Enterprise brand value evaluation method

An evaluation method and brand technology, applied in the direction of instruments, data processing applications, forecasting, etc., can solve the problems of not really reflecting the corporate brand value, inaccurate brand value evaluation, etc., and achieve objective and scientific market competitiveness, accurate scoring system, and scoring system more effective

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

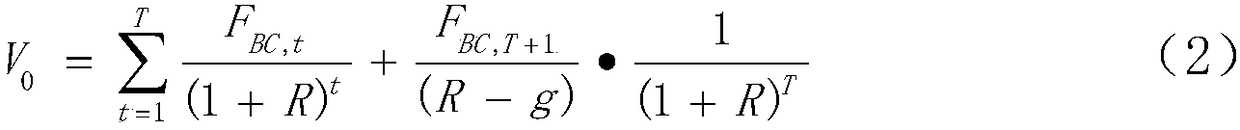

[0035] Enterprise brand value evaluation method, including steps: calculating brand expected revenue V 0 and brand development potential V C , where the brand value V B = brand expected revenue V 0 +Brand development potential value V C ;

[0036] 1. For option pricing on brand development potential, five index parameters need to be determined: S is the sum of the present value of the brand’s future excess returns (the present value of the assets traded), and L is the expected future brand’s final value of the total investment cost of the brand Input cost (option delivery price), T n is the validity period of the brand option (option validity period), r is the risk-free interest rate based on continuous compound interest, and σ is the brand value volatility (volatility rate, that is, the annualized variance).

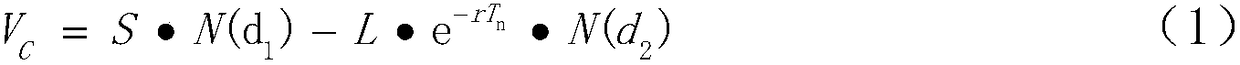

[0037] The brand development potential value V C The calculation formula of is formula (1):

[0038]

[0039] in, L is the final value of the expected total...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com