Patents

Literature

52 results about "Financing cost" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Financing cost (FC), also known as the cost of finances (COF), is the cost, interest, and other charges involved in the borrowing of money to build or purchase assets. This can range from the cost it takes to finance a mortgage on a house, to finance a car loan through a bank, or to finance a student loan.

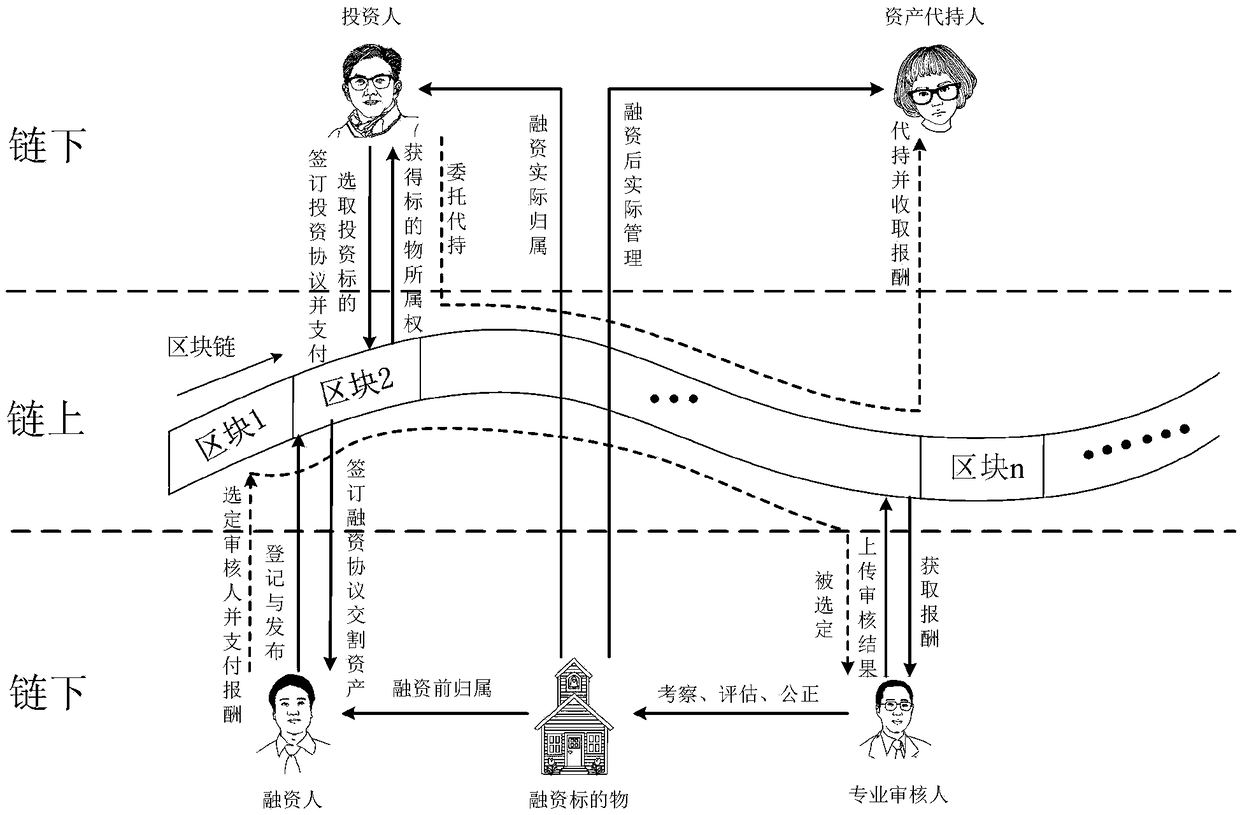

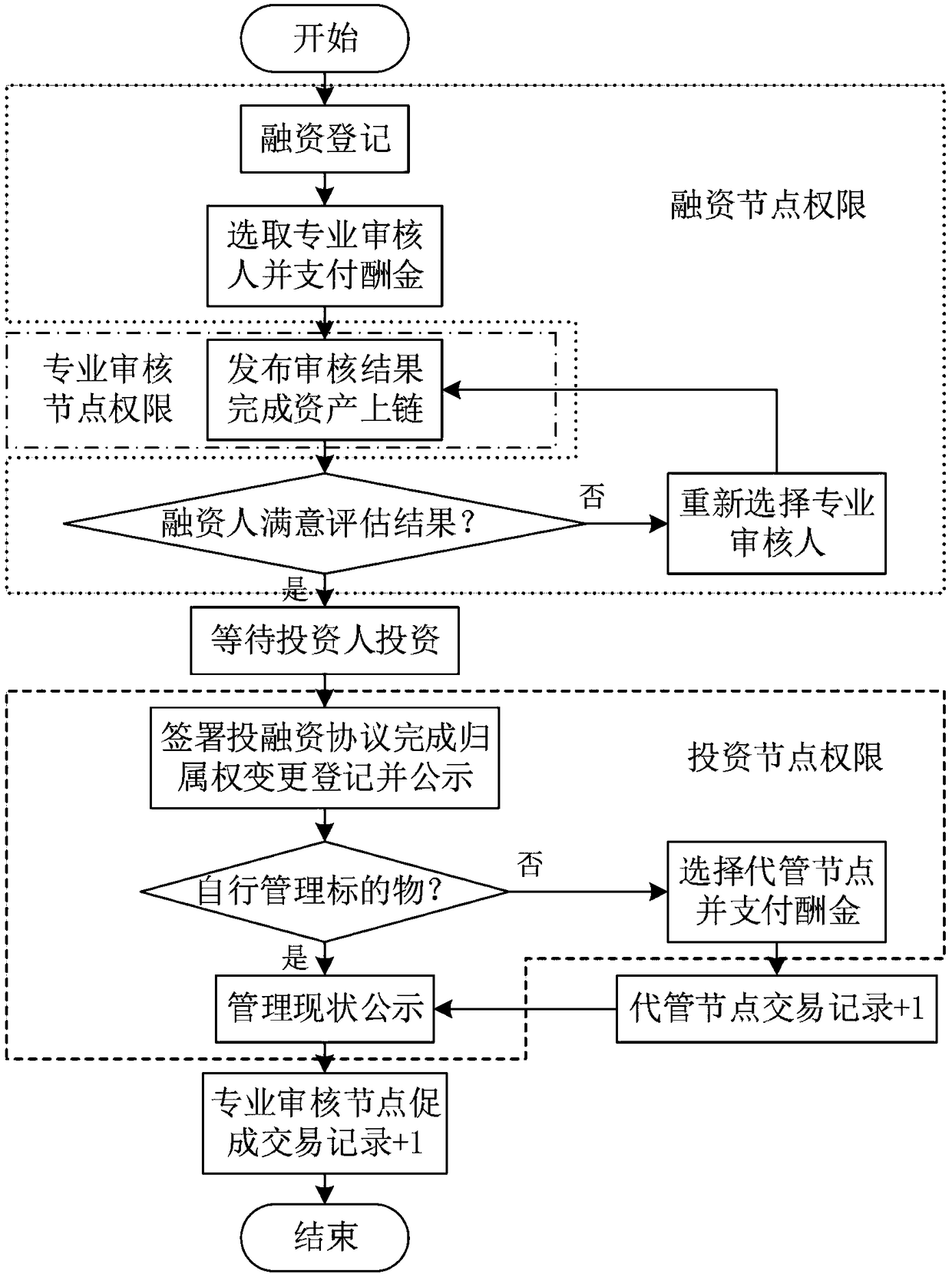

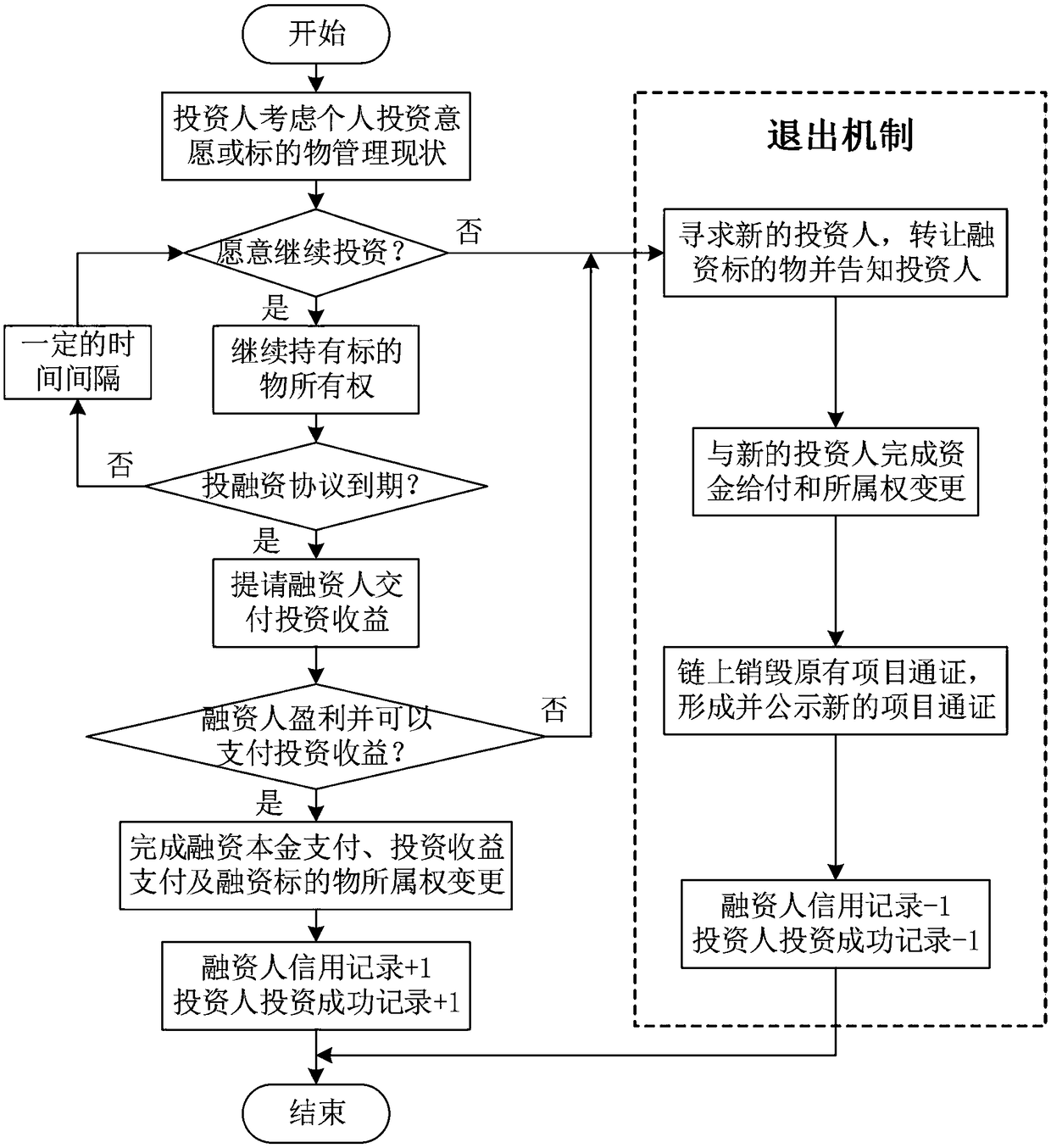

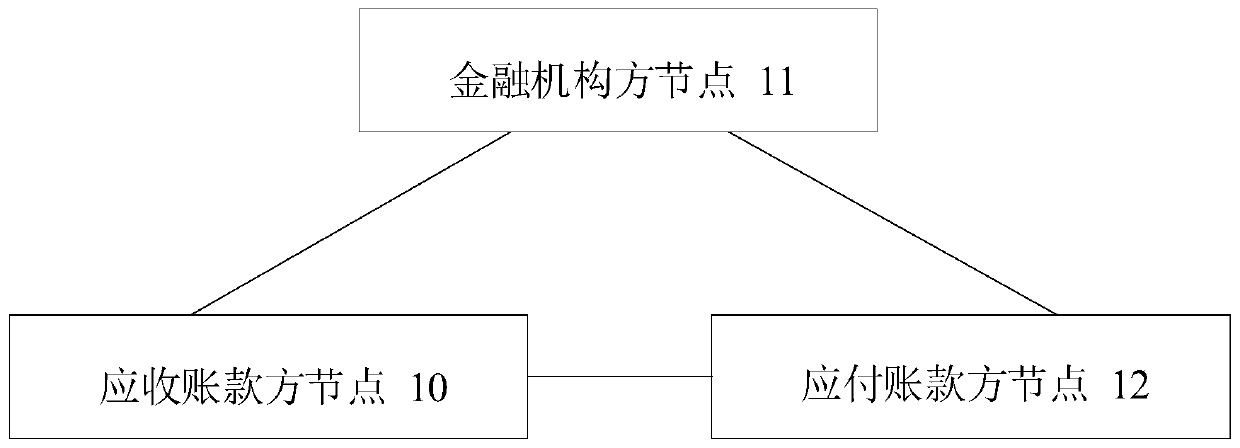

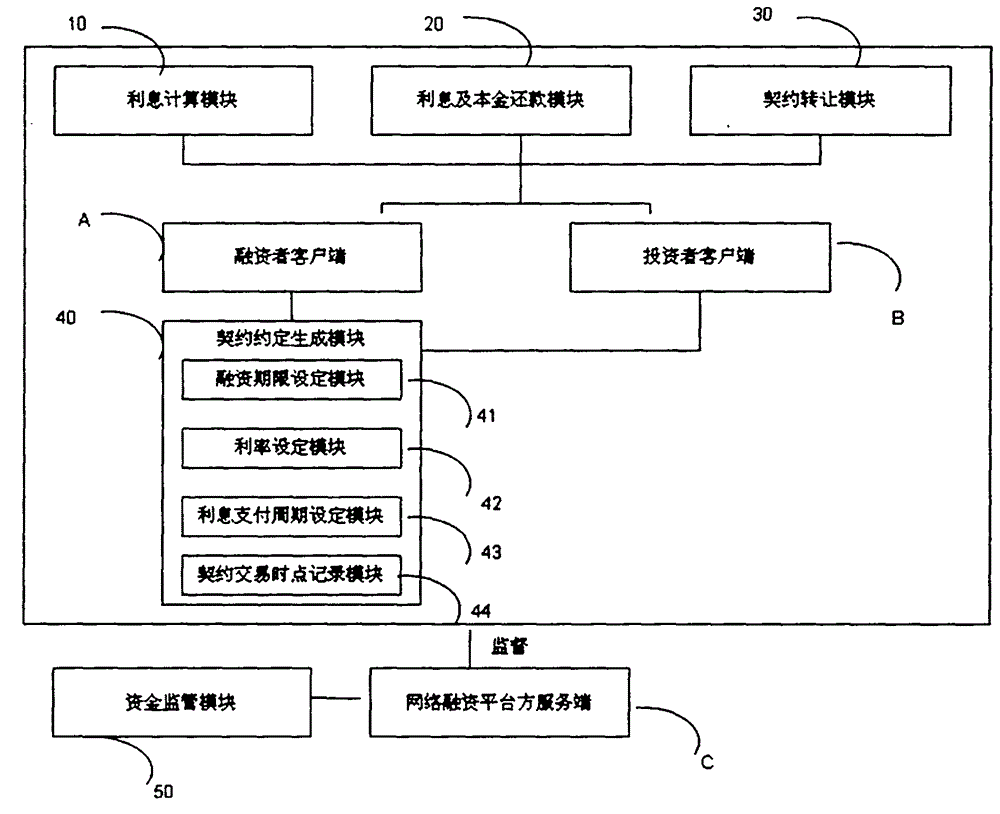

Distributed autonomous financing platform construction method based on block chain technology

InactiveCN108876621AImprove financing efficiencyImprove investment incomeFinanceFinancing costThe Internet

The invention discloses a distributed autonomous financing platform construction method based on a block chain technology. In the context of the conventional centralized Internet investment platform becoming increasingly unsuitable for the increasing demands of financial assets configuration efficiency and the continuous improvement of a system security threshold, introducing an emerging block chain technology to establish a system autonomous Internet financing platform which comprising a plurality of distributed homogeneous peer financial nodes; getting rid of a drawback that all the financing services in a conventional system, is subject to a unique system center node; and realizing the safe and efficient configuration of the financial assets with an operation mechanism of node mutual cooperation and system self-optimization. The method can be used for establishing a distributed financing Internet platform. According to the distributed autonomous financing platform construction method based on the block chain technology, the configuration transfer efficiency of money and the financial assets can be effectively improved, financing costs and investment risks are reduced, and investment income is improved.

Owner:HANGZHOU YUNXIANG NETWORK TECH

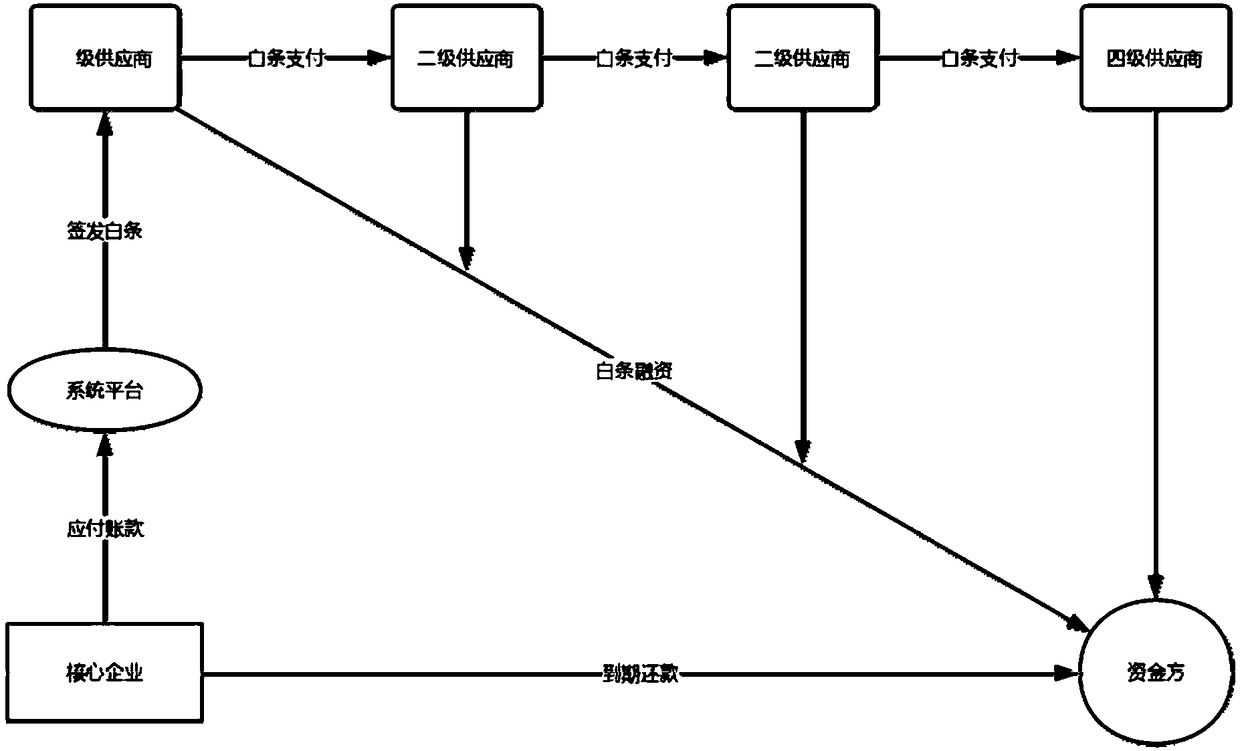

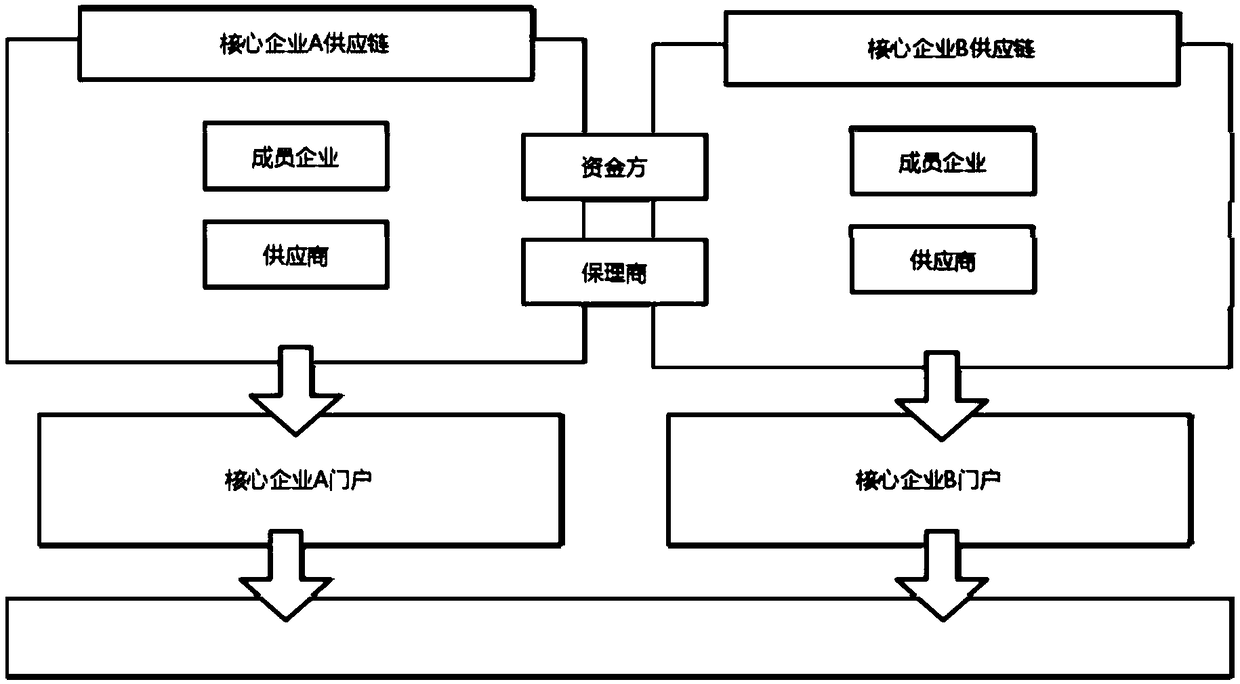

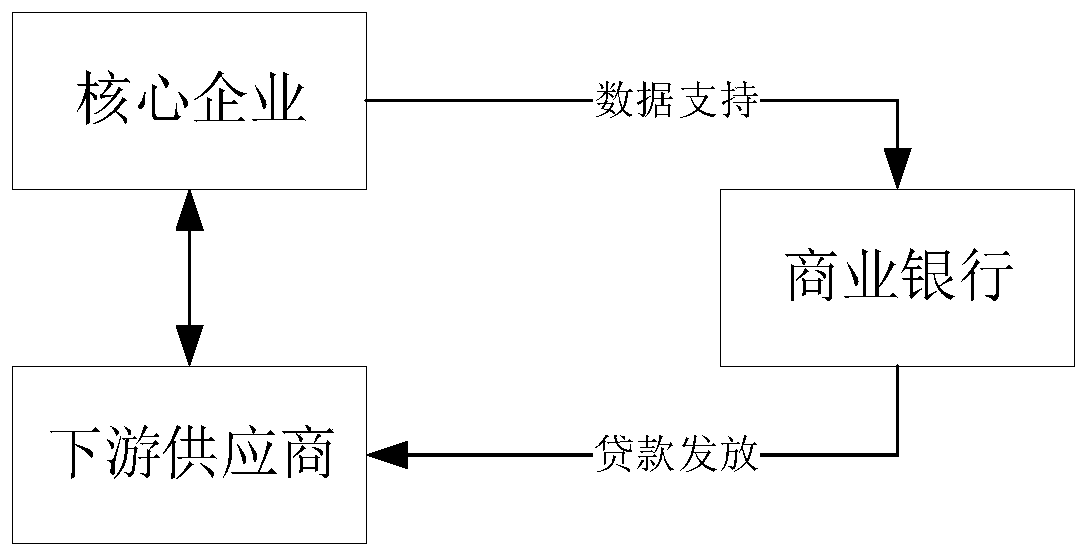

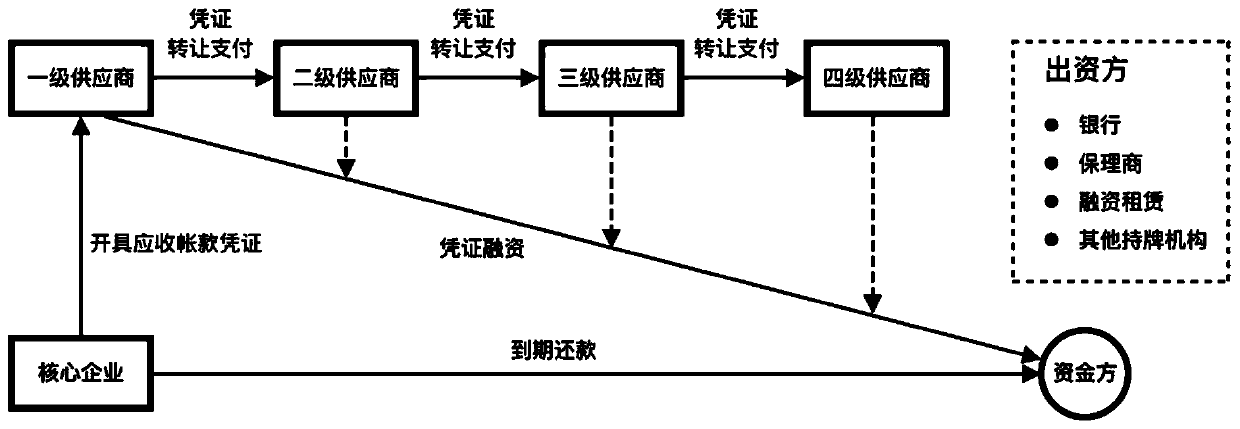

Supply chain financial system based on a block chain and a construction method thereof

The invention provides a supply chain financial system based on a block chain and a construction method thereof. According to the system, credit overflow of a core enterprise is utilized; real trade is taken as a support; an industrial network of symbiotic development between the core enterprise and the upstream multi-stage supplier is constructed; by relying on platform asset vouchers formed by first-level suppliers for receivable accounts of core enterprises, comprehensive financial services such as fund financing, payment settlement and process optimization are provided for the first-levelsuppliers, all the asset vouchers are stored through block chain nodes, and rapid confirmation and real-time sharing synchronization of all participants of a system platform are achieved. The supply chain financial system based on the block chain technology is realized, the problem of mutual trust among participants such as a core enterprise, a fund party and a factoring party is solved, the credit of the core enterprise can be effectively transferred, and the financing cost of small and medium-sized enterprises is effectively reduced.

Owner:HANGZHOU QULIAN TECH CO LTD

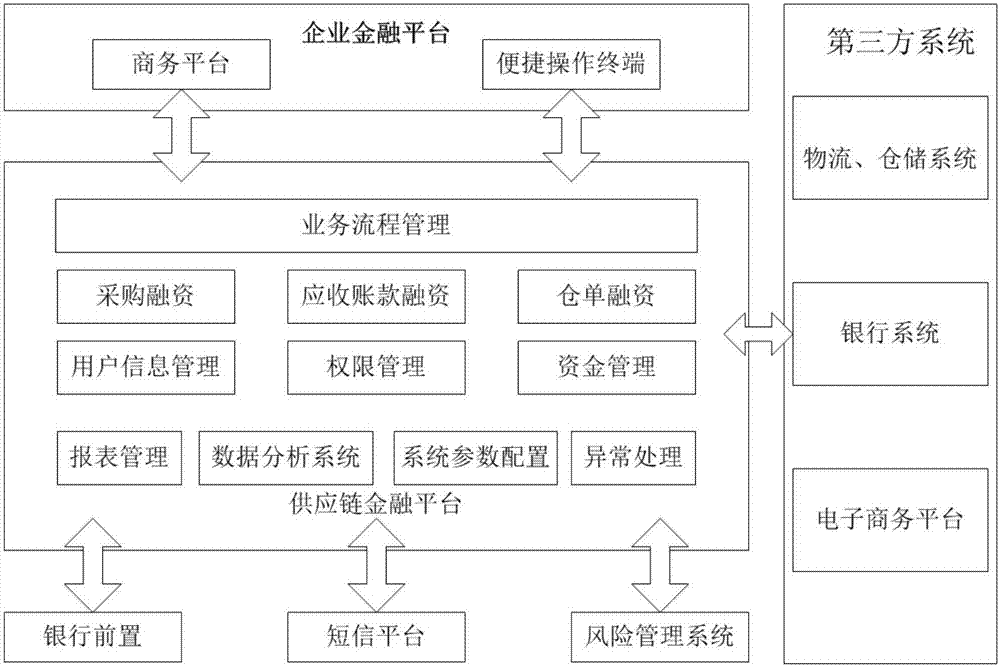

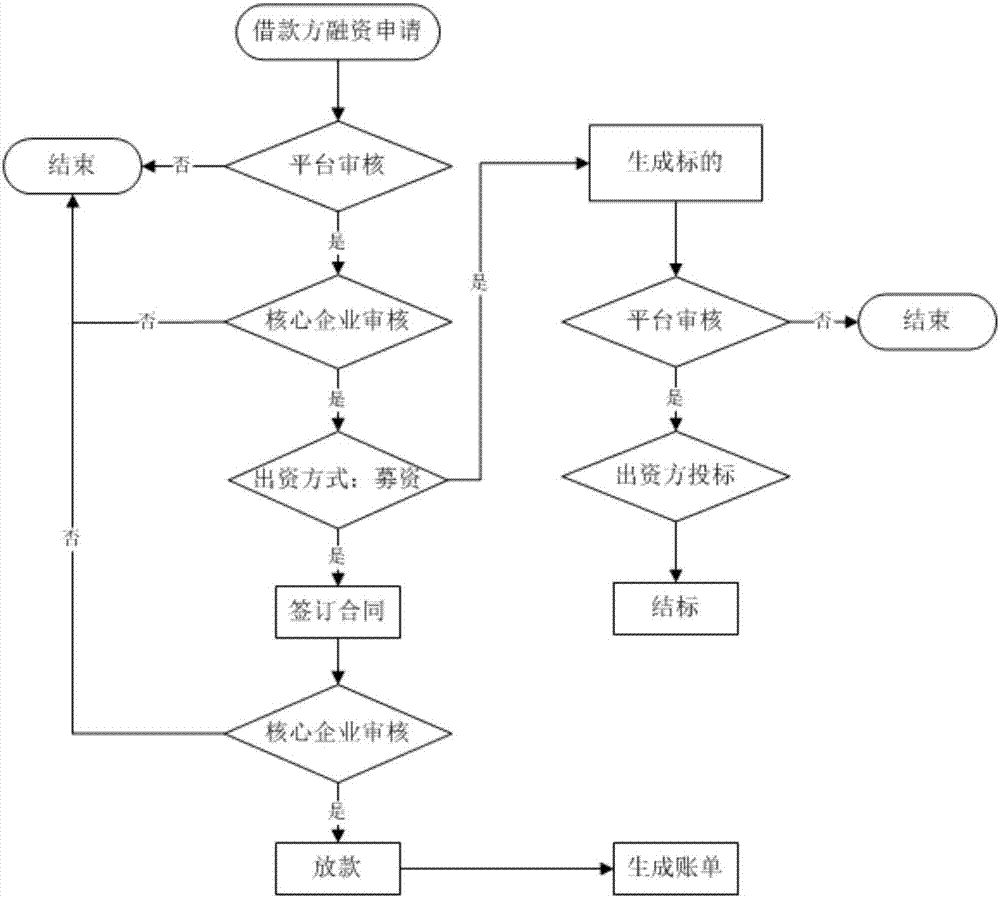

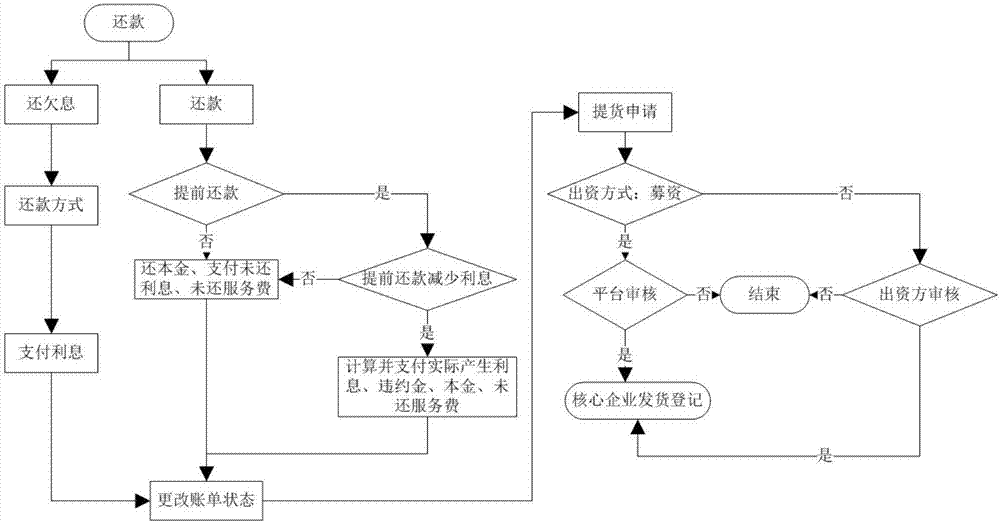

System for providing supply chain intelligent financial service

InactiveCN106991610ASolve financing difficultiesBreak through the rating and credit requirementsFinanceResourcesFinancing costLogistics management

The invention relates to a system for providing supply chain intelligent financial service which comprises an enterprise financial platform module, a supply chain financial platform module and a standard external interface module; the enterprise financial platform module is used for interconnecting with enterprises and providing a commercial platform for enterprises, and financial service requirements are initiated through the commercial platform; the supply chain financial platform module is used for receiving and checking enterprise financial service requirements, and after the requirements passes the checking, logistics and storage system are connected through the standard external interface module; a bank system or an e-commerce platform execute the enterprise financial service; online supply chain financing service is provided, uniform and effective management can be performed, and the flexibility, integrity, rigor and efficiency of the supply chain financing service are improved. According to the invention, the future requirements of the supply chain financing development are adapted, upstream and downstream financing bottleneck is got through, the supply chain financing cost can be reduced, and the competitiveness core enterprise and supporting enterprises are improved.

Owner:深圳前海智链金融服务有限公司

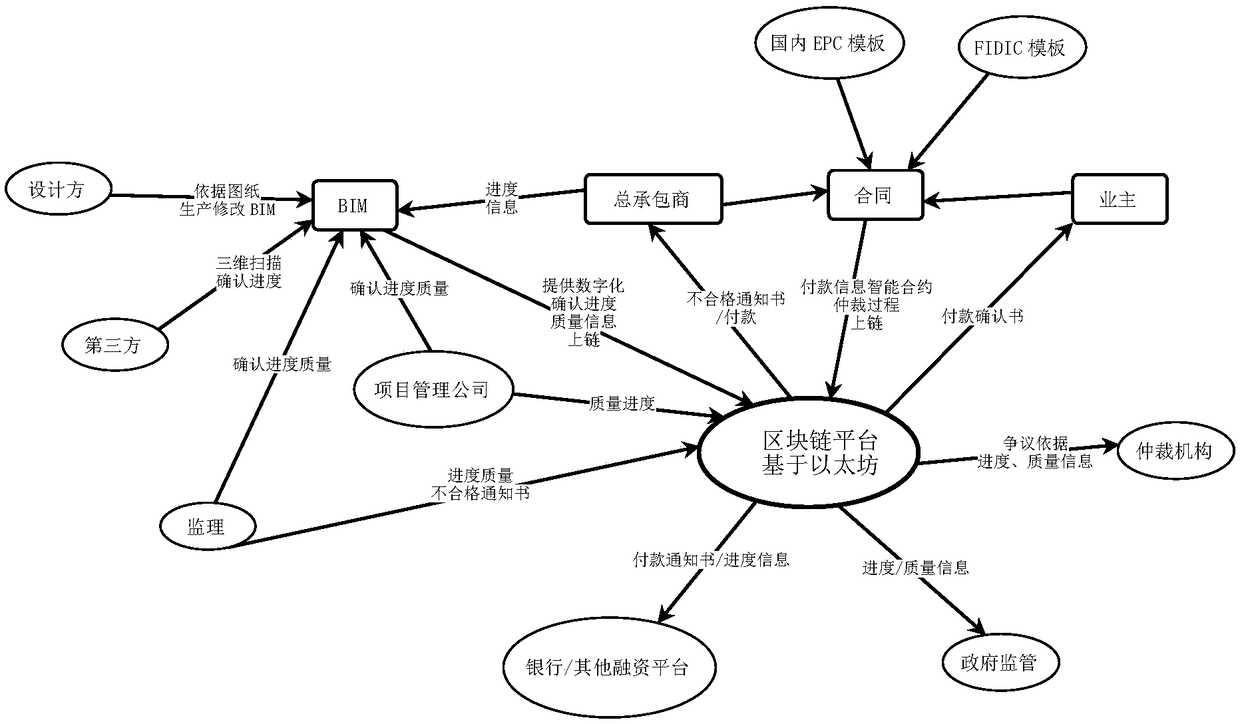

Construction contract payment method based on block chain technology

ActiveCN108921491AWorkload DigitizationSolve construction arrearsUser identity/authority verificationOffice automationFinancing costProject management

The invention discloses a construction contract payment method based on the block chain technology, which is used in the field of construction project management. The construction contract payment method includes: establishing a block chain network consisting of general contractors, designers, project management companies, supervisors, owners, banks or other financiers, government regulators, arbitration institutions, and third-party service agencies; and using a block chain platform to exchange information with the arbitration institutions, the government regulators, the banks or other financing platforms, the owners, and the general contractors, and monitoring project contract payment smart contracts and arbitration process information, establishing contacts with the supervisors, the project management companies, and BIMs, exchanging information, and confirming the quality of project progress. It is able to establish reliable trust of point-to-point in the network, so that the interference of the intermediary is removed in a value transfer process, information is disclosed, and privacy is protected; and both decision-making and protection of individual rights are achieved. The method effectively solves the problem of construction arrears in the construction industry and reduces the financing costs of construction enterprises.

Owner:诸然

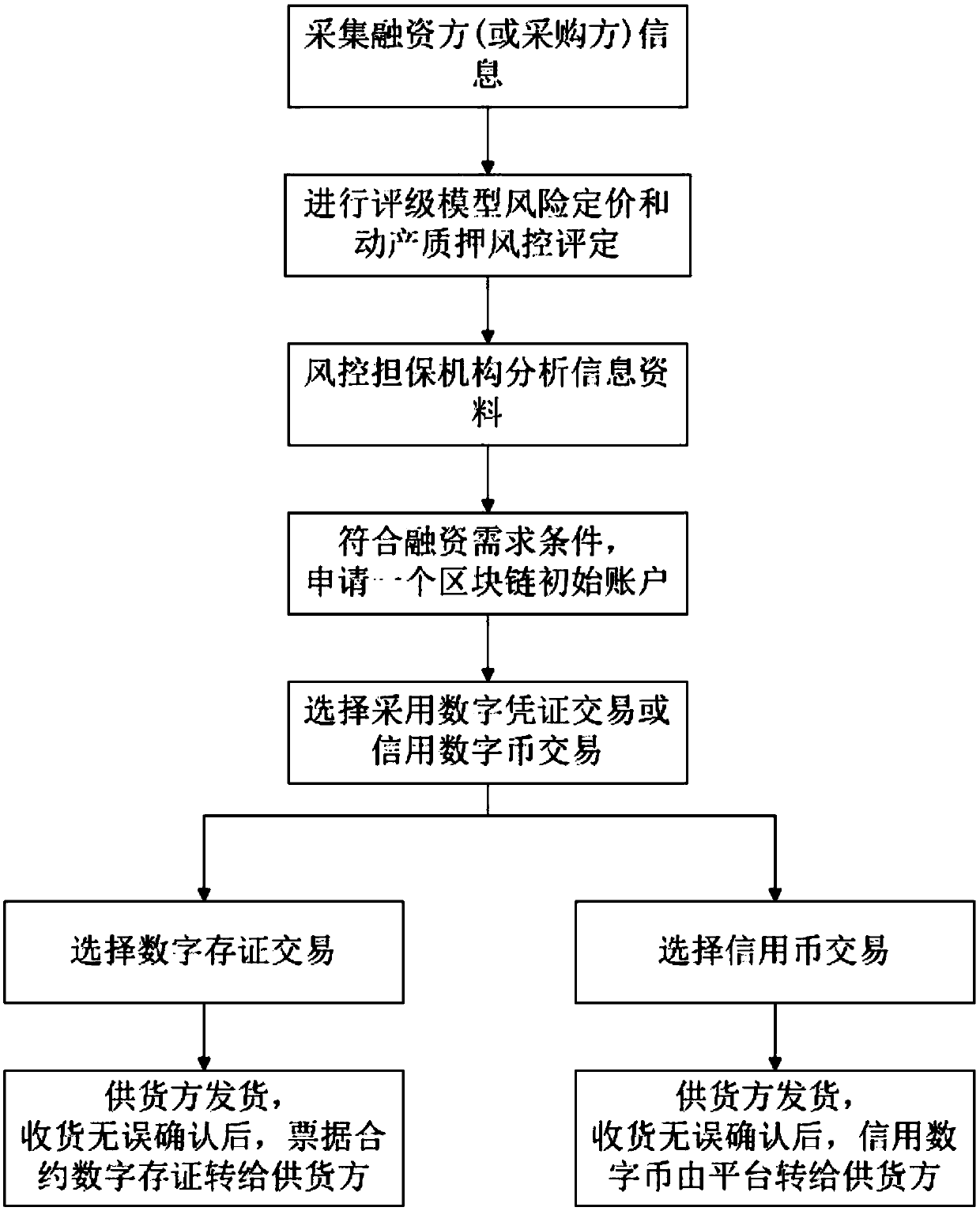

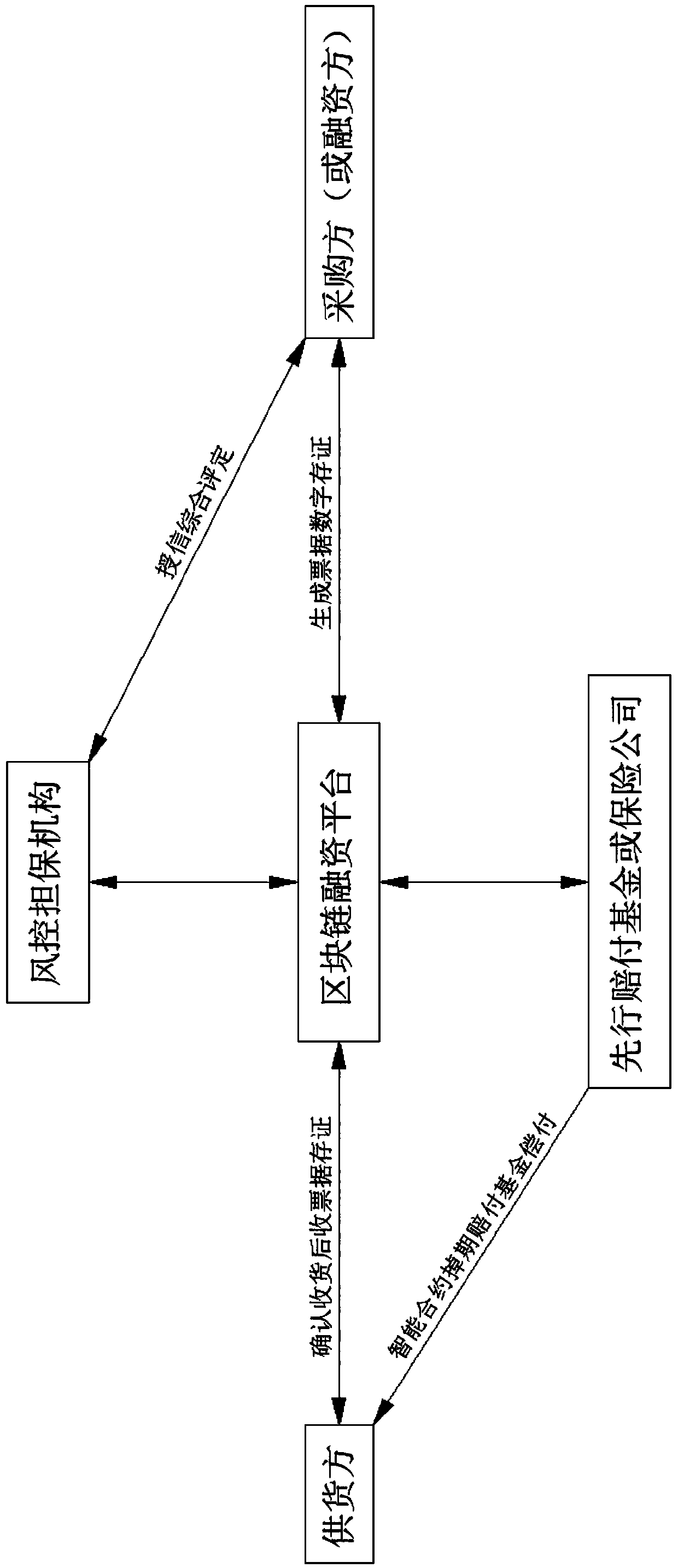

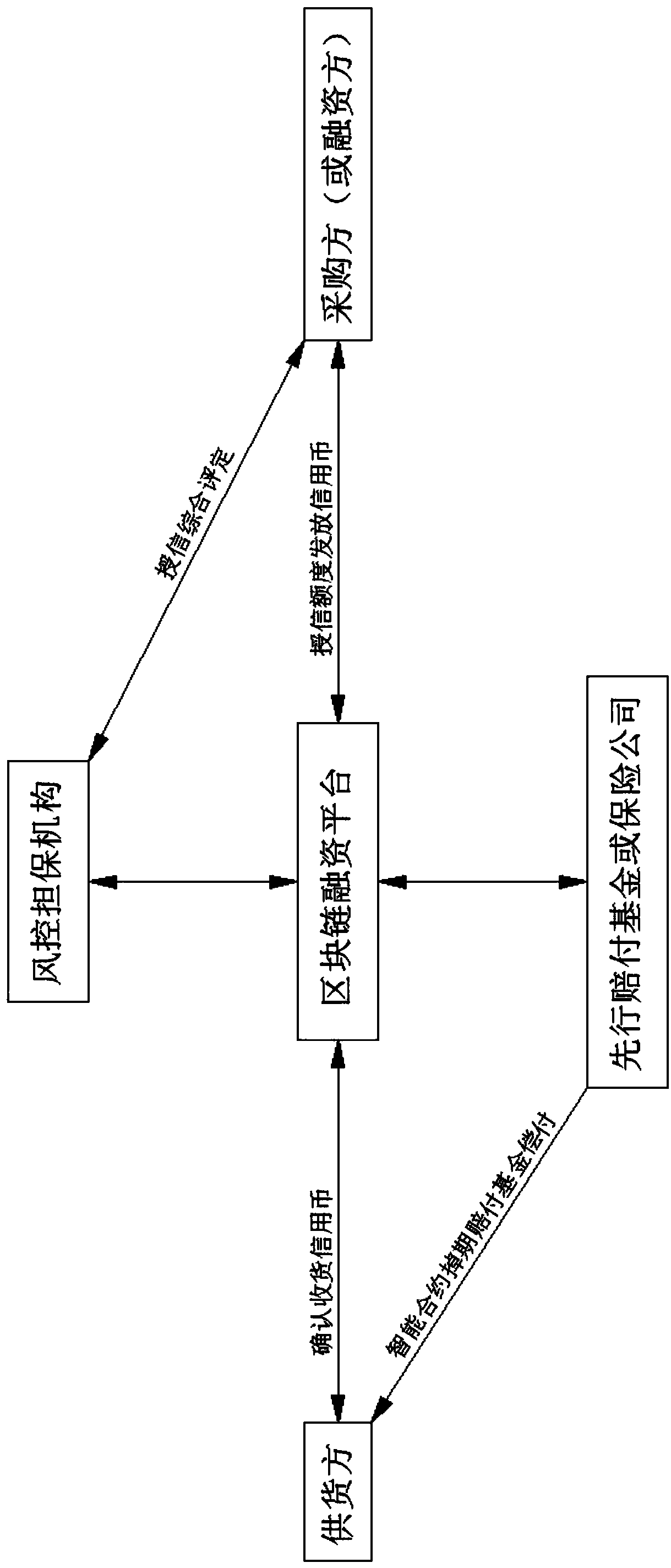

A financing mode method based on blockchain credit currency or digital storage

A financing mode method based on block chain credit currency or digital storage comprises the following steps: firstly, collecting and integrating information of a financing party to obtain industrialdata; Evaluating the industrial data; The risk control guarantee mechanism receives the financing demand application from the platform, carries out offline investigation and evaluation on the financing party, and determines whether a financing condition is met or not; if the financing requirement condition is met, a guarantee and insurance contract is signed, the financing party pays related fees, the financing party needs to apply for a block chain initial account, then a digital certificate transaction or a credit coin transaction is selected according to own requirements, and transaction rules agreement firstly pays digital certificates or credit coins to a platform party to be delivered by a supplier; After the financing party confirms that the receipt is correct, the digital certificate or credit coin is transferred to the supplier for payment or credit coin receiving through the platform, and the combined methods such as risk control guarantee agencies (or financial institutions), earlier compensation funds or insurance and the like are combined and utilized, so that the purposes of reducing financing cost and improving efficiency are achieved.

Owner:程玉亮

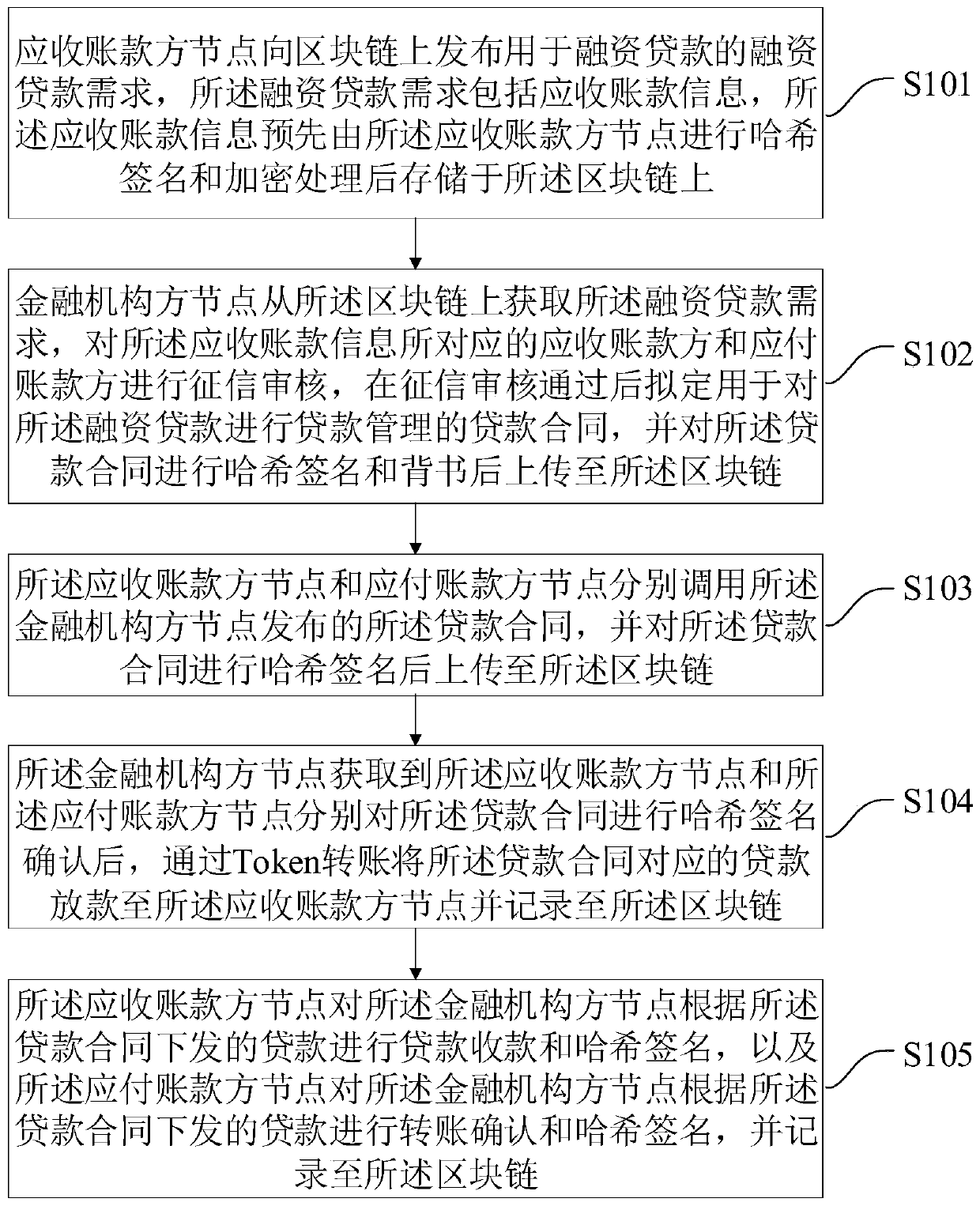

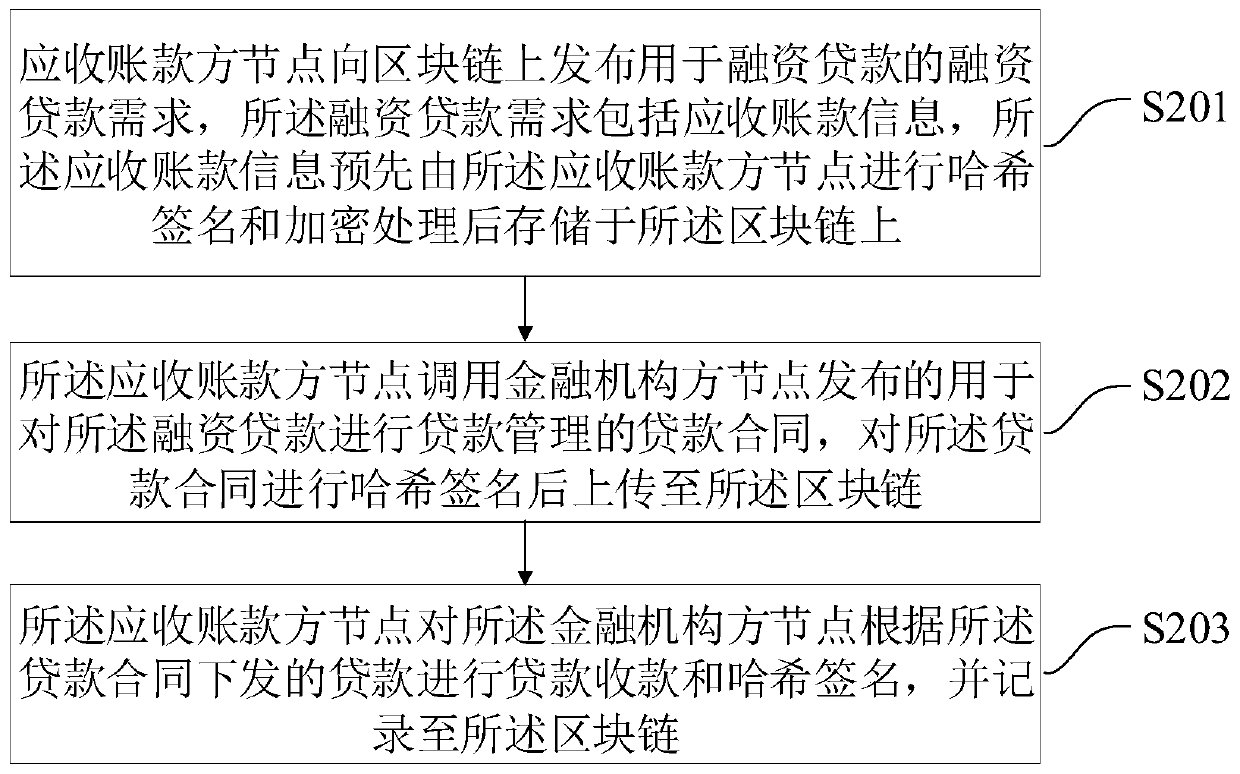

Account receivable financing loan method, equipment, medium and account receivable financing loan system based on blockchain

ActiveCN110148054AImprove efficiencyImprove securityFinanceDigital data protectionFinancing costAccounts payable

The invention discloses an account receivable financing loan method based on a block chain, equipment, a medium and an account receivable financing loan system based on a block chain. The method comprises: enabling an account receivable party node to issue a financing loan demand for financing loan to the block chain, and the financing loan demand comprises account receivable information; callinga loan contract which is published by the financial institution side node and is used for carrying out loan management on the financing loan, carrying out Hash signature on the loan contract and uploading the loan contract to the block chain; and performing loan collection and hash signature on the loan issued by the financial institution side node according to the loan contract, and recording theloan collection and hash signature to the block chain. According to the account receivable financing loan method based on a block chain, the equipment, the medium and the account receivable financingloan system based on a block chain, the account receivable party carries out financing loan on the financial institution party through the block chain in an account receivable mode, all transaction processes are recorded on the block chain, signature confirmation of the account receivable party, the financial institution party and the account payable party is needed in the transaction processes,the financing efficiency and safety are improved, and the financing cost is reduced.

Owner:HUNAN UNIV

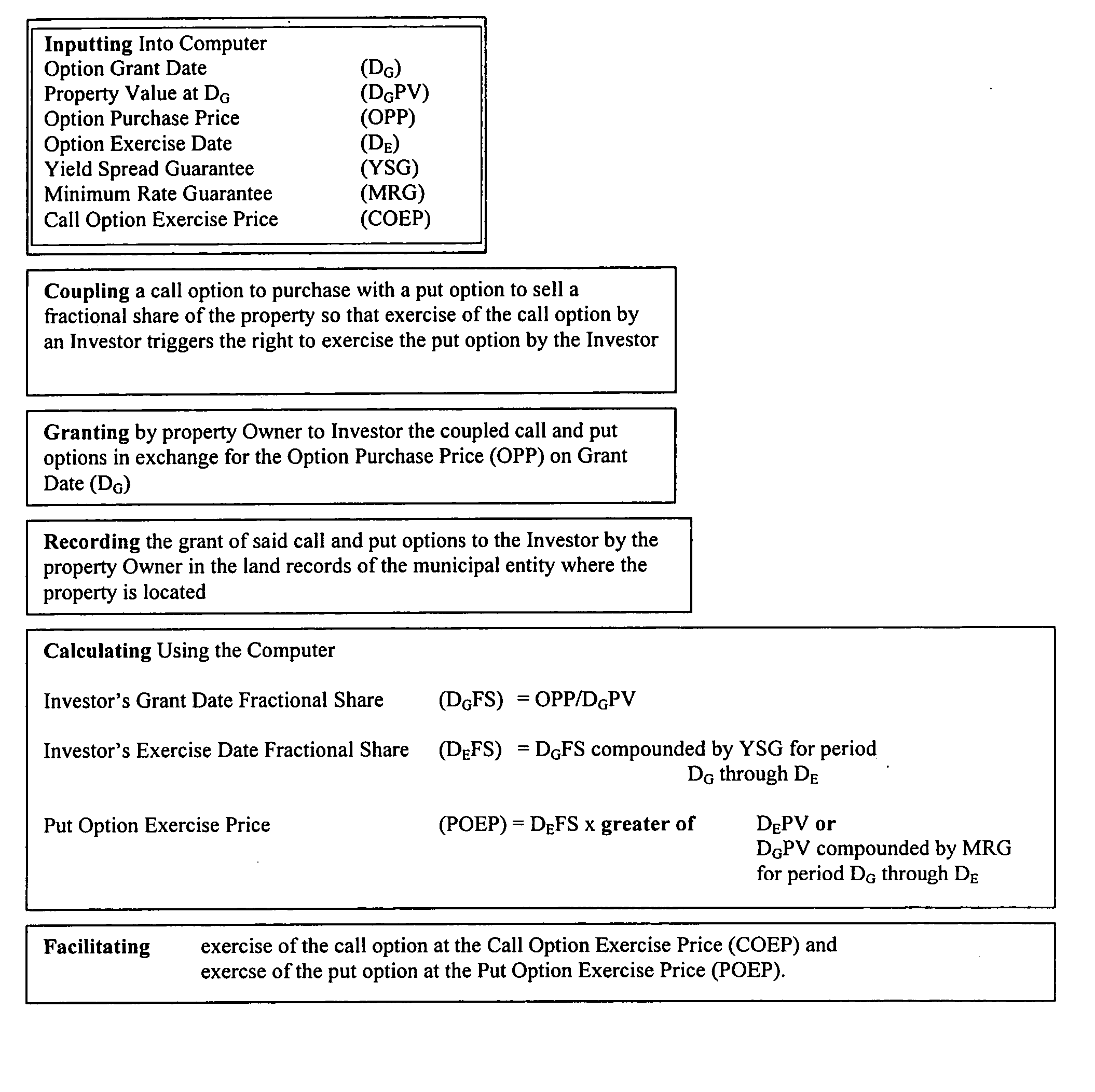

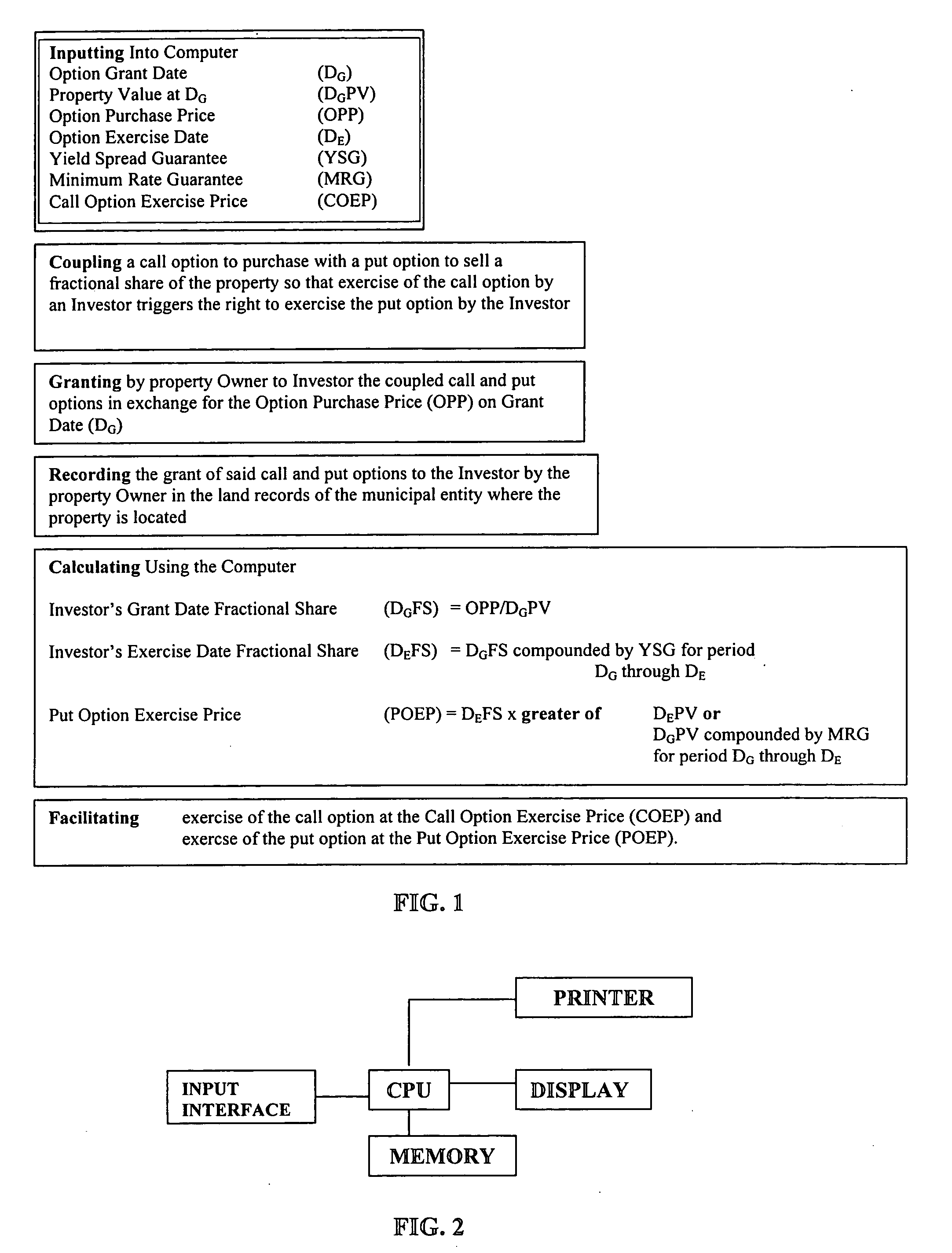

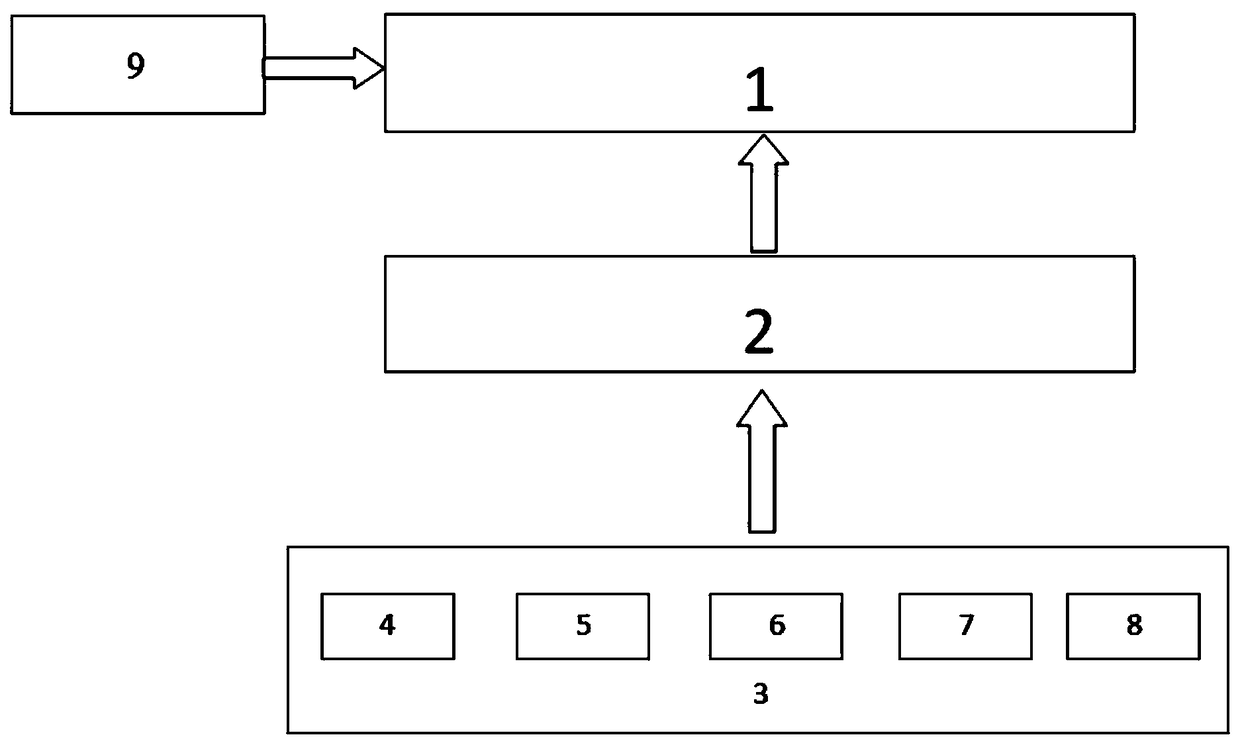

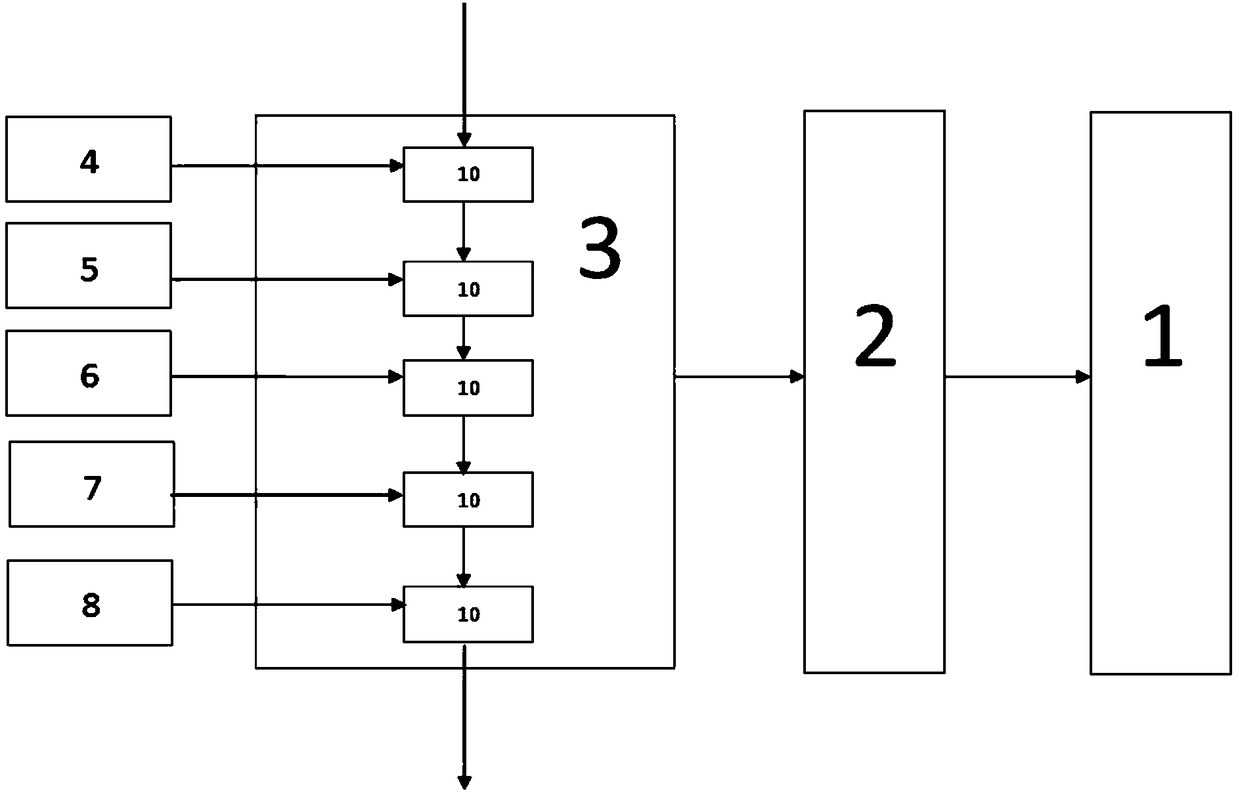

Method and system for implementing option interests in real property

The invention is a method and system of implementing option interests in real property. The owner of the property receives funds from an investor, which can be used to provide the property owner with income for living expenses or to use to lower the property owner's financing costs. In exchange for each payment, the property owner grants the investor a call option to purchase coupled with a put option to sell a fractional interest in the real property at some future date. The value of the investor's fractional share will increase along with the value of the property, allowing the investor to participate in rising property values. The owner does not pay interest on the monies received, leaving the cash flow for other purposes.

Owner:WOYKE JOHN

Financial dynamic air control system based on block chain technology and construction method thereof

InactiveCN108074180AEasy to shareProtection of rights and interestsFinanceFinancing costControl system

A financial dynamic air control system based on the block chain technology comprises a block chain account system, a data processing center and an air control rule engine, wherein the block chain account system comprises an enterprise basic information block chain collecting module, a payment transaction block chain collecting module, a logistic block chain collecting module, an invoice block chain collecting module and an entrepreneur credit investigation module; the data processing center performs storage and verification on uplink information; the air control rule engine recommends relatedfinancial products for enterprises according to the uplink information; a financial dynamic air control construction method based on the block chain technology comprises the steps of collecting integrated data, verifying storage data and analyzing matched data. The enterprise financing channel can be broadened, and the financing cost is saved.

Owner:广州富融信息技术有限公司

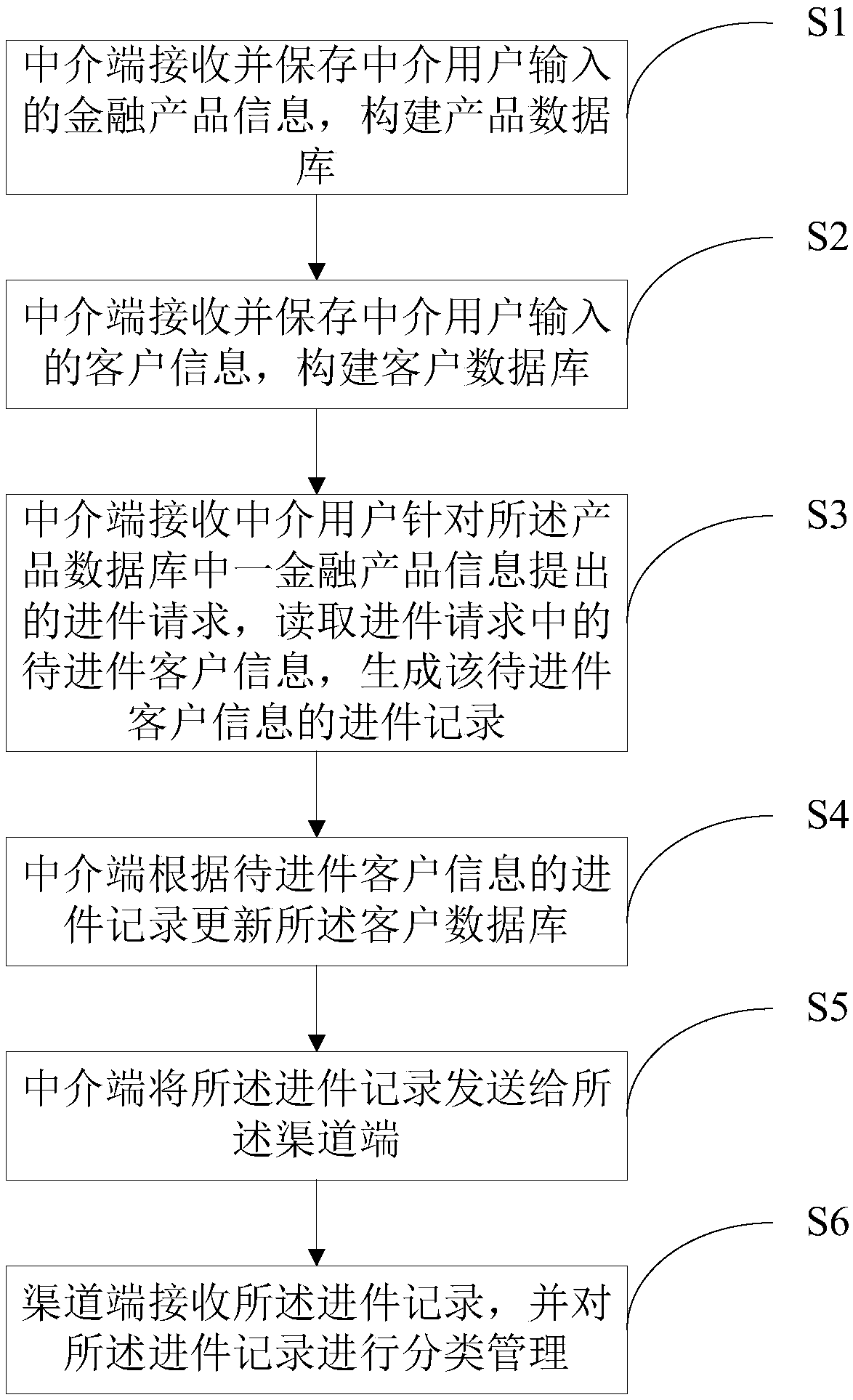

Client management system suitable for financial intermediary industry

ActiveCN109493234ASolve management problemsSolve sales problemsFinanceOperational costsFinancing cost

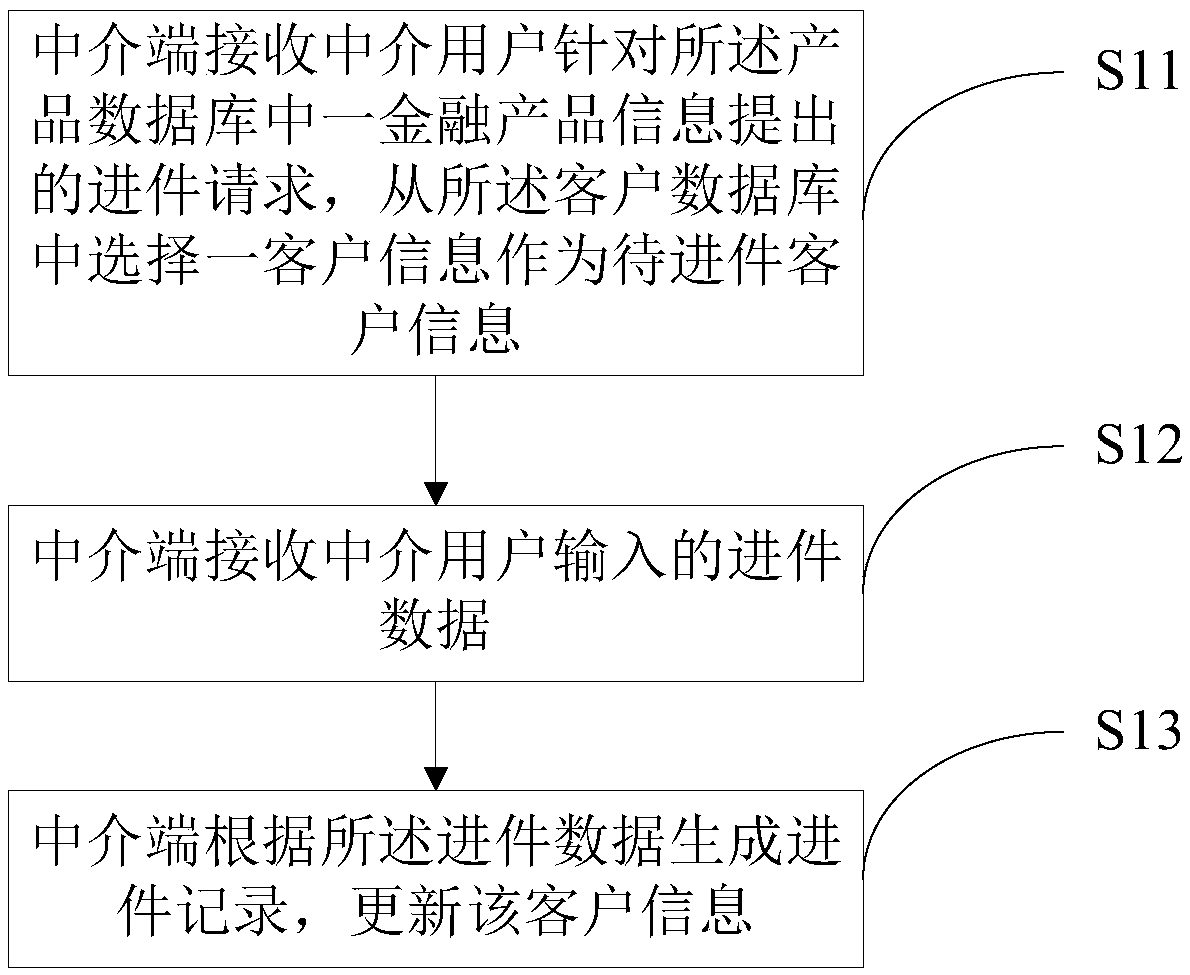

The invention provides a client management system suitable for the financial agent industry. An agent end constructs a product database and a client database; a delivery incoming request proposed by an intermediary user for financial product information in the product database is received, to-be-delivered client information in the delivery incoming request is read, a delivery incoming record of the to-be-delivered client information is generated, and the client database is updated according to the delivery incoming record of the to-be-delivered client information; and the channel end receivesthe incoming record and carries out classification management on the incoming record. The system provides bank loaning resource information for the intermediary end, provides intermediary agent channel resources for the channel end, can help the financial intermediary to automatically manage clients, reduces the operation cost of intermediary companies, and improves the working efficiency. On-lineinformation and resource integration is carried out on the upstream and downstream supply and demand relation of the industry, the upstream and downstream supply and demand relation is broken through, the problem of information resource asymmetry is solved, and a user is helped to reduce financing cost and improve financing efficiency.

Owner:杭州奕奕网络科技有限公司

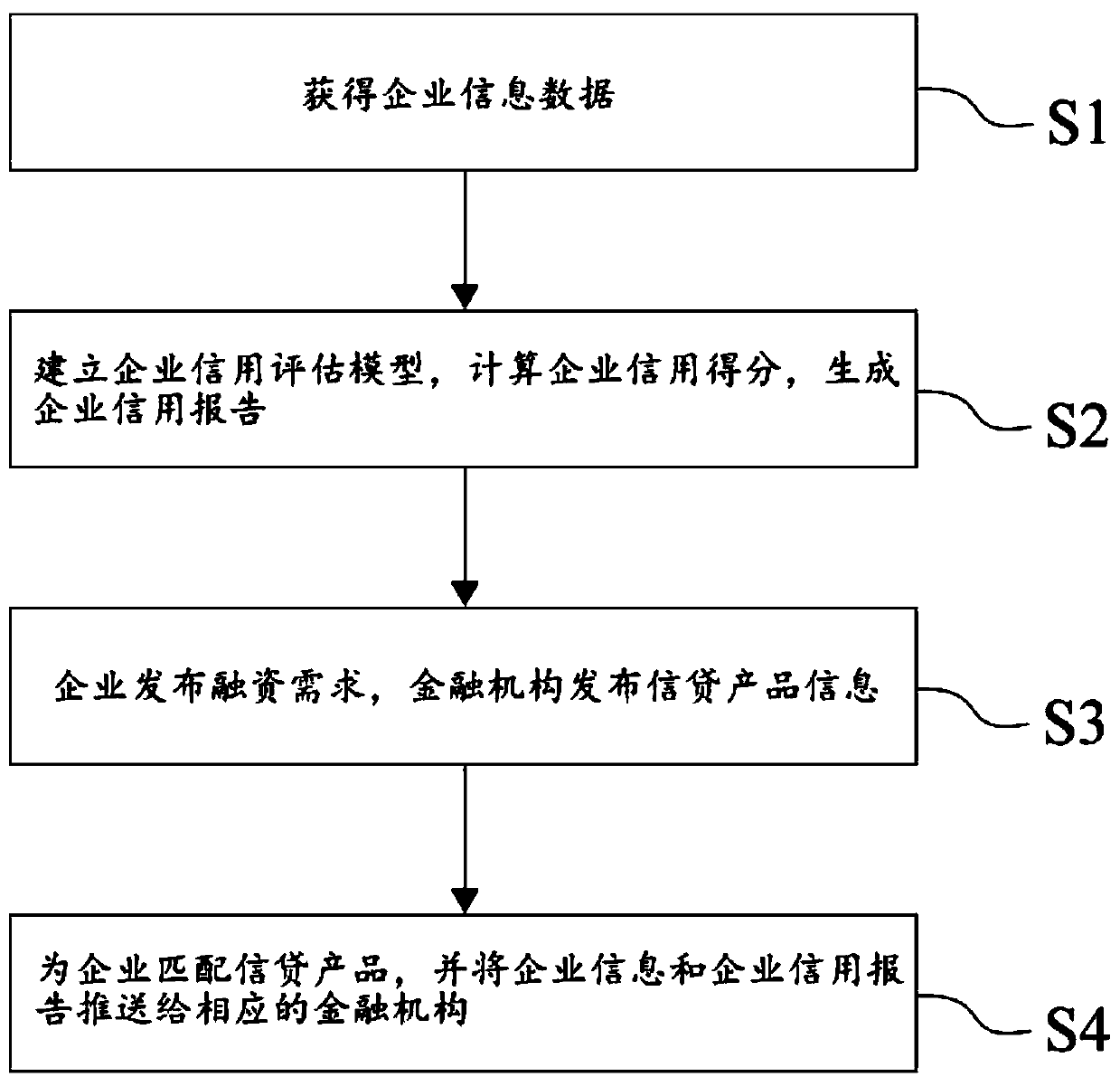

Credit evaluation device and credit evaluation system

InactiveCN110443698AEliminate information asymmetryRemove asymmetryFinanceFinancing costEvaluation system

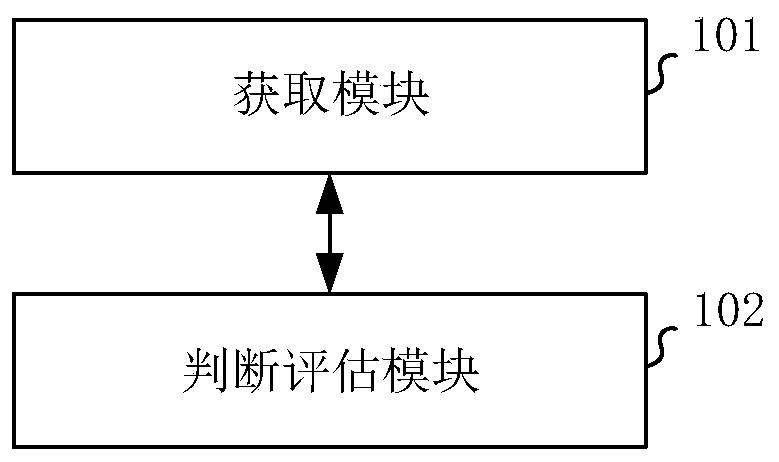

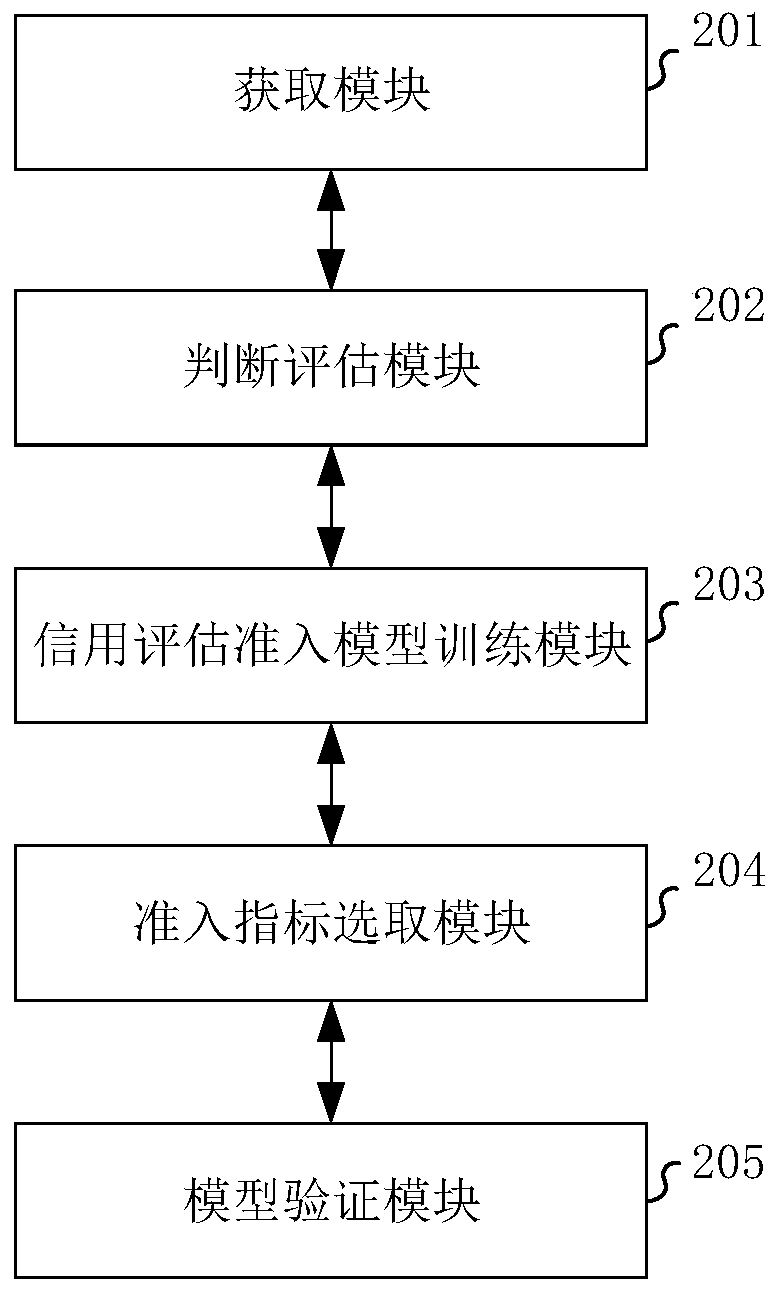

The embodiment of the invention provides a credit evaluation device and a credit evaluation system, and the device comprises an obtaining module which is used for obtaining the evaluation data of an enterprise according to the loan request of the enterprise; a judgment and evaluation module, used for judging whether the enterprise meets an admission condition of participating in credit evaluationor not according to the evaluation data of the enterprise; if so, carrying out credit assessment on the enterprise according to the assessment data of the enterprise; if not, refusing the loan requestof the application enterprise. Information asymmetry between a financial institution and small and medium-sized enterprises is eliminated. The financial institution is helped to screen small and medium-sized enterprises, loans are provided for small and medium-sized enterprises with high credit, credit relations are established, the fund safety of the financial institution is guaranteed, the fundincome is stabilized. Meanwhile, the problems that the small and medium-sized enterprises are difficult to finance and high in financing cost are solved, and development of national economy is promoted.

Owner:爱信诺征信有限公司

Financing credit guarantee method and system based on multi-source data block chain tamper prevention

InactiveCN111222175AEasy to understandEnsure authenticityDigital data protectionBuying/selling/leasing transactionsThird partyFinancing cost

The invention discloses a financing credit guarantee method and system based on multi-source data block chain tamper prevention. The method comprises the following steps of: uploading evaluation information: uploading enterprise operation information evaluated by a third-party certification authority to a block chain; collaborative manufacturing order data uploading: uploading the order data in the collaborative manufacturing process to the block chain; financing credit guarantee: submitting a financing application to the block chain, and granting access permission to the block chain; financing decision: carrying out financing judgment; determining financing and generating a financing contract to the block chain; determining a financing contract; the invention aims to provide a financing credit guarantee method and system based on multi-source data block chain tamper prevention. The authenticity of the multi-source data is guaranteed through the block chain, the multi-source data provides credit guarantee for financing of small and medium-sized enterprises, and the problems that financing is difficult, financing time is long, financing processes are complex and bank financing costis high due to the fact that credit of the small and medium-sized enterprises in a collaborative manufacturing mode cannot be guaranteed are solved.

Owner:GUANGDONG UNIV OF TECH

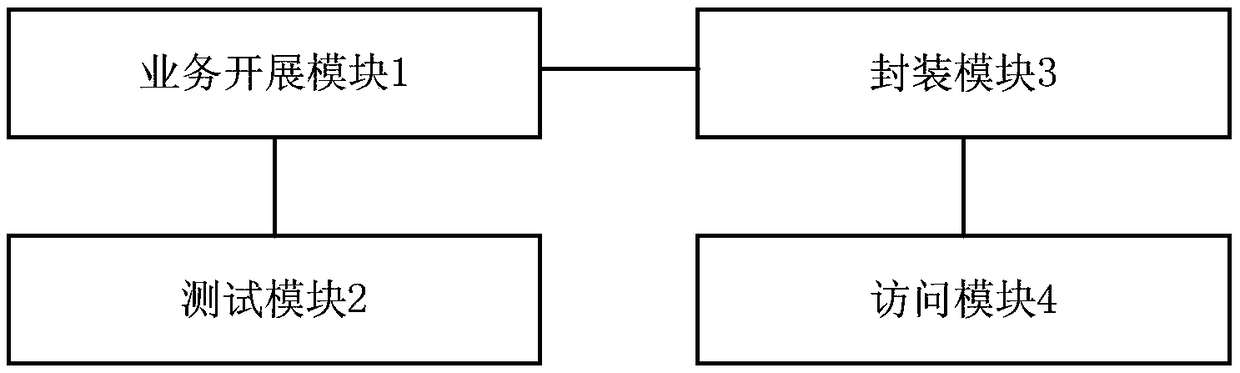

Blockchain public financing system

InactiveCN108764905AImprove securityAchieve decentralizationFinancePayment protocolsTest performanceFinancing cost

The invention provides a blockchain public financing system. The system includes a service carrying-out module, a test module, an encapsulation module and an access module. The service carrying-out module carries out public financing on the basis of a blockchain. The test module is used for testing performance of the service carrying-out module. The encapsulation module is used for encapsulating blockchain interfaces. The access module is used for accessing the encapsulated blockchain interfaces. The system has the advantages that the provided blockchain public financing system is based on blockchain technology, decentralization and trust-free effects in a financing process are realized, financing costs are reduced, and financing efficiency and fund security are improved.

Owner:肖鑫茹

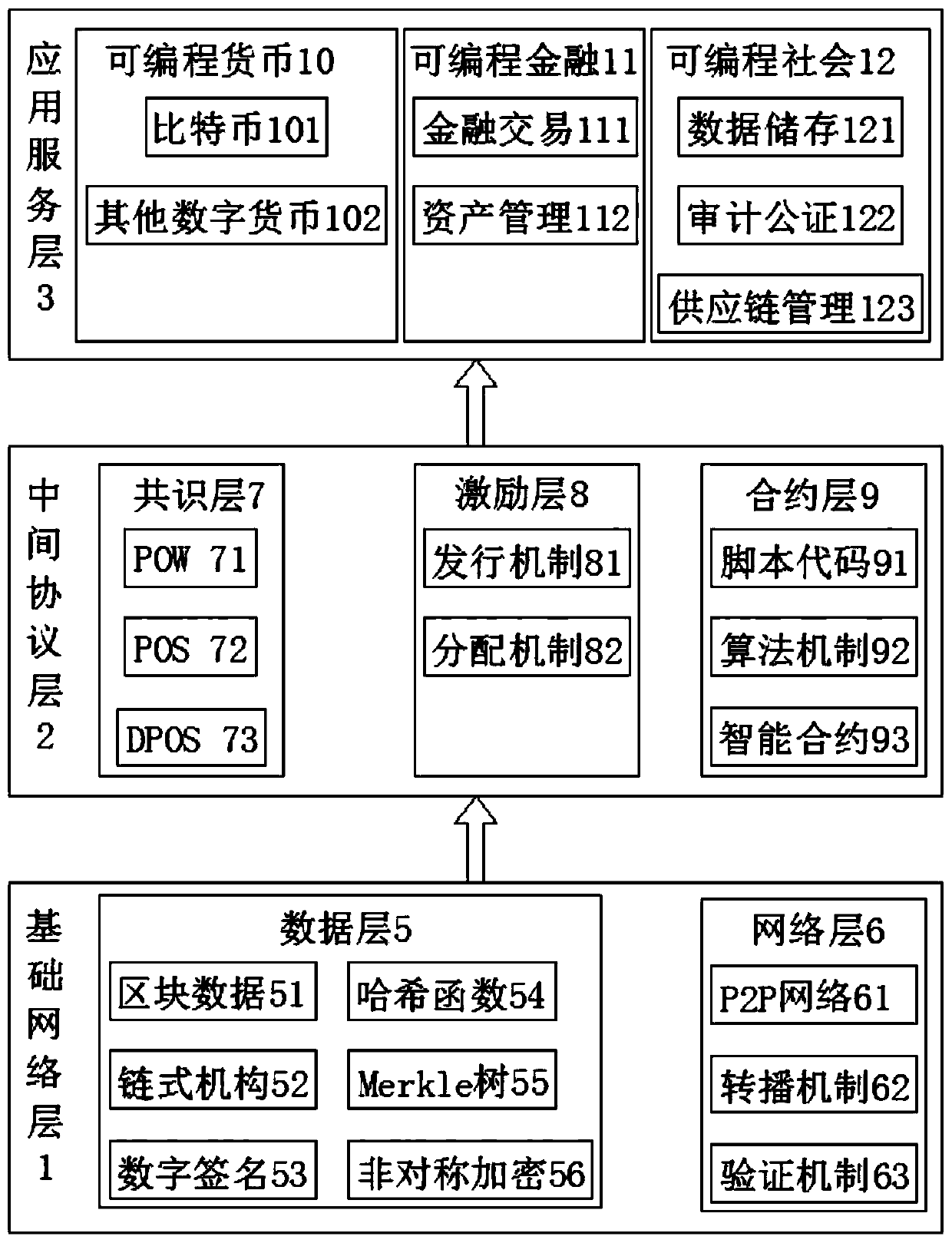

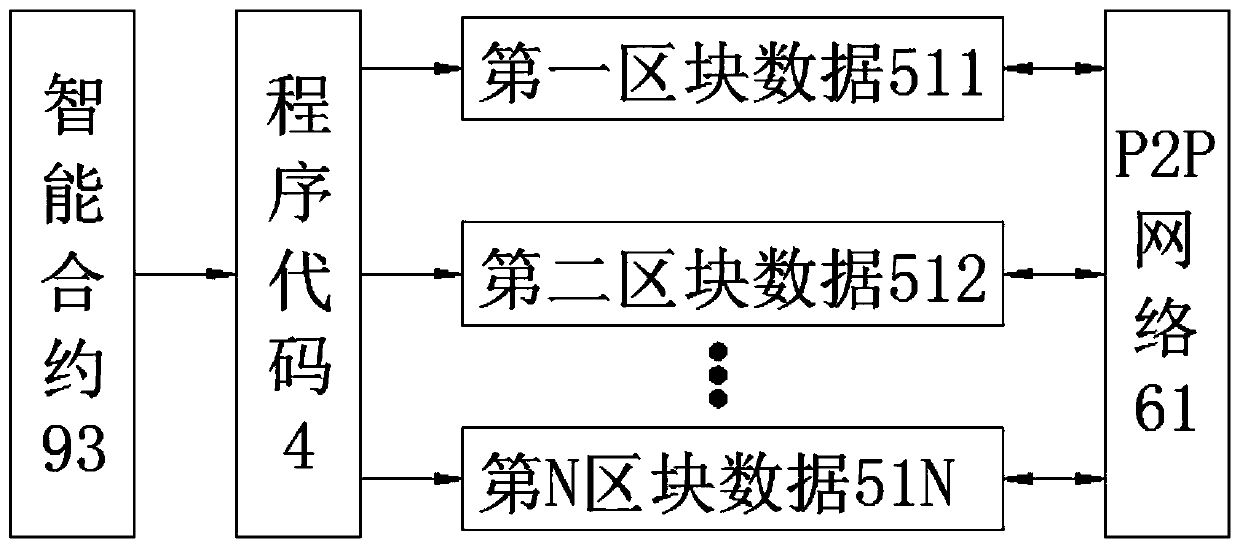

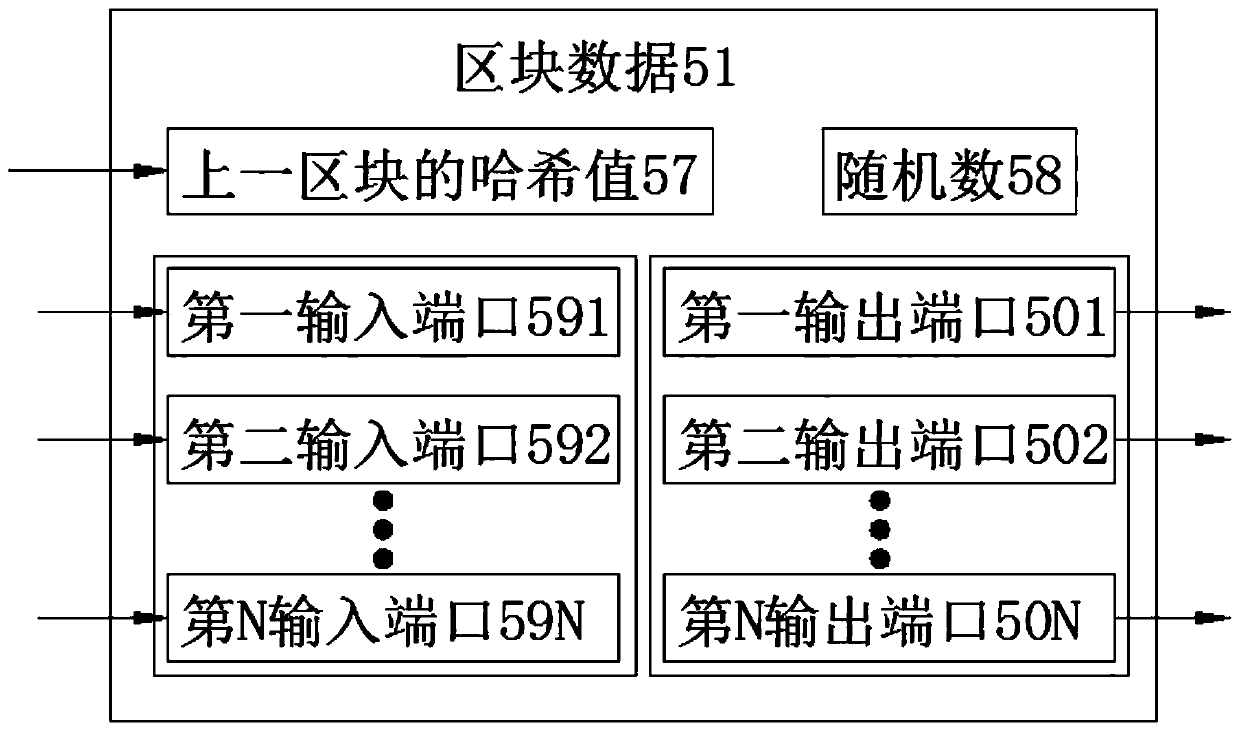

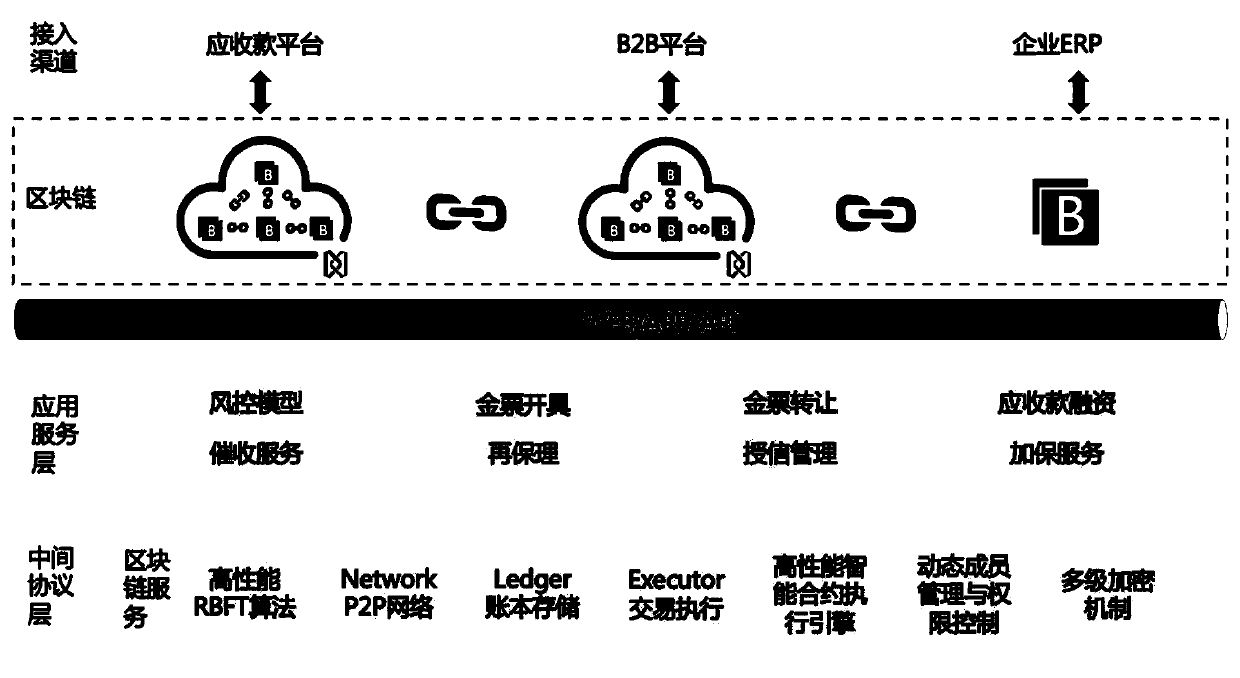

Big data intelligent operation management system based on block chain technology

InactiveCN109859046AEffective connectionReduce financial costsFinanceEncryption apparatus with shift registers/memoriesCredit systemFinancing cost

The invention discloses a big data intelligent operation management system based on a block chain technology. The system comprises a basic network layer, an intermediate protocol layer, an applicationservice layer and an intelligent contract, the output end of the basic network layer is connected with the input end of the intermediate protocol layer, and the output end of the intermediate protocol layer is connected with the input end of the application service layer. The invention relate to the technical field of operation management system. According to the big data intelligent operation management system based on a block chain technology, a block chain structure is formed by N pieces of block data, The whole system is supported by using the block chain, and after other feature modulesare carried, intermediation removal, consensus mechanism and tamper resistance are realized, so that the factors hindering enterprise development, such as weak trust foundation between people, imperfect personal credit system and the like, are effectively solved;, and meanwhile, after the blockchain is used, a third-party credit increasing institution does not need to identify the authenticity ofvarious related certificates on the supply chain, so that the financing cost is reduced, the financing period is shortened, and help is provided for intelligent operation of enterprises.

Owner:威海华智数字经济研究院有限公司

Credit evaluation and credit extension method based on big data

PendingCN111369340ASolve the problem of difficult financing and expensive financingFinanceFinancing costBusiness enterprise

Owner:易信(厦门)信用服务技术有限公司

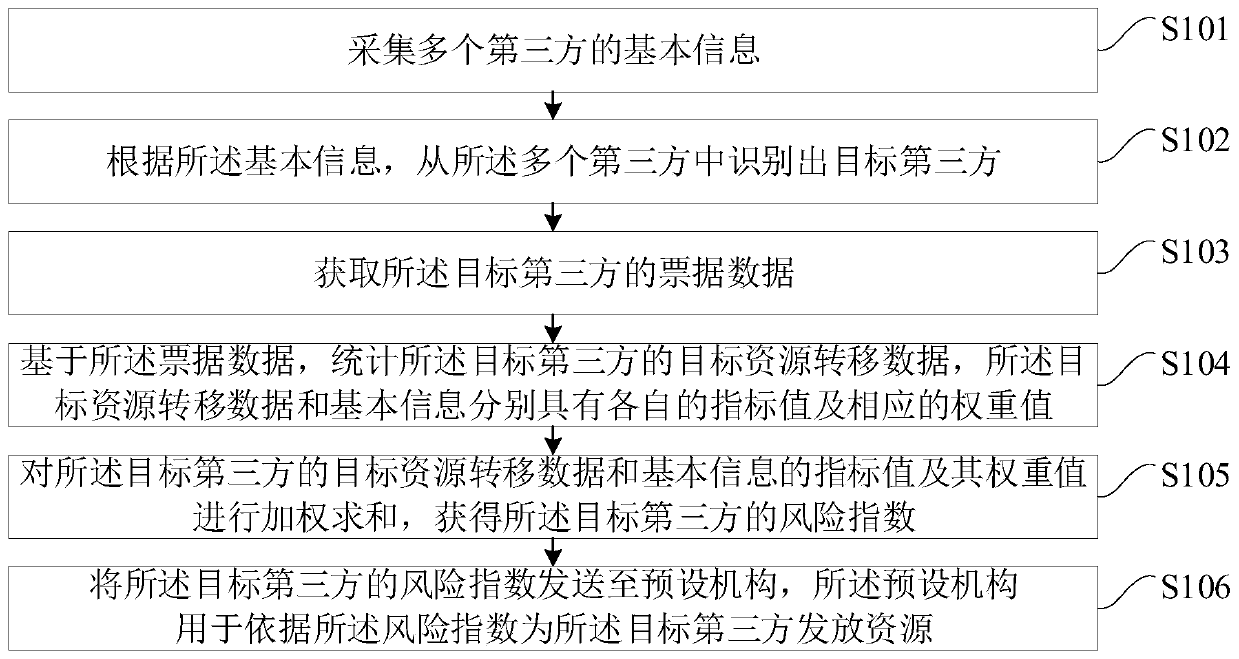

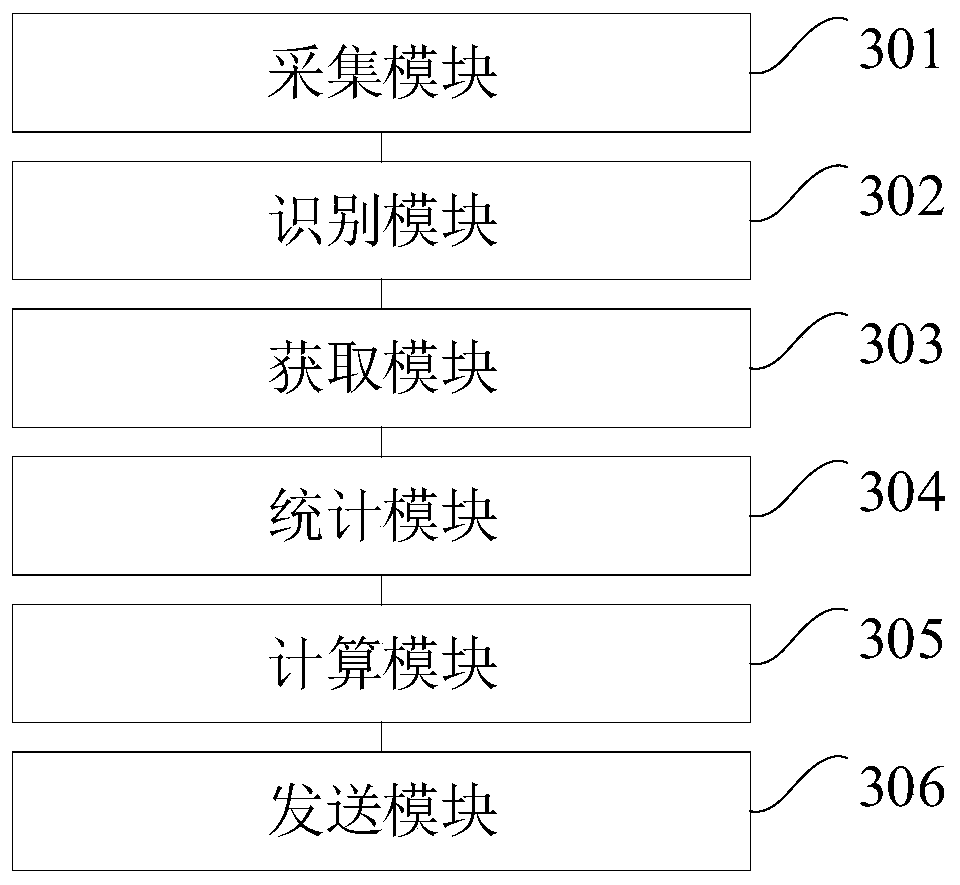

Risk index evaluation method and device

PendingCN110363647ASolve the problem of insufficient loans for downstream suppliers of core enterprisesReduce financial costsFinanceThird partyFinancing cost

The embodiment of the invention is suitable for the technical field of the Internet, and provides a risk index evaluation method and device, and the method comprises the steps: collecting the basic information of a plurality of third parties; identifying a target third party from the plurality of third parties according to the basic information; acquiring bill data of the target third party; counting target resource transfer data of the target third party based on the bill data; performing weighted summation on the index values and the weight values of the target resource transfer data and thebasic information of the target third party to obtain a risk index of the target third party; and sending the risk index of the target third party to a preset mechanism, whereinthe preset mechanism is used for issuing resources to the target third party according to the risk index. The problem that commercial banks cannot issue loans to downstream suppliers of core enterprises due to insufficientdata is solved, credit endorsement is carried out on the downstream suppliers through the core enterprises, and the financing cost of the downstream suppliers is reduced.

Owner:ONE CONNECT SMART TECH CO LTD SHENZHEN

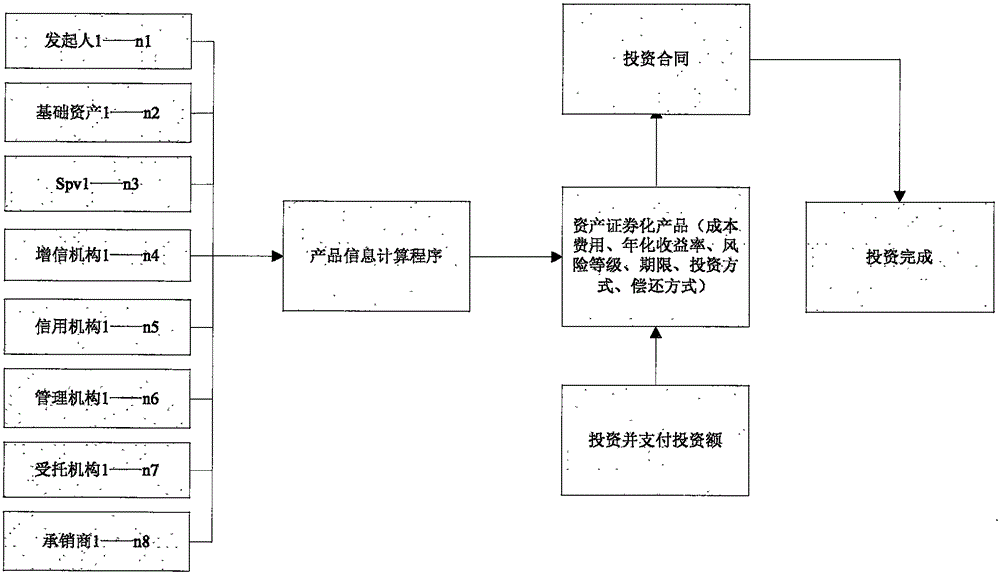

Internet culture-finance resource integration system

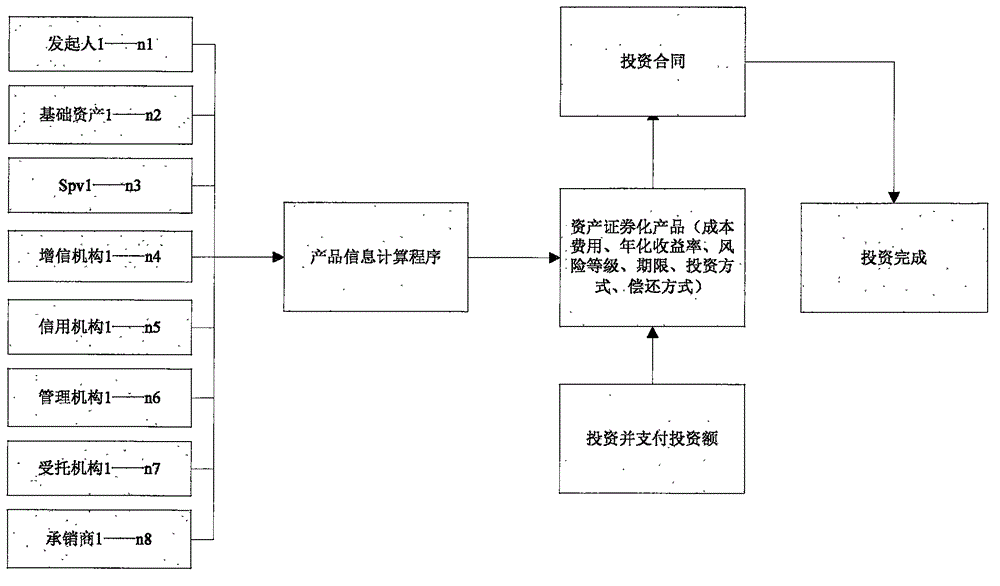

InactiveCN105205713ABroaden source channelsImprove financial structureFinanceFinancing costSubject Element

The invention provides an internet culture-finance resource integration system in order to solve a problem that the existing cultural industries are non-smooth in financing channel, tensed in capital source and simple and traditional in used financing tool. The system comprises an originator module, a basic asset pool module, a special purpose vehicle (SPV) module, a credit adding agency module, a credit rating agency module, a management agency module, a trustee agency module, an underwriter module and an investor module, and is characterized in that each module comprises a plurality of subjects, investors can select different subject elements according to preferences, risks, earnings and liquidity principles, the selected elements are regarded as a whole and inputted into a product information calculation program of the system, and the information calculation program can output investment information for the investors to refer. Through the internet culture-finance system, the cultural industries can vitalize a large amount of assets which lack liquidity, thereby improving the financial structure of enterprises, broadening capital source channels, and reducing the financing cost.

Owner:长沙星际泛函网络科技有限公司

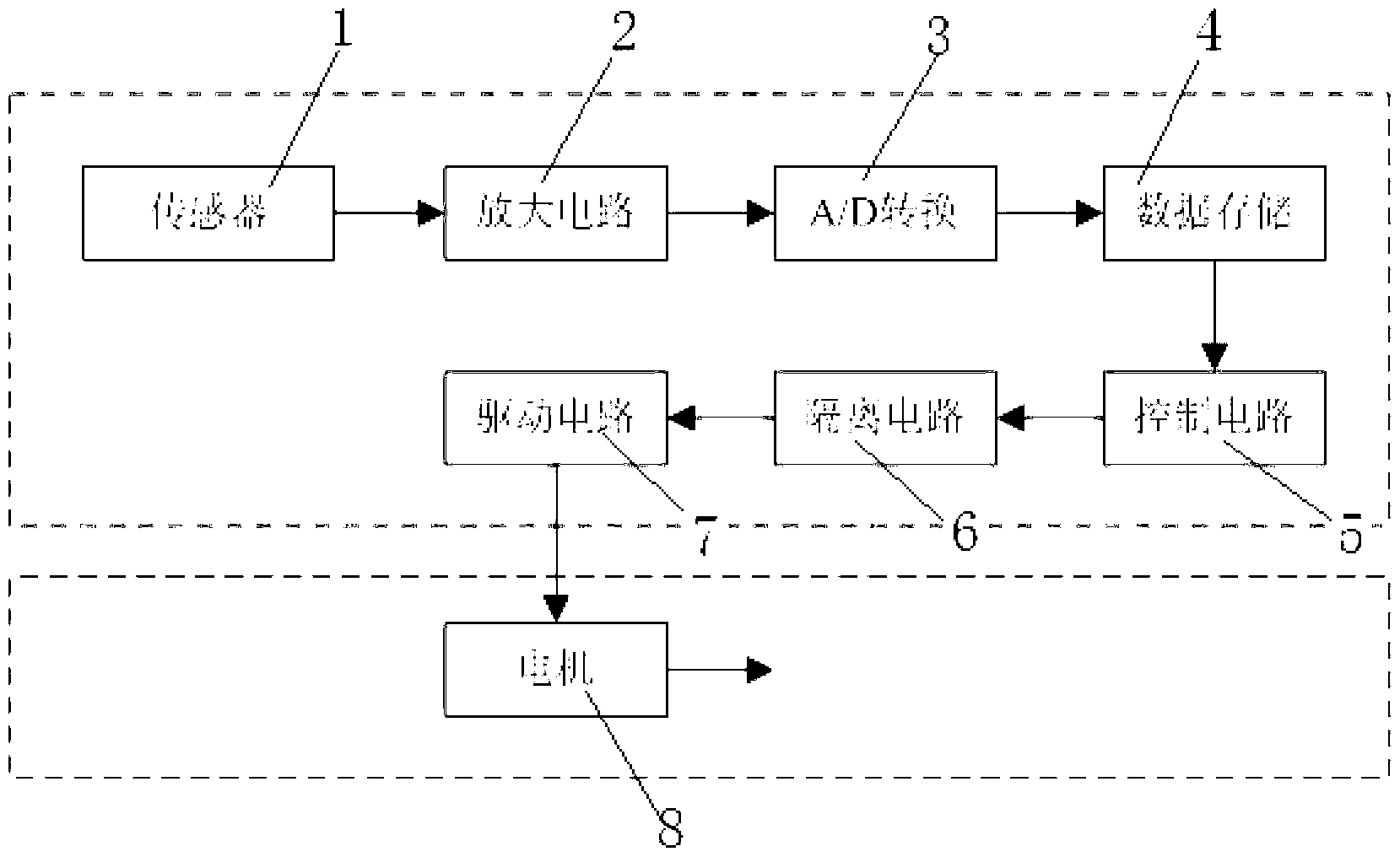

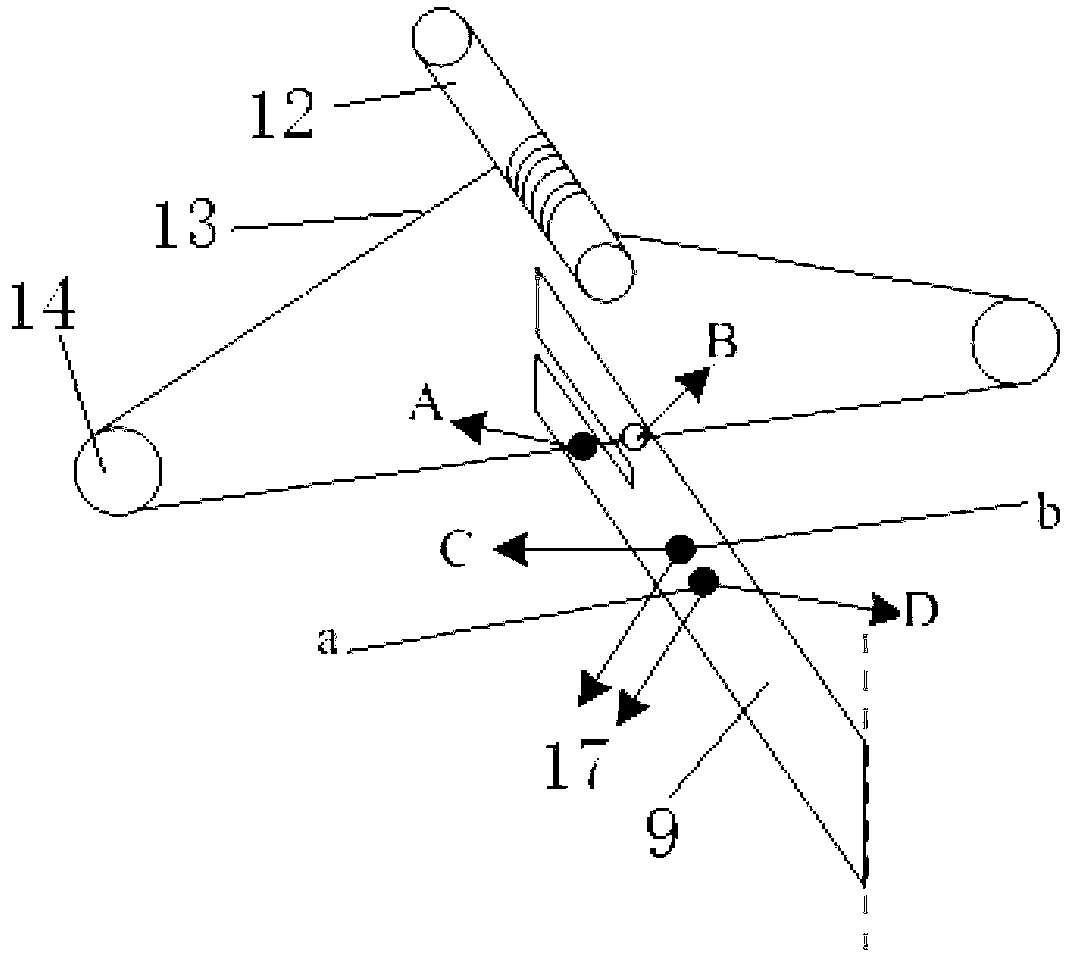

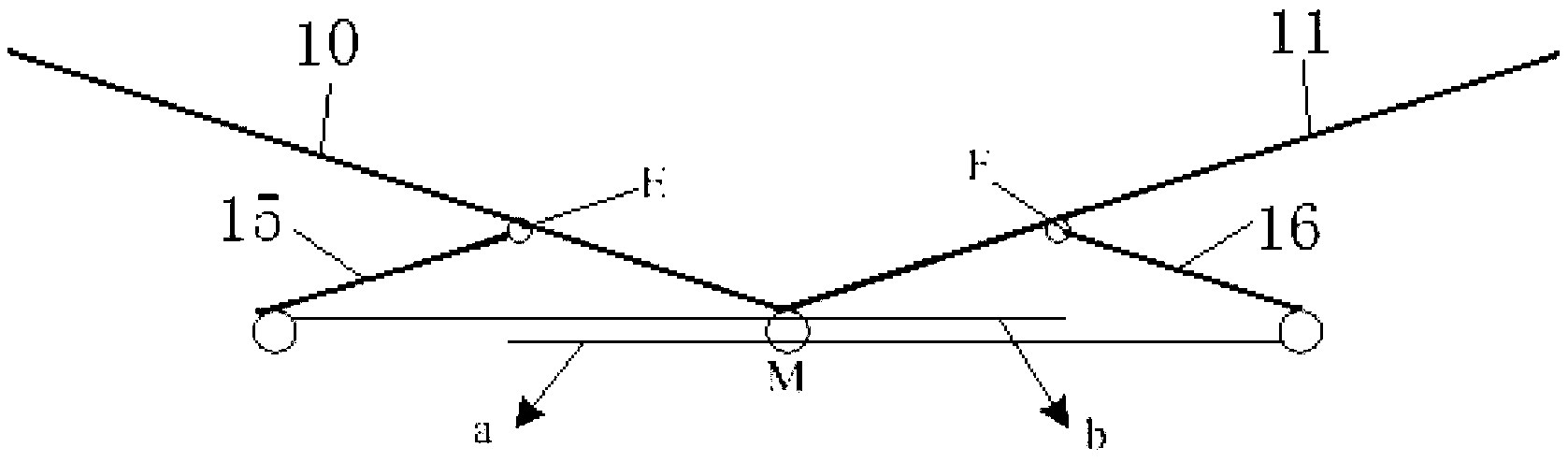

Snore stopping pillow

InactiveCN103251474AWill not interfere with each otherNo complicationsSnoring preventionThroatFlaccid muscles

The invention discloses a snore stopping pillow which comprises an intelligent automatic control module and a mechanical rotation module. The intelligent automatic control module comprises a sound sensor, an amplifying circuit, an A / D (analog / digital) conversion module, a data storage module, a control circuit, an isolating circuit and a driving circuit which are sequentially connected with one another, and the mechanical rotation device comprises a motor and a mechanical device. When a patient sleeps and snores, a corresponding signal is transmitted to control operation of the motor after the intelligent control module carries out monitoring and analysis operation, a pillow piece is driven to rotate upwardly, accordingly, the head of the snorer is pushed to rotate, at the moment, relaxed muscles of the throat of the snorer can be tilted towards one side, the respiratory tract of the snorer cannot be blocked easily, and the purpose of stopping the snorer from snoring can be achieved. The snore stopping pillow has the advantages that risks and side effects which are associated with surgical and drug treatment are prevented when the snore stopping pillow is used, both the financing cost and the psychological cost are greatly reduced, the snore stopping pillow has an excellent popularization prospect, and a substantial economical benefit can be created.

Owner:许彦斌

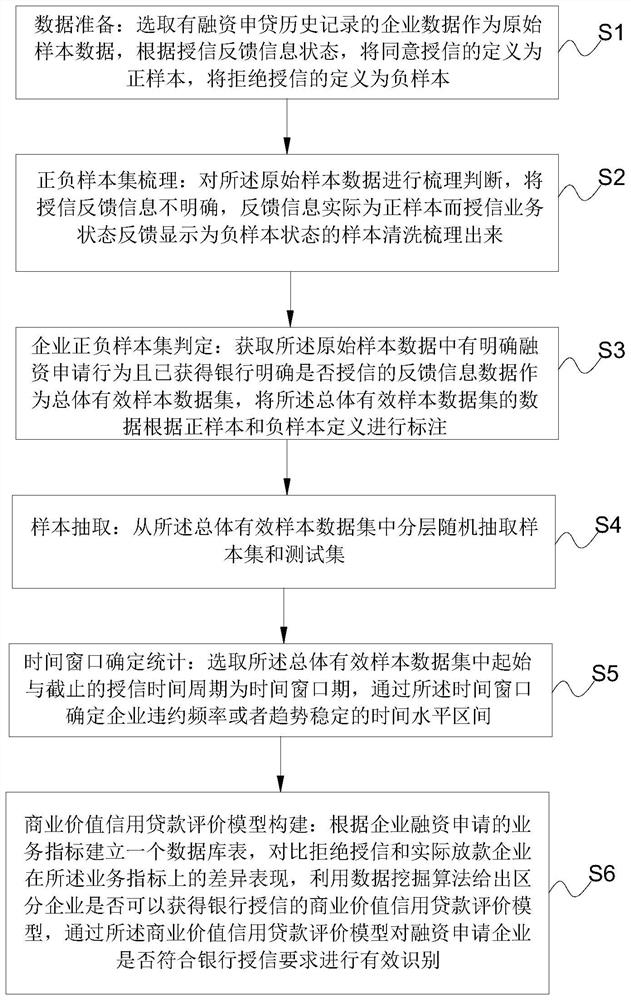

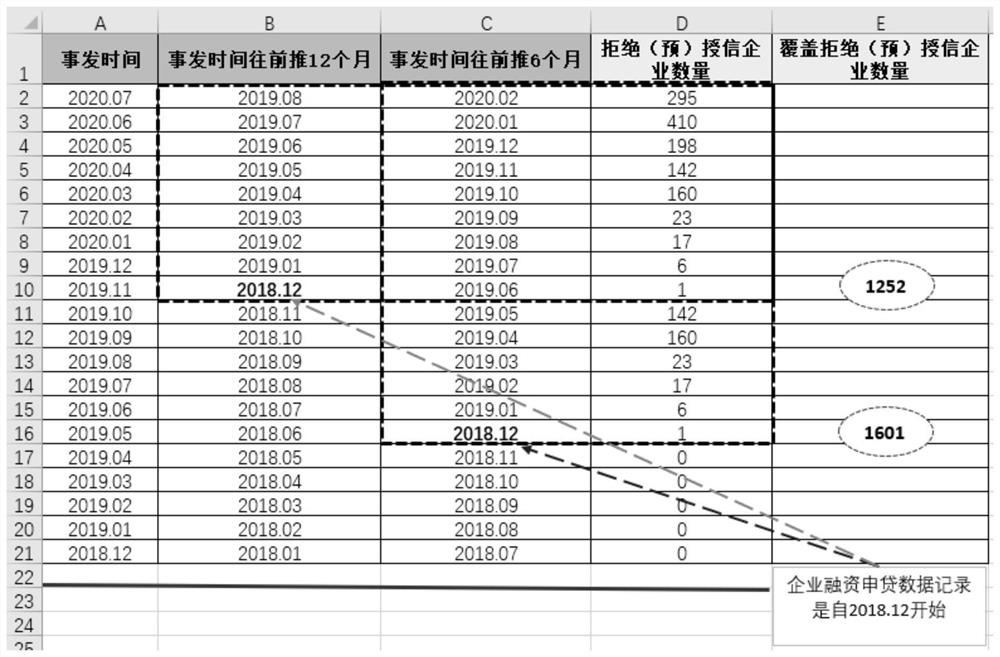

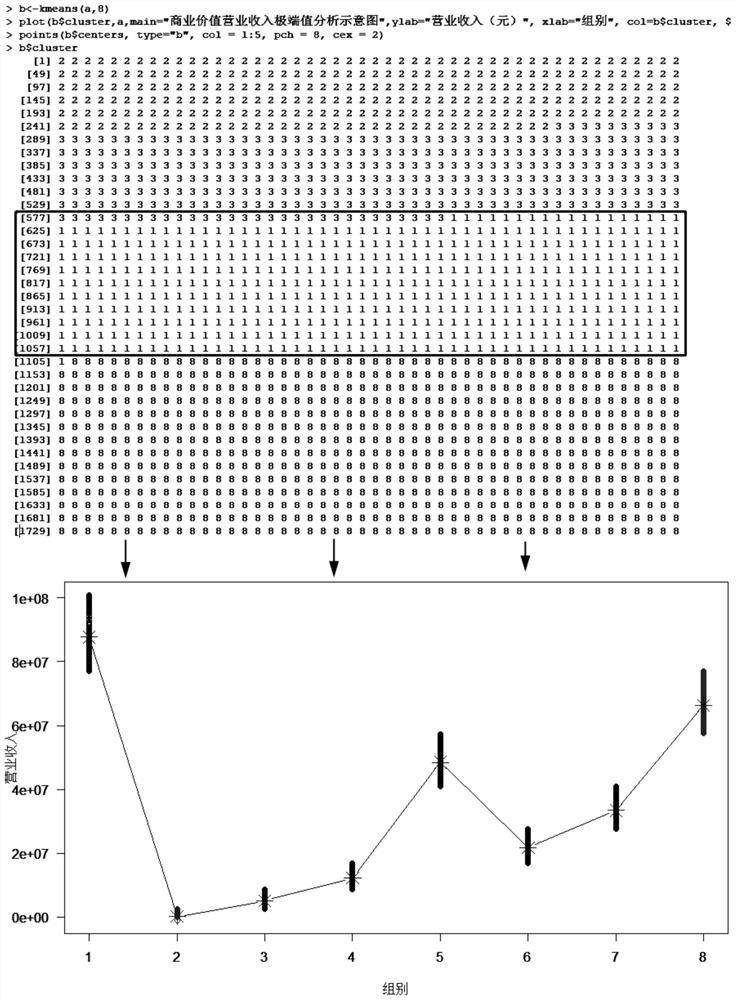

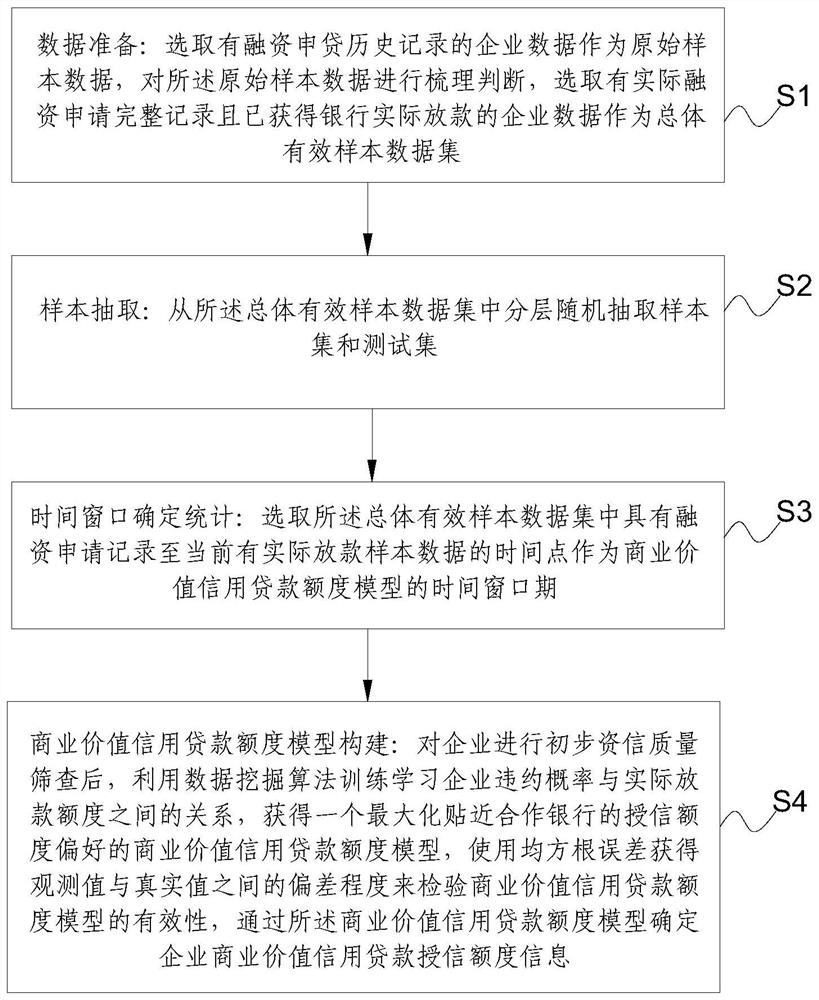

Commercial value credit loan evaluation method for small and medium-sized enterprises

PendingCN112330441AImprove the loan rateSolve financing difficultiesFinanceEnsemble learningData setFinancing cost

The invention discloses a medium and small enterprise commercial value credit loan evaluation method. The method comprises steps of selecting a starting and ending credit granting time period in an overall effective sample data set as a time window period, and determining an enterprise default frequency or a time level interval with a stable trend through a time window; establishing a database table according to the business indexes of the enterprise financing application, comparing the difference between denial of credit granting and actual loaning enterprises on the business indexes, and providing a commercial value credit loan evaluation model for distinguishing whether the enterprises can obtain bank credit granting or not by utilizing a data mining algorithm; and whether the financingapplication enterprise meets the bank credit granting requirement being effectively identified through the commercial value credit loan evaluation model. According to the method, the commercial valuecredit loan evaluation requirements of small and medium-sized enterprises are realized based on historical data, the enterprise object capable of obtaining the current cooperative bank loan with highprobability can be effectively identified, the loan obtaining rate of platform financing application enterprises is improved, and problems of difficult financing, high financing cost and slow financing of small and medium-sized enterprises are solved.

Owner:北京宸信征信有限公司

Internet asset securitization resource integration system

InactiveCN105184648ABroaden source channelsImprove financial structureFinanceFinancing costThe Internet

The invention discloses an Internet asset securitization resource integration system. The objective of the invention is to solve the problems of unsmooth financing channels, insufficient capital sources and simple and traditional financing tools existing on enterprises at present. The Internet asset securitization resource integration system includes a sponsor, an underlying asset pool, a special purpose vehicle (SPV), a credit increasing mechanism, a credit rating mechanism, a management mechanism, a trustee mechanism, a underwriter and an investor module; each module includes a plurality of subjects; an investor can select different subject elements according to his or her own preferences, risks, earnings and liquidity principle, and input selected elements into the product information calculation program of the system as a whole; and the information calculation program will outputs investment information for reference for the investor. With the Internet asset securitization resource integration system adopted, the enterprises can vitalize a large quantity of assets lack of liquidity, and therefore, the financial structure of the enterprises can be improved, and channels of fund sources can be broadened, and financing cost can be reduced.

Owner:长沙星际泛函网络科技有限公司

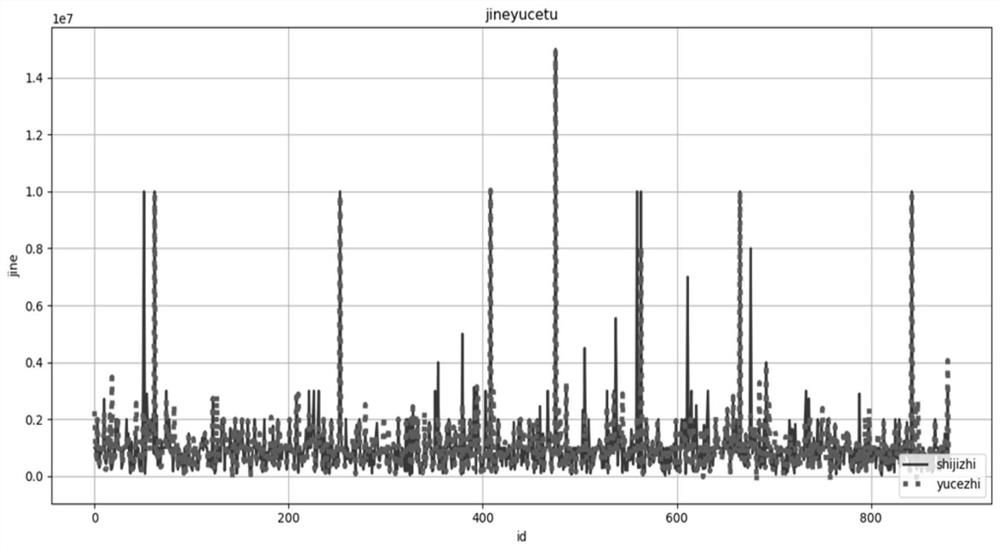

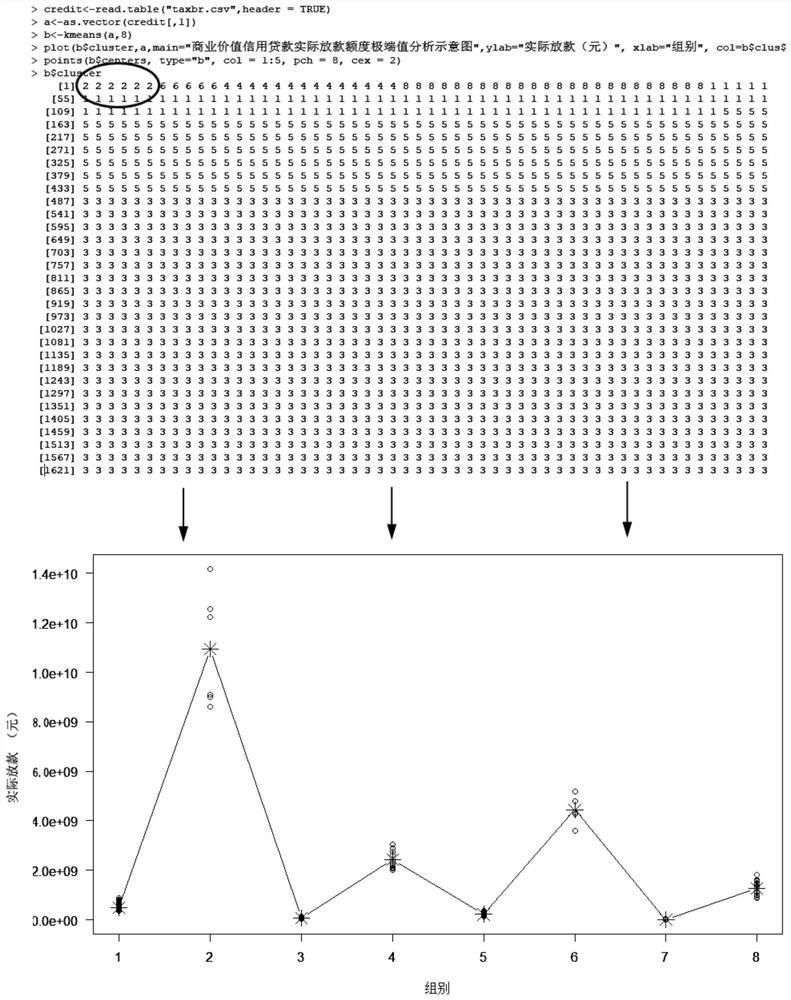

Method for judging commercial value credit loan quota of medium and small enterprises

PendingCN112365339ASolve financing difficultiesSolving expensive financingFinanceCharacter and pattern recognitionFinancing costData set

The invention discloses a method for judging commercial value credit loan quota of medium and small enterprises. The method comprises the following steps: selecting a time point with financing application records in an overall effective sample data set to current actual loan sample data as a time window period of a commercial value credit loan quota model; after preliminary credit quality screening is carried out on an enterprise, using a data mining algorithm to train and learn a relationship between an enterprise default probability and an actual loan limit, and acquiring a commercial valuecredit loan limit model which is close to credit line preferences of a cooperative bank to the maximum extent; and obtaining the deviation degree between the observed value and the real value by usingthe root-mean-square error to check the effectiveness of the commercial value credit loan limit model, and determining the commercial value credit loan limit information of the enterprise through thecommercial value credit loan limit model. The credit quality of the enterprises is reflected to the maximum extent, the bank is guided to give the credit line, and the problems of difficult financing, high financing cost and slow financing of medium and small enterprises enterprises are solved.

Owner:北京宸信征信有限公司

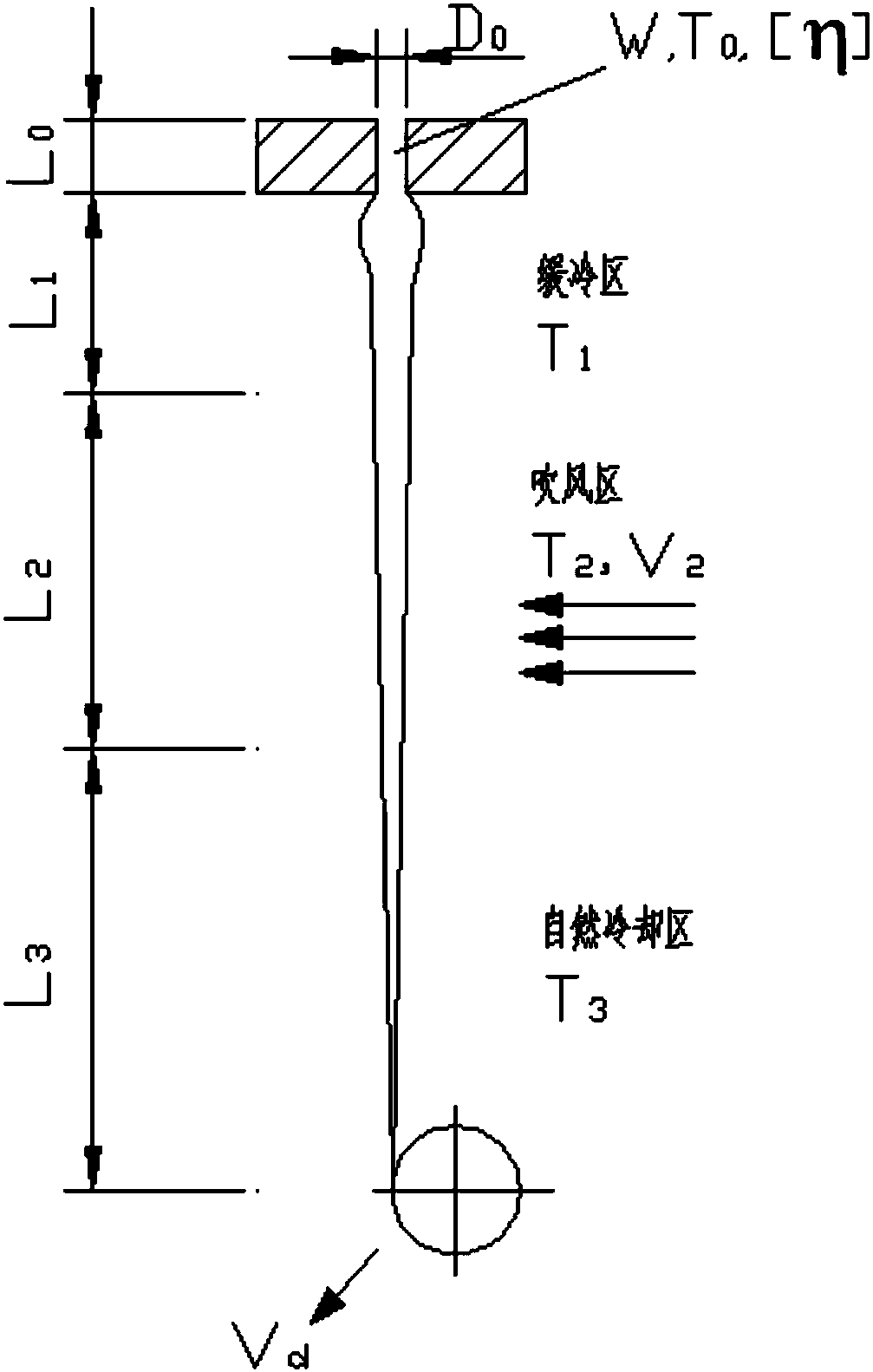

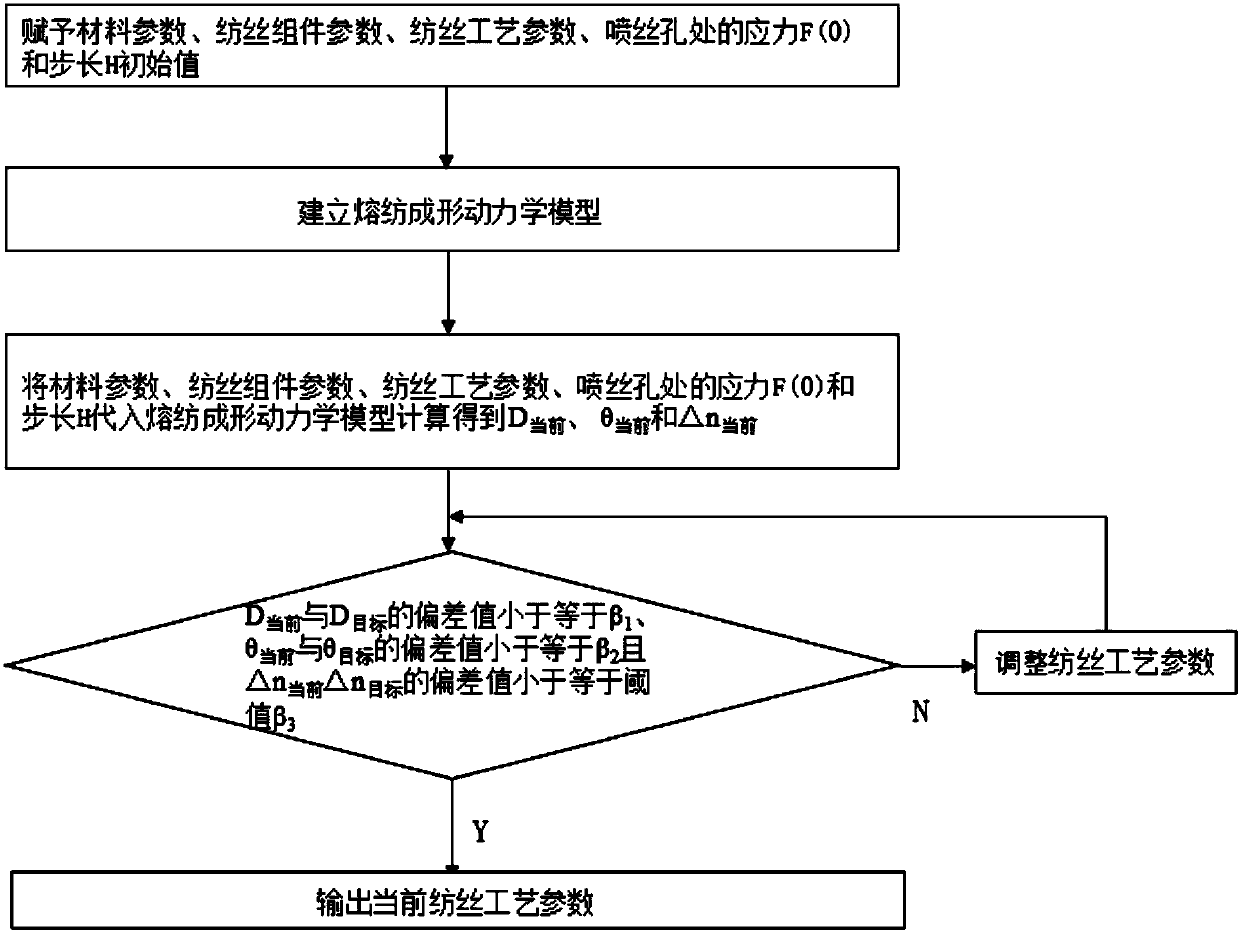

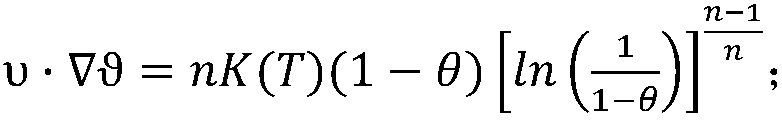

Method for optimizing melt spinning processes

ActiveCN107557885ASave human effortSave time and costMelt spinning methodsFinancing costProcess engineering

The invention relates to a method for optimizing melt spinning processes. Spinning process parameters are simulated and computed according to target diameters, target crystallinity and target orientation degrees of fibers, and then melt spinning is carried out according to the spinning process parameters obtained by means of simulating and computing. The method includes simulating and computing steps of (1), assigning initial values of material parameters, spinning assembly parameters, the spinning process parameters, stress F(0) at spinneret holes and step lengths H; (2), building melt spinning forming kinetic models; (3), substituting the material parameters, the spinning assembly parameters, the spinning process parameters, the stress F(0) at the spinneret holes and the step lengths H into the melt spinning forming kinetic models; (4), judging whether termination conditions are met or not, acquiring the spinning process parameters obtained by means of simulating and computing if thetermination conditions are met, terminating programs or carrying out a next step if the termination conditions are not met; (5), adjusting the spinning process parameters; (6), returning to the step(3). The method for optimizing the melt spinning processes has the advantages of high production efficiency and capability of saving labor, time and financing costs of experiments.

Owner:DONGHUA UNIV

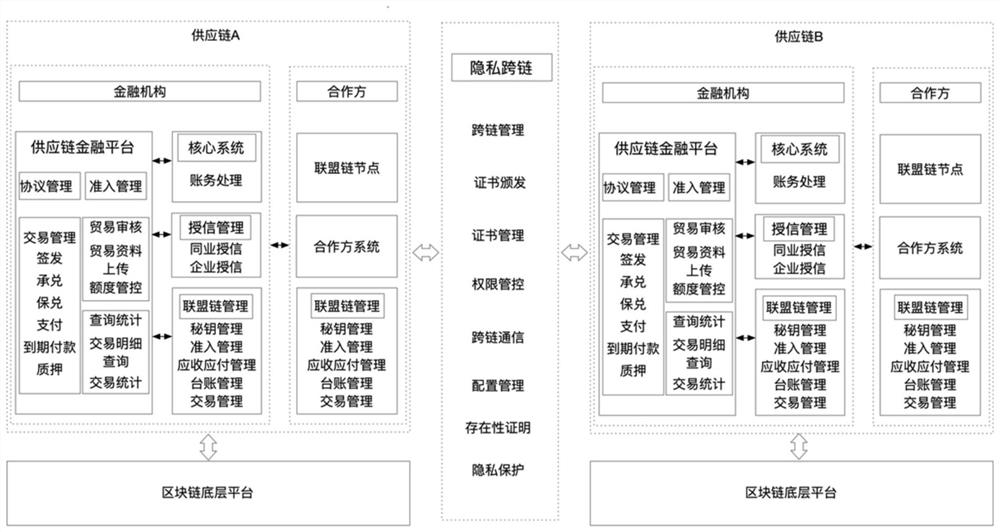

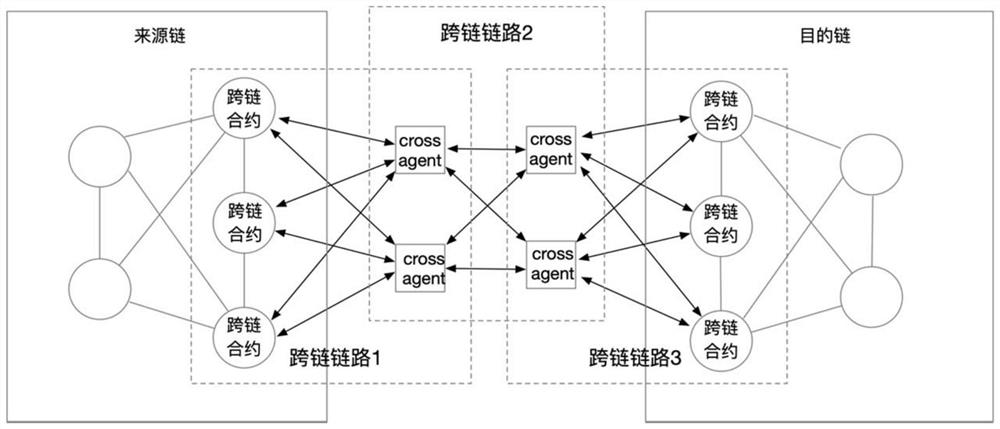

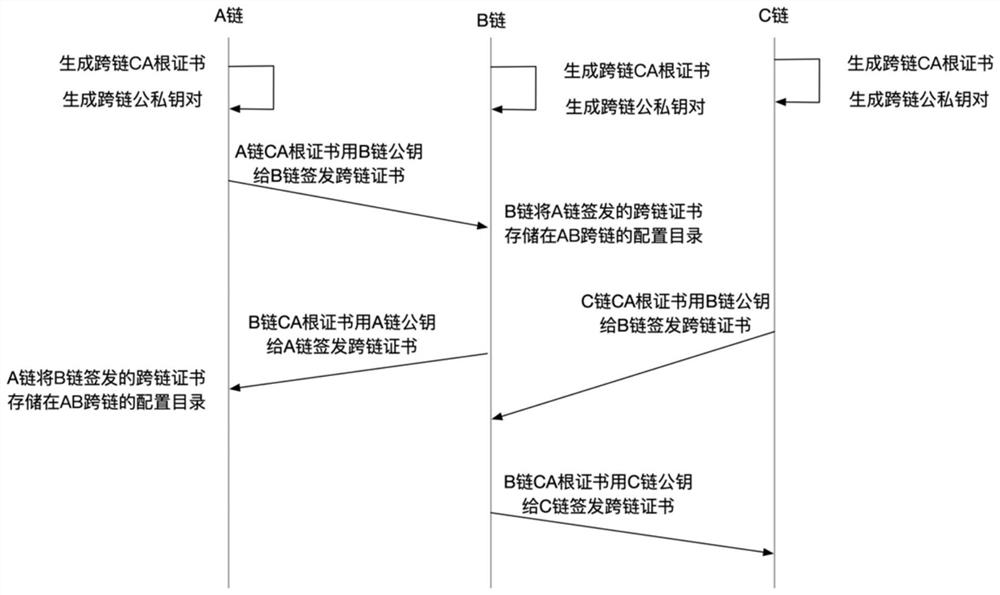

Supply chain finance method based on decentralized cross-chain

PendingCN113783698ASolving Data Sharing ProblemsRemove asymmetryFinanceUser identity/authority verificationFinancing costBusiness enterprise

The invention discloses a supply chain finance method based on decentralized cross-chain, and the method comprises the steps: constructing an alliance chain with a financial institution, a core enterprise, and upstream and downstream enterprises as organization members, and carrying out the supply chain finance business on the alliance chain through an intelligent contract. Through a safe and reliable decentralized cross-chain mechanism, supply chain barriers of different core enterprises and different industries are broken through, information asymmetry in supply chain finance is more conveniently eliminated, risks of fraud, bogus transactions and repeated financing are reduced, and the problem of data sharing between financial institutions and the core enterprises and between upstream and downstream small and micro enterprises is solved; through decentralized cross-chain, credit transmission is realized from a single industry supply chain to a multi-industry supply chain, the performance risk is managed and controlled by an intelligent contract, the supervision convenience is improved, the financing cost is reduced, the financing efficiency is improved, and the purpose of constructing a supply chain financial system with a larger scale and more complete ecology is achieved.

Owner:CHINA ZHESHANG BANK

Blockchain-based e-commerce platform receivable management system and method

The invention discloses a block chain-based e-commerce platform receivable management system and method. The system comprises nine modules including a user management module, a platform management module, a my fund ticket module, a to-do task module, a limit management module, a collection and payment management module, a user center module, a historical record module and an on-chain information module. According to the invention, an e-commerce platform multistage supplier receivable financing system is established through a block chain technology, full-chain information sharing is promoted, supply chain finance visualization is achieved, the financing cost of small and medium-sized enterprises can be reduced by relying on credit of core enterprises, the fund circulation efficiency is improved, the overall production cost is indirectly reduced, and products of the enterprises have more competitive advantages. The blockchain ensures the authenticity of a business scene, and depends on the payment of a core enterprise, so that enterprises on the whole industrial chain can finance safely, and financial institutions can more efficiently, conveniently and steadily run through the wholeindustrial chain.

Owner:杭州产链数字科技有限公司

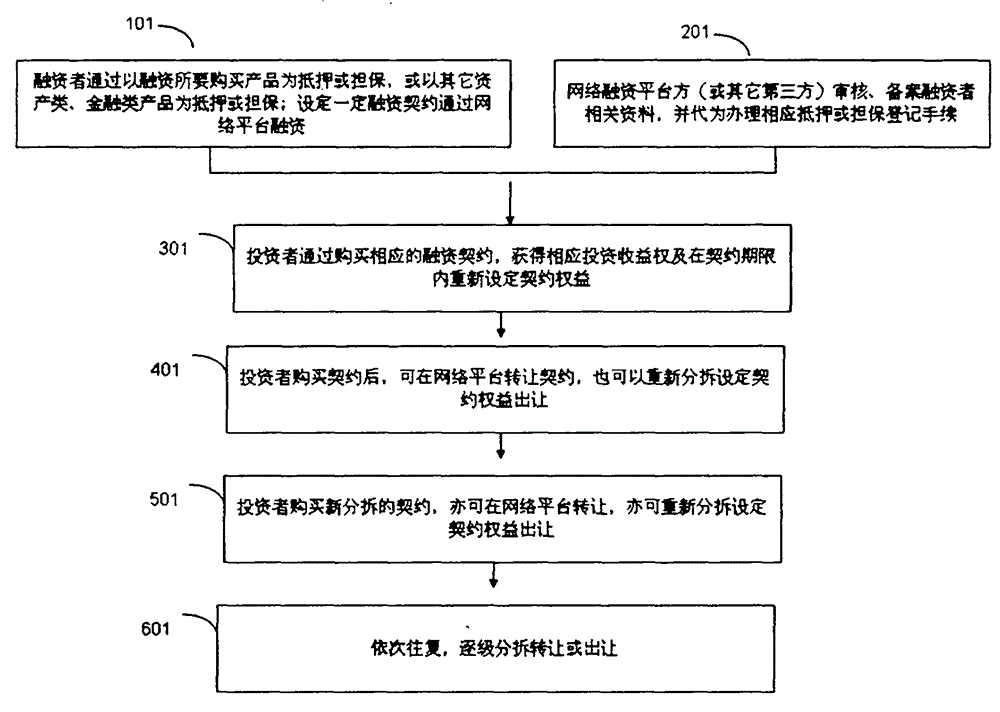

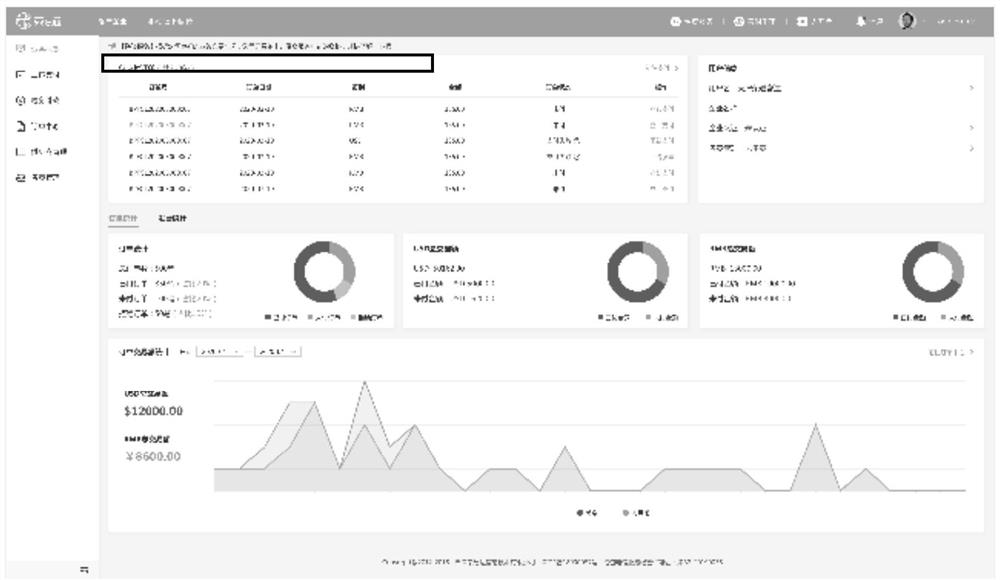

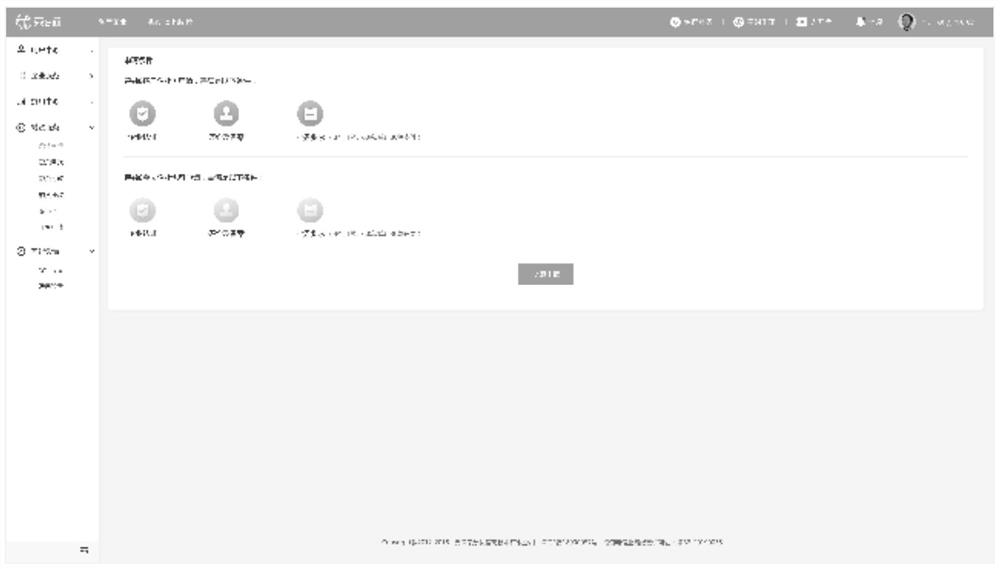

Method for increasing investment and financing earnings with low risks and corresponding network system

The invention relates to a method for increasing the investment and financing earnings with low risks and a corresponding network system. According to the technology, the capital leverage effect (a sum of idle money can be repeatedly used through a purchasing contract, contract splitting and transferring, capital recovery, repurchasing and re-splitting and re-transferring to achieve the capital leverage benefit) is achieved through a multi-level asymmetric return contract splitting function, long-term investors and short-term investors can be commonly mobilized to participate in the investment, and the functions of increasing the earning rate of the investors and shortening the investment horizon are achieved under the condition of reducing the financing cost and shortening the financing maturity of financing persons.

Owner:王升

Rong eTong international logistics settlement platform supply chain financial financing service system

PendingCN112116447AImprove structural performanceHigh riskFinanceCredit schemesPaymentFinancing cost

The invention belongs to the technical field of supply chain finance in international logistics internet service, and particularly relates to a Rong eTong international logistics settlement platform supply chain finance financing service system. According to the system a Ronge-Tong international logistics settlement platform is taken as a core platform and a user enterprise of the platform is taken as a service object. Main body real-name authentication guidance and credit rating are carried out on enterprises meeting financing conditions on the supply chain, and financing services are provided for links such as enterprise purchasing and selling in the supply chain; the service flow of the service system comprises the following five links: enterprise financing qualification judgment, enterprise credit evaluation, credit and agreement signing, financing service opening, financing declaration and payment, and financing repayment. The method has the beneficial effects that the financing business process is simplified, the enterprise financing cost is reduced, the problem of information asymmetry of borrowing and lending parties is effectively solved, the financing risk of small and medium-sized enterprises is greatly reduced, and a new way for solving the financing problem of small, medium-sized and micro-sized enterprises in China is developed.

Owner:天津荣易达信息技术有限公司

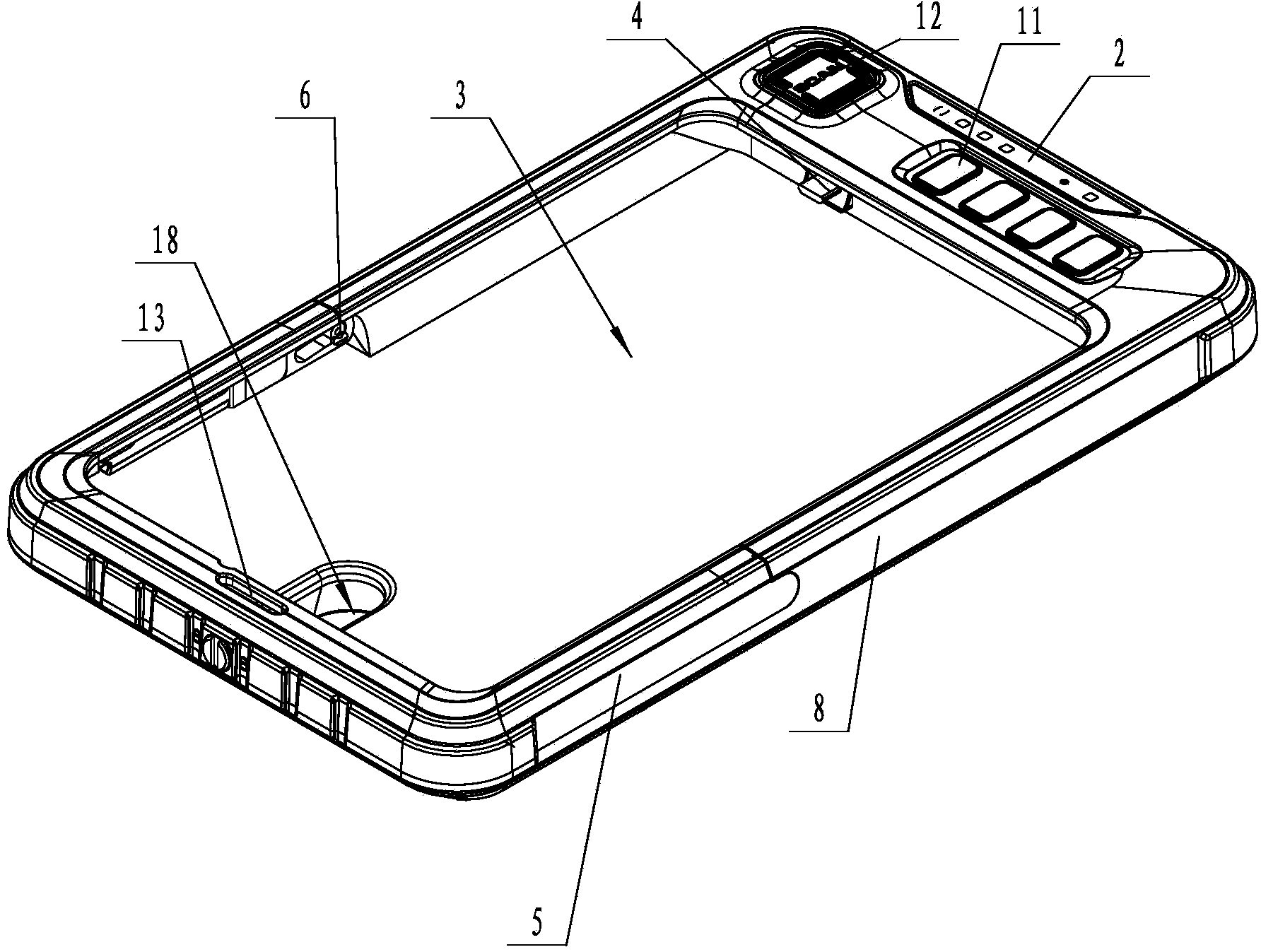

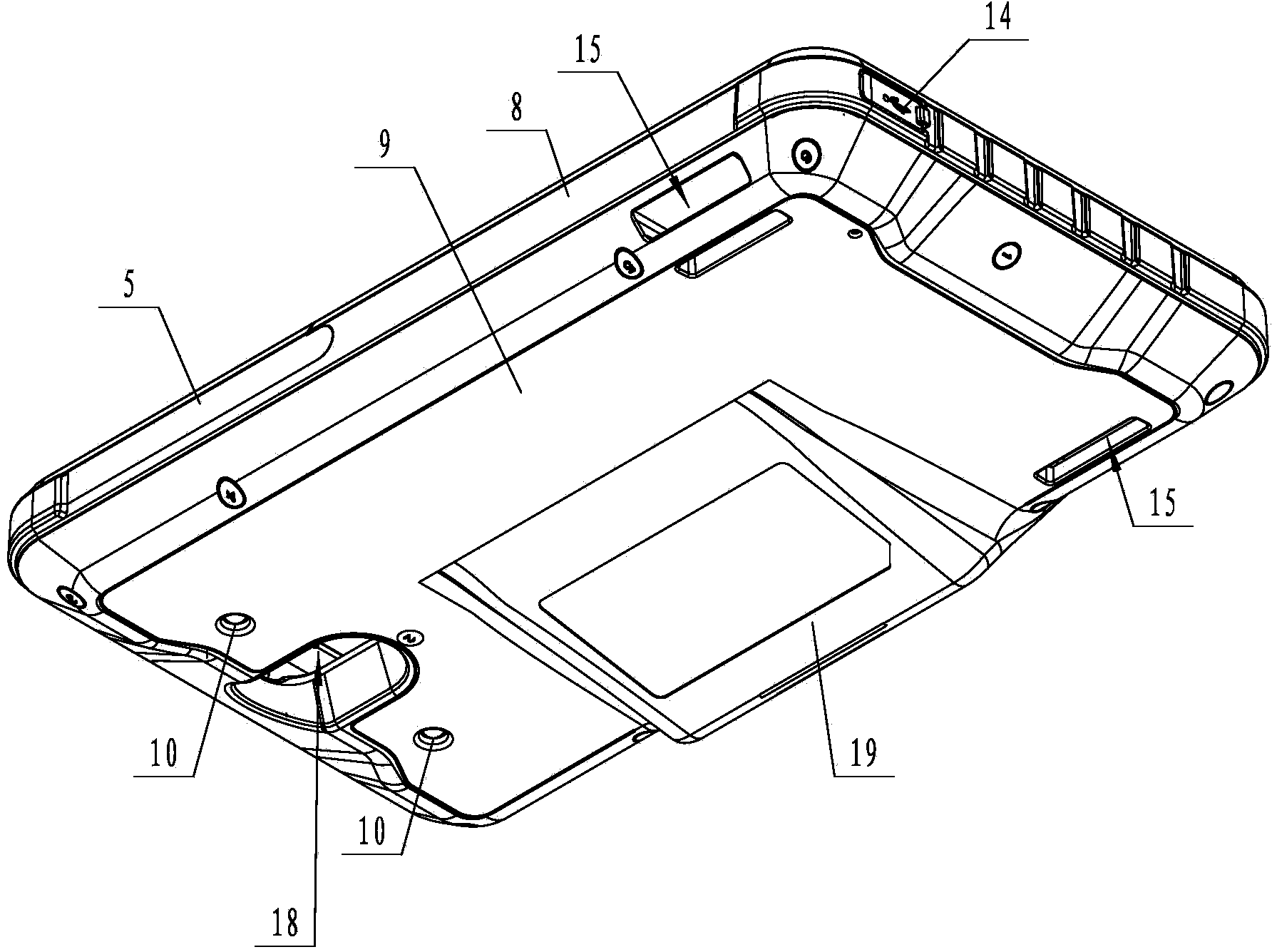

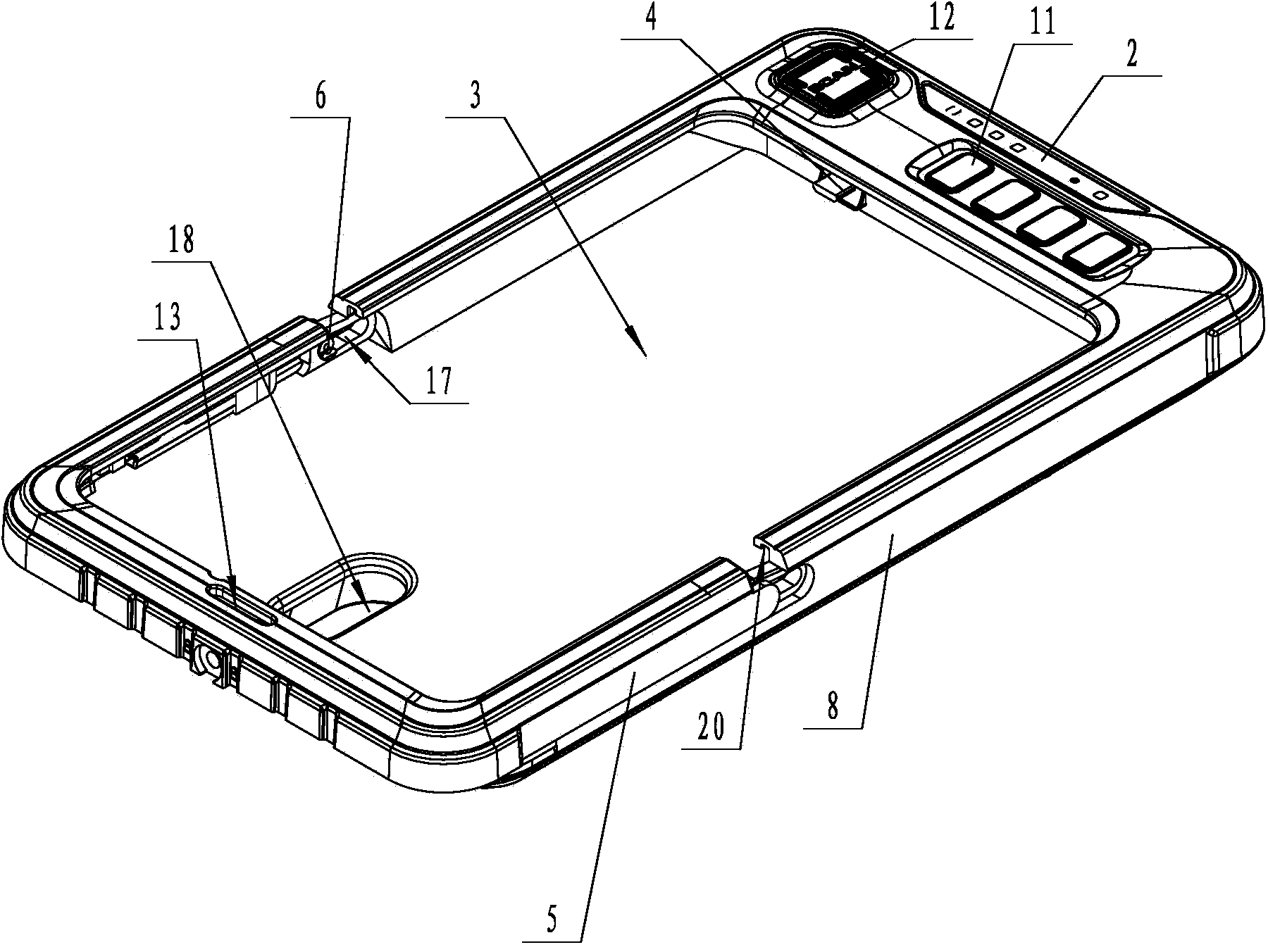

Back clip type bar code scanner and working method thereof

ActiveCN104182716AImprove work efficiencyIncrease time rateSensing by electromagnetic radiationFinancing costComputer module

The invention relates to the field of power marketing, in particular to a back clip type bar code scanner. At present, the problems that a manual record error is inevitable in a process for acquiring a save degree of a power meter, the working efficiency is low and the like. The back clip type bar code scanner comprises a casing, a power supply, a lighting lamp, a storage, a processor and a bar code scanning module, wherein a mobile terminal accommodating cavity is formed in the middle of the casing; the upper edge of the casing is bent inwards; a data power supply plug is arranged on the right side wall of the mobile terminal accommodating cavity; the casing comprises a main casing and a mobile casing; the mobile casing is arranged in the upper left position of the main casing and is in a horizontal U shape; a slide fastener is arranged at an opening of the mobile casing; a slide hole is formed in the main casing; a concave data power supply socket is arranged on the outside of the main casing; the main casing comprises an upper main casing and a lower main casing; a back clip cavity is formed between the upper main casing and the lower main casing. According to the technical scheme, the working efficiency of a worker and the error correction timeliness ratio are effectively improved, and manpower and financing cost are saved.

Owner:STATE GRID ZHEJIANG ELECTRIC POWER +2

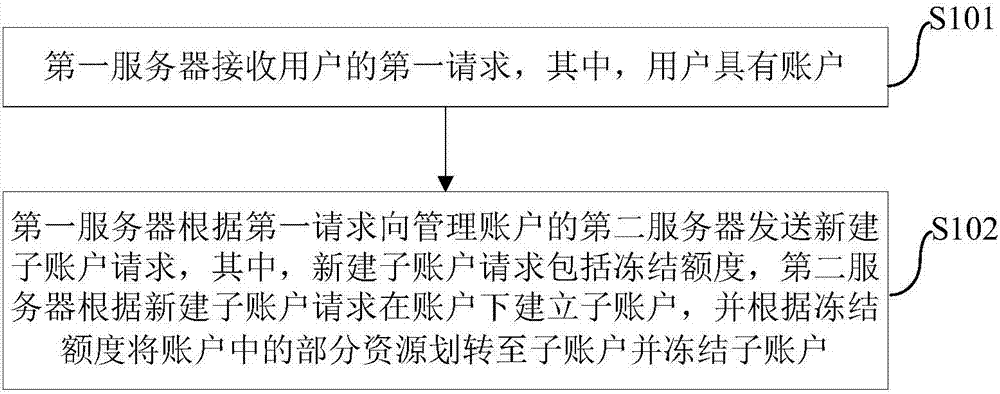

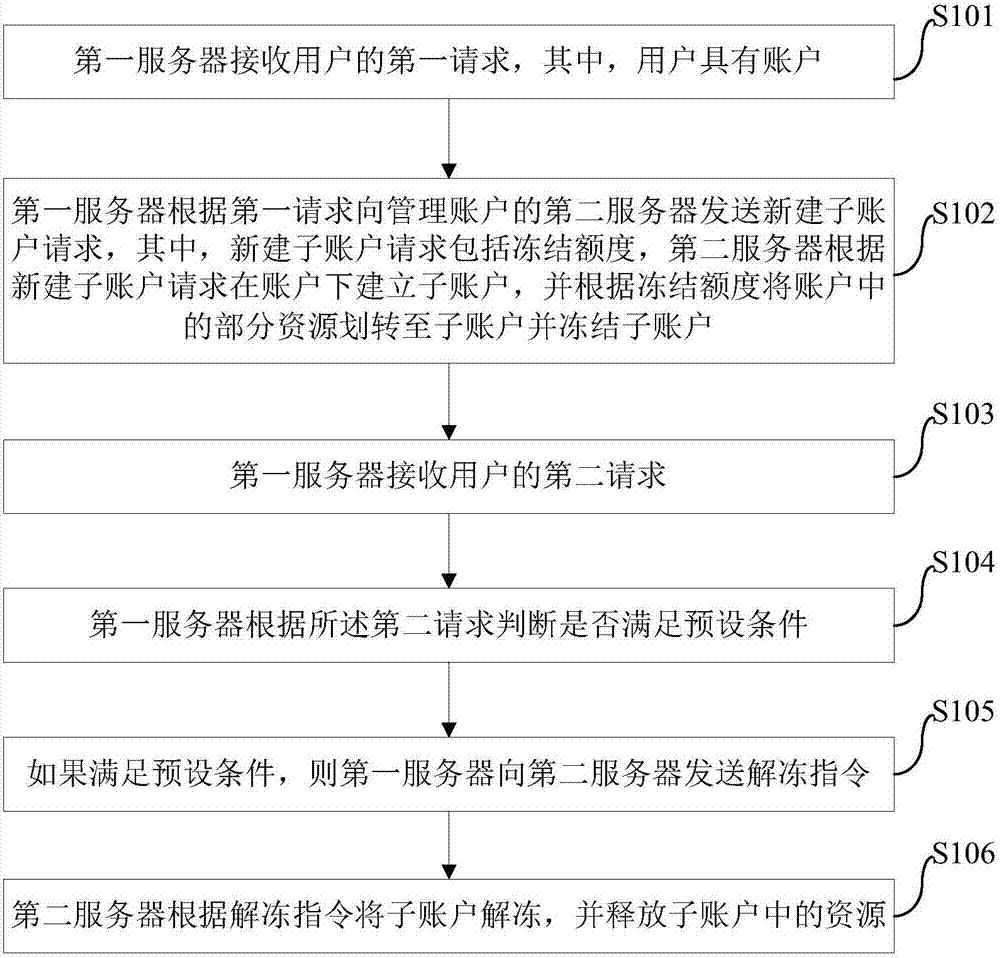

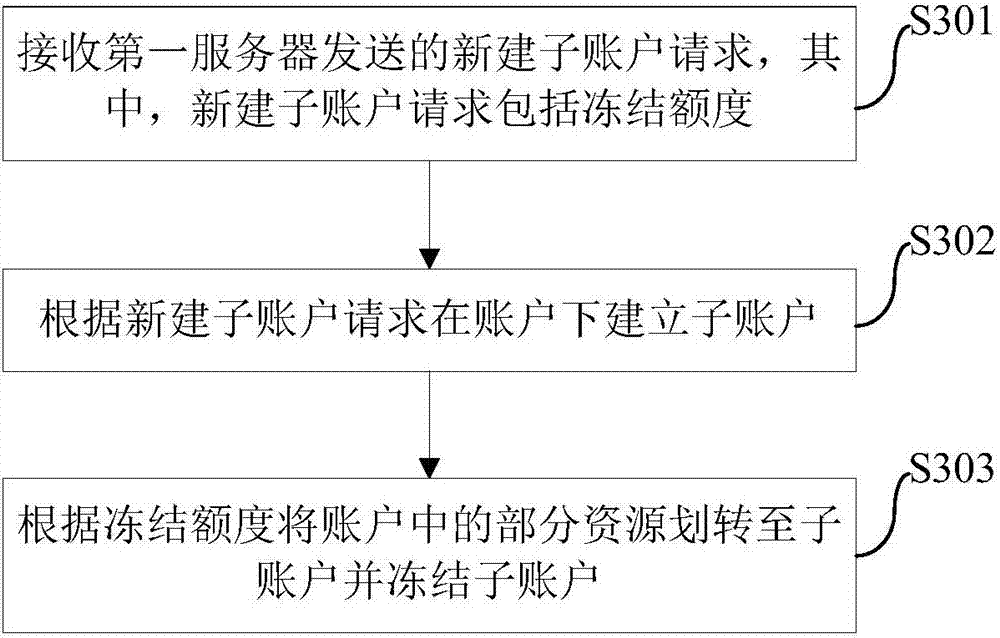

Management method and management system for user accounts, and servers

InactiveCN106991608AReduce financing riskLower insurance premiumsFinanceFinancing costApproaches of management

The invention discloses a management method and a management system for user accounts, and servers, wherein the management method comprises the following steps of receiving a first request of a user by a first user, wherein the user has accounts; transmitting a sub-account establishing request by a first server according to the first request to a second server which manages the accounts, wherein the sub-account establishing request comprises a freezing quantity, establishing the sub-account by the second server according to the sub-account establishing request, and transferring partial resource in the account to the sub-account according to the freezing quantity and freezing the sub-account. The management method provided by the invention can reduce financing risk and financing cost.

Owner:ADVANCED NEW TECH CO LTD

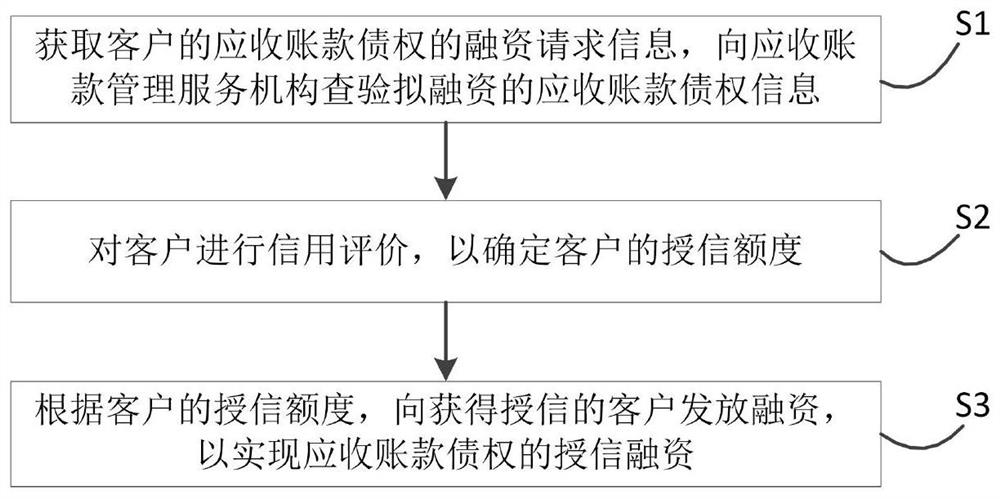

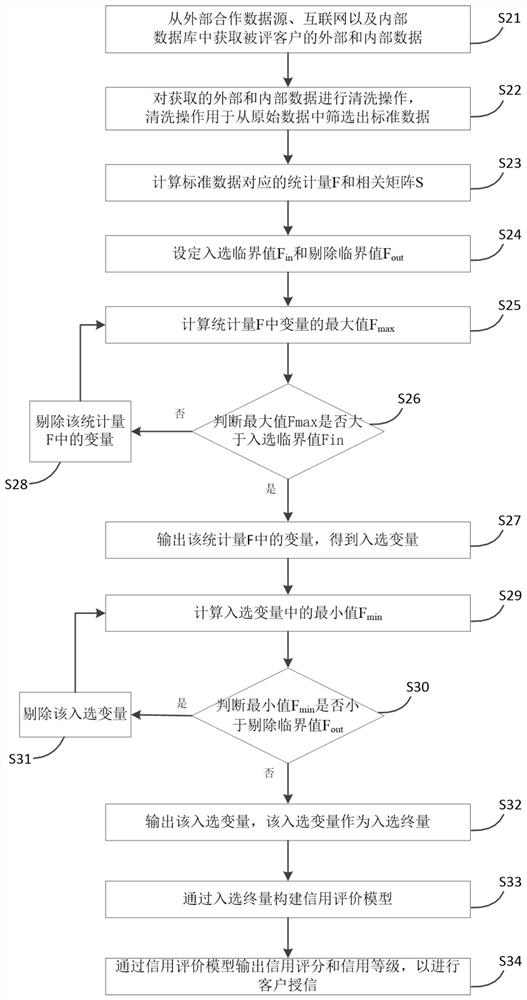

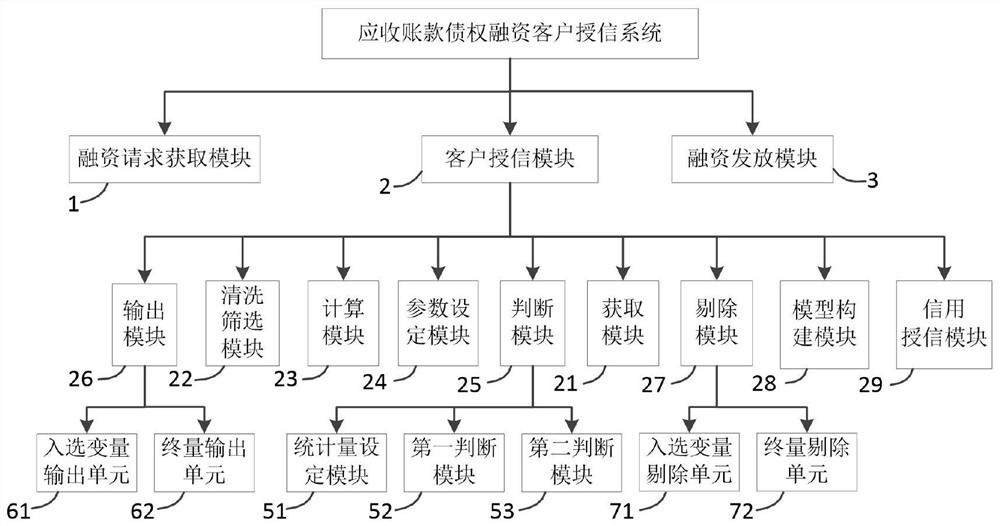

Account receivable creditor's right financing customer credit granting method and system

The invention discloses an account receivable creditor's right financing client credit granting method and system. The method comprises the following steps: a bank and other credit granting mechanismsobtain the account receivable creditor's right financing request information of a client, and check the account receivable creditor's right information; carrying out credit evaluation on the client to determine a credit line of the client; account receivable pledge or transfer registration is handled, and financing is issued to the clients obtaining credit granting according to the credit granting quotas of the clients; a client (borrower) or an account receivable debtor who committes payment or an initial creditor who committes repurchase returns (pays) money to a credit granting institutionsuch as a bank according to an agreement so as to clear a loan and synchronously relieve the pledge of the account receivable. Through cooperation and system butt joint of an account receivable creditor's right management service mechanism and credit granting mechanisms such as banks, credit granting approval is efficiently and conveniently conducted on account receivable creditor's right financing clients, so that the credit granting approval efficiency and loaning speed are improved, top-speed and instantaneous loaning can be achieved for high-quality clients, and the financing cost is reduced.

Owner:安徽海汇金融投资集团有限公司

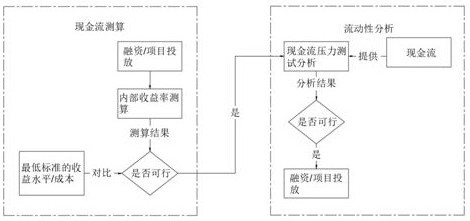

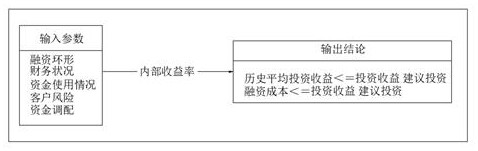

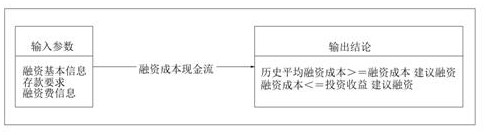

Enterprise fund risk prediction system based on cash flow measurement and liquidity analysis

PendingCN114202411ATo achieve the effect of risk management and controlAvoid blind investment and other behaviorsFinanceResourcesFinancing costBusiness enterprise

The invention discloses an enterprise fund risk prediction system based on cash flow calculation and liquidity analysis, and the system comprises a cash flow calculation module which is used for calculating whether or not earnings are generated during financing or investment; and the mobility analysis module is used for calculating the mobility coverage rate. According to the enterprise fund risk prediction system based on cash flow measurement and calculation and fluidity analysis, whether profit can be brought if an investment behavior is adopted at this time is comprehensively judged; the method comprises the steps of collecting financing process data, calculating financing cost and cash flow information according to financing information, comparing financing income with putting income, judging whether related benefits are generated in an investment behavior or not if financing is adopted according to a result before an actual fund profit behavior occurs, and then adopting related decisions. Therefore, the fund risk management and control effect is achieved, and the behaviors of blind investment and the like without considering the own ability and development goal are effectively avoided.

Owner:信华信技术股份有限公司

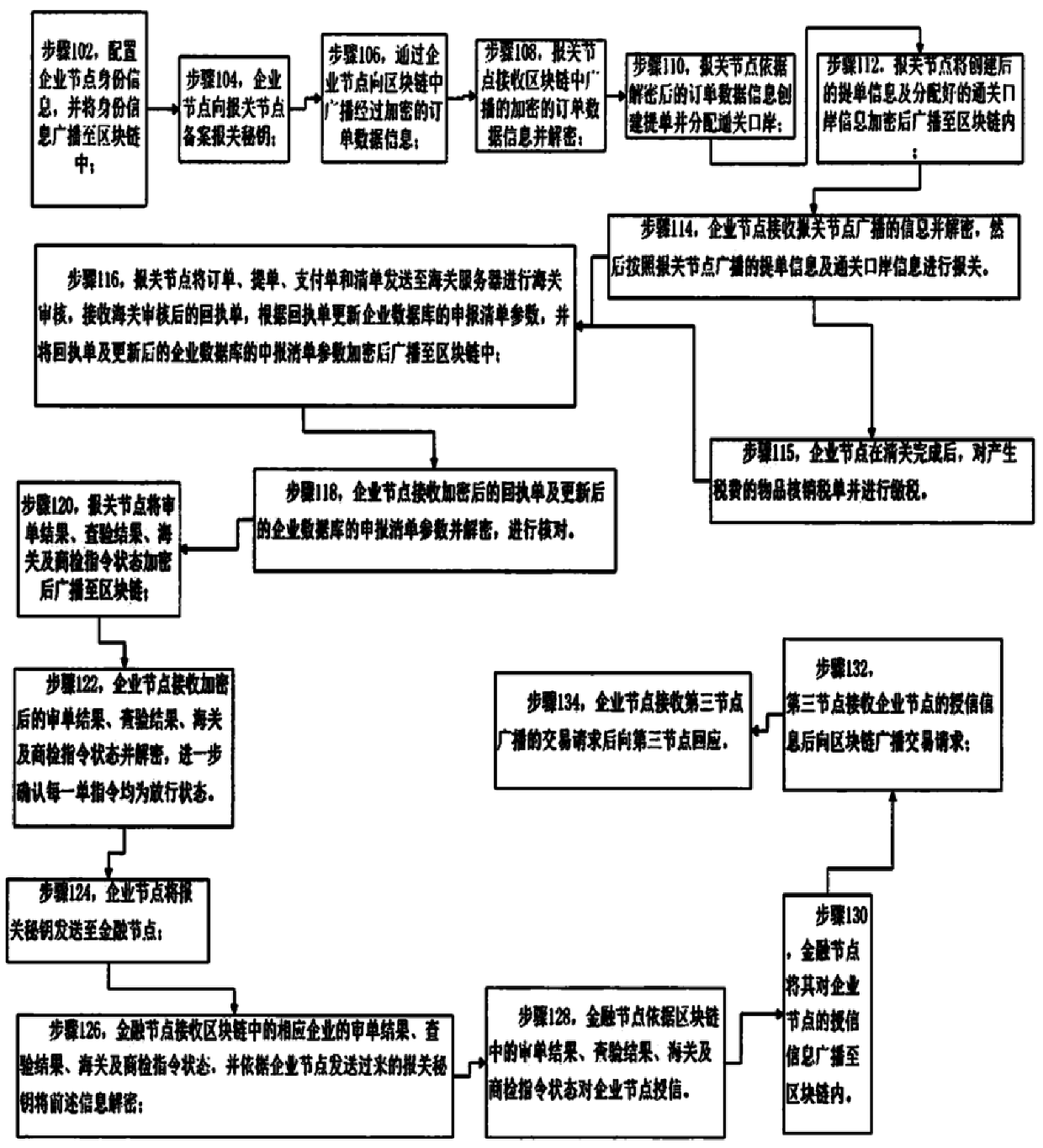

Customs declaration method and system based on block chain

PendingCN111539017ADock stableEfficient communicationFinanceDigital data protectionFinancing costBusiness enterprise

The invention discloses a customs declaration method and system based on a block chain. Cross-border electronic service is combined with block chain technology to execute online customs declaration operation, thereby greatly improving customs declaration efficiency, reducing the workload of a user and increasing the success rate of customs declaration. Meanwhile, the openness, transparency, tamperproofing and non-replicability attributes of the block chain are utilized to guarantee the security of information in the process; the customs declaration operation is completed by relying on the block chain, the authenticity and the reliability of the cross-border transaction are ensured; on the basis of the endorsement, the transaction is entrusted to a financial institution for evaluation andcredit granting, the credit granting transaction is broadcasted in a block chain system, the existing export account receivable trade financing process is reconstructed based on the background of thecurrent foreign exchange business policy, the real economy is practically served, and the problems of difficult financing and high financing cost of enterprises are emphatically solved.

Owner:天津金农企业管理咨询合伙企业(有限合伙)

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com