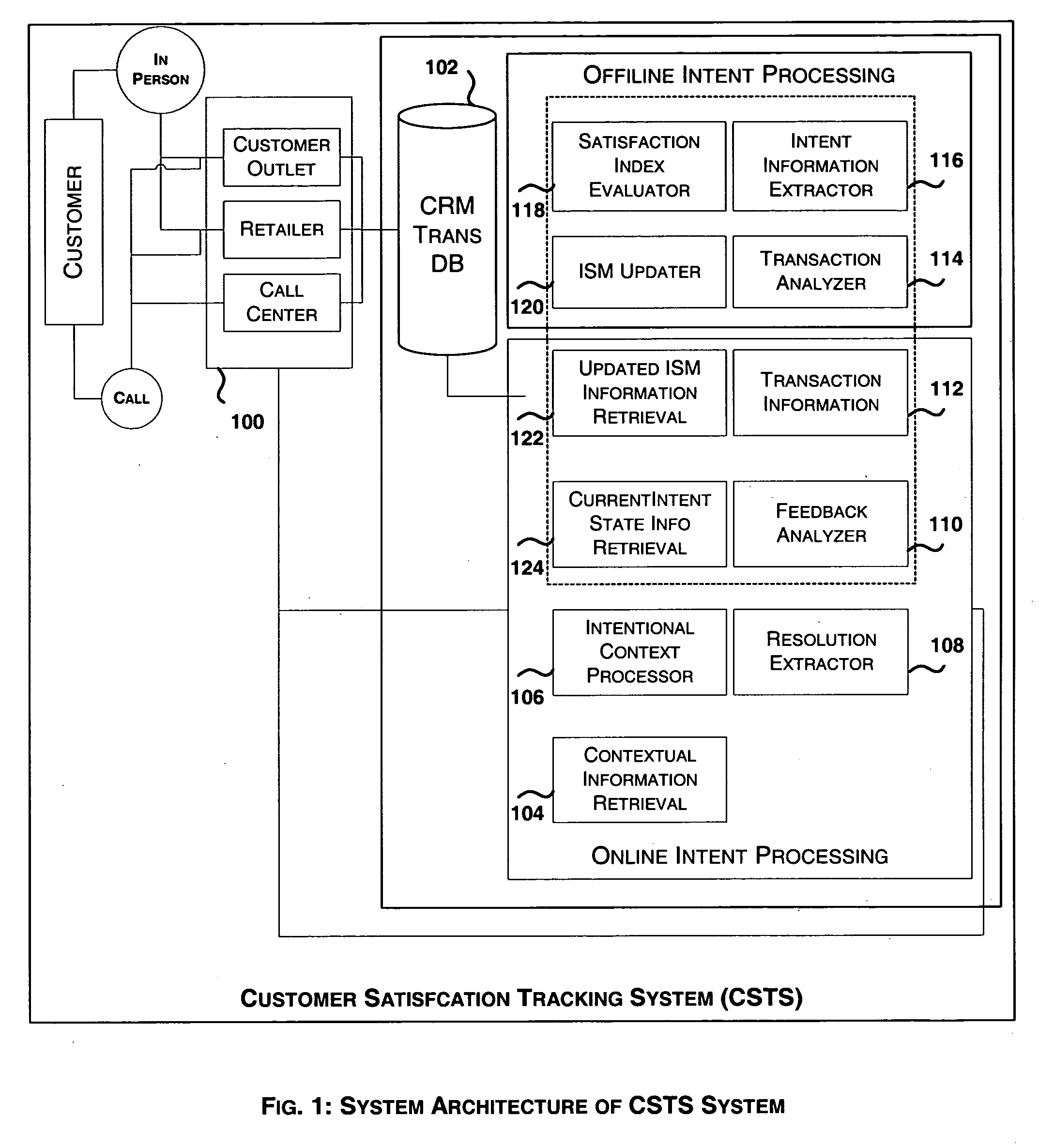

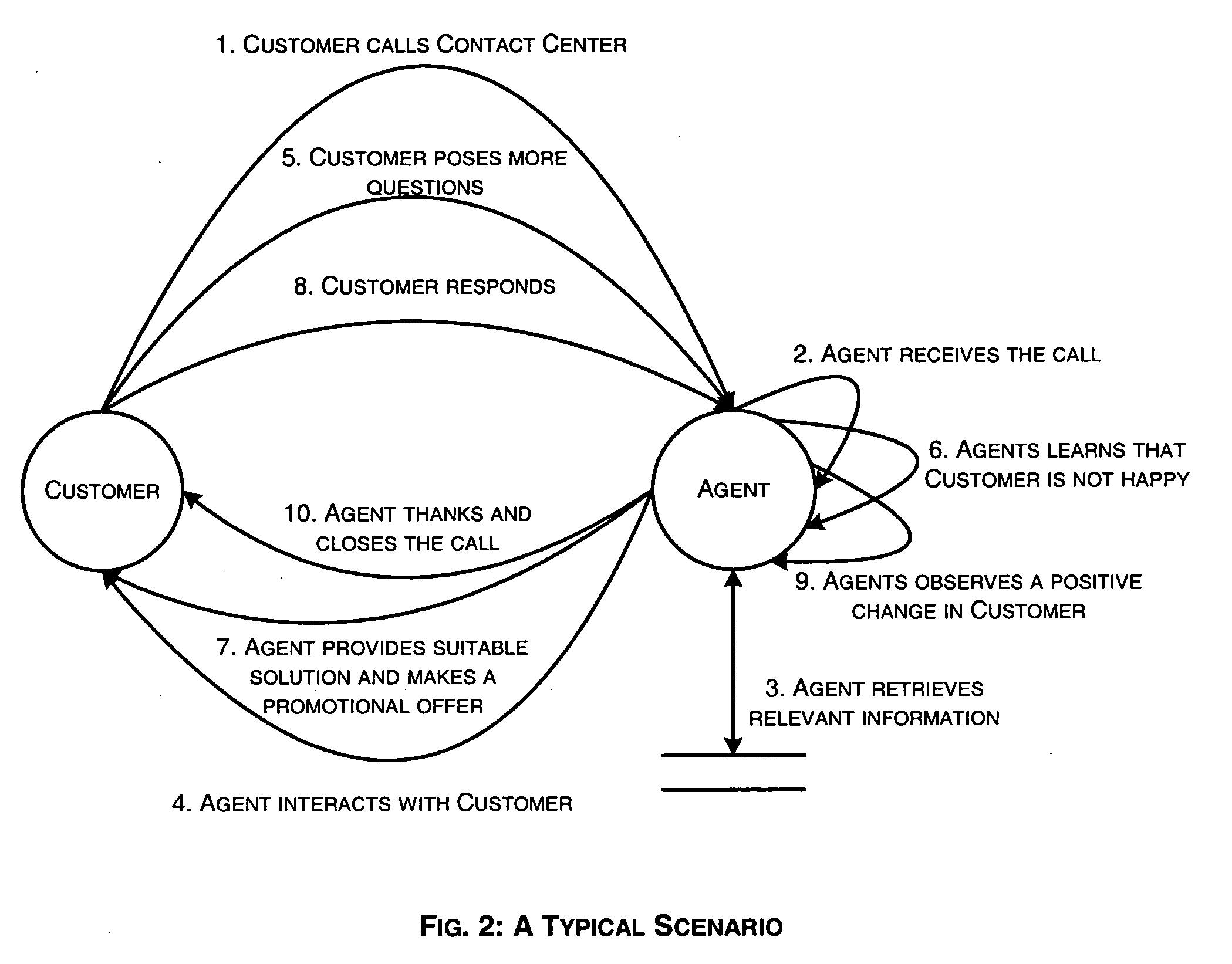

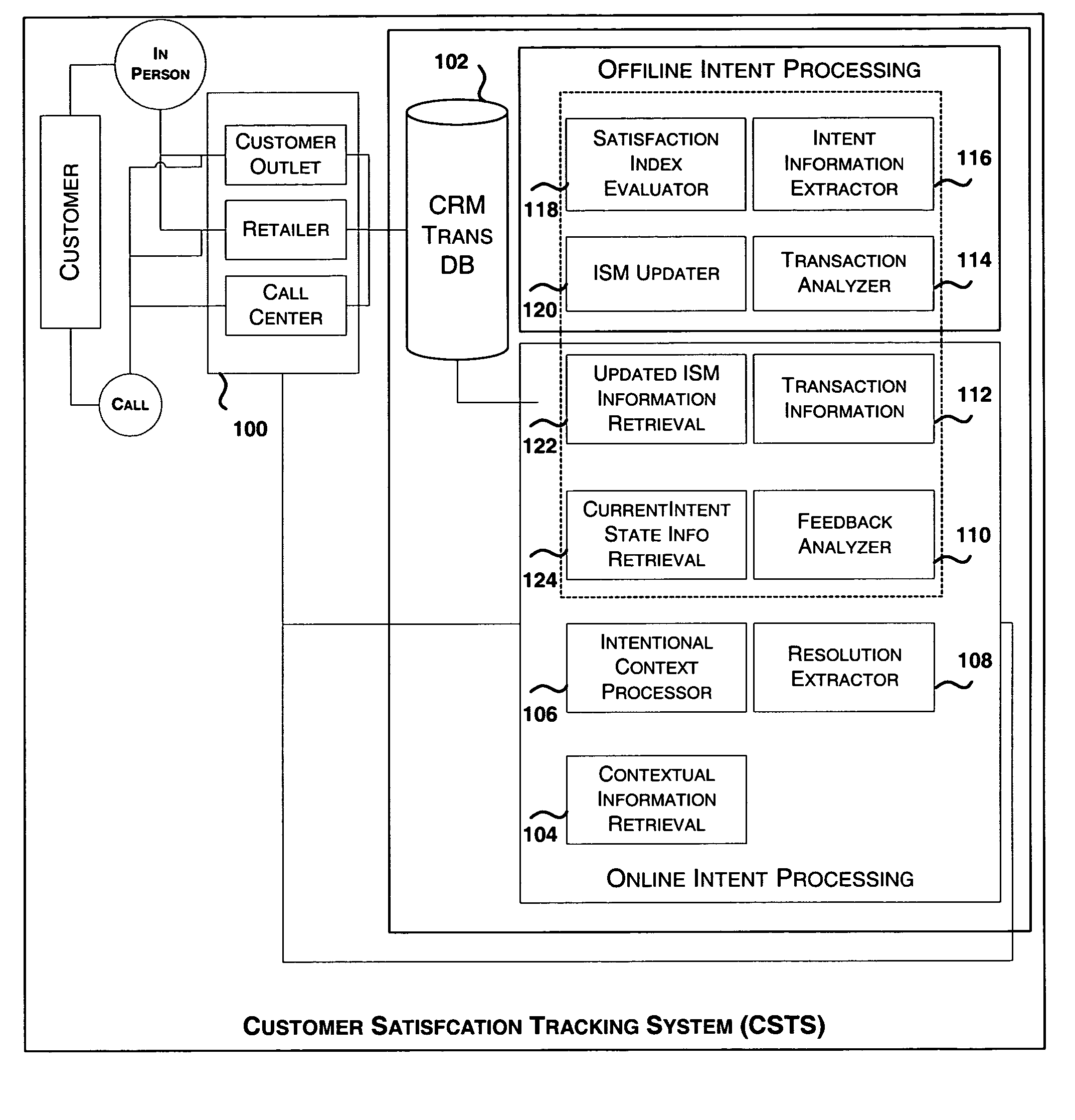

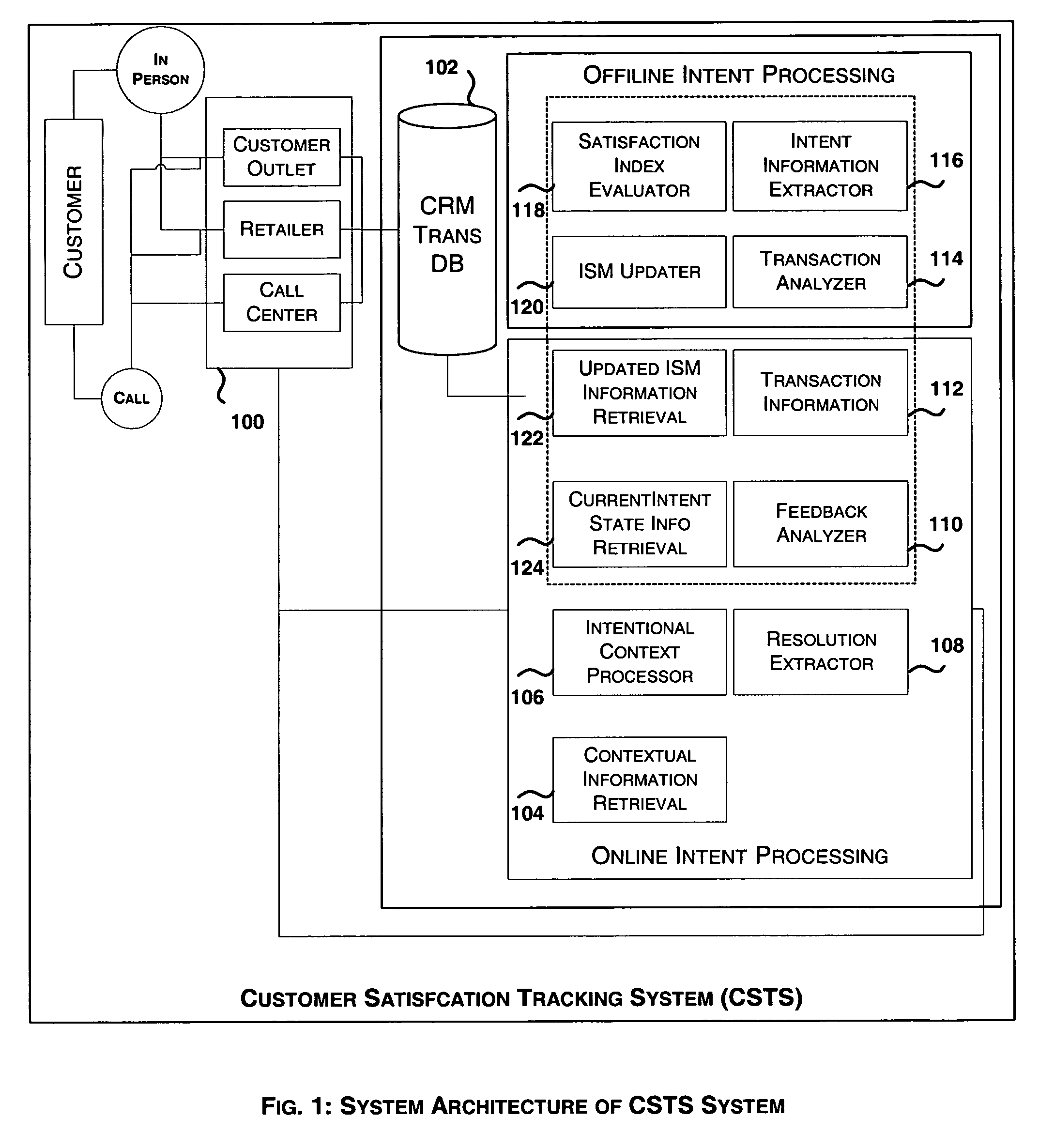

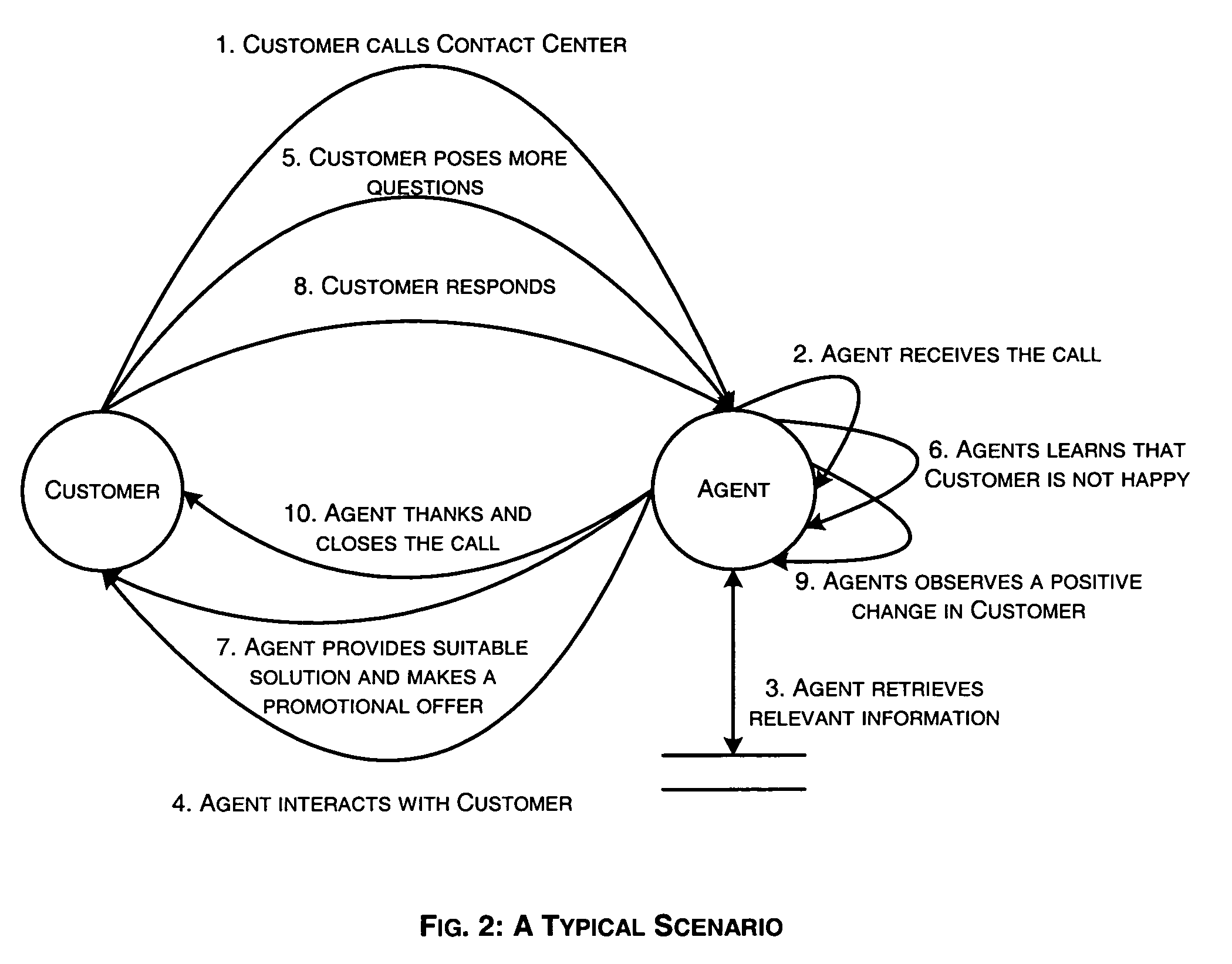

System and method for tracking customer satisfaction index based on intentional context

InactiveUS20070127692A1Manual exchangesAutomatic exchangesCustomer attritionCustomer relationship management

Customers buy a variety of equipments and gadgets from multiple vendors and interact with manufacturers through contact centers to get their questions on the bought products answered. The market opportunities and competitiveness are forcing manufacturers to be accommodative and innovative in providing post-sale support. An essential aspect of this market dynamics is customer churn and the manufactures are required to ensure that product loyalty and brand loyalty of the customers are high. While Customer Relationship Management (CRM) has been playing an all important role of monitoring and managing customer relationships, it is necessary to augment CRM with more specific enhancements. The need is to have an integrated, practical, and realizable approach that focuses on measuring customer satisfaction index based on multiple interactions of customers with manufacturers. A system and method for tracking customer satisfaction index involves tracking of the intentional states of customers and assessing them just in time to help improve the satisfaction index.

Owner:TECH MAHINDRA INDIA

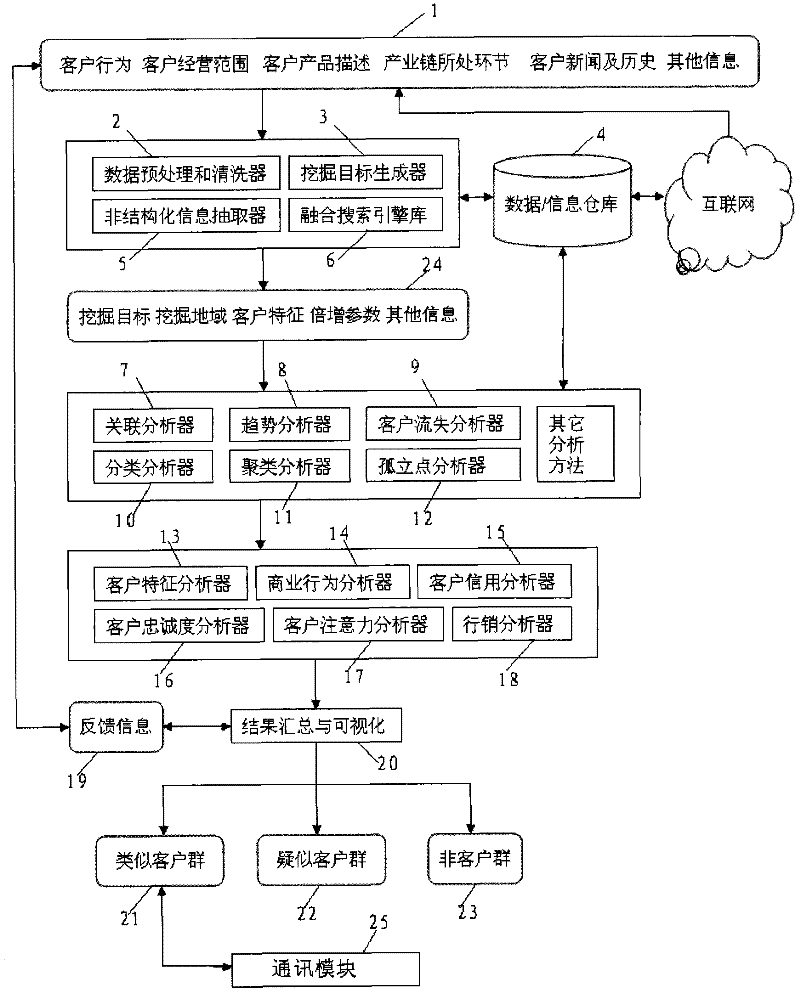

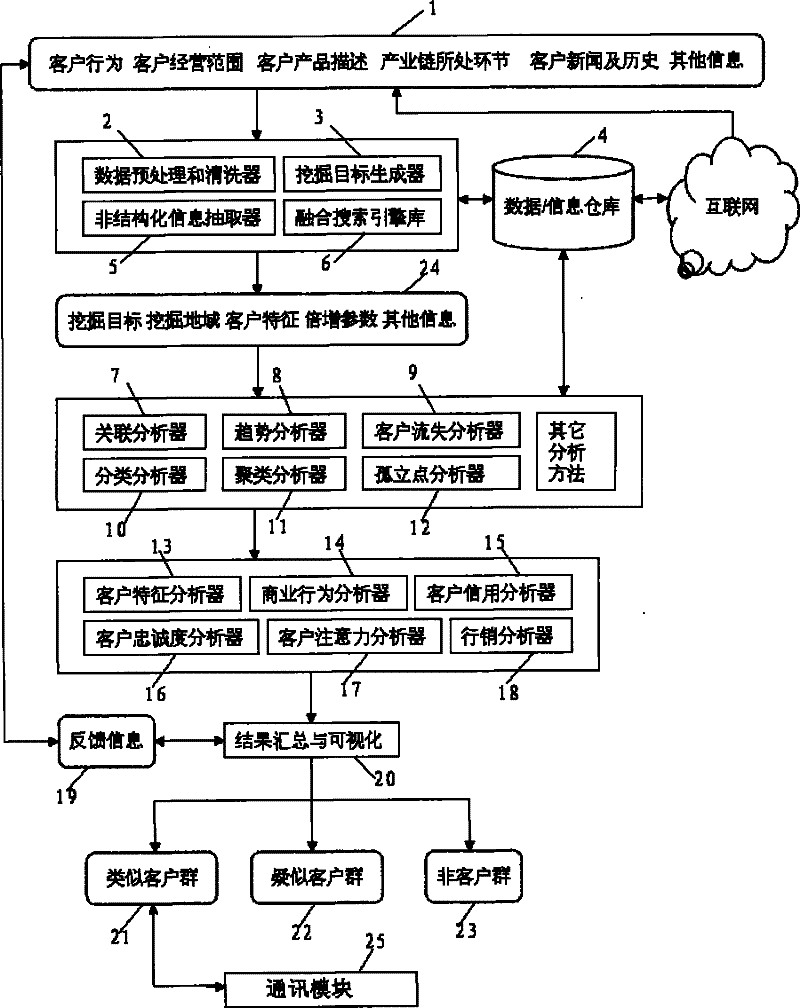

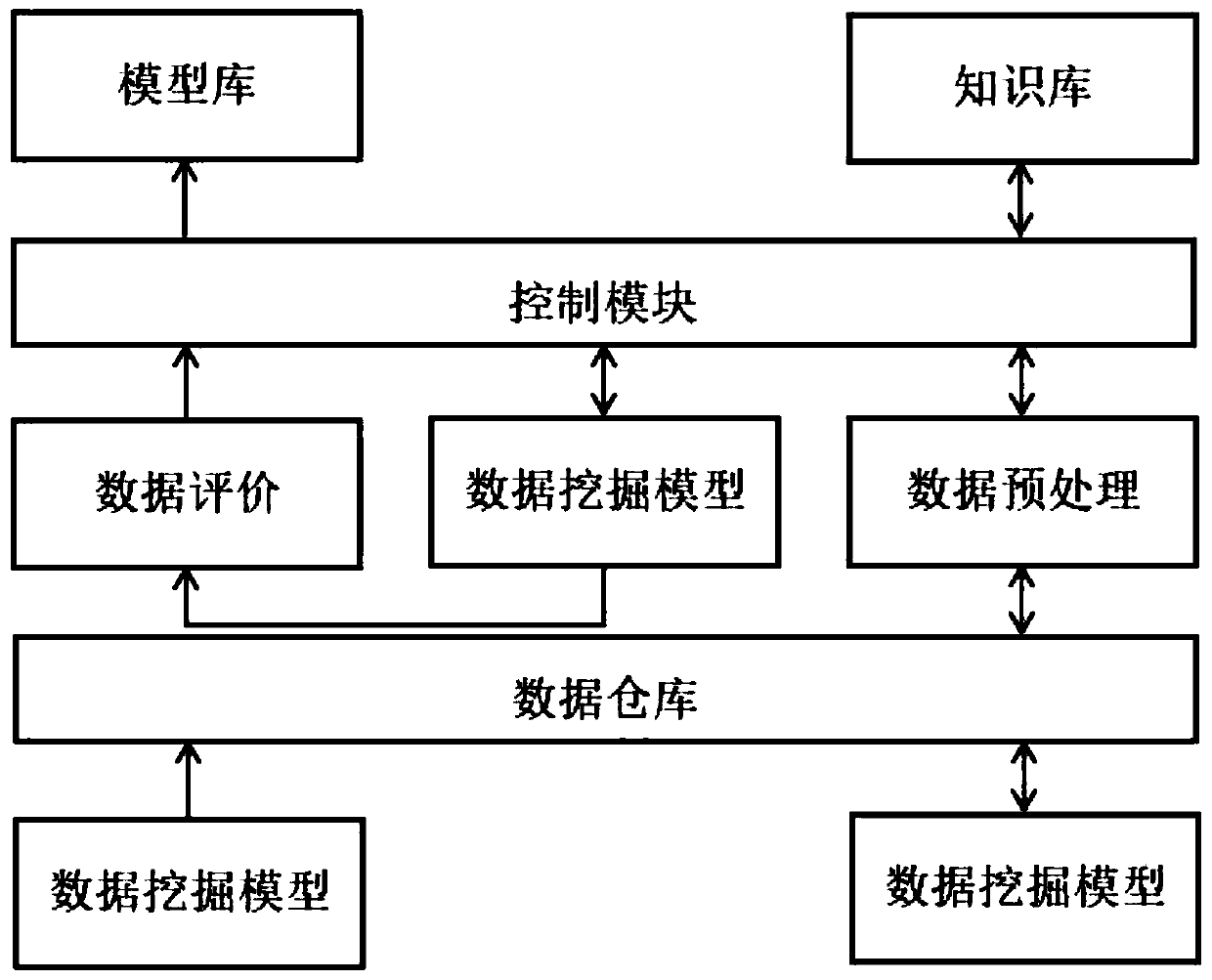

Automatic excavation system for analogous customer groups

InactiveCN102163205AQuick implementationImprove sales performanceCommerceSpecial data processing applicationsData warehouseCustomer attrition

The invention discloses an automatic excavation system for analogous customer groups, which comprises a data preprocessing and cleaning device, an unstructured information extractor, a fusion search engine, an excavation target generator, a data warehouse, a relevance analyzer, a tendency analyzer, a customer lose analyzer, a classification analyzer, a cluster analyzer, an isolated point analyzer, customer enterprise characteristic analyzer, a commercial activity analyzer, a customer enterprise credit analyzer, a customer enterprise loyalty index analyzer, a customer enterprise attention analyzer, a customer enterprise marketing analyzer and a result summarization and visualization module. With the system, the contracted customer enterprises are taken as cases, and the analogous customer groups are deeply and accurately excavated in real time, so that value-added services of analogous customer enterprise groups can be immediately provided for users according to rules of a case expansion method.

Owner:施章祖

Apparatus and Method for Predicting Customer Behavior

ActiveUS20150242860A1Low costImprove customer experienceProbabilistic networksResourcesCustomer attritionData warehouse

Owner:24 7 AI INC

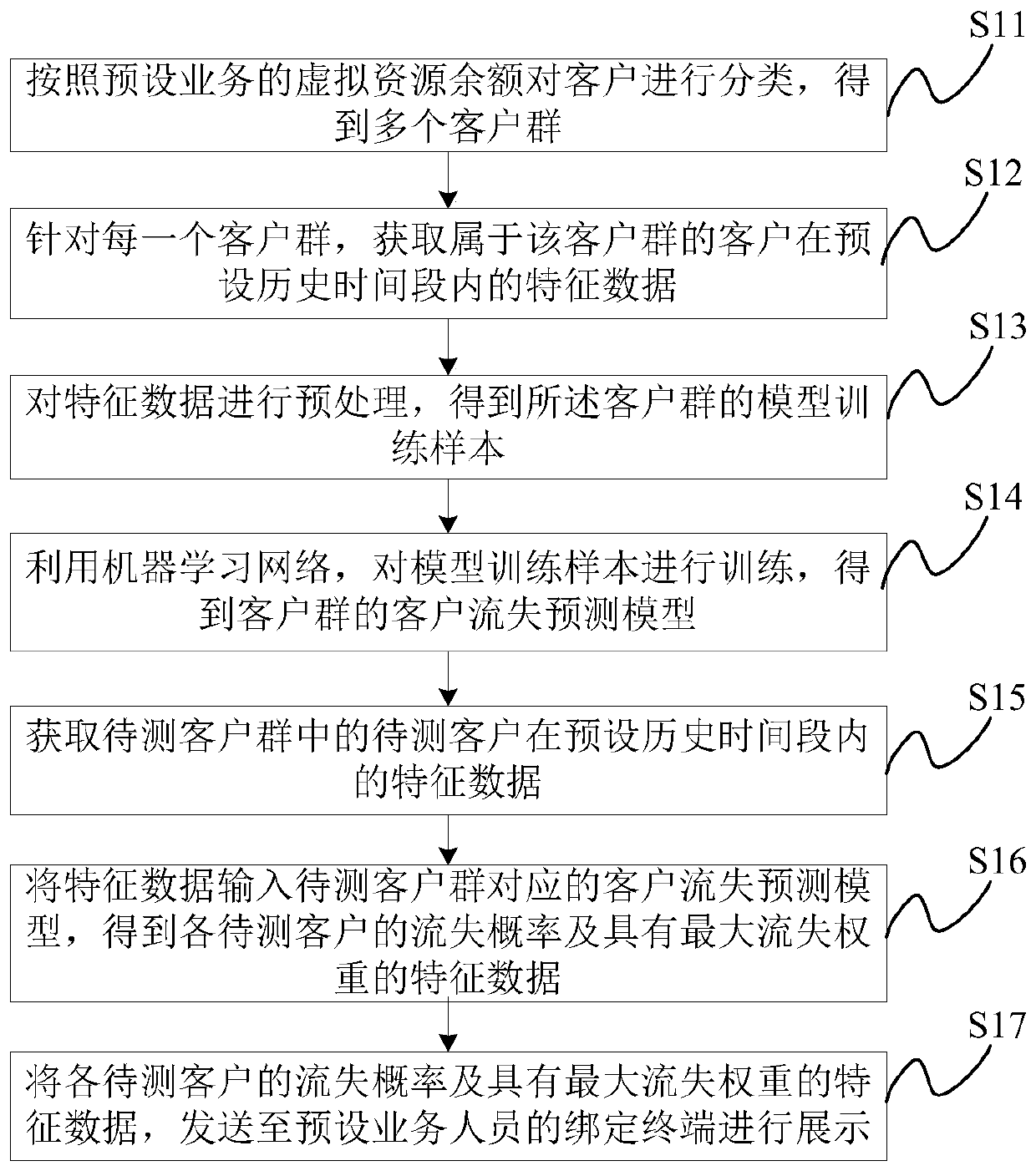

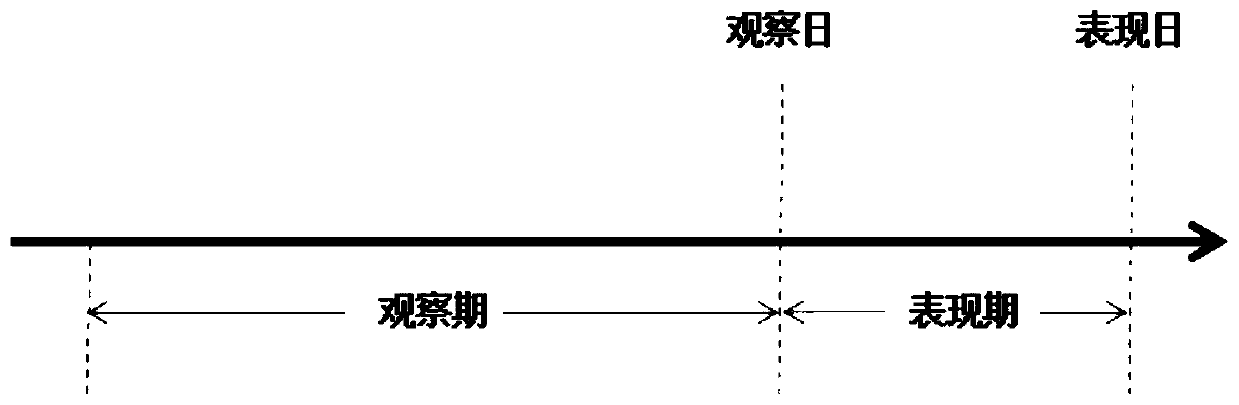

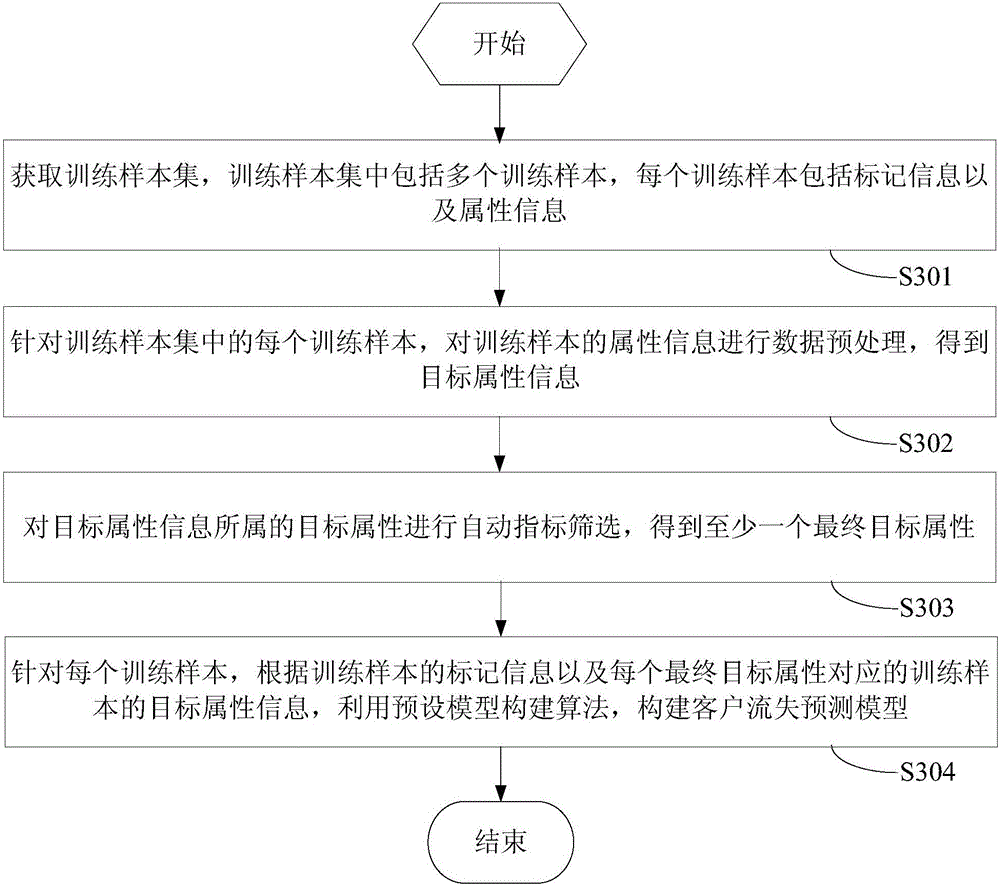

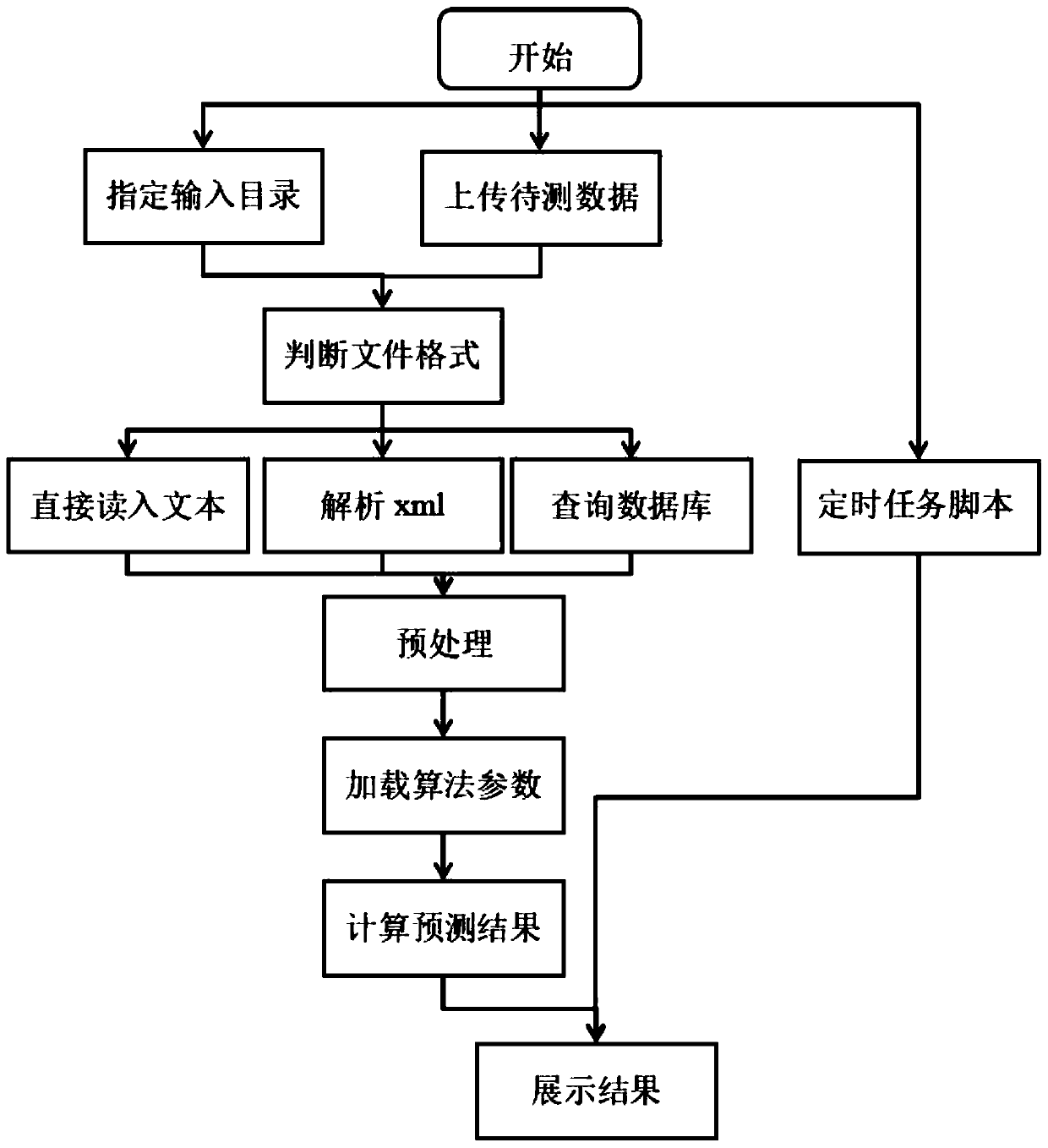

Customer loss prediction method and device and storage medium

ActiveCN110837931AReduce churnImprove forecast accuracyForecastingCharacter and pattern recognitionBusiness PersonnelCustomer attrition

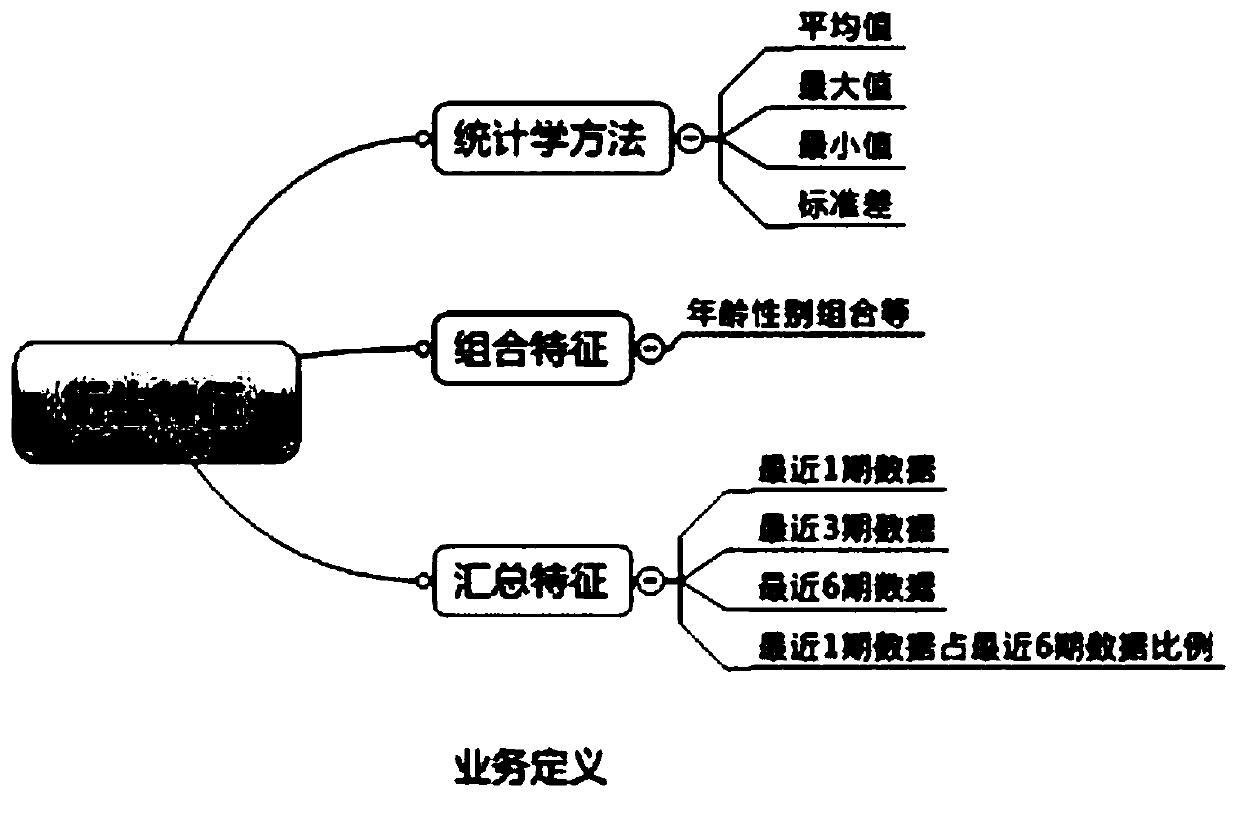

The invention discloses a customer loss prediction method and device and computer equipment. In a process of obtaining a customer loss prediction model, the clients are classified according to the virtual resource balance of the preset service to obtain a plurality of client bases which are more refined and reflect personal preferences of clients in the preset service; then, aiming at each customer group, original feature data of multiple dimensions of a corresponding client in a preset historical time periodand derived characteristic data of multiple dimensions are processed to obtain a modeltraining sample of the customer group; the types of model training samples are greatly enriched; thus, the model training samples are trained by using a machine learning algorithm, the prediction accuracy of the customer loss model obtained by training is greatly improved, and then the service personnel can accurately and timely know the possible lost customer list in advance according to the prediction accuracy, save the customers by adopting appropriate policies, and reduce the customer loss amount.

Owner:AGRICULTURAL BANK OF CHINA

Churn analysis system

A churn analysis system helps a business analyze, predict, and reduce customer churn. The system analyzes customer experiences by using an insightful block level approach to correlate customer experience with customer churn. Through the block level approach, the system is able to more accurately predict and effectively reduce future customer churn. As a result, businesses are able to reduce customer acquisition costs and improve customer retention rates.

Owner:ACCENTURE GLOBAL SERVICES LTD

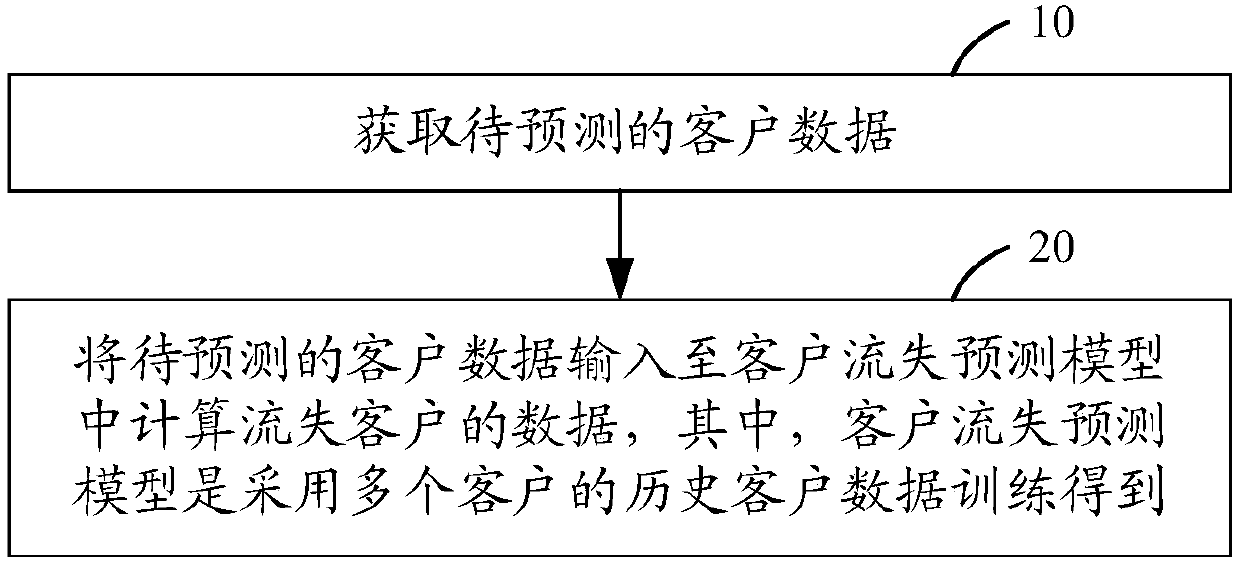

Customer loss prediction method and device

The invention provides a customer loss prediction method and apparatus. The method comprises the steps of obtaining to-be-predicted customer data; and inputting the to-be-predicted customer data intoa customer loss prediction model to calculate data of lost customers, the customer loss prediction model being obtained by training historical customer data of a plurality of customers. By means of the mode, the customer loss prediction method and system can accurately predict the customer loss and find the customer possibly losing, so that the customer is saved in time, the customer saving cost is saved, the saving effect is improved, and the customer loss problem is effectively solved.

Owner:DATACANVAS LTD

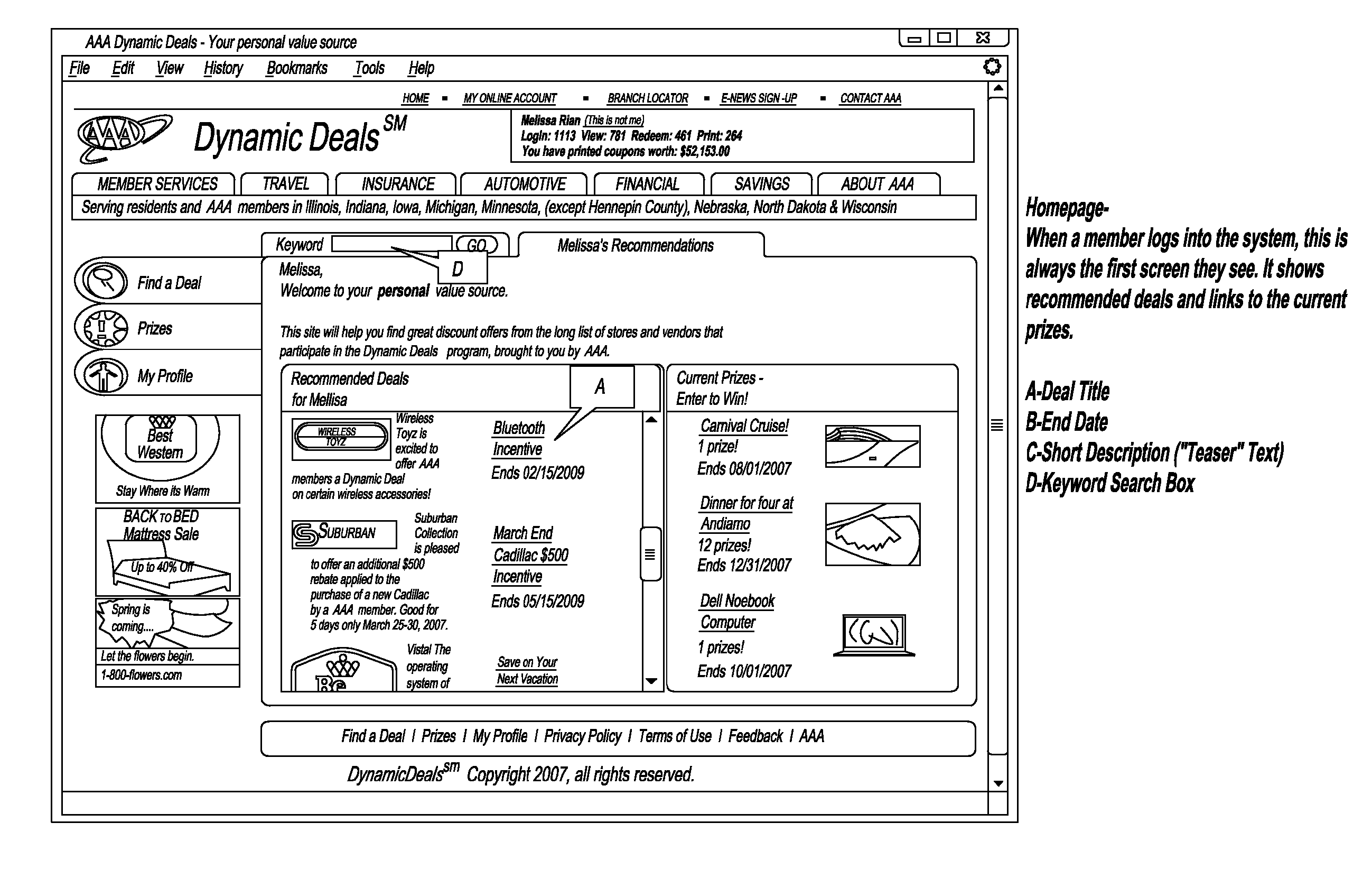

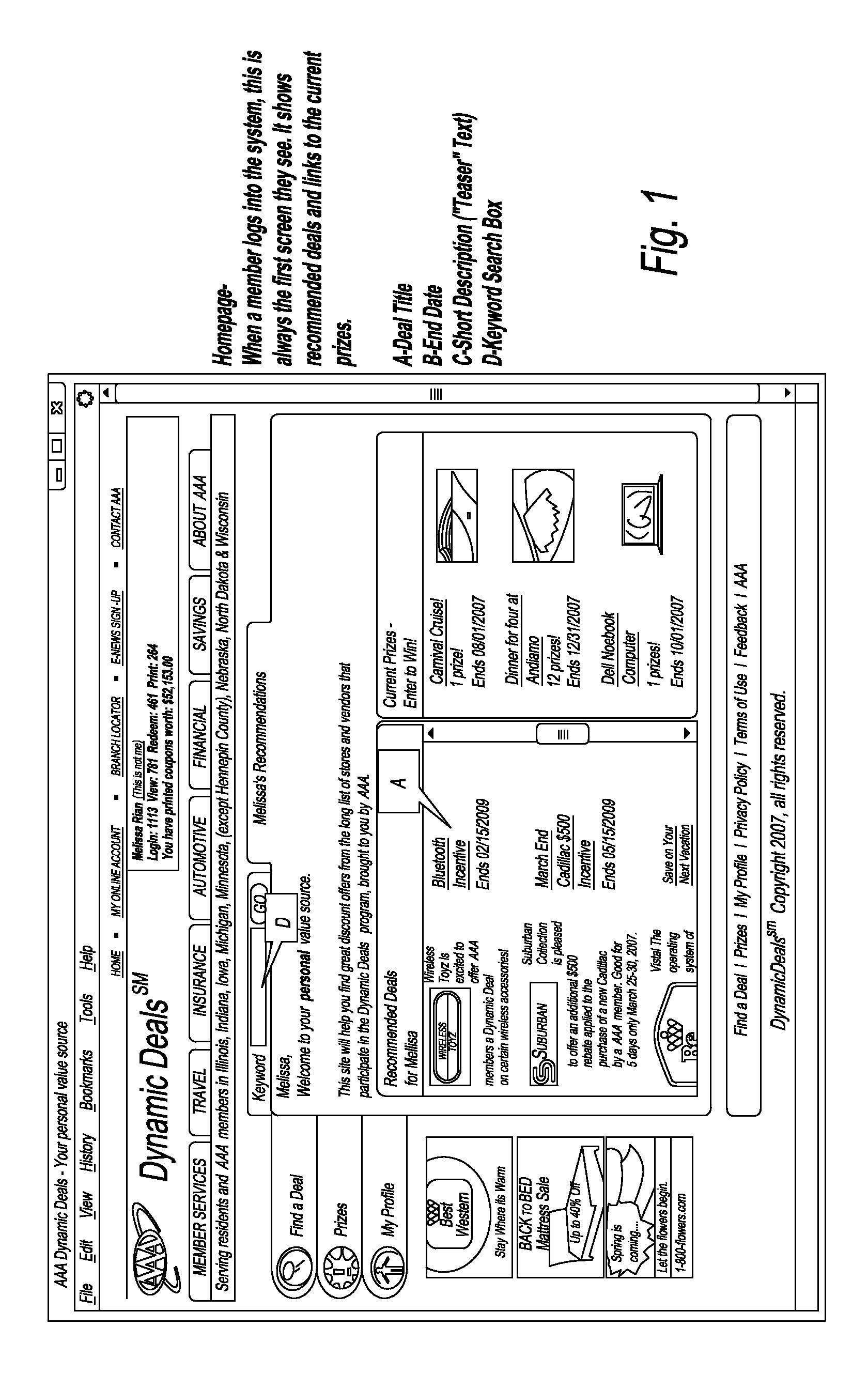

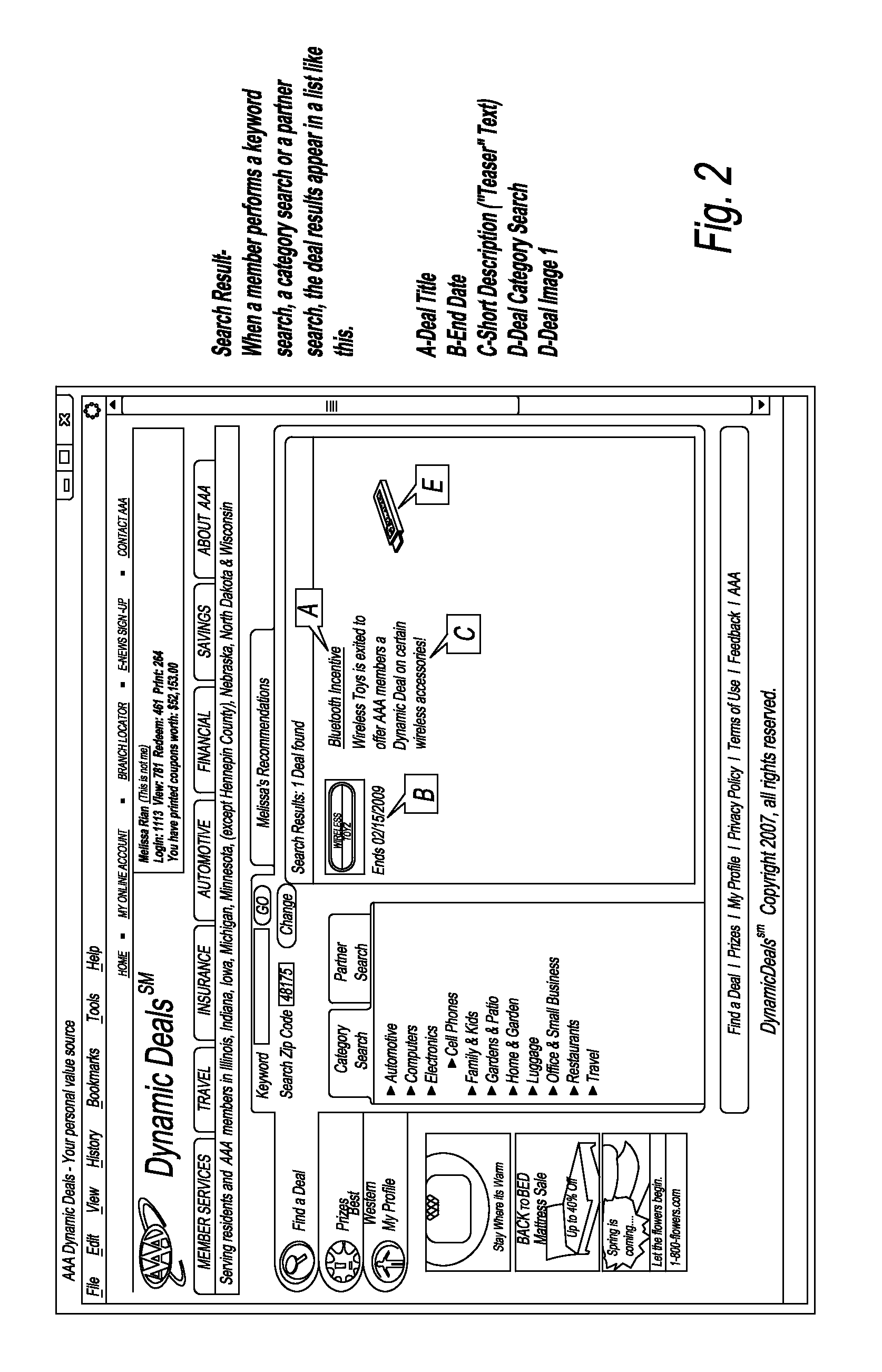

Consumer Marketing System and Method

InactiveUS20080082396A1Efficiently focusEnhances existing Internet-based programsMarket predictionsData acquisition and loggingCustomer attritionThe Internet

Consumer marketing systems and methods that utilize consumer data gathering techniques to allow merchants and businesses to more efficiently focus their marketing efforts towards those customers that are likely to buy their goods and / or services. The system provides: (1) increased customer usage and loyalty through unique, timely and relevant values from merchants or businesses that customers are not likely to find elsewhere; (2) quantifying the value of patronizing the merchant or business by demonstrating to customers that the overall savings exceeds the cost of any membership fees and / or the like; (3) incorporating an information based strategy that will enable management to better understand their own customer base in order to increase penetration with its own products and services and identify opportunities for new services; (4) attracting new customers and reduce defection among existing customers; (5) enhancing the value of the Internet-based program for merchants or businesses, allowing them to better target market to the merchant's or business' existing customers; and (6) increasing the number of overall merchant or business relationships and the number of merchants or businesses willing to pay for access and enhanced features.

Owner:OCONNOR JOSEPH J +1

System and method for tracking customer satisfaction index based on intentional context

InactiveUS7801761B2Special data processing applicationsMarket data gatheringCustomer attritionCustomer relationship management

Customers buy a variety of equipments and gadgets from multiple vendors and interact with manufacturers through contact centers to get their questions on the bought products answered. The market opportunities and competitiveness are forcing manufacturers to be accommodative and innovative in providing post-sale support. An essential aspect of this market dynamics is customer churn and the manufactures are required to ensure that product loyalty and brand loyalty of the customers are high. While Customer Relationship Management (CRM) has been playing an all important role of monitoring and managing customer relationships, it is necessary to augment CRM with more specific enhancements. The need is to have an integrated, practical, and realizable approach that focuses on measuring customer satisfaction index based on multiple interactions of customers with manufacturers. A system and method for tracking customer satisfaction index involves tracking of the intentional states of customers and assessing them just in time to help improve the satisfaction index.

Owner:TECH MAHINDRA INDIA

Predicting likelihood of customer attrition and retention measures

InactiveUS9165270B2Easy to measureReduce customer lossForecastingResourcesCustomer attritionTransaction data

The present invention relates to a system and method for customer retention. Historical transaction and customer data may be received from stores. Likewise, recent customer transaction data may be received from the stores. The transactions are linked to each customer. Attriters, historical customers who discontinued shopping, are identified. Next, risk factors for attrition may be identified by examining the attriters' transaction history for commonalities. From the risk factors a loss model may be generated. The loss model may be used, in conjunction with current transaction data, to generate the likelihood of loss for each of the current customers, which may then be reported. Retention measures may be generated for each customer by comparing the customer's transactions to the loss model and the risk factors. The retention measures may be outputted to the stores, and a price optimization system. Likewise, the retention measures may be validated by comparing actual customer loss to the loss model.

Owner:ACOUSTIC LP

Method and apparatus for customer retention

ActiveUS20080167934A1Easy retentionEasy to satisfyHand manipulated computer devicesAutomatic call-answering/message-recording/conversation-recordingCustomer attritionCustomer delight

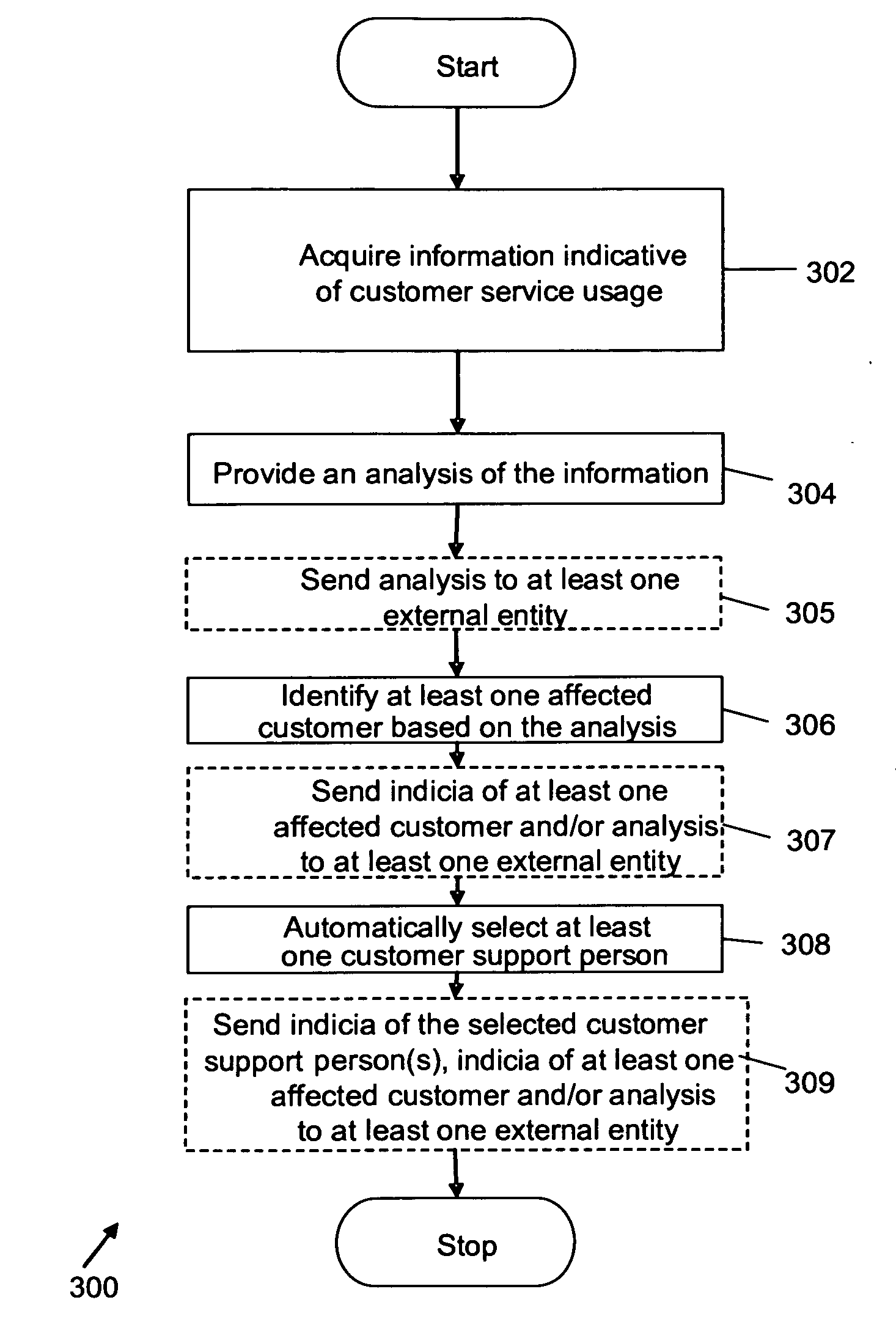

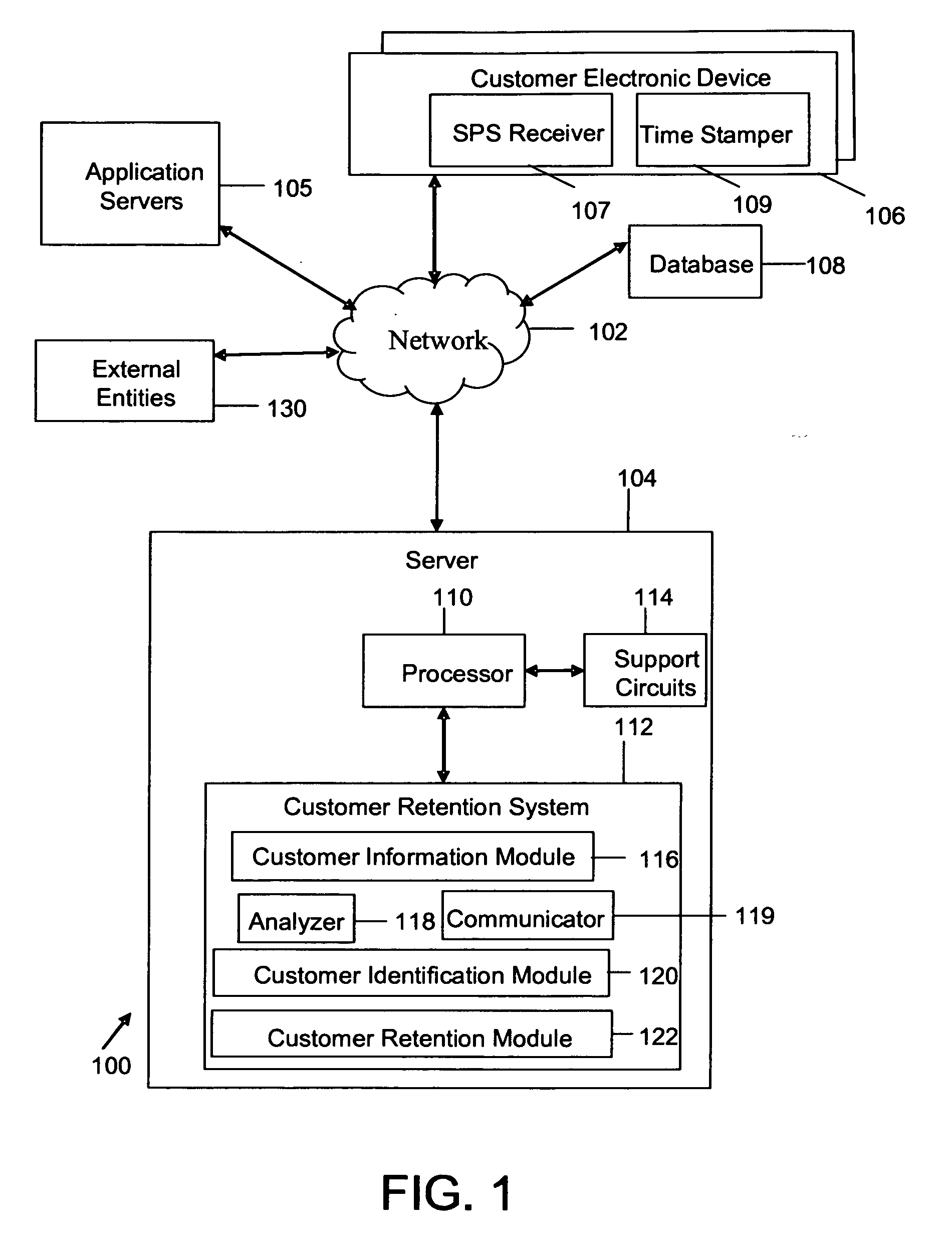

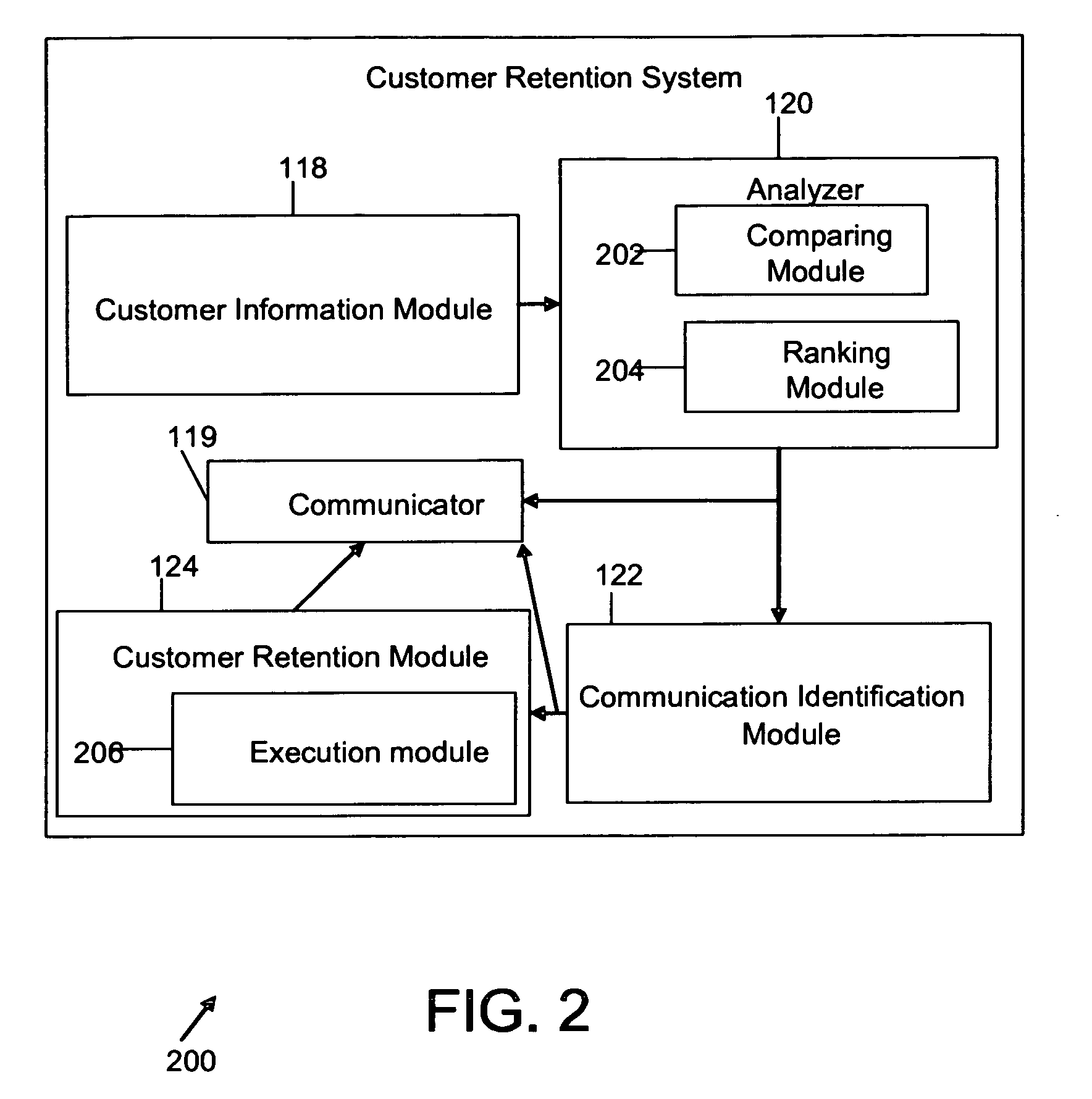

Method and apparatus that facilitates customer retention, churn reduction, and customer satisfaction by predicting customer churn and taking an appropriate action to retain a customer is described. In an example, a customer retention method acquires information indicative of customer service usage by customers. The customer retention method then provides an analysis of the acquired information. The analysis predicts the likelihood of churn for each customer. The customer retention method then identifies affected customers based on the analysis. The customer retention method then automatically selects customer support executives to initiate an action for each of the affected customers. The customer retention method selects the customer support executives based on skill in handling the affected customers, among other factors.

Owner:CLICKSOFTWARE TECHNOLOGIES

Churn prediction and management system

ActiveUS8712828B2Avoid erosionFacilitates efforts to retain high profitability customersMarketingData dredgingCustomer attrition

A system and method for managing churn among the customers of a business is provided. The system and method provide for an analysis of the causes of customer churn and identifies customers who are most likely to churn in the future. Identifying likely churners allows appropriate steps to be taken to prevent customers who are likely to churn from actually churning. The system included a dedicated data mart, a population architecture, a data manipulation module, a data mining tool and an end user access module for accessing results and preparing preconfigured reports. The method includes adopting an appropriate definition of churn, analyzing historical customer to identify significant trends and variables, preparing data for data mining, training a prediction model, verifying the results, deploying the model, defining retention targets, and identifying the most responsive targets.

Owner:ACCENTURE GLOBAL SERVICES LTD

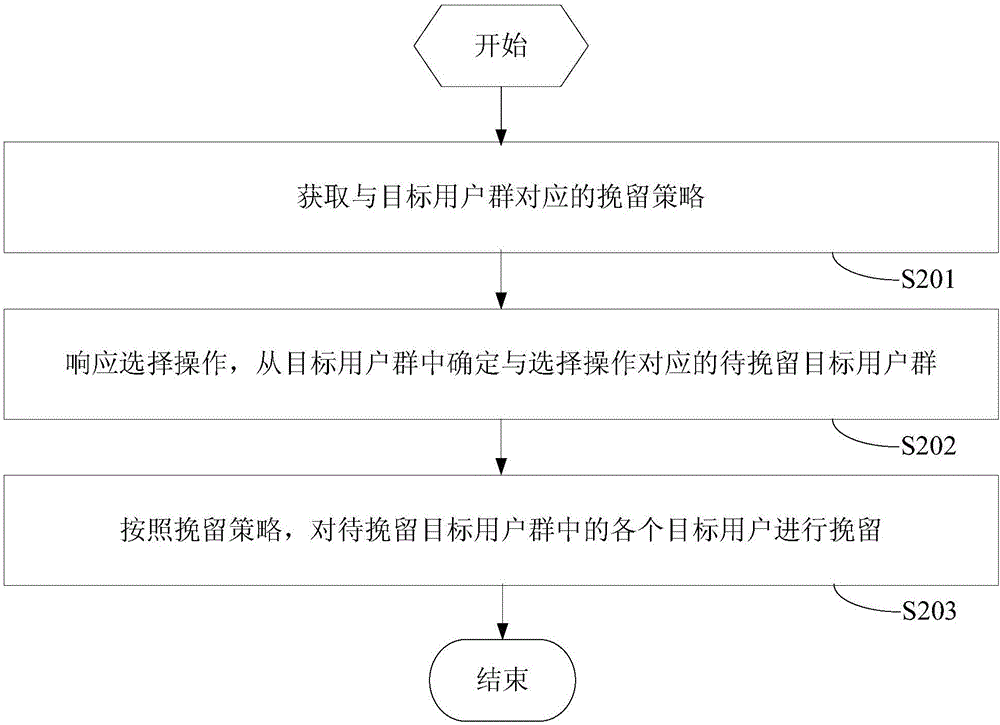

Data management method and device

The invention provides a data management method and device. A data management request which carries a user set to be predicted is received, a preset customer churn prediction model is used for independently carrying out customer churn prediction on each user to be predicted in the user set to be predicted to obtain a target user set, all target users in the target user set are grouped to obtain at least one user group, and a target user in the target user group is retained to realize the prediction, the grouping and the retaining of the customer churn so as to reduce a customer churn phenomenon.

Owner:AGRICULTURAL BANK OF CHINA

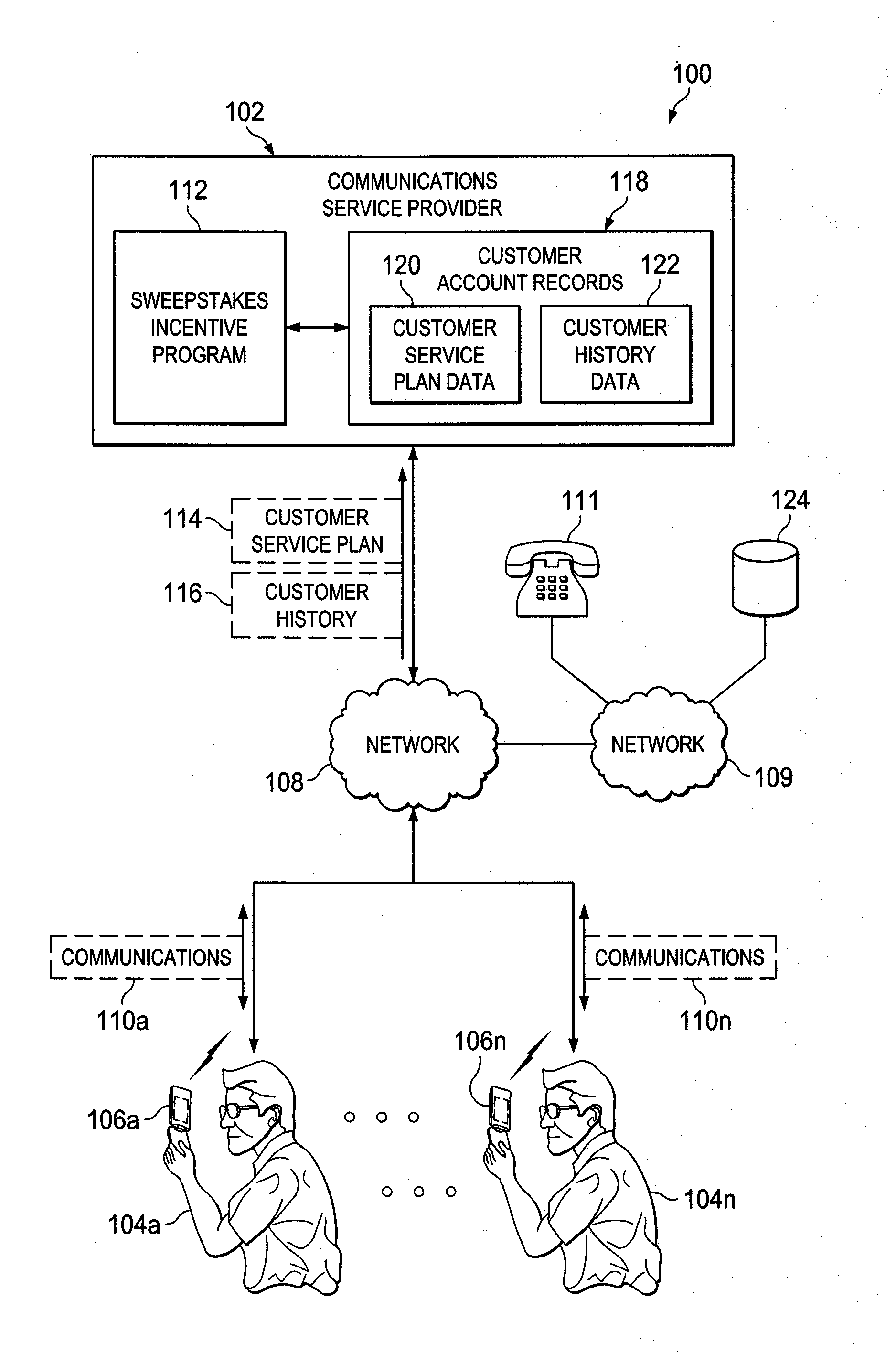

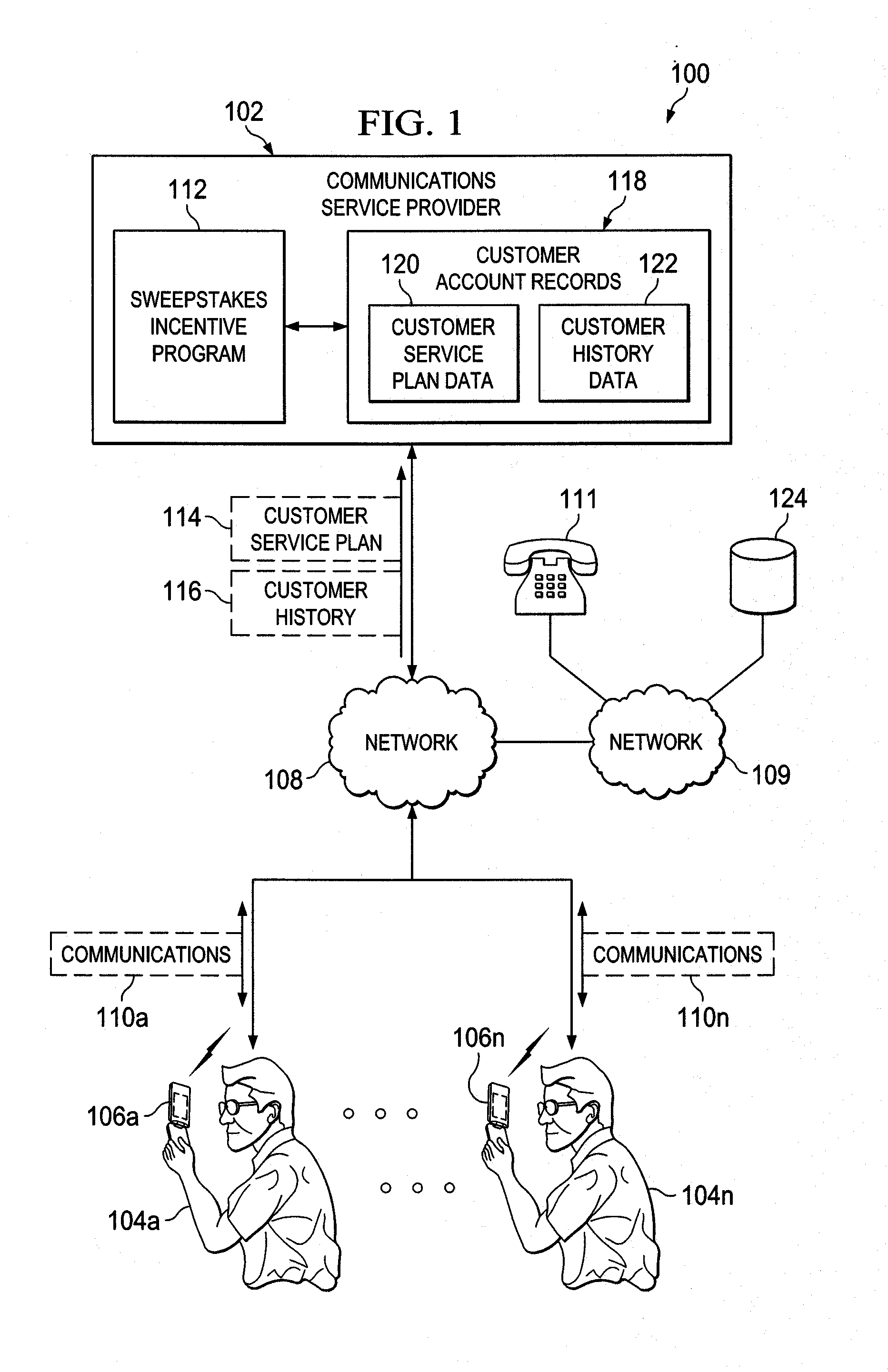

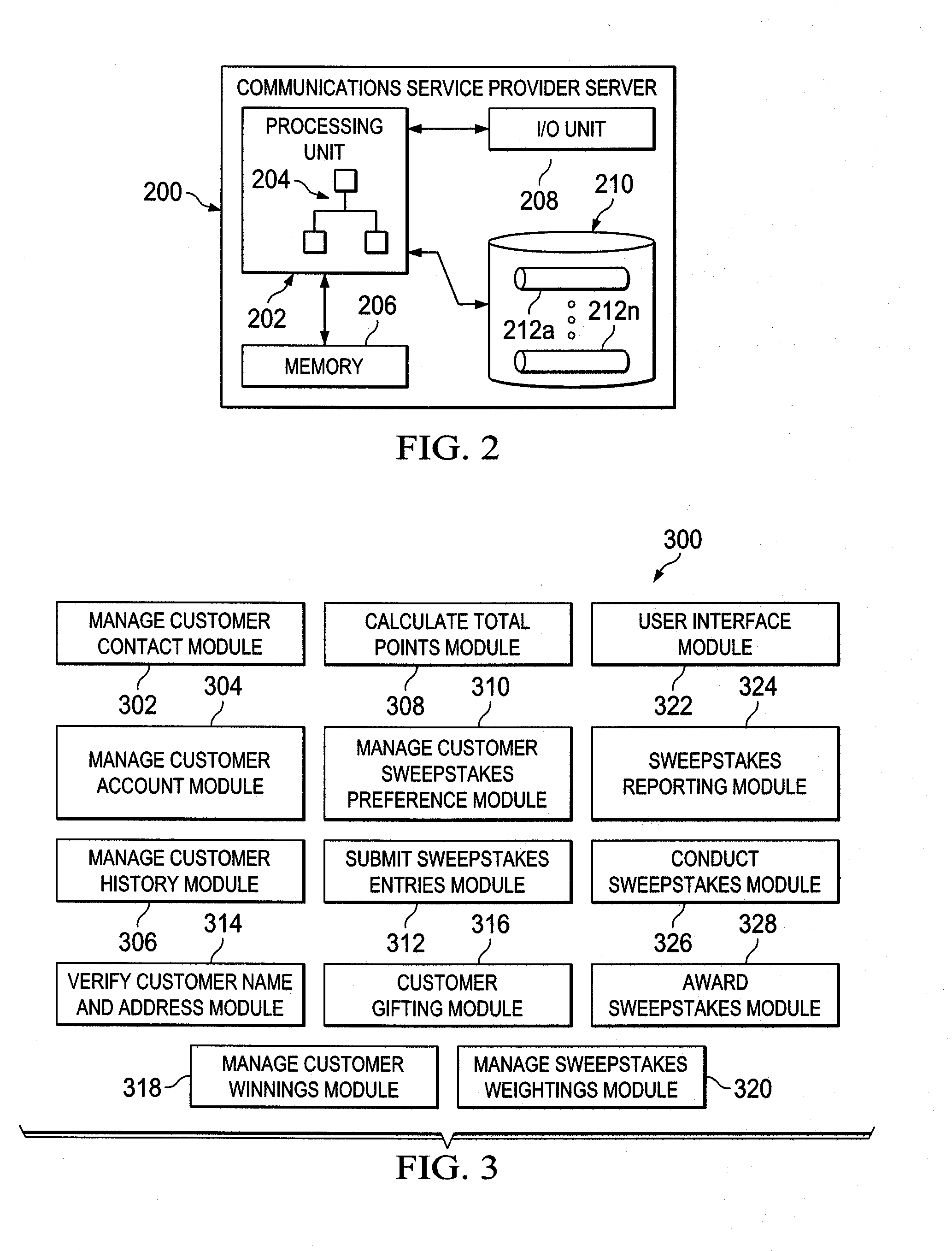

System and method for reducing churn for a communications service

InactiveUS20130204682A1Reduce cancellationIncrease pointsMarketingCustomer attritionService provision

A method and system of reducing churn of customers for a communications service provider may include storing account information of a customer of the communications service provider. The customer account information may include customer service plan data and customer history data. The customer account information may be accessed by a computing unit. A total number of points collected by the customer during a time period based on the customer account information may be determined. The calculation may include totaling points associated with the customer service plan data and customer history data. A number of sweepstakes entries the customer achieved based on the calculated total number of points may be determined. The customer may be entered into the sweepstakes with one or more achieved sweepstakes entries for the time period. A sweepstakes drawing for the sweepstakes may be conducted, and a prize may be awarded to a winner of the sweepstakes.

Owner:METROPCS WIRELESS

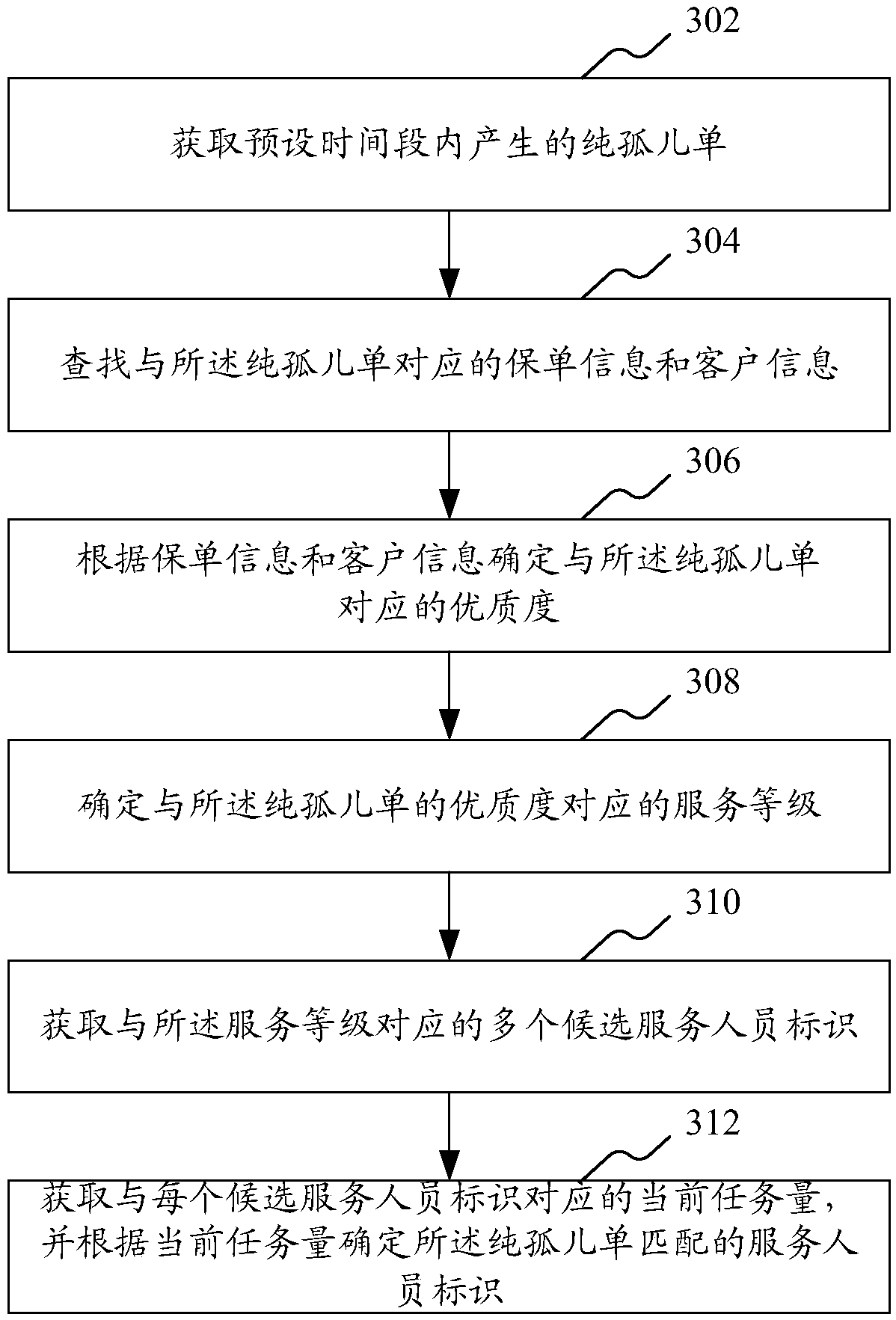

Pure orphan insurance policy distribution method and device

InactiveCN108074027AEffective distributionAvoid churnFinanceResourcesService personnelCustomer attrition

The invention provides a pure orphan insurance policy distribution method. The method comprises steps that pure orphan insurance policies generated in the preset time period are acquired, the insurance policy information and the client information corresponding to the pure orphan insurance policies are searched, the high-quality degrees corresponding to the pure orphan insurance policies are determined according to the insurance policy information and the client information, service grades corresponding to the high-quality degrees of the pure orphan insurance policies are determined, multiplecandidate service personnel identifiers corresponding to the high-quality degrees are acquired, the present task load corresponding to each service personnel identifier is acquired, and the service personnel identifiers matched with the pure orphan insurance policies are determined according to the present task loads. The method is advantaged in that the high-quality pure orphan insurance policiescan be timely and effectively distributed, and loss of clients corresponding to the high-quality orphan insurance policies can be prevented. The invention further provides a pure orphan insurance policy distribution device.

Owner:PING AN TECH (SHENZHEN) CO LTD

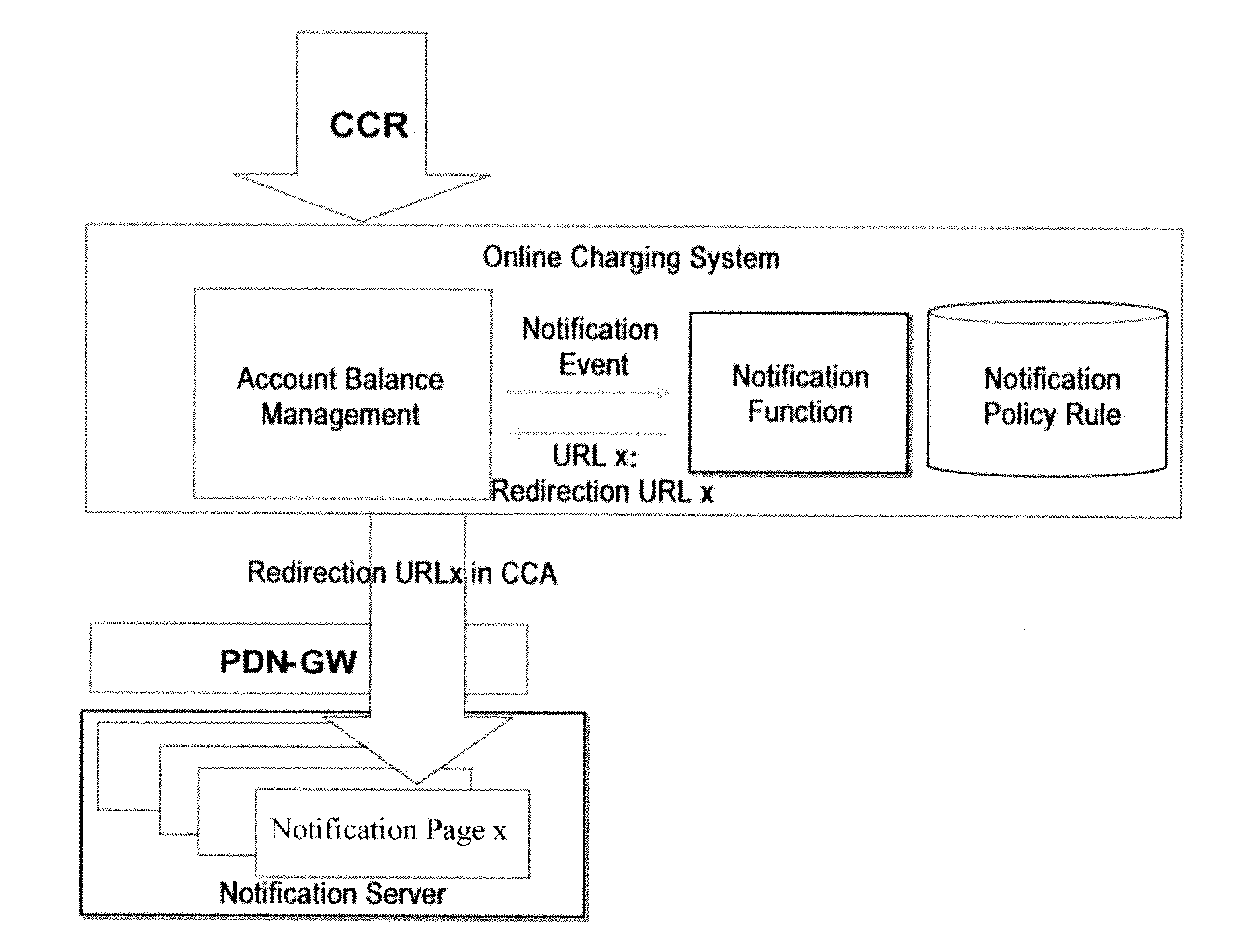

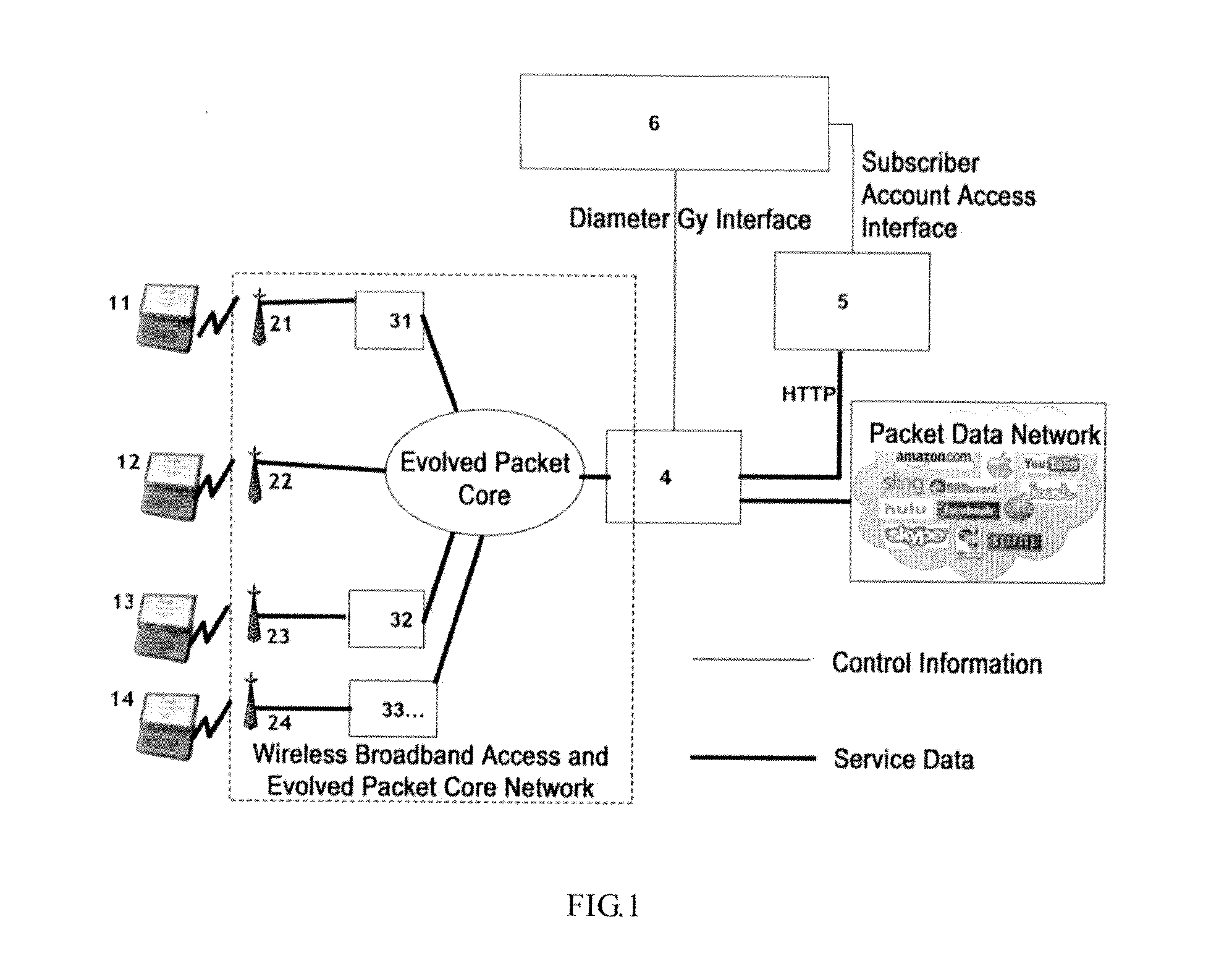

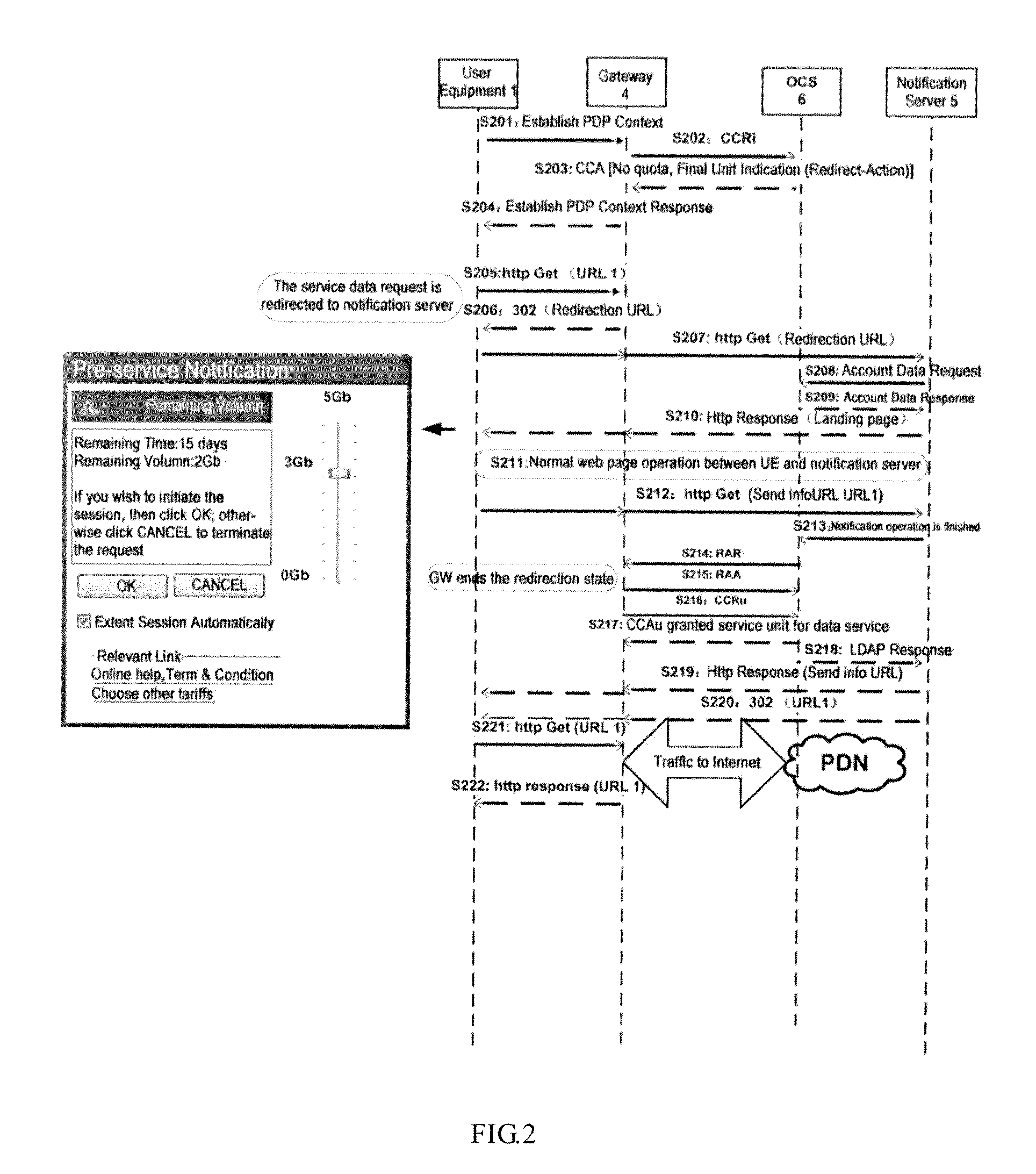

Method and apparatus for notifying account information of a data-type-oriented user equipment

InactiveUS20130031231A1Avoid connectionReduce frequencyMetering/charging/biilling arrangementsDigital computer detailsService domainNetwork addressing

The invention discloses a method of and apparatus for notifying account information of a data-type-oriented user equipment. The method comprises the steps of: determining whether each user satisfies a predetermined condition; and if the predetermined condition is satisfied, then causing a packet data network gateway to activate account information notification control information for the user, wherein the account information notification control information includes a network address of a web notification server. With the invention, the terminal user can get to know his own account information more timely to thereby adjust the usage mode of the wireless broadband data service according to the account information, for example, lower the frequency of accessing the service or disable the service for a duration to thereby avoid a large bill or perform prepayment charging to thereby prevent an important connection from breaking down due to an overdue account. An operator and a service provider can improve the user experience of the wireless broadband data service to thereby reduce the complaint of the user and avoid the loss of customers in the field of wireless broadband data services. In the inventive method, good compatibility with other types of user equipments is possible while offering the new function.

Owner:ALCATEL LUCENT SAS

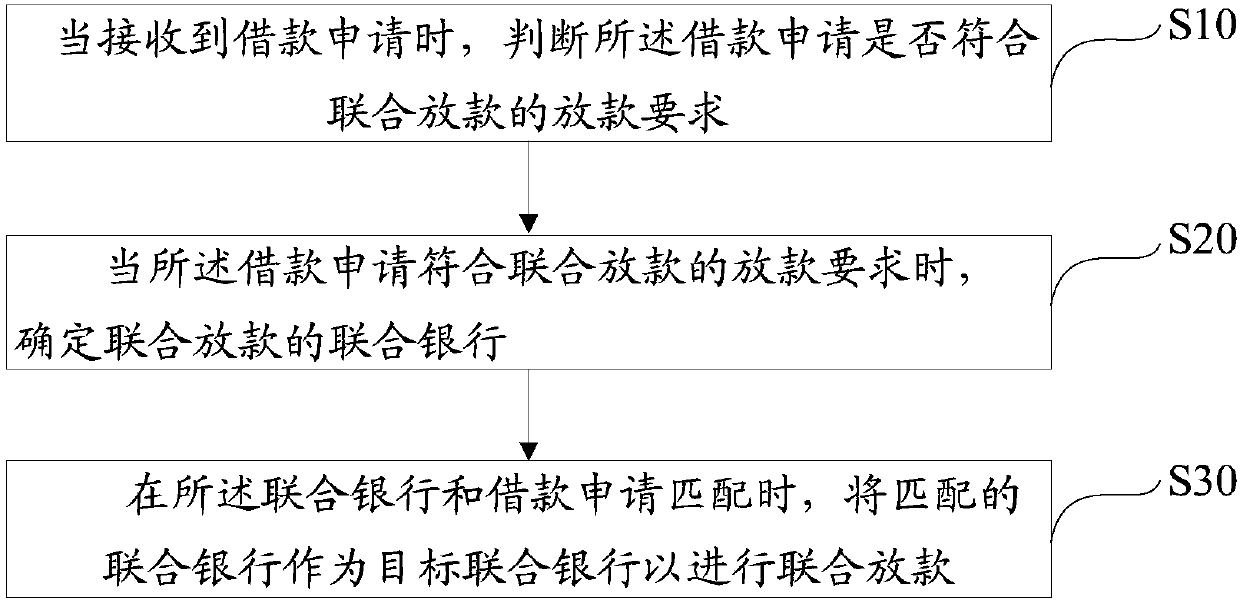

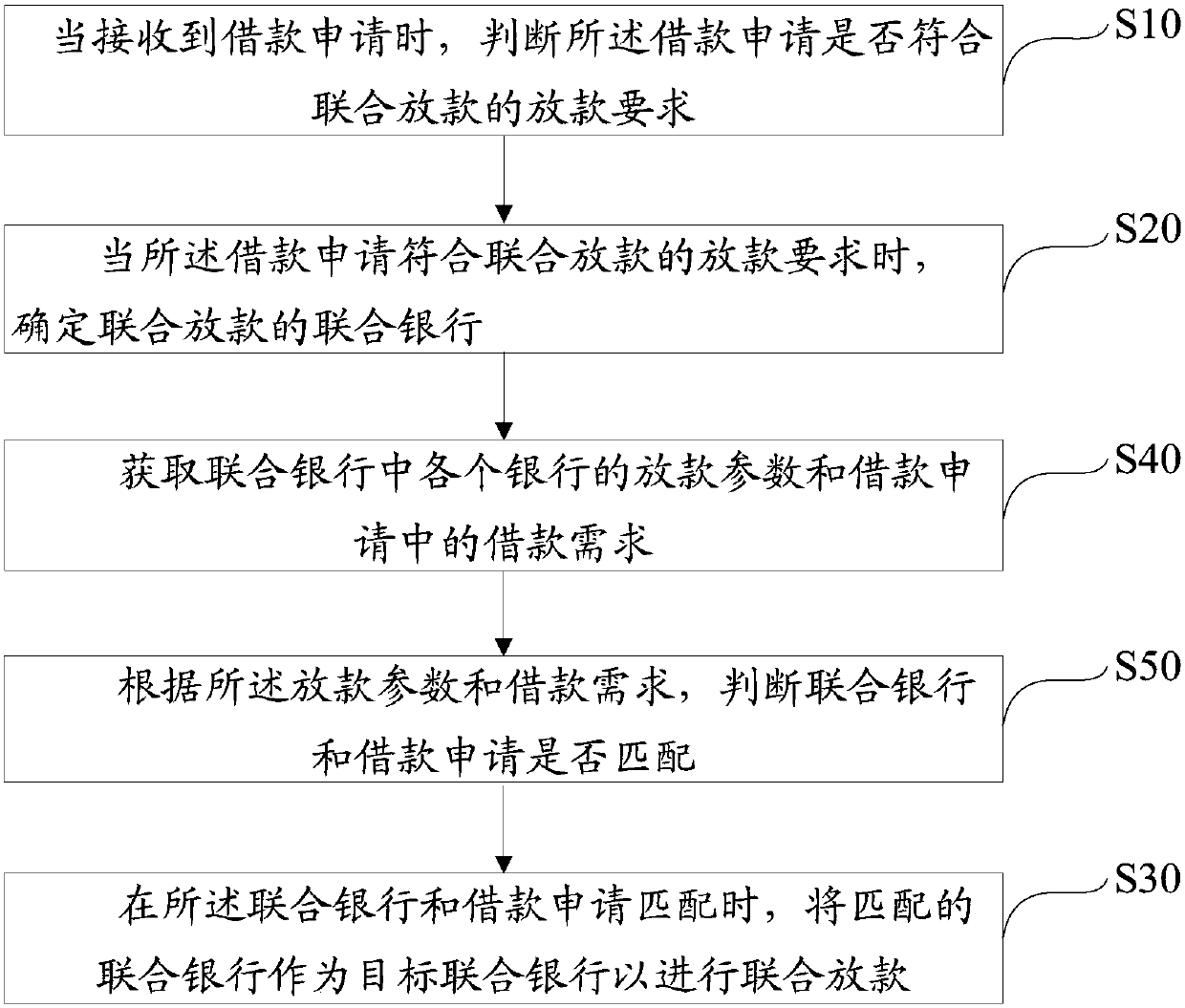

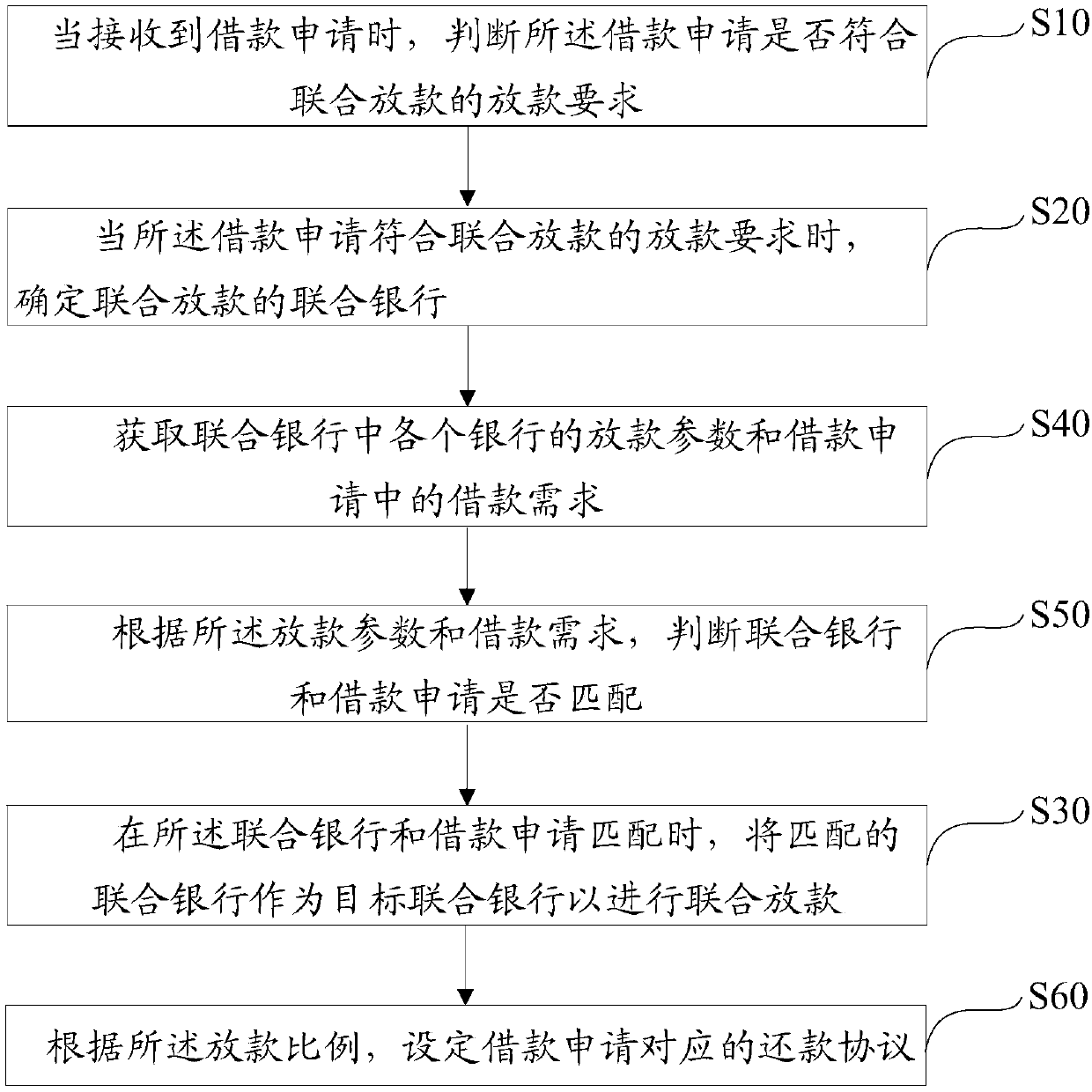

Bank combined loaning method, device and computer readable storage medium

The invention discloses a lending method, device and computer-readable storage medium for joint lending by banks. The method includes: when a loan application is received, judging whether the loan application meets the lending requirements for joint lending; When the loan requirements for joint lending are met, the joint bank for joint lending is determined; when the joint bank and the loan application are matched, the matching joint bank is used as the target joint bank for joint lending. In this scheme, when the loan application meets the lending requirements for joint lending, it matches the joint bank determined to be eligible for joint lending with the loan application. When the joint bank and the loan application are successfully matched, the matching joint bank is used as the target joint bank for multi-bank processing. joint lending. Through this bank joint lending method, the borrower can borrow money while reducing the risk of bank lending, realizing risk sharing, preventing customer loss and improving customer experience.

Owner:PINGAN PUHUI ENTERPRISE MANAGEMENT CO LTD

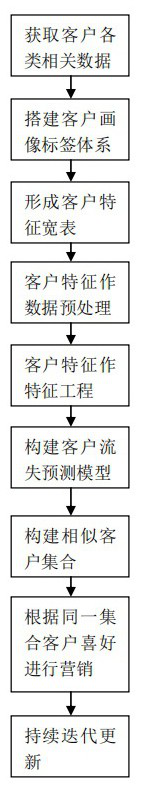

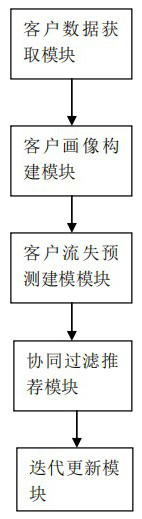

Customer portrait-based customer loss prediction and retrieval method and system

PendingCN112561598AUnderstand the needsImprove accuracyMarket predictionsDigital data information retrievalCustomer requirementsPersonalization

The invention discloses a customer portrait-based customer loss prediction and retrieval method and system. The customer portrait-based customer loss prediction and retrieval method comprises the steps of S1, obtaining various types of related information of customers; S2, mapping the customer information to customer portraits to obtain customer features, and performing system description on the customer information in a specific business scene; S3, after the customer features are obtained, predicting the customer loss condition by using a machine learning model; S4, for the prediction resultof the customer loss condition in the S3, performing personalized marketing retrieval on the customers with high customer loss probability; S5, updating the labels of the customers according to the response condition of the customers to the marketing activity, and completing the updating of the customer portraits; S6, optimizing the customer loss prediction model. A label system is built through the customer portraits, customer loss prediction is carried out through the formed features, customer requirements can be known, and a foundation is laid for providing targeted services for customers.

Owner:中国农业银行股份有限公司重庆市分行

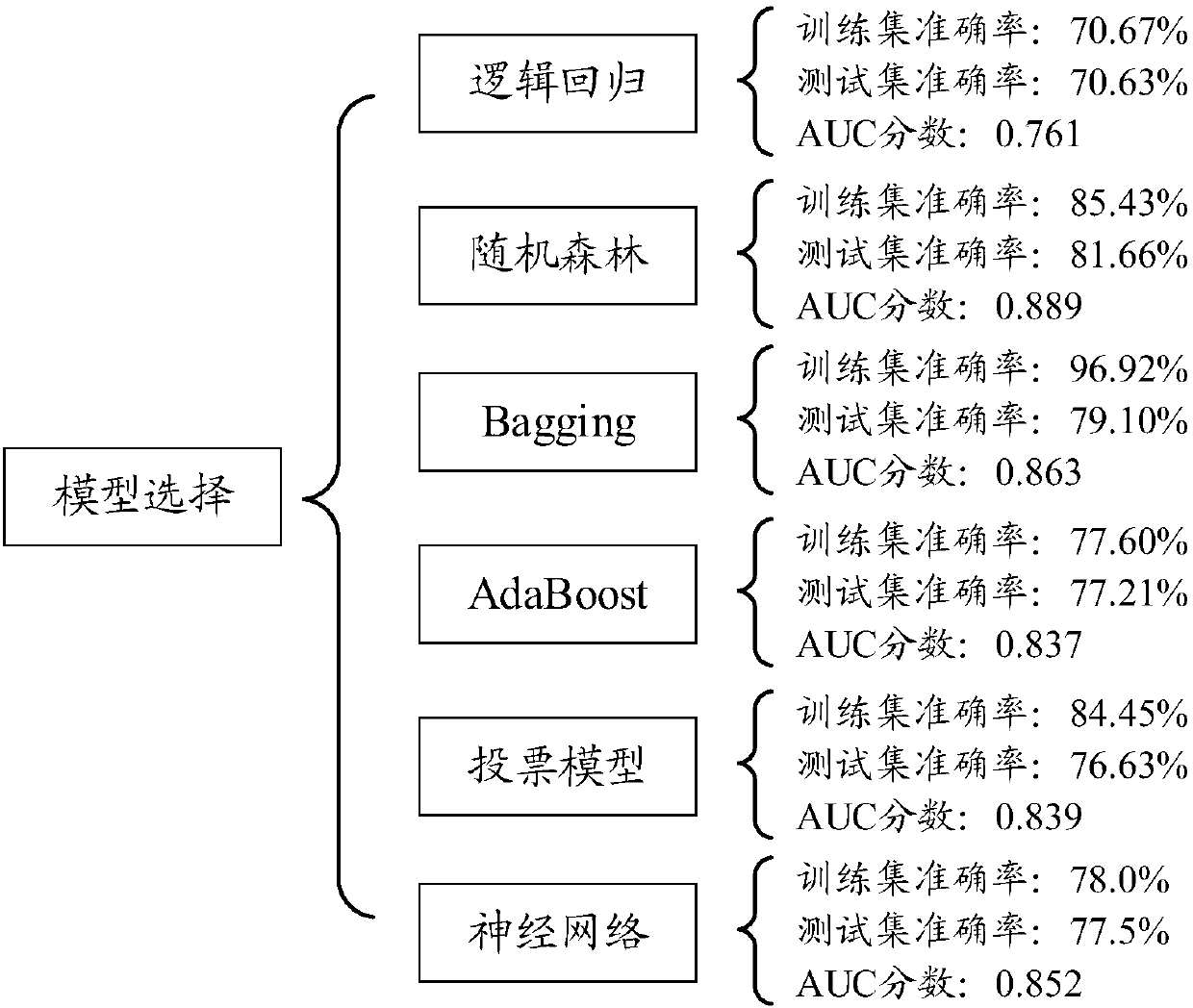

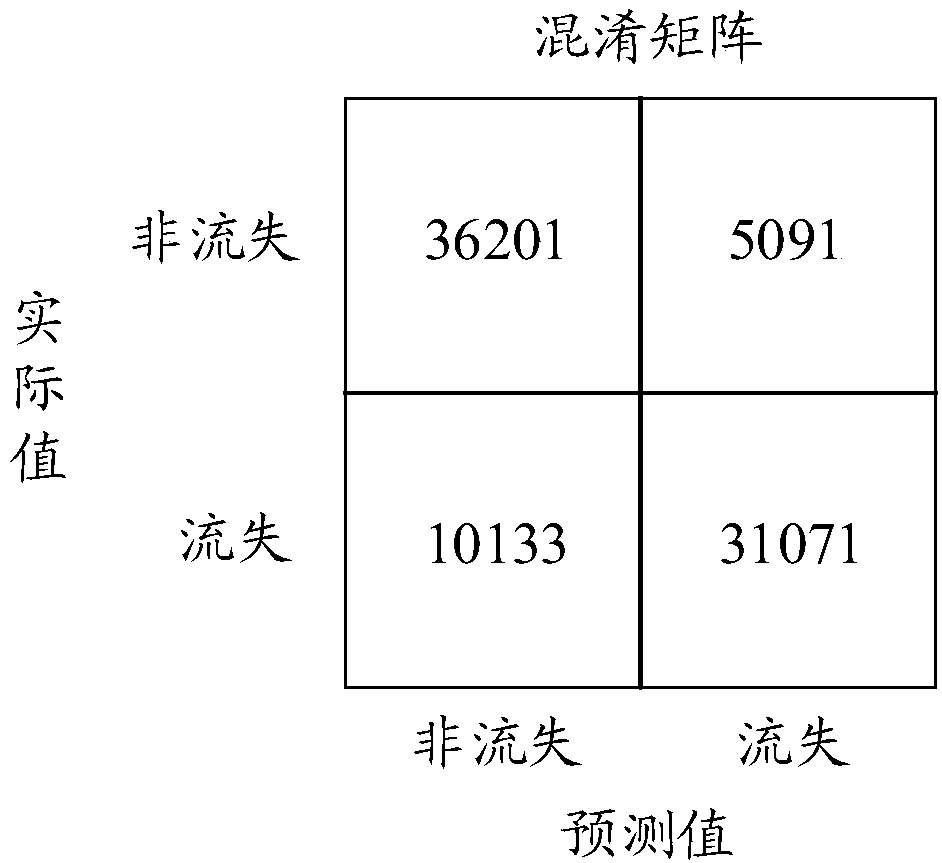

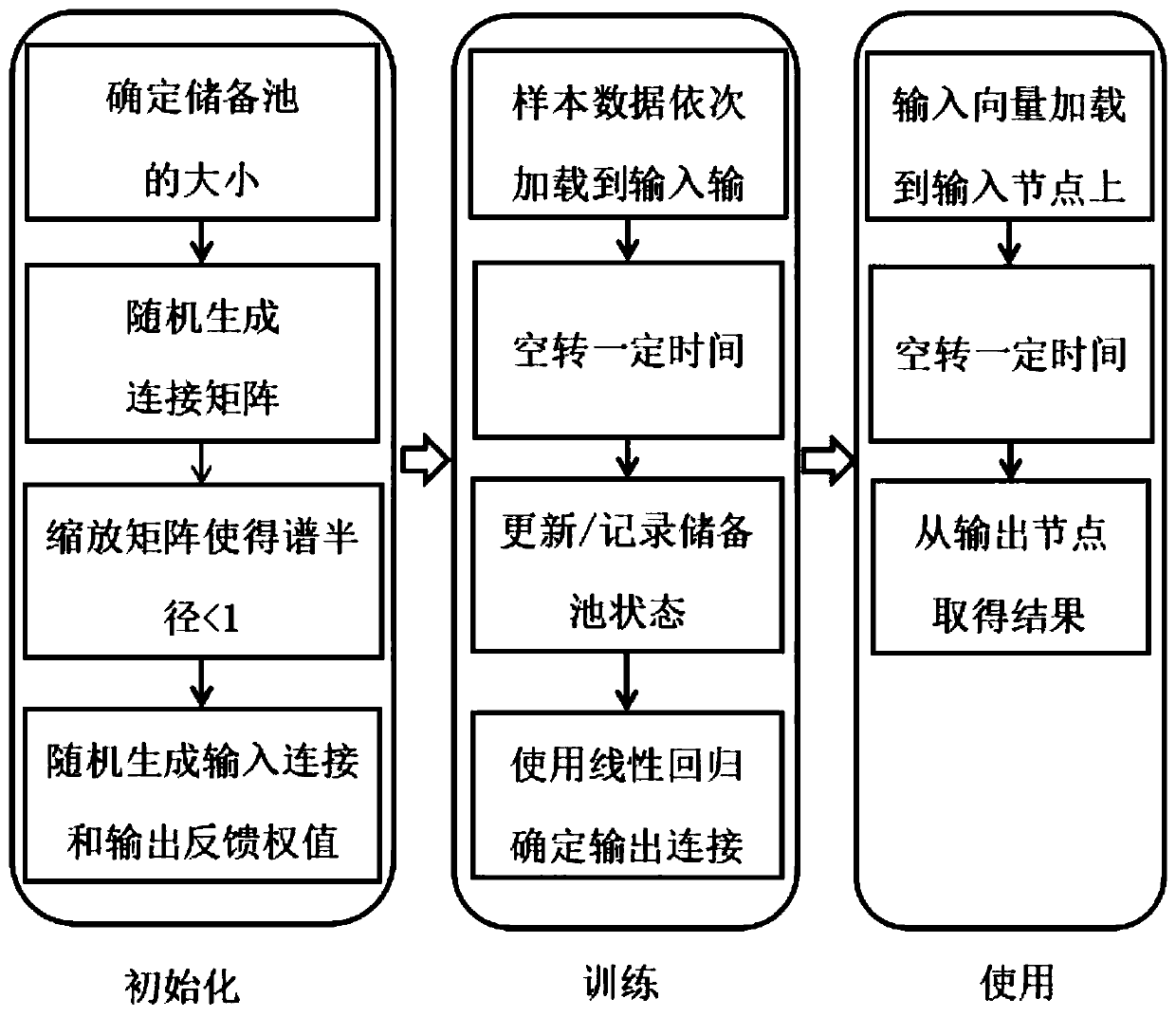

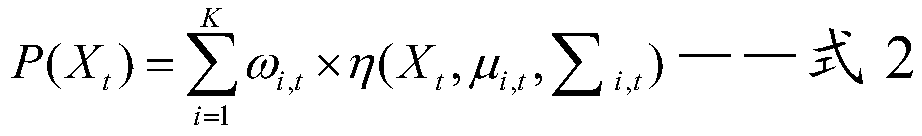

A customer loss prediction model based on a combined classifier

InactiveCN109886758AEfficient use ofImprove hit rateCharacter and pattern recognitionMarketingSupport vector machineEcho state network

The invention provides construction of a loss prediction model combining an echo state network and a support vector machine. Aiming at a non-ideal single model prediction effect, a classifier construction method is explored and improved, and the construction of the classifier can be divided into three aspects of a training set construction strategy, a classifier selection strategy and a predictionvalue determination strategy, comprehensively evaluating features and categories by fusing the Mahalanobis distance and the maximum information coefficient, and jointly measuring the redundancy between the features and the correlation degree between the features and the categories. The advantages of an echo state network and a support vector machine are integrated, and the problem of secondary optimization is solved through linear constraint, so that the performance of a telecom customer loss system is improved, and the prediction effect of a customer loss prediction model is improved.

Owner:CENT SOUTH UNIV

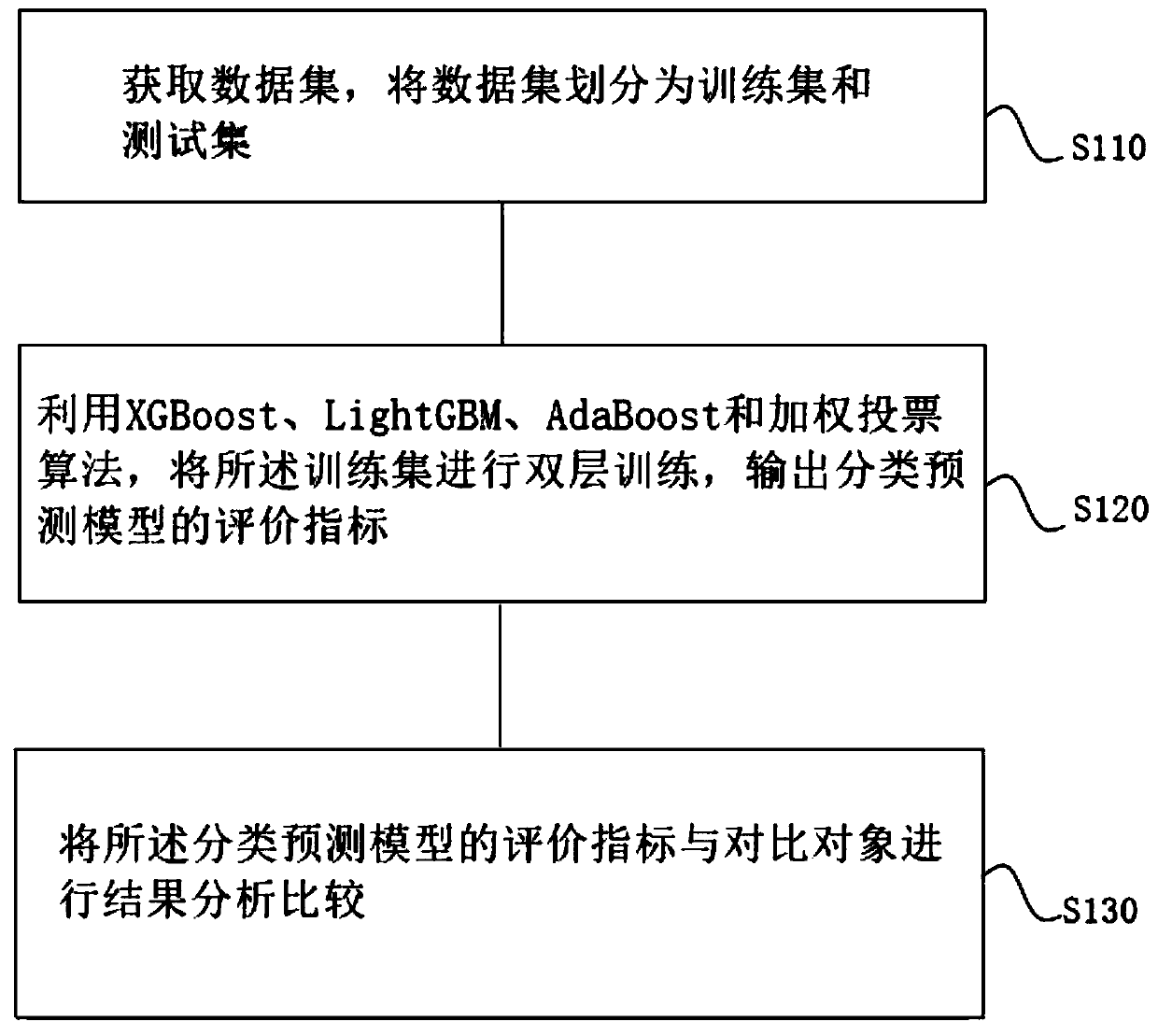

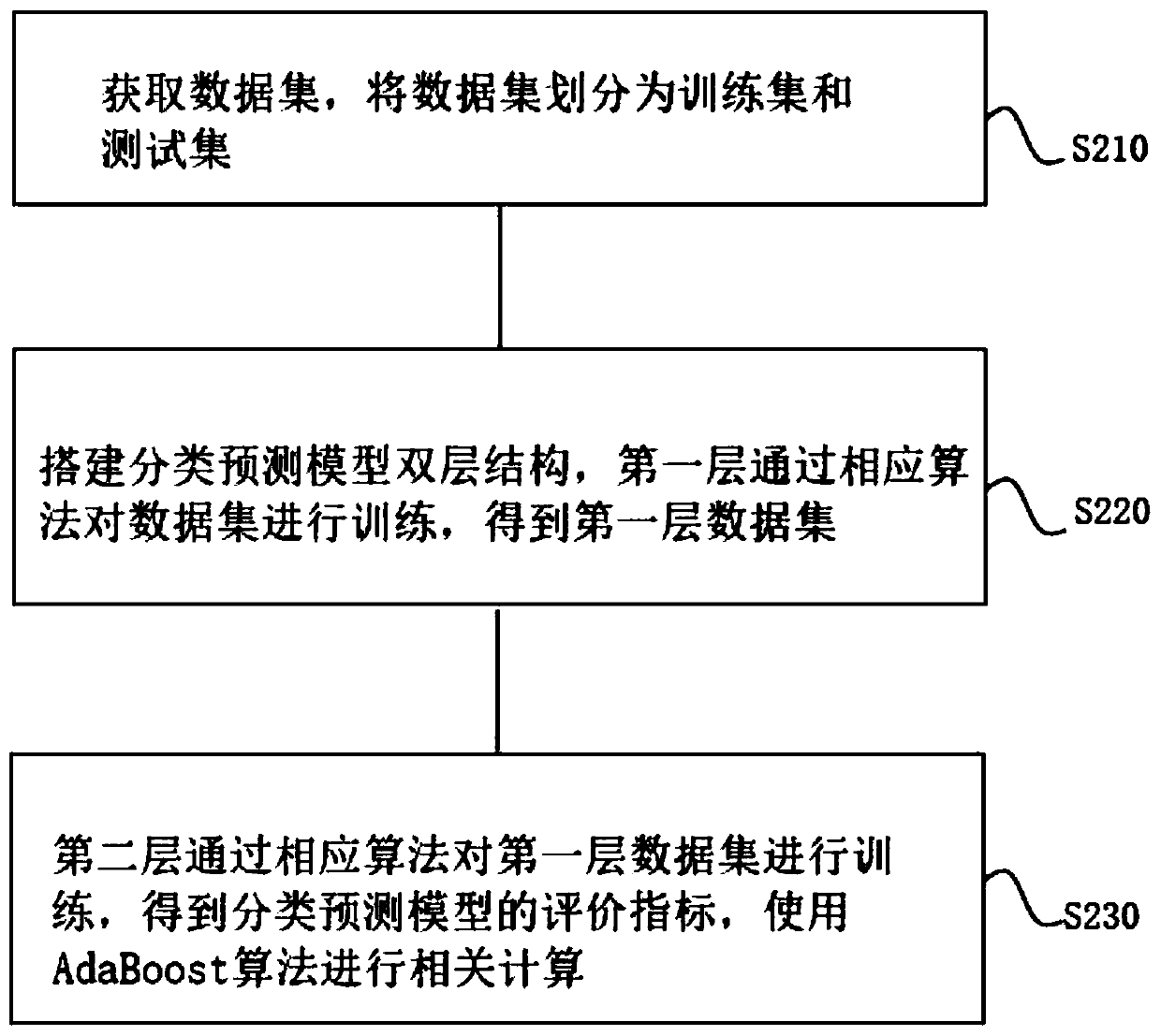

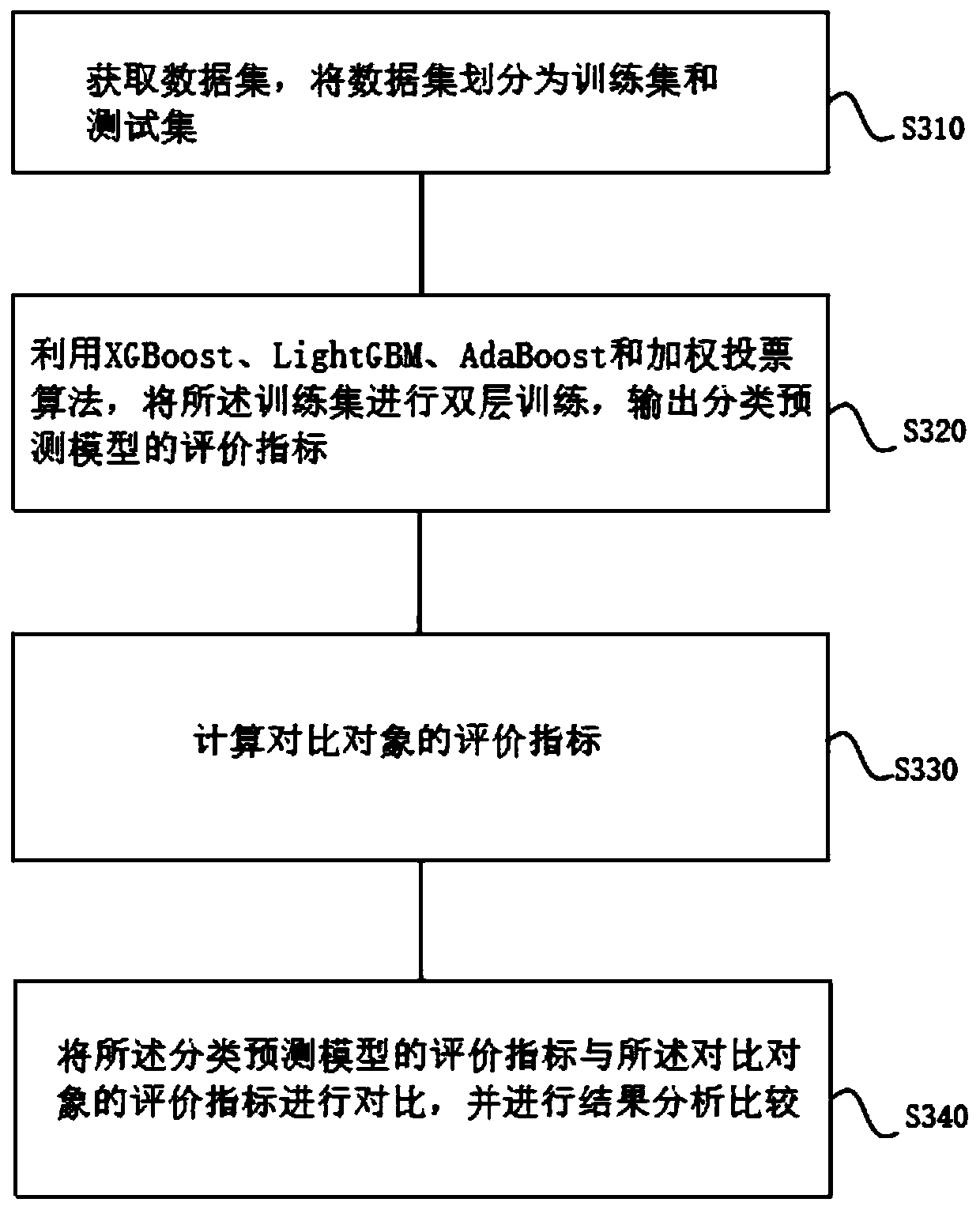

Enterprise information loss prediction method of double-layer structure

PendingCN111242358AImprove accuracyForecastingCharacter and pattern recognitionData setCustomer attrition

The invention discloses an enterprise information loss prediction method of a double-layer structure. The method comprises the steps: enabling a system to obtain a data set, and dividing the data setinto a training set and a test set; performing double-layer training on the training set by utilizing XGBoost, LightGBM, AdaBoost and a weighted voting algorithm, outputting evaluation indexes of a classification prediction model, and finally performing result analysis and comparison on the evaluation indexes of the classification prediction model and a comparison object. By using a double-layer fusion method and an adaptive algorithm, the accuracy and precision of the customer loss prediction model are improved, and the customer loss prediction model is further perfected.

Owner:杭州策知通科技有限公司

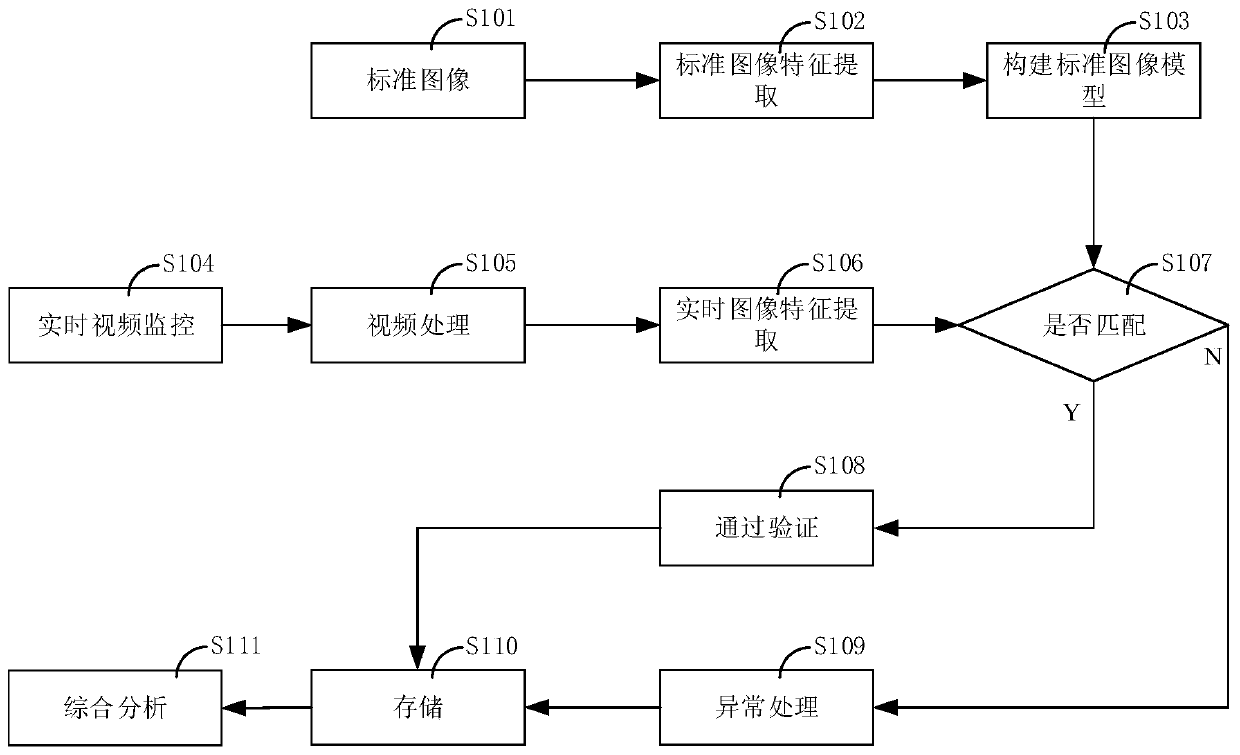

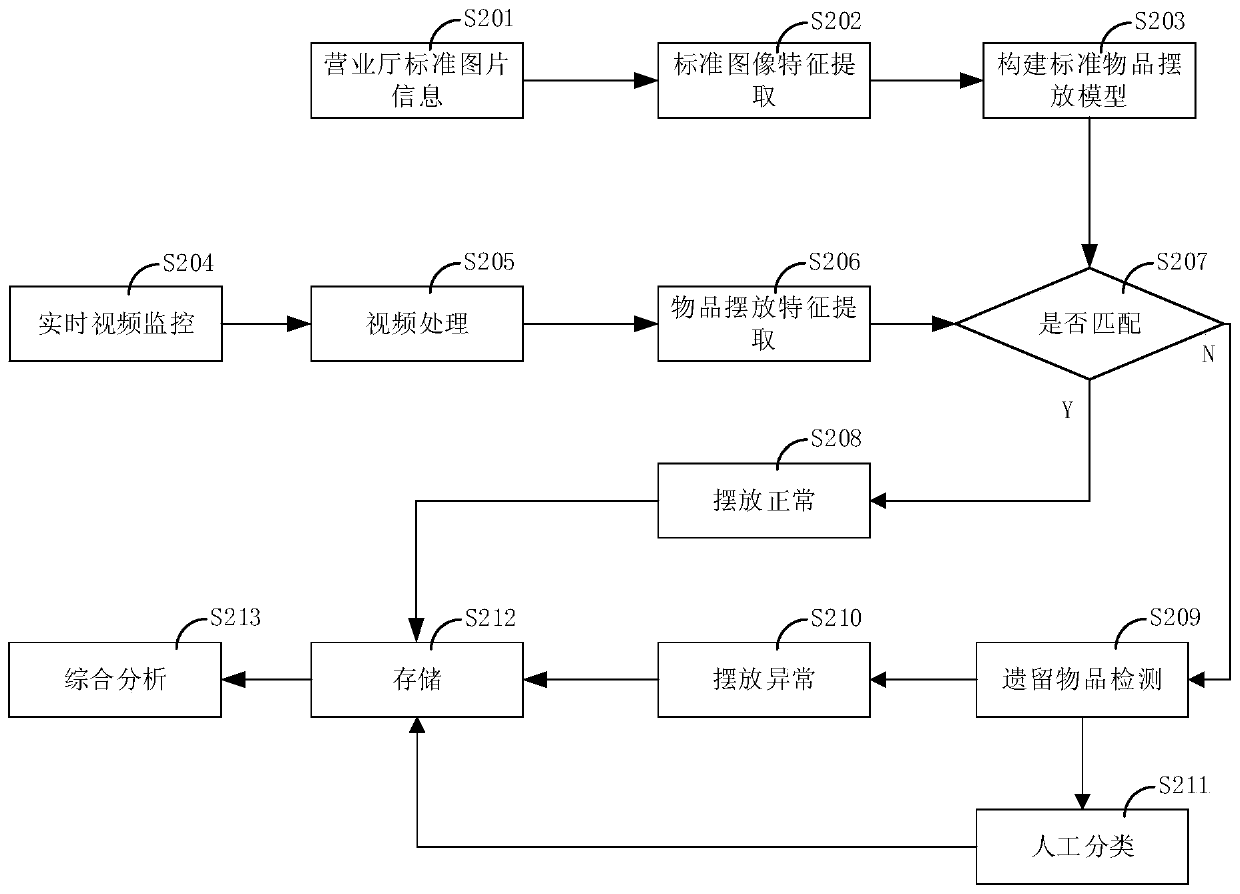

Business hall service specification quality inspection method based on video monitoring

PendingCN111353343AImprove service qualityImprove deficienciesCharacter and pattern recognitionClosed circuit television systemsVideo monitoringCustomer attrition

The invention provides a business hall service specification quality inspection method based on video monitoring. The business hall service specification quality inspection method comprises the following steps: A, establishing a standard image model; B, acquiring real-time video monitoring, and confirming a monitoring target in the video monitoring; C, extracting features of the monitoring target,comparing the features with the standard image model, and performing service specification quality inspection according to a comparison result; and D, processing based on the result of the service specification quality inspection, and generating a service quality inspection report. Based on video monitoring and video analysis technologies, the business hall environment and worker behaviors are monitored, so that the service quality of workers is improved, the customer complaint rate is reduced, the insufficient service quality is found by analyzing the service quality data of the workers, thedeficiencies of the workers are summarized, sorted and supervised, the service quality of the workers is effectively improved, and customer loss is avoided.

Owner:国家电网有限公司客户服务中心 +1

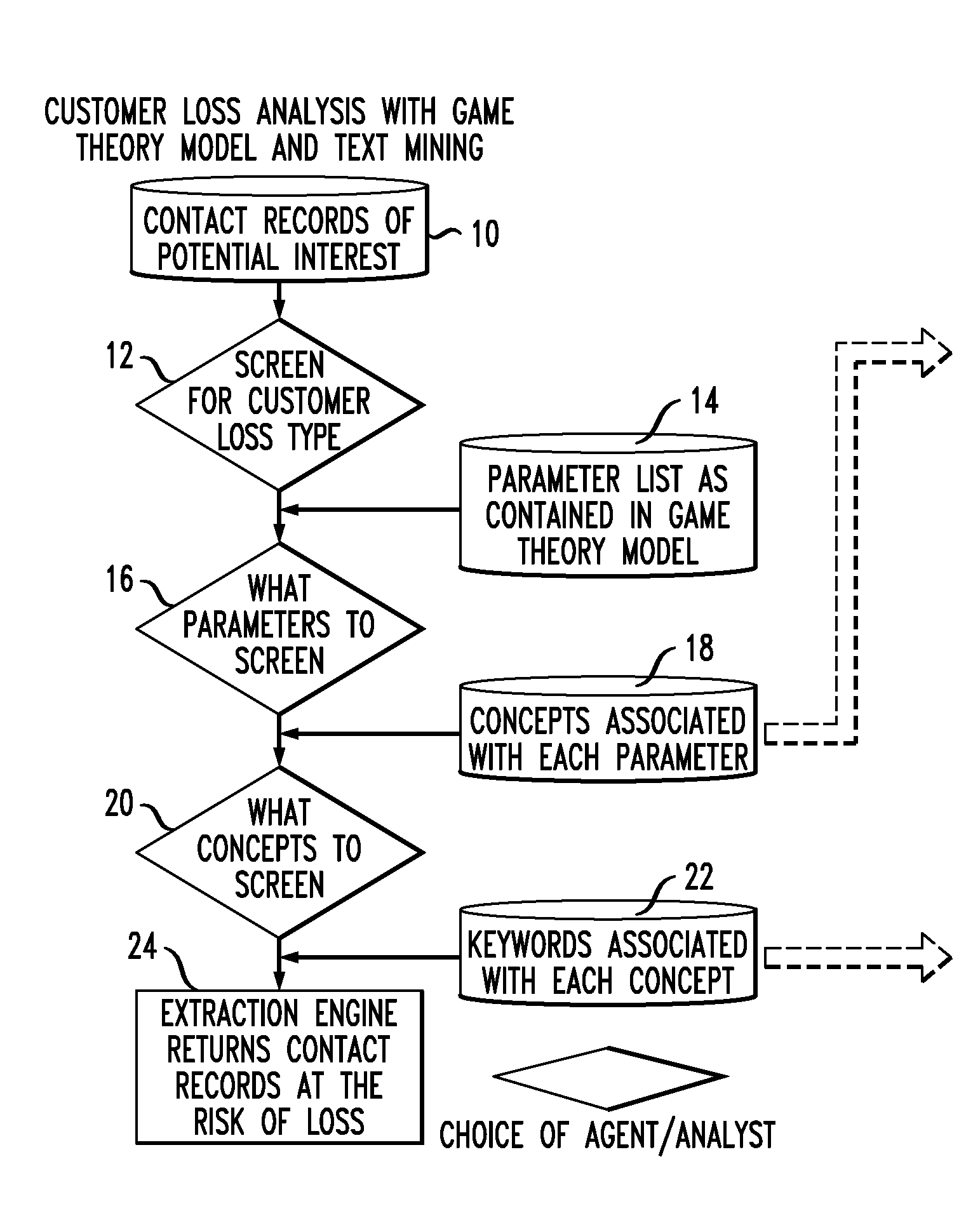

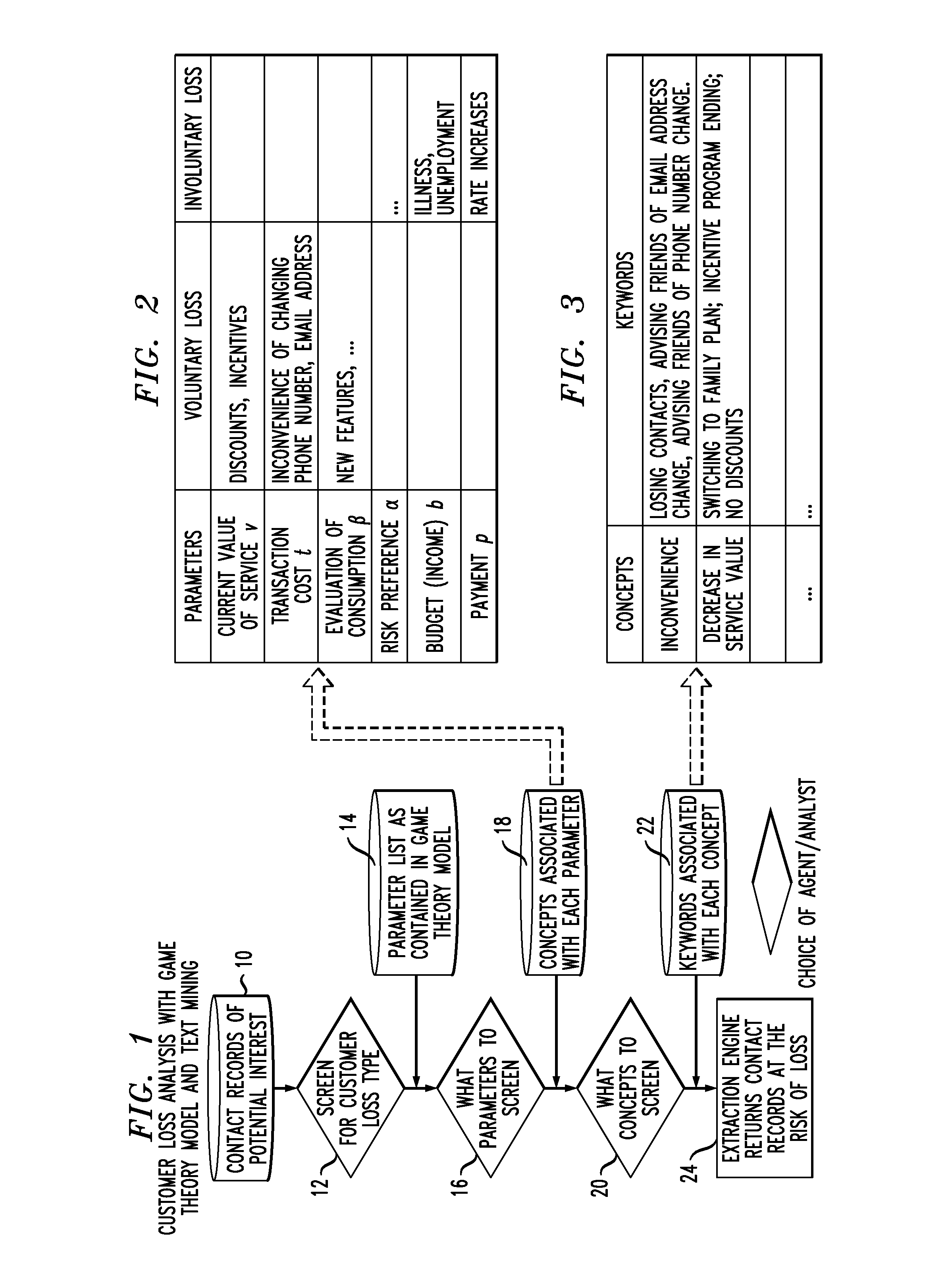

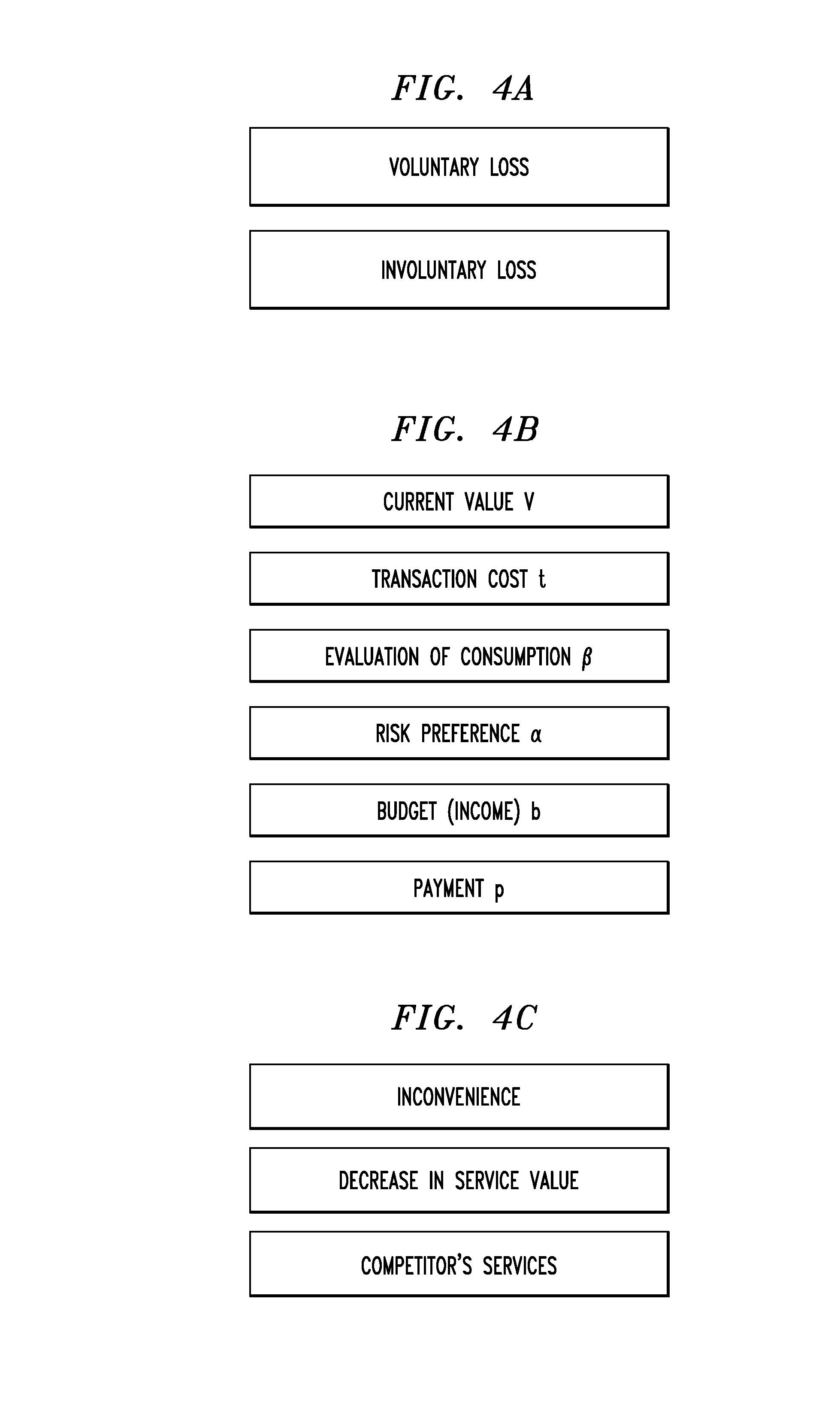

Customer retention and screening using contact analytics

Potential customer loss is identified under circumstances where structured data may be ineffective. Game theory analytics of customer loss enable the construction of a parameter list to be screened. Concepts are associated with the parameters and their ranges. Keywords associated with the concepts are mined by an extraction engine to identify contact records of customers at risk of loss. Appropriate customized loss mitigation and customer retention strategies can be implemented.

Owner:IBM CORP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com