A credit condition credit risk intelligent analysis and evaluation method and system

A technology of risk intelligence and risk assessment, applied in the field of credit risk assessment, can solve problems such as inability to analyze, inaccurate assessment results, and large consumption of assessment resources, so as to achieve effective control of credit risks, reduce assessment workload, and improve assessment efficiency Effect

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

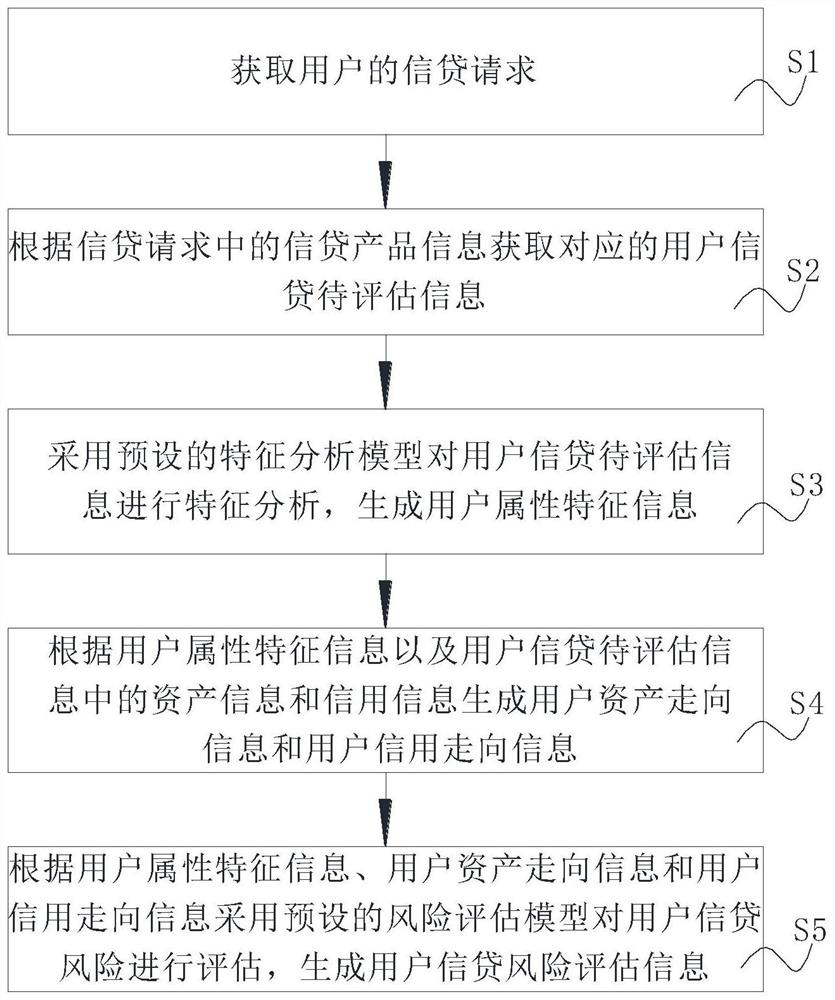

[0061] Such as figure 1 As shown, in the first aspect, the embodiment of the present invention provides a credit condition credit risk intelligent analysis and evaluation method, including the following steps:

[0062] S1. Obtain the credit request of the user; when a user needs credit, send a credit request, the credit request includes the basic information of the user and the content of the credit product.

[0063] S2. Obtain the corresponding user credit information to be evaluated according to the credit product information in the credit request;

[0064] When the user's credit request is obtained, the corresponding credit product needs to be reviewed and evaluated according to the credit product information in the credit request to obtain the corresponding credit product information to be evaluated, and the user's credit to be evaluated information includes user asset information, user Credit repayment information, etc., after obtaining the corresponding information that...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com