Discrimination Method of Bank's Corporate Loan Default Based on Logistic Regression

A technology of logistic regression and discriminant method, applied in the computer field, can solve problems such as small sample size, inability to meet the needs of business departments for risk investigation, and reduced work efficiency of business personnel

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0254] According to a specific embodiment of the present invention, the method for judging the default of a bank's corporate loan based on binomial logistic regression of the present invention will be described in detail below.

[0255] The invention provides a method for judging the default of a bank's corporate loan based on logistic regression, comprising the following steps:

[0256] Default predictor pre-extraction step,

[0257] Using one-way analysis of variance or multicollinearity verification method, according to the company's basic information and company financial indicators in the database, extract the N indicators that have the greatest impact on the default rate;

[0258] The basic information of the enterprise includes: enterprise name, data year, default or not, date of establishment, number of on-the-job employees, total assets and the borrower's organization code;

[0259] The financial indicators of the enterprise: main business income, current ratio, quic...

Embodiment 2

[0268] According to a specific embodiment of the present invention, the method for judging the default of a bank's corporate loan based on binomial logistic regression of the present invention will be described in detail below.

[0269] The invention provides a method for judging the default of a bank's corporate loan based on logistic regression, comprising the following steps:

[0270] Default predictor pre-extraction step,

[0271] Using one-way analysis of variance or multicollinearity verification method, according to the company's basic information and company financial indicators in the database, extract the N indicators that have the greatest impact on the default rate;

[0272] The basic information of the enterprise includes: enterprise name, data year, default or not, date of establishment, number of on-the-job employees, total assets and the borrower's organization code;

[0273] The financial indicators of the enterprise: main business income, current ratio, quic...

Embodiment 3

[0288] According to a specific embodiment of the present invention, the process of extracting the N indicators that have the greatest impact on the default rate by the one-way ANOVA method of the present invention will be described in detail below.

[0289] The one-way ANOVA method is used to extract the N indicators that have the greatest impact on the default rate, including the following steps:

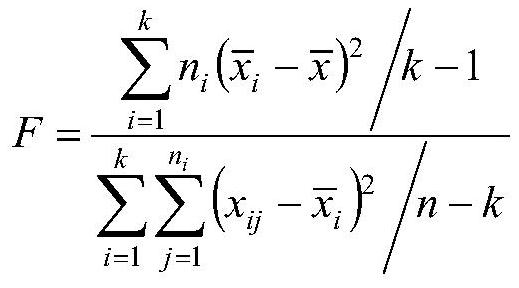

[0290] One-way analysis of variance is carried out for each indicator and default or not, and the data in the set year is taken, and the value of the test statistic F is obtained according to the following formula:

[0291]

[0292] in,

[0293] k is the set year number;

[0294] n is the number of all companies in the same industry of the company in the database;

[0295] is the mean value of the index variable corresponding to each company in the same industry in the i-th year database;

[0296] is the total mean value of the index variable corresponding to each company...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com