Patents

Literature

94 results about "Arrears" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

Arrears (or arrearage) is a legal term for the part of a debt that is overdue after missing one or more required payments. The amount of the arrears is the amount accrued from the date on which the first missed payment was due. The term is usually used in relation with periodically recurring payments such as rent, bills, royalties (or other contractual payments), and child support.

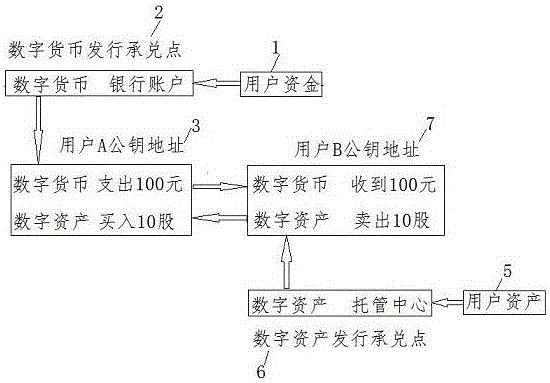

Settlement method on block chain

ActiveCN105681301AImprove transaction efficiencySimple processUser identity/authority verificationDigital data protectionDigital currencyBlockchain

The invention discloses a settlement method on a block chain. The method is characterized in that some public key addresses are authorized with the right to issue digital currencies or digital assets through a voting system on the block chain, and association can be achieved through CA certificates with relevant authorities; a user can convert cash into the digital currencies on the block chain in equivalent value, or entrust assets to an issuer to obtain the digital assets on the block chain in equivalent value; as long as both parties reach a transaction agreement, even without an intermediary, the digital currencies or the digital assets can be simultaneously transferred to a public key address of the other party after private key signing by one party in person on the block chain, so that the digital currencies and the digital assets can be settled without arrears.

Owner:HANGZHOU FUZAMEI TECH CO LTD

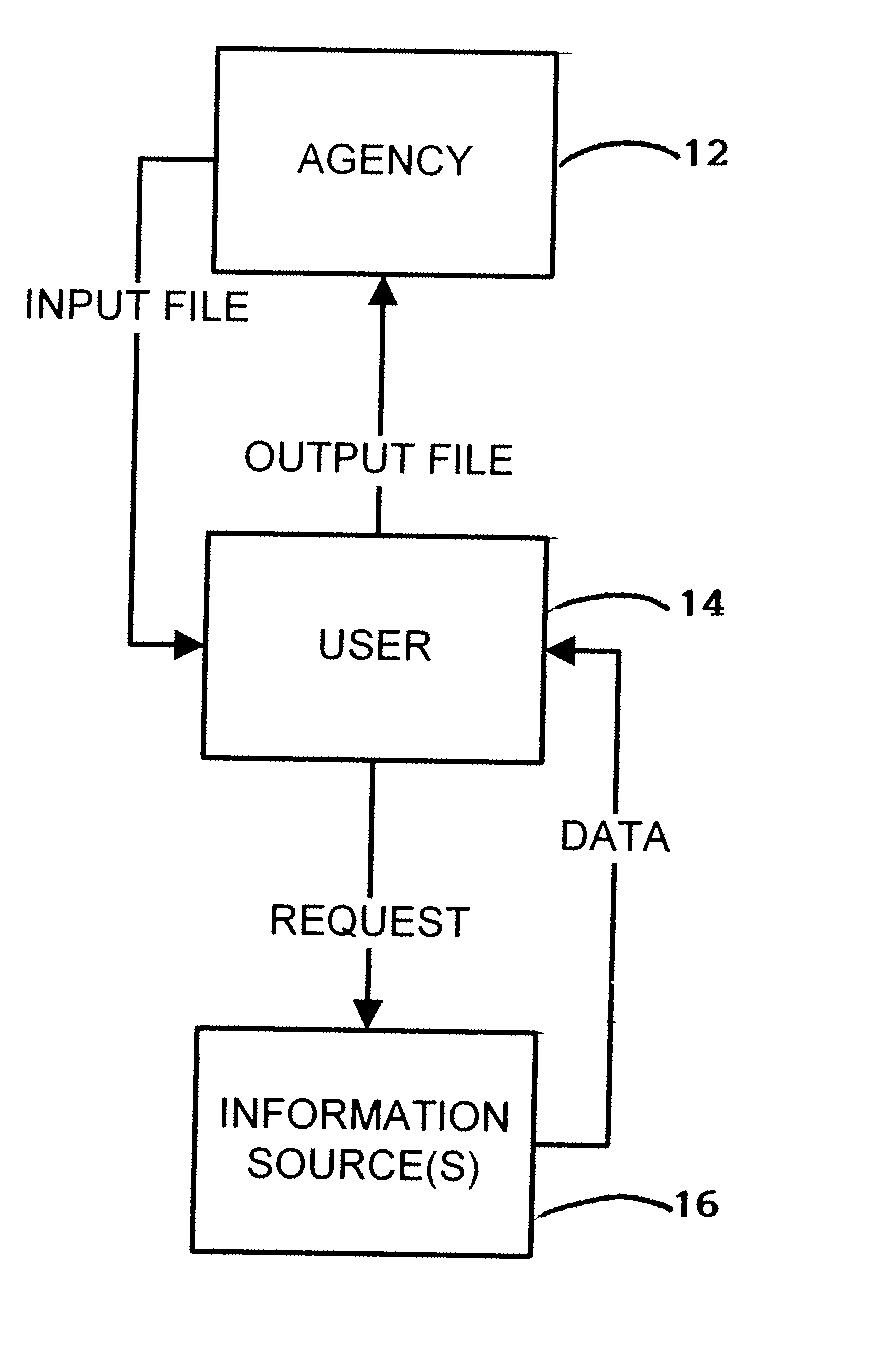

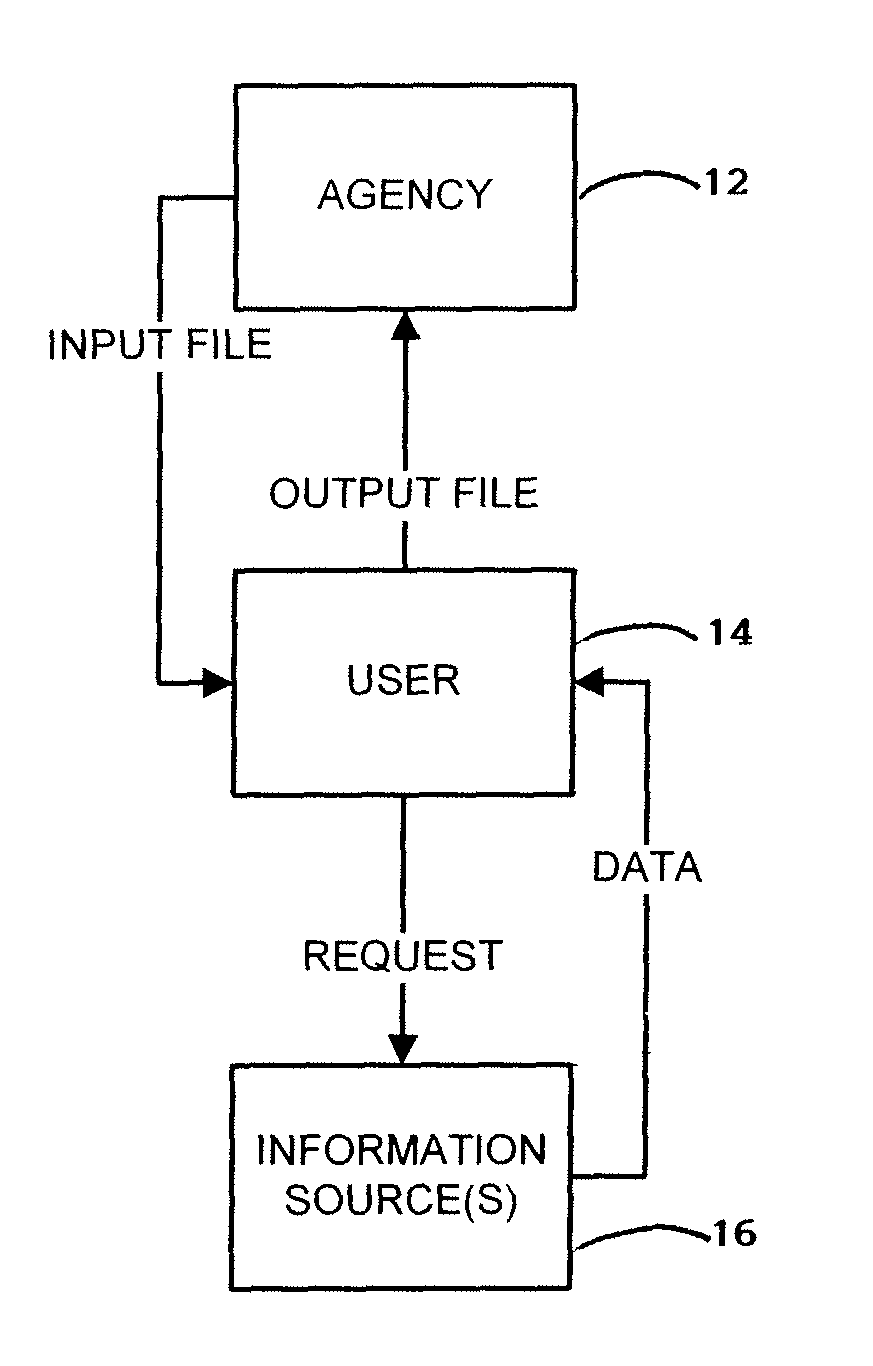

Method to increase collection of debts owed to government

InactiveUS20080215392A1Input data accurateAccurate dataFinanceSpecial data processing applicationsComputer scienceArrears

Owner:FINANCIAL MANAGEMENT SYST

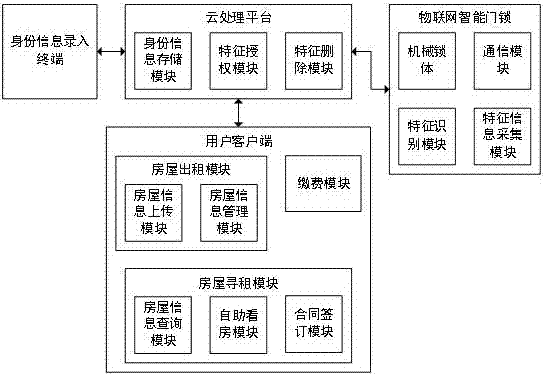

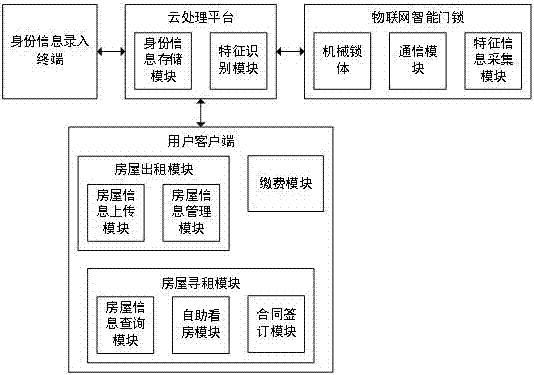

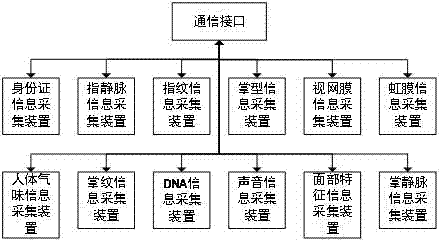

Renting system based on Internet of Things intelligent door lock

InactiveCN107274278AReduce labor costsDegree of reductionIndividual entry/exit registersBuying/selling/leasing transactionsCloud processingThe Internet

The invention provides a renting system based on an Internet of Things intelligent door lock. The system is characterized in that the system comprises an identity information input terminal which is used for inputting user identity information, namely user characteristic information, to complete user registration, the Internet of Things intelligent door lock which is used for issuing instructions and information according to the system to allow a legitimate user to enter a rental house in a specified time period, a cloud processing platform which is used for storing the user characteristic information input by the user on the identity information input terminal to authorize the Internet of Things intelligent door lock to allow the legitimate user to enter the rental house in the specified time period, and a user client which is used for supporting online house renting. Through in-depth integration with wireless and wired Internet technologies, the user of the system can quickly and conveniently perform various formalities in a house renting process, which saves time and effort. The involvement and workload of a broker of a letting agency which uses the system can be significantly reduced in leasing businesses. The labor cost and even the overall operating cost of the company are substantially reduced. According to the invention, the headache problems of a renter, such as rent arrears, unauthorized replacement or introduction of new renters, are effectively solved.

Owner:成都科耐睿科技有限公司

Method to increase collection of debts owed to government

Owner:FINANCIAL MANAGEMENT SYST

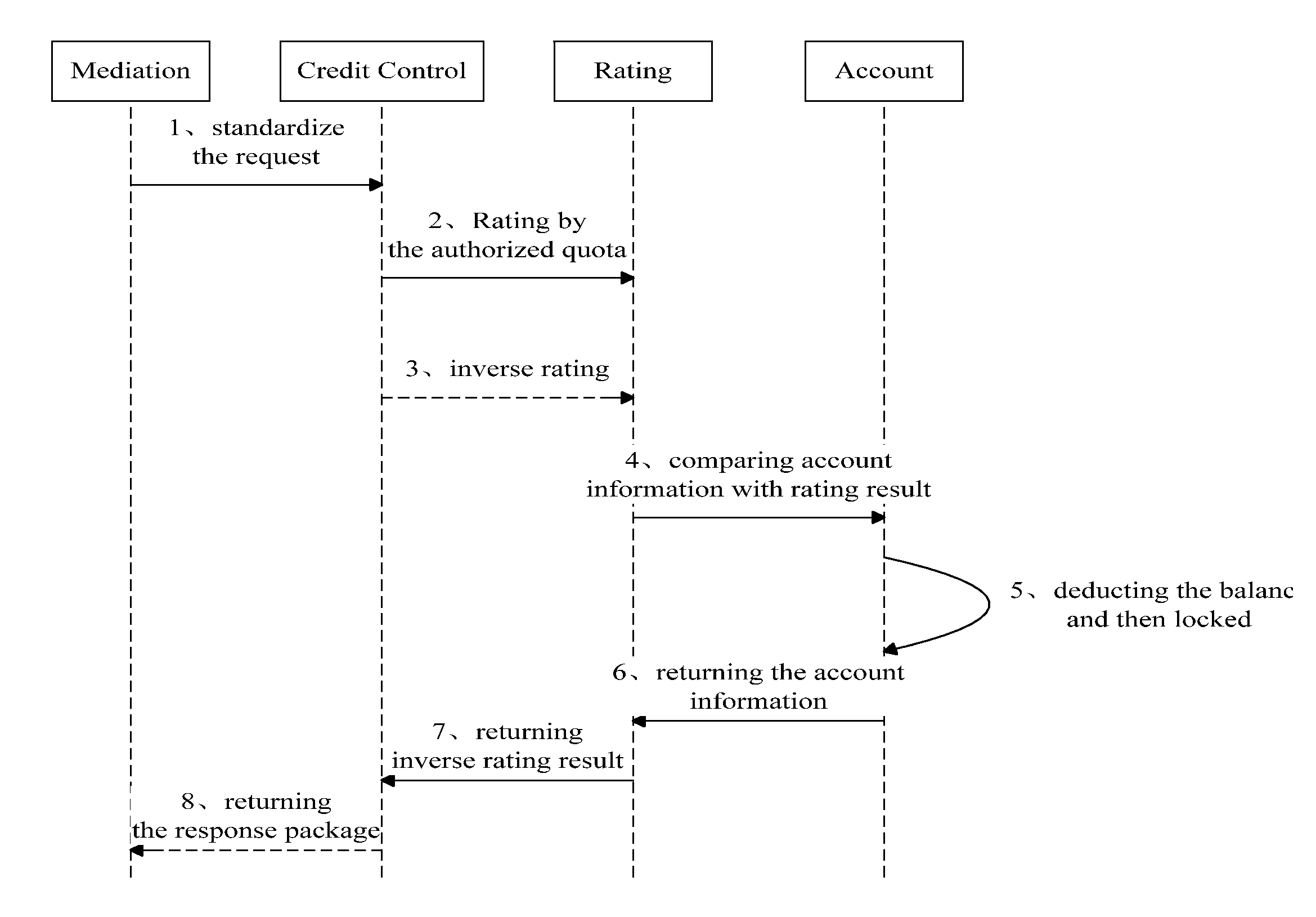

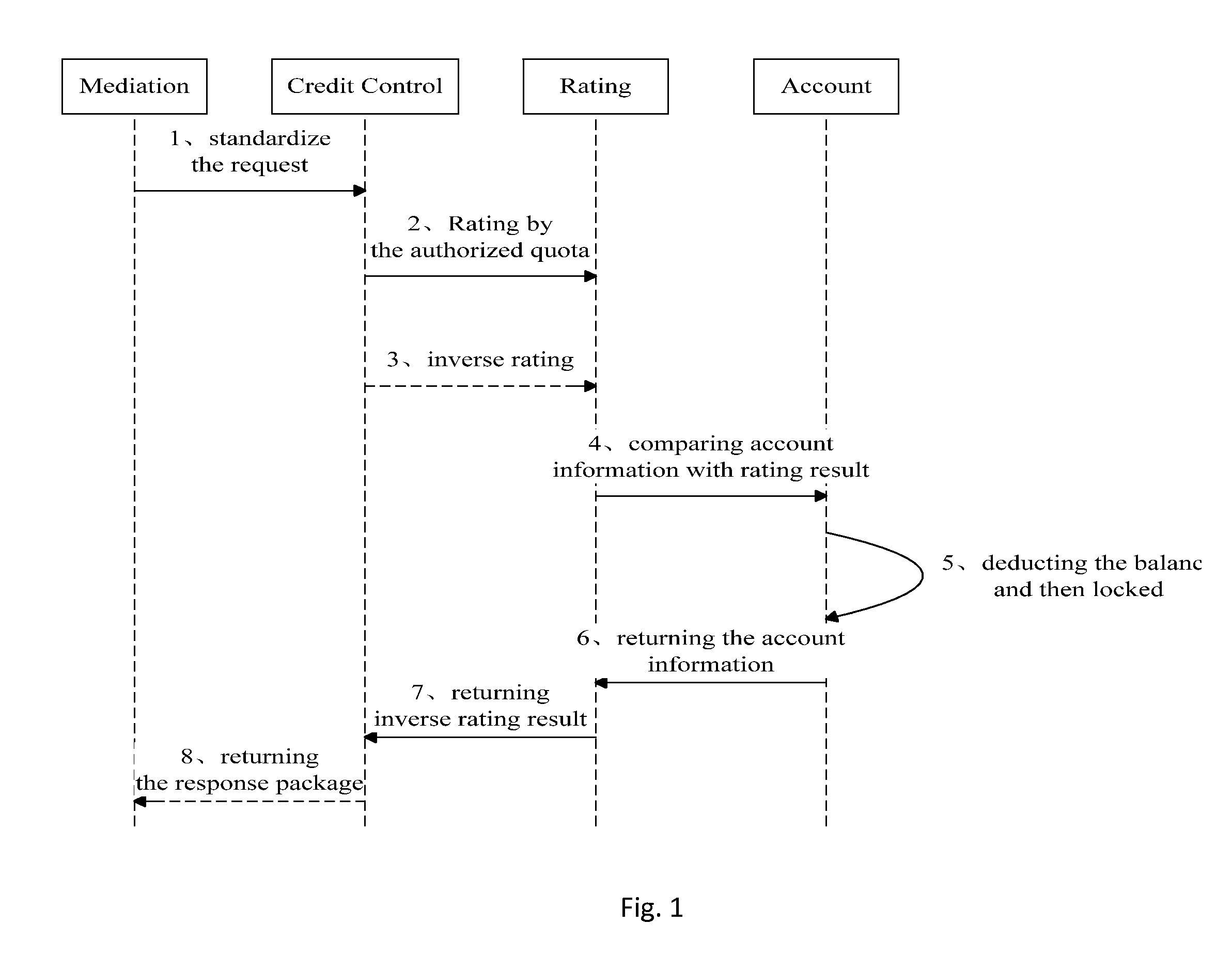

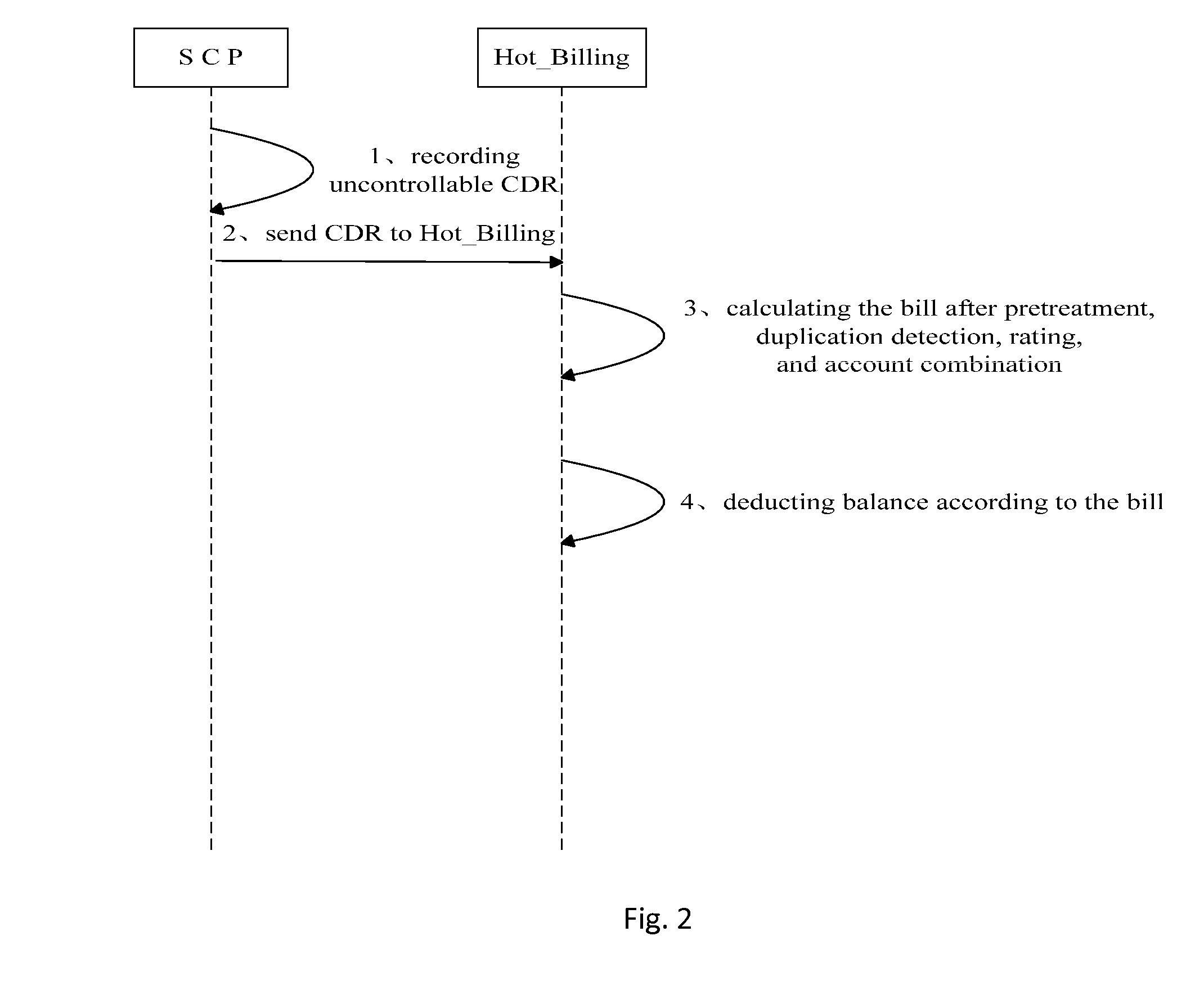

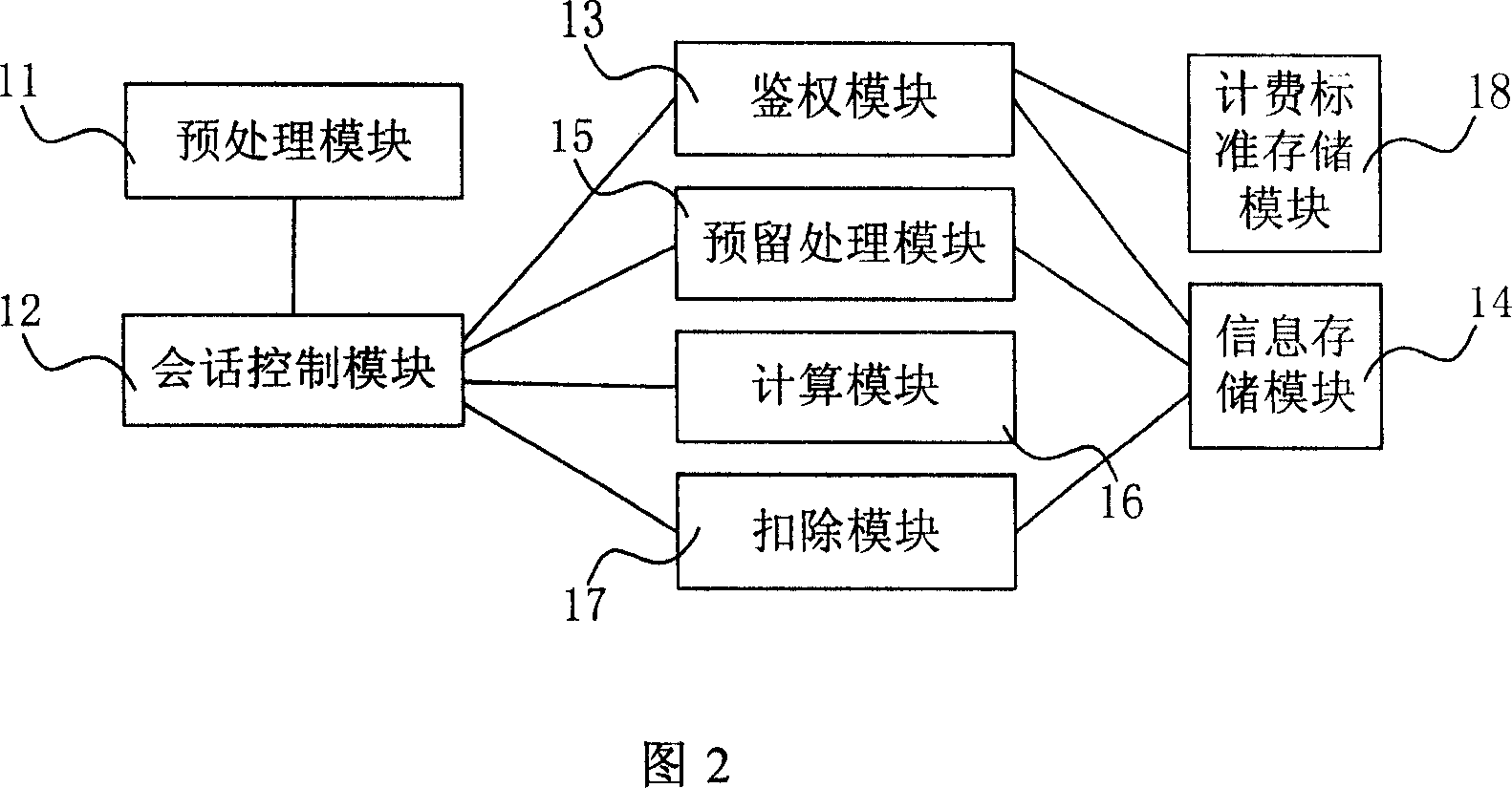

Application Method of Online Charging System in Arrears Risk Control System

An application method of On-line Charging System in Arrears Risk Control System: 1) The subsystem of OCS, Mediation, communicates with CC Client, receives a credit control request raised by the CC Client and processes with a fault-tolerant management. 2) The Credit Control analyses call request, identifies a type of service and request, selects necessary service transaction logic, and judges an authorized quota of the service, after receiving the quota, the Credit Control requests for real time forward modeling from the Rating. 3) After receiving a price of the service, the Credit Control requests real time inversion from the Rating and meanwhile transfers the price to the Rating. 4) The Rating requests account comparison from the Account after receiving the price. 5) The Account compares the price with a customer's account information to make decision of subsistence lock, if there is enough balance in the account, then the fee of the price will be deducted from the balance and then locked. 6) The Account returns the account information of the compared result. 7) The Rating inverses the authorization amount according to the compared result returned by the Account, and send back to the Credit Control. 8) The Credit Control constructs a service relevant responding package according to the authorization amount, and sends the responding package to the Mediation to complete the OCS processing flow.

Owner:LINKAGE TECH GROUP +1

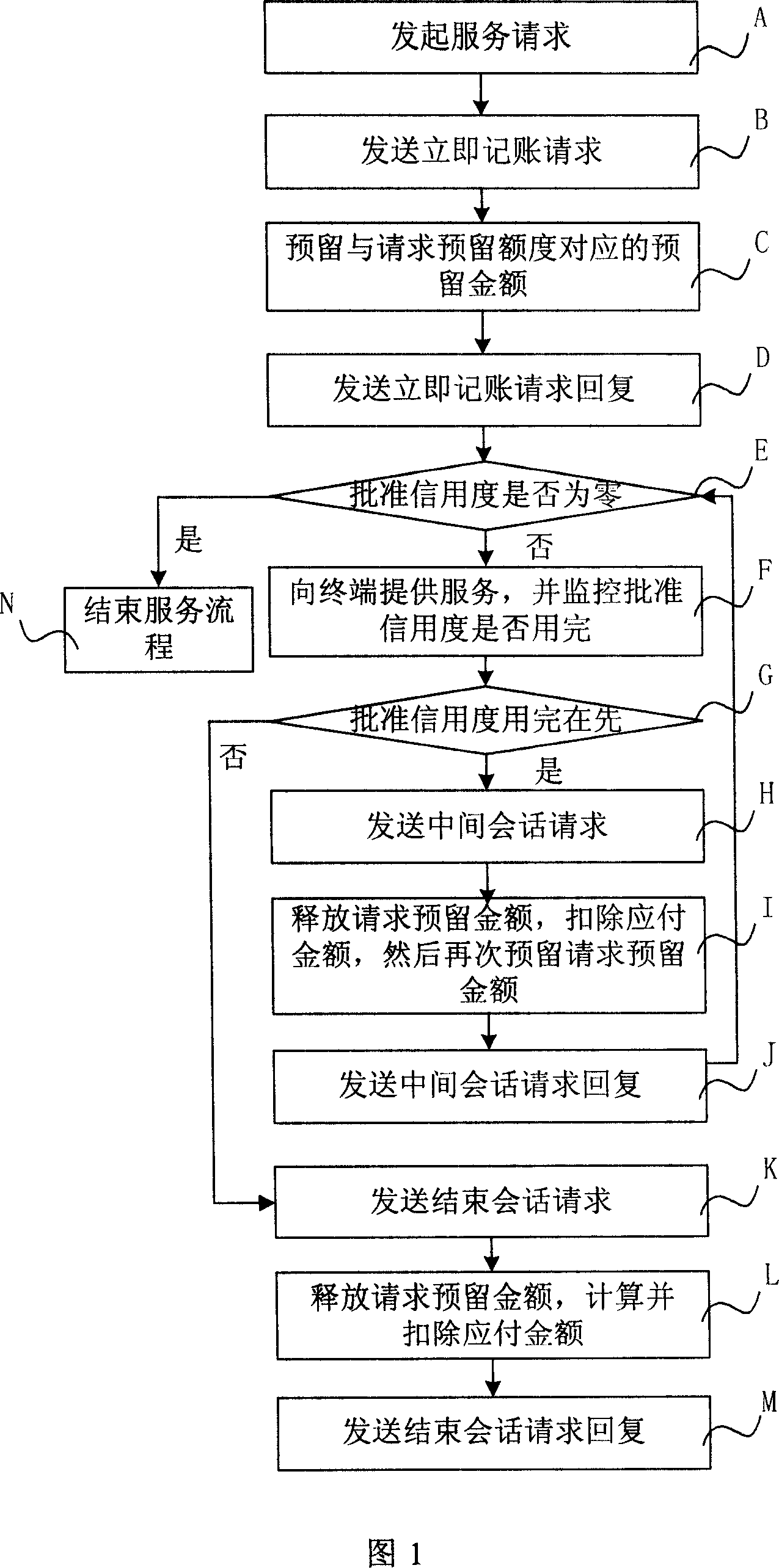

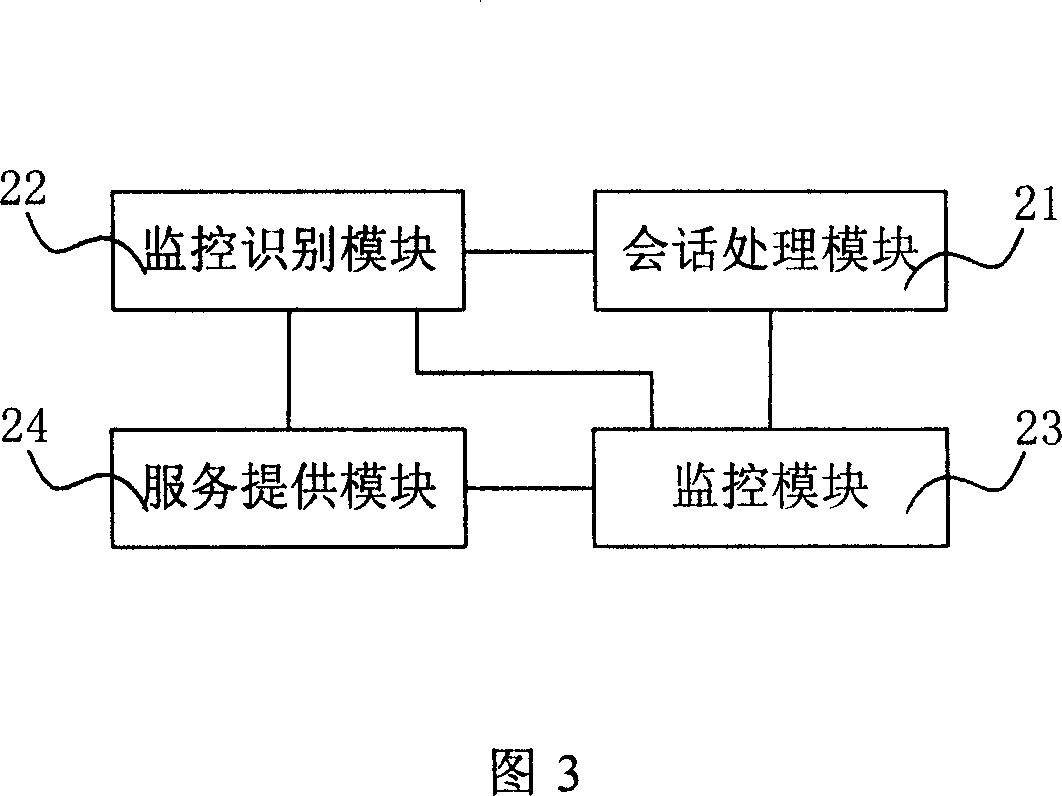

Credit control client terminal, credit control server, charging system and charging method

ActiveCN101035002AReduce information interactionAvoid lostData representation error detection/correctionPulse modulation television signal transmissionComputer terminalClient-side

This invention discloses a credit control client, credit control server, billing systems and billing methods which includes the following steps: to get the end-user identification of the request beginning the conversation that received; Judge the whether the account on user IDs corresponded is enough, yes, use the after billing method is used for the services that request for terminal to bill; Otherwise, use the reserved manner in billing services for billing. This invention simplifies the process of service ; Reduction of unnecessary intermediate conversational request and the credit control and credit control client server interaction between information and reduce the burden of network transmission and control of credit and credit control client server workload, improve its performance and the work for efficiency, ensure the normal handling of service requests, and facilitate the operators and users; avoid the end-user account, the balance of the shortage of arrears and even malicious use of overdraft services, and bringing losses to operators.

Owner:HUAWEI TECH CO LTD

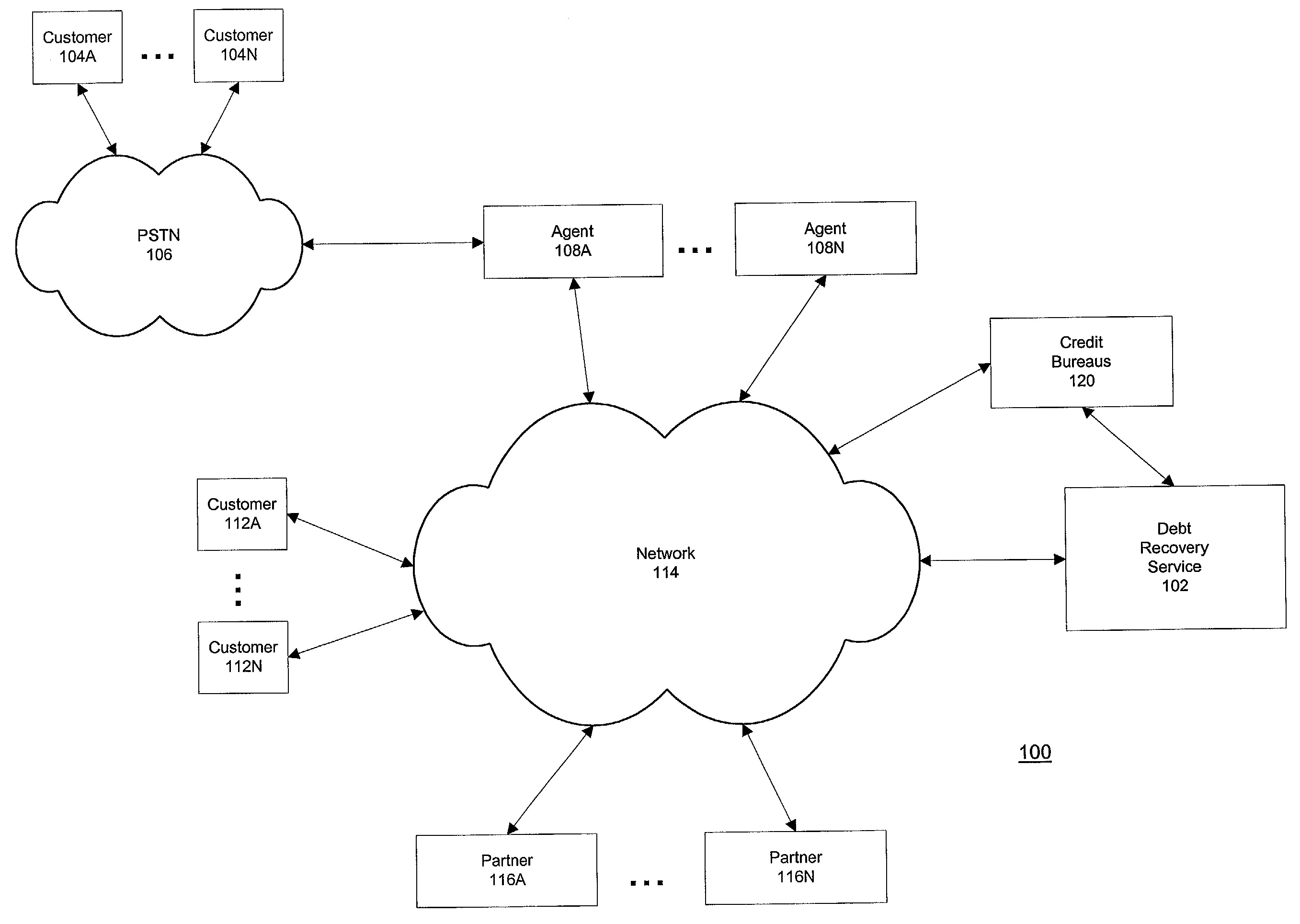

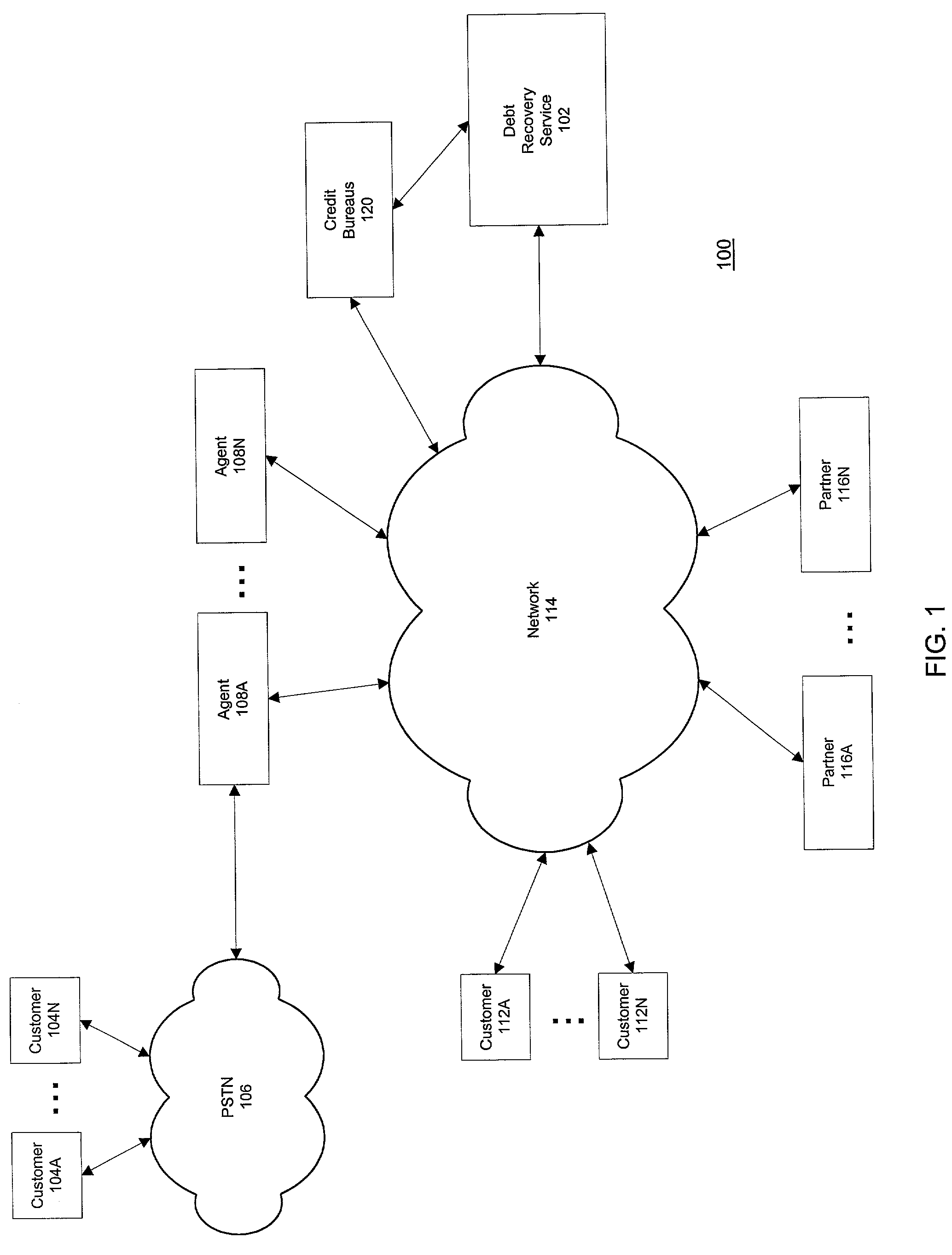

Methods and systems for providing debt recovery partnership

Methods and systems for collecting payments from customers having delinquent accounts are disclosed. Under a debt recovery partnership, a debt recovery service extends an offer for a debt recovery product to a customer with a delinquent account. If the offer is accepted, the debt recovery service receives an acceptance to the offer from the customer and, thereafter, pays a commission for the delinquent account to the partner. The partner ceases attempts to collect payments on the delinquent account corresponding to the accepted offer and continues attempts to collect payments on delinquent accounts not corresponding to an accepted offer.

Owner:CAPITAL ONE SERVICES

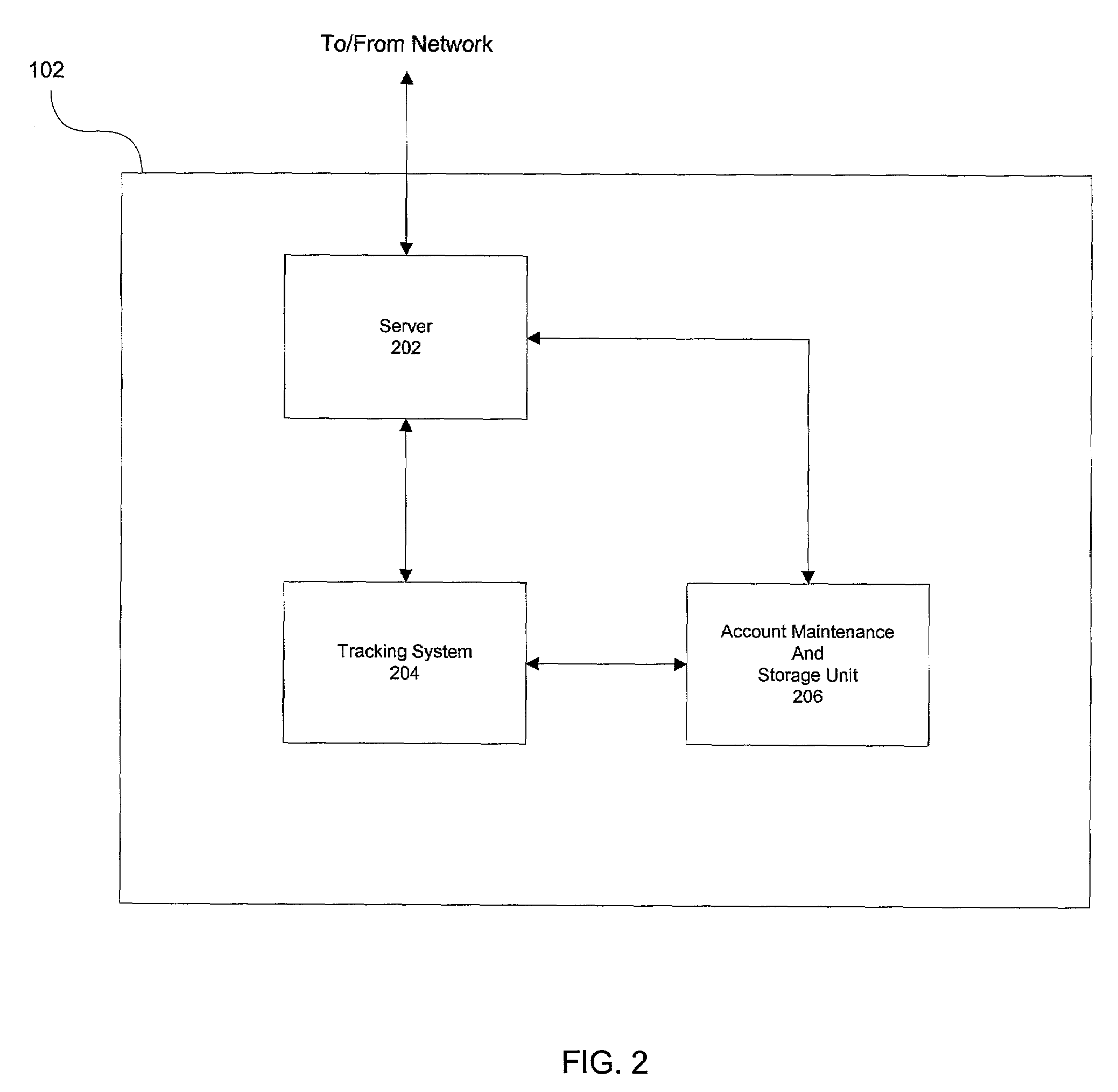

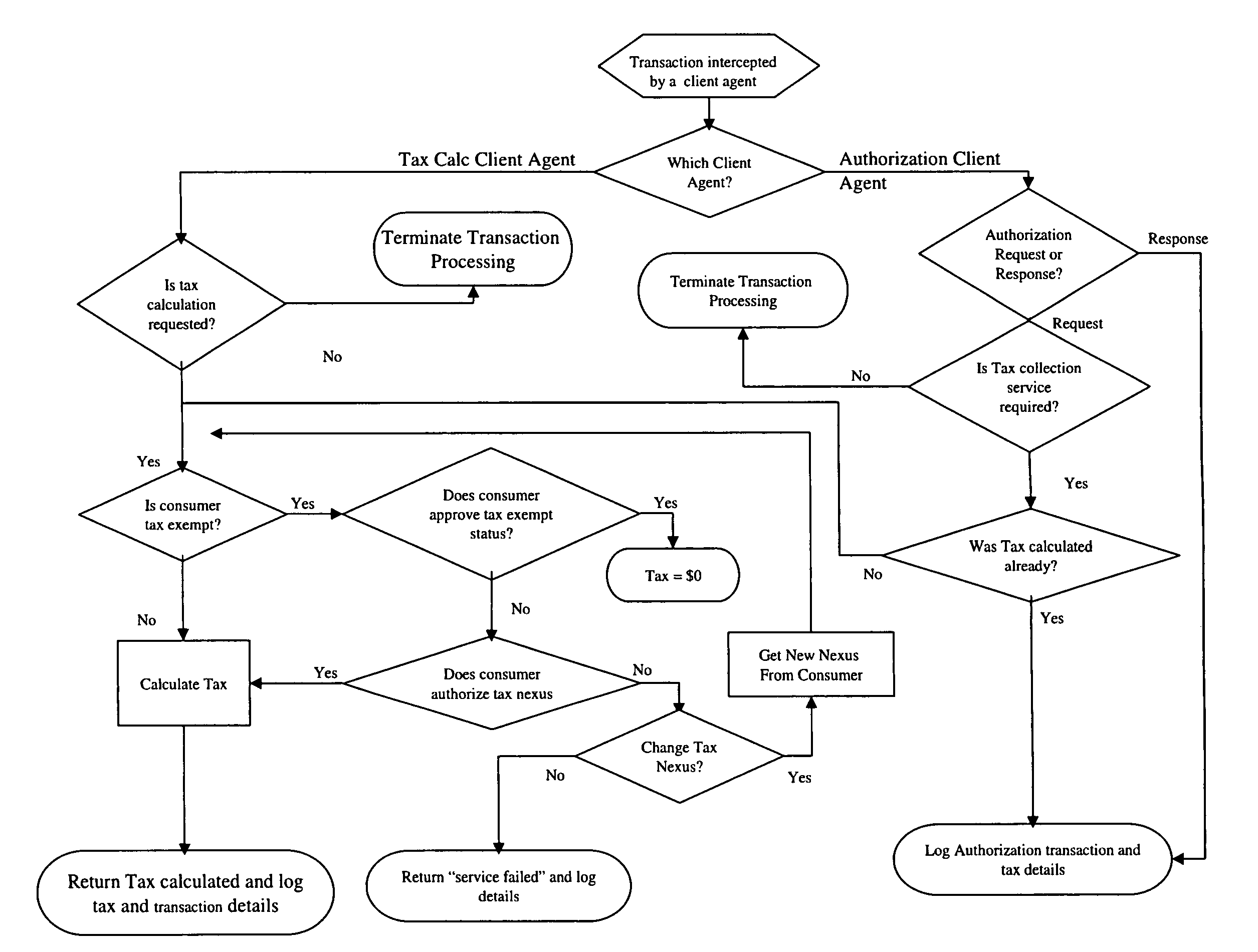

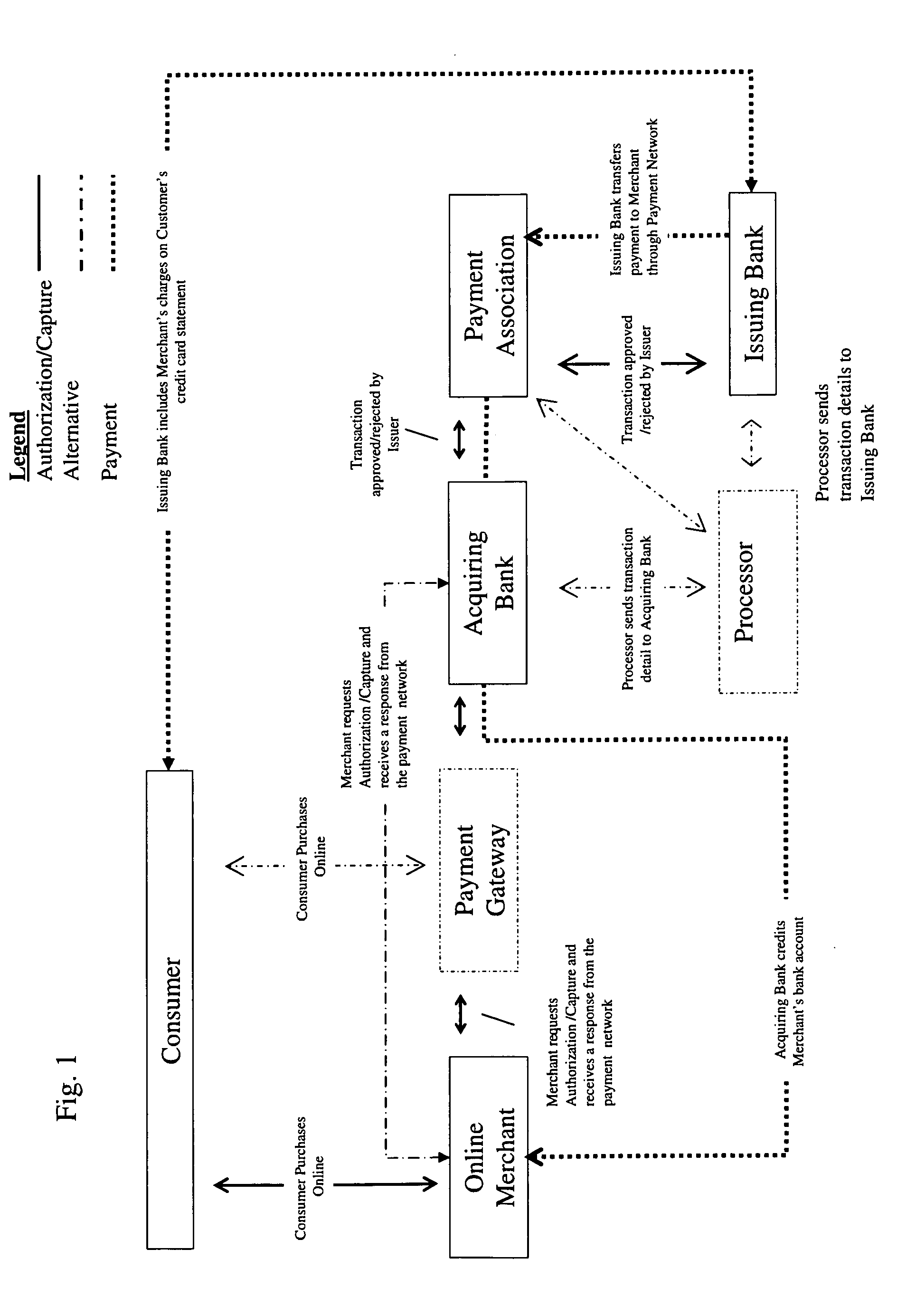

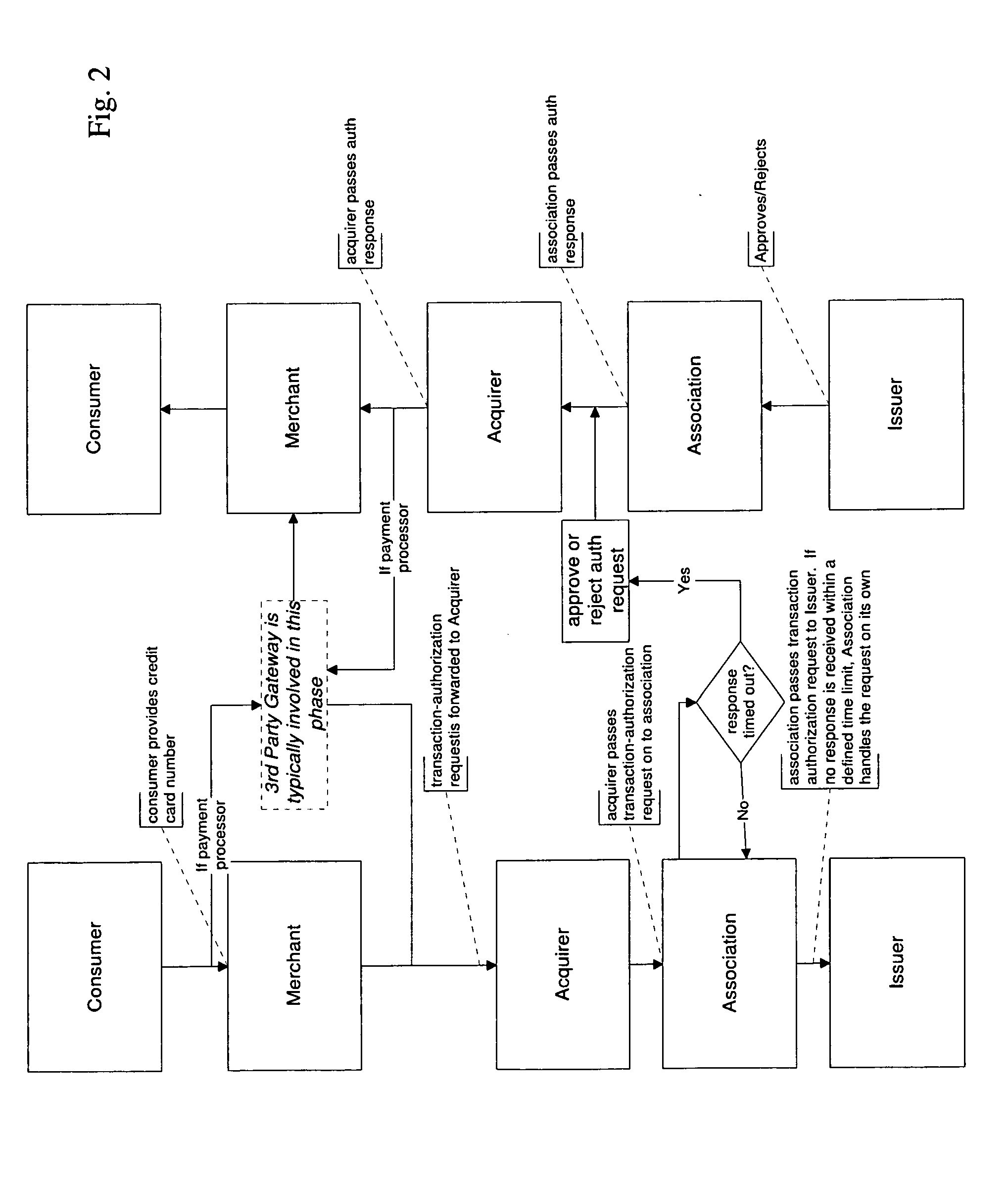

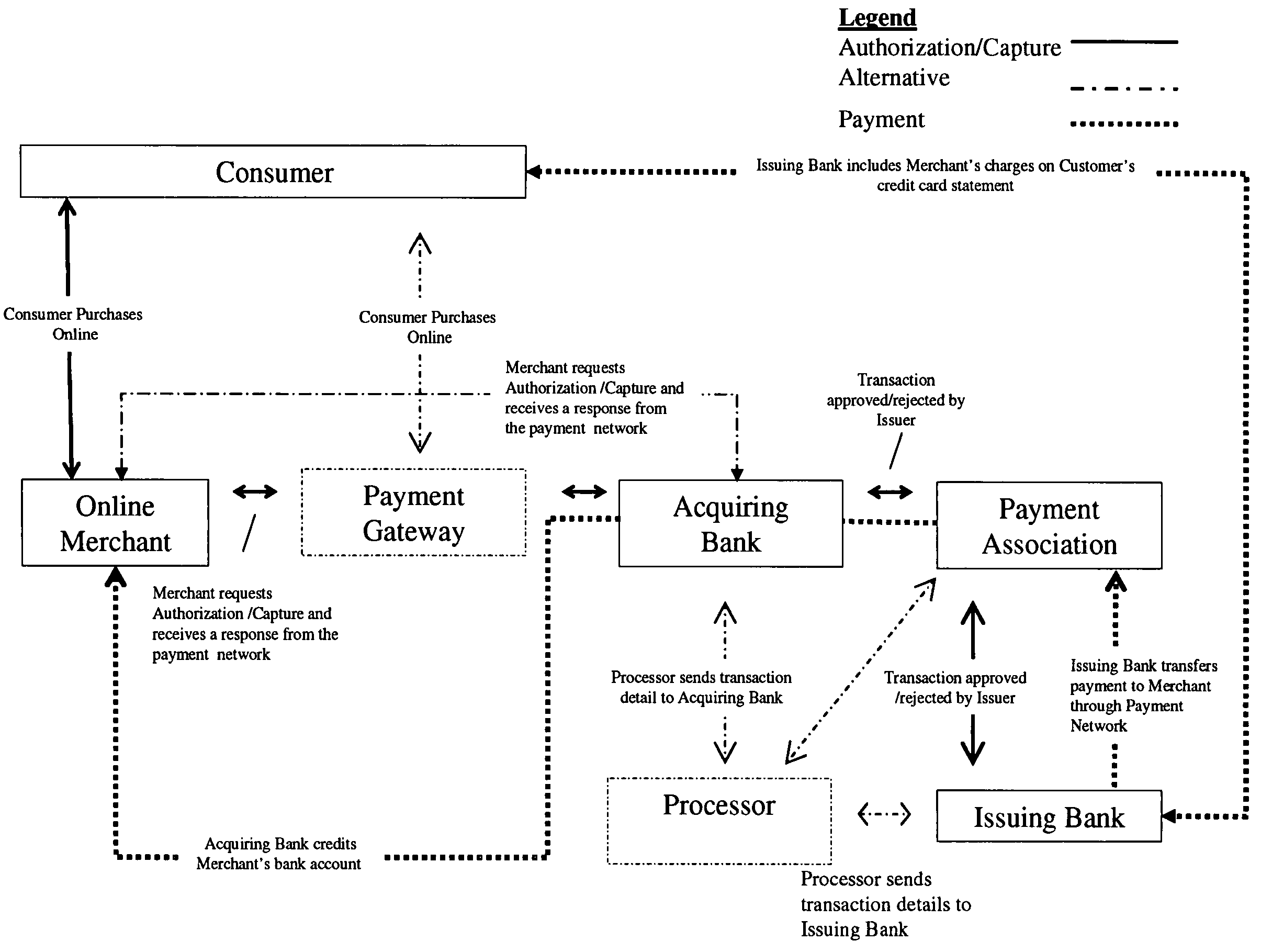

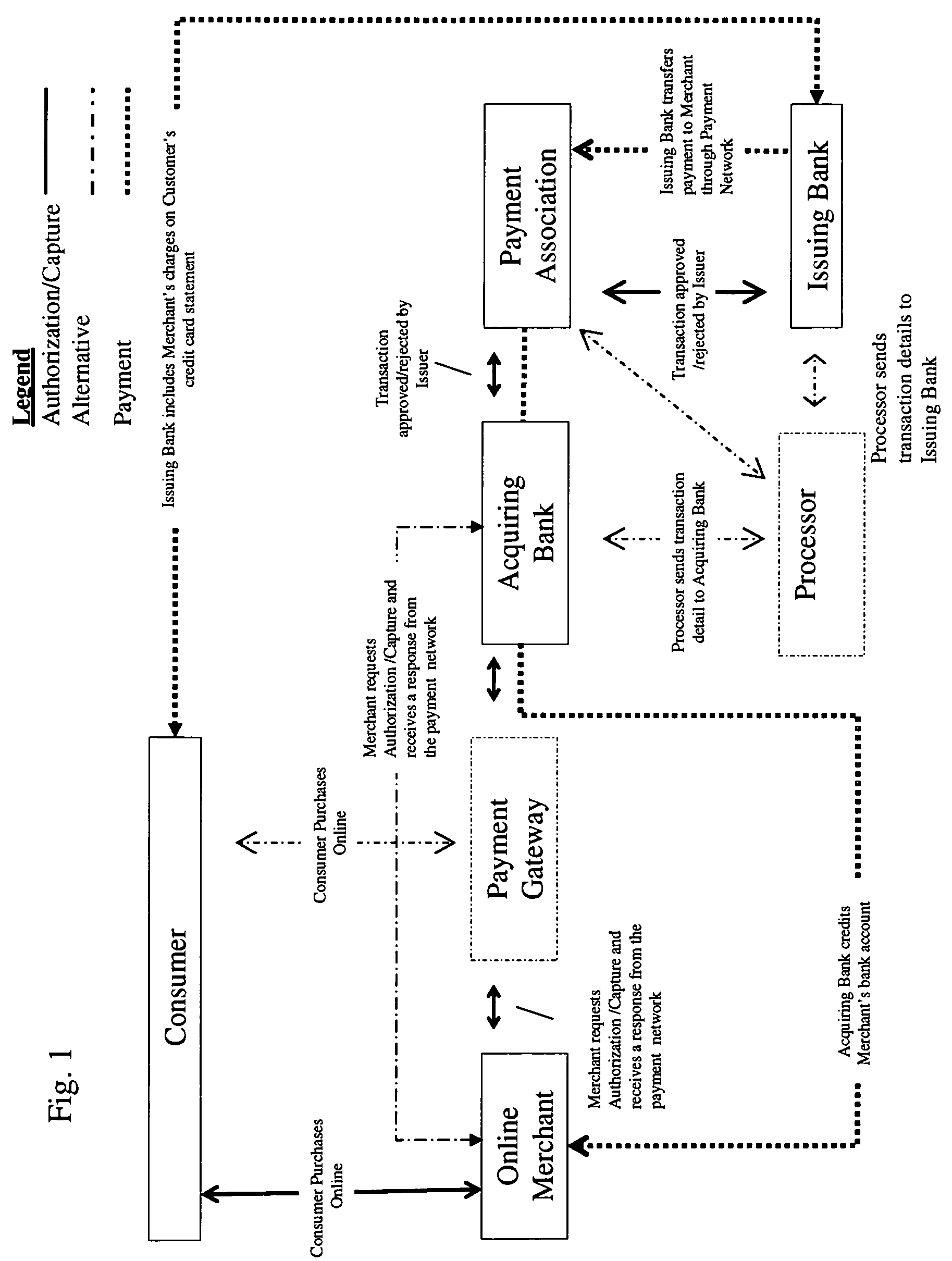

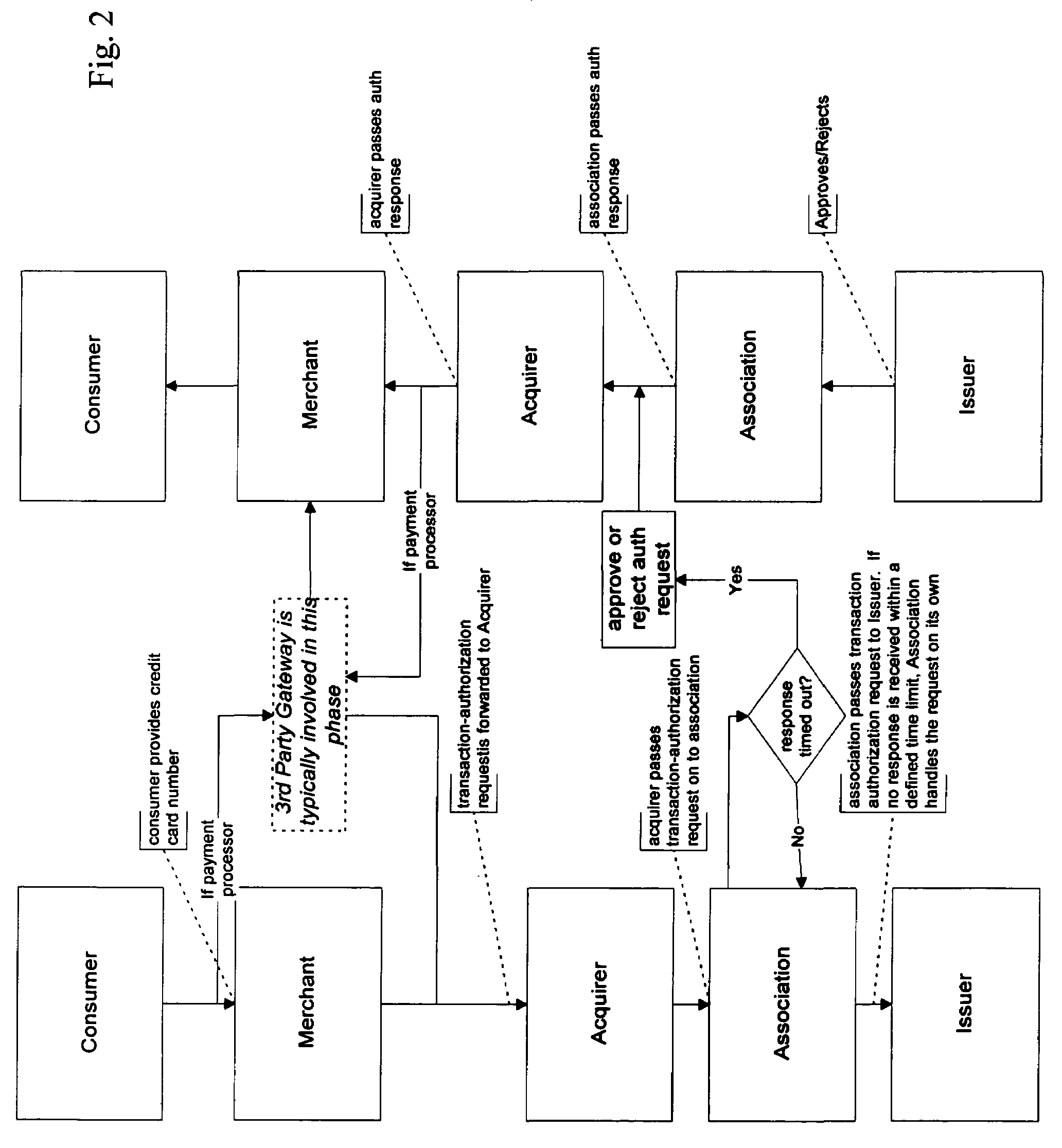

E-Commerce Sales and Use Exchange System and Method

ActiveUS20080294538A1Reduce the burden onEasy and reasonable to implement and enforceComplete banking machinesFinanceCredit cardThird party

The invention provides a system and method for calculating, collecting and / or disbursing one or more third party payments owed to one or more third parties resulting from one or more electronic transactions occurring over a wide area network (WAN) between a customer and a merchant. The transaction concern one or more services and / or products provided by the merchant. The system and method require that the calculation of the amount owed to the third party occur at a WAN node that is different than and at a different locale than that of the merchant. By so doing, the merchant is not required to purchase and install equipment and / or software of the third party to which a payment is due. The present system includes a merchant node, third party payment processing node, financial network, and third party payment receiving node. A consumer conducts a transaction at a merchant node. As a result of the transaction, a third party may or may not be due a payment. The third party payment processing node determines whether such payment is due, calculates the amount of the third party payment, and / or authorizes payment of the third party payment. The financial network, which includes at least the merchant's acquirer bank, the customer's credit card issuing bank and the credit car association, then handles payment of the amount(s) due to the third party, the amount(s) due to the merchant and the amount(s) owed by the customer. The system of the invention can be a fee for service type of system wherein those (the merchant or the third party) that employ the system and / or method pay a fee, for example per transaction or per amounts collected and disbursed, to the provider of the claimed system.

Owner:INTUIT INC

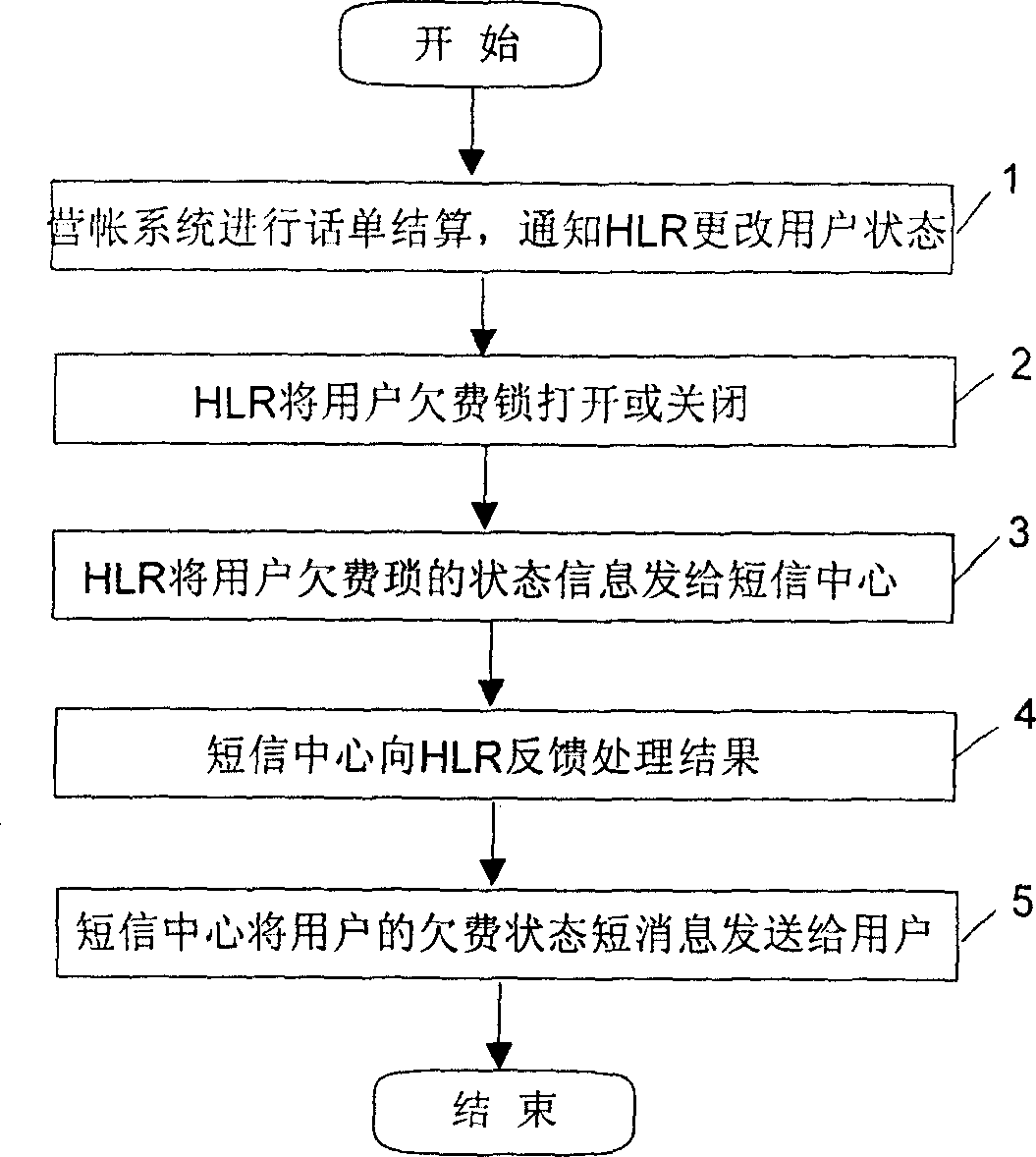

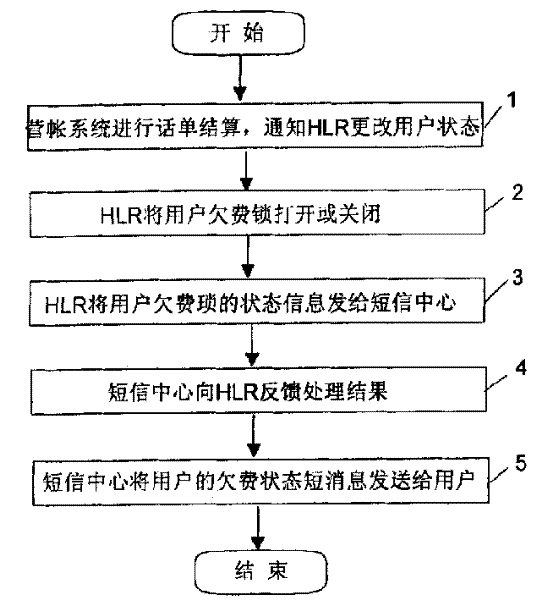

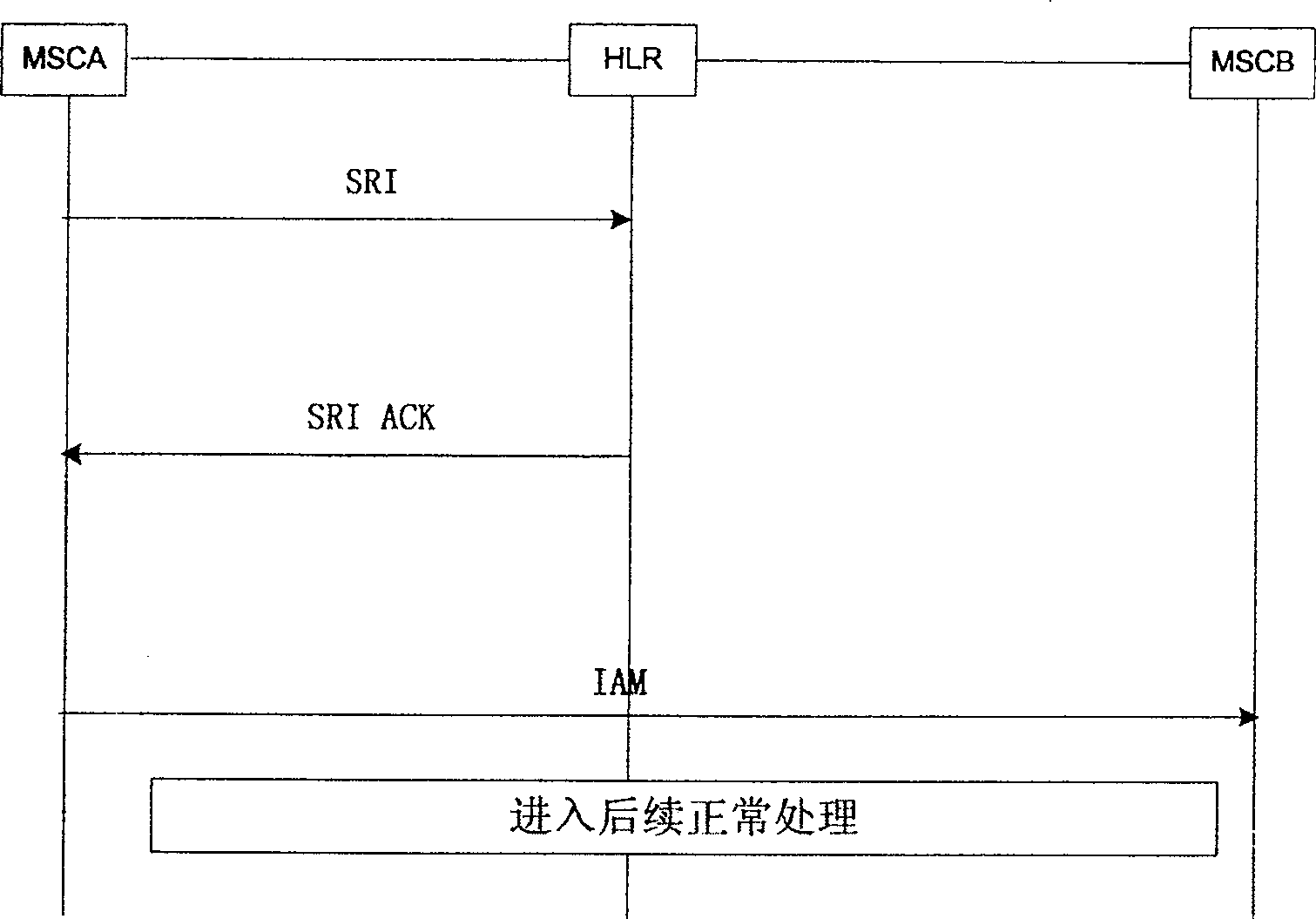

Method for realizing user debt information notice

InactiveCN1510893ALow costEasy to implementAccounting/billing servicesSpecial service for subscribersProcessor registerNetwork Communication Protocols

A method for implementing the notice of users arrears information, this method is: when the state of users arrears are changed, the center of accounting management informs location register (LR) to modify the state of users, according to the notice set the state of charging lock, meanwhile, send the state of charging lock to the system short massage, through the center of short massage send the state information to users, the implementing method of the said plan is utilize the network communication protocol, so it is low cost and easy to implement.

Owner:HUAWEI TECH CO LTD

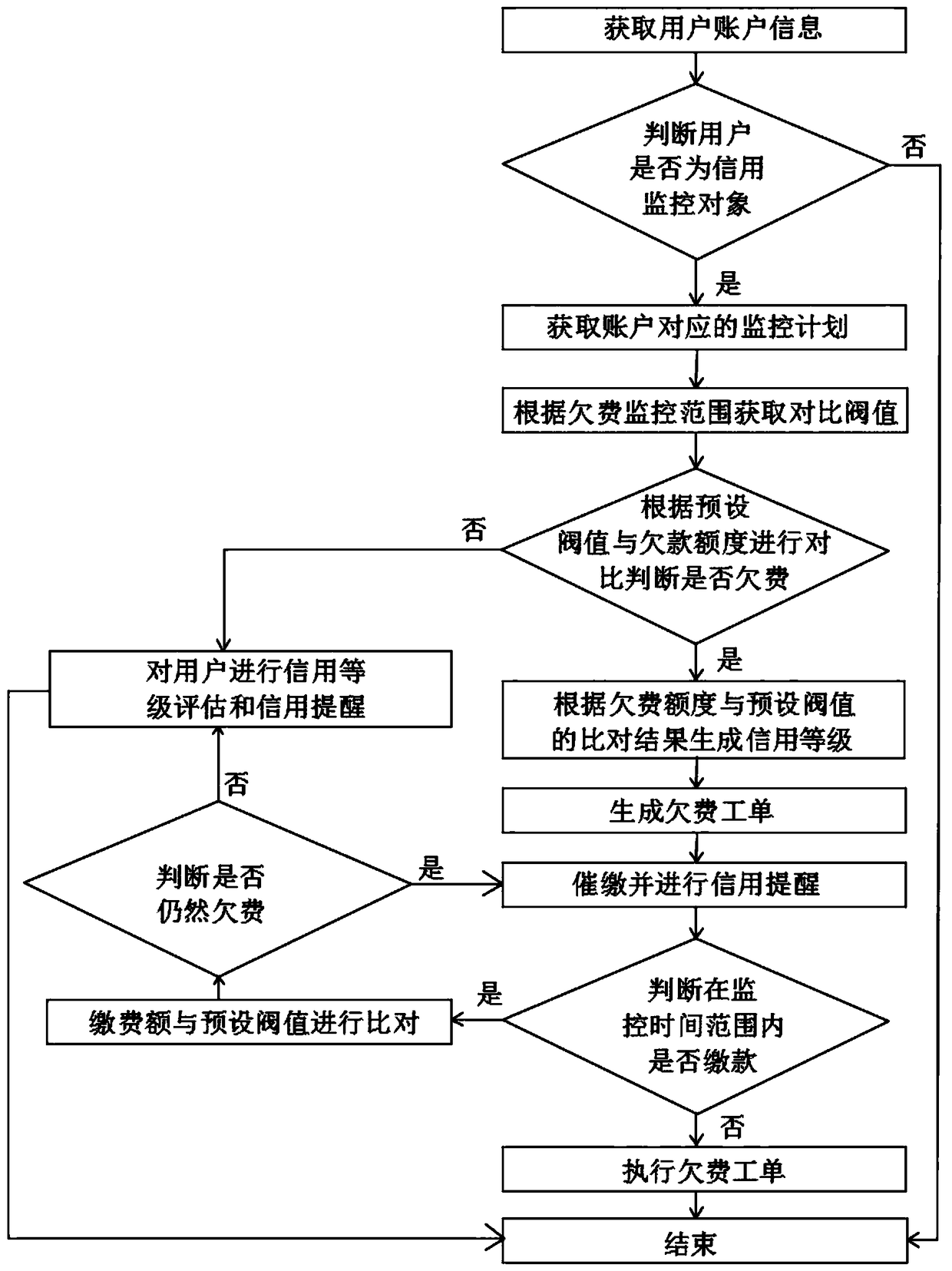

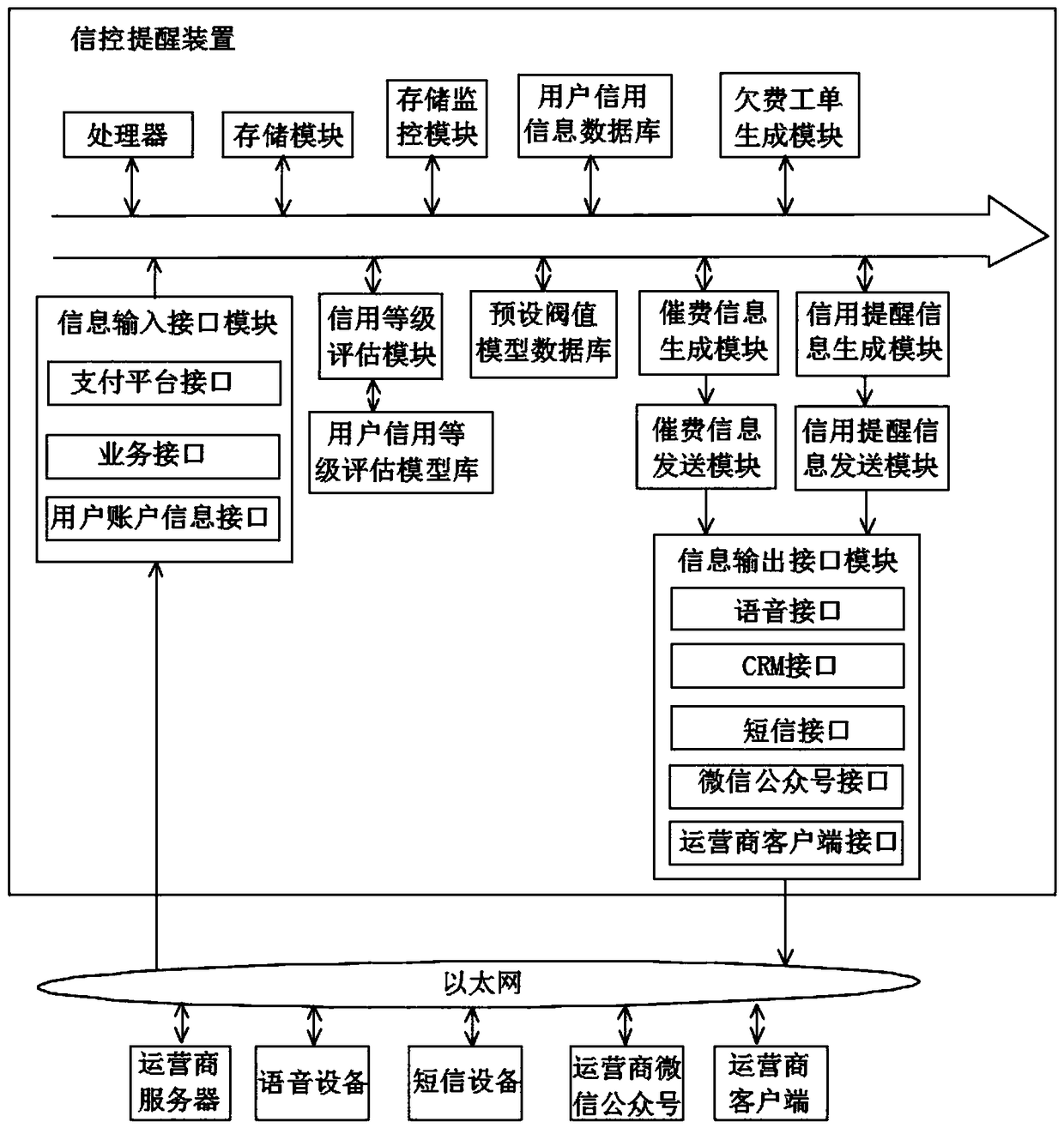

A credit control prompting method and device

InactiveCN108712586AReliable basis for credit assessmentAccurate assessmentAccounting/billing servicesTelephonic communicationPaymentThreshold model

The invention discloses a credit control prompting method and device and relates to the technical field of credit control. The method includes the following steps: the account information of users isobtained, whether the users are credit monitoring objects or not is judged, the contrast threshold is obtained according to the overdue sum monitoring range, contrast is performed according to the preset threshold and the arrearage quota to judge whether the user are in arrearage or not, grade assessment and credit prompting are performed on the users, and the credit grade is generated according to the contrast result of the arrearage quota and the preset threshold. Through accessing an information input interface module and an information output interface module to the credit control prompting device, the credit grade assessment model database of different users is established and the preset threshold model database matching the account information of the users, different monitoring plansare adopted for different users, the user payment reminder message and the credit prompting information are transmitted to the clients through various forms and devices of the Ethernet, and the credit control prompting speed and the diversity of the mode and platform of the arrearage and credit information pushing are improved.

Owner:合肥天源迪科信息技术有限公司

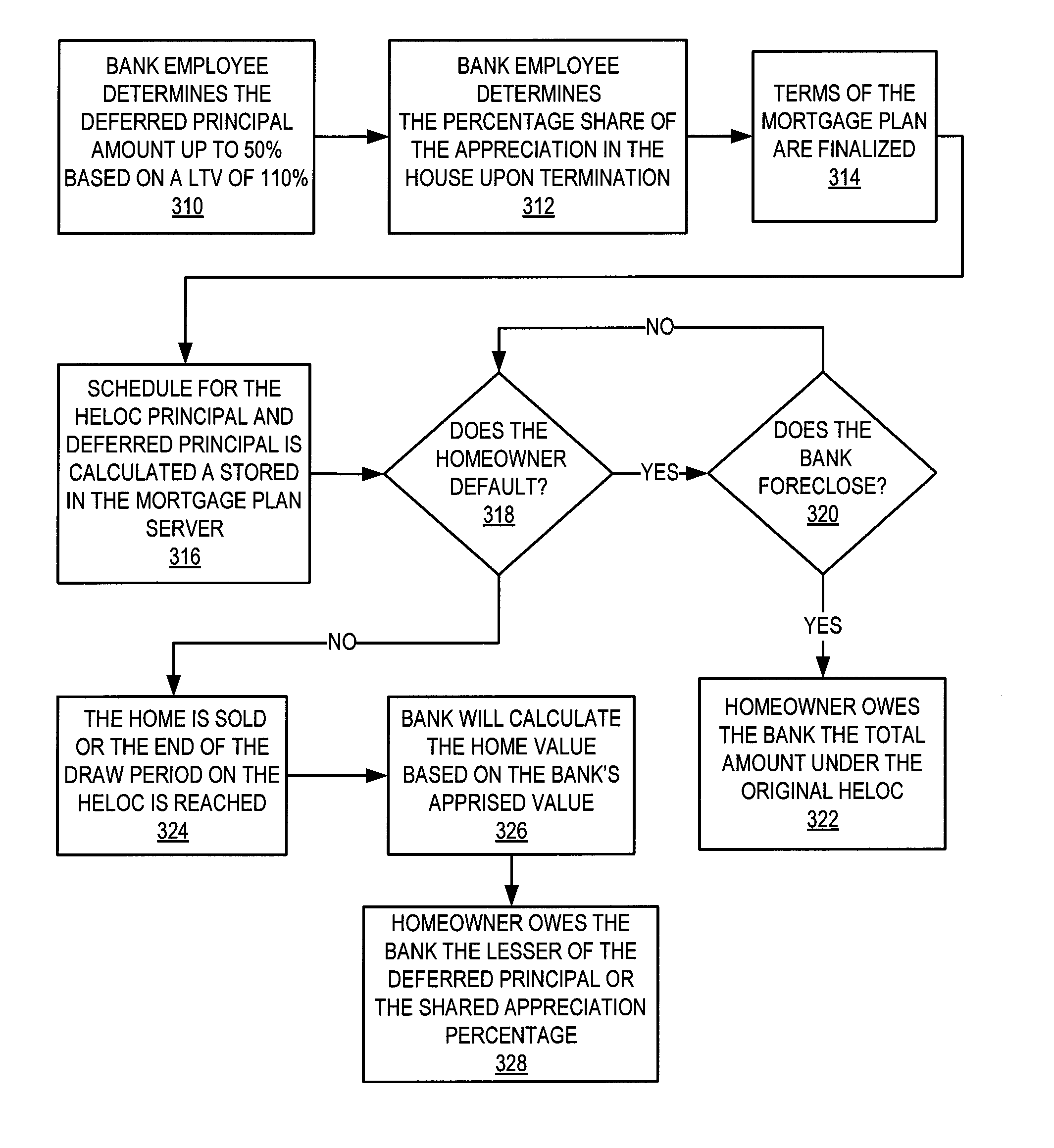

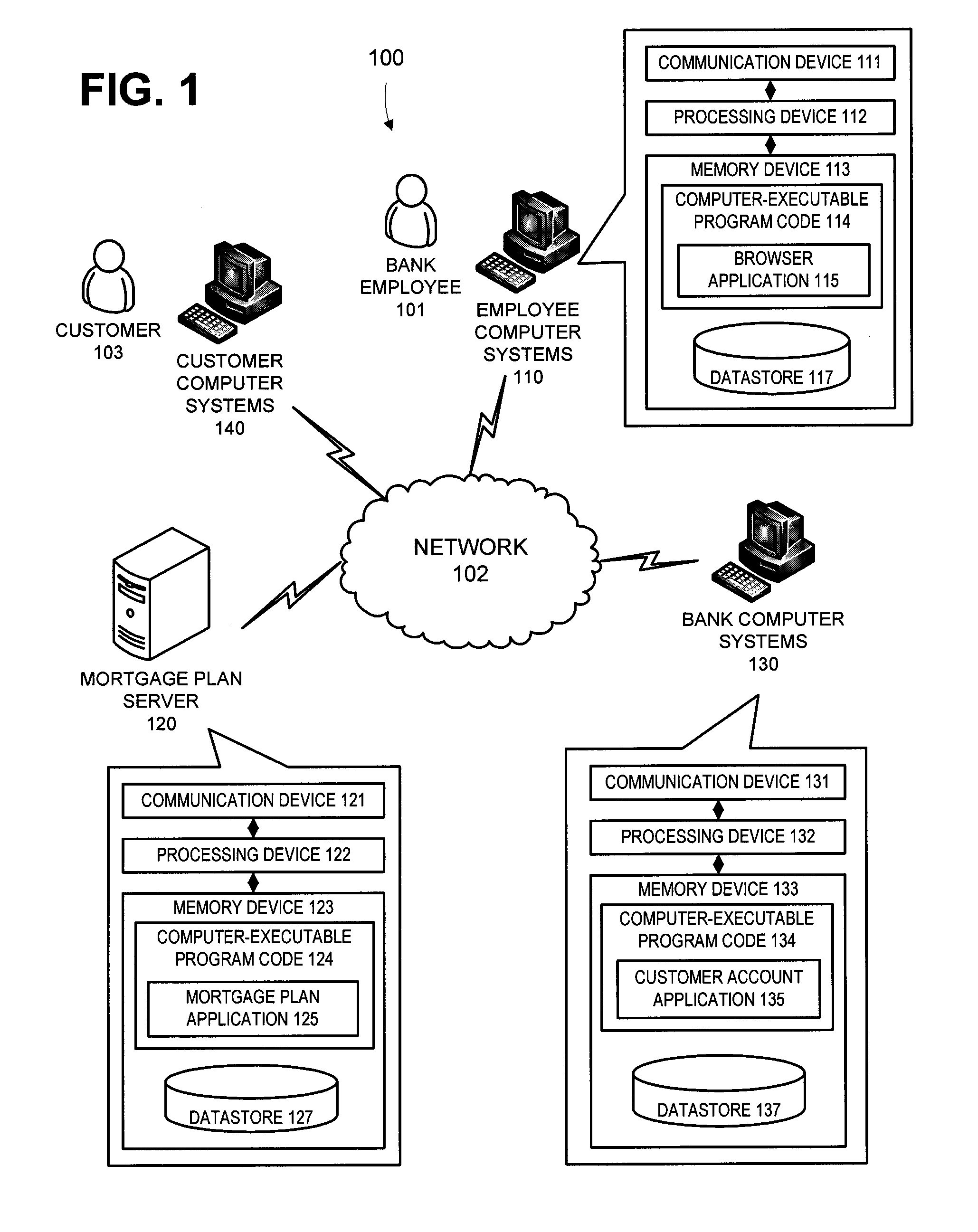

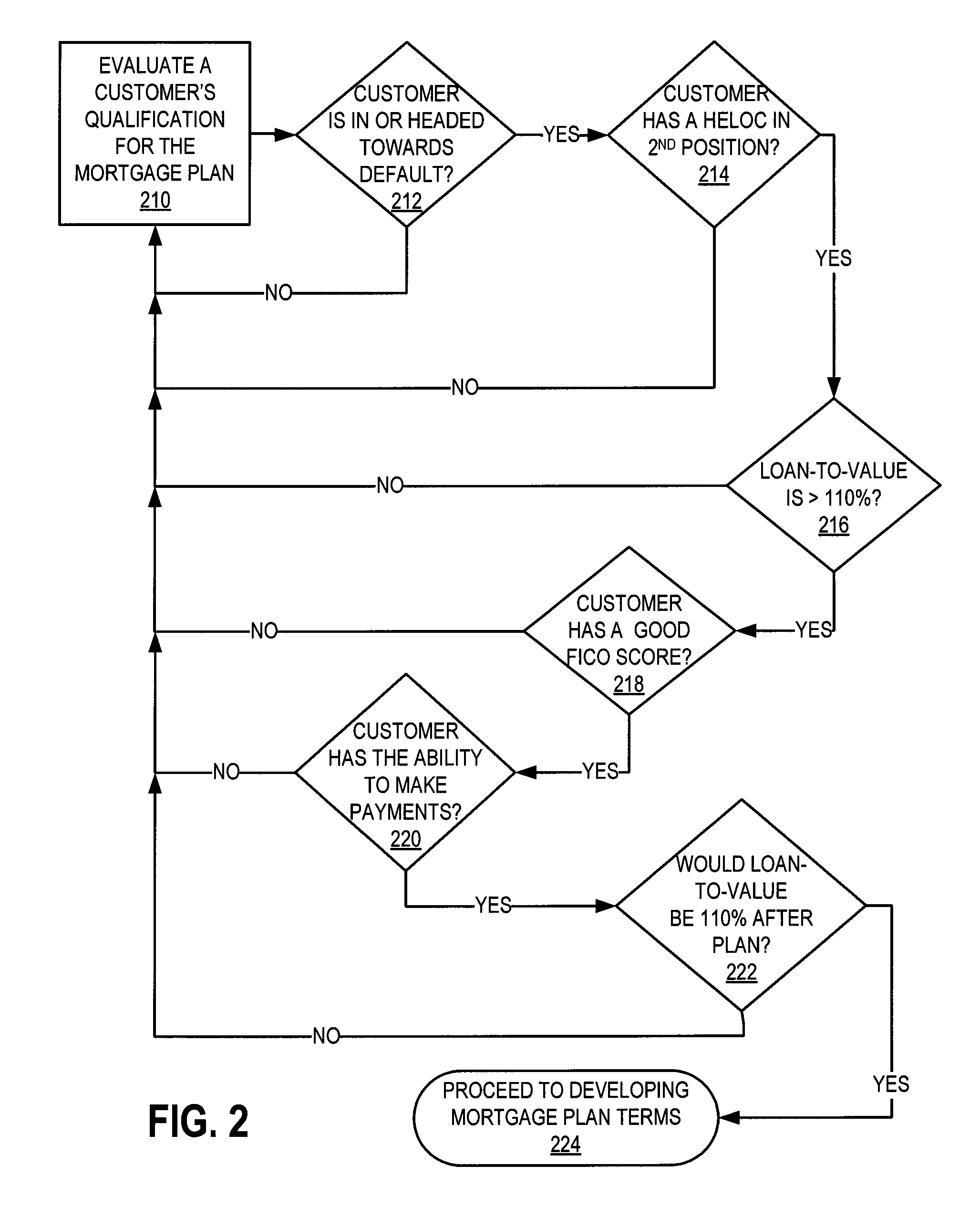

Shared appreciation loan modification system and method

ActiveUS20100179904A1Reducing and deferring lossPreserving the borrower's credit ratingComplete banking machinesFinanceProgram planningComputer science

Embodiments of the present invention provide systems, methods, and computer program products for modifying the terms of a loan and for providing for a shared appreciation loan program. For example, in one embodiment the amount owed on an existing HELOC is split into two portions. A qualifying borrower can defer the obligation to pay interest and payments on a portion of the HELOC in exchange for sharing up to 50% of the future appreciation in the real property that serves as the underlying security for the HELOC. This mortgage plan can provide an incentive for the borrower to remain in the home since the borrower may be able to share in the appreciation of the home even if the home never appreciates beyond the full amount owed on the home, while at the same time preserving the borrower's credit rating and reducing the borrower's monthly payment. The bank may benefit from the mortgage plan by both reducing and deferring losses.

Owner:BANK OF AMERICA CORP

Integrated e-commerce sales & use tax exchange system and method

ActiveUS7562033B2Reduce the burden onEasy and reasonable to implement and enforceFinanceBuying/selling/leasing transactionsThird partyInternet privacy

A system and method for calculating, collecting and / or disbursing one or more third party payments owed to one or more third parties resulting from one or more electronic transactions occurring over a wide area network (WAN) between a customer and a merchant. The present system includes a merchant node, third party payment processing node, financial network, and third party payment receiving node. A consumer conducts a transaction at a merchant node; whereby, a third party may or may not be due a payment. The third party payment processing node determines whether such payment is due, calculates the amount of the third party payment, and / or authorizes payment of the third party payment. The financial network then handles payment of the amount(s) due to the third party, the amount(s) due to the merchant and the amount(s) owed by the customer.

Owner:INTUIT INC

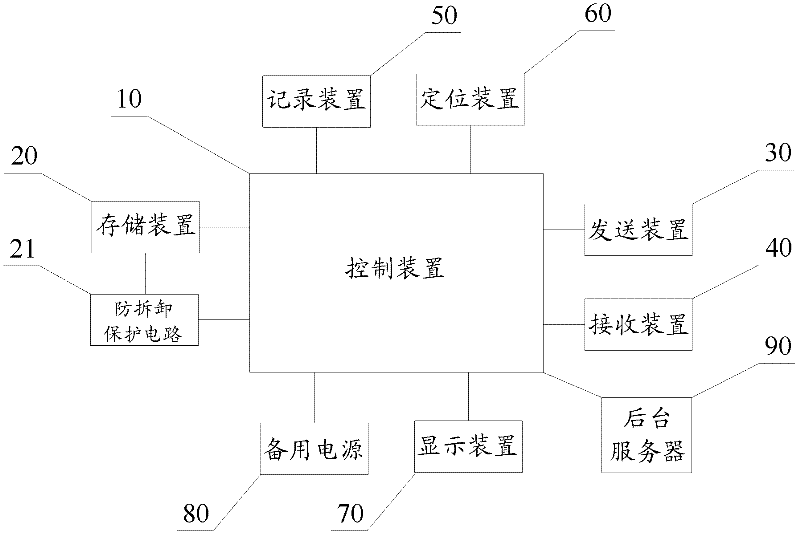

Vehicle electronic identity vehicle-mounted terminal

InactiveCN102509459AAvoid robberyPrevent theftRoad vehicles traffic controlComputer terminalComputer science

The invention relates to a vehicle electronic identity vehicle-mounted terminal which can be mounted on a vehicle, can record and store unique vehicle identity information of the vehicle in an electronic data form, simultaneously can save the vehicle identity information in a background server database through wireless remote synchronous backup and can perform data legality calibration in a timing manner. On the one hand, the vehicle identity information of the vehicle can be sent to an external device passing certification so as to realize accurate long-distance getting of the information of the vehicle; and on the other hand, after the unique identity information which can not be changed is mounted in the vehicle, the loophole of enabling lawless persons to have chances can be made up, the vehicle can be effectively prevented from being robbed and stolen, illegal activities, such as application of license plates of other persons, arrears and evasion of various stipulated fees, illegal transportation of the vehicle, illegal operation and the like can be avoided, and the terminal provided by the invention contributes to social stability and harmony.

Owner:SHENZHEN TDF TAI INTELLIGENT TECH CO LTD

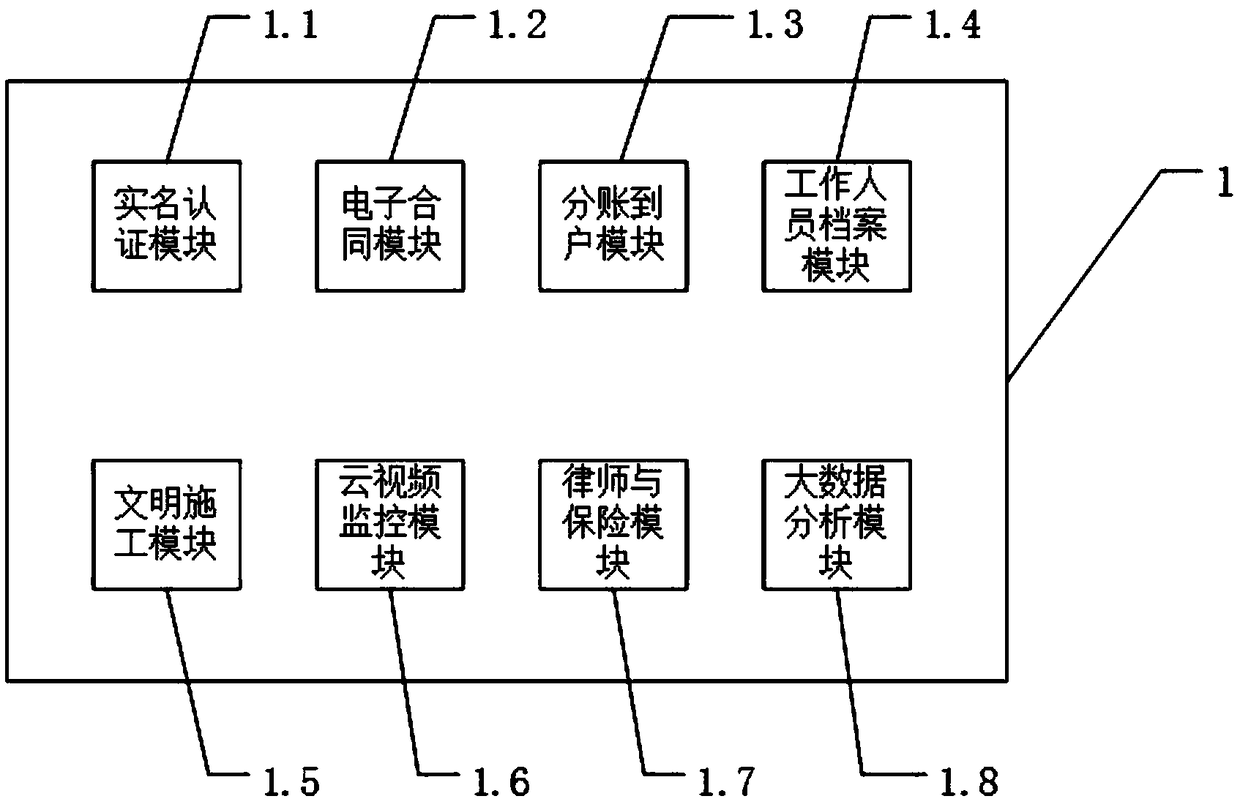

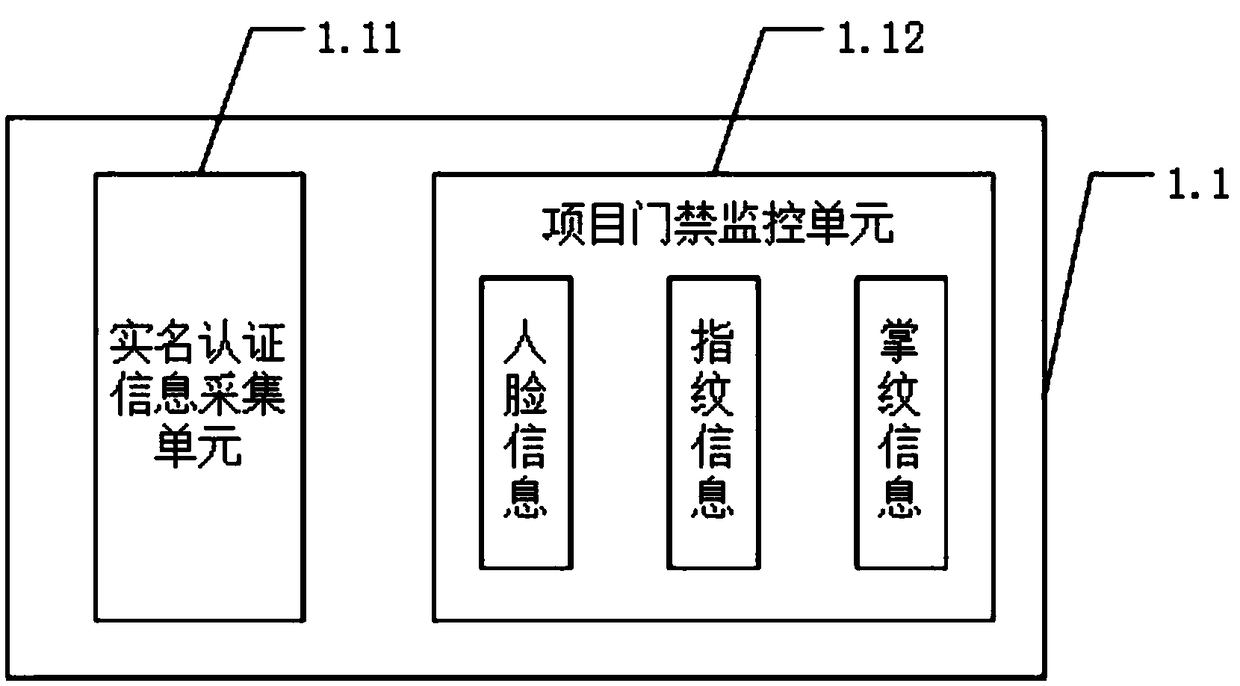

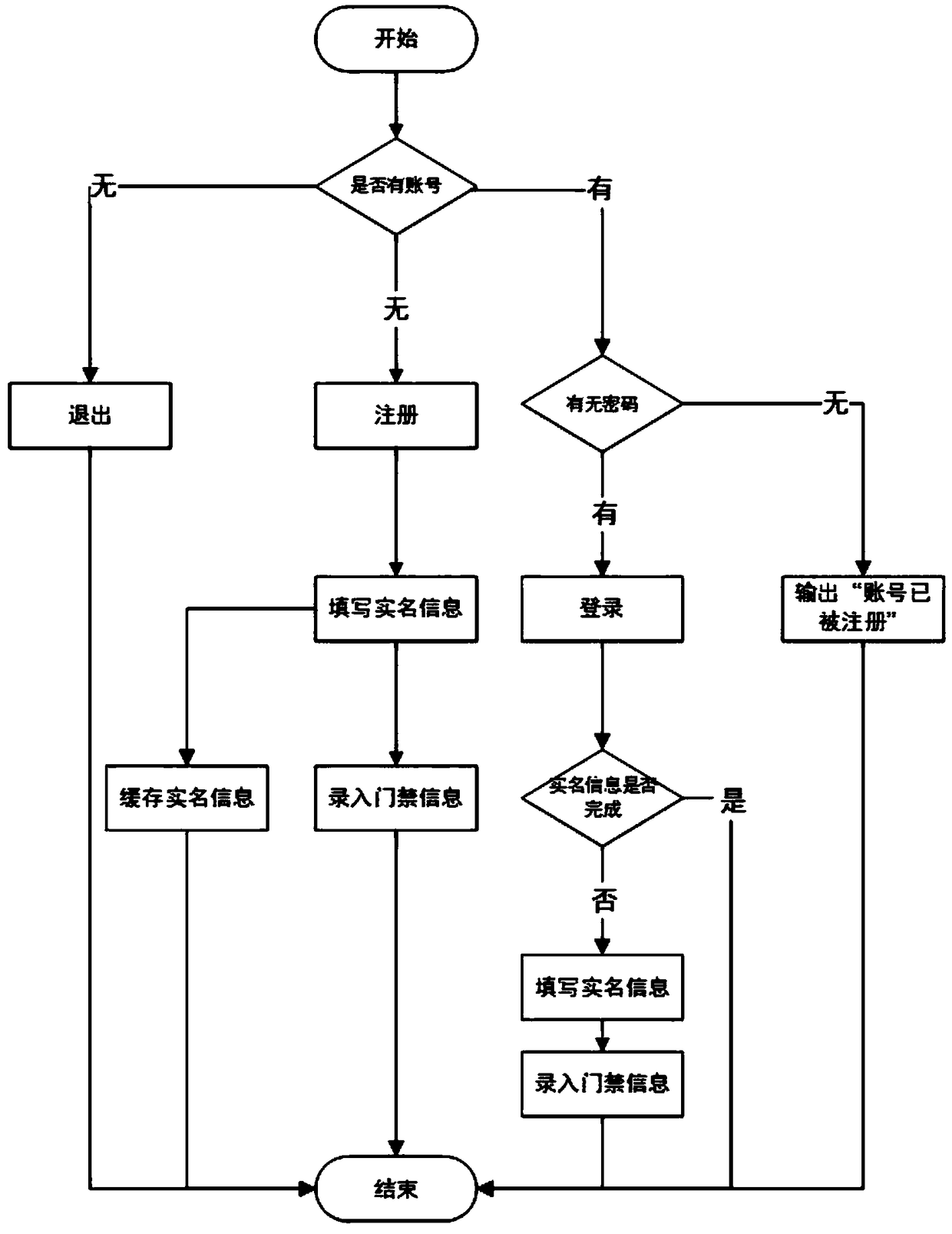

Construction site construction personnel management system

InactiveCN109325733ARealize precise managementImplement schedulingOffice automationResourcesElectronic contractsIntelligent management

Owner:深圳市恒天吉科技技术发展有限公司

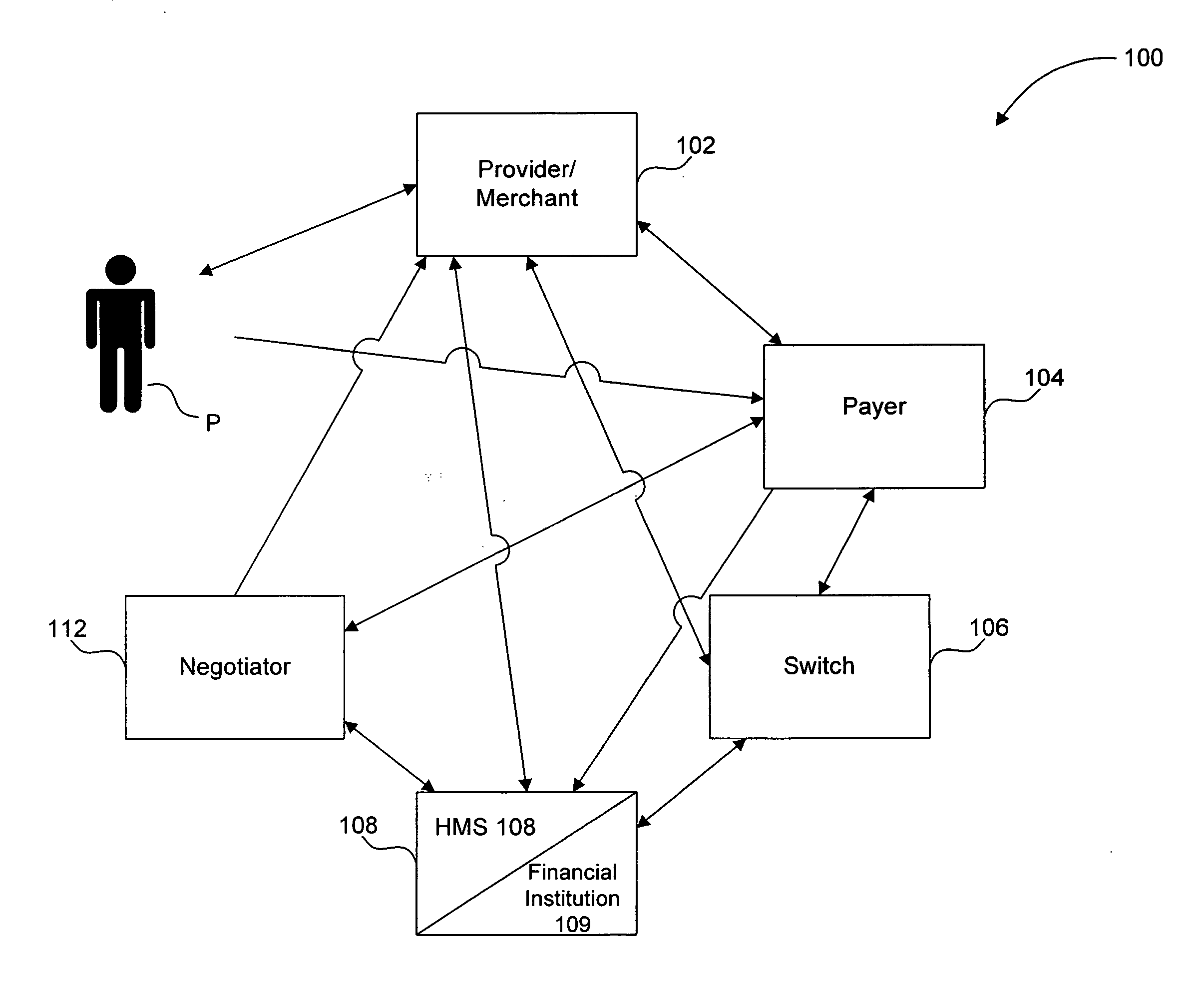

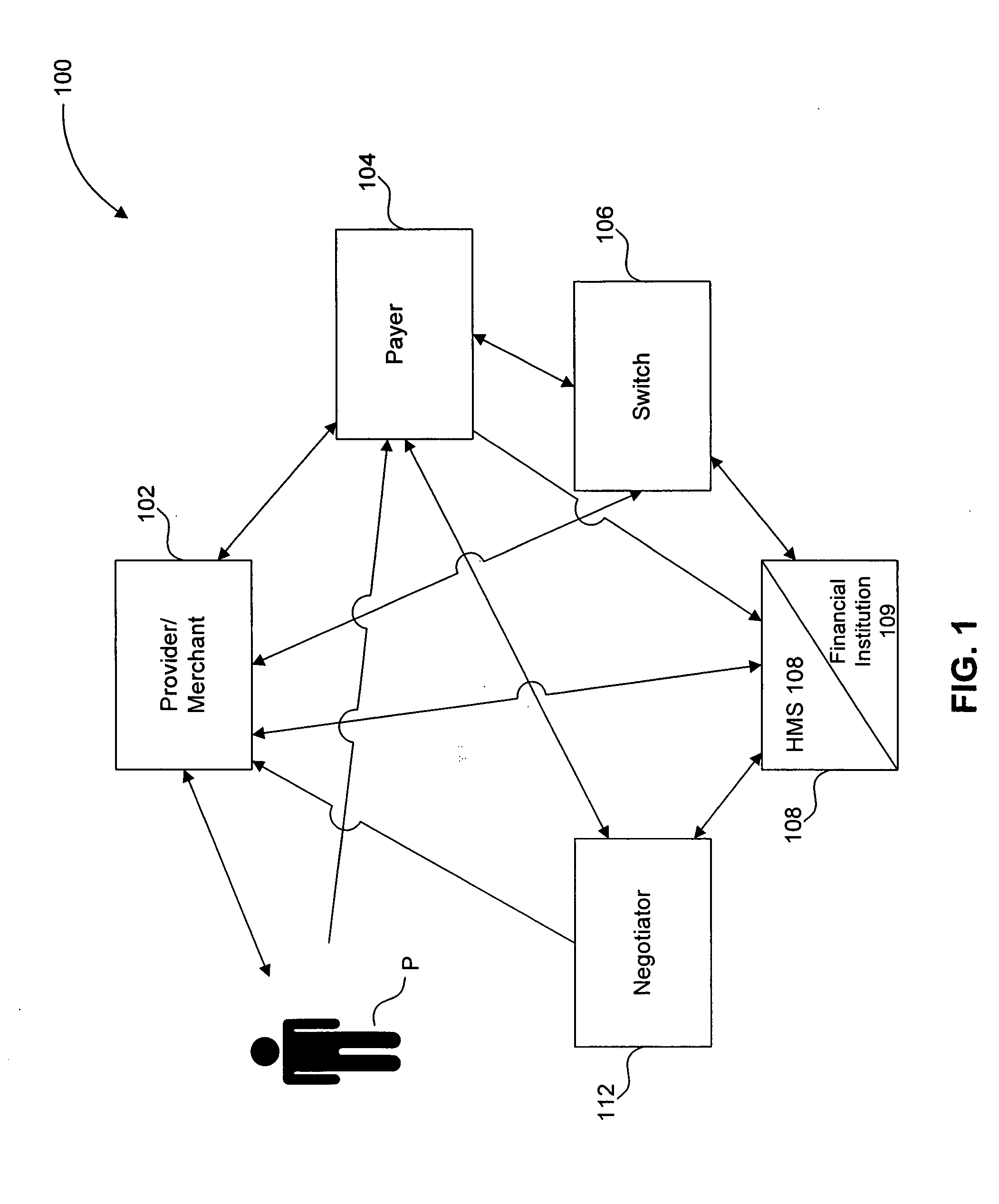

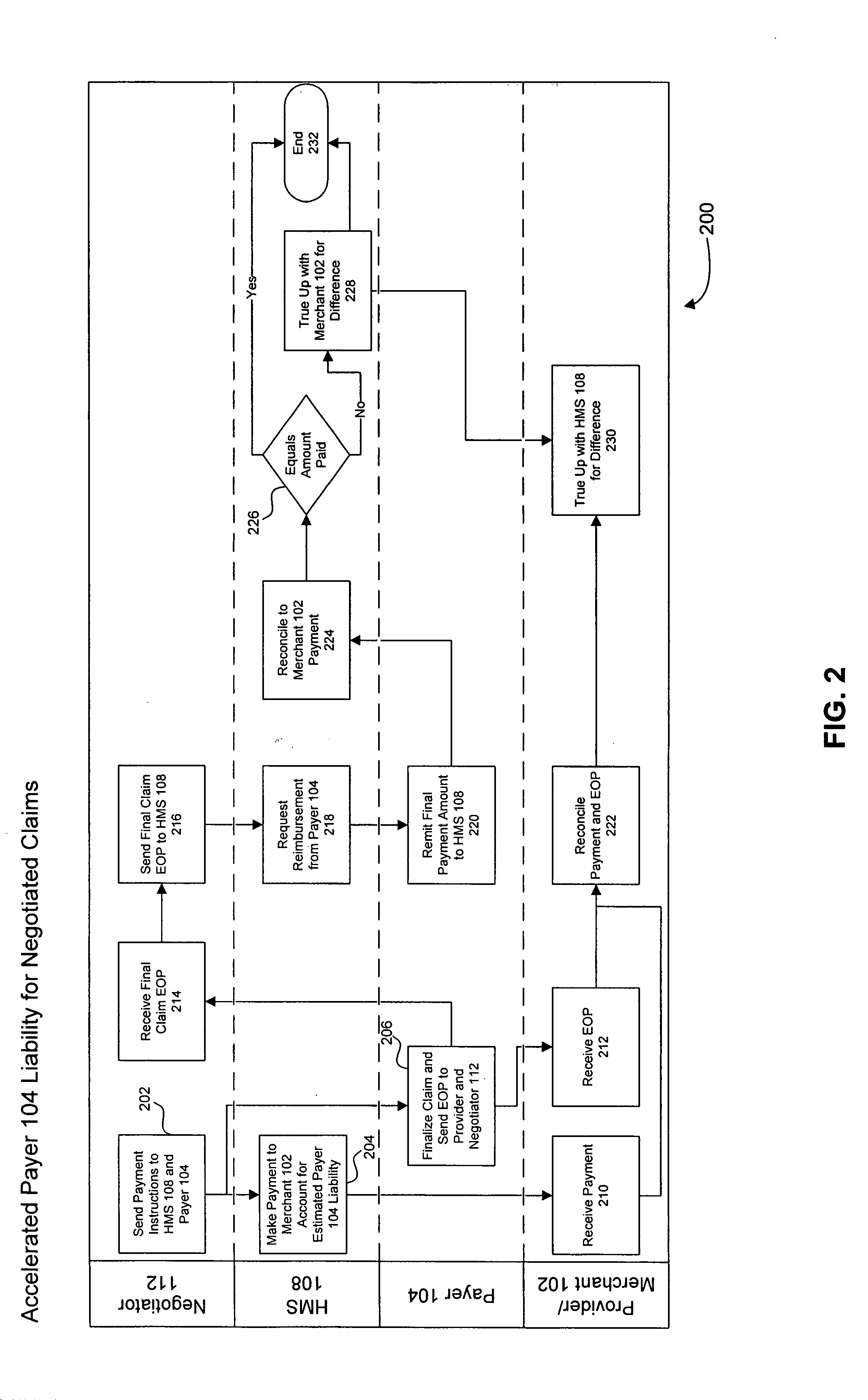

Accelerated Payments for Health Care Plans

A method for accelerating a payment to a merchant for a healthcare related claim. The method comprises submitting a healthcare related claim for payment from the merchant to a payer; determining at the payer whether the member is eligible for services covered as a part of his or her healthcare plan. If the member is determined to be eligible for payment of claim(s) submitted, then a financial institution is notified of an estimated amount of liability for the claim. At least a portion of the estimated amount of liability for the claim is paid to the merchant by the financial institution. The financial institution thereafter receives a reimbursement / payment from a healthcare finding source for the adjudicated amount of liability for the claim. Once the claim is adjudicated, a healthcare management system reconciles with the merchant for any under or over payment.

Owner:LIBERTY PEAK VENTURES LLC +1

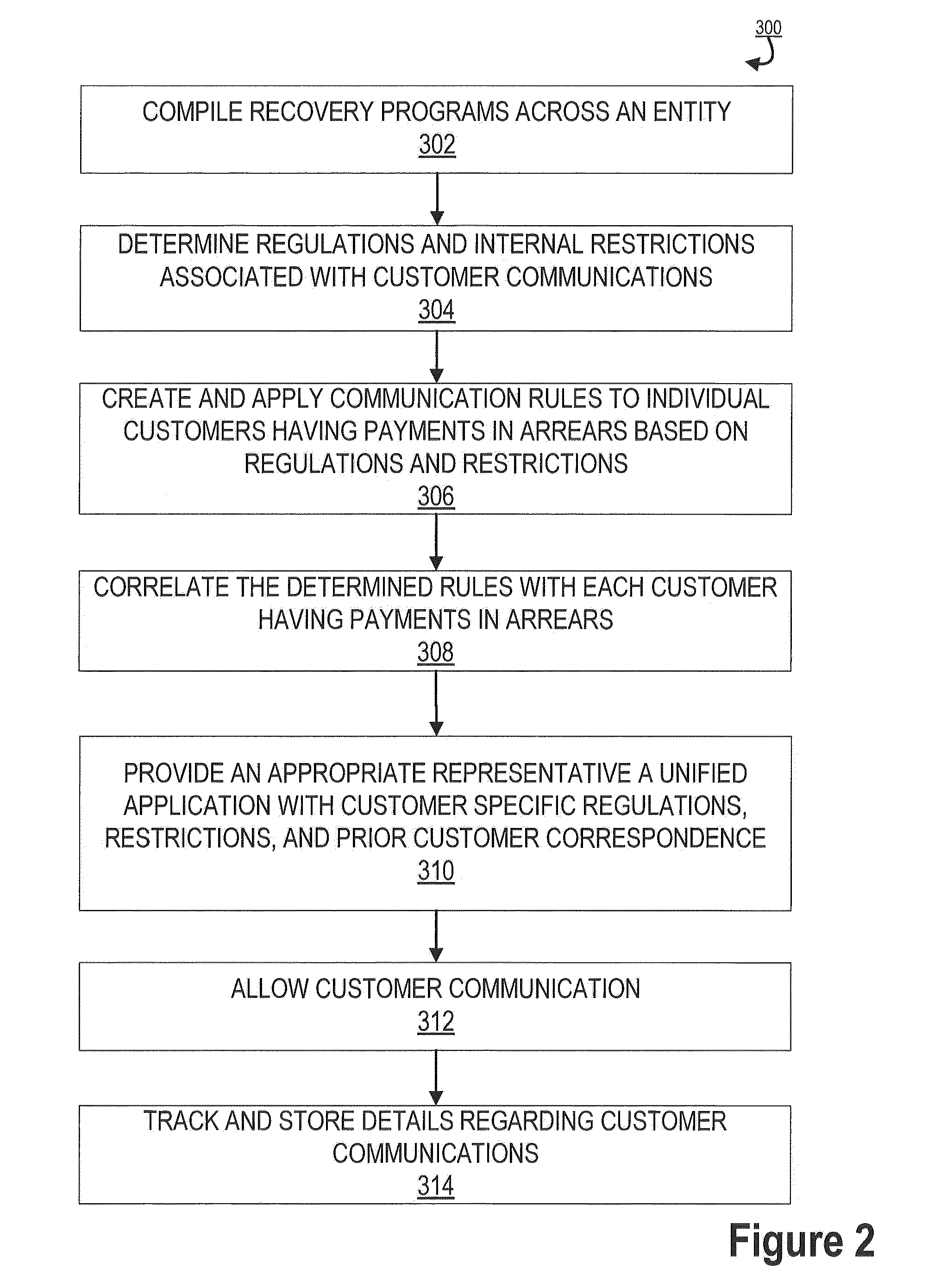

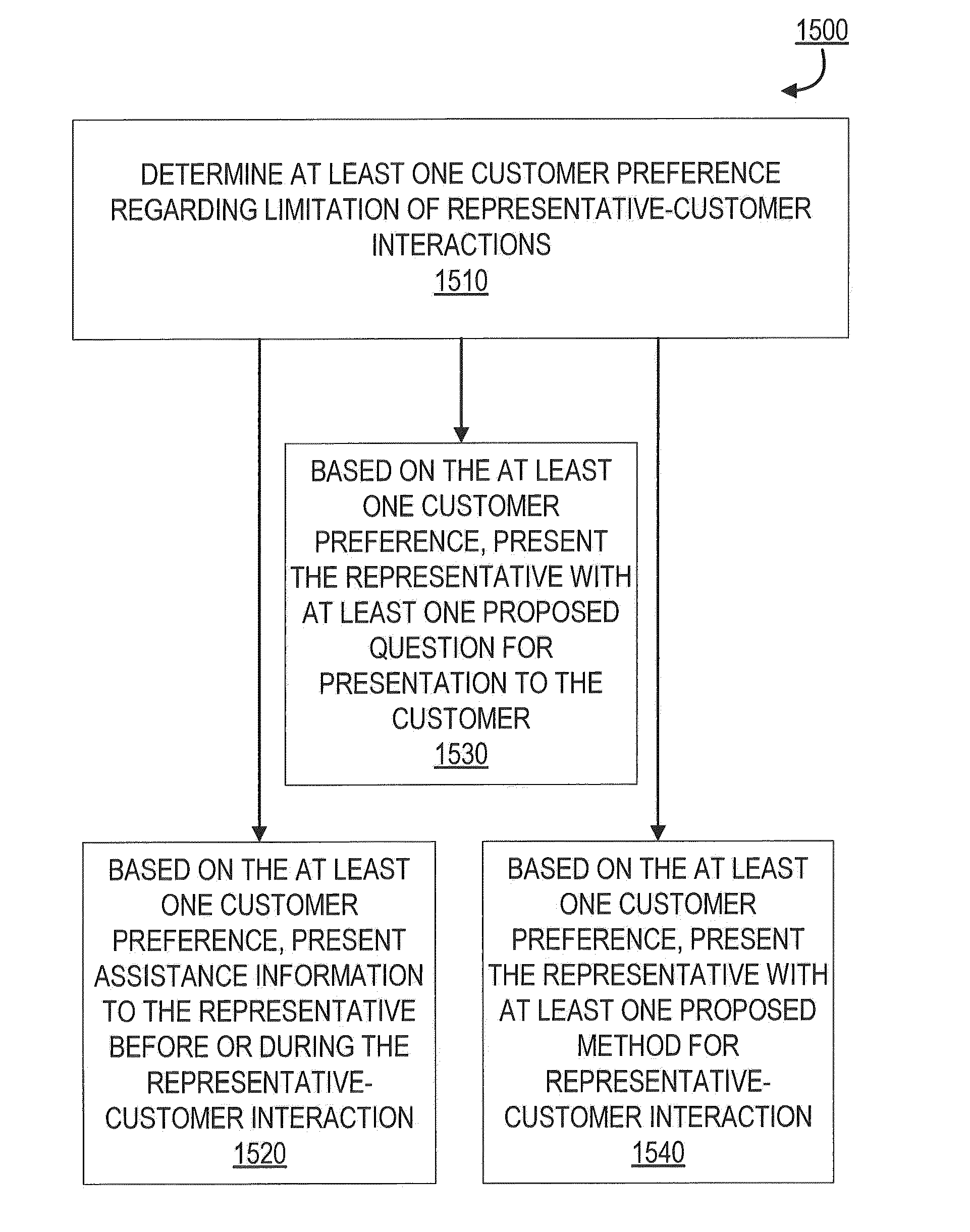

Determining appropriate course for representative working to recover payment in arrears

Embodiments of the invention are directed to a system, method, or computer program product for determining an appropriate course of action for a representative working to recover payment in arrears. Embodiments may determine at least one customer preference regarding limitation of representative-customer interactions; and, based on the at least one customer preference, present assistance information to the representative before or during the representative-customer interaction, the assistance information configured to at least one of inform the representative of the at least one customer preference, present the representative with at least one proposed question for presentation to the customer, or present the representative with at least one proposed method for representative-customer interaction.

Owner:BANK OF AMERICA CORP

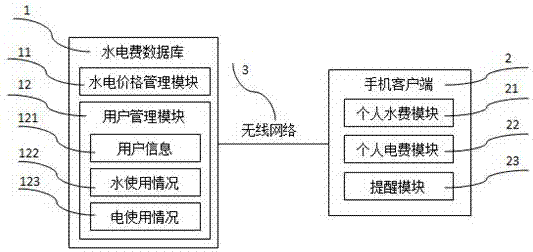

Payment reminding system for water and electricity charges

InactiveCN107509177AImprove completenessImprove efficiencyData processing applicationsSubstation equipmentWater useElectricity price

The invention provides a payment reminding system for water and electricity charges. The system comprises a water and electricity charge database and a mobile phone client, wherein the water and electricity charge database is connected with the mobile phone client through a wireless network, the water and electricity charge database comprises a water and electricity price management module and a user management module, the water and electricity price management module is used to manage the price of water and electricity, and the user management module is used to manage user information, water use conditions and electricity use conditions of users; and the mobile phone client comprises a personal water charge module, a personal electricity charge module and a reminder module, the personal water charge module can check the water use conditions and water charge information, the personal electricity charge module can check the electricity use conditions and electricity charge information, and the reminder module sends reminding information to the users in case of personal water charge or electricity charge arrears. According to the payment reminding system for the water and electricity charges provided by the invention, the users can master the own real-time water and electricity use conditions through the mobile phone client, and can be timely reminded in case of the water charge or electricity charge arrears; and thereby, the normal operation of hydropower stations can be ensured, the consumption of manpower resources can be reduced, and the timeliness degree and efficiency that the users pay the water and electricity charges can be improved.

Owner:TAICANG CHENGZE NETWORK TECH CO LTD

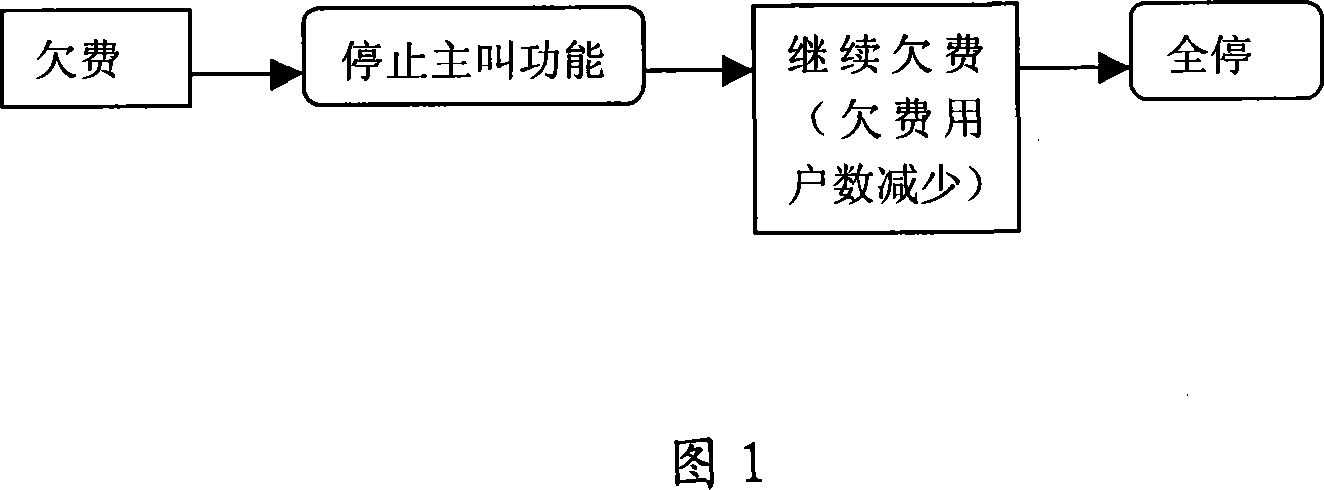

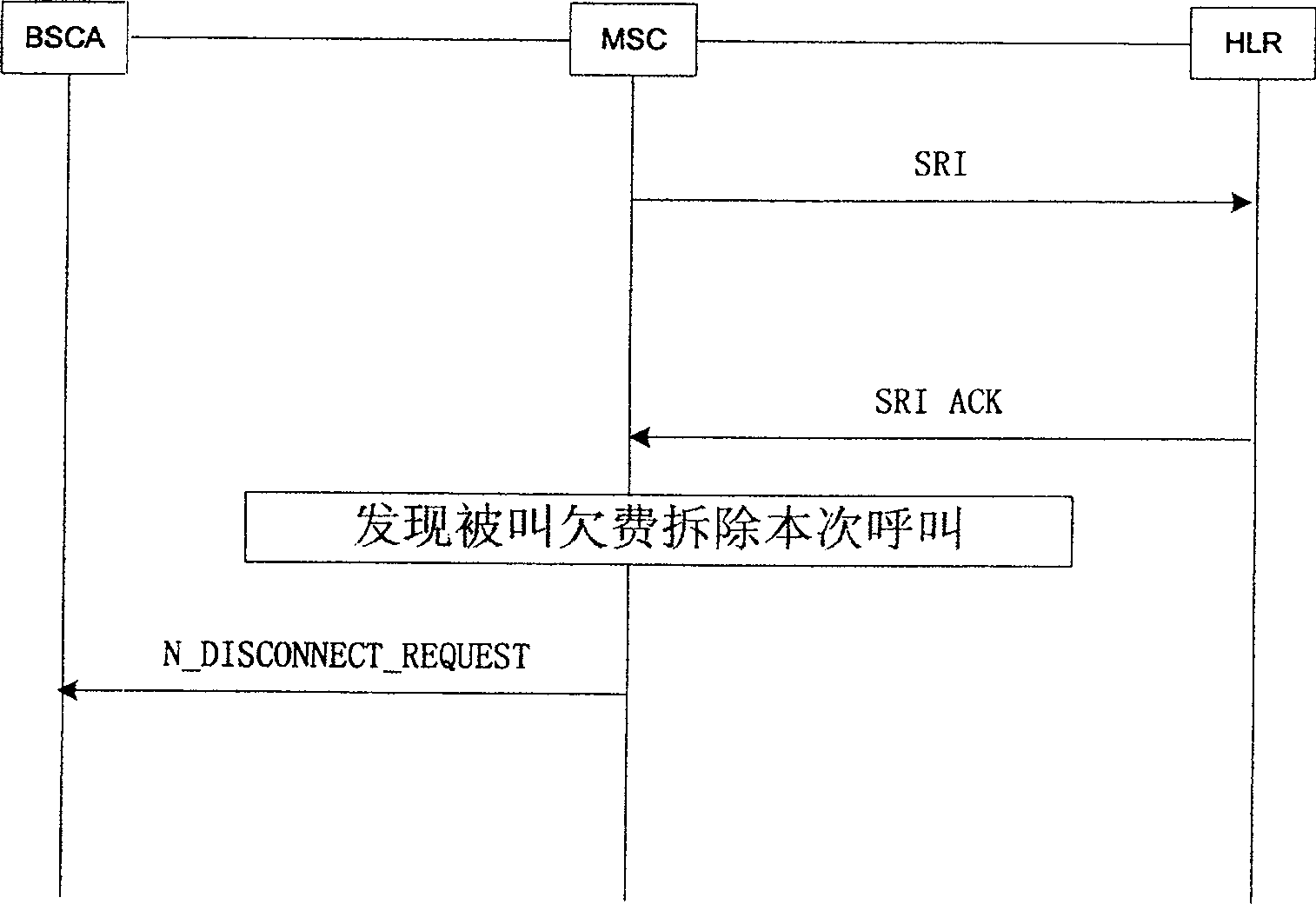

Service disabling method for default users of telecom companies

InactiveCN101079919AMultiple phone bill incomeDoes not significantly affect callsSupervisory/monitoring/testing arrangementsPrepayment telephone systemsComputer scienceArrears

This invention discloses a shutdown method for arrear users by telecommunication enterprises, which first of all applies a method of stopping the calling function to an arrear user, namely, the user can receive normal call-in phones, yet when the user dials out, it hears the system arrear recording message, after stopping the calling function for a period of time or the account balance of the user is lowered to a threshold, the system stops its session function completely. Since the called function of a user is not shutdown, the turn-on rate of exchange will not drop at the time when the calling function of a user is shutdown, and the user hears arrear prompt to pay the money and resume the calling function.

Owner:CHINA MOBILE GRP FUJIAN CO LTD

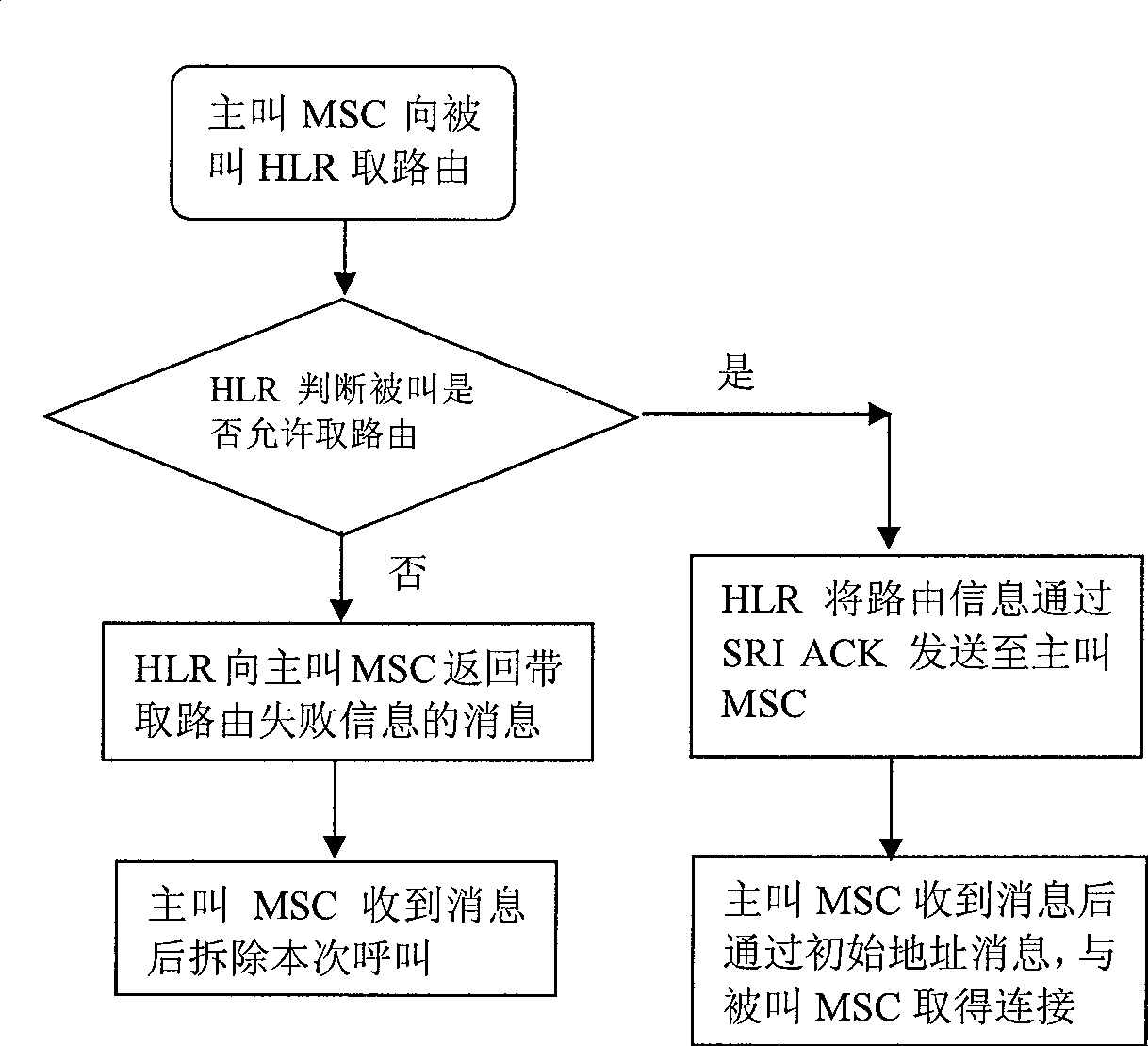

Mobile telecommunication system and method for accessing call in mobile telecommunication system

ActiveCN100493241CAvoid delayIncrease incomeAccounting/billing servicesAssess restrictionTelecommunicationsMobile communication systems

Owner:HUAWEI TECH CO LTD

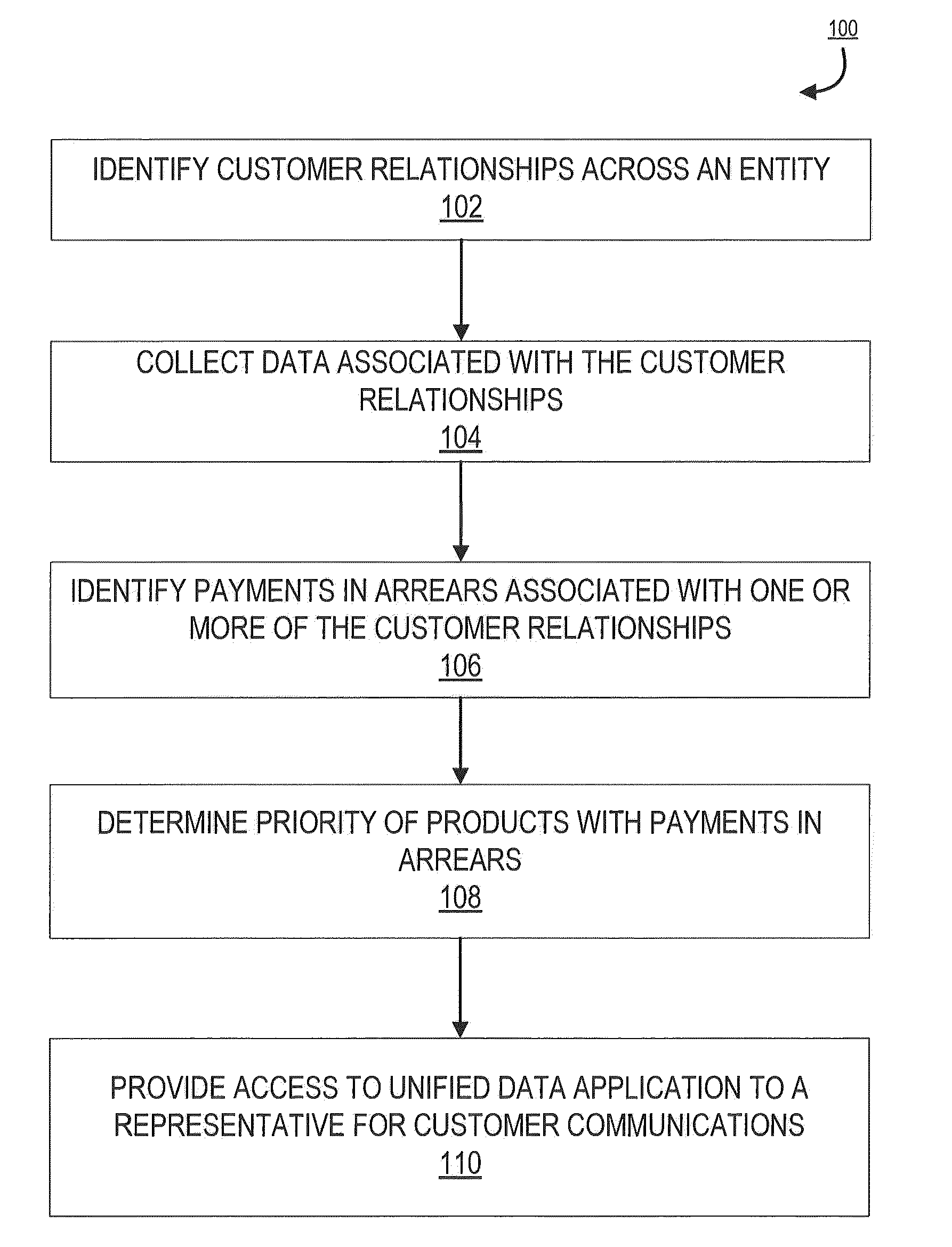

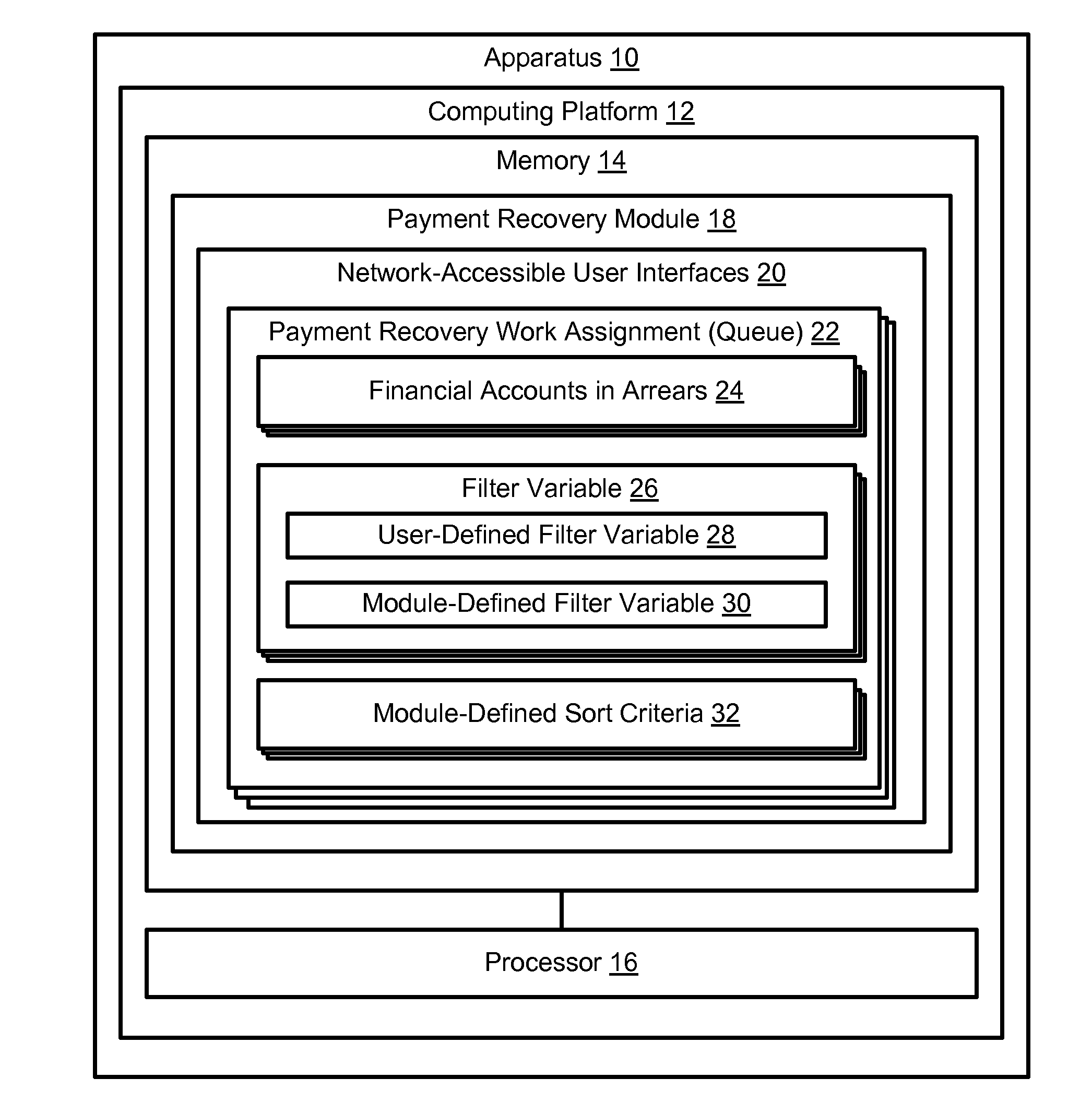

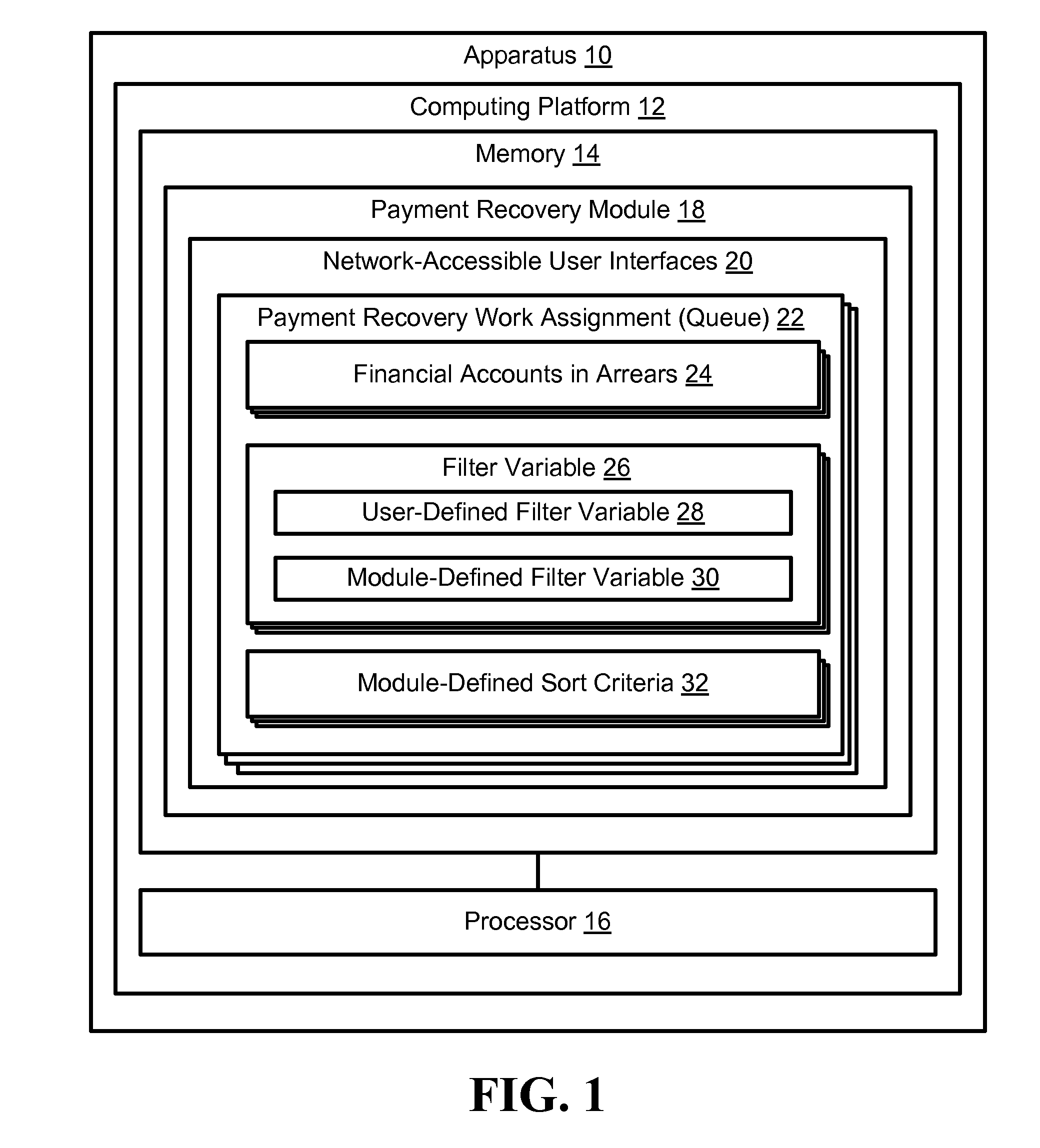

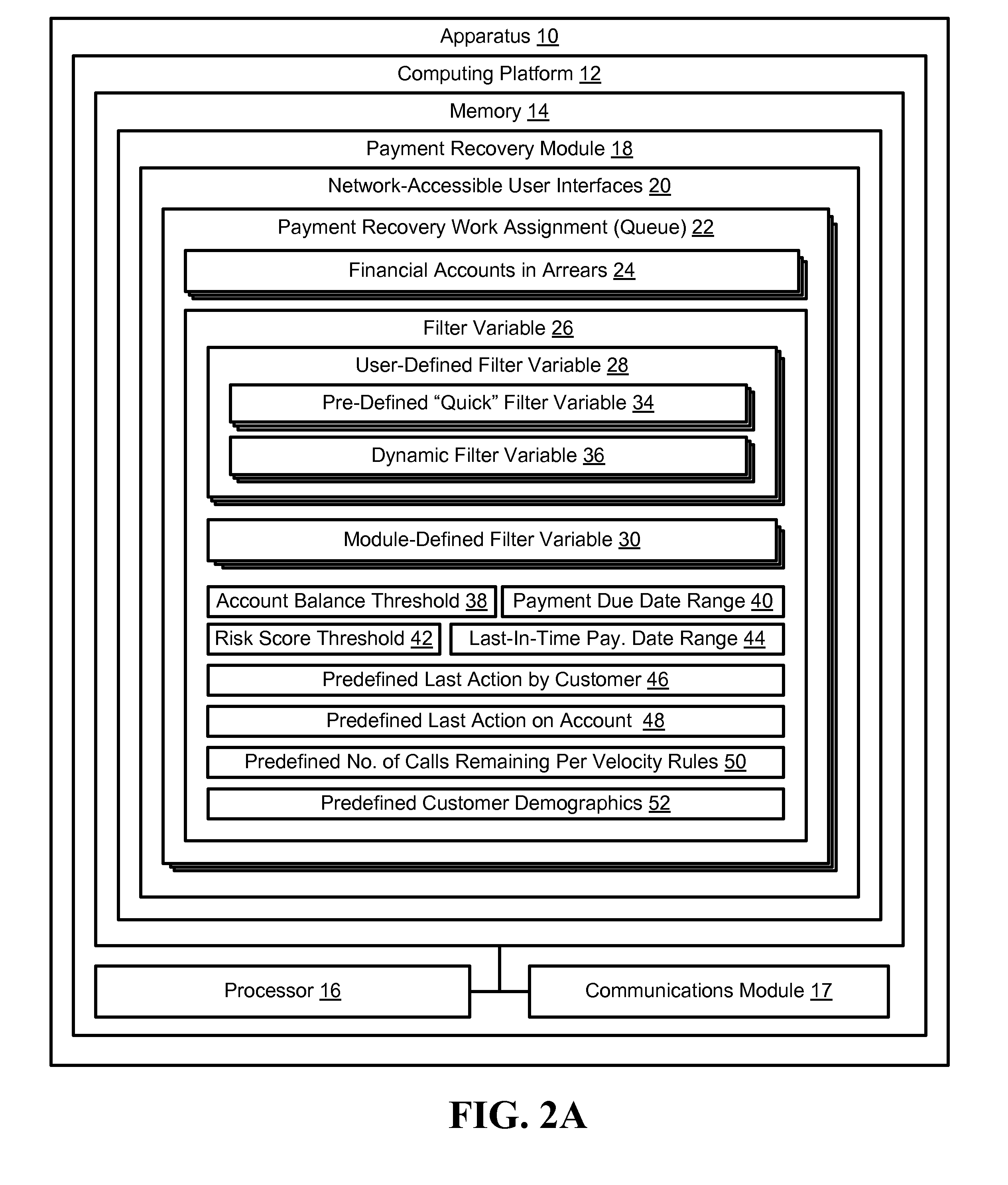

User interface for managing payment recovery queues used in the recovery of payment from financial accounts in arrears

InactiveUS20150127398A1Efficient executionImprove assessmentFinanceResourcesHuman–computer interactionUser interface

Apparatus, methods, and computer program products are described which detail comprehensive user interfaces that provides representatives / associates, managing payment recovery work assignment queues, views of all accessible information pertaining to the customer and the accounts held or associated with the customer. The user interface further provides for the representative to filter and / or the accounts in arrears displayed in the queues within the user interfaces, so as to meet the dynamic needs of the representative as he or she manages the work assignment queues or communicates with the customer. In additional embodiments, the representative is provided the ability to save commonly utilized filters or combinations of filters for subsequent efficient management of the work assignment queues.

Owner:BANK OF AMERICA CORP

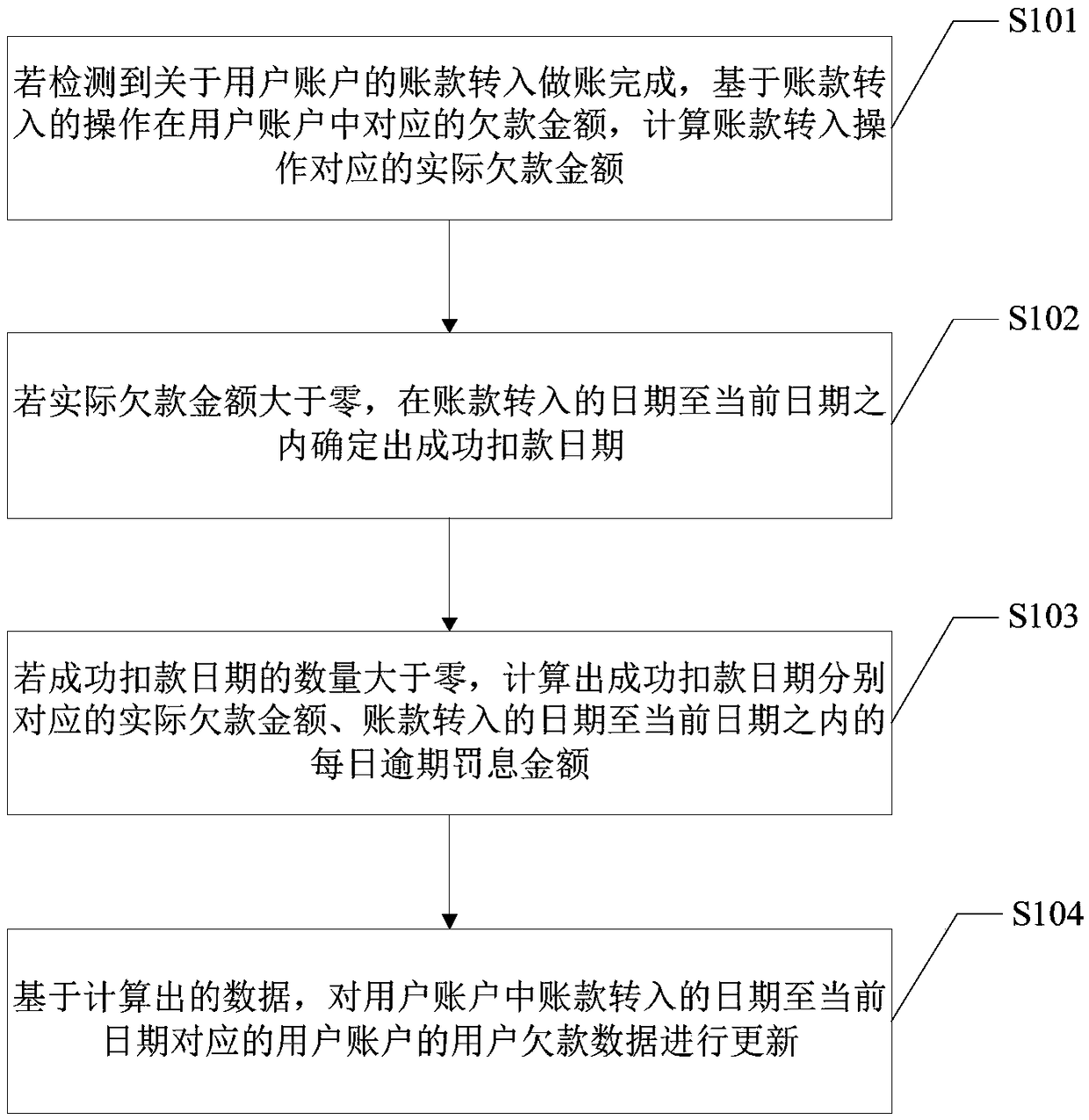

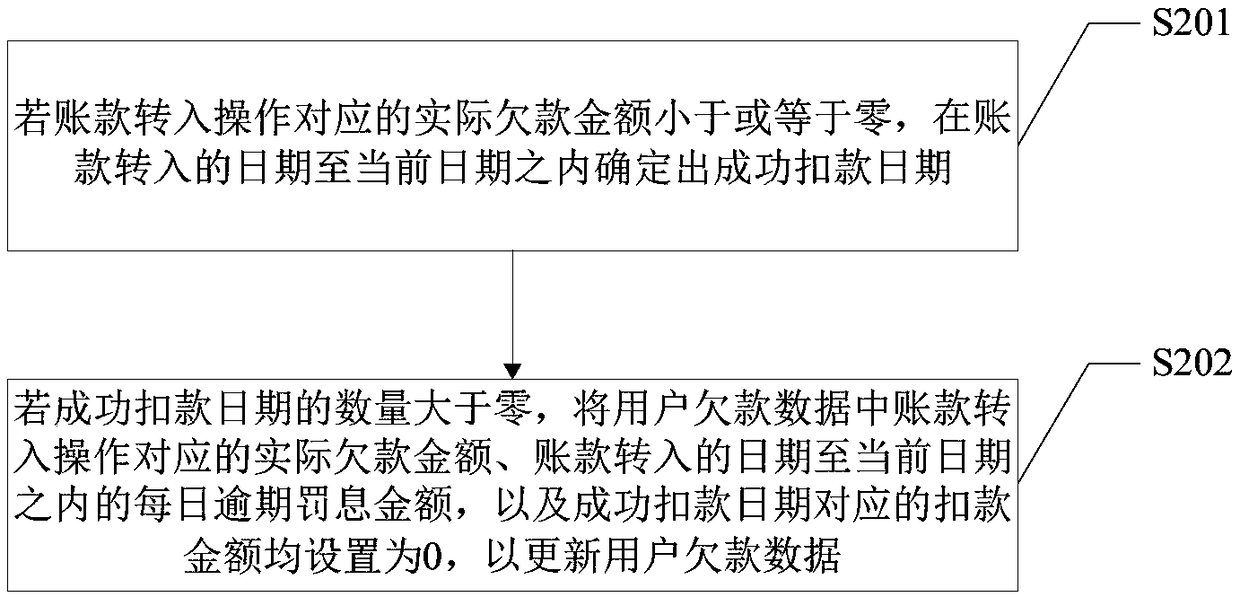

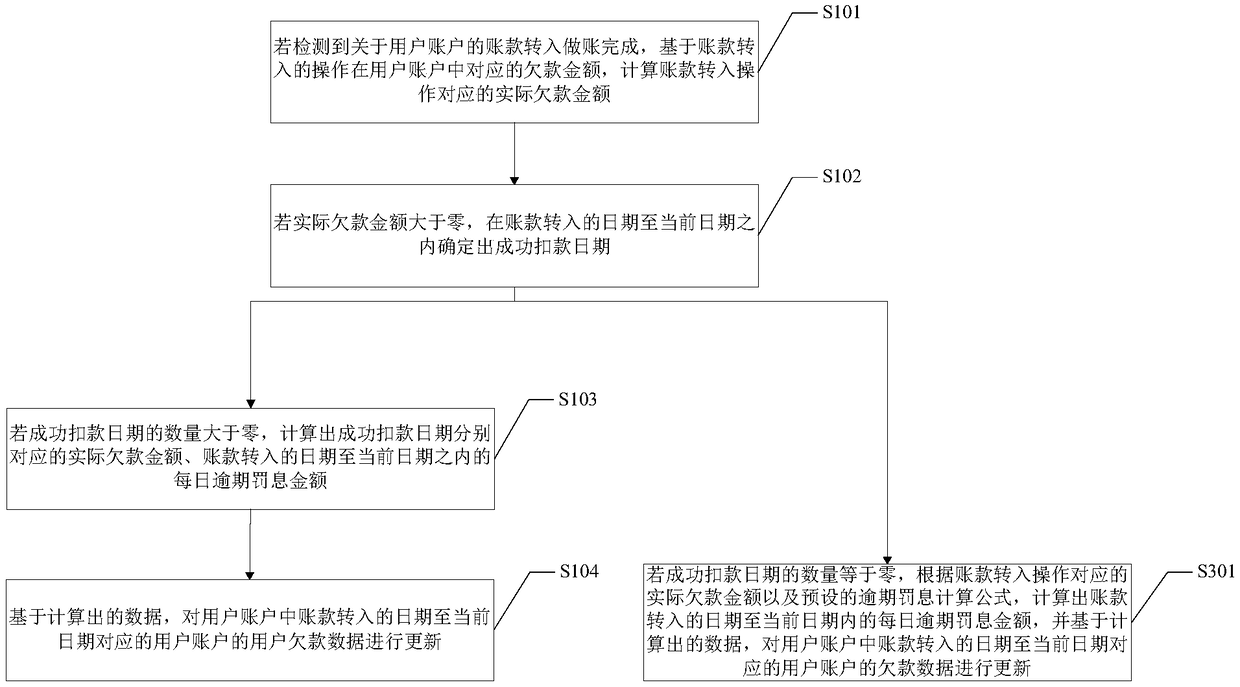

Debt data processing method based on user data resources and terminal device

PendingCN109325728AAccurate and efficient calculationAvoid economic lossFinancePayment architectureTerminal equipmentData mining

The invention provides a debt data processing method based on user data resources and a terminal device, which are applicable to the technical field of data resource processing. The method comprises the following steps of: if it is detected that the account transfer-in of the user account is completed, calculating the actual amount of arrears corresponding to the account transfer-in operation based on the principal amount of arrears corresponding to the account transfer-in operation in the user account; if the actual amount owed is greater than zero, determining the date of successful deduction within the period from the date of account transfer to the current date; if the quantity of the successful deduction date is greater than zero, calculating the actual arrears amount corresponding tothe successful deduction date and the daily overdue penalty interest amount from the account transfer-in date to the current date; based on the calculated data, updating the user arrears data of theuser account corresponding to the account transfer date in the user account to the current date. The embodiment of the invention can timely and accurately update the user arrears data, ensure the accuracy and effectiveness of the user arrears data, and avoid the economic loss of the user.

Owner:PINGAN PUHUI ENTERPRISE MANAGEMENT CO LTD

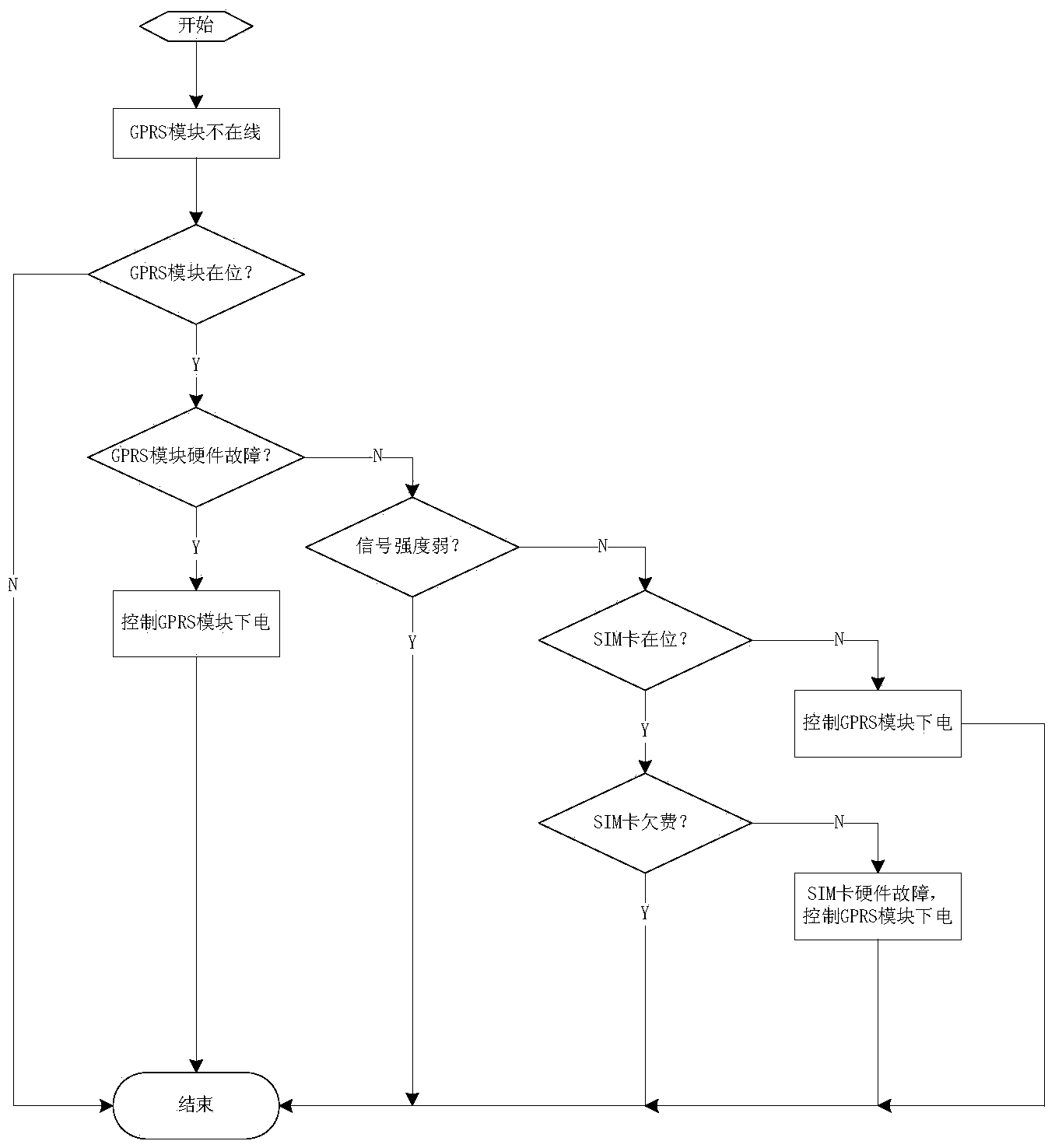

Maintenance method for dealing with GPRS/CDMA module unable to access Internet

InactiveCN103870370ALow costDetecting faulty computer hardwareSubstation equipmentElectricityComputer module

The invention discloses a maintenance method for dealing with a GPRS / CDMA module unable to access the Internet. The method includes the first step of judging whether the GPRS / CDMA module is in place, the second step of judging whether the GPRS / CDMA module has hardware faults if the GPRS / CDMA module is in place, the third step of controlling the GPRS / CDMA module to be powered off if the hardware faults exist, and judging the signal intensity of the GPRS / CDMA module if the hardware faults do not exist, the fourth step of judging whether an SIM card is in place if the signal intensity is higher than a set value, the fifth step of controlling the GPRS / CDMA module to be powered off if the SIM card is not in place, and judging whether the SIM card is in an arrear state if the SIM card is in place, and the sixth step of stopping the process if the SIM card is in the arrear state, and judging that the SIM card has the hardware faults if the SIM card is not in the arrear state, controlling the GPRS / CDMA module to be powered off and stopping the process. According to the method, the reasons that the GPRS / CDMA module can not access the Internet can be judged, different processing can be carried out according to different reasons, the GPRS / CDMA module does not need to be powered on and powered off repeatedly, the manual and device cost caused by impact on a GPRS / CDMA module power chip and a communication module due to repeated power-on and power-off can be saved, and the problem that the GPRS / CDMA module can not access the Internet is solved.

Owner:合肥瑞纳智能能源管理有限公司

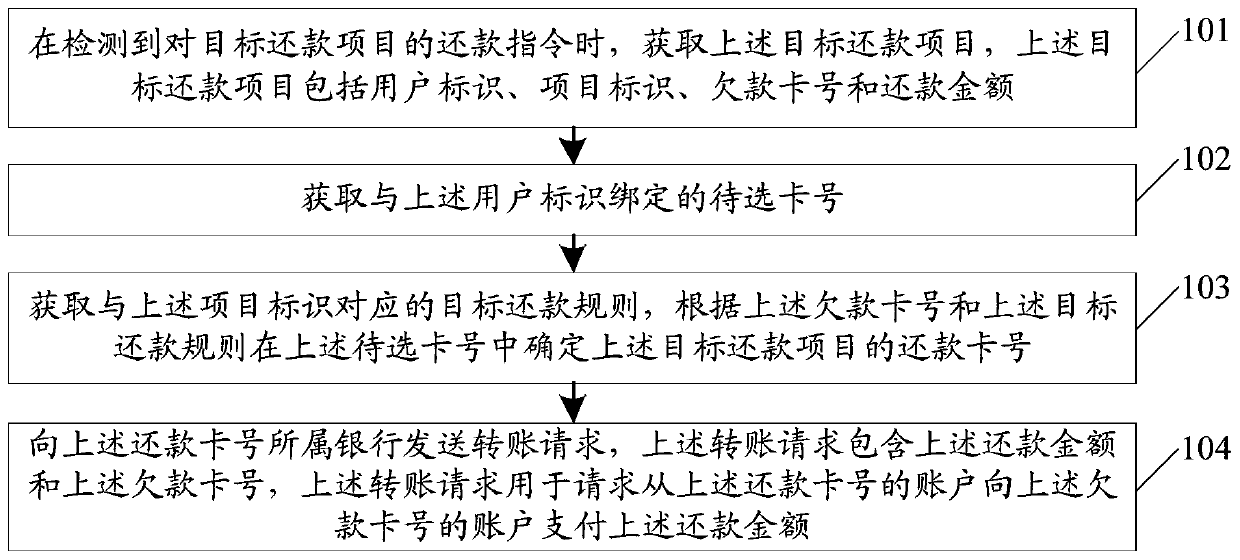

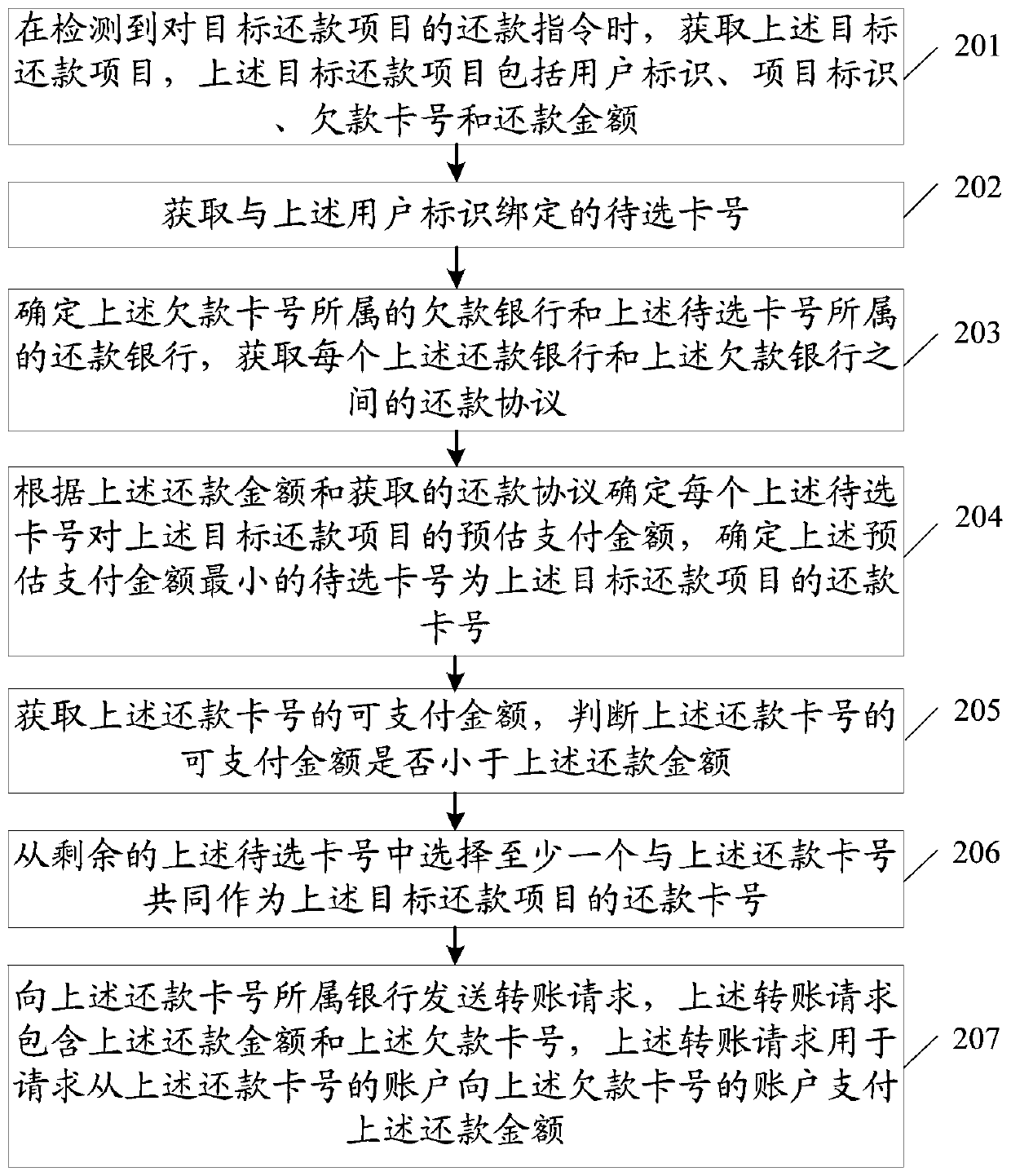

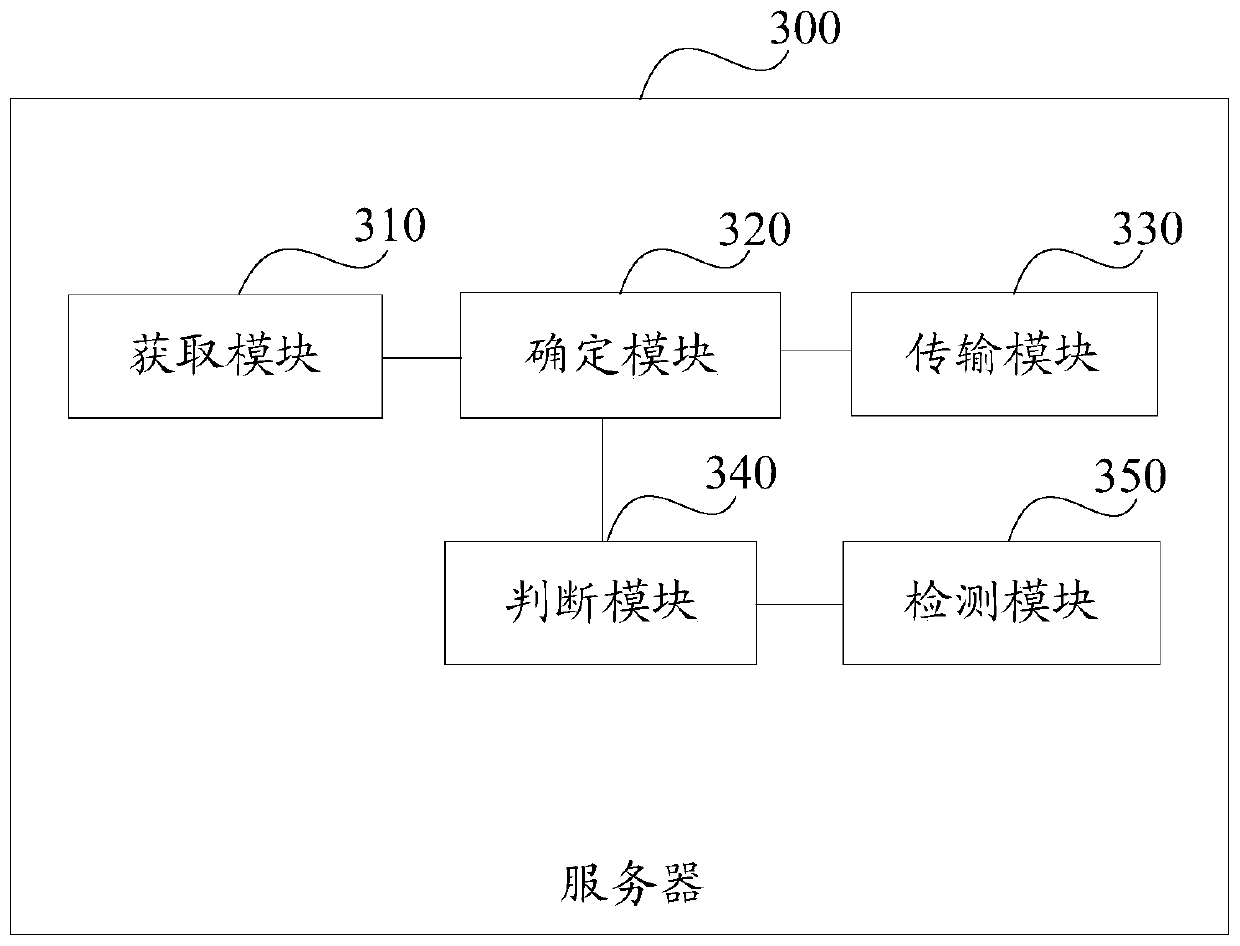

Transaction processing method, terminal equipment and computer storage medium

Owner:PING AN TECH (SHENZHEN) CO LTD

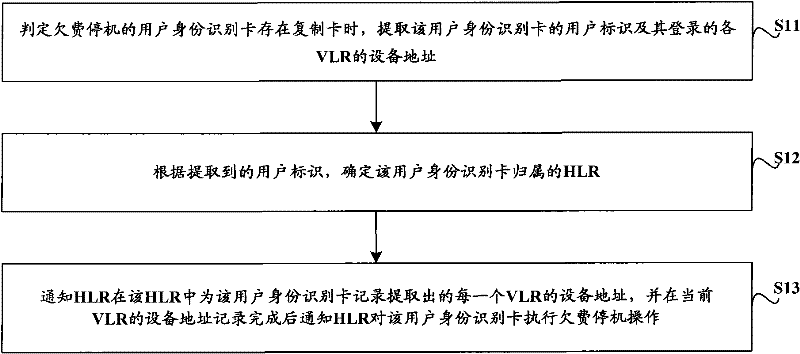

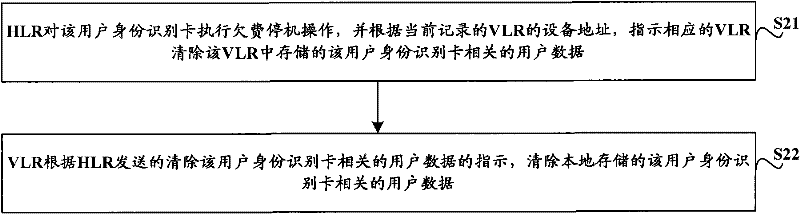

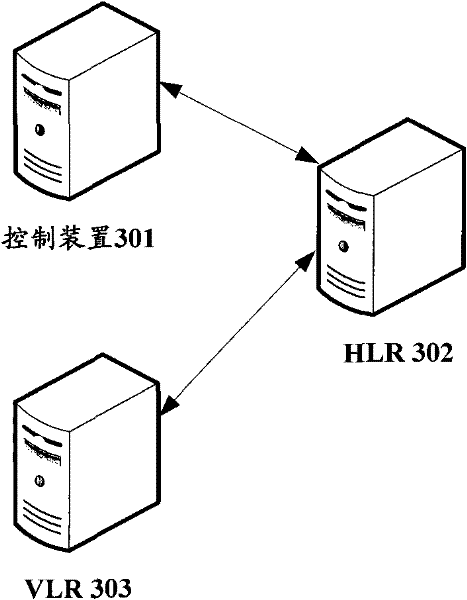

A control method, device and system for a user identification card

InactiveCN102264053AResist the problem of high arrearsImprove efficiencyAccounting/billing servicesNetwork data managementComputer hardwareHigh resistance

The invention discloses a user identification card control method, device and system, which are used to resist the problem of high arrears caused by illegal copying of the user identification card. The control method of the user identification card includes: when determining that there is a duplicating card in the user identification card of the arrears shutdown, extracting the user identification of the user identification card and the equipment addresses of each VLR logged in; , determine the HLR to which the user identification card belongs; notify the HLR to record the equipment address of each VLR for the user identification card in the HLR, and notify the HLR to record the equipment address of the current VLR after the completion of the equipment address recording. The user identification card executes the arrears shutdown operation.

Owner:XINYANG BRANCH HENAN CO LTD OF CHINA MOBILE COMM CORP

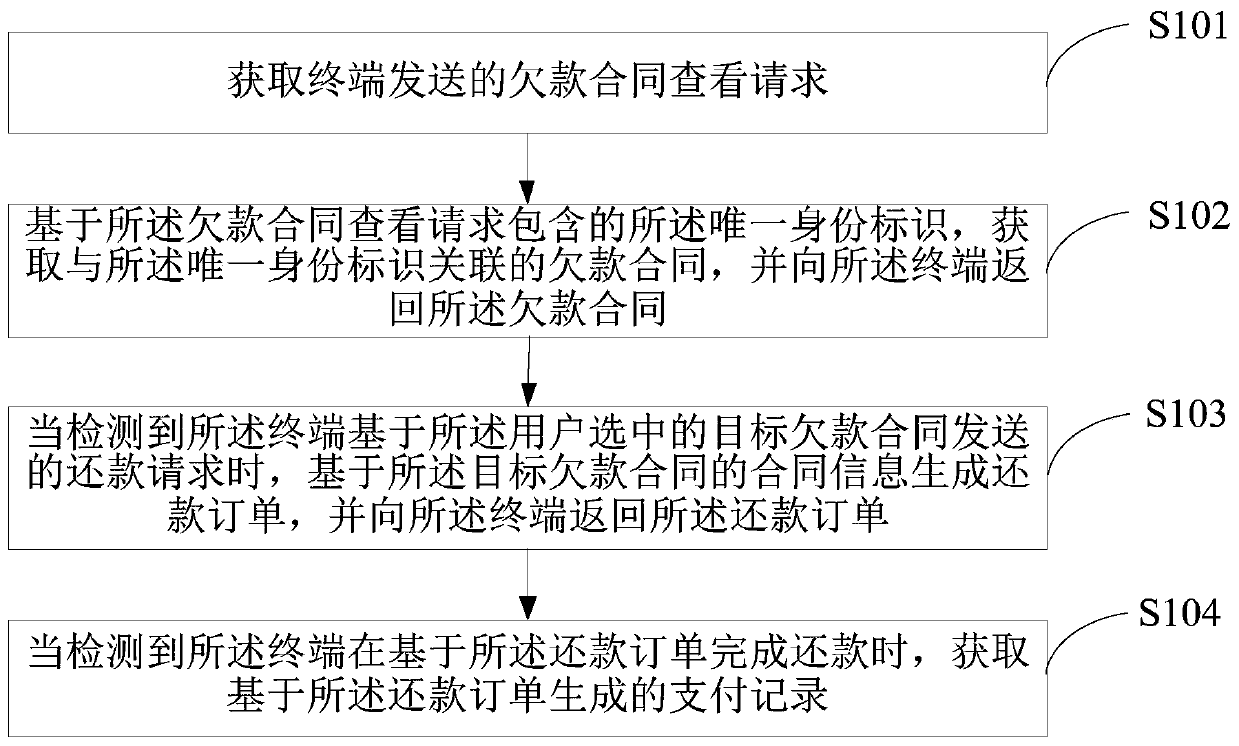

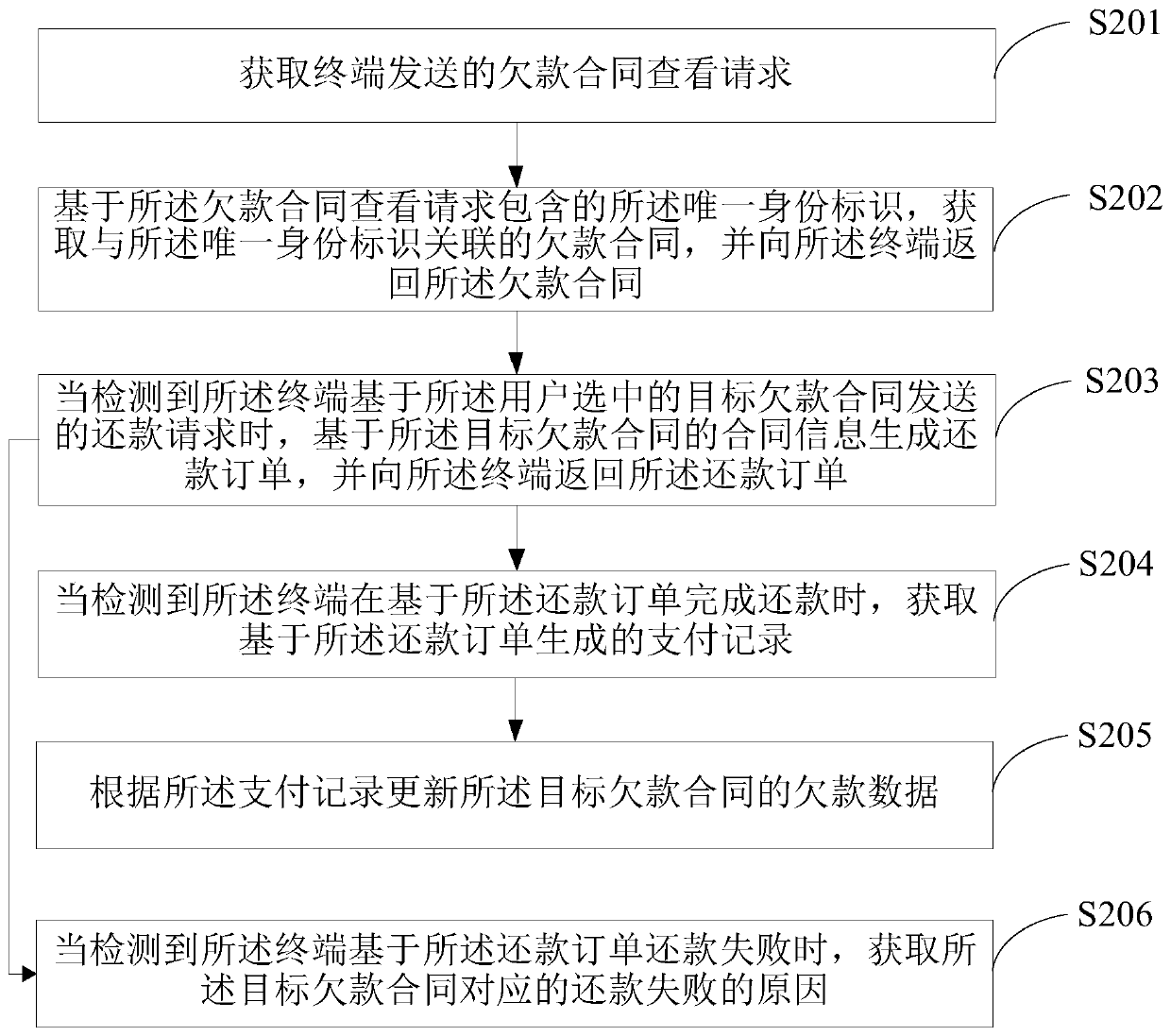

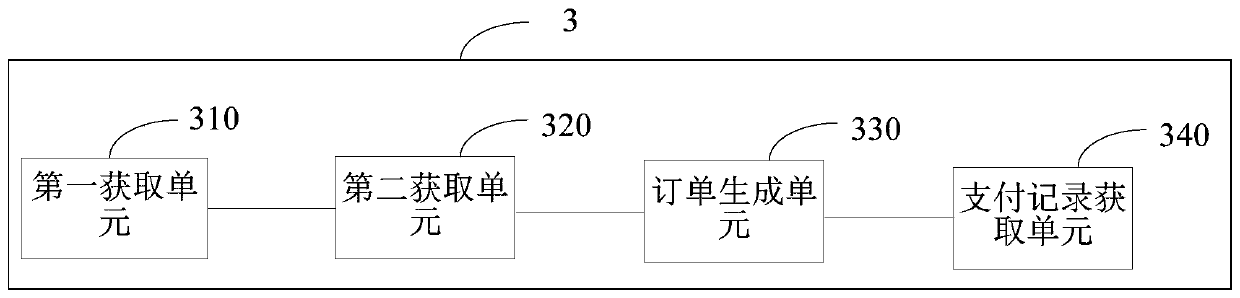

A repayment method and a repayment management device

InactiveCN109840757AEnsure safetyReduce repayment stepsPayment circuitsPayments involving neutral partyPresent methodOperating system

The invention is applicable to the technical field of computers, and provides a repayment method and repayment management equipment, and the repayment method comprises the steps: obtaining a debt contract checking request sent by a terminal; Based on the unique identity identifier contained in the debt contract viewing request, obtaining a debt contract associated with the unique identity identifier, and returning the debt contract to the terminal; When a repayment request sent by the terminal based on the target debt contract selected by the user is detected, generating a repayment order based on contract information of the target debt contract, and returning the repayment order to the terminal; And when it is detected that the terminal completes repayment based on the repayment order, obtaining a payment record generated based on the repayment order. According to the scheme, the user can select the repayment contract for repayment through the official account, the safety of repaymentfunds can be ensured, the repayment operation steps are reduced, and the repayment efficiency can be improved.

Owner:SHENZHEN BILLIONS FINANCE CO LTD

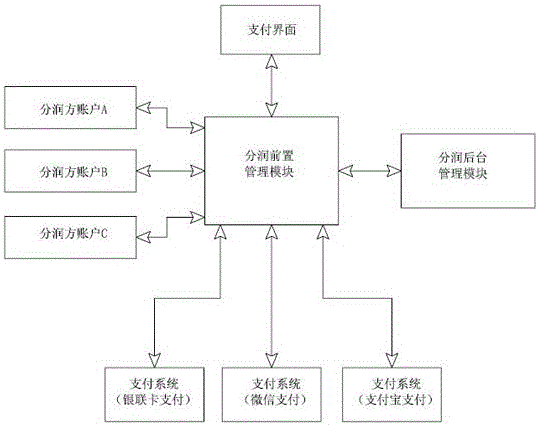

Instant profit sharing method based on various payments

InactiveCN106022750AOvercome mutual arrearsAvoid economic disputesBuying/selling/leasing transactionsProtocol authorisationComputer sciencePayment system

The invention discloses an instant profit sharing method based on various payments. Problems such as arrears or economic disputes of various parties and troubles and errors of fund accounting are solved. The instant profit sharing method comprises the steps that 1, a total charging bill including an encrypted payment way, a transaction sum, a profit sharing account list, a profit sharing proportion, or profit sharing sum information is generated, and the payment way is determined by a payment party; 2, after the total charging bill is added to payment system information, the total charging bill and the payment system information are transmitted to the payment party to determine a payment system, and the payment system is used to generate a payment system total bill corresponding to the total charging bill, and after a record is checked and determined, a payment determining request is generated, and then the payment of the total bill is completed, and the payment system is used to complete the total payment; 3, the payment system is used to pay shared profits respectively to the profit sharing accounts according to the profit sharing account list; 4, a total clearing table of payment of an order is generated and stored. The instant profit sharing method is advantageous in that the payment of the profits is completed, and at the same time, the profits are shared automatically according to agreements.

Owner:SHENZHEN TAOTAOGU INFORMATION TECH

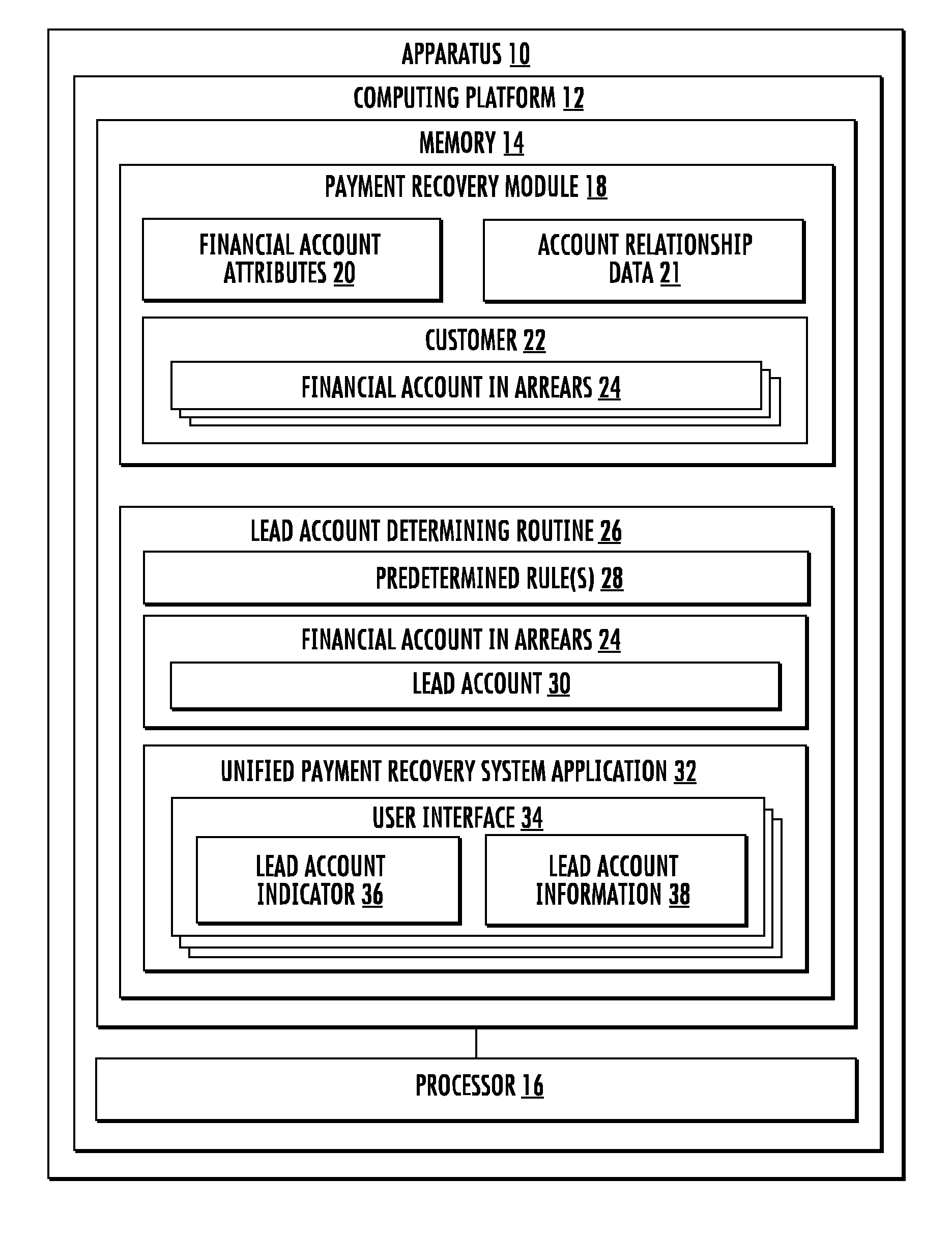

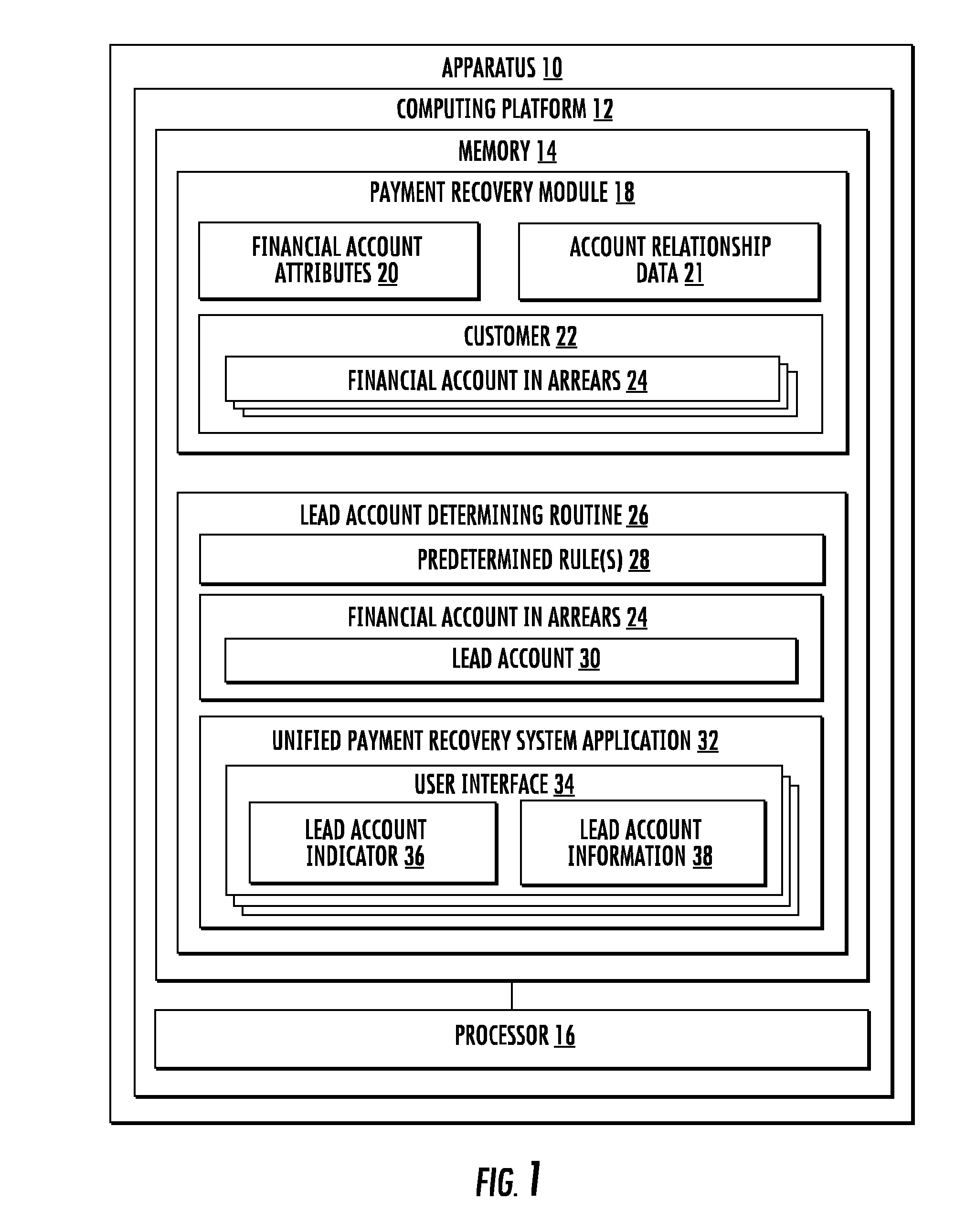

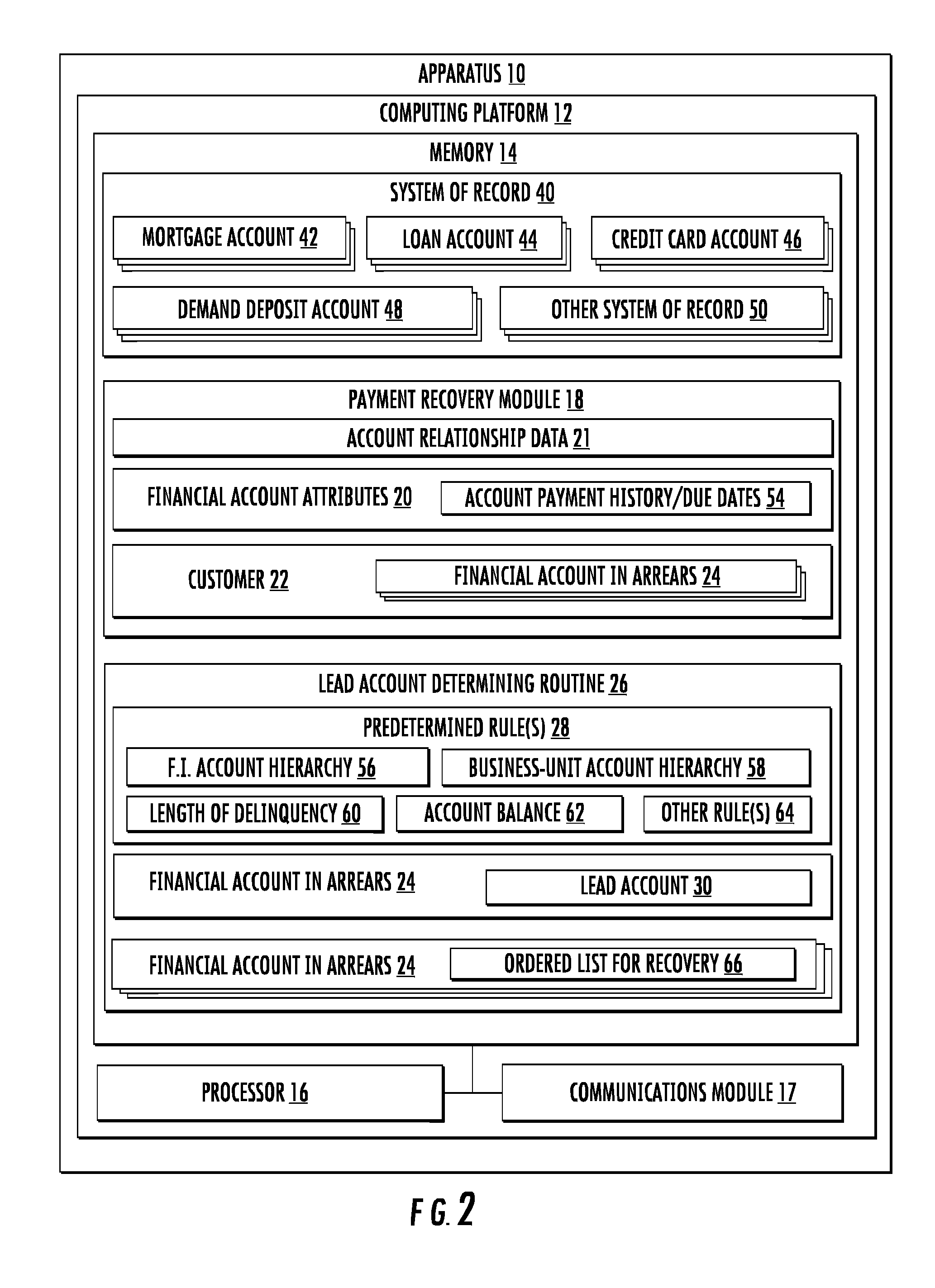

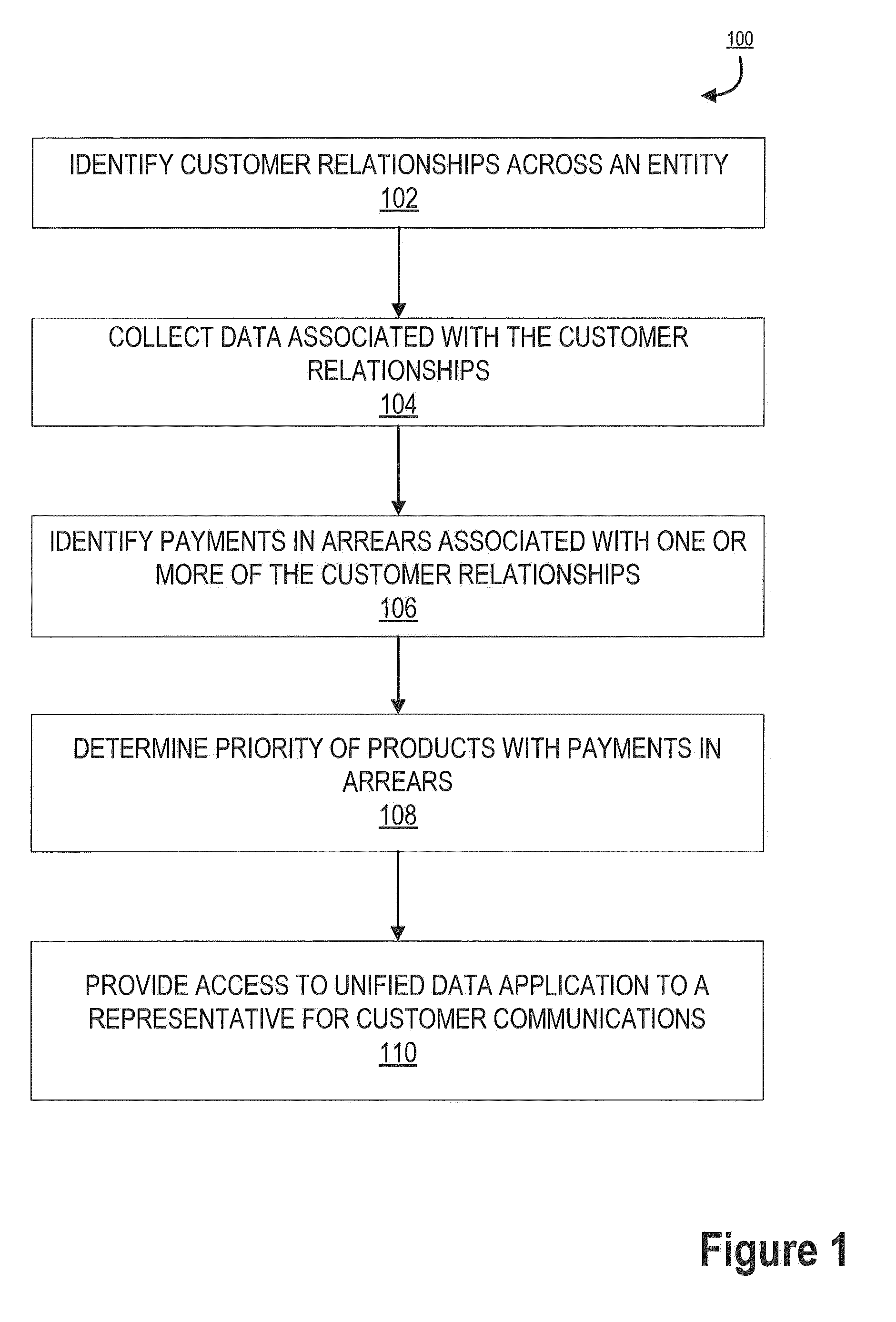

Determining financial account payment hierarchy for recovery of payment in arrears

InactiveUS20150127500A1Easy to identifyComplete banking machinesFinanceApplication softwareComputer science

Embodiments of the invention are directed to apparatus, methods, and computer program products for determining a lead account from amongst one or more financial accounts associated with a customer that are currently in arrears. Once the lead account has been determined a lead account indicator is provided within user interfaces of a unified account payment recovery system application in conjunction with information pertaining to the account. In this regard the representative using the application as a tool to assist in contacting, or being contacted by, customers can readily identify which of the accounts in arrears associated with the customer should be the initial account which the representative attempts to recover payment from.

Owner:BANK OF AMERICA CORP

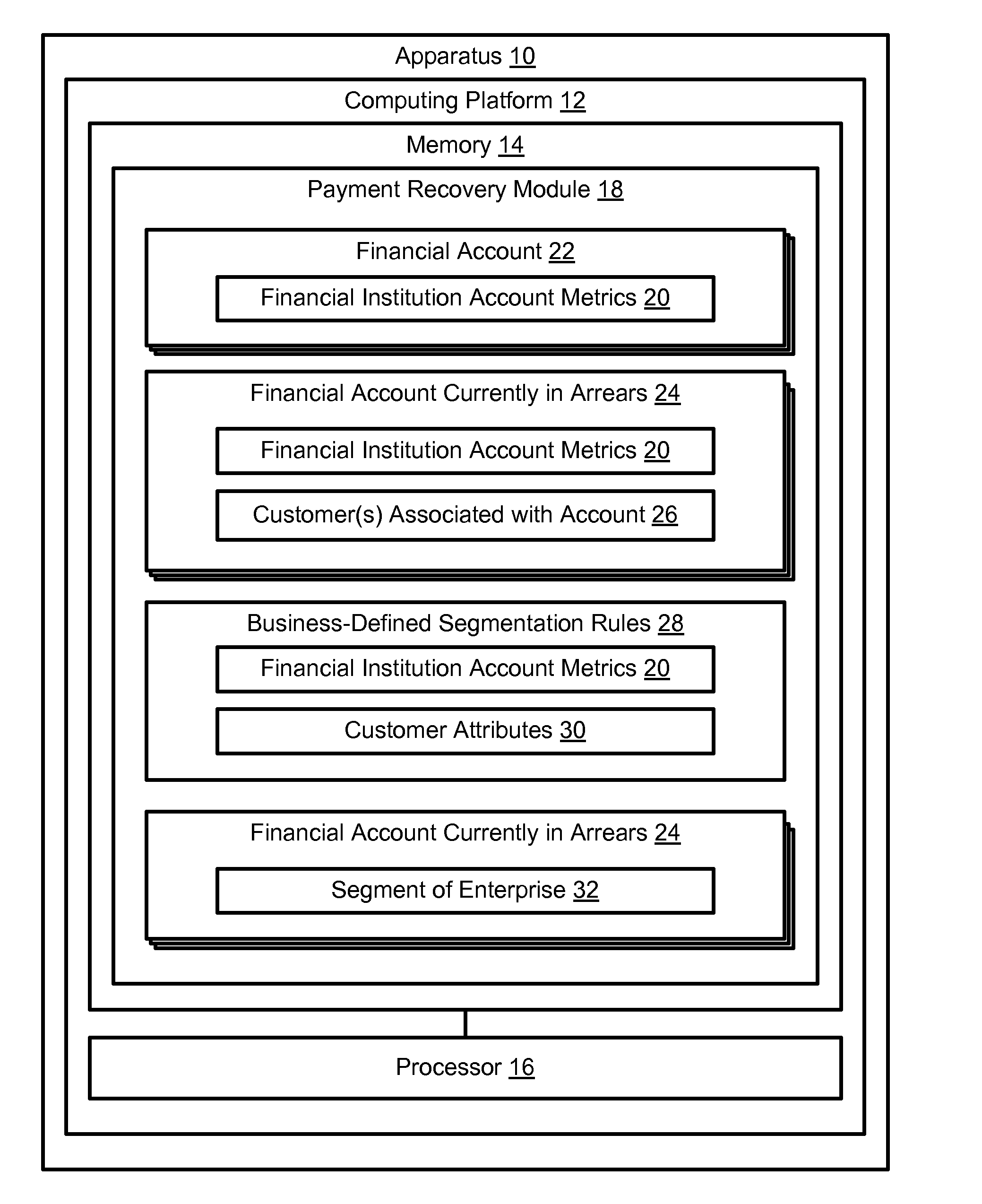

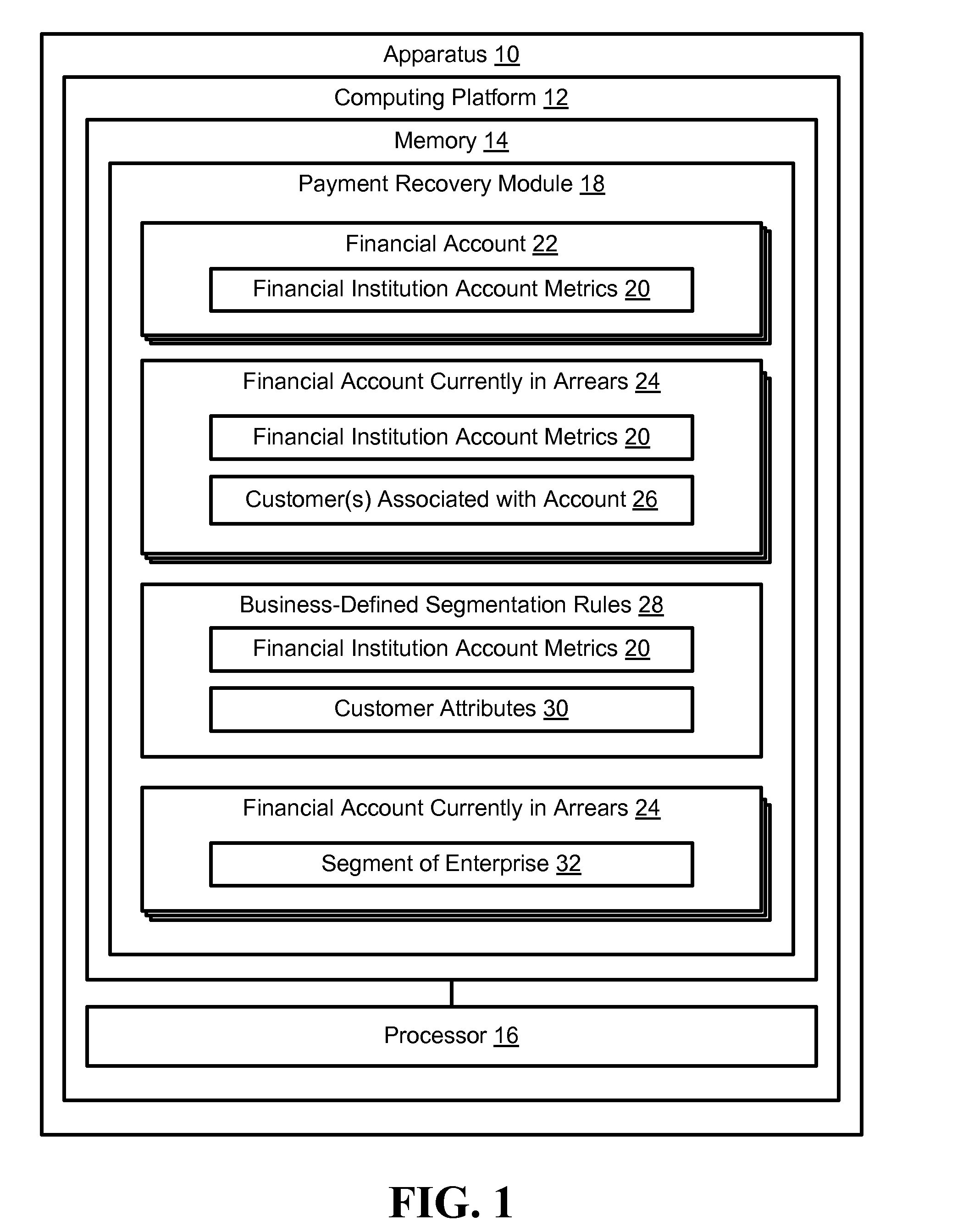

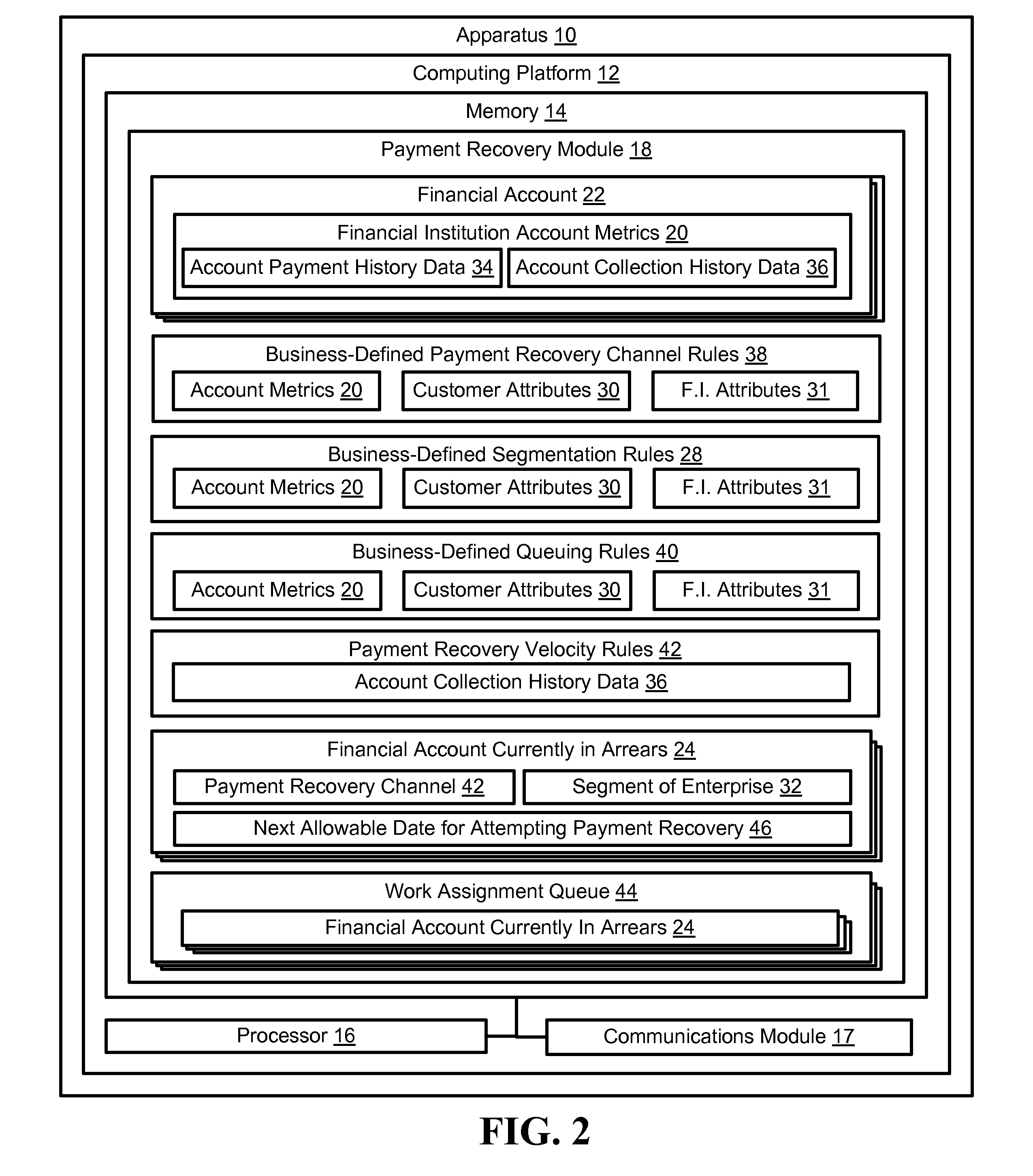

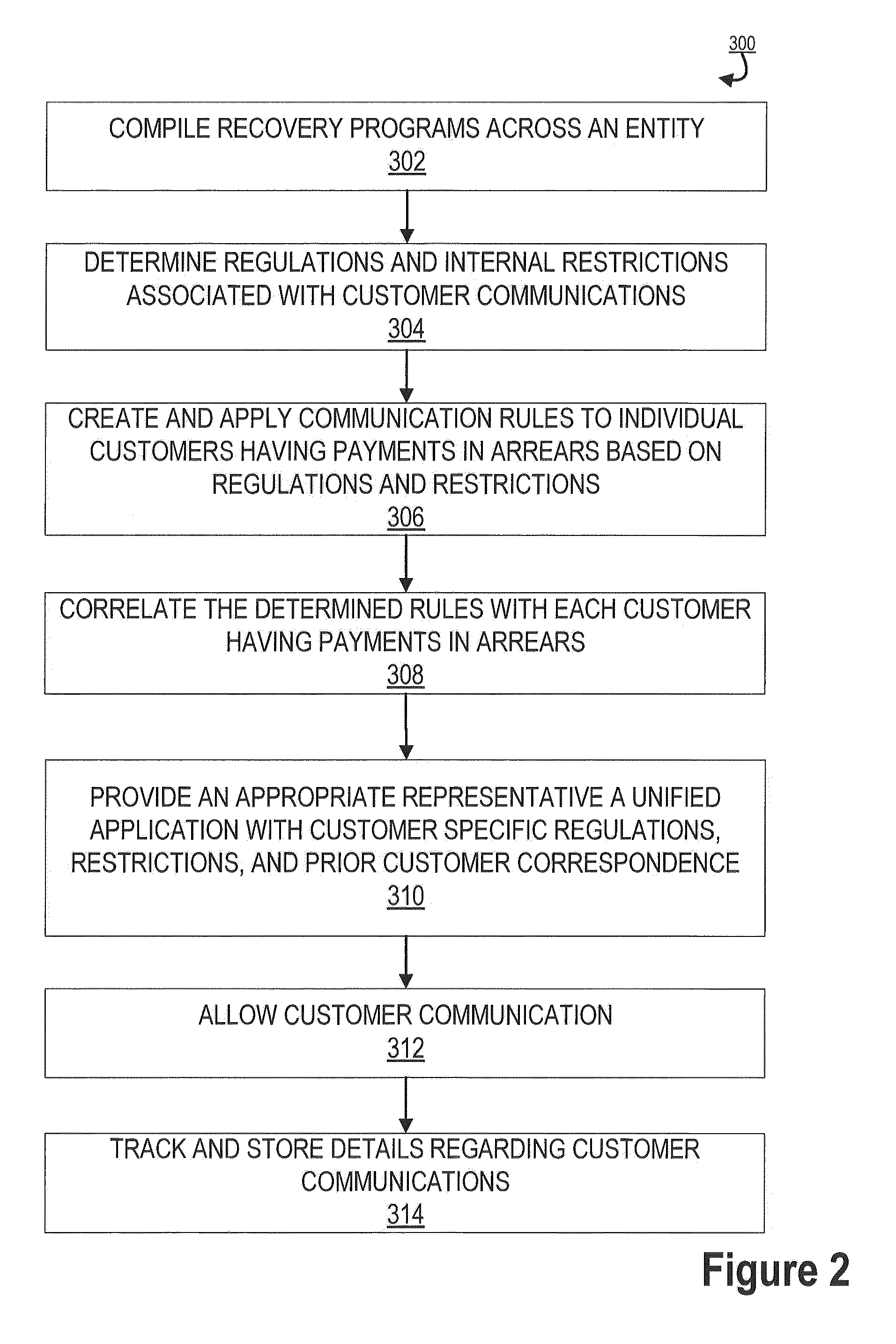

Determining segmentation and queues for recovery of payment from financial accounts in arrears

Embodiments of the invention are directed to apparatus, methods, and computer program products for determining which segment of the enterprise financial institution to assign to payment recovery for accounts in arrears. The segment determination process applies financial institution account metrics and customer attributes to the requisite business rules to determine which segment to assign for financial account payment recovery so as to maximize profitability. In additional embodiments, work assignment queues and / or payment recovery communication channels may be determined for the accounts in arrears based on applying customer attributes and / or financial account metrics to business rules. In still further embodiments of the invention, a next-allowable-date for contacting the customer regarding an account in arrears is determined based on applying collection history data to payment recovery velocity rules which define the criteria for contacting a customer and the frequency at which a customer can be contacted.

Owner:BANK OF AMERICA CORP

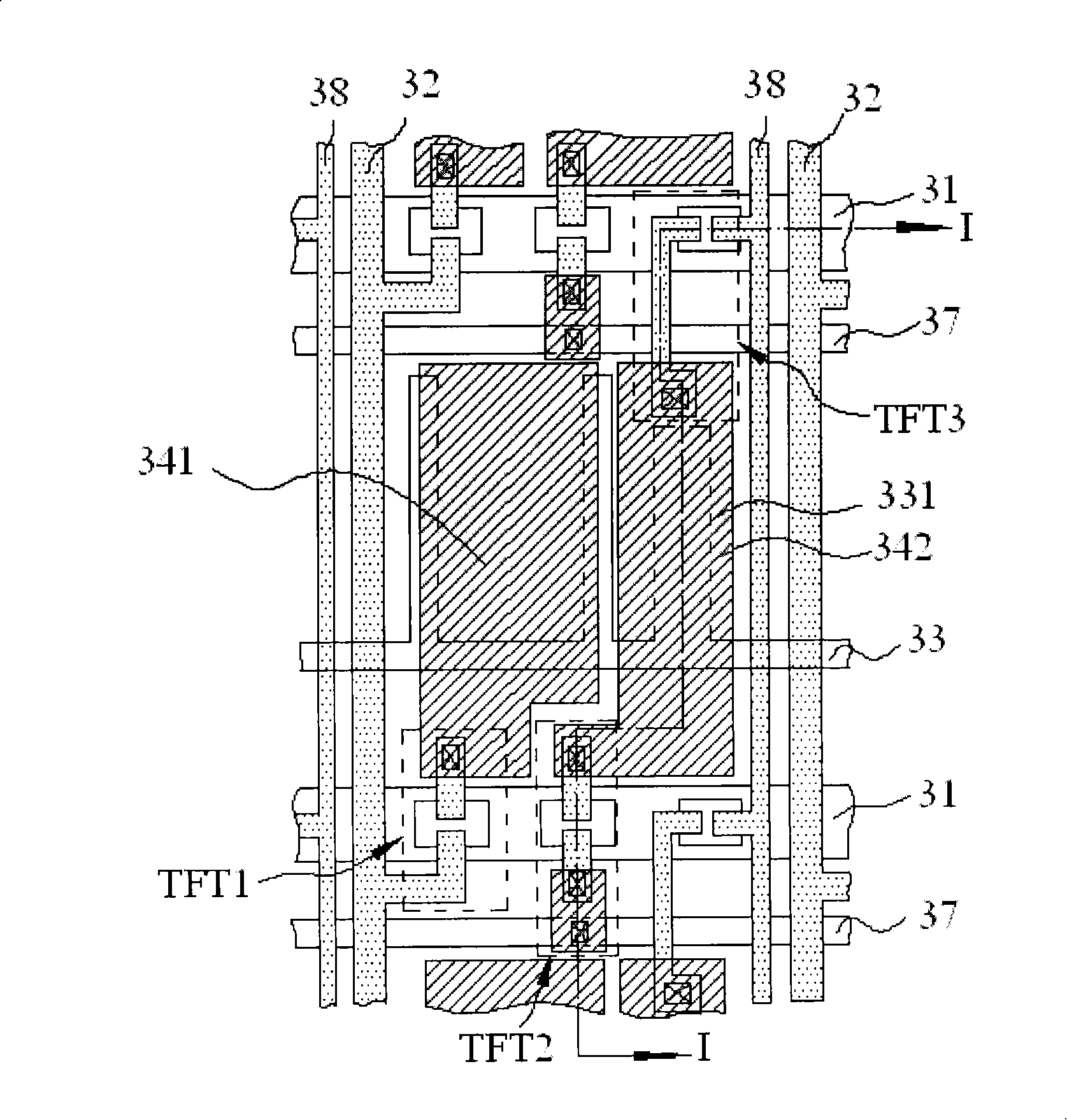

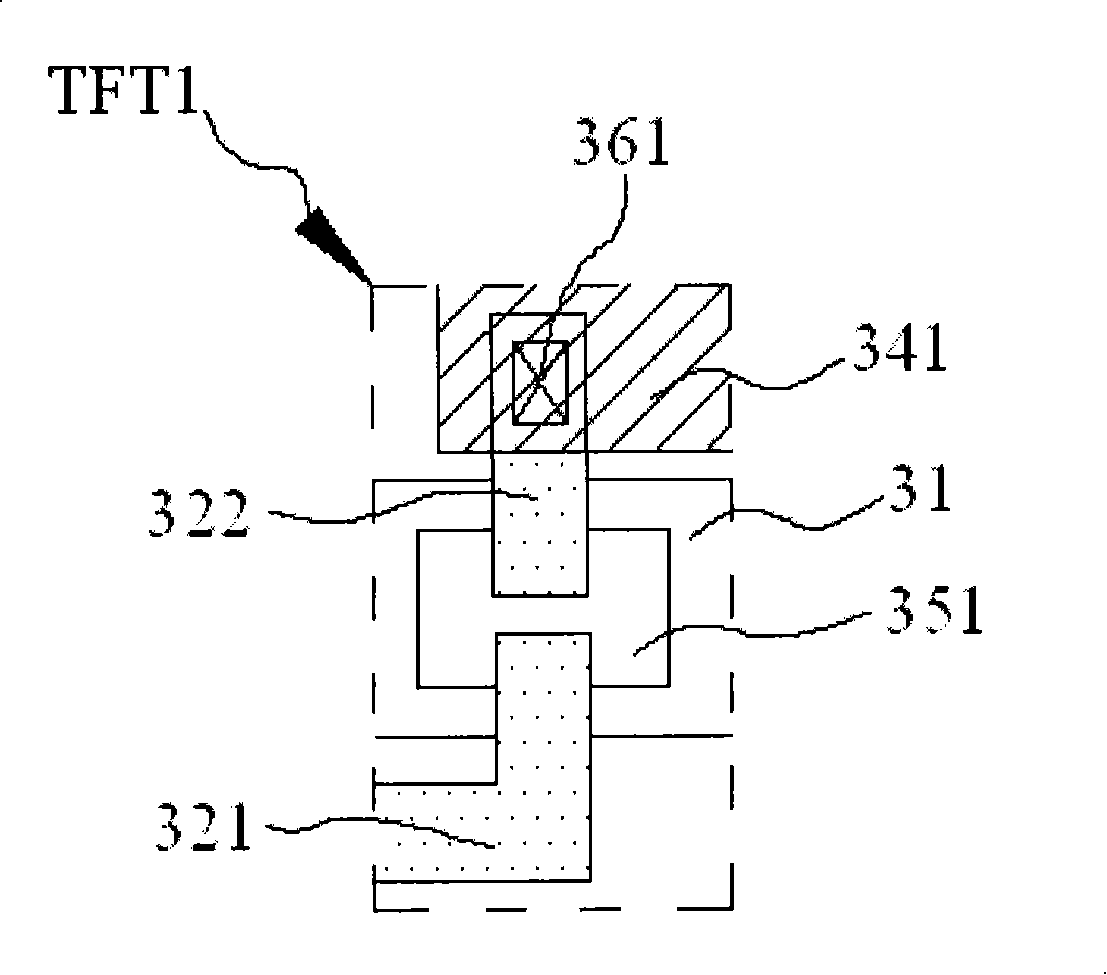

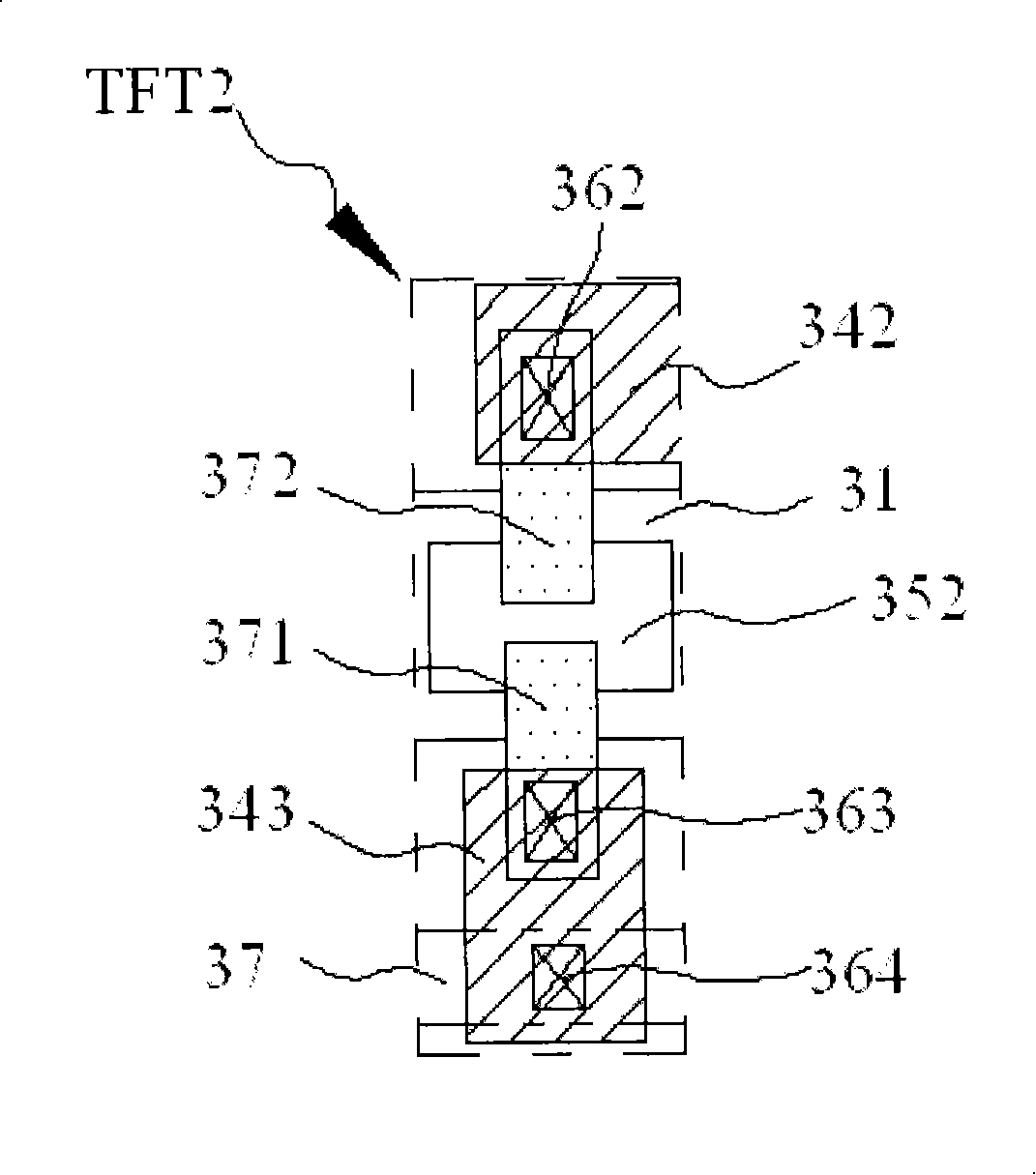

Touch control type liquid crystal display array substrates and LCD device

ActiveCN101320185BReduce weightReduce thicknessStatic indicating devicesNon-linear opticsCapacitanceLiquid-crystal display

The present invention relates to a touch control type liquid crystal display array base panel which comprises a plurality of scanning beams, a plurality of data wires, pixel electrodes, stored capacitor electrodes and a first switch element; wherein, the data wires are perpendicular to the scanning beams, and are crossed and arranged for limiting pixel areas; the pixel electrodes are formed in the pixel areas; the stored capacitor electrodes and the pixel electrodes form a first stored capacitor; the data wires convey data signals to the pixel electrodes through the first switch element; the array base panel also comprises signal checking wires, touch control electrodes formed in the pixel arrears, a second switch element and a converter; the touch control electrodes and the storing capacitor electrodes form a second stored capacitor; the signal checking wires input or output voltage signals to the touch control electrodes through the signal checking wires; the converter is used for controlling the input or the output of the voltage signals on the signal checking wires. Therefore, the touch control type liquid crystal device of the present invention has the advantages of light weight, small thickness, low cost and high display brightness.

Owner:KUSN INFOVISION OPTOELECTRONICS

Determining appropriate course for representative working to recover payment in arrears

Embodiments of the invention are directed to a system, method, or computer program product for determining an appropriate course of action for a representative working to recover payment in arrears. Embodiments may determine at least one customer preference regarding limitation of representative-customer interactions; and, based on the at least one customer preference, present assistance information to the representative before or during the representative-customer interaction, the assistance information configured to at least one of inform the representative of the at least one customer preference, present the representative with at least one proposed question for presentation to the customer, or present the representative with at least one proposed method for representative-customer interaction.

Owner:BANK OF AMERICA CORP

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com