Commercial value credit loan evaluation method for small and medium-sized enterprises

A technology for small and medium-sized enterprises and evaluation methods, applied in the field of data processing, can solve the problems of slow financing, expensive financing, and difficult financing for small and medium-sized enterprises

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

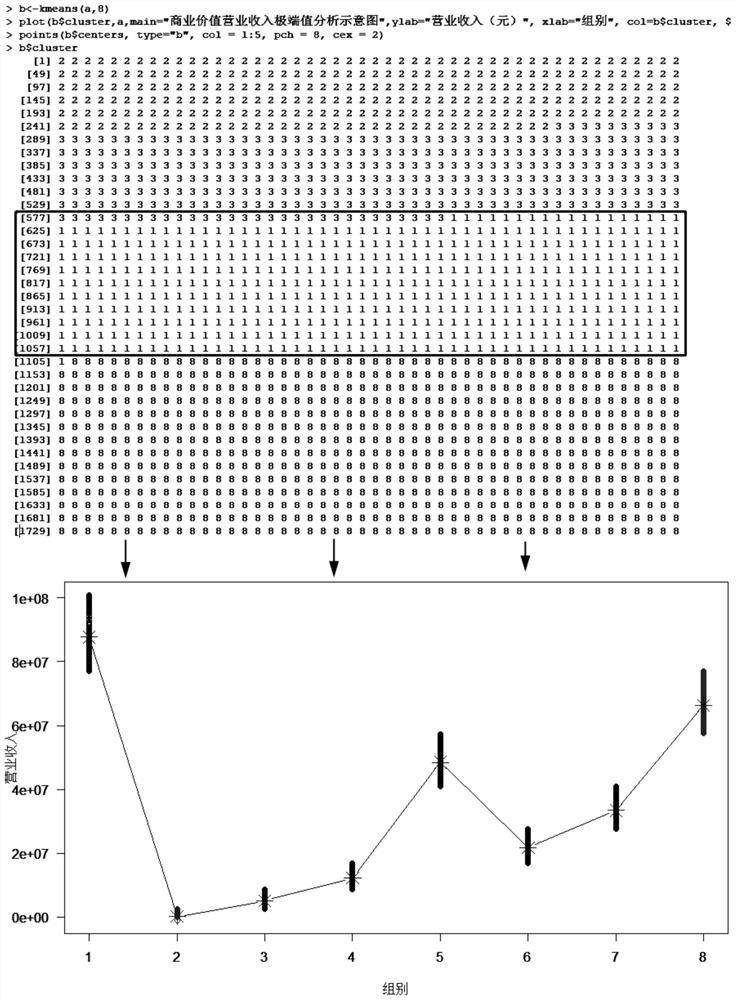

Embodiment Construction

[0029] The implementation mode of the present invention is illustrated by specific specific examples below, and those who are familiar with this technology can easily understand other advantages and effects of the present invention from the contents disclosed in this description. Obviously, the described embodiments are a part of the present invention. , but not all examples. Based on the embodiments of the present invention, all other embodiments obtained by persons of ordinary skill in the art without making creative efforts belong to the protection scope of the present invention.

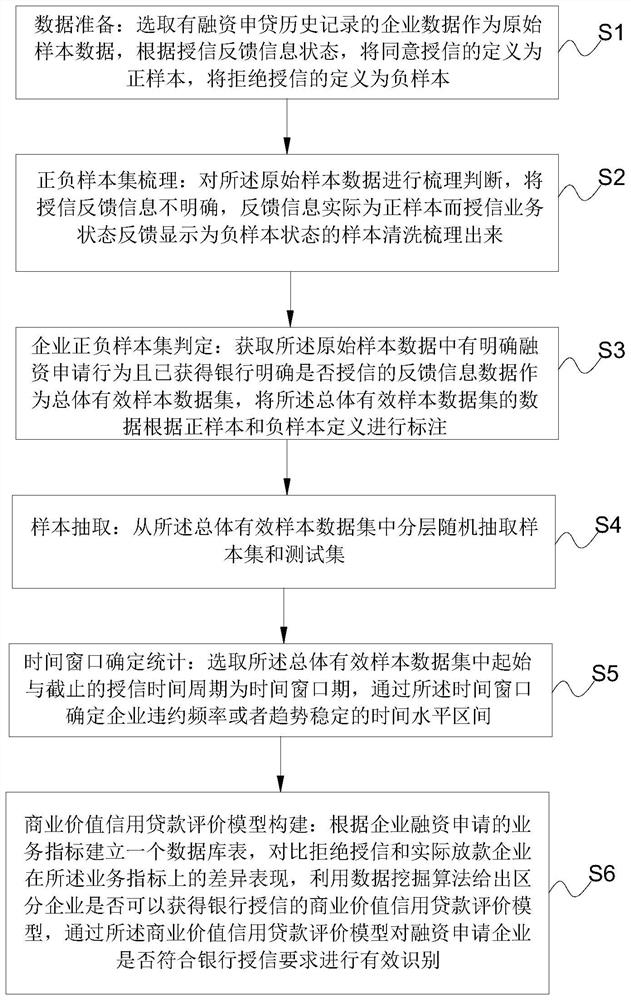

[0030] see figure 1 , providing a commercial value credit loan evaluation method for small and medium-sized enterprises, including the following steps:

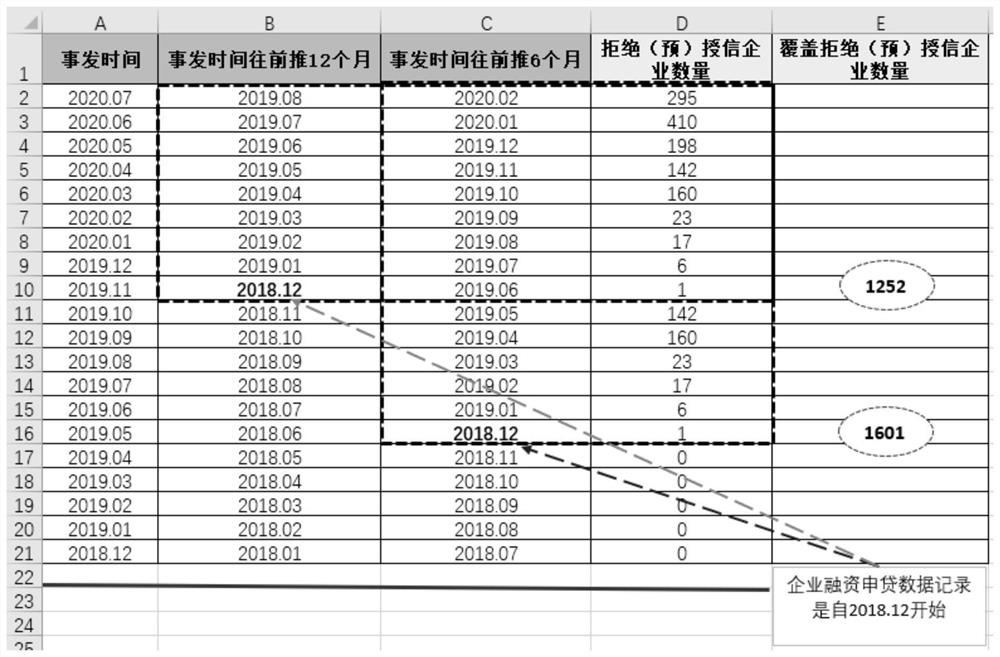

[0031] S1. Data preparation: select the data of enterprises with historical records of financing and loan applications as the original sample data, and define those who agree to grant credit as positive samples and those who refuse credit as ne...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com