Enterprise family-oriented small and micro enterprise credit evaluation model construction method and system

A technology of credit evaluation and evaluation model, applied in data processing applications, instruments, finance, etc., can solve problems such as weak anti-risk ability, irregular operation and management, and few collaterals

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

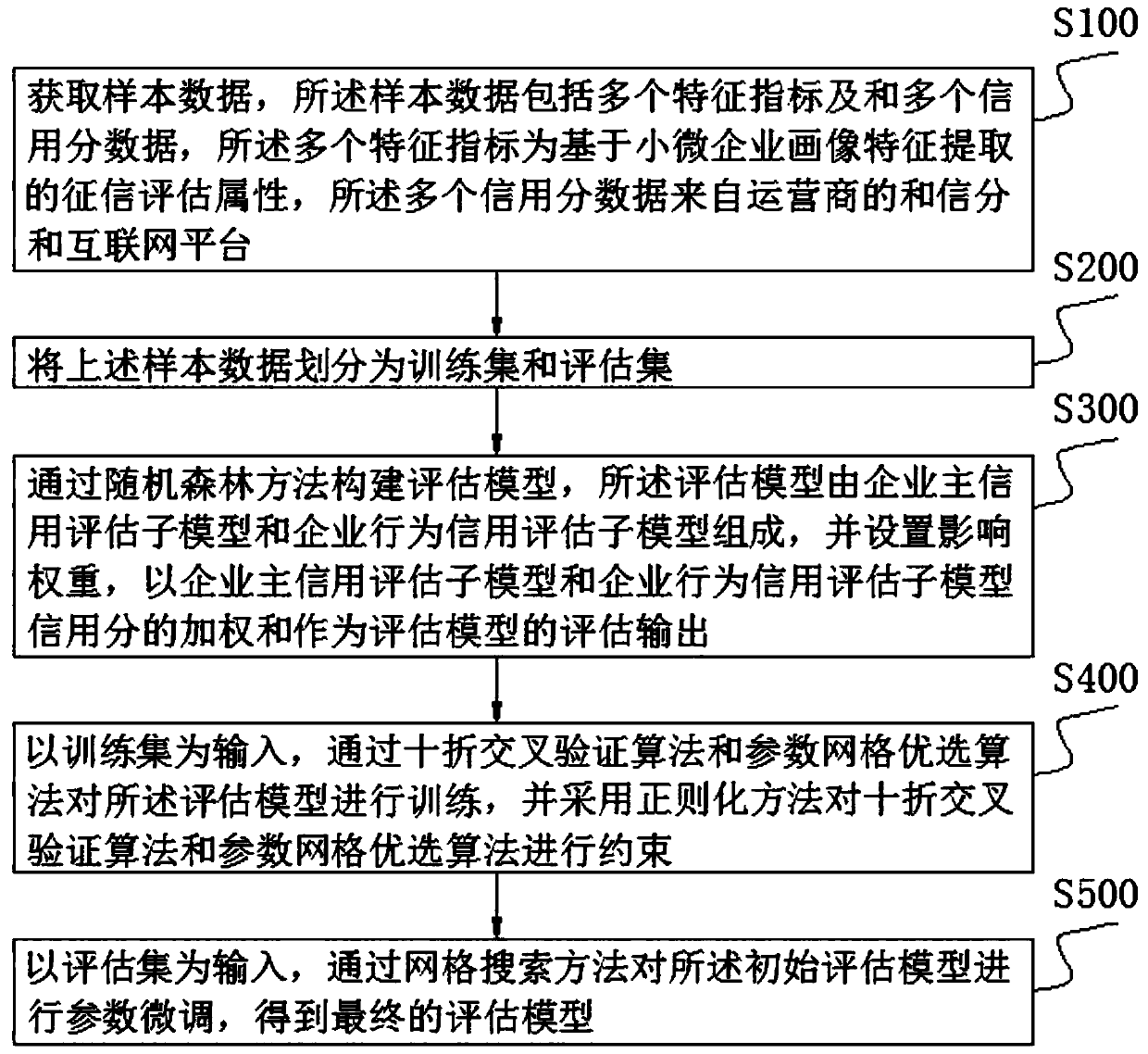

[0073] as attached figure 1 As shown, the enterprise family-oriented small and micro enterprise credit evaluation model construction method of the present invention includes the following steps:

[0074] S100. Obtain sample data. The sample data includes multiple feature indicators and multiple credit score data. The above multiple feature indicators are credit evaluation attributes based on the extraction of small and micro enterprise portrait features. The above multiple credit score data comes from the operation Hexin points and Internet platforms of merchants, Internet platforms such as Qichacha;

[0075] S200. Divide the above sample data into a training set and an evaluation set;

[0076] S300. Construct an evaluation model by the random forest method, the evaluation model is composed of an enterprise owner credit evaluation sub-model and an enterprise behavior credit evaluation sub-model, and setting influence weights, based on the business owner credit evaluation sub-...

Embodiment 2

[0111] The enterprise family-oriented small and micro enterprise credit evaluation model building system of the present invention includes a data collection module, a sample division module, a model building module, a model training module and a model optimization module.

[0112] Wherein, the data acquisition module is used to obtain sample data, and the sample data includes multiple feature indicators and multiple credit score data, the above multiple feature indicators are credit evaluation attributes based on the extraction of small and micro enterprise portrait features, and the above credit score The data comes from the operator's Hexinfen and Internet platforms, such as Qichacha.

[0113] The sample division module is used to divide the collected sample data into a training set and an evaluation set.

[0114] The model construction module is used to construct the evaluation model by the random forest method, and the evaluation model is composed of the business owner cre...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com