Comparing method and comparing system of electronic invoice

A technology of electronic invoices and subsystems, applied in the fields of instruments, finance, data processing applications, etc., can solve the problem of multiple use of invoices, and achieve the effect of improving the audit ability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

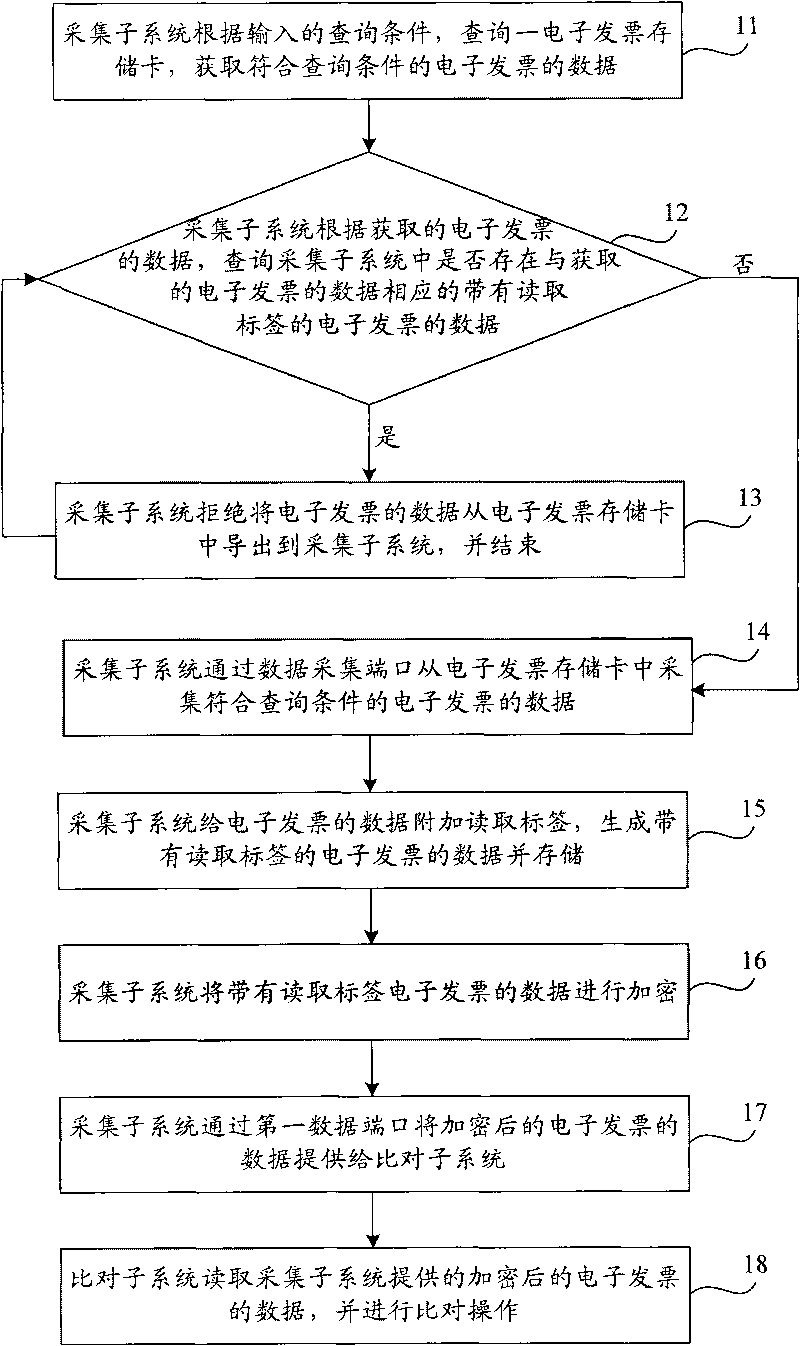

[0035] figure 1 It is a flow chart of the method for comparing electronic invoices provided by Embodiment 1 of the present invention. The subject of this method is the electronic invoice comparison system, and more specifically refers to the collection subsystem and comparison subsystem in the comparison system, such as figure 1 As shown, the comparison method provided in this embodiment includes:

[0036] Step 11, the acquisition subsystem queries an electronic invoice storage card according to the input query conditions, and obtains the data of the electronic invoices that meet the query conditions; wherein, the query conditions include at least the name of the enterprise and the date interval of invoicing;

[0037] Step 12, the acquisition subsystem inquires whether there is an electronic invoice data corresponding to the acquired electronic invoice data in the acquisition subsystem according to the acquired electronic invoice data; if it exists, then execute step 13, othe...

Embodiment 2

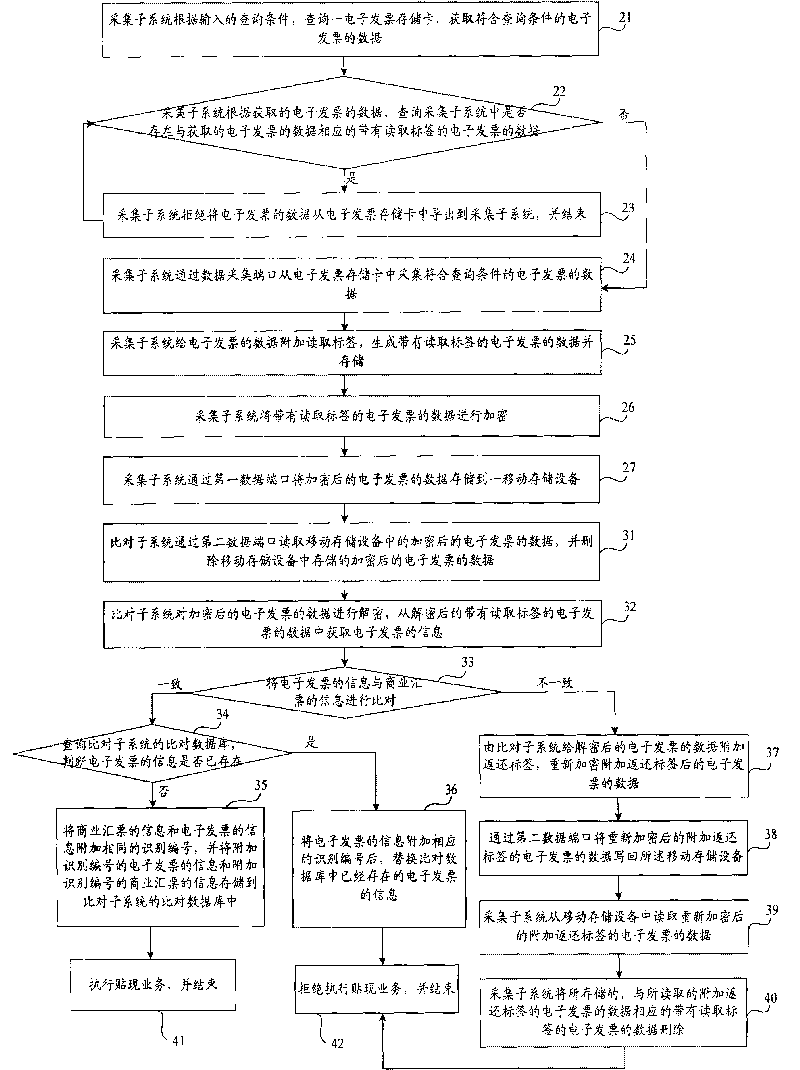

[0048] figure 2 The flow chart of the method for comparing electronic invoices provided by Embodiment 2 of the present invention, Embodiment 2 is implemented based on Embodiment 1, such as figure 2 As shown, the comparison method provided in this embodiment includes the following steps:

[0049] Step 21, the acquisition subsystem queries an electronic invoice storage card according to the input query conditions, and obtains the data of the electronic invoices that meet the query conditions;

[0050] Step 22, the acquisition subsystem inquires whether there is data corresponding to the acquired electronic invoice in the acquisition subsystem according to the acquired electronic invoice data; if it exists, execute step 23, otherwise , execute step 24;

[0051] Step 23, the acquisition subsystem refuses to export the data of the electronic invoice from the electronic invoice storage card to the acquisition subsystem, and ends; specifically, it refers to ending the collection ...

Embodiment 3

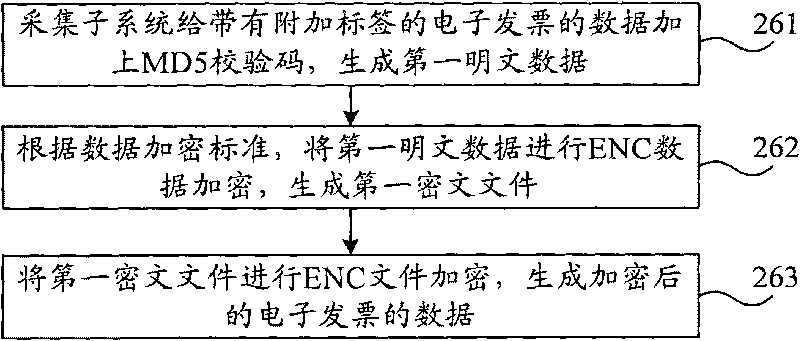

[0084] The technical solution provided by the embodiment of the present invention can be applied to the above-mentioned value-added tax anti-counterfeiting tax control system. Specifically, the electronic invoice in the embodiment of the present invention refers to the value-added tax invoice, and the electronic invoice storage card refers to the golden tax card on the enterprise side, wherein the electronic invoice The data specifically refers to the face information of the value-added tax invoice and other information contained in it, such as: the name of the buyer, the date of invoicing, the name of the goods, and the amount of the goods. Figure 4 It is a flow chart of the electronic invoice comparison method provided in Embodiment 3 of the present invention. The executive body of this embodiment is the electronic invoice comparison system, and the comparison system includes a collection subsystem and a comparison subsystem, such as Figure 4 As shown, the method provided i...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com