A penetrating type full-transparent high-efficiency real estate network borrowing information intermediary platform system

A technology for online lending and real estate, applied in instruments, finance, data processing applications, etc., can solve the problems of high difficulty in risk control process, inability of lenders to supervise borrowing matters, time-consuming and labor-intensive, etc.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0226] The technical solutions of the present invention will be further specifically described below through specific embodiments and in conjunction with the accompanying drawings.

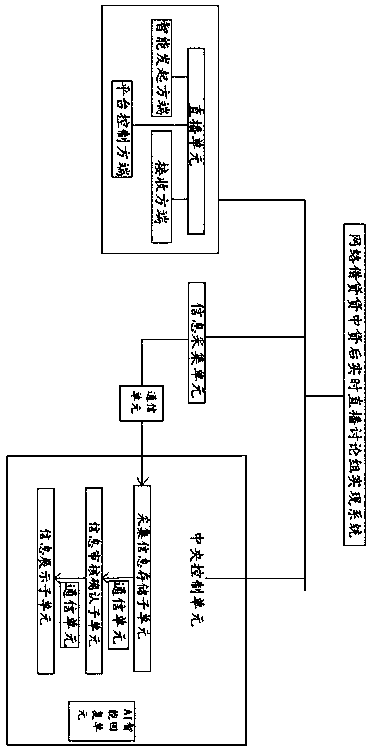

[0227] The penetrating fully transparent and efficient real estate network lending information intermediary platform system of the present invention,

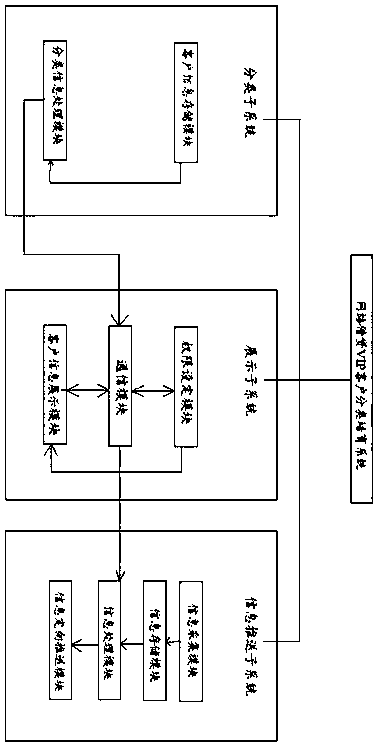

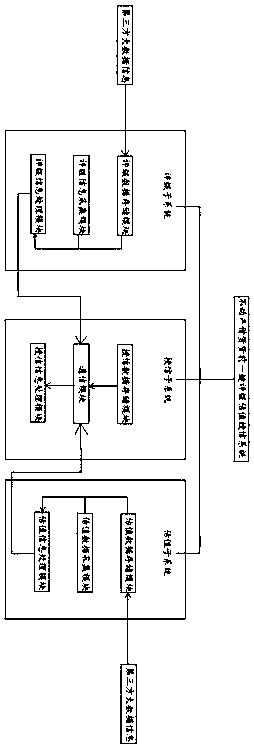

[0228] Including the pre-loan one-click rating and valuation credit system, the pre-loan remote risk control system, the live broadcast processing system after the loan and the VIP customer classification and cultivation system;

[0229] Such as figure 1 As mentioned above, the pre-loan one-click rating and valuation credit system includes:

[0230] A rating subsystem, the rating subsystem comprising:

[0231] Rating data storage module, used for storing credit evaluation information data;

[0232] The rating information collection module is used to collect credit evaluation information of borrowers;

[0233] The rating information processing m...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com