Credit evaluation and credit extension method based on big data

A technology of big data and credit evaluation, applied in the field of data analysis, can solve the problems of shortage of funds, high financing cost, inability to convert financing credit, etc., and achieve the effect of solving difficult financing and expensive financing

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment

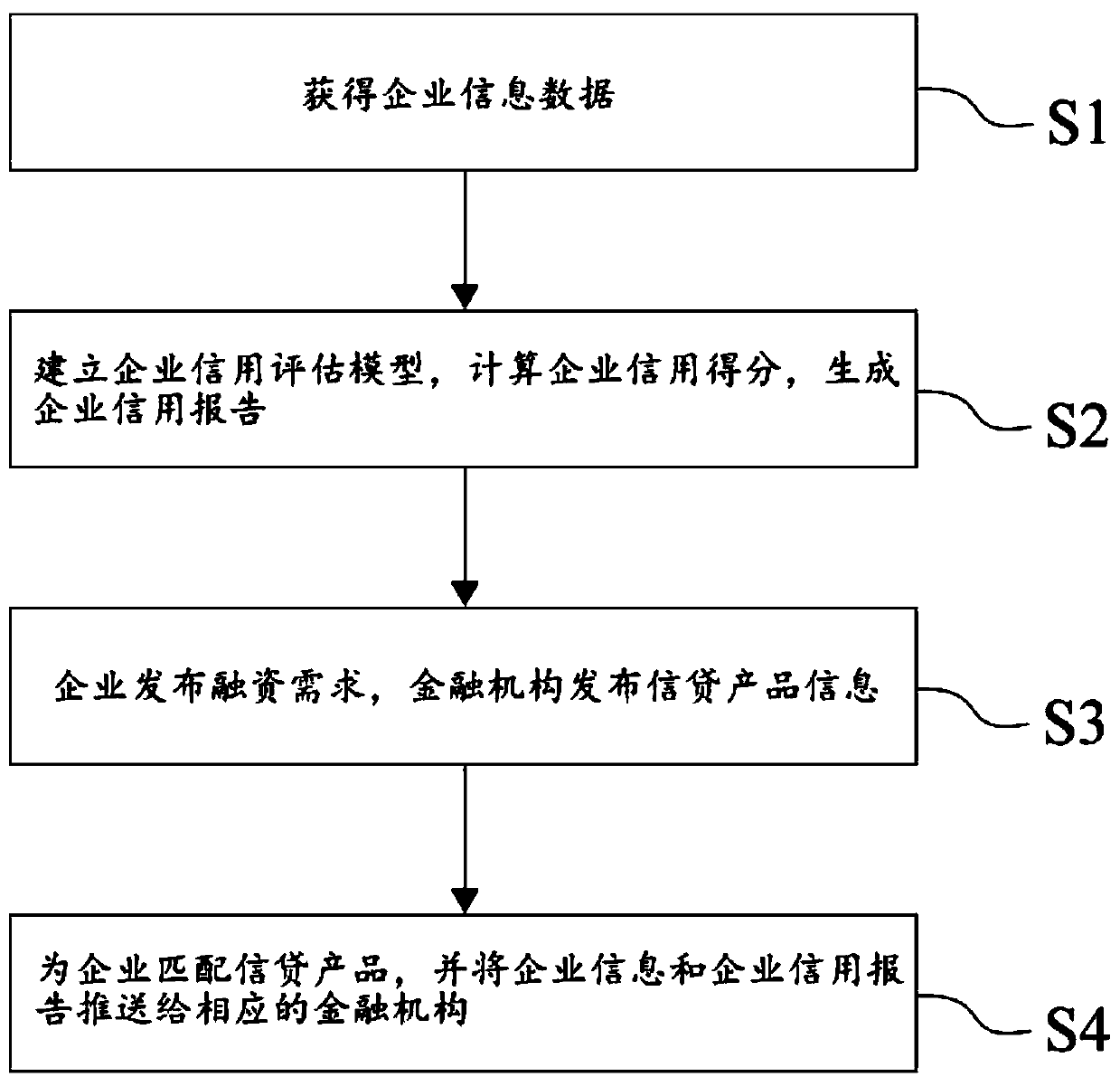

[0020] refer to figure 1 As shown, the present invention discloses a method for credit evaluation and credit granting based on big data, including the following steps:

[0021] S1. Obtain enterprise information data, which includes enterprise basic information, industrial and commercial information, business status, qualification certificates, honorary certificates, technical personnel, credit information, intellectual property rights, enterprise annual reports, and bid-winning project information.

[0022] S2. Establish an enterprise credit evaluation model, calculate enterprise credit scores based on enterprise information data, and generate enterprise credit reports and enterprise portraits. The enterprise credit evaluation model is realized based on a multi-dimensional system, which includes enterprise background, operating status, innovation ability, credit history, industry strength, and contract performance. The enterprise credit evaluation model assigns value to each ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com