System and method for predicting security price movements using financial news

a technology of security price and financial news, applied in the field of system and method for predicting security price movements using financial news, can solve the problems of not incorporating events, using neural networks or statistical regression, and not providing prediction results

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

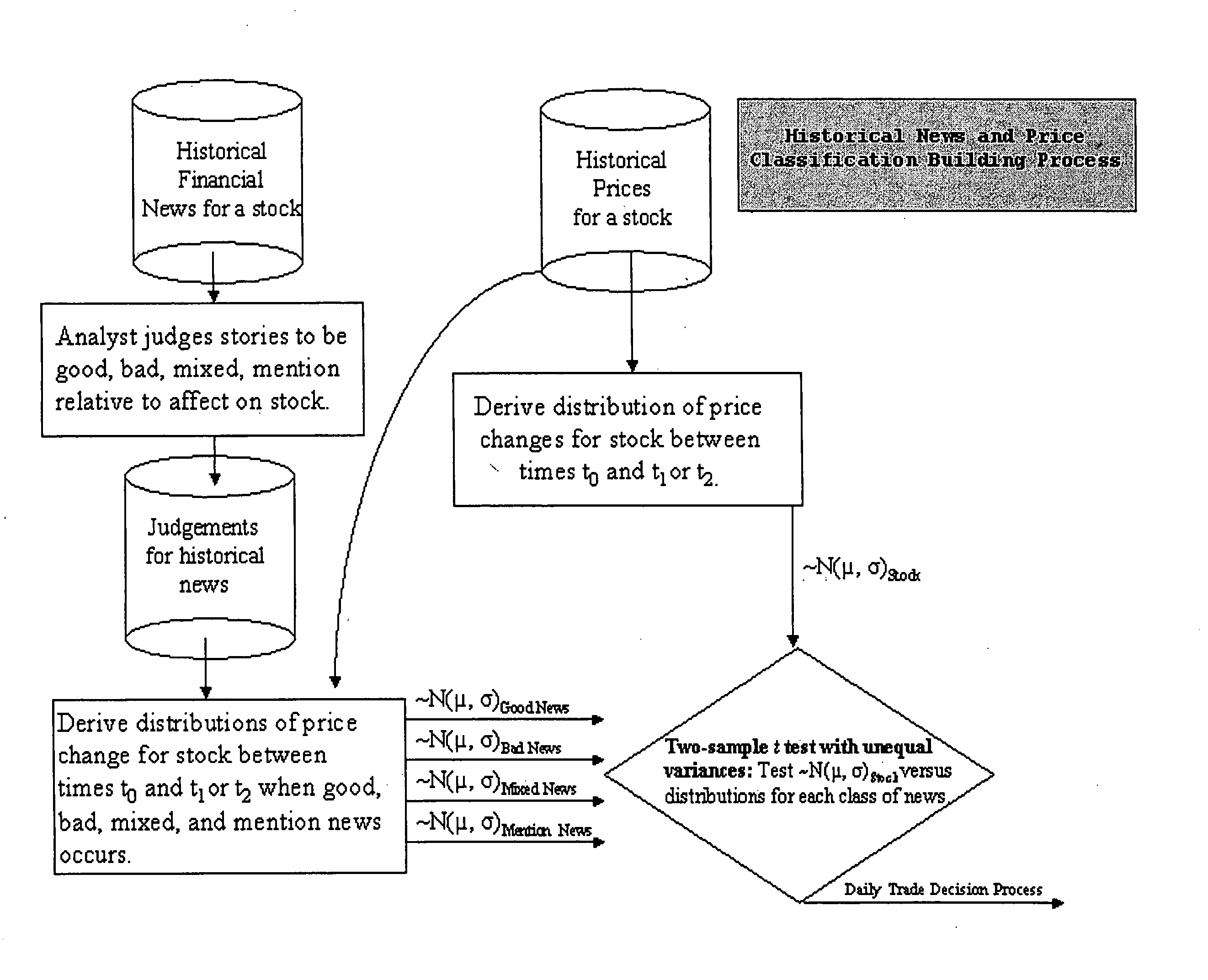

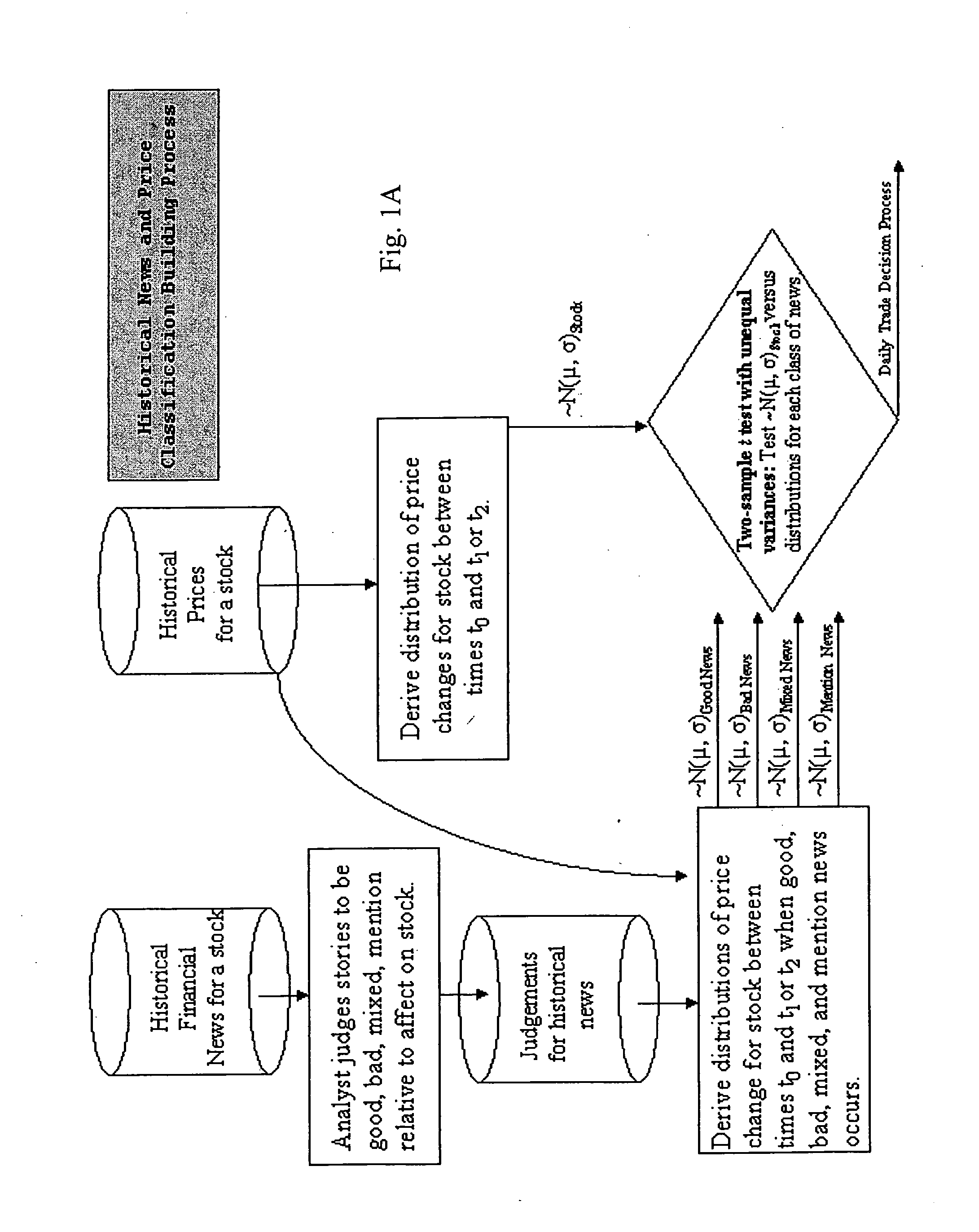

Method used

Image

Examples

example 1

[0034]The training period is Jan. 2, 2002-Jan. 5, 2000.

[0035]The distribution of the 1-day change in price of the stock in general is:

t1=0.5, t2=−0.17, and t3=0.6.

[0036]The distribution of the 2-day change in price of the stock in general is:

t2=−0.25, and t3=0.33.

[0037]Incorporated herein is references to A-1 to A-3 of the Appendix, which provide a description and equations for calculating the mean the standard deviation of a distribution.

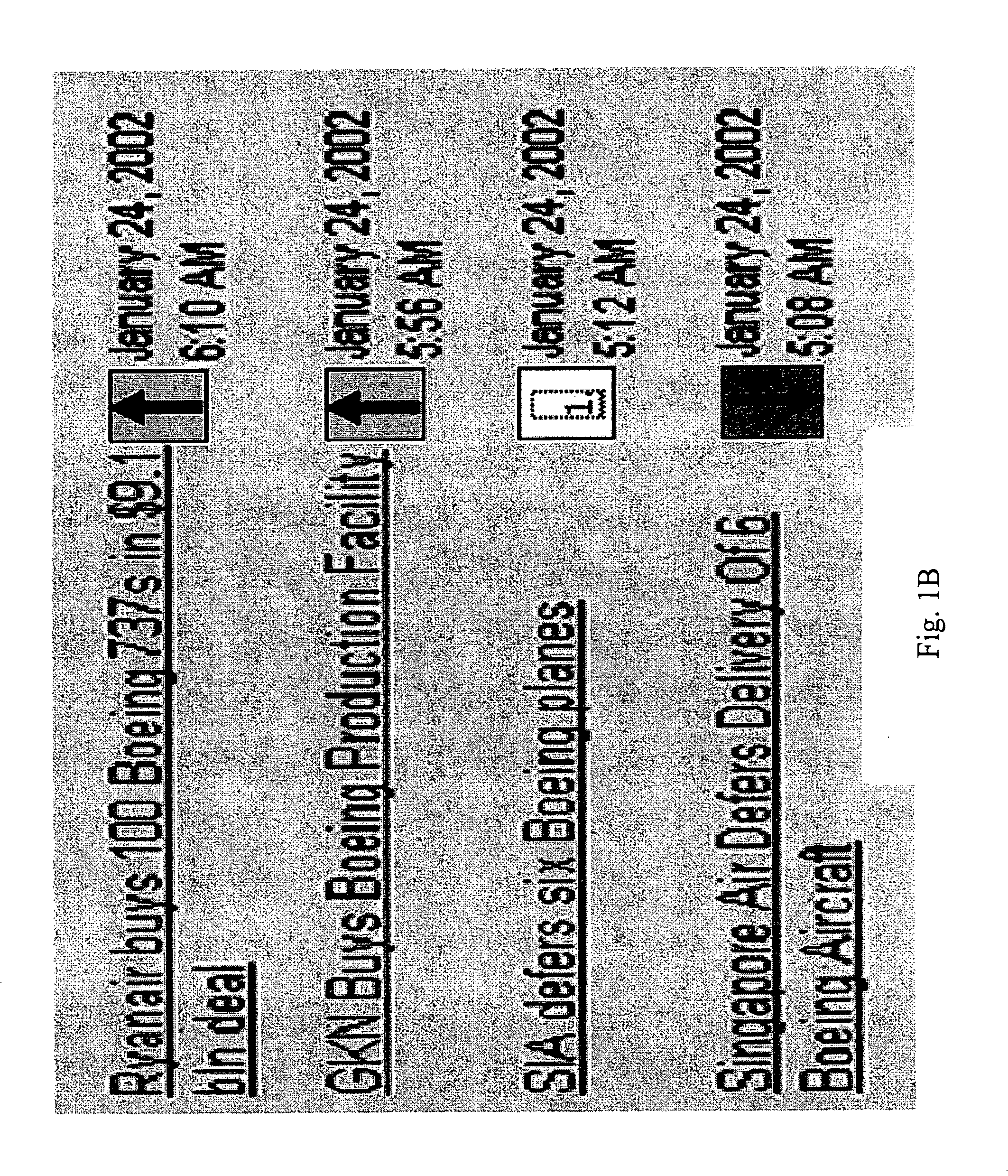

[0038]The apparatus for collecting analyst classifications via a website is illustrated in FIGS. 1B-C. A listing of news article titles for a company is displayed on the computer screen. In addition, each article has a graphic indicating the classification of the article, or a graphic indicating that the article needs to be classified. In one embodiment of the experiment (see FIG. 1B), an up arrow in a green box indicated the article was classified as good news, a down arrow in a red box indicated bad news. An up and down arrow in a yellow box indi...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com