Interception strategy derivation method and system for credit anti-fraud

A strategy and credit technology, applied in data processing applications, finance, instruments, etc., can solve problems such as the inability of anti-fraud methods to adapt, and achieve the effect of high accuracy, strong interpretability, and strong business interpretability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Example Embodiment

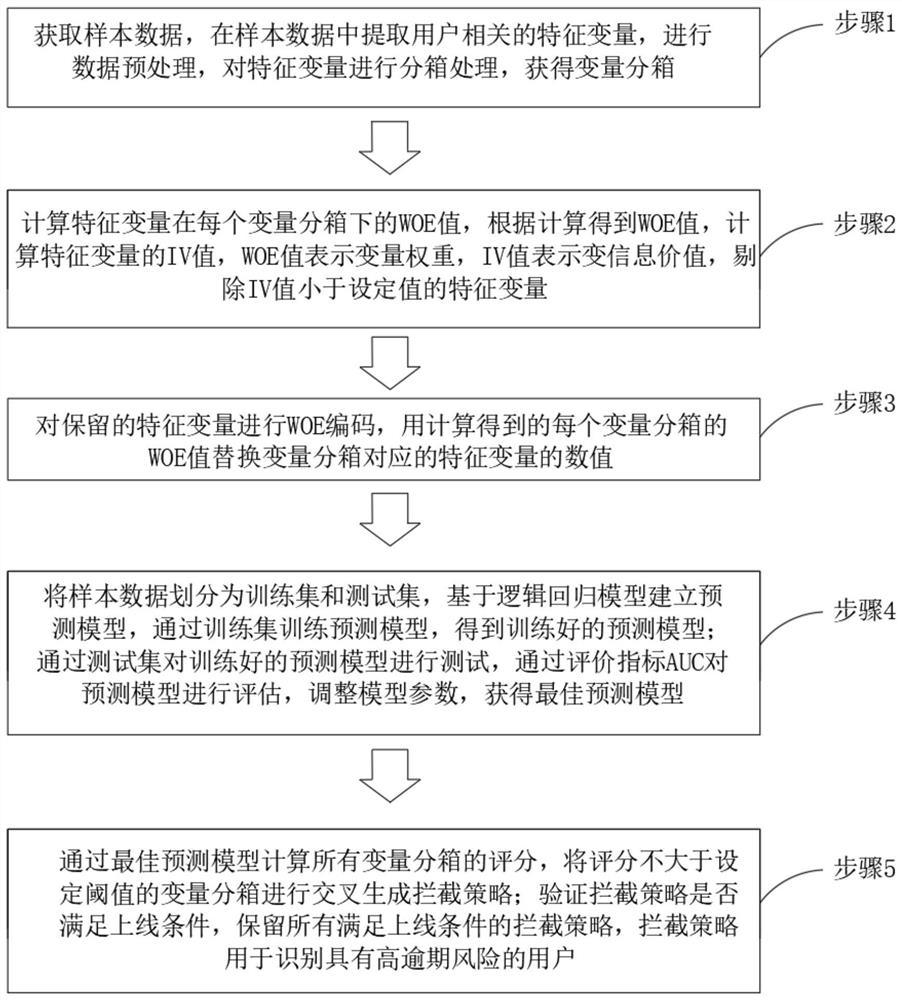

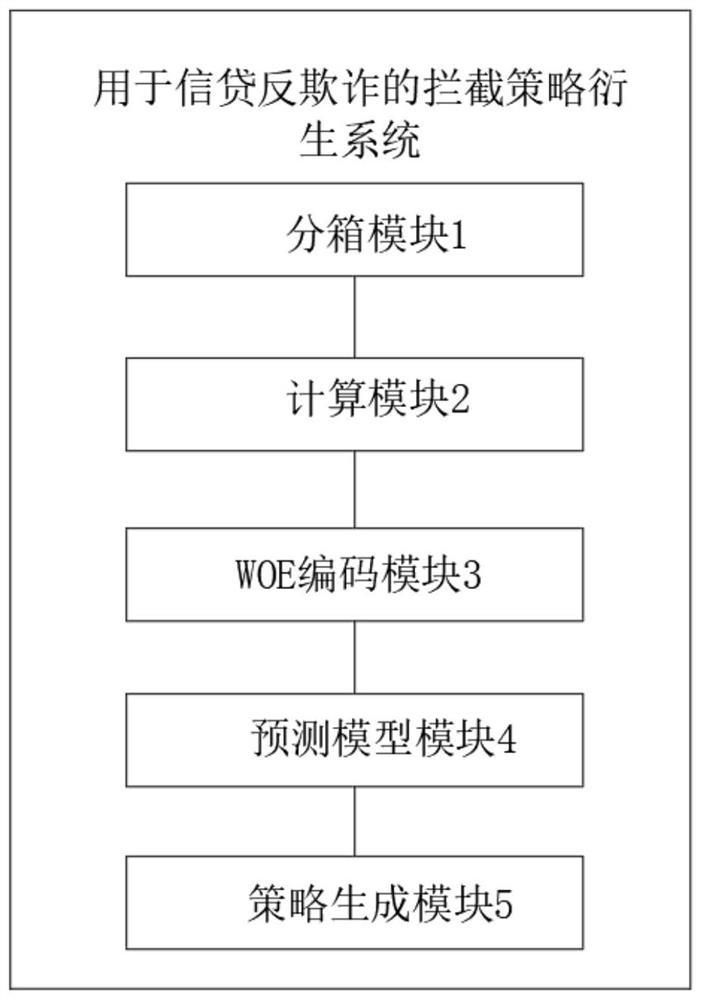

[0056]本发明的一种用于信贷反欺诈的拦截策略衍生方法,至少包括以下步骤:

[0057]步骤1:获取样本数据,在样本数据中提取用户相关的特征变量,进行数据预处理,对特征变量进行分箱处理,获得变量分箱;

[0058]步骤2:计算特征变量在每个变量分箱下的WOE值,根据计算得到WOE值,计算特征变量的IV值,WOE值表示变量权重,IV值表示变信息价值,剔除IV值小于设定值的特征变量;

[0059]步骤3:对保留的特征变量进行WOE编码,用计算得到的每个变量分箱的WOE值替换变量分箱对应的特征变量的数值;

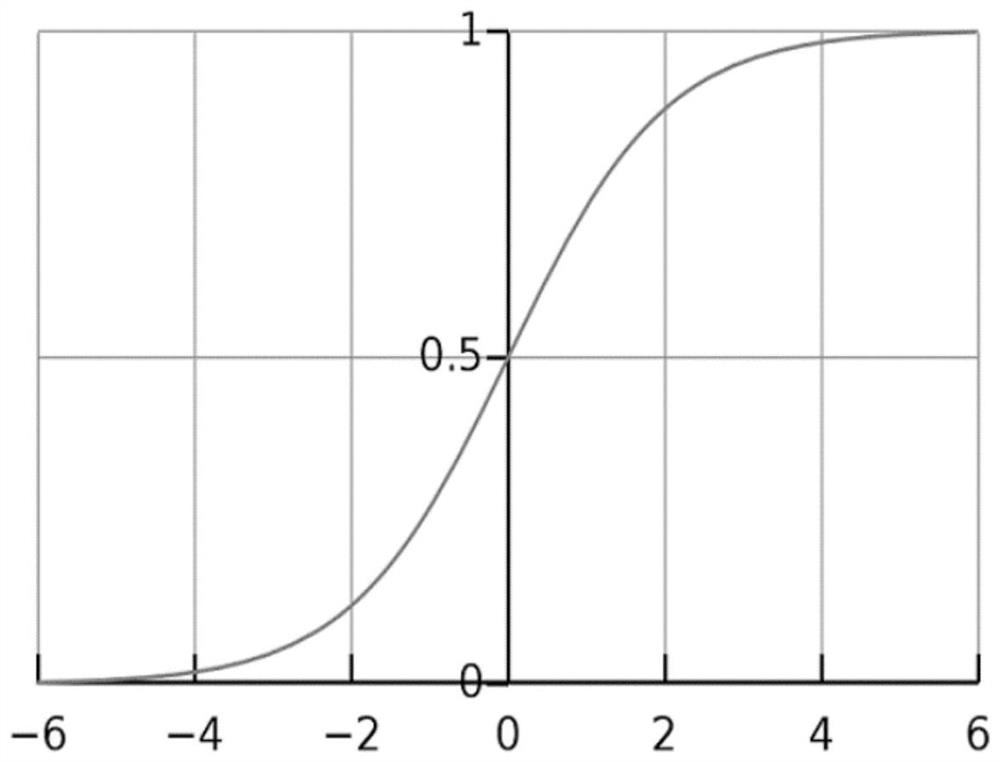

[0060]步骤4:将样本数据划分为训练集和测试集,基于逻辑回归模型建立预测模型,通过训练集训练预测模型,得到训练好的预测模型;通过测试集对训练好的预测模型进行测试,通过评价指标AUC对预测模型进行评估,调整模型参数,获得最佳预测模型;

[0061]步骤5:通过最佳预测模型计算所有变量分箱的评分,将评分不大于设定阈值的变量分箱进行交叉生成拦截策略;验证拦截策略是否满足上线条件,保留所有满足上线条件的拦截策略,拦截策略用于识别具有高逾期风险的用户。

[0062]本发明实施例提供的用于信贷反欺诈的拦截策略衍生方法,能快速学习到海量数据中能标识坏客户的特征变量,并基于这些变量进行特征交叉,衍生出具有强业务解释性的黑样本拦截策略。

[0063]具体在本发明的实施例中,方法在步骤1中,具体包括:

[0064]步骤101:以信贷业务中的正常用户为白样本,逾期用户为黑样本,进行用户打标,获得样本数据;具体在一个实施例中,对于信贷业务的骗贷场景,通常选取首期即逾期超过30天的作为黑样本,三期内未有逾期超过30天的作为白样本。

[0065]步骤102:在样本数据中提取用户相关的特征变量,这些特征变量中不可避免会遇到有些变量单类别占比多大的问题。本发明的目的就是解决众多特征变量的情况下,快速找到具有业务解释性及高区分性的特征变量组合,所以输入的特征变量不是固定的,特征变量包括数值型特征变量和类别型特征变量;

[0066]步骤103:对样本数据进行数据预处理,对样本数据中的异常值和缺失值进行处理,剔除不满足数据缺失率要求和表现为异常值的特征变量;

[0067]具体在一个实施例中,首先对数据中缺失值进行处理,在反欺诈场景中,通常面临着黑白样本极不平衡的问题,相应的特征变量也存在单类别占比过多的情况,但这并不...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com