System and method using securities issuance for risk transference

a technology of securities and risk transfer, applied in the field of system and method using securities issuance for risk transfer, can solve the problems of affecting the value of fis under fair value accounting standards, investors largely exiting certain sectors of the fis market, and difficulty in appropriately valuing, finance or trading fis, so as to avoid non-economic losses, counter adverse capital impact, and eliminate or transfer the non-economic risk of financial securities

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

example 1

Share Issuance Program Example 1

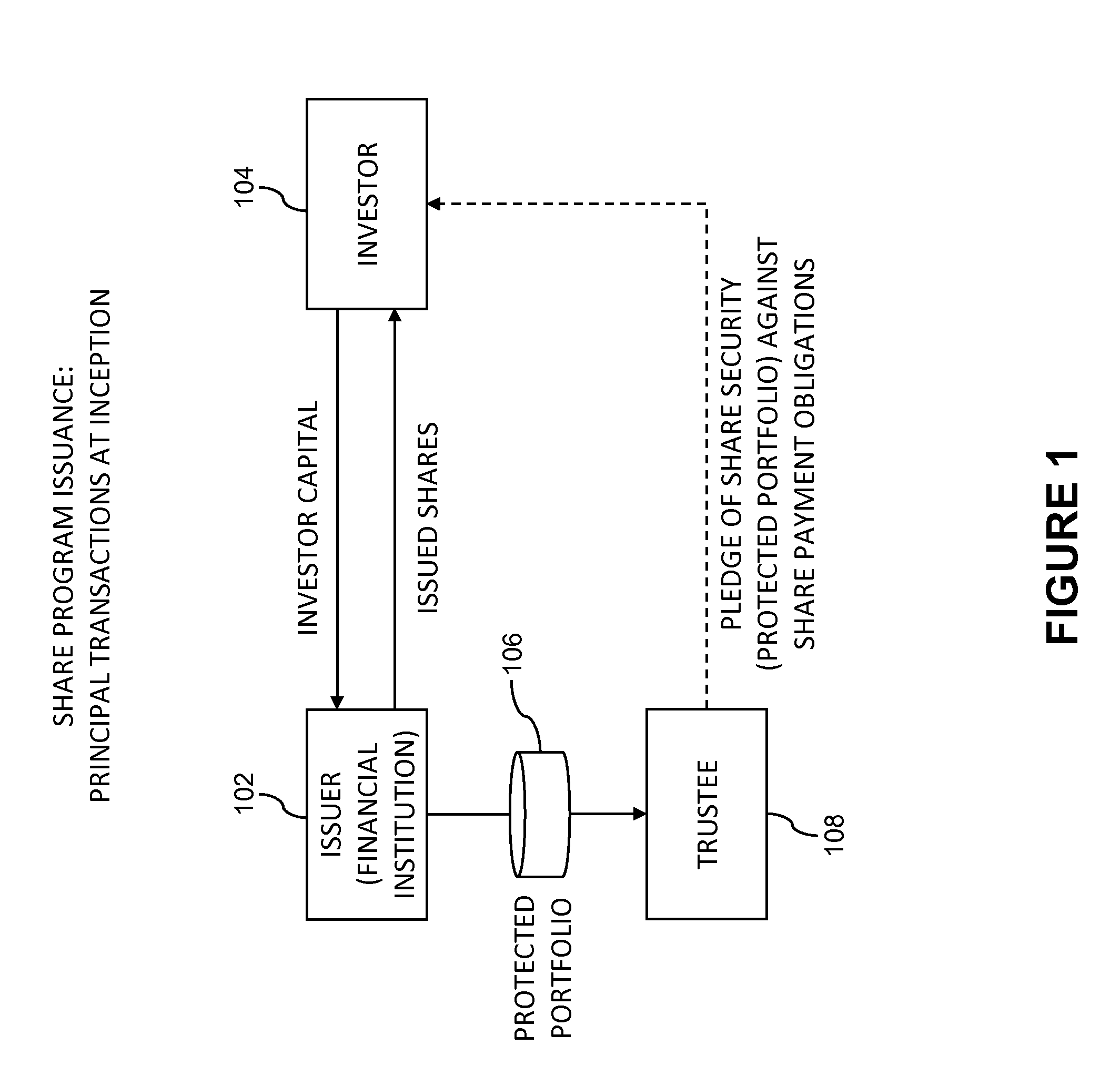

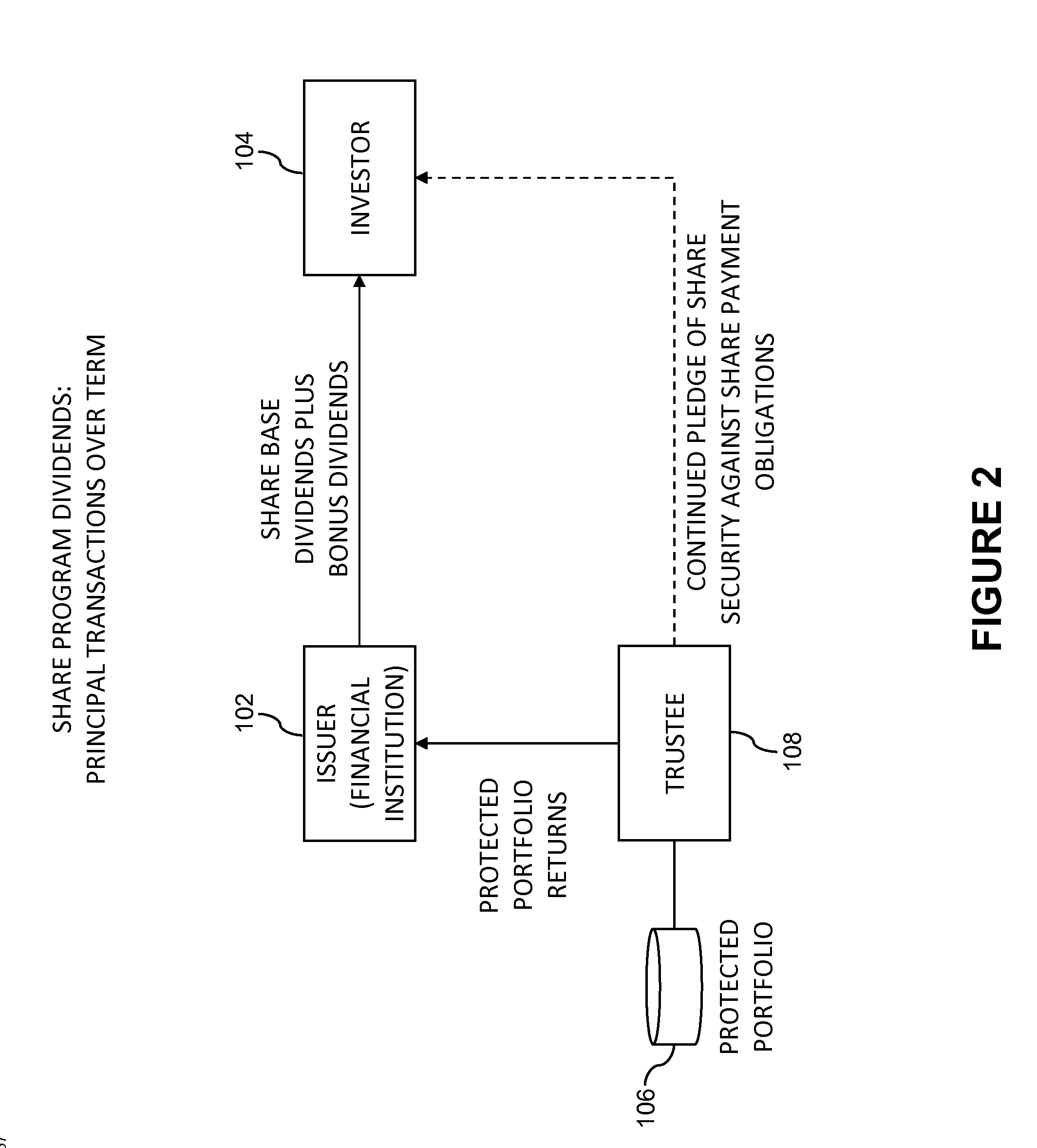

[0043]In one example, a first party financial institution (the “Issuer”) and a second party investment group (the “Investor”) enter into an agreement to establish a share program for the mutual benefit of both parties. The parties select as the Protected Asset a FIS Portfolio (the “Protected Portfolio”) owned by the Issuer which the Issuer either determines to be undervalued in the current market, or desires to protect against future losses in value due to market conditions. In order to recognize a value for capital purposes of the Protected Portfolio that is more consistent with internal estimates of economic value, the Issuer coordinates with or consults the Investor or an investment advisor to develop a specific share program that takes into account the amount of economic and non-economic risk associated with the Protected Portfolio.

[0044]By agreement of the parties, the share program is established on a Protected Portfolio having a Book Value of 8...

example 2

Share Issuance Program Example 2

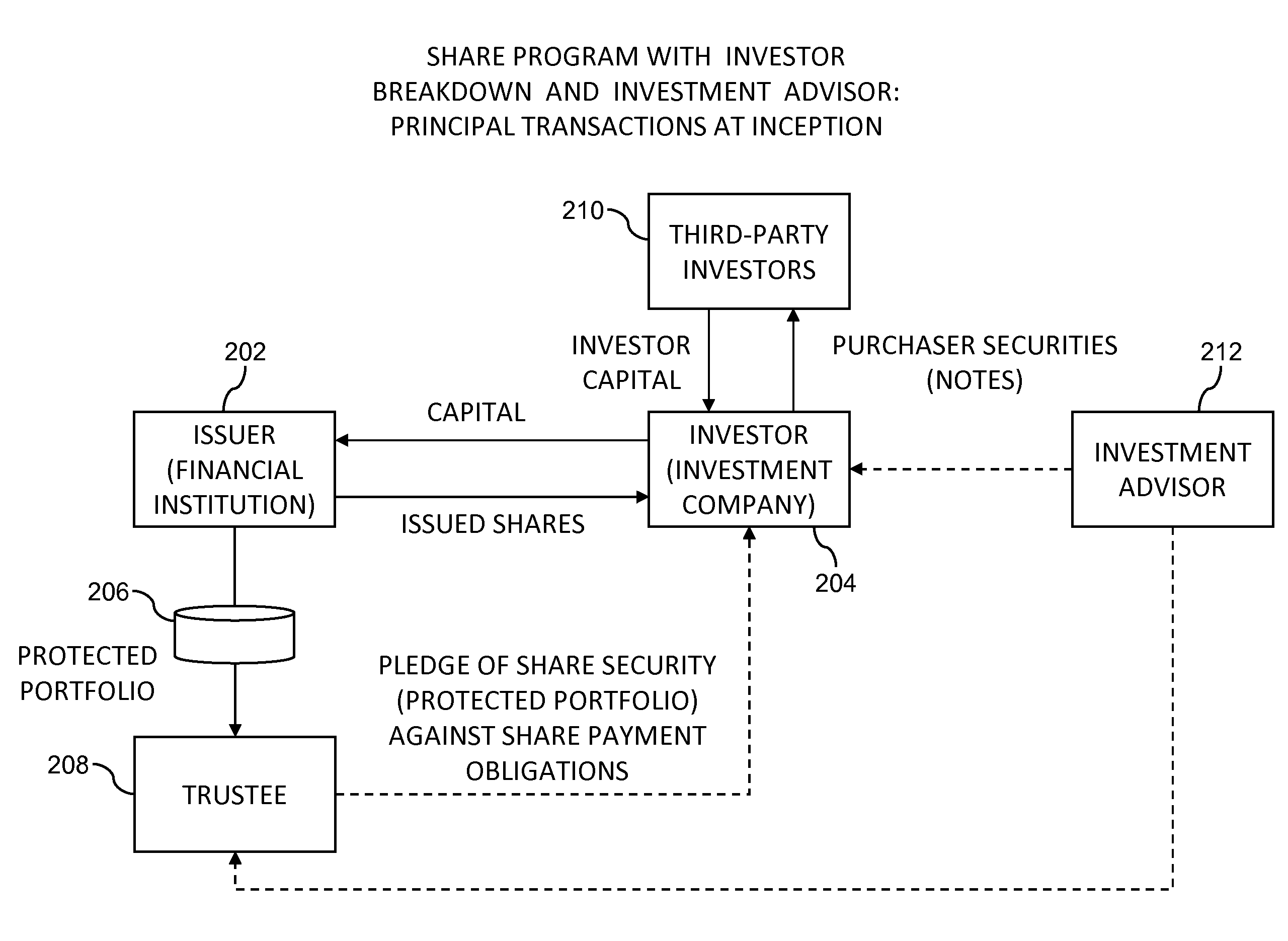

[0052]In another example, a first party financial institution (the “Issuer”) and a second party investment group (the “Investor”) enter into an agreement to establish a share program for the mutual benefit of both parties. Referring generally to FIGS. 5-7, the parties have selected as the Protected Asset a FIS Portfolio (the “Protected Portfolio”) owned by the Issuer 202 which the Issuer either determines to be undervalued in the current market, or desires to protect against future losses in value due to market conditions. In order to recognize a value for capital purposes of the Protected Portfolio 206 that is more consistent with internal estimates of actual economic value, the Issuer 202 coordinates with or consults the Investor 204 and an investment advisor 212 to develop a specific share program that takes into account the amount of economic and non-economic risk associated with the Protected Portfolio 206.

[0053]At the outset of the program, the ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com