Serious disease insurance product scoring method and device based on factorization rule

A factoring and product technology, applied in the insurance field, can solve the problems of difficult choice for consumers, large amount of information, complex responsibilities, etc., and achieve the effect of intuitive product scoring

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0024] In order to make the content of the present invention clearer and easier to understand, the content of the present invention will be described in detail below in conjunction with specific embodiments and accompanying drawings.

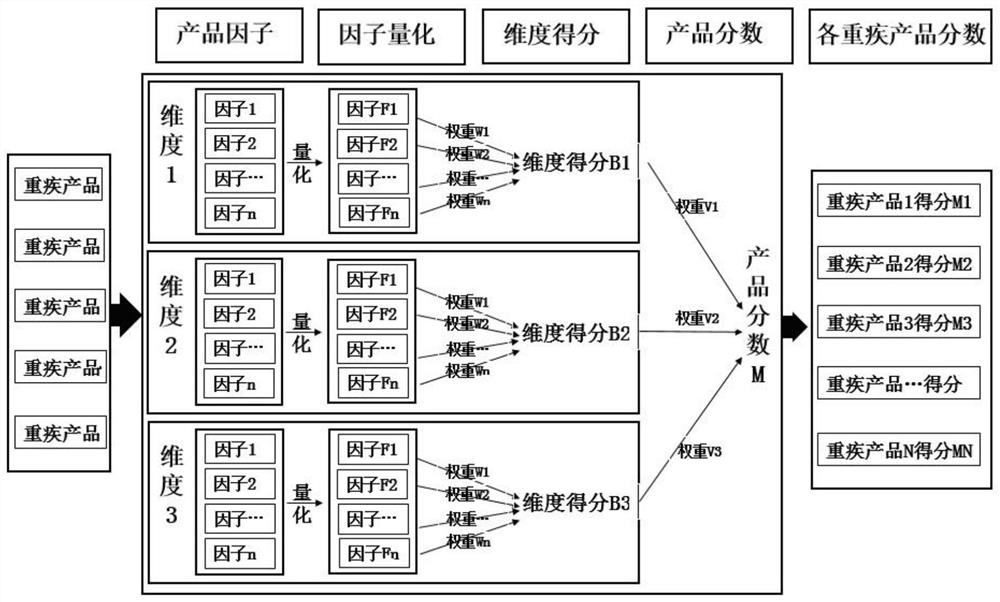

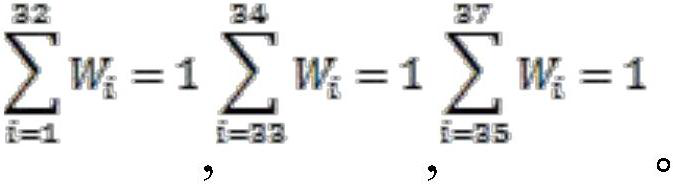

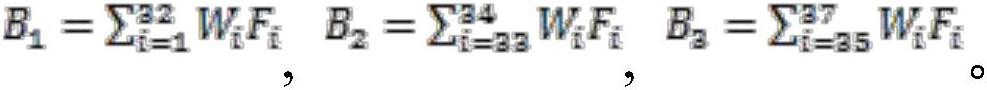

[0025] The present invention aims to form a set of factorized rule evaluation methods for critical illness insurance products based on the characteristics of different factors in different dimensions, to comprehensively evaluate critical illness insurance products from multiple angles, and to score each product. Specifically, the present invention analyzes the main features and dimensions of critical illness insurance products, determines the key scoring factors under each dimension, quantifies the scoring factors, and assigns weights to each scoring factor under each dimension, and the weight of each dimension in each dimension. The weight in the product scoring model, the comprehensive calculation of dimension scores and the final product score...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com