Consumption financial product credit scoring method and device based on customer grouping

A technology for credit scoring and financial products, applied in finance, data processing applications, instruments, etc., can solve problems such as low model discrimination, large differences in model variables for customer grouping types, and the impact of customer credit scores

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0054] The present invention will be further described below in conjunction with the accompanying drawings and specific embodiments.

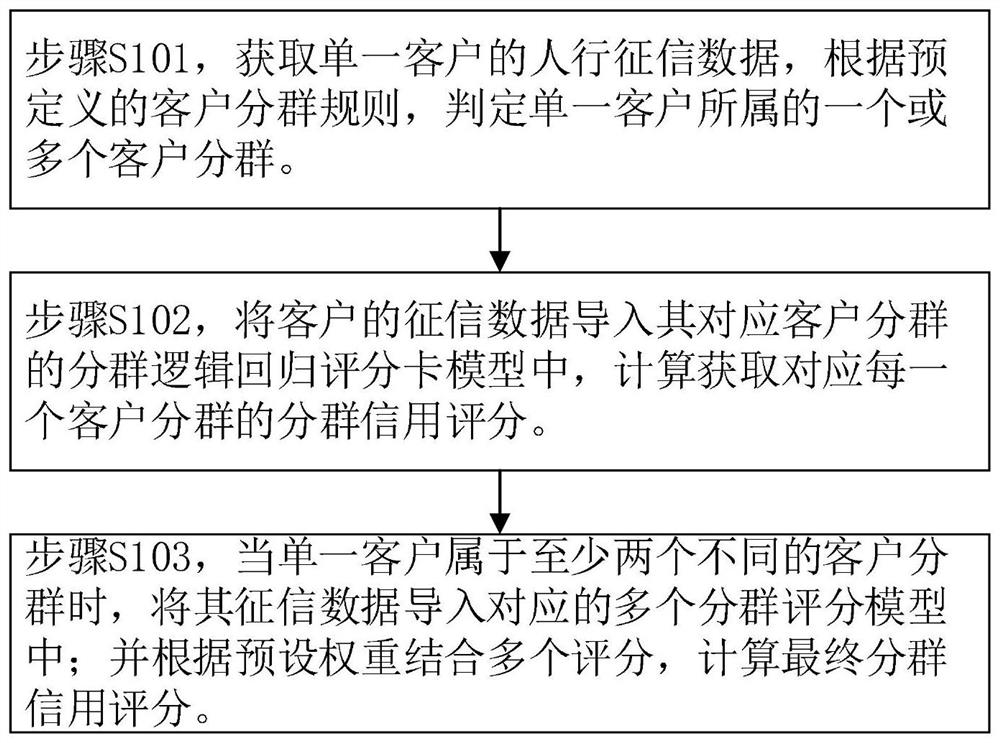

[0055] like figure 1 As shown, the present application provides a method of consumption finance based credit score based on a customer-based population, the method comprising the steps of:

[0056] Step S101, acquire a single customer's credit information, determine one or more customer divisions belonging to a single customer according to a predefined customer population rule.

[0057] Step S102, introducing the customer's credit data into the group logic regression evaluation card model corresponding to the customer's population, calculates the bracket credit score corresponding to each customer's population.

[0058] Step S103, when a single customer belongs to at least two different customer split, the syndrome data imported into the corresponding plurality of bracket score model; and combines a plurality of scores based on the preset weight, c...

PUM

Login to view more

Login to view more Abstract

Description

Claims

Application Information

Login to view more

Login to view more - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap