Credit risk determination and data processing method and equipment, medium and program product

A risk determination and credit technology, applied in the field of data processing, can solve problems such as poor interpretability of deep learning models, inability to meet the interpretability requirements of credit risk control scenarios, and difficulty in meeting the needs of deep network data. The effect of interpretive requirements

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

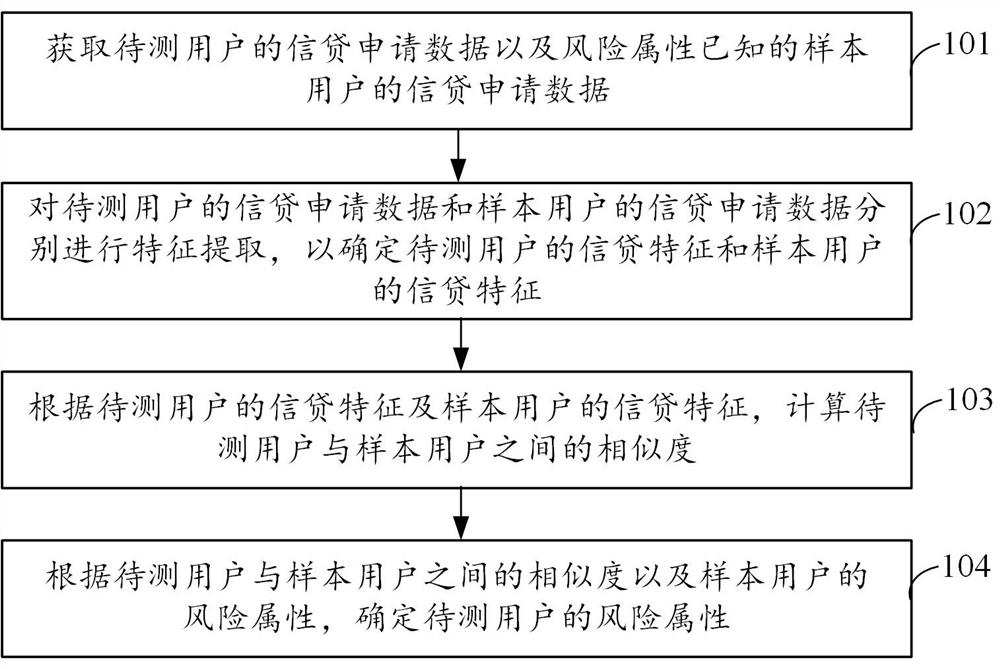

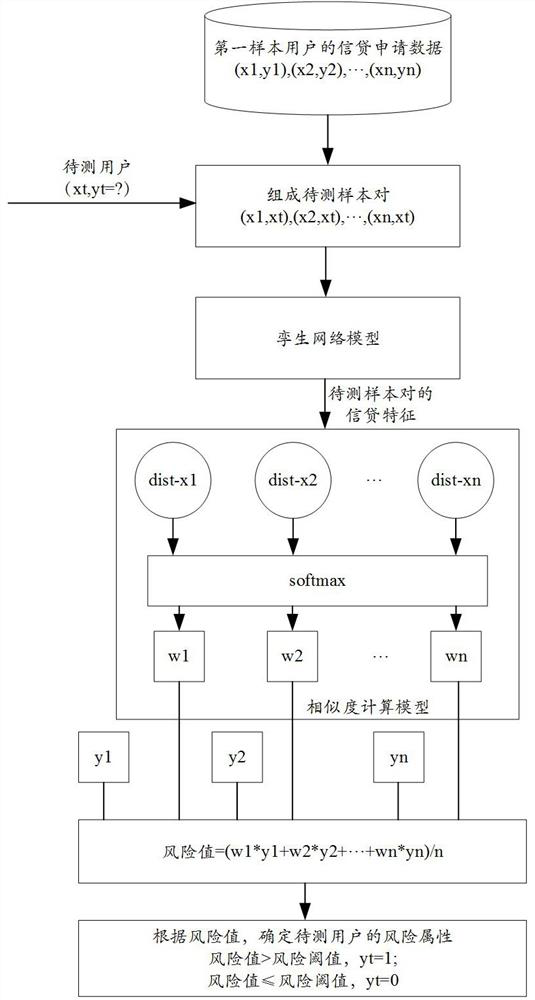

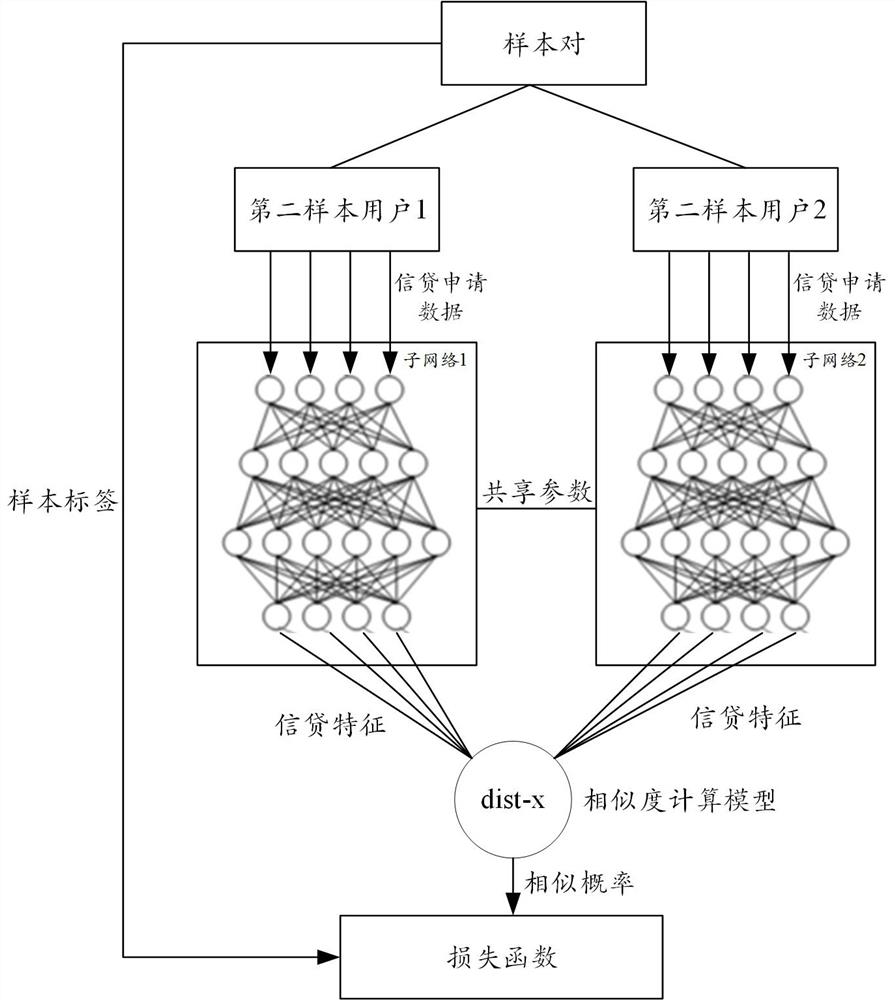

[0026] In order to make the purpose, technical solution and advantages of the present application clearer, the technical solution of the present application will be clearly and completely described below in conjunction with specific embodiments of the present application and corresponding drawings. Apparently, the described embodiments are only some of the embodiments of the present application, rather than all the embodiments. Based on the embodiments in this application, all other embodiments obtained by persons of ordinary skill in the art without making creative efforts belong to the scope of protection of this application.

[0027] In the credit risk control scenario, the current mainstream risk prediction model is the scorecard model. However, the scorecard model is a linear model, which cannot capture the nonlinear relationship between features, resulting in low accuracy of credit risk prediction. Although the deep learning model can obtain complex feature relationship...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com