Method and system for hybrid calculation of individual tax in different income modes

A hybrid computing and income technology, applied in the tax system field, can solve problems affecting work efficiency, affecting data accuracy, easy data loss or artificial modification, etc., to achieve the effect of ensuring accuracy and improving work efficiency

Pending Publication Date: 2022-06-10

SHANDONG IRON & STEEL GRP YONGFENG LINGANG CO LTD

View PDF0 Cites 0 Cited by

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

However, under the circumstances of various incomes of current employees (including pre-tax income, cash handouts, donations, different insurances, deductions), and for large-scale companies with tens of thousands of people, the normal standard individual tax Calculation tools or programs are no longer satisfactory for the human resources department to perform payroll accounting, and the financial department to pay personal income tax

A single salary calculation method requires the human resources department and the financial department to transfer data to each other, and then look for different personal tax calculation tools or programs, and finally realize the calculation of personal tax payment. Not only is the data easy to be lost or artificially modified during the transfer process , which affects the accuracy of the data, brings certain risks to the personal tax declaration, and greatly affects the work efficiency in the calculation process

Method used

the structure of the environmentally friendly knitted fabric provided by the present invention; figure 2 Flow chart of the yarn wrapping machine for environmentally friendly knitted fabrics and storage devices; image 3 Is the parameter map of the yarn covering machine

View moreImage

Smart Image Click on the blue labels to locate them in the text.

Smart ImageViewing Examples

Examples

Experimental program

Comparison scheme

Effect test

Embodiment Construction

the structure of the environmentally friendly knitted fabric provided by the present invention; figure 2 Flow chart of the yarn wrapping machine for environmentally friendly knitted fabrics and storage devices; image 3 Is the parameter map of the yarn covering machine

Login to View More PUM

Login to View More

Login to View More Abstract

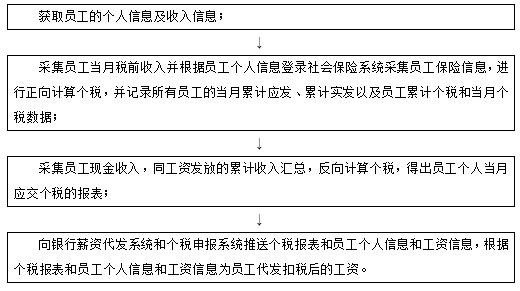

The invention discloses a method for hybrid calculation of individual tax based on different income modes. The method comprises the following steps: obtaining personal information and income information of employees; the method comprises the following steps of: acquiring the pre-tax income of employees in the current month, logging in a social insurance system according to the personal information of the employees to acquire the insurance information of the employees, performing forward calculation of individual tax, and recording the current-month accumulative issuing, accumulative actual issuing, the employee accumulative individual tax and the current-month individual tax data of all the employees; collecting cash revenue of the employees, summarizing the cash revenue with accumulated revenue of salary payment, and reversely calculating individual tax to obtain a report of the individual tax which should be paid by the employees in the current month; and issuing wages after tax deduction to the employees according to the individual tax report, the personal information of the employees and the wages information. Through calculation of two modes of the system, two modes of paying salaries by a human resource department and paying bonus by finance are effectively combined, so that the accuracy of data is ensured, the working efficiency is improved, the trouble caused by different paying modes of the human resource department and the finance department is solved, and the working efficiency is improved.

Description

technical field [0001] The present invention relates to the technical field of taxation systems, and more specifically, relates to a method and system for calculating individual tax by mixing different income modes. Background technique [0002] At present, the personal tax calculation adopts the traditional Excel table for the company's forward calculation method, as well as many current public personal tax calculation tools or programs, which basically meet the needs of the human resources department to issue pre-tax wages. However, under the circumstances of various incomes of current employees (including pre-tax income, cash handouts, donations, different insurances, deductions), and for large-scale companies with tens of thousands of people, the normal standard individual tax Calculation tools or programs are no longer sufficient for the human resources department to perform salary accounting and the financial department to pay personal income tax. A single salary calc...

Claims

the structure of the environmentally friendly knitted fabric provided by the present invention; figure 2 Flow chart of the yarn wrapping machine for environmentally friendly knitted fabrics and storage devices; image 3 Is the parameter map of the yarn covering machine

Login to View More Application Information

Patent Timeline

Login to View More

Login to View More Patent Type & Authority Applications(China)

IPC IPC(8): G06Q40/00

CPCG06Q40/125G06Q40/123

Inventor 张兆民宋利平吴则勇尹晓高春辉

Owner SHANDONG IRON & STEEL GRP YONGFENG LINGANG CO LTD

Features

- R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

Why Patsnap Eureka

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Social media

Patsnap Eureka Blog

Learn More Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com