Invoicing method, invoicing system and tax control server thereof

A server and tax control technology, applied in invoicing/invoicing, instruments, finance, etc., can solve the problem of low office efficiency in large and medium-sized enterprises, and achieve the effect of reducing personnel consumption and improving office efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

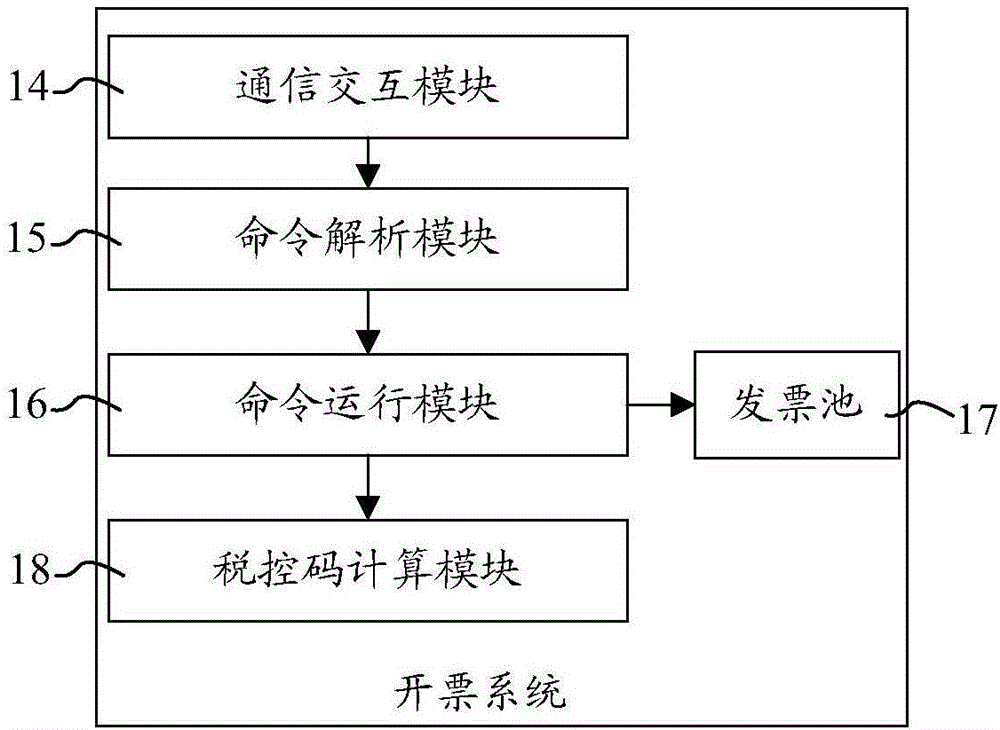

[0039] A billing system is provided in this embodiment, such as figure 1 As shown, the billing system includes:

[0040] The communication interaction module 14 is used to signally connect the billing terminal to the billing system; the command analysis module 15 connected to the communication interaction module 14 is used to analyze the information of the bill to be billed, and resolve the information in the billing system corresponding to the bill to be billed. The invoice pool 17; the command running module 16 connected with the command parsing module 15 is used to find the parsed invoice pool 17, and obtain a blank invoice and a blank invoice number corresponding to the blank invoice from the invoice pool 17, the blank The invoice ticket number is obtained from the tax bureau and stored in the invoice pool 17; the invoice pool 17 connected with the command operation module 16 is used to store the invoice information to be issued; the tax control code calculation module 18 ...

Embodiment 2

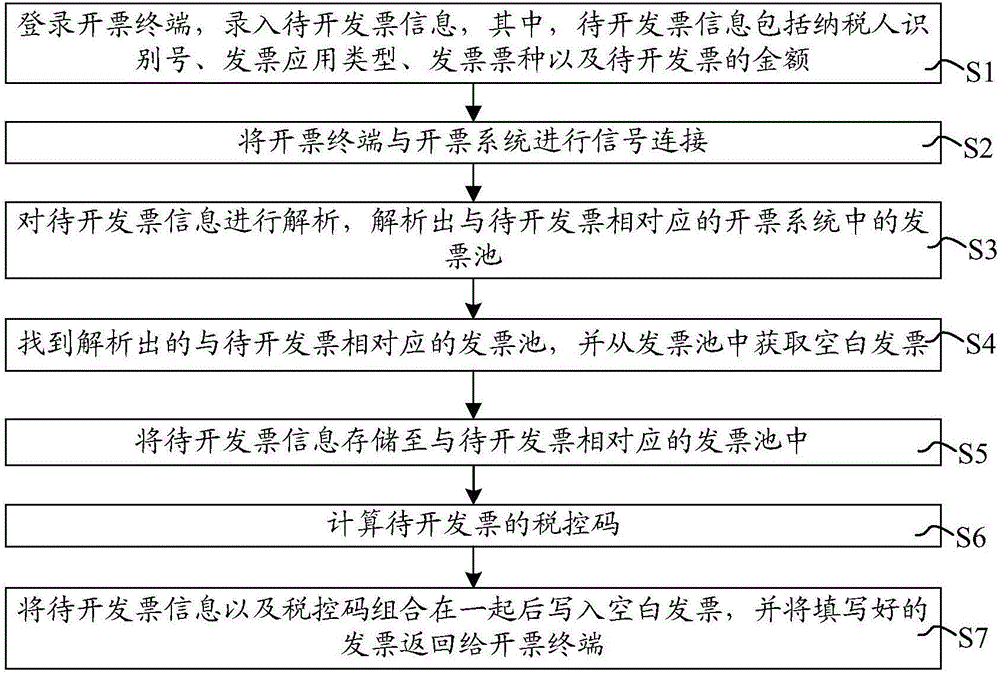

[0045] This embodiment provides a billing method, such as figure 2 As shown, the billing method includes:

[0046]Step S1, log in to the billing terminal, and input the information of the invoice to be issued, wherein the information of the invoice to be issued includes the taxpayer identification number, the application type of the invoice, the type of the invoice, and the amount of the invoice to be issued.

[0047] Step S2, making signal connection between the billing terminal and the billing system.

[0048] Step S3, analyzing the invoice information to be issued, and analyzing the invoice pool in the invoicing system corresponding to the invoice to be issued.

[0049] Step S4. Find the parsed invoice pool corresponding to the invoice to be issued, and obtain a blank invoice and a blank invoice number corresponding to the blank invoice from the invoice pool. The blank invoice number is obtained from the tax bureau and stored in the invoice in the pool.

[0050] Step S5...

Embodiment 3

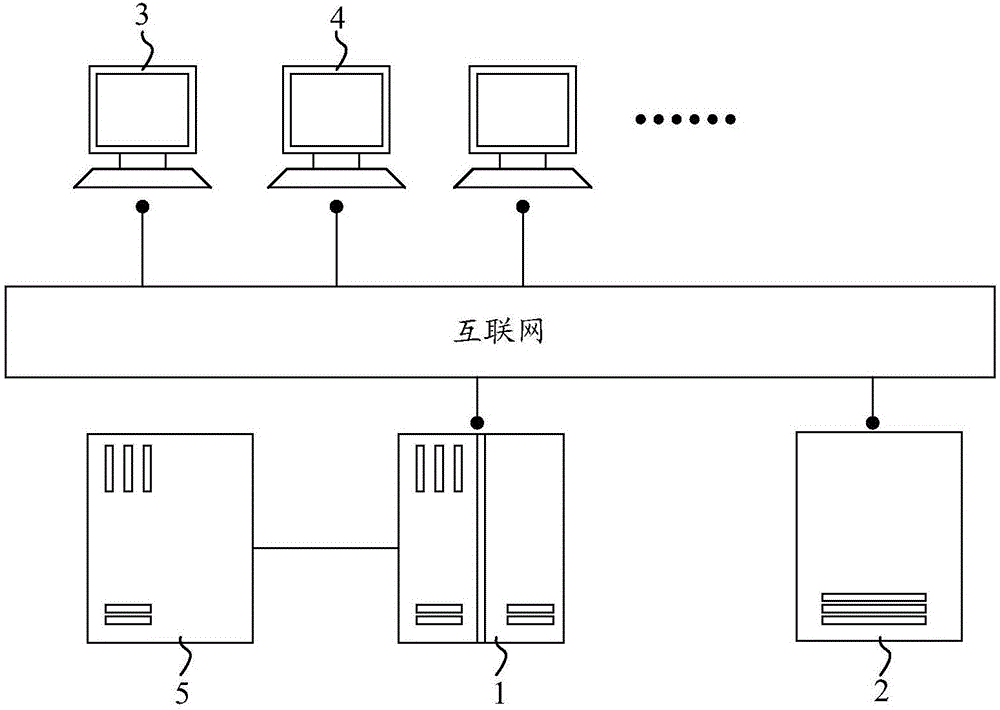

[0060] This embodiment provides a tax control server, such as Figure 3-4 As shown, the tax control server 1 includes a general server 11, a tax control board 12 and a tax control core board 14. The general server 11 is equipped with multiple tax control boards 12, and the tax control board 12 is connected with multiple tax control boards. Tax control core board 13; wherein, the communication interaction module 14, the command analysis module 15, the command operation module 16 and the invoice pool 17 included in the billing system mentioned in the second embodiment are all integrated in the general server 11, and the tax control code The calculation module 18 is integrated on the tax control core board 13 .

[0061] In order to facilitate the understanding of those skilled in the art, the application background in the embodiment of the present invention is introduced in detail, specifically, as image 3 As shown, the tax control server 1 is respectively connected to the back...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com