NFC (near field communication) mobile terminal and payment method

A mobile terminal and terminal technology, applied in the field of NFC mobile terminal and payment, can solve the problems of information leakage, leakage of user property security, threats, etc., and achieve the effects of improving security, enriching payment methods, and improving payment experience

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Example Embodiment

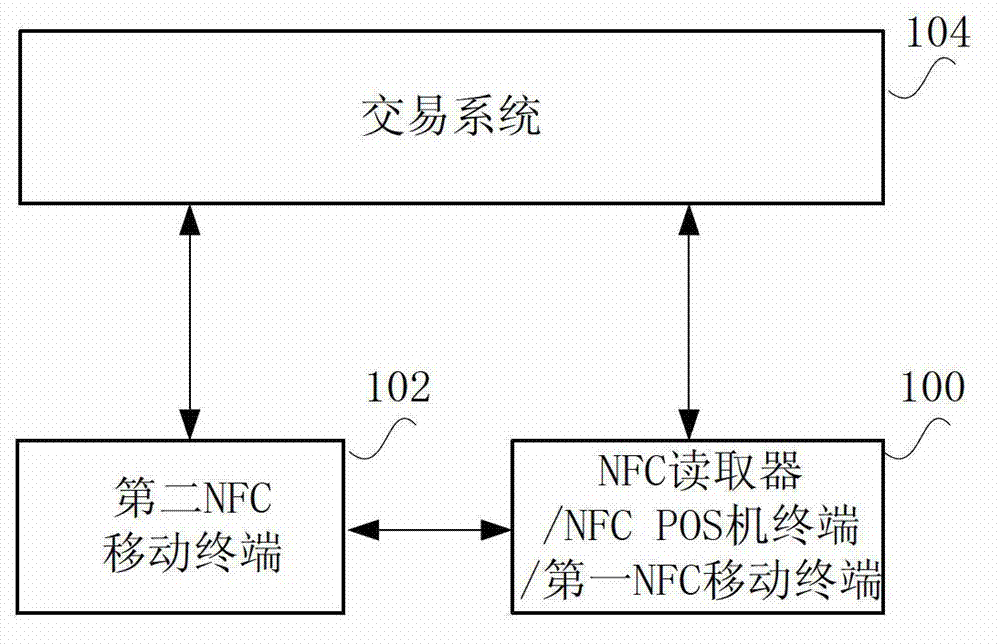

[0019] In view of the problems existing in the prior art, the embodiment of the present invention considers using NFC (Near Field Communication, Near Field Communication or Near Field Communication) technology. It is evolved from the integration of non-RFID (Radio Frequency Identify, radio frequency identification) and interconnection technologies, combining inductive card readers, inductive cards and point-to-point communication functions on a single chip. NFC technology also utilizes wireless frequency electromagnetic induction coupling. NFC technology became the ISO / IECIS 18092 international standard in 2002, and has since been approved as the EMCA-340 standard and the ETSI TS102 190 standard. In a short distance, multiple devices with NFC communication function can identify each other and exchange data. The NFC chip that realizes the NFC communication function can be built in various communication devices, such as built in a mobile communication terminal. The mobile communi...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com