Systems and methods for assessing the potential for fraud in business transactions

a technology of business transactions and potential fraud, applied in the field of detecting potential fraud, can solve problems such as the assessment of potential fraud, and achieve the effect of higher or lower fraud potential

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

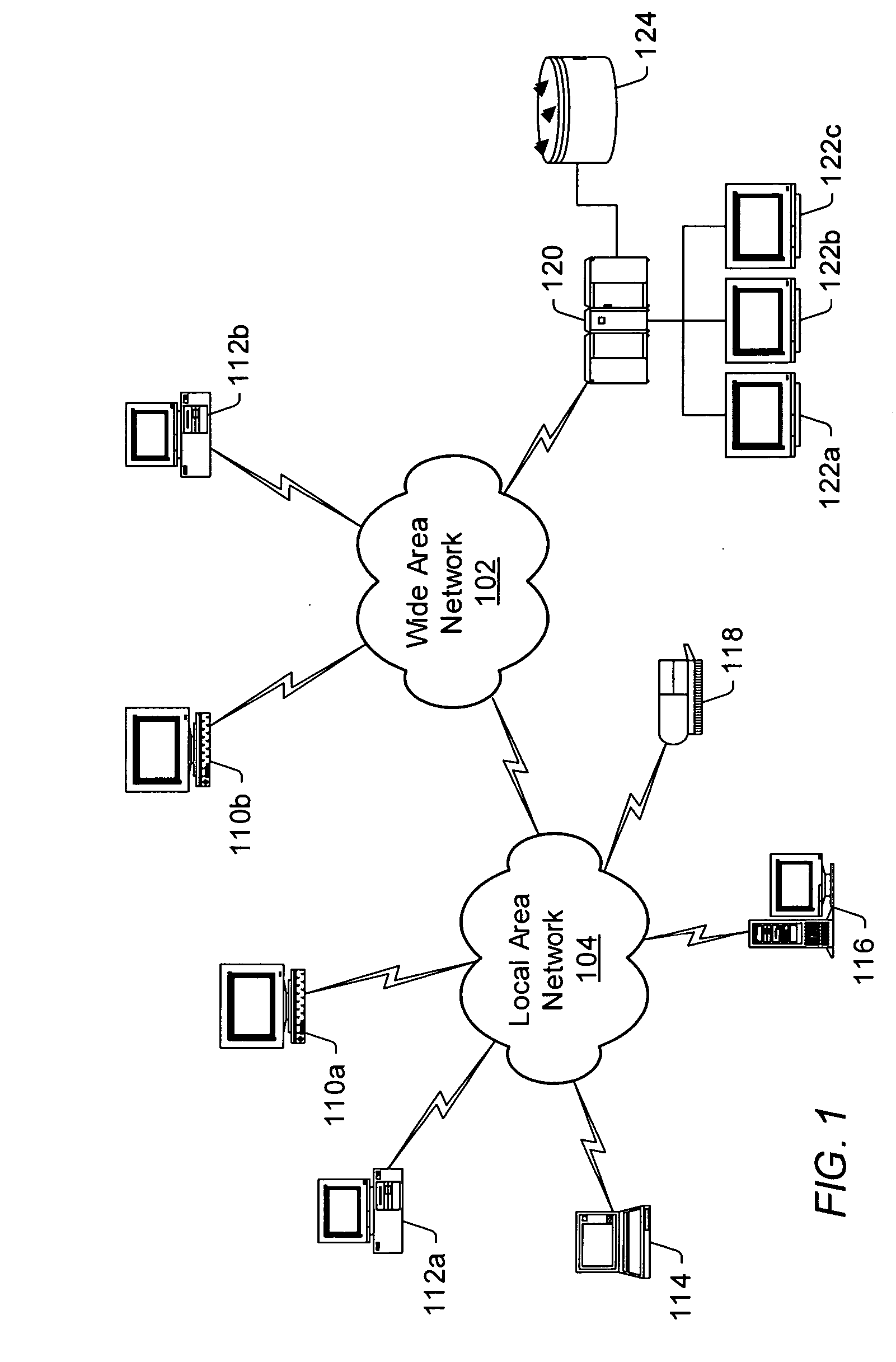

[0044]FIG. 1 illustrates an embodiment of a wide area network (“WAN”). WAN 102 may be a network that spans a relatively large geographical area. The Internet is an example of WAN 102. WAN 102 typically includes a plurality of computer systems that may be interconnected through one or more networks. Although one particular configuration is shown in FIG. 1, WAN 102 may include a variety of heterogeneous computer systems and networks that may be interconnected in a variety of ways and that may run a variety of software applications.

[0045] One or more local area networks (“LANs”) 104 may be coupled to WAN 102. LAN 104 may be a network that spans a relatively small area. Typically, LAN 104 may be confined to a single building or group of buildings. Each node (i.e., individual computer system or device) on LAN 104 may have its own CPU with which it may execute programs, and each node may also be able to access data and devices anywhere on LAN 104. LAN 104, thus, may allow many users to s...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com