Loan repaying processing method and system

A processing method and processing system technology, applied in the field of loan repayment processing methods and systems, can solve the problems of lack of fund guarantee and supervision mechanism, lack of guarantee of lender's funds, difficulty in recovery of direct lenders, etc., to alleviate short-term funds pressure, increase the cost of default, and reduce the effect of loan funds risk

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

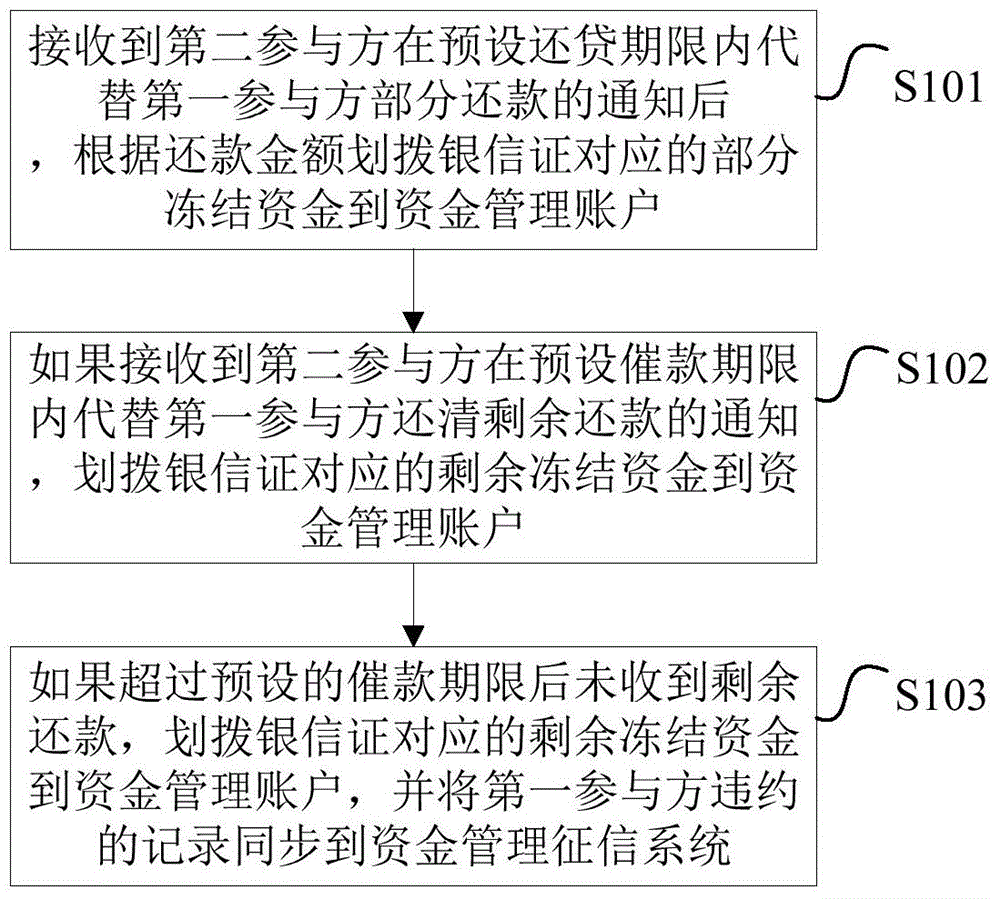

[0024] Such as figure 1 As shown, a loan repayment processing method provided by an embodiment of the present invention is applied to a fund management server, and the method includes the following steps:

[0025] S101. After receiving the notification that the second participant will partially repay the loan on behalf of the first participant within the preset loan repayment period, transfer the part of the frozen funds corresponding to the bank letter of credit to the fund management account according to the repayment amount.

[0026] Specifically, the bank letter certificate is an electronic commitment payment certificate that the second participant applies to the fund management server with its account fund or credit line as a deposit and is issued by the fund management server. The first participant and the second participant can reach an agreement offline, and the second participant will replace part of the first participant's repayment within the preset dunning period, ...

Embodiment 2

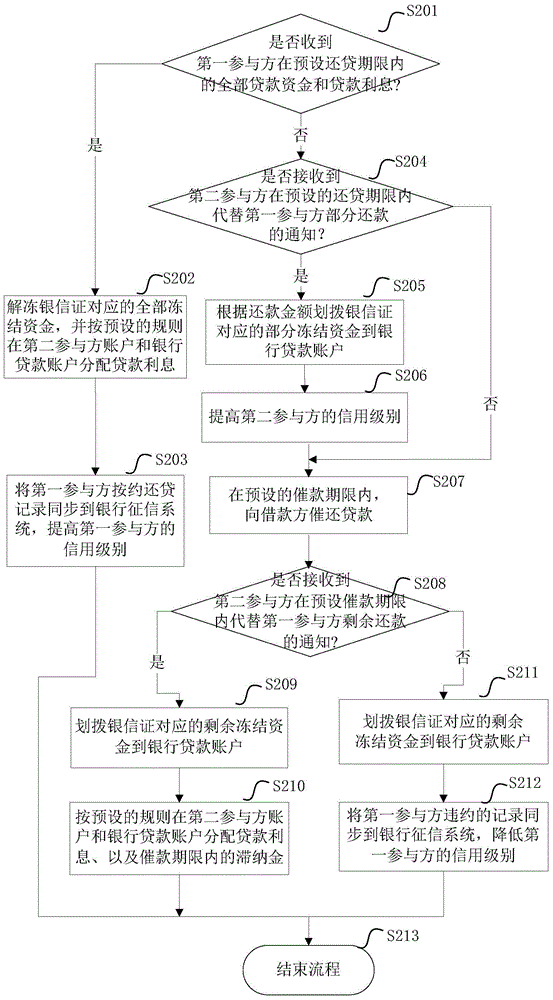

[0032] Such as figure 2 As shown, a loan repayment processing method provided by the embodiment of the present invention is described by taking the fund management institution as a bank and the fund management server as a bank server as an example. The method includes the following steps:

[0033] S201. Judging whether all the loan funds and loan interest of the first participant within the preset loan repayment period have been received, if yes, execute step S202, otherwise execute step S204.

[0034] S202. Unfreeze all frozen funds corresponding to the bank letter of credit, and distribute loan interest among the second participant's account and the bank loan account according to preset rules.

[0035] Specifically, if the first participant repays all the loan funds and loan interest within the agreed loan period, the bank server unfreezes all the remaining frozen funds corresponding to the bank letter of credit, and at the same time, the unfrozen frozen funds and correspon...

Embodiment 3

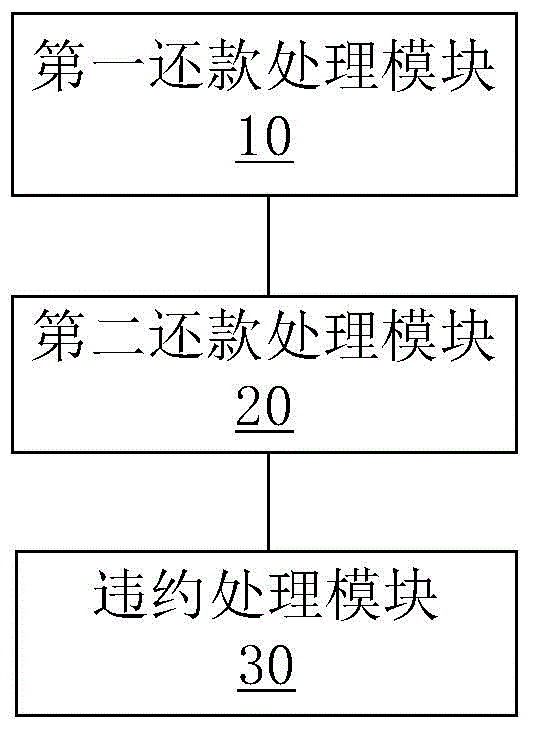

[0055] Such as image 3 As shown, a loan repayment processing system provided by an embodiment of the present invention is applied to a fund management server, and the system includes a first repayment processing module 10 , a second repayment processing module 20 and a default processing module 30 .

[0056] The first repayment processing module 10 is configured to transfer the part of the frozen funds corresponding to the bank letter of credit to the fund according to the repayment amount after receiving the notice that the second participant replaces the first participant's partial repayment within the preset loan repayment period Manage accounts.

[0057] The second repayment processing module 20 is used to transfer the remaining frozen funds corresponding to the bank letter of credit to the fund management account if receiving the notice that the second participant pays off the remaining repayment on behalf of the first participant within the preset dunning period .

[...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com