Historical insurance transaction system and method

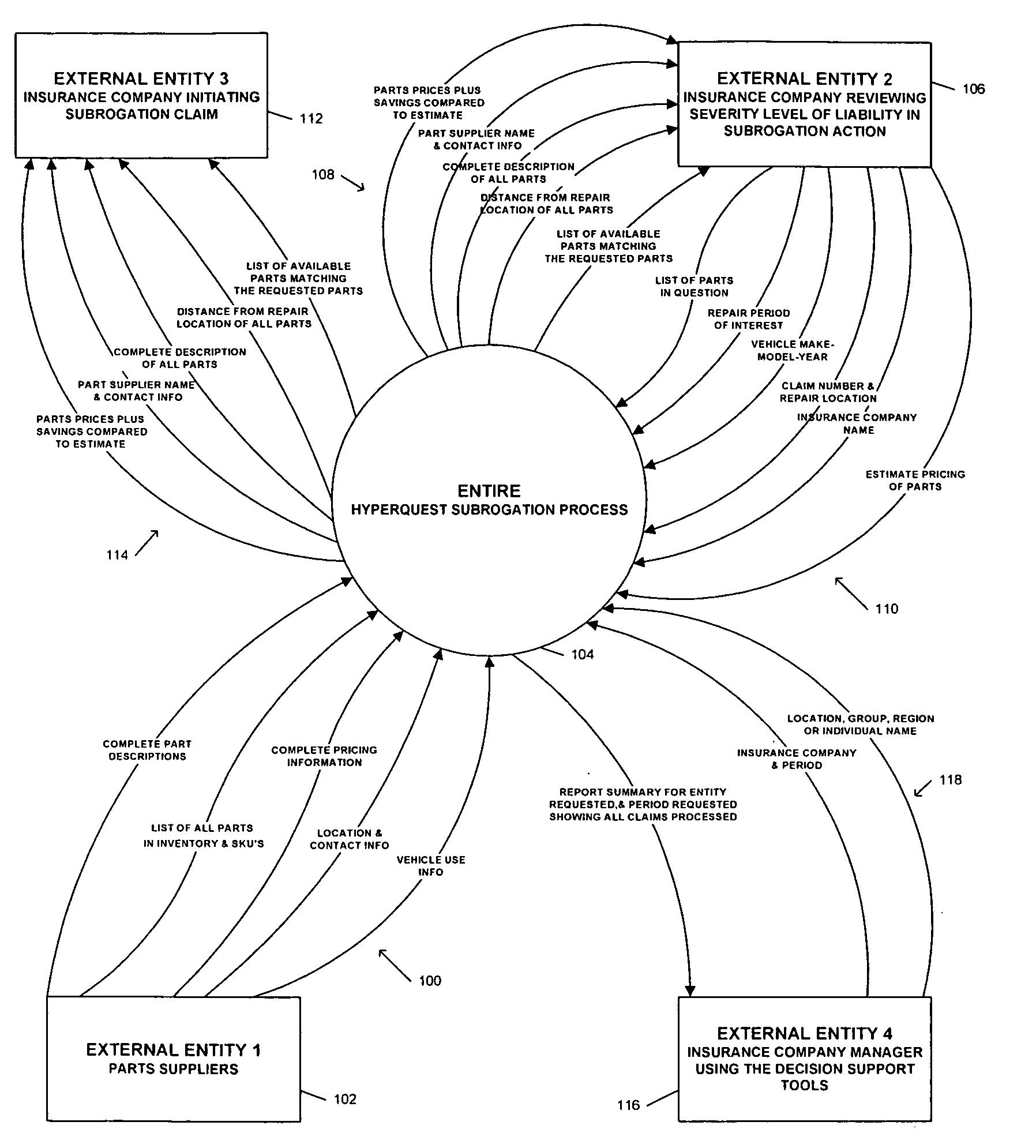

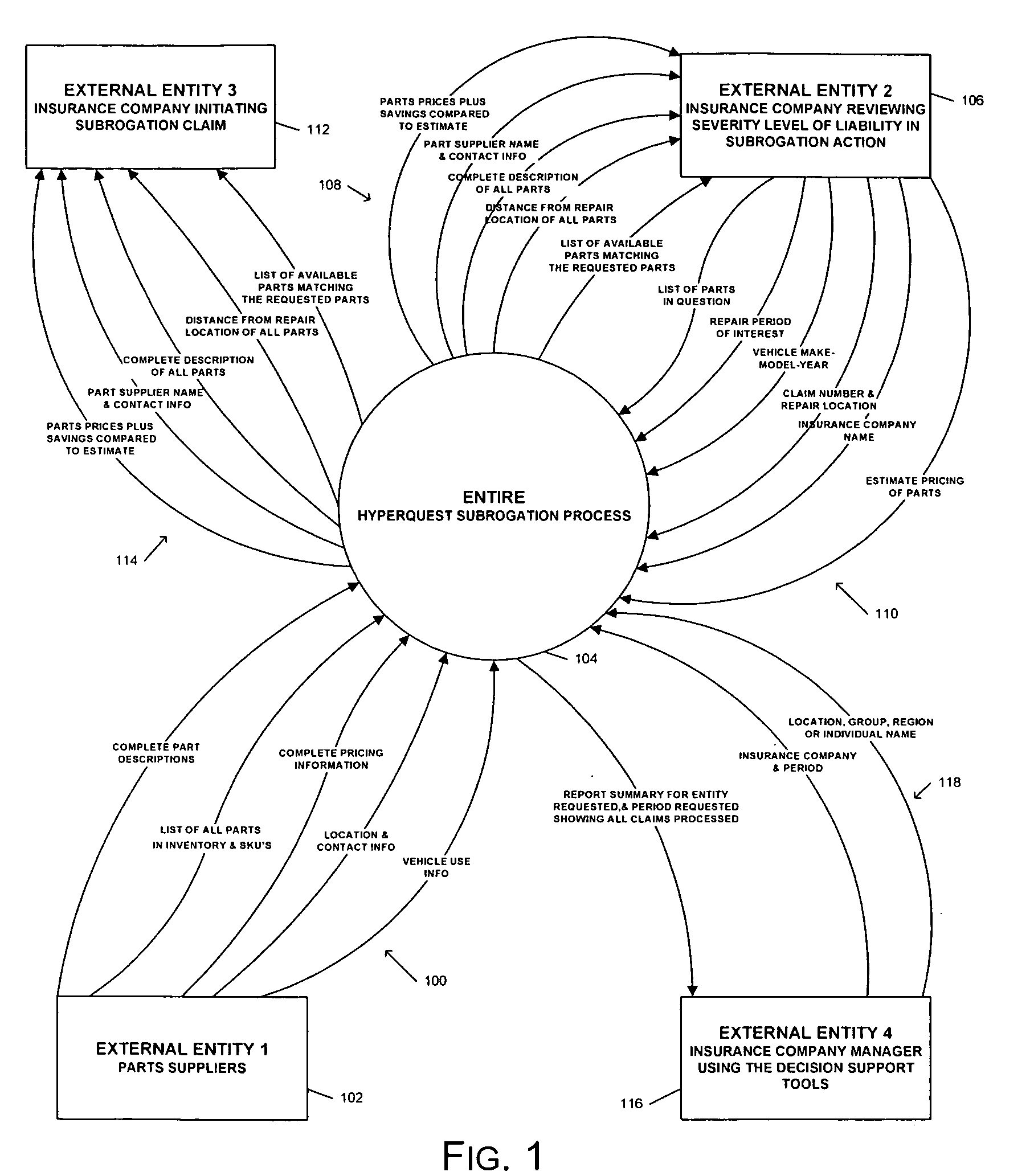

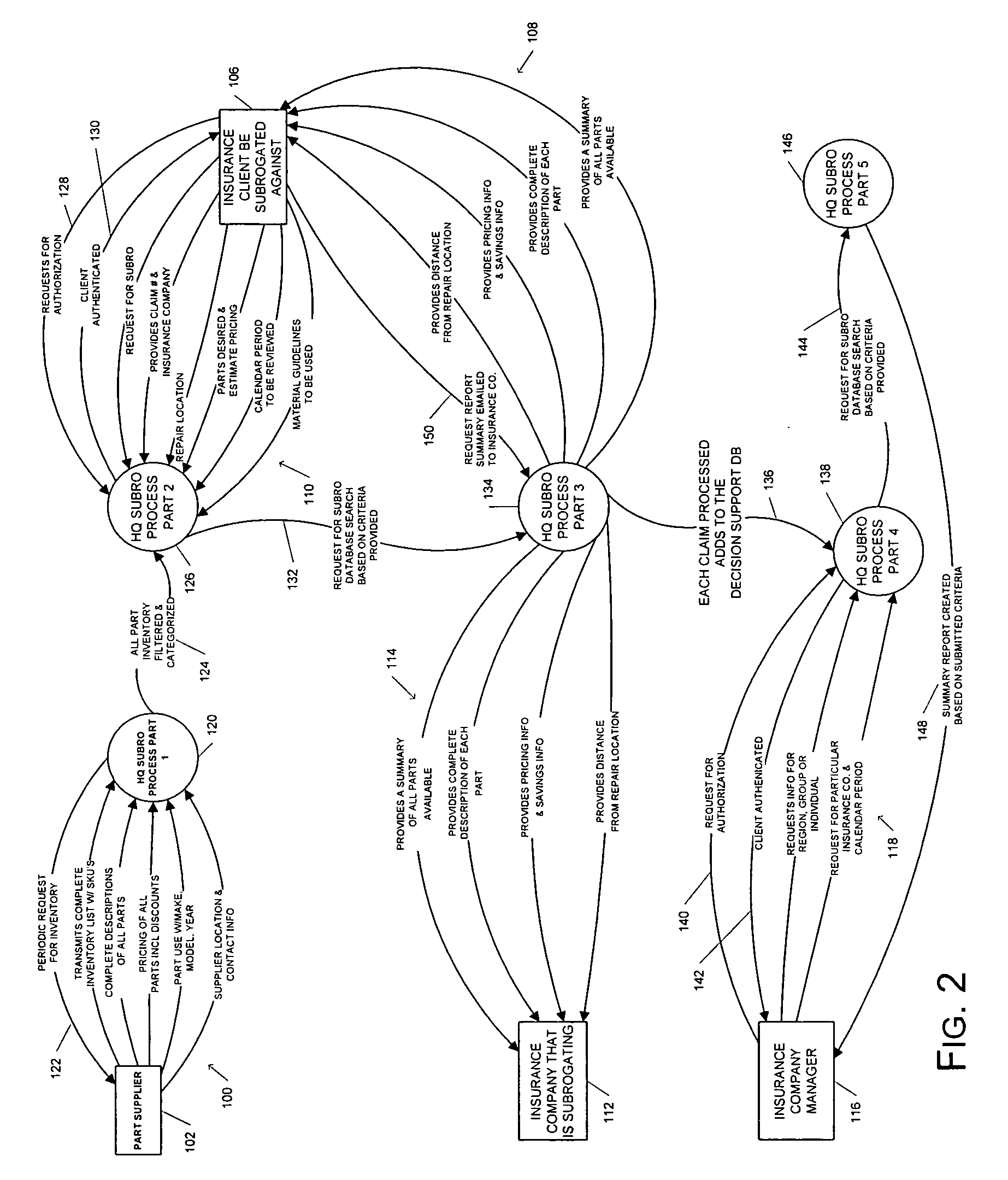

a transaction system and historical technology, applied in the field of historical insurance transaction system and method, can solve the problems of inefficiency and unnecessary expenses, insurance companies have been unable to access real-time information on purchasing practices, and cannot receive more aggressive pricing on parts, etc., and achieve the effect of accurate resolution

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0044]The invention allows a carrier to perform a parts review on an estimate on a specific historical date or range of dates, and in accordance with its own parts' guidelines or the guidelines of the Insurance Carrier / Self-Insured that subrogated the claim, or against a custom rule set. This allows a party that receives a subrogated claim to conduct a part and price search with confidence on the exact date an estimate was written, and in the same geographic area, versus conducting a search on the current date the subrogated claim was received by the responding party and trying to establish agreement with the demanding party that the parts “most likely” were available on the day an estimate was written, or on some other past date. The system allows for a search for the same data points that were on the original estimate AND on the actual date the estimate was written. This allows a party that receives a subrogated claim to conduct a part and price search with confidence on the given...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com