Patents

Literature

45 results about "Investment evaluation" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Grid investment benefit evaluation method based on multiple indexes and multiple levels

InactiveCN102509240AImprove accuracyIndex reductionFinanceInformation technology support systemInvestment evaluationPower grid

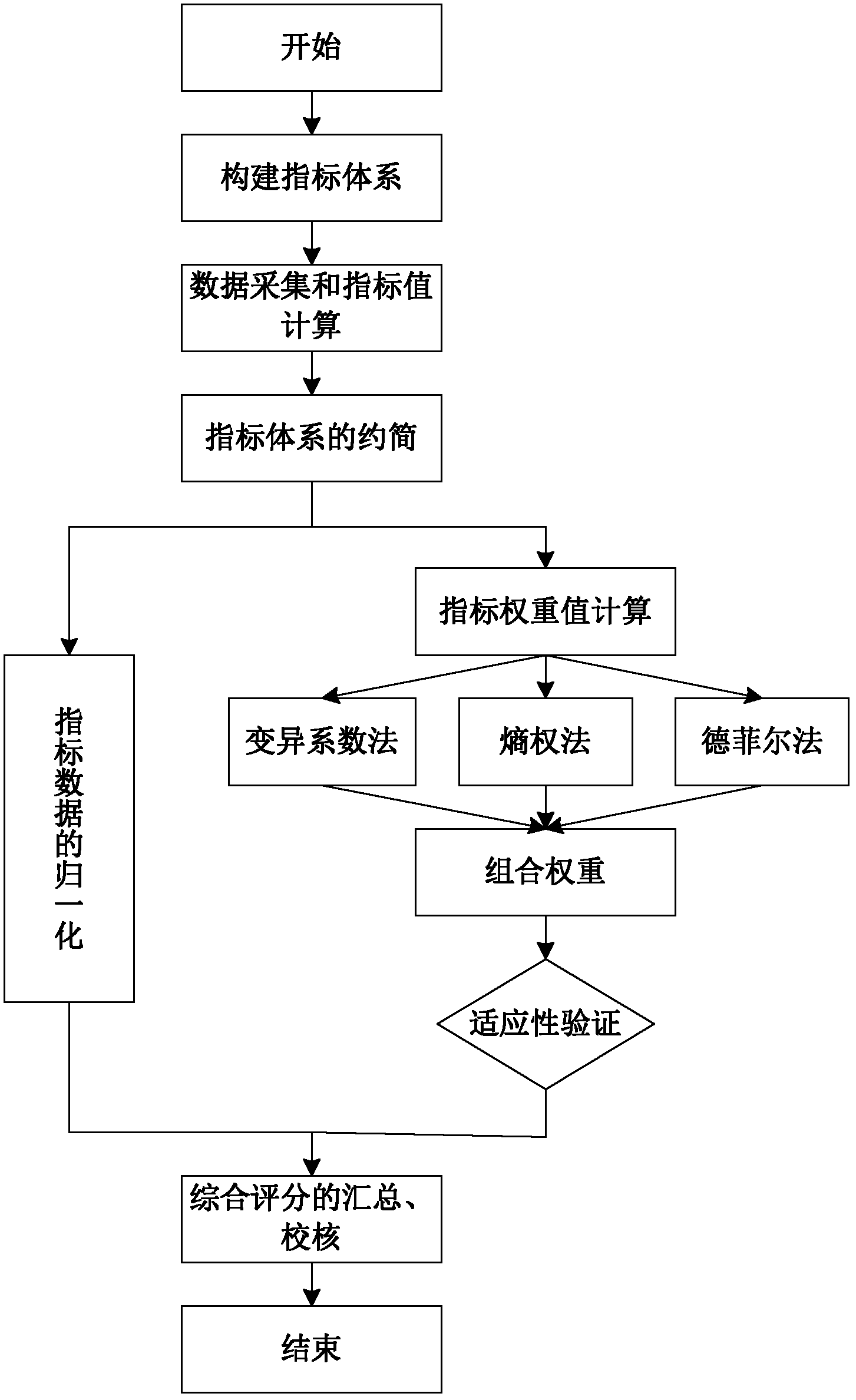

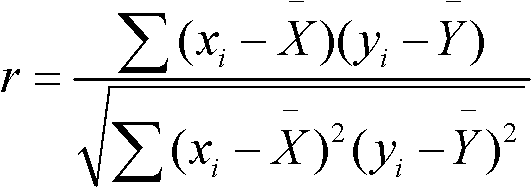

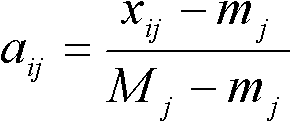

The invention discloses a grid investment benefit evaluation method based on multiple indexes and multiple levels. The grid investment benefit evaluation method is technically characterized by comprising the following steps of: constructing a grid investment benefit evaluation system comprising a main grid frame, a distribution network sub unit, a dividing specialty and a component voltage level investment benefit index; carrying out simplified processing on the index in the grid investment benefit evaluation system; carrying out unitization processing on the index in the grid investment benefit evaluation system; carrying out index weight calculation on the index in the grid investment benefit evaluation system; and evaluating the investment benefit of each examination object by using a linear comprehensive marking method. According to the method, the grid investment benefit evaluation system is constructed from four levels such as the main grid frame, the distribution network sub unit, the dividing specialty and the component voltage level investment benefit index; the accuracy of the investment evaluation is improved; the comparing and the finding of the problems existing in the grid investment are facilitated; and the grid investment benefit evaluation method can not only be used for post evaluation of the grid investment benefit or used for providing an important decision reference for the grid construction investment direction for the coming year.

Owner:STATE GRID TIANJIN ELECTRIC POWER +1

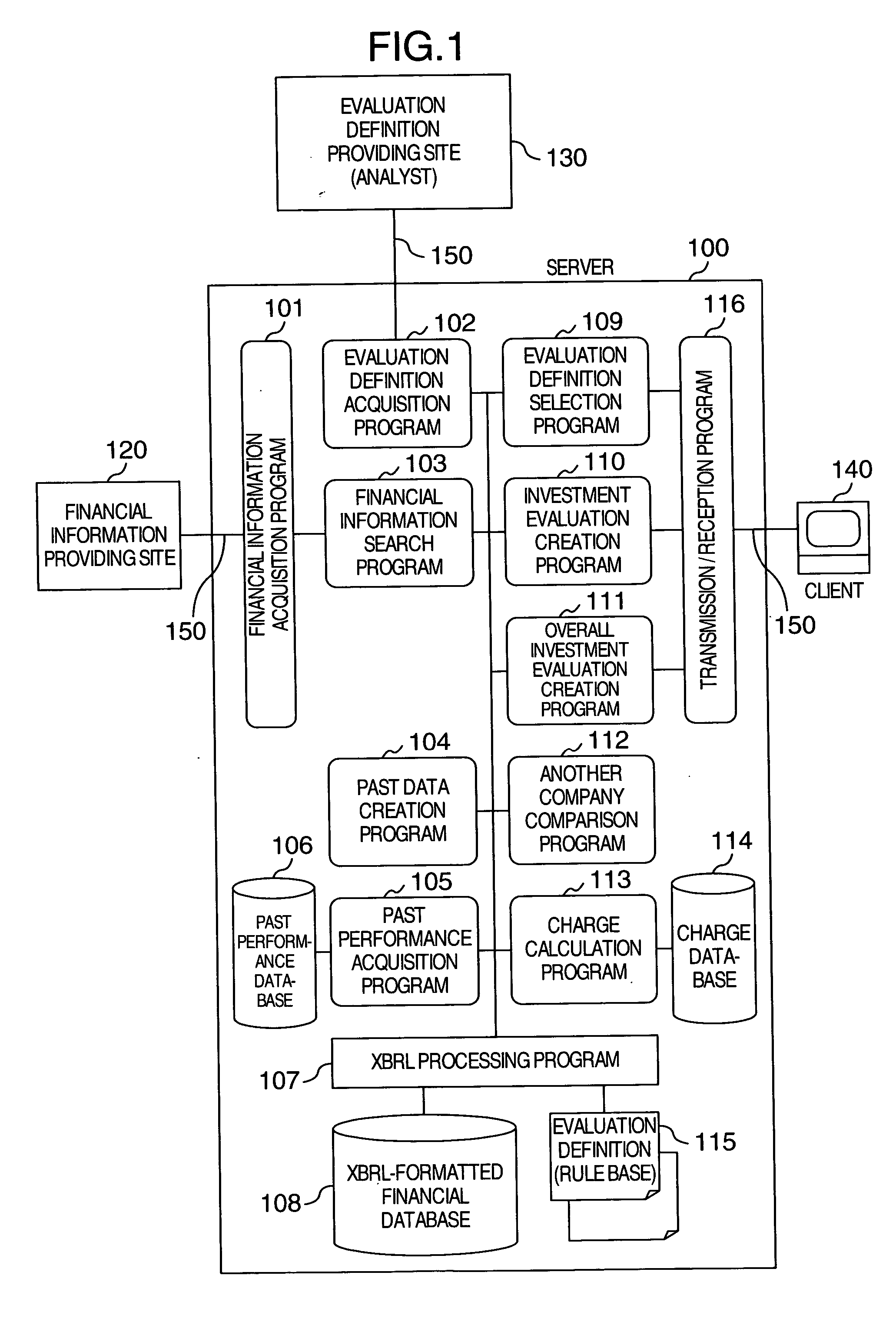

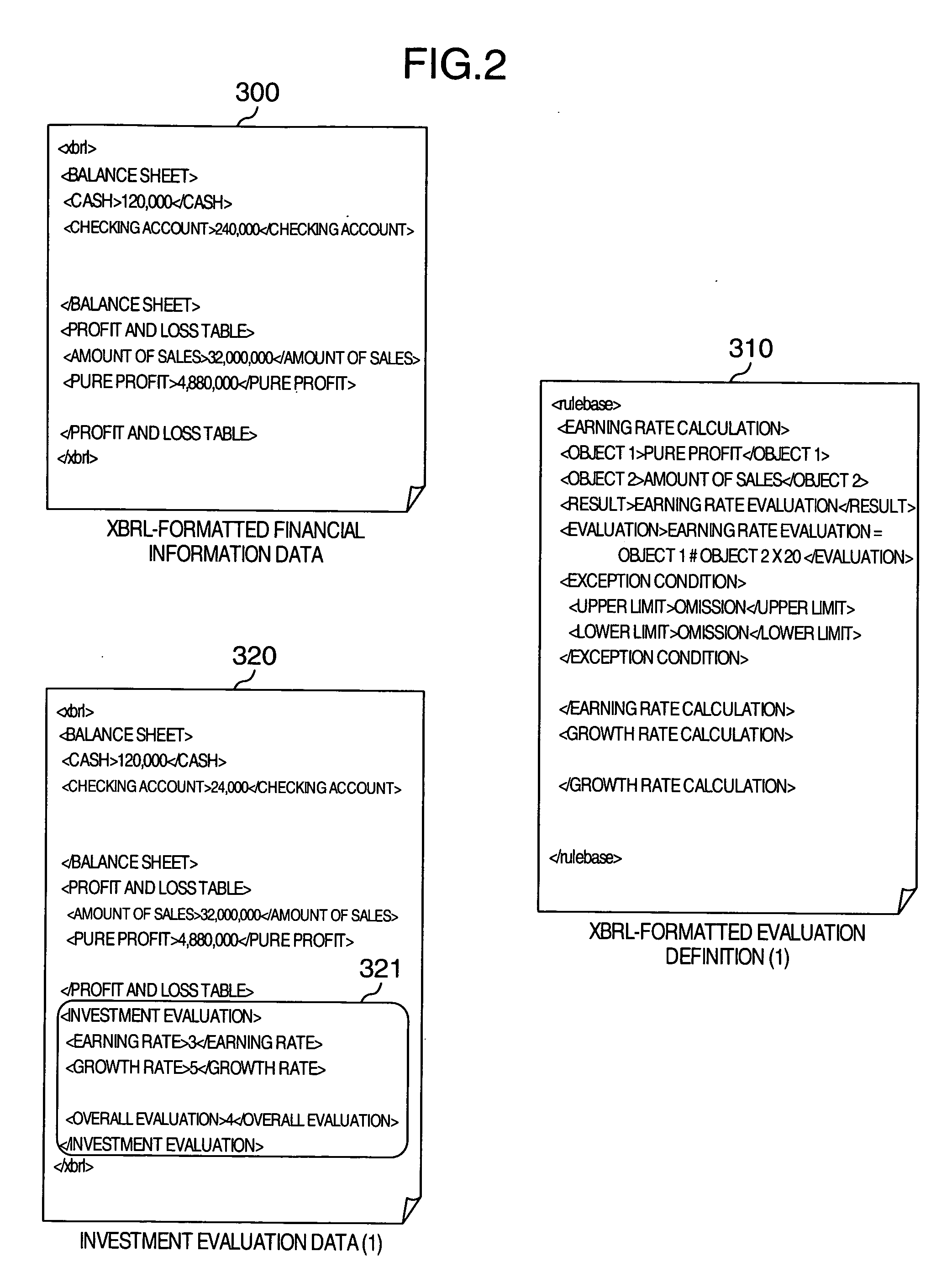

Financial data processing method and system

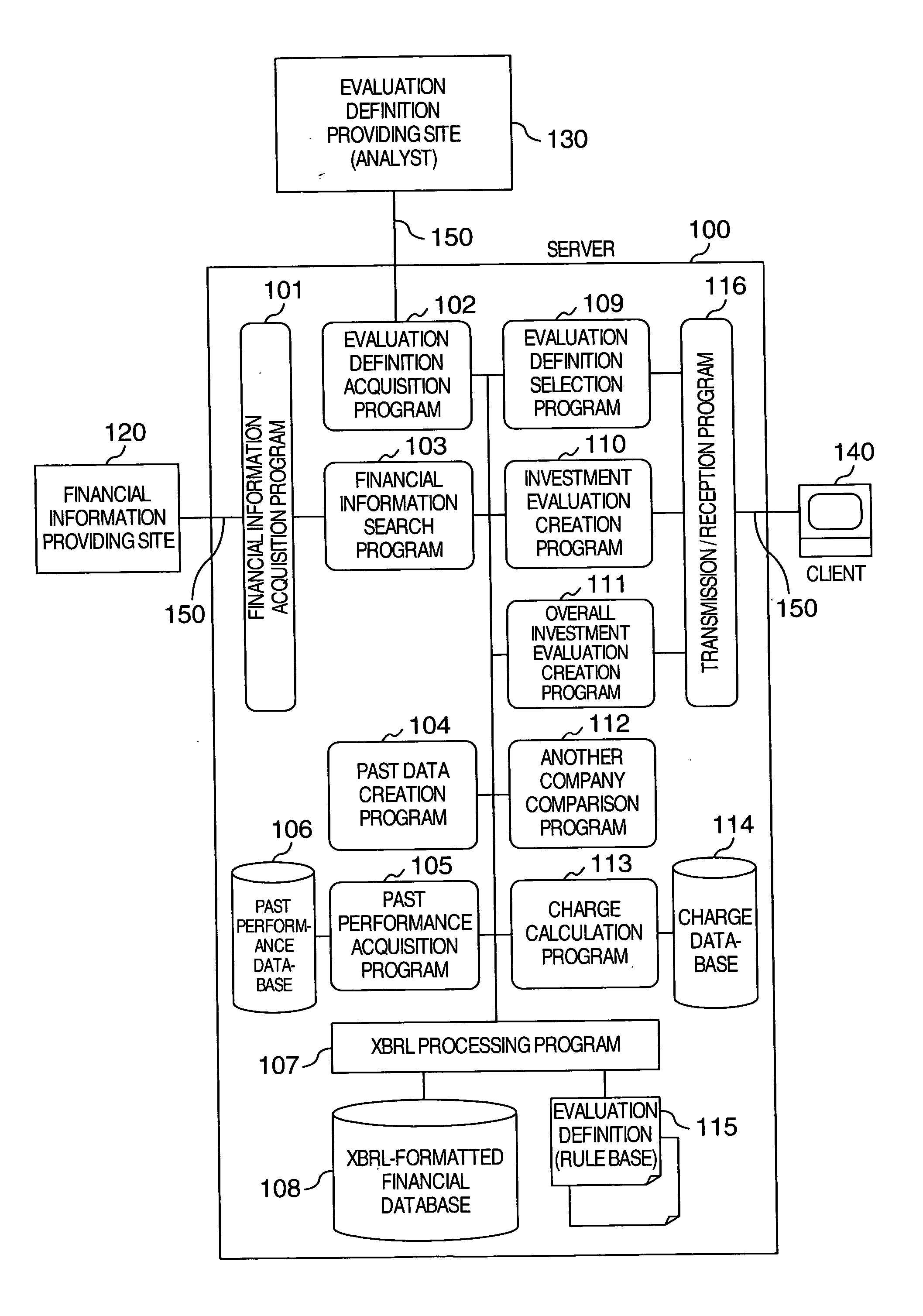

When a name of an enterprise to be evaluated and a plurality of evaluation definition names entered by a client are received by a server, an overall investment evaluation creation program creates an overall investment evaluation from a plurality of investment evaluations created according to a plurality of XBRL-formatted evaluation definitions corresponding to the plurality of evaluation definition names and displays the overall investment evaluation to the client.

Owner:HITACHI LTD

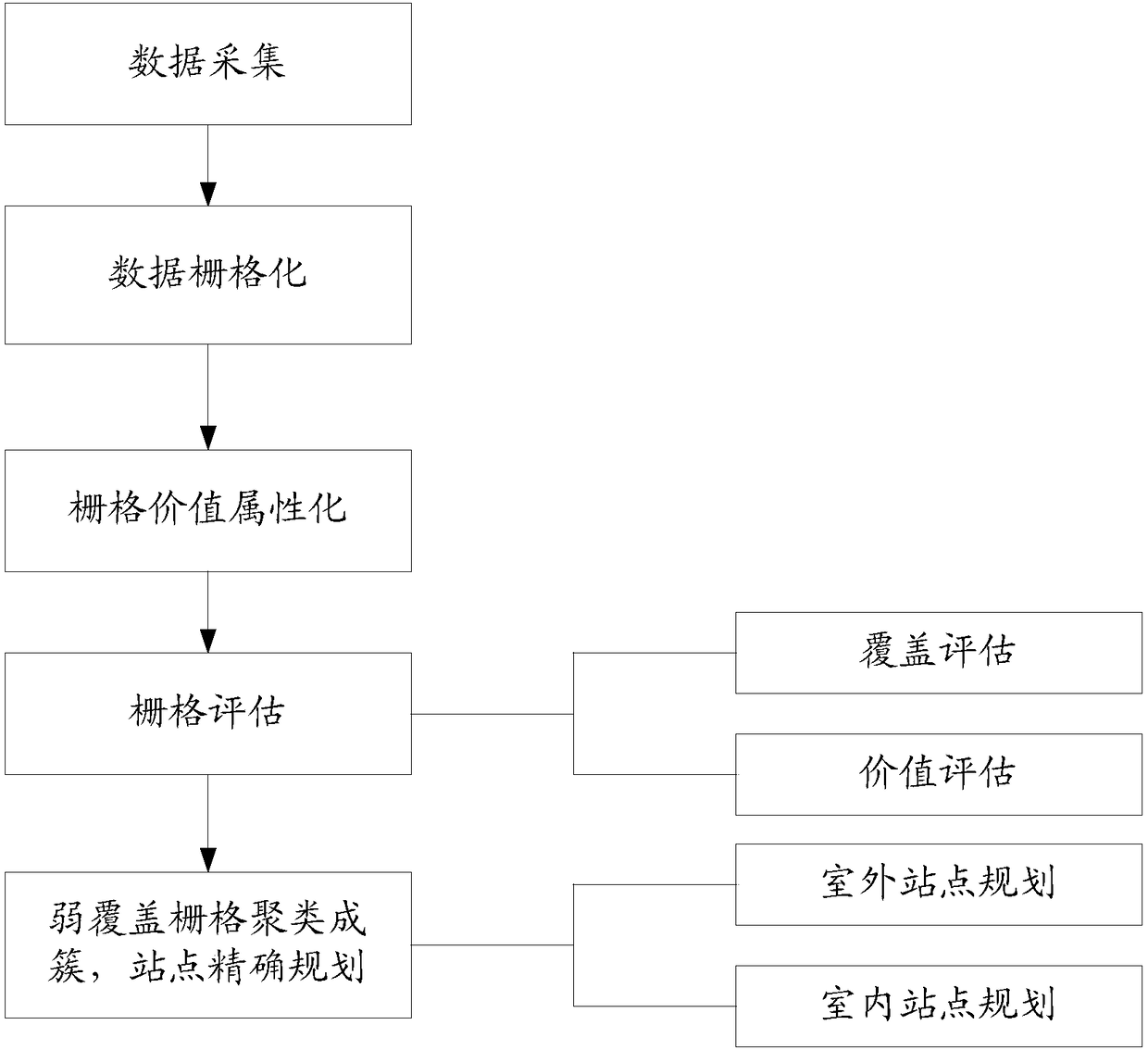

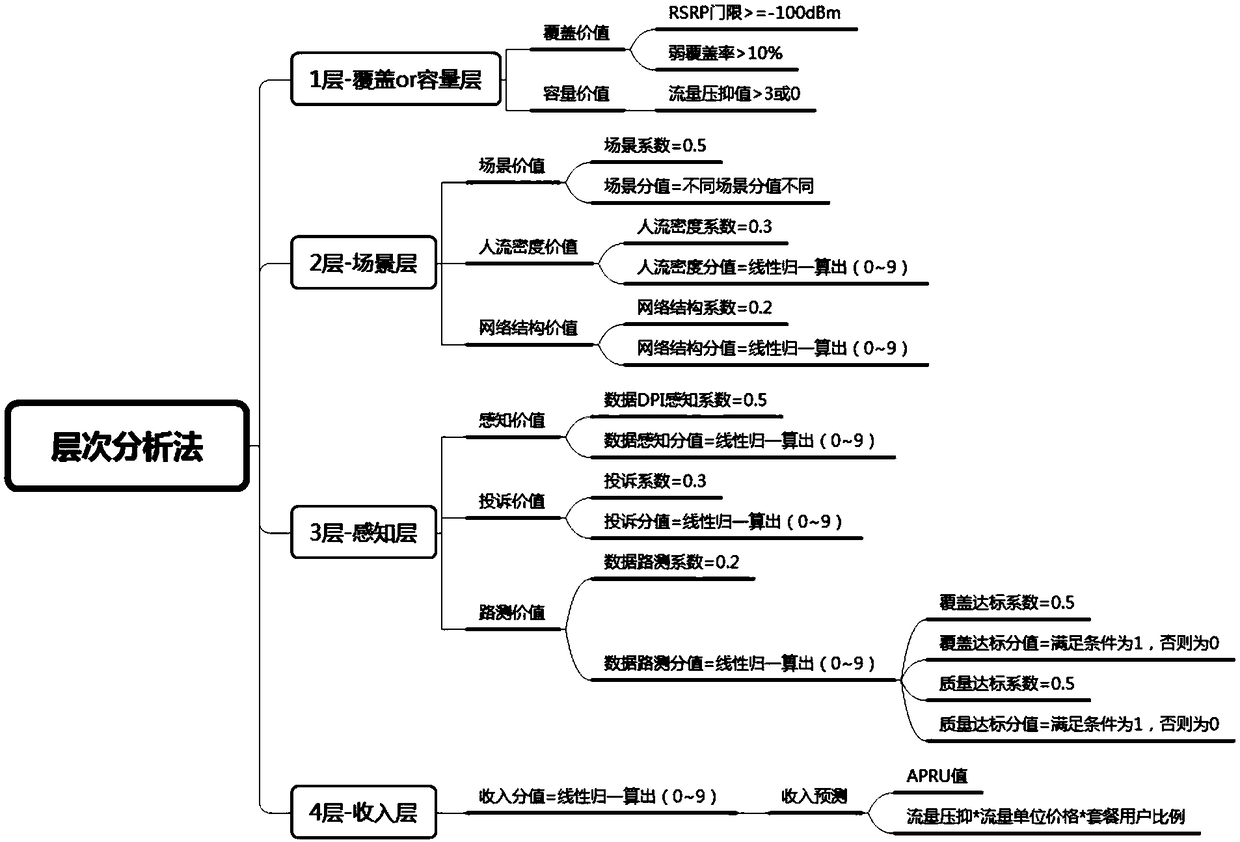

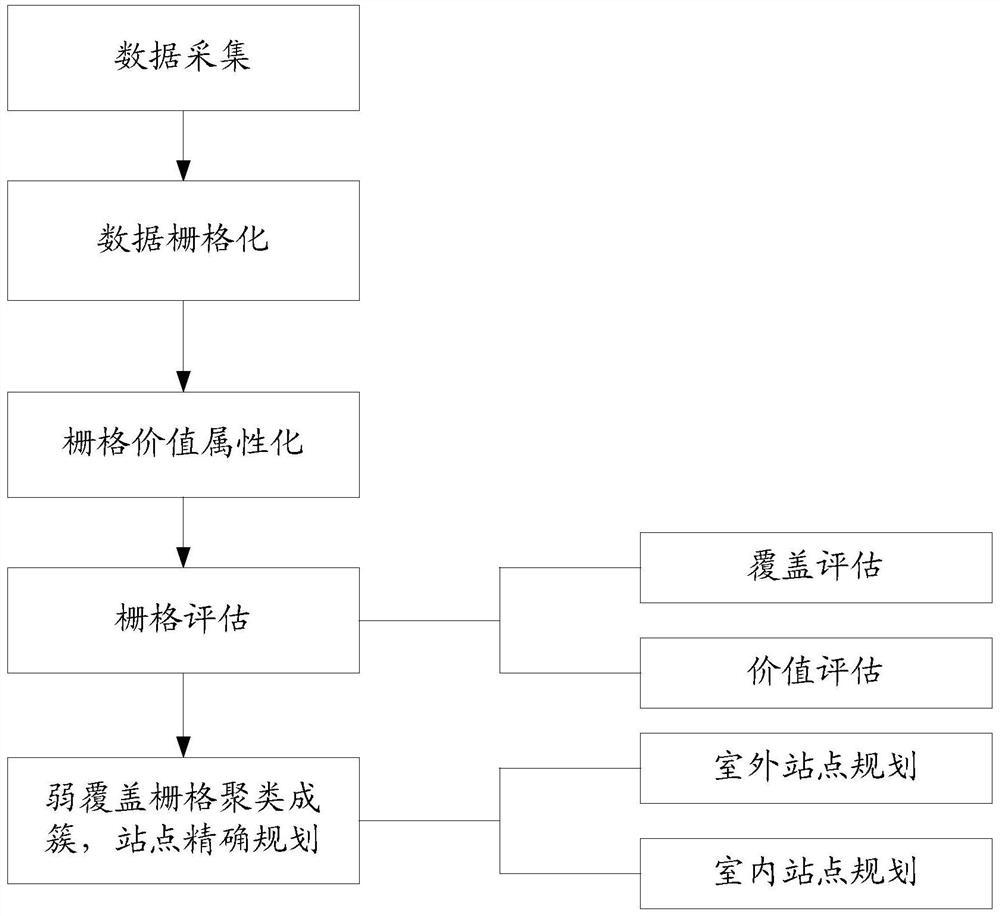

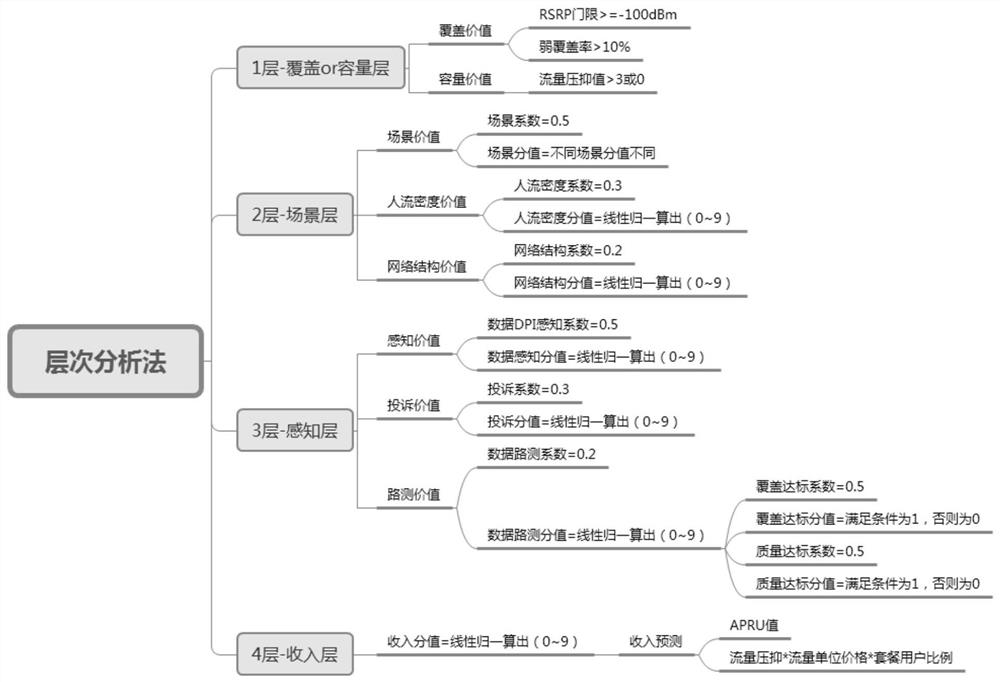

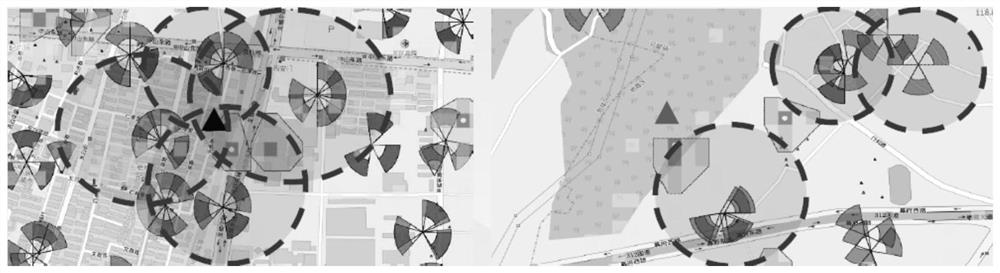

Multi-dimensional assessment and precise construction investment evaluation method based on coverage and value relevance

ActiveCN109327841AEnhance construction valueImprove efficiencyTransmissionNetwork planningCoverage ratioNetwork awareness

The invention discloses a multi-dimensional assessment and precise construction investment evaluation method based on coverage and value relevance and relates to the technical field of big data analysis in data communication. The method disclosed by the invention performs multi-dimensional analysis on an MR poor coverage ratio, a quantity of MR sampling points, user flow, number of users, user perception data and / or user set information, field road test data, complaint information and suppression flow big data, so that indoor values are excavated, precise planning is performed, site building value is effective improved, service turn-around time is shortened, a network awareness word-of-mouth image of an operator is improved, and finally enterprise benefit is improved.

Owner:湖南华诺科技有限公司

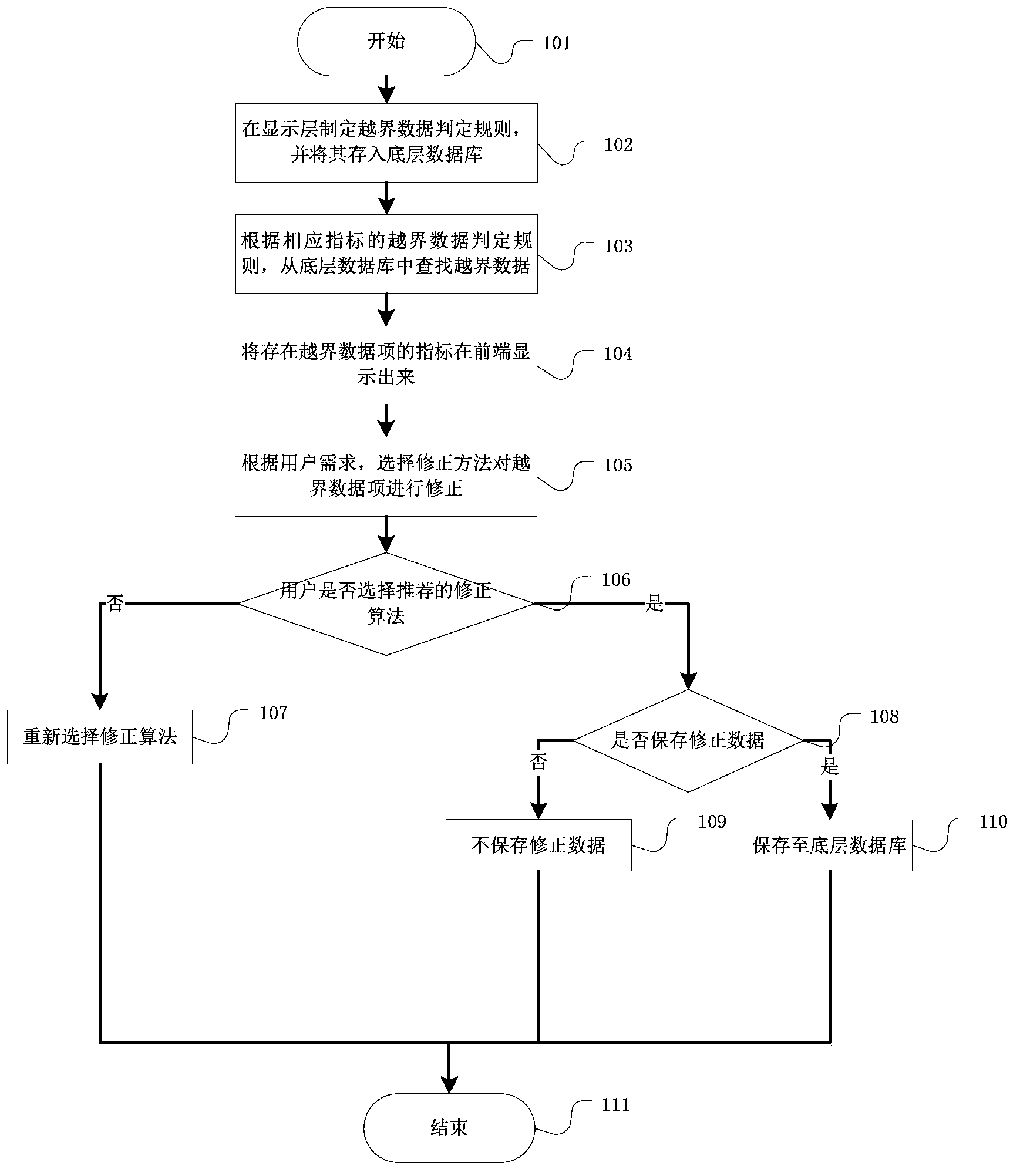

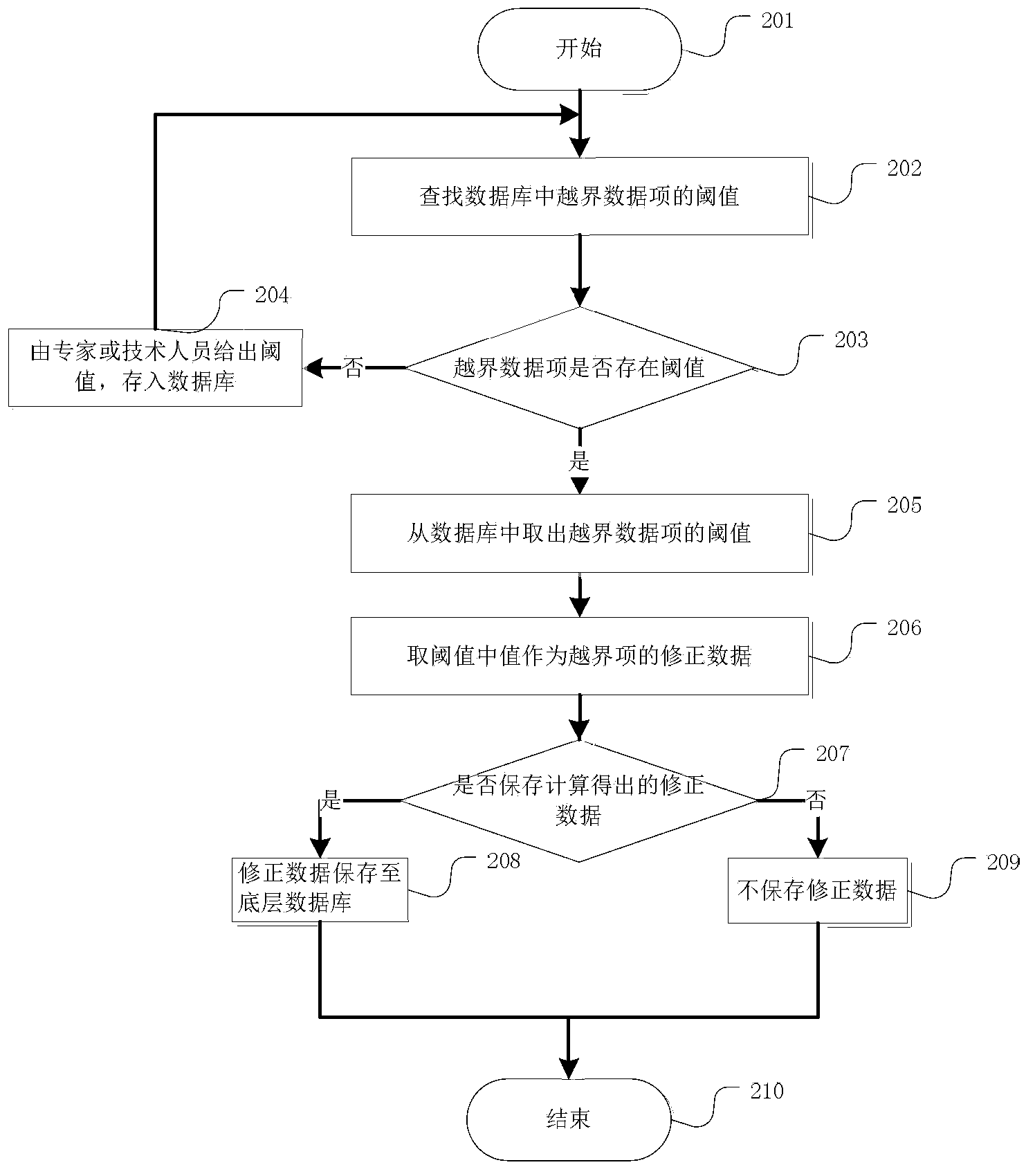

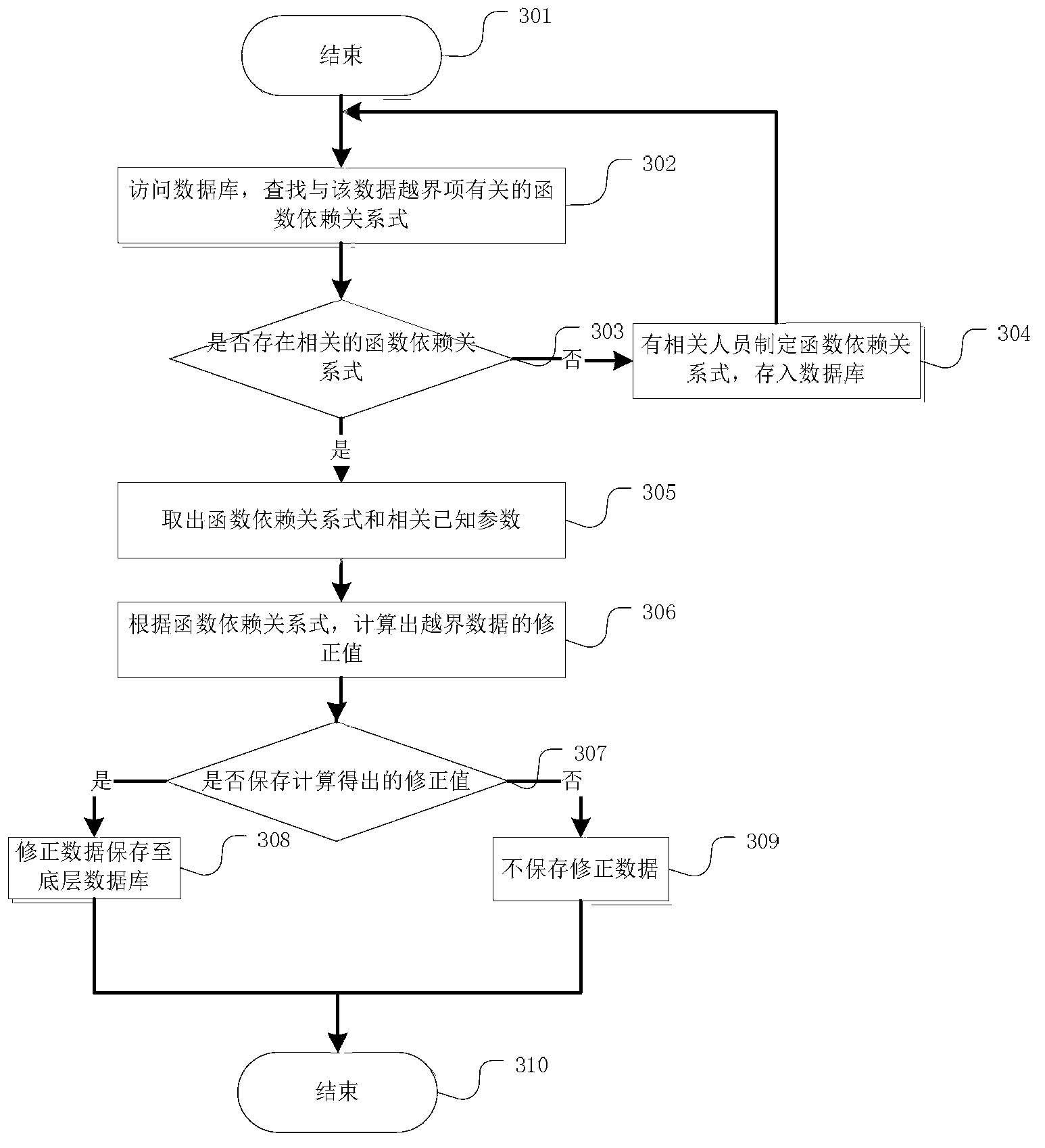

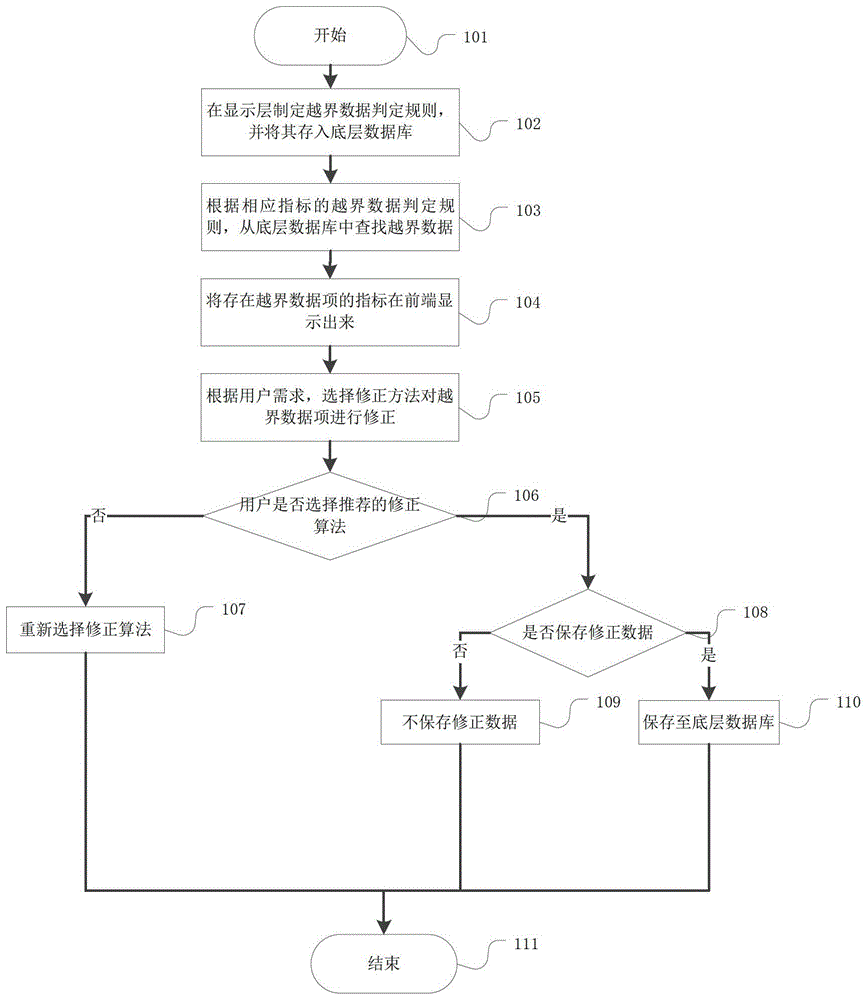

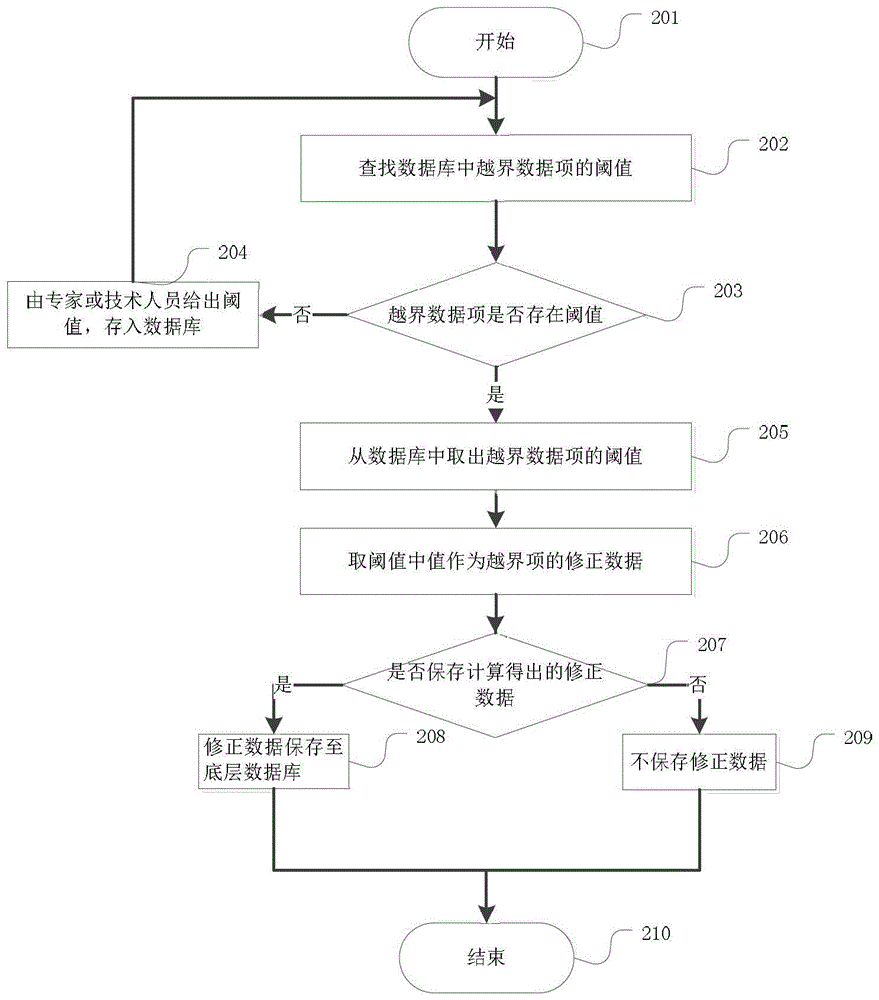

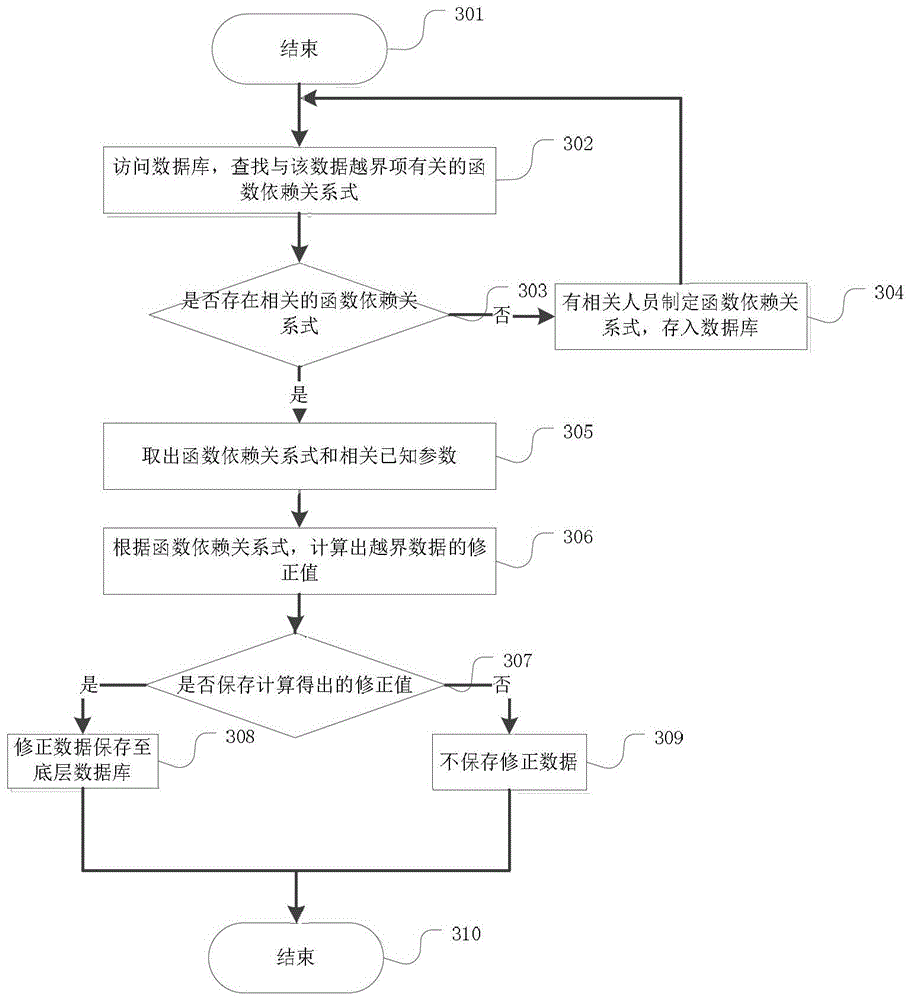

Abnormal data detection and modification method based on numerical value relevance model

InactiveCN103514259AImprove accuracyHigh precisionSpecial data processing applicationsInvestment evaluationStatistical analysis

The invention discloses an abnormal data detection and modification method based on a numerical value relevance model. The method includes the following steps that first, abnormal data judgment conditions are defined by a display module and stored into a source indicator database; second, a data access layer traverses service indicator data in the source indicator database, judges whether the service indicator data meet the abnormal data judgment conditions or not and displays the service indicator data meeting the abnormal data judgment conditions in the display module, and meanwhile the third step is executed; third, the service indicator data meeting the abnormal data judgment conditions are modified by a service logic module, and the modified data are stored into the source indicator database according to needs. The abnormal data detection and modification method based on the numerical value relevance model greatly improves accuracy of service data of a power grid and accuracy for calculating statistical data groups, makes the statistical analysis result more reliable and provides favorable data support for enterprises in the respects of investment evaluation, benefit analysis and the like.

Owner:NORTH CHINA ELECTRIC POWER UNIV (BAODING)

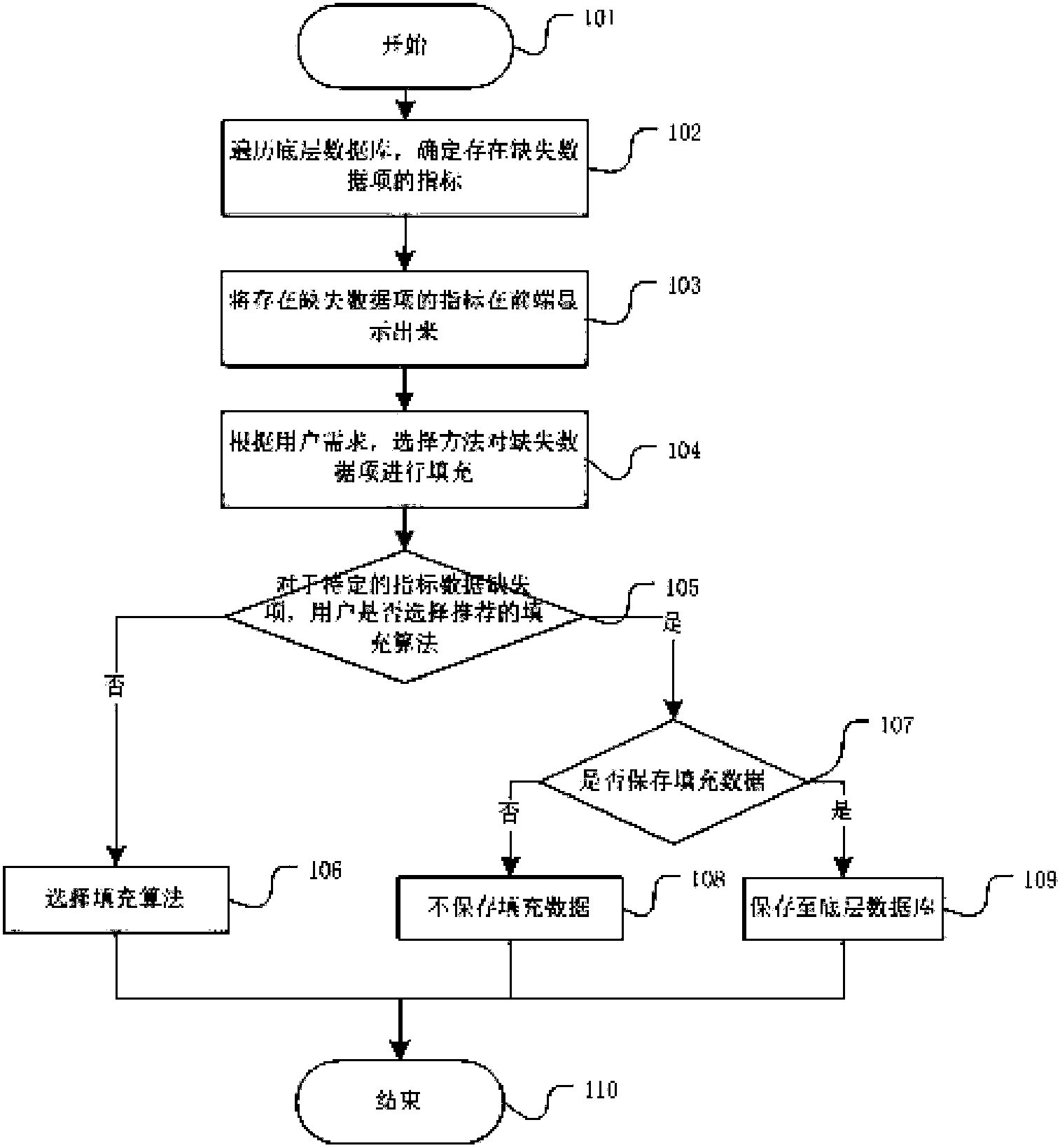

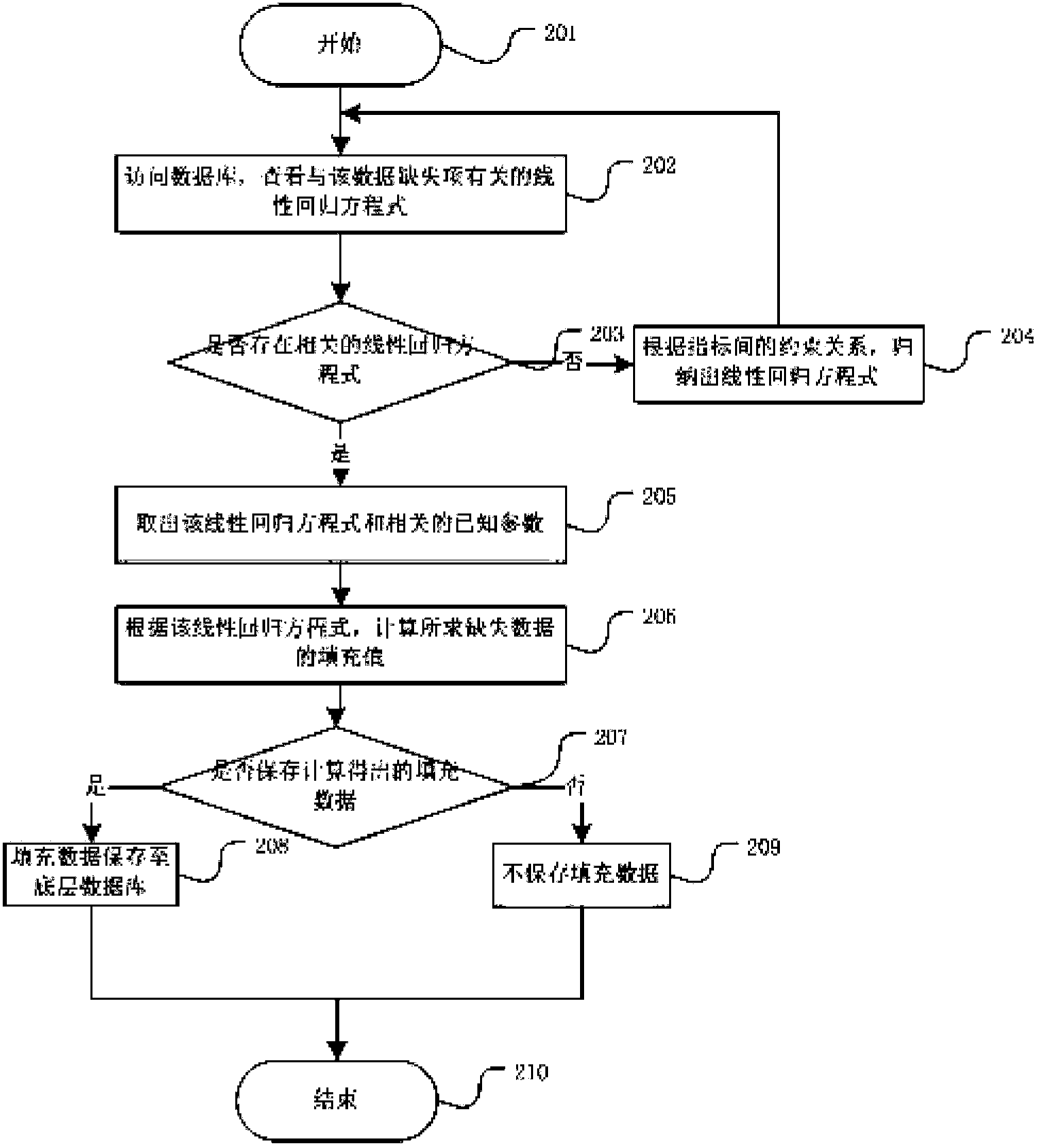

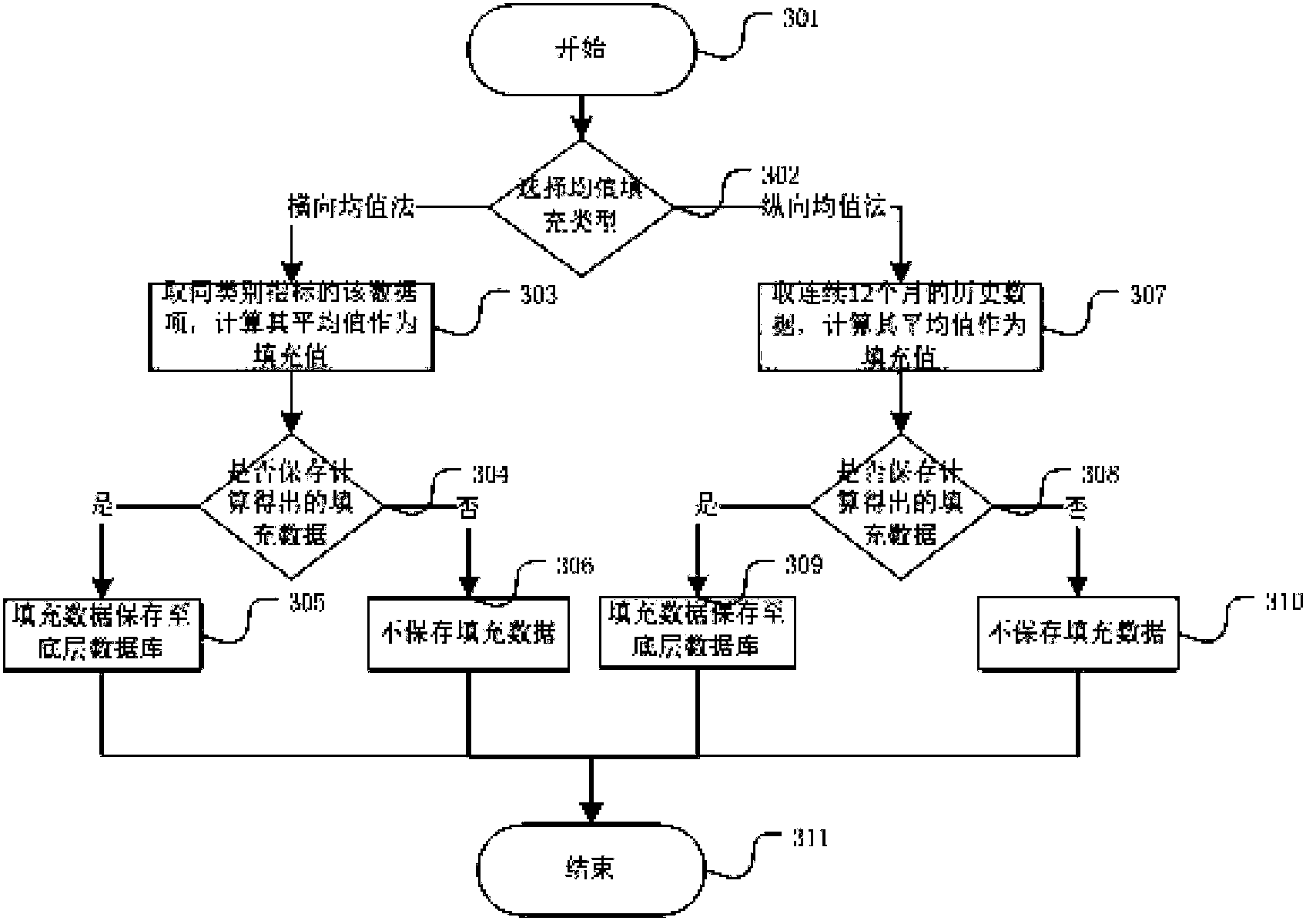

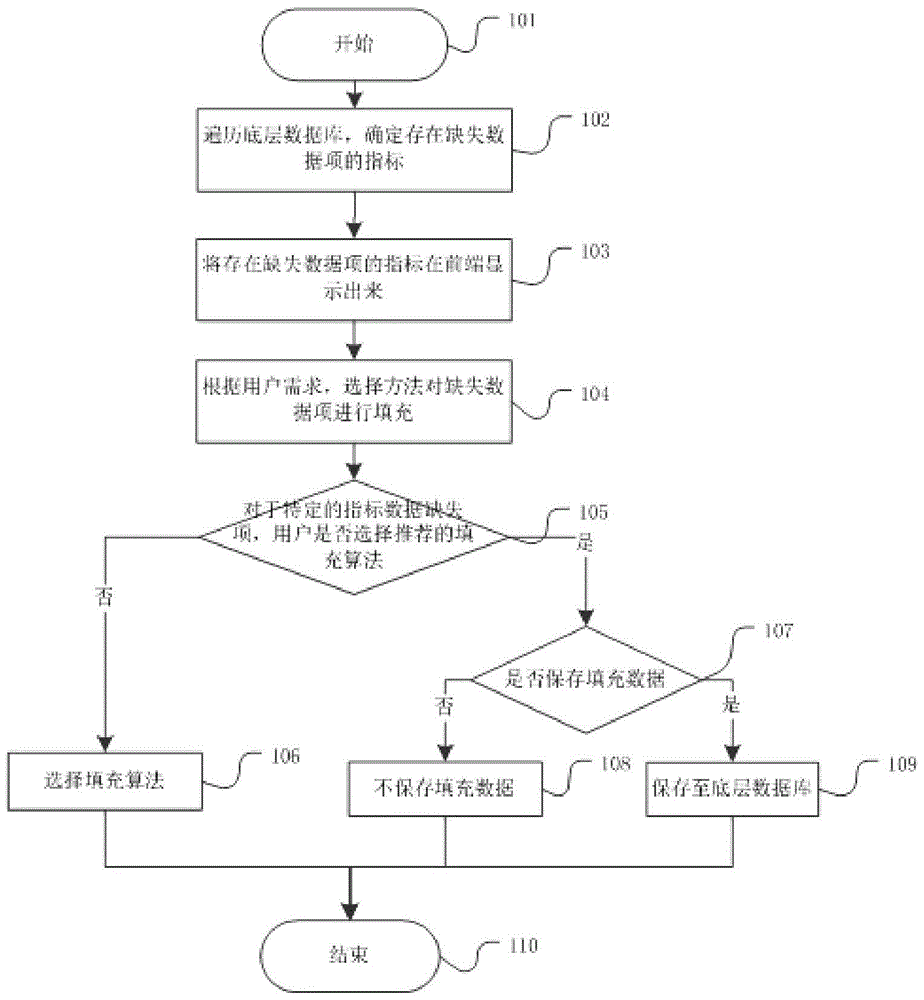

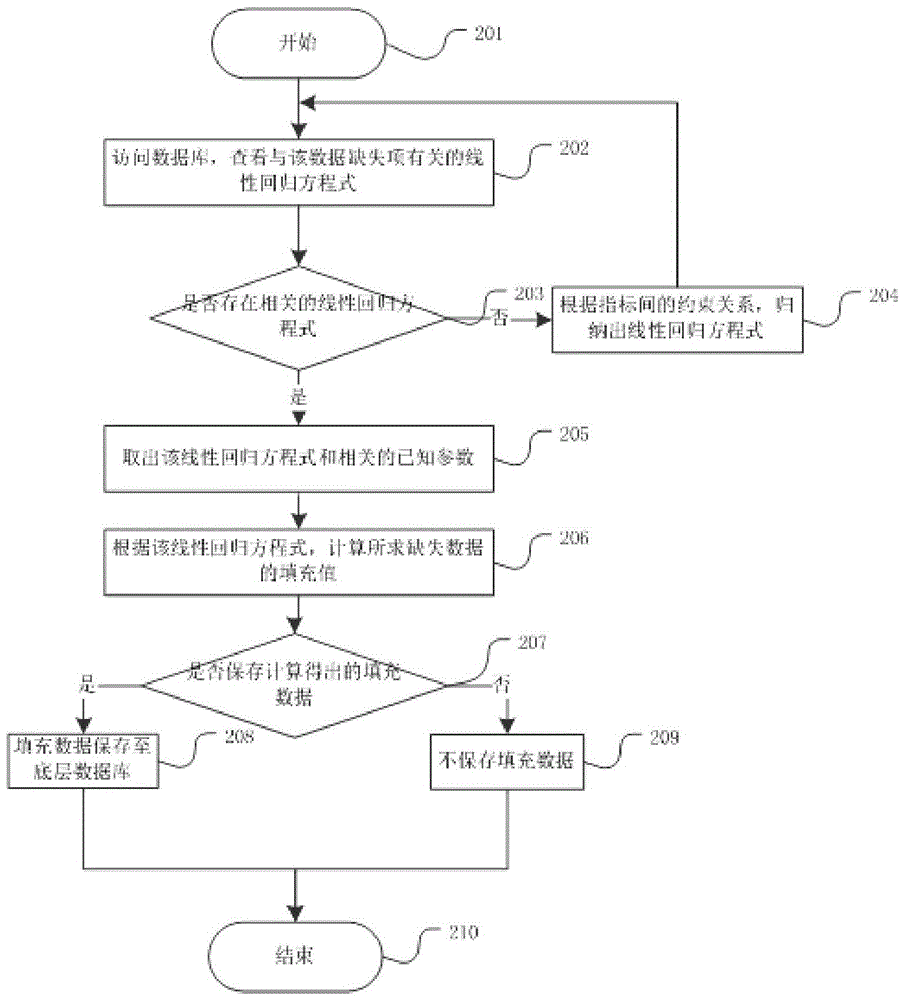

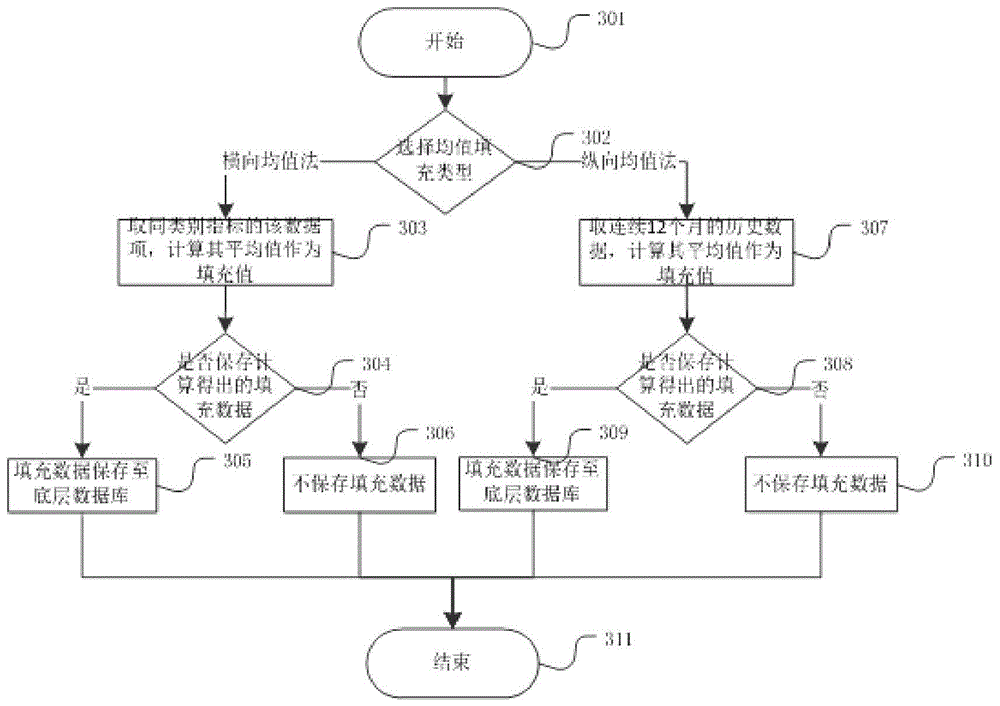

Vacancy filling system for measured point data and vacancy filling method

InactiveCN103440283AImprove accuracyHigh precisionSpecial data processing applicationsData displayInvestment evaluation

The invention discloses a vacancy filling system for measured point data and a vacancy filling method. The vacancy filling system comprises a business indicator data detecting system and a data filling system connected with a business indicator data detecting module, wherein the business indicator data detecting system comprises a source business indicator database module, a data access module connected with the source business indicator database module, a business logic module connected to the data access module, and a data display module connected to the business logic module; and a linear regression filling system, a mean value filling system and an artificially filling system are arranged in the data filling system. According to the vacancy filling system and the vacancy filling method disclosed by the invention, the correctness of business data is greatly improved, the computation precision of a statistic data group is improved, a statistic analysis result is more reliable, and more advantageous data support is provided for jobs such as enterprise investment evaluation and benefit analysis.

Owner:NORTH CHINA ELECTRIC POWER UNIV (BAODING) +1

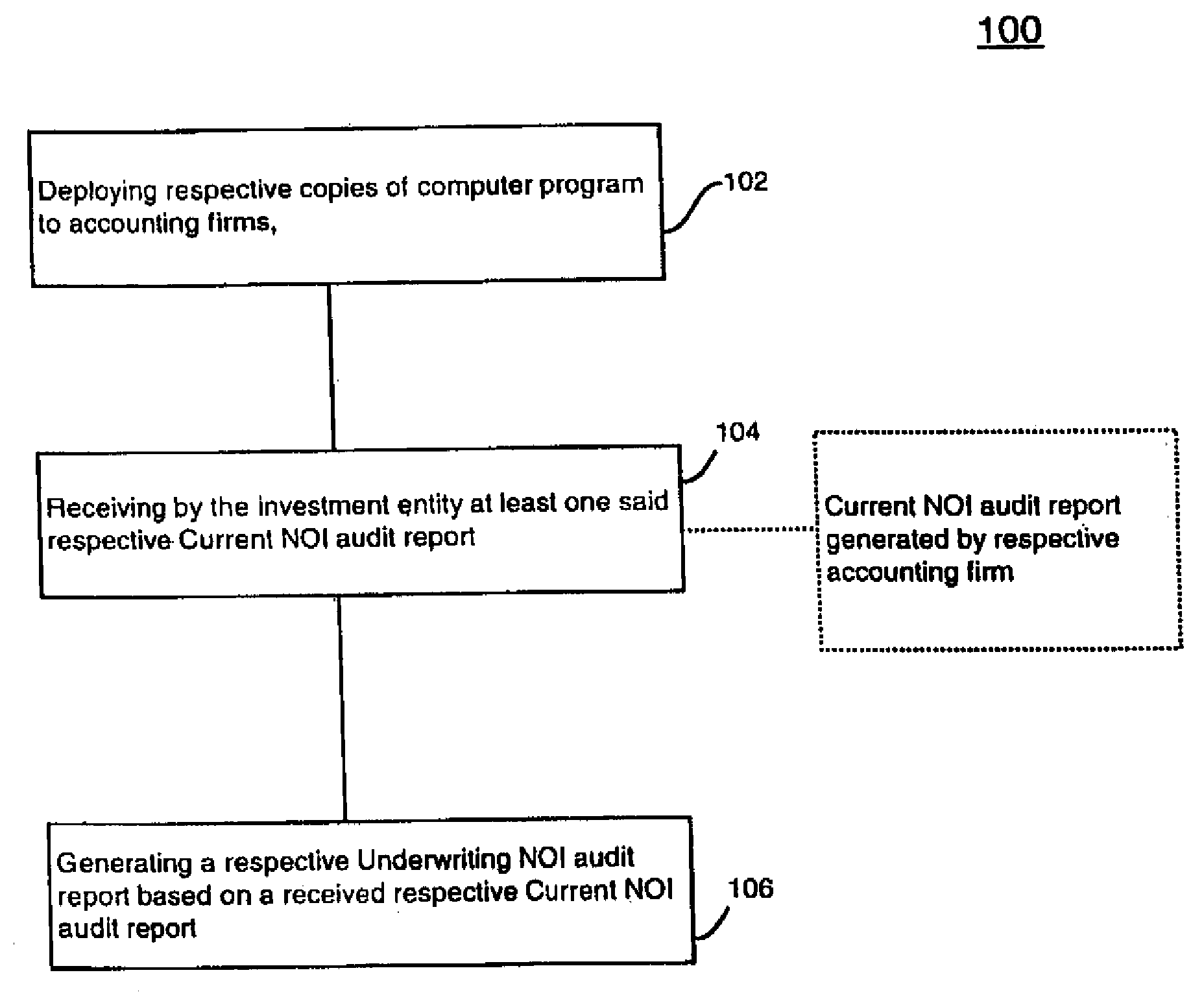

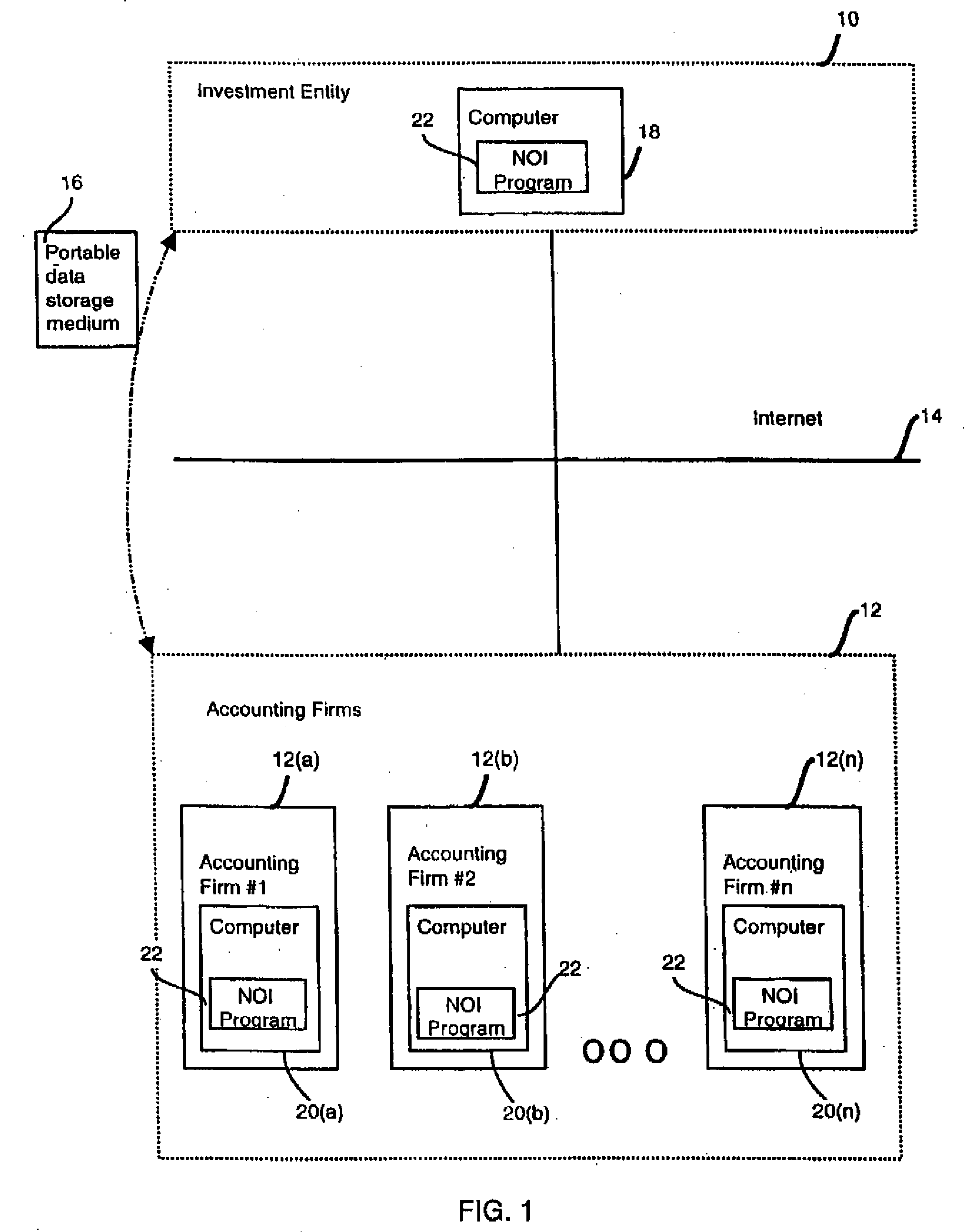

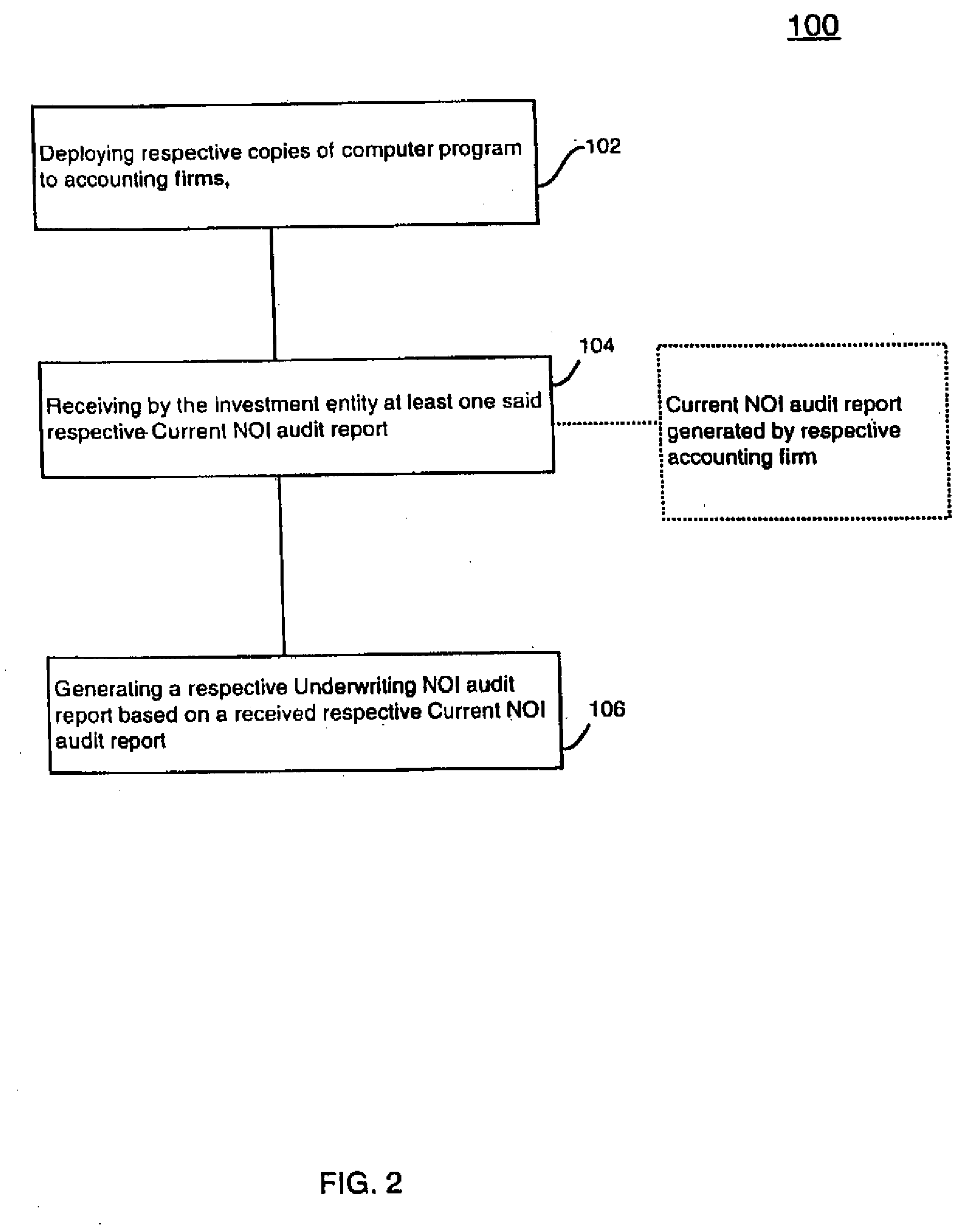

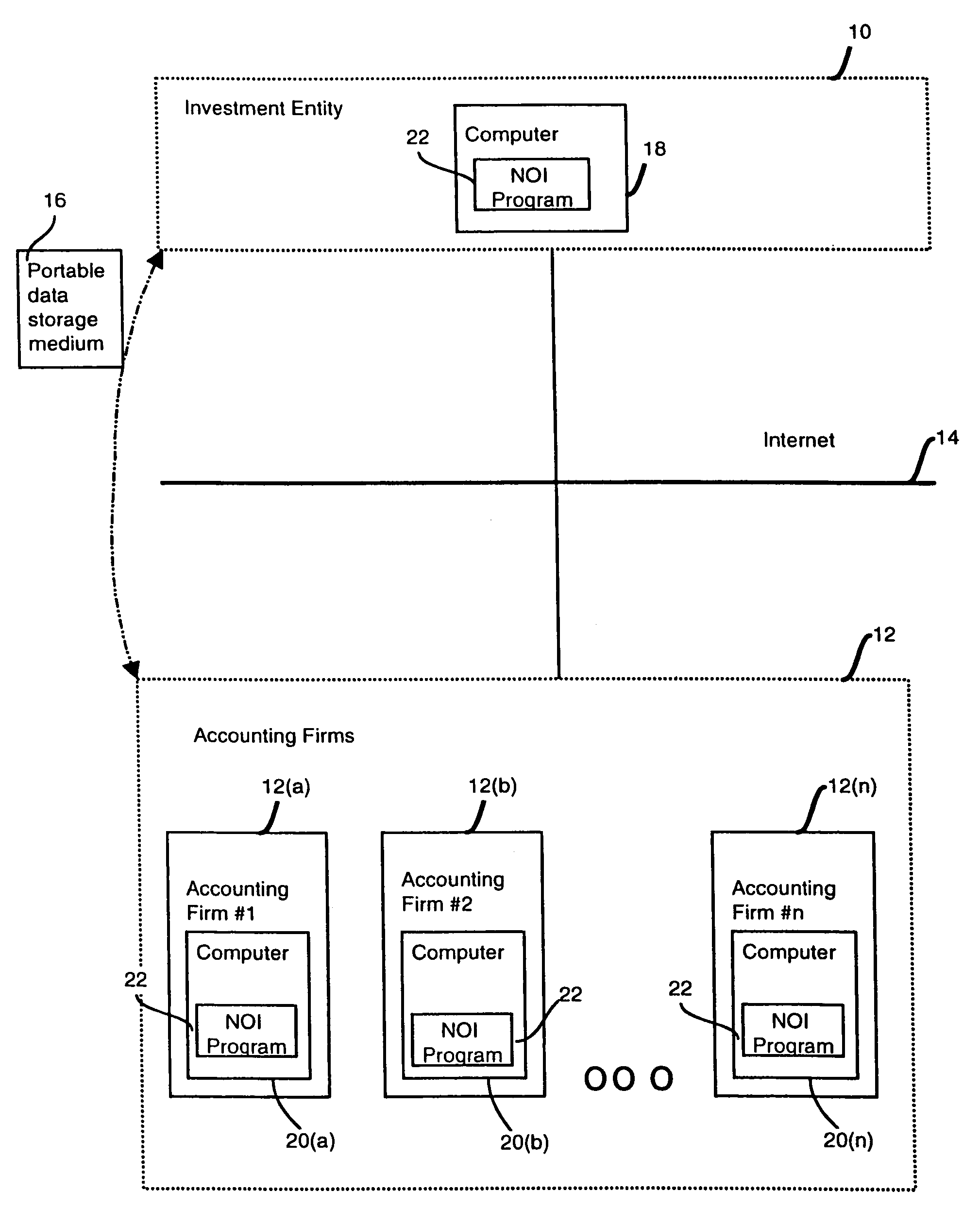

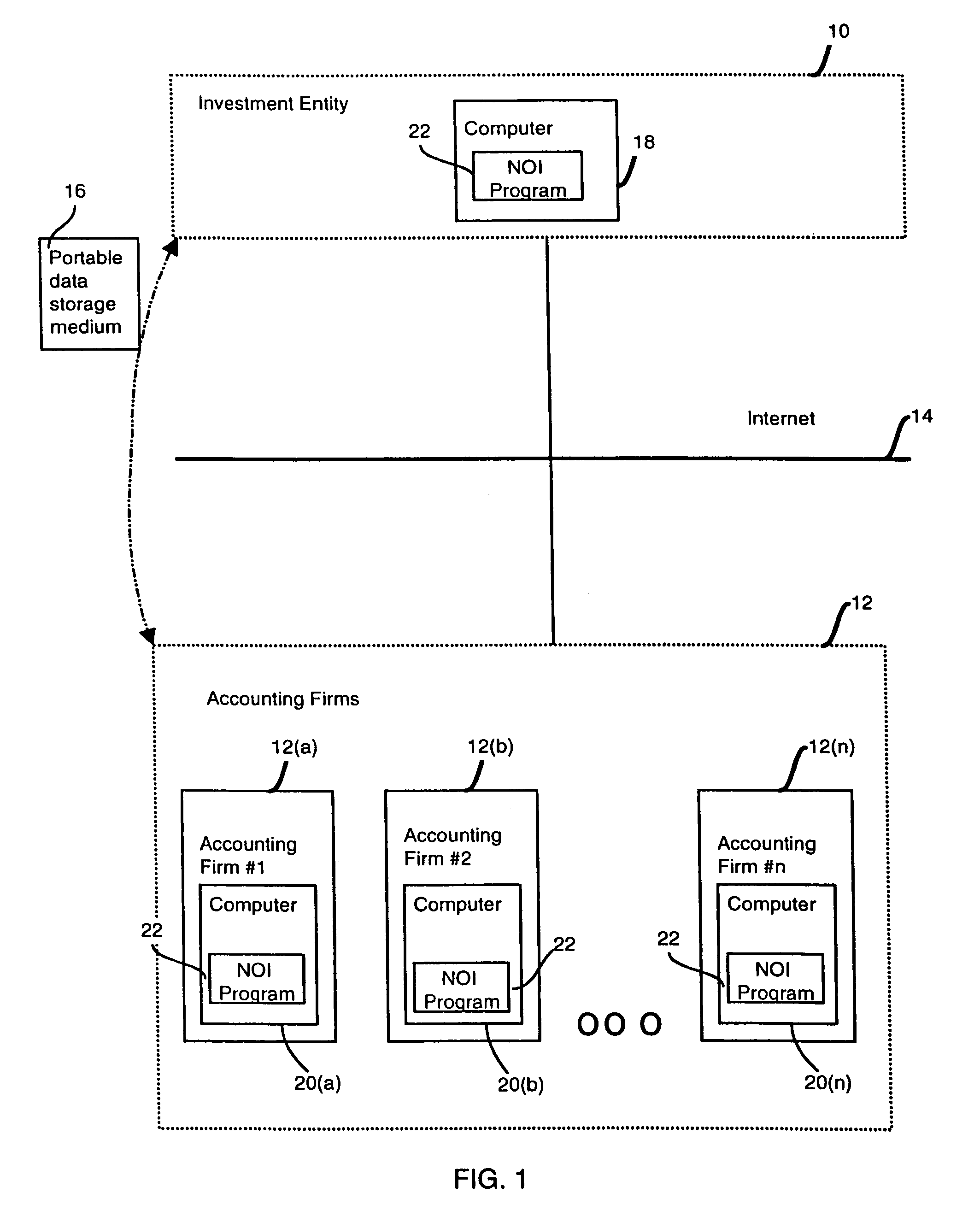

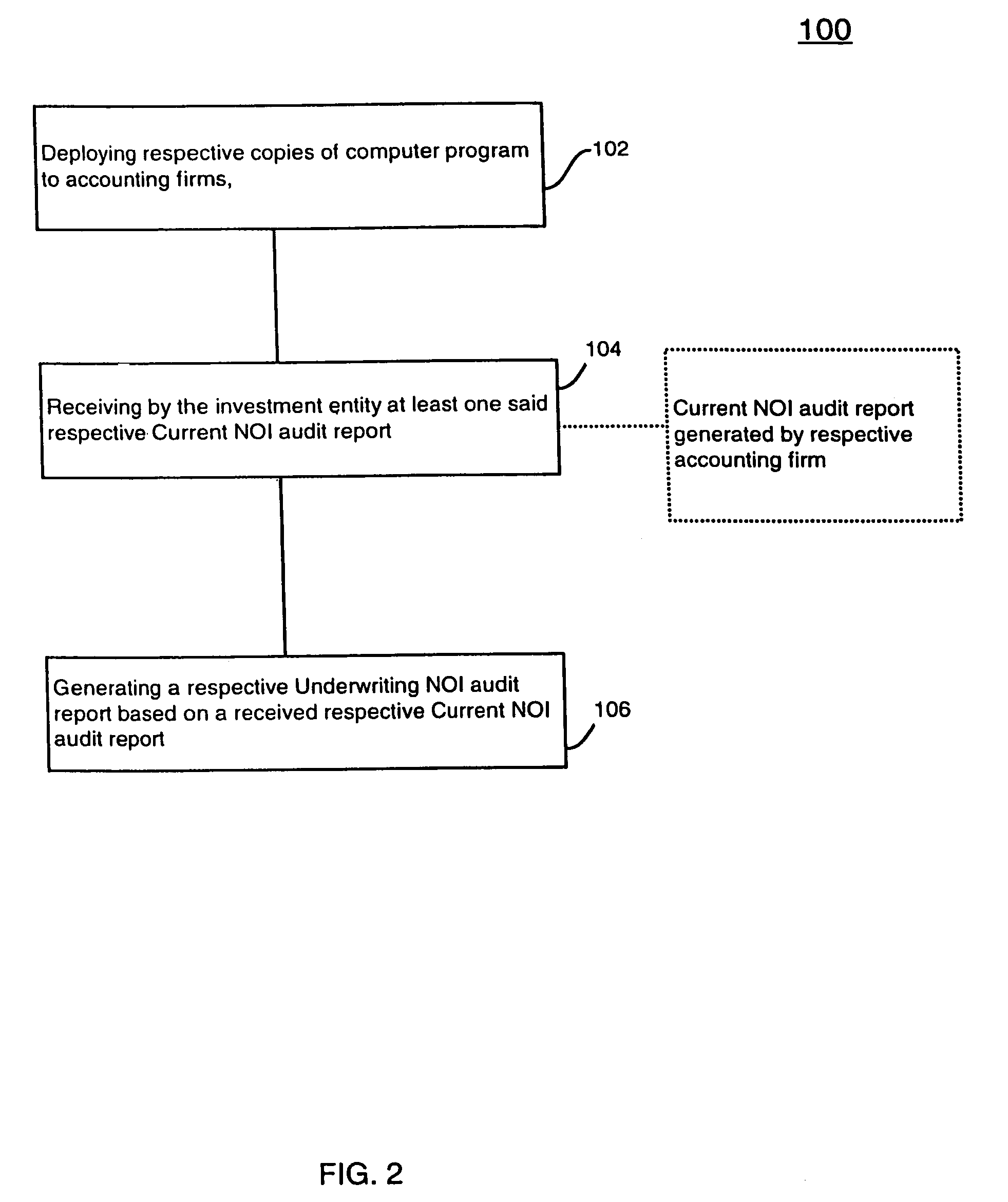

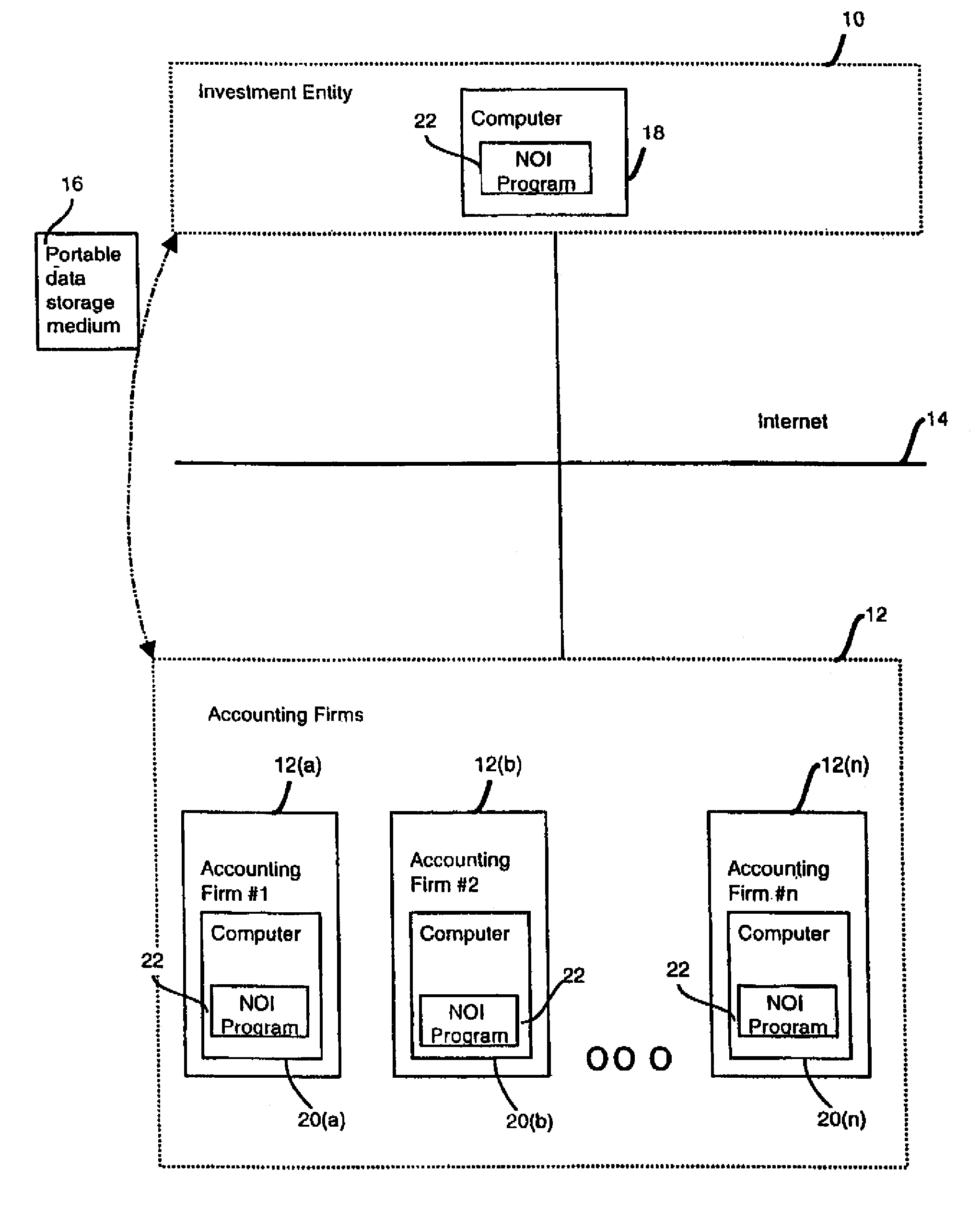

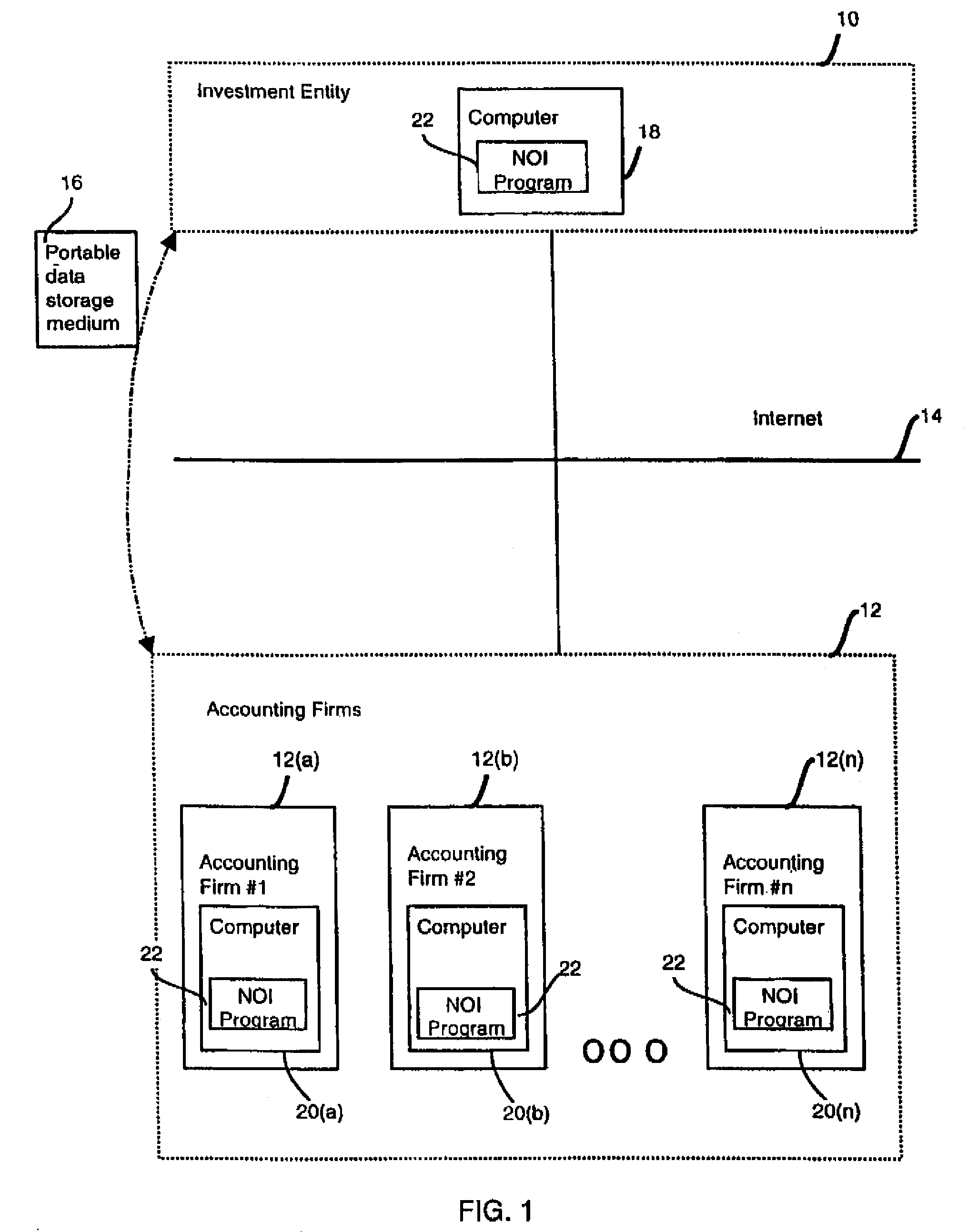

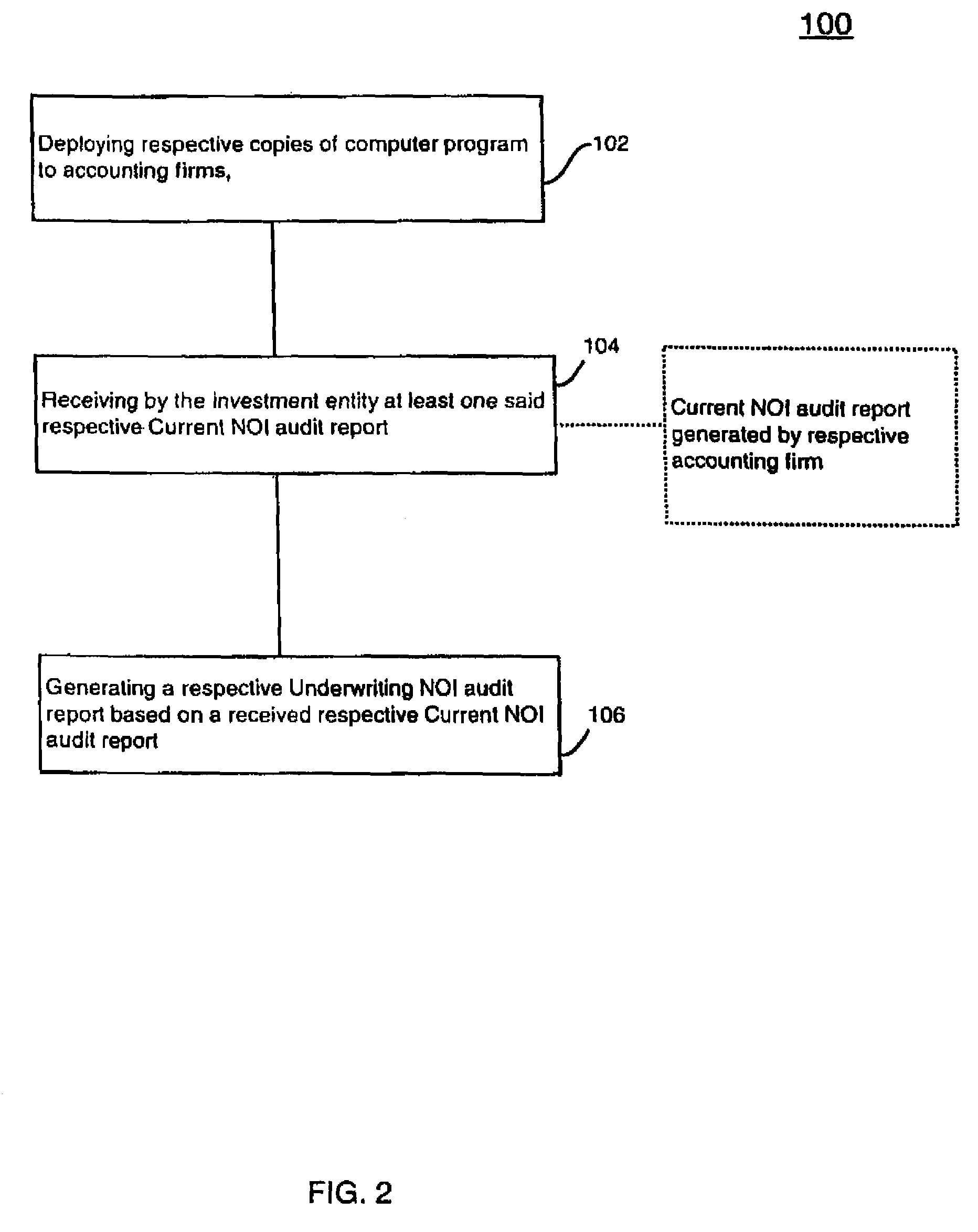

Method and product for calculating a net operating income audit and for enabling substantially identifical audit practices among a plurality of audit firms

InactiveUS20090106254A1Uniform resultComplete banking machinesFinanceDocumentation procedureInvestment evaluation

Deployment of a computer program including a global NOI audit model together with standards, procedures, documentation, and reporting requirements in interactive, digital form to a plurality of audit firms operating independently of each other and having a reporting relationship with an investment entity. The program is adapted for receiving audit data from a respective audit firm in connection with an associated real estate property and for generating an associated respective Current NOI audit report. The specific fields and screen arrangements, together with interactive instructions and definitions of the program require that each audit firm identify a consistent set of input parameters and apply them in a consistent way, as driven by the global audit model, thereby assuring computation and transmission of structurally consistent Current NOI audit reports to the investment entity, wherein the Current NOI calculations have been developed by substantially identical audit practices, procedures and assumptions. Using the same program, the investment entity then calculates and stores an Underwriting NOI set of values corresponding to each Current NOI report for the purpose of investment evaluation. The program generates a consolidated report of both Current and Underwriting NOI values for all of the plurality of audit firms so that the investment entity can effect a uniform analysis of all investment properties under consideration.

Owner:GE CAPITAL US HLDG INC

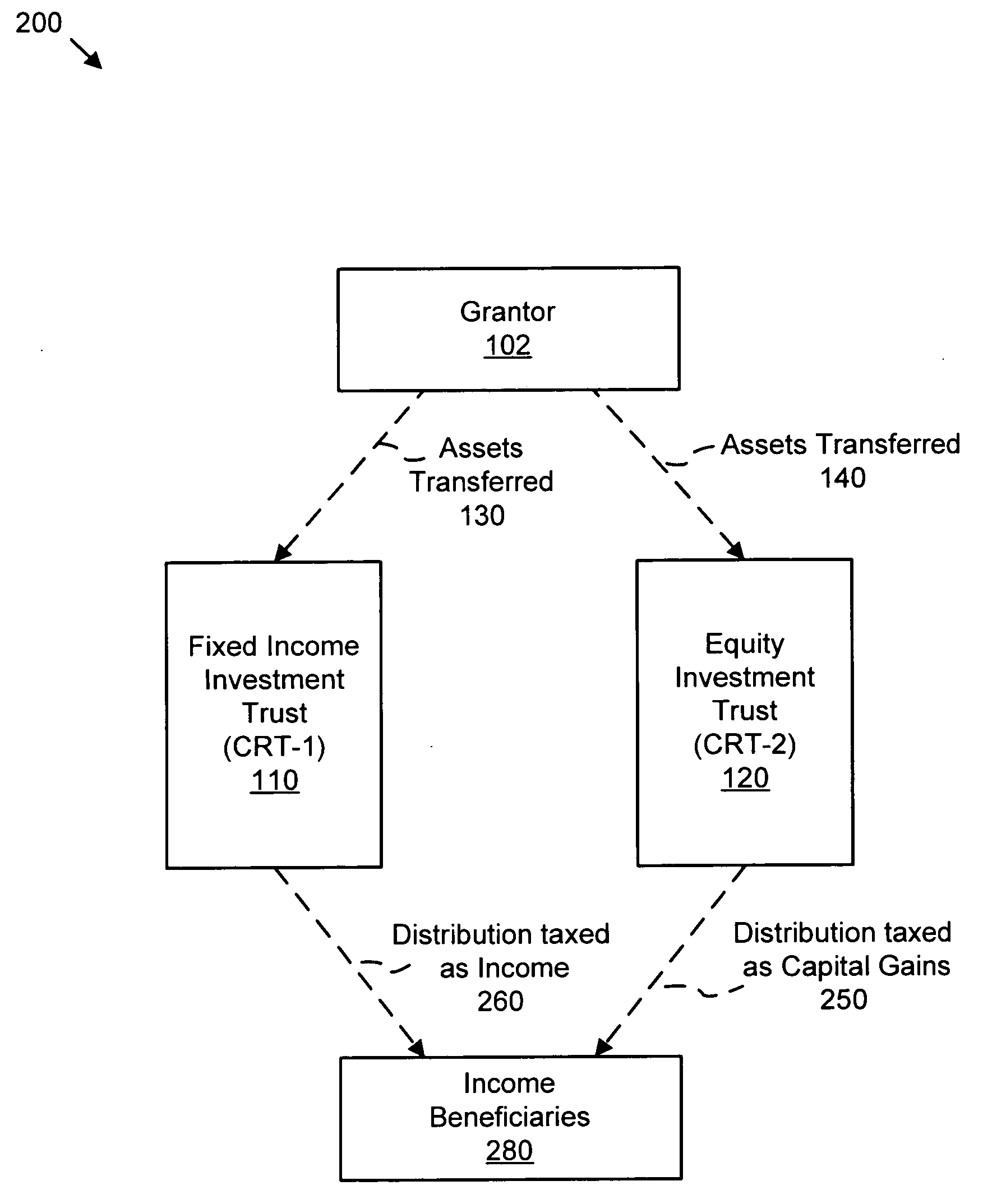

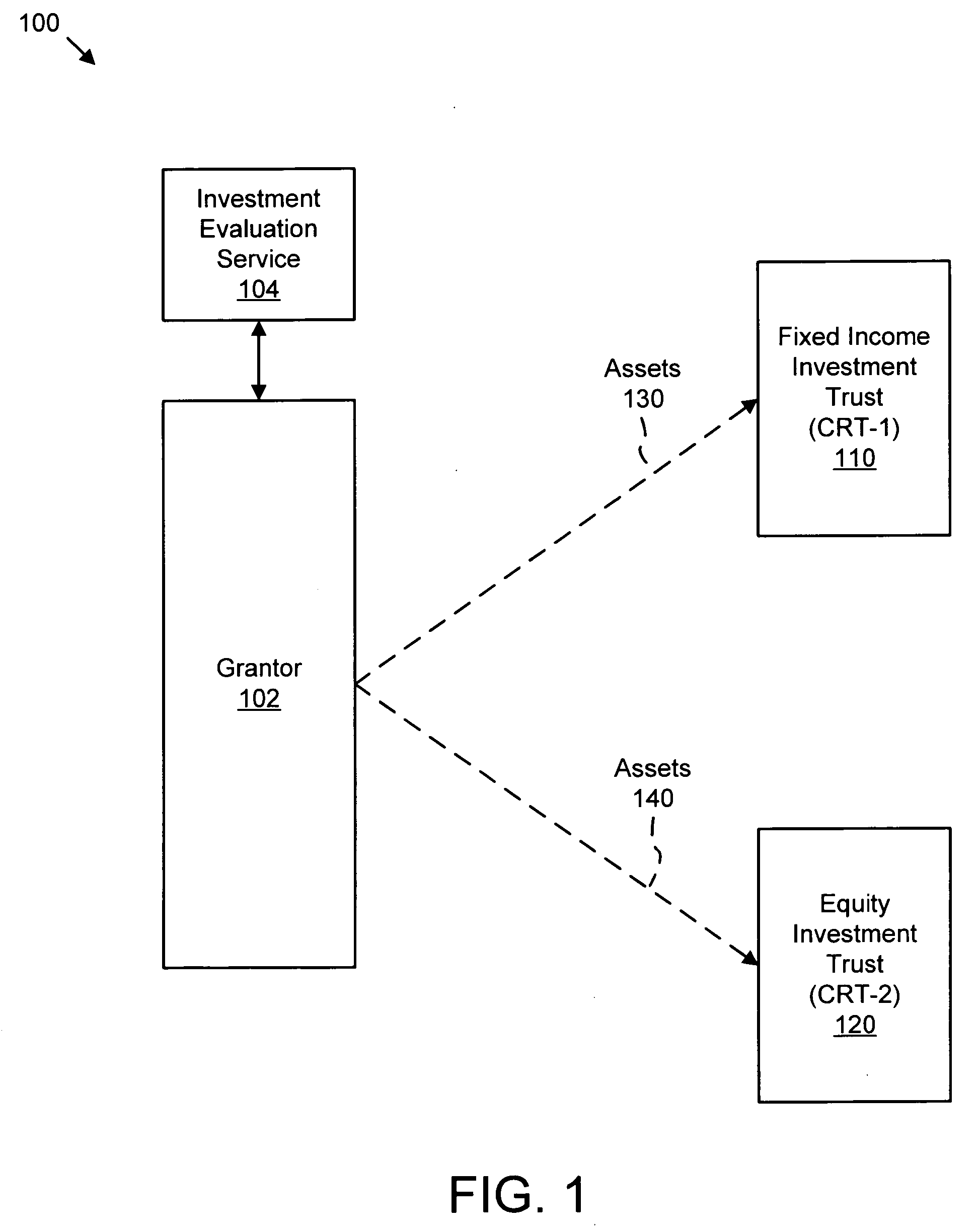

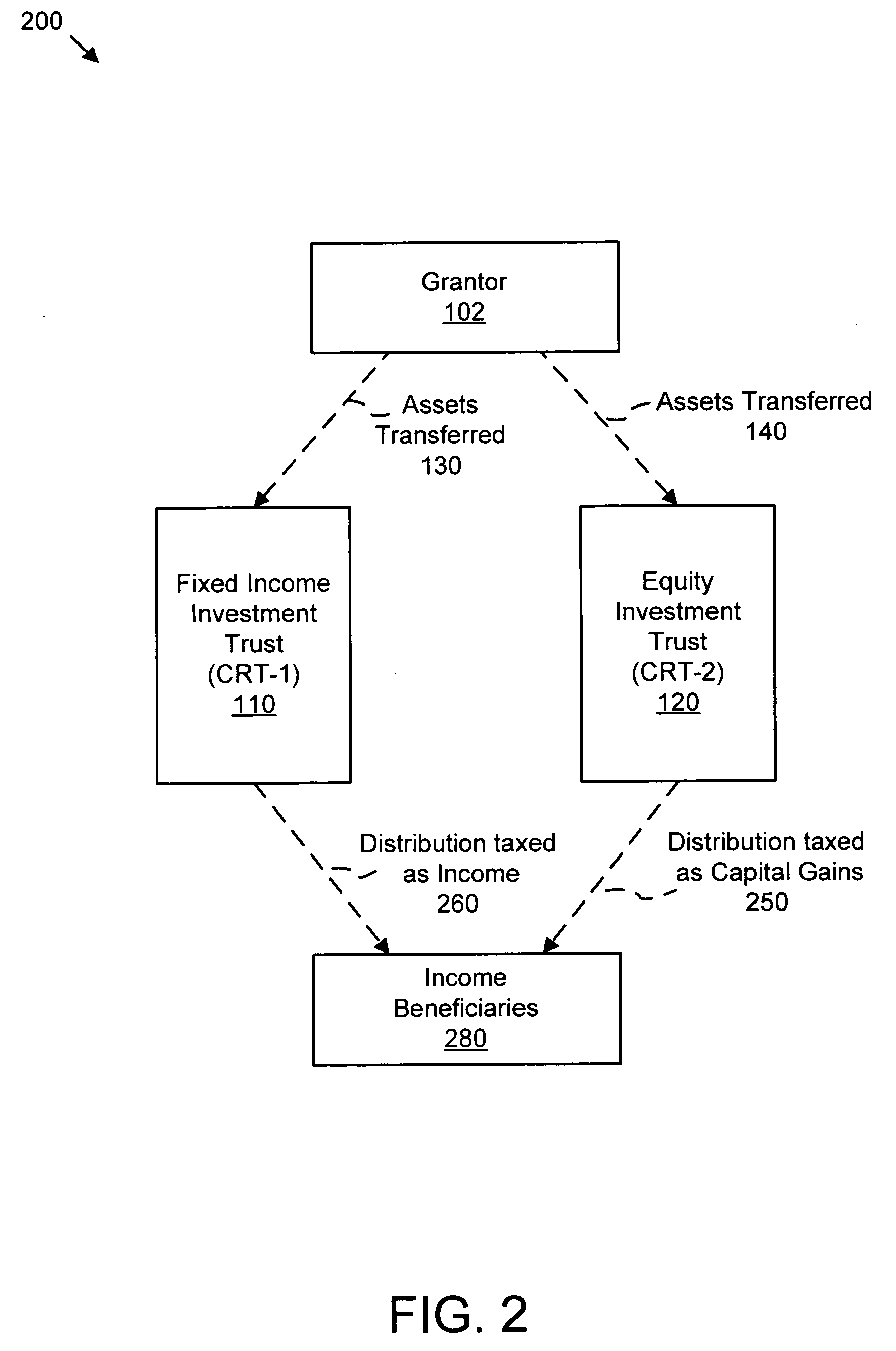

System and method for maximizing after-tax income using split method charitable remainder trusts

InactiveUS20050283419A1FinanceSpecial data processing applicationsInvestment evaluationRisk-benefit analysis

A system, method, and apparatus are disclosed for maximizing after-tax income from trusts, including charitable remainder trusts, through balanced distribution of assets between fixed income and equity investments (and possibly tax free and return of principle) based on a customized risk benefit analysis tailored to the unique circumstances and preferences of an individual donor or investor, the customized risk benefit analysis preferably being performed by an investment evaluation service optionally comprising computer or electronic calculations.

Owner:SCHAUB BENSON L

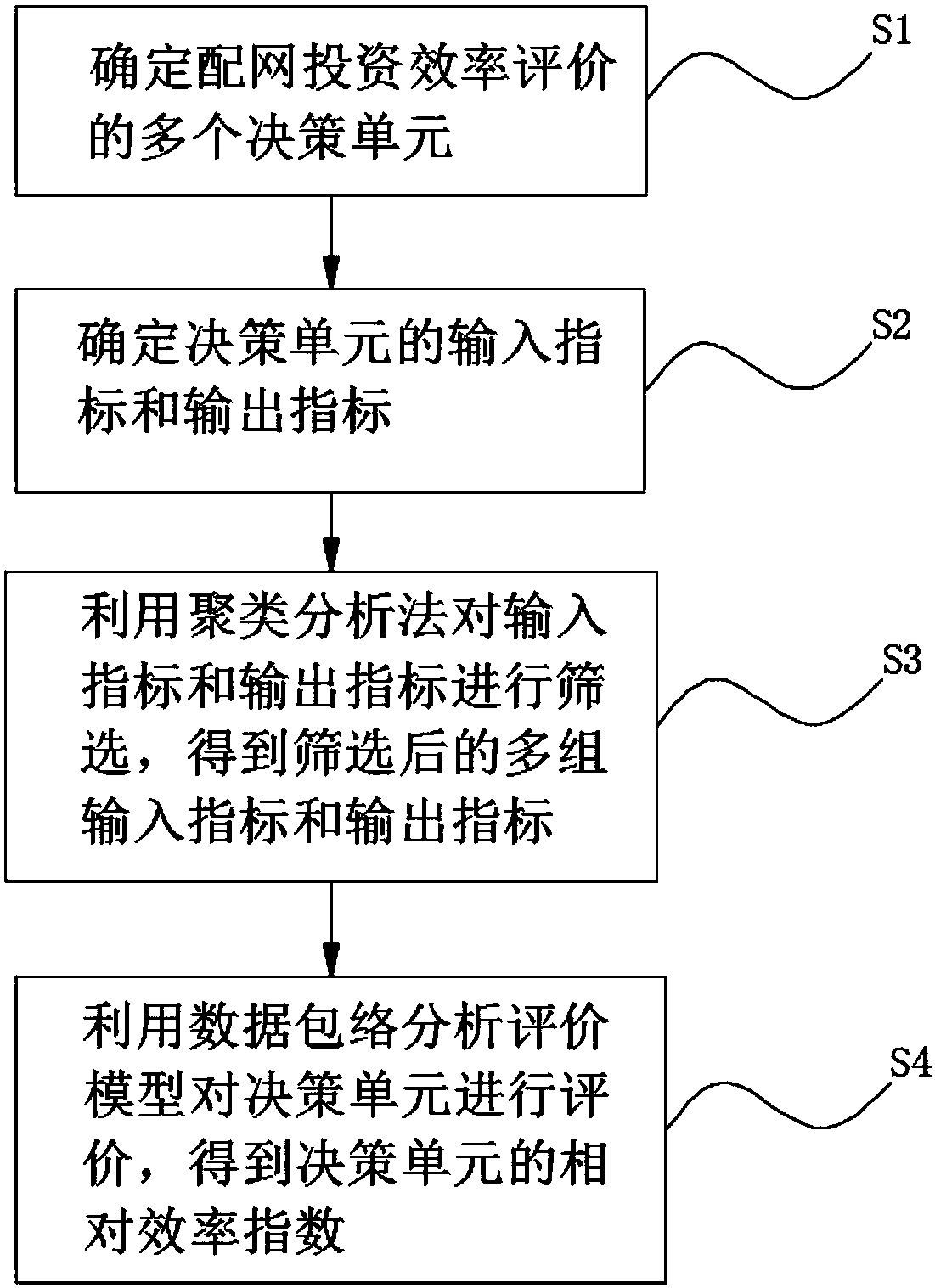

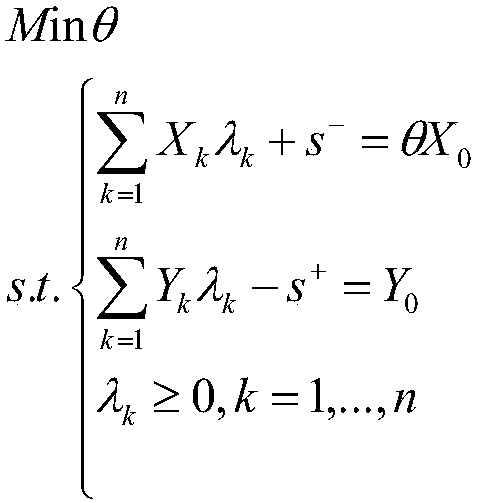

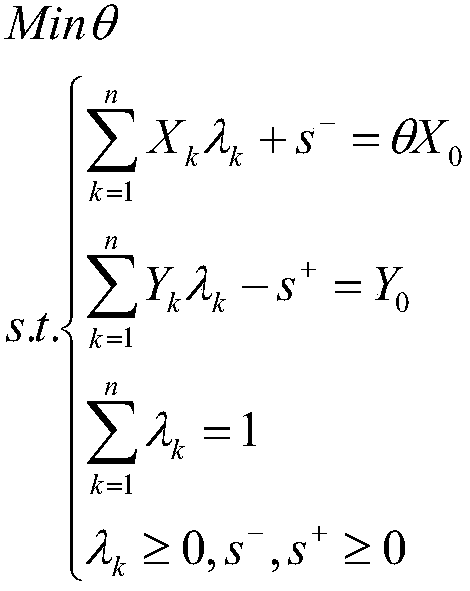

DEA analysis based distribution network investment efficiency evaluation method

InactiveCN108564245AThe evaluation result is accurateImprove satisfaction rateCharacter and pattern recognitionResourcesEvaluation resultInvestment evaluation

A DEA analysis based distribution network investment efficiency evaluation method is provided. The method comprises the following steps: S1, determining multiple decision-making units for distributionnetwork investment efficiency evaluation; S2, selecting input indicators and output indicators of the decision-making units for the distribution network investment efficiency evaluation; S3, using the clustering analysis method to classify the input indicators and output indicators of the decision-making units, and obtaining multiple sets of screened input indicators and output indicators; and S4, using a data envelopment analysis and evaluation model to evaluate the multiple decision-making units, and obtaining the relative efficiency indices of the multiple decision-making units. The methodprovided by the present invention has the following advantages that: the clustering analysis method is used to screen the distribution network investment evaluation indicators, treasonable input indicators and output indicators are screened for the DEA analysis of the distribution network investment, and the indicators that have big differences between the indicators and can properly reflect distribution network investment efficiency can be screened, so that with less and better indicators to perform DEA analysis, more accurate evaluation results can be obtained.

Owner:ELECTRIC POWER RES INST STATE GRID JIBEI ELECTRIC POWER COMPANY

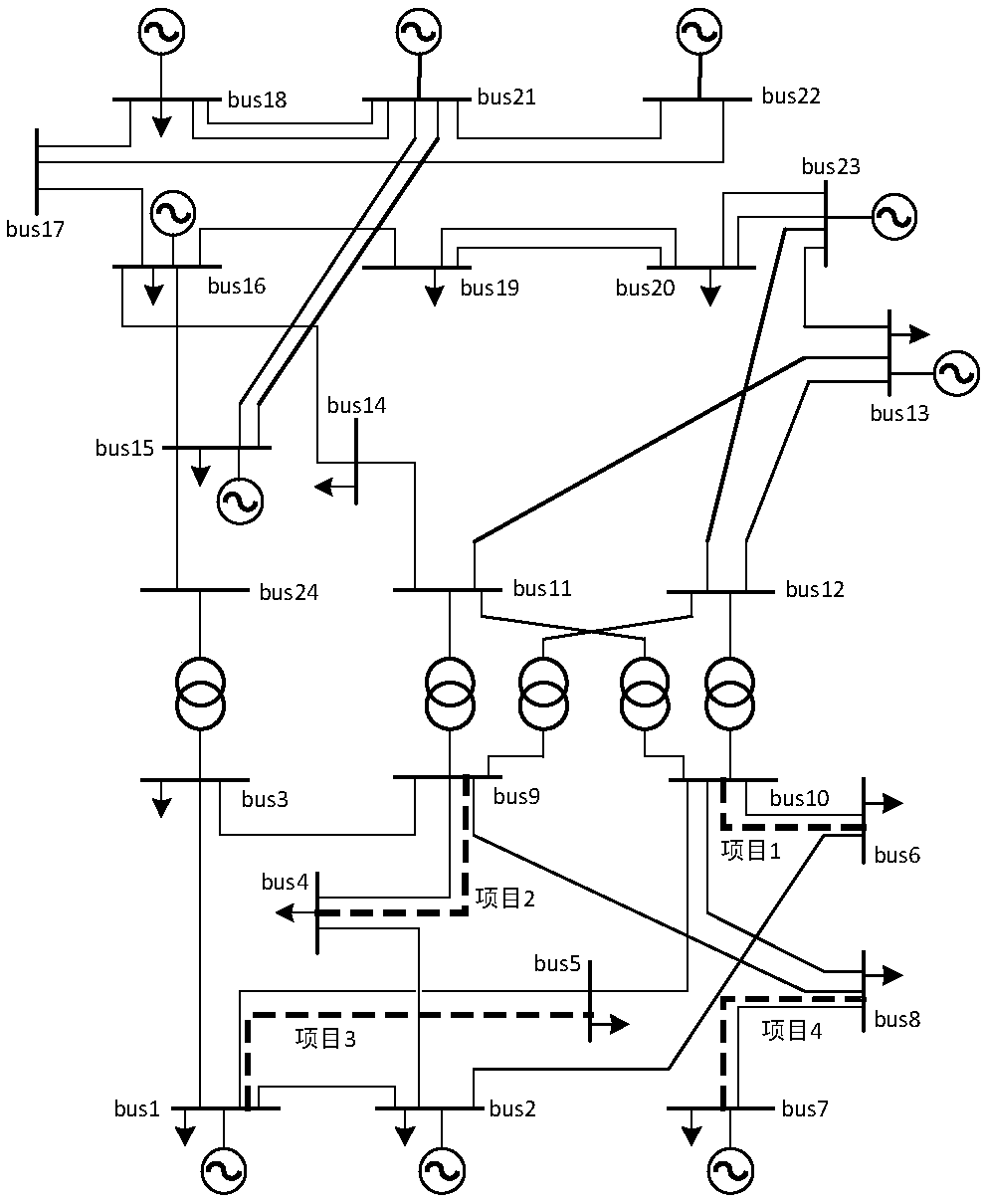

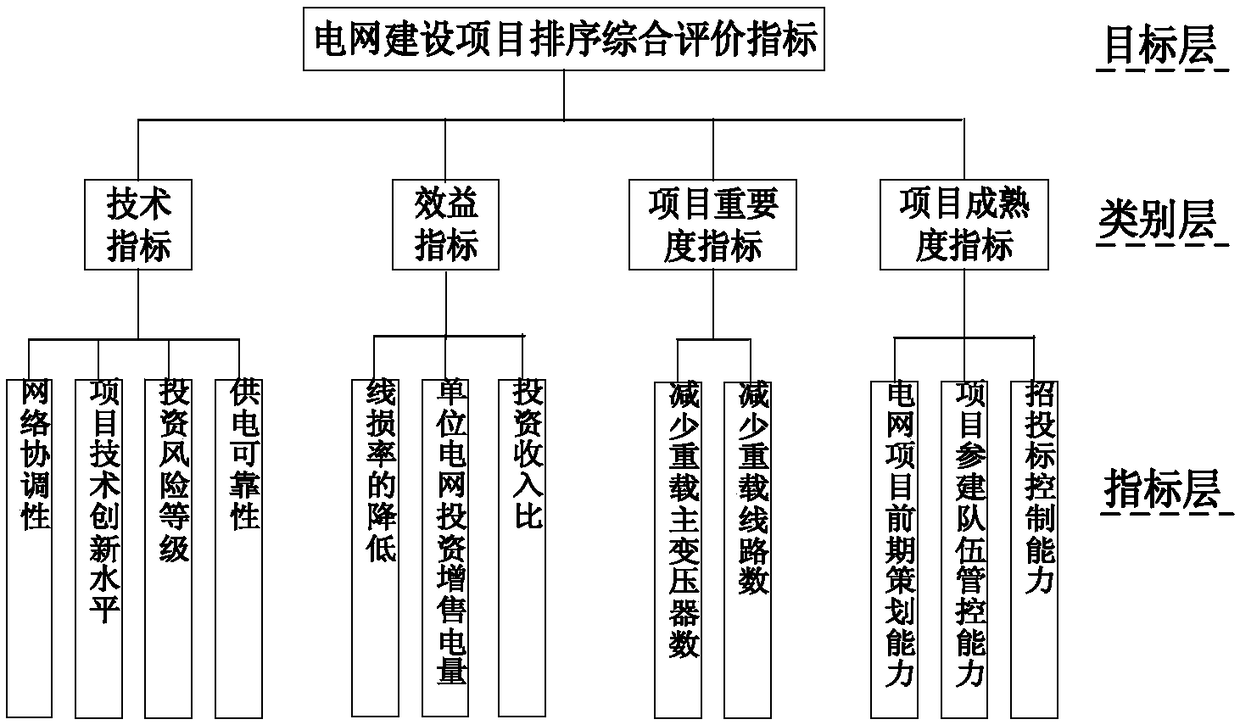

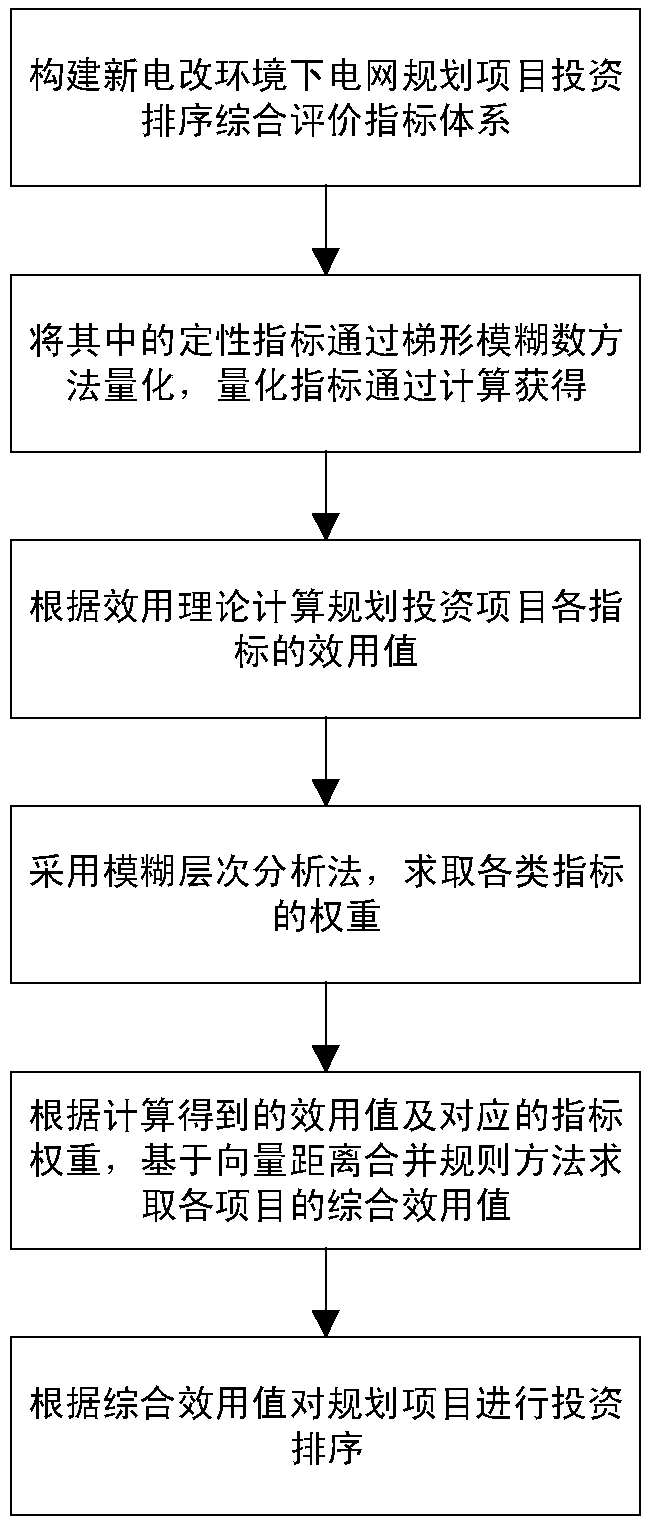

Investment ranking evaluation method of power network planning project in new electric power reform environment

ActiveCN109165809AIn line with the actual situationReduce investment riskResourcesElectricityRisk prevention

The invention discloses an investment ranking evaluation method of a power network planning project under a new electric power reform environment, belonging to the field of power network investment evaluation. Firstly, a comprehensive index system of investment ranking for power grid planning projects is constructed from four indexes: technology, benefit, project importance and project maturity. Then the qualitative indexes are quantified by trapezoidal fuzzy number method, and the quantitative indexes are obtained by calculation. Further, the utility value of each index is obtained accordingto the utility theory. The weight of each index is calculated by using fuzzy analytic hierarchy process. Finally, the utility values and weights are synthesized, and the utility values of each projectare calculated based on the vector distance consolidation rule, according to which the investment of power network planning projects is sorted. Compared with a conventional evaluation method which only considers the investment benefit, the method of the invention can consider the risk preference of the decision maker and improve the risk prevention ability of the power grid company.

Owner:JIANGSU ELECTRIC POWER CO +1

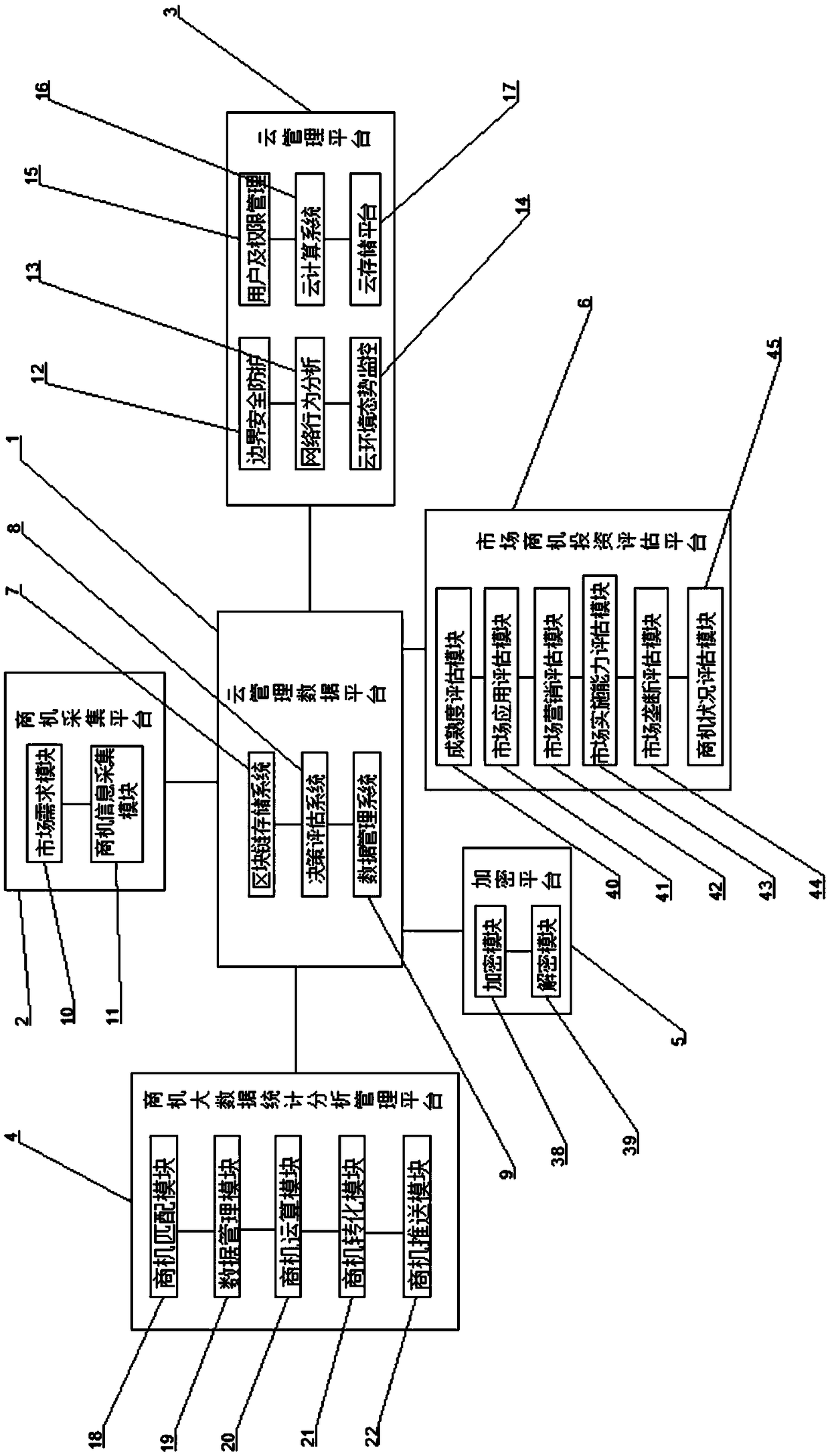

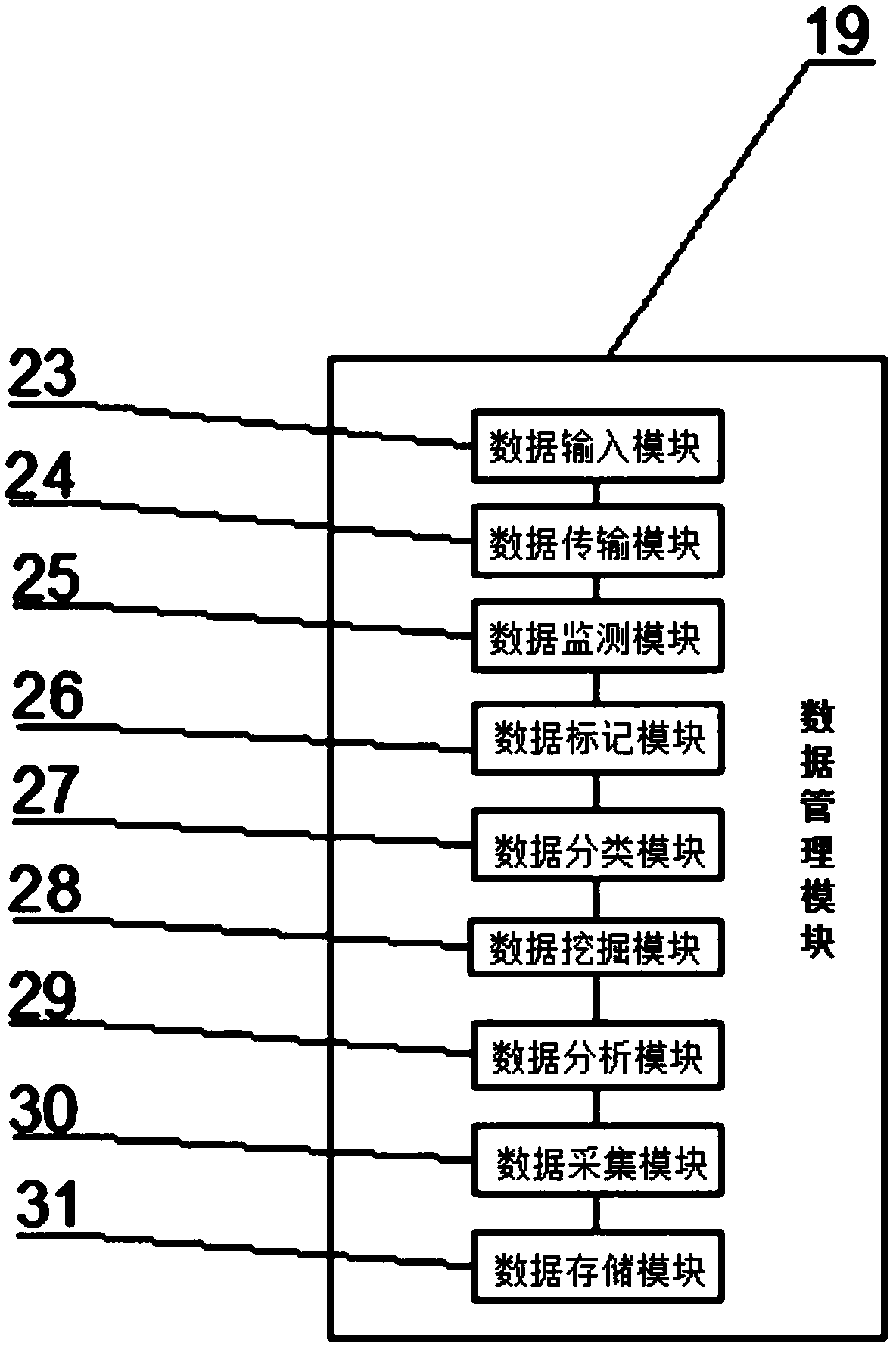

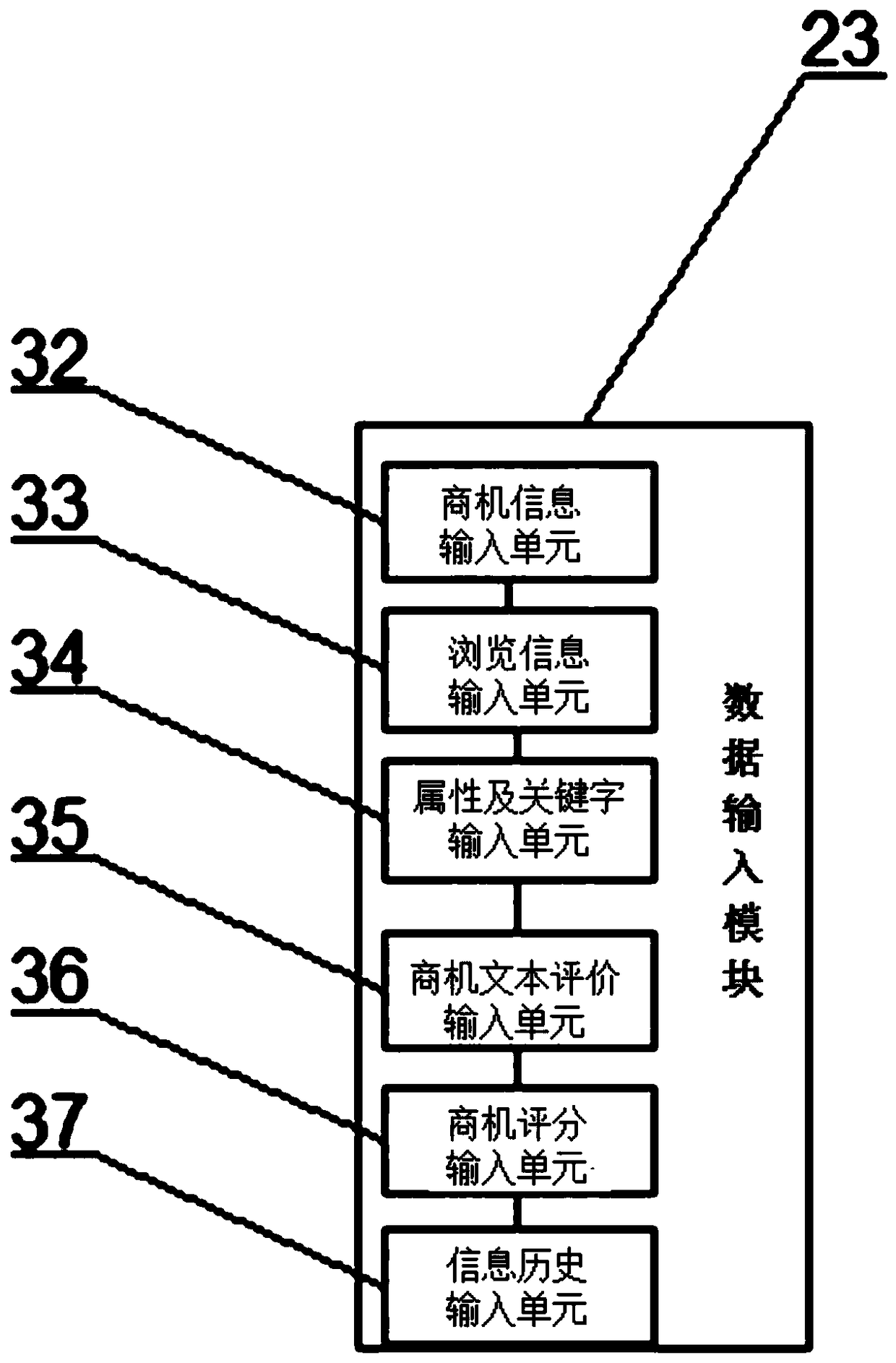

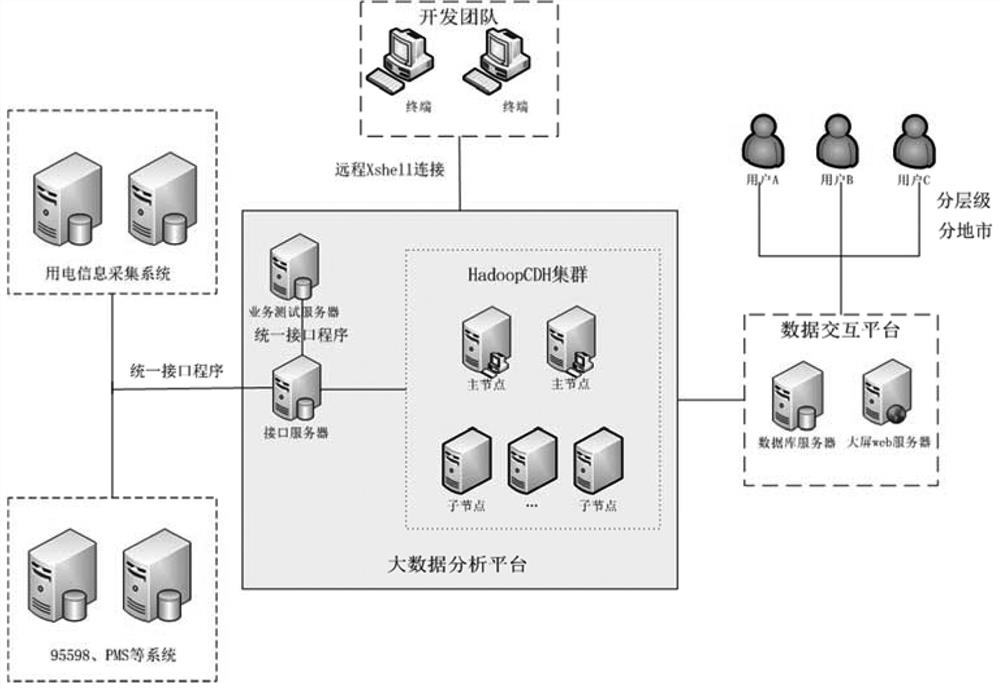

A business opportunity big data management system platform

InactiveCN109409926APrevent leakageImprove securityMarket data gatheringData informationData platform

The invention discloses a business opportunity big data management system platform, including a cloud management data platform, an opportunity collection platform, a cloud management platform, a business opportunity big data statistical analysis management platform, encryption platform and market opportunity Investment Evaluation Platform. At that same time, the opportunity acquisition platform the above-mentioned cloud management platform. A management platform for statistic and analysis of big data of business opportunities the encryption platform and the market opportunity investment evaluation platform are respectively connected with the cloud management data platform. The cloud management data platform comprises a block chain storage system, a decision evaluation system and a data management system, wherein the block chain storage system is connected with the decision evaluation system, and the decision evaluation system is connected with the data management system. Beneficial effect: The system manages the big data of the business opportunity and improves the security of the data information of the business opportunity.

Owner:安徽恒科信息技术有限公司

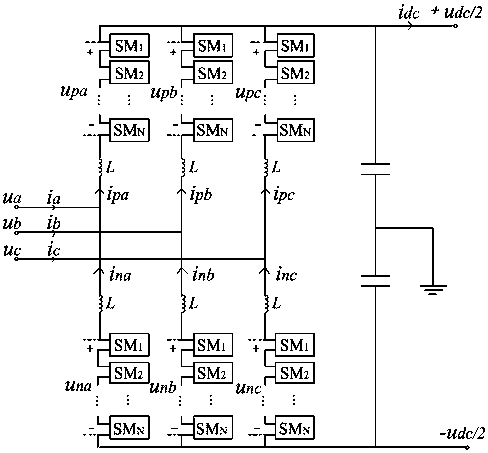

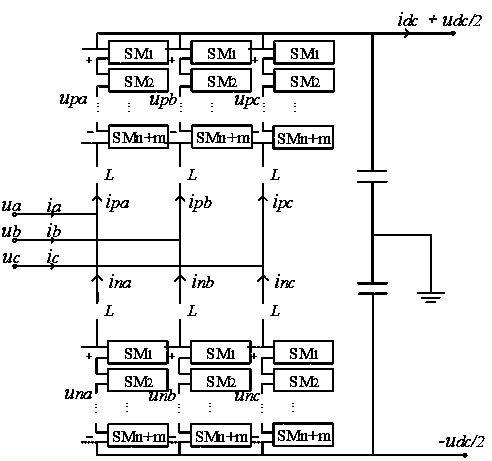

Investment evaluation model considering redundancy for flexible direct current converter

InactiveCN108155826ASmall harmonic circulationShorten charging timeAc-dc conversionElectric power transfer ac networkInvestment evaluationWork cycle

The invention relates to an investment evaluation model considering redundancy for a flexible direct current converter, and belongs to the field of flexible direct current transmission. No special redundant sub-modules are set, all the sub-modules take turns to work, and the sub-modules which are not involved in the work are the redundant sub-modules for this round; in a working cycle, appropriaten sub-modules are selected from 2 (n+m) sub-modules of one phase to be put into work, and all the remaining redundant sub-modules are also involved in sub-module sorting and switching operation at all times; after a fault occurs, the redundant sub-module is put into work through a bypass fault sub-module to replace the faulty sub-module, and at most m sub-modules can be allowed to fail. It can beensured that an MMC is always in symmetrical operation. Compared with other schemes which have asymmetrical operation situations, the investment evaluation model has the advantages that the generatedharmonic circulating current is small. Compared with other schemes which have the problem that redundant sub-modules need to be charged before being put into use, the investment evaluation model hasthe advantages that the charging time is effectively shortened, and the input sub-modules are determined only through a selection strategy to complete the input action.

Owner:GLOBAL ENERGY INTERCONNECTION RES INST CO LTD +3

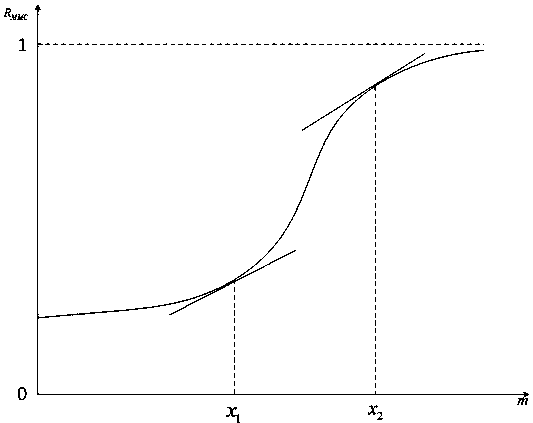

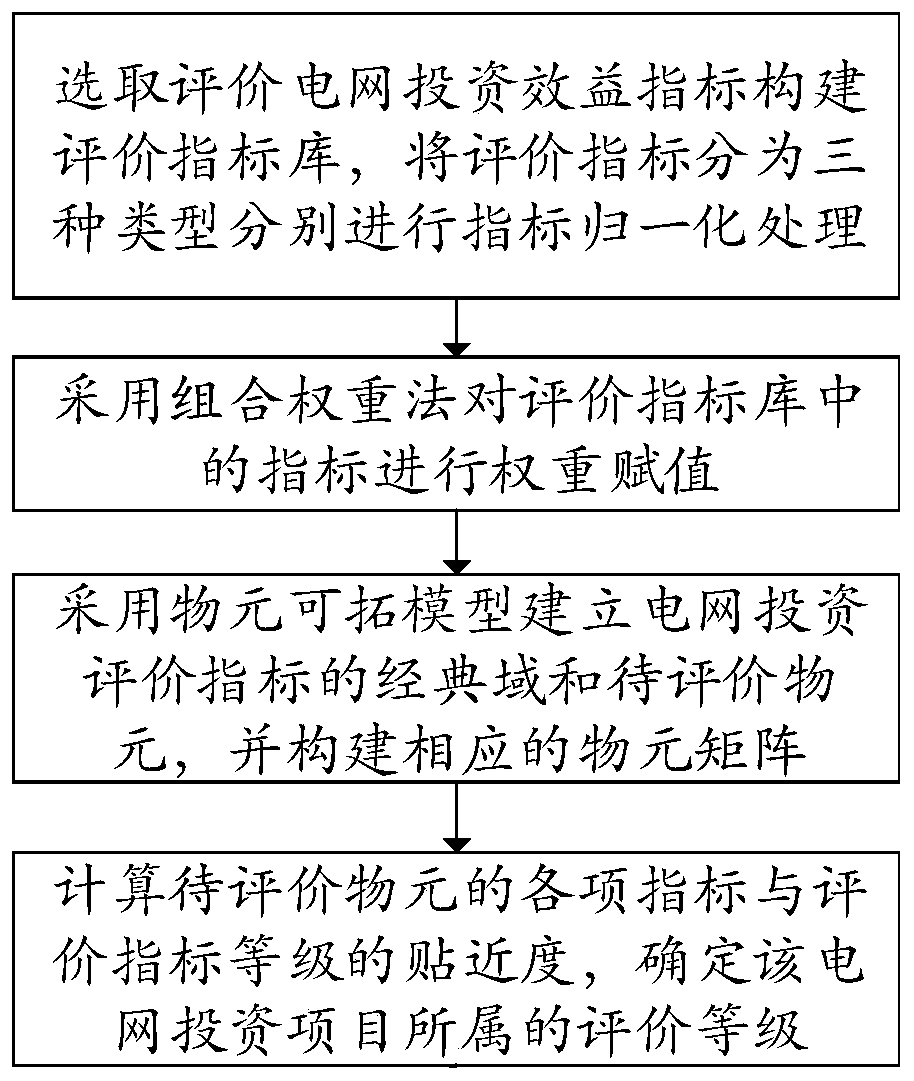

Power grid investment benefit evaluation method based on improved matter element extension model

The invention discloses a power grid investment benefit evaluation method based on an improved matter element extension model, and belongs to the technical field of power planning. According to the method, power grid investment benefit evaluation indexes are selected to construct an evaluation index library; the evaluation indexes are divided into three types to be subjected to index normalizationprocessing respectively; the method also has steps of carrying out weight assignment on indexes in the evaluation index library by adopting a combined weight method; establishing a classic domain ofa power grid investment evaluation index and a to-be-evaluated matter element by adopting a matter element extension model; constructing a corresponding matter element matrix, calculating the closeness between each index of the matter element to be evaluated and the evaluation index level, and finally determining the evaluation level to which the power grid investment project belongs. The power grid investment project evaluation method can accurately and effectively evaluate the benefit of the power grid investment project and overcome the defects that a traditional evaluation model is insufficient in directionality and low in information utilization rate, and the power grid investment project evaluation method can be used for evaluating the benefit of the power grid investment project accurately and effectively.

Owner:CHUZHOU POWER SUPPLY CO OF STATE GRID ANHUI ELECTRIC POWER CORP +1

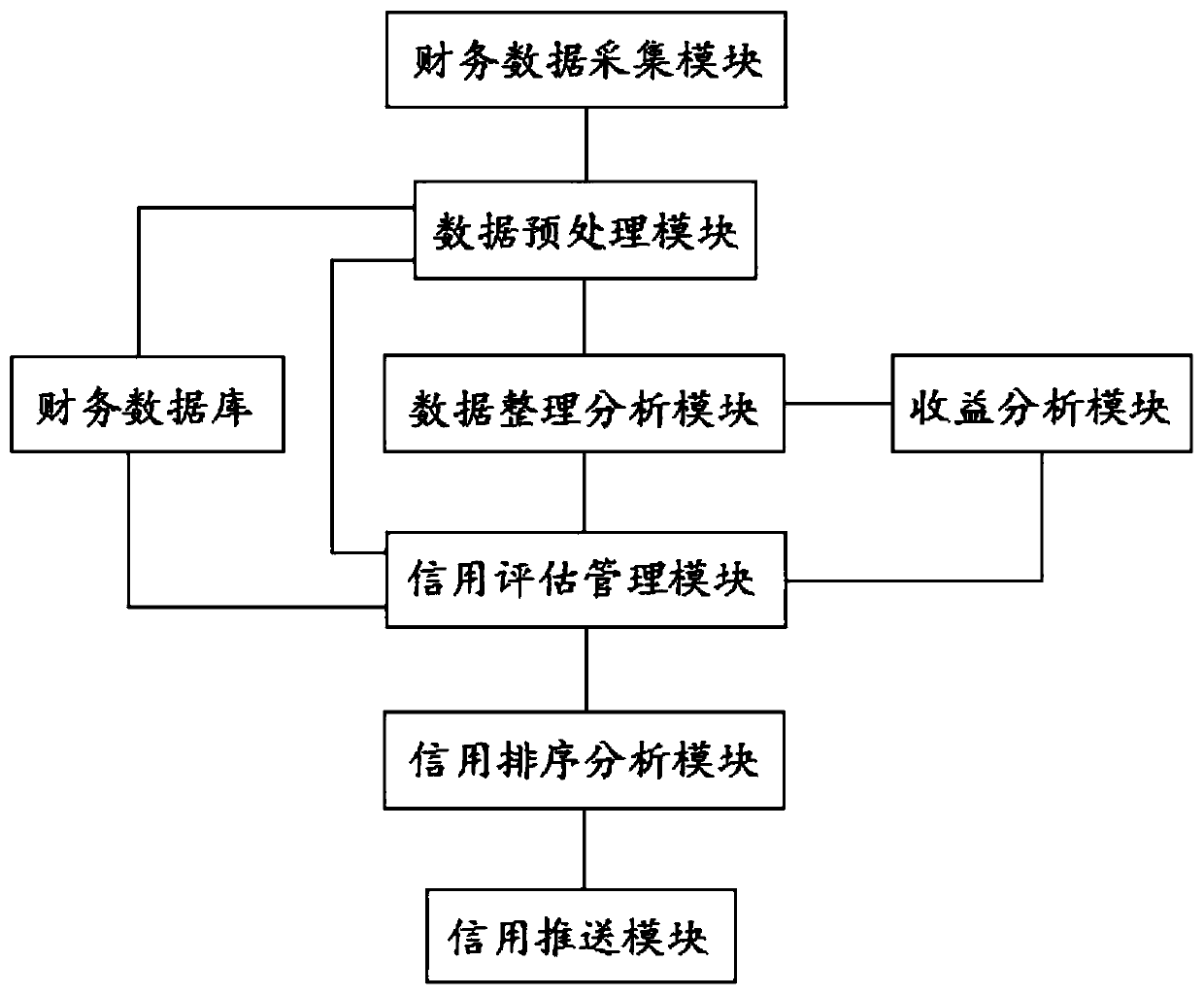

Investment management service system based on credit system

The invention discloses an investment management service system based on a credit system. The investment management service system comprises a financial data acquisition module, a data preprocessing module, a data arrangement and analysis module, a financial database and revenue analysis module and a credit evaluation management module. The system performs the following steps: collecting basic financial information of a to-be-funded enterprise; preprocessing, analyzing and evaluating the basic financial information of the to-be-funded enterprise; obtaining an investment credit evaluation coefficient of each to-be-funded enterprise; screening the investment credit evaluation coefficient of each investment enterprise and a set investment credit evaluation coefficient threshold value; and sorting according to the descending order of the investment credit evaluation coefficients, and pushing the sorted investment credit evaluation coefficients to the investment users in sequence. The system is convenient for analyzing the credit of each to-be-funded enterprise, has the characteristic of high accuracy, provides reliable investment evaluation analysis for investment users, avoids the situation that the investment users cannot effectively screen the funded enterprises, and provides reliable investment pushing service for investment management of the investment users.

Owner:北京智云信国际信用评价有限公司

Method and product for calculating a net operating income audit and for enabling substantially identical audit practices among a plurality of audit firms

InactiveUS7353228B2Uniform resultConsistent resultComplete banking machinesFinanceInvestment evaluationDocumentation procedure

Deployment of a computer program including a global NOI audit model together with standards, procedures, documentation, and reporting requirements in interactive, digital form to a plurality of audit firms operating independently of each other and having a reporting relationship with an investment entity. The program is adapted for receiving audit data from a respective audit firm in connection with an associated real estate property and for generating an associated respective Current NOI audit report. The specific fields and screen arrangements, together with interactive instructions and definitions of the program require that each audit firm identify a consistent set of input parameters and apply them in a consistent way, as driven by the global audit model, thereby assuring computation and transmission of structurally consistent Current NOI audit reports to the investment entity, wherein the Current NOI calculations have been developed by substantially identical audit practices, procedures and assumptions. Using the same program, the investment entity then calculates and stores an Underwriting NOI set of values corresponding to each Current NOI report for the purpose of investment evaluation. The program generates a consolidated report of both Current and Underwriting NOI values for all of the plurality of audit firms so that the investment entity can effect a uniform analysis of all investment properties under consideration.

Owner:GE CAPITAL US HLDG INC +1

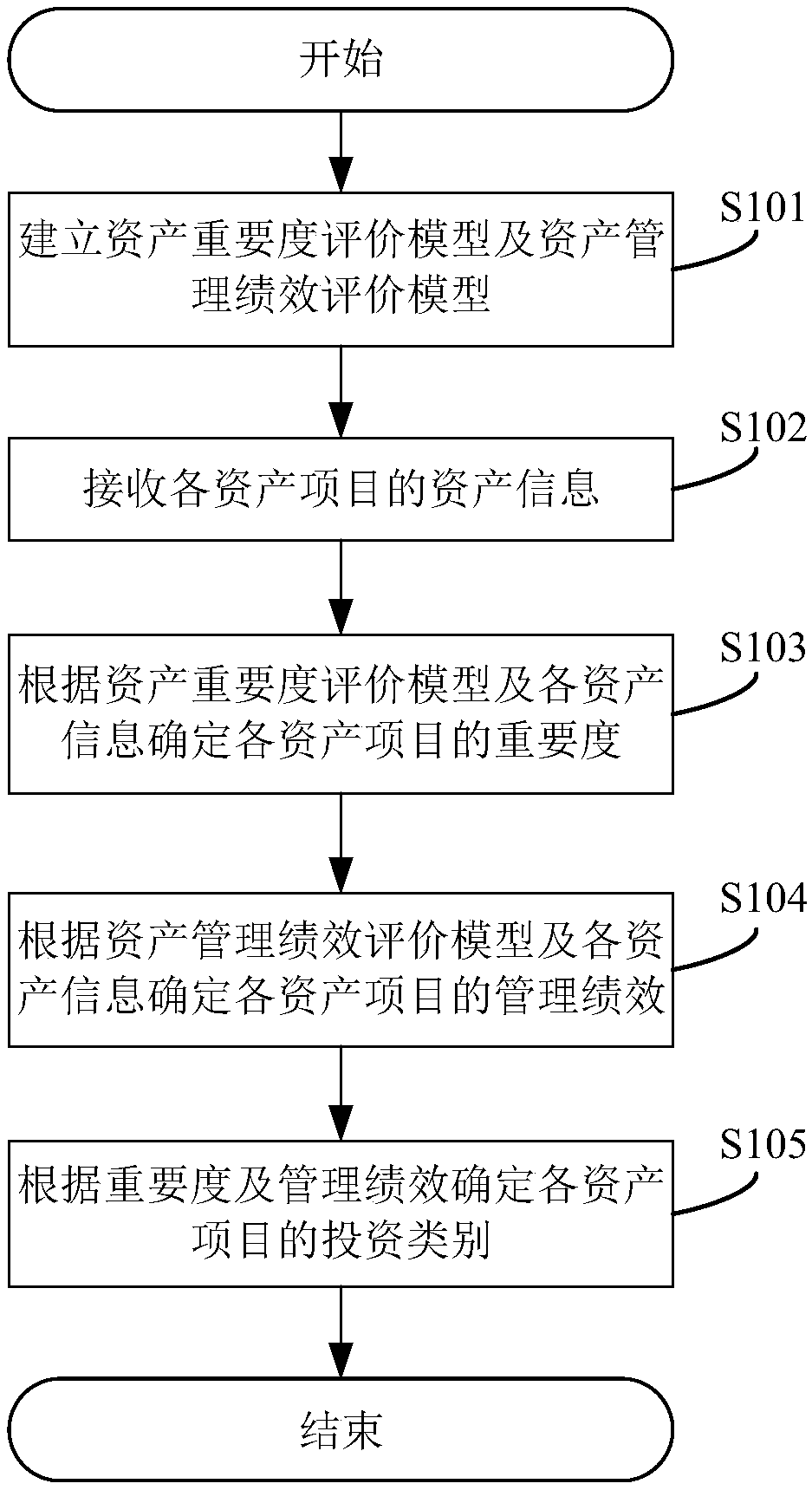

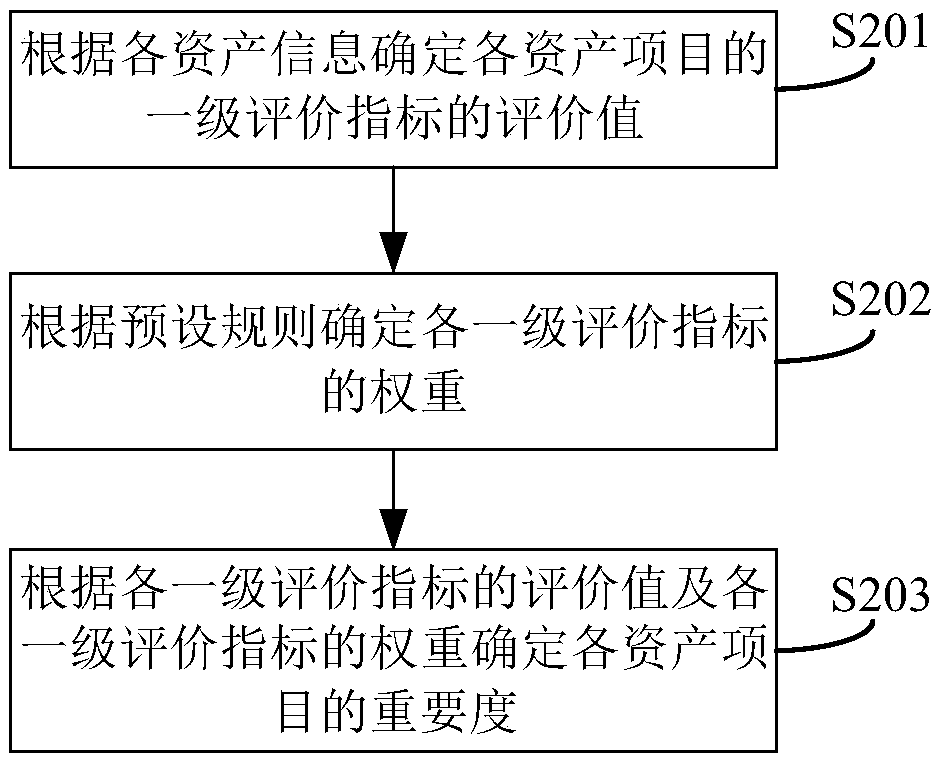

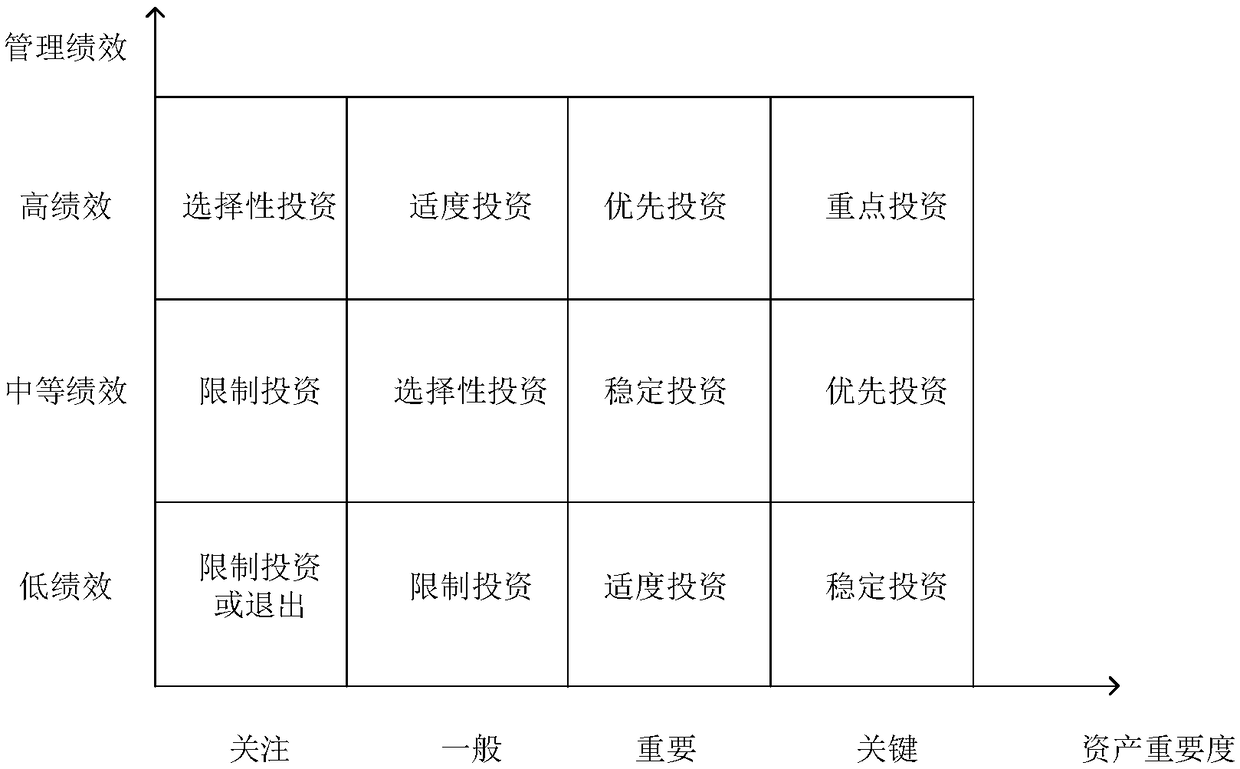

Asset project investment classification method and system and server

InactiveCN108921425ADecide on an investment strategyBroaden applicationFinanceResourcesInvestment evaluationClassification methods

The invention discloses an asset project investment classification method. The method comprises the steps that an asset importance evaluation model and an asset management performance evaluation modelare established; asset information of each asset project is received; the importance of each asset project is determined according to the asset importance evaluation model and the corresponding assetinformation; management performance of each asset project is determined according to the asset management performance evaluation model and the corresponding asset information; and the investment category of each asset project is determined according to the importance and the management performance. According to the method, the investment category of each asset project is determined depending on the two dimensions of asset importance and asset management performance, it is convenient for a user to decide an investment strategy of each asset project according to the corresponding investment category, application and feedback of asset importance and asset management performance evaluation are improved, and a power grid enterprise is helped to perform more scientific and reasonable asset investment evaluation. The invention meanwhile provides an asset project investment classification system, a server and a computer readable storage medium. The asset project investment classification system, the server and the computer readable storage medium have the above advantages.

Owner:GUANGDONG POWER GRID CO LTD +1

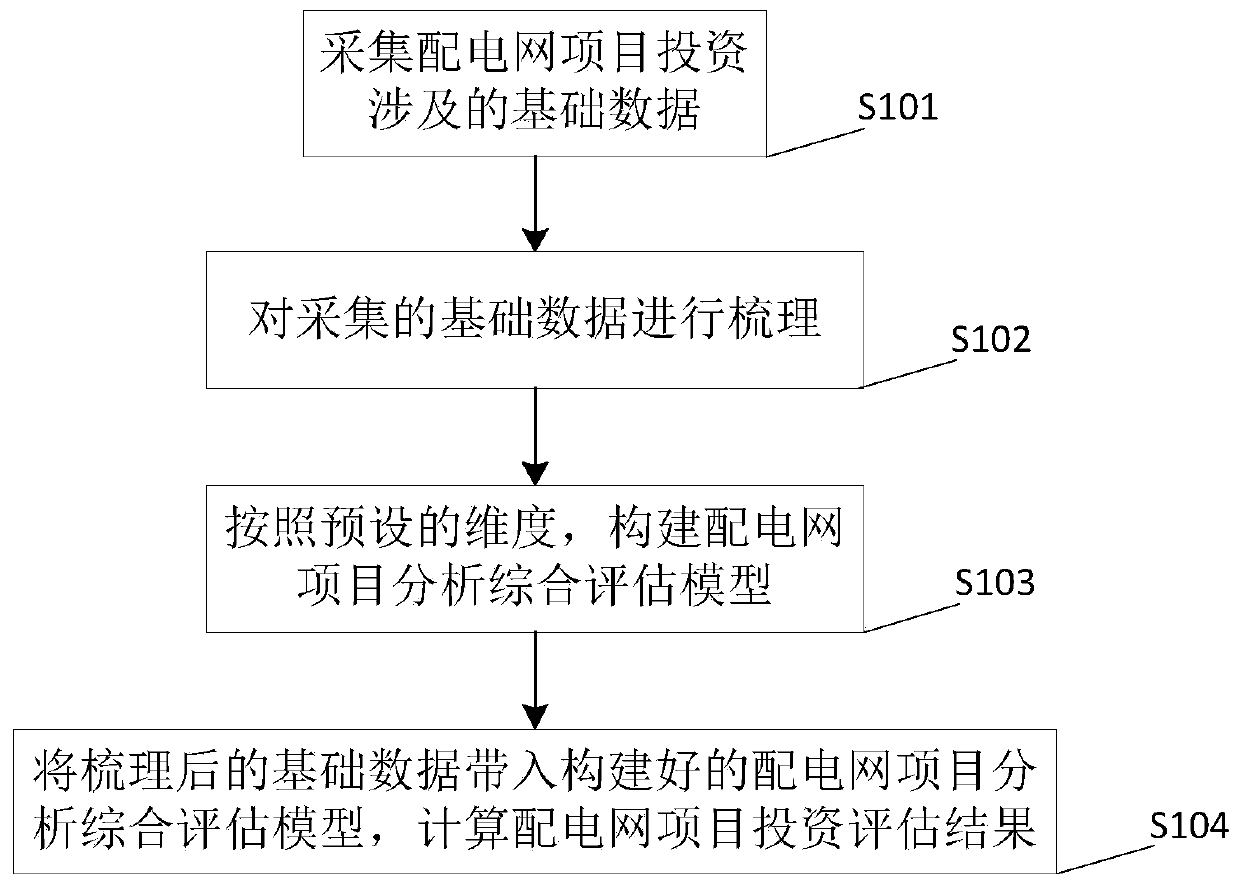

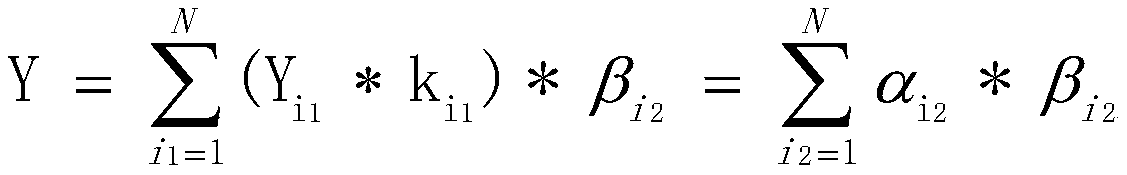

Power distribution network project investment evaluation method and system

PendingCN111178676AAccurately reflect investment statusOffice automationResourcesInvestment evaluationData mining

The invention discloses a power distribution network project investment evaluation method and system. Basic data related to power distribution network project investment is collected; data is carded,according to a preset dimension, a power distribution network project analysis comprehensive evaluation model is constructed, the sorted basic data is substituted into the power distribution network project analysis comprehensive evaluation model, and a power distribution network project investment evaluation result is calculated, so that the power distribution network investment condition can beaccurately reflected from comprehensive multi-dimensional data, and data support is provided for power distribution network investment.

Owner:BEIJING GUODIANTONG NETWORK TECH CO LTD +2

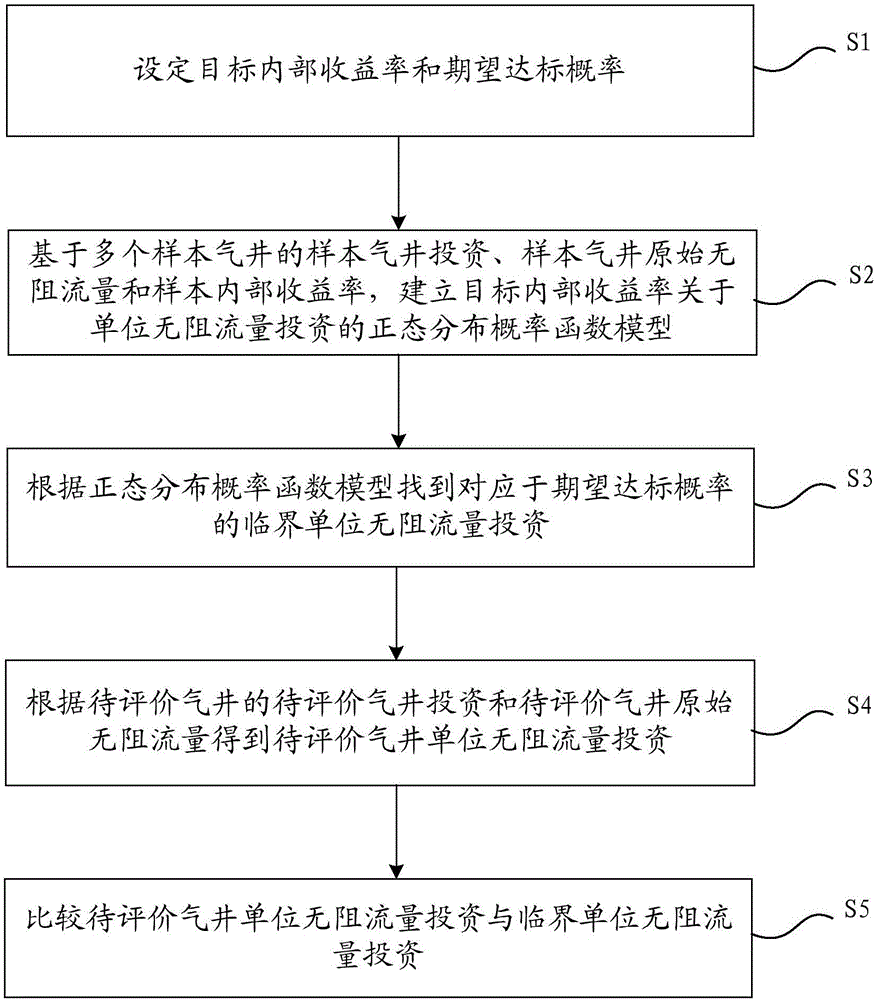

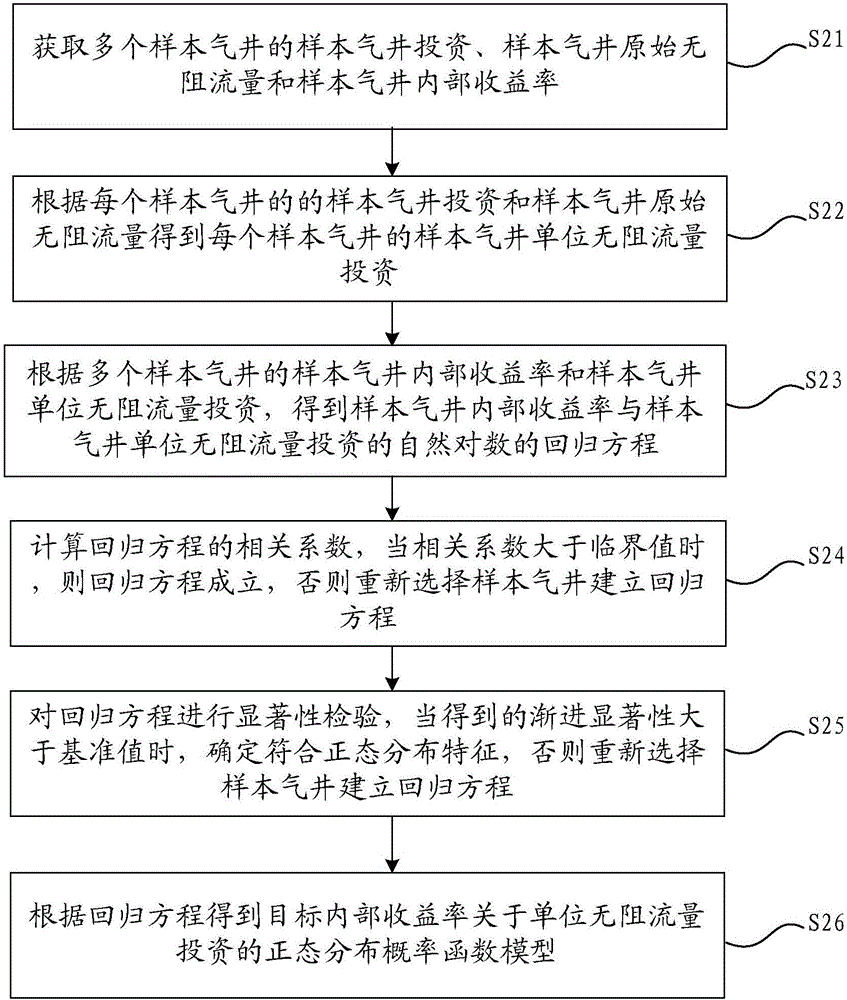

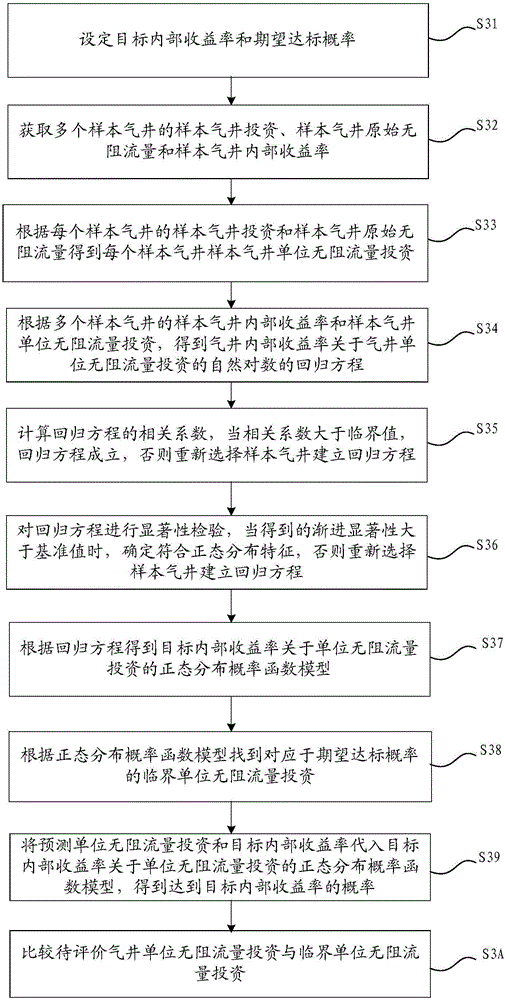

Gas well investment evaluation method and device

InactiveCN106504095AOvercome the shortcoming of lagging benefit evaluationShorten the decision cycleFinanceHysteresisInvestment evaluation

The invention discloses a gas well investment evaluation method and device. The method comprises the following steps: setting a target internal yield rate and an expected target-reaching probability; establishing a normal distribution probability function model of the target internal yield rate with respect to a unit open flow capacity investment based on the sample gas well investment of the sample gas wells, the original open flow capacity of the sample gas wells, and the sample internal yield rate; finding out the critical unit open flow capacity investment corresponding to the expected target-reaching probability according to the normal distribution probability function model; obtaining the unit open flow capacity investment of the gas well to be evaluated according to the gas well investment to be evaluated of the gas well to be evaluated and the original open flow capacity of the gas well to be evaluated; comparing the unit open flow capacity investment of the gas well to be evaluated with the critical unit open flow capacity investment. The method and device may perform investment evaluation after acquiring gas well original open flow capacity and budgeting the investment after oil testing, greatly advances the gas well benefit evaluation time, overcomes the hysteresis of the traditional gas well benefit evaluation, and shortens a gas field development and construction investment decision cycle.

Owner:PETROCHINA CO LTD

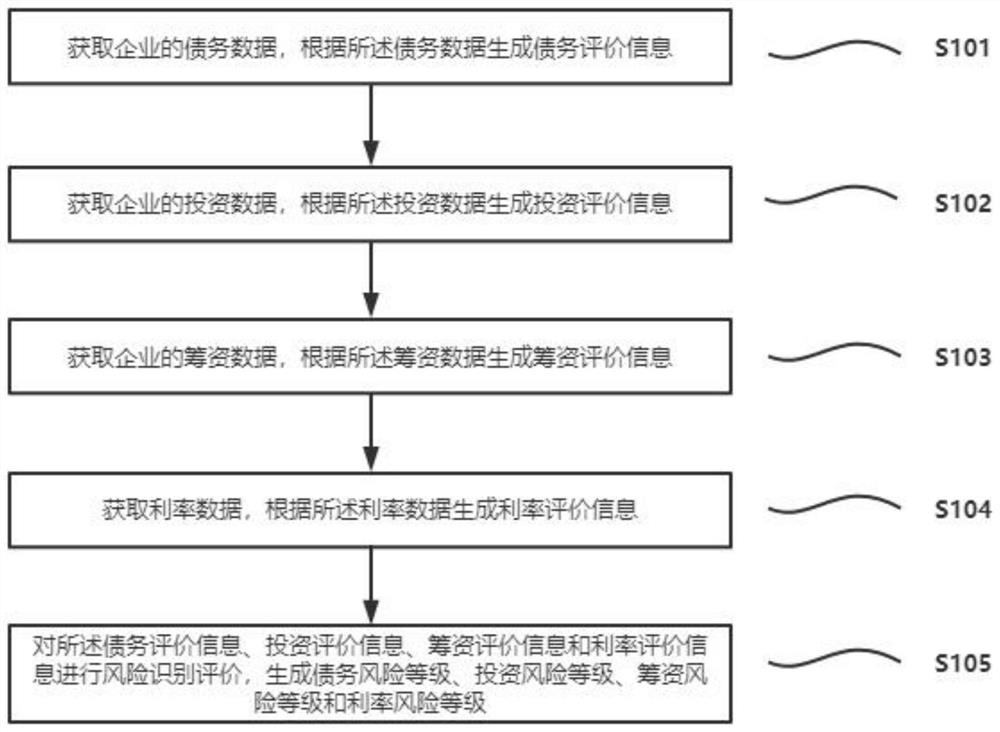

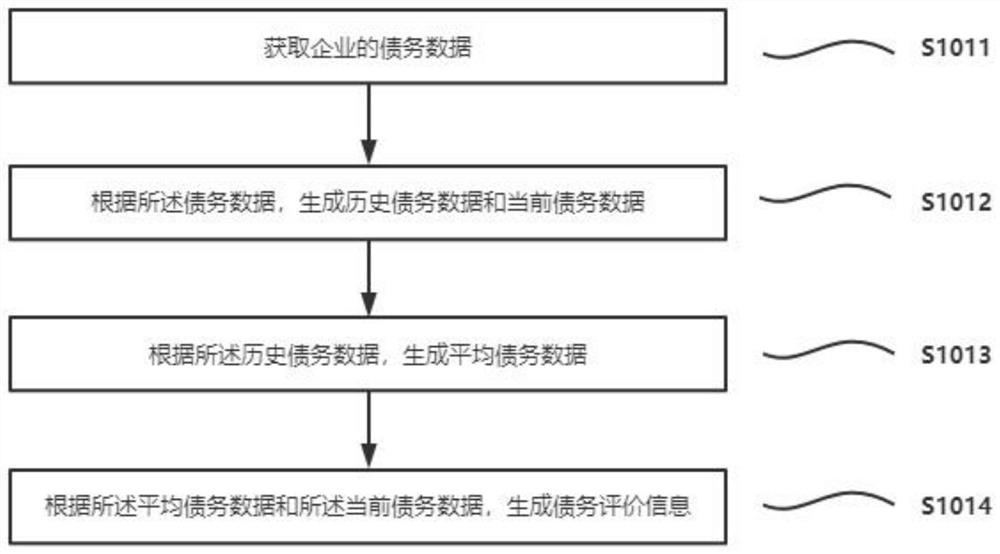

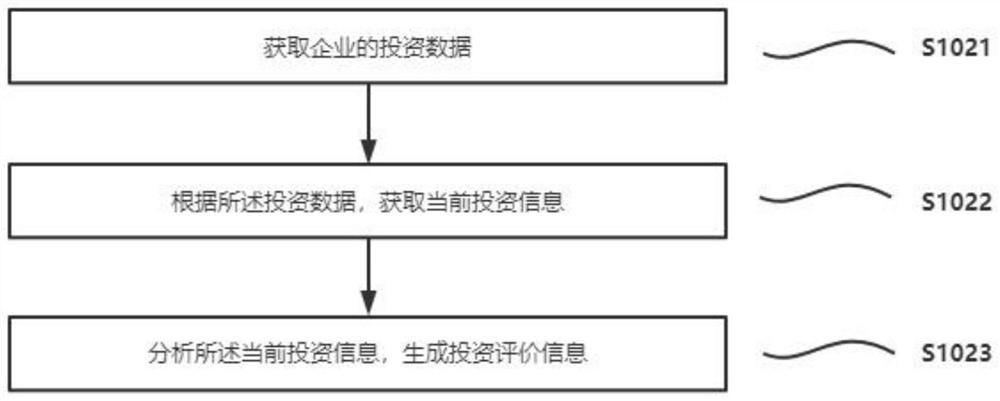

Enterprise financial management risk identification method and system

PendingCN114266667AQuick judgmentAvoid slow recognitionFinanceResourcesRisk levelInvestment evaluation

The embodiment of the invention relates to the field of enterprise financial management, and particularly discloses an enterprise financial management risk identification method and system. According to the embodiment of the invention, debt data of an enterprise is obtained, and debt evaluation information is generated according to the debt data; obtaining investment data of an enterprise, and generating investment evaluation information according to the investment data; obtaining financing data of an enterprise, and generating financing evaluation information according to the financing data; obtaining interest rate data, and generating interest rate evaluation information according to the interest rate data; and according to the debt evaluation information, the investment evaluation information, the financing evaluation information and the interest rate evaluation information, generating a debt risk level, an investment risk level, a financing risk level and an interest rate risk level. The financial management risk of the enterprise can be quickly judged and identified according to the debt data, the investment data, the financing data and the interest rate data of the enterprise, the debt risk, the investment risk, the financing risk and the interest rate risk can be respectively subjected to grade evaluation, and the risk identification is accurate.

Owner:深圳工博达策科技有限公司

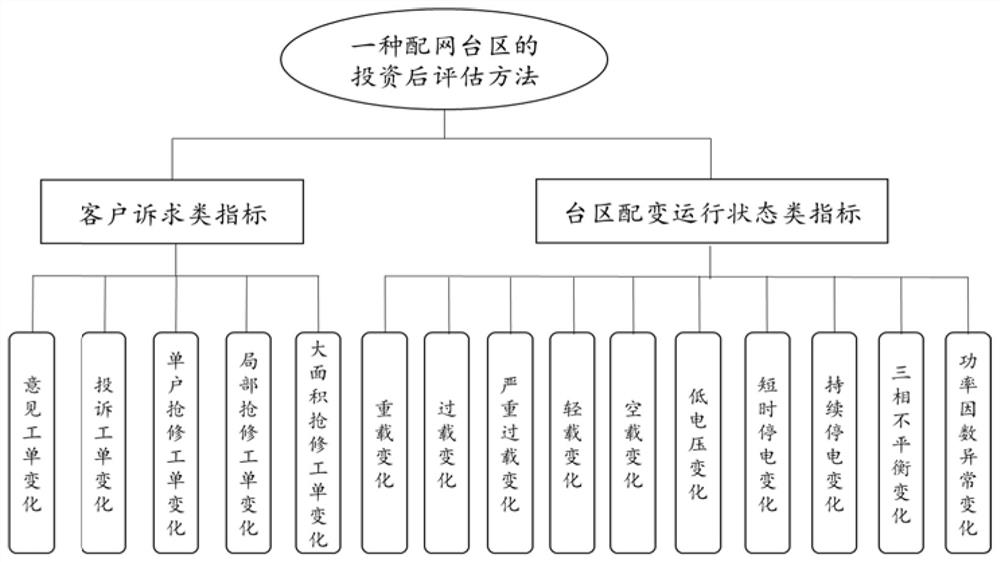

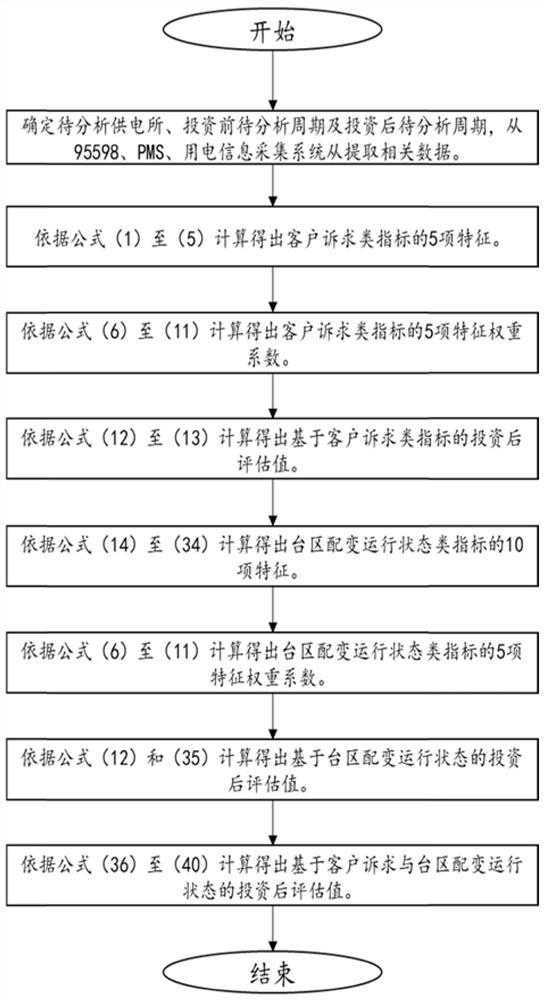

Post-investment evaluation method for distribution network district

PendingCN111724057AEfficient use ofInvest comprehensively and convincinglyResourcesDistribution transformerInvestment evaluation

The invention relates to a post-investment evaluation method for a distribution network district, and the method comprises the following steps: (1), taking a power supply station as a unit, and collecting customer appeal indexes and district distribution transformer operation state indexes in the same time period before and after the investment of the distribution network district in a jurisdiction region of the power supply station; (2) respectively utilizing an AHP analytic hierarchy process to obtain a post-investment evaluation value based on customer appeals and a post-investment evaluation value based on a transformer district distribution transformer operation state; and (3) performing weighted summation on the post-investment evaluation value based on the customer appeal and the post-investment evaluation value based on the district distribution transformer operation state to finally obtain a comprehensive post-investment evaluation value of the power supply station. The higherthe score is, the better the investment effect is. Based on customer appeal information and operation state data, a big data means is applied, and the transformer area investment effect is comprehensively evaluated in a multi-dimensional mode.

Owner:STATE GRID HEBEI ELECTRIC POWER RES INST +2

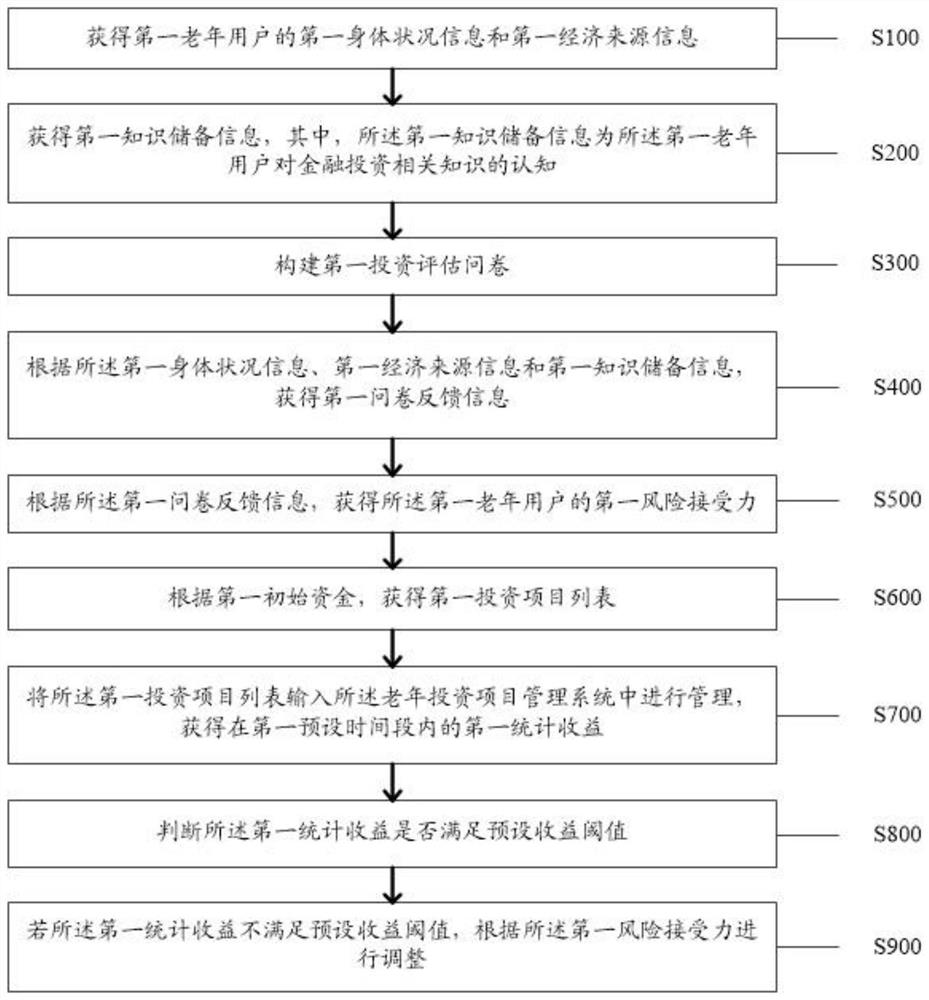

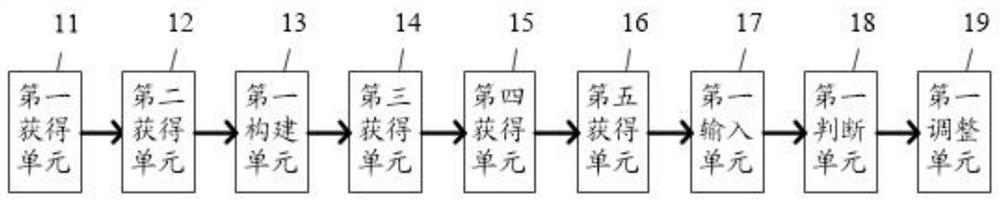

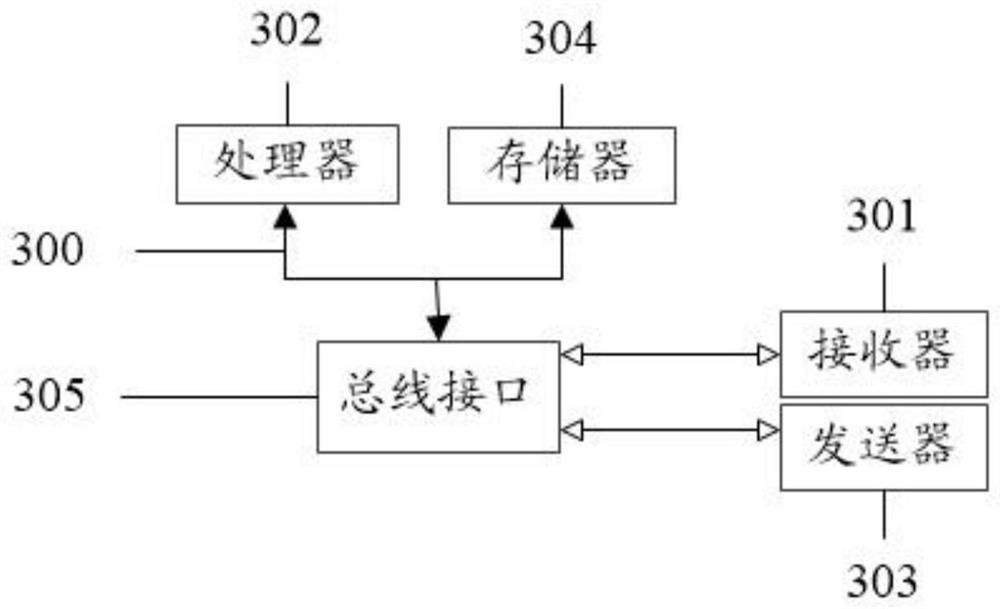

Intelligent management method and system based on financial investment project

PendingCN113256432AOptimize management systemImprove securityFinanceNeural learning methodsInvestment evaluationIntelligent management

The invention discloses an intelligent management method and system based on a financial investment project, the method is applied to an elderly investment project management system, and the method comprises the steps: obtaining first physical condition information and first economic source information of a first elderly user; obtaining first knowledge reserve information; constructing a first investment assessment questionnaire; obtaining first questionnaire feedback information according to the first physical condition information, the first economic source information and the first knowledge reserve information so as to obtain first risk acceptance of the first elderly user; obtaining a first investment project list according to the first initial fund; inputting the first investment project list into the elderly investment project management system for management, obtaining a first statistical income in a preset time period, and judging whether the first statistical income meets a preset income threshold value or not; and if not, performing project adjustment. The technical problems that in the prior art, an old people investment management system is not intelligent enough and the safety is not perfect are solved.

Owner:牛少侠科技山西有限公司

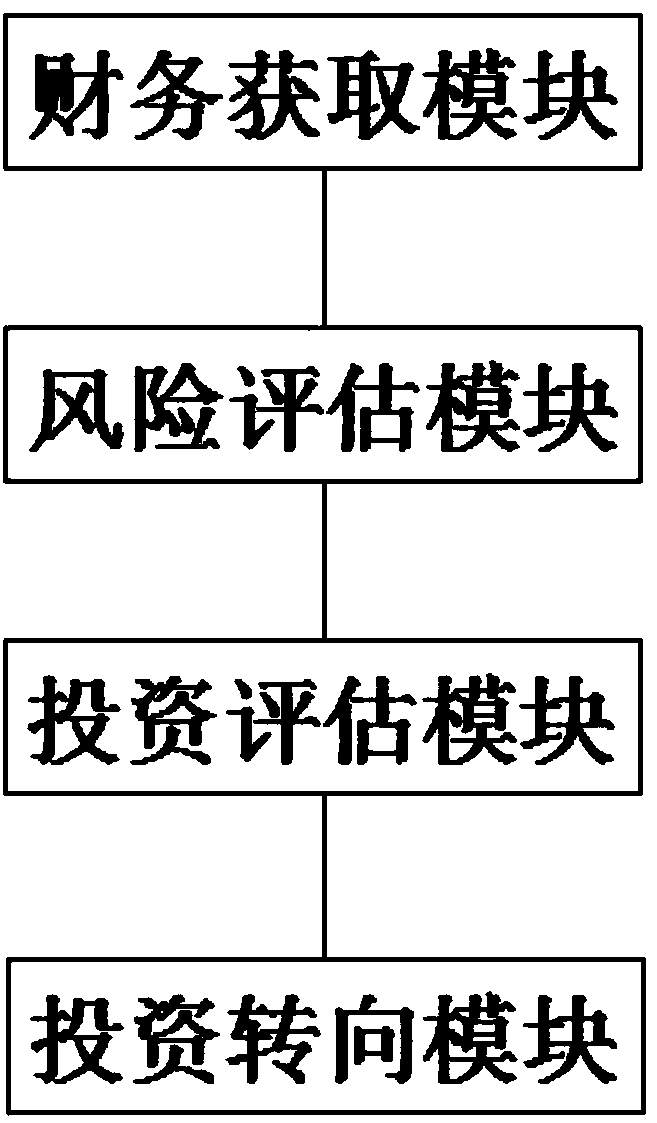

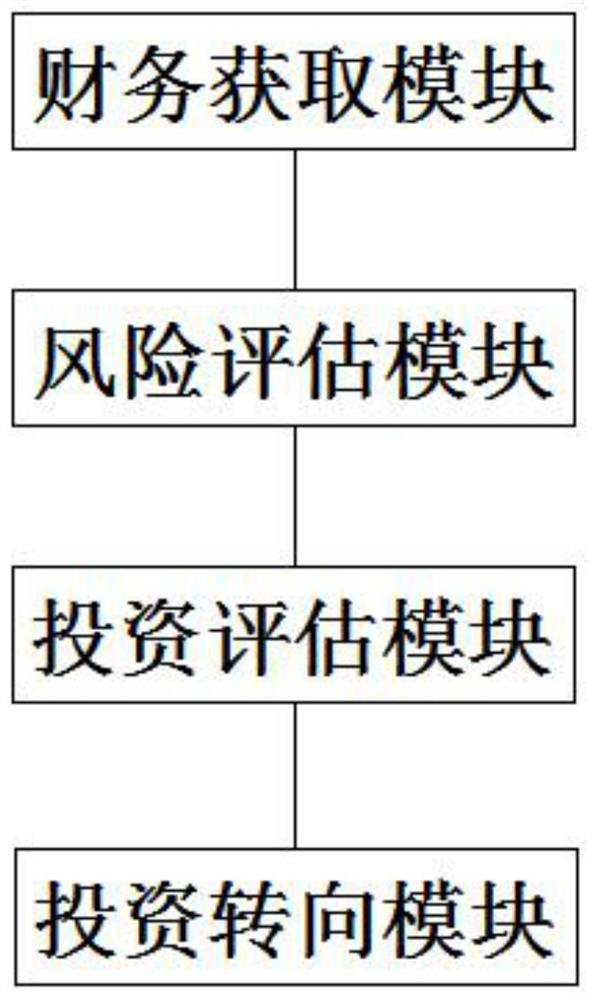

Investment auditing management analysis system

ActiveCN108510171AHelps to chooseImprove the efficiency of investment auditFinanceResourcesInvestment evaluationIncome level

The invention discloses an investment auditing management analysis system. The system includes a finance acquisition module, a risk evaluation module, an investment evaluation module and an investmentsteering module. The finance acquisition module is used for acquiring running information of enterprises under investment and current income and expenditure situations acquired by investment, and sequentially sending the same to the risk evaluation module according to an order of sums of income-expenditure differences. The risk evaluation module receives information, which is sent by the financeacquisition module, to determine risk factors and income level factors of investment, and sending the same to the investment evaluation module. The investment evaluation module is used for judging investment comprehensive-coefficients of all the enterprises under investment, and outputting the investment comprehensive-coefficients to the investment steering module. According to the system, the risk coefficients and the income level coefficients of the enterprises under investment are calculated through the risk evaluation module, the investment comprehensive-coefficients are evaluated throughthe investment evaluation module to screen out enterprises of higher investment comprehensive-coefficients under investment, selection of an administrator on the enterprises under investment is facilitated, and efficiency of investment auditing is improved.

Owner:安徽天勤盛创信息科技股份有限公司

A filling system and filling method for measuring point data

InactiveCN103440283BImprove accuracyHigh precisionSpecial data processing applicationsData displayStatistical analysis

The invention discloses a vacancy filling system for measured point data and a vacancy filling method. The vacancy filling system comprises a business indicator data detecting system and a data filling system connected with a business indicator data detecting module, wherein the business indicator data detecting system comprises a source business indicator database module, a data access module connected with the source business indicator database module, a business logic module connected to the data access module, and a data display module connected to the business logic module; and a linear regression filling system, a mean value filling system and an artificially filling system are arranged in the data filling system. According to the vacancy filling system and the vacancy filling method disclosed by the invention, the correctness of business data is greatly improved, the computation precision of a statistic data group is improved, a statistic analysis result is more reliable, and more advantageous data support is provided for jobs such as enterprise investment evaluation and benefit analysis.

Owner:NORTH CHINA ELECTRIC POWER UNIV (BAODING) +1

Multi-dimensional evaluation and precise construction evaluation method based on coverage and value association

ActiveCN109327841BEnhance construction valueImprove efficiencyTransmissionNetwork planningInvestment evaluationNetwork awareness

The invention discloses a multi-dimensional assessment and precise construction investment evaluation method based on coverage and value relevance and relates to the technical field of big data analysis in data communication. The method disclosed by the invention performs multi-dimensional analysis on an MR poor coverage ratio, a quantity of MR sampling points, user flow, number of users, user perception data and / or user set information, field road test data, complaint information and suppression flow big data, so that indoor values are excavated, precise planning is performed, site building value is effective improved, service turn-around time is shortened, a network awareness word-of-mouth image of an operator is improved, and finally enterprise benefit is improved.

Owner:湖南华诺科技有限公司

An Abnormal Data Detection and Correction Method Based on Numerical Correlation Model

InactiveCN103514259BImprove accuracyHigh precisionSpecial data processing applicationsStatistical analysisBenefit analysis

Owner:NORTH CHINA ELECTRIC POWER UNIV (BAODING)

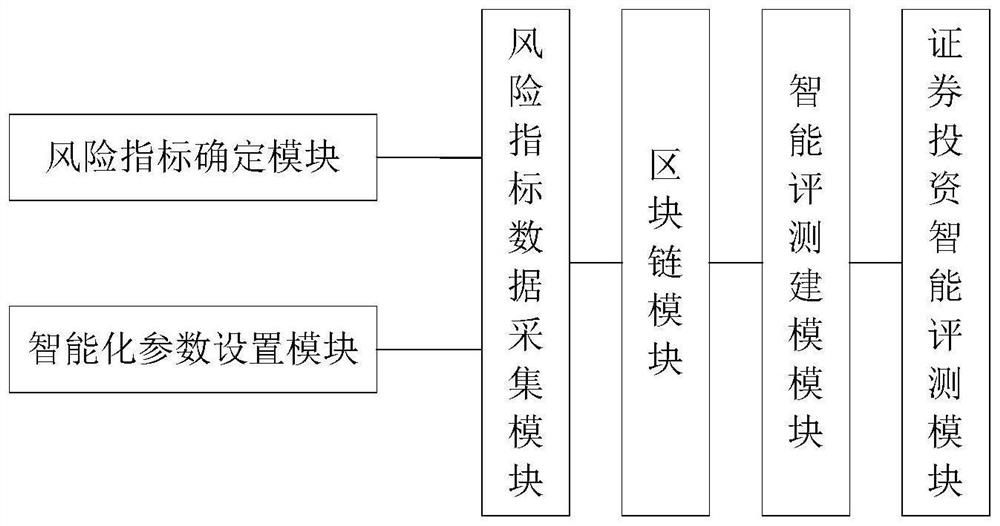

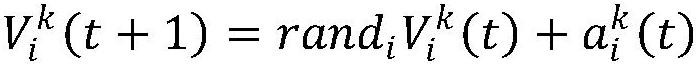

Intelligent security investment evaluation system based on block chain and big data

A security investment intelligent evaluation system based on a block chain and big data comprises a risk index determination module, an intelligent parameter setting module, a risk index data acquisition module, a block chain module, an intelligent evaluation modeling module and a security investment intelligent evaluation module. The risk index determination module is used for determining a risk index for evaluating the security investment risk; the risk index data acquisition module is used for acquiring risk index data in a time period set by the intelligent parameter setting module and storing the risk index data into the block chain module; the intelligent evaluation modeling module constructs a security investment risk evaluation model according to the risk index data in the block chain module; and the security investment intelligent evaluation module obtains the investment risk of the security to be invested by using the constructed security investment risk evaluation model. According to the invention, the security investment risk is evaluated through the constructed security investment risk evaluation model, so that the risk avoidance countermeasure can be adjusted in time according to the risk evaluation result, and the security investment income risk is effectively reduced.

Owner:樊心敏

Method and product for calculating a net operating income audit and for enabling substantially identical audit practices among a plurality of audit firms

InactiveUS7805497B2Uniform resultComplete banking machinesFinanceInvestment evaluationDocumentation procedure

Deployment of a computer program including a global NOI audit model together with standards, procedures, documentation, and reporting requirements in interactive, digital form to a plurality of audit firms operating independently of each other and having a reporting relationship with an investment entity. The program is adapted for receiving audit data from a respective audit firm in connection with an associated real estate property and for generating an associated respective Current NOI audit report. The specific fields and screen arrangements, together with interactive instructions and definitions of the program require that each audit firm identify a consistent set of input parameters and apply them in a consistent way, as driven by the global audit model, thereby assuring computation and transmission of structurally consistent Current NOI audit reports to the investment entity, wherein the Current NOI calculations have been developed by substantially identical audit practices, procedures and assumptions. Using the same program, the investment entity then calculates and stores an Underwriting NOI set of values corresponding to each Current NOI report for the purpose of investment evaluation. The program generates a consolidated report of both Current and Underwriting NOI values for all of the plurality of audit firms so that the investment entity can effect a uniform analysis of all investment properties under consideration.

Owner:GE CAPITAL US HLDG INC

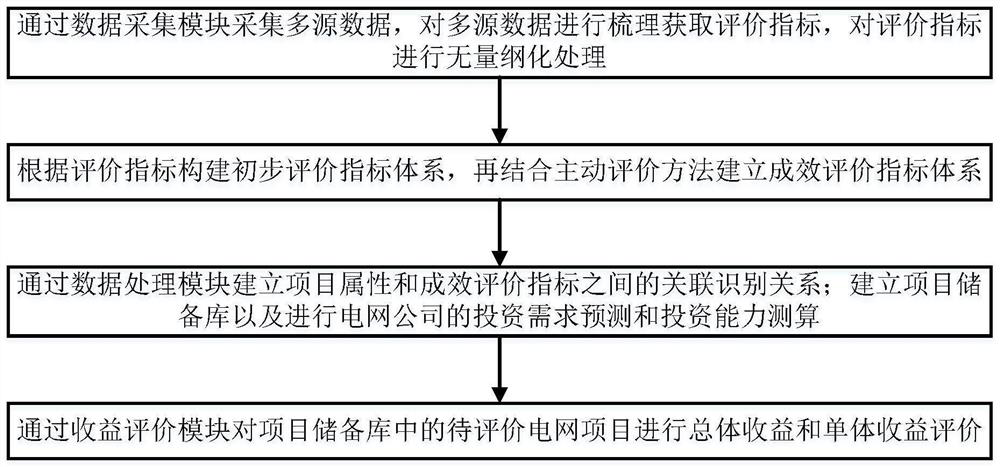

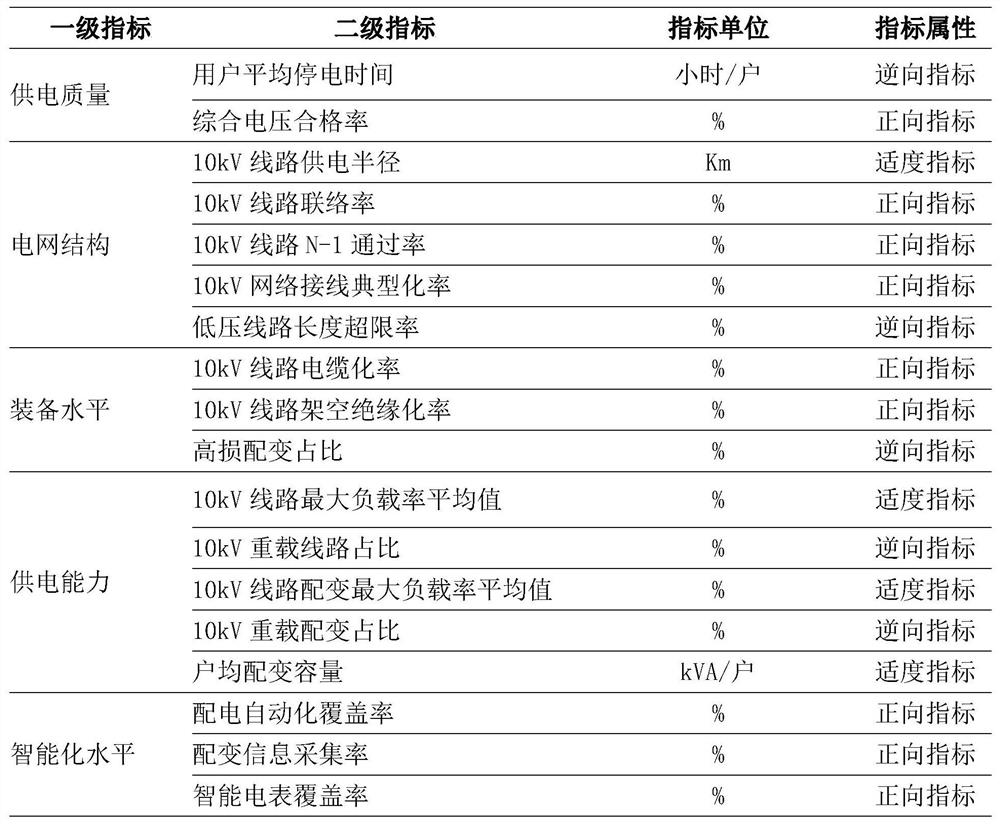

Multi-source data-based power grid investment benefit evaluation system and evaluation method

InactiveCN114219225AAccurate feedback on revenue statusFast return on investmentLoad forecast in ac networkForecastingLoad forecastingInvestment evaluation

The invention discloses a multi-source data-based power grid investment benefit evaluation system and evaluation method, relates to the technical field of power grid company investment decision making, and solves the technical problems of unreasonable power grid project investment evaluation and poor investment return income caused by dependence on personal experience and difficulty in coordination of departments in an implementation process of an existing scheme. An index system module and a data processing module are arranged, an effect evaluation index system is established according to evaluation indexes, and then income evaluation is performed on a to-be-evaluated project in combination with a correlation recognition relationship; the power grid project investment is reasonably evaluated, the income state of the power grid project can be accurately fed back, data support is provided for the power grid investment, and the investment return is improved; according to the method, the load of the measurement and calculation area is predicted through the load prediction model, the load prediction model is based on a fitting function or an artificial intelligence model, the calculation amount can be reduced, the load prediction precision is improved, and the accuracy of power grid investment benefit evaluation is further improved.

Owner:国网安徽省电力有限公司怀远县供电公司

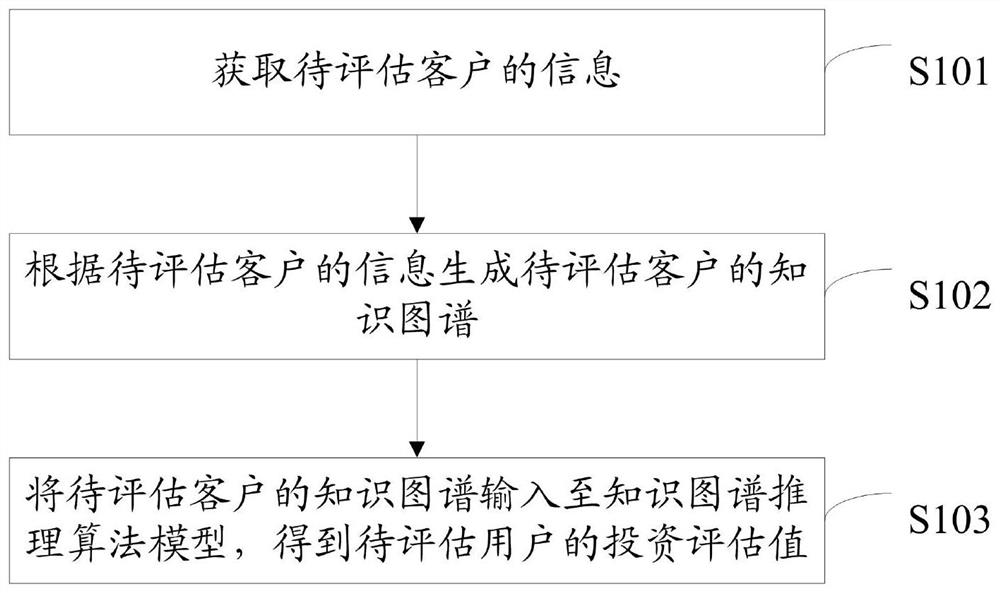

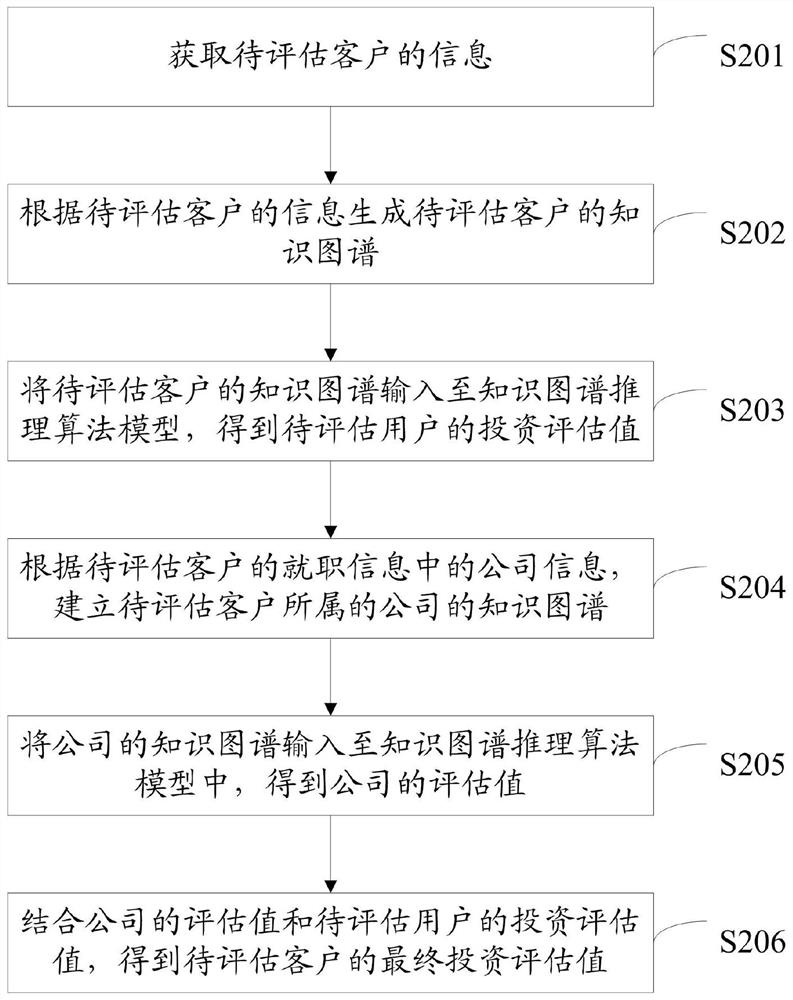

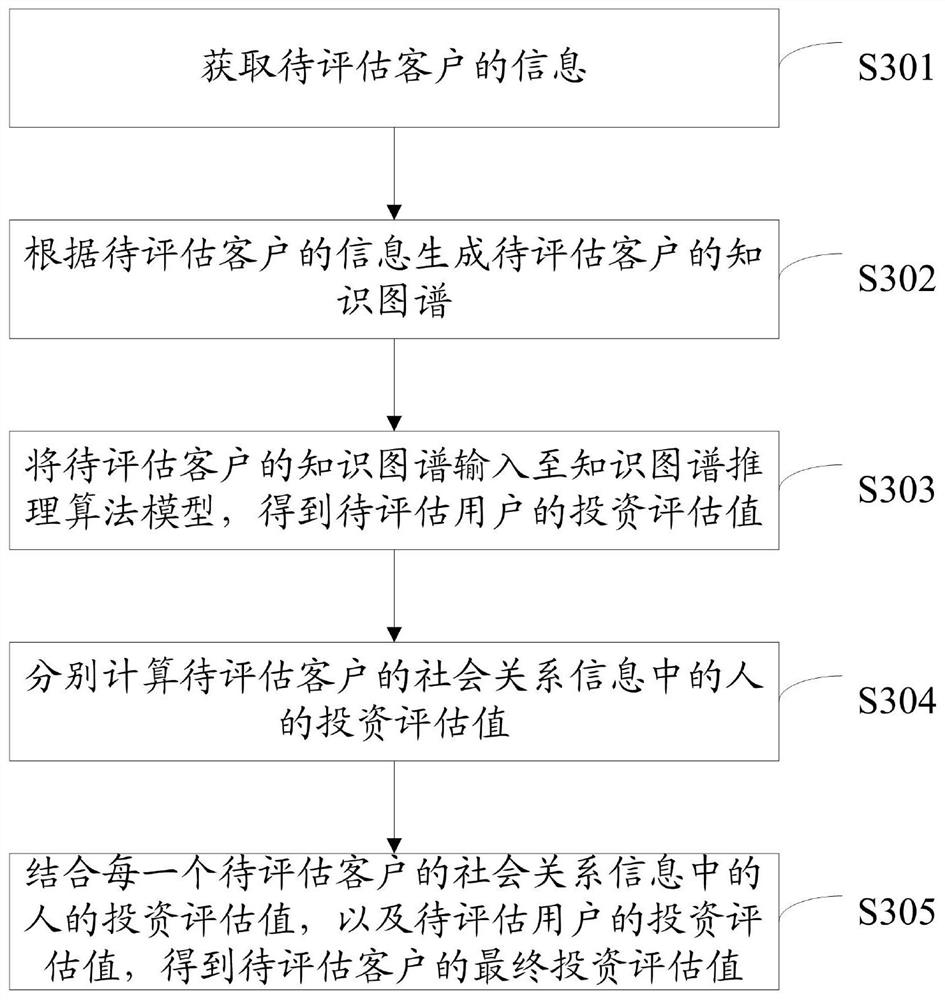

Investment capability assessment method and device, electronic equipment and computer storage medium

PendingCN112102097AAccurate assessmentFinanceSpecial data processing applicationsInvestment evaluationReasoning algorithm

The invention provides an investment capability assessment method and device, electronic equipment and a computer storage medium, and the method comprises the following steps: firstly, obtaining the information of a to-be-assessed customer, wherein the to-be-assessed client information comprises personal information of the to-be-assessed client, social relation information of the to-be-assessed client and employment information of the to-be-assessed client; then, generating a knowledge graph of the to-be-assessed customer according to the information of the to-be-assessed customer; and finally, inputting the knowledge graph of the to-be-assessed customer into a knowledge graph reasoning algorithm model to obtain an investment assessment value of the to-be-assessed customer, wherein the investment evaluation value is used for indicating investment preference and investment capability. Therefore, the purpose of accurately evaluating the investment capability of the customer is achieved.

Owner:BANK OF CHINA

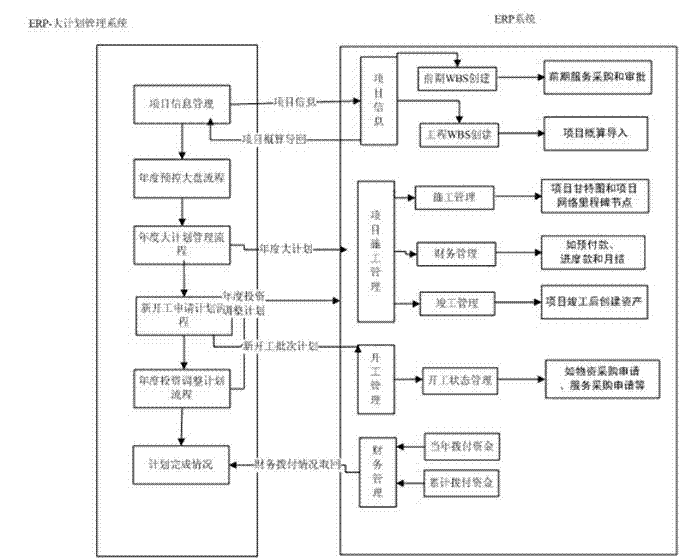

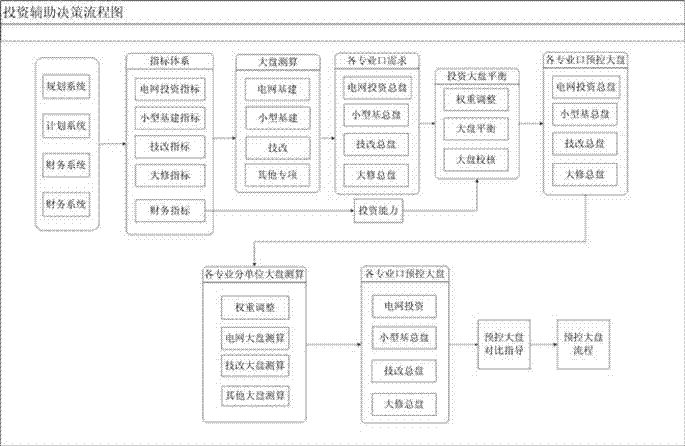

Full-aperture project investment market calculating method

InactiveCN103578034AImprove investment intensificationImprove the level of lean managementFinanceForecastingInvestment evaluationPower grid

The invention relates to a full-aperture project investment market calculating method. The method is characterized by comprising the following steps: 1) obtaining corresponding indexes in an index system; 2) forecasting and calculating power grid capital construction investment demands; 3) according to the reference to unit price information, calculating the comprehensive historical unit price of latest three years, namely, the comprehensive historical unit price is equal to the historical unit price of this year * Kd1 plus the historical unit price of the last year * Kd2 plus the historical unit price of the year before the last year * Kd3, wherein the Kd1, the Kd2 and the Kd3 are weighted values which can be adjusted according to the actual conditions. According to the method, investment evaluation work of the next year can be arranged scientifically, the investment scale can be determined reasonably, the investment structure can be optimized, the investment benefit can be improved, investment control can be strengthened, and the investment intensification and lean management level of companies is improved.

Owner:STATE GRID CORP OF CHINA +1

An investment audit management analysis system

ActiveCN108510171BHelps to chooseImprove the efficiency of investment auditFinanceResourcesInvestment evaluationBusiness enterprise

The invention discloses an investment audit management analysis system, which includes a financial acquisition module, a risk assessment module, an investment assessment module, and an investment diversion module; the financial acquisition module is used to acquire the operation information of the invested enterprise and the current revenue and expenditure status obtained from the investment, And send them to the risk assessment module in sequence according to the sum of income and expenditure differences; the risk assessment module receives the information sent by the financial acquisition module to determine the risk coefficient and income level coefficient of the investment, and sends it to the investment assessment module; the investment assessment module is used to judge the value of each invested The comprehensive investment coefficient of the enterprise, and output the comprehensive investment coefficient to the investment steering module. The invention calculates the risk coefficient and income level coefficient of the invested enterprise through the risk evaluation module, and evaluates the investment comprehensive coefficient through the investment evaluation module, so as to screen the invested enterprise with a higher investment comprehensive coefficient, which is helpful for managers to The selection of invested enterprises improves the efficiency of investment audit.

Owner:安徽天勤盛创信息科技股份有限公司

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com