Patents

Literature

266results about How to "Send quickly" patented technology

Efficacy Topic

Property

Owner

Technical Advancement

Application Domain

Technology Topic

Technology Field Word

Patent Country/Region

Patent Type

Patent Status

Application Year

Inventor

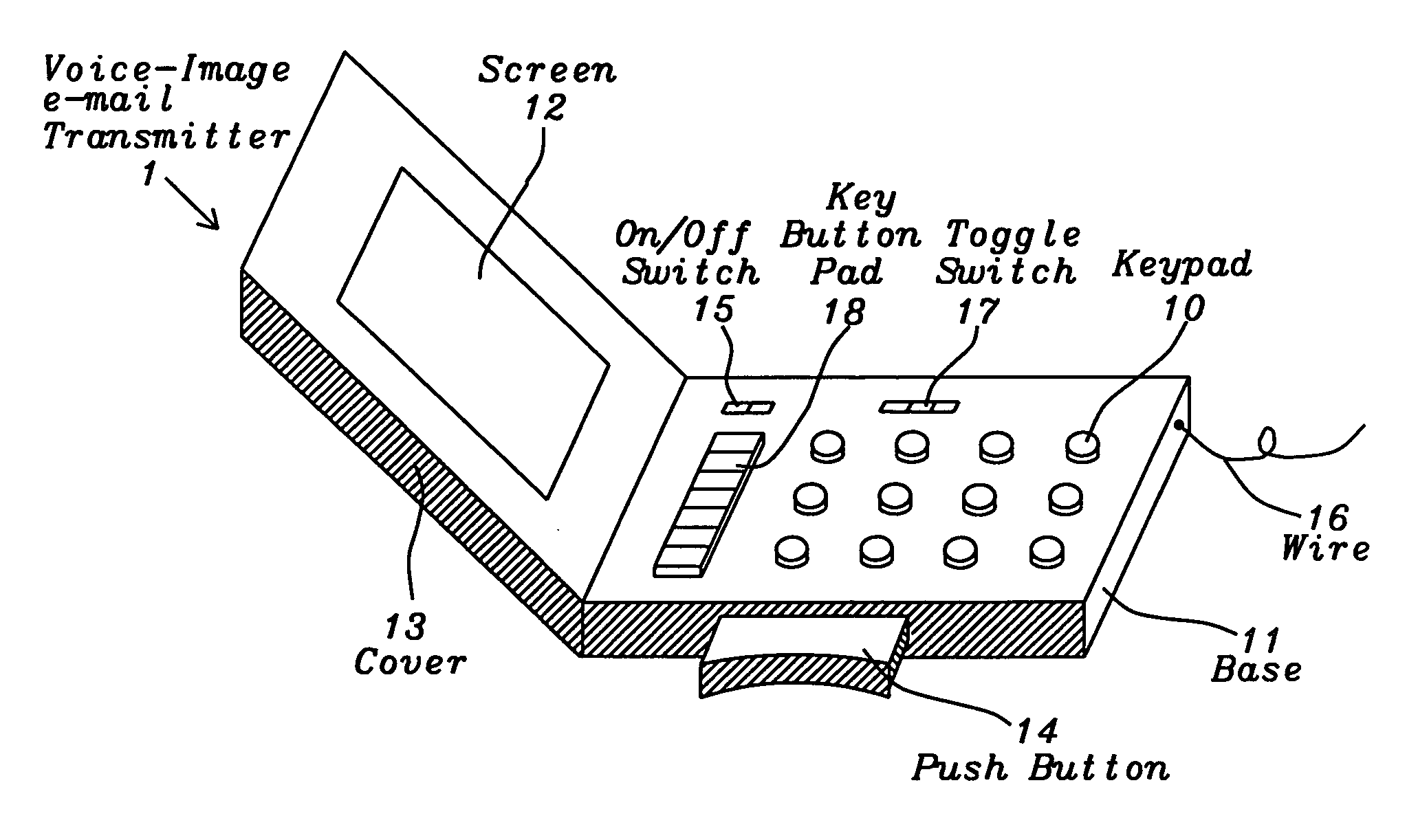

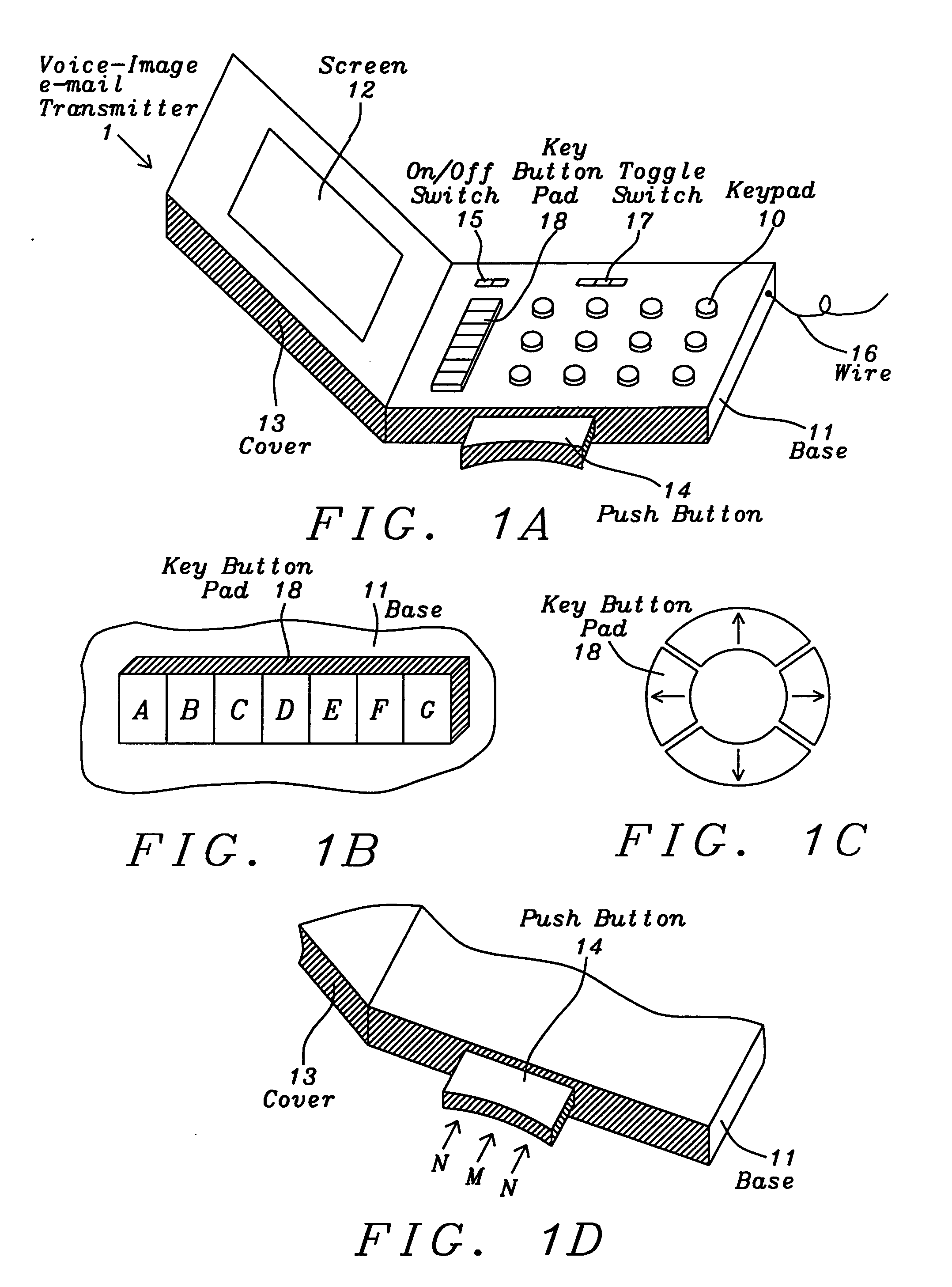

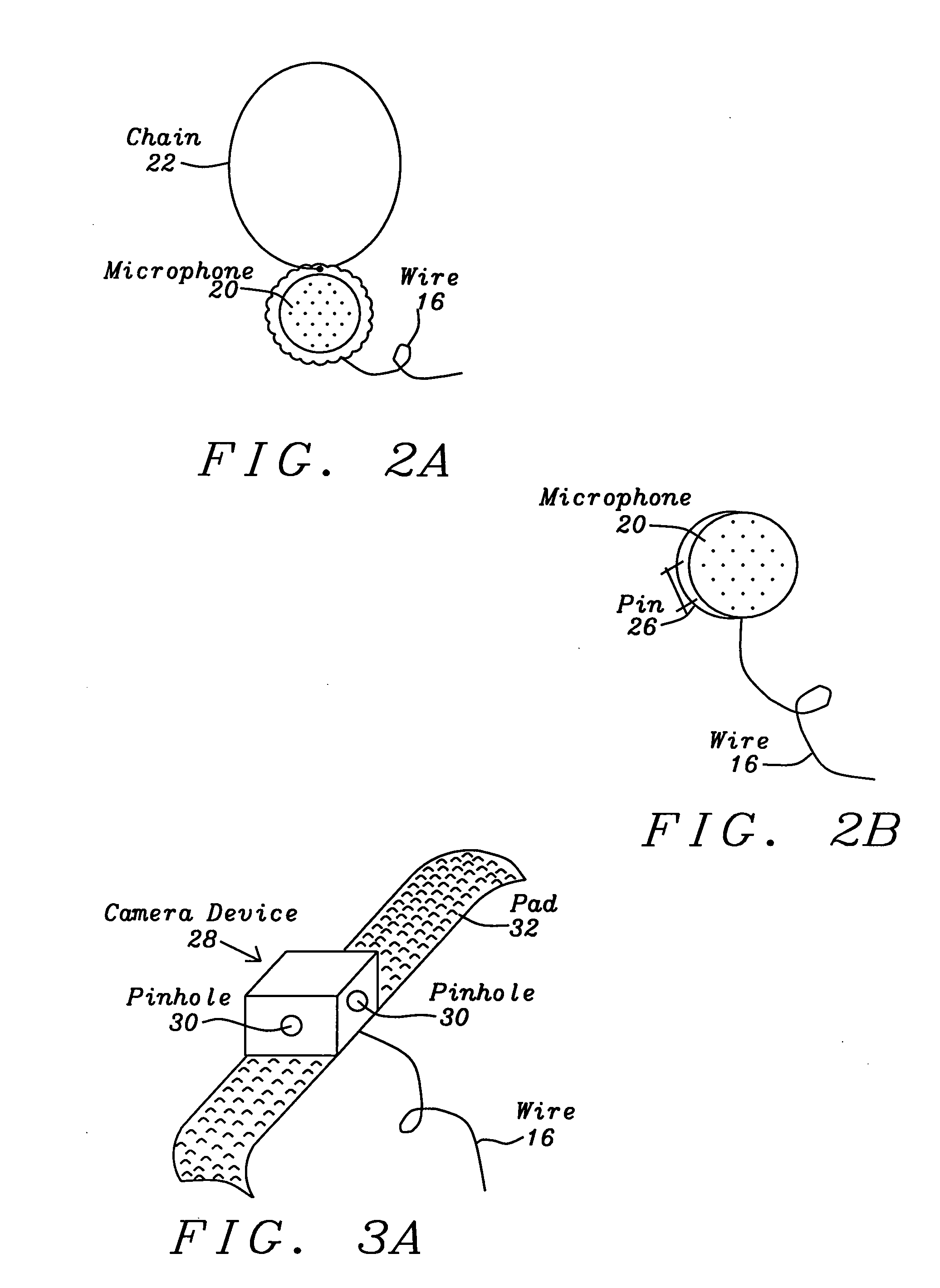

System and method for the emergency voice and image e-mail transmitter device

InactiveUS20120282884A1Justice be serveEasy and fastDevices with GPS signal receiverSubstation equipmentElectronic equipmentDigital signal

A voice and image e-mail transmitter device with an external camera attachment that is designed for the emergency and surveillance purposes is disclosed. The device converts voice signals and photo images into digital format, which are transmitted to the nearest voice-image message receiving station from where the digital signal strings are parsed and converted into voice, image, or video message files which are attached to an e-mail and delivered to user pre-defined destination e-mail addresses and a 911 rescue team. The e-mail also includes the caller's voice and personal information, photo images of a security threat, device serial number, and a GPS location map of the caller's location. The digital signal data may be recorded and transmitted within few seconds. The victim's family or police may either check the GPS location map in an e-mail or apply a new GPS based people tracking system of the present invention to search for a missing victim.

Owner:SUN NICHOLAS

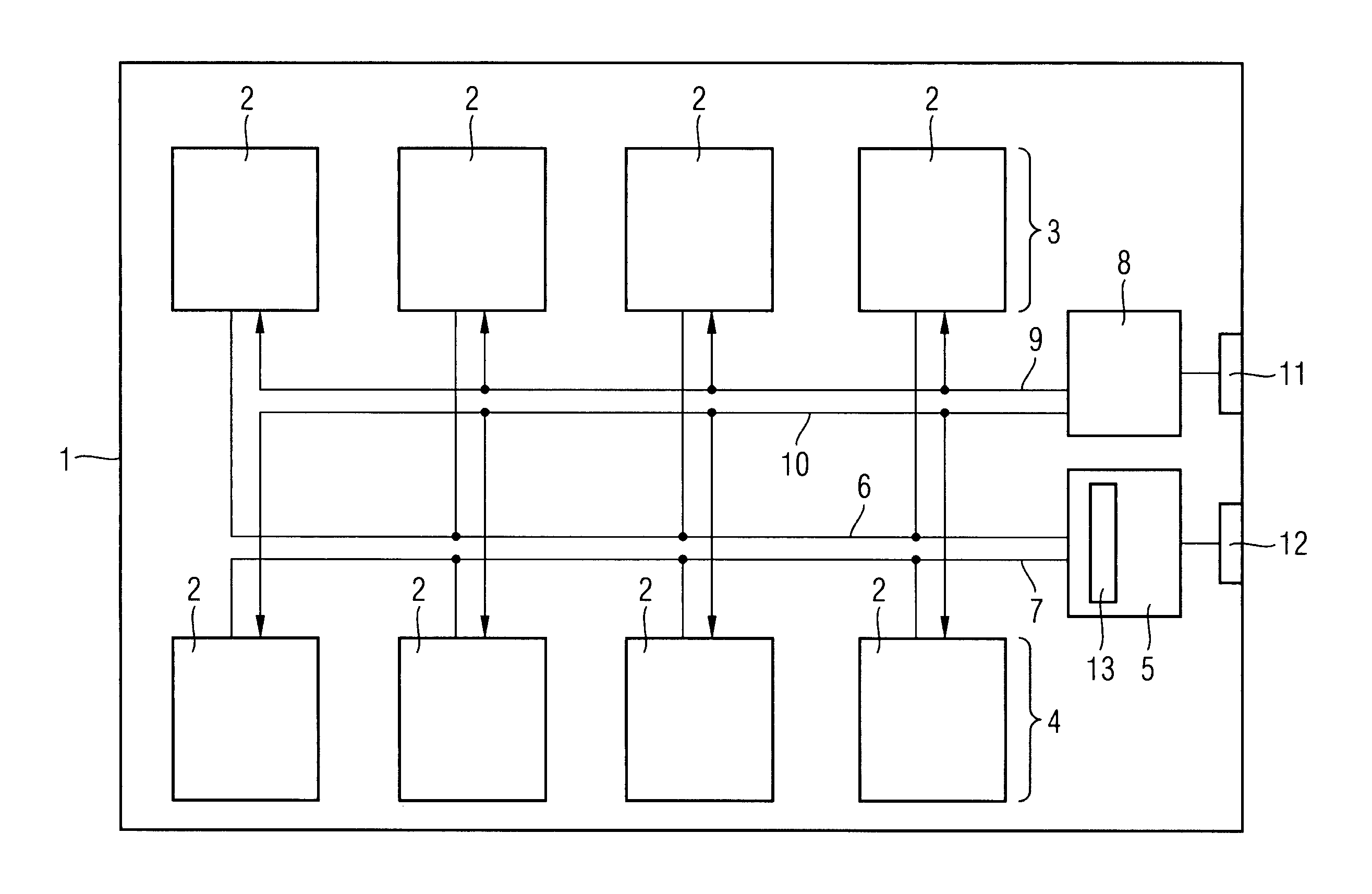

Memory device, memory controller and method for operating the same

InactiveUS20060129740A1Send quicklyMemory adressing/allocation/relocationDigital storageMemory bankData access

One embodiment of the present invention provides a memory device comprising a plurality of sets of memory banks, wherein each memory bank includes a memory array and is adapted to be read out in a data access; a plurality of internal data buses and a plurality of internal command and address buses connected to the plurality of sets of memory banks, respectively, such that each set of memory banks is associated with one of the internal data buses and one of the internal command and address buses; a command and address port for receiving command and address data from outside; and a command and address unit to direct the received command and address data to one of the sets of memory banks via the associated command and address bus, depending on the address data; and a data output unit for receiving data read out from one set of memory banks via the respective internal data bus in the data access and for serially outputting the received data.

Owner:INFINEON TECH AG

Method and system for synchronously sharing mobile terminal data

InactiveCN102638774ASend quicklySimplify storage stepsSynchronisation arrangementMessaging/mailboxes/announcementsData synchronizationTelecommunications

The invention relates to the technical field of communications, in particular to a method and a system for synchronously sharing mobile terminal data, which enable users in a same network to have the same audio-visual experience. The method for synchronously sharing the mobile terminal data includes A, establishing connection of a local wireless network among a plurality of mobile terminals; B, detecting data synchronous trigger events by a first mobile terminal of the mobile terminals; C, sending current operating data to other mobile terminals in the local wireless network in real time by the aid of the first mobile terminal through local wireless network connection; and D, receiving the data and operating by the other mobile terminals.

Owner:王方淇

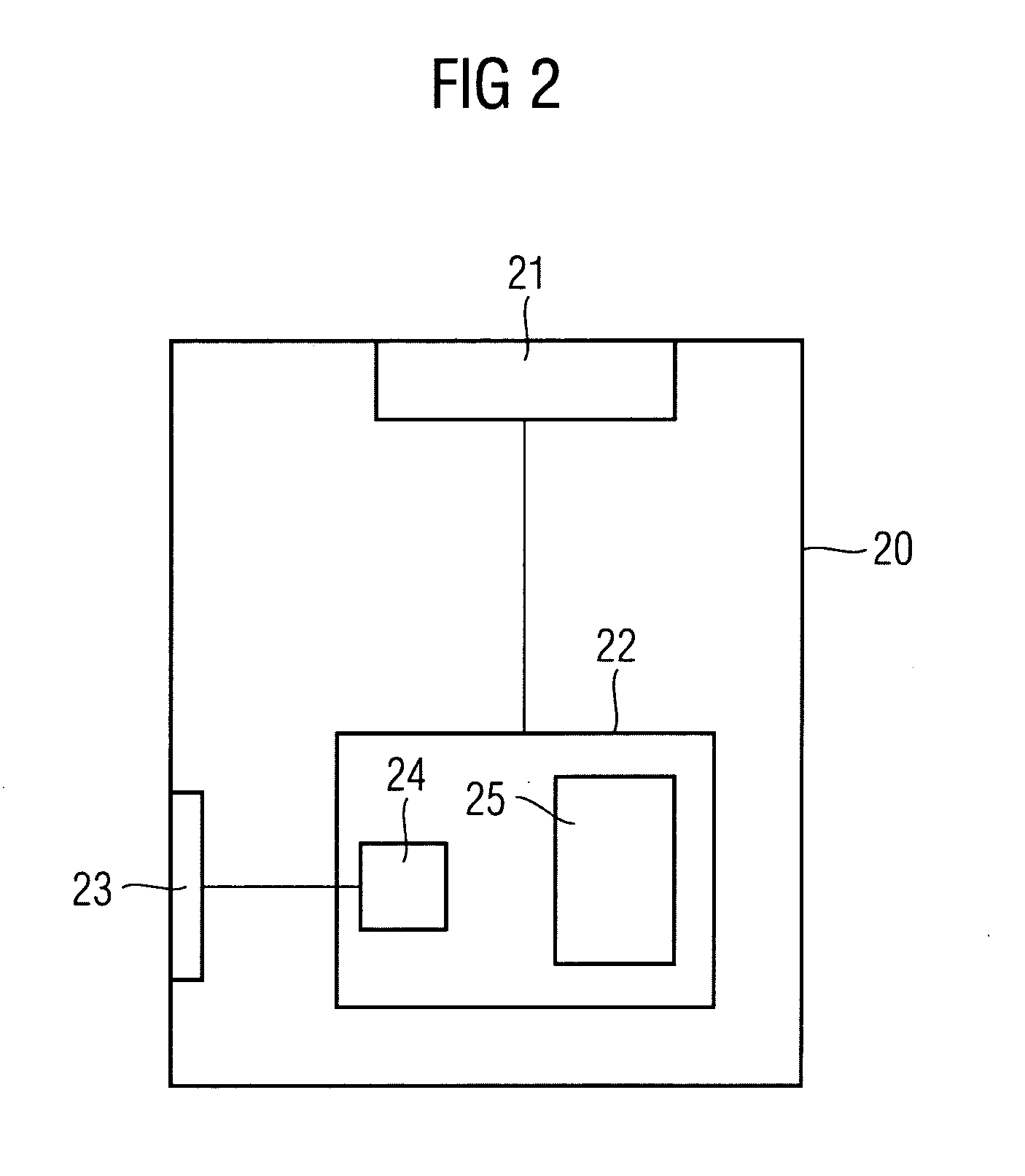

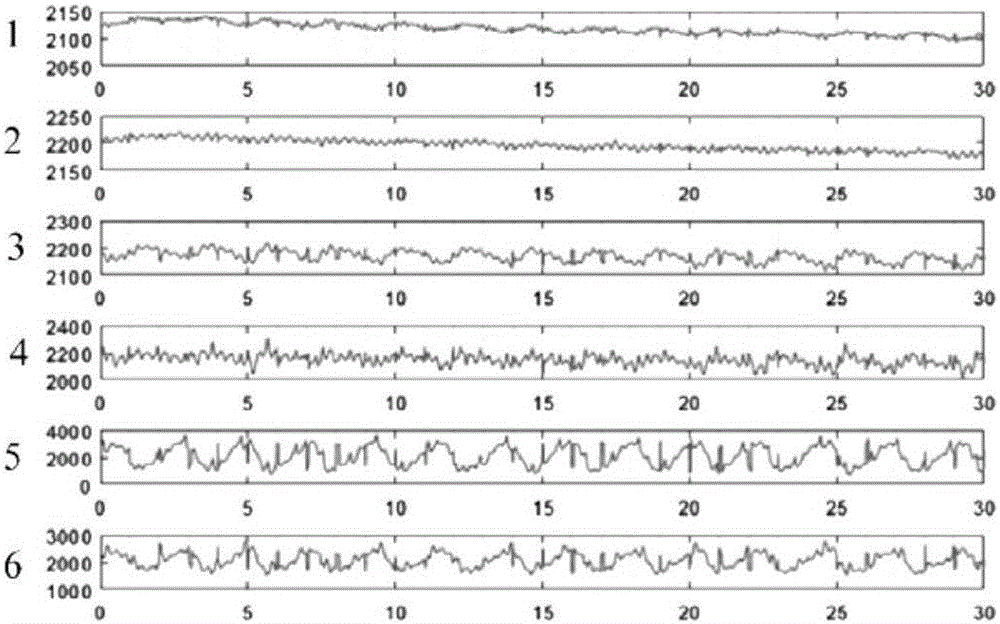

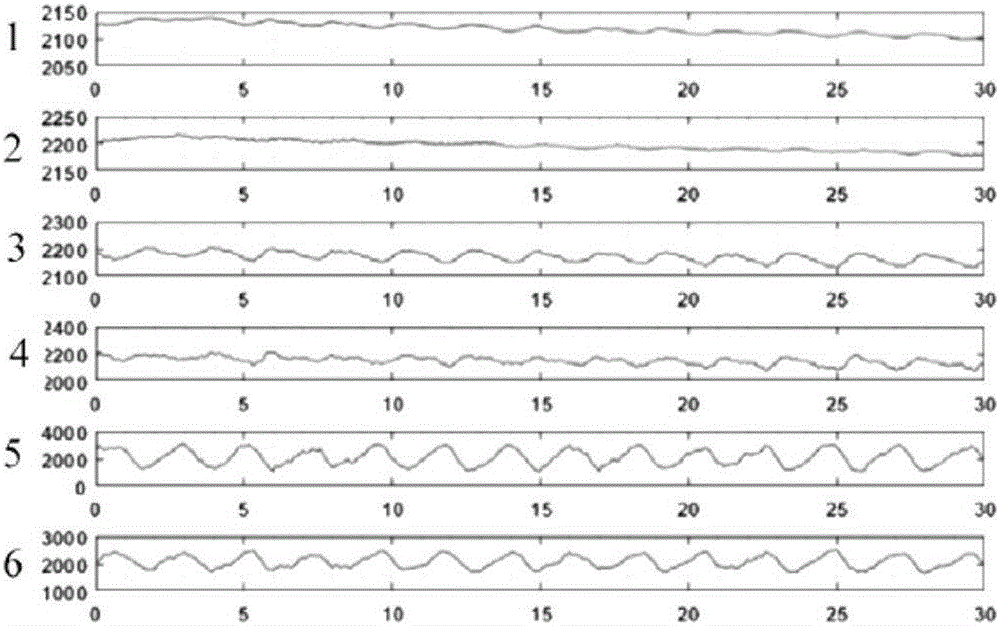

Intelligent mattress warning system

ActiveCN106846735AThe monitoring results are accurateSend quicklyRespiratory organ evaluationSensorsCloud serverWarning system

The invention relates to an intelligent mattress warning system. The intelligent mattress warning system comprises a collection device, an anomaly monitoring module, a cloud server, a mobile terminal and an early warning module. The anomaly monitoring module monitors sleep data collected by the collection device, judges the individual type, and judges whether a direct early warning mode or an analysis early warning mode based on the anomaly variation of the sleep data relative to the individual type; the cloud server counts physiological information of at least one individual based on the sleep data collected by the collection device, recognizes a sleep mode, interactively associates the physiological information, the individual type, the sleep mode and / or abnormal data so as to analyze the abnormal state level of a user, and sends corresponding early warning request information to the early warning module and / or the mobile terminal according to the abnormal state; the early warning module sends out corresponding early warning information based on the early warning request information; the mobile terminal sends assistance information to preset assistance personnel and / or an assistance agency based on the early warning information. According to the intelligent mattress alarm system, early warning is conducted based on the individual type, and the early warning is accurate and rapid.

Owner:DONGGUAN UNIV OF TECH

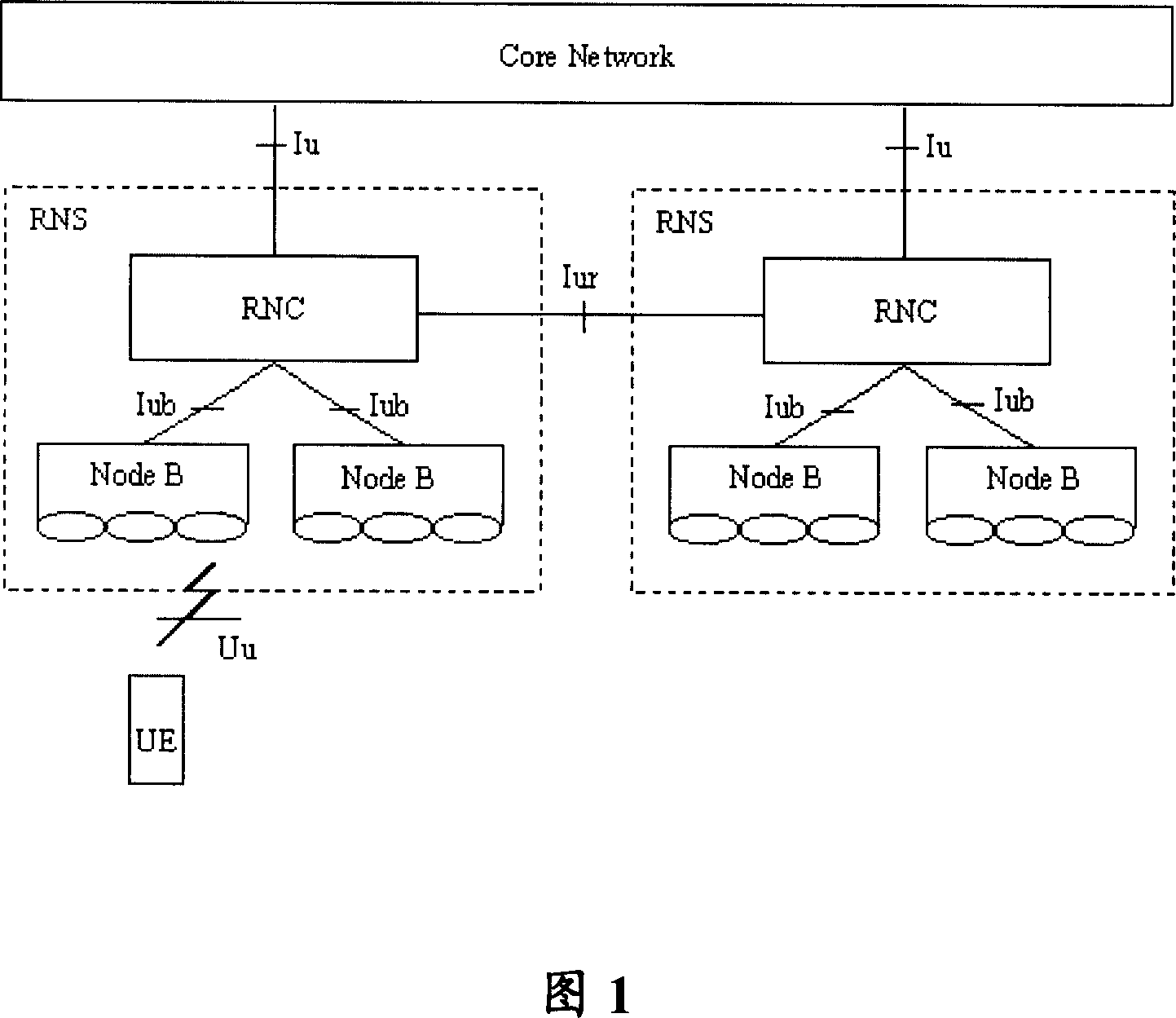

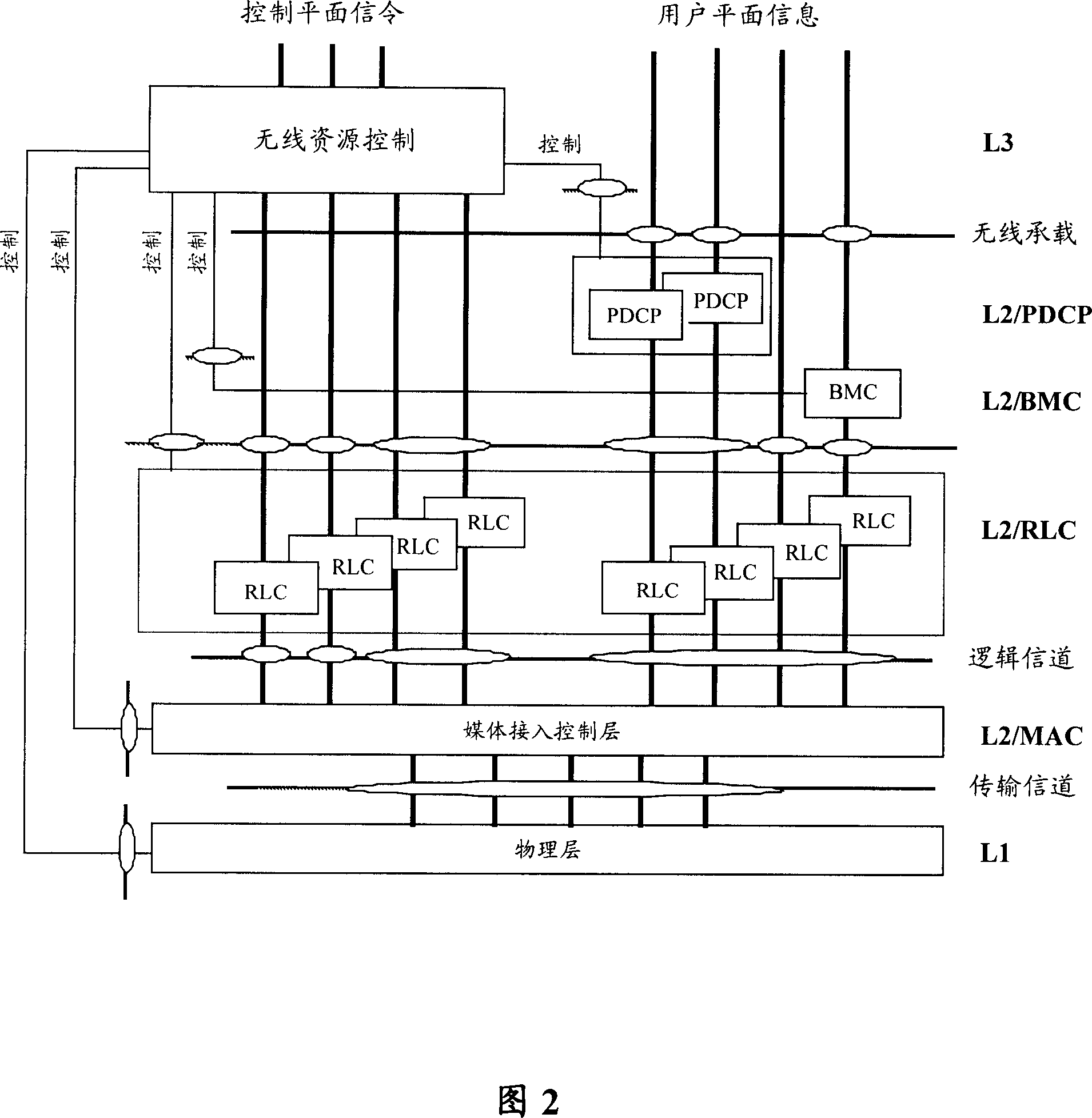

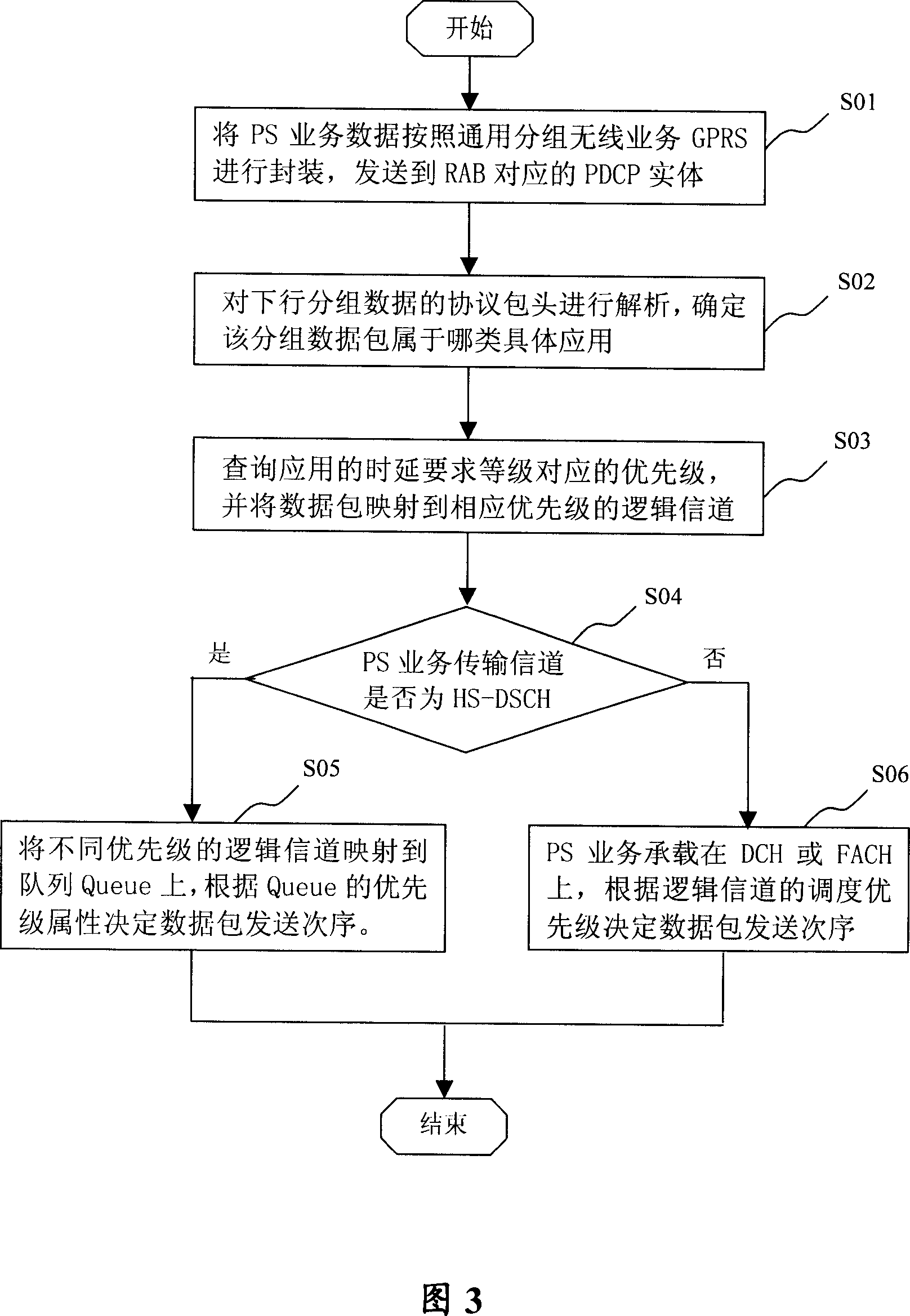

Wireless access loaded packet data service QoS management method.

InactiveCN1968198ASend quicklyMeet performance requirementsRadio/inductive link selection arrangementsData switching networksTraffic capacitySupport group

The invention relates to a QoS manage method of wireless access support group data service, wherein it comprises that: judging the service type of data supported by wireless access; based on said type, finding the sending priority of data pack; projecting the data pack with high priority to the channel with high priority, to be sent out. When the time delay demand of application service, based on the data flux of target address, classifying the priorities; projecting the data pack with low data flux to the logic channel with high priority, to confirm the application data pack with high time delay demand to be sent quickly, to meet the service quality QoS of different application services.

Owner:HUAWEI TECH CO LTD

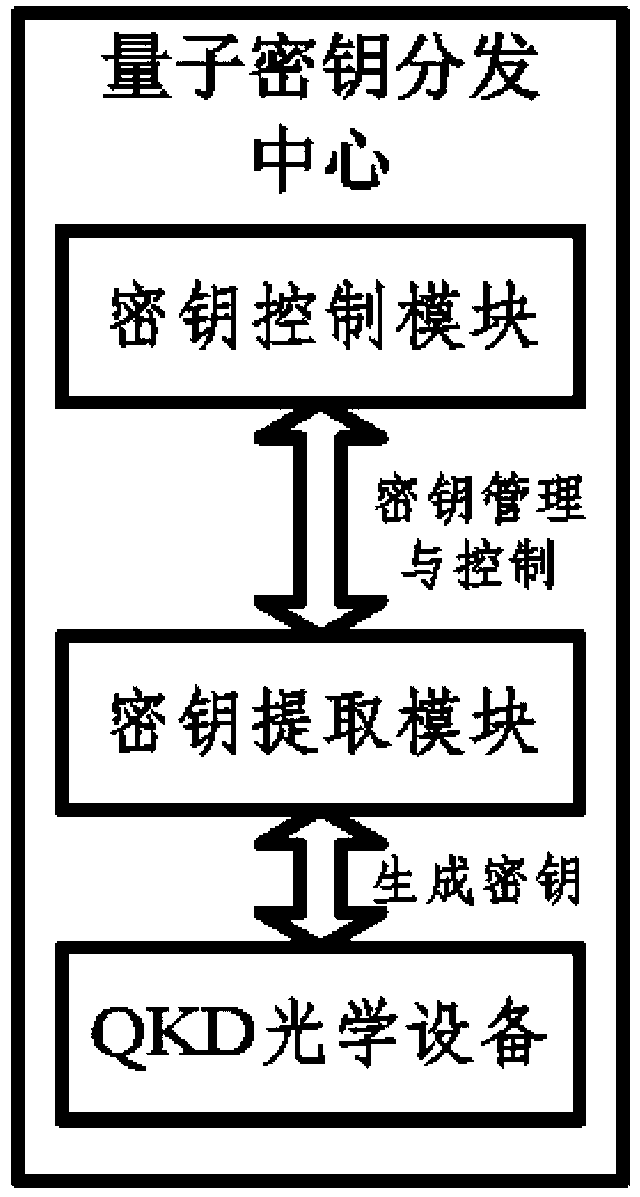

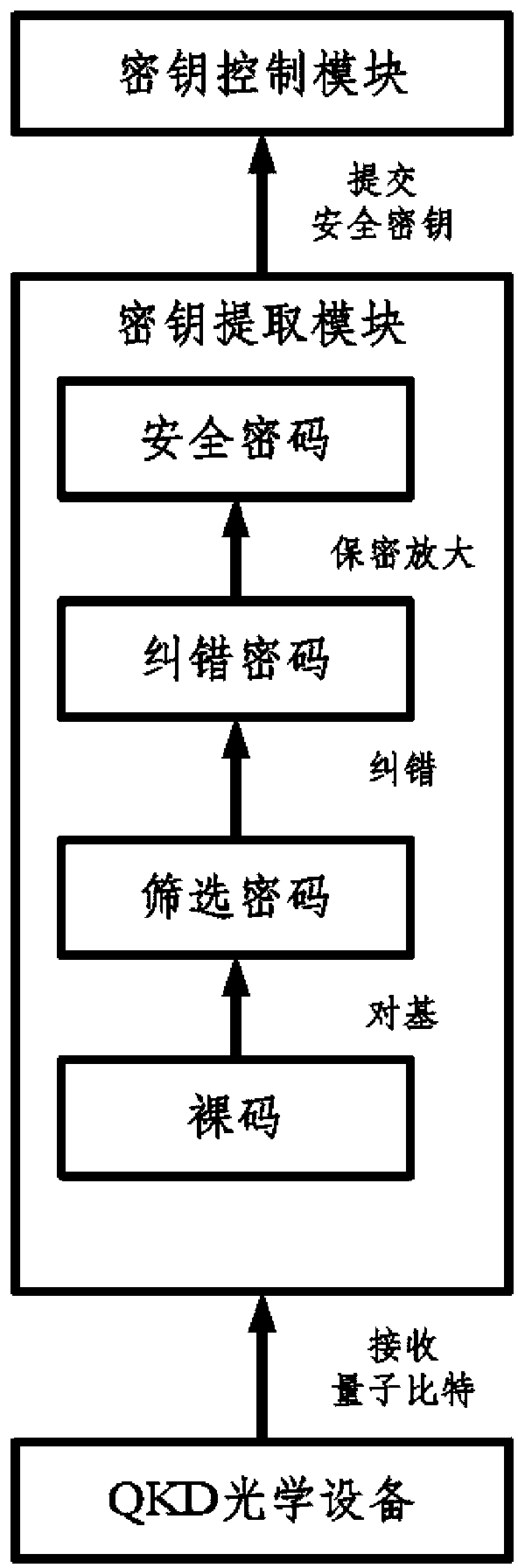

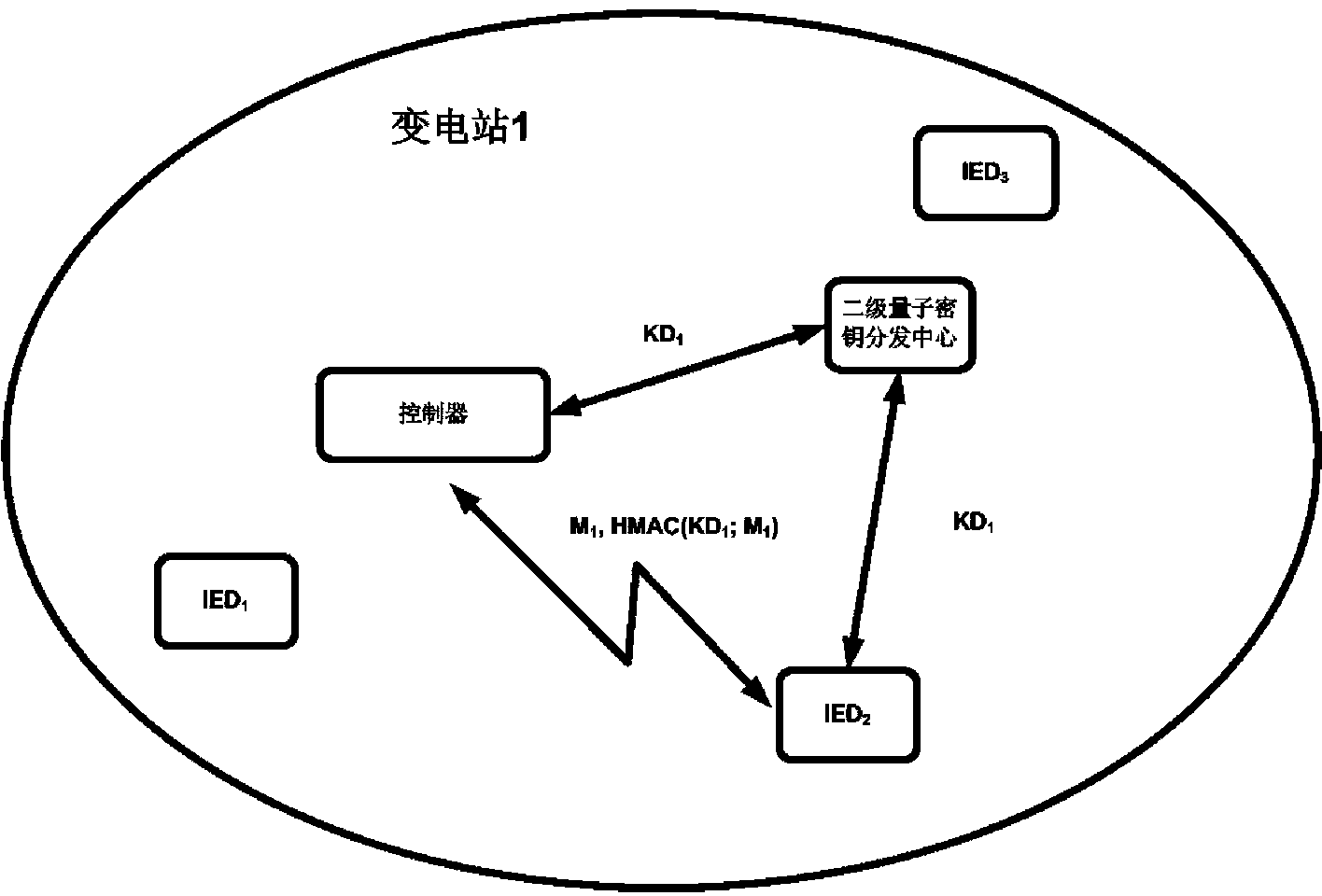

Transformer substation quantum communication model, quantum secret key distribution center and model achieving method

ActiveCN102983965AImprove efficiency and safetyEnhanced secure transportKey distribution for secure communicationKey distribution centerQuantum key distribution

The invention relates to a transformer substation quantum communication model, a quantum secret key distribution center based on the model and a model achieving method. The communication model is a quantum secret key distribution system and comprises a quantum secret key distribution (QKD) optical device, a secret key obtaining module and a secret key control module. The secret key control module, the secret key obtaining module and the QKD optical device are connected in sequence. The quantum secret key distribution center comprises two levels. A primary quantum secret key distribution center (QKDC) is configured in a control center, and a second QKDC is configured at the controller end of a transformer substation. By defining a password suite compatible with secret key distribution protocol and designing a secret key distribution method, the safety and the efficiency of secret key distribution are improved, safe transmission of data is strengthened, and stability and safety of a power system network in operation are guaranteed.

Owner:CHINA ELECTRIC POWER RES INST +2

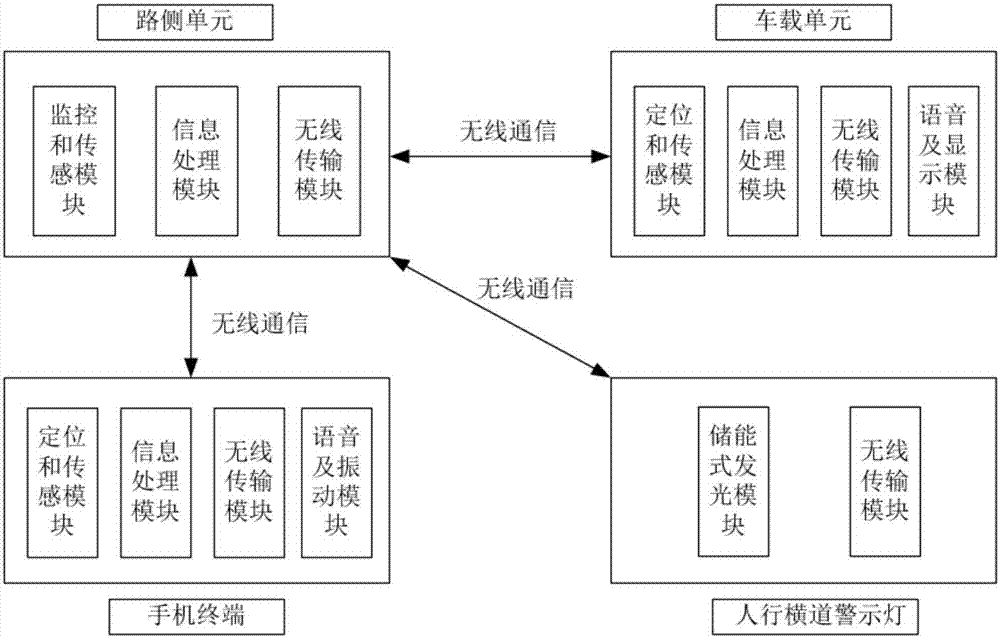

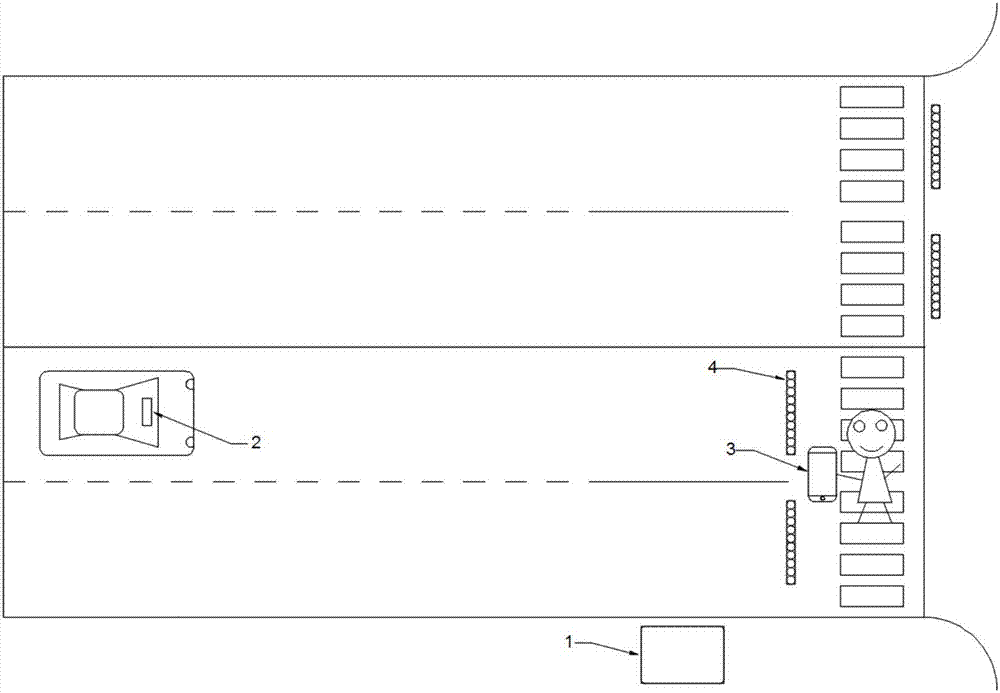

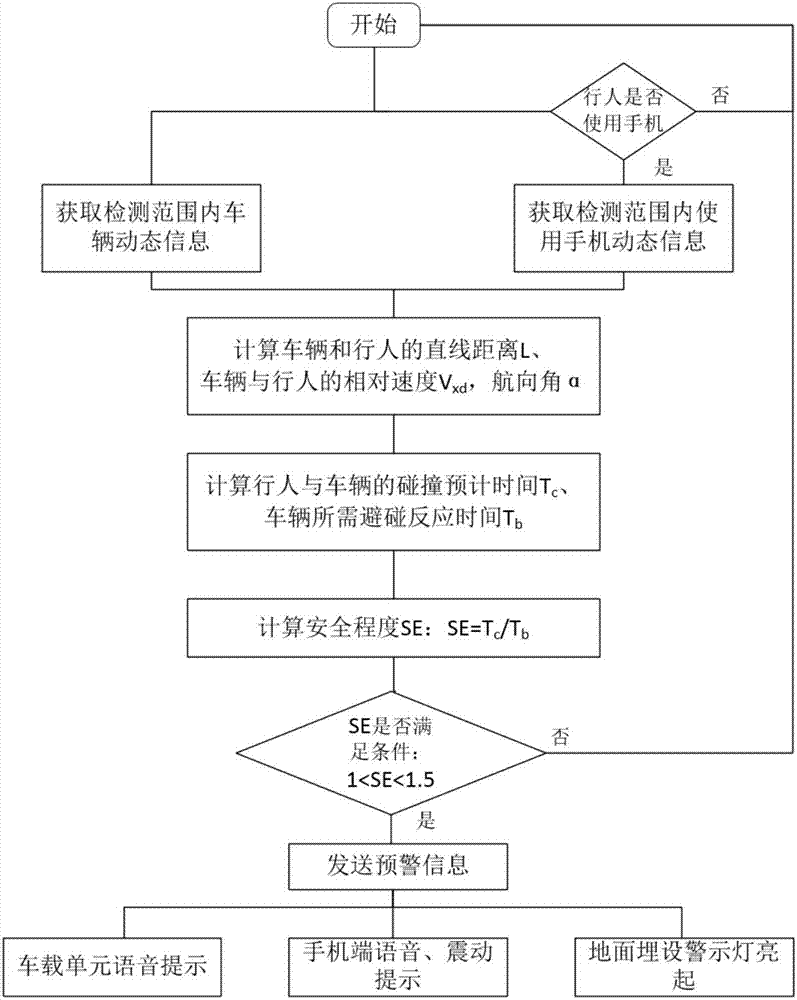

A traffic safety pre-warning system and method for pedestrians using mobile phones

InactiveCN107274722AAchieve sharingImprove street safetyArrangements for variable traffic instructionsAnti-collision systemsVehicle dynamicsInformation sharing

The invention provides a traffic safety pre-warning system for pedestrians using mobile phones. The system comprises mobile terminals arranged in the mobile phones of the pedestrians; on-board units arranged in vehicles; a pedestrian crossing warning light arranged on a pedestrian crossing and used for giving alarm light when receiving a pre-warning instruction sent by a road side unit; and the road side unit arranged at the roadside of a pedestrian crossing of an intersection or a road section and used for analyzing whether conflict occurs between vehicles and pedestrians according to pedestrian dynamic information and vehicle dynamic information in a radiation area, and sending the pre-warning instruction to the mobile terminals of the pedestrians and the on-board units of the vehicles, wherein the pedestrians and the vehicles may have conflict, as well as the pedestrian crossing warning light. The system is arranged on the pedestrian crossing of an unsignalized intersection or road section, so that information sharing between drivers and crossing pedestrians can be realized efficiently and safely; and a unified safety early warning judgment criteria is established, thereby making up for the dangers possibly brought about by sensory differences between the drivers and the pedestrians.

Owner:WUHAN UNIV OF TECH

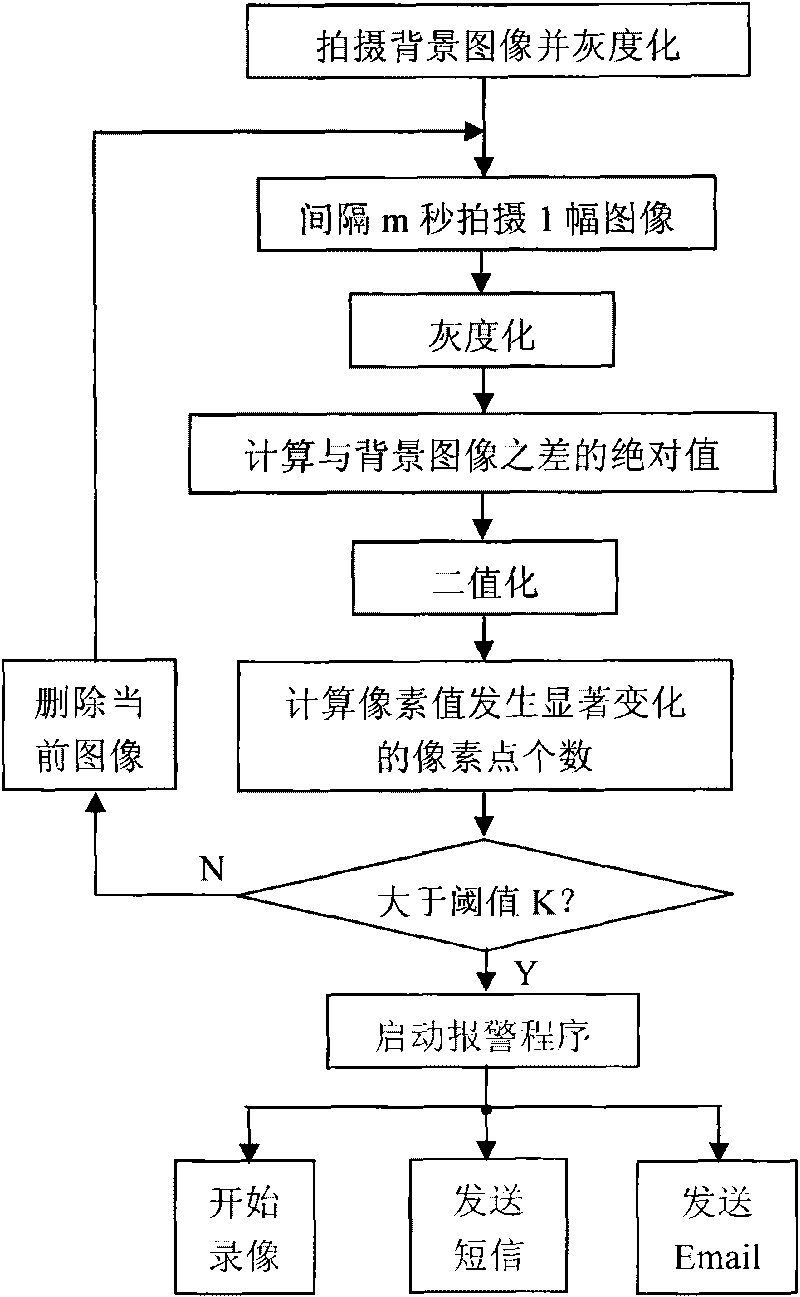

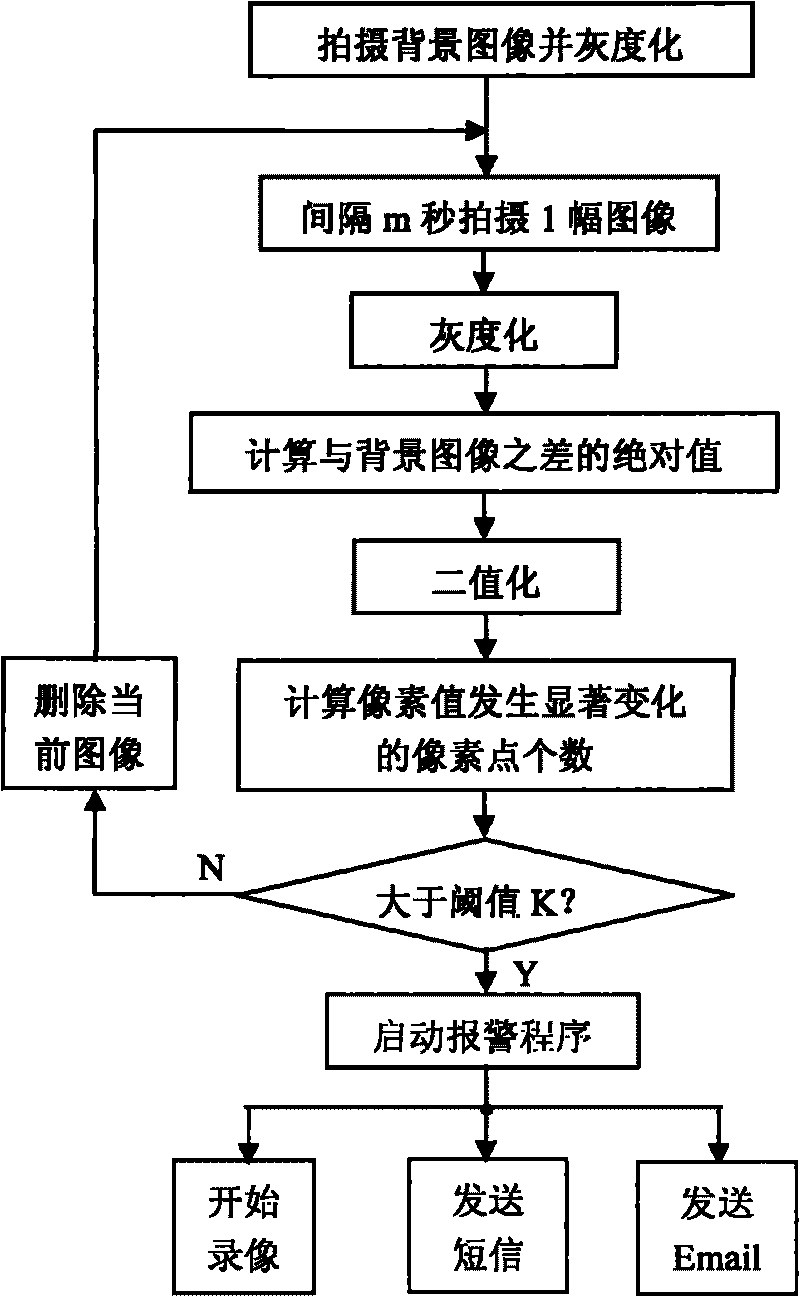

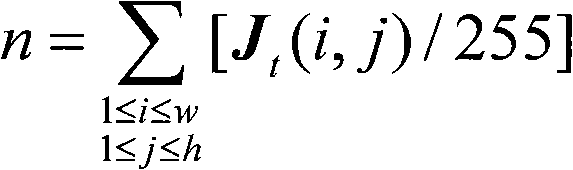

Difference method-based indoor video monitoring and alarming method

InactiveCN101720031ASave storage spaceSend quicklyTelevision system detailsColor television signals processingVideo monitoringSecurity guard

Owner:BEIJING INSTITUTE OF TECHNOLOGYGY

Multimedia data transmission method of concurrent access of multiple threads

InactiveCN101309125AOvercoming Bandwidth BottlenecksHigh real-time requirementsError prevention/detection by using return channelData switching networksData transmissionMulti link

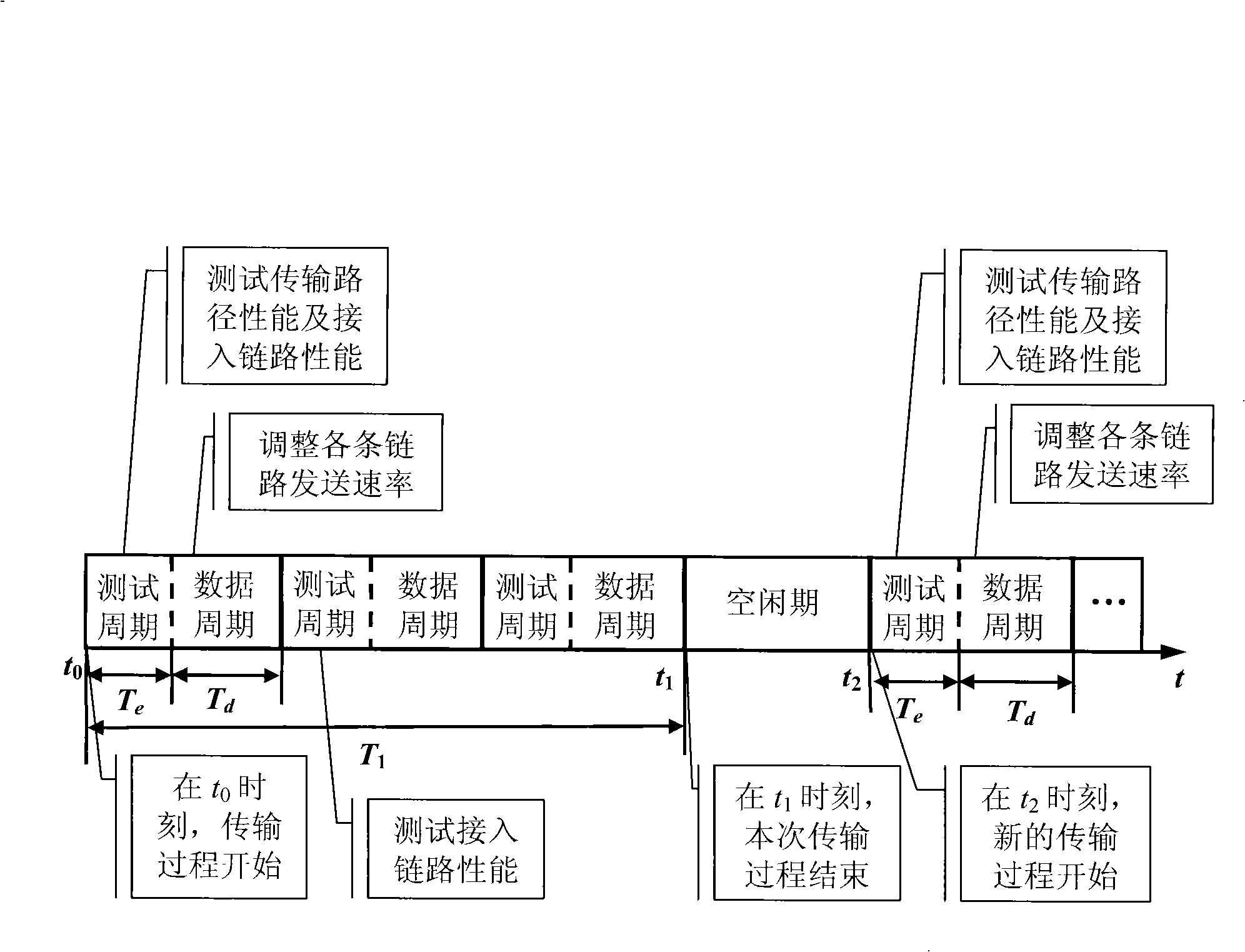

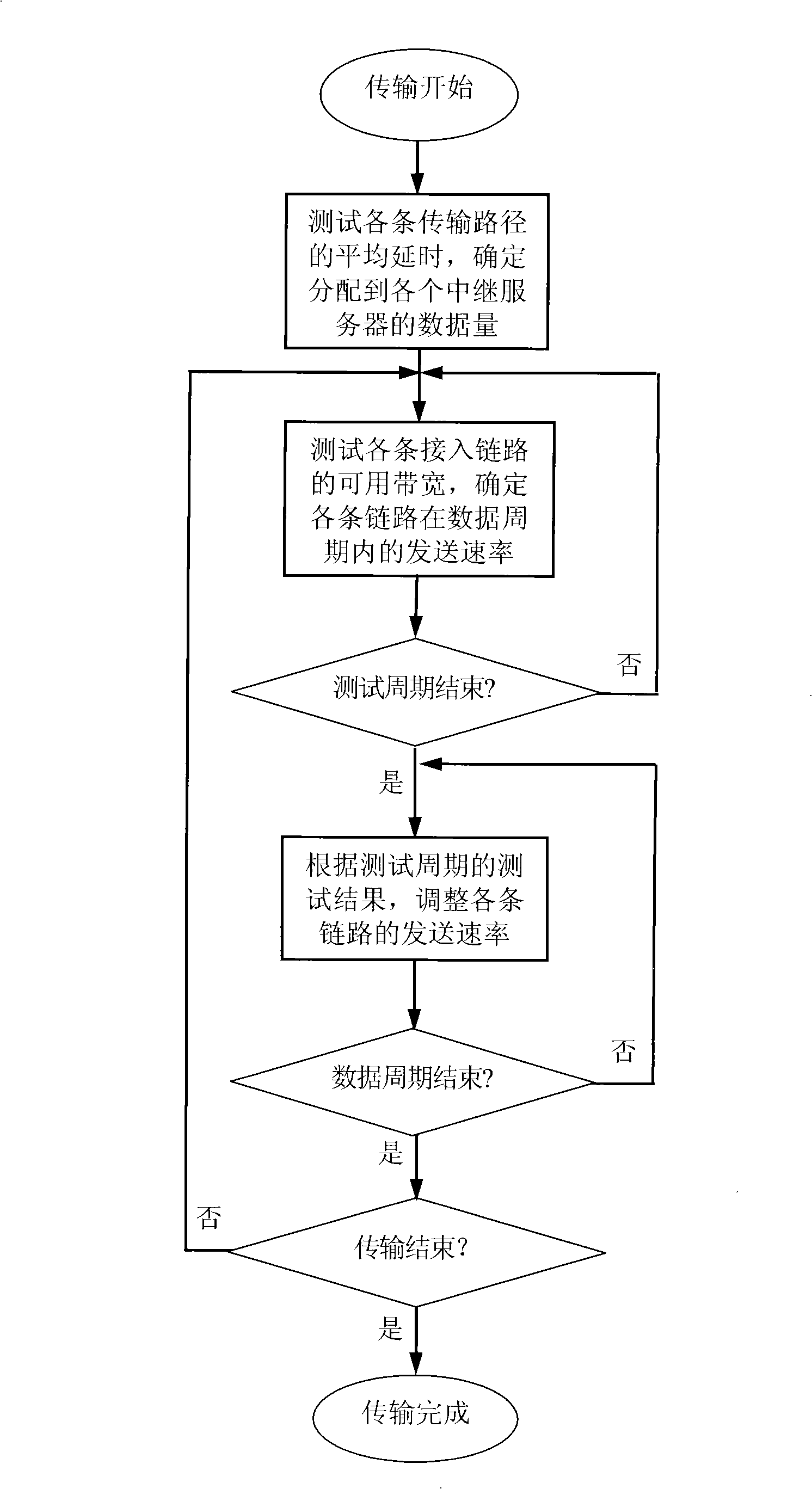

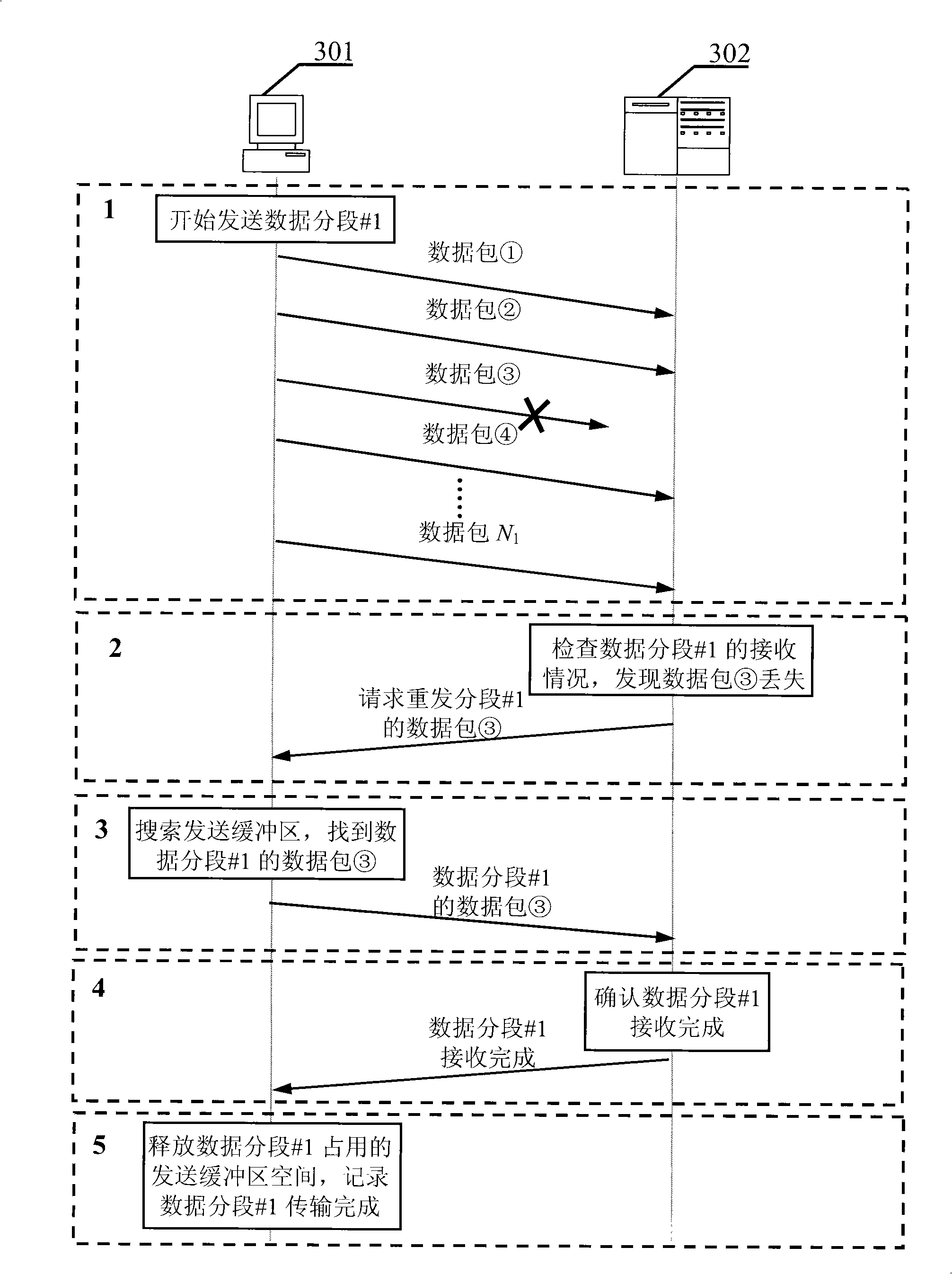

The invention relates to a multi-link concurrent access multimedia data transmission method. The present method that using a single operator to provide transmission bandwidth can not support the high quality and real time transmission of multimedia service. The invention provides a multi-link concurrent access multimedia data transmission method which includes the server information acquisition, the segmentation of the data to be transmitted, the data transmission, and priority distinguished data transmission and data protection. Wherein, the data transmission includes an alternative test cycle and a data cycle; in the test cycle, the transmitting equipment test the performance of the data transmission link and the access link; in the data cycle, the transmitting equipment transmits data at each link according to the test result of the test cycle, thereby making full use of the link bandwidth resource and avoiding the link congestion. The multi-link concurrent access multimedia data transmission method of the invention adopts the transmission type by distinguishing the priority of different data at different priority; thereby ensure the transmission reliability of the high priority data.

Owner:ZHEJIANG UNIV

Digital touch on live video

InactiveUS20170357324A1Faster and efficient method and interfaceIncreased efficiency and effectiveness and user satisfactionInput/output for user-computer interactionDrawing from basic elementsFinger touchLive video

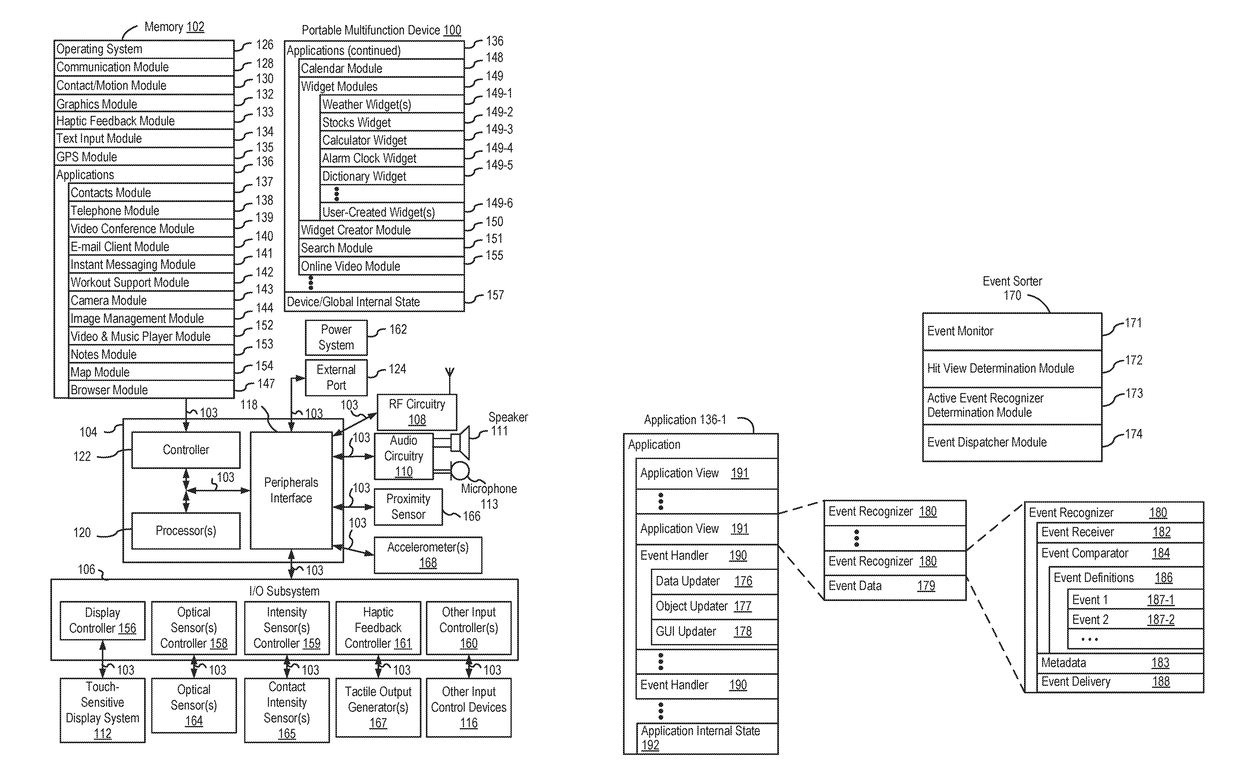

The present disclosure generally relates to electronic touch communications that include visual information, such as a video or image in combination with visual representations that are based on a single-finger touch input or a multiple-finger touch input.

Owner:APPLE INC

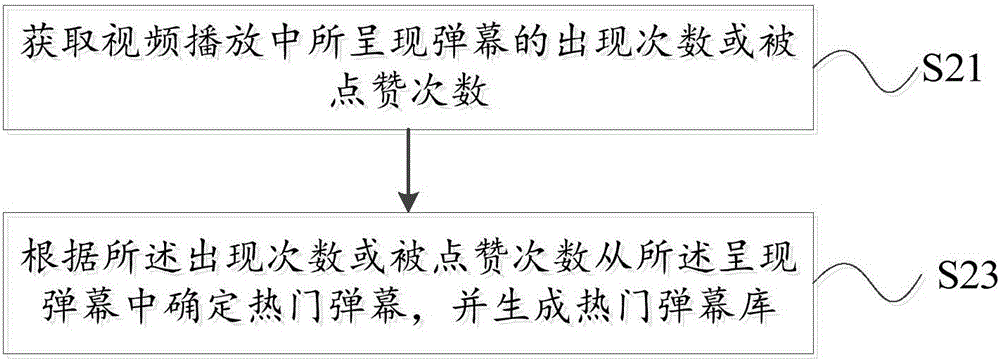

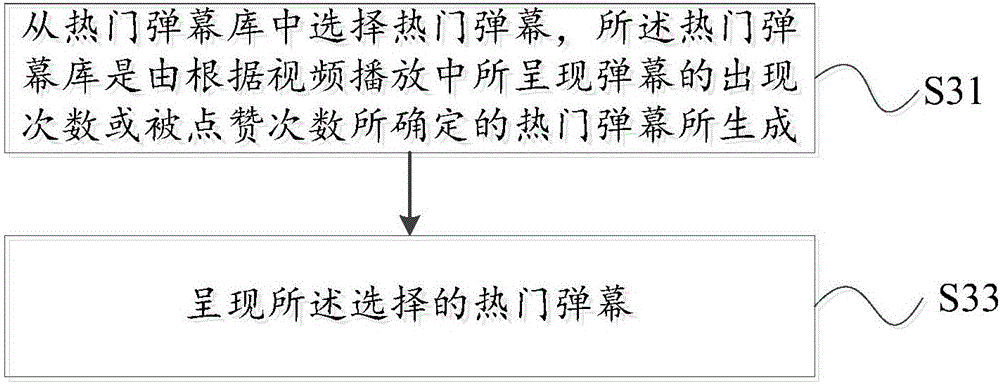

Bullet screen generation method and apparatus, bullet screen presentation method and apparatus, server and client

InactiveCN106028161ASend quicklyImprove experienceSelective content distributionSoftware engineeringMechanical engineering

The invention relates to a bullet screen generation method and apparatus, a bullet presentation method and apparatus, a server and a client. The bullet screen generation method comprises the steps of: acquiring occurrence frequencies or liked frequencies of bullet screens presented in the video playing process; and according to the occurrence frequencies or the liked frequencies, determining hot bullet screens from the presented bullet screens, and generating a hot bullet screen library. According to the embodiment of the methods and apparatuses, the server, and the client, by generating the hot bullet screen library and selecting the hot bullet screens from the hot bullet screen library, rapid sending of bullet screens is implemented, and user experience is enhanced.

Owner:LETV HLDG BEIJING CO LTD +1

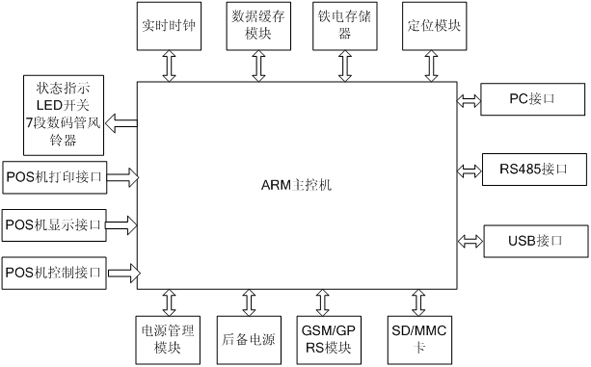

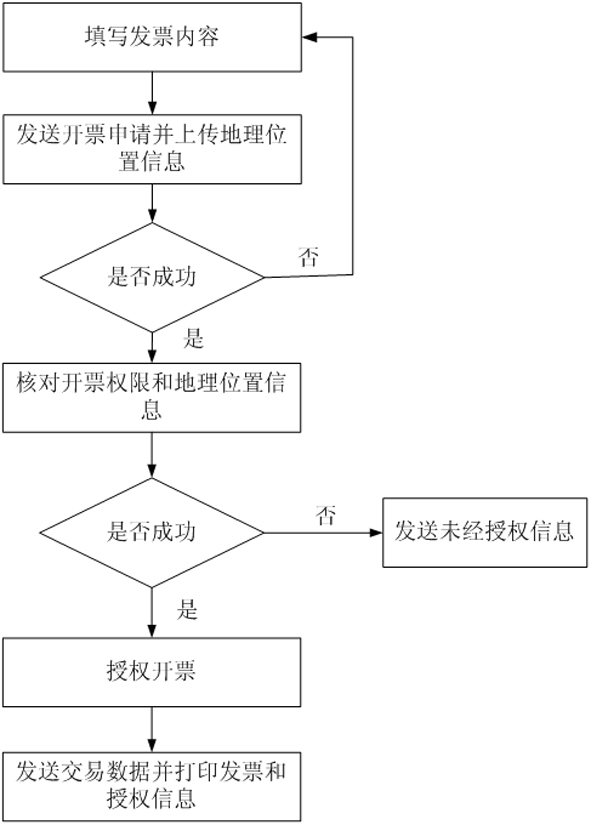

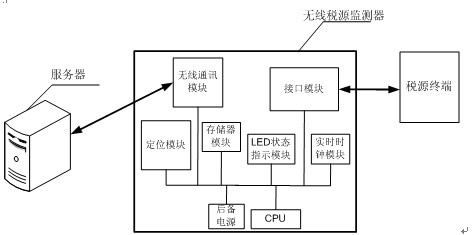

System and method for preventing taxpayer from invoicing beyond geographic range

InactiveCN101916487AStrengthen tax source monitoringTo achieve the purpose of data management taxCash registersTransaction dataInvoice

The invention relates to a system for preventing a taxpayer from invoicing beyond a geographic range. The system comprises a tax source terminal, a wireless tax source monitor and a background server, wherein the wireless tax source monitor corresponds to the tax source terminal; the background server is used for checking the authority of the wireless tax source monitor, checking geographic position information and authorizing and receiving transaction data; the wireless tax source monitor comprises a wireless communication module, a positioning module, a memory module, a processor, an interface module and the like; the wireless communication module is used for transmitting invoice application, receiving authorization information and transmitting the transaction data; the positioning module is used for positioning the geographic position; the memory module is used for recording the real-time transaction data; the processor is used for acquiring the transaction data and controlling the operation of the whole monitor; and the interface module is used for connecting the processor with a point-of-sale (POS) machine and / or a computer. The invention also provides a wireless tax source monitoring method using the system. The tax source monitoring is enhanced from a source by combining a wireless communication technique, a geographic positioning technique and an on-line real-time invoicing technique, so that the aim of managing taxes through the data can be fulfilled really.

Owner:周绍君 +1

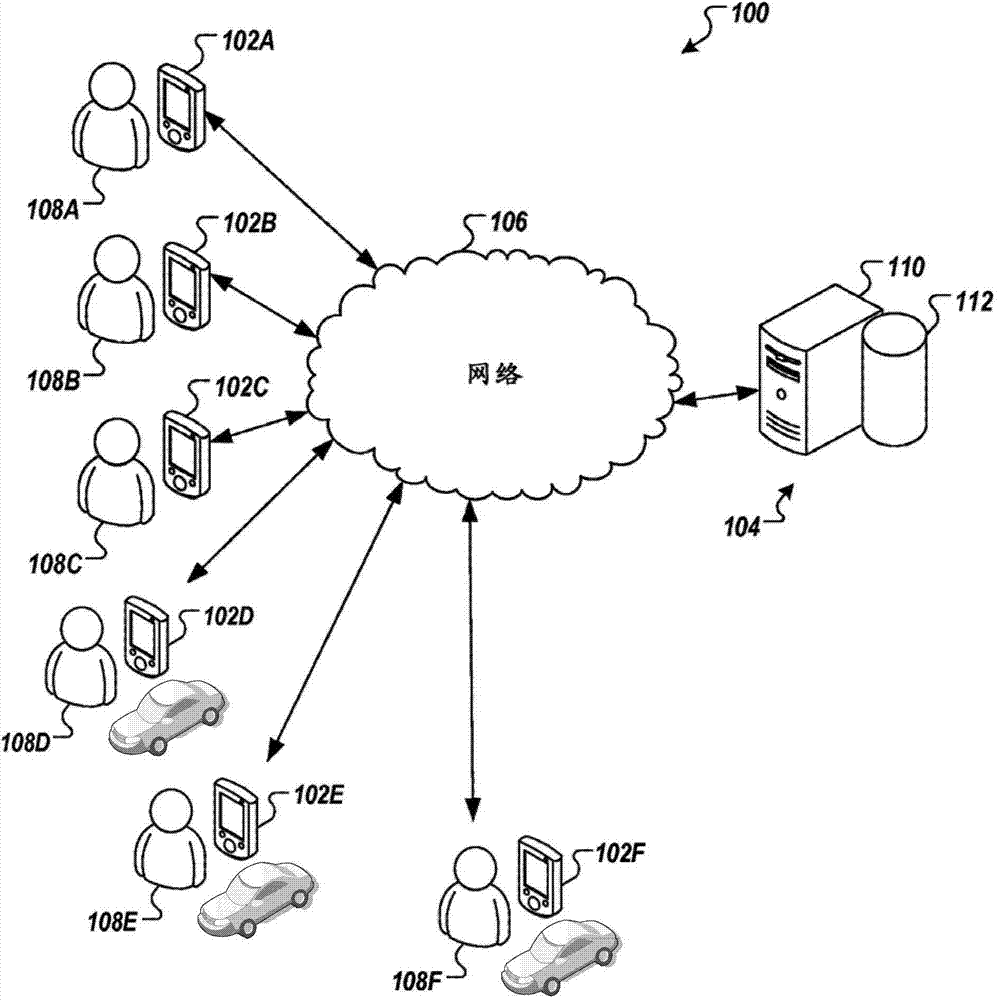

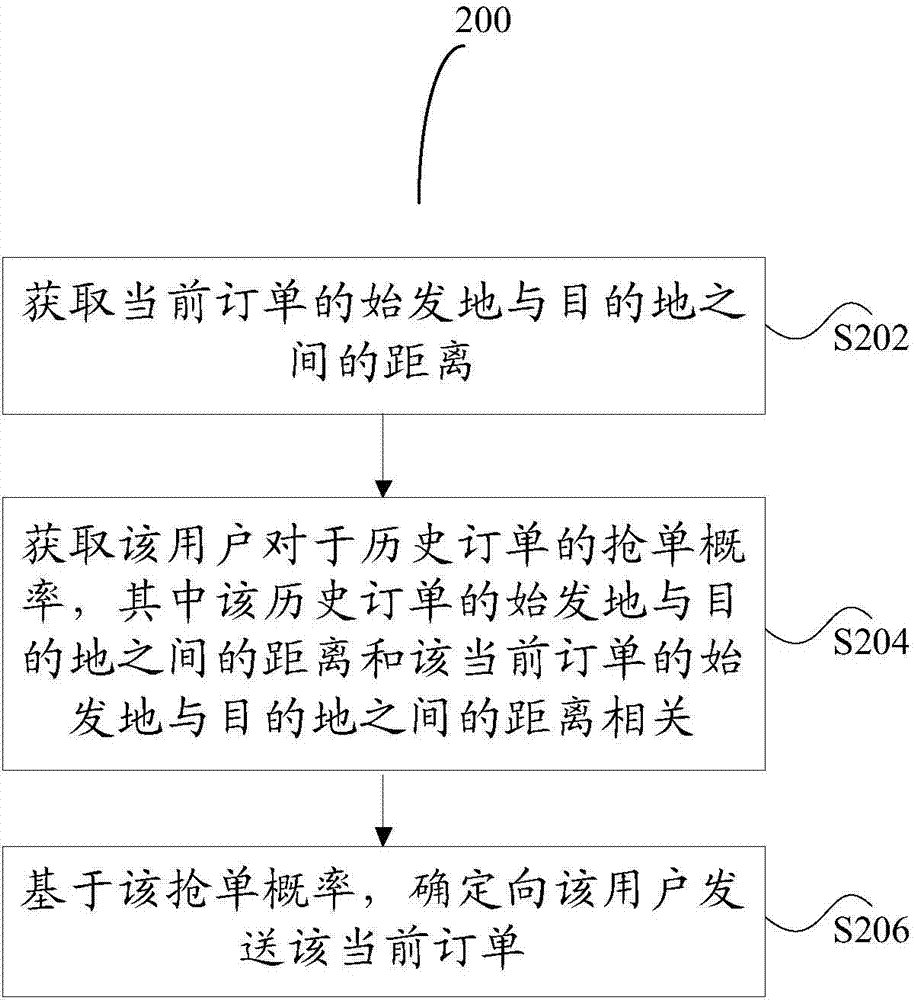

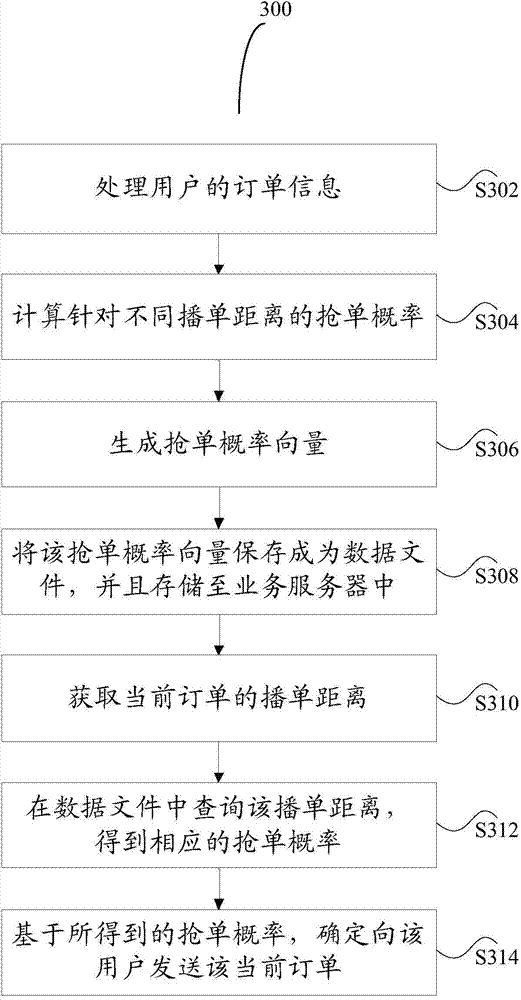

Method and device for processing orders

The embodiment of the invention discloses a method and a device for processing orders. The method comprises the following steps: acquiring the distance between a starting place and a destination of a current order; acquiring an order grabbing probability of historical orders, wherein the distance between the starting place and the destination of the horizontal orders is related to the distance between the starting place and the destination of the current order; transmitting the current order to the user on the basis of the order grabbing probability. According to the embodiment, the current order is transmitted to the user according to the order grabbing probability of the historical orders, and the distance between the starting place and the destination of the historical order is related to the distance between the starting place and the destination of the current order. By adopting the method and the device, the transmission of the order with no value or low value for the user can be reduced, and the high-value order for the user can be rapidly and precisely transmitted.

Owner:BEIJING DIDI INFINITY TECH & DEV

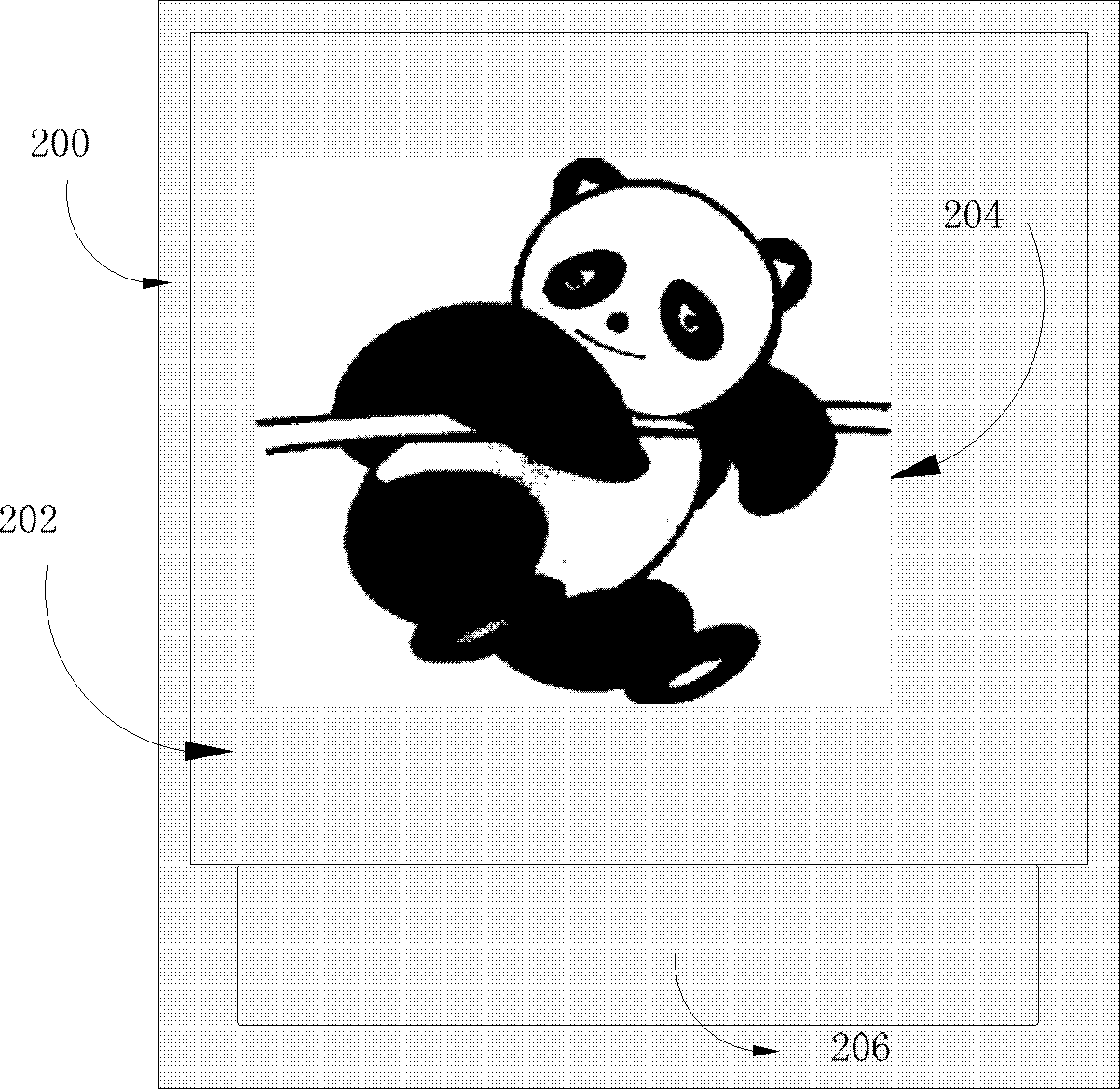

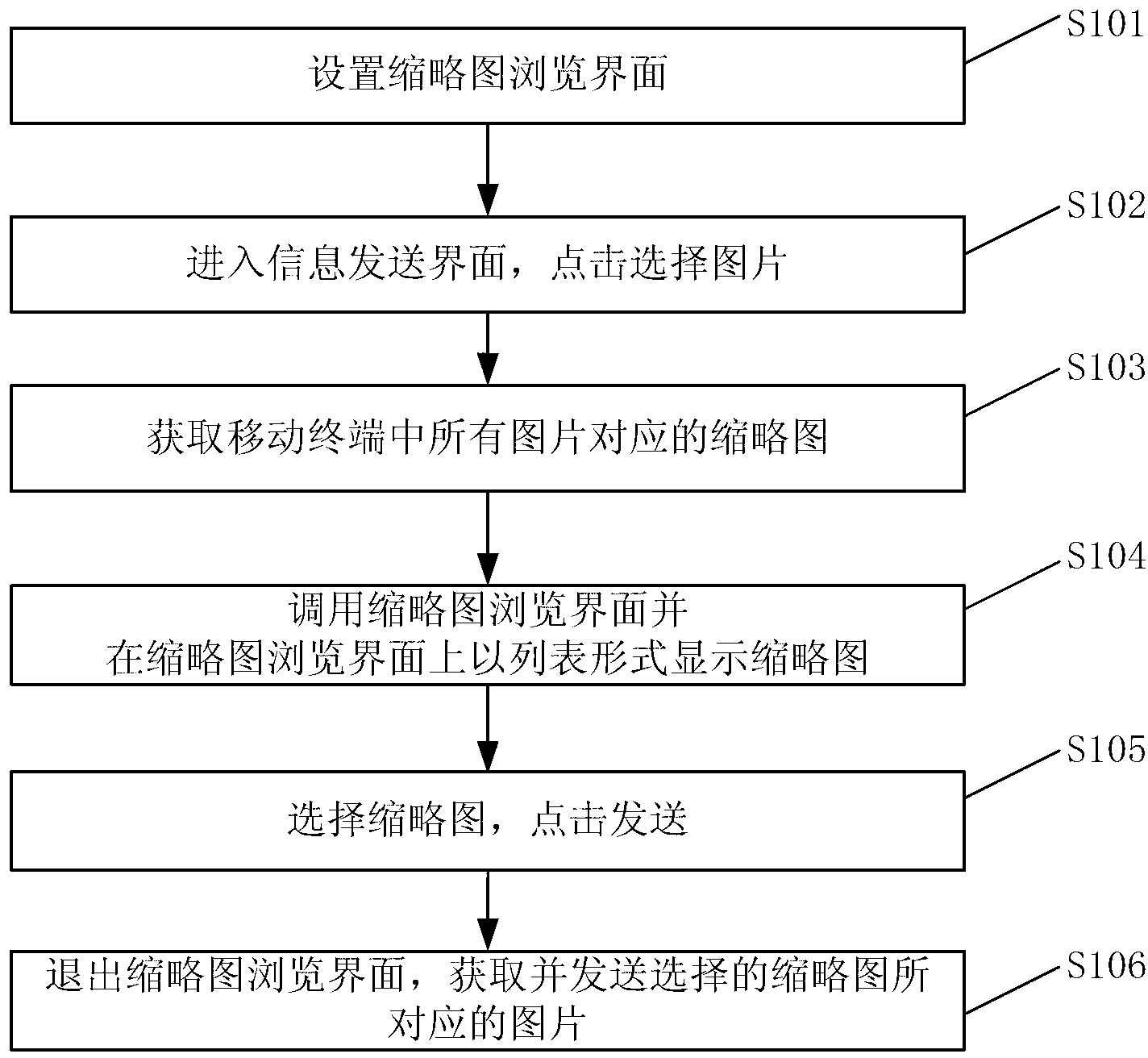

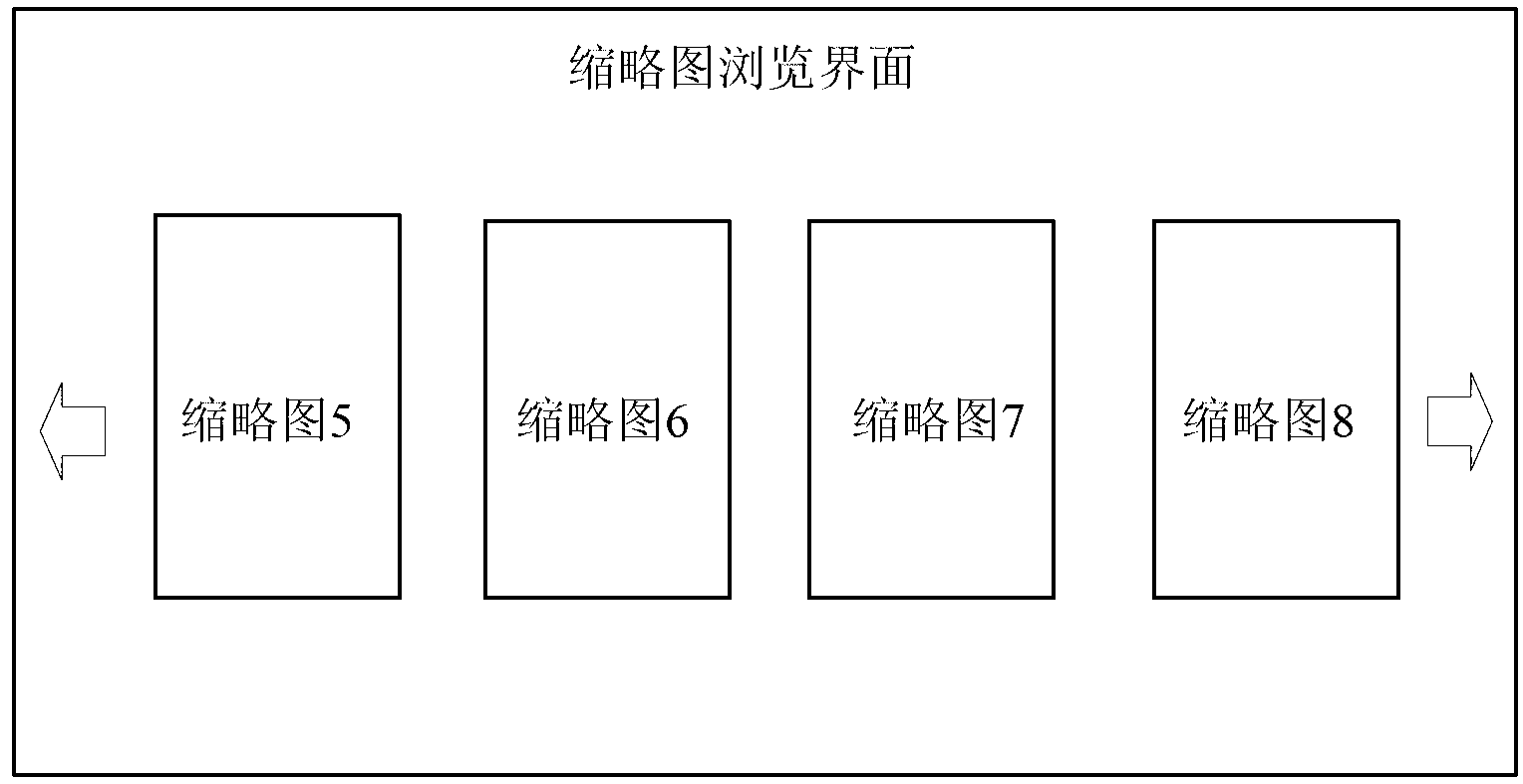

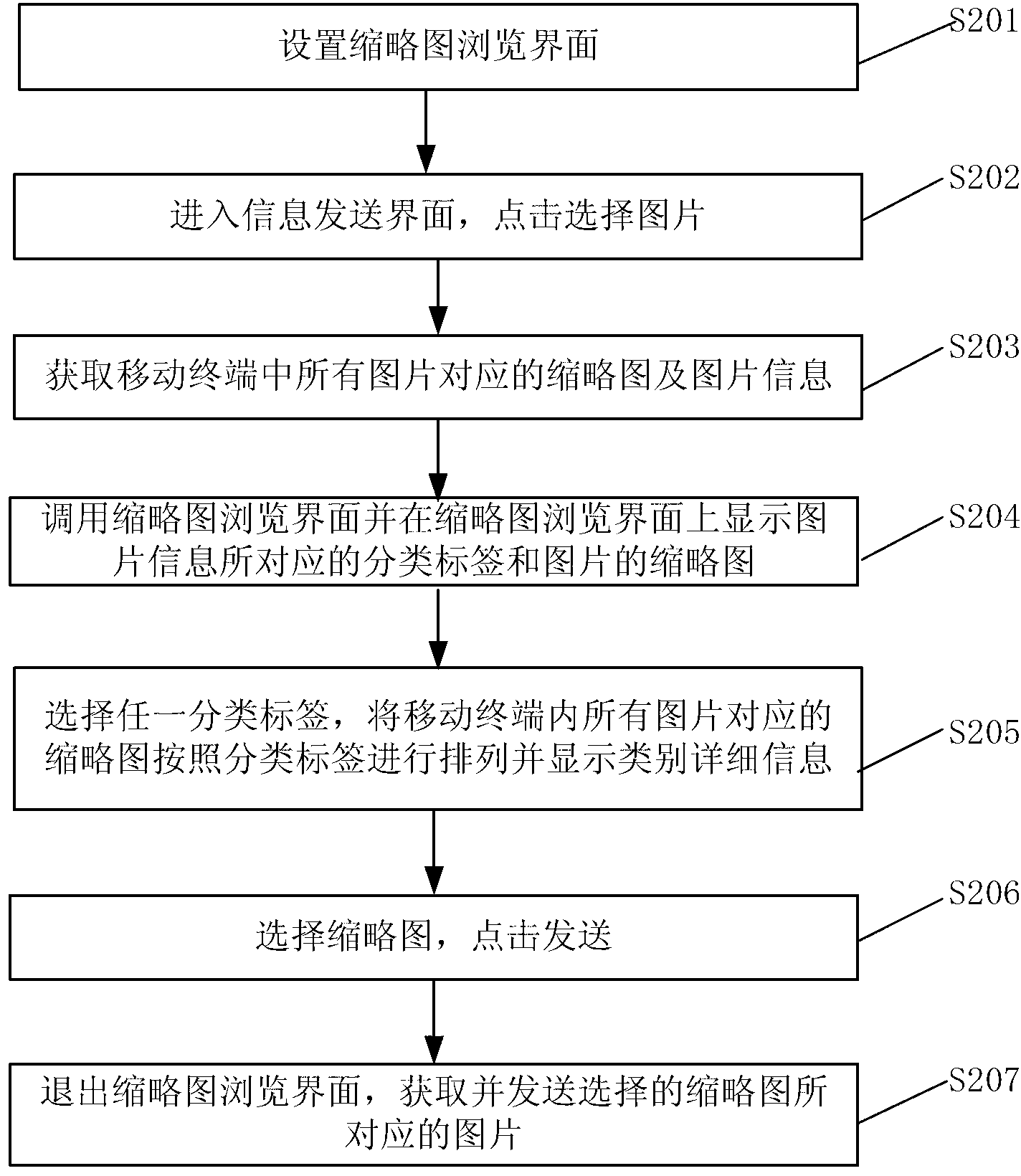

Method for rapidly sending pictures and mobile terminal thereof

InactiveCN103327182ASend quicklyImprove experienceSubstation equipmentInput/output processes for data processingThumbnailComputer terminal

The invention discloses a method for rapidly sending pictures. The method includes the following steps of obtaining and displaying thumbnails corresponding to all pictures in the mobile terminal, selecting the thumbnails, and obtaining and sending the pictures corresponding to the selected thumbnails. Compared with the prior art, the method for rapidly sending the pictures can directly obtain and display the thumbnails of all the pictures in the mobile terminal. When a certain picture needs sending, the corresponding thumbnail is selected, the picture corresponding to the thumbnail can be directly obtained from the mobile terminal and sent after the fact that the corresponding thumbnail is sent is confirmed, thus the problems that the pictures are difficult to open or obtain in a image browser and too much time is spent when a number of pictures exist are avoided, the pictures can be sent rapidly, and user experience is improved. The invention discloses the mobile terminal for rapidly sending the pictures at the same time.

Owner:GUANGDONG OPPO MOBILE TELECOMM CORP LTD

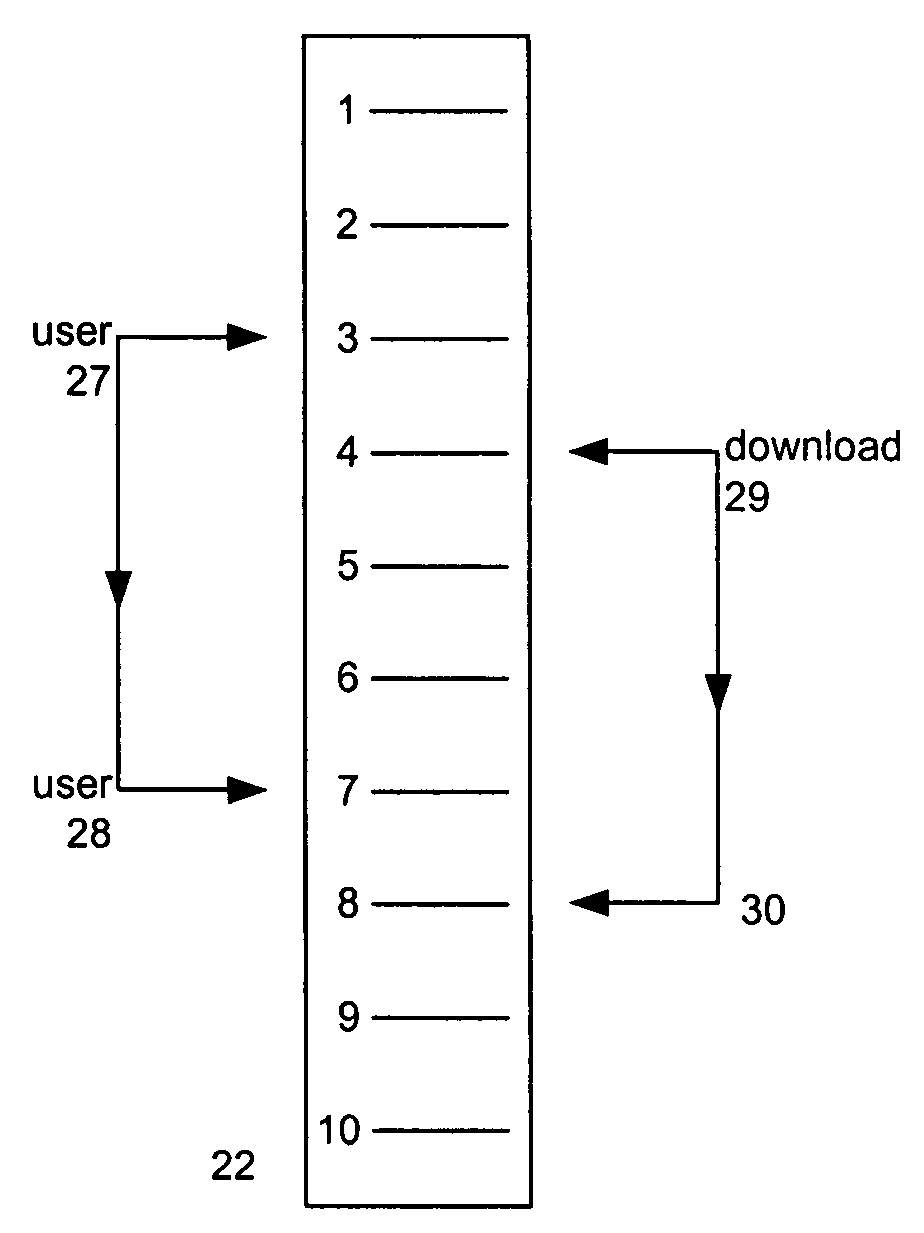

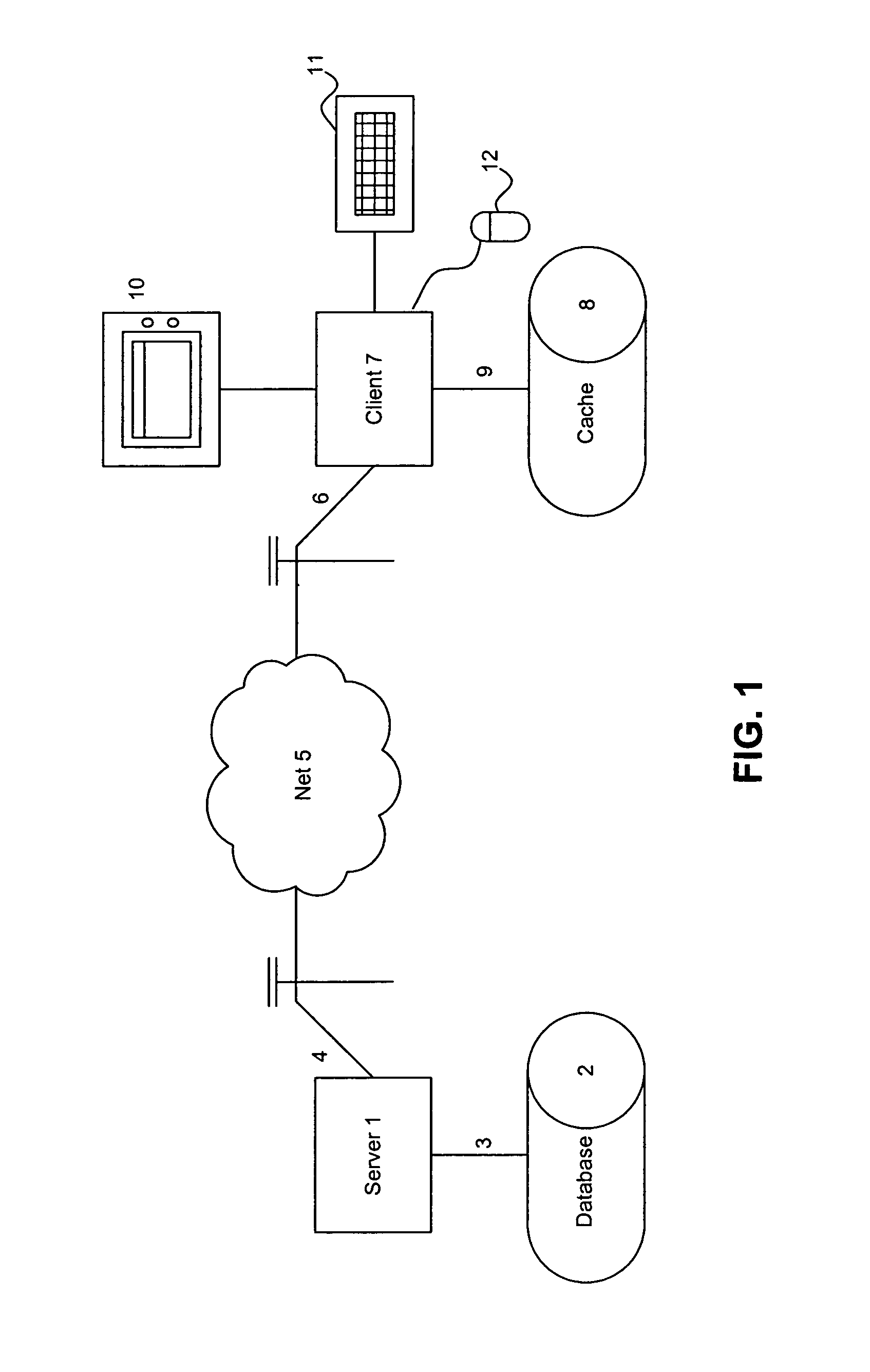

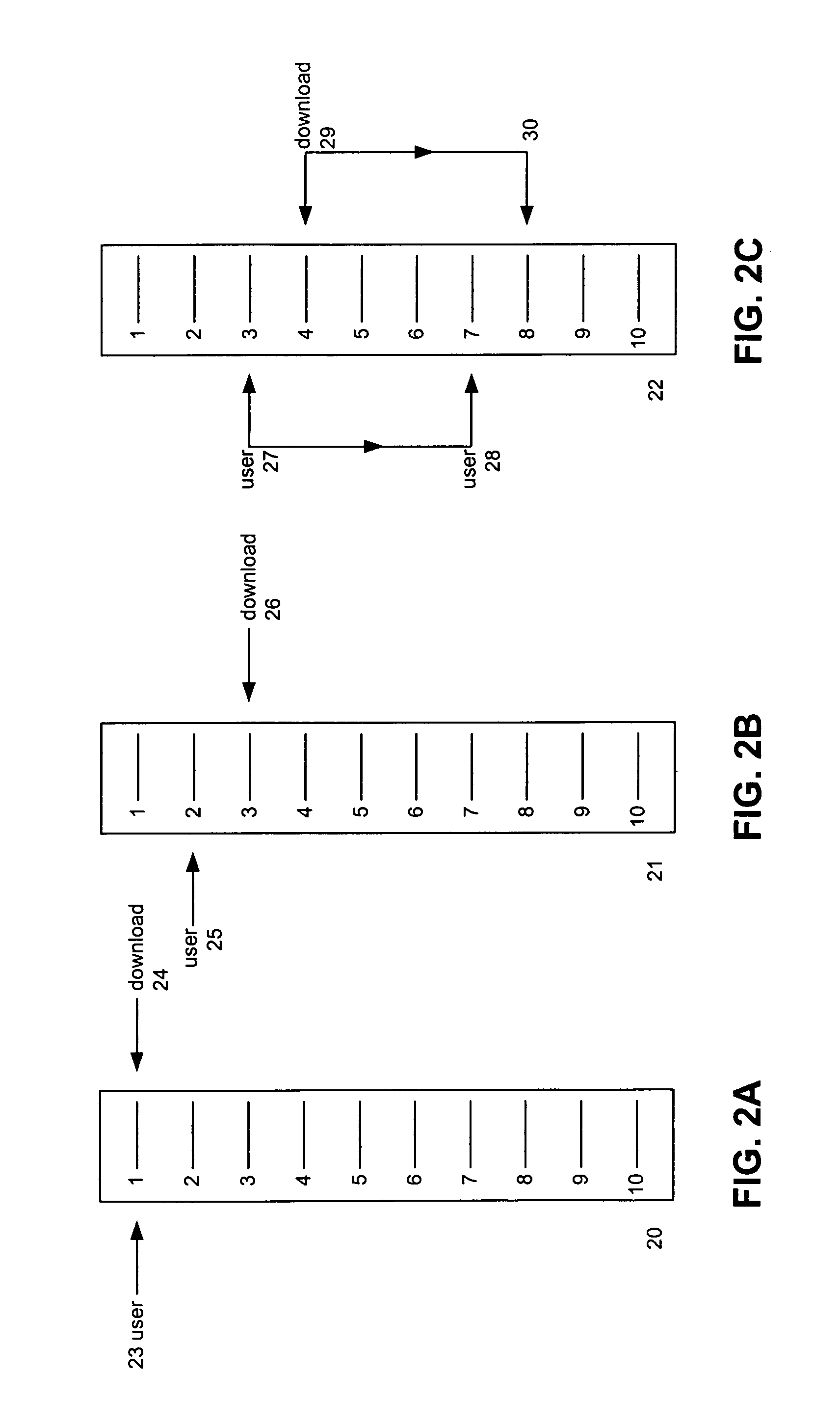

Method for queued overlap transfer of files

InactiveUS7024465B1Less cancellationSend quicklyDigital data information retrievalMultiple digital computer combinationsFile transmissionTelecommunications link

It is therefore an object of the invention to provide a system and method for prequeuing of files predicted to be desired by a user, through a telecommunications link, into a local cache, based on a list, wherein the prequeuing system is responsive to any change in file sequence of user review, such that predicted latencies for sequential file review from any given starting point are minimized. A system and method for reducing latency in a sequential record browser are provided, for defining a sequential list of records; selecting a record from the list for review; downloading the selected record, and records sequentially thereafter until interrupted; interrupting the downloading by electing a non-sequential record; and downloading the a non-sequential record and records sequentially thereafter until interrupted.

Owner:ACCESSIFY LLC

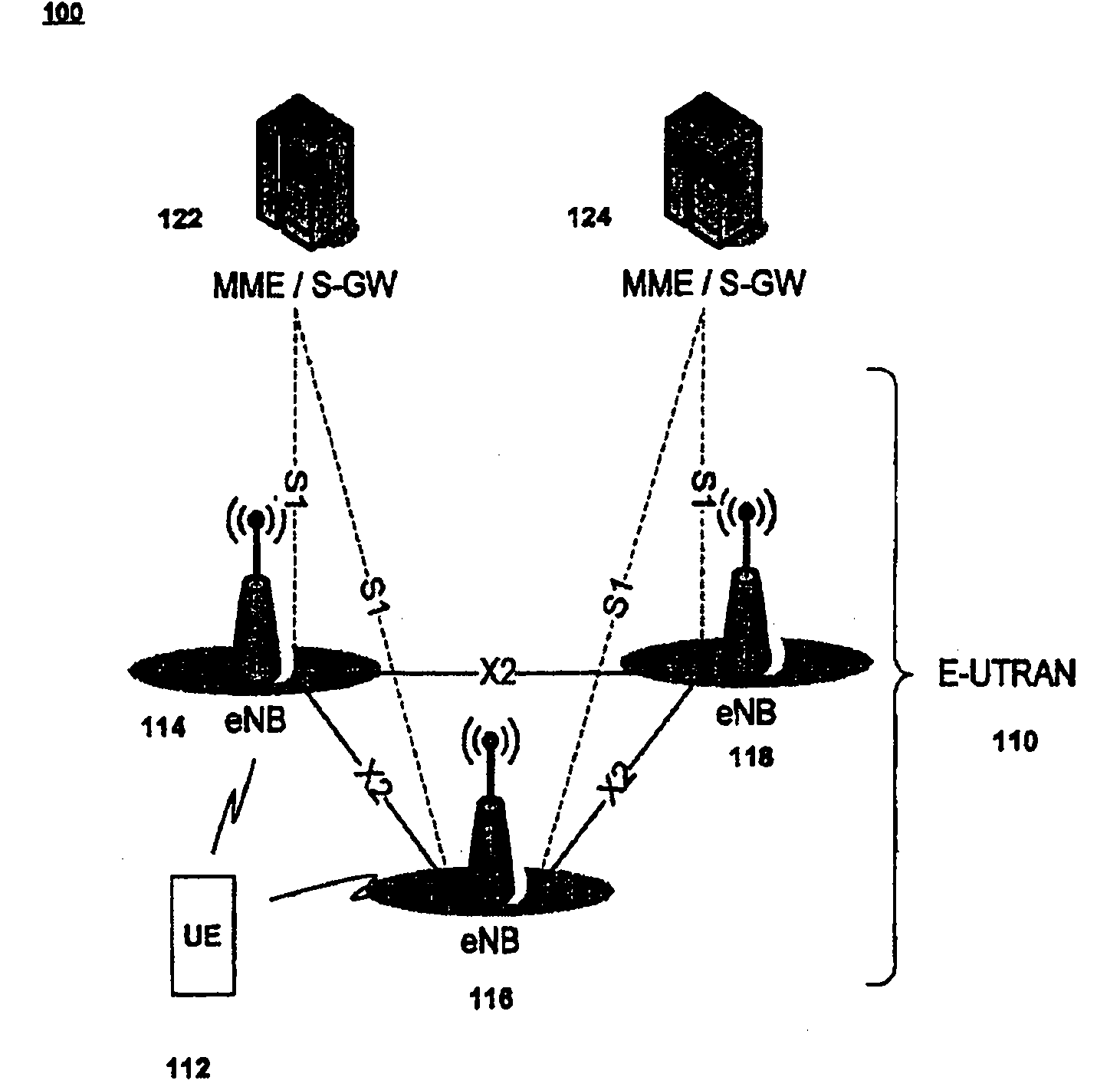

Method for transmitting MAC PDU

ActiveCN102067479ASend quicklySend efficientlyPower managementEnergy efficient ICTComputer hardwareRadio resource

With respect to generating and sending a MAC PDU by using the radio resources allocated to the mobile terminal, the level of priority between the buffer status report (BSR) and the established logical channels are defined such that the data of each logical channel and buffer status report can be more effectively, efficiently and quickly transmitted.

Owner:LG ELECTRONICS INC

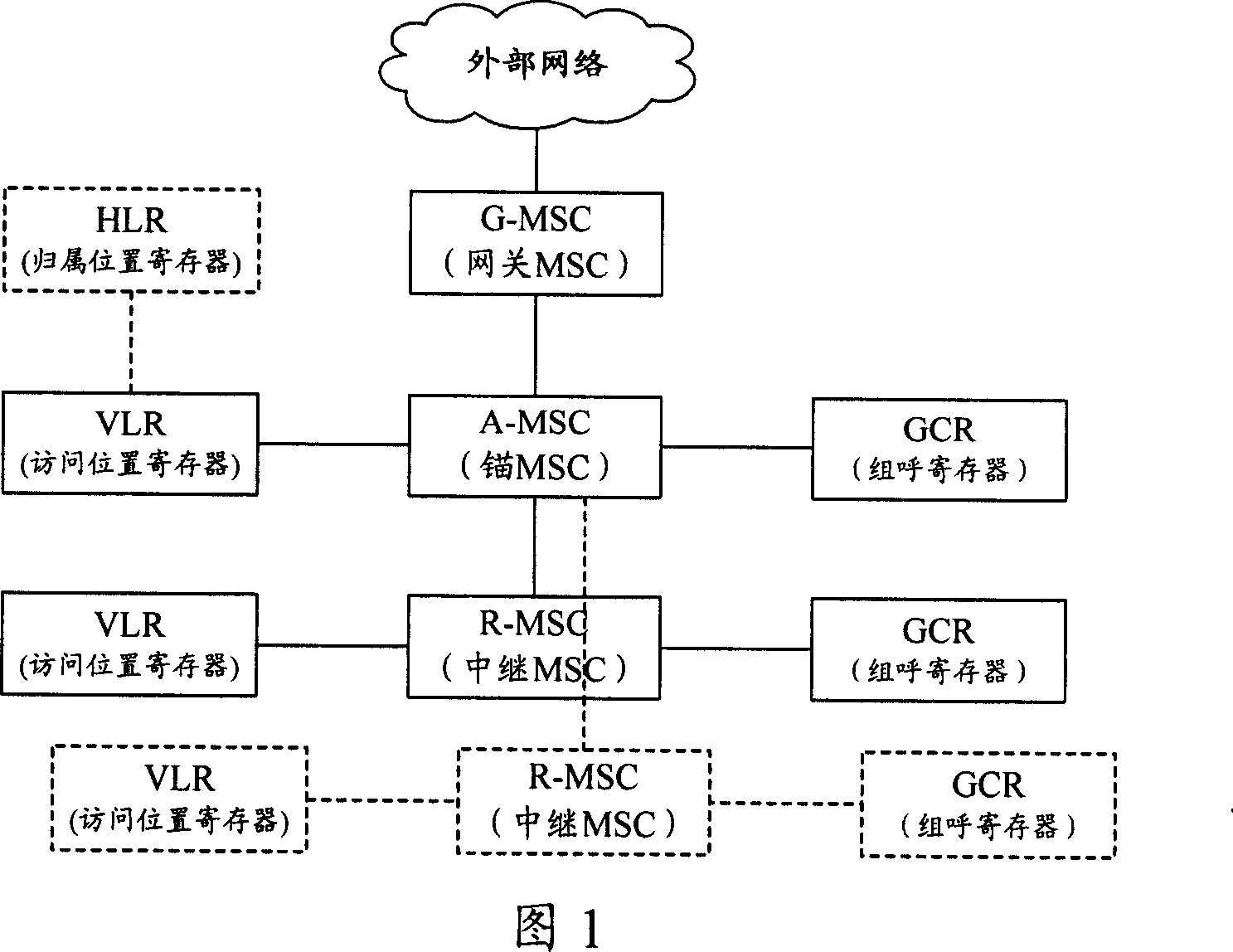

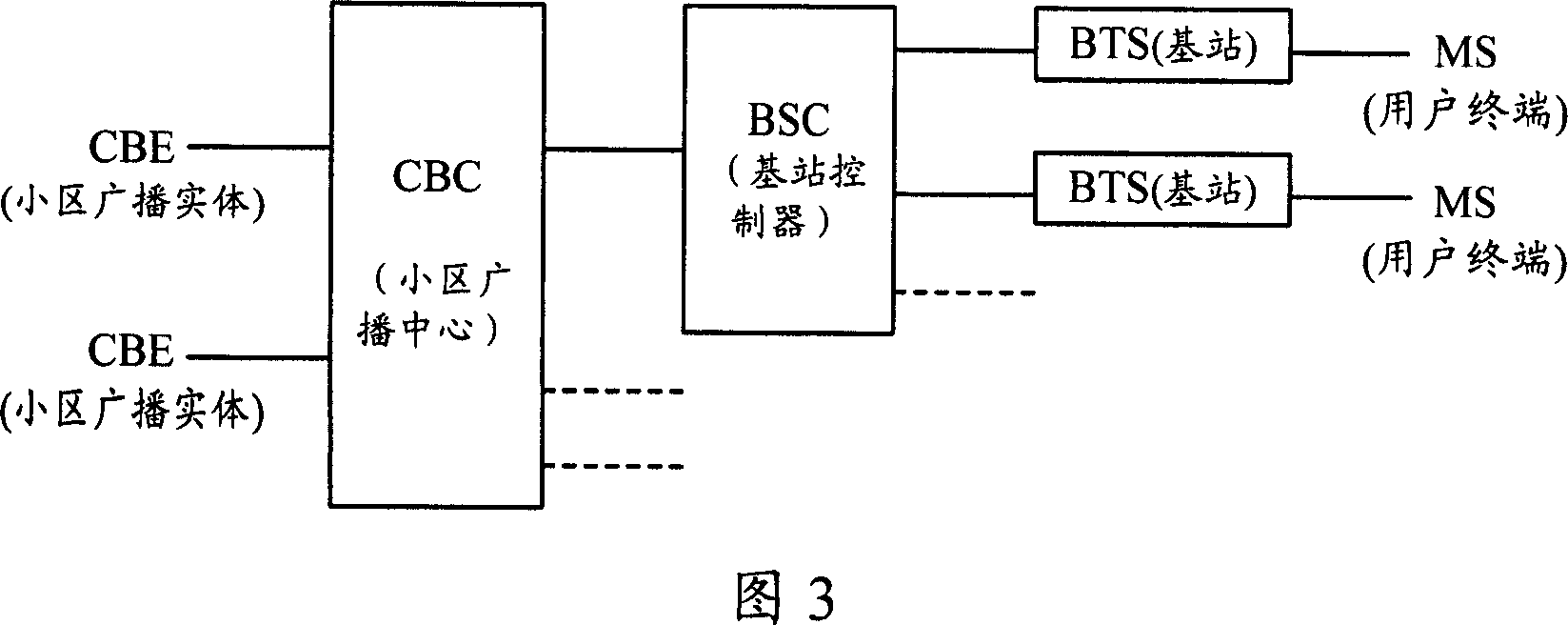

Method for transmitting grouped SMS

InactiveCN1941931ASend quicklyImprove resource utilizationBroadcast service distributionRadio/inductive link selection arrangementsCommunications systemResource utilization

The method is used for sending short message in trunking communication system in which the calling is not established, and comprises: anchor-mobile switch center (A-MSC) sends the received group-sending short messages to the base station controller (BSC) belonging to the calling cell under its direct control; the BSC uses the radio channel in the calling cell to send the group-sending short messages, and broadcasts the channel parameter information in the cell; user end receives the group-sending short message identical with his own subscription group in the group sending messages through the corresponding channel. By the invention, the group sending short messages can be sent out in case of not establishing the group calling.

Owner:HUAWEI TECH CO LTD

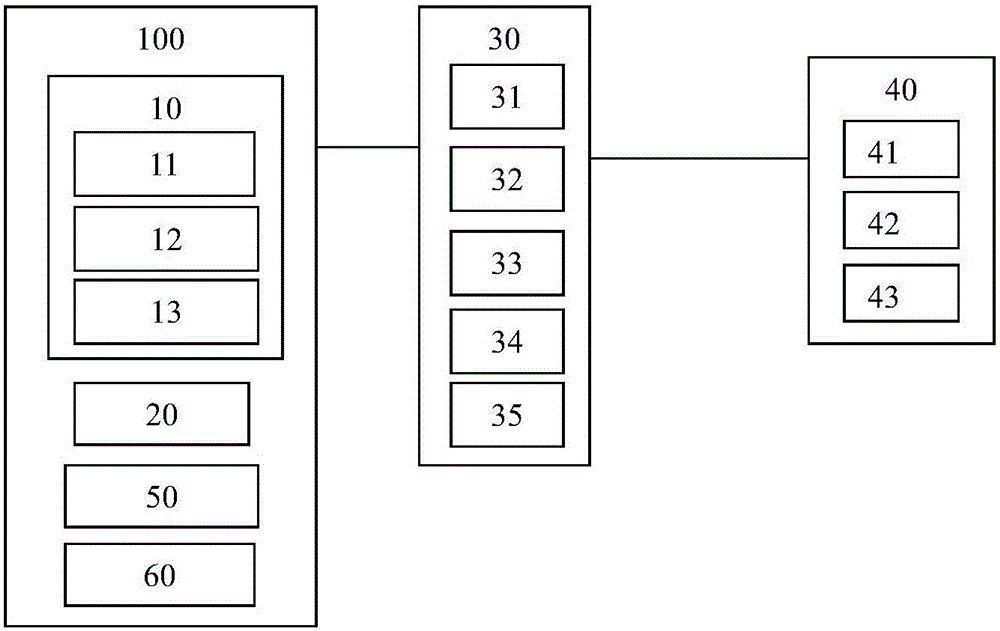

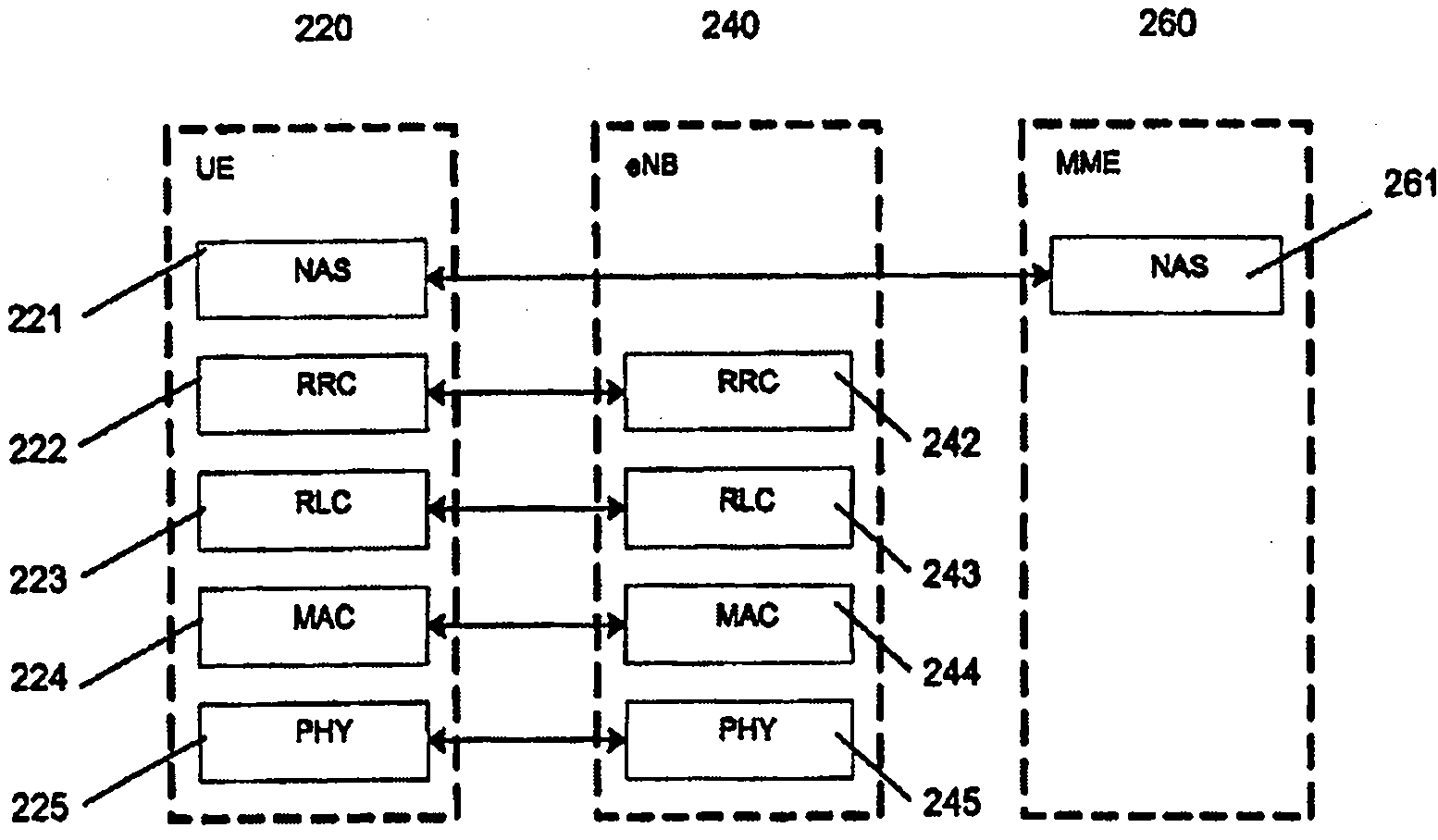

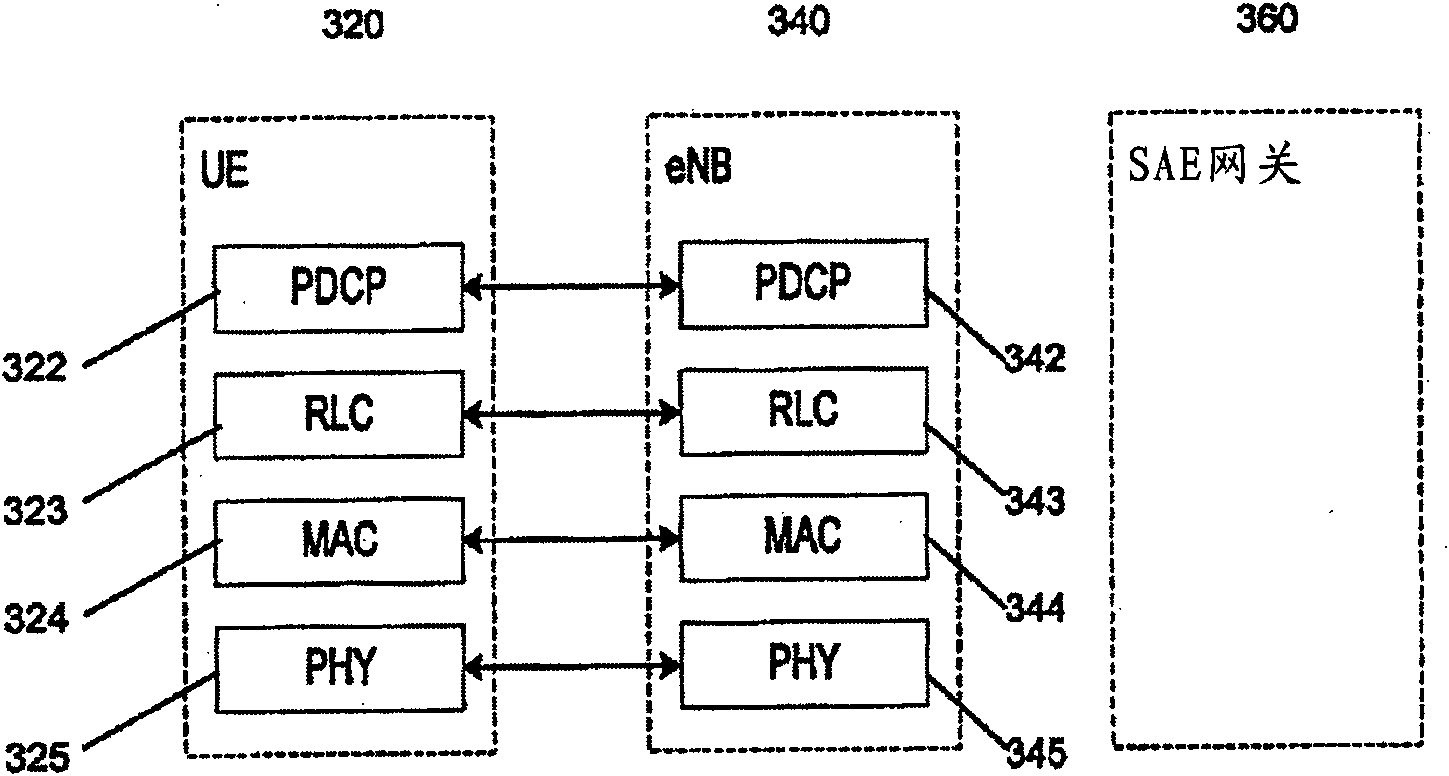

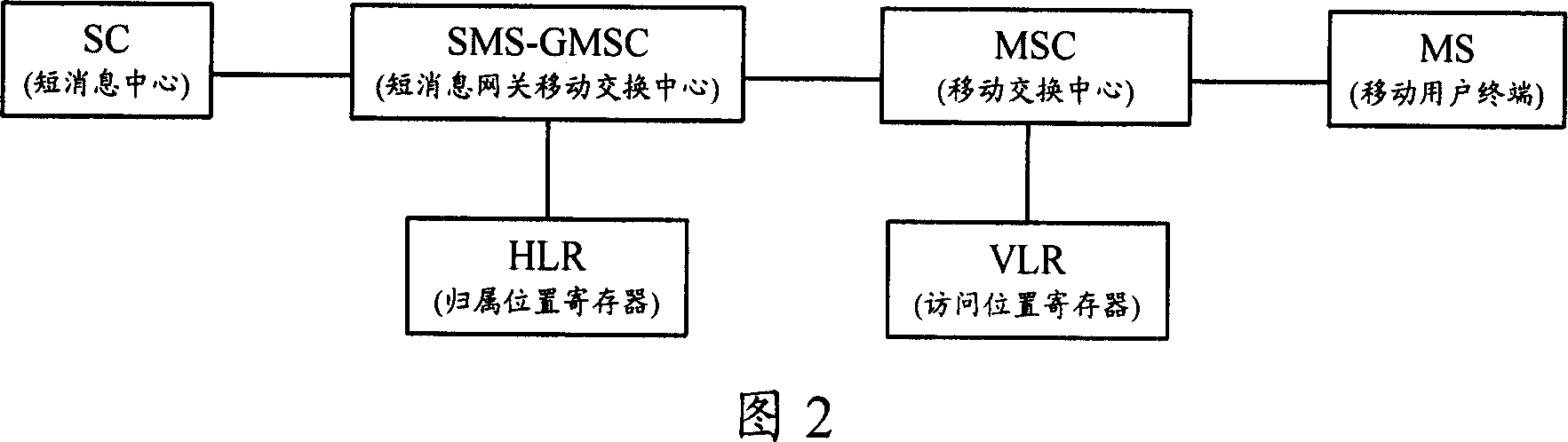

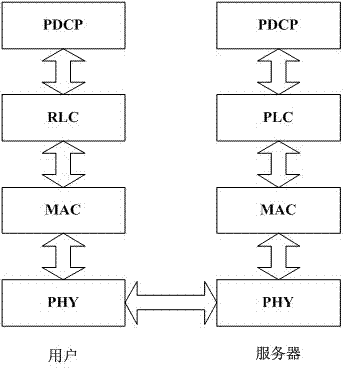

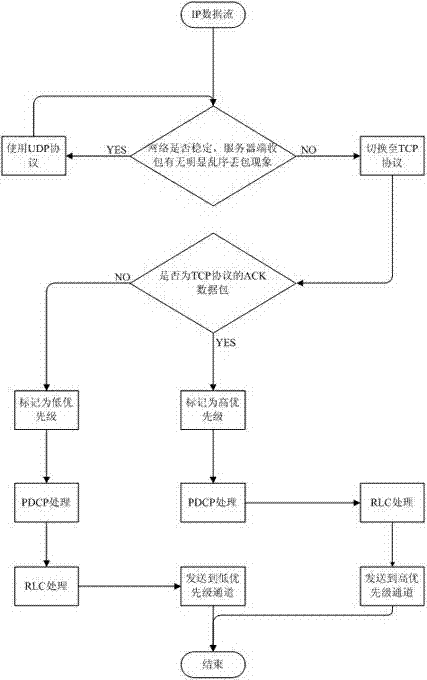

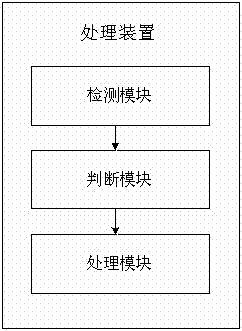

Method and device for processing user layer data in practically deployed tumble detecting system

The invention provides a method for processing user layer data in a practically deployed tumble detecting system. The method comprises the steps: detecting IP data flow; judging whether the network is stable or the obvious disorder packet missing phenomenon exists at the server side during packet receiving, if yes, using the UDP to transmit IP data flow, and if not, using the TCP to transmit the IP data flow; when using the TCP to transmit the IP data flow, judging whether the IP data flow is an ACK data packet of the TCP, if yes, marking the IP data flow as high priority and sending the IP data flow to a high priority channel for transmission after PDCP processing and RLC processing are conducted on the IP data flow, and if not, marking the IP data flow as low priority and sending the IP data flow to a low priority channel for transmission after PDCP processing and RLC processing are conducted on the IP data flow. The method and device for processing user layer data in the practically deployed tumble detecting system can monitor the movement state of each person in real time.

Owner:NANJING SOCOOL INFORMATION TECH CO LTD

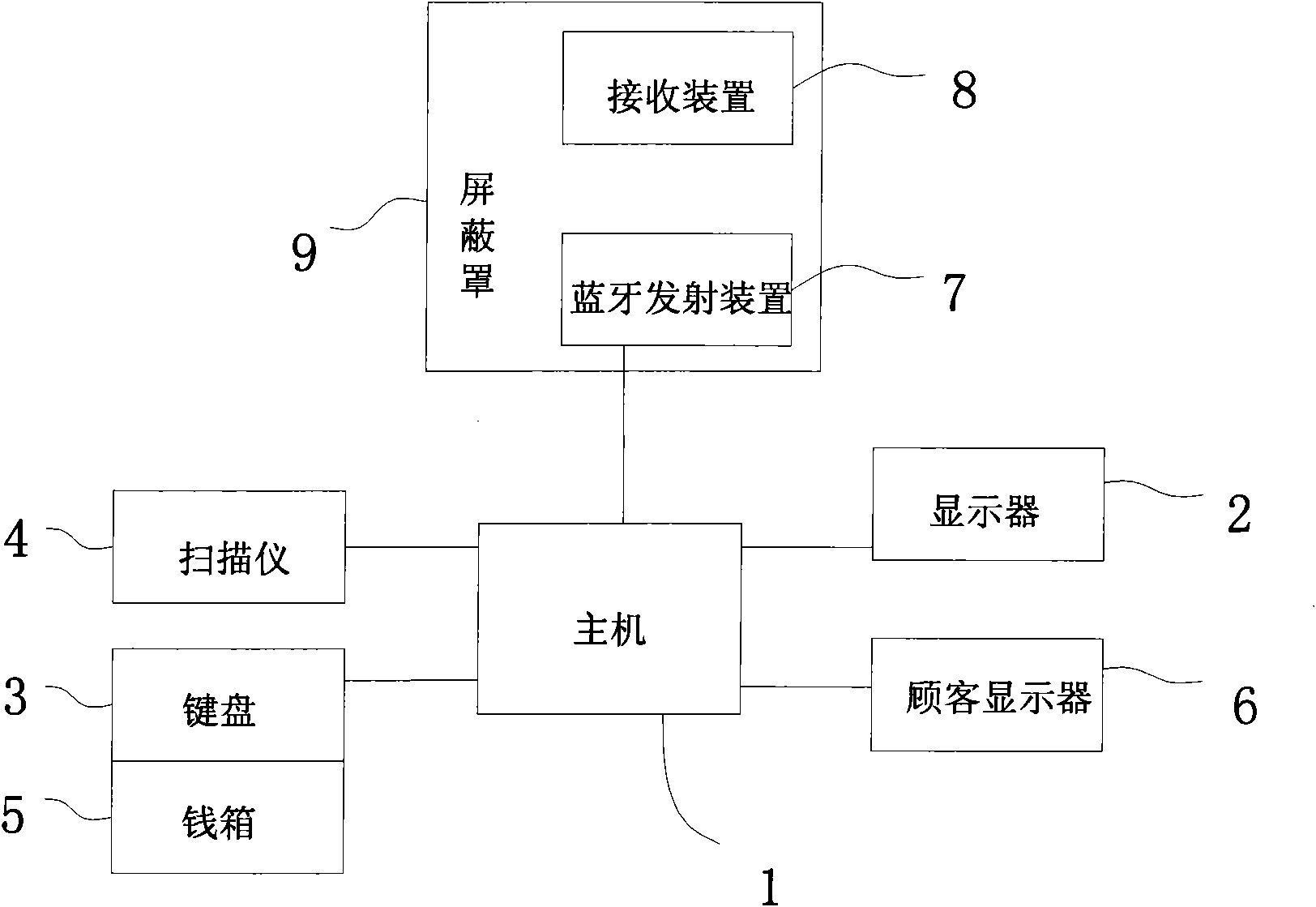

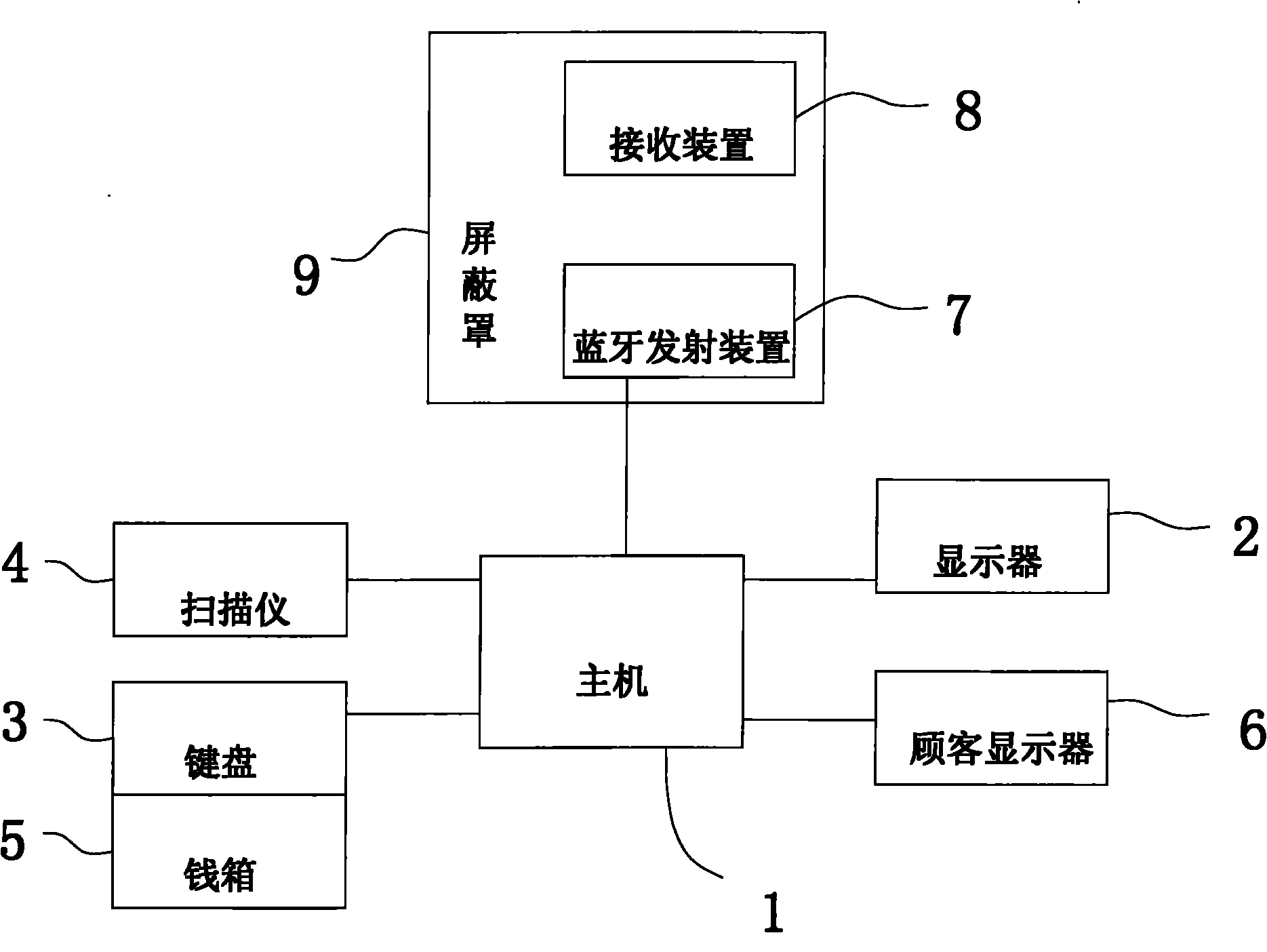

System and method for transmitting shopping receipt through Bluetooth

InactiveCN102402826AReduce usageSend quicklyNear-field transmissionCash registersRelevant informationInvoice

The invention relates to a system and a method for transmitting shopping receipt through Bluetooth. The system comprises a cash register, and is characterized in that: the cash register is connected with a Bluetooth transmitting device; a receiving device is also provided; and a screening cover is disposed out of the transmitting device. The method comprises the following steps of: acquiring shopping information; editing the shopping information to be information to be sent; placing the receiving device in the screening cover by a receiving party; searching and finding the receiving device and sending the information to the receiving device by the transmitting device; and storing the information in a host. The shopping receipt instead of paper receipt is sent by Bluetooth, so that paper can be saved and environment protection can be realized; and electronic information is quickly sent without waiting for receipt printing. For the same receiving device, the cash register also can make statistics on the shopping information, and the customer can regularly make out an invoice but not collect paper receipt of every time, so that statistical time in making invoices is saved; in addition, the sent contexts of the information can produce more contexts, including related information such as preferential information of businessmen, advertisements and the like.

Owner:胡华敏

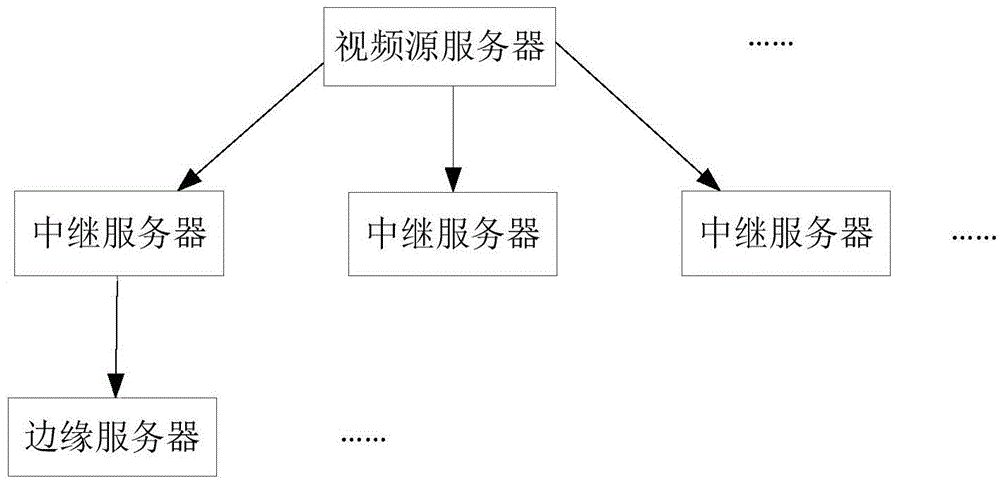

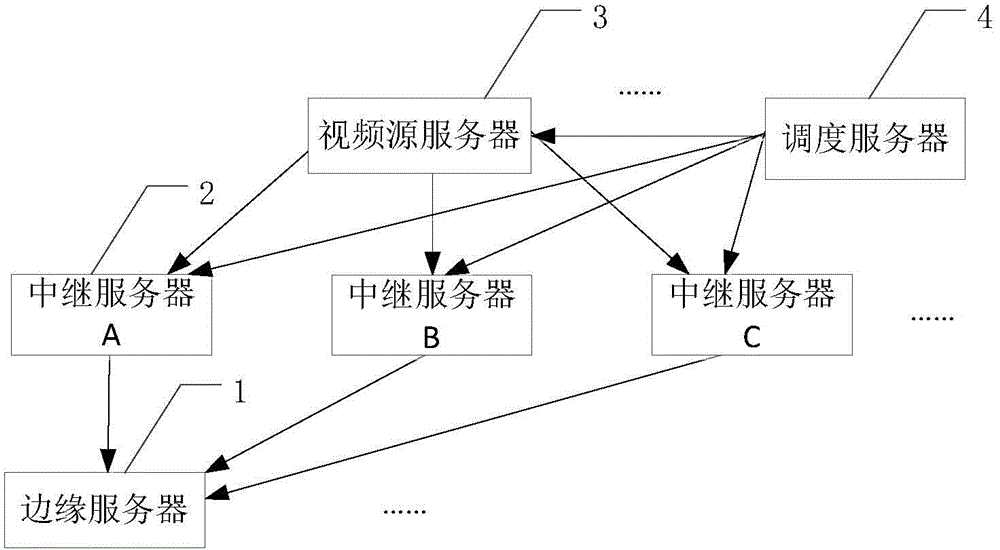

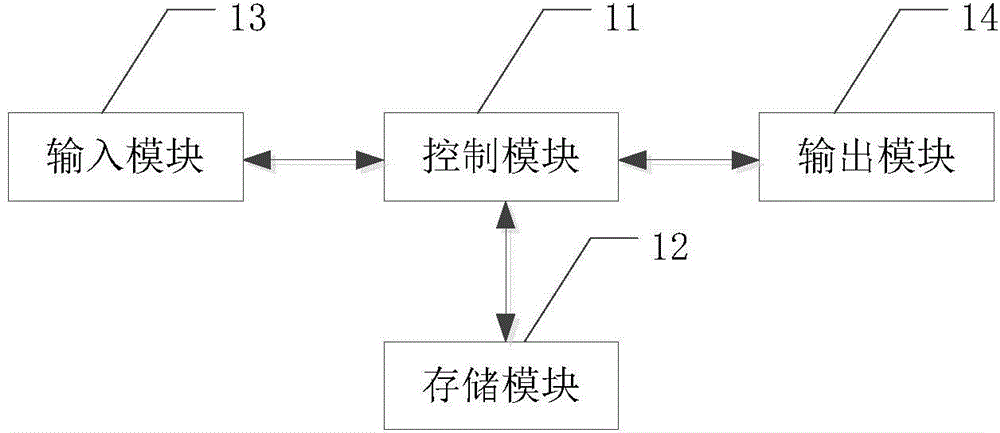

Live video transmission method, live video transmission device, and video direct broadcast system

InactiveCN105812840AFacilitate transmissionEliminate the effects ofSelective content distributionData segmentEdge server

The present application provides a live video transmission method, device, and video live broadcast system. When the method of the present application is applied to an edge server, the method includes: requesting index files of live video streams from at least two relay servers at intervals of a first preset period, and determining the data volume of each segment file according to the index files; According to the data volume of the fragment file and the transmission status of each edge server and the relay server, request the data segment of the fragment file to each relay server respectively; receive the fragments downloaded in parallel from each relay server Different data segments of the file; the different data segments are assembled into a complete fragmented file of the live video stream. This application can quickly realize the sending of fragmented files from the video source server to the ultimate server, and at the same time eliminate the problem that some users cannot watch the live video broadcast due to the failure of the relay server.

Owner:LETV INFORMATION TECH BEIJING

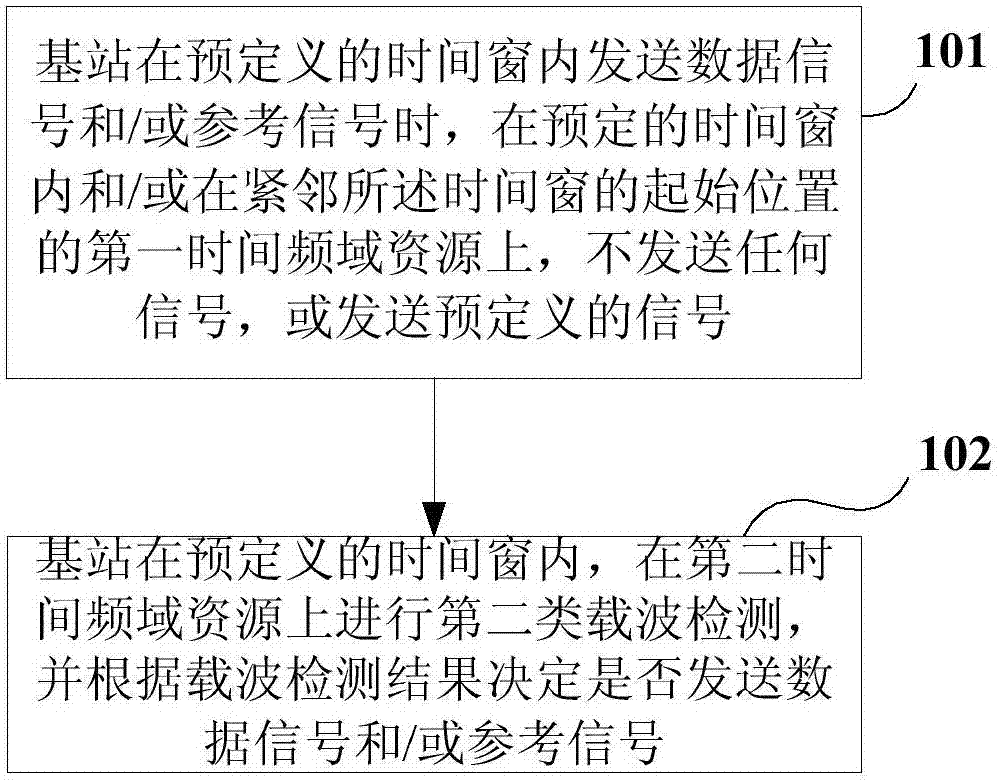

Signal sending and receiving method and user equipment

ActiveCN107040938AImprove the frequency domain multiplexing factorShorten the lengthNetwork traffic/resource managementTransmission path divisionCarrier signalAccess technology

The application discloses a signal sending and carrier detection method. The method comprises the following steps: a signal sending way at a communication node is different from a sending way out of a time window in a predefined time window, and the method comprises a carrier detection way and / or data transmission way. By applying the application disclosed by the invention, a frequency domain reuse factor among the nodes in the same access technology can be improved, and meanwhile, the coexistence of other access technology can be guaranteed.

Owner:BEIJING SAMSUNG TELECOM R&D CENT +1

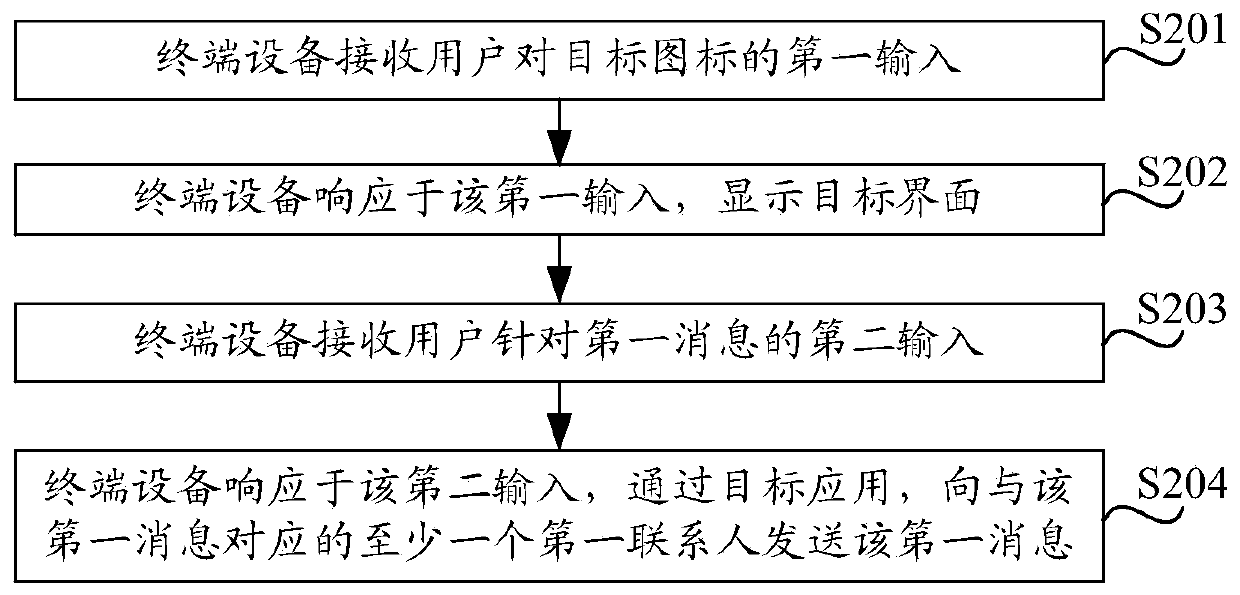

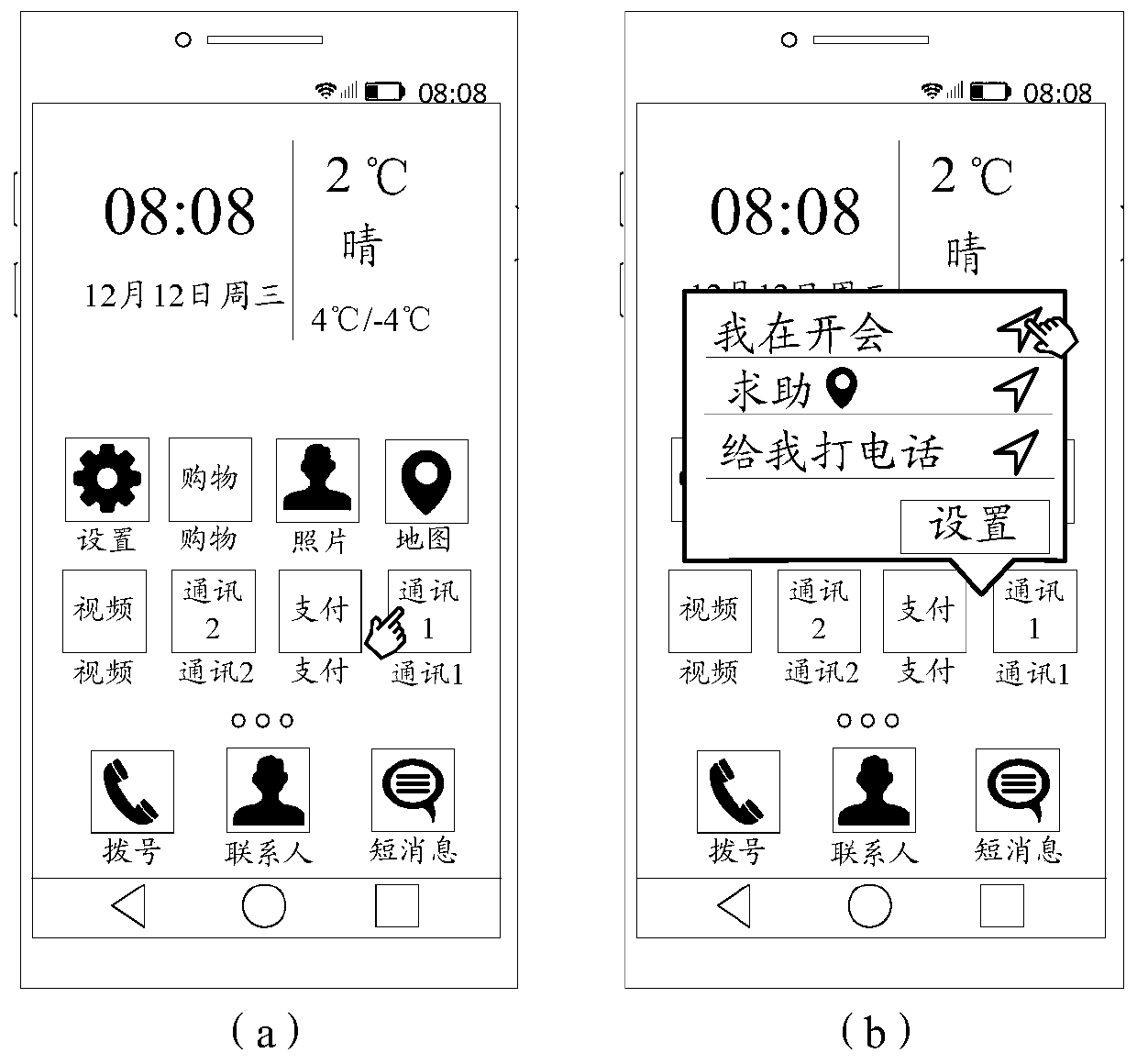

Message sending method and terminal equipment

ActiveCN109871164AReduced execution stepsImprove efficiencySubstation equipmentMessaging/mailboxes/announcementsComputer hardwareTerminal equipment

The embodiment of the invention provides a message sending method and terminal equipment, relates to the technical field of communication, and aims to solve the problem that existing terminal equipment is low in message sending efficiency. The method comprises the following steps: receiving a first input of a user to a target icon, wherein the target icon is used for indicating a target application; in response to the first input, displaying a target interface with the target interface comprising at least one message, each message of the at least one message corresponding to at least one contact; receiving second input of a user for a first message, wherein the first message is a message in the at least one message; and in response to the second input, sending the first message to at leastone first contact corresponding to the first message through the target application. The method is applied to a scene where the terminal equipment sends the message.

Owner:VIVO MOBILE COMM CO LTD

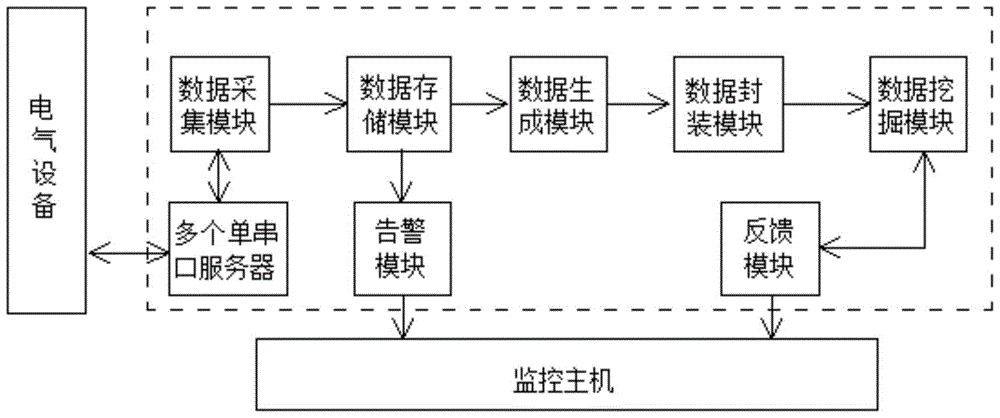

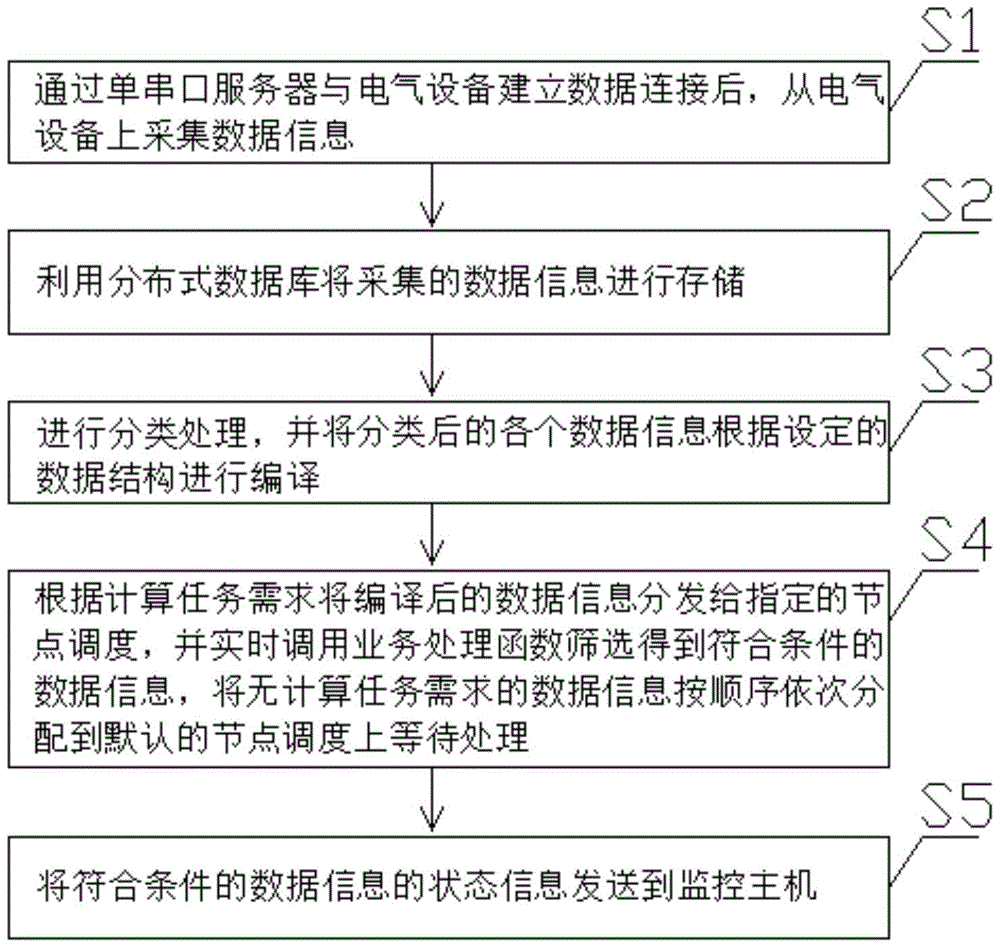

Distributed data processing system and method

ActiveCN105760459AIncrease the total amount of dataNormal Habitat ServicesDatabase management systemsDatabase distribution/replicationData informationData access

The invention provides a distributed data processing system and method. The system comprises a plurality of single-serial servers and further comprises a data collection module for signal data collection, a data storage module for storing complied data information, a data generation module for performing data structure compiling on the data information, a data mining module for scheduling the data information according to the calculated task requirement and a sending module for sending status of the data information meeting the conditions to a monitoring host. The collected device data are preprocessed, the collected mass data are stored in a distributed mode, and the problems that existing data access modes are independent and no dependency or precedence relationship exists are solved; during data mining, a plurality of data scheduling nodes are processed at the same time, the response speed is high, and the data can be sent to the monitoring host within the shortest time; when data is inserted and inquired at the same time, the system performance is not lowered, and the input cost is lowered.

Owner:SICHUAN JUSTBON ASSET MANAGEMENT GRP CO LTD

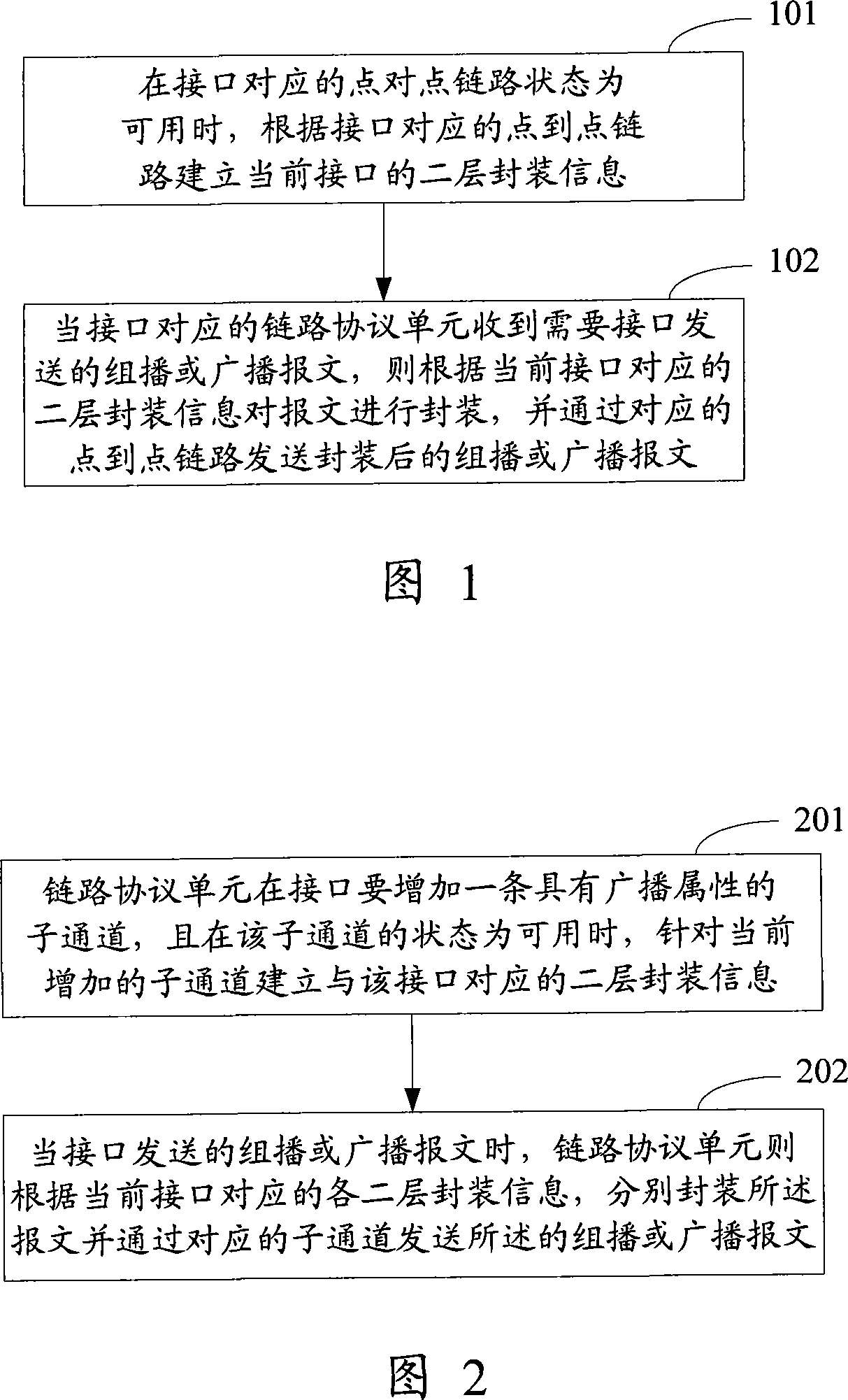

Method and device for transmitting message

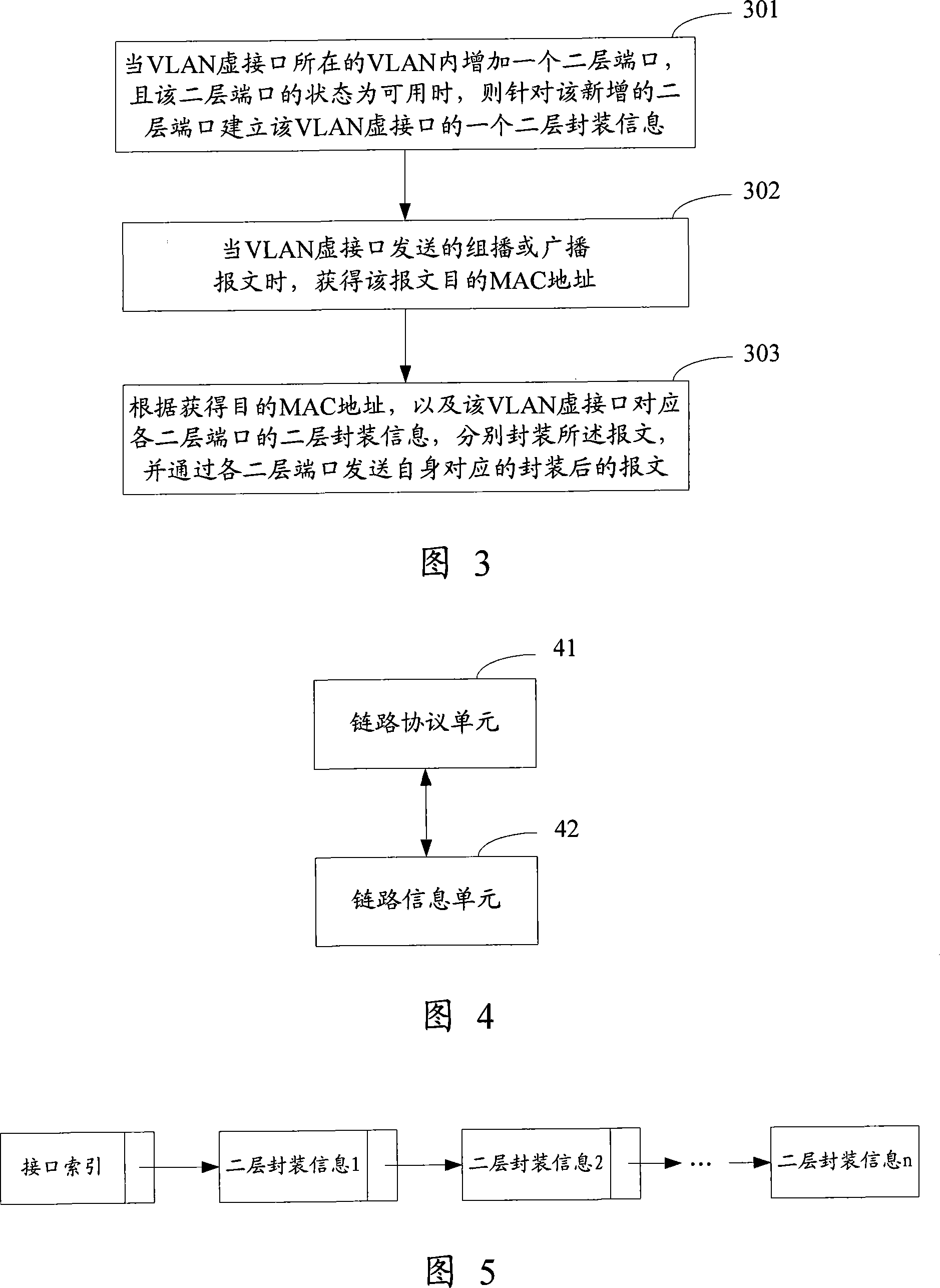

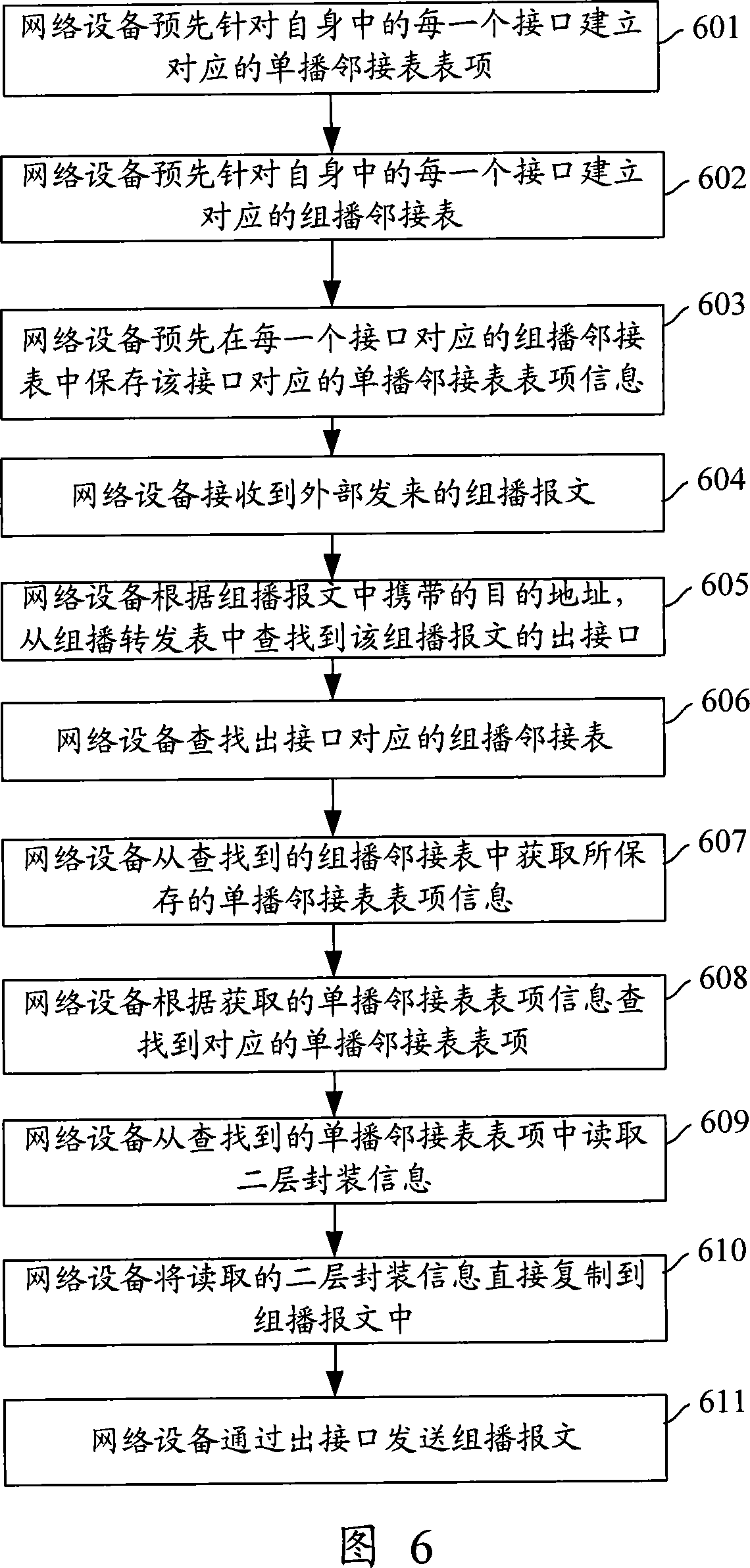

This invention discloses a method for sending messages including: when a link corresponding to an interface can be used, a second layer package message of the interface is set up, when sending multicast or broadcast messages, the interface packages and sends the messages according to the second layer package information of the interface, in which, it's only necessary for an interface to package and send said message according to the registered second layer package information so as to speed up the transmission. This invention also provides a device for sending messages.

Owner:NEW H3C TECH CO LTD

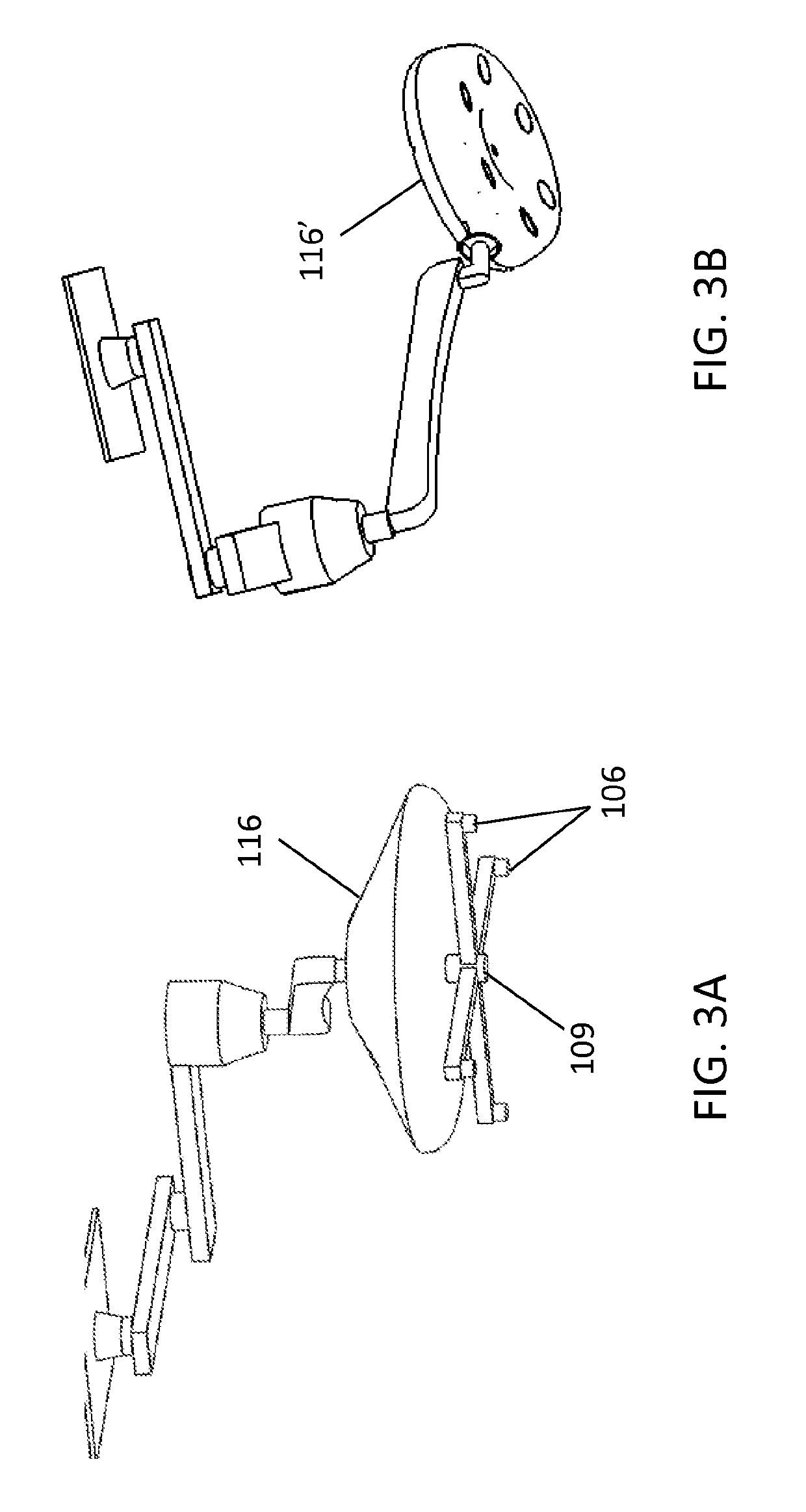

Visible light communication system for transmitting data between visual tracking systems and tracking markers

ActiveUS10507063B2Promote resultsEfficient executionSurgical navigation systemsDiagnostic markersComputer-aidedOrthopedic surgery procedures

An optical tracking system includes at least one tracking array for generating and optically transmitting data between 1 and 2,000 MB / s. At least one tracker for optically receiving the optically transmitted data between 1 and 2,000 MB / s is also provided. The tracking system is used not only for tracking objects and sending tracking information quickly but also providing the user or other components in an operating room with additional data relevant to an external device such as a computer assisted device. Orthopedic surgical procedures such as total knee arthroplasty (TKA) are performed more efficiently and with better result with the optical tracking system.

Owner:THINK SURGICAL

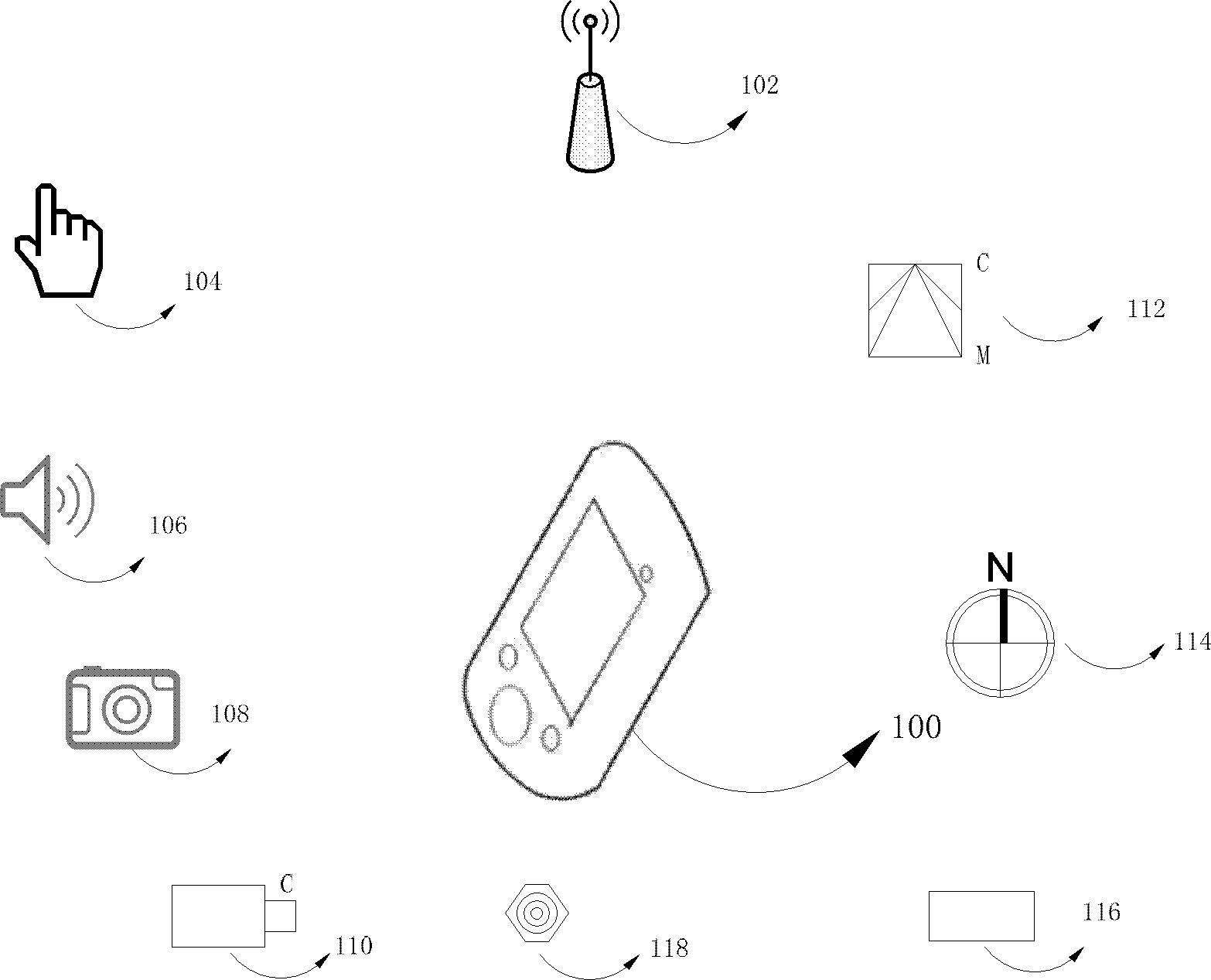

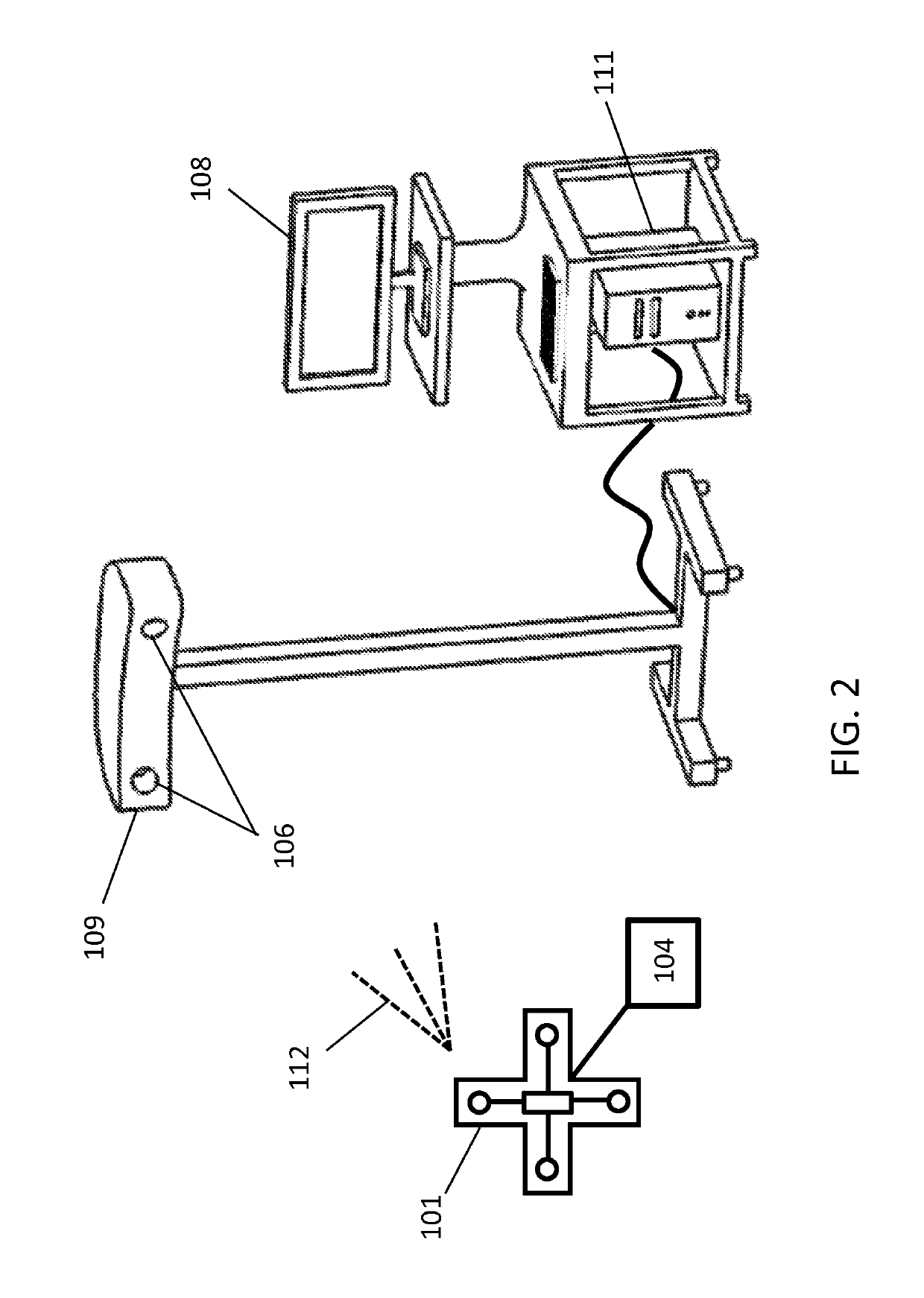

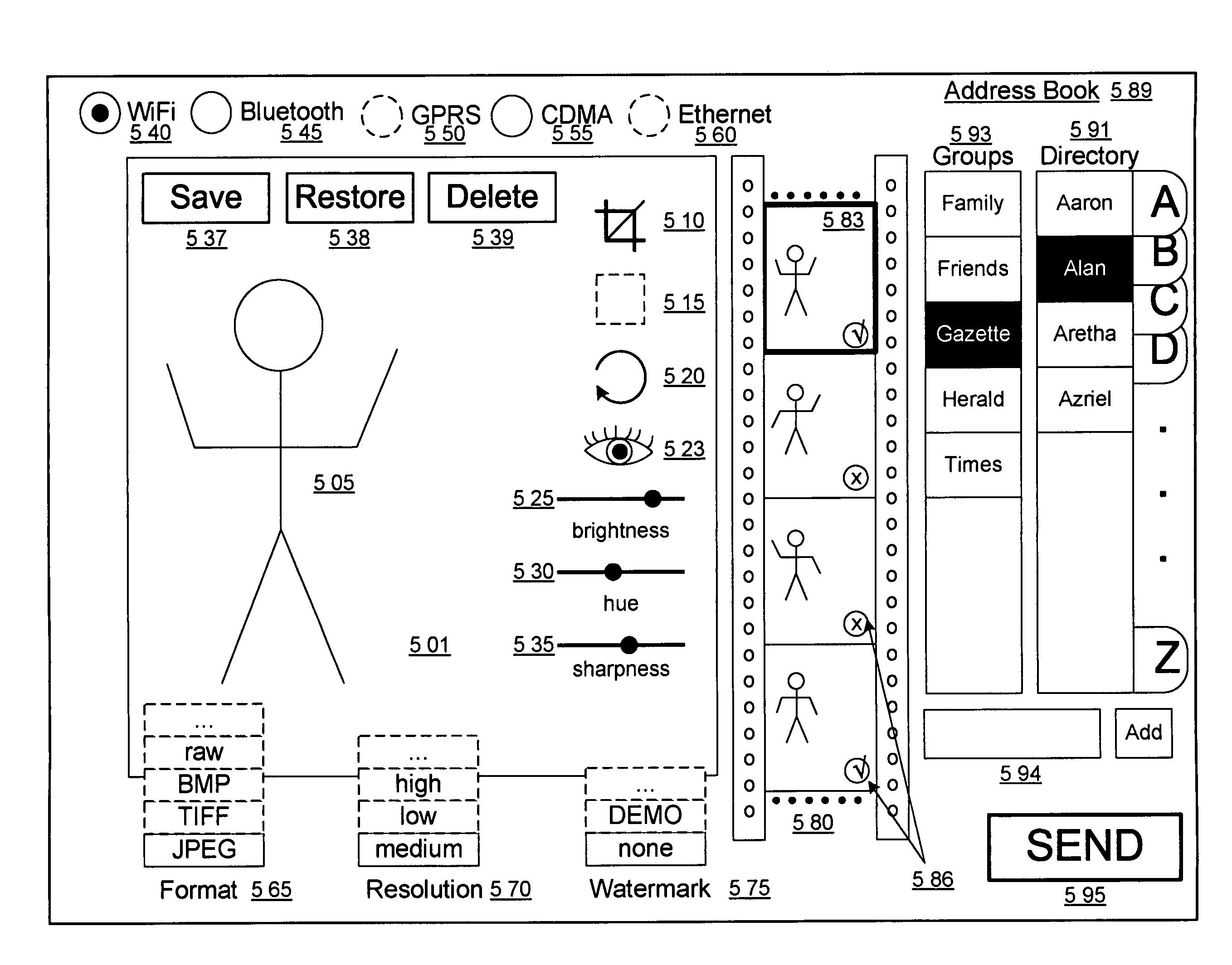

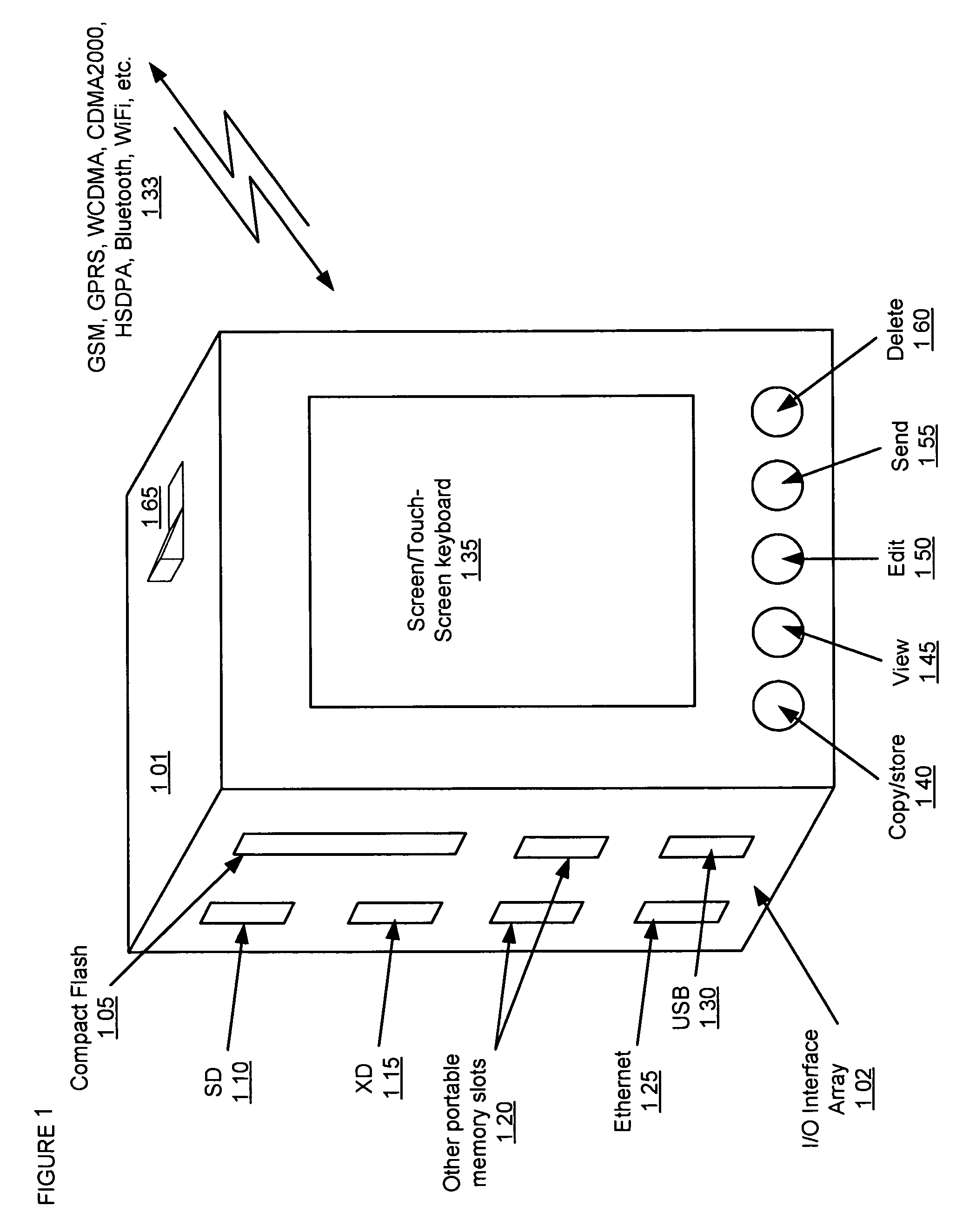

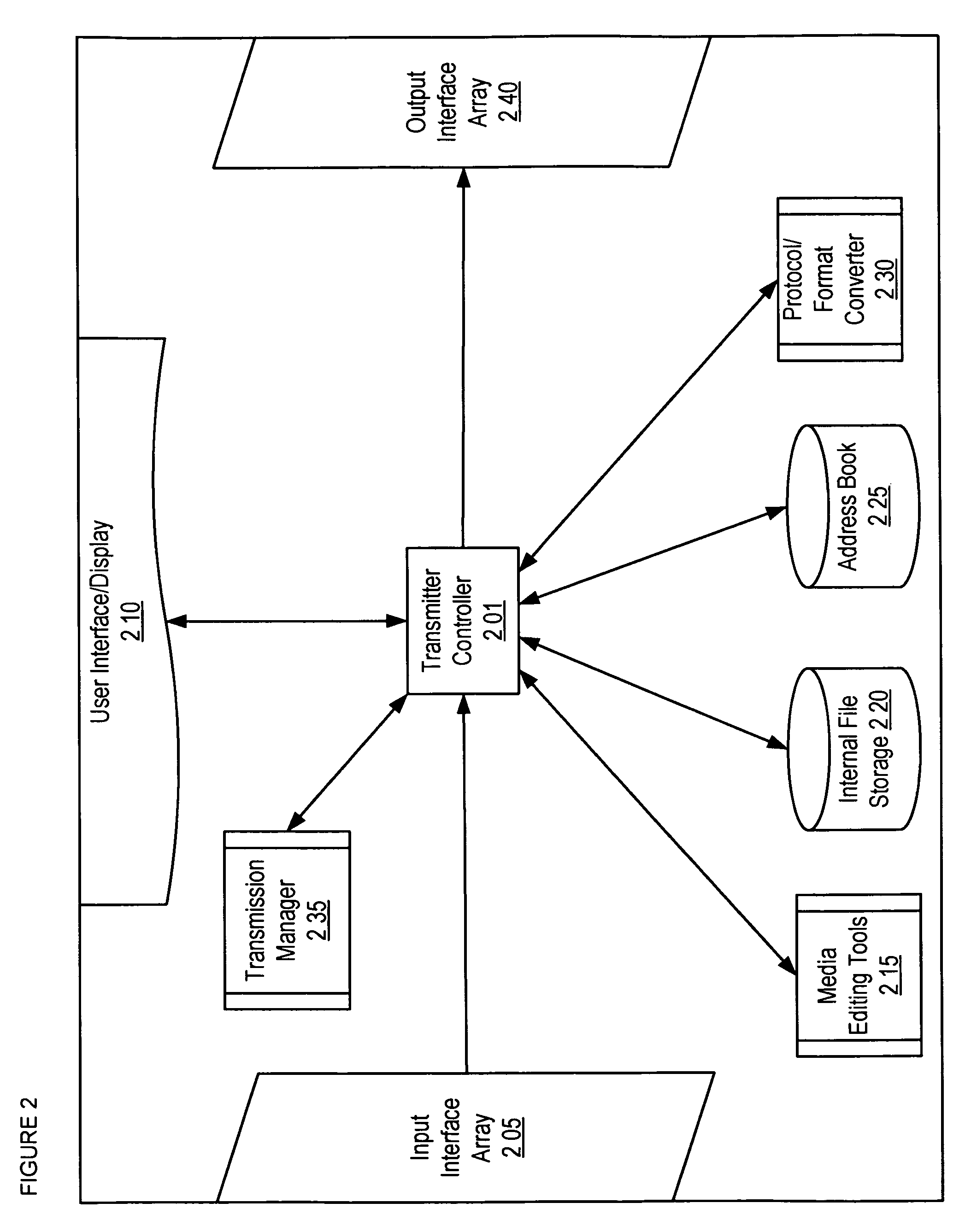

User interface for a portable, image-processing transmitter

InactiveUS7873746B2Quick and convenient manipulationQuick and convenient and distributionMultiple digital computer combinationsPayment architectureComputer hardwareImaging processing

This disclosure details the implementation of a user interface for a portable, image-processing transmitter. The Transmitter's user interface comprises a compact and efficient forum for managing, manipulating, storing, and transmitting digital images of various formats across a wide array of transmission means and protocols. Embodiments of the Transmitter may be employed by photographers, photojournalists, and / or the like to rapidly process, edit, and send high-quality photographs or video to multiple news agencies, newspapers, magazines, television studios, websites, and / or the like while maintaining control over their photographs by allowing them to send reduced quality and watermarked proofs. The Transmitter may be configured via the user interface to allow users seeking to transmit large, high-resolution images to first generate and transmit low-resolution preview images, thereby saving on transmission time and resources. Full resolution versions of the images may then be transmitted as approvals of the preview versions are received.

Owner:LAGAVULIN

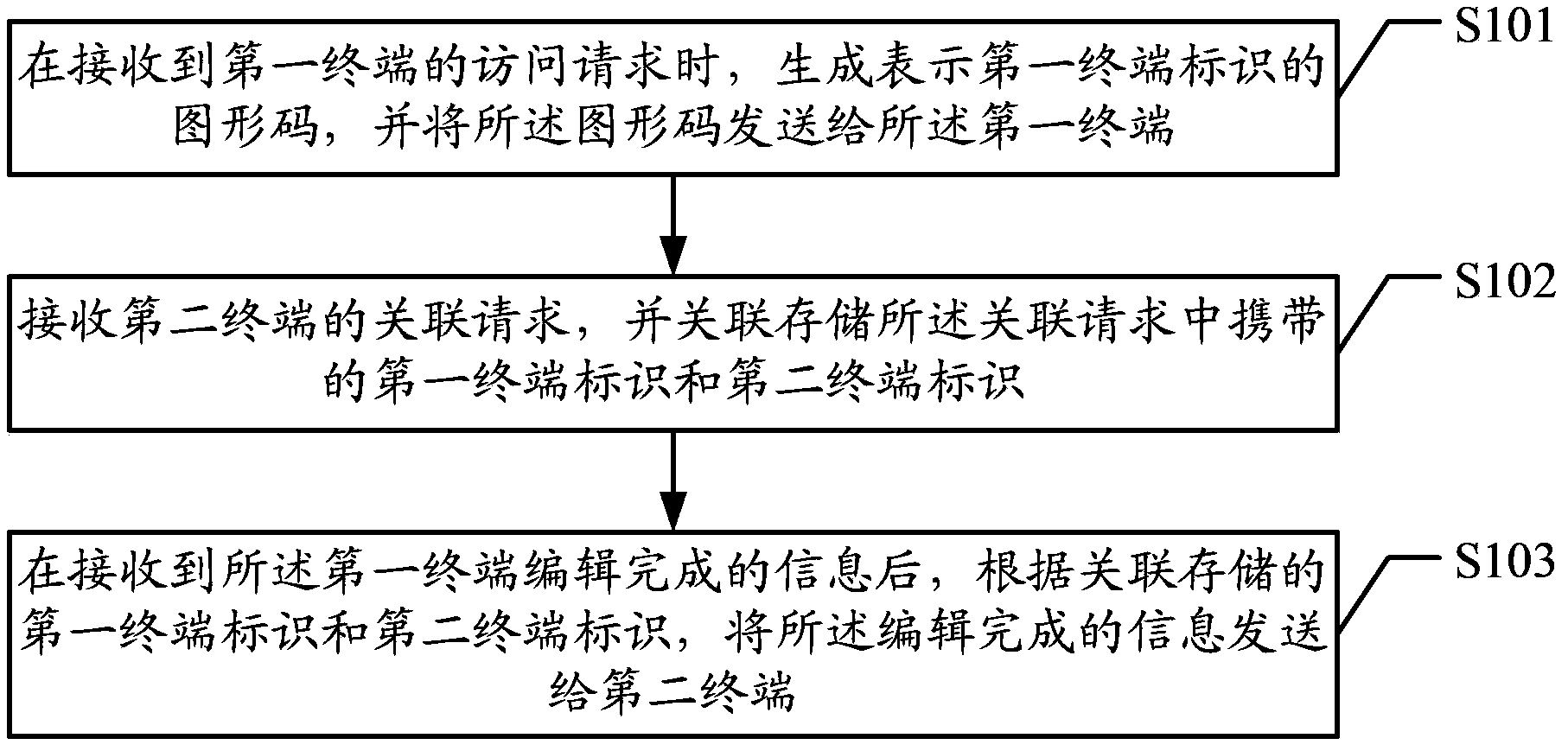

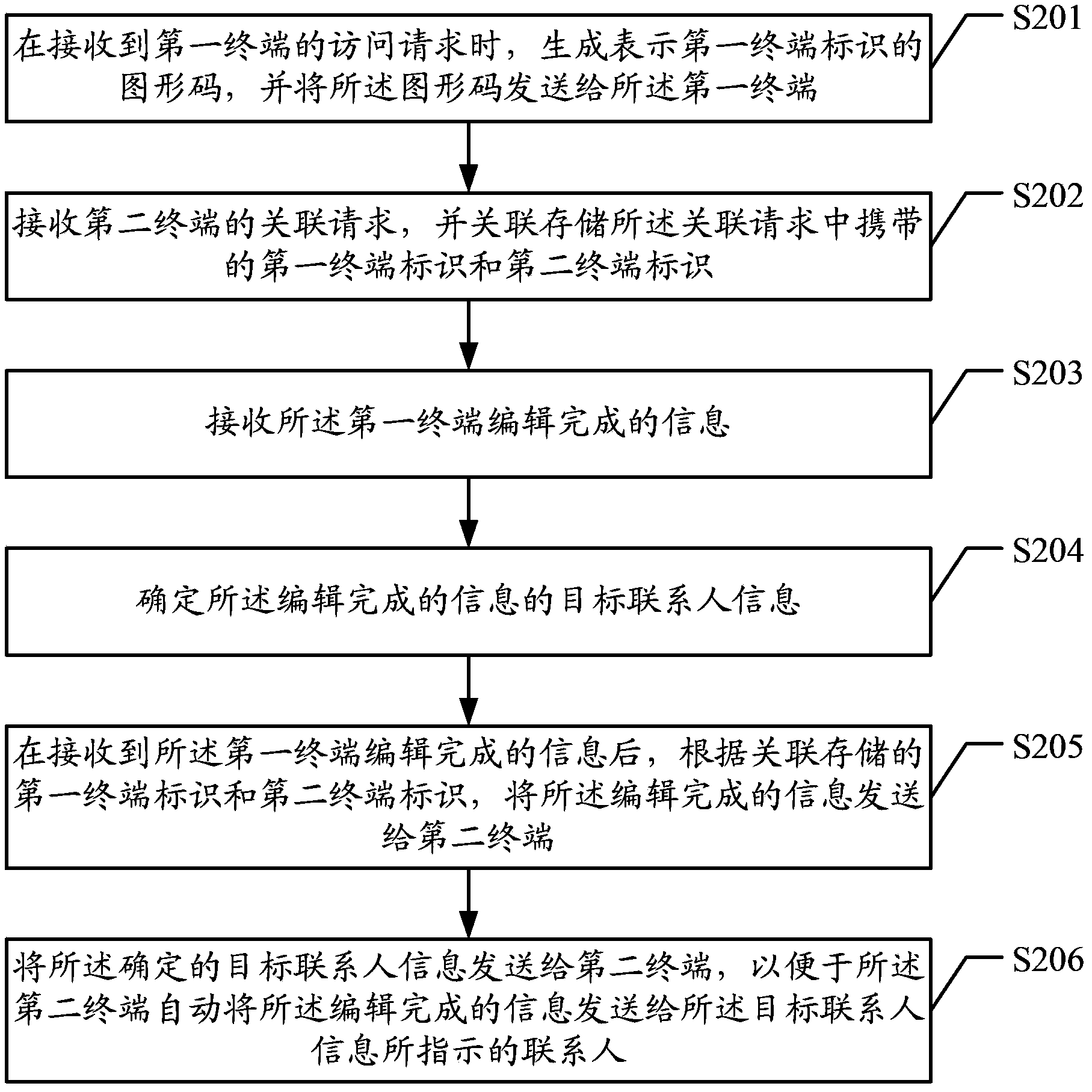

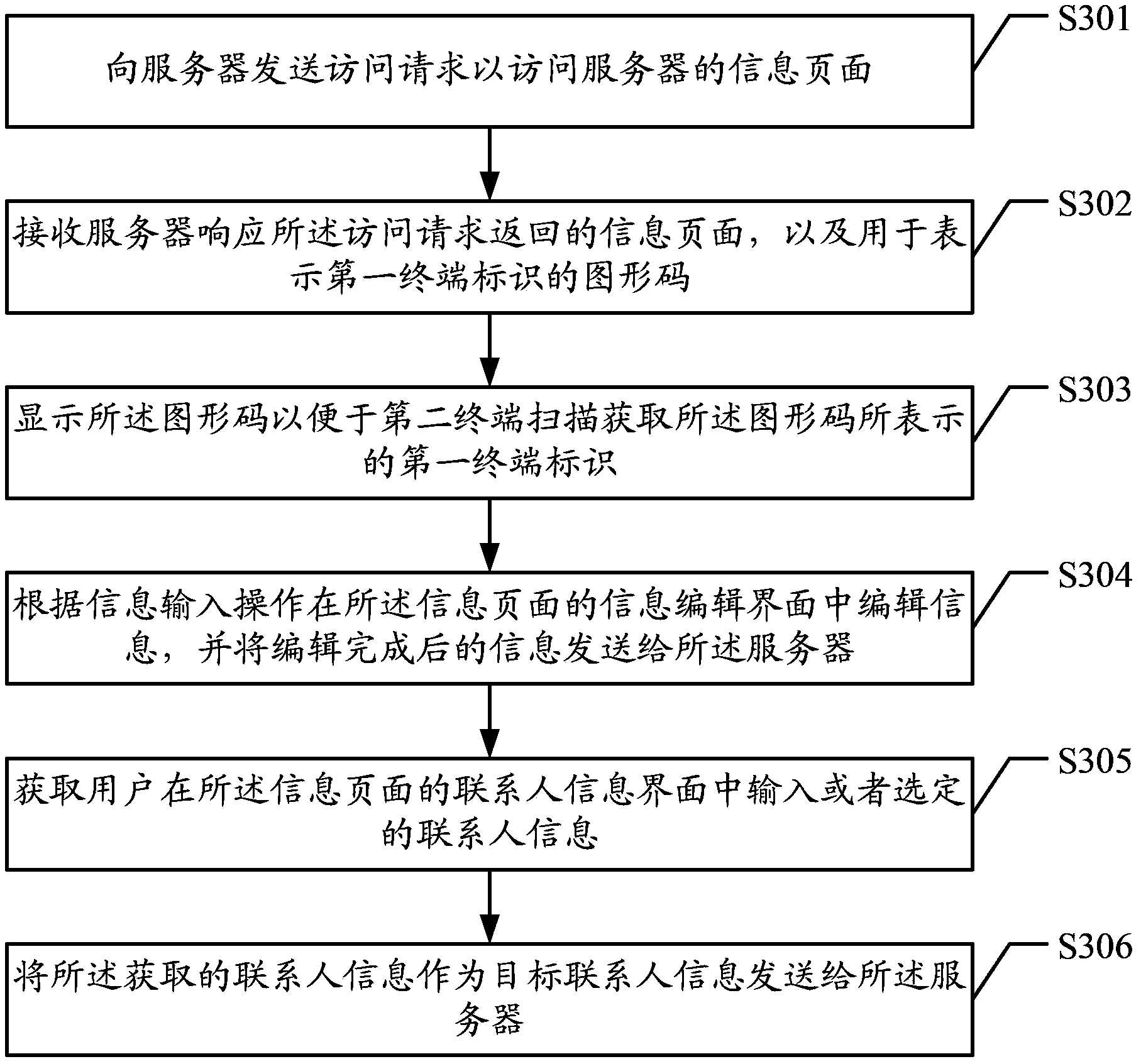

Information processing method, device and system

ActiveCN104301199AEasy inputQuick editInput/output for user-computer interactionMessaging/mailboxes/announcementsInformation processingComputer module

According to an embodiment,a server provides a webpage containing an information entry area and a contact information entry area to a first terminal with a hardware keyboard of a transmitting-side user, wherein the server stores a relationship between identification information of the first terminal and an account of the transmitting-side user for logging in an application in a second terminal of the transmitting-side user. The server receives from the first terminal information to be sent to the receiving-side user and contact information of the receiving-side user. The server transmits the information and the contact information to the second terminal according to the relationship, such that the second terminal transmits the information to the receiving-side user according to the contact information.

Owner:TENCENT TECH (SHENZHEN) CO LTD

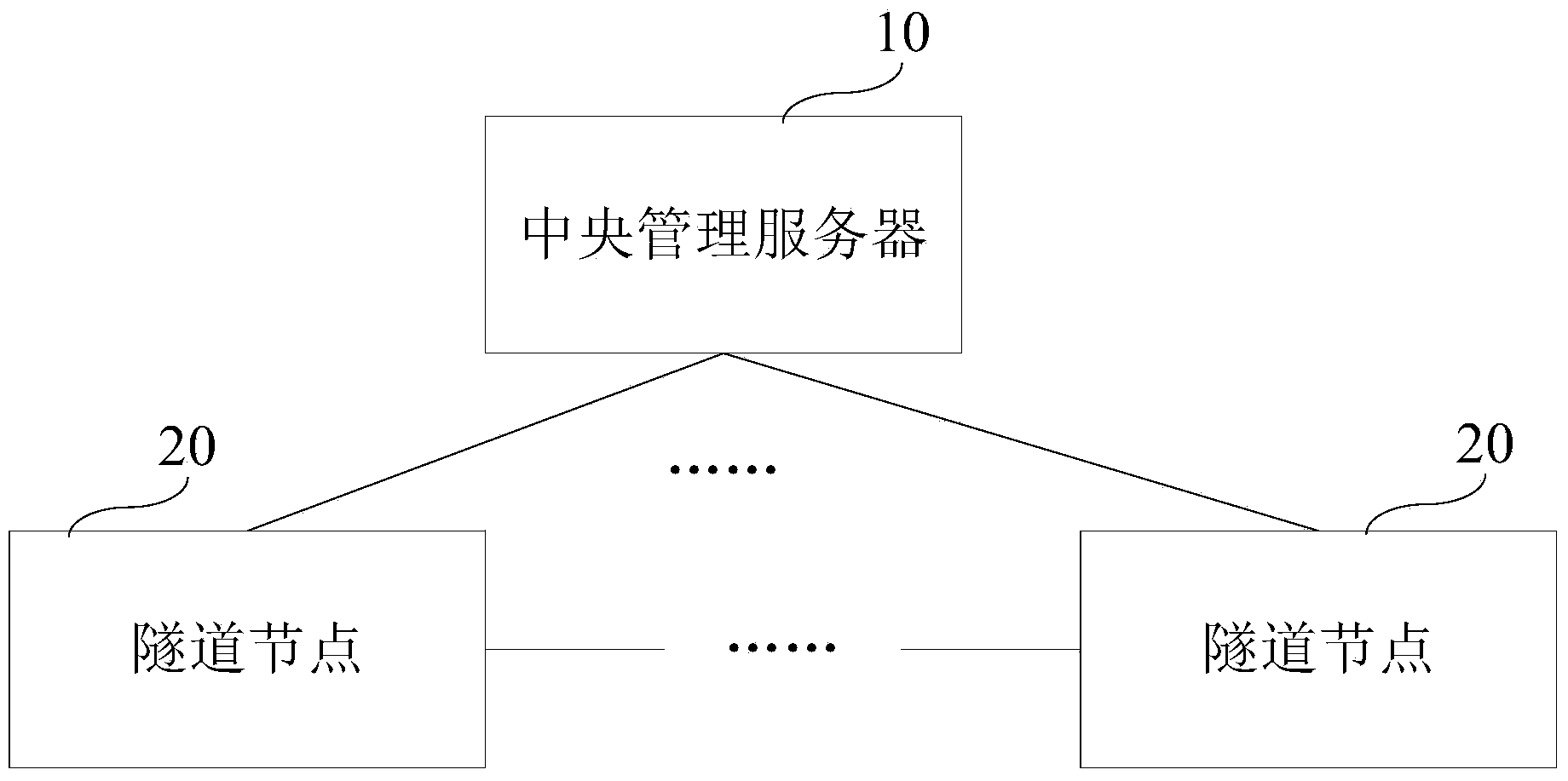

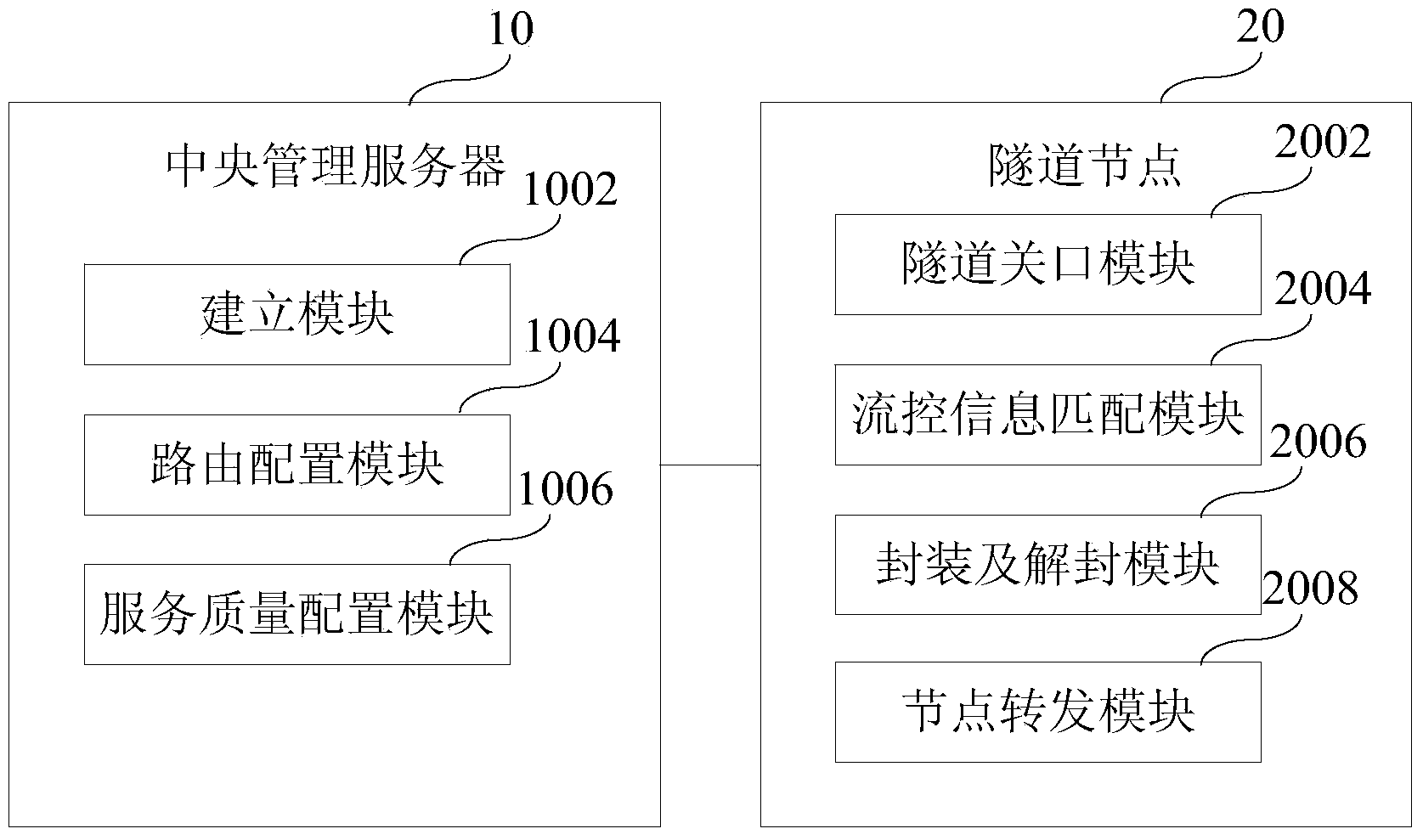

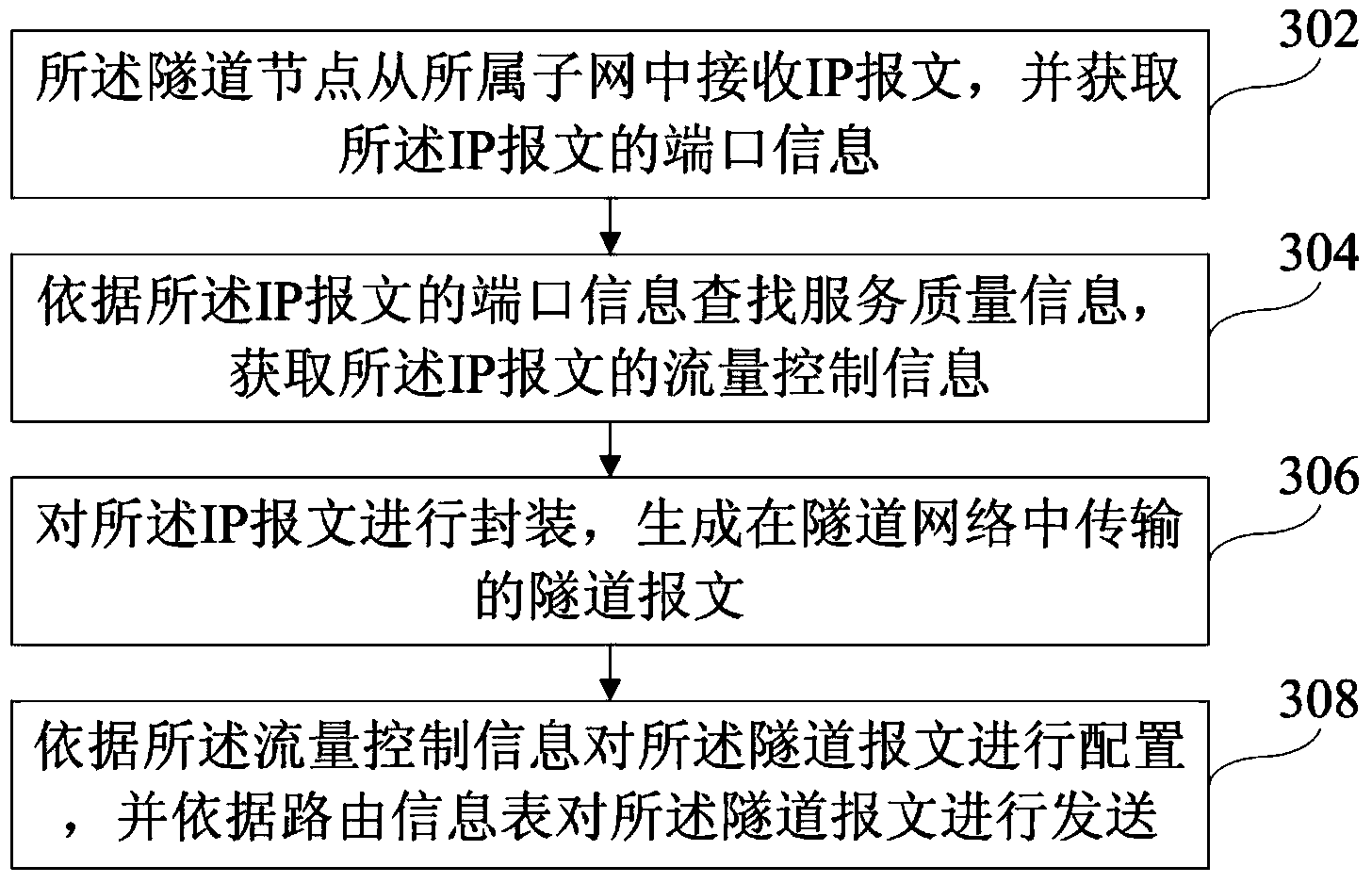

Data sending system and method

ActiveCN104301252ASend accuratelySend quicklyData switching networksQuality of serviceNetwork addressing

The embodiment of the invention provides a data sending system and method which can solve the problems happening when an existing inside network sends data. The data sending system comprises a central management server and tunnel nodes. The central management server is used for configuring and managing a tunnel network, the tunnel nodes are configured on subnets established at different geographic positions in the same inside network according to configured topological information so that the tunnel network can be established, a routing information table and service quality information of the tunnel network are configured, hence, after the tunnel nodes receive IP messages transmitted by the subnets, the service quality information can be searched for and be matched with flow control information, the transmitting flow control strategy of the messages in the tunnel network is determined, and thus the problem such as delay in a link can be solved; then the IP messages are packaged into tunnel messages, the routing information table is searched for, the tunnel messages are sent according to configuration of the flow control information, and it is guaranteed that data can be sent into a target network address accurately and quickly.

Owner:BEIJING QIYI CENTURY SCI & TECH CO LTD

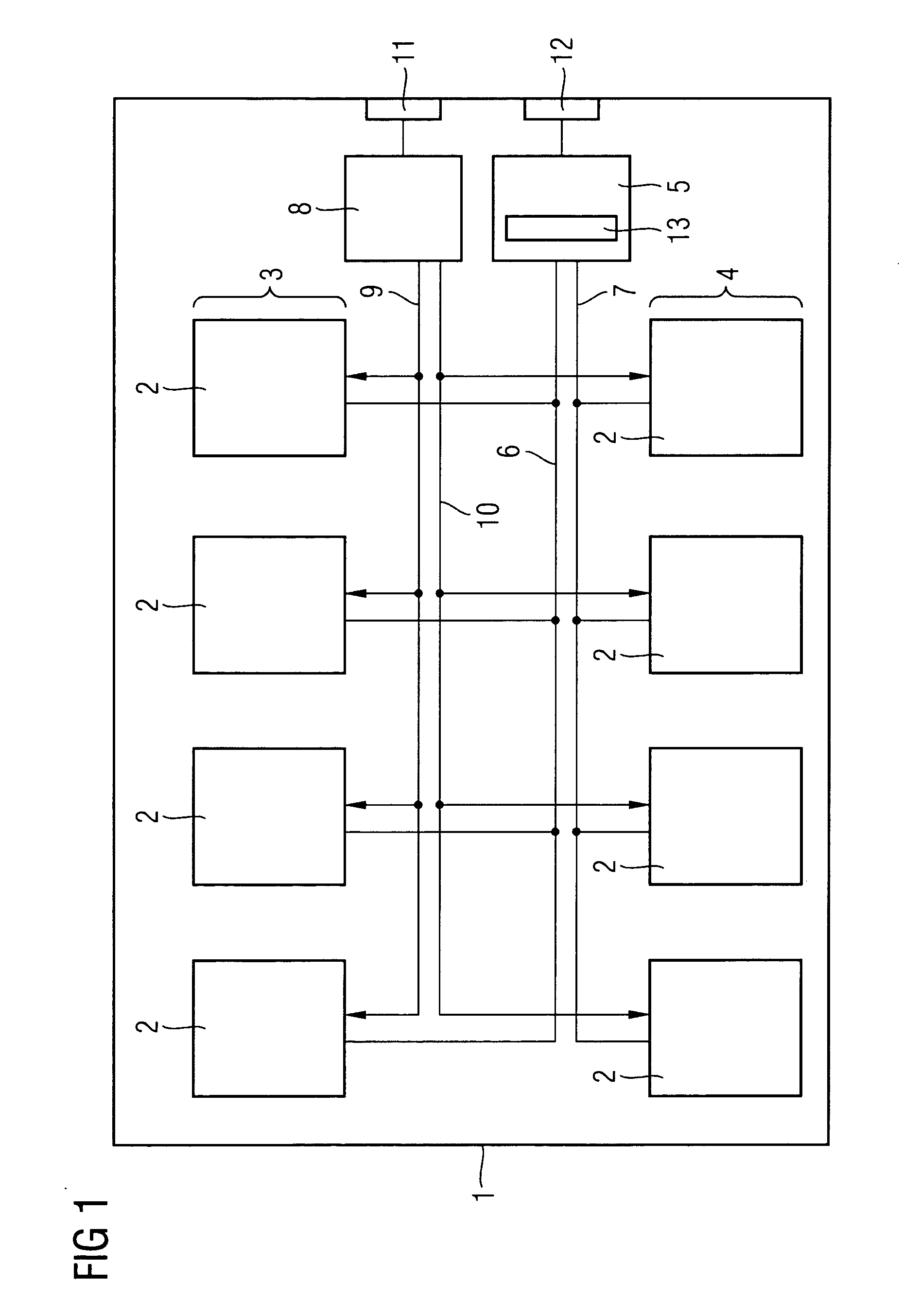

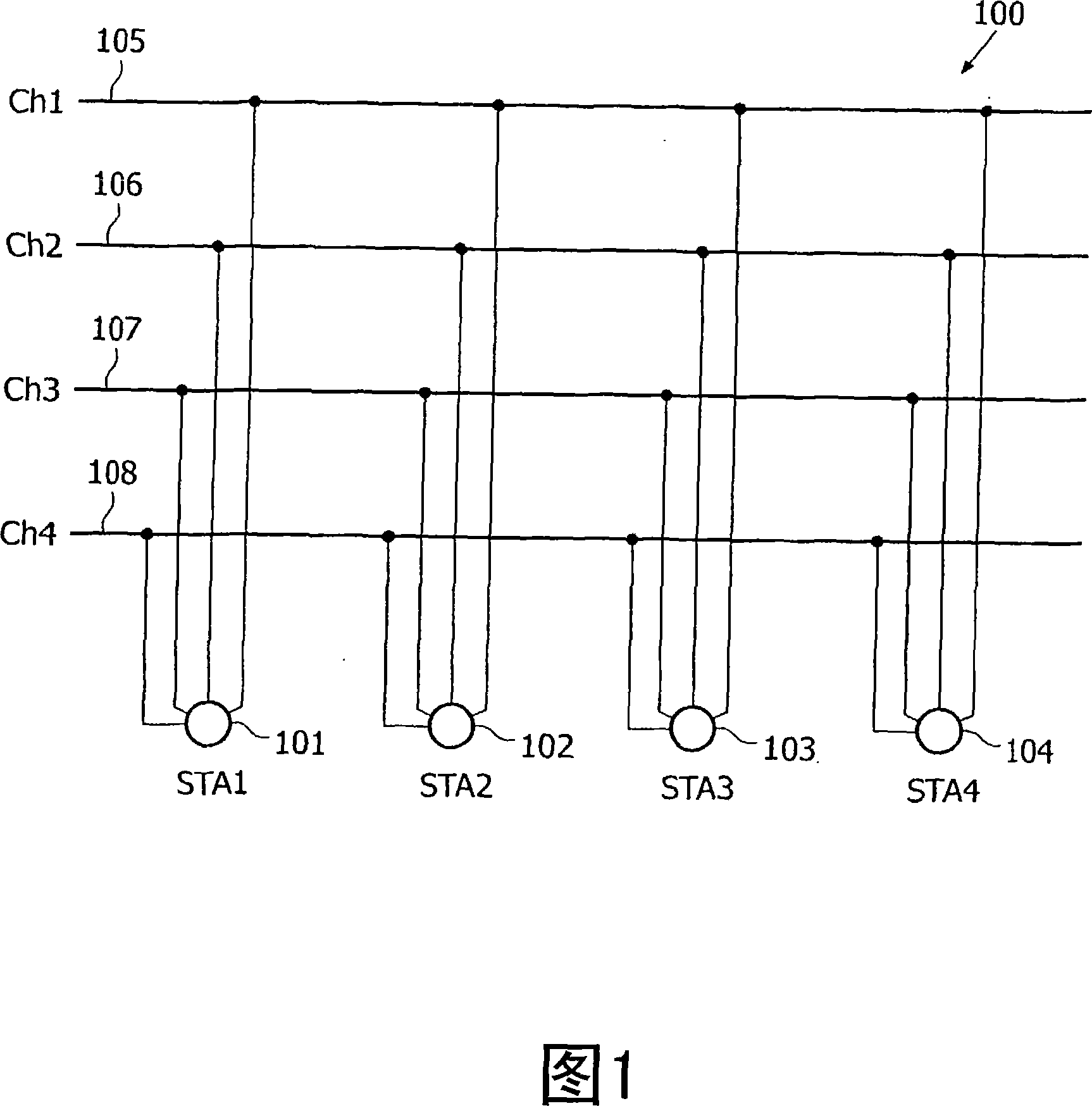

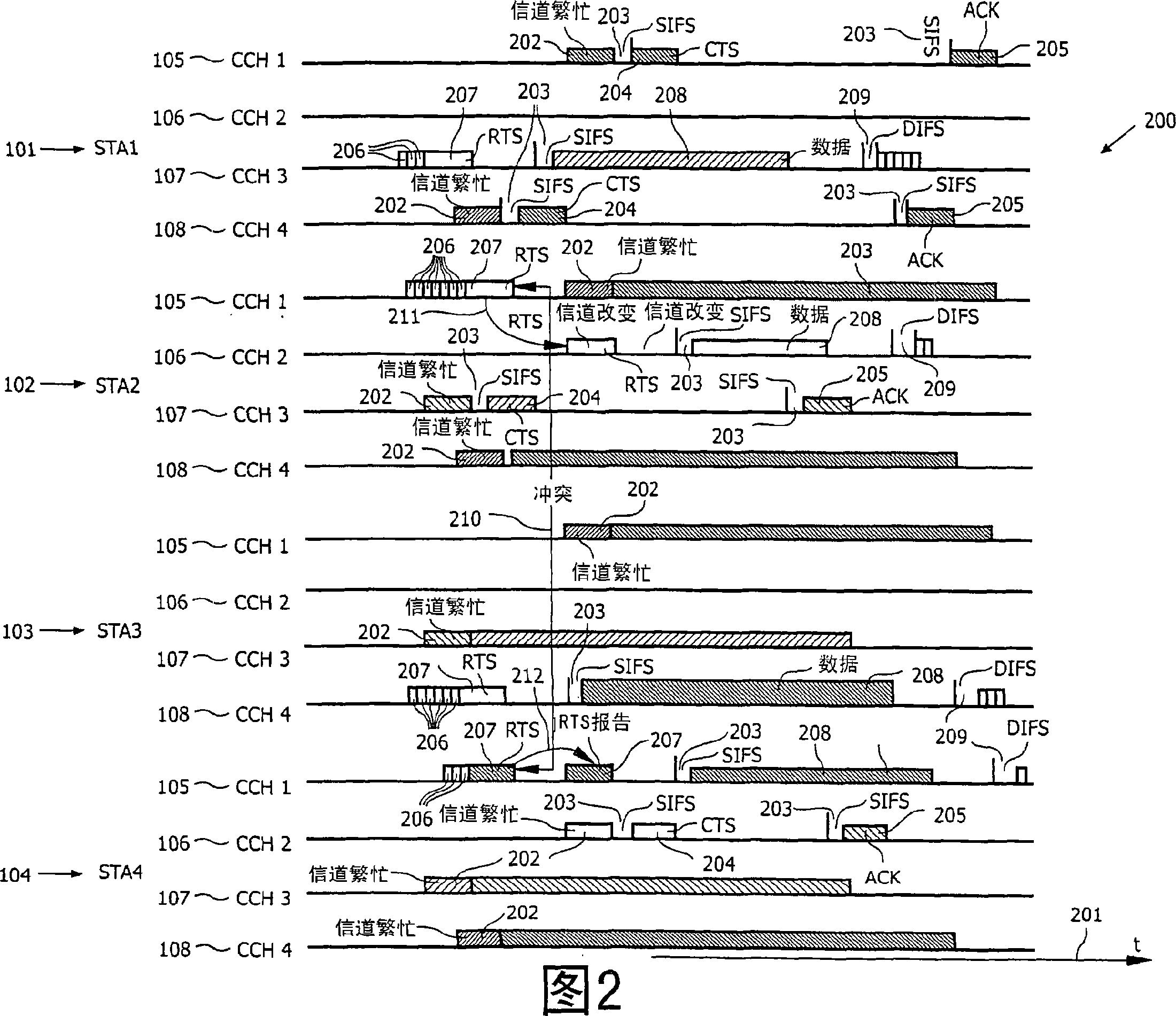

A method of operating a network node of a network, a network node, a network system, a computer-readable medium, and a program element

ActiveCN101048975AImprove business sending efficiencyImprove business processing speedData switching by path configurationWireless communicationComputer networkNetworked system

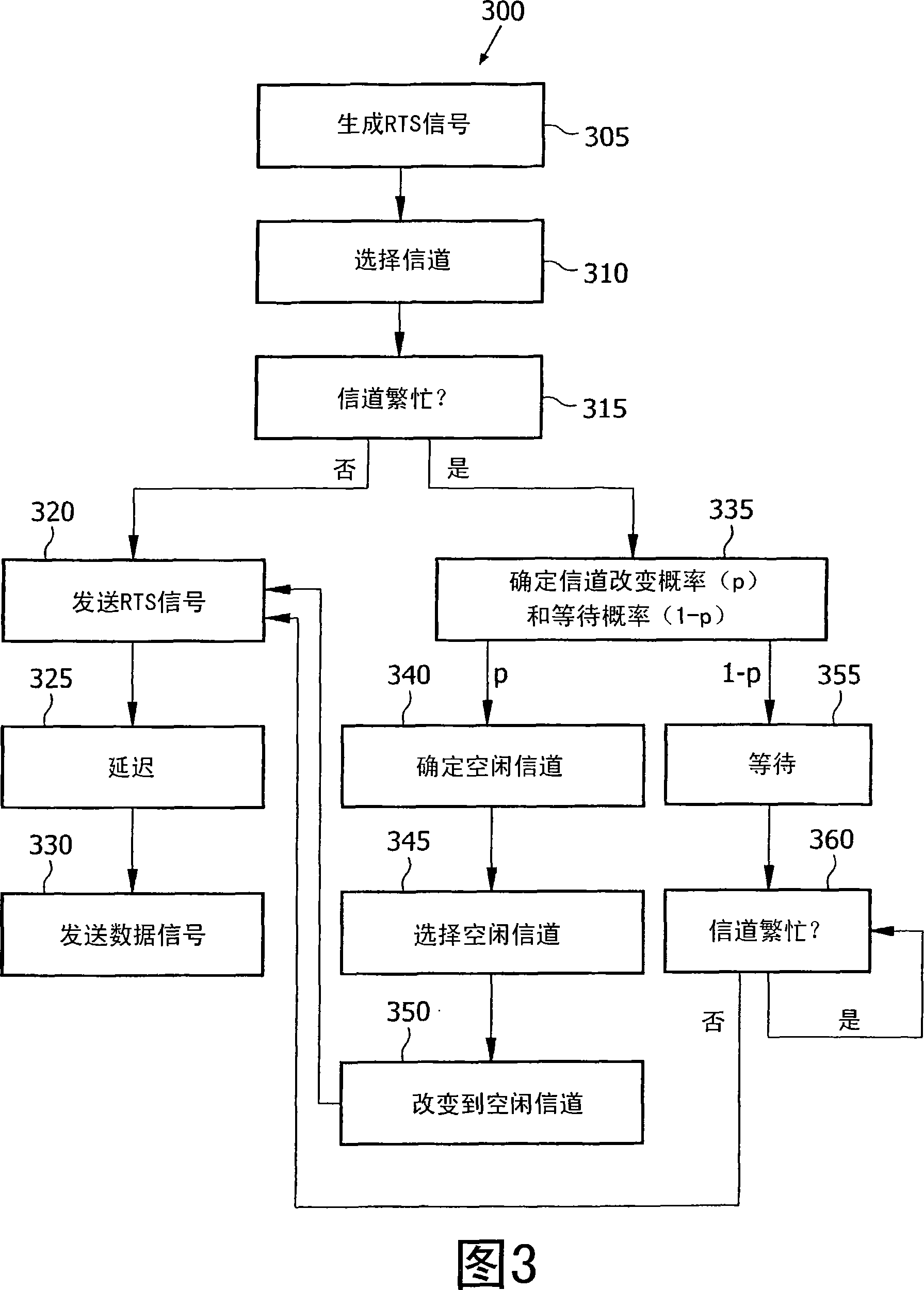

A method of operating a network node of a network, a network node, a network system, a computer-readable medium, and a program element A method (300) of operating a network node (101 - 104) of a network system (100), comprising the steps of generating (305) a signal to be transmitted, selecting (310) one of a plurality of communication channels (105 - 108) of the network system (100) for transmitting the signal, and, in case that the selected channel (105 - 108) is not ready for transmitting the signal, selecting (345) another one of the plurality of communication channels (105 - 108) for transmitting the signal.

Owner:KONINKLIJKE PHILIPS ELECTRONICS NV

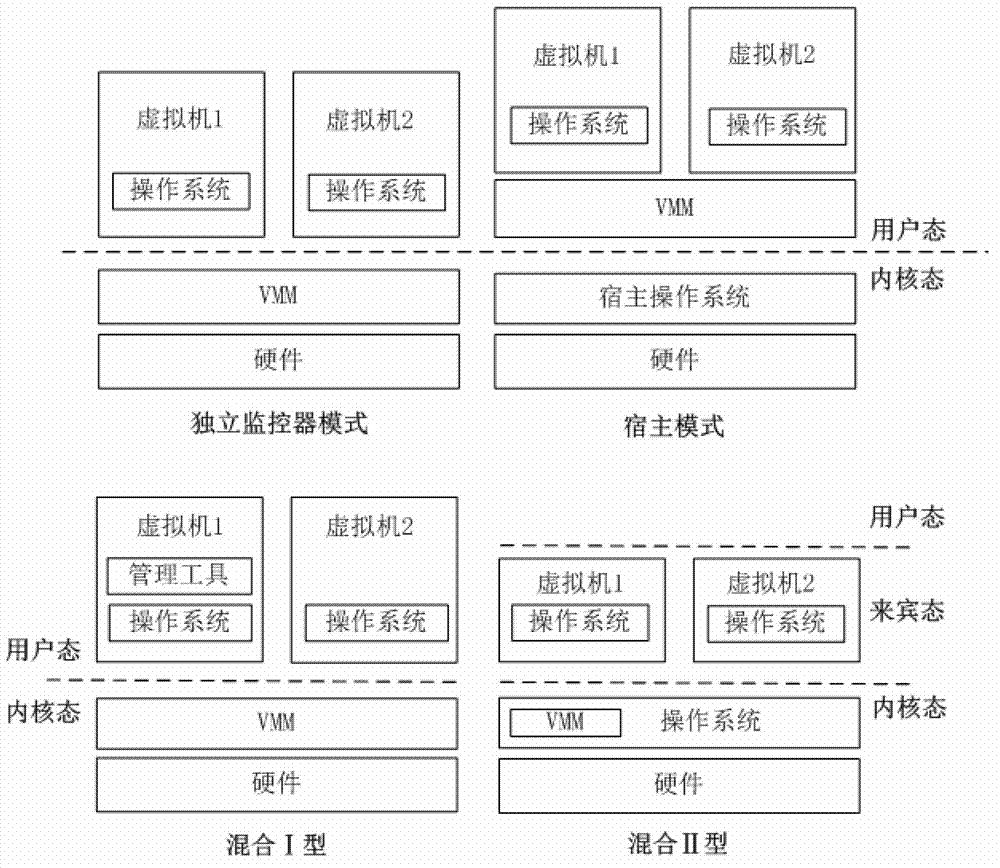

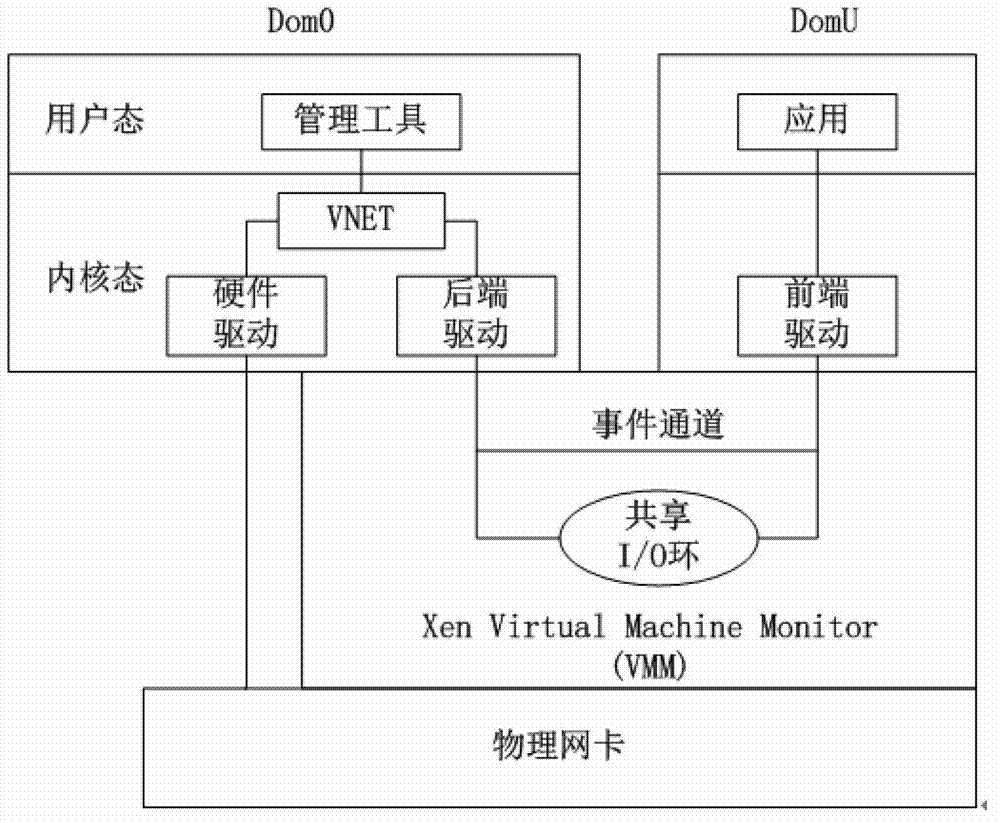

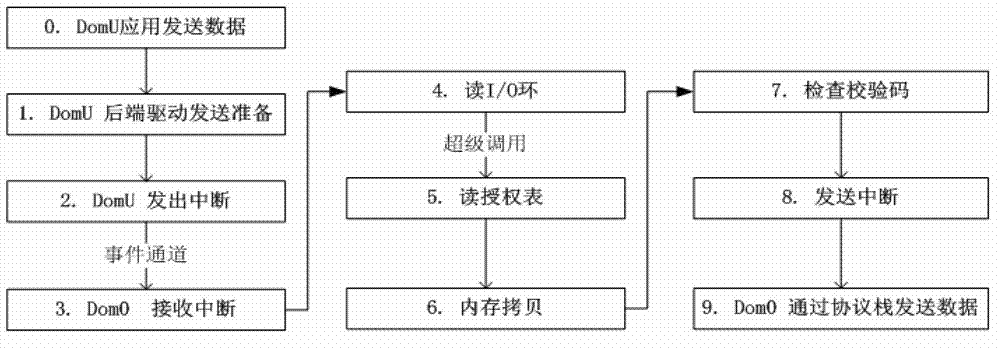

System reducing overhead of central processing unit (CPU) of network input/output (I/O) operation under condition of X86 virtualization

The invention relates to a system reducing overhead of a central processing unit (CPU) of network input / output (I / O) operation under condition of X86 virtualization. The system reducing the overhead of the CPU of the network I / O operation under the condition of the X86 virtualization comprises a data-caching module, a network data demand interception module, and a caching data exchange communication module. An interface of the caching data exchange communication module is applied and called to transmit data to be cached, serial number of the data and eigenvalue of the data to the data-caching module. When the network data demand interception module receives a data package from the network, the eigenvalue of the data package is extracted at first, and then the network data demand interception module search whether corresponding matching exists or not by utilization of the eigenvalue as an index. When the corresponding matching exists, the data is enabled to return and the data package is discarded. When no corresponding matching exists, the data package is delivered to an upper layer protocol to be processed. The system reducing the overhead of the CPU of the network I / O operation under the condition of the X86 virtualization can effectively reduce the CPU overhead occupied by the I / O virtualization and improve I / O performance.

Owner:INST OF SOFTWARE - CHINESE ACAD OF SCI

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com