System and method for preventing taxpayer from invoicing beyond geographic range

A Geographically Scoped, Monitoring System Technology

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0029] The principles and features of the present invention are described below in conjunction with the accompanying drawings, and the examples given are only used to explain the present invention, and are not intended to limit the scope of the present invention.

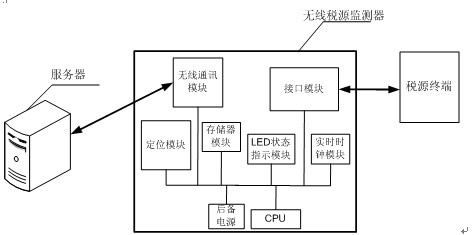

[0030] Such as figure 1 As shown, the tax source monitoring system includes a tax source terminal, a wireless tax source monitor corresponding to the tax source terminal, and a background server for checking authority, verifying geographic location information, authorizing and receiving transaction data for the wireless tax source monitor.

[0031] Obviously, there may be multiple tax source terminals and wireless tax source monitors corresponding to the tax source terminals.

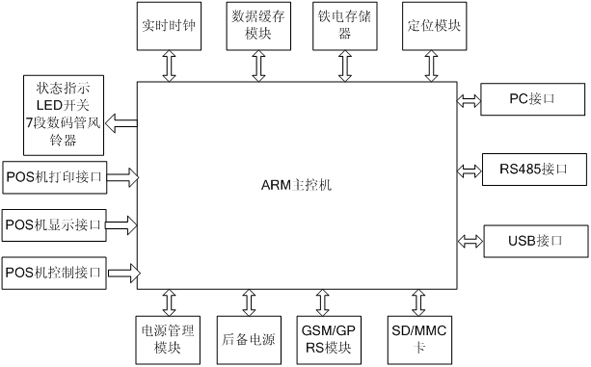

[0032] figure 2 It is a structural schematic diagram of the wireless tax source monitor in the tax source monitoring system of the present invention. As shown in the figure, the wireless tax source monitor includes an ARM master computer, a...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com