Enterprise tax fraud detection method, electronic device and storage medium

A detection method and tax technology, applied in instruments, invoicing/invoicing, finance, etc., can solve the problems of imperfect tax detection methods, low practicability, low efficiency, etc., to solve data imbalance and abnormal enterprises and normal enterprises Highly cross-fused effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0046] Below, in conjunction with accompanying drawing and specific embodiment, the present invention is described further:

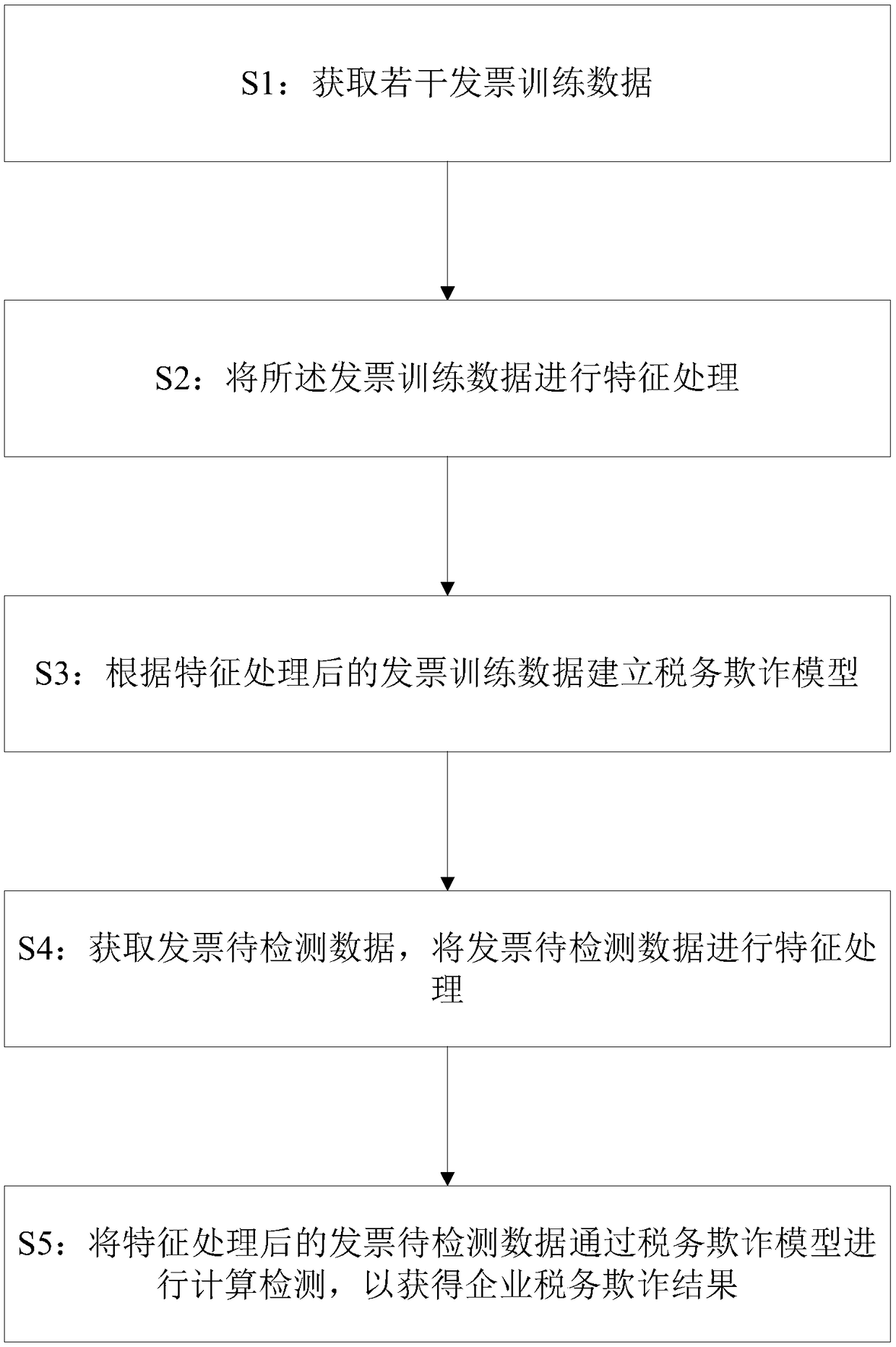

[0047] The present invention provides a tax fraud detection method for enterprises. It is found in the current tax audit that enterprises with tax abnormalities are rare compared with normal enterprises. The feature difference is not very obvious, and these two points are the difficult problems encountered in doing tax fraud at present, and the present invention adopts measures to overcome them. The enterprise tax fraud detection method of the present invention includes two major stages, one is the tax fraud model training stage, and the other is the enterprise tax fraud detection stage. Such as figure 1 shown, including the following steps:

[0048] S1: Obtain a number of invoice training data; the invoice training data includes invoice data of enterprises with abnormal taxation and invoice data of enterprises with normal taxation;

[0049] The invo...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com