Fund evaluation method and device

An evaluation method and fund technology, applied in finance, instruments, data processing applications, etc., can solve the problem of not being able to distinguish the relative value strategy stock long and stock index futures hedging side risks and income sources well.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

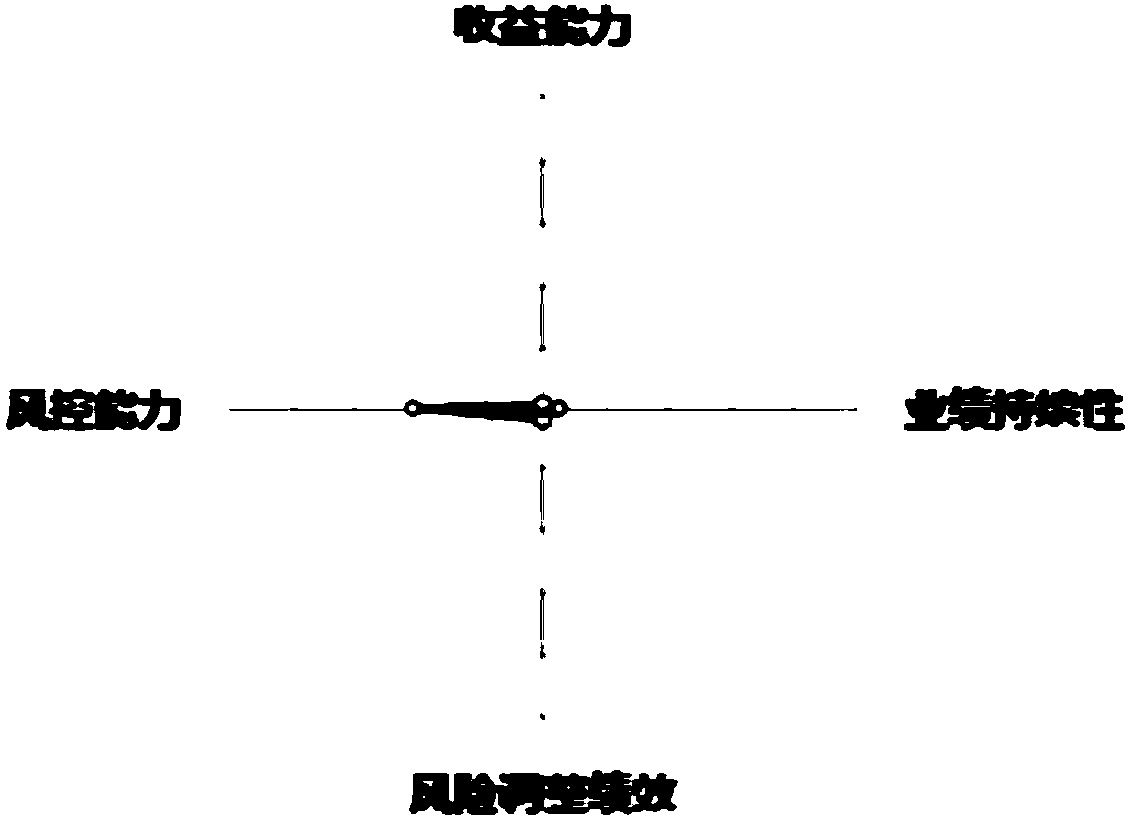

[0047] An embodiment of the present invention provides a fund evaluation method. Fund evaluation is to analyze and judge the risk, income, style, cost, source of performance of the fund and the investment ability of the fund manager through some quantitative or qualitative indicators. Its purpose is to help investors better understand the investment objects. Risk-return characteristics and performance make it easier for investors to compare and choose between funds.

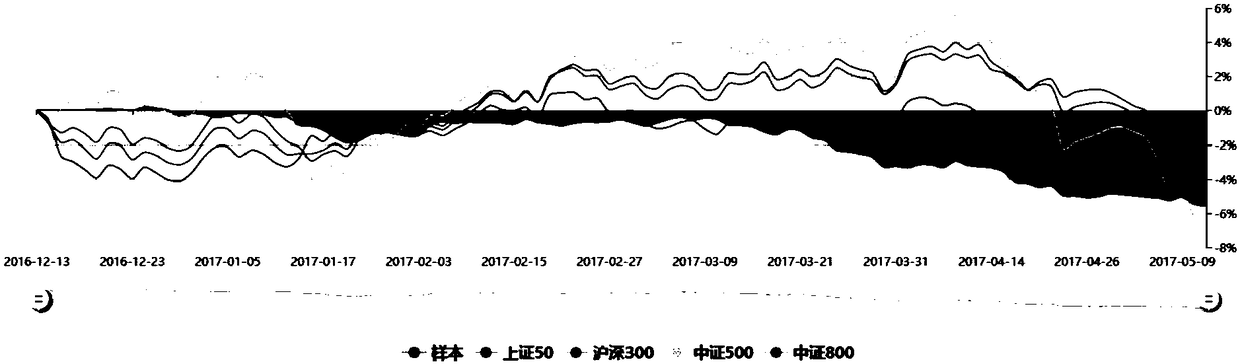

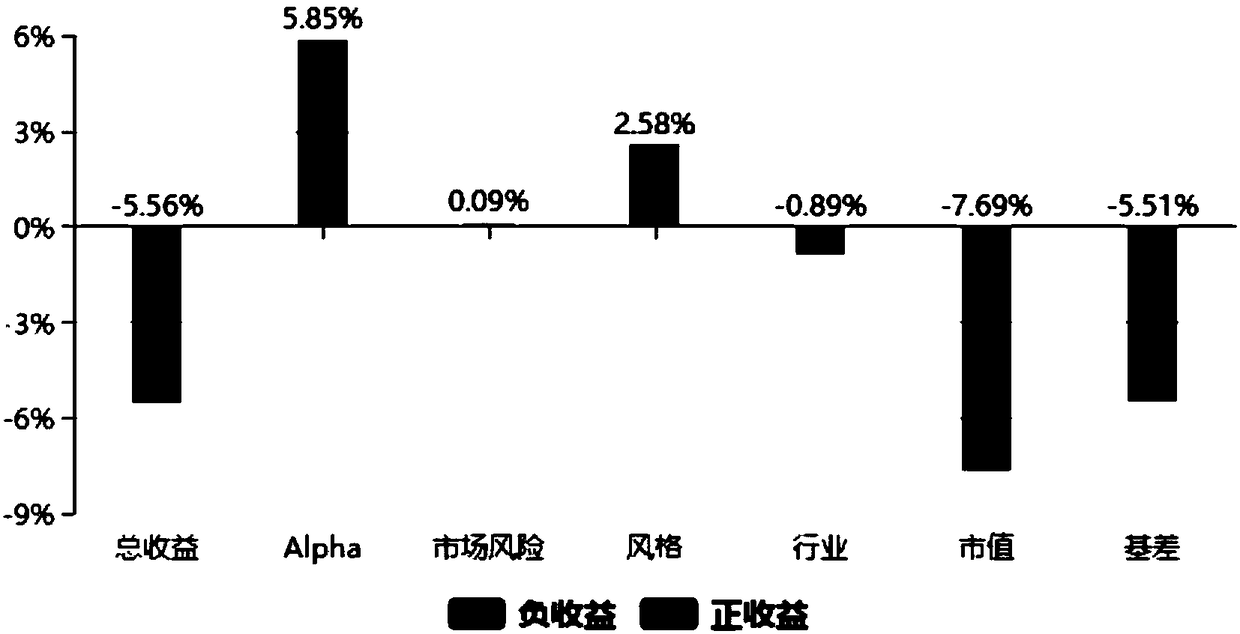

[0048] First, obtain the valuation table of the target fund during the evaluation period; the assets of the target fund include: stocks, stock index futures and cash; read the information of the first parameter of the target fund from the valuation table; the first parameter includes: target The start and end time of investment in each stock and stock index futures in the fund, the income during the investment period, net worth, investment strategy, investment principal, position data, product name, and company n...

Embodiment 2

[0095] The embodiment of the present invention provides a fund evaluation device, and its structural block diagram is as follows Figure 20 As shown, the fund evaluation device includes a valuation table acquisition module 100, which is used to obtain the valuation table of the target fund within the evaluation time period; the assets of the target fund include: stocks, stock index futures and cash; the reading module 110 is used for Read the information of the first parameter of the target fund from the valuation table; the first parameter includes: income and net worth during the investment period; the calculation module 120 is used to calculate the second parameter of the target fund from the first parameter; the second parameter includes : Annualized rate of return, scanning statistics, winning rate, Sharpe ratio, Karma ratio, Sortino ratio, volatility, maximum retracement rate and CVaR; the ranking method is determined by the second parameter; the ranking method includes: ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com