Insurance policy risk evaluating method and device, terminal equipment and storage medium

A technology of risk assessment and insurance policy, applied in the field of financial services, can solve the problems of no insurance policy data mining analysis, low recognition rate of group fraud risks, etc., and achieve the effect of improving efficiency and accurate and efficient identification

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

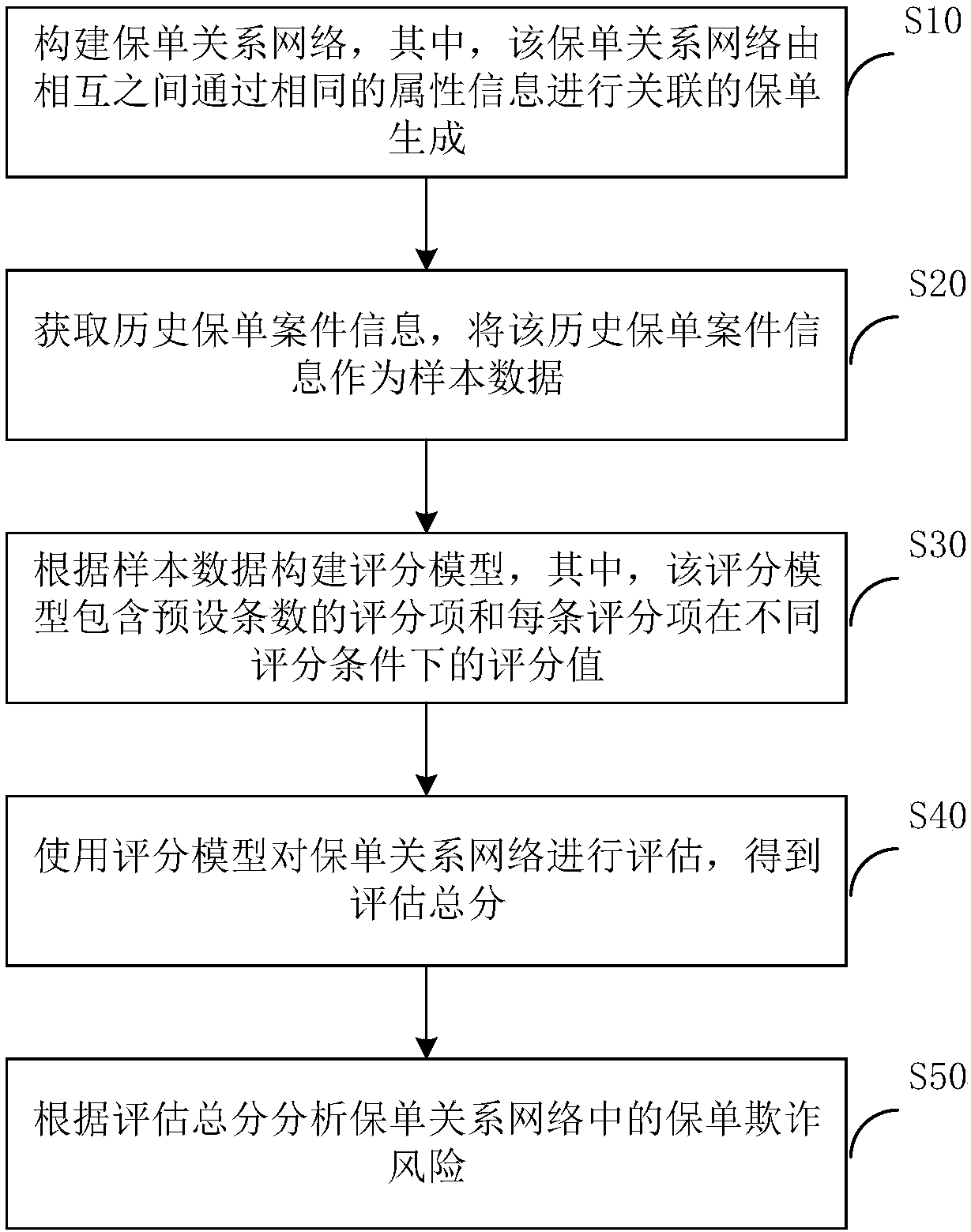

[0030] see figure 1 , figure 1 It shows the implementation flow of the insurance policy risk assessment method provided by the embodiment of the present invention. The policy risk assessment method can collect historical policy case information from the policy database, so as to perform policy risk assessment model training based on the collected historical policy case information. The insurance policy risk assessment method can be specifically applied in the insurance industry policy information database management system, a data management system, to evaluate the fraud risk of the insurance policy relationship network, and can effectively improve the identification rate of group fraud risks. Such as figure 1 As shown, the insurance policy risk assessment method includes steps S10 to S50, which are described in detail as follows:

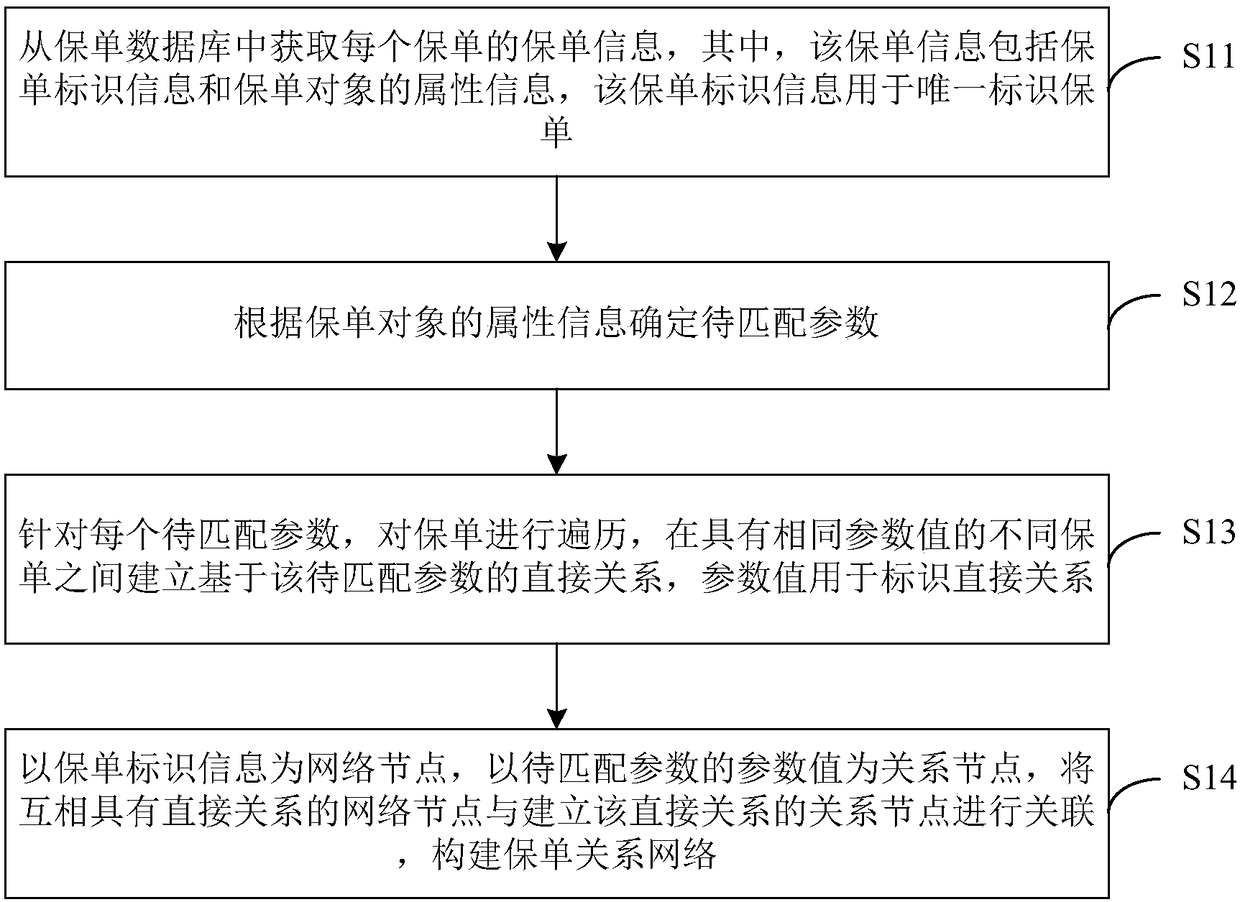

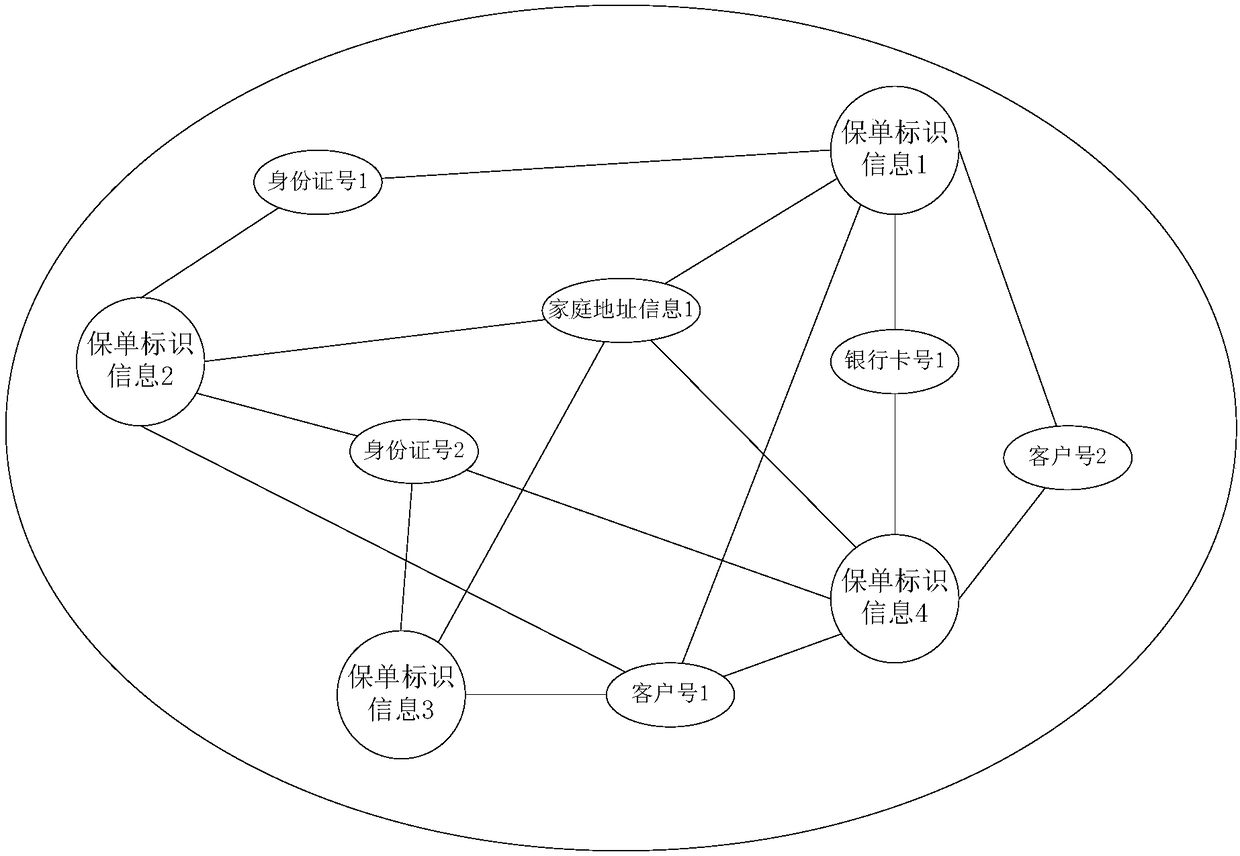

[0031] S10: Build an insurance policy relationship network, wherein the policy relationship network is generated by policies that are associate...

Embodiment 2

[0121] Corresponding to the policy risk assessment method in Example 1, Figure 6 An insurance policy risk assessment device corresponding to the insurance policy risk assessment method shown in Embodiment 1 is shown. For the convenience of description, only the parts related to the embodiment of the present invention are shown.

[0122] Such as Figure 6 As shown, the insurance policy risk evaluation device includes an insurance policy relationship network construction module 61 , an insurance policy sample data collection module 62 , an insurance policy evaluation model construction module 63 , an insurance policy relationship network evaluation module 64 and an insurance policy fraud risk analysis module 65 . The detailed description of each functional module is as follows:

[0123] An insurance policy relationship network construction module 61, configured to construct an insurance policy relationship network, wherein the policy relationship network is generated by polici...

Embodiment 3

[0148] This embodiment provides a computer-readable storage medium, on which a computer program is stored. When the computer program is executed by a processor, the insurance policy risk assessment method in Embodiment 1 is implemented. To avoid repetition, details are not repeated here. Alternatively, when the computer program is executed by the processor, the functions of each module / unit in the insurance policy risk assessment device in Embodiment 2 are realized, and details are not repeated here to avoid repetition.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com