Risk enterprise determination method and device, equipment and medium

A technology of venture enterprise and determination method, applied in the field of taxation, which can solve the problem of inability to identify risky enterprises that evade consumption tax of ultra-luxury motor vehicles.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

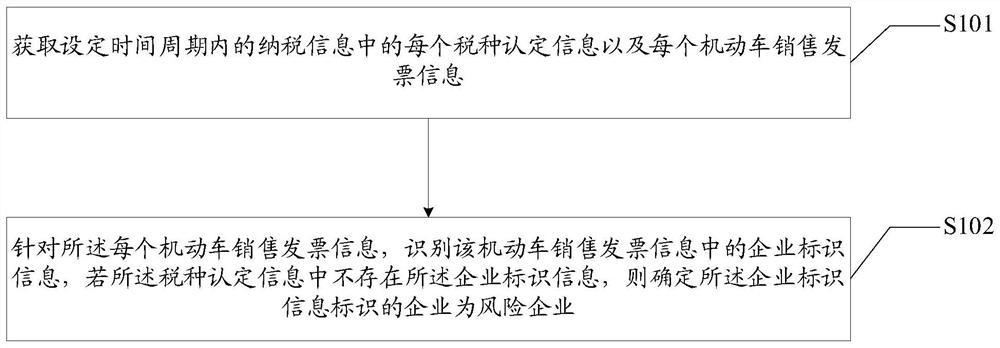

[0052] figure 1 It is a process diagram of a method for determining a venture enterprise provided by an embodiment of the present invention, and the process includes the following steps:

[0053] S101: Acquiring identification information of each tax type and information of each motor vehicle sales invoice in the tax payment information within a set time period.

[0054] The venture enterprise determination method provided by the embodiments of the present invention is applied to electronic devices, which may be smart terminal devices such as smartphones, tablet computers, and PCs; or devices such as local servers and cloud servers. The specific embodiments of the present invention are specific to This is not limited.

[0055] In order to determine the risky enterprises evading the consumption tax on ultra-luxury motor vehicles, the electronic device obtains the identification information of each tax type in the tax payment information and the information of each sales invoic...

Embodiment 2

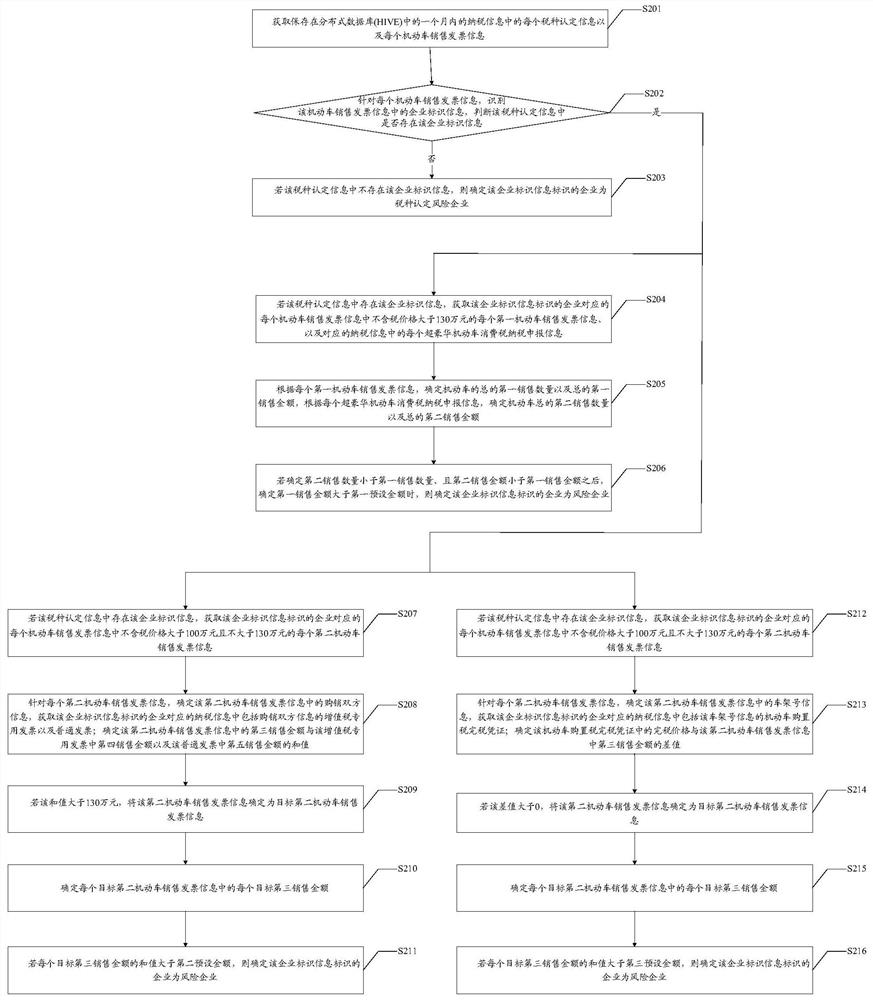

[0066] In order to determine the venture enterprise, on the basis of the above embodiments, in the embodiment of the present invention, if the enterprise identification information exists in the tax identification information, the method further includes:

[0067] Obtain each first motor vehicle sales invoice information corresponding to the enterprise identified by the enterprise identification information in the sales invoice information of each motor vehicle whose tax-free price is greater than the first price, and each super luxury motor vehicle in the corresponding tax payment information GST return information;

[0068] According to the sales invoice information of each first motor vehicle, determine the first sales quantity and the first sales amount of the motor vehicle, and determine the second sales quantity and the first sales amount of the motor vehicle according to the consumption tax declaration information of each ultra-luxury motor vehicle the second sales amou...

Embodiment 3

[0081] In order to determine the venture enterprise, on the basis of the above embodiments, in the embodiment of the present invention, if the enterprise identification information exists in the tax identification information, the method further includes:

[0082] Obtaining the sales invoice information of each motor vehicle corresponding to the enterprise identified by the enterprise identification information, and the sales invoice information of each second motor vehicle whose tax-free price is greater than the second price and not greater than the first price;

[0083] For each of the second motor vehicle sales invoice information, determine the buyer and seller information in the second motor vehicle sales invoice information, and obtain the value-added tax of the buyer and seller information included in the tax payment information corresponding to the enterprise identified by the enterprise identification information. Special invoices and ordinary invoices; determine the ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com