Method and device for evaluating client credit

A credit and customer technology, applied in the field of computer networks, can solve the problems of lack of evaluation of human factors on both sides of the transaction, cannot objectively reflect the real credit of users, and lack of clear and clear understanding of credit, so as to accurately quantify customer credit and reduce online The transaction failure rate and the effect of improving transaction trust

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

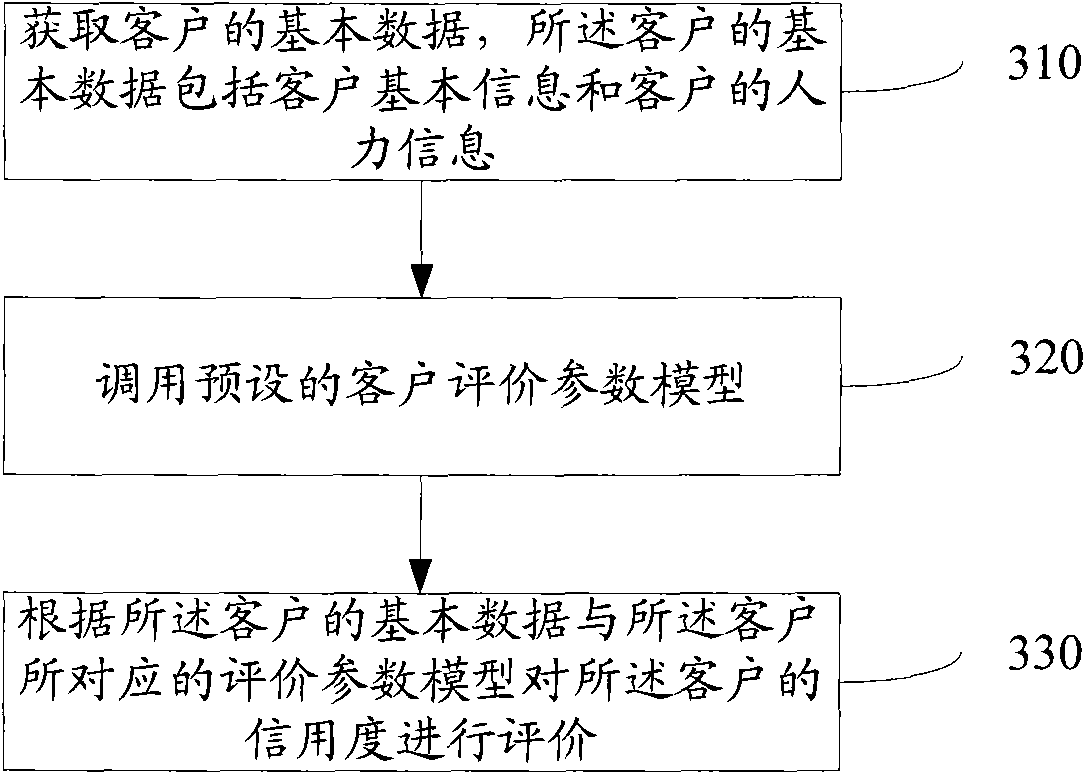

[0062] The following will clearly and completely describe the technical solutions in the embodiments of the present invention with reference to the drawings in the embodiments of the present invention.

[0063] Such as image 3 As shown, the embodiment of the present invention provides a method for evaluating customer credit, including,

[0064] Step 310, acquiring the basic data of the customer, the basic data of the customer includes the basic information of the customer and the human information of the customer;

[0065] Step 320, call the preset customer evaluation parameter model;

[0066] Step 330: Evaluate the credit degree of the customer according to the basic data of the customer and the evaluation parameter model corresponding to the customer.

[0067] Wherein, before acquiring the basic data of customers, it also includes determining the type of customers, and the types of customers include demanders and suppliers.

[0068] Wherein, the basic data of the custome...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com