Quantitative trading method and system for financial derivatives

A technology of financial derivatives and trading methods, applied in the field of quantitative trading methods and quantitative trading systems of financial derivatives, can solve the problems that do not involve the tracking of market ups and downs, adverse effects on trading performance, and the inability to provide personalized trading advice information, etc.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0037] The technical solutions of the various embodiments of the present invention will be clearly and completely described below in conjunction with the accompanying drawings. Apparently, the described embodiments are only some of the embodiments of the present invention, not all of them. Based on the embodiments of the present invention, all other embodiments obtained by persons of ordinary skill in the art without making creative efforts belong to the protection scope of the present invention.

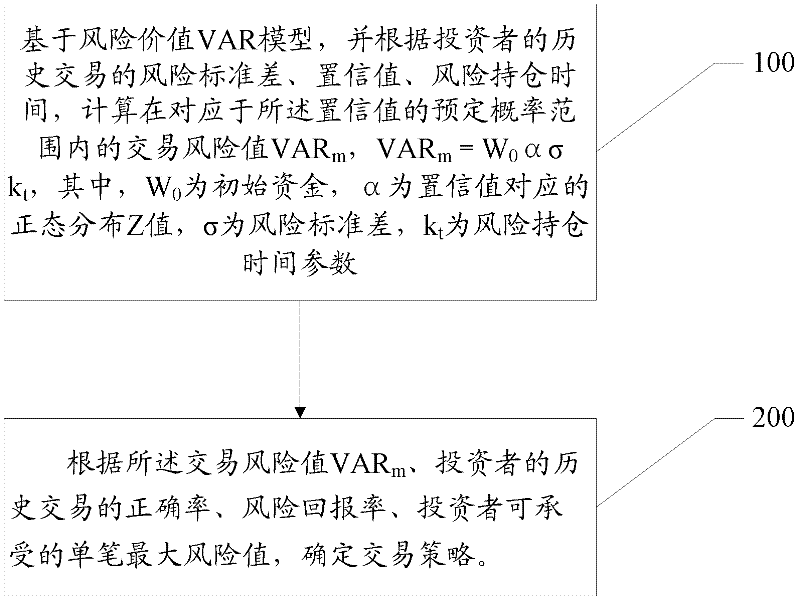

[0038] According to one aspect of the present invention, a quantitative trading method for financial derivatives is provided, comprising the following steps:

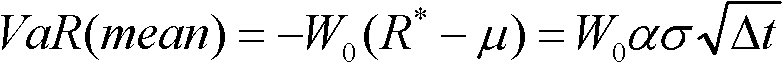

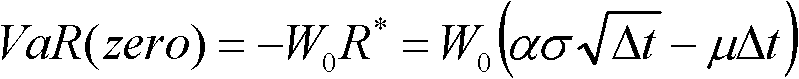

[0039] Based on the value-at-risk VAR model, and according to the risk standard deviation, confidence value, and risk holding time of investors' historical transactions, calculate the transaction risk value VAR within the predetermined probability range corresponding to the confidence value m , VAR m =W 0 ασk t , where W ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com