Methods used for preventing and controlling credit risk

A risk and credit technology, applied in data processing applications, instruments, finance, etc., can solve the problems of weakening the ability of subjective intentional breach of contract, no upload authority, and risk control party not having inquiry authority

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0048] Loan is a form of credit activity in which banks or other financial institutions lend monetary funds according to a certain interest rate and must be returned. The safety of unsecured credit loans will be specifically described below in conjunction with Embodiment 1.

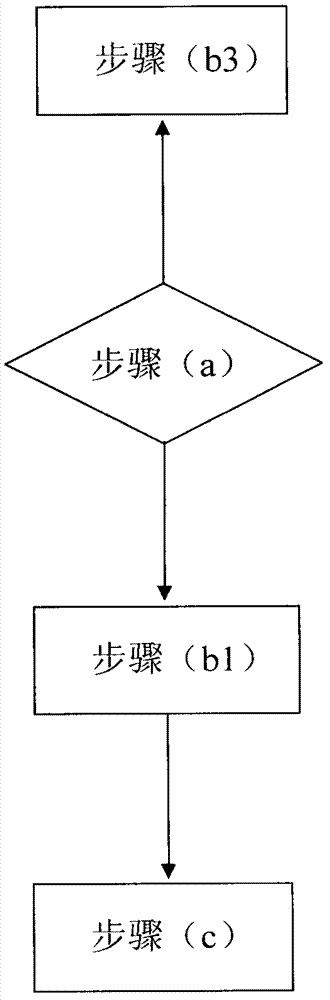

[0049] XX Bank provides a loan of 1 million yuan to AA Company. According to the agreement in the "Loan Contract": the effective date of the loan contract is February 1, 2012, and the first repayment period of AA Company is 2012 On March 1, 2009, AA Company regularly repaid 90,000 yuan to XX Bank on the 1st of each month, and repaid all the principal and interest in 12 installments. XX bank is as the risk controller of this loan, and AA company is as the risk controlled party of this loan. Using the present invention to prevent and control credit risk includes: step (a), step (b1) after step (a), step ( Step (c) after b1), step (b3) after step (a), such as figure 1 shown.

[0050] Step (a): XX Bank req...

Embodiment 2

[0072] Credit cards are issued by commercial banks to individuals and units. With this, they can shop, consume and deposit and withdraw cash from special units. They are special carrier cards with consumer credit. They are a small amount that banks provide users with consumption first and repayment later. Credit payment instrument. The present invention can be applied to the prevention and control of credit risk in credit card business, which will be specifically described in conjunction with Embodiment 2 below.

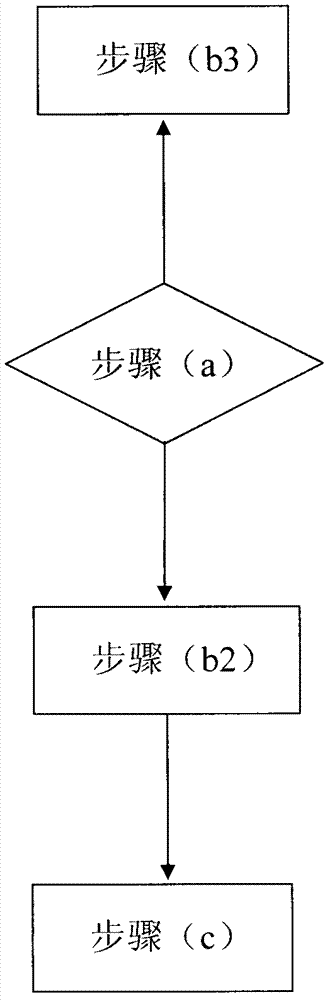

[0073]XX Bank issued a credit card to Li Si, a natural person, according to the agreement in the "Credit Card Application Contract": the credit limit of this credit card is 30,000. XX bank is as the risk controller of issuing this credit card, and Li Si is used as the risk controlled party of this credit card, and using the present invention to prevent and control credit risk includes: step (a), step (b1) after step (a), Step (c) after step (b1), step (b3) after ste...

Embodiment 3

[0095]Loan guarantee is a third-party guarantee provided by guarantee institutions for lenders (financial institutions) and borrowers (mainly industrial and commercial enterprises and natural persons). The guarantee agency guarantees that when the borrower fails to repay the principal and interest within the time limit stipulated in the loan contract, it will be responsible for paying the borrower's payable but unpaid principal and interest. The loan guarantee contract becomes effective when the borrower receives the loan, and terminates after the borrower or guarantor repays the principal and interest. The main purpose of loan guarantees is to share the credit risks that may arise from bank lending and corporate financing. The present invention can be applied to the prevention and control of credit risk in the loan guarantee business, which will be specifically described in conjunction with Embodiment 3 below.

[0096] XX Bank provided a loan of 5 million yuan to BB Feed Com...

PUM

Login to view more

Login to view more Abstract

Description

Claims

Application Information

Login to view more

Login to view more - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap