A system and a method for one-key rating, value estimation and credit granting before real estate lending

A real estate and valuation technology, applied in the field of financial credit and financial services, can solve problems such as time-consuming and laborious, difficult and lengthy credit granting process, and achieve the effect of clear rule engine, convenient borrowing efficiency, and high certainty

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0081] The technical solutions of the present invention will be further specifically described below through specific embodiments and in conjunction with the accompanying drawings.

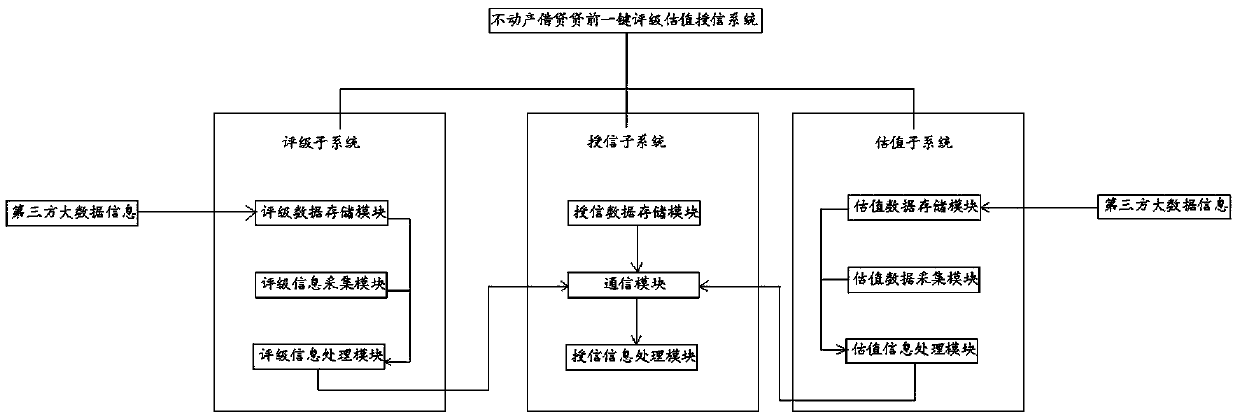

[0082] Such as figure 1 The one-click rating, valuation and credit granting system before real estate lending shown, the system includes:

[0083] A rating subsystem, the rating subsystem comprising:

[0084] Rating data storage module, used for storing credit evaluation information data;

[0085] The rating information collection module is used to collect credit evaluation information of borrowers; collect data (such as credit investigation, cash flow, operating income, asset responsibility, etc.) ) for storage, after summarizing the data, use the rating rule engine to compare, analyze, and calculate to draw rating conclusions;

[0086] The rating information processing module, based on the acquired credit evaluation information of the borrower, uses the rating rule engine to compare and analy...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com