Credit granting management method and device, electronic equipment and computer readable medium

A management method and a technology of preset values, which are applied in computing, data processing applications, finance, etc., can solve the problems that the evaluation data is too dependent on the provision of financial institutions, and the credit management model does not have universality, so as to achieve the effect of enriching the calculation method

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

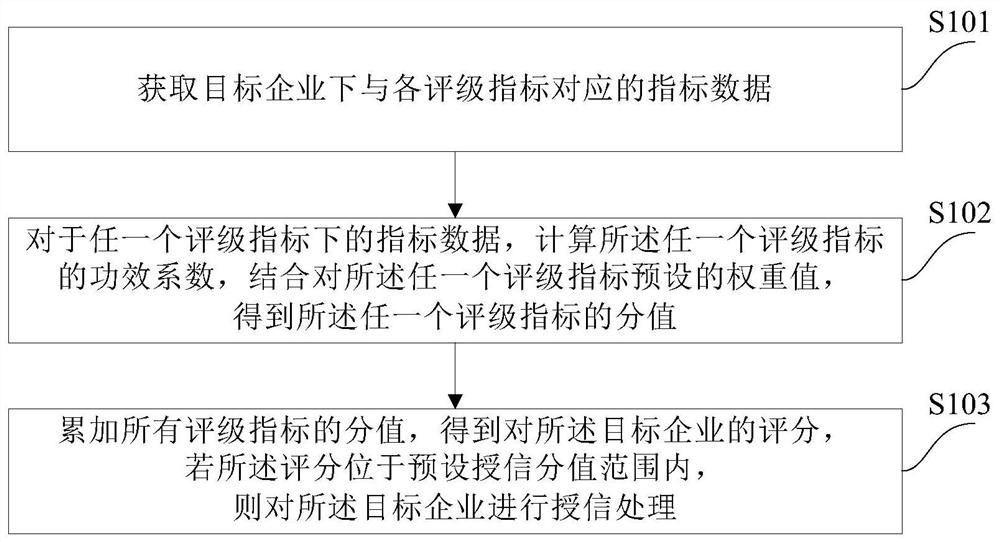

Method used

Image

Examples

Embodiment 1

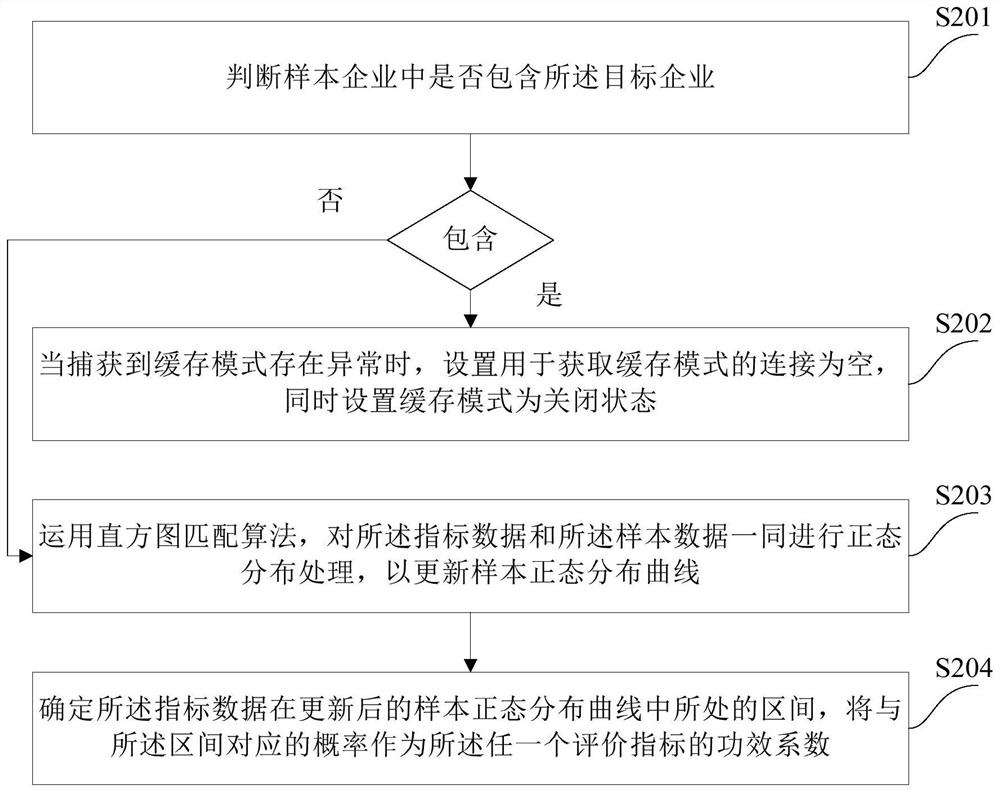

[0117] Embodiment one, see figure 2 Shown:

[0118] S201: Determine whether the target enterprise is included in the sample enterprises;

[0119] S201: If it is included, determine the interval of the index data from the sample normal distribution curve, and use the probability corresponding to the interval as the efficacy coefficient of any evaluation index;

[0120] S202: If not included, use a histogram matching algorithm to perform normal distribution processing on the index data and the sample data together, so as to update the sample normal distribution curve;

[0121]S203: Determine the interval of the index data in the updated sample normal distribution curve, and use the probability corresponding to the interval as the efficacy coefficient of any evaluation index.

[0122] The sample normal distribution curve is generated from sample data, the sample data corresponds to sample enterprises, and the number of sample enterprises is multiple. This embodiment is based ...

Embodiment 2

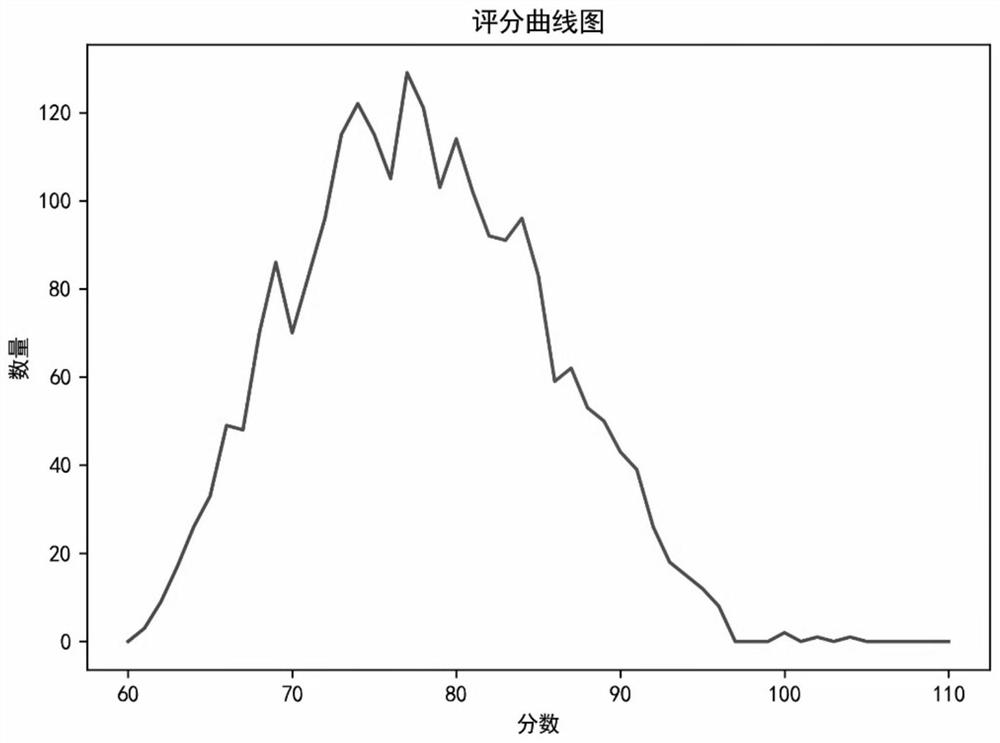

[0126] Embodiment two, see Figure 4 Shown:

[0127] S401: Use the efficacy coefficient method to convert the index data under any rating index into a value within a preset range;

[0128] S402: Based on the scale information and industry information of the target enterprise, perform normal distribution processing on the data;

[0129] S402: Determine the interval of the processing result in the sample normal distribution curve, and use the probability corresponding to the interval as the efficacy coefficient of any one of the evaluation indicators; wherein, the sample normal distribution curve is obtained by normalizing the sample data The sample data corresponds to multiple sample enterprises;

[0130] S404: Using a histogram matching algorithm, perform normal distribution processing on the index data of the target enterprise and the sample data together, so as to update the sample normal distribution curve.

[0131] In this embodiment, the efficacy coefficient method is ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com