Rong eTong international logistics settlement platform supply chain financial financing service system

A service system and supply chain technology, applied in the field of international logistics, can solve problems such as high financing threshold, inability to detect and deal with expected risks in time, and high bad debt rate.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

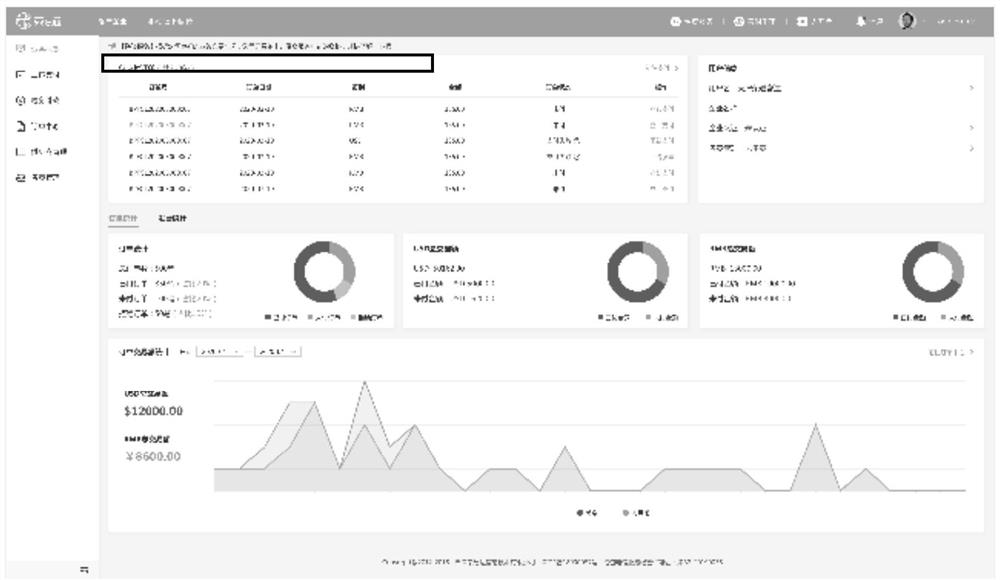

[0127] Example 1: Standardized business model of Rongetong International Logistics Settlement Platform

[0128] The flow and page description of the standardized business model in this embodiment are as follows:

[0129] figure 1 It is the flow chart of the standardized business model of Rongetong International Logistics Settlement Platform. In this business model, the Rongetong platform is used as the main body of the financing business, a designated and qualified enterprise is used as the financing guarantor, the user company that needs to pay for the booking business is used as the financing borrower, and the platform Enterprise information certification and credit evaluation, as well as accounts receivable and payable business transaction data and bill information are used as financing risk control controls.

[0130] In order to enhance risk control, the borrower enterprise needs to sign a financing agreement with the financial institution before financing. When the loa...

Embodiment 2

[0171] Example 2: Financing Service Upgrade Mode 1 of Rongetong International Logistics Settlement Platform

[0172] The process and page description of financing service upgrade mode 1 in this embodiment are as follows:

[0173] Figure 15It is the upgraded and optimized business model (upgrade model 1) process of Rongetong International Logistics Settlement Platform. In this business model, the enterprises in the Rongetong platform that have payment needs are the operating entities and guarantors of the financing business (that is, the upstream sellers in the supply chain), and the downstream purchasers in the supply chain that have payment needs. The borrower of the financing business uses the enterprise information certification and credit evaluation in the platform, as well as the transaction data and bill information of the accounts receivable and payable business as the financing risk control control.

[0174] In order to enhance risk control, the guarantor and the bo...

Embodiment 3

[0205] Example 3: Financing Service Upgrade Mode 2 of Rongetong International Logistics Settlement Platform

[0206] The process and page description of financing service upgrade mode 2 in this embodiment are as follows:

[0207] Figure 28 It is the upgraded and optimized business model (upgrade model 2) process of Rongetong International Logistics Settlement Platform. In this business model, large enterprises with payment requirements and guarantee qualifications on the Rongetong platform are used as the operating entities and borrowers of the financing business (that is, the purchaser enterprises in the middle and downstream of the supply chain), and conduct financing for their own enterprises during the financing process. guarantee. At the same time, the enterprise information authentication and credit evaluation of platform users, as well as accounts receivable and payable business transaction data and bill information are used as financing risk control.

[0208] In or...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com