Method and apparatus for trading securities or other instruments

a technology of securities or other instruments, applied in the direction of instruments, special data processing applications, electric digital data processing, etc., can solve the problems of inability to secure the best execution for customers, inefficient from a transaction cost perspective, and many limitations of the traditional method of executing orders

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0013] Although the embodiments of the present invention are described herein in terms of orders to buy shares of stock, the present invention can be equally applicable to orders to buy any instrument representing an underlying tradable asset or liability, including, but not limited to government bonds, Treasury-bills, shares in mutual funds, shares in investment trusts, derivatives, investment contracts, bearer bonds, mutual funds, bank notes, insurance contracts, letters of credit, etc. Furthermore, although the embodiments of the present invention are described in terms of dollars, the present invention can be equally applicable to transactions in any currency or denomination or other variable that is deterministically convertible to a number of shares. In fact, one aspect of the present invention provides certain advantages for processing of orders received in multiple currencies.

Overview

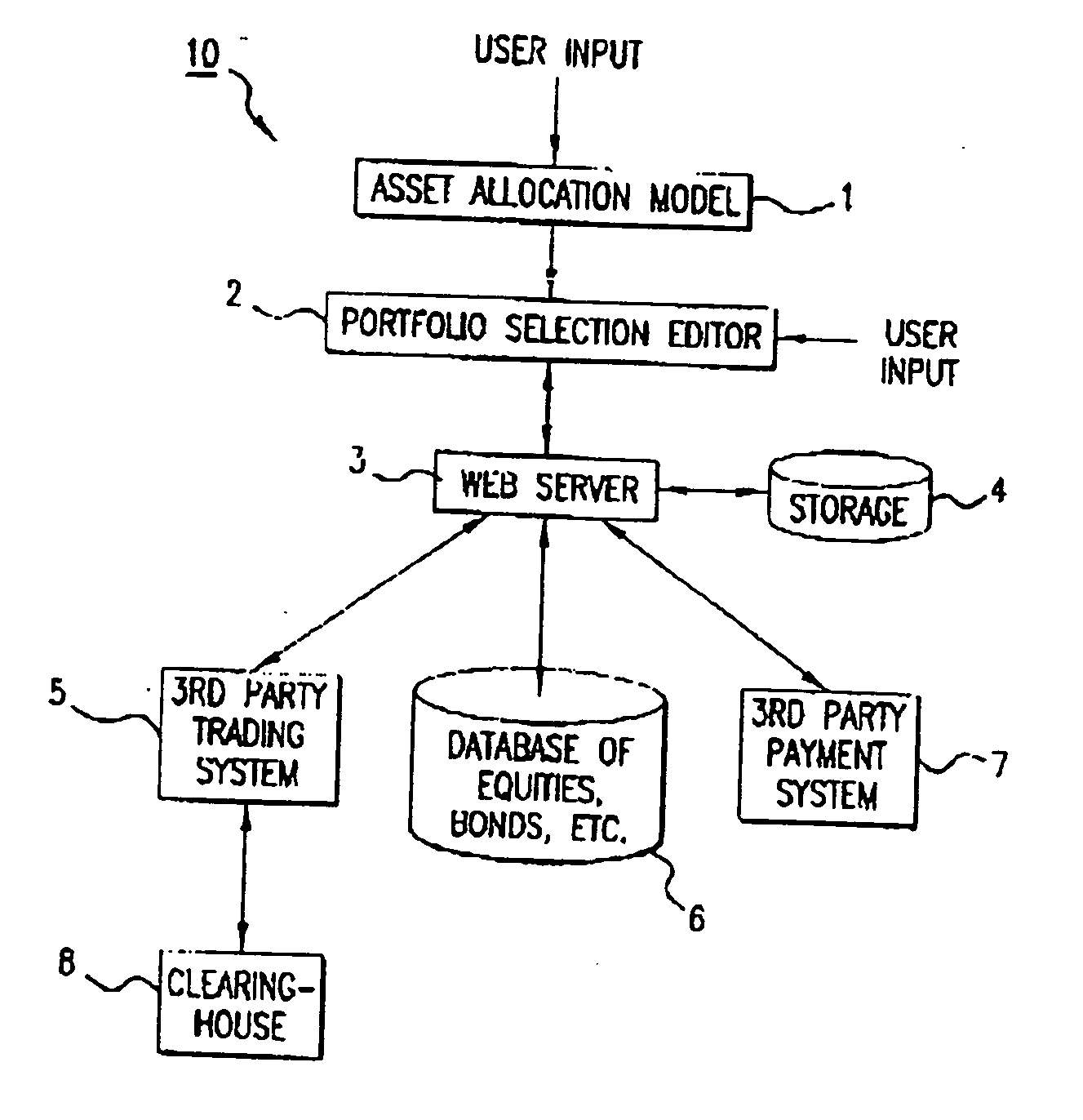

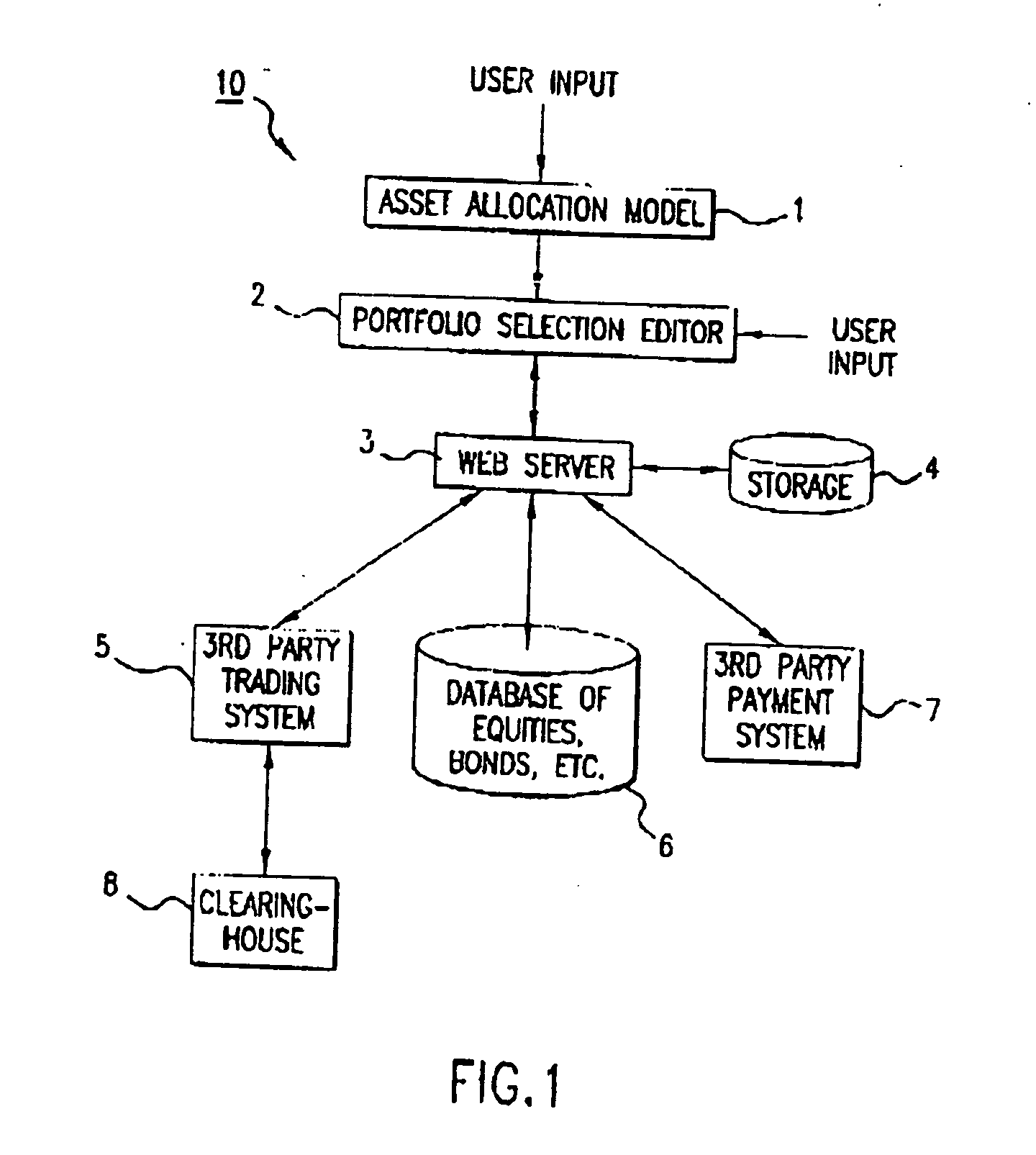

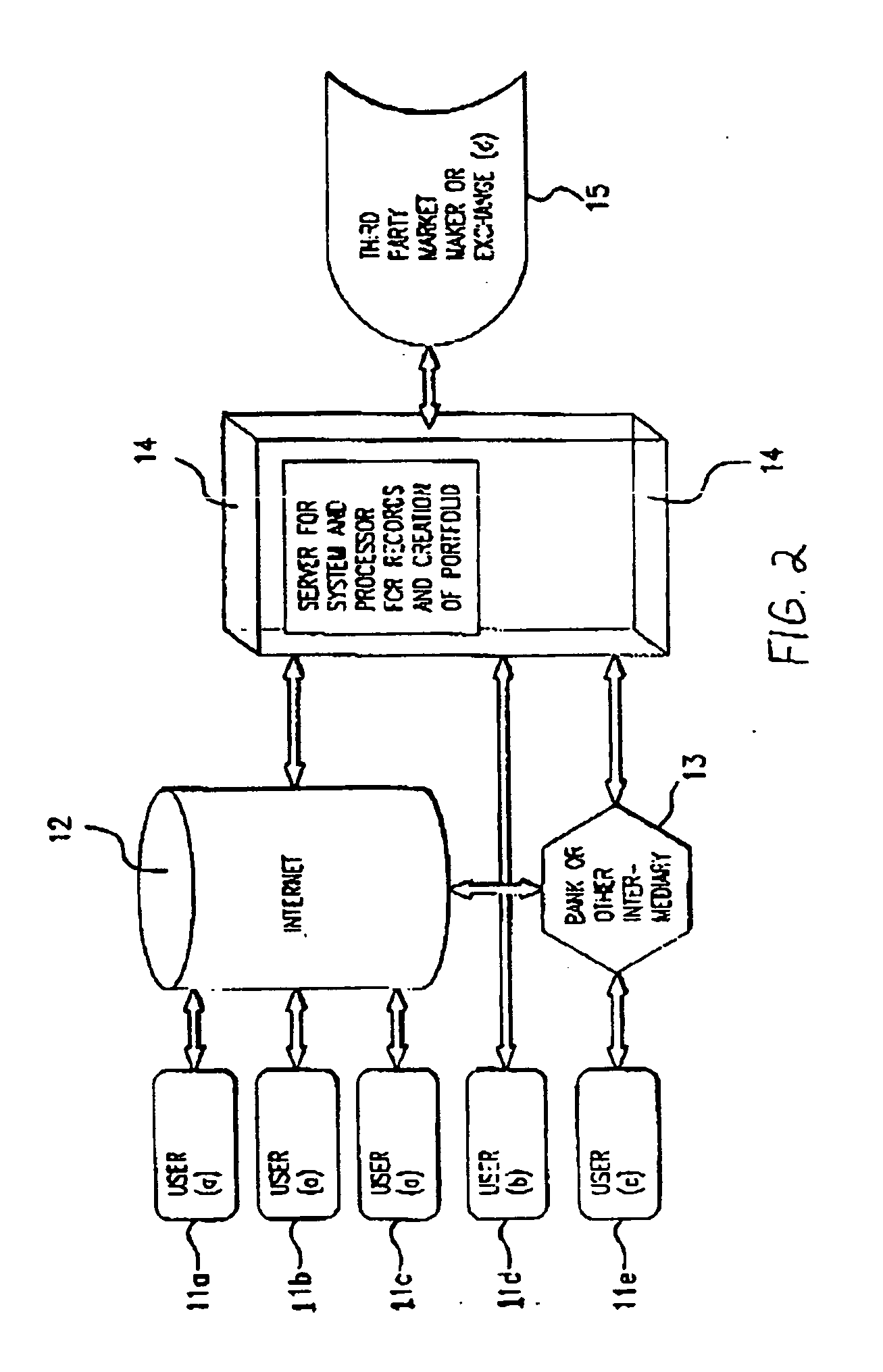

[0014] Referring to FIG. 1, shown therein is an exemplary embodiment of a system 10 for c...

PUM

Login to view more

Login to view more Abstract

Description

Claims

Application Information

Login to view more

Login to view more - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap